Case Reports: 2018 Vol: 24 Issue: 3

Working Capital Management of An International Online Book Trading Start-Up

Simon Zaby, College of Management, Mahidol University

Case Description

An international online book trading start-up, based in Bangkok, specialized on textbooks about financial management and corporate finance, called FM SMILE INC., needs help in manag-ing its working capital. The founders are known as highly specialized bookworms only, so they need help from management graduates. To receive a high quality of consulting expertise, they choose management graduates of a top-ranked university, as they expect a practical curriculum there. The case focusses on start-ups, in order to especially make highly motivated entrepreneurs without a strong background in management education aware of the importance of financial issues even in very early stages along the entrepreneurial life cycle.

After successful initial months, the bookworms realized that their sales are steadily declin-ing. They decide to take some action, namely to increase the quality of their books. To be suc-cessful with that, they temporarily hire a finance professor. She or he should have a close look into the contents of the financial management books in FM SMILE INC.’s portfolio. Crucial pa-rameter: sort out all unnecessary, overly theoretic contents, and integrate practical knowledge and cases for the everyday use in the management of enterprises.

The primary subject matter of this case concerns managing the working capital of a corpo-ration. Secondary issues examined include costs of carrying receivables, common forms of short-term bank loans and costs of trade credit. Pre-requisite for the case is basic accounting knowledge. The case has a difficulty level of 4-5. Including explanations of the basics, the case is designed to be taught in a 2-3 h session.

Case Synopsis

Firstly, the case is indicating that sending out bills to the customers of a corporation is not for free; managers need to think in opportunities and must take costs of carrying receivables into account. Secondly, with regard to the liabilities & equity part of the balance sheet, the case fo-cusses on certain possibilities of short-term bank loans and sheds light on the difference between nominal and effective interest rates. Lastly, it shows the necessity of calculating the costs related to a corporation’s accounts payable, in case it is paying after the end of a cash discount period.

Methodology

This case has been developed by the author throughout several years of teaching various financial management and corporate finance courses and during the time as a program chair of Entrepreneurship Management (Master’s level).

Teaching Objectives

The case is designed to make especially non-finance management students aware of the importance of daily-life basic financial issues that matter for all corporate managers. Moreover, it is widely known that a poor handling of financial issues is a major reason leading to the failure of start-ups. Therefore, the case uses a start-up as example.

Discussion Questions

The credit sales of FM SMILE INC. amounted to 37.8 M Baht (B) net in the past business period from 1st January 2017 to 31st December 2017. The accounts receivable at the end of this period have been calculated with 5.8 M Baht, and with 5.0 M Baht as of 31st December 2016.

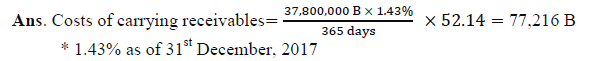

Q1. Please calculate the “costs of carrying receivables” for FM SMILE INC. If necessary, please apply the Thai Baht interest rate for 1-year government bonds*.

The annual credit sales of 37.8 M B are multiplied by the interest rate of a 1-year Thai government bond that can be viewed as a risk-free investment alternative; the result is the annual cost of carrying receivables. This being multiplied by the days sales outstanding (365 divided by accounts receivable turnover; accounts receivable turnover=the company’s credit sales of 37.8m B divided by the average accounts receivable of 5.4 M B), then divided by 365 days, results in a breakdown of the costs of carrying receivables to the company’s average receivables collection period (=days sales outstanding). Thus, it costs FM SMILE INC. 77,216 B in interest every ~52 days (or 540 B annually) to provide its clients 37.8 M B in annual credit facilities.

Q2. Please explain your result from Task to the bookworms.

Ans. Because the bookworms are sending out bills to their customers, they lose the chance of doing anything else with the money, e.g. investing in Thai government bonds.

Moreover, the Receivables Collection Period (RCP) seems quite high for an online book store. To have a certain RCP is not avoidable; otherwise, you won’t get customers, or lose some, respectively. But the corporation should try to shorten its RCP (e.g., by granting cash discounts).

The FM SMILE INC.’s management decides to finance the finance professor by a “short-term bank loan”. Please work out several possibilities for FM SMILE INC. You assume the project (including the budget for 3 assistants to the project) to cost 555,000 Baht over a period of 180 days.

Q3. Please calculate a simple interest loan with an interest rate of 9% p.a. for that period.

a. What is the payback amount?

Ans. 555,000 B+[555,000 B x 0.09 x (180/360)]=579,975 BThe nominal per annum interest rate needs to be divided according to the duration of the simple interest loan.

b. What is the nominal interest rate p.a.?

Ans. 24,975 B/555,000 B x (360/180)=9%

As shown in Task a., the company needs to pay 24,975 B on a 555,000 B loan. For a 360 days year, the nominal interest rate of 9% results.

c. What is the effective interest rate p.a.?

Ans. (1+0.09/2)2–1=9.2025%

We need to apply the following formula to convert nominal interest rates into effective in-terest rates for certain loan durations: (1+nominal interest rate/n)n–1=effective interest rate; n=number of periods that we divide one year into.

Q4. To explain the difference between nominal and effective interest rates to the bookworms at FM SMILE INC., please assume that the project costs 555,000 Baht over a period of 360 days and will be financed by a simple interest rate loan for the complete period.

a. What is the payback amount?

Ans. 555,000 B+[555,000 B x 0.09]=604,950 B

For an annual simple interest loan, we only need to multiply the loan volume by the p.a. in-terest rate, to receive the amount of interest. Combined with the loan volume, we get the payback amount upon the end of the loan’s duration.

b. What is the nominal interest rate p.a.?

Ans. 49,950 B/555,000 B=9%

The nominal interest rate is the p.a. interest rate provided by the bank.

c. What is the effective interest rate p.a.?

Ans. (1+0.09)=9%

If interest rates apply for periods less than a year, there is no difference between nominal and effective interest rates.

d. Why is the effective interest rate different to Q3.c.?

Ans. In Task Q3.c. an investor gets back 555,000 B+24,975 B after 6 mon. If he invests these 579,975 B again for 6 mon (9% p.a./2), he will get back 606,074 B at the end of one year. He earned 24,975 B+26,099 B on his investment of 555,000 B as of the beginning of the year. The effective rate p.a. therefore amounts to 9.2025%.

Q5. Let’s go back to our assumption that the project will cost 555,000 B over a period of 180 days. Please calculate a simple interest loan with a compensating balance of 7.5%, and an inter-est rate of 9% p.a.

a. What is the interest payment?

Ans. First, we need to calculate how much the face value of the loan should be. We need to pay 555,000 B anyway → 555,000 B/(1–0.075)=600,000 B face value of the loan i.e., compensating balance is the difference between face value and effective loan volume: 45,000 B Interest pay-ment=600,000 B x (0.09/2)=27,000 B

b. What is the nominal interest rate p.a.?

Ans. (27,000 B/555,000 B) x 2=[0.09/(1–0.075)]=4.8649% x 2=9.7297%

The company needs to pay 9% interest rate p.a. on the face value of the loan (600,000 B). However, they only receive 555,000 B that they can work with. This results in “real” costs of 9.7297%.

c. What is the effective interest rate p.a.?

Ans. (1+0.048649)2–1=9.9664%

We need to apply the following formula to convert nominal interest rates into effective in-terest rates for certain loan durations: (1+nominal interest rate/n)n–1=effective interest rate; n=number of periods that we divide one year into.

The professor has done her job. FM SMILE INC. expects its sales to double or even triple quite soon. However, this means they need to hold more inventory to be ready for the run.

Q6. FM SMILE INC. expects to buy the revised book from its supplier for a cash price of 7.3m Baht net throughout the coming business period. The supplier’s billing conditions are “3/30, net 60.” Please calculate the “nominal and the effective costs of trade credit”, if the bookworms on average just manage to pay on day 65.

Ans. First of all, we need to break down the company’s purchase into a daily basis:

Net daily purchases=7.3 M B/365=20,000 B

In the next step, we need to calculate the annual gross purchases. Basis for that are the giv-en net purchases which include the 3% cash discount:

Annual gross purchases=7.3 M B/(1–0.03)=7,525,773 B

The difference between gross and net purchases is the surplus that the company needs to pay, in case they are leaving the cash discount period:

Extra payment if not taking the discounts=225,773 B

If the company takes the discount and pays at the last day of the discount period, the paya-bles level can be obtained by multiplying the net daily purchases by 30:

A/P level if taking the discount=20,000 B x 30=600,000 B

If they do not take the discount and pay at day 65, the payables level can be obtained through multiplying the net daily purchases by 65:

A/P level if not taking the discount=20,000 B x 65=1.3 MB

The difference between the two latter results is that proportion of the trade credit which results after leaving the cash discount period:

→ Costly trade credit=700,000 B

To conclude, the company pays 225,773 B to have the payables on its balance sheet for additional 35 days. This is the expense they need to pay for leaving the cash discount period (and get financed by their supplier!).

Nominal cost of costly trade credit=225,773 B/700,000 B=32.2533%

As we are breaking down one year into the cash discount period (30 days) and into the ef-fective timeframe of payment (upon day 65), we can finally compute the effective rate of the costly trade credit.

Effective Annual Rate (EAR)=(1+3/97)^(365/{65-30})–1=37.3890%

References

- Abor, J.Y. (2017). Entrepreneurial Finance for MSMEs (First Edition). Basingstoke: Palgrave Macmillan.

- Brigham, E.F., & Houston, J.F. (2018). Essentials of Financial Management (Fourth Edition). Singapore: Cengage Learning Asia.

- Gibbons, G., Hisrich, R.D., & DaSilva, C.M. (2015). Entrepreneurial Finance. Thousand Oaks. CA: Sage Publishing.

- Jutter, J.C., & Smart, S.B. (2018). Principles of Managerial Finance (Fourteenth Edition). London: Pearson.

- Koh, A., Ser-Keng, A., Brigham , E.F. & Ehrhardt , M.C. (2014). Financial Management-Theory and Practice, An Asia Edition (First Edition). Singapore: Cengage Learning Asia.

- Ross, S., Westerfield, R., Jaffe, J., & Jordan, B. (2016). Corporate Finance (Eleventh Edition). New York, NY: McGraw-Hill Education.