Research Article: 2022 Vol: 25 Issue: 1S

Trust, transaction transparency, volatility, facilitating condition performance expectancy towards cryptocurrency adoption through intention to use

Mahadi Hasan Miraz, Sunway University

Mohammad Tariq Hasan, United International University (UIU)

Mohammad Sarwar Rekabder, North South University (NSU)

Rahma Akhter, BRAC University

Citation Information: Miraz, M. H., Hasan, M. T., Rekabder, M. S., & Akhter, R. (2022). Trust, transaction transparency, volatility, facilitating condition, performance expectancy towards cryptocurrency adoption through intention to use. Journal of Management Information and Decision Sciences, 25(S5), 1-20.

Abstract

The cryptocurrency enhances today's digital currency ecosystem. The use of cryptocurrencies leads to better understanding, higher intention, trust, and acceptance. However, the lack of cryptocurrency acceptance is a severe issue in the digital market. Cryptocurrency adoption is a requirement for implementing technology functionality supported by intentioned patterns. The main goal of this study is to examine the factors that influence cryptocurrency adoption in the digital market in Malaysia. The research also confidently concludes that cryptocurrencies would continue to increase in prevalence. This empirical study examined the role of trust (TR), transaction transparency (TT), volatility (VO), facilitating conditions (FC), performance expectancy (PE), and intention to use (ITU) in cryptocurrency adoption (AD). Therefore, the study identifies intention to use as a mediator of cryptocurrency adoption. Therefore it examined the significance of intention in the context of cryptocurrency adoption. Systematic random sampling was utilized in this study to ensure the most rigorous analysis of research objectives. Besides that, the survey questions were asked at the cryptocurrency consumers' location in Malaysia. Also, a total of 263 valid responses were taken for the final assessment. This study considered Partial Least Squares Structural Equation Modeling (PLS-SEM) for data analysis. Finally, the findings showed that TR, TT, VO, and FC are all found to help in the AD (dependent variable) through the mediation of intention to use (ITU) in Malaysia's digital market. On the other hand, performance expectancy negatively impacts the digital market of Malaysia. The findings in this study may be replicated by future researchers in different locations, in various industries, and then use equivalent constructions to expand our current body of knowledge. This paper extends the limited literature on the cryptocurrency and digital currency perspectives. Besides that, it helps to understand mediating impact on cryptocurrency adoption and intention to use. Moreover, identify the significant factors that affect the cryptocurrency in Malaysia's digital market.

Keywords

Cryptocurrency; Trust; Transaction transparency; Volatility; Facilitating condition; Performance expectancy.

Introduction

The unbelievable improvement of technology drives the customer to a digital transaction (De Keyser et al., 2019; Singh et al., 2019; Ercis et al., 2012). The consumer requires versatile, simple, cost-effective, and time-effective digital operations in the financial sector. One of the most exciting digital development and evolution of digital currencies is known as cryptocurrency. Its payment transaction is well described to individuals clients (Gonzalez, 2019). Also, it is an alternative to the traditional fiat currency that allows clients to make digital payments for properties and services, where intermediaries are needless (Al-Jaroodi & Mohamed, 2019). In other terms, it is an advanced form of online-based digital currency platform (Tajpour et al., 2021). The transaction records remain recorded publicly for the monetary transaction. Hence, cryptocurrency trading is also governed by numerous informal exchanges for fiat currencies (Cowen, 2019).

Literature Review

Cryptocurrency is a new type of currency that uses blockchain technology as its foundation ((Jiang et al., 2021). The concept is drawing attention from academics, industry, and people who are interested in new things. Besides that, it creates a new thought in the digital market of Malaysia (Choo, 2015). It also mentioned that cryptocurrency is a distinguished currency that gives a unique essence to the Malaysian digital market. Although the cryptocurrency exchange rate has a high annualized volatility, the transaction process is perceived to be more secure (Zulhuda & Sayuti, 2017).

The cryptocurrency in Malaysia has created a new paradigm shift in today's financial transactions (Alaeddin & Altounjy, 2018). Bakar, Rosbi, and Uzaki (2017) ascertained that digital currencies dominated by cryptocurrency account for total market capitalization. It was initiated that the first decentralizing cryptocurrency has gained widespread attention in the media, academia, and finance industry (Zulhuda & Sayuti, 2017). Based on the trend of financial technology, bitcoin, as a cryptocurrency pioneer, has shown no signs of slowing down.

Chan et al. (2018) noted that cryptocurrency is a new term for buying or selling virtual currency. It is more reliable and trusted for every consumer, and it is a reliable currency in the digital market of Malaysia (Ghalwesh, Ouf, & Sayed, 2020). Also, it provides a secure transaction among the consumer of the cryptocurrency in the market (Gazali et al., 2018).

The digital market is a market that runs through an online platform (Van Loo, 2019), an electronic device, and a secure system (Lukiyanchuk et al., 2020). The researcher described the digital market area as the basement to run the cryptocurrency. Also, it is a simulated digitalization's role in the market for the cryptocurrency ecosystem.

Issues of Cryptocurrency in the Digital Market of Malaysia

The cryptocurrency market changed dramatically and became even more complicated, and it must converge in a more demanding and sophisticated way (Khazaei, 2020). A faster-than-real-time digital financial system is required when engage in currency trading (Fauzi et al., 2020). In addition, factors such as the overall market situation also influence cryptocurrency adoption in the digital market (Fauzi et al., 2020; (Jani, 2018; (Lehner et al., 2017). This comes after trust is shown to be an insightful look into how cryptocurrencies are used in the digital market of Malaysia (Ku-Mahamud et al., 2019; Mendoza et al., 2018; Nilashi et al., 2016; Paul et al., 2018). It also gives customers peace of mind and reassurance in usage and adoption (Erciş et al., 2012; Sultan & Wong, 2019; Tajvidi et al., 2017). Besides that, transaction transparency is the firm's trustworthiness for the end-user in that they have cryptocurrencies (Alaeddin & Altounjy, 2018; Ayedh et al., 2020; (Iryan, 2020). Although Bitcoin has some bad effects in Asia, the lack of transaction transparency is among the most significant (Alzahrani & Daim, 2019; Chan et al., 2018; Guych et al., 2018b). Additionally, given the ever-fluctuating market price of cryptocurrencies, it is recommended to use them in the digital market (Bakar & Rosbi, 2017; Celeste et al., 2020). The customer's intents are strongly related to how familiar and well-connected they are with their friends and associates (Hanson et al., 2011; Herrero & San Martín, 2017; Hsu & Lu, 2004; Malhotra & Galletta, 1999; Tajvidi et al., 2017; Zhang et al., 2020). So as a result, volatility is expected to decrease the use of cryptocurrency. Moreover, supporting the many conditions necessary for the digital market is also essential. (Bakar et al., 2017; (Fauzi et al., 2020; Jani, 2018). It complies with the trading method and requirements for bitcoin trading that have been agreed to by all players (Pandya et al., 2019; Phillips & Gorse, 2018; Schaupp & Festa, 2018). Since the condition that facilitates the customer's move out of the digital market has been removed, the consumer is no longer attracted to cryptocurrencies (Abbasi et al., 2021; Alzahrani & Daim, 2019; Chan et al., 2018). When the consumer gets dissatisfied with the current cryptocurrency system, they are motivated to stop using it in the digital market (Phillips & Gorse, 2018); Sas & Khairuddin, 2015; Schaupp & Festa, 2018; Xiong & Tang, 2020; Yeong, 2019; Zulhuda & binti Sayuti, 2017). The condition that facilitates the use of any digital product is what we call the "basis" of it (Alalwan et al., 2015; (2016; 2017; Arias et al., 2019; Ayedh et al., 2020). The cryptocurrency is a technology-based product, and the user will require a minimum level of technological capacity to utilize (Arias et al., 2019; Ayedh et al., 2020; Gunawan & Novendra, 2017; Gurrea & Remolina, 2020).

The lack of a digital market facility reduces the extent to which cryptocurrency is used in the market (Ayedh et al., 2020; Chow et al., 2019; Gunawan & Novendra, 2017). Besides that, performance expectations are an essential consideration that influences how people utilize cryptocurrencies (Guych et al., 2018b; Mendoza et al., 2018; Mohamed et al., 2018). It establishes the level of accessibility of rapid and speedy cryptocurrency applications in the digital market (Burton et al., 2003; Calderón et al., 2017). For this reason, delayed cryptocurrency performance lowers cryptocurrency user demand (Arias et al., 2019; Bosco et al., 2015; Davis, 1989). By improving the user's propensity to utilize cryptocurrencies in the digital market, it helps reduce intention to use it (Dinev & Hu, 2005; Herrero & San Martín, 2017; Karim et al., 2016; Maruping et al., 2017). To a similar extent, cryptocurrency adoption is not sufficiently fleshed out in Malaysia's digital economy ((Ayedh et al., 2020). It's relevant because it means there's new information to be had and continue exploring how cryptocurrency might be implemented in the digital market (Alzahrani & Daim, 2019). Based on previous researchers' suggestions, this study will examine the deficiencies described above by observing the factors like trust (TR), transaction transparency (TT), Volatility (VO), facilitating condition (FC), performance expectancy (PE), intention to use (ITU), and adoption (AD) of cryptocurrency in the digital market Malaysia.

Underpinning Theory

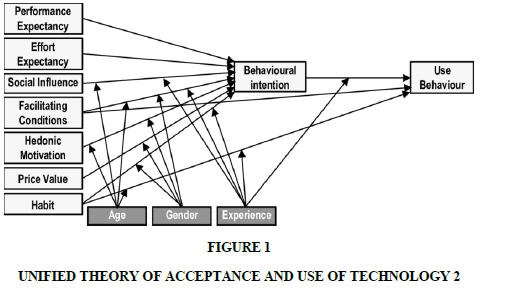

(Venkatesh et al. (2012) established the unified theory of acceptance and use of technology 2 (UTAUT2) to predict technology uptake in organizations. Based on the Unified Theory of Acceptance and Use of Technology literature, the researcher created a model of cryptocurrency acceptance in the digital market. We must understand the organization's professional behaviour and the cryptocurrency transaction network relationships among the stakeholders. Based on the existing UTAUT 2 model, most of the constructs were extracted from the literature (Figure 1).

Furthermore, It is firmly a person believes using the programme will improve their work performance. Second, the convenience of using technology presumes commitment. Third, the assumption that an organizational and technological infrastructure uses the programme. Seeing others think researchers need to use the new way and technology. The UTAUT2 extension increased performance, expectation, satisfaction, trust, and facilitating conditions. Theoretical and organizational implications will be covered.

A study found the most vital link between behavioural intent towards the new technology adoption (Venkatesh et al., 2008). Consumers regard time and effort to establish favourable impressions of technologies within companies (Venkatesh et al., 2012). UTAUT2 and comparable theories are based on deliberate action and intentionality (Venkatesh et al., 2012). In contemporary usage studies, patterns rather than usage counterexamples have been shown to be essential in evaluating modern technology use.

Therefore, this study adopted this theory to construct the research hypothesis. Also, build the research framework.

Research Hypothesis

The following hypotheses are developed below.

Trust and Intention to Use

All business concepts rely on trust. Also, an important consideration is understanding the significance of trust in numerous circumstances (Wu et al., 2011). Thus, it is highly recommended to utilize a service trust method to meet the organization's requirements in complete comprehension of the digital market relationships (Batrancea et al., 2019). Trust is an essential variable for the intention to use (Soedarto et al., 2019). Intention and trust relationships are fundamental to trust's functions (Ku-Mahamud et al., 2019). For instance, an information-sharing connection is necessary for operations (Tajpour et al., 2021). Due to the lack of trust in the stakeholder , enterprises face serious difficulty (Mendoza-Tello et al., 2018). A practical solution is implementing cryptocurrency transparency while controlling Malaysia's digital market (Sas & Khairuddin, 2015). Additionally, cryptocurrency promotes supply chain trust(Akinbode et al., 2010) as recent research in the digital industry (Mendoza-Tello et al., 2018; Miraz, 2020). Another study completely understands that social media use is through trust (Tajpour et al., 2021).Therefore, the researcher suggests the following hypotheses:

H1: Trust affects intention to use to the adoption of cryptocurrency.

Transaction Transparency and Intention to Use

Transparency regards to cryptocurrency transactions towards the use of cryptocurrency and its use intention (Lehner et al., 2017). Its chain network supports visibility at all digital market levels (Khazaei, 2020). Cryptocurrency helps improve transaction transparency and traceability in the digital market (Biswas & Gupta, 2019). It also claims that crypto transaction transparency is a crucial indicator of a coin's behavior in the Malaysian digital market (Roussou & Stiakakis, 2016). Furthermore, cryptocurrency transparency can contribute to a significant change in the sector and the digital market (Aste, 2019). Because of this, consumers are aware of and linked to intentions (Yoo et al., 2020). Cryptocurrency offers increased transaction transparency by intention to use (Saleh et al., 2020). It creates a connection between intentions (Novendra & Gunawan, 2017).

Also, their internal relationship is proportionate to their transaction history (Beckett, 2019). Further transaction transparency demonstrates higher commitment (Francisco & Swanson, 2018). They are enabling users to have a pleasant experience when using the product (Nilashi et al., 2016). Transparency is one of the most influential to the intention of use (Li et al., 2017). Therefore, the researcher put the following hypothesis:

H2: Transaction transparency positively affects intention to sue to adopt cryptocurrency.

Volatility and Intention to Use

Volatility, sometimes known as the 'squishiness' of prices, measures how rapidly an asset's price moves (Bakar & Rosbi, 2017). In the cryptocurrency market, investments are characterized as being very volatile if their prices move quickly up or down each day (Celeste et al., 2020). It is highly correlated to the intention to use and cryptocurrency use. Few studies also identified the factors that influence volatility and use intention for new technology. Researchers have not thoroughly addressed the purpose of suggesting technology and its determinants (Furtado et al., 2020). However, no such study has been done for volatility towards intention to use to cryptocurrency adoption in Malaysian digital market (Tun, 2020). Researchers analyzed several factors that affect Malaysia's user volatility but did not extensively examine them, leading to recommendations to use technology (Sarker et al., 2020). The current study reveals this emptiness and the connection between user intent, volatility, and influence the intention to use it in Malaysia's digital market (Sarker et al., 2020). Therefore, the researcher suggests a hypothesis:

H3: Volatility positively affects intention to use to the adoption of cryptocurrency.

Facilitating Condition and Intention to Use

In facilitating conditions (FC), people believe a regulatory and technical framework supports the system's use. A facility is a framework of new technology to support utilization in an organization (Venkatesh et al., 2008; Venkatesh et al., 2012). Facilitating conditions help to build greater awareness and intimate connection with intentions (Ghalandari, 2012). The study shows a sound effect (Onaolapo & Oyewole, 2018). At the same time, another researcher discovered a substantial, and noteworthy influence of purpose (Vairetti et al., 2019). Furthermore, the researcher identified a strong impact in encouraging behavioural intentions (Venkatesh et al., 2008). This research will highlight the employee's comprehension of institutions' resources to assist cryptocurrency. Prior studies show that helping conditions affect technology uptake and utilization (Tang & Mayersohn, 2007). Cryptocurrency is more usable if customers have specific levels of support services. Facilitating conditions impact cryptocurrency use intention (Alalwan et al., 2017). This illustrates a strong dependence on the digital market's infrastructure costs. Therefore, the researcher suggests the following hypotheses:

H4: Facilitating conditions positively affect intention to use to the adoption of cryptocurrency.

Performance Expectancy and Intention to Use

The degree to which someone believes using the system would help them gain job performance is called performance expectancy (Venkatesh et al., 2008). This research includes the assumption that a degree of employee belief will boost cryptocurrency digital market productivity and performance. In addition, it's tied to individuals' motivation to adopt new technologies in the digital market. Thus, the expectation was high for new and innovative digital needs and other changes (Kshetri, 2018). However, according to the literature, technology use and adoption depend heavily on projected performance (Baker &; Delpechitre, 2013; Chandler et al., 1987; ).

Customers will use and accept new technology if they believe it is more advantageous and valuable in their daily lives (Ghalandari, 2012; Gull et al., 2020). A more efficient means of providing widespread consumer access to various services (Chaudhuri & Holbrook, 2001; ; ). Therefore, the researcher suggests the following hypothesis:

H5: Performance expectancy positively affects intention to use to adopt cryptocurrency.

Intention to Use and Adoption

The intention is the degree to which a person plans to engage or not in future conduct (Alalwan et al., 2016; Alsheikh & Bojei, 2014). Most cryptocurrencies upgraded their operations to potential users in subsequent digital transactions (Tun, 2020). So, when people want to use cryptocurrencies, it results in a frenzy (Dinev & Hu, 2005). Additionally, cryptocurrency is to strengthen its financial sector and boost to intention to use. Consumers adopt the cryptocurrency facility and usefulness (Guych et al., 2018b; Husin et al., 2019). Therefore, digital market participants are willing to track and trace client information to lower insurance and fiduciary fraud and promote data interchange (Kozakov et al., 2021).

Thus, the researcher observed that cryptocurrency acceptance is influenced by its goal to be used (Guych et al., 2018b; Husin et al., 2019; Maruping et al., 2017; Mendoza-Tello et al., 2018). In addition, digital currency produces benefits and improves the economy, encouraging cryptocurrency adoption (Mendoza-Tello et al., 2018; Miraz et al., 2020). Also, keep a close eye on digital money since it has the potential to impact businesses significantly (Oulasvirta et al., 2014). Finally, it comprehends the new cryptocurrency and makes it more widely used (Sair & Danish, 2018). Therefore, the researcher suggests the following hypotheses:

H6: The intention to sue will positively influence the adoption of cryptocurrency in the digital market.

Intention to Use as Mediator

According to the criteria established by Baron and Kenny (1986), a significant relationship must be established between the predictor variable and the criterion variable, the predictor variable and the mediating variable, and the mediating variable and the criterion variable (Baron & Kenny, 1986; Baruch et al., 2016). In their opinion, the calculations were correct, and that the criteria variable did not result in the emergence of an intermediary variable (Nejati et al., 2011). Even though Baron and Kenny repeatedly violated these assumptions, (Preacher and Hayes (2004; 2008) questioned the necessity of their mediation requirements (Preacher & Hayes, 2004; 2008). In their view, no significant overall impact of the predictor variable on the criterion variable was required for the mediation to occur for the mediation to take place (Khadim et al., 2018). According to Preacher and Hayes (2008), researchers might explore meditation in instances where a causal relationship between the predictor, mediator, and criterion variable could be established theoretically and procedurally (Preacher & Hayes, 2008); Preacher & Kelley, 2011; (Preuveneers & Ilie-Zudor, 2017). (Preacher and Hayes (2008) found a framework for mediation, and the researcher offered intention to use it as a mediator.

In mediation, a chain of triggers occurs in which a second variable influences a third variable. The intention has been shown to be a potent mediator in several investigations (Hayes, 2009; Hanson et al., 2015). The construct of intention to use is a useful mediating construct. Trust fosters confidence in intention to use, which has an impact on the adoption of cryptocurrencies. After the first use, if consumers gain greater faith and satisfaction, they are more likely to prolong their engagement with the business (Park & Chai, 2020). The intention is based on the assumption of reliability. In the field of technology adoption, the role of behavioral intention as a mediator is well recognized. Developing a connection based on trust opens the door to a variety of possibilities for cryptocurrency adoption.

The aim to mediate intention to use is widely established in transaction literature, from an empirical point of view (Ahmed et al., 2016). Conductual purpose as a mediator was found to be significant in the transparency and technological adoption of cryptocurrency transactions (Alalwan et al., 2016; Anser et al., 2020). Apart from that intention to use modulates the relationship between volatility and the adoption of cryptocurrency. It also determines the impact on the digital market of volatility and cryptocurrency. Ku-Mahamoud et al. (2019) research has shown that around half of respondents understand cryptocurrency in the media, and the other half knows its existence. It also shows that the blockchain is the same consciousness as cryptocurrency. Facilitating conduct and intentions affect the adoption (Bazkiaei et al., 2020; Buchhorn, 2010). Furthermore, the facilitating condition purposes influence the mentality that emphasizes the adoption of cryptocurrencies (Gazali et al., 2018; Guych et al., 2018a). A comparable favorable role was observed between ease of health and intention of adoption as a mediator (Hong et al., 2020; Husin et al., 2019). The intention to conduct has also mediated the connection between the expected performance and cryptocurrency acceptance. The investigator, therefore, took the following hypothesis:

H1A: The intention to use mediates the relationship between trust and the adoption of cryptocurrency.

H1B: The intention to use mediates the relationship between transaction transparency and the adoption of cryptocurrency.

H1C: The intention to use mediates the relationship between volatility and the adoption of cryptocurrency.

H1D: The intention to use mediates the relationship between facilitating condition and the adoption of cryptocurrency.

1E: The intention to use mediates the relationship between performance expectancy and adoption of cryptocurrency.

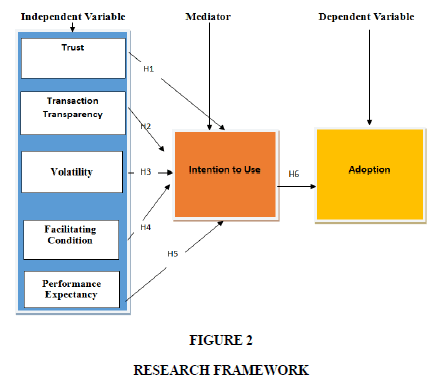

Research Framework

The independent variables are trust (TR), transaction transparency (TT), volatility (VO), facilitating condition (FC), and performance expectancy (PE). On the other hand, adoption (AD) represents the dependent variable. Thus, the mediator of this study is the intention to use (Figure 2).

Analysis

In this section, the researcher described the analysis of the responses and discussed them below.

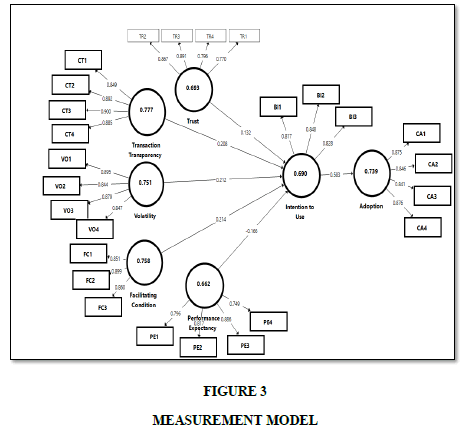

Individual Item Reliability

Reliability differs from researcher to researcher; it is essential to evaluate each predictor's reliability. The indicator's reliability is sometimes referred to as "outer loading," which indicates that the latent design explains the indicator's variance. The overall load changes between 0 and 1 depending on the situation. The usual rule of thumb is that a researcher should delete an object with a loading value less than 0.4 and remain a loading value greater than 0.7 (Hair et al., 2011; Hair Jr et al., 2014b).

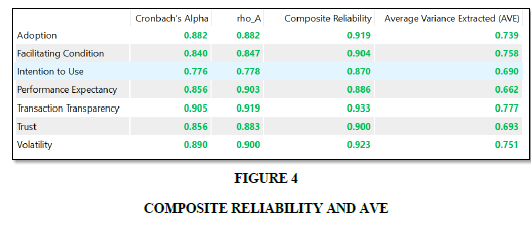

Internal Consistency Reliability

The researchers proposed two internal quality measures, such as Cronbach's alpha and composite reliability. Cronbach's alpha and Cronbach's d are the usual parameters for the internal coherence test (Henseler, 2017; Henseler et al., 2009). It is also more reasonable to employ composite reliability for determining internal accuracy than individual dependability (Hair et al., 2011; Hair Jr et al., 2014; Henseler et al., 2009; Hulland, 1999). Composite reliability between 0.6 and 0.7 is reasonable, while it is satisfactory to have it between 0.6 and 0.7. (Hair Jr et al., 2017). In this study, all-composite reliability values were acceptable; in other words, they were more than the 0.7 standards set by the researchers (Figure 4).

Discriminant Validity

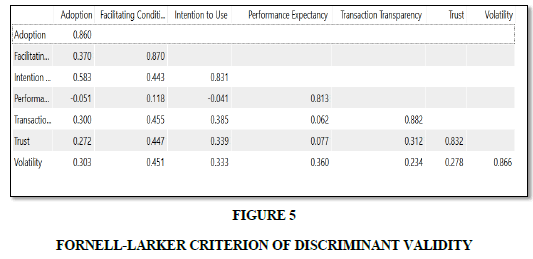

The validity of discrimination is defined as the presence of sufficient differences between two different concepts (Hair Jr et al., 2017; Henseler, 2017; Henseler et al., 2009; Hulland, 1999; Jin & Wang, 2019). Also been stated that the individual constructs must be distinct from one another (Henseler, 2017; Henseler et al., 2009). The Fornell-Larcker Criterion and Cross Loading are two commonly used measures that have discriminating validity (Hair Jr et al., 2017; Henseler et al., 2009; Hair Jr et al., 2017; Henseler et al., 2009). According to Fornell Larcker, the requirement that a latent variable explains more variation than other latent variables is a valid criterion ( Fornell et al., 1996; (Fornell & Larcker, 1981). The variation between its indicators is more significant than the variation between its indicators. AVE's squared root should be above diagonally in the same columns and rankings in the statistics for all of the variables (Ramayah et al., 2018; Ramayah et al., 2017). Other criteria for discriminative validity include cross-loadings. In other words, any indicator loading must be greater than the sum of all of its cross-loadings (Chin, 1998; Kimmerl, 2020).In this research, the Fornell-larker ratio for the discriminant validity. Figure 5 shows that the top value is higher than the below value. It shows that the top value is inclined and higher; therefore, there is no discriminant in the study.

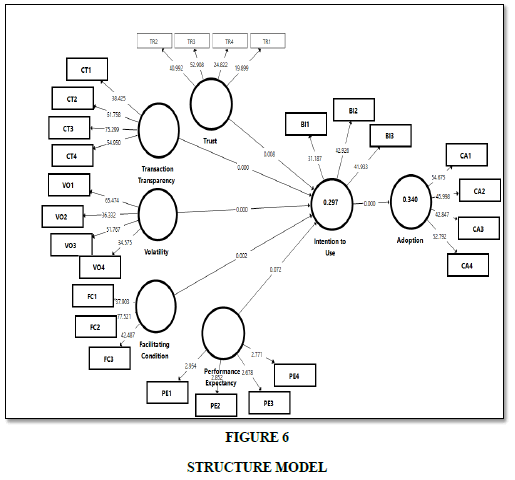

Assessment of the Significance of Structural Model Relationships

During this stage, PLS-SEM calculates the relationship between the structural model and the latent buildings, which reflects the presumed relationship between the latent structures (Hair et al., 2011; Hair et al., 2012; Hair Jr et al., 2017; Hair Jr et al., 2014b; Ramayah et al., 2018). The use of t and p values defines the significance of a given association, regardless of whether it is necessary or not. PLS-SEM employs an observational t and p-value bootstrapping methodology to estimate the sample size (Hair et al., 2011; 2012; 2013; 2017; Hair Jr et al., 2014; Hairudin et al., 2020). Even though t-values more than 1.645 are statistically significant, p-values 0.05 and lower are accepted or supported (Ramayah et al., 2018). The value of the direction coefficients, this study use regular bootstrapping with a range of 500 bootstraps and 326 examples (Figure 6). As shown in Figure 4, the conceptual model for this study incorporates latent external mechanisms, a mediating factor (intention to use), and a latent endogenous component (adoption).

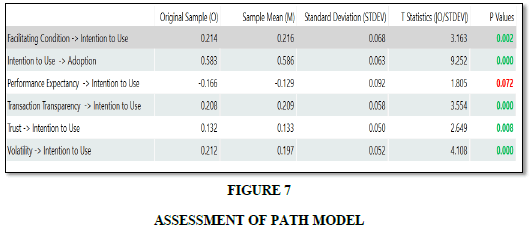

Assessment of Path Model

The relationship between trust and intention to use was significant (p=.008), and hypothesis H1 was supported. Likewise, hypothesis H2 demonstrated the relationship of transaction transparency was significant (p=0.000). Similarly, H3 and H4 volatility and facilitating condition has a significant relationship towards intention to use (p=0.000 and p=0.002) and accepted in this study. Opposite relations are seen in hypothesis H5, where performance expectancy has a non-significant relationship in the direction of intention to use (ITU). On the other hand a significant relation between the intention to use and adoption (p=0.000) (Figure 7).

Assessment of Mediation

In this study, the intention to use as a mediator between trust, volatility, transaction transparency, facilitating condition, and cryptocurrency adoption. Figure 8 represents the mediation results of this study.

Nonetheless, acceptable mediation was found between trust (TR) and adoption (AD) through intention to use (p=0.011). Besides, the study predicted that intention to use (ITU) would mediate the relationship between TT and AD, and the study also found a significant result (p=0.001) and p<0.003) for this relationship, which supported the hypothesis H7A and H7B. Subsequently, hypothesis H10c, the mediator as intention to use (ITU), mediates the relationship between volatility (VO) and adoption (AD) (p<0.000). In H10D intention to use (ITU) mediates the relationship between facilitating condition (FC) & adoption (AD), and it found significant for the study (p<0.007). On the other hand, a non-significant result in hypothesis H10f (p<0.079) on performance expectancy and adoption of cryptocurrency mediates through intention to use.

Discussion

This study was discussed in accordance with research goals. This study refers to the mediating impacts of intent to use towards trust (TR), transaction transparency (TT), volatility (VO), facilitating condition (FC), performance expectancy (PE), and adoption (AD). Next, there was a discussion of the intention link to adoption. The debate ensued in the research framework describes how the factors (TR, TT, VO, FC, PE, and ITU) relate to the AD. The association is also incorporated into the variable mediator with intention to use (ITU). The questionnaire items have also been altered in order to ensure that, following a thorough literature assessment, the research has been integrated into the research target by conducting the content validities. The questionnaire was completed to test the survey tool, which had 263 respondents, and the participant is a Malaysian cryptocurrency user. In addition, all responders are from Malaysia, which also includes all cryptocurrency consumers in Malaysia. The study questionnaire was based on a Likert scale of five points ranging from 1 (strongly agree) to 5 (strongly disagree). The scale validation was based on reliability factors. PLS-SEM is also employed to evaluate the model assessing content validity, factor load importance, and convergent validity. The structural model has also been studied to test the hypothesis as an internal model. Discussions on the variable criterion resume with direct and indirect effects of predictor variables. Therefore, this study represents the precise effect on the adoption of cryptocurrency in the digital market of Malaysia.

Implications of Study

Theoretical Implication

From a theoretical aspect, it is anticipated that the research will have a substantial impact on UTAUT 2 Venkatesh et al. (2012). It also a theory to relationship analysis by using the service adoption model as a channel (Salamzadeh, 2020; Salamzadeh et al., 2021).

Methodological Implication

There has never been a more convoluted cryptocurrency adoption mechanism. To begin with, this research has approached the topic of cryptocurrency acceptance from the perspective of integrating several variables. The third point to mention is that this study used seven higher-order constructs: TR, TT, VO, FC, PE, CA and ITU. Another rarity in bitcoin adoption research is the inclusion of seven higher-order structures in a single study, which is also uncommon. As a result, this study confirmed the variables from the standpoint of development, notably in Malaysia (TR, TT, VO, FC, PE, CA and ITU). Finally, in this investigation, the PLS-SEM model was employed as a reference in the analysis of the variance. PLS-SEM is the setup with the highest predictability.

Practical Implication

The outcomes of this study provide vital insights into the realities of the situation. The major insights and conclusions of the Malaysian cryptocurrency market are presented in this report.'

Evidence-based Implication

According to the findings of this study, customer happiness is not a significant factor in the adoption of cryptocurrencies in Malaysia's digital marketplace. Thus, it indicates how this research has made an addition to the field.

Population-based Implication

This is a one-of-a-kind study in which the cryptocurrency user population of Malaysia is represented by a population survey. It comprises bitcoin users in Malaysia's digital market, as well as other countries.

Limitation of Study

The focus of this study was not on the liquidity shortage that exists in Malaysian banks. Other variables, such as price volatility, acceptability, transactions, the pandemic effect, and so on, were not taken into consideration. Finally, only cross-sectional data was employed in this study. Because of this, further research should be undertaken using longitudinal data. It assists in understanding how the relationship changes during this time span.

Conclusion

This research aimed to examine the variables that affect the relationship between intention to use and adoption for the digital market in Malaysia. Malaysian digital marketers need to improve their intention relationship because cryptocurrency is very new to Malaysia's digital market. The following conclusion can be drawn from the results of this study:

1. Trust, transaction transparency, volatility, and facilitating conditions have played a significant role in consumer relationships with Malaysian cryptocurrency adoption. Performance expectancy in Malaysia cannot directly affect consumer ties with cryptocurrency adoption digital market Malaysia.

2. The study also revealed that intention to use directly influenced the cryptocurrency adoption relationship in Malaysia's digital market. It means that the higher the level of intention to use is the higher cryptocurrency adoption.

3. The study also discovered that intention to use indirectly influenced the cryptocurrency adoption of Malaysia's digital market. This study also demonstrates the interrelation of the predictor, mediator, and dependent variable. The study also found that the predictor variable (TR, TT, VO, FC, and PE) and cryptocurrency adoption mediation affect intention to use.

References

Akinbode, M., ADEGBUYI, O., Kehinde, O., Agboola, M. G., & Olokundun, A. M. (2010). Percieved value dimensions on online shopping intention: The role of trust and culture. Academy of Strategic Management Journal, 18(1).

Alaeddin, O., & Altounjy, R. (2018). Trust, technology awareness and satisfaction effect into the intention to use cryptocurrency among generation Z in Malaysia. International Journal of Engineering & Technology, 7(4.27), 8-10.

Alsheikh, L., & Bojei, J. (2014). Determinants Affecting Customer's Intention to Adopt Mobile Banking in Saudi Arabia. Int. Arab. J. e Technol., 3(4), 210-219.

Alzahrani, S., & Daim, T. U. (2019). Evaluation of the cryptocurrency adoption decision using hierarchical decision modeling (HDM). Paper presented at the 2019 Portland International Conference on Management of Engineering and Technology (PICMET).

Batrancea, L., Nichita, A., Olsen, J., Kogler, C., Kirchler, E., Hoelzl, E., . . . Fuller, J. (2019). Trust and power as determinants of tax compliance across 44 nations. Journal of Economic Psychology, 74, 102191.

Bazkiaei, H. A., Heng, L. H., Khan, N. U., Saufi, R. B. A., & Kasim, R. S. R. (2020). Do entrepreneurial education and big-five personality traits predict entrepreneurial intention among universities students? Cogent Business & Management, 7(1), 1801217.

Beckett, P. (2019). Ownership, financial accountability and the law: transparency strategies and counter-initiatives. Abingdon, Oxon ; New York, NY: Routledge.

Biswas, B., & Gupta, R. (2019). Analysis of barriers to implement blockchain in industry and service sectors. Computers & Industrial Engineering, 136, 225-241.

Bosco, F. A., Aguinis, H., Singh, K., Field, J. G., & Pierce, C. A. (2015). Correlational effect size benchmarks. Journal of Applied Psychology, 100(2), 431.

Buchhorn, A. (2010). Markets of Good Intentions: Constructing and Organizing Biogas Markets Amid Fragility and Controversy: Frederiksberg: Copenhagen Business School (CBS).

Burton, S., Sheather, S., & Roberts, J. (2003). Reality or perception? The effect of actual and perceived performance on satisfaction and behavioral intention. Journal of service research, 5(4), 292-302.

Calderón, C. A., López, M., & Peña, J. (2017). The conditional indirect effect of performance expectancy in the use of Facebook, Google+, Instagram and Twitter by youngsters. Revista Latina de Comunicación Social(72), 590.

Celeste, V., Corbet, S., & Gurdgiev, C. (2020). Fractal dynamics and wavelet analysis: Deep volatility and return properties of Bitcoin, Ethereum and Ripple. The Quarterly Review of Economics and Finance, 76, 310-324.

Chan, K. H., Chiew, S. M., Chong, J. Y., Foong, P. Y., & Lee, X. Z. (2018). Acceptance of Cryptocurrency among Ipoh residents. (Bachelor of Marketing ). University Tun Abdur Razzak,

Chandler, T. A., Chiarella, D., & Auria, C. (1987). Performance expectancy, success, satisfaction, and attributions as variables in band challenges. Journal of Research in Music Education, 35(4), 249-258.

Chaudhuri, A., & Holbrook, M. B. (2001). The chain of effects from brand trust and brand affect to brand performance: the role of brand loyalty. Journal of marketing, 65(2), 81-93.

Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern methods for business research, 295(2), 295-336.

Choo, K.-K. R. (2015). Cryptocurrency and virtual currency: Corruption and money laundering/terrorism financing risks? In Handbook of digital currency (pp. 283-307): Elsevier.

Chow, Y. Y., Sugathan, S. K., Kalid, K. S., & binti Arshad, N. I. (2019). What Determines the Acceptance of Cryptocurrency in Malaysia? An Analysis based on UTAUT2. Proceedings of the Twenty-Third Pacific Asia Conference on Information Systems, China 2019.

Dinev, T., & Hu, Q. (2005). The centrality of awareness in the formation of user behavioral intention toward preventive technologies in the context of voluntary use. SIGHCI 2005 Proceedings, 10.

Francisco, K., & Swanson, D. (2018). The supply chain has no clothes: Technology adoption of blockchain for supply chain transparency. Logistics, 2(1), 2.

Furtado, N. G., Furtado, J. V., Filho, L. C. V., & Silva, R. C. D. (2020). The influence of technology payment adoption in satisfaction: a study with restaurant consumers. International Journal of Business Excellence, 21(2), 209-230.

Gazali, H. M., Ismail, C. M. H. B. C., & Amboala, T. (2018). Exploring the intention to invest in cryptocurrency: The case of bitcoin. Proceedings of 2018 International Conference on Information and Communication Technology for the Muslim World (ICT4M).

Ghalandari, K. (2012). The effect of performance expectancy, effort expectancy, social influence and facilitating conditions on acceptance of e-banking services in Iran: The moderating role of age and gender. Middle-East Journal of Scientific Research, 12(6), 801-807.

Gull, I. A., Khan, A., & Sheikh, A. M. (2020). Employee engagement-performance relationship through innovative work behaviour and intention to stay. International Journal of Information, Business and Management, 12(4), 79-87.

Gunawan, F. E., & Novendra, R. (2017). An analysis of bitcoin acceptance in Indonesia. ComTech: Computer, Mathematics and Engineering Applications, 8(4), 241-247.

Gurrea, A., & Remolina, N. (2020). Global Challenges and Regulatory Strategies to Fintech. SMU Centre for AI & Data Governance Research Paper Forthcoming, 1(36).

Guych, N., Anastasia, S., Simon, Y., & Jennet, A. (2018b). Factors influencing the intention to use cryptocurrency payments: An examination of blockchain economy. Munich Personal RePEc Archive, 1-11.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing theory and Practice, 19(2), 139-152.

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long range planning, 46(1-2), 1-12.

Hair, J. F., Sarstedt, M., Pieper, T. M., & Ringle, C. M. (2012). The use of partial least squares structural equation modeling in strategic management research: a review of past practices and recommendations for future applications. Long range planning, 45(5-6), 320-340.

Hair Jr, J. F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM). European business review.

Hanson, C., Lipinski, B., Friedrich, J., & O'Connor, C. (2015). What’s Food Loss and Waste Got to Do with Climate Change? A Lot, Actually.

Hanson, C., West, J., Neiger, B., Thackeray, R., Barnes, M., & McIntyre, E. (2011). Use and acceptance of social media among health educators. American Journal of Health Education, 42(4), 197-204.

Hayes, A. F. (2009). Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Communication monographs, 76(4), 408-420.

Henseler, J. (2017). Bridging design and behavioral research with variance-based structural equation modeling. Journal of advertising, 46(1), 178-192.

Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. In New challenges to international marketing: Emerald Group Publishing Limited.

Herrero, Á., & San Martín, H. (2017). Explaining the adoption of social networks sites for sharing user-generated content: A revision of the UTAUT2. Computers in Human Behavior, 71, 209-217.

Hong, L. M., Sha'ari, M. A. A. H., Zulkiffli, W. F. W., Aziz, R. C., & Ismail, M. (2020). Determinant factors that influence entrepreneurial intention among students in Malaysia. Jurnal Manajemen dan Kewirausahaan, 22(1), 80-86.

Hsu, C.-L., & Lu, H.-P. (2004). Why do people play on-line games? An extended TAM with social influences and flow experience. Information & management, 41(7), 853-868.

Husin, M. M., Haron, R., & Aziz, S. (2019). The role of perceived benefits in formation of intention to use islamic crowdfunding platform among small and medium enterprises in Malaysia. International Journal of Entrepreneurship, 2(7), 39-47.

Iryan, A. (2020). Theoretical and legal perspective of civil liability in cryptocurrency relations. (Master ). Taras Shevchenko National University Of Kyiv,

Jani, S. (2018). The Growth of Cryptocurrency in India: Its Challenges & Potential Impacts on Legislation. (MBA). Parul University, Vadodara, India,

Jiang, S., Li, X., & Wang, S. (2021). Exploring evolution trends in cryptocurrency study: From underlying technology to economic applications. Finance Research Letters, 38, 101532.

Karim, A., Salleh, R., & Khan, M. K. (2016). SMARTbot: A Behavioral Analysis Framework Augmented with Machine Learning to Identify Mobile Botnet Applications. PLoS One, 11(3), e0150077.

Khadim, R. A., Hanan, M. A., Arshad, A., Saleem, N., & Khadim, N. A. (2018). Revisiting antecedents of brand loyalty: Impact of perceived social media communication with brand trust and brand equity as mediators. Academy of Strategic Management Journal, 17(1), 1-13.

Khazaei, H. (2020). Integrating Cognitive Antecedents to UTAUT Model to Explain Adoption of Blockchain Technology Among Malaysian SMEs. JOIV: International Journal on Informatics Visualization, 4(2), 85-90.

Kimmerl, J. (2020). Understanding Users' Perception on the Adoption of Stablecoins-The Libra Case. Paper presented at the PACIS.

Kozakov, V., Kovalenko, N., Golub, V., Kozyrieva, N., Shchur, N., & Shoiko, V. (2021). Adaptation of the public administration system to global risks. Journal of Management Information and Decision Sciences, 24(2), 1-8.

Kshetri, N. (2018). 1 Blockchain’s roles in meeting key supply chain management objectives. International Journal of Information Management, 39, 80-89.

Lehner, E., Hunzeker, D., & Ziegler, J. R. (2017). Funding science with science: Cryptocurrency and independent academic research funding. Ledger, 2, 65-76.

Li, T., Abla, P., Wang, M., & Wei, Q. (2017). Designing Proof of Transaction Puzzles for Cryptocurrency. IACR Cryptol. ePrint Arch., 2017, 1242.

Lukiyanchuk, I., Panasenko, S., Kazantseva, S., Lebedev, K., & Lebedeva, O. (2020). Development of online retailing logistics flows in a globalized digital economy. Revista Inclusiones, 407-416.

Malhotra, Y., & Galletta, D. F. (1999). Extending the technology acceptance model to account for social influence: Theoretical bases and empirical validation. Proceedings of the 32nd Annual Hawaii International Conference on Systems Sciences. 1999. HICSS-32..

Maruping, L. M., Bala, H., Venkatesh, V., & Brown, S. A. (2017). Going beyond intention: Integrating behavioral expectation into the unified theory of acceptance and use of technology. Journal of the Association for Information Science and Technology, 68(3), 623-637.

Mendoza-Tello, J. C., Mora, H., Pujol-López, F. A., & Lytras, M. D. (2018). Social commerce as a driver to enhance trust and intention to use cryptocurrencies for electronic payments. IEEE Access, 6, 50737-50751.

Mendoza, J. C., Mora, H., Pujol, F. A., & Lytras, M. D. (2018). Social commerce as a driver to enhance trust and intention to use cryptocurrencies for electronic payments. IEEE Access, 6, 50737-50751.

Miraz, M. H. (2020). Trust Impact on Blockchain & Bitcoin Monetary Transaction. Journal of Advanced Research in Dynamical and Control Systems, 12(3), 155-162.

Miraz, M. H., Hasan, M. T., Masum, M. H., Alam, M. M., & Sarkar, S. (2020). Factors Affecting Consumers Intention to Use Blockchain-Based Services (BBS) in the Hotel Industry. International Journal of Mechanical and Production Engineering Research and Development (IJMPERD), 10(3), 8891–8902.

Mohamed, M. S., Khalifa, G. S., Nusari, M., Ameen, A., Al-Shibami, A. H., & Abu-Elhassan, A. (2018). Effect of Organizational Excellence and Employee Performance on Organizational Productivity Within Healthcare Sector in the UAE. Journal of Engineering and Applied Sciences, 13(15), 6199-6210.

Nejati, M., Salamzadeh, Y., & Salamzadeh, A. (2011). Ecological purchase behaviour: insights from a Middle Eastern country. International Journal of Environment and Sustainable Development, 10(4), 417-432.

Nilashi, M., Jannach, D., bin Ibrahim, O., Esfahani, M. D., & Ahmadi, H. (2016). Recommendation quality, transparency, and website quality for trust-building in recommendation agents. Electronic commerce research and applications, 19, 70-84.

Novendra, R., & Gunawan, F. E. (2017). Analysis of technology acceptance and customer trust in Bitcoin in Indonesia using UTAUT framework. Transactions on Internet and Information Systems, 1-18.

Park, M., & Chai, S. (2020). The Effect of Information Asymmetry on Investment Behavior in Cryptocurrency Market. Paper presented at the Proceedings of the 53rd Hawaii International Conference on System Sciences.

Phillips, R. C., & Gorse, D. (2018). Cryptocurrency price drivers: Wavelet coherence analysis revisited. PLoS One, 13(4), e0195200.

Preacher, K. J., & Hayes, A. F. (2004). SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behavior research methods, instruments, & computers, 36(4), 717-731.

Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior research methods, 40(3), 879-891.

Preacher, K. J., & Kelley, K. (2011). Effect size measures for mediation models: quantitative strategies for communicating indirect effects. Psychological methods, 16(2), 93.

Preuveneers, D., & Ilie-Zudor, E. (2017). The intelligent industry of the future: A survey on emerging trends, research challenges and opportunities in Industry 4.0. Journal of Ambient Intelligence and Smart Environments, 9(3), 287-298.

Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. (2018). Partial least squares structural equation modeling (PLS-SEM) using smartPLS 3.0. In An Updated Guide and Practical Guide to Statistical Analysis: Pearson.

Ramayah, T., Yeap, J. A., Ahmad, N. H., Halim, H. A., & Rahman, S. A. (2017). Testing a confirmatory model of facebook usage in smartPLS using consistent PLS. International Journal of Business and Innovation, 3(2), 1-14.

Roussou, I., & Stiakakis, E. (2016). Adoption of Digital Currencies by Companies in the European Union: A Research Model combining DOI and TAM. Paper presented at the 4 th International Conference on Contemporary Marketing Issues ICCMI June 22-24, 2016 Heraklion, Greece.

Sair, S. A., & Danish, R. Q. (2018). Effect of performance expectancy and effort expectancy on the mobile commerce adoption intention through personal innovativeness among Pakistani consumers. Pakistan Journal of Commerce and Social Sciences (PJCSS), 12(2), 501-520.

Salamzadeh, A. (2020). What Constitutes A Theoretical Contribution? Journal of Organizational Culture, Communications and Conflict, 24(1), 1-2.

Salamzadeh, A., Tajpour, M., Hosseini, E., & Brahmi, M. (2021). Human Capital and the Performance of Iranian Digital Startups: The Moderating Role of Knowledge Sharing Behaviour. International Journal of Public Sector Performance Management, 2(1), 12944.

Saleh, A.-H. A. I., Ibrahim, A. A., Noordin, M. F., & Mohadis, H. M. (2020). Factors Influencing Adoption of Cryptocurrency-Based Transaction from an Islamic Perspective. Global Journal of Computer Science and Technology, 20(4), 1-13.

Sarker, P., Hughe, L., Dwivedi, Y. K., & Rana, N. P. (2020). Social Commerce Adoption Predictors: A Review and Weight Analysis. Paper presented at the Conference on e-Business, e-Services and e-Society.

Sas, C., & Khairuddin, I. E. (2015). Exploring trust in Bitcoin technology: a framework for HCI research. Paper presented at the Proceedings of the Annual Meeting of the Australian Special Interest Group for Computer Human Interaction.

Schaupp, L. C., & Festa, M. (2018). Cryptocurrency adoption and the road to regulation. Paper presented at the Proceedings of the 19th Annual International Conference on Digital Government Research: Governance in the Data Age.

Sobel, M. E. (1982). Asymptotic confidence intervals for indirect effects in structural equation models. Sociological methodology, 13, 290-312.

Soedarto, T., Kurniawan, G. S. A., & Sunarsono, R. J. (2019). The parceling of loyalty: brand quality, brand affect, and brand trust effect on attitudinal loyalty and behavioral loyalty. Academy of Strategic Management Journal, 18(1), 1-15.

Sultan, P., & Wong, H. Y. (2019). How service quality affects university brand performance, university brand image and behavioural intention: The mediating effects of satisfaction and trust and moderating roles of gender and study mode. Journal of Brand Management, 26(3), 332-347.

Tajvidi, M., Wang, Y., Hajli, N., & Love, P. E. (2017). Brand value Co-creation in social commerce: The role of interactivity, social support, and relationship quality. Computers in Human Behavior, 115, 105238.

Tang, H., & Mayersohn, M. (2007). Utility of the coefficient of determination (r2) in assessing the accuracy of interspecies allometric predictions: illumination or illusion? Drug metabolism and disposition, 35(12), 2139-2142.

Tun, P. M. (2020). An Investigation of Factors Influencing Intention to Use Mobile Wallets of Mobile Financial Services Providers in Myanmar. The Asian Journal of Technology Management, 13(2), 129-144.

Vairetti, C., González-Ramírez, R. G., Maldonado, S., Álvarez, C., & Voβ, S. (2019). Facilitating conditions for successful adoption of inter-organizational information systems in seaports. Transportation Research Part A: Policy and Practice, 130, 333-350.

Van Loo, R. (2019). Digital Market Perfection. Michigan Law Review, 117(5), 815-883.

Venkatesh, V., Brown, S. A., Maruping, L. M., & Bala, H. (2008). Predicting different conceptualizations of system use: the competing roles of behavioral intention, facilitating conditions, and behavioral expectation. MIS quarterly, 483-502.

Venkatesh, V., Thong, J. Y., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS quarterly, 157-178.

Xiong, J., & Tang, Y. (2020). Mobile Cryptocurrency for Development in Asia-Moderating Effects of Advantage, Complexity, and Compatibility.

Yeong, Y.-C. (2019). What drives cryptocurrency acceptance in Malaysia? Science Proceedings Series, 1(2), 47-50.

Yoo, K., Bae, K., Park, E., & Yang, T. (2020). Understanding the diffusion and adoption of Bitcoin transaction services: The integrated approach. Telematics and Informatics, 53, 101302.

Zhang, Q., Cao, M., Zhang, F., Liu, J., & Li, X. (2020). Effects of corporate social responsibility on customer satisfaction and organizational attractiveness: A signaling perspective. Business Ethics: A European Review, 29(1), 20-34.

Zulhuda, S., & binti Sayuti, A. (2017). Whither Policing Cryptocurrency in Malaysia? IIUM Law Journal, 25(2), 179-196.