Research Article: 2020 Vol: 24 Issue: 3

Working Capital Management Strategies in Polish SMEs

Grzegorz Zimon, Rzeszow University of Technology

Abstract

Today, during the Covid-19 pandemic the situation of many companies around the world is very difficult. Additionally, to a continuous fight with powerful competitors the smallest businesses and SMEs are closing or losing most of their contractors now. This situation clearly requires the need to create financial reserves and develop strategies that will allow maintaining positive working capital. The purpose of the article is to present the working capital management strategy in Polish SMEs operating in the manufacturing, commercial and service sectors. The tests were conducted on the basis of financial statements for 2016-2018. The analysis showed that SMEs had problems with working capital management. It turns out that the companies operating in the service sector that provide tourist services use the safest strategies. This results from the lack of inventories in the structure of current assets, which certainly facilitates the management of working capital. Transport and commercial companies already have some problems with working capital management. The results clearly indicate the need to search for a strategy that will secure long-term liquidity and allow obtaining optimal profits in all the sectors.

Keywords

Working Capital, Current Liquidity, Management, Polish SMEs.

JEL Classifications

G30; G32; G33; L22.

Introduction

Working capital management is a very complicated process since it is related to current assets and current liabilities. Thus, this process applies to such elements that affect every ongoing decision that is made in each enterprise regardless of its size or the sector where it operates. According to Dewing (1941), it is, along with fixed capital, one of the ‘‘key elements’’ of the firm.

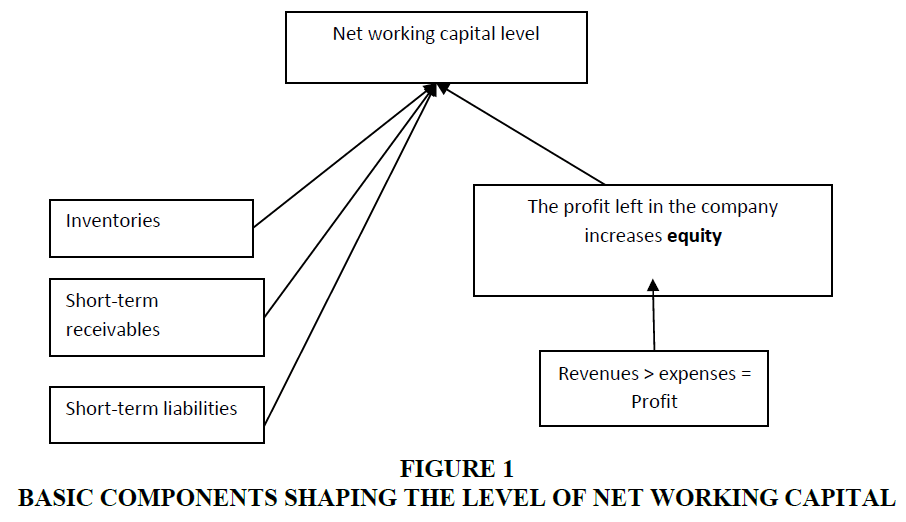

Currently, when analyzing and assessing the working capital management process in enterprises, two more important elements should be added as they have the direct impact on the level of working capital. These elements include costs and revenues. Net working capital (NWC) is the part of equity that finances current assets, so one can see that profit will have the large impact on its value. Especially when the profit is retained in the enterprise and increases the level of equity. Figure 1 presents the most important elements of the balance sheet and profit and loss account shaping the level of working capital.

Another obstacle in the process of working capital management is the choice managers have to make when creating strategies for NWC management, profit or liquidity? They have to decide whether to run the company towards security and high liquidity or towards high profitability and low liquidity. The impact of working capital on the profitability and liquidity of enterprises has been confirmed in many studies carried out around the world (Ding et al., 2013; Enqvist et al., 2014; Vahid et al., 2012; Bei & Wijewardana, 2012; Opler et al., 1999; Jose et al., 1996; Kim et al. 1998; Chen & Kieschnick, 2018; Padachi, 2006; Falope & Ajilore, 2009; Dong & Su, 2010) on various types of enterprises, in various industrial sectors, e.g. construction, aviation, restaurant and automotive (Mun & Jang, 2015; Deloof, 2003; Shin & Soenesen, 1998). This relationship is also confirmed by subsequent studies conducted by other authors on the example of Belgian, Greek, and Spanish SMEs companies. (Lazaridis & Tryfonidis, 2006). The authors inform that shortening the cash conversion cycle improves the firm’s profitability. (Garcia-Teruel & Martinez- Solano, 2007;).Several studies have shown that the length of the production process and other technological characteristics are important determinants of working capital demand (Nunn, 1981; Kim & Srinivasan, 1988; Lazaridis & Tryfonidis, 2006).

Therefore, the choice of the right working capital management policy is difficult as it is the result of a strategy for managing current assets, current liabilities, costs and revenues.

Literature Review

Working capital management is basically based on three classic management strategies: Conservative, Moderate, Aggressive.

To put it briefly, the conservative strategy is to keep current assets at a high level and shortterm liabilities at a relatively low level. Enterprises implementing these types of strategies maintain a high level of cash and inventory. Compared to the aforementioned items, enterprises maintain lower amounts due from customers since it is associated with an aggressive debt collection policy (Gardner et al. 1986; Weinrub & Visscher, 1998).

The aggressive strategy, in turn, consists in keeping current assets at a low level compared to current liabilities, which are clearly higher. However, managers try to maintain a slight advantage of current assets over current liabilities. This strategy minimizes the most liquid assets, i.e. cash, it also seeks to minimize inventory, and tries to keep receivables at a relatively high level. The high level of receivables is caused by the fact that sales as trade credit are directed to regular customers, also to unreliable ones. (Zimon 2018, Belt 1979). This strategy may lead to a decrease in financial liquidity (Van Horne & Wachowicz 2004).

The moderate strategy aims to minimize the weaknesses of previous strategies and maximizing their benefits.

Aggressive, conservative and moderate strategies are combinations of current asset strategies and current liabilities. Due to the different approach to managing liabilities and current assets in the literature one can find even more detailed division of these strategies.

The choice of the strategy is basically based on the decision whether one manages risky and low net working capital possessed, or safely accumulates net working capital which in the event of problems with financial liquidity will allow protecting the company against bankruptcy for a certain period of time. There are various opinions on this subject in the literature. There are authors who recommend maintaining high levels of net working capital (Zimon, 2020). Studies have shown that higher levels of working capital allow companies to increase their sales volume and get larger discounts on earlier payments (Deloof, 2003; Ukaegbu, 2014 Chlodnicka & Zimon, 2020).

Maintaining a high level of working capital means “trapping” money in working capital. Therefore, the level of effectiveness of enterprise management is reduced and it is financially limited to some extent (Fazzari & Petersen, 1993; Hill et al., 2010; Aktas et al., 2015; Tsuruta. 2019). In turn, effective working capital management can free capital for strategic purposes, reduce financial costs and improve profitability (Zimon & Zimon, 2019; Peng & Zhou, 2019).

However, there are authors who claim that keeping a high level of net working capital is a mistake because then unjustified costs arise that will negatively affect the company financial result (Lind et al. 2012). In addition, a big group of authors suggest that a high level of net working capital not only reduces potential profits, but also raises the risk of enterprises functioning. (Shim & Siegel, 2008; Kim & Chung, 1990; Berryman, 1983). Therefore, the company must manage it carefully to ensure liquidity or reduce the risk of insolvency. In particular, when during the recent financial crisis bank loans were extremely difficult to obtain for SMEs.

Worldwide research on working capital management has shown that its level has the great impact on the financial security of enterprises (Zimon 2019; Peel & Wilson 1994, de Almeida & Eid, 2014). Investigating the appropriate relationships between individual current assets will help determine appropriate management strategies for them, and later for the entire net working capital management strategy.

To obtain high results of financial liquidity and profitability in enterprises, managers need to abandon the classic strategies of net working capital management. Faulkender and Wang (2006), was the first research to show the relationship between working capital management and firm value for a sample of US firms.

They should look for intermediate solutions, i.e. various types of moderate (indirect) strategies.

Research Methodology

The analysis of working capital management strategy was conducted on a group of 426 Polish SMEs. The enterprises were divided into three groups:

1. Commercial enterprises operating in the construction industry.

2. Manufacturing companies operating in the metallurgical industry.

3. Service.

The purpose of the article is to review working capital management strategies and to present the weaknesses and strengths of working capital management in the surveyed enterprises. The research conducted by many authors showed that the specificity of the industry had the impact on the structure of assets, especially current assets. In trade and production enterprises there are inventories, in service usually there are none. In turn, the share of non-current assets in total assets is different compared to manufacturing and commercial enterprises. Service enterprises should also be divided. In the analysis, two groups of service enterprises were identified, i.e. transport and tourist. After the division, the research sample was as follows:

1. Company 248

2. Production companies 82

3. Service enterprises - transport 85

4. Service enterprises - tourism 11

The tests were conducted on the basis of financial statements for the years 2016-2018. The analyzes of financial ratios and statistical methods were used as the basic research tools. In tables of descriptive statistics characterizing the distribution of ratios in particular years there were such measures as: average, median, minimum and maximum.

Results

The first group that was analyzed concerned commercial enterprises. In these enterprises, inventories and receivables from customers are an important category in the structure of current assets. The average results for the enterprises are presented in Table 1.

| Table 1 Average Results of Selected Financial Ratios for Trade Enterprises for the Period 2016-2018 | |||||

| Ratio | Mean | Me | Std. Dev. | Min | Max |

| Current liquidity | 1.34 | 1.32 | 0.55 | 0.86 | 3.23 |

| Quick ratio | 0.78 | 0.75 | 0.27 | 0.42 | 1.11 |

| Conversion cycle in days | 33 | 31 | 13 | 2 | 45 |

| Receivables turnover in days | 68 | 73 | 21 | 23 | 81 |

| Liabilities turnover in days | 66 | 71 | 23 | 19 | 86 |

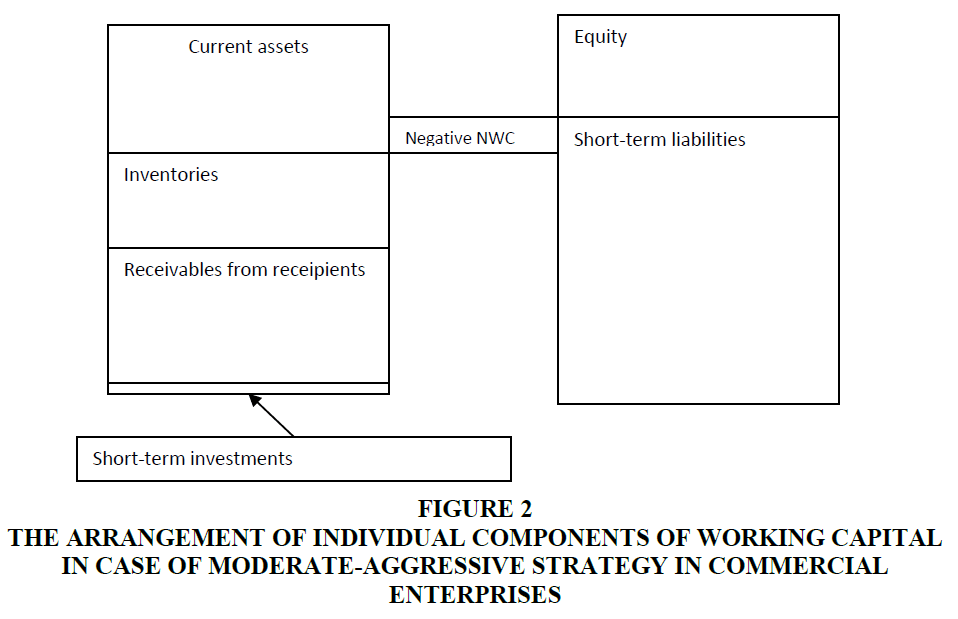

The analysis of the data presented in table 1 shows that in a group of 248 commercial enterprises, the businesses use in general an intermediate strategy, i.e. the one between the moderate and aggressive ones. The moderate-aggressive strategy is based on an aggressive strategy that has been modified accordingly. The changes are aimed at increasing the level of financial liquidity, i.e. the financial security of enterprises. In inventory management, there is a movement away from the Just in Time strategy towards the optimal volume of deliveries. This is to increase the level of inventories, introduce inventory reserves and to avoid the appearance of stock shortages that would stop production and sales. By managing receivables from customers, the company introduces more control over customers. Trade credit is not granted to all contractors, which is to improve the debt collection process. Liabilities to suppliers are regulated according to the funds at their disposal, on time. Therefore, their share is lower in the structure of liabilities compared to an aggressive strategy. A detailed distribution of individual working capital components is presented in Figure 2.

Figure 2 The Arrangement of Individual Components of Working Capital in Case of Moderate-Aggressive Strategy in Commercial Enterprises

The moderate-aggressive strategy should increase the level of financial liquidity and reduce the level of negative net working capital. Limiting inventories and increasing the financing of assets with obligations to suppliers should reduce the level of costs, which will increase profits and profitability in the enterprise.

The second group of enterprises which was analyzed concerned the units providing services. In this group there were 96 companies, which were divided into transport (85) and tourism (11) ones.

Working capital management in service enterprises, e.g. those providing financial, transport, catering and tourist services, is quite different from management strategies in commercial enterprises. However, the basic difference is virtually a lack of inventory service companies. Table 2 presents the results for transport companies.

| Table 2 Average Results of Selected Financial Ratios for Transport Enterprises for the Period of 2016-2018 | |||||

| Ratios | Mean | Me | Std. Dev. | Min | Max |

| Current liquidity | 1.31 | 1.22 | 0.59 | 1.05 | 2.77 |

| Quick ratio | 0.72 | 0.88 | 0.26 | 0.45 | 1.11 |

| Conversion cycle in days | 22 | 24 | 11 | 12 | 39 |

| Receivables turnover in days | 51 | 52 | 10 | 30 | 66 |

| Liabilities turnover in days | 31 | 32 | 22 | 12 | 69 |

One may notice that such enterprises are made to use strategies based on the principles of the aggressive strategy in managing working capital. However, higher liquidity ratios compared to the minimum values indicate that it is a moderate-aggressive strategy. In this strategy, when managing receivables from recipients, a greater control of recipients is introduced in order to avoid overdue receivables. Liabilities to suppliers are regulated according to the funds at their disposal, on time. Their share is therefore lower in the structure of liabilities compared to the aggressive strategy.

The next group which was analyzed concerned tourist enterprises. Table 3 presents the results for tourism enterprises.

| Table 3 Average Results of Selected Financial Ratios for Tourist Enterprises for the Period of 2016-2018 | |||||

| Ratios | Mean | Me | Std. Dev. | Min | Max |

| Current liquidity | 2.3 | 2.1 | 0.82 | 1.3 | 4.2 |

| Quick ratio | 2.2 | 1.8 | 0.55 | 1.1 | 3.8 |

| Conversion cycle in days | 102 | 101 | 34 | 6 | 148 |

| Receivables turnover in days | 81 | 75 | 23 | 43 | 109 |

| Liabilities turnover in days | 112 | 101 | 28 | 51 | 133 |

The results indicate the use of the conservative strategy. It consisted in maintaining high levels of cash, low due amounts from customers and liabilities to suppliers. The level of short-term investments will vary and depend on the type of service the company offers. For instance, in the biggest tourist offices in Poland, the largest share in the structure of assets is cash in hand and on bank accounts. Managing supplier commitments for the conservative strategy also involves maintaining low levels from the industry average. According to the rule, the lower current liabilities, the fewer problems with timely payment, the liabilities are settled as soon as possible. When analyzing service units, it should be noted that the share of non-current assets in the structure of total assets will be higher compared to commercial enterprises. However, this depends on the type of services the company provides. The enterprises providing tourist services may not have fixed assets. On the other hand, in the case of liabilities, equity should have a high share in the structure of financing sources. In production enterprises, as in the case of trade units, inventories appear. Table 4 presents the results for manufacturing enterprises.

| Table 4 Average Results of Selected Financial Ratios for Manufacturing Enterprises for the Period of 2016-2018 | |||||

| Ratio | Mean | Me | Std. Dev. | Min | Max |

| Current liquidity | 1.60 | 1.53 | 0.61 | 0.95 | 3.42 |

| Quick ratio | 0.92 | 0.88 | 0.27 | 0.21 | 1.22 |

| Conversion cycle in days | 34 | 31 | 14 | 22 | 46 |

| Receivables turnover in days | 59 | 55 | 18 | 44 | 72 |

| Liabilities turnover in days | 64 | 62 | 21 | 41 | 87 |

The results presented indicate that production companies apply the conservative-moderate strategy. Production companies often carry out production for specific orders. Therefore, in case of inventory management, often the volume of deliveries of a given material is strictly determined by the volume of production to be made. At most, they can order material with a certain safety margin so that there is no situation that, as a result of errors in the production department, material shortage and production is stopped. Therefore, inventories will generally be at optimal levels in production units. Conservative debt management should be based on a quick recovery. Receivables turnover in days must be definitely shorter than liabilities turnover in days. In the case of the companies surveyed, the process of collecting receivables from customers is loosening, which indicates moderate management. The commitments will be paid on time, certainly after the due date of receivables from customers. The moderate-conservative strategy in manufacturing enterprises will have model liquidity levels, as inventories will not unnecessarily inflate financial liquidity ratios. Their optimal level will have the positive impact on inventory management costs, which will allow maintaining high profitability. In production units in each strategy, fixed assets will constitute the largest share in the total assets structure.

Conclusions

The analysis showed that each industry was trying to manage working capital in a different way. In case of service units, the working capital management policy is less complicated because it is basically based on receivables from customers and liabilities to suppliers. The moderate aggressive strategy is used in transport companies. In this sector the management policy is mainly based on the management of receivables, which must be collected as soon as possible, and the management of liabilities, whose settlement is postponed as far as possible in time by managers. The optimal situation is when the liabilities turnover in days is longer than the receivables turnover in days. In case of enterprises operating in the tourism sector, it is clearly seen that enterprises apply the conservative strategy. This policy is confirmed by high financial liquidity, lack of inventories and a high share of cash.

The production companies surveyed are trying to lead companies in a conservative direction in case of working capital management. This strategy should be defined as the moderate - conservative, as indicated by optimal, even exemplary results of financial liquidity ratios and the quick liquidity ratio. In turn, trade enterprises show that SMEs have problems maintaining positive working capital and financial liquidity. The moderate-aggressive strategy is used in trade companies This is generally due to poor inventory turnover, a long receivables turnover period in days compared to liabilities turnover in days. The turnover rates for these two measures are at a similar level, which is not good for managers. Temporary problems when receivables are received from recipients can cause payment bottlenecks and suspension of payments to their suppliers. Commercial SMEs should accelerate receivables turnover in days.

To sum up the research, it can be seen that SMEs are particularly exposed to the loss of liquidity. Therefore, their managers should try to create some reserves that will allow them to maintain positive working capital, which in the event of financial problems will enable them to survive in the market at least in the short term. Observing the results of individual industries that have been surveyed, it can be seen that theoretically the enterprises operating in the tourism industry are well protected from bankruptcy. On the other hand, the enterprises operating in the commercial sector are highly threatened with bankruptcy. However, the theory strongly deviates from reality. Today, during the COVID-19 pandemic, it is the tourism industry that suffers the largest losses and virtually no working capital management strategy was able to ensure their safe functioning. Today, lack of sales is a problem that affects most SMEs around the world. However, right now enterprise managers should strive to build long-term strategies for the future, which turnover will be based on conservative management of the enterprise, based on certain financial reserves, which will ensure that the entity will function for several months in the event of another pandemic. Enterprise management policy should change its direction towards financial security and give up profit maximization.

References

- Aktas, N., Croci, E., & Petmezas, D. (2015). Is working capital management value-enhancing? Evidence from firm performance and investments. Journal of Corporate Finance, 30, 98-113.

- Bei, Z., & Wijewardana, W. (2012). Working capital policy practice: Evidence from srilankan companies. Proced. Soc. Behav. Sci., 40, 695–700.

- Belt, B. (1979). Working capital policy and liquidity in the small business. Journal of Small Business Management, 17(3), 46.

- Berryman, J. (1983). Small business failure and bankruptcy, A Survey of the literature. Eur. Small Business J. 1 (4), 47–59.

- Chen, C., & Kieschnick, R. (2018). Bank credit and corporate working capital management, Journal of Corporate Finance 48, 579-596.

- Ch?odnicka, H., & Zimon, G. (2020). Bankruptcu Risk Assessment Measures of Polish SMEs, WSEAS Transactions on Business and Economics, Volume 17, 2020, 14-20.

- De Almeida, J.R., & Eid W.Jr. (2014). Access to finance, working capital management and company value: Evidences from Brazilian companies listed on BM&FBOVESPA. Journal of Business Research, 67, 924-934.

- Deloof, M. (2003). Does working capital management affect profitability of Belgian firms? Journal of Business Finance & Accounting, 30, 573–587.

- Dewing, A.S. (1941). The Financial Policy of Corporations, fourth ed. The Ronald Press Company, New York.

- Ding, S., Guariglia, A., & Knight, J. (2013). Investment and financing constraints in China: Does working capital management make a difference? J. Bank. Finance, 2013, vol. 37 (5), 1490–1507.

- Dong, H., Su, J. (2010). The relationship between working capital management and profitability: a Vietnam case. International Research Journal of Finance and Economics 49, 62–71.

- Enqvist, J., Graham, M., & Nikkinen, J. (2014). The impact of working capital management on firm profitability in different business cycles: evidence from Finland. Res. Int. Bus. Finance, 2014, 32, 36-49.

- Falope, O., & Ajilore, O., (2009). Working capital management and corporate profitability: Evidence from panel data analysis of selected quoted companies in Nigeria. Research Journal of Business Management, 3, 73–84.

- Faulkender, M., & Wang, R. (2006). Corporate financial policy and the value of cash. Journal of Finance, 61(4), 1957–1990.

- Fazzari, S.M., & Petersen, B. (1993). Working capital and fixed investment: New evidence on financing constraints. The Rand Journal of Economics, 24, 328–342.

- Garcia-Teruel, P.J., & Martinez-Solano, P. (2007). Effects of working capital management on SME profitability. Int. J. Managerial Finance, 3(2), 164–177.

- Gardner, M.J., Mills, D.L., & Pope, R.A. (1986). Working capital policy and operating risk: An empirical analysis. The Financial Review, 21(3), 31.

- Hill, M.D., Kelly, G., & Highfield, M.J. (2010). Net operating working capital behaviour: A first look. Financial Management, 39, 783–805.

- Kim, J.H., & Chung, K.H. (1990). An integrated evaluation of investment in inventory and credit: A cash flow approach. Journal of Business Finance & Accounting, 17, 381–390.

- Kim, Y., & Srinivasan, V. (1988). Advances in Working Capital Management. JAI Press, Greenwich, Connecticut.

- Kim, C.S., Mauer, D.C., & Sherman, A.E. (1998). The determinants of corporate liquidity: theory and evidence. J. Financial Quantitative Anal. 33 (3), 335–359.

- Jose, M., Lancaster, C., Stevens, J., (1996). Corporate returns and cash conversion cycles. Journal of Economics and Finance, 20, 33–46

- Lazaridis, I., & Tryfonidis, D. (2006). Relationship between working capital management and profitability of listed companies on the Athens Stock Exchange. J. Financial Management Anal. 19 (1), 26–35.

- Lind, L., Pirttil, M., Viskari, S., Schupp, F., & Karri, T. (2012). Working capital management In the Automotive industry. Financial value chain analysis. Journal of Purchasing and Supply Management,18(2), 92–100.

- Mun, S.G., & Jang, S. (2015). Working capital, cash holding, and profitability of restaurant firms. Int. J. Hospit. Manag, 48, 1–11.

- Nunn, K. (1981). The strategical determinants of working capital: a product line perspective. Journal of Financial Research, 4, 207–219.

- Opler, T., Pinkowitz, L., Stulz, R., & Williamson, R. (1999). The determinants and implications of corporate cash holdings. J. Financial Economics, 52, 3–46.

- Padachi, K. (2006). Trends in working capital management and its impact on firms’performance: An analysis of Mauritian small manufacturing firms. Int. Rev. Bus. Res. Pap. 2 (2), 45–58.

- Peel, M.J., & Wilson, N. (1994). Working capital and financial management practices in the Small Firm sector. Int. Small Business J.14(2), 52–68.

- Peng, J., & Zhou, Z. (2019). Working capital optimization in a supply chain perspective. European Journal of Operational Research, 277(2019), 846–856

- Shim, J.K., & Siegel, J.G. (2008). Financial management, Barrons.

- Shin, H.H., Soenen, L. (1998). Efficiency of working capital and corporate profitability. Financial Practice Education, 18(2), 37–45.

- Ukaegbu, B. (2014). The significance of working capital management in determining firm profitability: Evidence from developing economies in Africa, Research in International Business and Finance 31 (2014), 1–16.

- Tsuruta, D. (2019). Working capital management during the global financial crisis: Evidence from Japan. Japan & The World Economy, 49, 206-219.

- Vahid, T.K., Elham, G., Khosroshahi Mohsen, A., & Mohammadreza, E. (2012). Working capital management and corporate performance: evidence from iranian companies. Proced. Soc. Behav. Sci., 62, 1313–1318.

- Van Horne, J.C., & Wachowicz, J.M. (2004). Fundamental of Financial Management, 12 thed. Prentice Hall, New York.

- Weinraub, H.J., & Visscher, S. (1998). Industry practice relating to aggressive conserva-tive working capital policies. Journal of Financial and Strategic Decision, 11(2), 11–18.

- Zimon, G. (2018). Influence of group purchasing organizations on financial situation of Polish SMEs. Oeconomia Copernicana, 9(1), 87-104.

- Zimon, G., & Zimon D. (2019). An assessment of the influence of nominalized quality management systems on the level of receivables in enterprises operating in branch group purchasing organizations. Quality-Access to Success, 20(169), 47-51.

- Zimon G. (2019). The impact of quality management on inventories in commercial enterprises operating within group purchasing organizations. Problems and Perspectives in Management, 17(3), 362-369.

- Zimon G. (2020). Management strategies of working capital in polish services providing companies. WSEAS Transactions on Business and Economics, 17, 225-230.