Research Article: 2022 Vol: 25 Issue: 4

Without good corporate governance, corporate social responsibility has been implementing: evidence from state owned enterprises in Indonesia

Nanu Hasanuh, Universitas Singaperbangsa Karawang

Sri Suartini, Universitas Singaperbangsa Karawang

Harpa Sugiharti, Universitas Pendidikan Indonesia

Aditya Kristamtomo Putra R, Universitas Bina Nusantara

Citation Information: Hasanuh, N., Suartini, S., Sugiharti, H., & Putra, A.R.K. (2022). Without good corporate governance, corporate social responsibility has been implementing: evidence from state owned enterprises in Indonesia.Journal of Management Information and Decision Sciences, 25(4), 1-12.

Abstract

There are many studies on Government Ownership, Good Corporate Governance (GCG) and their influence on Corporate Social Responsibility (CSR) with varied and different results. It allows researchers to re-analyze the effect of Government Ownership and GCG on CSR. The GCG elements used in this study consisted of the size of the board of directors, the size of the board of commissioners, the proportion of independent commissioners, and the audit committee. The population studied were state-owned companies listed on the Indonesia Stock Exchange with a sample of 10 companies and the data collection period from 2011-2020, so that the observation data obtained were 100. To test the hypothesis using multiple regression tests. The results of the study showed that Government Ownership, Size of the Board of Directors, Size of the Board of Commissioners, Proportion of Independent Commissioners and the Audit Committee had no effect. The value of the coefficient of determination of this research model showed that Corporate Social Responsibility (CSR) in government-owned companies was influenced by the variables studied in this study amounting to 14.6%, and the rest by other variables outside the study.

Keywords

Corporate Social Responsibility (CSR); Good Corporate Governance (GCG); Government Ownership.

Introduction

Every organization established and operates certainly has an impact, both social, economic and even environmental. In order to reduce the impact, the government obliges every company to carry out the social responsibility, especially social and environmental responsibilities. This responsibility is regulated in Law no. 40 of 2007 concerning limited liability companies. Companies that do not carry out their social responsibilities will be subjected to serious sanctions.

Controlling the implementation of corporate social responsibility by the government is getting tighter, especially since the digitalization era makes it easier to oversee the implementation of CSR. In this era, companies are forced to implement CSR transparently.

In (Mutmainah, 2020), companies are required to report their CSR activities by providing information on CSR activities and costs. Financial information voluntary disclosure contains CSR as a form of corporate responsibility to the environment.

The implementation of CSR must be carried out by government-owned companies or State-Owned Enterprises (BUMN). State-owned companies were established with the main aim of providing a prosperous impact for the people and the surrounding community. Of course, the implementation of CSR for state-owned companies is a reinforcement and guide in achieving the goals of government-owned companies. For government-owned companies, of course, they must become models in supporting CSR programs in Indonesia, especially the implementation of CSR for state-owned companies that is regulated in the Regulation of the Minister of State for State-Owned Enterprises No. Per-05/MBU/2007 concerning partnership program between BUMN and small businesses and environmental development programs (Chen, 2019).

Differences in interests related to CSR occur between company owners and management. The owner of the company certainly expects a high return on his investment. Management is required to fulfill the wishes of the owners of capital. For the management of state-owned companies, there are three things that must be fulfilled, namely Law no. 40 of 2007 and Regulation of the Minister of State-Owned Enterprises No. PER-08/MBU/2013 Year 2013 which strengthens the Ministerial Regulation No. Per-05/MBU/2007. Fulfillment of the prosperity of the owner of the company and Law NO. 40 of 2007 often makes management anticipate its CSR activities. The greater the ownership of the company, the greater the task to provide prosperity to the owner. The greater the government ownership in state-owned companies, the greater the responsibility for achieving profits. The greater the profit, the more significant the implementation of CSR for the community in the company's environment. The question is whether state-owned companies always implement CSR if they make a profit. It should be based on Ministerial regulation no. Per-05/MBU/2007, every state-owned company regardless of profit still carries out CSR.

Good Corporate Governance (GCG) is a tool to achieve a balance between company owners and management in Breliastiti et al. (2020), The Indonesian Institute for Corporate Governance (IICG) revealed that GCG is a system used by company organs to encourage professional, transparent, effective and efficient company management so as to increase the company’s added value. Elements of the company that are very important for the implementation of GCG in the company include; Board of Directors, Board of Commissioners, Independent Commissioners, and the Audit Committee.

Implementation of GCG directly affects the CSR practices (Althoff, 2021). The implementation of CSR is certainly caused by encouragement of GCG implementation. In state-owned companies, it is still necessary to implement GCG to seriously encourage the implementation of CSR. Even though it is clear that state-owned companies are obliged to implement CSR in the ministerial regulation mentioned above. With the laws and regulations of the Minister, absolutely without GCG practices that CSR must be implemented.

There are many studies related to the effect of government ownership and Good Corporate Governance (GCG) on Corporate Social Responsibility (CSR), but the results are still inconsistent. Research conducted by (Ramadhani & Maresti, 2021; Rizky, & Afri Yuyetta, 2014; Winalza & Alfarisi, 2021) concludes that government ownership had an effect on CSR. On the other hand, (Farhan & Freihat, 2021) stated in a different study that government ownership had no effect on CSR.

According to Ramadhani and Maresti (2021); Setiawan et al. (2018); Nadhiyah & Fitria (2021), the size of the board of directors affected CSR disclosure, the opposite result is obtained in research (Susilowati et al., 2018) that the size of the board of directors had no effect on CSR. Another element of GCG, the size of the board of commissioners and their effect on CSR, researched by Agustia (2013); Chen (2019); Mayliza & Yusnelly (2021); Niron (2018); and Ramdhaningsih (2013) showed that the size of the board of commissioners had an effect on towards CSR, but the opposite results are from research results (Farhan & Freihat, 2021; Ramdhaningsih, 2013). Research related to the proportion of independent commissioners and their effect on CSR was also conducted by (Mayliza & Yusnelly, 2021) and the result is that the proportion of independent commissioners has an effect on CSR. According to Ariani and Agustia (2020); Farhan and Freihat (2021); and Mutmainah (2020) that the proportion of independent commissioners had no effect on CSR. Likewise, research on the influence of the audit committee on CSR, the results of the research (Mutmainah, 2020; Niron, 2018) of the audit committee had an effect, but the research results (Mayliza & Yusnelly, 2021) of the audit committee had no effect on CSR.

Based on the background and inconsistent results of previous research, the researcher will re-examine government ownership, GCG and the effect on CSR implementation.

Literature Reviews

Agency Theory

The conflict of interest between the agent and the owner of the company is due to the opportunity for the agent to prioritize the interest. The difference of the interest between them also allows the information asymmetry. Information asymmetry allows owners not to get complete financial information from management/agents. So that management is not more concerned with the interests, a clear employment contract is needed. Therefore, the agent needs to get a contract from the owner to contribute to the welfare of the owner (Liang et al., 2019). In order to achieve the goal, GCG is implemented, it means that the agency perspective is used as a reference for implementing GCG in order to achieve company goals.

Legitimacy Theory

Based on Law no. 40 of 2007 and Ministerial Regulation No. Per-05/MBU/2007, every government-owned company is required to implement CSR. CSR n is the responsibility of state companies to provide prosperity to the community. Companies must be able to influence the economic and social life of the community. The purpose of establishing a state-owned company with the values that exist in society is an effort to fulfill the mandate in the Law and Ministerial Regulation. To make the company accepted by the community the company must carry out the operations without disturbing and disturbing the surrounding community (Olateju et al., 2021). The perception alignment of the company with overall activities with the systems, norms and values in society is important so that community legitimacy towards the company becomes the main capital. Legitimacy as a social value related to business activities that are accepted according to the norms and larger social system.

Corporate Social Responsibility

CSR is carried out by companies as an implementation of agency theory. This theory is to limit the opportunist behavior of management within the company. Restrictions are made so that the interests of management and owners run in harmony, so that the impact can be felt by the community around the company. The community will always support the company to continue operating. The community provides legitimacy for the running of the company in a sustainable manner.

Concerning the implementation of CSR is increasingly being carried out by various business entities, including in Indonesia. CSR is the company commitment to the economic development of the surrounding community to improve the quality of life of the surrounding community. This concern is especially intense for state-owned companies. It is in line with the purpose of establishing a state company, namely providing services and prosperity for the community. To strengthen this goal, it is for this reason that the government issued Law no. 40 of 2007. Providing public services and prosperity is not only the obligation of the government but also state-owned companies.

Agustia (2013) stated that companies that implement CSR well will get several benefits, including; will provide a good image for the company, grow a sense of pride, get convenience from the government, manage the risks of the company's relationship with the community, assist the government in social missions, and create business continuity

Government Ownership

Ab Razak et al. (2008) state that Government ownership is a controlling mechanism for disciplining management behavior to align management personal interests with company goals. In line with Farhan & Freihat's (2021) concept, government share ownership in a company will encourage management to strictly adhere the corporate governance with real-time and active implementation. Government ownership is a control mechanism for management so that the implementation of governance is carried out properly, including the implementation of CSR. High government ownership will control the power of management so that the company is always subject to the government goal, namely the prosperity of the community. Thus, high government ownership will affect CSR activities in the company.

Good Corporate Governance

The demand for transparency and accountability in the implementation of management is a requirement. This phenomenon develops in such a way that all corporate organizations generate good profits, the higher the profit, the better the performance assessment of management. The owner of the company will increasingly believe in management, but behind all the profits that can be obtained there is also a personal management interest. In the process, there will be a difference of interest between the owner and management that results the conflict of interest.

To overcome differences in interests, it is necessary to implement GCG. It is in accordance with the statement of Breliastiti et al. (2020) GCG as an organizational mechanism that guides and directs the balance of interests between management and company owners. The implementation of GCG can reduce the concern of the company owner to the management in fulfilling their interests. Claessens & Yurtogle (2013) also said the same thing, namely if the company uses GCG voluntarily it will reduce the concerns of outside investors about the takeover of the company's role by management. GCG practices in companies as a form of management responsibility to owners (Asiah et al., 2020).

GCG mechanisms include the size of the board of directors, the size of the board of commissioners, the proportion of independent commissioners and the audit committee. The board of directors is a group of managers who determine the direction and implementation of the company by having full policy towards the company. Commissioner is a position created and appointed personally to oversee all company activities, especially policies made by the board of directors. Independent commissioners are members of the board of commissioners with no relation with the board of directors; owners are free from any business that affects their independence.

Hypothesis

H1: Kepemilikan Pemerintah berpengaruh terhadap Corporate Social Responsibility Disclosure.

H2: Ukuran Dewan Direksi berpengaruh terhadap Corporate Social Responsibility Disclosure.

H3: Ukuran Dewan Komisaris berpengaruh terhadap Corporate Social Responsibility Disclosure.

H4: Proporsi Komisaris Independent berpengaruh terhadap Corporate Social Responsibility Disclosure.

H5: Komite Audit berpengaruh terhadap Corporate Social Responsibility Disclosure.

Data and Methodology

This research approach is quantitative research. This research is based on secondary data obtained from the annual financial reports and CSR reports of companies, both through the Indonesia Stock Exchange website and the companies studied.

The population of this study is all state-owned enterprises (BUMN) listed on the Indonesia Stock Exchange. The sample is 10 (ten) state-owned companies listed on the IDX from 2011-2020. In determining the sample using the Purposive Sampling Technique that is a technique as the fundamental to certain conditions determined by the researcher.

Data analysis was carried out with the following steps; collecting data, grouping data according to each variable, tabulate data, present data per variable, perform calculations to answer the formulation of the problem and then test the hypothesis. The analysis in this study used descriptive statistical analysis, classical assumption test and hypothesis testing.

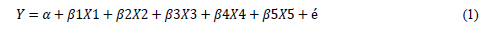

The research model used multiple regression models. This model aims to regress the independent variable to the dependent variable. The regression model can be seen as follows.

Where, Y = Corporate social responsibility; X1= Government ownership; X2= board of direction size; X3= Board of commissioners size; X4 = Proportion of independent commissioners; X5= Audit committee; α= Constant; β1,β2,β3,β4,β5= Regression coefficient; é= Error.

Operational Definition and Variable Measurement

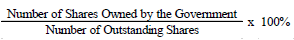

Government ownership

Government ownership is defined as the amount of ownership interest in a company. In this study, government ownership is based on the formula below.

Good corporate governance

Good Corporate Governance is based on the available mechanisms. The GCG mechanism in this study is based on four (4) proxies, namely the Size of the Board of Directors, Size of the Board of Commissioners, Proportion of Independent Commissioners, and the Audit Committee.

Board of directors’ size

Basically, the size of the board of directors is all members of the board of directors in the company determined. This study also applies the calculation of the board of directors with the total number of the board of directors with absolute numbers.

Number of Board of Directors (Absolute Number)

Board of commissioners’ size

The function of the board of commissioners is to maintain the board of directors in carrying out their duties. The number of commissioners is usually determined by the owners of the company at the general meeting of shareholders using the following formula;

Number of Board of Commissioners (Absolute Number)

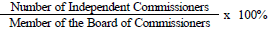

Proportion of independent commissioners

The variable proportion of independent commissioners is based on the number of commissioners from outside of the company compared to the total number of commissioners. This study used the formula for the proportion of independent commissioners with the following formula;

Audit committee

Companies that have entered the stock exchange are required to have an audit committee to carry out the audit function on their accounting. This study used a dummy variable, with the choice of value if there is an audit committee in the company, then it is rated as 1, on the contrary, companies without an audit committee were rated 0.

Dummy: 0 = Have not an Audit Committtee 1 = Have an Audit Committtee

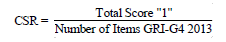

Corporate Social Responsibility Disclosures

The variable of CSR implementation is an assessment of the company activities that have complied with the provisions of the law and applicable regulations in providing the role in the social and environmental fields. In this study using the Global Reporting Initiative Index. Companies that announce their CSR are given value of 1, and otherwise are given 0. CSR formula is as follow:

Results and Analysis

Classical Assumption Test

Based on Table 1 & 2, it can be seen the feasibility of the data can be processed in the next test by using the regression test on the model. Table 1. shows the normality of the data distribution in which the One-Sample Kolmogorov-Smirnov Test had a significance level of 0.713. The significance value of 0.713 showed a value greater than 0.05, it can be interpreted that the data obtained for this study was normally distributed. The feasible data to be processed in the research was normal data.

| Table 1 One-Sample Kolmogorov-Smirnov Test | ||

|---|---|---|

| Residual_1 | ||

| N | 100 | |

| Normal Parameters | Mean | 0 |

| Std. Deviation | 0.075897 | |

| Most Extreme Differences | Absolute | 0.07 |

| Positive | 0.07 | |

| Negative | -0.055 | |

| Kolmogorov-Smirnov Z | 0.699 | |

| A symp. Sig. (2-tailed) | 0.713 | |

Another feasibility test is the multicollinearity test. If the condition of the data does not occur multicolline, then the data is feasible to be further processed in the regression test. The multicollinearity test in this study used the VIF value, the data requirement is not multicollinear if the VIF value is between the coefficient values of 1-10. Table 2, showed that all variables in the study had a VIF coefficient value that was between 1-10, it means that the data in the study we’re not multicollinear between the independent variables.

| Table 2 Coefficient Of Vif | ||

|---|---|---|

| Model | Collinearity Statistics | |

| Tolerance | VIF | |

| (Constant) | ||

| Government ownership | 0.78 | 1.281 |

| Director Board | 0.11 | 9.113 |

| Commissioner Board | 0.176 | 5.668 |

| Independent Committee | 0.155 | 6.471 |

| Audit Committee | 0.593 | 1.685 |

Descriptive Statistics

Table 3 showed the characteristics of the variables studied, so that it is possible to provide reinforcement to the research results. The government share ownership in all state-owned companies is more than 64% owned by the government. The control over SOEs is very large, it is possible for the government to take certain policies, especially in the implementation of CSR.

| Table 3 Descriptive Statistics | |||||

|---|---|---|---|---|---|

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Government ownership | 100 | 0.487 | 0.967 | 0.64253 | 0.128076 |

| Director Board | 100 | 3 | 12 | 6.96 | 2.636 |

| Commissioner Board | 100 | 3 | 10 | 6.02 | 2.04 |

| Independent Committee | 100 | 0.043 | 1 | 0.62313 | 0.14791 |

| Audit Committee | 100 | 0 | 1 | 0.44 | 0.499 |

| CSR | 100 | 0.31 | 0.67 | 0.4571 | 0.079051 |

All BUMN companies have a minimum of 3 directors and a maximum of 12 people. Only two companies have a small number of boards of directors, the rest have boards of directors with more than 3 boards of directors. The more the board of directors the better in the monitoring process so that the implementation of CSR will be carried out more.

The board of commissioners in this study with three minimum members and a maximum of 10 members. The board of commissioners functions as a supervisor for the activities of the board of directors, the more the number of supervision and control will be carried out properly. In this study, there are only two companies that use 3 commissioners, the rest BUMN companies use more boards of commissioners.

The number of commissioners in BUMN companies is in average of 62.3%, it means that the number of commissioners is dominated by independent commissioners. It showed that monitoring of all management activities of state-owned companies will be increasingly stringent. Implementation of the policies that have been set will be carried out better. All companies that already have an audit committee. It showed that the compliance of state-owned companies to IDX rules which require companies to hold audit committees in their business activities. Meanwhile, on average, state-owned companies have implemented CSR with an average implementation value of 45.7%.

Hypothesis Testing

The F Anova test aims to the simultaneous effect of the independent variables in this research model to the dependent variable. The results of this study, in Table 4, showed that the F value was 1.595 and the result had significance value of 0.169. The standard value of significance was 0.05 or 5%, then H0 can be accepted with evidenced by the results of the calculation of significance, 0.169>0.05. This study showed that Government Ownership, Board of Directors Size, Board of Commissioners Size, Proportion of Independent Commissioners and Audit Committees simultaneously had no effect on the implementation of CSR in state-owned companies.

| Table 4 Simultant Test (Anova) | ||||||

|---|---|---|---|---|---|---|

| Model | Sum of Squares | df | Mean square | F | Sig | |

| 1 | Regression | 0.048 | 5 | 0.01 | 1.595 | .169b |

| Residual | 0.57 | 94 | 0.006 | |||

| Total | 0.619 | 99 | ||||

Table 5 showed adjusted R square of 0.146 or 14.6%, it means that 14.6% of CSR implementation in state-owned companies is influenced by this research model that was quite small. The purpose of this study was to examine the effect of Government Ownership, Size of the Board of Directors, Size of the Board of Commissioners, Proportion of Independent Commissioners and the Audit Committee on the implementation of CSR, based on the results of the F Anova test no effect, then the Partial Test did not need to be done.

| Table 5 Determinant Test | |||||

|---|---|---|---|---|---|

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | .435a | 0.189 | 0.146 | 0.07304 | 1.785 |

Discussion

Based on Table 4 the results of the ANOVA test of the independent variables simultaneously had no effect on the dependent variable, so there is no need to test the partial test or t test. Interpretation of research results is based on facts and research results.

CSR Implementation

The average company that becomes the object in this research was ten state-owned companies that have implemented CSR, according to the results of the GRI standard calculation that showed a minimum index value of 0.310 and a maximum index value of 0.670. This showed that state-owned companies had actually implemented CSR as much as possible. For state-owned companies CSR implementation is a must base on Law No. 40 of 2007 and Regulation of the Minister of State-Owned Enterprises No. PER-08/MBU/2013 of 2013 which strengthens Ministerial Regulation No. Per-05/ MBU/2007. The government as the owner issues a law for its strategic interests and a Ministerial Regulation that technically regulates the implementation of CSR in state-owned companies. With the aforementioned Law and Ministerial Regulation, it is clear and authoritative that state-owned companies are obliged to implement CSR for prosperity of the community around the company.

The Effect of Government Ownership on CSR Implementation

The test results showed that the variable of government ownership had no effect on the level of CSR implementation. The results of this study were in accordance with the research (Farhan & Freihat, 2021) that states government ownership had no effect on CSR disclosure. Through its share ownership, the government has the right to appoint management. The government goal is to improve the social welfare of the community, so the government has strong influence through the political power to appoint management to implement CSR in a sustainable manner based on the laws and regulations made by the government. With the laws and regulations of the Minister, the management of state-owned companies that is obliged to implement CSR regardless of how big the government's share ownership is in the company.

The Effect of Board of Directors Size on CSR Implementation

The test results revealed that the size of the board of directors had no effect on the implementation of CSR. The results of this study did not prove the hypothesis that was built, that the size of the board of directors affects the implementation of CSR. In theory, an increase in the board of directors will increase CSR, and vice versa. However, based on the results of this study, it showed something different, an increase or decrease in the number of the board of directors did not affect the level of value of CSR implementation.

This research is in line with (Susilowati et al., 2018) stated that the size of the board of directors did not affect the amount of CSR disclosure. The power of influence of laws and regulations of the Minister of SOEs was greater than the size of the board of directors.

The Influence of Board of Commissioners Size on CSR Implementation

The results in this study showed that the size of the commissioners board did not affect the implementation of CSR. Meanwhile, in the hypothesis it is said that the size of the board of commissioners affects the implementation of CSR. The results of this study prove the fact that the board of commissioners does not affect the level of CSR implementation in state-owned companies.

This research is in line with Farhan and Freihat (2021); and Ramdhaningsih (2013) that the research results showed that the size of the board of commissioners had no effect on the implementation of CSR. These results showed that there wasno intervention by the board of commissioners on management social activities. There is a tendency for the board of commissioners to supervise the company's financial performance. CSR policy is a strategic management step that is guided by Law no. 40 of 2007 and Regulation of the Minister of State-Owned Enterprises No. PER-08/MBU/2013 Year 2013 that strengthens the Ministerial Regulation No. Per-05/MBU/2007.

The Influence of the Proportion of Independent Commissioners on CSR Implementation

Based on the results of the study, the proportion of independent commissioners had no effect on the implementation of CSR. This result rejected the hypothesis that the proportion of independent commissioners has an effect on CSR implementation. This study found the fact that the existence of independent commissioners in BUMN companies did not encourage companies to carry out social activities in the form of CSR in real terms. The results of this study are in accordance with research conducted by Ariani & Agustia (2020); Farhan & Freihat (2021); and Mutmainah (2020). Their research results revealed that the existence of independent commissioners did not affect the level of CSR implementation in the company. The existence of independent commissioners in state-owned companies was not effective, considering that they were appointed by people with political interests.

Influence of the Audit Committee on CSR Implementation

Based on the results, the audit committee had no effect on the implementation of CSR in state-owned companies. These results rejected the hypothesis built in this study. In the hypothesis stated that the audit committee had no effect on the implementation of CSR. The fact is found that the audit committee is more focused on audit supervision and the company's financial performance.

This research supports Mayliza & Yusnelly (2021) study that resulted in the audit committee research did not affect the CSR implementation in the company. The task of the audit committee is to help the board of commissioners control the management of the company. The more audit committees, the more influence the CSR implementation will be. The results of this study rresisted this theory.

Conclusion

The results of the study using multiple regression statistical analysis, government ownership variables, the size of the board of directors, the size of the board of commissioners, the proportion of independent commissioners and the audit committee had no effect on the implementation of CSR in state-owned companies. The variables studied were only able to explain the relationship in the regression of 14.6%, while 86.6% were other variables outside the study.

Suggestions

The results of the study revealed the fact that the variables of government share ownership, the size of the board of directors, the size of the board of commissioners, the proportion of independent commissioners and the audit committee had no effect on the practice of CSR implementation. However, in this study, the implementation of CSR was carried out well by state-owned companies. This implementation is about the implementation of Law no. 40 of 2007 and Regulation of the Minister of State-Owned Enterprises No. PER-08/MBU/2013 Year 2013 that strengthens the Ministerial Regulation No. Per-05/MBU/2007. The company in carrying out the social activities is more concerned with laws and government regulations, not more than the implementation of the Good Corporate Governance Mechanism that consists the size of the board of directors, the size of the commissioners, the proportion of independent commissioners and the audit committee.

To make better implementation of CSR it is recommended that state-owned companies should maximize the role of the GCG mechanism and not rely on laws and government regulations.

References

Ab Razak, N.H., Ahmad, R., & Aliahmed, H.J. (2008). Government ownership and performance: An analysis of listed companies in Malaysia. Corporate ownership and control, 6(2), 434-442.

Agustia, D. (2013). Pengaruh Struktur Kepemilikan Dan Dewan Komisaris Terhadap Corporate Social Responsibility Dan Reaksi Pasar. EKUITAS (Jurnal Ekonomi Dan Keuangan), 17(3):376-390.

Indexed at, Google Scholar, Cross Ref

Althoff, C. (2021). Corporate Social Responsibility as an Element of Good Corporate Governance - a Chronology of Its Historical and Contemporary Development. International Journal of Economics and Accounting, 10(1), 57-87.

Indexed at, Google Scholar, Cross Ref

Ariani, D.I.R., & Agustia, D. (2020). The Impacts of Good Corporate Governance on Corporate Performance with Corporate Social Responsibility Disclosure as The Intervening Variable. International Journal of Innovation, Creativity and Change, 11(9), 280–299.

Asiah, N., Haryanti, S., & Zulkarnain, Z. (2020). Penerapan Prinsip-Prinsip Good Corporate Governance pada Program Corporate Social Responsibility. Winter Journal: Imwi Student Research Journal 1(1), 9-21.

Breliastiti, R., Putri, S., & Valentina, S. (2020). Penerapan CGG dan dampaknya pada penerapan CSR (Perusahaan Pemenang IICG- ASEAN CG SCORECARD). Jurnal Akuntansi Bisnis, 13(2), 66–77.

Indexed at, Google Scholar, Cross Ref

Chen, M. (2019). Pengaruh Ukuran Dewan Komisaris Dan Kepemilikan Asing Terhadap Luas Pengungkapan Csr. EL Muhasaba Jurnal Akuntansi, 10(2), 141.

Indexed at, Google Scholar, Cross Ref

Claessens, S., & Yurtoglu, B.B. (2013). Corporate governance in emerging markets: A survey. Emerging Markets Review, 15, 1–33.

Indexed at, Google Scholar, Cross Ref

Farhan, A., & Freihat, A.R.F. (2021). The Impact of Government Ownership and Corporate Governance on the Corporate Social Responsibility: Evidence from UAE. Journal of Asian Finance, Economics and Business, 8(1), 851–861.

Indexed at, Google Scholar, Cross Ref

Liang, X., Shen, G.Q., & Guo, L. (2019). Optimizing Incentive Policy of Energy-Efficiency Retrofit in Public Buildings: A Principal-Agent Model. Sustainability (Switzerland), 11(12), 17–20.

Indexed at, Google Scholar, Cross Ref

Mayliza, R., & Yusnelly, A. (2021). Pengaruh Good Corporate Governance Terhadap Islamic Social Responsibility Pada Bank Umum Syariah Di Indonesia. Jurnal Tabarru’: Islamic Banking and Finance, 4(2), 369-379.

Indexed at, Google Scholar, Cross Ref

Mutmainah, I. (2020). Apakah Classification Shifting Memoderasi Pengaruh Good Corporate Governance terhadap Corporate Social Responsibility Pada Perusahaan Manufaktur yang Terdaftar di BEI? Jurnal Akuntansi, Ekonomi Dan Manajemen Bisnis, 8(2), 141–149.

Indexed at, Google Scholar, Cross Ref

Nadhiyah, P., & Fitria, A. (2021). Pengaruh good corporate governance, profitabilitas, dan leverage terhadap nilai perusahaan. Jurnal Ilmu Dan Riset Akuntansi, 10(1), 131-138.

Niron, B.E. (2018). Good Corporate Governance on Corporate Social Responsibility with Profitability , Size and Leverage as Moderating Variables. Advances in Social Science, Education and Humanities Research, 125(Icigr 2017), 279–282.

Indexed at, Google Scholar, Cross Ref

Olateju, D.J., Olateju, O.A., Adeoye, S.V., & Ilyas, I.S. (2021). A Critical Review of The Application of The Legitimacy Theory to Corporate Social Responsibility. International Journal of Managerial Studies and Research, 9(3), 1–6.

Indexed at, Google Scholar, Cross Ref

Ramadhani, R., & Maresti, D. (2021). Pengaruh Leverage dan Ukuran Dewan Direksi Terhadap Pengungkapan CSR. Ekonomis: Journal of Economics and Business, 5(1), 78.

Indexed at, Google Scholar, Cross Ref

Ramdhaningsih, A. (2013). Pengaruh Indikator Good Corporate Governance Dan Profitabilitas Pada Pengungkapan Corporate Social Responsibility. E-Jurnal Akuntansi, 3(2), 368–386.

Rizky, Z., & Afri Yuyetta, E.N. (2014). Pengaruh Kepemilikan Manajerial, Kepemilikan Pemerintah, Konsentrasi Kepemilikan, Ukuran Pemerintah, Daya Saing Industri, serta Profitabilitas Perusahaan terhadap Luas Pengungkapan Corporate Social Responsibility. Diponegoro Journal of Accounting, 4(1),262-271.

Setiawan, D., Hapsari, R.T., & Wibawa, A. (2018). Dampak Karakteristik Dewan Direksi Terhadap Pengungkapan Corporate Social Responsibility Pada Perusahaan Pertambangan Di Indonesia. Mix: Jurnal Ilmiah Manajemen, 8(1), 1-15.

Indexed at, Google Scholar, Cross Ref

Susilowati, K.D.S., Candrawati, T., & Afandi, A. (2018). Analisis Pengaruh Ukuran Perusahaan, Profitabilitas Dan Ukuran Dewan Direksi Terhadap Pengungkapan Tanggung Jawab Sosial Perusahaan (Studi Kasus Pada Perusahaan Makanan Dan Minuman Di Indonesia). Jurnal Ilmu Manajemen, 4(2), 62–82.

Indexed at, Google Scholar, Cross Ref

Winalza, R., & Alfarisi, M.F. (2021). Pengaruh Karakteristik Perusahaan Terhadap Csr Disclosure the Influence of Corporate Characteristics on the Disclosure. Menara Ilmu, 15(1), 75–85.

Received: 12-Apr-2022, Manuscript No. JMIDS-22-11741; Editor assigned: 15-Apr-2022, PreQC No. JMIDS-22-11741(PQ); Reviewed: 23-Apr-2022, QC No. JMIDS-22-11741; Revised: 26-Apr-2022, Manuscript No. JMIDS-22-11741(R); Published: 30-Apr-2022