Research Article: 2024 Vol: 23 Issue: 5

Women???s Financial Literacy a Bibliometric Analysis and Future Research Agenda.

Kavita Joshi, Amity University

Ritesh Dwivedi, Amity University

Ruchi Tyagi, Asian Institute of Technology

Citation Information: Joshi, K., Dwivedi, R. & Tyagi, R. (2024). Women’s financial literacy a bibliometric analysis and future research agenda. Academy of Strategic Management Journal, 23(5), 1-10

Abstract

Financial literacy, crucial for informed decision-making, exhibits persistent gender disparities. This paper employs a meticulous bibliometric analysis, leveraging the Scopus database, to illuminate the landscape of women's financial literacy research. The study explores annual publication trends, citation impacts, prominent journals, global contributions, and keyword co-occurrences. The analysis reveals a notable surge in publications from 2013, underscoring increasing awareness of financial literacy's role in gender equality. Noteworthy contributors, including Angela Lusardi, shape the thematic diversity within the field. Journal analysis unpacks the interplay between publication frequency and citation impact, highlighting unexpected leaders like the Journal of Pension Economics and Financial. Global collaboration involves 17 countries, with the United States, India, the United Kingdom, and Australia playing pivotal roles. Keyword co-occurrence analysis identifies central themes, with "financial inclusion," "financial literacy," and "gender" emerging prominently. This study not only presents a comprehensive overview of women's financial literacy but also serves as a valuable resource for researchers, policymakers, and educators. By pinpointing trends, influential authors, and thematic clusters, this work lays a foundation for targeted interventions, contributing to broader goals of financial inclusion, gender equality, and empowerment

Keywords

Financial Literacy, Women Entrepreneurs, Financial Education, Financial Planning, VOS viewer, Bibliographic Coupling, Bibliometric Analysis.

Introduction

Financial literacy is the comprehensive understanding and proficiency in various financial aspects, including effective money management, investment knowledge, and budgeting (Lusardi, 2019). Additionally, financial literacy is associated with concepts such as financial education, capability, and awareness. However, possessing basic financial knowledge is insufficient unless it translates into real financial behaviour (Atkinson & Messy, 2012). Despite the universal importance of financial literacy, gender disparities persist. Women face significant obstacles in acquiring financial literacy, engaging in retirement planning, and managing finances due to cultural standards, socioeconomic factors, and gender-based expectations. Studies indicate that in societies with higher gender equality, girls and women tend to exhibit greater financial literacy (Preston et al., 2023; Tyagi 2012 ). Examining financial literacy through a gendered lens reveals distinct implications for women (Garz et al., 2021; Tyagi & Vasiljeviene 2012). Various studies suggest that women generally possess less financial knowledge, confidence, and interest in financial matters compared to men (Nițoi et al., 2022). It is essential to provide women with global opportunities for improving financial knowledge and education, as these steps can significantly impact their financial inclusion, empowerment, and planning (Ahmed et al., 2021). The allocation of financial planning responsibilities in societies often follows gender norms, with men taking on specialized roles and women predominantly managing household affairs. This division can lead to a reduction in women's overall financial literacy and an increase in their financial risk (Fonseca et al., 2012). Recognizing these challenges, this study aims to provide deeper insights into academic discussions on women's financial literacy and well-being.

Bibliometric analysis has emerged as a robust technique for comprehensively reviewing literature, evaluating historical and contemporary landscapes, and guiding future research endeavours. This study focuses on scrutinizing the state of research on women's financial literacy within the Scopus database.

In this context, answers to the following questions were sought.

a) How has the annual scientific publication output in women's financial literacy evolved over the period?

b) How does the citation impact of key articles contribute to the overall influence of research in this area?

c) Which journals have been prominent in publishing research on women's financial literacy?

d) What is the geographic distribution of research contributions in the field of women's financial literacy?

e) What are the most common keywords co-occurring in articles related to women's financial literacy?

The findings of this analysis are crucial for researchers and policymakers alike. Understanding publication trends, citation impacts, and key research contributors will inform targeted initiatives and interventions to improve women's financial literacy. This, in turn, contributes to broader economic empowerment and financial inclusion.

The subsequent sections of this study will delve into a comprehensive exploration of women's financial literacy, employing bibliometric analysis to analyse publication trends, presenting the data analysis process, unveiling key findings, and concluding with discussions on the implications and potential avenues for future research in the field of women's financial literacy.

Literature Review

The 2020 report from the Organization for Economic Co-operation and Development (OECD) establishes financial literacy as a holistic concept, encompassing knowledge, attitude, awareness, behaviour, and skills. These elements collectively play a crucial role in fostering the ability to make informed financial evaluations, contributing to overall financial growth (Karakurum-Ozdemir et al., 2019). In light of the numerous obstacles that women face in financial security and planning, it is essential to recognize the significant ramifications these challenges pose for women. Research consistently indicates gender discrepancies in financial education, with evidence suggesting that women often exhibit lower levels of financial literacy compared to their counterparts (Were et al., 2021). Emphasizing the importance of initiatives promoting financial inclusion becomes crucial in embracing women’s economic empowerment and addressing the gender gap in financial literacy (Swati Prasad, 2021). Despite the promising opportunities offered by the evolution of electronic financial services, a persistent challenge lies in women’s electronic financial literacy (Asuming et al., 2019). Socio-economic factors play a pivotal role in enhancing women’s financial literacy. (Mishra et al., 2022) noted that women in developing countries tend to exhibit lower levels of financial literacy. Education emerges as a key factor in enhancing financial literacy, as highlighted by studies such as (Lone & Bhat, 2022) and (Rink et al., 2021). Effectively addressing these challenges has the potential to foster sustainability and equality in economic opportunities for women, ultimately improving their overall financial well-being. Economic abuse significantly impacts the economic self-sufficiency of females who have experienced such abuse (Farrell et al., 2016) This underscores the importance of curricula designed to improve financial literacy, with a particular emphasis on individuals who have survived intimate partner violence (IPV)(Thompson et al., 2018). The confidence level an individual holds in efficiently managing their finances is a paramount factor impacting their financial actions and decision-making (Bannier & Schwarz, 2018). In conclusion, improving women's proficiency in managing investments not only enhances their financial decision-making but also makes them more efficient in managing their savings products (Bannier & Schwarz, 2018).

A growing number of studies on women's financial literacy are becoming available. Nevertheless, due to limitations, a qualitative review can only encompass a restricted number of studies. This paper addresses this gap by offering a comprehensive systemic analysis of trends in women's financial literacy studies, co-authorship networks, and recent topics in the field.

Methodology

Bibliometric analysis is a method that enables researchers to obtain extensive insights into the history and progress of a particular field by using bibliometric indicators (Jiménez-García et al., 2020). We conducted a bibliometric analysis to improve our understanding of the most paramount factors affecting women’s financial literacy and to know how the available literature on women’s financial literacy is organized. To fulfil our purpose we utilized the Scopus database, renowned in the research community and consists of over 27 million abstracts, as it stands as the largest database (Burnham, 2006). Other databases including Web of Science, SSRN, Dimensions, Econlit, and Google Scholar are viable alternative options for conducting bibliometric analysis.

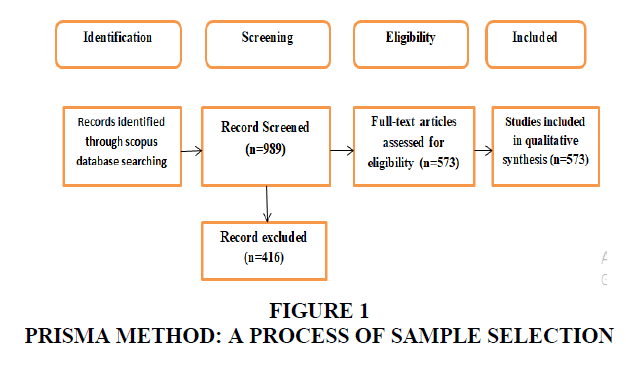

The search criteria for articles include keywords like “Women Financial Literacy, Financial planning, financial education, and financial inclusion”. From 1983 to 15 January 2024, a bibliographic search yielded 989 results. Subsequently, the article selection steps inclusive of four criteria. Firstly, the article had to be written in the English language. Secondly, it should be a scientific paper published in a peer-reviewed journal and a conference paper, as these are considered authentic sources of information (Podsakoff et al., 2005, Tyagi & Vishwakarma, 2022). Thirdly the article had to be relevant to the subject fields of “Economics, Econometrics and Finance,” “Business, Management and Accounting,” and “Social Sciences”. Lastly, the articles must not have been published as book chapters or review papers, the criteria further refined the selection to 573 research articles as shown in Figure 1. This methodology is based on the PRISMA method guidelines (Liberati et al., 2009). The current study analyses the temporal growth of research publications, identifies the most prominent authors in the field, assesses the highly productive journal based on the total number of published articles, and determines the countries contributing the maximum number of research articles utilizing a set of bibliometric indicators.

In their Literature review adopting bibliometric analyses, (Paul & Criado, 2020) mentioned three approaches: theory-based (highlighting generalizations about articles applying the same theory), domain-based( blending contents into themes), and method-based( establishing generalization about studies that shared common methodology). The domain-based approach is taken for this study, which can be used to encapsulate the importance of literature content and investigate future research gaps (Goyal & Kumar, 2021; Tyagi et al 2023).

The analysis used VOS viewer software version 1.6.10 because it utilizes bibliometric methods for identification, graphic representation, and classification of groups within a strategic matrix based on differences and commonalities. This graphical presentation provides a further in-depth exploration of relationships between the variables, increasing comprehension in the field of research and making it an indispensable analytical tool (Vallaster et al., 2019). Through category maps, VOS viewer software enables the graphical presentation of different data (Cavalcante et al., 2021)

Data Analysis and Findings

Authors are now presenting findings in sequence to research questions scientific publication per year (publications over the specified period 1983-2024), Articles citation (based on the most prominent authors), journal publication analysis (based on journal productivity and publication volume per journal), country analysis (determining the countries contributing the maximum number of a research article, Co-occurrence (keywords) analysis.

Scientific Publication per Year

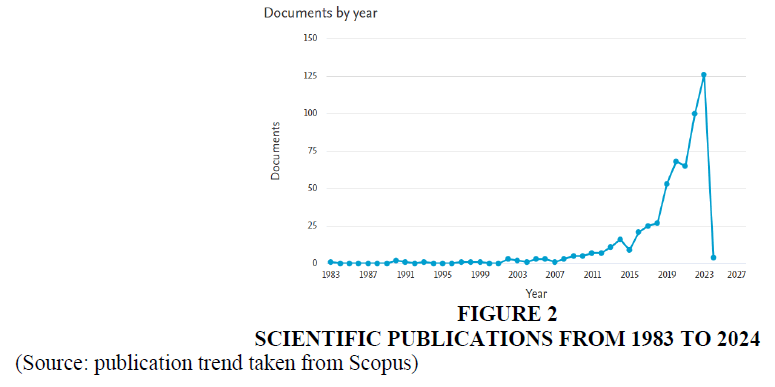

The number of publications in the dataset opted from Scopus has been going up, likely in recent years (shown in Figure 2). From 1983 to 2008, only a few research papers were published. The first article about women’s financial literacy in our dataset was in 1983. But in 2013, things changed with eleven papers, showing a big increase in research work. There was a slight dip in 2015, but after that, the number of articles about financial literacy and women kept going up a lot, reaching a peak in 2023 with one hundred and twenty-seven articles. The increase in articles about women’s financial literacy from 2013 to 2022 happened because of a few reasons. A lot of people started realizing how paramount it is to understand money. Challenges faced by women were also noticed by the people, especially in money matters, it showed a focus on making things equal for women and men. Overall, the growing number of publications underscores the rising recognition of the importance of financial literacy and gender equality, supported by factors like policies, awareness and research advancements.

Article Citations

Table 1 lists the 20 most cited research articles. The Publication was sorted based on the most cited articles, extracted through VOS viewer. The analysis of the authorship landscape in the presented dataset highlights Angela Lusardi's significant contributions to financial literacy, including the seminal work "Financial Literacy around the World: An Overview" (2011) and "Planning and Financial Literacy: How do women fare?" (2008). A notable theme in this collection is the exploration of gender differences in financial behaviour, with studies like "What Explains the Gender Gap in Financial Literacy?" by Fonseca (2012) and "Gender, Stock Market Participation and Financial Literacy" by Almenberg (2015) shedding light on the intricate relationship between gender and financial knowledge. The international perspective is evident, with researchers like Bucher-Koenen T. (Germany) and Klapper (worldwide) contributing to a global understanding of financial literacy and retirement planning. Furthermore, the dataset reflects an evolving research landscape, encompassing interdisciplinary approaches such as the impact of artificial intelligence on digital financial inclusion (Mhlanga, 2020) and a contemporary focus on financial resilience worldwide (Klapper , 2020). This analysis underscores the diversity and dynamism within the field of financial literacy research.

| Table 1 Most Cited Articles | |||||

| No. | Authors | Title | Year | Citations | DOI |

| 1 | Lusardi A. | Financial literacy around the world: An overview | 2011 | 751 | 10.1017/S1474747211000448 |

| 2 | Lusardi A. | Planning and financial literacy: How do women fare? | 2008 | 681 | 10.1257/aer.98.2.413 |

| 3 | Lusardi A. | Financial literacy and retirement planning in the United States | 2011 | 383 | 10.1017/S147474721100045X |

| 4 | Bucher-Koenen T. | Financial literacy and retirement planning in Germany | 2012 | 232 | 10.1017/S1474747211000485 |

| 5 | Fonseca R. | What Explains the Gender Gap in Financial Literacy? | 2012 | 226 | 10.1111/j.1745-6860.2011.01221.x |

| 6 | Bucher-Koenent T. | How Financially Literate Are Women? An Overview and New Insights | 2011 | 198 | 10.1111/joca.12121 |

| 7 | Farrell L. | The significance of financial self-efficacy in explaining women's personal finance behaviour | 2016 | 194 | 10.1016/j.joep.2015.07.001 |

| 8 | Swamy V. | Financial Inclusion, Gender Dimension, and Economic Impact on Poor Households | 2014 | 194 | 10.1016/j.worlddev.2013.10.019 |

| 9 | Almenberg J. | Gender, stock market participation and financial literacy | 2015 | 190 | 10.1016/j.econlet.2015.10.009 |

| 10 | Hassan Al-Tamimi H.A. | Financial literacy and investment decisions of UAE investors | 2020 | 153 | 10.1108/152656940911001402 |

| 11 | Klapper L. | Financial literacy and financial resilience: Evidence from around the world | 2020 | 146 | 10.1016/j.fima.12283 |

| 12 | Mhlanga D. | Industry 4.0 in finance: the impact of artificial intelligence (AI) on digital financial inclusion | 2020 | 145 | 10.3390/ijfs8030045 |

| 13 | Ghosh S. | What Constrains Financial Inclusion for Women? | 2017 | 140 | 10.1016/j.worlddev.2016.11.011 |

| 14 | Bannier C.E. | Gender differences in financial risk taking: The role of financial literacy and risk tolerance | 2016 | 136 | 10.1017/S1474747216000533 |

| 15 | Sekita S. | Financial literacy and retirement planning in Japan | 2016 | 133 | 10.1017/S1474747212000527 |

| 16 | Lusardi A. | Financial literacy and financial sophistication in the older population | 2013 | 130 | 10.1017/S1474747214000031 |

| 17 | Almenberg J. | Financial Literacy and Entrepreneurship in Sweden | 2017 | 129 | 10.1017/S1474747214000497 |

| 18 | Agarwalla S.K. | Financial Literacy among Working Young in Urban | 2016 | 127 | 10.1016/j.worlddev.2014.10.004 |

| 19 | Boisclair D. | Financial literacy and retirement planning in Canada | 2017 | 124 | 10.1017/S1474747215000311 |

| 20 | Rai K. | Association of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modelling Approach | 2019 | 88 | 10.1177/23197124519828651 |

Journal Analysis

Using VOS Viewer, we compiled a list of journals that feature articles on women’s financial literacy, employing a threshold limit of 5 published articles for shortlisting sources. Out of the 348 sources initially considered, 18 met the specified criteria. Presents sources that publish articles related to women’s financial literacy. Notably, the Journal of Financial Counselling and Planning emerged as the most frequent publisher, with a total of 13 articles. Following closely are Cogent Economics and Finance, and Sustainability (Switzerland). However, upon closer analysis, it was revealed that the Journal of Financial Counselling and Planning, despite its high publication frequency, is not the most cited. Surprisingly, the most cited journal is the Journal of Pension Economics and Financial, boasting a total citation count of 1855. Consequently, the Journal of Pension Economics and Financial stands out as the most influential source in the realm of women’s financial literacy.

Country Analysis

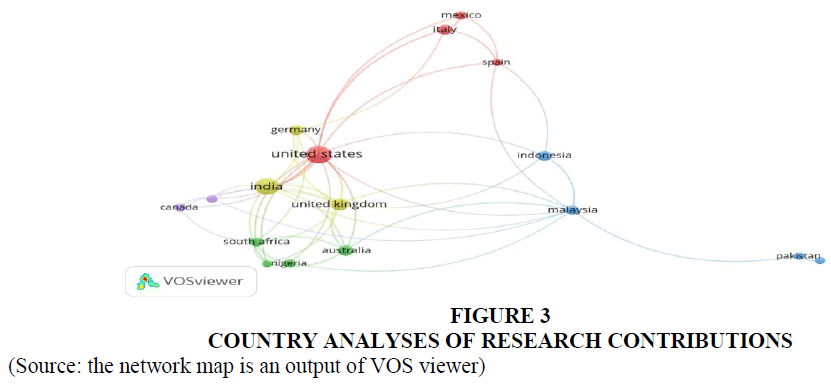

The research on women’s financial literacy has garnered attention from around the world, involving contributors from 17 different countries. In Figure 3, when we look at where the authors come from, the United States stands out, having produced 135 documents with a remarkable 4781 citations, showcasing its significant impact on global research. India closely follows, demonstrating a substantial research output of 110 documents and 1252 citations, highlighting its influence in the academic sphere. The United Kingdom also plays a solid role, contributing 46 documents and 419 citations. Australia takes a more focused approach, with 30 documents and 454 citations. In terms of collaboration, the United States and the United Kingdom emerge as central figures, being at the core of the collaborative network with strong connections to many other countries. This analysis gives us a comprehensive picture of how research efforts are distributed globally, identifying key contributors and illustrating how they collaborate in advancing knowledge on the chosen research topic.

Figure 3 Country Analyses of Research Contributions

(Source: the network map is an output of VOS viewer)

Co-Occurrence (Keywords)

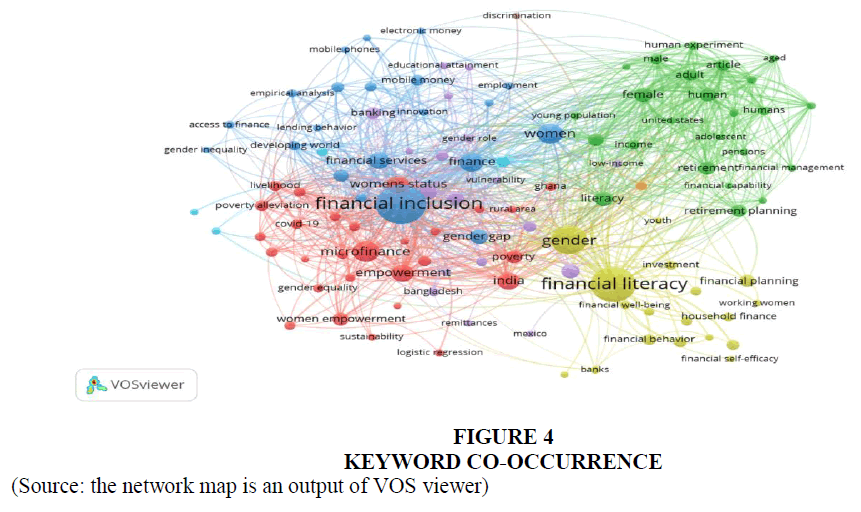

Utilizing VOS Viewer, we conducted a comprehensive analysis of 573 studies on women's financial literacy, employing keyword co-occurrence networks to extract insights into the interconnected themes within the articles. As emphasized(Oraee et al., 2017), author keywords serve as the nucleus of a study, reflecting the selected focus of the investigation. The strength and nature of relationships between different knowledge domains were elucidated through keyword co-occurrence analysis, revealing 115 keywords out of a total of 1795 that surpassed the established threshold.

Among the identified keywords, "financial inclusion" emerged as the most prevalent, occurring 171 times with total link strength of 472. Following closely, "Financial Literacy" appeared 136 times with link strength of 276. Other prominent keywords included "Gender" (occurrence=85, link strength=278), "women" (occurrence=46, link strength=178), "finance" (occurrence=38, link strength=193), and "financial services" (occurrence=30, link strength=163). Figure 4 visually represents the keyword network.

A more in-depth exploration of keyword co-occurrence using VOS Viewer unveiled eight clusters, each comprising 115 items, with a minimum occurrence threshold set at 5. Cluster 1, dominated by 28 items, and prominently featured the keyword "microfinance," while Cluster 2, with 24 items, highlights "literacy." Cluster 3, consisting of 21 items, highlighted themes related to financial inclusion, financial services, gender gap, and gender inequality. Clusters 4 and 5, each encompassing 18 items, focused on financial literacy, financial behaviours, financial safety, financial education, financial market, and financial system. Cluster 6, with 4 items, delved into the decision-making process. Lastly, Clusters 7 and 8, each with 1 item, addressed economic empowerment and discrimination, respectively. Also, the authors present the top 100 keywords.

Discussion and Conclusion

Discussion

The surge in scientific publications on women's financial literacy, particularly evident since 2013, reflects a growing interest in comprehending the intricate relationship between financial knowledge and gender equality. Noteworthy contributions from esteemed researchers, including Angela Lusardi, alongside the diverse range of topics explored by others such as Bucher-Koenen and Klapper, underscore the vibrant and evolving nature of this field of study.

The discrepancy observed between the frequency of publications and their corresponding impact, as gauged by journal citations, prompts a deeper exploration into the factors contributing to the enduring influence of certain journals. The unexpected prominence of the Journal of Pension Economics and Financial, despite a lower publication frequency, challenges conventional metrics and beckons for a nuanced understanding of what defines scholarly impact.

The collaborative efforts across 17 countries, with prominent contributions from the United States, India, the United Kingdom, and Australia, demonstrate a shared commitment to advancing knowledge on women's financial literacy at a global scale. This collaborative network not only enriches the diversity of perspectives but also highlights the interconnectedness of research efforts on a worldwide scale.

The analysis of keywords provides valuable insights into the prevalent themes within women's financial literacy research. Key concepts such as "financial inclusion," "financial literacy," and "gender" emerge as pivotal, offering a strategic framework for delineating future research trajectories. The identified keyword clusters, ranging from microfinance and literacy to financial behaviour and decision-making, paint a nuanced picture of the multifaceted dimensions encapsulated within this research domain.

Conclusions

In summary, this comprehensive study offers a panoramic view of the evolving landscape of research on women's financial literacy. The escalating number of publications signifies not just a quantitative increase but a qualitative deepening of our understanding of the role financial knowledge plays, particularly in the context of women and gender equality.

The incongruity between publication frequency and citation impact, notably exemplified by the unexpected prominence of the Journal of Pension Economics and Financial, urges a re-evaluation of traditional metrics of scholarly influence. The collaborative endeavours spanning 17 countries, with major contributions from the United States, India, the United Kingdom, and Australia, underscores the global relevance and collective dedication to advancing knowledge on women's financial literacy.

This study, with its identified trends, prominent authors, and thematic clusters, offers a rich foundation for researchers, policymakers, and educators. By delving deeper into the intricacies of women's financial literacy, we not only contribute to the current academic discourse but also pave the way for targeted interventions that align with broader objectives of financial inclusion, gender equality, and empowerment.

References

Ahmed, Z., Noreen, U., Ramakrishnan, S. A. L., & Abdullah, D. F. B. (2021). What explains the investment decision-making behaviour the role of financial literacy and financial risk tolerance. Afro-Asian Journal of Finance and Accounting, 11(1), 1-19.

Indexed at, Google Scholar, Cross Ref

Asuming, P. O., Osei-Agyei, L. G., & Mohammed, J. I. (2019). Financial Inclusion in Sub-Saharan Africa: Recent Trends and Determinants. Journal of African Business, 20(1), 112–134.

Indexed at, Google Scholar, Cross Ref

Bannier, C., & Schwarz, M. (2018). Gender- and education-related effects of financial literacy and confidence on financial wealth. Journal of Economic Psychology, 67(C), 66–86.

Indexed at, Google Scholar, Cross Ref

Burnham, J. F. (2006). Scopus database: A review. Biomedical Digital Libraries, 3(1), 1.

Indexed at, Google Scholar, Cross Ref

Cavalcante, W. Q. D. F., Coelho, A., & Bairrada, C. M. (2021). Sustainability and Tourism Marketing: A Bibliometric Analysis of Publications between 1997 and 2020 Using VOSviewer Software. Sustainability, 13(9), 4987.

Indexed at, Google Scholar, Cross Ref

Farrell, L., Fry, T. R. L., & Risse, L. (2016). The significance of financial self-efficacy in explaining women’s personal finance behaviour. Journal of Economic Psychology, 54, 85–99.

Indexed at, Google Scholar, Cross Ref

Fonseca, R., Mullen, K. J., Zamarro, G., & Zissimopoulos, J. (2012). What explains the gender gap in financial literacy? The role of household decision making. Journal of Consumer Affairs, 46(1), 90-106.

Indexed at, Google Scholar, Cross Ref

Goyal, K., & Kumar, S. (2021). Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies, 45(1), 80–105.

Indexed at, Google Scholar, Cross Ref

Jiménez-García, M., Ruiz-Chico, J., Peña-Sánchez, A. R., & López-Sánchez, J. A. (2020). A Bibliometric Analysis of Sports Tourism and Sustainability (2002–2019). Sustainability, 12(7), Article 7.

Indexed at, Google Scholar, Cross Ref

Karakurum-Ozdemir, K., Kokkizil, M., & Uysal, G. (2019). Financial Literacy in Developing Countries. Social Indicators Research: An International and Interdisciplinary Journal for Quality-of-Life Measurement, 143(1), 325–353.

Indexed at, Google Scholar, Cross Ref

Lone, U. M., & Bhat, S. A. (2022). Impact of financial literacy on financial well-being: A mediational role of financial self-efficacy. Journal of Financial Services Marketing, 1–16.

Indexed at, Google Scholar, Cross Ref

Lusardi, A. (2019). Financial literacy and the need for financial education: Evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1.

Indexed at, Google Scholar, Cross Ref

Paul, J., & Criado, A. R. (2020). The art of writing literature review: What do we know and what do we need to know? International Business Review, 29(4), 101717.

Indexed at, Google Scholar, Cross Ref

Podsakoff, P. M., MacKenzie, S. B., Bachrach, D. G., & Podsakoff, N. P. (2005). The influence of management journals in the 1980s and 1990s. Strategic Management Journal, 26(5), 473–488.

Preston, A., Qiu, L., & Wright, R. E. (2023). Understanding the gender gap in financial literacy: The role of culture. Journal of Consumer Affairs, joca.12517.

Indexed at, Google Scholar, Cross Ref

Rink, U., Walle, Y. M., & Klasen, S. (2021). The financial literacy gender gap and the role of culture. The Quarterly Review of Economics and Finance, 80(C), 117–134.

Indexed at, Google Scholar, Cross Ref

Tyagi R., Mohammed S., Vishwakarma S. and Paul A. (2023). Development of Training Need Analysis Scale for the Utility Sector. Water and Energy International. 65r (10):43-50.

Vallaster, C., Kraus, S., Merigó Lindahl, J. M., & Nielsen, A. (2019). Ethics and entrepreneurship: A bibliometric study and literature review. Journal of Business Research, 99, 226–237.

Indexed at, Google Scholar, Cross Ref

Received: 26-Jan-2024, Manuscript No. ASMJ-23-14790; Editor assigned: 29-Jan-2024, PreQC No. ASMJ-23-14790(PQ); Reviewed: 15- Feb-2024, QC No. ASMJ-23-14790; Revised: 20-Feb-2024, Manuscript No. ASMJ-23-14790(R); Published: 28-Aug-2024