Research Article: 2021 Vol: 20 Issue: 6S

Transformation of the Russian Financial Sector: The Need for Innovation, its Purpose, Objectives and Principles

Natalia E. Sokolinskaya, Financial University under the Government of Russian Federation

Lyudmila M. Kupriyanova, Financial University under the Government of Russian Federation

Maral Seitkulovna Kaskirova, NOKS Events Ltd, Almaty

Elena Andreevna Zinovyeva, Financial University under the Government of the Russian Federation

Abstract

A qualitative and quantitative change in the economic processes of any state is not possible without active introduction of innovation and modern technologies. However, innovation must have a solid methodological basis. Moreover, innovative activities cannot be undertaken without predetermined and clearly defined specific, achievable and measurable goals. In the absence of such basis, the effectiveness of introducing a particular innovation, as well as its further use, will tend to zero. Thus, the authors of the present study focus on the key theoretical aspects of the innovative transformation of the Russian financial sector. The study employs general scientific methods – comparison and grouping, induction and deduction, analysis and synthesis. As empirical and primary data, the authors analyze the regulatory framework in the field of innovative development of the Russian Federation, studies of major consulting companies, as well as Internet information on the key modern financial technologies (including information provided by the Bank of Russia).

Based on the results of the study, the authors approach the classification and content of principles, goals, objectives and main areas of innovation in the Russian financial sector. The role of the state and the Bank of Russia in supporting and developing innovation activities is noted. An overview of major innovations was prepared for the development of innovation activities in the Russian financial sector, and it concluded that development requires combined efforts of the State, the scientific and educational world, the enterprise segment and the institutions of civil society which would ensure the interests of the country's socio-economic development. The research materials will be useful to students and teachers in the field of economics, and for cientists and practitioners in the field of the introduction and implementation of innovations.

Keywords

Financial Sector, Ecosystem, Innovation, Modern Technologies, Digital Transformation, Digital Ruble, Globalization.

Introduction

Innovative development in the financial sector is a key factor for the success of the country's economy. Innovation is an integral part of life of a modern person and society. In the context of the fourth technological revolution, the development of the country's economy is determined, first of all, by the support of innovations, radical changes in all industries, global digital transformation, introduction of modern technologies and the their fast penetration into the country's life.

Innovation is a new or significantly improved product, service or process, a new sales method, or a new organizational method in business practice, workplace organization or in external relations (Federal Law No. 127, 1996). The term ‘innovation’ comes from the Latin novatio – renewal, change + the prefix in – in the direction, that is, ‘in the direction of change’.

Thus, a new banking and/or non-banking product having more attractive consumer properties than the previous one, a completely new product covering previously unmet needs of customers, or a new technology can be called financial innovation (Ioda, 2008).

The financial sector plays a key role in the country's economy, acting as an intermediary in the allocation of resources that are available to other economic sectors. Currently, the global financial sector is undergoing changes caused by various unfavorable factors (recession, poor epidemiological situation and the risk of its further escalation). The demand for innovation here is dictated by consumers whose main requirements are: accelerated and constantly available (24x7) service, the possibility of obtaining a full range of services through a single window and interface, increased financial inclusion, diversified financial services, and digital technologies; all these allow creating state-of-the-art products and services. At the same time, large and technologically advanced players create their own innovative ecosystems that provide new sources of income and improve customer service.

Thus, it is obvious that introducing new high-quality products using digital technologies is becoming the main competitive advantage in the market. Let us consider the foundation of innovation and the ways to achieve a high rate of new technologies while increasing the efficiency of current activities.

According to the authors, the answers lie in the essential characteristics of innovation, the analysis of which is impossible without researching its three main ‘pillars’ – principles, goals and objectives of innovation.

Materials and Methods

Doctrine. Certain issues of introducing innovations into the activities of organizations, enterprises and banks are widely covered in modern economic literature, for example, by Kosarev (2018); Nikolaevsky & Vikhnovskaya (2020); Shpalerskaya (2011); Mikhailova & Polyakova (2011); Korostoshivets (2010); Artyukhin, Dyatkov & Seredkin (2011); Andreychikova & Selyanin (2006); As well as in theses by Okhlopkov (2011); Ivanov (2009). Among the fundamental works that indirectly touch upon the indicated problems, it is also necessary to note the monograph by Lavrushin & Solovyov (2020), as well as the textbook by Brovkina (2014), and the research by Rudakova (2020); Sokolinskaya (2014); Sokolinskaya (2019).

At the same time, no comprehensive studies were made on the theoretical foundations for introducing innovations in the doctrine of economic science.

Normative Basis

Some regulations and documents of the Bank of Russia (dedicated to introducing innovations in the country) are:

• The main directions of financial technologies development for 2018-2020 (https://cbr.ru/Content/Document/File/84852/ON_FinTex_2017.pdf.);

• Order of the Government of the Russian Federation of December 08, 2011 No. 2227-r "On the approval of the Strategy for innovative development of the Russian Federation up to 2020" (Article 216);

• Order of the Government of the Russian Federation of July 28, 2017 No. 1632-r "On the approval of “Digital economy of the Russian Federation" program;

• Decree of the Government of the Russian Federation of June 03, 2019 No. 710 "On conducting an experiment to improve the quality and coherence of data contained in state information resources" (Article 2963);

• Decree of the President of the Russian Federation of December 01, 2016 No. 642 "On the strategy of scientific and technological development of the Russian Federation" (Russian Federation. 2016. No. 49. St. 6887);

• Federal Law of August 23, 1996 No. 127 FZ "On science and state scientific and technical policy" (Federal Law No. 127 FZ of 23.08.1996).

Consulting research. In addition, the research of the following international consulting companies contains the data important for the present study:

Research by McKinsey & Company "Innovation in Russia – an inexhaustible source of growth" (hereinafter, McK&Co research).

The study noted that to gain significant benefits, players in any industry need an integrated approach to implementing innovations of three types: product innovation, process innovation and innovation in business models (Table 1):

| Table 1 Main Types of Innovation Type |

||

|---|---|---|

| Product innovations | Process innovations | Innovations in business models |

| Creating and introducing a new product or service, or improving an existing one | Developing and promoting a new method or process, such as production/distribution | Improving economic parameters in the value chain, diversifying profit sources |

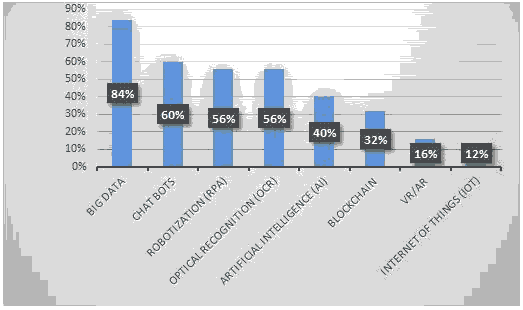

Research of the auditing company KPMG "Digital technologies in Russian companies" (hereinafter, KPMG research). Within the framework of this study, statistics are provided on the use of digital technologies most in demand for implementation in Russia (Figure 1).

Thus, to achieve the goals set for this study, the authors analyzed the provisions and conclusions of authentic doctrines, legislative and administrative regulations, as well as the results of McK&Co and KPMG research.

Results and Discussion

Financial Sector Innovation Principles

According to McK&Co research, innovation requires a lot of resources that may not be available in one organization. Moreover, partnerships with other innovation participants play a vital role in the implementation of innovative ideas and in their successful commercial component, which allows achieving the synergy of joint innovation interaction.

At the same time, it is necessary to take into account that innovative activity is accompanied by a certain amount of risk and may yield unpredictable results. Therefore, it is necessary to rebuild the corporate culture and to change the system of motivation, creating a kind of ‘loyalty’ to risk, giving innovators-researchers more opportunity to experiment and introduce innovations.

At the same time, working with innovations in building a business model, it is necessary to focus on increasing not only banking but non-banking sources of income and create own ecosystems and partnerships, which determines the innovative potential and efficiency of the organization.

Thus, the following key principles for introducing innovations in the financial sector can be distinguished:

1. The principle of complexity, implying the need for ‘end-to-end’ implementation of innovations in all business models, products and processes (both internal and external) of the organization, for the awareness of all the employees, and for the development of a system of initiatives and value guidelines.

2. The principle of updating, associated with the need for continuous development of the existing internal resources of the organization (including in terms of skills, knowledge and competencies of employees), as well as updating the range of products and services provided with additional investments in their digitalization.

3. The principle of interaction, implying mutually beneficial partnership and cooperation with various participants in innovative activities (government, scientific institutions, large technology companies, startups, companies in related industries, etc.).

4. The principle of consistency and completeness, associated with the adaptation of familiar operational processes (organizational structure, corporate culture, employee motivation) meant to develop speed and flexibility in decision-making, in creating an innovative strategy for the organization, and in using software and hardware tools and risk management.

5. The principle of increasing innovation ‘literacy", which implies developing tools related to implementing innovations: portfolio management, digital technologies, Agile, creation of a professional standard (for example, labor functions, requirements for knowledge and experience), etc.

6. The principle of perceived risk and freedom for the experiment, associated with the need to support innovations using the description of the ‘contour’ of technical (personnel errors, flaws and shortcomings of information programs, errors in calculations) and substantive (algorithms, cyber threats, technological failures, data quality, public availability of systems, fraud) risks.

7. The principle of efficiency, implying material and financial investments in innovative projects with the lowest possible costs and with maximum effect.

Goals, objectives and Main Directions of Innovation in the Russian Financial Sector

In accordance with the Strategy for Innovative Development of the Russian Federation, a key priority of the country's economic development and increased well-being of the population is the transition of the domestic economy to an innovative socially-oriented development model, which, in turn, highlights the need to implement the following key goals of innovative activities in the Russian financial sector:

1. Development of competition in the financial market as one of the most important drivers of improving market efficiency and of stimulating its institutions to modernize business models, to develop innovative ideas and to comprehensively meet customer needs.

2. Increase in the level of accessibility and quality of financial services, including in hard-to-reach areas and for groups of people with disabilities, for the elderly and other people with limited mobility.

3. Reduction in information security risks (cyber risk) when using innovative financial technologies and services.

4. Creation of a competitive financial infrastructure through digital technologies.

5. Optimization of costs for financial market participants.

In accordance with the goals, the following main tasks and areas of innovation can be identified:

1. The state and the Bank of Russia creating legal mechanisms and structures that allow effective implementation of innovative technologies in the financial market.

2. Developing digital technologies in the financial market to stimulate the emergence of innovative products and services for end consumers.

3. Reducing bureaucratic barriers in interaction between the state and business in the innovation sphere. Creating a flexible system of public-private partnerships in the development and implementation of innovations.

4. Creating state regulatory platforms that allow testing innovative financial technologies, products and services.

5. Using the opportunities for integration interaction within the Eurasian Economic Union (EAEU): forming a single innovation space, exchanging technologies and best practices for introducing innovations in the financial sector.

6. Ensuring safety and sustainability in the implementation of innovations: creating systems and algorithms that allow predicting, identifying, responding to and preventing risks of the innovation process (legal, informational, social, etc.) timely.

7. Training highly professional personnel capable in the field of introducing innovations and new technologies in the financial market, possessing a wide range of competencies and ready to carry out change management.

Therefore, innovation doubtlessly brings impressive benefit. The McK&Co research presents the components of the effect of innovation development (Table 2):

| Table 2 Main Benefits of Innovation |

||

|---|---|---|

| Private Business Benefits | Benefits to society | Benefits to the state as a whole |

| Revenue and profit growth | Improved quality of life | GDP growth |

| Accelerated growth of small and medium-sized businesses | New employment opportunities | Reduced inequality |

| Development of new economic sectors | Population income growth | Diversified economy |

The well-being of society, business development and increased competitiveness in the financial sector are possible, first of all, through the introduction of innovations, the development of innovative activities, and the constant transformation of science and technology (Nikolaenkov, 2020).

Government Support and the Role of the Bank of Russia in the Development of Innovations

To comprehensively form the digital financial space is not possible without a symbiosis of consolidated actions of all its participants and timely rational regulation, on the one hand, supporting the stability of the financial system and protecting consumer rights, and on the other hand, promoting the development and implementation of digital innovations.

Active participation of the state in innovative activities help accelerate the pace of industry development. In modern conditions, the role of the state is not only in financing science and new developments but also in determining priority areas, identifying critical vulnerabilities in the industry and promising niches. Moreover, understanding of what is holding back innovation and addressing those barriers is needed. As part of government support, platforms for dialogue between business and representatives of science and technology companies can be organized to search for new ideas and solutions to complex problems.

For the domestic economy digitalization development in the Russian Federation, the Program ‘Digital Economy of the Russian Federation’ was approved aimed at building an ecosystem of the digital economy of the Russian Federation, providing conditions for the creation of high-tech businesses, and increasing competitiveness in the global market.

The Bank of Russia is also actively involved in creating a favorable environment for the development of the digital space and of innovative activities in the financial sector. In 2016, on the initiative of the Bank of Russia, the FinTech Association was founded aimed to improve regulation and find effective ideas for the use of advanced financial technologies. In the spring of 2018, a ‘regulatory sandbox’ began functioning which can be defined as a special platform for market participants to test new financial technologies without violating the law. In 2020, the Bank of Russia launched a marketplace, i.e., a plug&play platform that connects financial service providers – banks, insurance organizations, mutual funds, issuers of government and corporate bonds. The marketplace is designed to provide the opportunity to receive almost the entire range of financial services 24/7 with the best price and quality indicators, regardless of the geographical boundaries of its participants. Thus, the rapidity of technological change obliges the regulator to show more flexibility. Adequate industry regulation will protect the market and companies from the risk of cyber threats, and a stable market situation will foster active innovation. At the same time, successful implementation of innovations is determined, among other things, by the quality of cross-functional interaction between the Bank of Russia and market participants.

An Overview of Major Innovations in the Financial Sector

At present, innovations in the Russian Federation are introduced primarily in the financial sector, which is more susceptible to the influence of technological progress and to introduction of modern advanced technologies.

In 2018, a digital platform was created in the Russian Federation – the Unified Biometric System (hereinafter, the UBS), with which remote biometric identification of individuals becomes possible. The creation of such platform transfers financial services and services to a new digital sphere, increasing their accessibility to citizens, including those with disabilities, as well as increasing competition in the market. The UBS and the Unified Identification and Authentication System provide reliable identification of users and allow them to receive a basic package of services, for example, opening a deposit or obtaining a loan, without being present at the bank's office. Collection of biometrics started in Russia in the summer of 2018; as of March 1, 2020, this service operates in more than 13.5 thousand structural units of commercial banks (https://cbr.ru/fintech/digital_biometric_id). This mechanism was developed by the Bank of Russia as part of the implementation of the Main Directions for the Development of Financial Technologies for 2018–2020.

At the moment, the Bank of Russia and the Ministry of Digital Development, Communications and Mass Media of the Russian Federation have launched an experiment service that allows customers (through personal accounts of the Unified Portal of Public Services) to remotely indicate information about themselves to credit and insurance organizations and receive digital services without having to visit the office. Through the new service, financial organizations will be able to obtain the information they need about individuals stored in the databases of various departments (Federal Tax Service, Federal State Registration Service, Cadastre and Cartography, etc.), with consent stored in a unified register of digital consents (https://cbr.ru/press/event/?id=6723). The service is implemented as part of the program for starting a digital profile of Russian citizens in accordance with the decree of the Government of the Russian Federation dated 03.06.2019 No. 710 "On conducting an experiment to improve the quality and connectivity of data contained in state information resources"( Article 2963).

In addition, the Bank of Russia is considering the possibility of issuing the central bank's digital currency, the digital ruble, which may become an additional form of the national currency of the Russian Federation. The use of the digital ruble is planned as both non-cash (for remote settlements and payments) and cash (offline, if there is no Internet access). The digital ruble will perform the same functions as ordinary banknotes – a means of payment, a measure of value and a store of value. The emission of the digital ruble will help reduce the cost of payment services and increase competition among financial institutions, which will serve as the basis for the development of innovation and the digital economy. Thanks to the digital ruble, the availability of financial services for citizens in hard-to-reach regions will increase, which will ultimately improve the quality of life of the population. In sum, the digital ruble will be an obligation of the Bank of Russia and will be implemented through digital technologies (https://cbr.ru/analytics/d_ok/dig_ruble; Kupriyanova; 2017).

The plans of Russian organizations are correlated with global trends. In the coming years, Russian organizations will continue to develop technologies and introduce innovations in the financial sector (Kiselev, 2020).

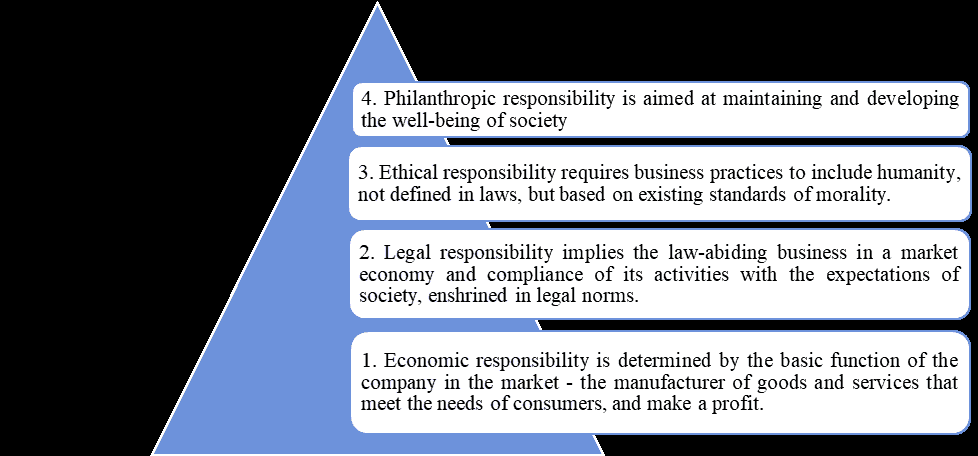

Needless to say, socially oriented problems are to be solved. Introduction of innovations can be correlated with the Pyramid of Social Responsibility by A. Caroll.

Figure 2 shows the pyramid of social responsibility by A. Caroll; its steps are also characteristic of innovation (Rudakova, 2020):

Conclusion

The implementation of innovations in the financial sector is a complex multi-stage process of interconnection of numerous elements that bring together economic, technological and legal issues. The speed of innovation is constantly growing, so the constant introduction of new and high-quality products using digital technologies is becoming the main competitive advantage in the market.

Financial market participants realize that their effective activity depends not only on the ability to adapt to a dynamically changing world but also to influence and change it. The key role is now given to the formation of a philosophy of constant renewal, an integral part of which is the atmosphere of generating ideas and introducing innovations. Innovation requires a wide range of competencies, a radically new approach to work, the investment of a completely different amount of resources for innovative development and the involvement of all the components: products, processes, technologies, management system, labor motivation, and employee thinking.

Innovation has significant social and economic impacts and affects private business, government institutions and society as a whole.

For successful development and implementation of innovations, market participants need a long-term strategy with clear goals for all types of innovations. When working with innovation in building a business model, one needs to focus on increasing non-bank sources of income by developing own ecosystems and partnerships. The Bank of Russia can contribute to this process by continuing to create a favorable climate for working with innovations and actively supporting the financial infrastructure, including such organizations as accelerators, business incubators and independent fintech companies (Innovations in Russia – an inexhaustible source of growth, January 2019; Kazak, 2019).

Thus, for the development of innovative activities in the Russian financial sector, it is necessary to combine the efforts of the state, the scientific and educational world, the entrepreneurial segment and civil society institutions, which will ensure the interests of the country's socio-economic development.

References

- Federal Law No. 127 FZ of 23.08.1996 "On science and state scientific and technical policy", Collection of Legislation of the Russian Federation. 1996. No. 35. St. 4137.

- What is innovation [Electronic resource]. URL: https://dic.academic.ru/dic.nsf/ruwiki/152267

- Ioda, P., Ioda, Yu.V., & Podkolzin, V.V. (2008). Innovations in the financial sector of the economy. ISSN 1810-0201. Bulletin of TSU, 5 (61), 70-77.

- Kosarev, V.E. (2018). At the junction of economic disciplines and information technologies: interdepartmental project "Banking information systems and technologies". Bulletin of the tula branch of the financial university. 1, 124, 125.

- Nikolaevsky, V.V., & Vikhnovskaya, E.I. (2020). Possibilities of using big data technologies and collaborative filtering in modern banking technologies, Global problems of digital economy modernization. Proceedings of the IX International Scientific and Practical Conference. 187-194.

- Shpalerskaya, V.V. (2011). Remote banking service as a new technology for providing banking services. Scientific Bulletin of Volgograd Academy of Public Service. Series: Economics, 1(5), 61-66.

- Mikhailov, N.V., & Polyakov, V.M. (2011). Expanding the functional capabilities of banking information systems with the use of intelligent agent technologies. Bulletin of Belgorod State University named after V. G. Shukhov, 3,159 – 161.

- Korostoshivets, M.V. (2010). Innovative banking technologies as a factor of competitiveness of Russian commercial banks, Education. Right, 3(13), 68 – 73.

- Artyukhin, V.V., Dyatkov, V.S., & Seredkin, A.N. (2011). Neural network information technologies in the banking sector. Bulletin of Bryansk State Technical University, 4(32), 86-91.

- Andreychikov, A.V., & Selyanin, V.E. (2006). The use of neural network technologies and expert systems for assessing bank reporting on reliability. Bulletin of Volgograd State Technical University, 5 (22), 211-216.

- Okhlopkov, A.V. (2011). Innovations in the provision of banking services: PhD thesis. Moscow, 193.

- Ivanov, A.A. (2009). New banking products and their implementation in the conditions of the Russian economy: PhD thesis. Rostov-on-Don, 30.

- Lavrushin, O.I., Solovyov, V.I.M. Edited by Bank Information systems and technologies: textbook / collective of authors, KNORUS, 528.

- Brovkina, N.E. (2014). The market of banking services for individuals: Trends and prospects of development: A textbook, KNORUS, 264.

- Rudakova, O.S., Sokolinskaya, N.E. (2020). Corporate governance in a commercial bank: Textbook, KNORUS, 440.

- Sokolinskaya, N.E. (2014). Development of scientific research in the field of risk management and their implementation in the program of courses for masters. International Journal: Economics. Business. Cans, 2(7), 119-126.

- Sokolinskaya, N.E. (2019). The role of innovative banking disciplines in the formation of competencies in the conditions of digitalization of banks. Journal of Banking, 6, 49-53.

- The main directions of the development of financial technologies for the period 2018-2020 [Electronic resource]. https://cbr.ru/Content/Document/File/84852/ON_FinTex_2017.pdf."

- Order of the government of the Russian Federation of 08.12.2011 No. 2227-r "On approval of the Strategy of innovative development of the Russian Federation for the period up to 2020" / / Collection of Legislation of the Russian Federation. 2012. No. 1. Article 216.

- Decree of the government of the Russian Federation No. 1632-r of 28.07.2017 "On approval of the program" Digital Economy of the Russian Federation " / / Collection of Legislation of the Russian Federation. 2017. No. 32. St. 5138. The document became invalid on 12.02.2019 due to the publication of the decree of the Government of the Russian Federation No. 195-r of 12.02.2019.

- Resolution of the government of the Russian Federation No. 710 of 03.06.2019 "On conducting an experiment to improve the quality and connectivity of data contained in State information resources". 2019. Article 2963.

- Decree of the president of the Russian Federation of 01.12.2016 No. 642 "On the Strategy of scientific and technological development of the Russian Federation" / / Collection of Legislation of the Russian Federation. 2016. No. 49. St. 6887.

- Innovations in Russia – an inexhaustible source of growth, January 2019 [Electronic resource]. URL: www.mckinsey.com/~/media/McKinsey/Locations/Europe%20and%20Middle%20East/Russia/Our%20Insights/Innovations%20in%20Russia/Innovations-in-Russia_web_lq-1.ashx.

- Digital technologies in Russian companies, January 2019 [Electronic resource]. URL: https://assets.kpmg/content/dam/kpmg/ru/pdf/2019/01/ru-ru-digital-technologies-in-russian-companies.pdf.

- Remote identification [Electronic resource]. https://cbr.ru/fintech/digital_biometric_id.

- The service for digital interaction between citizens and banks through the Unified Portal of State Services, May 2020, has been launched. URL: https://cbr.ru/press/event/?id=6723.

- Digital ruble. Report for public consultations [Electronic resource]. URL: https://cbr.ru/analytics/d_ok/dig_ruble.

- Nikolaenkov, N.S., Kupriyanova, L.M., & Kiselev, M.N. (2020). Trends and prospects of research and development and legal protection of their results in Russia in 2019. International scientific journal: Economics. Business. Banks, (41), 23-36.

- Kiselev, M.N., Kupriyanova, L.M., Nikolaenkov, N.S. (2020). Formation of the IP portfolio in connection with the development of civilian production by enterprises of the military-industrial complex. International scientific journal: Economics. Business. Banks, 11(37), 45-56.

- Kupriyanova, L.M. (2017) Actual problems of the commercialization of high technology. Scientific journal: Economics. Business. Banks, 1(18), 52–64.

- Kazak, E. (2019). The impact of drudgery jobs and procedures on quality and performance. Educational Administration: Theory and Practice, 25(4), 693-744.

- Kupriyanova, L.M. (2019). An effective model for the commercialization of intellectual property. Scientific journal: World of the New Economy, 13(1), 104–110.