Research Article: 2021 Vol: 25 Issue: 5

The Impact of State Revenue and Bonus Mechanism on Transfer Pricing Decisions with Tax Minimization as A Moderating Variable

Trisni Suryarini, Accounting Department, Faculty of Economics Universitas Negeri Semarang

Ain Hajawiyah, Accounting Department, Faculty of Economics Universitas Negeri Semarang

Retnoningrum Hidayah, Accounting Department, Faculty of Economics Universitas Negeri Semarang

Etty Gurendrawati, Universitas Negeri Jakarta

Magdalena Nany, Universitas Kristen Surakarta

Abstract

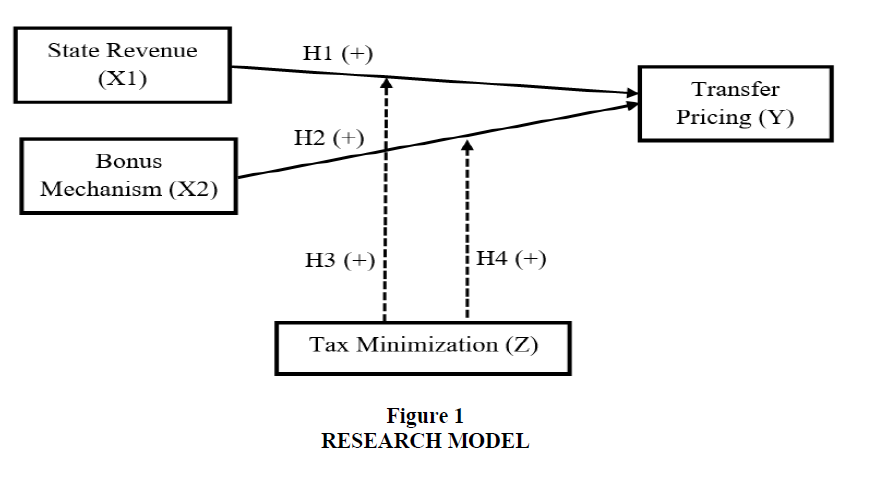

This study aims to examine the effect of state revenue and bonus mechanism on transfer pricing. This study also aims to examine the role of tax minimization as moderating variable in the effect of state revenue and bonus mechanism on transfer pricing. The population of this study is manufacturing companies listed on the Indonesia Stock Exchange from 2013 to 2018, totaling 145 companies. The sample was selected by purposive sampling technique with a total of 108-unit analysis. The analytical method used in this study is moderation regression analysis with an absolute difference test. The hypothesis testing used is the IBM SPSS Version 23 application. The result shows that the state revenue and bonus mechanism variable do not significantly affect on the transfer pricing variable. The tax minimization variable moderates the effect of state revenue on transfer pricing positively. However, tax minimization does not moderate the effect of the bonus mechanism on transfer pricing.

Keywords

Bonus Mechanism, Tax Minimization, Transfer Pricing, State Revenue.

Article Classification

Research paper

Introduction

Companies carry out tax management to minimize tax. Tax planning reduce the tax burden as maximum as possible to increase efficiency and competitiveness (Suandy, 2016). One of the tax planning methods used is the transfer pricing. Companies do transfer pricing to maximize profits and minimize taxes since taxes are considered a burden that will reduce profits.

Suandy (2016) defined transfer pricing into two different definitions. First, transfer pricing is a pure business strategy and tactic without reducing the tax burden. Second, transfer pricing saves tax with tactics, such as shifting taxes to countries with low tax rates. Transfer pricing also means the price of a product in divisions within one company, between local companies, or local companies with abroad companies (Hartati et al., 2015).

Ernst & Young in (2010) conducted a survey entitled Global Transfer Pricing Survey with Taxpayer respondents from Europe, America, and the Asia Pacific. The survey results indicate that taxpayers in various countries consider transfer pricing as the most critical taxation issue.

When viewed from an international perspective, transfer pricing is a tool to mobilize operating profits for its business purposes. However, tax authorities want transactions between divisions or between companies in one group to always refer to fair market prices (Mispiyanti, 2015). Companies operating in Indonesia try to do transfer pricing to divert potential taxes from Indonesia to other countries with low tax rates. Susanti & Firmansyah (2018) stated that transfer pricing is often used in the case of shifting profits from companies in countries with higher tax rates to affiliated companies in countries with lower tax rates.

The Directorate General of Taxes has issued a regulation regarding transfer pricing in Article 18 of Law Number 36 Year 2008 concerning Income Tax. Article 18 paragraph (3) of the Income Tax Law regulates that according to the principles of fairness and business normality, The Directorate General of Taxes has the authority to re-determine the amount of taxable income for Taxpayers who have special relationships with other Taxpayers.

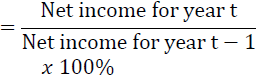

One factor that influences a company's decision to do transfer pricing is bonus mechanism at companies. The bonus scheme implemented by companies will affect management behaviour. They will try to manipulate profits to look good so that the bonuses earned will be high and remuneration will increase. One of the ways to increase profits is by minimizing the tax burden through transfer pricing.

State revenue is measured by multiplying the current tax rate with company profits. State revenue shows the company's contribution to the state in the form of taxes paid. Yuniasih et al. (2012) found that a more significant tax burden causes companies to carry out transfer pricing. The probability of companies to carry out transfer pricing practices will increase if a country sets a high tax rate. Companies with high profits in countries with high tax rates will shift their profits to countries classified as low-tax countries.

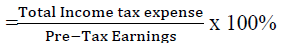

Tax minimization is a strategy to minimize the corporate tax burden. Kiswanto & Purwaningsih (2014) argued that a significant tax burden triggers companies to do transfer pricing in the hope that it can reduce the tax burden. The researchers choose tax minimization as a moderating variable because giving bonuses to management and directors through bonus mechanism will affect its strategy. Managers will try to get bonuses by increasing company profits, one of which is by doing transfer pricing. The tax burden will reduce the profit after tax. The existence of bonus mechanism supported by tax minimization encourages managers to transfer pricing.

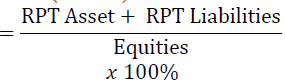

The study combines variables from the previous studies regarding the effect of state revenue and bonus mechanism on transfer pricing decisions. The tax minimization variable, which acts as a moderating variable between state revenue and bonus mechanism, has not been widely studied in the previous research studies. The measurement for the dependent variable is also different from most of the measurements used by the previous researchers, where this study uses RPTAL (Related Party Transaction of Assets and Liabilities) to measure transfer pricing. This is different from the previous studies that use dichotomous measurements, such as in the research conducted by Noviastika et al. (2016), where transfer pricing is measured with the presence or absence of sales to related parties.

Previous research has shown inconsistent results regarding the effect of the bonus mechanism and state revenue on transfer pricing. The bonus mechanism has a positive effect on transfer pricing (Lo et al., 2010), has a negative effect (Indriaswari & Aprillia, 2018), and has no effect (Rosa et al., 2017; Nuradila & Wibowo, 2018; Saraswati & Sujana, 2017). State revenue has a significant effect on the company's decision to carry out transfer pricing (Noviastika et al., 2016; Saraswati & Sujana, 2017; Masri & Martani, 2013).

This study aims to examine the effect of state revenue and bonus mechanism on transfer pricing. This study also aims to examine the role of tax minimization as moderating variable in the effect of state revenue and bonus mechanism on transfer pricing.

Literature Review

Agency theory explains a relationship between shareholders who act as principals delegating authority to managers as agents. The managers are given the duty of managing the company to get the profit expected by the principals. They report to the principals to determine whether the company's performance is running according to the target. The managers will get incentives or remuneration for the level of achievement of success in managing the company (Anissa & Handayani, 2015).

Agency theory also explains that management chooses accounting methods to increase earnings in financial statements, which can distort the quality of financial statements (Febriyanto & Firmansyah, 2018). Mispiyanti (2015) explained that agency problems arise due to opportunistic actions taken by managers as agents to precede their interests as opposed to the interests of principals. According to Septiyani et al. (2018), Agency theory states that there is information asymmetry between managers (agents) and shareholders (principals) as managers know better about the company's internal information and prospects in the future than shareholders who do not have access to the information.

Tax management through tax avoidance is carried out because of differences in interests between managers and shareholders. On one side, managers as agents want an increase in compensation, while shareholders want to reduce tax costs (Jensen & Meckling, 1976).

Positive Accounting Theory by Watts & Zimmerman (1986) explains how accounting policy making can be a problem for companies and related parties with financial statements. This theory is also used to predict which accounting policies the company should choose under certain conditions.

Klasen in Lo et al. (2010) found evidence that there was a shift in earnings that multinational companies had made in response to changes in tax rates in Canada, Europe, and the United States. Yuniasih et al. (2012) found that a more significant tax burden causes companies to carry out transfer pricing. The tax burden shows the company's contribution to state revenue.

To reduce the total tax burden, the company chooses to carry out tax management by making transactions with other companies located in other countries that are still affiliated. Companies' probability of carrying out transfer pricing practices will increase if a country sets a high tax rate. Companies with high profits in countries with high tax rates will shift their profits to countries with low tax (Aharony et al., 2010).

H1: State revenue has a significant positive effect on transfer pricing.

The bonus plan hypothesis presented in Positive Accounting Theory explain the relationship between bonuses and profits. Managers at the company with the bonus mechanism will tend to choose accounting procedures with changes in reported earnings from future to present periods. In their research, Lo et al. (2010) explained that the tendency of management to take advantage of transfer pricing transactions to maximize the remuneration of the bonuses they receive would increase if bonuses are based on profit. Pramana (2014) also argues that managers will prefer to take policies to regulate net income to maximize the bonuses they receive, including by doing transfer pricing. The greater the company profit generated, the better the directors' image in the eyes of the company owner. Several studies, such as Hartati et al. (2015), Pramana (2014), and Saraswati & Sujana (2017), proved the positive effect of the bonus mechanism on transfer pricing decisions.

H2: Bonus mechanism have a significant positive effect on the decision to carry out transfer pricing.

Tax minimization is a strategy undertaken by companies to minimize the corporate tax burden. Kiswanto & Purwaningsih (2014) argued that a significant tax burden triggers companies to do transfer pricing. This happens since the companies will reduce the tax burden (Septiyani et al., 2018). This opinion strengthens the statement of Mangoting (2000), which states that companies often use transfer pricing as a tool to minimize tax.

Tang (2016) states that tax revenue can be one incentive for tax avoidance. Companies can make tax savings by diverting company profits from countries with high tax rates to countries with low tax rates.

H3: Tax minimization significantly moderates the effect of state revenue on the decision to carry out transfer pricing.

The bonus mechanism will affect the company's strategy. Managers will try to get bonuses by increasing company profits, one of which is by doing transfer pricing. The greater the company profit generated, the better the directors' image in the eyes of the company owner. The bonus plan hypothesis explains that company managers tend to prefer methods that increase profit for the current period (Cahyadi & Noviari, 2018; Djumena, 2009).

The tax minimization makes company profits higher because the company's tax burden is appropriately minimized. The bonus mechanism is supported by tax minimization which further encourages managers to carry out transfer pricing (Nuradila & Wibowo, 2018). The tax minimization will strengthen management's actions to maximize profits. Managers will strive to increase profits to optimize the earning of bonuses. This is in line with tax minimization efforts aimed at maximizing profit after tax. Both decisions can be realized using transfer pricing, so the tax minimization effort will strengthen the bonus mechanism effect on transfer pricing (Claessens & Djankov, 1999).

H4: Tax minimization significantly moderates the effect of bonus mechanism on transfer pricing.

Figure 1 show the research model used in this study.

Methodology

The research used secondary data in annual reports and financial reports of the manufacturing companies listed on the Indonesia Stock Exchange (IDX) in 2013-2018. The data were sourced from IDX website (www.idx.co.id) and companies' website. This study used purposive sampling technique with some criteria. The population was 145 companies, the sample was 18 companies, and the units of analysis were 108. Table 1 shows the sample selection criteria. Table 2 shows the operational definition and measurement of variables used in this study (Chan et al., 2016; Kurniasih & Sari, 2013).

| Table 1 Sample Selection Criteria | ||

| No | Criteria | Quantity |

| 1 | Manufacturing companies listed in IDX 2013-2018 | 145 |

| 2 | Companies suffered losses in 2013-2018 and had tax loss carryforward | (39) |

| 3 | The financial report is presented in other than Indonesian Rupiah currency | (25) |

| 4 | Companies controlled by foreign shareholders (20% or more). | (45) |

| 5 | Companies did not disclose Board of Directors compensation. | (6) |

| 6 | Companies did not disclose related party transaction of asset and liabilities. | (10) |

| Number of samples | 18 | |

| Number of unit analysis (6 years x 18 companies) | 108 | |

| Outlier | 16 | |

| Number of unit analysis | 92 | |

| Source: Data processed, 2020 | ||

| Table 2 Summary of Operational Definitions and Variable Measurement | |||

| No | Variables | Definition | indicators |

| 1. | Transfer Pricing | The price contained in each product or service from one division to another within the same company or between companies that have special relationships (Hartati et al., 2014) | Related Party Transaction of Assets and Liabilities (RPTAL) (Utama, 2015) |

| 2 | State Revenue | The amount of money that must be paid to the State on the profits earned by the company during the tax year concerned. | State Revenue= Company Profit x 25% The 25% is the company tax rate. |

| 3 | Bonus Mechanism | Appreciation given by company owners to managers if the company's profit targets are met (Purwanti, 2010). |  (Nuradila & Wibowo, 2018) (Nuradila & Wibowo, 2018) |

| 4 | Tax Minimization | Strategies to minimize the payable tax burden through various actions (Nuradila & Wibowo, 2018). | ETR  (Santosa & Suzan, 2018) |

This study is quantitative research with descriptive and inferential analysis using multiple linear regression and moderated regression analysis. This study used absolute difference value test in analyzing the moderating variable (Frucot & Shearon, 1991 in Ghozali, 2016; McColgan, 2001).

Results

The normality test is used to determine whether the research data is usually distributed or not. One of the requirements for a good regression model is that the data must be normally distributed. The results show that the data for the variables of bonus mechanism, tax minimization, and transfer pricing have fulfilled the requirements as data with a normal distribution. This can be seen from the Asymp-Sig. (2-tailed) values for unstandardized residuals have values of more than 5% or 0.05 significance, equal to 0.200, so the variables can be used to conduct regression tests (Santoso, 2004).

The multicollinearity results show that the tolerance of bonus mechanism and tax minimization variables is more than 0.1, so it can be concluded that there is no multicollinearity in this study. In addition to the tolerance values, the VIF values also show that all independent variables meet the requirements to be free from multicollinearity symptoms because they have a VIF value of less than 10.00.

The results of the heteroscedasticity test through the Glejser test show that all independent variables used in this study, namely bonus mechanism and tax minimization, have a significance level (Sig.) above 5% or 0.05. This can conclude that there is no heteroscedasticity in the regression equation model used, so the regression model is feasible to predict transfer pricing (Mutamimah, 2009; Septarini, 2012).

The results of the Run Test show that the Sig. (2-tailed) value for the unstandardized residual variable for bonus mechanism, tax minimization, and transfer pricing is 0.461. This indicates that the regression model has met the requirements to be free from autocorrelation symptoms as the significance value based on the test results is more than 5% or 0.05 (0.461> 0.05).

A moderated regression analysis test is conducted to examine the moderating variable of tax minimization. In this study, the authors use the absolute difference test method to examine the effect of moderation, which is the model assessing the absolute difference between the independent variable and the moderating variable. This study's absolute difference value test is used to examine bonus mechanism variables on the transfer pricing variable and the interaction of the bonus mechanism variables as the independent variables with the tax minimization variable as the moderating variable to the dependent variable of transfer pricing. Table 3 shows the summary of hypotheses testing results.

| Table 3 Summary of Hypothesis Testing Results | |||

| No | Hypothesis | Significance Value | Results |

| 1 | H1: State revenue has a significant positive effect on transfer pricing. | 0.891 | Rejected |

| 2 | H2: Bonus mechanism have a significant positive effect on transfer pricing. | 0.502 | Rejected |

| 3 | H3: Tax minimization significantly moderates the effect of state revenue on transfer pricing. | 0.000 | Accepted |

| 4 | H4: Tax minimization significantly moderates the effect of bonus mechanism on transfer pricing. | 0.167 | Rejected |

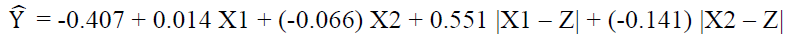

The regression equation is:

The Adjusted R Square value is 0.146. This means that 14.6% of the transfer-pricing variable is influenced by state revenue and bonus mechanism variables and the interaction of these variables with the moderating variable of tax minimization. While the other 85.4% is influenced by other factors not included in the research model.

Discussions

The Effect of State Revenue on Transfer Pricing

The state revenue does not affect transfer pricing. This result may happen because companies in Indonesia apply the Advance Pricing Agreement process under the Income Tax Article 18 paragraph 3a Law. Companies are more careful in conducting transfer pricing transactions with foreign parties even though they have a subsidiary-parent relationship.

This study does not support Noviastika et al. (2016) and Saraswati & Sujana (2017) which states that state revenue has a significant effect on transfer pricing. This study does not prove that a more significant tax burden causes companies to carry out transfer pricing by (Yuniasih et al., 2012).

The Effect of Bonus Mechanism on Transfer Pricing

The bonus mechanism does not affect transfer pricing. This result may occur because the companies have a Good Corporate Governance mechanism that prevents management from manipulating tax to increase their bonus. They have an audit committee with the capacity in financial supervision and audits, which can detect fraud by company management. This study indicates that the management commits to not enormously increasing profit but maintaining the company’s value.

A bonus plan hypothesis in Positive Accounting Theory is not supported in this study. The bonus plan hypothesis explains that company managers tend to choose accounting procedures with changes in the reported earnings from future periods to present periods. If their bonus depends on the net income, they are likely to increase the bonus in that period by reporting the highest possible net income as they want high bonuses.

This study supports the previous research conducted by Saraswati & Sujana (2017) and Septiyani et al. (2018), proving that the bonus mechanism does not affect transfer pricing. The explanation is that sample companies' net income data shows a stable value from year to year. This study contradicts Hartati et al. (2014), which finds that management would use more transfer pricing transactions to maximize the bonuses they receive if the bonuses are based on annual profits.

Tax Minimization Moderates the Effect of State Revenue on Transfer Pricing

The results show that tax minimization significantly moderates the effect of state revenue on transfer pricing. This study proves that tax minimization can strengthen the relationship between state revenue and transfer pricing. High state revenue affects the increase in companies to carry out transfer pricing so that companies can reduce high tax burdens as indicated by higher tax minimization (Marfuah & Azizah, 2014).

Tax Minimization Moderates the Effect of Bonus Mechanism on Transfer Pricing

Tax minimization cannot significantly moderate the effect of the bonus mechanism on transfer pricing. This condition explains that tax minimization does not affect the relationship between bonus mechanism and transfer pricing. This may happen because the companies carry out tax planning to minimize tax burdens through other schemes such as delaying tax liability payments, optimizing tax credits, capital repatriation, tax treaty protection/facilities, and so on (Noviastika et al., 2016). The sample might already have a suitable stakeholder supervision mechanism. Good supervisions make companies reduce inappropriate accounting measurements and disclosures to reduce fraud by management.

This result does not support the bonus plan hypothesis discussed in positive accounting theory which explains that company managers seek to enrich themselves through bonus maximization by increasing the annual profit.

Conclusions

This study concludes that (1) state revenue does not significantly affect transfer pricing; (2) bonus mechanism does not affect transfer pricing; (3) tax minimization variable positively moderates the effect of state revenue on transfer pricing; (4) tax minimization variable does not moderate the effect of the bonus mechanism on transfer pricing.

This study only uses related party transactions of asset and liability as a measurement of transfer pricing. Future research can use another measurement, such as related party transactions of sales and expenses. This study uses Indonesian companies as samples. Future studies can use other developing countries as samples to know whether it gives the same result.

References

- Aharony, J., Wang, J., & Yuan, H. (2010). Tunnelling as An Incentive for Earnings Management During the IPO Process in China. Journal of Accounting and Public Policy, 29(1), 1–26.

- Anissa, R.R., & Handayani, B.D. (2015). Analisa Faktor yang Memotivasi Manajemen Perusahaan Melakukan Tax Planning. Accounting Analysis Journal, 4(1), 1–11.

- Cahyadi, A.S., & Noviari, N. (2018). Pengaruh Pajak, Exchange Rate, Profitabilitas, dan Leverage pada Keputusan Melakukan Transfer Pricing. E-Jurnal Akuntansi Universitas Udayana, 24(02), 1441–1473.

- Chan, K.H., Mo, P.L.L., & Tang, T. (2016). Tax Avoidance and Tunnelling: Empirical Analysis from an Agency Perspective. Journal of International Accounting Research, 15(3), 49–66.

- Claessens, S., & Djankov, S. (1999). Ownership Concentration and Corporate Performance in the Czech Republic. Journal of Comparative Economics, 27(3), 498–513.

- Djumena, E. (2009). Diduga Gelapkan Pajak, PT Adaro Dilaporkan ke Polisi.lhttps://nasional.kompas.com/read/2008/07/09/21333188/diduga.gelapkan.pajak.pt.adaro.dilaporkan.ke.polisi. (diakses tanggal 27 Desember 2018)

- Ernst &Young. (2010). 2010 Global Transfer Pricing Survey.

- Febriyanto, A.S., & Firmansyah, A. (2018). The Effects of Tax Avoidance, Accrual Earnings Management, Real Earnings Management, and Capital Intensity on the Cost of Equity. Jurnal Dinamika Akuntansi, 10(1), 40–50.

- Ghozali, I. (2016). Aplikasi Analisis Mulitvariete dengan Program IBM SPSS 23 (8th ed.). Semarang: Badan Penerbit Universitas Diponegoro.

- Hartati, W., Desmiyawati, & Azlina, N. (2014). Analisis Pengaruh Pajak dan Mekanisme Bonus Terhadap Keputusan Transfer Pricing: Studi Empiris pada Seluruh Perusahaan yang Listing di Bursa Efek Indonesia. Simposium Nasional Akuntansi 17 Mataram, (18), 1–18.

- Hartati, W., Desmiyawati, & Julita. (2015). Tax Minimization, Tunnelling Incentive dan Mekanisme Bonus terhadap Keputusan Transfer Pricing Seluruh Perusahaan yang Listing di Bursa Efek Indonesia. Simposium Nasional Akuntansi 16 Medan.

- Indriaswari, Y.N., & Aprillia, R. (2018). The influence of tax, tunneling incentive, and bonus mechanism on transfer pricing decision in manufacturing companies. The Indonesian Accounting Review, 7(1), 69.

- Rosa, R., Andini, R., & Raharjo, K. (2017). Pengaruh Pajak, Tunneling Insentive, Mekanisme Bonus, Debt Covenant Dan Good Corperate Gorvernance (Gcg) Terhadap Transaksi Transfer Pricing ( Studi pada Perusahaan Manufaktur yang terdaftar di Bursa Efek Indonesia tahun 2013 – 2015) Ria. Journal of Accounting, 3(3), 24–35.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the Firm: Managerial Behavior, Agency Cost and Ownership Structure. Journal of Financial Economics, 3(4), 305–360.

- Kiswanto, N., & Purwaningsih, A. (2014). Pengaruh Pajak, Kepemilikan Asing, Dan Ukuran Perusahaan Terhadap Transfer Pricing Pada Perusahaan Manufaktur Di Bei Tahun 2010-2013. Jurnal Ekonomi Akuntansi, 1–15.

- Kurniasih, T., & Sari, M.M.R. (2013). Pengaruh Return on Assets, Leverage, Corporate Governance, Ukuran Perusahaan dan Kompensasi Rugi Fiskal Pada Tax Avoidance. Buletin Studi Ekonomi, 18(1), 58–66.

- Lo, A.W.Y., Wong, R.M.K., & Firth, M. (2010). Tax, Financial Reporting, and Tunnelling Incentives for Income Shifting: An Empirical Analysis of the Transfer Pricing Behavior of Chinese-Listed Companies. The Journal of the American Taxation Association, 32(2), 1–26.

- Marfuah, M., & Azizah, A.P.N. (2014). Pengaruh Pajak, Tunnelling Incentive dan Exchange Rate pada Keputusan Transfer Pricing Perusahaan. Jurnal Akuntansi & Auditing Indonesia, 18(2), 156–165.

- Masri, I., & Martani, D. (2013). Pengaruh Tax Avoidance Terhadap Cost Of Debt. E-. https://doi.org/10.1016/S0015-0282(16)59108-0

- McColgan, P. (2001). (34) Agency theory and corporate governance: a review of the literature from a UK perspective. Department of Accounting and Finance University of Strathclyde. https://doi.org/10.1021/bm900520n

- Mispiyanti. (2015). Pengaruh Pajak, Tunnelling Incentive dan Mekanisme Bonus terhadap Keputusan Transfer Pricing. Jurnal Akutansi Dan Investasi, 16(1), 62–73.

- Mutamimah. (2009). Tunnelling atau Value Added dalam Strategi Merger dan Akuisisi di Indonesia. Jurnal Manajemen Dan Terapan, 2(2), 161–182.

- Noviastika, F.D., Mayowan, Y., & Karjo, S. (2016). Pengaruh Pajak, Tunnelling Incentive dan Good Corporate Governance (GCG) terhadap Indikasi Melakukan Transfer Pricing pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia. Jurnal Perpajakan, 8(1), 1–9.

- Nuradila, R.F., & Wibowo, R.A. (2018). Tax Minimization sebagai Pemoderasi Hubungan antara Tunnelling Incentive, Bonus Mechanism dan Debt Convenant dengan Keputusan Transfer Pricing. Journal of Islamic Finance and Accounting, 1(1), 63–76.

- Pramana, A.H. (2014). Pengaruh Pajak, Mekanisme Bonus, Tunnelling Incentive dan Debt Covnant Terhadap Keputusan Perusahaan untuk Melakukan Transfer Pricing. Skripsi Jurusan Akuntansi Fakultas Ekonomika Dan Bisnis Universitas Diponegoro.

- Purwanti, L. (2010). Kecakapan Managerial, Skema Bonus, Managemen Laba, dan Kinerja Perusahaan. Jurnal Aplikasi Manajemen.

- Rosa, R., Andini, R., & Raharjo, K. (2017). Pengaruh Pajak, Tunnelling Incentive, Mekanisme Bonus, Debt Covenant dan Good Corperate Gorvernance (GCG) Terhadap Transaksi Transfer Pricing (Studi pada Perusahaan Manufaktur yang terdaftar di Bursa Efek Indonesia tahun 2013-2015). Journal of Accounting, 3(3).

- Santosa, S.J.D., & Suzan, L. (2018). Pengaruh Pajak, Tunnelling Incentive, dan Mekanisme Bonus Terhadap Transfer Pricing. Kajian Akuntansi, 19(2), 76–83.

- Santoso, I. (2004). Advance Picing Agreement dan Poblematika Transfer Pricing dari Prespektif Perpajakan Indonesia. Jurnal Akuntansi Dan Keuangan, 6(2), 123–140.

- Saraswati, G.A.R.S., & Sujana, I.K. (2017). Pengaruh Pajak, Mekanisme Bonus, dan Tunnelling Incentive Pada Indikasi Melakukan Transfer Pricing. E-Jurnal Akuntansi Universitas Udayana, 19(2), 1000–1029.

- Septarini, N. (2012). Regulasi dan Praktik Transfer Pricing di Indonesia dan Negara Maju. Universitas Negri Surabaya, 1(1).

- Septiyani, R.P.P., Ramadhanti, W., & Sudibyo, Y.A. (2018). Some Factors that Affect Transfer Pricing Decision. Soedirman Accounting Review, 03(1), 21–38.

- Suandy, E. (2016). Perencanaan Pajak (6th ed.). Jakarta Selatan: Penerbit Salemba Empat.

- Susanti, A., & Firmansyah, A. (2018). Determinants of Transfer Pricing Decisions in Indonesia Manufacturing Companies. Jurnal Akuntansi & Auditing Indonesia, 22(2), 81–93.

- Tang, T.Y.H. (2016). Privatization, Tunnelling, and Tax Avoidance in Chinese SOEs. Asian Review of Accounting, 24(3), 274–294.

- Utama, C.A. (2015). Penentu Besaran Transaksi Pihak Berelasi: Tata Kelola, Tingkat Pengungkapan, Dan Struktur Kepemilikan. Jurnal Akuntansi Dan Keuangan Indonesia, 12(1), 37–54.

- Viviany, S. (2018). Pengaruh Tarif Pajak, Tunnelling Incentive, Mekanisme Bonus dan Exchange Rate Terhadaptransfer Pricing (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun 2013-2016). Jurnal Online Mahasiswa FE UNRI, 1(1), 1–15.

- Wahyudin, A. (2015). Metodologi Penelitian. Semarang: Unnes Press.

- Watts, R., & Zimmerman, J. (1986). Positive Accounting Theory. Englewood Cliffs, N.J.: Prentice-hall.

- Yuniasih, N.W., Rasmini, N.K., & Wirakusuma, M.G. (2012). Pengaruh Pajak dan Tunnelling Incentives pada Keputusan Transfer Pricing Perusahaan Manufaktur yang Listing di Bursa Efek Indonesia. Simposium Nasional Akuntansi 15 Banjarmasin, 1–23.