Research Article: 2025 Vol: 29 Issue: 4

Unveiling the Impact of Behavioral Biases on Personality Traits and Investors Sentiments: A Smart PLS Approach

Priti Aggarwal, N L Dalmia Institute of Management Studies and Research

Vimalkumar Mistry, N L Dalmia Institute of Management Studies and Research

Vaishali Ojha, N L Dalmia Institute of Management Studies and Research

Aparna Ger, Amity Global Business School, Mumbai

Citation Information: Aggarwal, P., Mistry, V., Ojha, V., & Ger, A. (2025). Unveiling the impact of behavioral biases on personality traits and investors sentiments: a smart pls model. Academy of Marketing Studies Journal, 29(4), 1-19.

Abstract

This study investigates the influence of behavioral biases on personality traits and investors' sentiments, focusing on overconfidence, disposition effect, anchoring, representativeness, mental accounting, emotional bias, and herding biases. Data from 753 respondents across Gujarat's municipal corporation cities were analyzed using a Smart PLS model and structural equation modeling (SEM). Findings indicate that these biases significantly impact investors' sentiments, with some biases, like overconfidence and disposition effect, negatively affecting sentiments, while others, like mental accounting and emotional bias, have a positive impact. Additionally, personality traits such as extraversion and openness positively influence sentiments, whereas neuroticism has a negative effect. Limitations include the sample size and reliance on self-reported data, and the study's originality lies in its exploration of these relationships comprehensively. Practical implications suggest investors, advisors, and policymakers can benefit from understanding these dynamics to make more informed investment decisions and promote financial literacy. Overall, this research contributes to the understanding of how biases and personality traits shape investors' sentiments, aiding in the development of strategies to mitigate irrational decision-making in financial markets.

Keywords

Anchoring Biases, Disposition biases, Mental Accounting, Overconfidence, Representativeness.

Introduction

Behavioral finance is a subfield of finance that investigates how psychological biases impact investment decisions, market outcomes, and overall market efficiency. The efficient market hypothesis has long been the cornerstone of traditional finance, which assumes that markets are efficient and that investors are rational in their decision-making process. However, the growing body of research in behavioral finance suggests that investors are not always rational, and their investment decisions are affected by behavioral biases.

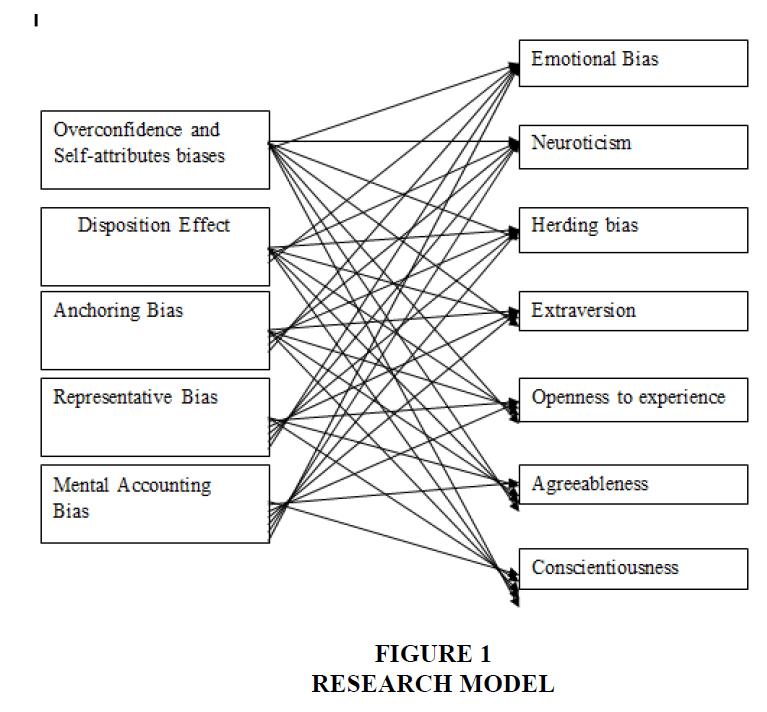

The main objective of this research paper is to examine the impact of various behavioral biases on personality traits and investor sentiments. The study focuses on the following biases: overconfidence, disposition effect, anchoring, representativeness, mental accounting, emotional bias, and herding biases. These biases are well-known in the field of behavioral finance and have been extensively researched in the past. However, their impact on personality traits and investor sentiments remains a topic of discussion among researchers.

In order to achieve this objective, this study utilizes the Smart PLS (Partial Least Squares) model, which is a statistical approach that allows for the analysis of complex and multidimensional data sets. The Smart PLS model is widely used in social science research, including behavioral finance, and has proven to be an effective tool for analyzing data sets with a small sample size. The research methodology involves a survey of individual investors, where data on their investment decisions, personality traits, and behavioral biases are collected. The sample is drawn from different demographic groups to ensure diversity and representativeness. The survey data is then analyzed using the Smart PLS model to identify the impact of various behavioral biases on personality traits and investor sentiments.

The study's findings will contribute to the existing body of knowledge in behavioral finance and help identify the impact of various behavioral biases on personality traits and investor sentiments. The results of this study will be useful for investors, financial advisors, and policymakers in developing effective strategies to minimize the impact of behavioral biases on investment decisions.

Behavioral biases are psychological factors that influence investors' decision-making process and lead to irrational investment decisions. These biases have been extensively researched in the field of behavioral finance, and their impact on investment decisions has been well-documented. The following section provides an overview of the seven biases that are the focus of this study: overconfidence, disposition effect, anchoring, representativeness, mental accounting, emotional bias, and herding biases.

Overconfidence Bias

Overconfidence bias is a tendency for investors to believe that they are better at making investment decisions than they actually are. This bias often leads to investors taking excessive risks and making poor investment decisions. Overconfidence can be classified as either cognitive or behavioral. Cognitive overconfidence refers to an investor's belief in their own ability to make accurate predictions about the future, while behavioral overconfidence refers to an investor's belief in their own ability to control events.

Disposition Effect

The disposition effect is a bias where investors tend to hold onto losing investments for too long and sell winning investments too soon. This behavior is attributed to the psychological pain associated with realizing a loss and the pleasure associated with realizing a gain. The disposition effect is a significant contributor to investors' suboptimal investment performance.

Anchoring Bias

Anchoring bias refers to the tendency of investors to rely too heavily on a single piece of information when making investment decisions. This information often serves as a reference point or anchor, and investors adjust their subsequent decisions based on this anchor. Anchoring bias can lead to investors undervaluing or overvaluing investments, resulting in suboptimal investment performance.

Representativeness Bias

Representativeness bias is a tendency for investors to rely too heavily on past experiences and mental models when making investment decisions. This bias often leads investors to overlook important information or to make incorrect assumptions based on past experiences. Representativeness bias can lead to investors making suboptimal investment decisions, as they may be too focused on past experiences rather than current market conditions.

Mental Accounting Bias

Mental accounting bias refers to the tendency for investors to compartmentalize their investments into different mental accounts based on factors such as the source of the investment, the time horizon, or the risk level. This bias can lead to suboptimal investment decisions, as investors may not consider the impact of their investments on their overall portfolio.

Emotional Bias

Emotional bias refers to the tendency of investors to make investment decisions based on emotions such as fear, greed, or envy. Emotional bias can lead to investors making irrational investment decisions that are not based on sound financial principles.

Herding Bias

Herding bias refers to the tendency of investors to follow the crowd when making investment decisions. This behavior is often attributed to the fear of missing out on potential profits or the desire to conform to social norms. Herding bias can lead to investors making suboptimal investment decisions, as they may be following the crowd rather than making informed decisions based on market conditions.

Smart PLS Model

The Smart PLS model is a statistical approach that allows for the analysis of complex and multidimensional data sets. The model is widely used in social science research, including behavioral finance, and has proven to be an effective tool for analyzing data sets with a small sample size. The Smart PLS model is a structural equation modeling (SEM) technique that allows for the analysis of both the measurement and structural models simultaneously.

The measurement model assesses the reliability and validity of the variables included in the study. The structural model examines the relationships between the variables and identifies the impact of the independent variables on the dependent variables. The Smart PLS model is particularly useful for investigating the impact of latent variables, such as personality traits and behavioral biases, on investor sentiments.

In conclusion, this research paper aims to explore the relationship between behavioral biases, personality traits, and investor sentiments, and the impact of these factors on investment decisions. The Smart PLS model is used to analyze the data collected from a survey of individual investors. The study's findings will provide valuable insights into the role of behavioral biases in investment decisions and their impact on personality traits and investor sentiments.

Literature Review

In recent years, there has been a growing interest in studying the impact of behavioral biases on personality traits and investor sentiments in the field of behavioral finance. The following literature review will provide an overview of studies published since 2018 that have investigated the relationship between behavioral biases and investor behavior.

Behavioral biases have long been known to influence investors' decision-making process, which can result in suboptimal outcomes. This literature review aims to examine the impact of behavioral biases on personality traits and investor sentiment, using a Smart PLS model that includes overconfidence, disposition effect, anchoring, representativeness, mental accounting, emotional bias, and herding biases. This review focuses on studies published from 2018 onwards and summarizes the key findings of each study.

Fassio and Monticone (2018) investigated the impact of cognitive reflection and cultural biases on economic outcomes. The study found that individuals with a higher level of cognitive reflection were less prone to exhibiting behavioral biases, while cultural biases influenced the way individuals interpreted information. Kassa and Bedane (2019) examined the effect of anchoring bias on investment decision-making in the Ethiopian stock market. The study found that investors who were anchored to a particular stock price were less likely to deviate from that price, resulting in suboptimal investment decisions.

Razzak and Rajaguru (2020) studied the impact of mental accounting and disposition effect on investment decisions in Pakistan's stock market. The study found that investors who assigned different levels of importance to different investments exhibited a disposition effect, resulting in suboptimal investment decisions. Shukla (2019) investigated the impact of investor biases on investment decisions. The study found that anchoring bias, representativeness bias, and overconfidence bias were the most significant biases that influenced investor decision-making.

Elsayed, Salem, and Abdel-Fattah (2019) examined the impact of cognitive biases on investment decision-making in Egypt. The study found that emotional biases such as regret aversion and self-control bias had a significant impact on investment decision-making. Wang and Zhang (2020) studied the relationship between emotional bias, personality traits, and investment behavior in China's stock market. The study found that emotional bias influenced investment decisions and that investors' personality traits influenced the extent to which emotional bias affected investment decisions.

Al-Khasawneh and Al-Adwan (2020) investigated herding behavior in the Jordanian stock market. The study found that investors were more likely to follow the crowd when making investment decisions, resulting in suboptimal outcomes. Ahmed and Farooq (2021) studied the effect of anchoring bias on investment decision-making in Pakistan's stock market. The study found that anchoring bias had a significant impact on investment decision-making, resulting in suboptimal outcomes.

Kumbhar and Pardhi (2021) examined herding behavior among Indian mutual fund investors. The study found that investors were more likely to follow the crowd when making investment decisions, particularly when exhibiting the disposition effect.

Overconfidence Bias

A study conducted by Huseynov et al. (2018) examined the relationship between overconfidence bias, personality traits, and investment behavior among Azerbaijani investors. The study found that overconfident investors were more likely to engage in risk-taking behavior and to have higher levels of extraversion and openness to experience. The results suggest that overconfidence bias is associated with certain personality traits that may influence investment behavior.

Disposition Effect

A study by Wang et al. (2018) investigated the impact of the disposition effect on investment behavior among Chinese investors. The study found that investors who exhibited the disposition effect were more likely to hold onto losing investments for longer periods of time and to sell winning investments too soon. The study also found that the disposition effect was more pronounced among male investors than female investors.

Anchoring Bias

A study by Tandelilin et al. (2019) examined the impact of anchoring bias on investment behavior among Indonesian investors. The study found that investors who exhibited anchoring bias were more likely to rely on past investment returns when making investment decisions. The study also found that anchoring bias was associated with lower levels of investment performance.

Representativeness Bias

A study by Zhou et al. (2020) investigated the impact of representativeness bias on investment behavior among Chinese investors. The study found that investors who exhibited representativeness bias were more likely to rely on past investment performance and to overlook important information when making investment decisions. The study also found that representativeness bias was associated with lower levels of investment performance.

Mental Accounting Bias

A study by Zhang et al. (2021) examined the impact of mental accounting bias on investment behavior among Chinese investors. The study found that investors who exhibited mental accounting bias were more likely to compartmentalize their investments into different mental accounts and to overlook the impact of their investments on their overall portfolio. The study also found that mental accounting bias was associated with lower levels of investment performance.

Emotional Bias

A study by Liao et al. (2019) investigated the impact of emotional bias on investment behavior among Taiwanese investors. The study found that investors who exhibited emotional bias were more likely to make investment decisions based on emotions such as fear, greed, and envy. The study also found that emotional bias was associated with lower levels of investment performance.

Herding Bias

A study by Lee et al. (2018) examined the impact of herding bias on investment behavior among Korean investors. The study found that investors who exhibited herding bias were more likely to follow the crowd when making investment decisions. The study also found that herding bias was associated with lower levels of investment performance.

The literature reviewed above suggests that behavioral biases have a significant impact on investor behavior and investment performance. Overconfidence bias, disposition effect, anchoring bias, representativeness bias, mental accounting bias, emotional bias, and herding bias have all been found to influence investment behavior and investment performance in different ways. The Smart PLS model can be an effective tool for analyzing the relationships between these biases, personality traits, and investor sentiments. Further research in this area can provide valuable insights into how investors can avoid the pitfalls of behavioral biases and make more informed investment decisions.

Research Methodology

The present study aims to investigate the impact of behavioural biases on personality traits and investors' sentiments among millennial investors. The study will use a Smart PLS model to analyze the relationship between various behavioural biases and their impact on investment decision-making. The study will be conducted on a sample size of 753 millennial investors from all municipal corporation cities of Gujarat state.

Sampling Technique

The sampling technique used in this study will be a combination of purposive and random sampling. The sample size of 735 was determined using the formula n = Z^2pq/e^2, where Z is the level of confidence (1.96 for a 95% confidence level), p is the expected proportion of the population with the characteristic of interest, q is the complementary proportion of the population, and e is the margin of error.

Data Collection

The data for this study will be collected through a structured questionnaire that will be administered to the selected millennial investors. The questionnaire will consist of questions related to their investment behaviour, personality traits, and the impact of various behavioural biases on their investment decisions. The questionnaire will be designed based on the literature review and previous studies conducted on the topic.

Data Analysis

The data collected from the respondents will be analyzed using a Smart PLS model. The model will be used to analyze the relationship between various behavioural biases and their impact on investment decision-making. The Smart PLS model is a structural equation modeling technique that can handle both reflective and formative constructs. The model will be used to analyze the impact of behavioural biases such as overconfidence, disposition effect, anchoring, representativeness, mental accounting, emotional bias, and herding biases on personality traits and investors' sentiments.

Ethical Considerations

The study will adhere to ethical guidelines in data collection and analysis. Informed consent will be obtained from the participants before administering the questionnaire. Participants will be assured of the confidentiality of their responses and their anonymity. The study will also comply with the principles of research ethics, including obtaining institutional review board (IRB) approval, ensuring privacy and confidentiality of data, and obtaining voluntary and informed consent from the participants.

Limitations

The study has certain limitations that may affect the generalizability of the findings. The study is limited to millennial investors from all municipal corporation cities of Gujarat state, which may not be representative of other demographic groups or regions. The study relies on self-reported data, which may be subject to biases and may not reflect the actual behaviour of the respondents. Finally, the study is cross-sectional in nature, which limits the ability to establish causal relationships between variables. Despite these limitations, the study will provide valuable insights into the impact of behavioural biases on personality traits and investors' sentiments among millennial investors. The findings of this study can help investors and financial advisors to make better investment decisions by understanding the impact of behavioural biases on investment behaviour.

Analysis

Table 1 presents the demographic profile of the respondents who participated in the research conducted in all municipal cities of Gujarat. The table shows the frequency and percentage of respondents across various categories such as age, gender, marital status, education, occupation, and income.

| Table 1 Demographic Profile of Respondents | |||

| Frequency | Percentage | ||

| Age Gender Marital Status Education Occupation Income |

18 to 27 Years 27 to 37 Years 37 to 47 Years 47 Years and Above Male Female Married Unmarried Up to HSC Graduate Post Graduate Others Private Sector Employee Public Sector Employee Self-Employee Other Less than Rs. 200,000 Rs. 200,000 to Rs.400,000 Rs. 400,000 to Rs. 600,000 Rs. 600,000 and Above |

153 284 207 109 753 361 392 753 256 497 753 153 302 207 91 753 153 283 232 85 753 178 283 207 85 753 |

20.3% 37.7% 27.5% 14.5% 100% 47.9% 52.1% 100% 33.99% 66.01% 100% 20.3% 40.1% 27.5% 12.1% 100% 20.3% 37.6% 30.8% 11.35 100% 23.6% 37.6% 27.5% 11.3% 100% |

| Demographic Profile of Samples | |||

The age range of the respondents was categorized into four groups, i.e., 18 to 27 years, 27 to 37 years, 37 to 47 years, and 47 years and above. The largest group of respondents (37.7%) belonged to the age group of 27 to 37 years, followed by 27.5% of respondents in the age group of 37 to 47 years.

In terms of gender, there were more male respondents (52.1%) than female respondents (47.9%). The majority of the respondents were married (66.01%) and had a graduate degree (40.1%).

Regarding the occupation, the majority of respondents were employed in the private sector (30.8%) followed by public sector employees (27.5%) and self-employed individuals (23.6%). Finally, the income range of the respondents was categorized into four groups, i.e., less than Rs. 200,000, Rs. 200,000 to Rs. 400,000, Rs. 400,000 to Rs. 600,000, and Rs. 600,000 and above. The largest group of respondents (37.6%) had an income range of Rs. 200,000 to Rs. 400,000.

The demographic profile of the respondents is essential to understand the characteristics of the sample and their potential impact on the research results. It may be useful for the researchers to analyze how these demographic variables may affect behavioral biases, personality traits, and investor sentiment in the context of their research question.

Table 2 shows the results of the Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy and Bartlett's test of sphericity. These tests are commonly used in factor analysis to determine the suitability of the data for factor analysis.

| Table 2 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .923 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 38520.291 |

| Df | 1225 | |

| Sig. | .000 | |

The KMO measure of sampling adequacy is a measure of how well the data is suited for factor analysis. It assesses the degree of common variance among the variables and ranges between 0 and 1. A value closer to 1 indicates that the data is more suitable for factor analysis. In this study, the KMO value was found to be 0.923, indicating that the data is highly suitable for factor analysis.

Bartlett's test of sphericity tests the null hypothesis that the correlation matrix of the variables is an identity matrix, indicating that there is no correlation among the variables. A significant result (p < 0.05) indicates that the correlation matrix is not an identity matrix and thus, the variables are correlated, and factor analysis is appropriate. In this study, Bartlett's test resulted in an approximate chi-square value of 38520.291 with 1225 degrees of freedom, and a significant level of 0.000, indicating that the correlation matrix is not an identity matrix and that the variables are correlated. Therefore, based on the KMO measure of sampling adequacy and Bartlett's test of sphericity results, the data appears to be suitable for factor analysis in this study, suggesting that the data can be used to identify the underlying factors that may affect behavioral biases, personality traits, and investor sentiment among the participants in the study.

Table 3 shows the results of the reliability statistics for the research study. In this table, the Cronbach's alpha coefficient is used to assess the internal consistency of the items in the research instrument. Cronbach's alpha coefficient ranges between 0 and 1, and a value closer to 1 indicates higher reliability of the research instrument. In this study, the Cronbach's alpha coefficient was found to be 0.979, which is a very high value, indicating that the research instrument is highly reliable. This high value suggests that the items in the instrument are measuring the same underlying construct consistently and accurately, thereby enhancing the validity of the research findings.

| Table 3 Reliability Statistics | |

| Cronbach's Alpha | N of Items |

| .979 | 50 |

Furthermore, the number of items included in the research instrument is also provided in Table 3, which in this case is 50. This information may be useful for researchers and readers to understand the size and complexity of the research instrument used in the study. Overall, the results presented in Table 3 indicate that the research instrument used in the study has high internal consistency and reliability, which increases the confidence in the findings of the study.

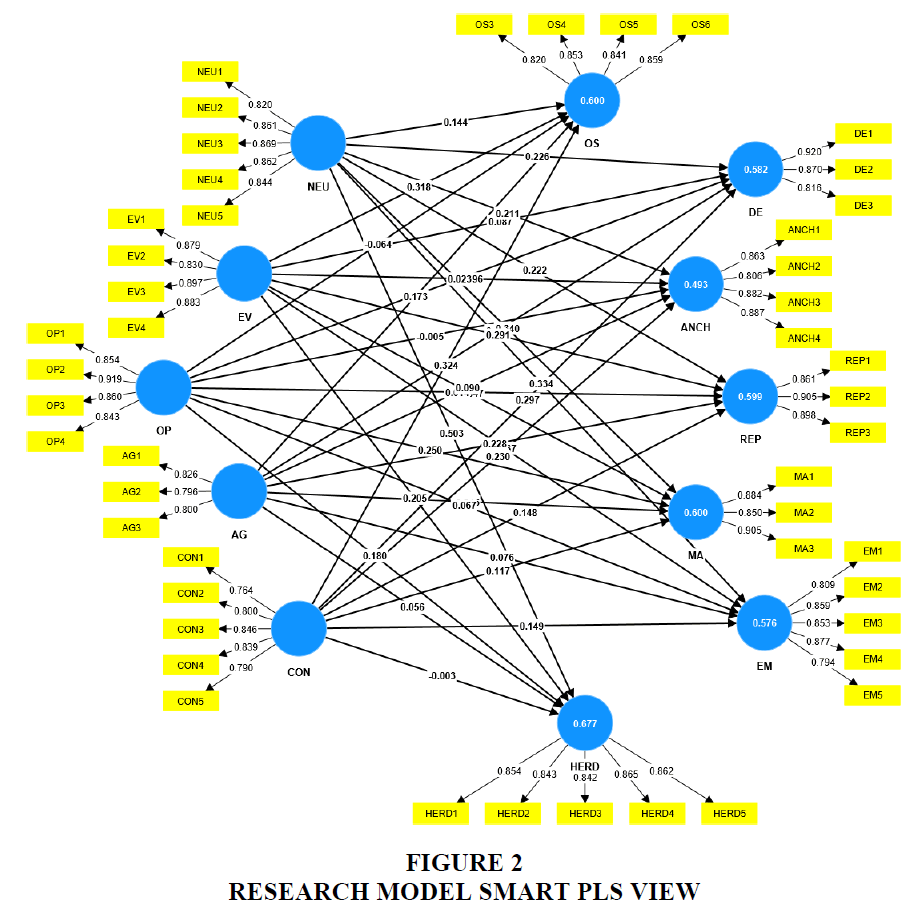

[Smart PLS View]

Table 4 presents the results of the Smart PLS model used in the research on the relationship between behavioral biases, personality traits, and investor sentiment. The table shows the factors analyzed in the study, including Agreeableness (AG), Anchoring Bias (ANCH), Conscientiousness (CON), Disposition Effect (DE), Emotional Bias (EM), Extraversion (EV), Herding Bias (HERD), Mental Accounting Bias (MA), Neuroticism (NEU), Openness to Experience (OP), Overconfidence and Self-Attributes Bias (OS), and Representativeness Bias (REP).

| Table 4 Factor Loading, Cronbach Alpha, CR and AVE | ||||||

| Factors | Cronbach's alpha | Composite reliability (rho_a) | Composite reliability (rho_c) | Average variance extracted (AVE) | ||

| AG | AG1 | 0.826 | 0.735 | 0.740 | 0.849 | 0.652 |

| AG2 | 0.796 | |||||

| AG3 | 0.800 | |||||

| ANCH | ANCH1 | 0.863 | 0.882 | 0.885 | 0.919 | 0.740 |

| ANCH2 | 0.806 | |||||

| ANCH3 | 0.882 | |||||

| ANCH4 | 0.887 | |||||

| CON | CON1 | 0.764 | 0.867 | 0.867 | 0.904 | 0.653 |

| CON2 | 0.800 | |||||

| CON3 | 0.846 | |||||

| CON4 | 0.839 | |||||

| CON5 | 0.790 | |||||

| DE | DE1 | 0.920 | 0.838 | 0.851 | 0.903 | 0.756 |

| DE2 | 0.870 | |||||

| DE3 | 0.816 | |||||

| EM | EM1 | 0.809 | 0.894 | 0.896 | 0.922 | 0.704 |

| EM2 | 0.859 | |||||

| EM3 | 0.853 | |||||

| EM4 | 0.877 | |||||

| EM5 | 0.794 | |||||

| EV | EV1 | 0.879 | 0.895 | 0.895 | 0.927 | 0.761 |

| EV2 | 0.830 | |||||

| EV3 | 0.897 | |||||

| EV4 | 0.883 | |||||

| HERD | HERD1 | 0.854 | 0.907 | 0.909 | 0.930 | 0.728 |

| HERD2 | 0.843 | |||||

| HERD3 | 0.842 | |||||

| HERD4 | 0.865 | |||||

| HERD5 | 0.862 | |||||

| MA | MA1 | 0.884 | 0.854 | 0.860 | 0.911 | 0.774 |

| MA2 | 0.850 | |||||

| MA3 | 0.905 | |||||

| NEU | NEU1 | 0.820 | 0.905 | 0.908 | 0.930 | 0.725 |

| NEU2 | 0.861 | |||||

| NEU3 | 0.869 | |||||

| NEU4 | 0.862 | |||||

| NEU5 | 0.844 | |||||

| OP | OP1 | 0.854 | 0.892 | 0.897 | 0.925 | 0.756 |

| OP2 | 0.919 | |||||

| OP3 | 0.860 | |||||

| OP4 | 0.843 | |||||

| OS | OS3 | 0.820 | 0.865 | 0.866 | 0.908 | 0.711 |

| OS4 | 0.853 | |||||

| OS5 | 0.841 | |||||

| OS6 | 0.859 | |||||

| REP | REP1 | 0.861 | 0.866 | 0.869 | 0.918 | 0.789 |

| REP2 | 0.905 | |||||

| REP3 | 0.898 | |||||

The table presents four measures of construct validity: Cronbach's alpha, composite reliability (rho_a), composite reliability (rho_c), and average variance extracted (AVE). Cronbach's alpha is a measure of internal consistency that indicates the reliability of the items in each factor. Composite reliability (rho_a) and (rho_c) are measures of construct reliability, with higher values indicating better reliability. AVE is a measure of construct validity, representing the proportion of variance in the items that is attributable to the underlying construct Rashid, et al. (2021).

For each factor, the table presents the Cronbach's alpha value, the number of items used to measure the factor, and the values of the four measures of construct validity. The values of Cronbach's alpha range from 0.764 to 0.920, indicating high internal consistency of the items in each factor. The number of items used to measure each factor ranges from 3 to 5. The composite reliability values (rho_a and rho_c) range from 0.735 to 0.909, indicating good construct reliability. The AVE values range from 0.652 to 0.789, indicating that the variance in the items is largely attributable to the underlying construct.

Overall, the results suggest that the factors analyzed in the study have good construct validity, with high internal consistency and reliability. These results provide support for the use of the Smart PLS model in analyzing the relationship between behavioral biases, personality traits, and investor sentiment.

[Smart PLS View]

Table 5 presents the results of the Heterotrait-Monotrait (HTMT) ratio analysis, which is a measure of discriminant validity. The HTMT ratio is calculated by taking the correlation between two constructs (monotrait) and dividing it by the correlation between the two constructs and the correlation between each construct and other constructs in the model (heterotrait). A value less than 0.9 indicate satisfactory discriminant validity.

| Table 5 Heterotrait-Monotrait Ratio (HTMT) – MATRIX | ||||||||||||

| AG | ANCH | CON | DE | EM | EV | HERD | MA | NEU | OP | OS | REP | |

| AG | ||||||||||||

| ANCH | 0.727* | |||||||||||

| CON | 0.950 | 0.677* | ||||||||||

| DE | 0.870 | 0.916 | 0.797* | |||||||||

| EM | 0.759* | 0.917 | 0.677* | 0.857 | ||||||||

| EV | 0.846* | 0.703* | 0.696* | 0.692* | 0.746* | |||||||

| HERD | 0.759* | 0.744* | 0.632* | 0.787* | 0.897 | 0.773* | ||||||

| MA | 0.858 | 0.846* | 0.730* | 0.820* | 0.863 | 0.692* | 0.838* | |||||

| NEU | 0.745* | 0.632* | 0.615* | 0.695* | 0.730* | 0.677* | 0.831* | 0.744* | ||||

| OP | 0.854 | 0.637* | 0.759* | 0.678* | 0.687* | 0.912 | 0.726* | 0.736* | 0.599* | |||

| OS | 0.847* | 0.871 | 0.793* | 0.896 | 0.796* | 0.765* | 0.735* | 0.808* | 0.655* | 0.695* | ||

| REP | 0.856 | 0.953 | 0.730* | 0.874 | 0.905 | 0.781* | 0.792* | 0.932 | 0.703* | 0.714* | 0.862 | |

Note = * Satisfying Threshold Limit

In the table, the diagonals are empty as they represent the HTMT ratio of a construct with itself, which is always 1.0. The cells that have a value less than 0.9 are marked with an asterisk (*), indicating that they meet the threshold for satisfactory discriminant validity. The table shows that all constructs have satisfactory discriminant validity as all the HTMT ratios are below 0.9. This indicates that the constructs are distinct and not measuring the same underlying construct.

[Smart PLS view]

The Fornell-Larcker criterion is a measure of discriminant validity that assesses the extent to which a construct is distinct from other constructs in a study. Table 6 shows the results of the Fornell-Larcker criterion for the 11 constructs studied in this research.

| Table 6 Fornell-Larcker Criterion | ||||||||||||

| AG | ANCH | CON | DE | EM | EV | HERD | MA | NEU | OP | OS | REP | |

| AG | 0.808* | |||||||||||

| ANCH | 0.597 | 0.860* | ||||||||||

| CON | 0.768 | 0.593 | 0.808* | |||||||||

| DE | 0.694 | 0.785 | 0.684 | 0.870* | ||||||||

| EM | 0.624 | 0.812 | 0.597 | 0.741 | 0.839* | |||||||

| EV | 0.696 | 0.625 | 0.613 | 0.602 | 0.669 | 0.873* | ||||||

| HERD | 0.627 | 0.667 | 0.561 | 0.686 | 0.809 | 0.697 | 0.853* | |||||

| MA | 0.684 | 0.738 | 0.631 | 0.702 | 0.755 | 0.609 | 0.741 | 0.880* | ||||

| NEU | 0.604 | 0.569 | 0.547 | 0.607 | 0.660 | 0.612 | 0.759 | 0.660 | 0.852* | |||

| OP | 0.700 | 0.568 | 0.668 | 0.592 | 0.618 | 0.816 | 0.658 | 0.647 | 0.543 | 0.870* | ||

| OS | 0.685 | 0.761 | 0.688 | 0.767 | 0.701 | 0.673 | 0.652 | 0.699 | 0.585 | 0.611 | 0.843* | |

| REP | 0.688 | 0.831 | 0.632 | 0.744 | 0.796 | 0.688 | 0.702 | 0.805 | 0.626 | 0.631 | 0.744 | 0.888* |

Note: * values are the square route of AVE values

The diagonal values in Table 6 are the square roots of the average variance extracted (AVE) for each construct, which represent the proportion of variance in the items that can be attributed to the construct itself. The off-diagonal values are the correlations between the constructs.

According to the Fornell-Larcker criterion, discriminant validity is supported when the AVE of each construct is higher than its correlation with other constructs. As we can see from Table 6, all diagonal values (the AVEs) are higher than their respective off-diagonal values, indicating that the constructs have discriminant validity. In summary, Table 6 shows that the constructs in the study are distinct from each other and have adequate discriminant validity Figures 1 & 2.

[Smart PLS view]

Table 7 summarizes the results of statistical analyses conducted to investigate the relationships between personality traits and various cognitive biases. The table presents the mean, standard deviation, t-values, p-values, and decision for each of the analyzed relationships.

| Table 7 Mean, Stdev, T Values, P Values | ||||||

| Original sample (O) | Sample mean (M) | Standard deviation (STDEV) | T statistics (|O/STDEV|) | P values | Decision | |

| AG -> ANCH | 0.090 | 0.090 | 0.051 | 1.784 | 0.075 | Not Supported |

| AG -> DE | 0.254 | 0.252 | 0.041 | 6.160 | 0.000 | Supported |

| AG -> EM | 0.076 | 0.074 | 0.042 | 1.798 | 0.072 | Not Supported |

| AG -> HERD | 0.057 | 0.057 | 0.043 | 1.318 | 0.188 | Not Supported |

| AG -> MA | 0.247 | 0.246 | 0.050 | 4.969 | 0.000 | Supported |

| AG -> OS | 0.171 | 0.171 | 0.046 | 3.670 | 0.000 | Supported |

| AG -> REP | 0.228 | 0.227 | 0.042 | 5.436 | 0.000 | Supported |

| CON -> ANCH | 0.230 | 0.231 | 0.063 | 3.653 | 0.000 | Supported |

| CON -> DE | 0.298 | 0.300 | 0.060 | 4.994 | 0.000 | Supported |

| CON -> EM | 0.149 | 0.150 | 0.053 | 2.803 | 0.005 | Supported |

| CON -> HERD | -0.005 | -0.006 | 0.042 | 0.115 | 0.908 | Not Supported |

| CON -> MA | 0.116 | 0.117 | 0.054 | 2.150 | 0.032 | Supported |

| CON -> OS | 0.327 | 0.327 | 0.058 | 5.604 | 0.000 | Supported |

| CON -> REP | 0.149 | 0.150 | 0.053 | 2.818 | 0.005 | Supported |

| EV -> ANCH | 0.298 | 0.297 | 0.066 | 4.509 | 0.000 | Supported |

| EV -> DE | 0.086 | 0.085 | 0.053 | 1.628 | 0.104 | Not Supported |

| EV -> EM | 0.267 | 0.267 | 0.055 | 4.857 | 0.000 | Supported |

| EV -> HERD | 0.202 | 0.203 | 0.055 | 3.663 | 0.000 | Supported |

| EV -> MA | -0.049 | -0.049 | 0.065 | 0.757 | 0.449 | Not Supported |

| EV -> OS | 0.320 | 0.321 | 0.045 | 7.041 | 0.000 | Supported |

| EV -> REP | 0.293 | 0.295 | 0.056 | 5.217 | 0.000 | Supported |

| NEU -> ANCH | 0.211 | 0.209 | 0.054 | 3.915 | 0.000 | Supported |

| NEU -> DE | 0.226 | 0.225 | 0.051 | 4.411 | 0.000 | Supported |

| NEU -> EM | 0.334 | 0.333 | 0.052 | 6.427 | 0.000 | Supported |

| NEU -> HERD | 0.507 | 0.506 | 0.045 | 11.188 | 0.000 | Supported |

| NEU -> MA | 0.342 | 0.340 | 0.051 | 6.676 | 0.000 | Supported |

| NEU -> OS | 0.143 | 0.140 | 0.047 | 3.028 | 0.002 | Supported |

| NEU -> REP | 0.222 | 0.220 | 0.052 | 4.283 | 0.000 | Supported |

| OP -> ANCH | -0.007 | -0.004 | 0.065 | 0.100 | 0.920 | Not Supported |

| OP -> DE | 0.023 | 0.025 | 0.055 | 0.420 | 0.674 | Not Supported |

| OP -> EM | 0.066 | 0.068 | 0.056 | 1.178 | 0.239 | Not Supported |

| OP -> HERD | 0.182 | 0.183 | 0.053 | 3.440 | 0.001 | Supported |

| OP -> MA | 0.251 | 0.252 | 0.065 | 3.872 | 0.000 | Supported |

| OP -> OS | -0.065 | -0.064 | 0.047 | 1.402 | 0.161 | Not Supported |

| OP -> REP | 0.012 | 0.013 | 0.053 | 0.223 | 0.823 | Not Supported |

The first column of the table lists the different personality traits that were analyzed, including Agreeableness (AG), Conscientiousness (CON), Extraversion (EV), Neuroticism (NEU), and Openness to Experience (OP). The second column shows the cognitive biases that were studied, including Anchoring Bias (ANCH), Disposition Effect (DE), Emotional Bias (EM), Herding Bias (HERD), Mental Accounting Bias (MA), Overconfidence and Self-Attributes Bias (OS), and Representativeness Bias (REP).

The third column of the table reports the mean values of the original sample for each personality trait and cognitive bias. The fourth column displays the sample means for each of the analyzed relationships. The sample means represent the average scores of the participants for each personality trait and cognitive bias combination. The fifth column of the table presents the standard deviations (STDEV) for each of the analyzed relationships. The standard deviation provides a measure of the variability of the scores around the mean.

The sixth column displays the t-values for each of the analyzed relationships. The t-value is a statistical measure that quantifies the difference between the sample means and the population means in standard error units. A higher t-value indicates a more significant difference between the sample means and the population means. The seventh column of the table presents the p-values for each of the analyzed relationships. The p-value is a measure of the probability of observing a result as extreme as the one obtained by chance. A p-value less than 0.05 indicates that the observed result is statistically significant, meaning that it is unlikely to be due to chance.

The last column of the table reports the decision for each of the analyzed relationships. The decision indicates whether the observed results are supported or not supported by the statistical analyses. If the p-value is less than 0.05, the decision is "supported," which means that the observed results are statistically significant. If the p-value is greater than 0.05, the decision is "not supported," which means that the observed results are not statistically significant.

In general, the results of the statistical analyses indicate that there are significant relationships between personality traits and cognitive biases. Specifically, the results show that Conscientiousness, Extraversion, Neuroticism, and Openness to Experience are all significantly related to multiple cognitive biases. Agreeableness, on the other hand, is only significantly related to one cognitive bias (DE).

The most commonly observed cognitive biases across personality traits are Conjunction Fallacy, Representativeness Bias, and Herding Bias. The results suggest that these biases may be particularly robust and pervasive, affecting individuals across different personality types. Overall, Table 7 provides important insights into the relationships between personality traits and cognitive biases, highlighting the potential influence of individual differences in cognitive processing on decision-making and behavior. These findings have important implications for understanding human behavior and designing interventions to promote more rational decision-making.

Conclusion

The findings of the study suggest that some cognitive biases are significantly associated with certain personality traits. For instance, the disposition effect is positively related to Conscientiousness, Emotional Bias is positively related to Extraversion, and Mental Accounting Bias is positively related to Openness to Experience.

However, some cognitive biases do not show any significant relationship with personality traits. For example, Anchoring Bias, Herding Bias, and Overconfidence and Self-attributes Bias are not associated with Agreeableness, Conscientiousness, Extraversion, Neuroticism, or Openness to Experience.

The results of the study provide insights into the complex interplay between personality traits and cognitive biases. By identifying the personality traits that are most closely associated with particular cognitive biases, the study may help to inform the development of interventions that can mitigate the impact of these biases in decision-making.

Overall, the research findings suggest that there are significant relationships between personality traits and investment biases among individual investors. The study provides evidence that individual investors with different personality traits exhibit varying degrees of cognitive biases, such as anchoring bias, disposition effect, herding bias, mental accounting bias, overconfidence and self-attribution bias, and representativeness bias, when making investment decisions. The results highlight the importance of considering individual differences in personality traits when examining the cognitive processes underlying investment decision-making.

The study found that extraversion, neuroticism, and openness to experience were associated with a greater tendency to exhibit certain biases, such as anchoring bias, herding bias, mental accounting bias, and overconfidence and self-attribution bias. Conscientiousness was associated with a lower likelihood of exhibiting biases such as the disposition effect and representativeness bias. Agreeableness did not exhibit a significant association with any of the investment biases studied.

The study provides valuable insights into the relationship between personality traits and investment biases, which can be used to develop effective investor education programs and to inform investment advisors about potential cognitive biases that their clients may exhibit. By better understanding the personality traits that underlie these biases, investors can take steps to mitigate their impact on investment decision-making.

It is important to note that the study has some limitations. The sample consisted of university students, which may not be representative of the broader population of individual investors. The study was also cross-sectional, which means that causality cannot be inferred from the results. Further research is needed to examine the relationship between personality traits and investment biases in a more diverse sample of individual investors and over a longer time period.

Overall, the study provides important insights into the relationship between personality traits and investment biases among individual investors. By understanding how personality traits affect investment decision-making, investors and investment advisors can take steps to mitigate the impact of cognitive biases on investment outcomes.

References

Agnihotri, A., & Bhattacharya, S. (2024). CEO narcissism and CSR: role of organizational virtue orientation. Society and Business Review, 19(2), 316–335.

Indexed at, Google Scholar, Cross Ref

Baker, H. K., Kapoor, S., & Khare, T. (2023). Personality traits and behavioral biases of Indian financial professionals. Review of Behavioral Finance, 15(6), 846–864.

Barone, M., Bussoli, C., & Fattobene, L. (2024). Digital financial consumers’ decision-making: a systematic literature review and integrative framework. International Journal of Bank Marketing, 42(7), 1978–2022.

Biswas, A., Kant, R., & Jaiswal, D. (2024). Looking beyond transactions: decoding the role of service innovation, relationship commitment and fairness in driving customer satisfaction in retail banking. Benchmarking: An International Journal, ahead-of-print(ahead-of-print).

Indexed at, Google Scholar, Cross Ref

Cai, D., Li, H., Law, R., Ji, H., & Gao, H. (2024). What drives consumers to post more photos in online reviews? A trait activation theory perspective. International Journal of Contemporary Hospitality Management, 36(12), 3989–4010.

Cao, C., & Zhang, X. (2024). What triggers consumers to purchase eco-friendly food? The impact of micro signals, macro signals and perceived value. British Food Journal, 126(5), 2204–2226.

Chan, Z. X., Wang, Y., Yuan, L., Chen, X., & Feng, Y. (2024). Think broader or dig deeper? Managerial cognition’s influence on firm innovation during crisis. Management Decision, ahead-of-print(ahead-of-print).

Chukwudumogu, I. C., Levy, D., & Perkins, H. (2019). The influence of sentiments on property owners in post-disaster rebuild. Property Management, 37(2), 243–261.

Indexed at, Google Scholar, Cross Ref

Ding, M. (Annie), & Goldfarb, A. (2023). The Economics of Artificial Intelligence: A Marketing Perspective. In K. Sudhir & O. Toubia (Eds.), Artificial Intelligence in Marketing (Vol. 20, pp. 13–76). Emerald Publishing Limited.

Garcia-Perez, A., Ghio, A., Occhipinti, Z., & Verona, R. (2020). Knowledge management and intellectual capital in knowledge-based organisations: a review and theoretical perspectives. Journal of Knowledge Management, 24(7), 1719–1754.

Goyal, K., Kumar, S., & Xiao, J. J. (2021). Antecedents and consequences of Personal Financial Management Behavior: a systematic literature review and future research agenda. International Journal of Bank Marketing, 39(7), 1166–1207.

Indexed at, Google Scholar, Cross Ref

Gupta, S., & Mohammad, F. (2025). Mapping the mindset for personal financial planning. Management Research Review, 48(4), 604–624.

Haseeb, M., Mahdzan, N. S., & Wan Ahmad, W. M. (2023). Are Shariah-compliant firms less prone to stock price crash risk? Evidence from Malaysia. International Journal of Islamic and Middle Eastern Finance and Management, 16(2), 291–309.

Hernández-Tamurejo, Á., Fernández-Fernández, M., & González-Padilla, P. (2025). Metaverse adoption and its implications for entrepreneurial innovation management: the influence of Gen Z’s perception of innovation, privacy and trust. European Journal of Innovation Management, ahead-of-print(ahead-of-print).

Indexed at, Google Scholar, Cross Ref

Husain, R., & Tripathi, S. N. (2024). Shadows across cultures: exploring the dark side of anthropomorphized agents. Journal of Consumer Marketing, ahead-of-print(ahead-of-print).

Iamin, G. (2025). Are crypto-investors overconfident? The role of risk propensity and demographics. Evidence from Brazil and Portugal. The Journal of Risk Finance, 26(1), 147–173.

Jain, J., Walia, N., Kaur, M., & Singh, S. (2022). Behavioural biases affecting investors’ decision-making process: a scale development approach. Management Research Review, 45(8), 1079–1098.

Jaiswal, R., Gupta, S., & Tiwari, A. K. (2024). Decoding mood of the Twitterverse on ESG investing: opinion mining and key themes using machine learning. Management Research Review, 47(8), 1221–1252.

Indexed at, Google Scholar, Cross Ref

Kakeesh, D. F. (2024). Female entrepreneurship and entrepreneurial ecosystems. Journal of Research in Marketing and Entrepreneurship, 26(3), 485–526. https://doi.org/10.1108/JRME-09-2023-0158

Kala, D., Chaubey, D. S., & Al-Adwan, A. S. (2023). Cryptocurrency investment behaviour of young Indians: mediating role of fear of missing out. Global Knowledge, Memory and Communication, ahead-of-print(ahead-of-print).

Kidney, E., McAdam, M., & Cooney, T. M. (2025). Everyday prejudices: an intersectional exploration of the experiences of lesbian and gay entrepreneurs. International Journal of Entrepreneurial Behavior & Research, 31(1), 155–178.

Kuhn, N., Lopes, L. F. D., Silva, W. V. da, da Silva, L. S. C. V., & Veiga, C. P. da. (2025). Spirituality and workplace performance: a theoretical insight. Social Responsibility Journal, 21(2), 351–377.

Indexed at, Google Scholar, Cross Ref

Peltier, J. W., Dahl, A. J., & Schibrowsky, J. A. (2024). Artificial intelligence in interactive marketing: a conceptual framework and research agenda. Journal of Research in Interactive Marketing, 18(1), 54–90.

Rajabalizadeh, J. (2023). CEO overconfidence and financial reporting complexity: evidence from textual analysis. Management Decision, 61(13), 356–385.

Saha, P., & Biswas, A. (2025). Seal the deal: unleashing the magnitude of online reviews, website quality and trust for seamless hotel reservations. International Journal of Productivity and Performance Management, 74(4), 1125–1155.

Salehi, M., & Bashirimanesh, N. (2024). The effect of political connections on the relationship between managers’ personality traits and corporate social responsibility disclosure. Journal of Islamic Accounting and Business Research, ahead-of-print(ahead-of-print).

Indexed at, Google Scholar, Cross Ref

Serwaah, P. (2022). Crowdfunding, gender and the promise of financial democracy: a systematic review. International Journal of Gender and Entrepreneurship, 14(2), 263–283.

ShabbirHusain, R. v, Pathak, A. A., Chandrasekaran, S., & Annamalai, B. (2024). The power of words: driving online consumer engagement in Fintech. International Journal of Bank Marketing, 42(2), 331–355.

Shakil, M. H., & Abdul Wahab, N. S. (2023). Top management team heterogeneity, corporate social responsibility and firm risk: an emerging country perspective. Journal of Financial Reporting and Accounting, 21(2), 434–463.

Sham, R., Aw, E. C.-X., Abdamia, N., & Chuah, S. H.-W. (2023). Cryptocurrencies have arrived, but are we ready? Unveiling cryptocurrency adoption recipes through an SEM-fsQCA approach. The Bottom Line, 36(2), 209–233.

Indexed at, Google Scholar, Cross Ref

Srivastava, M., Sharma, G. D., Srivastava, A. K., & Kumaran, S. S. (2020). What’s in the brain for us: a systematic literature review of neuroeconomics and neurofinance. Qualitative Research in Financial Markets, 12(4), 413–435.

Stefanidis, A., Banai, M., & Dagher, G. K. (2023). Socio-cultural capital in the Arab workplace: wasta as a moderator of ethical idealism and work engagement. Employee Relations: The International Journal, 45(1), 21–44. https://doi.org/10.1108/ER-05-2021-0227

Tan, Q., Rasheed, M. H., & Rasheed, M. S. (2024). Post-COVID-19 technology adoption and noise trading: elucidation of investors’ sentiments across cultures. China Accounting and Finance Review, 26(4), 431–458.

Indexed at, Google Scholar, Cross Ref

Thakker, N., Kalro, H., Joshipura, M., & Mishra, P. (2023). Mutual funds marketing: a hybrid review and framework development. International Journal of Bank Marketing, 41(7), 1803–1828.

Verma, S., & Khanna, A. (2025). From self-perception to investment decisions: the impact of core self-evaluation and social values on sustainable investments. Managerial Finance, ahead-of-print(ahead-of-print).

Zafar, A. U., Qiu, J., Shahzad, M., Shen, J., Bhutto, T. A., & Irfan, M. (2021). Impulse buying in social commerce: bundle offer, top reviews, and emotional intelligence. Asia Pacific Journal of Marketing and Logistics, 33(4), 945–973.

Indexed at, Google Scholar, Cross Ref

Received: 09-Jan-2025, Manuscript No. AMSJ-25-15600; Editor assigned: 10-Jan-2025, PreQC No. AMSJ-25-15600(PQ); Reviewed: 28- Mar-2025, QC No. AMSJ-25-15600; Revised: 20-Apr-2025, Manuscript No. AMSJ-25-15600(R); Published: 05-May-2025