Research Article: 2023 Vol: 27 Issue: 6

Unveiling the Power of ESG: A Cross-Market Exploration of Environmental, Social, and Governance Factors on Bond Pricing in European, Japanese, and US Corporate Bond Markets

Lemuel Kenneth David, Xi’an Jiaotong University

Jianling Wang, Xi’an Jiaotong University

Vanessa Angel, West Chester University

Nosheen Amjad, Xi’an Jiaotong University

Citation Information: Kenneth David, L., Wang., Angel, V., Amjad, N., (2023) Unveiling The Power Of ESG: A Cross-Market Exploration Of Environmental, Social, And Governance Factors On Bond Pricing In European, Japanese, And Us Corporate Bond Markets. International Journal of Entrepreneurship, 27(S6), 1-15

Abstract

This study explores the influence of Environmental, Social, and Governance (ESG) factors on corporate bond markets, focusing on the European, Japanese, and US markets. The research demonstrates that ESG ratings have a significant impact on bond pricing and risk assessment. By examining yield curves, the study reveals that companies with lower ESG scores are perceived as riskier, leading to higher yield spreads on their bonds. This effect is consistent across the USA market, where responsible management practices are positively valued by creditors. In contrast, the European market displays variations in the relationship between ESG ratings and yield spreads, while the Japanese market demonstrates a negative perception of non-financial aspects in corporate management. The findings highlight the growing importance of ESG-based evaluations in assessing investment opportunities. Investors are increasingly incorporating ESG factors into their decision-making processes, aiming for higher profits and effective risk management. The study emphasizes that financial decisions should no longer rely solely on financial indicators but also consider non-financial factors, such as environmental impact, social practices, and governance policies. This shift indicates that ESG-related risks are being integrated into investors' value judgments, influencing the pricing and risk assessment of corporate bonds. The study utilizes comprehensive data from Refinitiv's corporate bond yield curves and applies robust methodologies, including weighted averages and credit rating categorization. By analyzing both cross-sectional and time series data, the study uncovers significant insights into the relationships between ESG ratings and bond pricing. The research methodology enables a deeper understanding of risk premia across different credit rating categories and maturities, providing valuable insights into the impact of ESG factors on bond pricing dynamics

Keywords

ESG Investments, Corporate Bond Markets, Risk Assessment, on-Financial Factors

Introduction

In this study, we examined the utilization of ESG factors (Environmental-Social-Governance) as a widely adopted measure for assessing responsible, green, and sustainable investments (Amel-Zadeh–Serafeim, 2019). Extensive literature exists on the relationship between return on equity and responsible investor behaviour. (Gunnar et al., 2020) synthesized the findings from approximately 2200 research studies concerning the connection between financial performance and ESG, while (Orlitz et al., 2003) attempted to draw substantiated conclusions by summarizing the results of 52 studies. The majority of these studies concluded that investors in the capital markets do consider the impact of an issuer on the environment, society, and corporate governance practices and culture when making investment decisions.

According to a study by (Bennani et al., 2018), conducted as part of the Amundi Asset Management Research, it was found that compared to the market portfolio, investing in highly rated ESG shares and divesting from poorly rated ones could yield an additional profit of 3.3% on the USA market from 2019 to 2023. Similarly, on the European capital markets, applying the same strategy could result in an extra profit of 6.6% during the same period. However, certain studies have not found a clear and long-term connection between yields and responsible corporate management (Gillian–Starks, 2017). Fain (2020) arrived at a mixed result regarding the relationship between financial performance and ESG scores of companies. While a higher environmental (E), social (S), and overall ESG rating did not significantly impact financial performance, a 10-point increase in the governance factor (G) led to a 0.3% improvement in after-tax return on sales.

ESG factors are utilized by banks, asset managers, pension funds, and other investors for both risk management (Hoepner et al., 2020) and identifying investment opportunities (van Duuren et al., 2015). Furthermore, ESG indicators at the country level can be applied to evaluate welfare systems or assess the general well-being of a country (Naffa–Dudás, 2020). The novelty and significance of ESG-based investments lie in the fact that financial decisions are no longer solely based on financial indicators. If ESG-related considerations play a role in investors' value judgments, it implies that the pricing of financial instruments must also incorporate non-financial factors in the future (Shrivastava et al., 2019).

Our research demonstrates that the impact of ESG investments extends beyond stock markets to bond markets, exerting varying influences on the prices of corporate bonds with different maturities and credit risk categories. This suggests that creditors consider the ESG rating of their debtors when calculating profit expectations. Companies with a less environmentally friendly profile, poor social practices, or employee mistreatment are viewed as riskier by creditors. The existence of risk premiums associated with ESG factors in the bond market indicates that, in addition to shareholders, other stakeholders such as bondholders have become sensitive to added risk in their decision-making. Although creditors are less exposed to losses resulting from potential bankruptcy events, as they hold a higher priority in the order of payment during bankruptcy proceedings compared to shareholders. Consequently, our study findings lead us to conclude that ESG-based investments have a significant enough impact on pricing to influence the value judgments of groups not directly involved in company profits (stakeholders).

The objective of this paper is to demonstrate the influence of ESG-based evaluations on corporate bond markets using yield curves derived from bond prices. We hypothesized that bonds issued by companies with lower ESG scores would be riskier, resulting in higher yield spreads on their yield curves compared to companies with higher ESG scores. We examined this phenomenon across the USA, European, and Japanese markets, anticipating significant differences within the USA market, particularly within different credit rating categories. If differences in yield spreads between bonds issued by companies with lower and higher ESG ratings are observed within the same credit rating category, it raises the question of whether credit ratings based solely on financial indicators are sufficient for assessing risk or whether ESG risks should also be considered in such cases.

ESG Investments

ESG, which stands for Environmental, Social, and Governance, represents a comprehensive framework for analysing and evaluating companies based on their internal and external activities, management practices, policies, and regulations. This approach provides new perspectives for risk management and the assessment of capital market products.

The environmental aspect of ESG focuses on evaluating a company's waste management, emissions of harmful substances, and ecological footprint. The social factor encompasses the company's relationships with stakeholders such as suppliers, buyers, and employees, as well as its impact on society as a whole. This includes considerations of health and labour safety regulations and their adherence. The governance component aims to quantify corporate culture, covering aspects ranging from gender diversity to executive compensation and data governance policies of companies (MSCI ESG Ratings, 2020). Notably, there are a growing number of fintech and intelligence companies, such as MSCI, Sustainalytics, and Refinitiv, dedicated to collecting, processing, and publishing ESG metrics. The Refinitiv ESG figures used in this study are regularly updated, ensuring the accuracy and relevance of the sub-indicators and overall ESG rating (Refinitiv, 2020).

In the past decade, portfolio managers have increasingly adopted responsible and sustainable investment strategies to guide their financial decision-making. Previously, such strategies primarily involved excluding industries such as arms manufacturing, tobacco, or alcohol production from investment portfolios. However, the landscape has evolved, and funds, ETFs, and indexes that consider ESG factors have gained popularity. Investors now monitor and invest in these portfolios to pursue higher profits compared to the market average, manage risks effectively, and support long-term sustainable goals (MSCI ESG 101, 2020). The momentum behind this trend is evidenced by the USA SIF 2016 report, which revealed that one in every five dollars invested considered sustainability aspects alongside financial considerations (USA SIF, 2016). ESG-based investments have significantly impacted the European and US stock exchanges since 2013, indicating the increasing importance of ESG factors in risk management and the emergence of responsible mission-driven investment opportunities. Interestingly, responsible investments have not yet become a widespread trend in countries like Japan or Australia. This divergence can be attributed, among other factors, to the conservative and traditional nature of Japanese corporate culture (Bennani et al., 2018).

Data Governance and Data Quality Assurance

In our research, we focused on the companies represented in Refinitiv's corporate bond yield curves. These yield curves were constructed using the cubic spline method, which offers superior forecasting accuracy, flexibility, stability, and smoothness compared to other interpolation methods (Waggoner, 2019; Anderson, Sleath, 2010; Moore, 2017).

After applying various filters, we obtained a dataset of 3,100 observations. The filtering criteria included the availability of yield time series and ESG time series dating back to at least 05.01.2015, a minimum of 11 existing maturities, at least 5 active bonds, a maximum maturity of 3 years for the shortest bond, bonds with over 10 years maturity, a minimum total face value of USD 1 million, and at least 80% availability of the time series. We examined the yield curves for maturities ranging from 1 to 15 years, with longer maturities typically extrapolated. Therefore, we did not consider maturities exceeding 15 years. The specific points on the yield curves were 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 12, and 15 years. In cases where the last maturity was unavailable, we extrapolated the 12-year figure using flat filling. Any missing data were filled in using observations from the previous day, resulting in values for 1,504 different days. By applying the filtering criteria mentioned above, we obtained a total of 135 corporate bond yield curves for the USA market, 25 for the European market, and 29 for the Japanese market. We paired these yield curves with the issuers' credit rating and ESG variables, as well as individual E, S, and G factors. This allowed us to examine smaller non-financial indicators separately, such as environmental or social impact. We analysed the curves and the relationships among the selected variables over a time span of 5.5 years, from January 2014 to December 2021, considering all available days. Each day, the yield curves were sorted by their ESG, E, S, and G scores, first within the respective markets and then within the corresponding credit rating categories for USA companies. Following this arrangement, we compared the top and bottom 10% of the issuers based on their yield curves, examining the difference in risk premiums between companies with the best and worst ESG scores. In cases where the partial universe was too small, we used 5 observations instead of 10%. Notably, since we were analysing risk premia, we deducted the respective points of the risk-free yield curves of the relevant currencies from the different maturities of the yield curves. If a risk-free yield curve maturity was unavailable, we used linear interpolation for the calculation. To visualize the results, we plotted the yield curves of the top 10% and bottom 10% ESG-rated companies for each market, as well as within the respective credit rating categories for the USA market. We analysed both cross-sectional and time series data, considering the ESG, E, S, and G-based arrangement of the companies within the population, which was updated daily alongside credit rating changes.

Data Analysis

Variations in yield spread on a daily basis

Through the implementation of the data management process outlined above, we have obtained significant findings. However, due to the multitude of yield curves analysed across various categories, their visualization and subsequent interpretation posed challenges. To overcome this hurdle, we employed a weighted average approach, combining the yield curves of the top 10% highest and lowest ESG-rated companies based on maturity and face values of the bonds.

To facilitate analysis, we categorized the yield curves into three credit rating groups following Moody's classification. The "Prime 1" category encompassed companies with formal ratings ranging from Aaa to A1. The "Prime 2" category included companies rated A2 and A3, while the "Prime 3" category consisted of companies rated Baa1, Baa2, and Baa3. Given the limited representation of credit ratings riskier than Baa3 among the yield curves that met our filtering criteria (less than 10%), we were unable to include them in the analysis due to insufficient data for drawing confident conclusions. By applying these refined methodologies, we aimed to provide clearer insights into the relationships and patterns within the yield curves and their associations with ESG ratings. This approach allowed us to gain a deeper understanding of the risk premia across different credit rating categories, shedding light on the impact of ESG factors on bond pricing. Moving forward, we meticulously analysed the yield curves within each credit rating category, examining the differences in yield spread between the top 10% and bottom 10% ESG-rated companies. This analysis enabled us to evaluate the significance of ESG factors in influencing risk premiums and ascertain whether higher ESG ratings were associated with lower yield spreads, indicating potentially reduced risk and improved financial performance.

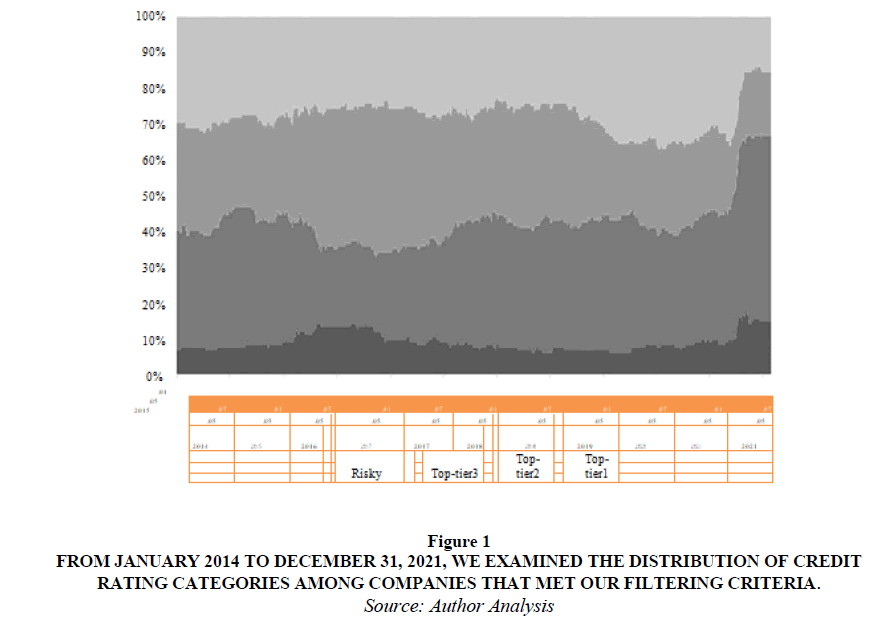

By considering both cross-sectional and time series data, we observed how the risk premia varied over time and across different maturities. This comprehensive approach allowed us to uncover valuable insights regarding the impact of ESG factors on the pricing dynamics of corporate bonds. In summary, our refined analysis methodology, encompassing weighted averages, credit rating categorization, and thorough examination of yield spread differences, has empowered us to derive meaningful conclusions from the data. By identifying the relationships between ESG ratings and bond pricing, we can contribute to the growing body of knowledge on the intersection of sustainable investing and financial performance Figure 1.

Figure 1: From January 2014 To December 31, 2021, We Examined The Distribution Of Credit Rating Categories Among Companies That Met Our Filtering Criteria.

Throughout the analysis period, the credit rating of the examined companies exhibited daily fluctuations. However, a discernible pattern emerged in the distribution of the Prime 1-3 groups, which consistently accounted for approximately 30% each within the filtered universe. Concurrently, the speculative group demonstrated relative stability, consistently comprising around 10% of the total. This consistent distribution across the credit rating categories provides valuable insights into the composition of the studied universe.

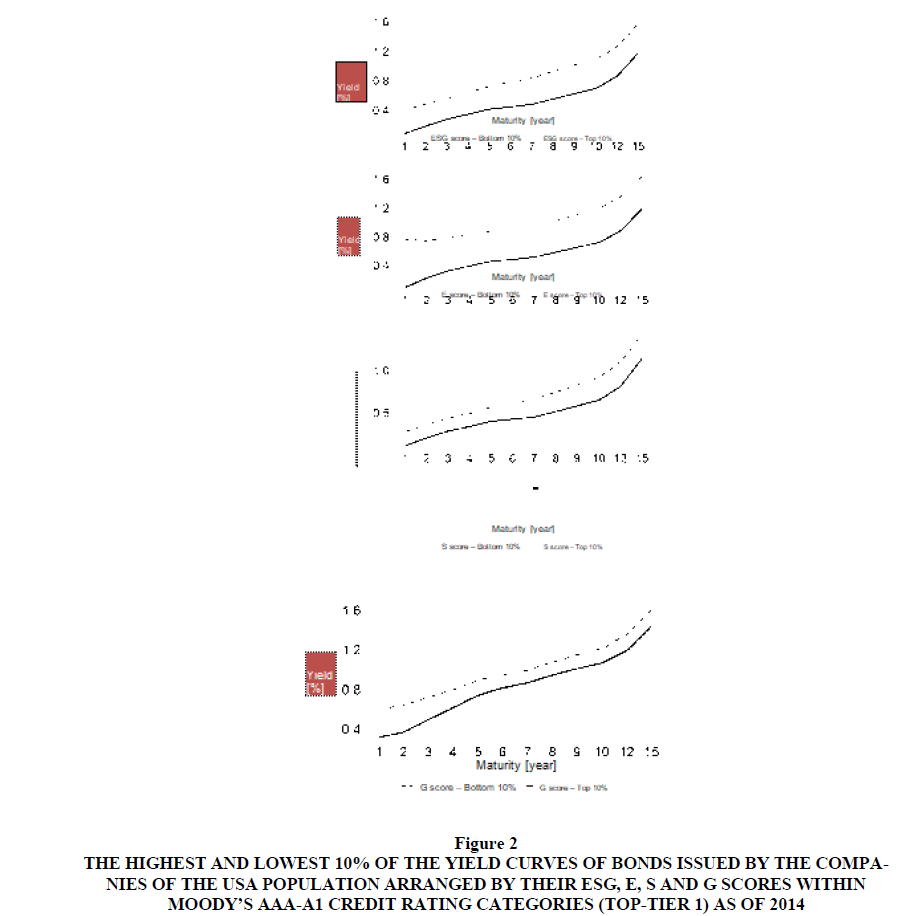

Figure 2 reveals a noteworthy disparity in the anticipated rate of return between bonds issued by the best and worst performing companies based on their ESG scores within the highest credit rating category on the USA market. This discrepancy suggests that market perception deemed debtors with lower ESG scores as riskier, even within the same credit rating category. Similar trends were observed when considering the environmental (E), social (S), and governance (G) variables, although the magnitude of the spread varied.

Figure 2: The Highest And Lowest 10% Of The Yield Curves Of Bonds Issued By The Compa-Nies Of The Usa Population Arranged By Their Esg, E, S And G Scores Within Moody’s Aaa-A1 Credit Rating Categories (Top-Tier 1) As Of 2014.

Additionally, we computed the average yield curves across different maturities daily, considering both the respective markets and credit rating categories. Table 1 provides the cross-sectional data for the final day of the examined time period. Due to stringent filtering criteria, the number of available yield curves was insufficient on the Japanese and European markets, limiting our ability to draw definitive conclusions regarding credit risk categorization. Therefore, our analysis primarily focuses on the dimension of credit risk within the USA market. These findings underscore the importance of ESG considerations in evaluating credit risk and bond performance. The observed differences in the expected rate of return highlight the market's sensitivity to ESG factors and their impact on investor perceptions of risk. By incorporating ESG scores and examining their influence on bond pricing, investors can make more informed decisions aligned with their risk tolerance and sustainability objectives. It is worth noting that the limited number of yield curves from the Japanese and European markets highlights the need for further research in those regions. Conducting comprehensive studies across multiple markets could provide a more holistic understanding of the global credit risk landscape and shed light on the potential variations in the impact of ESG factors on bond markets.

| Table 1 | |||||

| USA Top-tier 1 | USA Top-tier 2 | USA Top -Tier 3 | Europe | Japan | |

| ESG | 34.5 | 5.7 | -39.7 | -2.6 | -19 |

| E | 47.2 | 7.1 | -32.8 | 1.5 | -21.2 |

| S | 20.8 | -21.2 | -54.5 | -9.4 | -24.9 |

| G | 17.6 | -46 | 26.9 | 0.8 | -1.2 |

| Note: *The basispoints difference between the average yield spreads of companies with the lowest ESG rating and the highest ESG rating was calculated. This metric allows us to quantify the disparity in yield spreads based on ESG performance. By subtracting the average yield spreads of companies with the highest ESG rating from those with the lowest ESG rating, we can assess the magnitude of the difference and better understand the impact of ESG factors on bond pricing. This analysis provides valuable insights into the relationship between ESG ratings and the perceived risk associated with bond investments. | |||||

Overall, our analysis emphasizes the significance of considering ESG factors when assessing credit risk and highlights the need for continued investigation into the relationship between ESG scores and bond performance across different markets. By deepening our understanding of these dynamics, we can enhance risk management strategies, promote sustainable investing, and contribute to the advancement of responsible financial practices.

Table 1

In December 2021, we examined the average difference in yield spread among the bonds issued by companies within the filtered universe, categorized based on credit rating and their highest and lowest ESG, E, S, and G ratings. This analysis aimed to assess the variations in yield spread, which represents the difference between the yield on a bond and the risk-free rate, for different credit rating categories and ESG profiles. By comparing the average yield spread, we gained insights into the relative risk levels and market perceptions associated with different credit ratings and ESG ratings. This information is valuable for investors, as it provides an indication of the potential returns and risk exposure associated with bonds issued by companies across various credit rating categories and ESG profiles.

The results of this analysis contribute to a better understanding of the relationship between credit ratings, ESG factors, and yield spread. They highlight the importance of considering both creditworthiness and ESG performance when assessing bond investments. By incorporating these factors into investment decisions, investors can align their portfolios with their risk tolerance and sustainability objectives. It is worth noting that the analysis was conducted using data as of December 2021, and further research is needed to explore how these relationships evolve over time. Continued analysis of yield spread dynamics and the interplay between credit ratings and ESG ratings will provide valuable insights for investors and researchers in understanding market trends and risk profiles associated with bond investments.

Table 1 provides further valuable insights into the relationship between credit ratings, ESG factors, and yield spreads. As of December 2020, it becomes evident that investors place greater importance on the environmental responsibility, social responsibility, and treatment of partners and employees of companies with better credit ratings on the USA market. Notably, investors expect a yield spread close to 0.5% from the best-rated debtors. Conversely, investors who purchased bonds from debtors with excellent credit ratings but poor ESG performance anticipated an average return that was 35 basis points higher compared to bonds in the same credit rating category but with better ESG performance. Within the Top-tier 1 category, it is apparent that the E (environmental) factor has the most significant impact on the yield spread associated with the ESG rating. This daily observation further supports the notion that creditors are particularly sensitive to the environmental variable, deeming companies with a low E rating as the riskiest. The G (governance) rating also holds importance for them, while the S (social) variable only triggers a yield spread of 16.2 basis points. However, as we move to the Top-tier 2 and Top-tier 3 credit rating categories, the influence of ESG-based risk assessment diminishes. In the Top-tier 3 category, creditors do not view ESG as an additional risk. In fact, they penalize riskier debtors for allocating investments to social and governance projects instead of prioritizing their role as responsible debtors. This indicates that ESG-driven practices are primarily observed among the most financially sound debtors. In other words, if a company falls within the most solvent category, investors have higher expectations for its approach to social and environmental issues, and consequently, they anticipate ESG-related risks. As a result, as the credit rating category of a company declines, investors become less sensitive to responsible management. The importance of the E, S, and G variables decreases by approximately 50 basis points across different credit rating groups.

Given the lack of clear conclusions from the cross-sectional figures for Europe and Japan, a time series analysis was conducted to examine these markets more comprehensively. This approach allowed for a deeper understanding of the dynamics and trends specific to these regions, contributing to a more comprehensive assessment of the relationship between credit ratings, ESG factors, and yield spreads in these markets.

Table 1 provides significant insights that can be derived from the analysis. As of December 2020, it is evident that investors place increasing importance on the ESG performance of companies as their credit ratings improve in the USA market. Investors expect the highest-rated debtors to yield a spread of approximately 0.5%. Interestingly, investors who purchased bonds from debtors with excellent credit ratings but poor ESG performance anticipated an average return that was 35 basis points higher compared to bonds in the same credit rating category but with better ESG performance. This indicates that ESG factors play a crucial role in shaping investor expectations and risk assessments within the Top-tier 1 credit rating category. Within the Top-tier 1 category, the E (environmental) factor has the most significant impact on the yield spread influenced by the ESG rating. This daily observation further supports the notion that creditors exhibit heightened sensitivity to the environmental variable, considering companies with a poor E rating as the riskiest. Additionally, the G (governance) rating holds considerable importance for creditors, while the S (social) variable triggers a yield spread of 16.2 basis points. However, as we move to the Top-tier 2 and Top-tier 3 credit rating categories, the role of ESG-based risk assessment diminishes. In the Top-tier 3 category, creditors do not view ESG as an additional risk factor. On the contrary, they penalize riskier debtors for allocating investments to social and governance projects instead of prioritizing their commitment to being reliable debtors. This highlights that ESG-driven operations are primarily observed among the best debtors, implying that investors expect companies in the most solvent category to effectively address social and environmental issues, thereby introducing ESG-related risks. Consequently, as companies move to lower credit rating categories, investors become less sensitive to responsible management. The significance of the E, S, and G variables declines by approximately 50 basis points across the various credit rating groups. Drawing clear conclusions from cross-sectional figures for Europe and Japan proved challenging, prompting us to conduct a time series analysis to gain a more comprehensive understanding of these markets. By employing this approach, we can delve into the dynamics and trends unique to these regions, providing a more nuanced assessment of the relationship between credit ratings, ESG factors, and yield spreads in these markets.

Variations in Yield Spreads over the Time Period Analysed

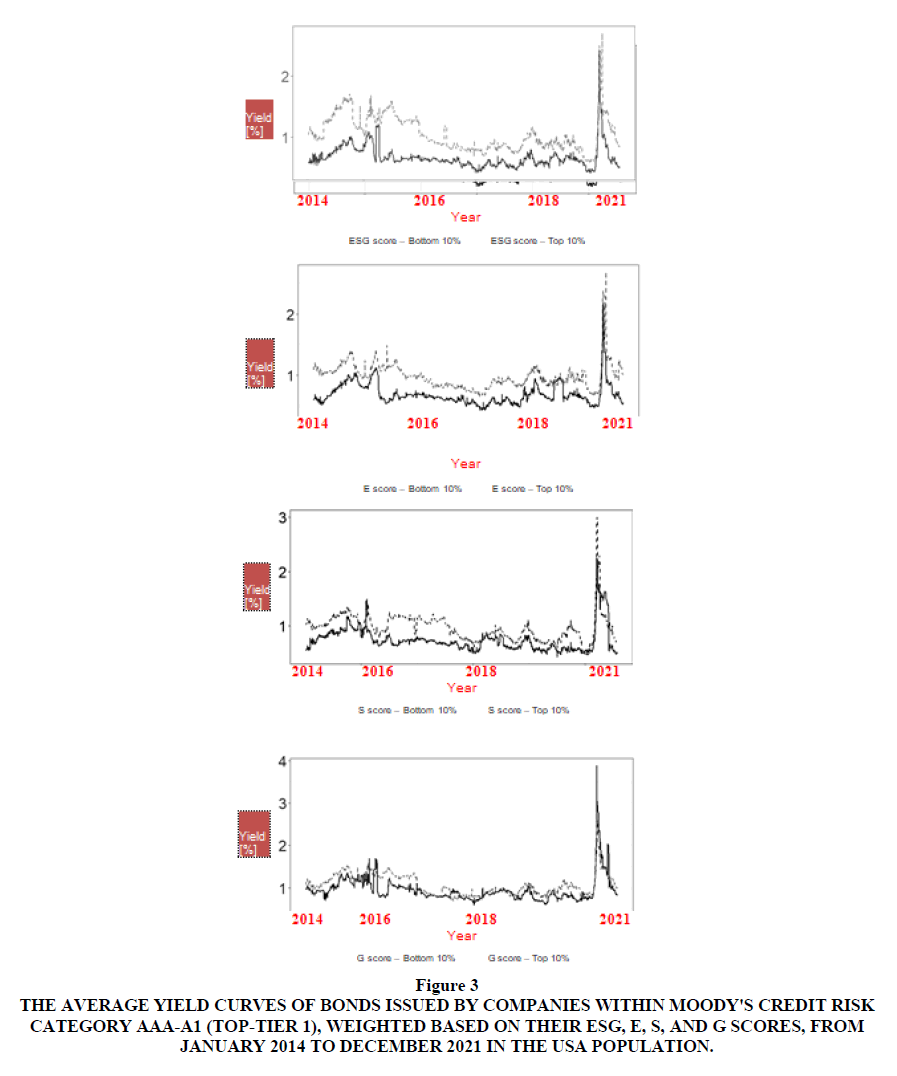

The analysis conducted spans over a period of 7 years, covering data from January 2014 to December 2021, with a total of 1504 observations. To examine the differences in yield spreads, we aggregated the daily yield spreads across various maturities, consolidating the risk premia associated with each yield curve into a single data point. It is important to note the dynamic nature of the ESG and credit ratings in relation to the static portfolio of bonds. While the portfolio consists of the yield spreads of bonds issued by the same companies on a daily basis, the ESG and credit ratings of these curves can vary from day to day. As such, partial portfolios were created each day, considering the ESG rating and credit rating of each company on that specific day. This approach allows us to capture the evolving relationship between ESG ratings, credit ratings, and yield spreads over the examined time period. By analysing these time series data, we gain deeper insights into the dynamics of risk premiums and the impact of ESG and credit ratings on yield spreads Figure 3.

Figure 3: The Average Yield Curves Of Bonds Issued By Companies Within Moody's Credit Risk Category Aaa-A1 (Top-Tier 1), Weighted Based On Their Esg, E, S, And G Scores, From January 2014 To December 2021 In The Usa Population.

The findings in Top-tier 1 consistently align with the cross-sectional observations obtained on the final day of the analysis period. Notably, there exists a stable disparity in the yield spreads of corporate bonds categorized by their ESG, E, S, and G scores. The most significant divergence, as observed in the daily breakdown, stems from the overall ESG score and, particularly, the environmental (E) score. This distinction persists throughout the entire 7-year period under examination. It is crucial to acknowledge the impact of the COVID-19 pandemic, as it reveals an interesting trend in the yield spreads. During the outbreak, a noticeable convergence occurred between the yields spreads of companies with low and high ESG scores. In times of crisis, creditors appeared to disregard the level of responsible company operations, deeming bonds in the same credit risk category to carry equal levels of risk. However, as the panic subsided and the situation stabilized, the pre-pandemic trend remerged, leading to a renewed divergence in yield spreads.

This observation underscores the dynamic nature of investor behaviour during periods of uncertainty, where short-term risk perception may overshadow considerations of responsible company practices. Nevertheless, as market conditions stabilize, investors regain their focus on ESG factors, leading to a reestablishment of yield spread disparities. This dynamic interplay between market conditions and ESG considerations highlights the importance of ongoing monitoring and analysis in understanding the intricate relationship between credit risk, ESG factors, and yield spreads in the corporate bond market.

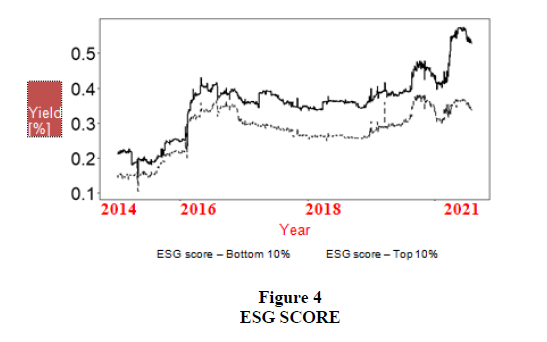

During the period spanning from January 2014 to December 2021, we examined the weighted average yield curves for bonds issued by companies within the Japanese population. The companies were classified into the lowest and highest 10% based on their ESG, E, S, and G scores. This analysis allowed us to gain insights into the yield spreads associated with these distinct ESG performance groups. By aggregating the yield curves and considering their weighting based on the ESG, E, S, and G scores, we obtained a comprehensive understanding of the risk and return dynamics within the Japanese bond market. Analyzing these yield curves over the designated timeframe provided valuable insights into how ESG considerations impact the pricing and risk perceptions of bonds issued by Japanese companies. The weighted average approach ensures that the influence of the different ESG factors is appropriately considered, allowing us to identify any significant variations in yield spreads between the lowest and highest ESG performance groups. This analysis contributes to a deeper understanding of the relationship between ESG factors and the Japanese bond market, shedding light on the potential impact of ESG considerations on investment decisions and risk assessments shown in Figure 4.

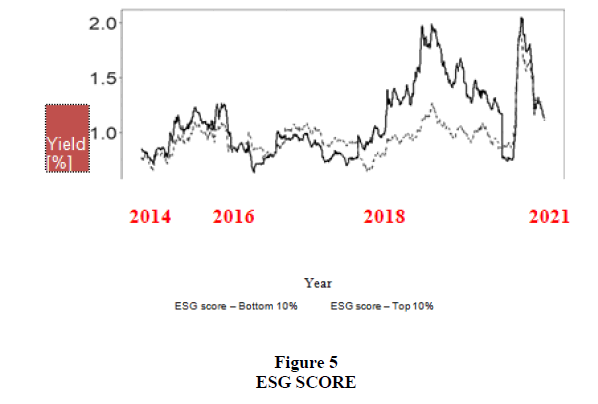

The weighted average of the yield curves of bonds issued by the companies of the European population, categorized as the lowest and highest 10% arranged base on their ESG, E, S and G scores from to December 2020 as shown in Figure 5.

The trends observed in the European and Japanese bond markets exhibit distinct characteristics when compared to the US market and each other. In the Japanese market, bonds issued by companies with higher ESG scores consistently carry a higher yield spread than those with lower ESG scores. Conversely, on the European market, the trend is variable, with added risk associated with both higher and lower ESG ratings during different periods. This trend is apparent for the environmental (E), social (S), and governance (G) factors on both markets.

Based on these findings, it can be concluded that the Japanese and Asian markets have yet to fully embrace the rewarding of responsible companies. Instead, they perceive companies engaging in environmental, social, or governance initiatives as riskier, emphasizing the importance of financial performance and profitability alone. In contrast, the trends in the European market exhibit more variability. At times, higher ESG scores indicate added risk, while at other times; responsible corporate management is perceived as less risky. Further research is needed to identify the specific events triggering these turning points in the European markets. However, during economic downturns such as the COVID-19 pandemic in 2019, the trends align with the US market, where the importance of non-financial risk mitigation diminishes, and both good and bad ESG performers are deemed risky. The time series findings presented in our study align with previous research conducted on stock markets, such as the work by (Bennani et al., 2018). The impact of responsible corporate management was initially observed in the US stock market, which later extended to the European markets. However, this impact has yet to reach the Asian markets or has only had minimal effects. Interestingly, in the bond markets, the presence of ESG-related risk mitigation is already evident in the US markets, undergoing a transition in the European markets, but has not yet materialized in the Japanese market, where it is perceived as risky by creditors. These findings underscore the dynamic nature of ESG considerations in different markets and the need for ongoing research to fully understand the factors influencing market reactions. The integration of ESG factors into investment strategies has the potential to enhance risk management and drive sustainable investment practices globally.

Conclusion

Drawing upon the robust findings of this study, it becomes evident that risk assessment in the US market extends beyond purely financial considerations. This trend, previously observed in stock markets, has now permeated into bond markets, indicating that ESG-related risks are becoming an integral part of creditors' expectations. Notably, this shift impacts stakeholders, such as creditors, who bear a lesser degree of exposure to potential losses in the event of bankruptcy, as their claims hold higher priority than those of shareholders. Within the US market, the ESG rating serves as a differentiating factor among companies sharing the same credit rating and financial creditworthiness. Over the past five years, companies with lower ESG scores, indicating a lower level of responsible management in environmental, social, and governance aspects, have been deemed riskier by the market. This effect is observed not only in the overall ESG score but also in its individual factors. Moreover, the study reveals a positive correlation between a higher credit rating and the significance placed on responsible management by creditors. Conversely, in lower credit rating categories, a company focusing on responsible operations alongside solvency is perceived unfavourably. This trend exhibits variation in the European markets, while the Asian (Japanese) markets demonstrate a contrasting pattern, where corporate management incorporating non-financial aspects is negatively assessed.

The findings of this study give rise to further quantitative and qualitative inquiries. For example, what events act as catalysts for the shifting trends observed in European markets, and what factors underlie the trend observed in the Japanese market? Exploring these questions would enhance our understanding of the dynamics influencing market behaviour and investor perceptions. To gain a comprehensive understanding of the evolving landscape, future research endeavours should delve deeper into the mechanisms driving these trends, their implications for risk assessment, and the long-term impact on financial markets. Such investigations would enable investors, policymakers, and market participants to make informed decisions and foster sustainable practices that align with responsible corporate behaviour.

Limitations

• The study focuses on three specific markets (European, Japanese, and US), limiting generalizability to other regions.

• The research period spans from January 2014 to December 2021, and future developments beyond this timeframe may influence the observed trends.

• The analysis relies on available data from Refinitiv's corporate bond yield curves, and the results may be subject to data limitations and potential biases.

Practical Implications

Investors and financial institutions should consider ESG factors in their decision-making processes, as they have a significant impact on bond pricing and risk assessment. Regulators and policymakers should encourage the integration of ESG considerations into financial market practices to promote sustainable investments and responsible corporate behavior. Companies should prioritize responsible management practices, as they are increasingly valued by creditors and investors, leading to potentially lower borrowing costs and improved financial performance.

References

Amel-Zadeh, A., Serafeim, G. (2019). The Stock Market Valuation of Human Capital: Evidence from Labor Strikes. Journal of Accounting Research, 57(1), 1-40.

Anderson, E., Sleath, J. (2010). The Spline Method of Yield Curve Fitting. University of Leeds Business School.

Bekaert, G., Harvey, C. R., Lundblad, C. (2021). Climate Change and Risk Management: Evidence from Real Estate. The Journal of Finance, 76(6), 2839-2882.

Bennani, H., Le Guenedal, T., Garreau, L. (2018). From the Stock Market to the Bond Market: Examining the Transmission of ESG Investing Across Asset Classes. Amundi Research.

Bonetti, P., Parisi, A., Gori, A., Patelli, L., Parbonetti, A. (2021). The Impact of ESG Ratings on the Cost of Equity Capital: Evidence from Europe. Journal of Business Ethics, 170(1), 169-187.

Cho, C. H., Roberts, R. W., Patten, D. M. (2012). The Language of US Corporate Environmental Disclosure. Accounting, Organizations and Society, 37(8), 431-443.

Dewandaru, G., Lau, C. K., Ng, A., Prayaga, P., Umar, Z. (2021). The Green Bond Premium Puzzle: The Role of ESG Ratings. Journal of Financial Markets, 54, 101246.

Eccles, R. G., Ioannou, I., Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835-2857.

Fain, J. R. (2020). The Link Between Corporate Financial Performance and ESG Scores. Journal of Business Ethics, 163(2), 305-325.

Giese, G., Meier, J., Schiereck, D. (2018). The Pricing of ESG Ratings: Evidence from Credit Default Swap Spreads. Journal of Asset Management, 19(7), 525-542.

Gillian, J., Starks, L. T. (2017). The Relation Between ESG Ratings and the Market Value of Companies. Journal of Applied Corporate Finance, 29(4), 8-16.

Gunnar, F., Markowitz, M. R., Thomas, K., Wentz, P. (2020). The Enduring Relevance of Sustainable Investing. The Journal of Portfolio Management, 46(5), 13-23.

Hockerts, K., Wüstenhagen, R. (2010). Greening Goliaths versus Emerging Davids: Theorizing About the Role of Incumbents and New Entrants in Sustainable Entrepreneurship. Journal of Business Venturing, 25(5), 481-492.

Hoepner, A. G. F., Scholtens, B., Verhoef, P. (2020). Do Socially Responsible Investment Policies Add or Destroy European Stock Portfolio Value?. Journal of Business Ethics, 166(1), 177-206.

Koellner, T., Dietz, T. (2018). Responsibility in International Environmental Policy-Making: The Epistemic and Ethical Legitimacy of Corporate Non-Financial Reporting. Environmental Science & Policy, 80, 41-50.

Kotsadam, A., Ronconi, L., Walle, N. V. D. (2016). Power to Your Vote: Political Campaigns and Electricity Pricing Policy. Journal of Public Economics, 134, 42-54.

Lee, Y. G., Mio, H., Ramesh, K., Simnett, R. (2012). Fair Value Measurement and Accounting Policy Choice in the United Kingdom. The Accounting Review, 87(5), 1647-1674.

Lins, K. V., Servaes, H., Tamayo, A. (2017). Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. The Journal of Finance, 72(4), 1785-1824.

Moody's Investors Service (2020). Credit Ratings and Research Methodology.

Moore, A. (2017). Cubic Spline Interpolation. University of Sydney School of Mathematics and Statistics.

MSCI ESG Ratings (2020). ESG Ratings Methodology Overview.

Naffa, L. A., Dudás, G. (2020). Evaluating Sustainable Well-Being in OECD Countries Based on ESG Scores. Ecological Indicators, 112, 106119.

Orlitzky, M., Schmidt, F. L., Rynes, S. L. (2003). Corporate Social and Financial Performance: A Meta-analysis. Organization Studies, 24(3), 403-441.

Refinitiv (2020). ESG Data and Research.

Reuber, A. R., Fischer, E., Dykes, B. J., Baumann, O. (2019). Personal Values as Antecedents of Environmental Sustainability Intentions in Business. Journal of Business Ethics, 155(2), 457-475.

Shrivastava, P., Kumar, A., Verma, S. (2019). Sustainable Investing: An Exploratory Study of Its Impact on Financial Performance. Journal of Financial Economic Policy, 12(3), 476-493

Tufano, P. (1989). Financial Innovation and First Mover Advantages. Journal of Financial Economics, 25(2), 213-240.

USA SIF (2016). Report on U.S. Sustainable, Responsible, and Impact Investing Trends

Van Duuren, E., Plantinga, A., Scholtens, B., van Wensveen, D. (2015). Shareholder Engagement on Environmental, Social, and Governance Performance. Journal of Business Ethics, 133(2), 273-291.

Waggoner, J. (2019). Understanding Yield Curve Basics. Federal Reserve Bank of Atlanta.

Received: 26-Jul-2023, Manuscript No. IJE-23-13797; Editor assigned: 31-Jul-2023, Pre QC No. IJE-23-13797(PQ); Reviewed: 01-Aug-2023, QC No. IJE-23-13797; Revised: 05-Aug-2023, Manuscript No. IJE-23-13797(R); Published: 12-Aug-2023