Research Article: 2021 Vol: 20 Issue: 6S

Valuation Methods in Emerging Financial Markets: Literature Review Study

Marek Garbowski, University of Warmia and Mazury in Olsztyn

Natalia Kozitska, National University of Shipbuilding

Yevheniia Poliakova, International Technological University

Nataliia Kornilova, Cherkassy State Technological University

Lidiya Synytsia, InterRegional Academy of Personnel Management

Abstract

The study aimed to review the evaluation models and their suitability for emerging financial markets, according to the concept, classification and characteristics of those markets, the study also aimed to present the stages of development of emerging financial markets, and its position according to international diversification , and what are the obstacles facing the emerging financial markets in terms of the legal and legislative structure and the determinants of the securities traded in them, and the limited activity. The study concluded by reviewing how to apply traditional and modern methods to emerging financial markets. In his study, the researcher used the reference approach based on the investment and financing literature that follows modern investment theory. The study concluded that the security is a commodity like all commodities in the economy. Which means that the process of pricing securities is governed by the same principles and theories that govern the process of pricing goods and services in the economy. Thus, the fair value or the appropriate market price for this paper is determined at the point of equilibrium between supply and demand. The demand side represents the expected interest from this asset (cash flow), The supply side represents the cost of owning or using this asset (opportunity cost). Finally, the researcher concludes that there are many models that were presented in an attempt to determine the appropriate value, and each of them has conditions and limitations for use. But we have not yet reached an optimal model that can be used in all circumstances and conditions.

Keywords

Keywords:

Valuation, FCF, DDM, DPS, EPS, WACC

Introduction

The Concept of Evaluation

Pereiro (2002) defined evaluation as a process of estimating the value of the asset. From this definition, the researcher believes that the aim of the evaluation process is to find the economic value of the asset to be valued. Valuation is used in many daily situations such as choosing stocks in an investment portfolio, or in mergers and acquisitions, or through making investments, or in financing and selecting stocks. Where the ideal financing tools must be consistent with specific and specific standards so that their theoretical basis is consistent with the practical reality, and the models used in the evaluation process should be easy to apply in order to reach results consistent with reality. Ideal valuation methods produce a high amount of transparency by referring to appropriate determinants of value to direct management to where it must intervene to influence the value of the subject asset.

But in terms of practical application, the valuation of assets or companies is a more complex process than the theories suggest, because the outcome depends a lot on what is being evaluated, why it is evaluated, and for whom the evaluation process is done (Abuamsha, 2021). Therefore, all the values derived from the valuation model must be understood in the appropriate context, because the same valued asset may have a different value if it is calculated on different scales for another seller and in another way. And both results should be considered equally accurate. Hence, the objective of evaluation in real life is to define the scope of the evaluation objective, i.e., the set of possible values that form the basis for decision-making in future negotiations.

Techniques of Evaluation in Developed Countries

In this part, the valuation Techniques that have found acceptance in both developed markets and valuation Techniques in emerging markets that fit the characteristics and environment of emerging markets consistent with finance theory, and the methodology of applying each of them will be presented. Special emphasis will be placed on its theoretical concept as well as its practical applicability. The financial literature provides many criteria for classifying the different Techniques, depending on:

• The nature of the buyer (strategic versus financial investor).

• The purpose of the evaluation (acquisition, project appraisal, taxes).

• Whether the valuation is for the whole entity or the value of the shares only.

If the value is calculated under continuity or under the assumption of liquidation.

In a study for Abuamsha (2014), section the structure of valuation methods for the two sections of intrinsic value (which depends on factors of internal processes) and extrinsic value (which depends on external information from the private or public market), and the following is a detailed presentation of these Techniques:

First: The techniques based on the actual value

2/1/1- Techniques that depend on discounting cash flows:

2/1/1/1 1- Cash flows available to owners:

According to this method, the cash flows available to the owners are calculated by subtracting the interest and the paid part (after tax) of the loan principal in each period to the lenders from the free cash flows and then adding the new debts that are obtained and this can be expressed as follows:

Cash Flows Available to Owners=Free Cash Flows-[Interest × (1-Tax Rate)]-Paid Portion of the Principal Loan+New Debt

According (Damodaran, 1997) These cash flows assume the existence of a specific financing structure in each period, and that this structure changes according to the interest and installments that are paid out of the principal of the loan as well as according to the loans obtained and after all this there remains a certain amount for the shareholders that they obtain either in the form of distributions or in the form of return Buy their shares.

(Abuamsha, 2017) see the rate of return requested by the owners is the appropriate discount rate that is used to discount the cash flows available to these owners, and both the capital asset pricing model and the arbitrage pricing model are among the most popular and used models, that are used to determine the rate of return required by ordinary shareholders (the discount rate). Models that will be dealt with in some detail in the next section (Damodaran, 1997).

1/1/2- Dividend Discount Model

When an investor buys a certain share (Gordon, 1963), he expects to obtain two types of cash flows.

• The first type: the cash dividends expected to be obtained during the period of his holding of the share.

• The second type: the expected price at the end of the period of holding the share.

But since the expected price itself is determined by future dividends, the value of the stock is the present value of the dividends, assuming the dividends are sustainable.

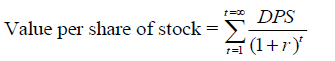

Where is:

∞ =infinity

DPS=Expected dividends per share

r=The required rate of return on the investment

This model is governed by the present value rule, which says that the value of any asset is the present value of expected future cash flows, which are discounted at an appropriate discount rate that reflects the degree of risk to which these flows are exposed.

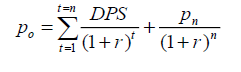

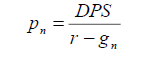

As for achieving a steady and sustainable growth rate, the share price is calculated through the following model Gordon, (1963):

That's when

Where is:

gn=Achieving a sustainable growth rate after year n

pn=share price at the end of year n

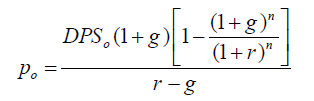

In the event that high profit growth rates are achieved and then suddenly decreased to stabilize at low levels, the following form is used to determine the share price:

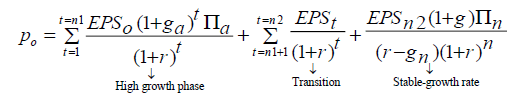

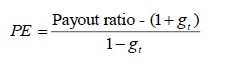

In the case of achieving high growth rates at the beginning of the period and then another phase in which there was a gradual decrease in the growth rate until it stabilized at low levels, the following model Gordon, (1963) is used:

Where is:

EPSt=Earing per share t.

DPSt= Dividends per share per year t.

ga=Growth rate in high growth phase (Lasts n1 periods)

πa=Payout ratio in high growth phase

πn=payout ratio in stable growth phase

R=the required rate of return on equity

2/1/1/3- Free Cash Flow Model

Free cash flows are the operating cash flows of the company or it can be defined Tom Copeland, et al., (2000) as the total cash flows after tax that are generated by the company and which are available to all providers of funds, whether they are lenders or shareholders (owners). Also, free cash flows can be considered as the after-tax cash flows available to a campaign. Shares in the event that the company does not rely on debt as a financing source. The definition of free cash flows is necessary so that it can be ensured that there is consistency between cash flows and the discount rate that are used to determine the value of the company. Thus, it can be said that:

* Free Cash Flow=[Net Operating Profit after Subtracting Adjusted Tax+Depreciation]

– [Net Investments+Depreciation)

The previous equation can also be written in the following form:

* Free Cash Flows=Total Cash Inflows - Total Investments.

Where is:

* Total investments=Net working capital+capital expenditures+other assets.

And if the free cash flows do not include non-operating cash flows, but they must be taken (non-operating cash flows) into account when calculating the value of the company, and therefore the value of the company in light of the concept of free cash flows:

* Firm value=Present value of free cash flows+[Present value of non-operating cash flows after tax+marketable securities]

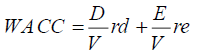

Bearing in mind that the weighted average cost of capital is the appropriate discount rate that is used to discount free cash flows and this cost is calculated as Richard et al. (1996) follows:

This model was introduced by Modigliani & Miller (1958) with no taxation.

rd= Cost of debt

re= cost of equity

D/V=debt-to-value of the firm ratio

E/V= ratio of equity to the value of the firm

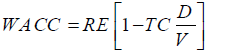

Then they modified it in 1963 and assumed the following taxes:

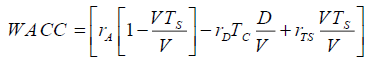

Whereas Harris & Pringle (1985) agreed with Miles & Ezzel (1980) that adjusting the weighted average cost of capital so that the tax rate is taken into account is as follows:

Where is:

Tc= marginal corporate tax rate

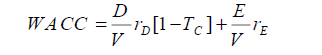

Whereas Farber et al. (2006) by incorporating the tax savings into the WACC calculation

Where is:

VTs=value of tax savings

rTS= required return on tax savings

rA= required return on assets (free cash flow)

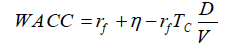

Grinblatt and Liu (2007) confirm that the weighted average cost of capital in the presence of a variable borrowing policy is as follows:

Where is:

η=unit risk premium

V= the value of the company whose capital structure consists of debt and equity

rfTcD/V=Components of the return on tax savings

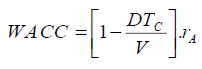

As for Haley & Schall (1973) they emphasized that the average cost of capital is according to the following equation:

Where is:

rA=Rate of return on assets after tax

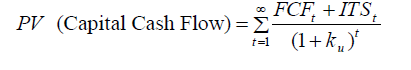

1/1/1-4 Capital Cash Flow Model

Ruback (2000) presented the capital cash flow method, which is an algebraically equivalent method to the free cash flow method. Capital cash flows include all cash flows available to capital providers, including tax savings, that is, it can be said that capital cash flows=free cash flows+tax savings.

Although both the free cash flow and capital cash flow methods treat tax savings differently, they are algebraically equivalent, or in other words, the capital cash flow method is a different way to determine the value of cash flows using the same assumptions and the same input that the free cash flow method used. The capital cash flow method is characterized by its simplicity when the debt value is predicted or when there are continuous changes in the capital structure, and the discount rate under the capital cash flow method does not need to be re-estimated every period, while under the free cash flow method, an estimate is made. According Abuamsha, (2014) the weighted average cost of capital after taxes per period. This method assumes that the debt is determined as a percentage of the value and therefore the higher the value of the company, the higher the debt ratio in the capital structure, and the increase in the debt ratio in the capital structure leads to an increase in tax savings, and therefore the risks to which tax savings are exposed depends on the risks involved in the debt In addition to changes in the level of debt. Which means that if the debt-to-value ratio of the company is fixed, the tax savings will be exposed to the same degree of risk that the company is exposed to, and according to this method, the value of the company is determined as follows:

Where is:

FCF=free cash flows in the period t.

ITSt= tax savings in the period t.

Ku=cost of capital when the company is fully financed through equity

2/1/1/5- Modified Present Value Model

The adjusted present value method is similar to the discounted cash flow method in that it deducts the free cash flows to estimate the value of operations and then adds non-operating assets to obtain the value of the enterprise and the value of the enterprise is calculated according to this method as follows:

Present value of the company=present value of equity+present value of tax savings

Although there are similarities between the revised present value and discounted cash flow methods, there are differences between them, and the most important of these differences are according to Bellinger, (1991):

1- The modified present value method separates the value of operations into two parts, the first part of which represents the value of the operations if the facility was fully financed through equity, and the second part represents the value of the tax savings that emerged as a result of borrowing.

2- Under the discounted cash flow method, tax savings are taken into account when calculating the weighted average cost of capital, that is, the cost of debts is adjusted for the value of the tax savings resulting from these debts. Benefits are estimated by deducting the expected tax savings.

2/1/2 Models for Determining the Value of Financial Options

2/1/2/1- Binomial Model

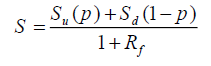

This model relies on a simple formulation of an asset pricing process that is likely to take one of two possibilities or two prices, and this means that under this method, either the price goes up to reach a certain level, let it be with a certain probability, or the price goes down to reach a certain level, let it be with a certain probability Let this be at any time period, and therefore the price of the asset is determined as follows Black, et al., (1972):

Where is:

S=current share price

Su= the potential price of the stock in the event of an increase

Sd= Potential price of the stock if it falls

P= The probability of the stock price going up

1-p=Probability of the stock price falling

Rf= risk-free rate of return

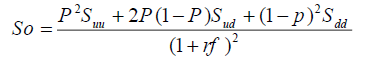

It is noted that the previous model is used to determine the selection price for one period of time, but in the case of two periods, the selection price is determined according to the followingGrinblatt and Titman (2001) model:

Where is:

Note that this form is used for two periods of time.

Suu= the share price if it increased in the first year and it increased in the second year

Sud= the share price if it rises in the first year and declines in the second year, or vice-versa

Sdd= share price in case of decline in the first year and decline in the second year

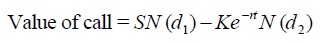

2/1/2/2- Black and Scholes Model

Black and Scholes presented this model in 1973, which was developed for the purpose of pricing European options, and the model also assumes that distributions do not affect the value of the choice. According to this model, the value of the call option is a function of each of:

S=The present value of the underlying asset (the stock)

K=Execution price to choose

t=The period of time until the date of execution of the selection

r=Risk-free rate of return

σ2=Variation in the value of the underlying asset

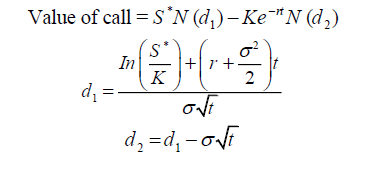

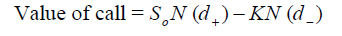

Thus, the value of the purchase option can be calculated according to the following equation:

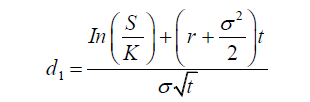

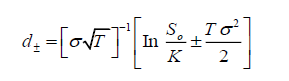

So that,

Where is:

N(d1 )& N(d2 )= The cumulative normal distribution function

KE -rt =The present value of the strike price

And under the following Ross (1996) assumptions:

- There are no restrictions for short selling.

- There are no taxes and no transaction cost.

- European type selection.

- There are no stock dividends.

- Share price is ongoing and there are no jumps.

- That the market is operating continuously.

- The interest rate is short term known and fixed.

- That the share price is subject to a lognormally normal distribution.

As for the steps for evaluating selection according to the Black and Scholes model, which are as follows:

-Using the inputs (variables) of the Black and Scholes model to estimate d1 & d2 which are standard variables.

-Appreciation N(d1 )& N(d2 )

-Calculate the present value of the execution price using the continuous time present value formula (Continuous time).

-Calculate the value of the purchase choice using the Black and Scholes model.

And as we have already mentioned that under the assumptions of the Black and Scholes model there are no distributions, which is an illogical assumption, and that the distributions lead to a decrease in the estimated value of the purchase selection. Therefore, the model can be modified in two ways so that it takes into account the distributions as is evident from the Damodaran (1997) following:

The First Method: In the Case of Short-term Choices

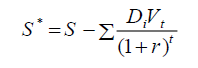

When the selection is short-term (less than a year) the present value of the dividends is deducted from the present value of the asset.

`

`

Where is:

S*= Adjusted value of the asset

S= present value of the asset

Thus the model becomes:

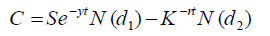

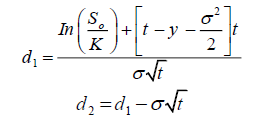

The Second Method: In the case of Long-Term Choices

In the case of long-term choices, distributions are more difficult to deal with, and the model can be modified in this case as follows:

The present value of the asset discounted at the present value of the dividend yield=Se-yt

In this case, the modifications had two effects:

The first effect: The present value of the asset has been deducted from the present value of the proceeds of distributions, taking into account the decrease in the value resulting from the distributions.

The second effect: the interest rate has been adjusted through the dividend yield to reflect the decrease in the cost of holding resulting from holding the stock.

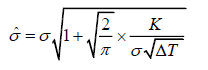

If we go back to the assumptions of the Black and Scholes model again, we will find that among the assumptions of the model is that there is no transaction cost, which is an unrealistic assumption because the reality says that the cost of transactions in money markets is very high. So Nikolai G. Dokuchaev & Andrey V. Savkin modified the Black and Scholes model to include transaction costing and the proposed model was:

Where is:

N(d ±)=the cumulative normal distribution function

T=Cost of transactions

K=strike price

S0=Present value of the asset

Leland (1985) modified the model to take into account transaction costs (that is, it modified the coverage errors caused by transaction costs as follows:

Where is:

π=Instantaneous rate of return

σ=Adjusted volatility (sigma in Black and Scholes)

σ=Instantaneous volatility of the asset

K=Transaction cost

ΔT= Time increment

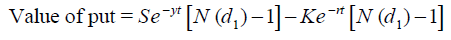

It is noted from all of the above that the Black and Scholes model is mainly used for evaluating the choice of purchase, but this does not mean that it is not suitable for pricing the choice to sell, but rather it can be modified to be used in determining the value of the choice to sell as Damodaran (1997) follows: ( )

Second: Models Based on Non-Actual Values

2/1/3- Models that Depend on Multiples

The objective of valuation methods that use multiples is to determine the value of the owners’ equity in the enterprise based on how market prices are used to comparing companies. The process of determining value using multiples includes four basic Schreiner, (2007) steps:

1- Choosing the appropriate measures that we want to use, and in general, practitioners prefer to use the multiples of the value of equity, because market capitalization does not require additional adjustments to net debts, such as those required by the multiples that are used to determine the value of the enterprise, and one of the most frequently used multiples that determine the value of equity is The price-to-book ratio, price-earnings-ratio, and price-to-sales ratio measure the market price of common stock.

2- Selection of comparison groups and these groups should be chosen to include a number of companies that have a set of operational and financial characteristics similar to those that the company wants to determine their value and preferably have a degree of similarity with respect to the main drivers of value [profitability, growth, risk].

3- Estimating a set of multiples of the corresponding companies. To make this estimate, a group of statistical methods are used, on top of which is the arithmetic mean, although some use the mean or the harmonic mean.

4- Carrying out the process of determining the value, the process of determining the value of the property rights is the last stage, and the value of the property rights is calculated directly by multiplying the multiples of the corresponding companies in the company's value engine when calculating the value of the property rights. Minus the net debt value of the company. The most important complications that are used are:

2/1/3/1 - Profitability multipliers: They are represented in four basic indicators:

1- Dividend-to-earnings ratio: PE

Where is:

PE=price-to-profit multiplier.

G=growth rate.

And that assuming a constant growth rate

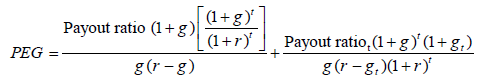

2- Price-earnings-to-earnings growth ratio

Where is:

r=discount rate

Assuming a constant growth rate.

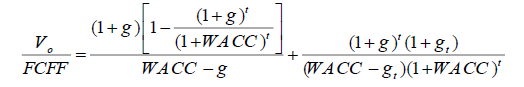

3- Ratio of value to free cash flow

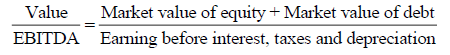

4-Value to EBIT and deprication ratio

2/1/3/2- Multiples that Depend on the Book Value

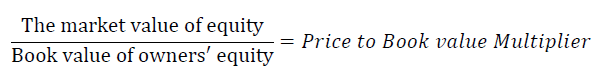

It is represented by the multiplier of price to book value

2/1/3/3- Multiples that depend on revenues: They are represented in two indicators

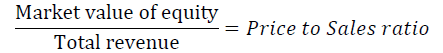

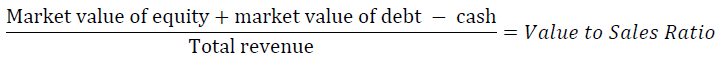

1- price-to-sales multiplier:

2- Value to Sales Ratio:

The multiples are characterized by many strengths, according Perriro (2002) which are:

1- Ease of application.

2- Ease of understanding.

3- Investors can easily obtain them from newspapers and magazines and through specialized websites on the Internet.

According Abuamsha (2017) as multiples are characterized by much strength, they suffer from many weaknesses, which are:

1- Determining the value using multiples reflects the current situation of the market, that is, it tries to measure the fair market value at the present time, a value that is not necessarily equal to the true intrinsic value.

2- It is based on a set of assumptions that are very superficial.

3- It assumes the continuation of the current situation and not changing it in the future.

It is characterized by the lack of transparency in the selection of input multiples that are used to determine the value, which opens the door for manipulation.

Emerging Markets Concept, Characteristics and Problems

3/1 the Concept of Emerging Markets

In the following, the researcher presents the concept of emerging markets as follows:

The term “emerging markets” was coined by the World Bank: in reference to countries in which the per capita Gross National Income (GNI) drops to less than 12,196 dollars in 2020, and more than that are considered developed countries. Using the criteria of the World Bank, out of only 213 countries, 69 are considered developed countries (S&P, 2020). The basic idea behind this term is that it describes social activity or business in countries that are characterized by a rapid industrialization process. Pereiro (2020) believes that the definition of the World Bank is complicated due to the existence of large and real differences between countries in their development behavior.

| Table 1 Global Gross National Income, Population, And Gross National Income Per Capita, 2020 |

||||

|---|---|---|---|---|

| GNI per capital (USD) | Population | GNI (USD billions) | No. of economies | Word Bank income grouping |

| 1018 | 1692 | 862 | 80 | Low (USD 12195 or Less) |

| 4,642 | 7,622 | 17,692 | 112 | Lower middle ( USD 1494 -5,918) |

| 15004 | 2004 | 15030 | 96 | Upper middle (USD 5,919-18,293) |

| 20,664 | 11,318 | 33,584 | 288 | Emerging markets |

| 75,980 | 2,234 | 84,836 | 138 | Developed markets (USD 12195) |

Source : Standard & Poor

The FTSE Group has classified international stock markets according to the level of development, developed markets, advanced emerging markets, secondary emerging markets and limited markets, and the classification of these markets is based on the development of their infrastructure. The country classification is based on fifteen qualitative criteria for stock markets. Table No. (2) below presents these classifications. Index World Ranking (FTSE).

| Table 2 Index World Ranking (FTSE) |

|||

|---|---|---|---|

| Limited Markets | Secondary emerging markets | Developed emerging markets | Developed markets |

| Argentina | Chile | Brazil | Australia |

| Bahrain Kingdom | China | Hungary | Austria |

| Bangladesh | Colombia | Mexico | Belgium/Luxembourg |

| Botswana | czech republic * | Poland | Canada |

| Belgrade | Egypt | South Africa | Denmark |

| Côte d'Ivoire | India | Taiwan | Finland |

| Croatia | Indonesia | France | |

| Cyprus | Malaysia * | Germany | |

| Estonia | Morocco, West, sunset | Greece | |

| Jordan | Pakistan | Hong Kong | |

| Kenya | Peru | Ireland | |

| Lithuania | Philippines | Israel | |

| Macedonia | Russia | Italy | |

| Malta | Thailand | Japan | |

| Mauritania | Turkey * | Netherland | |

| Nigeria | The United Arab Emirates | New Zealand | |

| Oman | Norway | ||

| Diameter | Portugal | ||

| Romania | Singapore | ||

| Serbia | South Korea | ||

| Slovakia | Spain | ||

| Sri Lanka | Sweden | ||

| Tunisia | Switzerland | ||

| Vietnam | United kingdom | ||

| United States of America | |||

The Czech Republic, Malaysia and Turkey will rise to the rank of advanced emerging markets starting from June 2021.

Morgan Stanley Capital International (MSCI) was developed, which is an index that measures the performance of emerging markets, and the (MSCI) emerging market index. Develop a framework for market classification (MSCI) consisting of the following three criteria: economic development, market size and liquidity, as well as market access. The MSCI Index is a free-float-adjusted market capitalization index designed to measure the performance of emerging stock markets. As of May 27, 2020, the index consists of the indices of emerging market countries, which are the indices of 21 countries as follows: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru; Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

The Standard & Poor's (S&P) Emerging Markets Database, now in its fourth decade, is a comprehensive and widely trusted benchmark of the world's emerging markets. Emerging markets have been defined as those markets in transition - in terms of an increase in size, an increase in activity, or an increase in the level of development. Most of the time, this term is defined by a number of metrics and parameters in an attempt to assess the relative level of stock markets of development or the level of economic development.

In general, an S&P rating for financial markets is "emerging" if it meets at least one of several broad criteria: (i) it is located in a low- or middle-income economy, as defined by the World Bank, and (ii) it has no depth Financial, with a low market-to-GDP ratio, (iii) highly controlled and restrictive (e.g. restrictions on ownership and restrictions on dividend redistribution), including for non-domestic investors, (iv) lack of transparency, Lack of market depth (this is in some participating markets), lack of market regulation and operational inefficiency.

The important characteristics of emerging markets are to create a comfortable and attractive environment in all areas of global business, foreign investment, and international trade. The emerging market country is defined as a general concept which is the transition to a free market-oriented economy, with increasing economic freedom and gradual integration into the world market, expanding the middle class, improving standards of living, social stability and tolerance, and as well as increase in cooperation with multilateral institutions.

According to Pereiro’s (2006); Chen & Sensini (2021) defined emerging markets as the existence of a national economy that contains the following characteristics Liu, et al., (2019):

• Attempting to encourage the system to shift to the privatization of state-owned companies and to liberalize economic activities.

• Attempting to achieve stability in the political system, the transition from authoritarian regimes to more liberal ones, the rules of democracy and the increase of popular participation in the formulation of policies.

• Attempting to accelerate the removal of barriers to trade and foreign investment.

• The increase in foreign capital, new technology and advanced management practices. It is experiencing profound changes in the structure of entire industries and individual companies.

• An increase in the growth rate of financial activities, joint ventures, and the establishment of branches of foreign-owned companies.

• The stock market is characterized by growth, and is more active and developed to some extent, and attracts all international financial investors.

• Expanding its influence on neighboring economies, which in turn begin to open up to the rest of the world.

3/2 Characteristics of Emerging Financial Markets

The majority of emerging stock exchanges share some features, although they differ with respect to some indicators (Mitchell, Jerold & Robert, 2002) Abuamsha, (2014, 2017, 2021) point out some of these characteristics as follows:

1-` Market Tightness: emerging markets are characterized by their narrowness, whether in terms of the number of listed companies or in terms of the total value of the stocks registered in them compared to the country's gross domestic product, which is expressed by the capitalization rate (Taux De Capitalization), where this ratio is calculated between the value of shares registered in the stock exchange and the value of the output In countries such as South Africa, this rate reaches more than one, and the rate reaches 0.06 in countries such as Indonesia. What can be said is that whenever the market is narrow, it cannot in any case play its role in financing the economy.

2- Concentration: This indicator measures the value of the contribution of a group of up to ten companies listed in the stock exchange, the first in terms of their rank in the total capitalization of the stock exchange. Emerging markets are characterized by recording a rate of 60%, while developed markets have a rate of no more than 20%.

3- Volatility: This indicator measures the extent of volatility and instability of market returns, and it is measured by calculating the ratio between the share price to its earnings, which is the ratio that records large increases in most emerging markets, which made them markets characterized by a high degree of risk, and this ratio was recorded on the Stock Exchange Brazil is eight times the ratio registered on the Netherlands Stock Exchange. Susmel, (2001); Abuamsha, (2014, 2021) adds the following characteristics:

4- Rapid Development: emerging financial markets record in a short period a significant growth in the number of companies listed therein as well as the volume of securities traded in them, as they were markets that coincided in their establishment with the entry of these countries into implementing broad privatization programs, the primary goal of which was to rid the state of what it owns of institutions. The public sector in favor of joint stock companies whose securities are traded on the stock exchange. In this context, it is possible to mention the Amman Stock Exchange, which witnessed the registration of 109 companies within a period not exceeding four years from its establishment (the period from 1979 to 1983).

5- Lack of Regulation: Emerging markets are mostly experiencing poor regulation and inefficiency in management, as they are markets that existed as a result of economic conditions that characterized the countries in which they existed, and in their creation it was not intended to prepare laws and regulations to work in them, meaning that the authorities of these countries did not attach due importance to the regulatory aspects. That directs its work to improve its efficiency. The regulatory aspects relate to the conditions for registering companies in these markets, the cost of obtaining and disseminating information about those companies, the modalities of transactions in the markets in terms of imposing disciplinary conditions on all their members and brokers.

6- High Returns on Investment in them: Emerging markets represent a center for attracting foreign investment, especially by investors in developed markets because of the high returns they achieve on their investments in these markets compared to what they achieve in developed markets. In a field study by a group of researchers, “using a database of 24 years of activity in some emerging markets; it was proven that the return on share is higher than the return on share in developed markets, and that the return on the portfolio achieves an annual growth of 1.5% per year.” This enabled these markets to attract local capital invested abroad and foreign capital to serve local investment.

7- Weak Reception of Foreign Investments: Despite the increase in capital destined for emerging financial markets from 13 billion dollars in 1990 to 107 in 2000, and to more than 295 billion dollars in 2019, there are studies by the World Bank showing that the largest share of capital Funds invested in the international emerging financial markets are concentrated in them, among the industrialized countries, because the emerging financial markets are more profitable and diversified.

2-3 Emerging Financial Markets Development Stages

Four basic stages of emerging market development can be distinguished according to Shirley & Smith (2009). It varies by country and by how well the market has developed itself:

The First Stage: It begins with the beginning of the use of the financial market Shirley and Smith (2009) as a method of financing and supporting the economic growth of the country, and in general, The emerging of such markets is related to the degree of economic and political stability of the country, as local investors tend to go towards this type of investment instead of traditional bank deposits and short-term treasury bonds. During this stage, Abuamsha (2021) stock prices tend to rise due to the small size of these markets; it also offers limited investment opportunities. These markets also relish a higher growth in size and in the degree of sophistication and cost, which distinguishes them from weak markets that show any signs of development (the countries of the former Soviet Union and some African countries).

The Second Stage: During this stage, the financial market is according to (Christopher, 2000) more active so that pressures from outside lead to obtaining facilities for entry, and from the inside to reduce the cost of capital to liberalize the financial system, in general and in this active and volatile stage, the financial market has improved its set of laws related to investments, especially foreign ones, Elia, et al., (2020) also Clearing and settlement systems in order to attract investors and increase the volume of securities traded on the market, but there are two factors that do not serve the interest of the investor greatly, small market size, and some regulatory restrictions remain (among the markets that are still at this stage: China, Colombia, India, Pakistan, Peru, the Philippines...etc).

The Third Stage: the expansion stage, Bekaert & Harvey (2002), as the market offers higher returns and less volatility, Investors get very easily and rapidly increasing new issues, However, this translates in fact to an increasing need for capital in institutions that were registered before, rather than privatization programmes. In addition to the stock market, an efficient financial intermediation system and banks are growing, This stage has been reached by the markets of Argentina, Brazil, Indonesia, Malaysia, Mexico, and Venezuela. In many of these markets, some mechanisms covering risks, such as derivatives and operations on indexes, have appeared in view of the market growth and the big surprises in it.

The Fourth Stage: or the final stage, which expresses the maturity of the market and the stability of its growth, where risk premiums are internationally competitive Filler (2009), at this stage, the market is approaching fully mature developed financial markets, at this stage also, it is noted that the market respects the recognized international standards, It develops marketing and communication strategies, making the market more attractive to international investors. On the other hand, Cui, et al., (2017) it is characterized by a large size that makes it comparable to developed markets, the market may not be considered promising at this point, in general, it can be said that the passage of markets through these stages slightly cancels the traditional division of the world between developing and development countries, although some distinctive features remain, but it is certain in any case that the emerging of these many poles across the world has changed the mapping of international financial flows.

The Position of Financial Markets within the International Diversification

The enhancement situation of emerging financial markets inside the economic global: This extraordinary advancement in the economies of arising nations was thought about emphatically worldwide capital streams to them with the start of the nineties of the 20th century, Bekaert & Harvey (2002), where it turned into a significant post to draw in global interests in different structures, and this beginning in activities with Emerging financial markets can indeed show the chance of controlling the well-known obligation emerging markets, as these nations can decrease their response to government acquiring from official or private offices, Cui, et al., (2017) by opening their business sectors to the progression of private investment capital and foreign investment, regardless of whether immediate or In the financial portfolios, as follows:

1- The Rise of the Role of Emerging Financial Markets (IFM, 2020) These emerging financial markets involved the forefront of returns during the nineties, and took incredible premium even after they were presented to the emerging financial markets by drawing in private capital, whose streams into the all of these emerging markets rose from 53.2 billion dollars in 1990, To reach $231 billion out of 1996, then, at that point $202.7 billion out of 1997 to reach in 2010 to $450 billion and to surpass $850 billion out of 2020, with its re-visitation of (true) government getting because of the thorough conclusion because of the Corona pandemic, and these assets have tended altogether towards Southeast Asia (47%) and Latin America (38%) as significant poles, while the remainder of the world areas share the leftover (15%). As a general rule, the significance of global financial inflows to developing emerging markets mirrors the degree of the financial and economic efficiency of these markets sectors, and there is no distortion on the off chance that you think about this period. We note the acceleration of capital streams to emerging markets sectors, which has become generally the principles and establishments of the new financial globalization.

2- Growing speculation investment attraction factors from future standpoint and steady assumption for high growth rates are what legitimize this heightening for emerging markets sectors (IFM, 2011). Even after the crises that struck in 1997 and 2008, they had the option, through growth assumptions in them, to recuperate their action, and these growth the significant levels for emerging financial markets and the powerless paces of return in major financial markets simultaneously, notwithstanding the extended transparency approaches sought after by the specialists of these nations, these elements helped in the development of capital on the planet, and in establishing the geological frameworks - global finance - and the reception of speculation hypotheses Cui, et al., (2017). It is generally founded on a two-dimensional examination (risk - return), in a less difficult way dependent on a correlation between the normal profits from investment, which are fundamentally the risks of nations in themselves: political risks, sovereignty risks, exchange rate risks in addition to volatility. This means that emerging markets - and for their financial integration into the global movement - have paid a price for this, in the form of high returns for foreign investors.

3- Emerging financial markets: in spite of the dangers of putting resources into them-are viewed by high return, (Richard Heaney & Vince Hooper, 2000). This addresses the main factor that draws in worldwide investment, and the high growth rates in them comprise a compelling pointer during the time spent structure to achieve the objectives and procedures of financial promoters, as they bear idealistic assumptions for the eventual fate of These business sectors, for instance, in 1996, the World Bank assessed that the yearly growth rate in developed nations came to 2.7% during the period 1994 to 2009 contrasted with 4.8% in arising nations overall (IFM, 2020), nearly multiplying and with the enormous movement, saw by the private area in Emerging economies and the help gave to it by governments inside the system of the primary exchanges of these economies, the interest for unfamiliar capital expanded: direct speculations, portfolio investment, bank loans and all foreign streams that follow those changes and economic changes, particularly those identified with investment laws just as the situation with the private area. It is currently workable for these developing business sectors to obtain expanding portions of worldwide creation, through their geological area, populace and normal abundance, and can arrive at a growth pace of about 6% with the exceptional advancement of the private area (Martin & Hélène, 2002). What's more, the market economy framework dependent on opportunity of investment and finance, which implies that the economy promising, economic development alongside political strength, to establish achievement factors for emerging markets to draw in global investment to them, and local authorities specialists work to help in political stable, particularly concerning their approach towards speculations. By and large, one might say that the transparency of arising financial emerging markets to foreign speculation, and the endeavor to give every one of the components of fascination for these financial streams, causes them to go into genuine contest with major worldwide monetary business sectors and may rely in this upon the upside of exceptional yields, and this implies that developing business sectors - and for their financial combination in Global development - I took care of that as better yields for foreign financial backers.

4- Non-correlation of returns with developed markets, (Shirley Hunter & Murphy Smith, 2009). This concept is used in analyzing the risks of the financial portfolio, as some financial analysts consider that the lack of correlation of returns with developed markets plays an important role in the success of investments in emerging financial markets. The lack of correlation here or the weak correlation coefficient between returns on developed markets and returns on emerging markets, this meaning that any change in the returns of developed markets does not necessarily lead to an impact on investment returns in emerging markets and this very weak correlation, this is explained from the point of view of analysts as having potential profits from Behind the process of portfolio diversification in emerging markets.

Since the global investors backer is searching for the best combination of an portfolio, of protections and admittance to the best gets back with the most minimal risks, as per experts in this field through their aggregated encounters, forming portfolios weighted with securities on emerging markets addresses a low level of hazard than those weighted with securities in the business sectors of industrialized countries.

Despite the previous characteristics that characterize most emerging markets, it remains an important mechanism that can play a fundamental role in the economic development of these countries by creating economic dynamism, through competition that distinguishes the market in the presence of a large private sector whose goal is to achieve and maximize profit, and by creating an investment a climate. There is confidence between two main parties at the level of each economy, the sum of savers (money bidders) and the pool of investors (money seekers) Deng (2012), which makes it an effective mechanism in mobilizing domestic savings and directing it to the right direction to achieve the largest possible return. In this regard, some believe that “direct investment opportunities are very wide in emerging markets, and that developing countries need large volumes of capital to finance their projects, meaning that there is a large gap between the need for funds and their offer. To the Latin American market, approximately 40 billion dollars during the year 1991.

From this standpoint, emerging markets play an active role in developing countries in general and Arab countries in particular, as they are an essential tool of economic growth, and constitute a driving force for the economies of developing countries.” Available field studies indicate that increasing liquidity in these markets leads to raising and strengthening economic growth. In other studies that focused on the aspect of liquidity in these markets, the study Lu'ary Minwer (2001) divided them according to the degree of their liquidity into four main groups:

1- The first category includes all markets that are still in their early stages, such as the Kenya Stock Exchange and Hungary, which are characterized by a small number of registered companies, a low number of shares traded in them, in addition to the low liquidity of their securities, the latter often witnessing large fluctuations in their prices.

2- The second category involves markets whose securities are characterized by greater liquidity compared to the previous one and characterized in general by diversity, which provides investors with opportunities to make profits through the formation of portfolios of securities that are more returnable and less risky. The most prominent markets that fall within this framework are Morocco, Egypt, and India.

3- The third category markets Deng (2012) are characterized by achieving a measure of stability in the prices of their securities, in addition to the high market value of the shares listed within them compared to the two previous categories, and perhaps the most important markets in this regard we mention Argentina and Malaysia.

4- The fourth category includes emerging markets that achieve a large degree of maturity in their activity, Elia, et al., (2020) as they have achieved high levels of liquidity, and are characterized by the large volume of their transactions, and the breadth of their scope, and includes in particular the Hong Kong, Taiwan and Singapore Stock Exchanges.

3/4 Stock Market Obstacles in Emerging Countries

Emerging financial markets, in playing their role in economic development, face several constraints that limit their activity. The latter is often incomplete and does not reach the recognized level, whether at the level of developed markets or at the level of emerging financial markets, where emerging countries are recording a funding deficit and that The largest part of the financing needs, especially what is related to new projects, is provided through local banks, and perhaps the most important of these obstacles, as identified by Bassem Saket (2000):

First: Legislation Shortcomings

Most emerging markets suffer Abuamsha (2014) from deficiency of legislation that governs their activities, especially with regard to providing adequate protection for investors and companies listed in them. There are markets that have not yet witnessed the issuance of disciplinary laws regarding violations and suspicious transactions. Some emerging markets lack a mechanism for oversight and supervision of trading and the discovery of any defect or deviation. Such as obtaining data illegally and leaking false information or rumors. In this context, we find that the sanctions are not categorically specific to such practices, a feature that specifically characterizes the Arab markets in general.

Second: Limited Financial Instruments

Trading activity in emerging financial markets Deng (2012) is limited to stocks and bonds as a form of debt financing issued by companies in cases where they need long-term financing, and some Islamic financial instruments such as sukuk. In this context, the figures indicate that the volume of bond trading constitutes 28% of the total trading in the Egyptian market, 22% in the Moroccan market, 3% in the Jordanian market, and 20% in Asian markets such as Malaysia, Singapore and Hong Kong, while Islamic sukuk is concentrated as a financing tool in Malaysia, Dubai, Kuwait and Bahrain account for about 10% of the volume of financing during the year 2019. At a time when other markets are recording high rates of bond trading, as the ratio in Denmark reached ten times the proportion of shares trading in the year 2020 (786 billion dollars in bonds compared to 102.4 billion dollars in shares).

He adds Alremawi (2001) the following obstacles:

Third: Limited Activity in Issuance Markets

The trading markets in emerging countries suffer from the small number and volume of issuances, whether related to existing projects or under establishment, which deprives the market of the diversity of financial instruments traded in them, and this is due to the expansion of the liquidity of commercial banks in a way that enabled them to cover a large part of investments in terms of long-term financing It is also due to the lack of financial institutions regulating issuance processes, such as investment banks, which are entrusted with the task of making markets because of their expertise and financial and human capabilities that are capable of setting up projects, pricing their issuance and ensuring the promotion of subscription operations in them Abuamsha (2021).

Fourth: Deficiency of Financial Disclosure Systems

Despite the legislation issued in this regard, the reality is far from the required level witnessed by developed markets. Financial disclosure systems in emerging countries are not audited and sometimes remain within the framework of generalities, and the financial reports of companies remain far from the desired quality, and their credibility varies from one market to another. In most cases, it is limited to providing the minimum required for financial disclosure, such as publishing the final budget, and sometimes delaying the publication of these statements and being satisfied with annual publications, which does not provide sufficient information for investors as a basis for making their investment decisions. It opens a wide field for some parties to obtain precedence in information without others and to achieve extraordinary profits at their expense Alremawi (2001).

After reviewing the concept of emerging financial markets, their classification criteria, characteristics, environment, conditions for the establishment of emerging financial markets, their stages of development, their position in international diversification, their dynamism in economic development and their obstacles, we will address in the next part the various evaluation models that have been tested and applied in advanced and emerging financial markets, and access to a special model for evaluating portfolios Securities are compatible with the nature of emerging financial markets and take their specificity into consideration in order to achieve their development and fair evaluation

Application of Traditional Methods in Emerging Markets

In the second part, the researcher dealt with the available evaluation methods and the assumptions behind them, in addition to their scientific methodology. In the third part, a description of the environment that valuation practitioners face when undertaking valuation in emerging markets is presented. In this part, a detailed explanation will be presented on whether the methods accepted in developed countries can be applied directly in emerging countries, or that the exceptional circumstances of emerging markets impose fundamental problems that result in the inability to practically apply and that leads to the imposition of decisive restrictions.

Evaluation based on the Discounted Cash Flow Model

An important factor in each assessment of the cash flow method is the determination of the cost of equity. This is usually based on the CAPM (Capital Asset Pricing Model). The capital asset pricing model itself has been criticized by researchers including Ross, (1976); Fama & French (1992); Estrada (2001); Abuamsha (2014) due to its strong theoretical limitations. It assumes efficient markets without transaction costs or inside information, In addition to the presence of a group of investors diversifying their investments well, Those who have either a risk-free investment only or shares within the market portfolio. These assumptions are not made even in developed markets. Whereas, transaction costs (excluding transaction fees for the financial intermediary) and inside information are present to a certain degree. But the disadvantages of financial markets in emerging countries are much higher, Large companies are often controlled by families or a few major shareholders. This group of investors is usually not very well diversified. Where businessmen own a large proportion of financial investments (Bruner et al., 2002). High Concentrated Ownership Challenge - Focus on informal information channels - From the access of many participants to the capital markets, etc. All of these factors lead to the creation of conditions and atmospheres within the market that are far from the assumed theoretical concept (of the capital pricing model).

Moreover, Abuamsha (2013) the practical application of the discounted cash flow model is quite complex-If not impossible-For the specific conditions emerging markets face. For example, as previously described, There are risks arising from information about unreliable data published by companies in these countries. Past financial statements within the discounted cash flow assessment play an important role in forecasting future cash flows. Which in turn has a significant impact on the value of the asset. Abuamsha (2011) Data processing, whether for illegitimate purposes or to take full advantage of local accounting options, is a problem in both developed and emerging countries. But it is represented in emerging countries, which often lack accounting standards, qualified supervision, and credible sanctions, as a major threat. The seller is characterized by possessing the information and realizing the interest that enables him to evaluate the performance of his company as positively as possible.

Cash flow forecasts Alareeni & Lulu (2018) is becoming more complex in emerging markets. This is due to the high level of volatility which is one of the basic characteristics of emerging markets. This puts valuation experts in a crisis where it is difficult to identify huge market fluctuations, to find a more balanced view of the company's performance and to analyze data over a long period of time. Because it is difficult to find a source of historical data required in emerging markets. Abuamsha (2014) there is a similar problem when forecasting future cash flows, which is absorbing and recognizing market fluctuations, where cash flows must be expected in detail for a long period of time at the expense of locality and accuracy. The common method for evaluators is to use scenarios to model expected cash flows, which is also a more complex method, especially when facing situations in emerging markets. As explained earlier, the risks of expropriation or expropriation threaten contracts in many emerging markets, especially for industries that are prone to expropriation. But including the forfeiture scenario in the cash flow model presents many difficulties,

Moreover, input factors based on multiples Buckley, et al., (2018) should be taken through the use of local stock market data while assessing cash flow. For example, the capital pricing model - which is used to calculate the appropriate cost of stock - The covariance between private equity and market portfolio equity is used to calculate the company's risk ratio. This requires an efficient stock market which provides reliable data for a longer period of time. As explained earlier, many emerging markets cannot offer such facilities. It distorts the changing level of intra-market liquidity Belbag, et al., (2019) and other market imperfections such as ownership limitations and sectoral misalignment of historical data. But the valuation of unlisted institutions is offset by calculating the cost of shares through companies with similar cash flow risks, in emerging markets, the limited number of companies listed on the stock exchange forces the valuation experts to use companies that are less similar to the company under evaluation, or with entities from other countries, and both methods reduce the credibility of the results..

The risk-free return which is another Buckley, et al., (2018) input criterion for the discount factor is also a drawback. While valuation experts in developed countries can expect the yield of long-term highly liquid sovereign bonds issued through their government to be close to the risk-free yield, however, the situation is different in emerging markets. Although emerging market governments theoretically cannot go bankrupt, it can always print more money or collect taxes from its citizens, however, history has proven that such governments (eg Argentina 2002), it can fail and stop paying its debts. This excludes the use of returns as a risk-free component, But it is one of the rare viable alternatives. In addition, liquid government bonds that match the life of the project are always unavailable.

These interpretations show that the application of DCF in the context of emerging markets violates the theoretical Belbag, et al., (2019) basis. In addition, the specific circumstances of developing countries complicate the overall methodology for each step of the assessment process. The discounted cash flow model always requires evaluators to be innovative, and using his intuition or settling on a somewhat compromise, which is the tolerant reality followed in developed countries. However, in emerging markets, it is difficult to justify the use of discounted cash flows to address the issues mentioned above. However, it is considered the preferred method for practitioners in emerging countries, as explained (Pereiro, 2006). The lack of reasonable alternatives and a limited desire to ask about the underlying mechanisms, all this supports the widespread acceptance of the cash flow method as also a "best practice" in emerging markets.

Evaluation on the Basis of Complications

Valuation on the basis of "relative" multiples appears Belbag, et al., (2019) attractive, requires a fairly simple methodology and promises to reflect the perception of the price of assets at the market level, in my opinion, as opposed to the of DCF method. But externally based on methods that show many disadvantages. First and foremost, the economic feasibility and acceptability of the terminal value depend to a large extent on the careful selection of comparable entities. In countries where there are a limited number of companies listed on the stock exchange produces a group of similar companies that may cause problems. This problem becomes even more pronounced in emerging markets: while there are approximately 7,000 companies listed on the US stock exchange, the only emerging market in which there are more than 1,000 companies listed on the stock exchange is Brazil. In countries in transition such as Indonesia, Russia and Turkey, there are about 250 companies listed on the stock exchange Pereiro, (2006). This number is not enough to allow analysts to gather the peer group for each company.

Moreover, relative valuation only makes sense under the assumption that money markets are efficient, and thus market prices display the "real" value of the asset as described earlier, but often this is not the case in emerging countries. Cavusgil, et al., (2021) However, in the context of high volatility in emerging markets, multiples can be a good indicator of where to buy and sell, but these multiples are not appropriate for long-term valuation of the company. A significant degree of uncertainty also arises due to the limited level of liquidity in emerging markets, as described previously, which relates to the realizable selling value of the valuation. Finally, many of the economic standards that are used to calculate multiples are subject to accounting rules, so that they can be manipulated and thus become an unreliable source, as mentioned earlier Copeland, et al., (2000).

Appraisal Methods in Emerging Markets

The previous section discussed the fact that traditional valuation methods applied in developed markets are not appropriate for the specific situations and conditions found in emerging countries. The following section illustrates the attempt of researchers and practitioners to adapt the valuation principles derived from finance theory in a realistic manner to emerging markets. The following modified models are analyzed according to their theoretical concept and practical applicability.

The general perception is to remain with the applying discounted technology cash flows method and adjust the capital assets pricing model, to determine the risks to which the country is exposed. An argument has arisen to show that these risks should be incorporated into the valuation model, and whether these risks should be added to the discount rate model or to the expected cash flow model.

Determining the Discount Rate Adjusted according to the Country's Risks

The cash flows that are generated in emerging markets, which are often in foreign currency and in an unfamiliar position, are considered very risky Cavusgil & Buckley (2016). Thus, increasing the discount rate to realize how dangerous it is seems to be an appropriate response. This method is attractive because it expresses the level of risk for a project or country in the form of a discount rate and is very intuitive and easy for comparisons and communication. However, academics are in disagreement about how to derive the country risk-adjusted discount rate, as Zenner & Akaydin (2002) have made clear that "the only real agreement is that there is no real agreement about estimating the international cost of capital".

Measuring Country Risk

Academics unanimously agree on the importance of country risks like Hassan, et al. (2021); de Salles (2021); damondaran (2021) in the assessment process in emerging markets, but they face an important challenge in how to measure them. The finance literature has unanimously agreed on three measures that are considered the most widely used to measure them, and they are as follows:

The sovereign credit rating of countries, which is issued by the credit rating agency (S&P, Moody’s, Fitch):

This metric measures the risk of a country's default and is more realistic than the risk of ownership. Given that both risks are affected to some extent by the same factors (currency stability, budget, trade balance, and political stability), this measure can be considered an almost valid measure of country risk.

Disadvantages of this Scale De Salles (2021)

A- This measure focuses on the risk of a state defaulting and ignores the rest of the factors that affect the stock market.

B- Does not take into account market movements and does not immediately reflect changes in default risk factors.

T- It is also noted that the credit rating agencies focused only on the risks of default, and this could exclude the risks that could affect the stock market.

d- The credit rating agencies have not disclosed the specific methodology, steps and considerations that they use and take into account in determining the value of the country's risk.

C - Ratings provided by a credit rating agency often do not fully reflect future expectations, but they have important historical elements.

H - Credit rating agencies do not provide ratings for all countries.

Measurement based on Market

In contrast to the credit rating scale issued by rating agencies, this scale instantly reflects changes in the market and has a wide range of use. There are two ways to calculate it Hassan, et al., (2021):

A- The difference between domestic dollar-denominated sovereign bonds and US or European government bonds:

It is measured by the difference between the yield on sovereign bonds issued by emerging countries, denominated in dollars or euros, and the yield on US government bonds for the same period. Both notes must be issued in the same currency and with the same maturity date. The spread between sovereign bonds is a broad and comprehensive measure of the country's overall risk premium stemming from market, credit, liquidity, and other risks damondaran (2021).

Problems with this Scale

1- Lack of data.

2- Most emerging countries do not issue sovereign bonds denominated in dollars, euros, or any of the currencies of developed countries.

3- This type of bond is considered illiquid.

B- It was suggested (Damodaran, 2011) to use the difference between the Credit Default Swap Spread (CDS) instead of the sovereign bonds:

These markets have grown rapidly in recent years Hassan, et al., (2021). They are more accurate and up-to-date than sovereign bond spreads. But at the same time, it is more vulnerable and sensitive to market information and sometimes moves irrationally. It is an important source of information regarding the country's risks and is flexible enough to change in information, especially when changing the country's credit ratings.

Problems with this Measurement

1- It is a misleading measure of state risk according to (Revoltella, Mucci & Mihaljek, 2010) and it was found that the CDS market can be subject to rapid shifts in investor sentiment and sentiment that have nothing to do with the fundamentals of state risk. This may lead to exaggeration of prices, whether above or below their value as a sovereign risk, and thus underestimating the informational content of the CDS as a measure of the country's risks.

2- The other big problem with this measure is the lack of data on it for emerging markets.

3- Stock market volatility:

It can be taken as a good measure of a country's risk. As the volatility in emerging markets is higher than that of developed countries. However, it was true that there is another problem in emerging markets, which is the lack of liquidity in them. Liquidity in the markets is the reason for the great volatility. High risk and illiquid markets often have low volatility, in contrast volatility can be high in a period of great liquidity.

General Criticisms of Country Risk Measurement Damodaran (2021)

1- State risk is assumed to be the same for all companies and for all projects.

2- The truth is that state risks are not the same for all companies and projects, as some sectors of the economy are less dangerous than others, and some parts of the project cannot be exposed to risk.

3- State risks are not all regular risks and part of it can be avoided by diversification, and that part should be compensated by the risk premium.

5/2 Incorporating Country Risks into Cash Flows

Although in practice most models suggest that the adjustment be in the discount factor, it is easy to find a number of proponents of the adjustment being in the cash flow method. The main argument is that only the risks that are not diversified and that are different should be included in the discount rate, and that it should not include the risks that are diversified and related to the country from the point of view of global investors Lessard (1996); Shapiro, (2003). James & Koller (2000) added another argument against the use of the rate of risk in the discount rate, as the risks are uniform in a country but significantly different between industries and even between firms within the same industry. Using the same level of risk across the country may increase the risk for some and reduce it for others. This line of argument was extended by Bruner, et al., (2003), in which they strongly criticized the common practice of adding a fixed rate of risk, which is inappropriate in their view because country risks vary greatly over time.

A common criticism of calculating country risk in cash flows is that it is difficult to measure the exact impact of political events such as political unrest. Lessard (1996) has attempted to counter this argument by suggesting that international political risk insurance rates can be used as an approximation to cover the costs of the implications. Although this seems at first an understandable method, the truth is that neither researchers nor practitioners have been able to come up with an idea that raises the assumption that this method is not what Lessard envisions.

Copeland, et al., (2000) also recommends cash flow adjustments, as they suggested that risks related to emerging markets could represent likely scenarios. Each scenario has a set of coherent macroeconomic variables such as the inflation rate, GDP growth and the exchange rate, and interest rates must be determined. Each group must relate how it matches a potential scenario ranging from total expropriation, hyperinflation or relative stability to booming growth. Subsequently, the impact of such economic conditions on the cash flows of each scenario can be assessed, and individual values are weighted with probabilities of occurrence to calculate the final value of the project. Copeland, et al., (2000) suggests using the Global CAPM model, assuming that there are entire markets and diversified investors on a global scale.

Shapiro (2003) also supports the potential scenario approach, but no author has addressed in detail the important possibilities of subjective and arbitrary decision making that are also present in cash flow forecasts. Weighting scenarios and assessing cash flow implications requires a significant degree of management knowledge and therefore those weights and assessments are vulnerable to manipulation. The results, as indicated by Copeland et al., (2000); Pereiro (2006) are "estimates based on the study at best" and should be considered with a certain degree of skepticism. But by creating scenarios and measuring their impact on project outcomes, management can identify the elements of risk with the greatest impact on the bottom line - and can develop plans to reduce these factors.

5/3 Adjusting Complications with the Country's Risks

Pereiro (2002) introduces a modification to the systematic multiplication method. It proposes the use of multiples from the US market with subsequent cross-border corrections to alleviate the problem of limited comparable companies and transactions in most emerging markets. The proposed method can be illustrated by the following diagram:

Source: Methodology for Country-Risk Adjusted Multiples, Pereiro (2019), own, illustration.

Different accounting standards require an amendment to the published figures, or multiples that depend on the denominators of cash flows must be used, as they are the least influential by accounting practices. Another issue is, national capital markets often value the same private assets differently. This may be due to perceptions about the country's risk, the level of general optimism in the economy or how market participants evaluate the management characteristics of the company Alareeni & Aljuaidi (2014).

As a result, even after cross-border complication adjustments, further adjustment is required. Pereiro (2002) recommended using the market-wide coefficient, eg dividing the average (price/earnings) multiplier of an emerging country by the reference value from the US and then assuming that capital markets are over- or under-valued for the same assets for this factor.

The need to correct for multiplier values calculated for different markets is self-evident and is supported by empirical results. This method provides ample scope for biased decision making, starting with the initial selection of the complication factor (depending on whether the P/E ratio or the P/Sales ratio is chosen, and this results in very different multiples) during the reference period to determine the correction factor for applying additional adjustment factors. He also discussed (Pereiro, 2002) that besides that, it is preferable to adjust the reference multiples related to the aspects of the liquidity of emerging capital markets, and the multipliers factors from the old transactions that must be modified to reflect the changes in economic conditions that occurred during this time.

This series of adjustments may extend to a point where the result is nowhere near the multiple of the initial derivative. You may find a theoretical justification for it but so far it lacks any relevance to realistic assessments.

Conclusion

From the above, the researcher concludes that the security is a commodity like all commodities in the economy, which means that the process of pricing securities is governed by the same principles and theories that govern the process of pricing goods and services in the economy. Thus, the fair value or the appropriate market price for this paper is determined at the point of equilibrium between supply and demand. The demand side represents the expected benefit from this asset (cash flow), while the supply side represents the cost resulting from owning or using this asset (opportunity cost). Finally, the researcher concludes that there are many models that were presented in an attempt to determine the appropriate value, and each of them has conditions and limitations for use, but we have not yet reached an optimal model that is suitable for use in all cases and circumstances.

Acknowledgment

We are indebted to Palestine Technical University -Khadoori for their support in completing this paper.

References

- Abu, A., & Muhammad, K. (2011). Risk management under the institutional control of Kuwaiti banks. Journal of Gulf and Arabian Peninsula Studies, Kuwait, 141.

- Abu, A., & Muhammad, K. (2011). The importance of capital market development in the Gulf Cooperation Council Countries. Journal of Arab Economic Research, 55-56.

- Abu, A., & Muhammad, K. (2013). Enhancing the role of the Qatar stock exchange in attracting foreign investments. Arab Economic Research Journal, 61-62.

- Abu, A., & Muhammad, K. (2013). Promoting and consolidating corporate governance rules and their various economic effects in the state of Kuwait. Journal of Gulf and Arabian Peninsula Studies, Kuwait, 149.

- Abu, A., & Muhammad, K. (2017). Predicting and evaluating the performance of sectoral portfolios and the JerusalemiIndex. Evidence from the Palestinian Stock Exchange, Palestine Technical University Journal.

- Abuamsha, M.K. (2014). The effect of the evaluation of securities portfolio's techniques on the performance in the financial markets. PH.D thesis, Cairo University, Egypt.

- Abuamsha, M.K. (2021). The role of the banking sector in financing the real estate and contracting sector in the Palestinian territories. International Journal of Housing Markets and Analysis.

- Alareeni, B., & Aljuaidi, O. (2014). The modified Jones and Yoon models in detecting earnings management in Palestine Exchange (PEX). International Journal of Innovation and Applied Studies, 9(4), 1472.

- Alareeni, B., & Lulu, M. (2018). The voluntary disclosure of companies listed on palestine exchange and its effect on stock price. International Journal of Business Ethics and Governance, 43-67.

- Anderson, S. (2007). Equity valuation using multiples: An empirical investigation.

- Aswath, D, (1997). Corporate finance: Theory and practice. John Wiley and Sons, 620-625.

- Bassem, S. (2000). The restructuring of jordan’s capital markets has improved the investment inflows. The Arab Bank Review, 2(2).

- Belbag, A.G., Üner, M.M., Cavusgil, E., & Cavusgil, S.T. (2019). The new middle class in emerging markets: How values and demographics influence discretionary consumption. Thunderbird International Business Review, 61(2), 325–337.

- Bellinger, W.K. (1991). Multigenerational value: Modifying the modified discounting method. Project Appraisal, 6(2), 101-108.