Research Article: 2021 Vol: 25 Issue: 3

Will Inward Foreign Direct Investment through Automatic Route in Manufacturing Sector Bring an Instrumental Change in Indias Growth?

Piyali Roy Chowdhury, VIT Business School

A Anuradha, Associate Professor, VIT Business School

Abstract

Intensity to capital accumulation, size of the market and scale of the production generally serve as the key determinants of FDI in any country. It is also discovered that the imported capital goods and intermediate products work as catalysts to augment the production in the manufacturing industries. This study aims to find out the relation between Foreign Direct Investment (FDI) and manufacturing sector in India. It analyses data from 1996 to 2020. It extracts a long run cointegration between the two variables. Analysing the short run scenario, the article considers error correction model to define the short run shocks and its effectiveness on these variables. There exist thirty seven percent chances to move from short run disequilibrium to long run stable equilibrium. Also, the error correction term proves long run causality from FDI to manufacturing sector. The cumulative sum and cumulative sum square test prove the economic model to be stable. Finally, the study suggests the Indian policymakers to relax FDI inflows norms and enable an automatic route up to 74% towards all the manufacturing sectors, as done for defence manufacturing in order to augment the overall development of Indian economy.

Keywords

Foreign Direct Investment (FDI), Manufacturing Sector, ARDL, Granger Causality, Automatic route, India.

Introduction

The industrialization of Indian economy indicated a positive environment for foreign investors since 1991. Specifically, construction and power sectors were highlighted during the expansion process. Limits of investment were increased to 51 percent and more for the prioritized manufacturing industries in India. Beginning of 2000 faced a sharp hike in the valuation of foreign investment as overseas corporate bodies could invest further here. Foreign Direct Investment (FDI) inflows and manufacturing sector outputs were mutually supporting each other throughout the period of 1990.

Cross border learning through enhanced communication and capability to imitate new technology will bring forward the specific development in the manufacturing sector in India.

The relaxation in FDI policies also facilitates better production environment in Indian economy as proved by sufficient literature reviews. Ease of entry, threats for imports, and encouragement towards manufacturing production will boost the productivity curve of Indian manufacturing sector. It will be followed by decrease in average cost structure for the same. Keeping these important areas in consideration, the article concentrates on finding a relationship between FDI and manufacturing sector in India.

The emergence of service sector has been working as a driver for growth for the developing economies for long period. Employment generation is also an outcome of the enhanced productivity created by service sector. Next to service sector, the manufacturing sector played a key role in determining the growth in overall output of any economy. A substantial amount of foreign funds is highly required to generate a considerable level of manufacturing productivity growth. Both developing and developed economies are beneficial of foreign funds in generating higher proportion of output from manufacturing sector that contributes to Gross Domestic Product (GDP) in a specified economy. The global trade due to manufacturing sector’s output growth plays a crucial role in shaping the future of economic development giving way for the current study.

The article is spanned between the subsections as follows: Section two explains review of the literature. Section three describes the methods of data collection and analysis of the data. Section four illustrates findings. Section five enters the discussion. Section six provides the conclusion.

Literature Review

The research and development related to productivity growth especially in manufacturing is crucial as it creates the innovation in production. In this respect, the foreign funds play an important part to augment the growth in innovation as many developing economies are not making enough domestic investment to spare for the development of the same. Cross border technology transfer can only happen through conduit foreign inflow of funds in the host country. The managerial skills, the technological know-how, the production structure – are the benefits that can be reaped through FDI. The inflow also depends on the political structure of an economy, though. It is noticed that relaxation in FDI policies brings upliftment in the status of the host country along with its export facilities. Hence this article concentrates on finding the association between FDI and production sector, that is, the manufacturing sector in India and also tries to find out the long run and short run relation between them. It looks into the current Indian scenario and finds out the trend existing between these two variables, to suggest some policy measures for the economic development in India.

Anwar and Sun, (2018) investigated on how the foreign firms would hamper the export functions of the host country in manufacturing sector. Ye, et al (2019) analysed how foreign firms would create heterogeneity in the manufacturing sector and add agglomeration in manufacturing sector. Cazzavillan & Olszewski, (2012) analysed the financial and non-financial contributions of foreign firms in the host country’s manufacturing sector. Sung, et al (2018) studied how FDI would affect Carbon emission level of the host country due to production. Alecsandru & Raluca, (2015) explored the effectiveness of FDI in manufacturing sector growth in the economies. Raluca & Alecsandru, (2013) explained the low labour cost and ease of raw material availability in Romania after relaxation of FDI inflow in that economy. Fernandes &Paunov, (2012) investigated the influence of FDI on the manufacturing production in Chile. The article analysed the importance of FDI inflow in determining the effective level of output here. Bandyopadhyay and Acharyya,(2006) analysed the liberalisation in input and product quality improvement with innovativeness in the developing economies with the aid of FDI. Aditya and Acharyya ,(2015) explored the effect of reduction in tariff and export diversification on the effectiveness of output production in manufacturing sector with the aid of foreign firms in the developing economies. Bajgar & Javorcik, (2013) analysed the importance of FDI in manufacturing sector’s growth in the developing economies in the world. Zhu & Fu, (2013) explained how capital deepening would be most important for enhancing the output growth in economies through FDI inflow. Kalirajan & Bhide, (2004) investigated on the growth in manufacturing sector through input rather than efficiency. Banga (2006) argued that FDI might lead to diversification in export in economies. Wang, (2009) investigated on heterogeneous level of FDI inflow that might hamper the growth rate in the manufacturing industry. Khachoo & Sharma, (2017) explained the importance of FDI in bringing the effectiveness in research and development outcome, in manufacturing sector. Doytch & Uctum, (2011) investigated the influence of FDI on the growth of manufacturing sector’s output. Nefussi & Schwellnus, (2010) analysed the factors affecting FDI in its locational perspective. Pazienza (2019) found the influence of FDI on manufacturing sector’s output in the developing economies. Guruswamy et al. (2005) analysed the importance of FDI in different sectors of the economies. Balasubramanyam & Forsans, (2010) examined the opening up of the Indian firms to its international level and its effect on output of manufacturing sector. Reganati & Sica, (2007) analysed the benefits of the host countries in taking the aid from Multinational Enterprises. Singh, (2019) examined the foreign funds inflows in India and its effect on Indian economy. Rezza, (2013) analysed the factors affecting the FDI in developing economies and it was found the creation of the positive environment created by FDI for development in the long run. Bhattacharyya, (2012) also found that FDI would work as a catalyst in developing all the other sectors in an economy. Agrawal & Khan, (2011) analysed FDI as a factor that would influence local production in any economy.

Covering the recent studies, Ding & Fu, (2020) investigated the contribution of FDI on the manufacturing sector’s production in China. It was observed that the foreign funds helped to augment the structure of manufacturing services industry. Nayyar and Mukherjee (2020) analysed the impact of FDI on the overall production in India in recent times. Varma, et al. (2020) found out the flow of foreign funds between India and Africa that helped both the countries’ production effectively from 2008 to 2016. Jithin & Suresh Babu, (2020) analysed the impact of FDI on the service and manufacturing outcomes in the emerging economies. The study examined the importance of foreign funds in encouraging the production of less developed economies. Mondal and Pant (2020) investigated the influence of FDI on Indian manufacturing firms in recent times. The study proved the existence of positive impact of FDI on Indian manufacturing firms till date. Kurtovi? et al. (2020) proved the influence of FDI on developing economies revealing the contribution of foreign funds for the overall development of a country. Chukwu & Adewuyi, (2020) analysed the impact of foreign inflow of funds on the different sectors of Africa through enhanced technology usage.

After reviewing all the available literature, the researchers found that not much of research has been done to find out the association between FDI and manufacturing sector. Further, different studies have deployed different definitions of manufacturing sector in their research. With, manufacturing sector being considered as a high growth sector in India, FCCI has identified the potential of this sector to reach US$ 1 trillion by 2025. Therefore with the right kind of policy support and positive measures taken by the government, this sector has the probability to account for 25-30 per cent of the country’s GDP and would create up to 90 million domestic jobs by 2025. Considering all these predictions, the current study has taken up the index of industrial production in manufacturing sector with a different econometric approach to analyse the available data and to find out the solid outcomes for the policy makers to act upon.

Conceptual Framework

Wang (2009) theoretically explained the relationship between manufacturing sector output and FDI in his model. The study concentrated on establishing domestic firms with the new and enhanced technology brought by foreign firms. The study analyzed the importance of input generation through foreign market capital. The study also extracted the impact of FDI on various sector of the economy. The present article also focuses on the study conducted by Romer, (1990) and Borensztein et al. (1998) that gave importance on human capital generation with the help of foreign aided technologies.

Based on the theoretical framework, the current study analyses the conceptual framework. The study investigates the relationship between FDI and manufacturing sector expenses in India. The interrelationship between two variables is to be found out for understanding the importance of FDI on expanding the production in manufacturing sector. The conceptual model is depicted in Figure 1.

Objectives of the Study

1. To find out the association between FDI and manufacturing sector in India.

2. To find out the long run and short run influence of FDI on manufacturing sector in India.

3. To find out granger causality between FDI and manufacturing sector in India.

Methodology

Methods of Data Collection

To analyse the data, FDI inflow and manufacturing sector have been obtained from World Bank Database. FDI is described as net inflows of foreign funds into host economy at its local currency unit and data on manufacturing sector data are described as index of industrial production.

Method of Data Analysis

Auto Regressive Distributed Lag (ARDL) modelling approach has been considered to analyse the data set. The effectiveness of ARDL is that it can be applied to all the ranges of data integration say, whether it is I (0), or I(1) or I(2), the method is applicable to all the integrated order of the data. The long run cointegration is proved at the first level. Augmented Dicky Fuller (ADF) and Phillips Perron (PP) test are applied for testing the stationarity. After performing the cointegration, the short run and long run influence are checked through Error Correction Model (ECM). The long run direction of causality is also found at this stage. Finally, the short run direction of causality is found through the application of Granger Causality (GC) test.

Hypotheses

H01: There is no long run co-integration among FDI and Manufacturing in India

H02: There is no long run significant impact of FDI on Manufacturing in India

H03: There is no short run significant impact of FDI on Manufacturing in India

H04: FDI does not granger cause Manufacturing in short run in India

H05: Manufacturing does not granger cause FDI in short run in India

Results and Discussion

Results

Tables 1 and 2 explain the results of ADF and PP tests. It shows both FDI and manufacturing sector data are integrated of I (1).

| Table 1 Result Of Augmented Dicky Fuller (ADF) | ||||

| Augmented Dickey-Fuller test statistic | Level | 1st Difference | ||

| t-Statistic | Probability | t-Statistic | Probability | |

| Manufacturing Sector | (1.980470) | 0.2923 | (3.0041) ** | 0.0508 |

| FDI | (1.268339) | 0.6351 | (6.7709) ** | 0.0000 |

| Table 2 Result of Phillips Perron (PP) | |||||

| Phillips Perron test statistic | Level | 1st Difference | |||

| Adjusted t-Statistic | Probability | Adjusted t-Statistic | Probability | ||

| Manufacturing Sector | (1.521357) | 0.5044 | (2.882849) | 0.0643 | |

| FDI | (1.216826) | 0.6581 | (8.73136) ** | 0.0000 | |

Auto Regressive Distributed Lag Modeling Approach:

The Auto Regressive Distributed Lag (ARDL) modeling approach explains the long run cointegration among the datasets. The benefit of ARDL is it can be applied to any order of data integration. Unlike Johansen cointegration, the present approach is free from any integration bias and can be applied rigorously. It also captures the long and short run analysis of the time series trend. The result of cointegration is presented below in Table 3.

| Table 3 Result of Cointegration | |||||

| Test Statistic | Value | Significance (10%) | Significance (5%) | ||

| F Statistic | 4.1* | I (0) | I (1) | I (0) | I (1) |

| 3.02 | 3.51 | 3.62 | 4.16 | ||

Table 3 shows the result of cointegration. The value is 4.1 which is more than the I (1) value at 10 percent. It proves the existence of long run association among the variables. Hence, we reject H01 and conclude that there exists a long run relationship between manufacturing sector and FDI inflow in India.

Error Correction Model

The Error Correction Model (ECM) is formed to analyze the short run causality among the datasets. The short run impacts as well as the long run direction of causality are also ensured through this model. The result of ECM is presented below in Table 4.

| Table 4 Result of Short Run Error Correction Model | |||

| Variable | Coefficient | t-Statistic | Prob. |

| Δln (FDI) | 0.155239 | 1.489522 | 0.1645 |

| Δln (FDI(1)) | 0.053321 | 0.482833 | 0.6387 |

| Δln (FDI(2)) | 0.342121** | 3.181311 | 0.0087 |

| Δln (FDI(3)) | 0.234740** | 1.905202 | 0.0832 |

| Δln (Manufacturing (1)) | 0.255726 | 1.391588 | 0.1915 |

| Error Correction Term | (0.372363) | (3.806749) | 0.0029 |

Table 4 analyses the short run influences of FDI on manufacturing sector. The result proves that there exists a positive impact of FDI on manufacturing sector in India. Higher the inflow of FDI, higher will be manufacturing sector output. It leads to reject H03 and assures a significant short run influence of FDI. The error correction term is negative and significant. It assures that any short run shocks will be overcome by Indian economy with possibility of thirty seven percent. Hence, the long run causality running from FDI to manufacturing sector has also been established by this percentage. This also leads to rejection of H02. The normality of the data is proved by Jarque-Bera statistics (0.45) with probability 0.8.The R square and the adjusted R square of the model are satisfactory to conclude the required goodness of fit of the model. The result of Breusch-Godfrey Serial Correlation LM Test (4.92 with probability 0.03) signifies that the data are serially correlated. The Breusch-Pagan-Godfrey Heteroskedasticity Test (3.60 with probability 0.03) explains that the data are not homoscedastic in nature. The Durbin- Watson statistic is 2.17 here, which proves that the model performs reasonably to explain the actual phenomena.

Granger Causality Test

After proving the long run direction of causality, the model chooses to prove short run direction of causality by applying Granger Causality (GC) test. The short run causality is important as it gives better projection to the policymakers to implement policies for short run. The result of GC test is presented below in Table 5.

| Table 5 Result of Granger Causality Test | ||

| Null Hypothesis | F statistic | Probability |

| ln(FDI) does not granger cause ln(Manufacturing) | 0.26678 | 0.7692 |

| ln(Manufacturing) does not granger cause ln(FDI) | 0.18252 | 0.8349 |

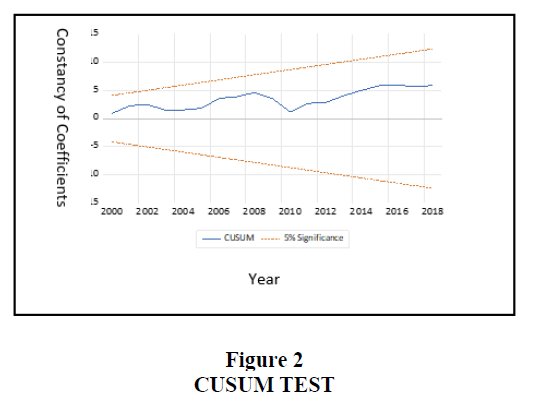

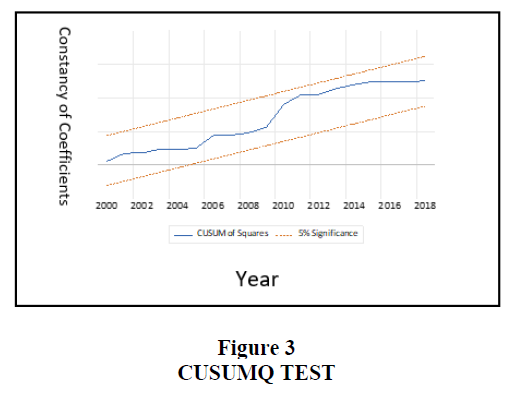

Table 5 analyses the result of granger causality. It signifies that there does not exist any short run directional causality between these variables. This leads to acceptance of both H04 and H04. Finally, the stability of the model is judged through Cumulative Sum (CUSUM) and Cumulative Sum of Square (CUSUMQ) test. The result proved that the model is stable. The results of CUSUM and CUSUMQ are presented in Figure 2 and Figure 3.

Discussion

The study explains the relationship between FDI and manufacturing sector in India. It shows a cointegration between the two variables. It proves the long run association between these two variables in India. The impact of FDI on manufacturing sector has also been found to be significant. This means, if inflow of FDI occurs to India, there will be growth in manufacturing sector in India leading to overall economic growth. The result also proves the long run direction of causality from FDI to manufacturing sector as there exists a significant error correction term in it. The possibility of short run correction from shocks and the movement to long run stability is thirty seven percent. The R square and the adjusted R square values are sixty-five and fifty two percent which proves that the model performs satisfactorily to explain the actual scenario. The Jarque-Bera statistics explains that the data in the model are normally distributed proving that the FDI in manufacturing sector is indispensable. India, which specifically focuses on service sector, needs to put in much effort to encourage the manufacturing sector to notice a commendable growth in its development process. The current need is to divert FDI to the manufacturing clusters namely Maharashtra, TamilNadu, Gujarat, AP, Telangana, Karnataka and Uttar Pradesh through “Make in India” move.

Conclusion

India, after welcoming the liberalization like any other developing country has been facing upheavals in the long run growth process. Though the flow of FDI has not been confirmed to have helped in all the sectors of the Indian economy, the need of manufacturing sector development with the help of it has always been an important area to be analyzed. In this respect, the study chose to find out the importance of FDI in manufacturing sector. The result provides satisfactory outcomes which lead to confirm the involvement of inflow of FDI to enhance the manufacturing sector both for short and long run. The inflow of funds of FDI will automatically channelize the growth in the manufacturing sector. Thus, it is suggested to frame the policies of FDI inflow in such a way that it encompasses the growth of manufacturing sector in India. Also, the relaxation of the FDI policies to hundred percent will ensure the growth of manufacturing and allied sectors by providing more employment opportunities and economic growth ultimately. The current study suggests the Indian policymakers to relax FDI inflows norms and enable an automatic route up to 74% towards all the industries in the manufacturing sector, as done for defense manufacturing in order to augment the overall development of Indian economy.

References

- Aditya, A., & Acharyya, R. (2015). Trade liberalization and export diversification, Int Rev Econ & Fin 39, 390-410.

- Agrawal, G., & Khan, M.A. (2011). Impact of FDI on GDP: A comparative study of China and India. Int J Bus & Manag, 6(10), 71.

- Alecsandru, S.V., & Raluca, D.A. (2015). A regional level hierarchy of the main Foreign Direct Investments’ Determinants–Empirical study, the case of Romanian manufacturing sector. Procedia Soc & Behavioral Sci. Eng, 181, 321-330.

- Anwar, S., & Sun, S. (2018). Foreign direct investment and export quality upgrading in China's manufacturing sector. Int Rev Econ & Fin, 54, 289-298.

- Bajgar, B., & Javorcik, B.S. (2013). "Exporters' Stargate: Suppling Multinationals and Entry into New Markets,"CESifo-Delphi Conference on The Econ Firm Exporting, 26-27.

- Balasubramanyam, V.N., & Sapsford, D. (2007). Does India need a lot more FDI?. Econ & Political weekly, 1549-1555.

- Bandyopadhyay, S. & Acharyya, R. (2006), Does input sector liberalization promote quality innovation and exports?. Int Rev Econ & Fin 15(4), 443-462

- Banga, R. (2006). The export-diversifying impact of Japanese and US foreign direct investments in the Indian manufacturing sector. J Int Bus Stud 37(4), 558-568.

- Bhattacharyya, R. (2012). The opportunities and challenges of FDI in retail in India. IOSR J Humanities & Soc Sci, 5(5), 99-109.

- Borensztein, E., De Gregorio, J., & Lee, J.W. (1998). How does foreign Direct Investment affect economic growth?, J Int Econ, (Working Paper Series)

- Cazzavillan, G., & Olszewski, K. (2012). Interaction between foreign financial services and foreign direct investment in Transition Economies: An empirical analysis with focus on the manufacturing sector. Res Econ, 66(4), 305-319.

- Ding, Y., & Fu, Y. (2020). Does Producer Service FDI Promote the Upgrading of China’s Manufacturing Sector?. China's Rise And Internationalization: Reg & Global Challenges & Impacts, 107. (Book Chapter)

- Doytch, N., & Uctum, M. (2011). Does the worldwide shift of FDI from manufacturing to services accelerate economic growth? A GMM estimation study. J Int Money & Fin 30(3), 410-427.

- Fernandes, A.M., & Paunov, C. (2012). Foreign direct investment in services and manufacturing productivity: Evidence for Chile. J Devel Econ, 97(2), 305-321.

- Guruswamy, M., Sharma, K., Mohanty, J.P., & Korah, T.J. (2005). FDI in India's Retail Sector: More Bad than Good?. Econ & Political Weekly, 619-623.

- Jithin, P., & Suresh Babu, M. (2020). Does sub-sectoral FDI matter for trade in emerging economies? Evidence from nonlinear ARDL approach. The J Int Trade & Econ Dev, 29, 1-21.

- Kalirajan, K., & Bhide, S. (2004). The post-reform performance of the manufacturing sector in India. Asian Econ Papers 3(2), 126-157.

- Khachoo, Q., & Sharma, R. (2017). FDI and incumbent R&D behavior: evidence from Indian manufacturing sector. J Econ Stud.

- Mondal, S., & Pant, M. (2020). FDI and Export Spillovers: A Case Study of India. In Accelerators of India's Growth-Industry, Trade and Employment,177-208. Springer, Singapore.

- Nayyar, R., & Mukherjee, J. (2020). Home country impact on Outward FDI from India. J Policy Modeling, 42(2), 385-400.

- Nefussi, B., & Schwellnus, C. (2010). Does FDI in manufacturing cause FDI in business services? Evidence from French firm?level data. Canadian J Econ/Revue canadienne d'économique, 43(1), 180-203.

- Pazienza, P. (2019). The impact of FDI in the OECD manufacturing sector on CO2 emission: Evidence and policy issues. Environ Impact Asses Rev, 77, 60-68.

- Raluca, D.A., & Alecsandru, S.V. (2013). The Impact of Romania's EU Accession on the Foreign Direct Investments Location-A Manufacturing Sector Analysis. Procedia-Soc & Behavioral Sci, 99, 65-74.

- Reganati, F., & Sica, E. (2007). Horizontaland vertical spillovers from FDI: Evidence from panel data for the Italian manufacturing sector. J Bus Econ & Manag, 8(4), 259-266.

- Rezza, A.A. (2013). FDI and pollution havens: Evidence from the Norwegian manufacturing sector. Ecol Econ, 90, 140-149.

- Romer, P.M. (1990). Endogenous technological change. Journal of political Economy, 98(5, Part 2), S71-S102.

- Singh, S. (2019). Foreign direct investment (FDI) inflows in India. J General Manag Res, 6(1), 41-53.

- Sung, B., Song, W.Y., & Park, S.D. (2018). How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: Evidence from panel data. Econ Sys, 42(2), 320-331.

- Varma, S., Bhatnagar, A., Santra, S., & Soni, A. (2020). Drivers of Indian FDI to Africa–an initial exploratory analysis. Transnational Corporations Rev, 12(3), 304-318.

- Wang, M. (2009). Manufacturing FDI and economic growth: evidence from Asian economies. Applied Economics, 41(8), 991-1002.

- Wang, M. (2009). Manufacturing FDI and economic growth: evidence from Asian economies. Appl Econ, 41(8), 991-1002.

- Ye, Y., Wu, K., Xie, Y., Huang, G., Wang, C., & Chen, J. (2019). How firm heterogeneity affects foreign direct investment location choice: Micro-evidence from new foreign manufacturing firms in the Pearl River Delta. Appl geography, 106, 11-21.

- Zhu, S., & Fu, X. (2013). Drivers of Export Upgrading, World Devel, 51(6), 221-233.