Review Article: 2025 Vol: 29 Issue: 2

Waiting to be Served: Investigating the Customer Waiting Experience in the Banking Sector in an Emerging Economy

Mustapha Iddrisu, University of Professional Studies, Accra

Kodjie Kwesi Peter, University of Professional Studies, Accra

Ivy Heward-Mills, University of Professional Studies, Accra

Akwasi Sarfo Kantanka, University of Professional Studies, Accra

Citation: Iddrisu, M., Peter, K.K., Heward-Mills, I., & Kantanka, A.S. (2024). Waiting to be Served: Investigating the Customer Waiting Experience in the Banking Sector in an Emerging Economy. Academy of Marketing Studies Journal, 29(2), 1-18.

Abstract

Purpose: This paper seeks to explore how queuing and waiting in the banking hall affect customers’ service experience and to suggest avenues for future success in handling customer frustration in the banking sector in Ghana. This is important because delay in the queuing system results in frustration and customer dissatisfaction.

Design/methodology/approach: Using a survey research design, data was collected from 306 bank account holders by the help of self-administered questionnaires and was analyzed using Partial Least Squares Structural Equation Modeling (PLS-SEM) approach.

Findings: The study found that queue management (Seeking hedonic gratification) queue environment (Seeking social interaction) impact on customer experience while available services (Seeking economic performance); queuing time (Seeking convenience) did not impact on customer experience. The study also found that customer experience impacts positively service delivery.

Originality/value: First, this study helps to improve our understanding of customer experience of waiting and queuing for services. Second, it examines the impact of waiting and queuing has on customer experience and quality service delivery. Third, the study then examines customer perceptions of waiting in line and focuses on methods for making waiting time more tolerable.

Keywords

Queuing, Waiting, Customer experience, Service delivery.

Introduction

Queues are a phenomenon that pervades in our everyday life. Usually, the phenomenon is observed at bus stops post offices, bank, hospitals, petrol filing stations and even call centers, etc. Queues usually are formed when the number of customers demanding a service exceed the of representatives or gadgets that are ready to serve them (Sharma, 2007). Queues are not uncommon in the service industry, especially in the banking sector. This is important because people are concerned about the length of time, they spend in queues to be served. Additionally, queueing and waiting time are considered to have great impact on customer perception of service delivery (Bielen and Demoul 2007), as research reveals that customers’ satisfaction with the in-branch experience has the greatest impact on their overall experience with their banks.

Individuals attach so much value to time as it is a very precious commodity to them and it passes so quickly and so fast (Alfakia et al., 2019). According to Abban (2011), time management is “a set of principles, practices, skills, tools and systems that help us use time to accomplish what we want”. In the banking sector especially, time helps in improving the quality of services as it reduces the frustration that customers go through in queues to be served.

Waiting in the queue is frustrating but it is even more frustrating when one does not know how long to be in queue described by Maister (1985) as uncertainty. Waiting is often a negative experience from both an economic and a psychological perspective which leads to all that is done in the service area (Kumar and Gilovich, 2016; Voorhees et al., 2017). In the banking industry, customers mostly are motivated by the speed with which they get services delivered to them (Amoaka, 2012). Usually waiting for services is in almost all services industry areas is inevitable as it is the reason why managers in the banks face a huge task in the management of queues in both the banking hall and at the ATM point of service (Eze and Odunukwe, 2015).

Given the importance of waiting time, Porter (2018), argued that, in recent times customers in a queue are compensated for the time they spend waiting. While waiting they are giving certain things for free which are part of the reasons they are at the company. Services such as free coffee or snack are enough to make some customers wait for longer than they would hitherto have. Another phenomenon that is creeping in the service industry is the issue of what is called “queue walkers” who walk through the queues to find out customer queries and direct them to the right solution area or help solve the issue if it can be solved there and then. The importance and role of waiting time has widely been discussed in literature in the field of marketing, economics, and operations. Competition in most of the service operations, such as banks, fast-food, call centres, drive-through restaurants, retail shops and health care facilities, is largely based on waiting time, quality and price (Singhal et al., 2018).

Existing literature examining customer queuing (Waiting time) have looked at the need to improve the efficiency in the banking sector with regards to queue management. Specific mention can be made of increasing staffing levels to improve employee’s productivity (Katz and Martin, 1985). Customer willingness to wait (Anderson et al., 2007), making wait more meaningful to the customer (Ulku et al., 2019), modelling the queue system in the banks for efficiency (Williams, et al., 2014; Agyei, Asare-Darko and Odilon, 2015), service improvement in the banking sector (Alfakia, et al., 2019; Azad, et al., 2019) and ATM service optimization (Burodoet et al., 2019) are some areas in the literature that have been done. Customer waiting experience literature have largely been based on Maister (1985) theory of queue psychology and rehearsed by Furnham et al., 2020. The focus is on a combination of expectations and perceptions management measures that are related to lowering customers’ perceptions of waiting time. Areas such as employee’s visibility (Clemmer and Schneider, 1989) lighting color (Shibasaki and Masataka, 2014; Bilgili, et al., 2018), design and decorations of the bank (Chien and Lin, 2015), television (Borges et al., 2015) and ambient waiting environment (Fenko and Loock 2014) have been worked on.

Studies on the relationship customer waiting experience and service delivery are not adequate especially in the context of emerging economies. Literature on customer waiting experience has also been limited especially regarding service delivery as argued by Giebelhausen et al., (2011); Debo et al., (2012) and Kremer and Debo (2016). Much of the literature aforementioned have concentrated on queue efficiency, perception management and modeling and analysis of queueing as well as customer experience at the service point to the neglect of customer experience in waiting lines and how it affects quality of services delivered (van Vaerenbergh et al., 2019) especially in emerging economies. This is particularly important as this paper seeks to examine the ingredients that will make customers wait to be served. The affluent and high standards of living further enhance Ghanaian customers’ search for value in services. Economic pressures have shifted consumer values. Since workers have fewer non-working hours, they place a greater value on their free time. Filling this gap in literature make this research very important.

Rather than taking an operational approach, such as looking at the effects of reducing actual waiting times on customer satisfaction this study largely has two aims:

1. To investigate customer experience of queuing (waiting time) and its impact on servile delivery in banking sector in Ghana and 2. To test customer experience antecedents by Anteblian et al. (2014) and its impact on waiting in line in order to attempt to deal with the call for research on individual experience in waiting by Durrande?Moreau (1999).

This study contributes to both theory and literature. The theoretical contribution of this study is the fact that it has tested the Social Exchange Theory in an emerging economy such as Ghana and in the service industry where majority of waiting and queuing to be serve is observed. This study comes almost the first in Ghana to be conducted in order to examine the customer experience with regards to waiting and queuing and service delivery quality. This study uses the model by Anteblian et al., (2014) in customer experience and redefines the constructs to suit customer waiting and queuing experience and test the model in a different environment with a different concept such as waiting.

Theoretical Background

The theoretical underpinning of this study is the social exchange theory (SET) to demonstrate the customer experience in queue and how they perceive service delivery. Homans (1961) defined Social exchange as “the exchange of activity, tangible or intangible, and more or less rewarding or costly, between at least two persons”. Blau (1964) also defined social exchange “as voluntary actions of individuals that are motivated by the returns they are expected to bring and typically do in fact bring from others." The theory argues that social exchange needs a number of transactions or interactions that are interdependent to force supportive actions from another area (Cropanzano and Mitchell 2005) and also, that within the process of exchange a particular behavior or transaction by one party in the process needs to create a mutual understanding (Blau 1964; Emerson 1976). Blau (1964), argues that SET in any transaction or exchange relationship the action taken by one party is conditioned by rewarding the reaction of the other party in the transaction. From the perspective of SET, customers visit the service point because they require some services and they have an expectation not to spend so much time to be served. Bank customers expect that they spend less time in the queues when they are in the banking hall so the bank should provide avenues for easy access.

In the banking sector, the bank provides services to the myriad of customers. Whiles the bank would want to deliver excellent services to the customers, the customers in turn have a perception about the services rendered by the bank. In this exchange when the customer values the interaction to be positive, the bank should also view the interaction as such. Therefore, a mutual social mechanism is in place.

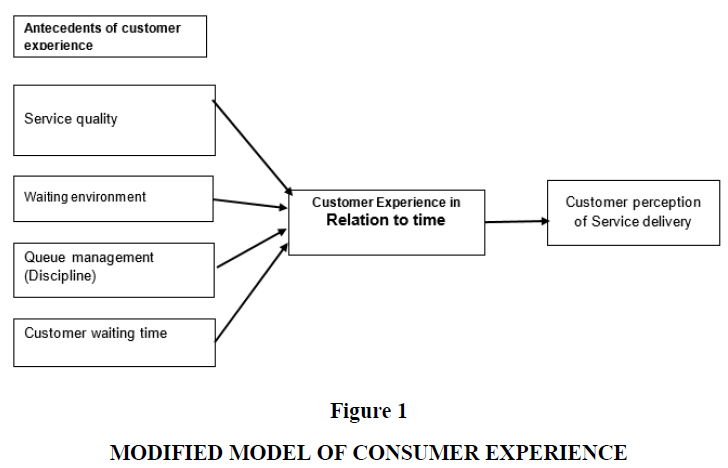

In this study, SET and the modified Anteblian et al., (2013) model of customer experiences the study sets out basic constructs that can lead to the mutual exchange would include Available services, waiting environment, queue management and customer and waiting time.

LITERATURE REVIEW

Queueing and Time Waiting

According to Davis and Heinek (1993), “every organization which directly interacts with its customers confronts the issue of queues”. Singhal and Singhal (2018) argued that for service organizations, the most crucial issue to handle is waiting time in queues. Customers wait for service in a wide variety of settings, including manufacturing and services business, profit and non-profit organizations, and private and public agencies. In each instance the key issue associated with queues is that: customers do not like to wait. It is a phenomenon universally that a customer does not like to wait. But for Ryan, et al., (2018) to diffuse this notion that is held long and conclude that waiting is not all that negative as they propose some positive effects of wait and queuing. This is evident in the fact that two very vital effects of waiting have been identified in the literature when it comes to firm performance. In the first place, queues have been seen to affect sales negatively due to loss of customers (Allon et al., 2011; Lu et al., 2013). Secondly, queues show the sign of quality and therefore help in customer attraction (Giebelhausen et al., 2011; Debo et al., 2012; Kremer and Debo 2016).

Customer Experience

One of the topical issues is gaining attention in marketing both in academia and practice is the concept of customer experience. Thus, Schmitt, et al., (2015), accordingly argue that some sort of customer experience is present in every exchange in services. Meyer and Schwager (2007) defined customer experience as ‘the subjective and internal responses that customers have in any direct or indirect contact with a company’. In the literature of services, the concept of experience is not highly developed (Dube and Helkkula, 2015). Customer experience research is approached differently, for example Helkkula, (2011) described it as a “process (focusing on the architectural and time element of the experience); as an antecedent to various outputs (such as satisfaction and repurchase intentions); or as a phenomenon (specific to an individual in a specific context)”. It can be argued that the concept is key in driving both business success customer satisfaction and competitive advantage (McColl-Kennedy et al., 2015; Lemon and Verhoef 2016; Mosavi, et al., 2018). For Jaakkola et al., (2017) customer experience is largely focusing on customers as the actors and is described as an internal and how customers subjectively respond (Dagger et al., 2013). Customer experience in waiting lines can be very frustrating and can either be positive or negative depending the length of time spent. Waiting is often a negative experience from both an economic and a psychological perspective which leads to all that is done in the service area. Holbrook and Hirschman (1982) introduced the concept ‘customer experience’ where they stated that consumers are not completely rational solvers of problems. According to Verleye, (2015) a positive customer experience leads to a much powerful way of explaining firms’ performance in the market. Providing an interesting Customer Experience gives the firm an advantage over its competitors (Schmitt, 2010), a better Customer Experience is acknowledged as a key to obtaining customer loyalty (Klaus and Maklan, 2011; Liu, Gong, et al., 2017). Marketing practitioners praise customer experience as one of consumer industries promising strategies (Homburg et al., 2015). Customer experience is a reflection of customer’s route throughout all their interactions with the organization–pre-consumption, consumption and post-consumption (Kandampully and Solnet, 2015). Customer experience has been seen as important in acquiring customer loyalty (Klaus and Maklan, 2011). As time becomes more precious for people now compared to about 10 to 20 years ago, it is important for an organization to properly deal with the management of customers’ waiting time to transact a business.

Antecedents of Customer Experience

Services availability: Customers visit firms because they have needs. Service firms provide those services to satisfy the needs desired by customers. In the banking sector for instance there are different types of services rendered in order to satisfy the needs of customers. Customer experience is seen as subjective customer’s responses that emanate from customer-organization interaction (Scheidt and Chung, 2018; Scherpena et al., 2018). Once the company is brought to the attention of a customer that is when experience begins and this affects all the channels from pre purchase to post purchase. Within this chain the customer considers what services are available to him/her from the firm (Heshmati, et al., 2019). Customer experience is motivated by the firm, its partners, and its peers, nature of the work, the environment, the services available and the character of the customer. Hinson et al., (2011) identified international banks to be doing better than their local counterparts in Ghana and this was attributed to factors such as the availability of services. In this regard customers would want to consider a firm because of the availability of services. Literature available have considered other areas such as the willingness of customers to pay and spent time waiting for products (Schoder et al., 2006). Spaulding and Perry (2013), Aichner and Coletti (2013) and Mehra et al. (2015) all studied the willingness of customers to pay a premium price and wait for tailor-made products/services a bit longer. dell’Olio et al (2011) found a relationship between available services, age and customer willingness to pay for quality services. Literature that examines the relationship between available services and the customers experience in waiting has been very little. Therefore, it is hoped this study will provide an insight that is helpful. Accordingly, this hypothesis has been developed.

H1 Services available at the service center has an impact on customer experience.

Customer Waiting Time

Acceptable waiting time is defined as “the longest waiting time a customer will accept in a particular environment” (Nunkoo, et al., 2017). Customer waiting time can either be perceived or actual (Baker and Cameron, 1996). Indeed, it is accepted generally that consumers disliked waiting regardless of their culture (Pamies, et al., 2016). One of the most common phenomena in the service industry is waiting. While researchers agree that consumers have expectation of negative experiences to move more faster when divided into different steps, the evidence is conflicting when it comes to positive experiences can be predicted to be longer (Tsai and Min 2011) or shorter (Lim et al., 2015) when divided into more episodes. Judging retrospectively how long an experience can last, consumers segmentation leads to a perception that a longer time compared with the similar experience unsegmented (Tsai and Min 2011). Customers do not tolerate waiting in line for long periods of time just to receive whatever kind of products or services unless those things are really important or more valuable than the time spent for waiting.

Tsai and Min (2011) explored the perceptions of waiting time between separate episodes. An experiment in manipulating customer waiting times at ATM, evidence showed that an effect of expected waiting times when judging prospectively, and judging retrospectively a recency effect with actual waiting time. Zhang, et al., (2017) found a positive relative between customer waiting and customer experience in queuing in online restaurant services. Qin, et al., (2019) observed a positive relationship between waiting satisfaction and customers’ waiting time and argue that customers will wait once they are satisfied with pre-service recovery.

H2 Customer’s waiting time has an impact on customer experience in service delivery.

Queue Management

A queue is largely described as a waiting line as well as a phenomenon in a social setting which is common our current societies as a result of insufficient or unavailability of facilities that will meet the needs of customers for a service or a product (Pardo and de La Fuente, 2010; Marin and Rossi, 2017). Queue management can be described as the process through which customer waiting times is managed so as to optimize end user and employee productivity. Firms in the services sector attempt to reduce waiting times of customers because when customers are frustrated by the long queues in the bank they leave and sought for more friendly competition (Adedoyin, et al., 2014). Most service firms have now introduced what is described as “queue walkers” to help customers whose issues can be solved easily so as to reduce the length of the queue while others encourage customers to buy more during off peak periods. Some studies conclude that, customers get dissatisfied even more when their expected waits are longer due to challenges that could be remedied by the organization e.g. understaffing, inefficient queue personnel, failure to provide express services (McCarthy, 2018) than delays which are as a result of external factors example random crowding, system breakdowns, time of day or the presence of customers with bulk amounts of deposits. Liang, (2016) has also stated that promotional activities are likely to affect customer’s perception of queuing management positively. Afolalu et al., (2019) in looking at the impact of queueing management model in the banking sector argued that customers would prefer a well-managed queue and support staff than the one without. Agyei et al., 2015) also modelling and analyzing the queuing theory in Ghana commercial bank in Kumasi found a relationship between queue management and customer experience therefore.

H3 Queue management has an impact on customer experience in service delivery.

Waiting Environment

Waiting environments according to (Pruyn & Smidts 1998) consist of “physical design elements such as architecture, layout and lighting, which create attractiveness in terms of, e.g., comfort, spaciousness and atmosphere, and elements of explicit distraction such as reading material and TV”. Arguably different factors affect customer waiting experience and the waiting environment is very key (de Vries et al., 2018). Studies into waiting experience have also looked at the environment. The decoration and design of the waiting environment (Chien & Lin, 2015), music (Bae and Kim, 2014), lighting color (Bilgili et al., 2018) scent (McDonnell, 2018), all of these affect the perceptions of customers about waiting time, and affects waiting experience indirectly (Qin, et al., 2019). Waiting environment can either be virtual (Hwang, et al., 2012). or physical (Borges, et al., 2015) and what is seen in that environment can affect customer experience positively or negatively (Baker and Camdron, 1996). Chang and Horng (2010), also mentioned physical environment as a component of service experience which can be juxtaposed to mean the waiting environment. In a paper by Ryan et al., (2018) they found that the environment in which one is waiting can impact on the experience of the customer not only negatively but also positively. Liang (2017) studied waiting time that is enjoyable and found queue environment to have positive impact on the customer experience. Customers can be influenced to ignore perceptions of the company that are negative about the waiting environment due to promotional activities (Saaksjarvi, et al., 2015). Therefore;

H4 The waiting environment has an impact on customer experience in service delivery.

Service Delivery and Customer Experience

According to Parasuraman et al. (1991), competitive advantage can be gained by companies if they use technology as a means enhancing service quality and gathering market demand. Chang (2008) argued that the concept of service quality should be generally approached from the customer’s point of view because they may have different values, different ground of assessment, and different circumstances. Lovelock and Wirtz (2007, P.420) also argued that the nature of service quality requires a distinctive approach to identify and measure service quality. It is difficult to evaluate service because of its multifaceted nature as compared to tangible products. Service quality is defined as “the global evaluation or attitude of overall excellence of services” (Parasuraman et al., 1985). There is a high degree of human interaction and intervention in the delivery of services (Kim and Kim, 2012). Quality of service, service experience and satisfaction are seen as some constructs of customer experience (Bueno et al., 2019) which complement one another (Vasconcelos et al., 2015). Afthanorhan et al., (2019) in research on library service quality found a significant relationship between service quality and customer satisfaction. Fullerton and Taylor, (2015) found that in circumstances where consumers expectations regarding the length of wait time for the completion of a service they become dissatisfied once the expectations are not met (Figure 1). Which shows a relationship between quality of service delivered and customer experience. Therefore;

H5 Customer experience influences customer perception of service delivery.

Methodology

To analyze the antecedents of customer experience and their influence of quality service delivery, such as testing the Antebilan et al., (2014) model we carried out an empirical study in the Ghanaian capital of Accra. This empirical study had two main objectives including 1) to investigate customer experience of queuing (waiting time) and its impact on service delivery in the banking sector in Ghana and (2) to test how the customer experience antecedents by Anteblian et al. (2014) can lead to experience and its influence service delivery using waiting in lines.

Sample

The study population of comprised of customers of banks aged 18 years and above. This age group was taken because per the laws of any one less than 18 years is not qualified to open a bank account. The account holders included both service and current accounts. Accra was chosen because it serves as home of the headquarters of all commercial and investment banks in Ghana (Bank of Ghana, 2020). The account holders were drawn from both private and public owned banks. Respondents were selected through convenience sampling method. A total of 400 questionnaires was sent out of which 340 were returned. A screening of data was carried out and completed responses was 306 obtained which is about 90% of returned responses.

Data Collection and Instrumentation

Data for this empirical study was collected using questionnaire developed from literature extensively reviewed using the scales in Antebilan et al., (2014). The scales in the study have all been obtained from previous literature used in the area of customer experience as the model was adopted and modified to suit this study. The antecedents to customer experience were adopted from Mehra et al., (2015), Nunkoo et al. (2017), Afolalu et al., (2019), and Ryan et al. (2018). The items that have been used for the research were on a five-point Likert scale with strongly disagree (1) to strongly agree (5). Customer experience scales were adopted from Dube and Helkkula, (2015) while service quality scales were taken from Bueno et al., (2019) and Vasconcelos et al., (2015).

RESULTS

Sample Characteristics

About 400 questionnaires were distributed to respondents who either have a bank account or have transacted business with a bank before. Out of this number, 306 responses were retrieved which represented three quarters of the questionnaires that went out. Gender was evenly distributed as 49.7% were female and almost a similar percentage of 48.7 were males with less than 2% missing. Majority (62.7%) were between 18-30 age bracket followed by 31 to 45 with 30.1%, 45-60 age group were 5.2% whiles above 60 were 7%. Students and employees had 51.3% and 37.9% respectively while employers had 6.9% traders only 15 and others 2.3%. In dealings with banks in Ghana majority (52.9%) had opened a bank accounts for over five years and almost same number (48.7) had operated with their banks for over five years. Over 90% had gone to the bank for deposits and withdrawals and about 60% had accounts or dealt with public owned banks whiles 29.7% were operating with private banks. Only 10% had businesses with public private banks.

Measures and Analysis

The SmartPLS software is used for the analysis of the study which is often recommended and preferable in situations where there is the need to balance predictions and explanations (Sarstedt et al., 2017a). SmartPLS is often considered to be preferable to other software for examining formative and reflective indicators (Henseler, 2009), such as what this study examined.

The measurement of waiting variables was based on the research conducted by Anteblian et al., (2014). Six constructs were used to test the validity of variables in waiting including Available Services (AS); Customer Waiting Time (CWT), Queue Management (QM), Waiting Environment (WE) representing the antecedents of customer experience. Customer Experience (CE) representing experience which can either be positive or negative in relation to time and Customer Perception of Service Delivery(CPSD) representing results of customer experience. The measurement of the dimensions used a five-point Likert scale, including strongly disagree, disagree, neutral, agree and strongly agree’. The social exchange theory (SET) and Antéblian et al., (2014) scale was then modified for the purpose of this study. Partial least squares (PLS), which is a variance-based Structural Equation Modeling (SEM) approach, has been used to test the model (Hair, et al., 2017). The decision was based primarily looking at the nature of the constructs. When combinations are linear, composites are formed as their dimensions or indicators. When dimensions or indicators are dropped from a construct the meaning of the construct is altered (Henseler, 2017). Unidimensional constructs can also be modeled through the PLS. To examine the convergent validity of the study, two different tests are used including are construct reliability and validity (Hair et al., 2017). Nunnally (1978) suggests that a 0.7 value as a good point for an agreed composite reliability. In this study, using the Nunnally’s suggested value of composite reliability (0.7) the output generated from the SmartPLS and SPSS 23 is shown in Table 1. The results for the table indicate the existence of convergent validity in the measurement model; the composite reliability is acceptable in this survey (Table 1).

In order to assess the validity, the average variance extracted (AVE) was used. Fornell and Lacker (1981) indicated that an AVE should be greater than 0.5. The AVE estimates for this study are greater than 0.5 for all the variables. The composite reliability score for this study shows more than 0.7. The composite reliability (CR) and the average variance extracted (AVE) have all met the requirement.

| Table 1 CONSTRUCT RELIABILITY AND VALIDITY |

||

| CR | AVE | |

|---|---|---|

| Available services | 0.957 | 0.917 |

| Customer perception of service delivery | 0.812 | 0.687 |

| Customer waiting time | 0.753 | 0.604 |

| Queue management | 0.829 | 0.619 |

| Waiting environment | 0.836 | 0.718 |

| Customer experience | 0.943 | 0.769 |

One of the tests used to examine discriminant validity is cross loading. We conducted cross-loading analysis and all the items showed high loadings of (>.707) presented in Table 2 considering their constructs demonstrating a very strong discriminant validity presented in Table 3. Together both the constructs discriminant and convergent properties were deemed to be excellent as presented in Tables 1 and 3.

| Table 2 CROSS LOADINGS |

||||||

| AS | CPSD | CWT | QM | WE | CE | |

|---|---|---|---|---|---|---|

| I am usually unable to wait for too long to be served because I can get the services else where | 0.939 | -0.035 | 0.166 | -0.159 | 0.236 | 0.024 |

| I go inside the bank depending on my need | 0.976 | -0.005 | 0.098 | -0.103 | 0.158 | 0.038 |

| Service delivery is efficient at the banking hall because of shorter waiting times | -0.001 | 0.127 | -0.089 | 0.153 | -0.209 | 0.828 |

| Service provision is interactive whiles I am in the queue | 0.005 | 0.239 | 0.021 | 0.236 | -0.136 | 0.913 |

| Service provision is friendly because there is queue support | 0.081 | 0.291 | -0.049 | 0.279 | -0.15 | 0.9 |

| The service process is relative short | 0.058 | 0.21 | -0.032 | 0.166 | -0.19 | 0.9 |

| The bank has customized service provision to my unique needs | -0.011 | 0.209 | -0.117 | 0.137 | -0.308 | 0.841 |

| Seats at the banking hall are adequate | -0.111 | 0.309 | -0.2 | 0.779 | -0.215 | 0.192 |

| I feel more comfortable in the banking hall than out side | -0.127 | 0.271 | -0.066 | 0.844 | -0.213 | 0.203 |

| I feel entertained by TV screen at the banking hall | -0.054 | 0.253 | 0.033 | 0.733 | -0.089 | 0.128 |

| I always wait for long to served | 0.157 | -0.188 | 0.807 | -0.137 | 0.283 | -0.048 |

| Automated queuing machine is convenient for requesting for service at the banking hall | 0.038 | 0.151 | 0.747 | -0.035 | 0.272 | -0.043 |

| I have always complained about the delay in queue movement | 0.227 | 0.063 | 0.313 | -0.144 | 0.874 | -0.204 |

| For a very long time I have not gone inside the bank due to queues | 0.095 | -0.053 | 0.291 | -0.257 | 0.82 | -0.173 |

| Queue support helps in reducing the waiting time | 0.038 | 0.71 | 0.069 | 0.296 | 0.038 | 0.133 |

| My bank provides queue staff to support customers | -0.042 | 0.933 | -0.083 | 0.307 | -0.005 | 0.26 |

| Table 3 DISCRIMINANT VALIDITY |

||||||

| AS | CPSD | CWT | QM | WE | CE | |

|---|---|---|---|---|---|---|

| AS | 0.957 | |||||

| CPSD | -0.018 | 0.829 | ||||

| CWT | 0.13 | -0.037 | 0.777 | |||

| QM | -0.13 | 0.354 | -0.115 | 0.787 | ||

| WE | 0.196 | 0.011 | 0.357 | -0.231 | 0.847 | |

| CE | 0.034 | 0.253 | -0.059 | 0.228 | -0.224 | 0.877 |

Structural Model

The results of the assessment model are shown in Table 4. Hypothesis 1 is not supported since both the t-value and p-value are positively insignificant for available services, as the t-value (1.051) and the p- Value (0.294), with the significance level of 0.001(t=1.051: p<0.001). Hypothesis 2 is also not supported because customer waiting time was positively insignificant effect on customer experience (t=0.256: p<0.001) (p=0.798: p<.01). All the other antecedents were said to have a significant positive effect on customer experience because the t-values with a significance level of 0.001 for hypothesis 3(t=2.355: p<0.001) indicating a strong positive relationship between queue management and customer experience. Therefore, hypothesis 3 is supported. Hypothesis 4 is also supported.

This is because the waiting environment had a positive significant effect on customer experience, as the t-values with a significance level of 0.001 shows (t=2.32: p<0.001). Customer experience had a positive significant effect on customer perception of service delivery (t=3.296: p<0.001). Therefore, hypothesis 5 is supported since the t-values with a significance level of 0.001 is greater 2.

| Table 4 PATH ANALYSIS |

||||||||

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | ||||

|---|---|---|---|---|---|---|---|---|

| AS -> CE | 0.096 | 0.101 | 0.092 | 1.051 | 0.294 | Not significant | ||

| CWT -> CE | 0.025 | -0.009 | 0.097 | 0.256 | 0.798 | Not significant | ||

| QM -> CE | 0.195 | 0.205 | 0.083 | 2.355 | 0.019 | Significant | ||

| WE -> CE | -0.206 | -0.196 | 0.089 | 2.32 | 0.021 | Significant | ||

| CE -> CPSD | 0.253 | 0.259 | 0.077 | 3.296 | 0.001 | Significant | ||

| R Squared | ||||||||

| R square | R square adjusted | |||||||

| Customer perception of service delivery | 0.064 | 0.059 | ||||||

| Customer experience | 0.092 | 0.07 | ||||||

DISCUSSION

The research findings indicate the importance of customer experience and service delivery for organizations in the banking sector. The results and model indicate that the four constructs including available services; customer waiting time, queue management, waiting environment representing the antecedents of customer experience are key to customer experience and customer perception of service delivery. The findings demonstrate that from the Anteblian et al., (2014) model, queue management (Seeking hedonic gratification) waiting environment (Seeking social interaction) are more important to customers than available services (Seeking economic performance); waiting time (Seeking convenience), since the two are significant and the other two are not significant.

These findings come with several academic implications. First, the scales used in the Anteblian et al., (2014) model has been tested in a different context looking at customer queuing and waiting experience with the use of Social Exchange Theory that focuses on a combination of expectations and perceptions management. Which has been shown in the study to be very key to managing the psychology of customers.

Second, the research emphasizes the fact that customers experience can come from seeking hedonistic gratification which we see as in our model as queue management is significant confirming studies conducted by (Zeithaml and Bitner, 2002; McCarthy, 2018; Liang, 2016) which found queue management strategies to play an important in customer experience and that can lead to quality service delivery. (Bielen and Demoul, 2007; McCarthy, 2018; Liang, 2016) study also confirms the importance of queue management strategies.

The findings of the study indicate customer waiting environment as part of customer experience. It is indicated that waiting environment has an impact on customer experience in the sense that customers will prefer a very conducive environment that comes with anything that can entertain them whiles they wait to be served. The findings support (Pruyn and Smidts, 1993; Bae & Kim, 2014) study which found waiting environment that is attractive to have a positive influence on service satisfaction and that the presence of a TV has an impact on the waiting room. Zakay, (1989) also found the presence of closer detractors to have influence on customer experience of the service delivered. Another interesting finding of the study is that customer experience has an impact on service delivery which has been supported by previous studies such as Fullerton and Taylor, (2015) who argued that the experience of customers with regards to length of waiting time can lead to customer dissatisfaction and that affects the services delivered. Interestingly, the findings of this study did not show availability of service to impact on customers experience with regards to waiting. This does not support the findings of (Meyer and Schwager, 2007) who described customer experience to entail all the offering of a company and that once there are available services customers are prepared to wait to be served. This study found that the available services do not matter to customers, maybe because same services could be found in a competitor environment.

Waiting is frustrating but interestingly our findings showed that most customers do not feel it when they are waiting so long as they will be served supporting the findings of Qin, et al., (2019). Researchers such as (Katz, et al., 2003; Tsai and Min 2011) have all found waiting to be enunciating but our study found otherwise in the sense that it is not of much concern to customers.

Limitations of the Study

There are limitations in this current study. The research was conducted in the banking sector in Ghana which is a developing economy faced with banking crises over the past three years which in itself is a limitation because most customers could be queuing for long because of the collapse of their parent banks which the study did not capture. More importantly the study was only limited to customers of banks in Accra the capital city of Ghana. The study also used a theory that is related to social exchange even though there are other theories of customer experience such as consumption value theory and service dominant logic that can also be used. Another limitation of this study is that the constructs that are used could not have been exhaustive and more constructs could be employed to get a broader picture of customer experience.

Managerial Implications

The question to answer by the findings now is whether there is the need to take a look at waiting and queuing inconveniences in a firm especially within the banking sector? The result is that management needs to critically examine the waiting environment and implement strategies that will not create boredom within the time that the customer is waiting to be served. It indicates that a serene waiting environment in our opinion is one of the ways that can give customers a positive experience. First of all, real time experience and expectations affect customers as it is seen to be core in issues of waiting. Therefore, management should work towards the expectation and experiences of customers. Secondly, queue management is very critical to customers indicating management should develop queue support strategies such as what is now popularly called “queue walkers” who will be attending to customers in the queue since there are some customer issues that can be solved without spending long time in the queue. The third implication for management is that queue distractors such as background music, TV, Point of Sale (POS) material can still be controlled by management but those things have not been proven to be efficient. However, if management understands more clearly how customers perceive waiting time, and how waiting time influences customer experience and evaluation of service quality, it will help to control costs and enhance customer satisfaction (Lee and Lambert 2005).

Directions for Future Research

In the light of these limitations we propose some directions for future research to be carried out in this area. For instance, since research into customer queuing and waiting experience is quite limited in emerging economies much more could be done in other countries. Our sample, even though quite large, bigger samples can be extended to obtain higher representation of the study population. Researchers could also extend the study into other fields especially in the service sector. The constructs used in this study could be helpful in other fields of study such as even the online business where queuing and internet traffic is also an issue. Longitudinal studies could also be carried out in order to measure customers’ memory of their stay in a queue to be served. Since the research into queuing is largely on customers, we propose that waiting in business-to-business and channels of distribution should be looked at.

CONCLUSION

Research into queuing and customer experience will as puts it “be one of the most challenging research issues in the years ahead. Service experience include sensory cognitive, social, emotional and behavioral responses to the firm and its environment. The study highlights the crucial role that waiting environment and queue management play in the perception of customers and their experience in service delivery. The study combines the theory of psychology of waiting and the model of customer experience to test the queue experience of customers and it showed that there is the need to consider this as part of strategies.

Although it is not completely true to think that waiting is always negative, one can argue that waiting is sometimes positive as some customers do not mind waiting which is argued in the studies of Reisinger and Turner; Pullman and Thompson; and Dickson et al. Hence, the study indicates that propositions outlined in this paper suggest that rather than struggling to eliminate, hide or camouflage waiting times, waiting can sometimes be beneficial for companies.

References

- Sharma, J.K. (2007). Operations Research: Theory and Application. 3rd Edition. Macmillan Ltd. India.

- Bielen, F., & Demoulin, N. (2007). Waiting time influence on the satisfaction-loyalty relationship in services. Managing Service Quality: An International Journal, 17(2), 174–193.

- Alfakia H.A., Daudab, M.K., & Magajib, A.S. (2019). Application of queuing theory in service improvement and time management in banking sector. Malaysian Journal of Computing and Applied Mathematics, 2(1), 1.

- Abban, K. (2011). Understanding the importance of time management to assistant registrars in the registrar’s department of the university of education. International Journal of Scientific & Engineering Research, 3(12), 1-16.

- Maister, D. (1985). The Psychology of Waiting Lines. Harvard Business School. Boston, Massachusetts.

- Kumar, A., & Gilovich, T. (2016). To do or to have, now or later? The preferred consumption profiles of material and experiential purchases. Journal of Consumer Psychology, 26(2), 169–178.

- Voorhees, C.M., Fombelle, P.W., Gregoire, Y., Bone, S., Gustafsson, A., Sousa, R. & Walkowiak, T. (2017). “Service encounters, experiences and the customer journey: Defining the field and a call to expand our lens”. Journal of Business Research, 79, 269-280.

- Amoaka, G.K. (2012). Improving customer service in the banking Industry-Case of Ghana Commercial Bank (GCB)-Ghana. International Business Research, 5(4), 134-148.

- Eze, E.O, & Odunukwe, A.D. (2015). On application of queuing models to customer’s management in banking system. American Research Journal of Bio Sciences, 1(2), 14-20.

- Porter, S. (2018). Hotpot chain Haidilao on fire ahead of Hong Kong listing. BBC News. Singapore.

- Singhal, K., Singhal, J., & Kumar, S. (2019). The value of the customer's waiting time for general queues. Decision Sciences, 50(3), 567-581.

- Katz, K., Larson, B., & Larson, R. (1991). Prescriptions for the waiting in line blues: Entertain, enlighten and engage. Sloan Management Review, Winter, 44-53.

- Anderson R. T, Camacho, F. T and Balkrishnan R. (2007). Willing to wait? The influence of patient wait time on satisfaction with primary care. BMC Health Services Research, 7, 31

[Crossref] [Google Scholar] [PubMed]

- Ulku, S., Hydock, C., & Cui, S. (2019). Making the wait worthwhile: Experiments on the effect of queueing on consumption. Management Science, 66(3), 1149-1171.

- Williams, H.T., Ogege, S., & Ideji, J.O. (2014). "An Empirical Analysis of Effective Customers Service on Nigeria Banks Profitability. (A Queuing and Regression Approach)." Asian Economic and Financial Review, Asian Economic and Social Society, 4(7), 864-876.

- Agyei, W., Asare-Darko, C., & Odilon F. (2015). Modeling and analysis of queuing systems in banks: (A case study of Ghana Commercial Bank Ltd. Kumasi Main Branch). International Journal of Scientific & Technology Research, 4(7), 160-163.

- Azad, T., Amitsaha, Sithil H.S., & Rafi, R. (2020). Performance improvements using multi server queuing model by reducing customer wait time of a bank. Research Journal of Management Science. 9(1), 1-10.

- Burodo, M.S., Suleiman S., & Shaba, Y. (2019). Queuing theory and atm service optimization: empirical evidence from First Bank Plc, Kaura Namoda Branch, Zamfara State. American Journal of Operations Management and Information Systems, 4(3), 80-86.

- Furnham, A., Treglown, L., & Horne, G. (2020). The Psychology of Queuing. Psychology, 11(3), 480-498.

- Clemmer, E.C., & Schneider, B. (1993). Managing customer dissatisfaction with waiting: Applying social-psychological theory in a service setting. JAI Press, Greenwich, London. 213-229.

- Shibasaki, M., & Masataka, N. (2014). The Color Red Distorts Time Perception for Men, But Not for Women. Scientific Reports, 4, 5899.

[Crossref] [Google Scholar] [PubMed]

- Bilgili, B., Ozkul, E., & Koc, E. (2018). The influence of colour of lighting on customers’ waiting time perceptions. Total Quality Management & Business Excellence, 31(9), 1–14.

[Crossref]

- Chien, S.Y., & Lin, Y.T. (2015). The effects of the service environment on perceived waiting time and emotions. Human Factors and Ergonomics in Manufacturing & Service Industries, 25(3), 319–328.

- Borges, A., Herter, M.M., & Chebat, J.C. (2015). “It was not that long!”: The effects of the in-store TV screen content and consumer’s emotions on consumer waiting perception. Journal of Retailing Consumer Service, 22, 96-106.

- Fenko, A., & Loock, C. (2014). The influence of ambient scent and music on patients’ anxiety in a waiting room of a plastic surgeon. Health Environments Research & Design Journal, 7(3), 38-59.

[Crossref] [Google Scholar] [PubMed]

- Giebelhausen, M.D., Robinson, S.G., & Cronin J. (2011). Worth waiting for: increasing satisfaction by making consumers wait. Journal of the Academy of Marketing Science, 39, 889-905.

- Debo L.G, Parlour C, & Rajan, U. (2012). Signaling quality via queues. Management Science. 58(2), 876–891.

- Kremer, M., & Debo, L. (2016). Inferring quality from wait time. Management Science, 62(10), 3023–3038.

- Van Vaerenbergh, Y., Varga, D., de Keyser, A., & Orsingher, C. (2019). The service recovery journey: Conceptualization, integration, and directions for future research. Journal of Service Research, 22(2), 103-119.

- Antéblian, B., Filser, M., & Roederer, C. (2014). Consumption experience in retail environments: A literature review. Research and Applications in Marketing, 28(3), 82-109.

- Durrande?Moreau, A. (1999). "Waiting for service: Ten years of empirical research". International Journal of Service Industry Management, 10(2), 171-194.

- Blau, P.M. (1964). Justice in social exchange. Sociological Inquiry, 34(2), 193-206.

- Cropanzano, R., & Mitchell, M.S. (2005). Social exchange theory: An interdisciplinary review. Journal of Management, 31(6), 874-900.

- Emerson, R.M. (1976). Social exchange theory. Annual Review of Sociology, 2, 335–362.

- Davis, M.M., & Heineke, J. (1998). How disconfirmation, perception and actual waiting times impact customer satisfaction. International Journal of Service Industry Management, 9(1), 64-73.

- Singhal, K., Singhal, J., & Kumar, S (2019). The value of the customer's waiting time for general queues. Decision Sciences, 50(3), 567-581.

- Pamies, M.M., Ryan, G., & Valverde, M. (2016). What is going on when nothing is going on? Exploring the role of the consumer in shaping waiting situations. International Journal of Consumer Culture, 40(2), 211-219.

- Allon, G., Federgruen, A., & Pierson, M. (2011). How much is a reduction of your customers’ wait worth? An empirical study of the fast-food drive-through industry based on structural estimation methods. Manufacturing & Service Operations Management, 13(4), 489-507.

- Lu, Y., Musalem, A., Olivares, M., & Schilkrut, A. (2013). Measuring the Effect of Queues on Customer Purchases. Management Science, 59, 1743-1763.

- Schmitt, B., Josko Brakus, J., & Zarantonello, L. (2015). From experiential psychology to consumer experience. Journal of Consumer Psychology, 25(1),166-1-71.

- Meyer, C., & Schwager, A. (2007). Customer experience. Harvard Business Review, 85(2), 116–126.

[Google Scholar] [PubMed]

- Dube, A., & Helkkula, A. (2015). Service experiences beyond the direct use: Indirect customer use experiences of smartphone apps. Journal of Service Management. 26(2), 224-248.

- Helkkula, A. (2011). Characterising the concept of service experience. Journal of Service Management, 22(3), 367–389.

- McColl-Kennedy, J.R., Gustafsson, A., Jaakkola, E., Klaus, P., Radnor, Z.J., Perks, H., & Friman, M. (2015). Fresh perspectives on customer experience. Journal of Services Marketing, 29(6), 430-435.

- Lemon, K.N., & Verhoef, P.C. (2016). Understanding customer experience throughout the customer journey. Journal of Marketing, 80(6), 69-96.

- Mosavi, S.M., Sangari, M.S., & Keramati, A. (2018). An integrative framework for customer switching behavior. The Service Industries Journal, 38(15), 1067-1094.

- Jaakkola, E., Helkkula, A., & Aarikka-Stenroos, L. (2015). Service experience co-creation: Conceptualization, implications, and future research directions. Journal of Service Management, 26(2), 182–205.

- Dagger, T.S., Danaher, P.J., Sweeney, J.C., & McColl-Kennedy, J.R. (2013). Selective halo effects arising from improving the interpersonal skills of frontline employees. Journal of Service Research, 16(4), 488–502.

- Holbrook, M.B and Hirschman, E.C. (1982) The experiential aspects of consumption: Consumer fantasies, feelings, and fun. Journal of Consumer Research, 9(2), 132–140.

- Verleye, K. (2015). The co-creation experience from the customer perspective: Its measurement and determinants. Journal of Service Management, 26(2), 321-342.

- Klaus, P. & Maklan, S. (2011). Bridging the gap for destination extreme sports: a model of sports tourism customer experience. Journal of Marketing Management, 27, 1341-1365.

[Crossref]

- Liu. S., Gong, J., L. Ma & Yu, M. (2017). Influence of waiting times on customer loyalty and queueing behavior in call centers. 29th Chinese Control and Decision Conference (CCDC). Chongqing, 1130-1134,

- Homburg, C., Jozic, D., & Kuehnl, C. (2015), Customer experience management: Toward implementing an evolving marketing concept. Journal of the Academy of Marketing Science, 45(3), 1-25.

- Kandampully, J. & Solnet, D. (2015). Service Management: Principles for Hospitality and Tourism. Kendall Hunt Publishing, Iowa.

- Scheidt, S. and Chung, Q.B. (2018). “Making a case for speech analytics to improve customer service quality: vision, implementation, and evaluation”. International Journal of Information Management, 45, 223-232.

- Scherpena, F., Draghicib, A., & Niemanna, J. (2018). Customer experience management to Leverage Customer loyalty in the automotive industry. Procedia-Social and Behavioral Sciences, 238, 374-380.

- Heshmati E., Saeednia, H., & Badizadeh A. (2019). Designing a customer-experience management model for the banking-services sector. Journal of Islamic Marketing, 10(3), 790-810.

- Hinson, R., Owusu-Frimpong, N., & Dasah, J. (2011). Brands and service-quality perceptions. Marketing Intelligence and Planning, 29(3), 264-283.

- Schoder, D., Sick, S., Putzke, J. & Kaplan, A.M. (2006). Mass customization in the newspaper industry: consumers’ attitudes toward individualized media innovations. The International Journal on Media Management, 8(1), 9-18.

- Spaulding, E., & Perry, C. (2013). Making it Personal: Rules for Success in Product Customization. Bain & Company Publication. Boston, Massachusetts.

- Aichner, T. & Coletti, P. (2013). Customers’ online shopping preferences in mass customization. Journal of Direct, Data and Digital Marketing Practice, 15(1), 20-35.

- Mehra, S., Ratna, P. & Sonwaney, V. (2015). Readiness of young Indian consumer for mass customised products: an exploratory study. International Journal of Indian Culture and Business Management, 10(3), 35-350.

- Dell’Olio, L., Ibeas, A., Cecín., P., & Dell’Olio, F. (2011). Willingness to pay for improving service quality in a multimodal area. Transportation Research Part C, 19, 1060-1070.

- Nunkoo, R., Teeroovengadum, V., Thomas, P., & Leonard, L. (2017). Integrating service quality as a second-order factor in a customer satisfaction and loyalty model. International Journal of Contemporary Hospitality Management, 29(12), 2978-3005.

- Baker, J., & Cameron, M. (1996). The effects of the service environment on affect and consumer perception of waiting time: An integrative review and research propositions. Journal of the Academy of Marketing Science, 24(4), 338-349.

- Tsai, C.I. & Min, Z. (2011). Predicting consumption time: The role of event valence and unpacking. Journal of Consumer Research, 38, 459-473.

- Lim, E., Kum, D. & Lee, Y. (2015). Understanding how changes within service experiences impact prospective vs. retrospective time judgments. Journal of the Academy of Marketing Science, 43, 730-745.

- Zhang, T., Zhao, F., Zhang, M. G., Ru, Y & Sutherladn J.W. (2019). An Approximation of the Customer Waiting Time for Online Restaurants Owning Delivery System. Journal System Science and Complexity, 32, 907-931.

- Qin, J., Xu, F., & Wang, R. (2019). Pre-service recovery: impact on customer satisfaction and acceptable waiting time, The Service Industries Journal, [Crossref] [Google Scholar] [PubMed]

- Pardo, M. J., & De La Fuente, D. (2010). Fuzzy Markovian decision processes: Application to queueing systems. Computers and Mathematics with Applications, 60(9), 2526–2535.

- Marin, A., & Rossi, S. (2017). Power control in saturated fork-join queueing systems. Performance Evaluation, 116, 101-118.

- Adedoyin S., Alawaye A., & Taofeek-Ibrahim F.A., (2014). Application of queuing theory to the congestion problem in banking sector (a case study of First Bank PLC. Ilorin). International Journal of Advanced Research in Computer Science & Technology, 2(2), 3.

- McCarthy, I.G. (2018). The BAHAMAS project: The CMB–large-scale structure tension and the roles of massive neutrinos and galaxy formation. Monthly Notices of the Royal Astronomical Society, 476(3), 2999-3030.

- Liang, C.C. (2016). Queueing management and improving customer experience: Empirical evidence regarding enjoyable queues. Journal of Consumer Marketing, 33(4), 257–268.

- Afolalu, A.S., Enesi, Y.S., Kehinde, O., Samuel, U.A., Ikechi, V.I., & Remilekun, R.E. (2018). Failure mode and effect analysis a tool for reliability evaluation. European Journal of Engineering Research and Science, 3(4), 65-68.

- Pruyn, A., & Smidts, A. (1998). Effects of waiting on the satisfaction with the service: Beyond objective time measures. International Journal of Research in Marketing, 15, 321–334.

- De Vries, J., Roy, D., & De Koster, R. (2018). Worth the Wait? How Restaurant Waiting Time Influences Customer Behaviour and Revenue. Journal of Operations Management, 63, 59-78.

- Bae, G., & Kim, D.Y. (2014). The effects of offering menu information on perceived waiting time. Journal of Hospitality Marketing & Management, 23(7), 746–767.

- McDonnell, J. (2018). Music, scent and time preferences for waiting lines. International Journal of Bank Marketing, 25(4), 223-237.

- Chang, T.Y., & Horng, S.C. (2010). Conceptualizing and measuring experience quality: The customer’s perspective. The Service Industries Journal, 30(14), 2401–2419.

- Ryan, G., Hernández-Maskivker, G.M., Valverde, M., & Pamies-Pallise, M.M. (2018). Challenging conventional wisdom: Positive waiting. Tourism Management, 64, 64–72.

- Liang, C.C. (2018). Enjoyable queuing and waiting time. Time & Society, 28(2), 543-566.

- Saaksjarvi, M., Hellen, K., & Desmet, P. (2016). The effects of the experience recommendation on short-and long-term happiness. Marketing Letters, 27, 675-686.

- Parasuraman, A., Berry, L.L. & Zeithaml, V.A. (1991). Refinement and reassessment of the SERVQUAL Scale. Journal of Retailing, 67(4). 420-450.

- Lovelock, C., & Wirtz, J. (2007). Services Marketing-People, Technology, Strategy. 6th Edition. Prentice-Hall, Upper Saddle River, New Jersey, US state.

- Kim, J., & Kim, J. (2012). Human factors in retail environments: A review. International Journal of Retail & Distribution Management, 40, 818–841.

- Bueno, E.V., Beauchamp W.T.B., Bomfim, E.L., & Kato, H.T. (2019). Measuring customer experience in service: A systematic review. The Service Industries Journal, 39(11), 779-798.

- Vasconcelos, A.M., Barichello, R., Lezana, A., Forcellini, A., Ferreira, M.G.G., & Miguel, P.A.C. (2015). Conceptualisation of the service experience by means of a literature review. Benchmarking: An International Journal, 22(7), 1301-1314.

- Afthanorhan, A., Awang, Z., Rashid, N., Foziah, H & Ghazali, P. (2019). Assessing the effects of service quality on customer satisfaction. Management Science Letters, 9(1), 13-24.

- Fullerton, G. & Taylor, S. (2015). Dissatisfaction and violation: Two distinct consequences of the wait experience. Journal of Service Theory and Practice, 25(1), 31-50.

- Sarstedt, M., Ringle, C.M., & Hair, J.F. (2017). Partial least squares structural equation modeling. Springer International Publishing. New York, United States. 587-632.

- Henseler, J., Ringle, M., & Sinkovics, R.R. (2009). The use of partial least squares path modeling international marketing. New Challenges to International Marketing, 20(10), 277-319.

- Hair, J., Hollingsworth, C.L., Randolph, A.B., & Chong, A.Y.L., (2017). An updated and expanded assessment of PLS-SEM in information systems research. Industrial Management & Data Systems, 117(3), 442-458.

- Henseler, J. (2017). Bridging design and behavioral research with variance-based structural equation modeling. Journal of Advertising, 46(1), 178-192.

- Fornell, C., & Larcker, D. (1981). Evaluating structural equations models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Zeithaml, V.A. (2009). Service Quality, Profitability, and the Economic Worth of Customers: What We Know and What We Need to Learn. Journal of Academy of Marketing Science, 28(1), 67-85.

- Zakay, D. & Levin, I. (1989). Time and Human Cognition, a Life Span Perspective. Elsevier Science Publishers, Amsterdam, New York, United States.

- Lee, W., & Lambert, C.U. (2006). The effect of waiting time and affective reactions on customers' evaluation of service quality in a cafeteria. Journal of Foodservice Business Research, 8(2), 19-37.

- Grewal, D., Roggeveen, A.L., & Nordfalt, J. (2017). The future of retailing. Journal of Retailing, 93(1), 1–6.

- Dagger, T. S., and Sweeney, J. C. (2007). Service quality attribute weights: How do novice and longer-term customers construct service quality perceptions?. Journal of Service Research, 10(1), 22-42.

- Zeithaml, V.A., Berry, L.L., & Parasuraman, A. (1993). The nature and determinants of customer expectations of service. Journal of the Academy of Marketing Science, 21(1), 1–12.

Received: 23-Aug-2024, Manuscript No. AMSJ-24-15177; Editor assigned: 26-Aug-2024, PreQC No. AMSJ-24-15177 (PQ); Reviewed: 09-Sept-2024, QC No. AMSJ-24-15177; Revised: 22-Mar-2025, Manuscript No. AMSJ-24-15177 (R); Published: 29-Mar-2025