Research Article: 2022 Vol: 25 Issue: 2S

Towards Islamic Village Financial Management (VFM) in Indonesia: A systematic literature review on VFM

Achdiar Redy Setiawan, Universitas Trunojoyo Madura

Murni Yusoff, Universiti Sains Malaysia

Citation Information: Setiawan, A.R., & Yusoff, M. (2021). Towards Islamic Village Financial Management (VFM) in Indonesia: A Systematic Literature Review On VFM. Journal of Management Information and Decision Sciences, 25(S2), 1-17.

Keywords

Village Financial Management (VFM), Indonesia, Systematic Literature Review, Islamic VFM

Abstract

Village Financial Management (VFM) this study is a pattern, system, and procedure for managing financial resources that must be carried out by the Village Government in Indonesia, as the smallest unit of the government structure in the state administration of the Unitary State of the Republic of Indonesia. VFM has been implemented as the consequence of the enactment of Law Number 6 of 2014 concerning Villages. The size of the budget mandated to the village government turned out to cause many problems in terms of several cases of abuse, one of the most prominent forms of which is corruption. This research aims to review the discussion of previous studies systematically on the existing concept and practices of VFM in Indonesia. This study applies the RAMESES review method protocol. This study's results are divided into three main themes. First, VFM implementation in several research locations/sites. Second, VFM in Indonesia is viewed and analyzed using the lens of good governance elements. Third the causes and solutions of fraudulent activities in VFM. The results provide a foundation for filling the literature gap that has not yet been entered to (re)design comprehensive VFM based on the ideal Islamic principle or value.

Keywords

Village Financial Management (VFM), Indonesia, Systematic Literature Review, Islamic VFM

Introduction

As the lowest unit at a government level, the village is directly connected to the community daily. The variety of community issues will become the affairs of the village administration at the first level. So, the provision of adequate resources, particularly in the financial aspect, is crucial. Village Financial Management (VFM) is an integral part of the village development system. The structure, pattern, and procedure of the village financial system are not similar to the global context countries. At this point, the formulation of a system and mechanism for proper and suitable VFM finds its relevance. Every country's central government faces challenges in setting up village (financial) management regulation and coordination with a higher government unit level.

Organization for Economic Co-Operation and Development (OECD) (2006a) released its research regarding the latest rural development management system. Based on experience and research in more than 30 member countries, the Organization for Economic Co-Operation and Development (OECD) (2006a) noted a paradigm-shifting of each country's perspective and approach to developing village policies and governance. The following table depicts the summary of the Organisation for Economic Co-Operation and Development (OECD) (2006a) research (Table 1):

| Table 1 The Old and New Paradigm of Rural Development Management System |

||

|---|---|---|

| Old Approach | New Approach | |

| Objectives | Equalization, farm income, farm competitiveness | Competitiveness of rural areas, valorization of local assets, exploitation of unused resources |

| Key Target Sector | Agriculture | Various sectors of rural economies (ex. rural tourism, manufacturing, ICT industry, etc.) |

| Main Tools | Subsidies | Investments |

| Key Actors | National governments, farmers | All levels of government (supra-national, national, regional, and local), various local stakeholders (public, private, NGOs |

Source: Organisation for Economic Co-Operation and Development (OECD) (2006a)

One aspect of the village management system highlighted by the Organization for Economic Co-Operation and Development (OECD) (2006a) is financial resources. The financial resource allocation policy leads to arranging a system of equitable allocation of financial support to the village unit level. Organization for Economic Co-Operation and Development (OECD) (2006b) further explains that village development in OECD member countries has indeed begun an implementation effort to make the village more independent and creative in its financial management.

Furthermore, Organization for Economic Co-Operation and Development (OECD) (2006b) highlights two principles that characterize this "new rural paradigm" in the context of strengthening financial capacity, i.e., focus on places instead of sectors; and focus on investments instead of subsidies. A primary tool to drive the village economy in the new paradigm is using investment mechanisms (Organization for Economic Co-Operation and Development (OECD), 2006b). Villages are required to be more independent in utilizing all of their resources to finance all village development needs. Financial dependence on the central government through the subsidies mechanism has been deemed obsolete and expected to be abandoned. Villages in developed countries are demanded to be more able to utilize the resources they have to become a source of income. The ability of villages to do entrepreneurship is encouraged to meet the needs of village development financing. Investment in several types of businesses is one of the dominant financial elements carried out as a provider of supply aspects of village finance.

The OECD's resume above regarding the new way or new paradigm in the village management system is justified by several research findings from rural development in developed countries. Bjärstig & Sandström (2017) explains the Public-Private Partnership (PPP) in Swedia's rural context. Although not yet running optimally, Bjärstig & Sandström (2017) believed that PPP is a significant solution for accelerating both the effectiveness (problem-solving capacity) and the legitimacy of sustainable village governance in terms of participation and accountability.

Gobattoni, Pelorosso, Leone & Ripa (2015) highlight the same sort in the context of sustainable village development in Italy. Italy runs a new Common Agricultural Policy (CAP) program. Its program is forming a Local Action Group (LAG) as a public-private partnership to design and implement Local Development Strategies (LDS). Based on his in-depth study in communities in his country, Finlandia, Kuhmonen & Kuhmonen (2015) saw four possible images of rural futures that are also in line with OECD findings: decentralized bio-economy, colonial country-side, museum country-side, and rural business islets.

In the same vein, Richter (2019) pointed out rural social enterprises' existence in Poland and Austria's rural region. Applying the social network approach, Richter (2019) demonstrates that agricultural social enterprises mobilize ideas, resources, and support from external sources not primarily for their benefit but also for their rural region. Steiner & Teasdale (2019) also tells the investment experience in social enterprise in rural areas in his country, England. Rural social enterprises could potentially enable an integrated approach to addressing local issues at the agricultural level.

Furthermore, Long & Liu (2016) describes China's experience, one of the world's largest countries in developing their rural areas. Rural China has experienced a quick and far-reaching rearrangement of social and economic structures since the late twentieth century. Currently, rural China is progressively integrated into global social and economic networks.

The concept of rural development in developed countries as applied in OECD member countries (which have entered a new paradigm) may differ from developing countries' experience. As a developing country, Thailand runs a program known as Village and Urban Community Fund (Boonperm, Haughton & Khandker, 2013). In 2001, the Thailand government provided almost US$2 billion – a million baht for each of Thailand's 78,000 villages and wards – to provide working capital for locally-run rotating credit associations. Thai Village and Urban Community Fund are large-scale microcredit schemes for rural communities.

Indonesia, under The Law of No. 6 of 2016 concerning Villages, has a specific system that governs more than 75.000 villages throughout the country on how to run their village development (and financial) management. The Law 6/2014 on Village focuses on the form of accelerated development. Every single village in Indonesia is expected to be able to carry out accelerated growth together with adequate funding support and proper village management (Agusta, 2014). In terms of financial management, the government subsidy mechanism from the central government toward local government (read: rural or village) is still the primary tool.

However, Indonesia has just begun a new era regarding village development management with Law No. 6 of 2014 concerning Village. The law puts villages no longer just as objects of national development. Villages are given the autonomy to build their regions and communities. Village authority covers government administration, implementation of development, community development, and community empowerment based on community initiatives, origin rights, and village customs (Article 18 of Law No. 6 of 2014).

As regulated in Law No. 6 of 2014 concerning Villages, VFM is a consequence of the existence of village financial mandated to the village government. Specifically, the regulation on VFM in Indonesia at present is stipulated explicitly in Minister of Home Affairs Regulation No. 20 of 2018 concerning VFM. Due to the importance of this aspect of VFM in the village development framework in the new paradigm of Law 6/2014, it is essential to see how this aspect is implemented in Indonesia's various villages.

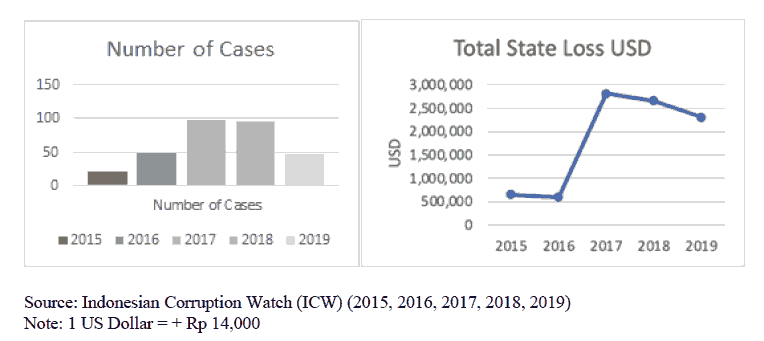

Law no. 6 of 2014 concerning Villages has effectively entered its first five years of implementation. The demand for greater responsibility to conduct good government governance faces several cases of VFM abuse. One of the most prominent forms to the public is the criminal act of corruption. Indonesia Corruption Watch (ICW), a Non-Government Organisation that concerns corruption matters, emphasizes that corruption crime in the village, especially those involving the village budget, is one of the fundamental problems. The village government is one of the institutions prone to corrupt practices since the managed budget is quite large (Indonesia Corruption Watch, 2016). ICW has monitored corruption in the village in the period of 2015 - 2019. Village budgets were one of the vulnerable sectors to corruption. Figure depicts ICW monitoring results in 2015-2019 concerning the fraud cases in the village territory:

Figure 1 demonstrates the number of village corruption tended to increase in the latest five years observed (Indonesian Corruption Watch (ICW), 2020). In 2015, corruption cases reached 22 cases and grew up to 48 cases in 2016. The increase more than doubled in 2017 and 2018 with 98 and 96 cases although then it went down in 2019 as many as 48 cases. Thus, the total number of village budget corruption cases in the 2015-2019 period was more than 300 cases.

Based on the number of corruption cases revealed, the total state losses are also quite large. In 2015, the loss reached Rp 9.12 billion (around USD 651,429) while in 2016 reached Rp. 8.33 billion (around USD 595,000). The state loss jumped to Rp 39.3 billion (roughly USD 2.8 million) in 2017 and Rp 37.1 billion in 2018 (roughly USD 2.7 million). The number of state losses decreased slightly in 2019 which was recorded at Rp 32 billion (approximately USD 2.3 million). Therefore, the total state losses caused by corruption in the village sector predicted more than Rp 125 billion (approximately USD 8.9 million) in total until 2019.

The high number of corruption cases in managing the village budget is due to the big budget that has been disbursed. Still, the capacity of the village apparatus in managing financial finances is relatively low. Adding with the oversight that is not too tight, the opportunity for misuse of village finances will be even more fantastic (Indonesia Corruption Watch, 2017). The trend of increasing corruption cases around VFM in the initial period of the implementation of Law No. 6 of 2014 is very alarming. This fact delivers a signal about potential abuse in the VFM budget.

This condition makes it important for this research to systematically review all previous research literature related to VFM implementation in Indonesia since it was effectively enacted following the issuance of Law No. 6 of 2014 concerning Villages. This systematic analysis will later aim to become a comprehensive map related to the VFM topic. The results of the analysis can be used as a basis to show the importance of redesigning the VFM arrangement to include more religious elements (Islam in this case).

Systematic Literature Review (SLR) is one of the methodologies to analyze and evaluate existing literature in more systematic ways. SLR is an organized and transparent searching process that is conducted over several databases, which is all its similar processes can be replicated and reproduced by other scholars (Mohamed Shaffril, Ahmad, Samsuddin, Samah & Hamdan, 2020). Furthermore, Mohamed Shaffril et al., (2020) pointed that SLR offers details on the review process to reproduce the investigation, confirm the analysis, or study the generality.

This review addresses one research question- what are the global insights from previous research on VFM in Indonesia? Therefore, this study aimed to present the gap in the previous studies to conduct a literature review systematically in obtaining more understanding of VFM implementation in Indonesia. The results of this study are expected to provide a comprehensive experience of the VFM praxis that currently exists. Besides, the findings of this paper provide a road map to construct the ideal VFM based on the Islamic perspective.

This research will be focusing on a review of Village Financial Management (VFM) in Indonesia. VFM began to be implemented since the release of Law (Undang-Undang) No. 6 of 2014 concerning Village. There is the shifting paradigm of regional autonomy in Indonesia that has given considerable changes in regulatory governance. The authority to manage government affairs is no longer only handled by the central government; the regions have carried some out. The regional government is carried out from the Provincial, Regency/City (Kabupaten/Kota) to the level of the Sub-District (Kecamatan), and Village (Village/Kelurahan) Governments.

VFM in this study is a pattern, system, and procedure to manage financial resources that must be carried out by the Village Government in Indonesia, as the lowest unit of government structure in the state administration of the Republic of Indonesia. Financial management at the village government level is a new system as a consequence of the release of Law no. 6 of 2014 concerning Villages. Specifically, the VFM system and procedures in Indonesia are regulated in Minister of Home Affairs Regulation (Permendagri) No. 20 of 2018 concerning Village Financial Management. Referring to Article 1 point 6 of Permendagri Number 20 of 2018, Village Financial Management is the entire activity that includes planning, implementation, administration, reporting, and accountability of village government finances.

Research Method

RAMESES as Publication Standard Protocol

This study utilizes RAMESES (Realist and Meta-narrative Evidence Syntheses: Evolving Standards), as suggested by Wong, Greenhalgh, Westhorp, Buckingham & Pawson (2013) as standard for preliminary publication standard. This standard is used to ensure that the review is provided with relevant and necessary information on the related article. Hence, the result of the evaluation would meet the highest quality and rigor (Wong et al., 2013).

The use of the RAMESES protocol is suitable for systematic reviews of literature in social sciences (Samsuddin, Shaffril & Fauzi, 2020). There are three benefits of RAMESES to be conducted in the review's works (Samsuddin et al., 2020). Firstly, it defines the research questions clearly. Secondly, it qualifies the criteria identification; and thirdly, endeavor to oversee central databases of scientific literature within a definite time. RAMESES proposes the rigorous search of terms based on diverse research designs related to studies on VFM in Indonesia. Moreover, RAMESES also provides the coding of valuable information for future sciences research and reviews in this field of study by monitoring research trends and patterns.

Database Sources

The study uses the databases 'Scopus' as primary references. Scopus, which is maintained by Elsevier, consists of 24,600 working titles and 5,000 publishers, which is rigorously vetted and selected by an independent review board and uses a rich underlying metadata architecture to connect people, published ideas, and institutions (https://www.elsevier.com/solutions/scopus).

The study also includes an additional database, namely Google scholar. Google scholar, maintained by Google, contains roughly 389 million documents, including articles and citations that making it the world's largest academic search engine (https://scholar.google.com/intl/en/scholar/about). The use of Google scholar as an additional search engine since it provides a broader search base than the primary research literature database providers. Furthermore, it is essential because, as previously explained; the topics relating to this study have not yet become a mainstream theme in various previous studies.

Systematic Searching Process

From Shaffril, et al., (2020), this study uses three main phases in systematically reviewing the related literature which so-called ISE (Identification, Screening, and Eligibility). Besides, this study conducts another step called quality appraisal. The following part explains each of all phases.

The first phase in this systematic review is called "identification." Identification is a process to search any terms, synonym, and related variations for the primary keywords from previous literature concerning Islamic VFM. The identification process was done by referring to several relevant sources such as a dictionary, online thesaurus, and keywords from former literature to search for other variations to the term VFM. The previous literature search is conducted with specific keywords and concepts from academic disciplines dealing with VFM. The following terms were selected for search queries to cover this theme from the research question, first, "Indonesian" or "Indonesia". Second, "village financial", or "rural financial", or "rural areas financial", or "sub-district financial", or "countryside financial” and third, "management" or "governance". Table 2 shows the detail of the keywords and searching strategy in the identification phase:

| Table 2 Keywords and Searching Information Strategy |

|

|---|---|

| Databases | Keywords used |

| Scopus | TITLE-ABS-KEY(( “Indonesia*” OR “Indonesi*” ) AND ( "villag*" OR "sub distric*" OR "rura*" OR "rural are*" OR "sub urba*" OR "countrysid*” ) AND ( "financia*" OR “financ*" ) AND ( “managemen*” OR “syste*” OR “concep*” OR “governanc*” )) |

| Google scholar | Indonesia Village Financial Management, "village financial development" |

The searching phase conducted in two databases of Scopus and Google scholars has resulted in a total of 1597 articles (297 in Scopus, 1300 in Google scholars).

The second step is the "screening" phase. The literature gathered in the identification phase is then screened by selecting the criteria for papers selection, which is done automatically based on the sorting function. Some requirements are conducted in this study. First of all, the timeline between 2015 and 2021 was selected as one of the inclusion criteria. The six years span is related to the implementation of VFM in Indonesia which has been effectively running since 2015. Thus, a six years timespan is adequate to overview the reviews, theoretically as well as practically, on the topic of VFM in Indonesia.

For the sake of the quality of the review, this study only selects papers that are written in peer-reviewed academic journals. English-written literature was chosen to avoid misunderstanding to catch the point of the article. Additionally, the paper type selected consists of empirical well as a conceptual article.

Through these selection criteria, the study mainly excluded papers that are published before the year 2015 and written in a non-English language. Furthermore, articles from Non-indexed journals, chapters in the book, conference proceedings were also excluded in this study. Table 3 indicates the screening inclusion and exclusion criteria of this article:

| Table 3 Inclusion and Exclusion Criteria |

||

|---|---|---|

| Criterion | Eligibility | Exclusion |

| Literature type | Indexed Journal (conceptual and empirical research articles) | Non-indexed journals, chapter in a book, conference proceeding |

| Language | English | Non-English |

| Timeline | Between 2015-2021 | <2015 |

The final phase is the "eligibility" process. Based on articles that meet the criteria in the previous stage, the search queries identified 130 potentials. The investigation was executed and finished in June 2021. Referring to the standard given, eventually, 58 articles appropriate with the criteria. Recent findings of those articles are used to pursue this study's objective in the on-going and developing discourse.

Quality Appraisal

The quality appraisal process was carried on by; first, both authors read the selected articles independently. Then, the writers sat together to supervised the paper's content for ensuring their quality. This quality process finally has chosen 58 remaining papers that were eligible for review. Table 4 explains the review process of this systematic literature review.

| Table 4 Systematic Literature Review Flow |

|

|---|---|

| Identification | 1. Articles identified through primary database searching (SCOPUS); n=297 |

| 2. Papers identified through additional database searching (Google scholar); n=1300 | |

| Screening | 1. Records excluded book chapter article, conference proceeding, non-English language and published < 2015 |

| 2. Total screened after irrelevant article removed (n=136) | |

| Eligibility | 1. Full text articles excluded (n=6) Reasons: duplicate article |

| 2. Full text articles assessed for eligibility (130) | |

| Quality Appraisal | Full-text articles excluded (n=72) due to out of topic |

| Data Analysis | Studies included in the Synthesis (n=58) |

Data Abstraction & Analysis

In order to analyze the eligibility papers selected, this study uses an integrative review, as suggested by Samsuddin, et al., (2020). The integrative design explains the remaining article by combining quantitative and qualitative approaches. The study examines and extracts the selected pieces to identify relevant themes and sub-themes (if any) by evaluating the whole aspect of the papers (title, abstract as well as body text)

The grouping phase into specific theme categories then leads to the next stage. Every article in a theme is reviewed in-depth to get a common thread and its relationship. In the end, the final findings of this study will find research gaps to be filled by further research.

Results

Background of Selected Articles

Based on 58 eligible articles reviewed, it shows that 26 papers used qualitative research design, while 32 pieces conducted quantitative methods. In terms of the year of publication, three papers were written in 2016 and 2017. There are five articles published in 2018 and 11 articles in 2019. Furthermore, 23 papers were written in 2020 and 13 papers were published in 2021. All articles were conducted in Indonesia. Table 5 illustrates the classification of those eligible articles reviewed from the SCOPUS and Google scholar database.

The analysis process resulted in three main themes and eight sub-themes on research regarding VFM in Indonesia (Table 5). The main topics are VFM Implementation on Several Locations/Sites, Good Governance of VFM, and The Causes and Solutions of Fraudulent Activities in VFM.

| Table 5 SLR Results (Themes and Sub-Themes) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Study | Years | VFM Implementation in Several Research Locations/Sites | Good Governance of VFM | The Causes and Solutions Of Fraudulent Activities In VFM | ||||||||

| VFM praxis | Village Consultative Body | IT Based Management | Accoun-tability | Transparancy | Effectivity Efficiency | Fraud Causes | VFM Fraud Prevention | |||||

| Siagian et al., | 2016 | √ | ||||||||||

| Wahyuningsih & Kiswanto | 2016 | √ | ||||||||||

| Tememggung, YA | 2016 | |||||||||||

| Khusniyatun & Kiswanto | 2017 | |||||||||||

| Kadir et al., | 2017 | √ | ||||||||||

| Tan et al., | 2017 | √ | ||||||||||

| Sululing et al., | 2018 | |||||||||||

| Karmawan | 2018 | √ | √ | |||||||||

| Yusnita & Anggita | 2018 | |||||||||||

| Atmadja & Saputra | 2018 | √ | ||||||||||

| Hartanti & Indrawati | 2018 | √ | √ | |||||||||

| Sumaryanto et al., | 2019 | |||||||||||

| Sumiyanti & Umiyati | 2019 | |||||||||||

| Supheni et al., | 2019 | √ | ||||||||||

| Bawono et al., | 2019 | |||||||||||

| Basuki et al., | 2019 | √ | ||||||||||

| Islaini et al., | 2019 | |||||||||||

| Febby & Silubun | 2019 | |||||||||||

| Dilaga et al., | 2019 | |||||||||||

| Rahman | 2019 | |||||||||||

| Handayati & Palil | 2020 | |||||||||||

| Utama & Wulandari | 2020 | |||||||||||

| Harani et al., | 2020 | |||||||||||

| Yusar & Mulyani | 2020 | |||||||||||

| Facrurrozie et al., | 2020 | |||||||||||

| Sujana et al., | 2020 | |||||||||||

| Adhinata et al., | 2020 | √ | ||||||||||

| Anjani et al., | 2020 | √ | ||||||||||

| Sujana et al., | 2020 | |||||||||||

| Ardiana & Sugianto | 2020 | |||||||||||

| Agustina & Wulandari | 2020 | √ | ||||||||||

| Budiasni & Ayuni | 2020 | √ | √ | |||||||||

| Chrismas et al., | 2020 | √ | ||||||||||

| Taufiq & Yatminiwati | 2020 | |||||||||||

| Shaleh et al., | 2020 | |||||||||||

| Faoziah & Salim | 2020 | |||||||||||

| Bawono et al., | 2020 | √ | ||||||||||

| Indriasari et al., | 2020 | √ | ||||||||||

| Yudha et al., | 2020 | |||||||||||

| Nafidah et al., | 2020 | |||||||||||

| Fauzi & Antoni | 2020 | |||||||||||

| Sulistyaningsih | 2020 | |||||||||||

| Pratolo & Jatmiko | 2020 | |||||||||||

| Marota et al., | 2021 | √ | √ | |||||||||

| Elim & Tafatfeto | 2021 | √ | ||||||||||

| Lukman et al., | 2021 | |||||||||||

| Darmawan et al., | 2021 | √ | ||||||||||

| Atmadja et al., | 2021 | |||||||||||

| Samadara et al., | 2021 | |||||||||||

| Basri et al., | 2021 | √ | √ | |||||||||

| Pangayow & Patma | 2021 | √ | ||||||||||

| Kareth et al., | 2021 | |||||||||||

| Seran | 2021 | |||||||||||

| Rosnidaha et al., | 2021 | √ | ||||||||||

| Jarnawansyah | 2021 | |||||||||||

| Shaleh et al., | 2021 | |||||||||||

In the first theme, the implementation of VFM gave a detailed explanation of the existing praxis at the village government unit. This first pattern consists of three subthemes: VFM praxis, Village Consultative Body role, and IT-based management.

The second theme focuses on the Good Governance of VFM. Good village government (GVG) is one of the central topics of discussion in the implementation of VFM because the amount of funds managed by the village government needs to be accompanied by good and prudent governance. This second pattern consists of three sub-themes which are also elements of GG, including accountability, transparency, and effectiveness & efficiency.

The third theme refers to VFM Fraudulent Activities. This theme is deriving two subthemes, namely fraud causes and VFM fraud prevention.

Research Themes, Sub-Themes, and Trends on VFM in Indonesia

This section describes the research themes and sub-themes, and trends in the specific research topic:

A. VFM Implementation in Several Research Locations/Sites

From 58 eligible articles, the majority (28 papers) discussed the VFM implementation in several villages. The article describes various empirical dynamics related to VFM practices in various places in Indonesia.

In this first theme, the majority of studies conducted trying to find the factors that determine the success of VFM implementation (Sumiyanti & Umiyati, 2019; Pura, 2019; Yusar & Mulyani, 2020; Sujana, Saputra & Manurung, 2020; Fauzi & Antoni, 2020; Seran, 2021; Atmadja, Adi, Saputra, Manurung & Wulandari, 2021). In the same vein, Sululing, Ode & Sono (2018) proposes a VFM model that is empirically able to provide evidence of effective VFM implementation. Harani, Siregar & Prianto (2020) also offers Multiple Linear Regression Methods in order to predict village spending on the VFM system.

Using a qualitative approach, several studies have explored the practice of VFM in various Indonesian villages. Sir, Samadara & Manuain (2019) explained the VFM praxis in a village in Timor Tengah Selatan district, East Nusa Tenggara province. The Village Financial resources are fully utilized to facilitate the village development and empowerment of village communities. The experience of implementing VFM in the eastern tip of Indonesia, namely Kampung Srer, Sorong Regency, West Papua province is also interesting when described by (Kareth, Saerang & Budiarso, 2021). The large number of funds managed by the village government is followed by compliance with regulatory rules related to VFM by village financial managers in Kampung Srer. In the province of South Sulawesi, the practice of VFM also involves traditional Bugis values as told by Shaleh, Sinaga, & Saudi (2021). The involvement of local traditional values is also underlined in the article written by Shaleh, Subing & Yustina (2020).

Several conceptual articles related to building a reliable VFM system also fill this first topic. Bawono, Purbasari & Adi (2019); Taufiq & Yatminiwati (2020) reveal the crucial points of VFM from the planning phase to the accountability reporting phase. Several issues that have arisen around the implementation of VFM were written by Sulistyaningsih (2020). Furthermore, suggestions for village development policies were given by a number of scholars (Handayati & Palil, 2020; Yudha, Juanda, Kolopaking & Kinseng, 2020; Temenggung, 2016; Seviola Islaini, Husni & Ilwan, 2019; Jarnawansyah, Sriyatun, Wahyudi & Pratama, 2021).

The second sub-theme of this first theme is raised about the role of the Village Consultative Body (Badan Permusywaratan Desa/BPD). This legislative institution at the village level is a partner of the Village Head to advance the village. Febby & Silubun (2019) underlined the substantial role of the BPD in overseeing village development, including the implementation of VFM run by the village government

Furthermore, the last subtheme in the first theme highlighting the important role of information technology-assisted VFM. The presence of the “SISKEUDES” application to assist the implementation of VFM nationally provides convenience for the village financial management apparatus. However, as with the use of other similar information systems, this needs to be supported by ongoing training (Pratolo & Jatmiko, 2020) and aspects of holistic end-user understanding of the application (Karmawan, Suhaidar, Yunita & Kusumah, 2019; Lukman, Ibrahim & Nara, 2021).

B. Good Governance of VFM

The second theme emphasizes the importance of the village government carrying out the mandate of financial management based on the principles of good (village) Governance (GVG). The three GVG principles that have been researched the most in this theme are accountability, transparency, and effectiveness & efficiency. Several studies empirically examines elements of VFM accountability in several villages based on established indicators (Wahyuningsih & Kiswanto, 2016; Kadir, Widarini, Gunawan & Puspitasari, 2017; Tan, Erlina & Khadafi, 2017; Atmadja & Saputra, 2018; Basri, Azlina & Arfendi, 2021; Bawono, Kinasih & Rahayu, 2020; Agustina & Wulandari, 2020; Hartanti & Yuhertiana, 2018; Budiasni & Ayuni, 2020; Indriasari, Sari, Arifin & Choiruddin, 2020; Karmawan, 2018; Rosnidaha, Muna, Michael & Fariani, 2021; Supheni, Rahmawati & Probohudono, 2019; Pangayow, 2017).

Several other researchers raised several best practices for implementing good governance in village financial management in detail using a qualitative approach. Implementation of VFM in Panggungharjo Village, Yogyakarta Province (Basuki, Setyowati & Wahyunengseh, 2019), Pecatu Village, Bali Province (Adhinata, Darma & Sirimiati, 2020), Tlogasari Village, East Java Province (Anjani, Rosidi & Achsin, 2020) is some good practices which are also thick with the involvement of local traditional values.

Furthermore, the study by Hartanti & Yuhertiana (2018); Karmawan (2018); Budiasni & Ayuni (2020); Basri, et al., (2021); Chrismas, et al., (2020); Elim & Tapatfeto (2021) empirically tested VFM practices in terms of transparency. Next, the study conducted by Darmawan, Suryadi, & Syafari (2021) highlighted the elements of the effectiveness and efficiency of village financial management.

C. Fraudulent Activities in VFM

The third theme focuses on discussing village financial fraud. The first subtheme consists of two studies that look for the causes of fraud in VFM. Fachrurrozie, et al., (2020) provide empirical evidence that the morality aspect and ethical culture of the village government organization are factors that can reduce the occurrence of financial fraud in VFM. On another aspect, Nafidah, Tjahjadi & Soewarno (2020) highlighted the existence of the dominant political attitude by the village leadership. Central power in Village Head as the highest power holder of VFM resulting in a decline of community trust in the rural development management.

Moreover, the high potential for abuse of village finances resulting in the element of fraud prevention becomes an important concern. There is a piece of study that emphasizing fraud prevention activities and systems on an ongoing basis in the second subtheme. Sujana, Suardikha & Laksmi (2020) proved that morality and village apparatus competence are substantial aspects of fraud prevention. The internal control system has been proven to play an important role in preventing fraud as shown by the study of Utama & Wulandari (2020); Sujana, et al., (2020). Furthermore, Dilaga & Ichsan (2019) proposes a risk management design that could be assisting the village government in looking at the village’s financial condition and providing solutions to control problems found in its financial activities. Lastly, Sumaryanto & Ngaisah (2019) emphasize the role of the university to do counseling and assistance regarding VFM continuously for village apparatus.

Discussion

The systematic review analysis resulted in three themes and eight sub-themes. This part presents further discussions of the resulted themes. The first theme of VFM focuses on several empirical evidence of VFM implementation in various villages in Indonesia. It must be admitted, based on a list of previous research results during the first five years, the practice of managing village finances as a consequence of the enactment of Law No. 6 of 2014 concerning villages has not run optimally. Limited human resources, lack of understanding, and many other factors make the task of managing village finances need to be continuously monitored by all parties. The village government needs to continue to be encouraged and assisted to continue to carry out all the mandates of managing village finances according to the laws and regulations.

One of the biggest challenges in managing village finances is the high rate of misuse of village finances. One form of abuse that is plural is the crime of corruption in village funds. A large amount of finance managed by the village government requires the manager to carry out their mandate based on the principles of good (village) governance as mentioned in the second theme. The three main values of Good governance that are most highlighted are Transparency, Accountability, and Participation. The task of the Village Government in managing the Village Budget has to meet those three main principles (Agusta, 2014). Unfortunately, the principles of transparency, participation, and accountability in village political, development, and financial governance are still not working along with the good intentions of building from the village philosophy (Arthana, 2019; Yunianingrum & Kolopaking, 2018; Umami & Nurodin, 2017).

The third theme is focusing to discuss fraudulent activities. The demand for greater responsibility to conduct good government governance faces several cases of VFM abuse the determinant factor and how to combat that such negative practices of VFM become the main area of study on this theme.

Based on the results of a systematic review of previous research, the topic of study around VFM is mostly dominated by the journey of VFM implementation and all of its dynamics throughout Indonesia. At least two primary challenges are still an obstacle for the current successful VFM after the release of Law No 6 of 2014 concerning Village (Nurjaman, 2018; Prasetyo & Muis, 2015; Srirejeki, 2015). First, village official's capability to manage village financial mechanisms according to Law's rules; Second, village community involvement and control in the development.

Corruption (including VFM fraud in it) eventually developed as a cultural problem. From a sociological perspective, the village is defined as an area with a particular pattern. There are local rules and relationships of layers growing within the community's structure itself. A religiosity insight (in this case, Islam, as the religion most widely believed by Indonesian people) approach can be one of the places to return to solve management problems in the village. Besides, a cultural approach, most of which are also loaded with religious values, is also included in the search for this solution. The aesthetic perspective in the smallest unit of government, namely the village, has not gained much space in Indonesia's scientific studies (Latuconsina & Kamala, 2019).

Thus, it needs to look for how the idealistic value of the VFM from the Islamic perspective. The search for idealistic values is based on the belief that religion is the main and basic guide for solving various social problems. Problems related to VFM that have persisted since the birth of Law No. 6 of 2014 concerning Villages need to find a basic solution from an Islamic perspective. This is even more relevant if it is associated with the fact that Indonesia is a country with the largest Muslim population in the world. Quoted from the site www.worldpopulationreview.com (downloaded on December 14th, 2020), Indonesia has a 229 million Muslim population. This amount is equivalent to 87.2 percent of Indonesia's 263 million total population and about 13% of approximately 1.9 billion Muslims globally

According to review results, the majority of the studies on VFM focuses on VFM implementation throughout Indonesia. The search results show that no discussion has been conducted on the practice of VFM based on religious values, specifically on the Islamic perspective. Since Islam is the religion adhered to by the majority of Indonesian people, the search for Islamic fundamental values in VFM needs to be conducted.

Moreover, the pattern, system, and management of village finance emphasizing Islam can also be encouraged to be put into practice in this kind of Muslim-majority village. Referring to the description of Salleh (2015), the concept of development based on Islam is a concept as a whole. Islamic-based development does involve not only material elements but also spiritual and spiritual aspects. Its dimensions are also not only profane/temporal affairs (ad-dunya dimension) but also the sacred one (al-akhirah dimension). Finally, the ultimate main goal is not only the eradication of material poverty but also the pleasure of Allah. Thus, the concept and practice of VFM still leave a significant research gap area to be filled in holistically with Islamic values and principles.

Other gaps in the research areas lie on the whole topic in the Islamic VFM. Based on the selected articles reviewed in this study, the research themes only focus on the aspect of strengthening village government to conduct good village governance. All stages of VFM, from planning, implementation to the accountability phase, need to be accompanied by strong Islamic values. The internal awareness process based on religion (Islam) to all village financial management officials also needs to be carried out comprehensively and sustainably. Thus, research that mainstreams the principles and elements of religion as the basis of epistemology and ontology is an important way for the process of inculcating this true transcendental awareness. Consequently, the negative excesses of village financial management that still exist will gradually be reduced based on this fundamental awareness of the Islamic religion.

Conclusion

This review study provides an understanding of the Indonesian VFM topic. To sum up, the study found three primary themes from a systematic review of previous papers concerning VFM. First, the VFM implementation from various locations/sites. The sub-theme that is described in this theme is VFM praxis, Village Consultative Body’s role, and IT-based management. Second, the Good Governance of VFM. There are three subthemes here: accountability, transparency, and effectiveness & efficiency. Third, fraudulent activities of VFM consist of two subthemes, namely determinant factor and fraud prevention.

This study has filled the gap in understanding, research themes, and trends in particular topics, namely Islamic VFM. Description from selected articles reviewed could contribute new knowledge for future scholarly work by fulfilling the empirical research gaps in the recent topic. The result of the study could facilitate science development in the area of Islamic VFM. By understanding the existing body of knowledge, the review offers the scholar to produce the comprehensive concept of VFM based on the (more) ideal Islamic principle or value. Nonetheless, according to the results, this review suggests strongly such policy recommendation to the government of a country to including religious aspects continuously in all VFM phases.

Like other research, this study has limitations. This study only focuses on article searches on two indexation databases, namely Scopus and Google scholar. Future research can investigate previous research related to this research topic from other databases such as Web of Science, Dimension, etc.

References

Adhinata, B., Darma, I.K., & Sirimiati, N.W. (2020). Good village governance in financial management to create independent village: Study of Pecatu Village Government. SOSHUM: Journal of Social and Humanities, 10(3), 334–344.

Agusta, I. (2014). Indonesian village transformation 2003-2025. In study of the Indonesian agricultural economic association (PERHEPI).

Agustina, D., & Wulandari, A. (2020). Overview of village financial management and implications for accountability. Integrated Journal of Business and Economics, 4(3), 277–291.

Anjani, H.L., Rosidi, R., & Achsin, M. (2020). How is accountability defined by village government in village fund financial management? International Journal of Research in Business and Social Science (2147- 4478), 9(7), 66–74.

Arthana, I.K. (2019). Analysis of the factors of fraud in the management of village funds in Amabi Oefeto Timur District. Journal of Accounting: Transparency and Accountability, 7(1), 35–43.

Atmadja, A.T., & Saputra, K.A.K. (2018). Determinant factors influencing the accountability of village financial management. Academy of Strategic Management Journal, 17(1).

Adi, A.A.T.K., Saputra, K., Manurung, D.T.H., & Wulandari, R. (2021). Factors that influence financial management : A case study in Indonesia. Journal of Asian Finance, Economics and Business, 8(6), 1203–1211.

Basri, Y.M., Azlina, N., & Arfendi, L.Z. (2021). Financial management, organizational commitment and legislative role on the implementation of good governance at village governments. The Indonesian Journal of Accounting Research, 24(01), 109–126.

Basuki, A.F., Setyowati, K., & Wahyunengseh, R.D. (2019). Accountability model of financial management in the public sector: A study on Panggungharjo village budget. Bisnis & Birokrasi Journal, 26(1).

Bawono, A.D.B., Purbasari, H., & Adi, S.W. (2019). Financial management reform process in the Indonesian village government. Humanities and Social Sciences Reviews, 7(4), 962–967.

Bawono, I.R., Kinasih, A.D.M., & Rahayu, A.K. (2020). Factors affecting accountability of village fund management through implementation of the Village Financial System (SISKEUDES). Journal of Accounting and Investment, 21(3).

Bjärstig, T., & Sandström, C. (2017). Public-private partnerships in a Swedish rural context - A policy tool for the authorities to achieve sustainable rural development? Journal of Rural Studies, 49, 58–68.

Boonperm, J., Haughton, J., & Khandker, S.R. (2013). Does the village fund matter in Thailand? Evaluating the impact on incomes and spending. Journal of Asian Economics, 25, 3–16.

Budiasni, N.W.N., & Ayuni, N.M.S. (2020). Transparency and accountability based on the concept of “Pada Gelahang” enhancing village financial management. International Journal of Social Science and Business, 4(3), 501.

Chrismas, R.Da., Mite, E., Maturbongs, E.E., Laode, I.C., Saragih, D.P., & Laiyan, D. (2020). Transparency in Village Fund Financial Management. Musamus Journal of Public Administration, 2(2), 63–67.

Darmawan, H., Suryadi, B., & Syafari, R. (2021). Effectiveness of Village Financial Management an approach to the output equation. International Journal of Humanities and Social Science Inventions (IJHSSI), 10(3), 44–48.

Dilaga, O.S., & Ichsan, M. (2019). Risk management design on Village’s Financial Activities: A case study of Barabali village, central Lombok. Advance in Social Science, Education and Humanities Research, 348(APRiSH 2018), 71–76.

Elim, M.A., & Tapatfeto, J.D. (2021). Analysis of Village Financial Management accountable and transparent. proceedings of the International Conference on Applied Science and Technology on Social Science (ICAST-SS 2020), 544, 278–281.

Fachrurrozie, F., Wahyudin, A., Nurkhin, A., Mukhibad, H., Kardiyem, K., & Saputri, F.M. (2020). The determinant of the financial fraud of the village fund management. Journal of Finance and Banking, 24(1), 95–105.

Fauzi, F., & Antoni, E. (2020). Analysis of implementation of Village Financial Management in village government in Garut District using Permendagri approach in number 113 the year 2014. Palarch’s Journal of Archaeology of Egypt/Egyptology, 2014(113), 2792–2797.

Febby, T., & Silubun, A.J. (2019). Function of Village People’s Representative council in Financial Management of Village Poo. International Journal of Civil Engineering and Technology (IJCIET), 10(3), 294–301.

Gobattoni, F., Pelorosso, R., Leone, A., & Ripa, M.N. (2015). Sustainable rural development: The role of traditional activities in Central Italy. Land Use Policy, 48(2015), 412–427.

Handayati, P., & Palil, M.R. (2020). The village financial management system: A policy towards Independent Villages. Journal of Economics and Development Studies, 12(1), 1–9.

Hanifah, S.I., & Praptoyo, S. (2015). Accountability and transparency of village revenue and expenditure budget accountability (APBDes). Journal of Accounting Science & Research, 4(8), 1–15.

Harani, N.H., Siregar, H.T., & Prianto, C. (2020). Implementation of multiple linear regression methods as prediction of village spending on village financial management system. Cursor Scientific Journal, 10(2), 53–64.

Hariyani, D.S., & Sudrajat, M.A. (2017). Analysis of the influence of competence of village government apparatus on the use of accounting information system technology in villages in madiun regency. Assets: Journal of Accounting and Education, 5(2), 113.

Hartanti, N., & Yuhertiana, I. (2018). Transparency, Accountability and Responsibility in an Indonesia Village Financial Management. Public Policy and Administration Research, 8(3), 71–77.

Indonesia Corruption Watch. (2016). Trends in Handling Corruption for the Year 2016.

Indonesia Corruption Watch. (2017). Trends in Enforcement of Corruption Cases Year 2017.

Indonesian Corruption Watch (ICW). (2018). Village Fund Outlook 2018 Potential Misuse of Village Budgets in the Political Year. Www.Anti-corruption.Org, (6).

Indriasari, D., Sari, K.R., Arifin, K.Z., & Choiruddin. (2020). Determinants of village financial management accountability. Advance in Social Science, Education and Humanities Research, 431(First 2019), 182–188.

Jarnawansyah, M., Sriyatun, Wahyudi, A., & Pratama, A.W. (2021). Pancasila values broadcast village financial management. International Journal of Innovative Science and Research Technology, 6(6), 287–292.

Kadir, A., Widarini, K.N., Gunawan, D.I., & Puspitasari, D. (2017). The Indonesian perspectives on village financial management accountability. International Journal of Economics, Business and Management Research, 1(04), 243–251.

Kareth, V., Saerang, D.P.E., & Budiarso, N.S. (2021). Village financial management : Case study in “Kampung Srer.” Indonesia Accounting Journal, 3(1), 1–13.

Karmawan. (2018). Role and contribution of village financial management to realize transparency and accountable village budgeting revenue and expenditure district of West Bangka. Advances in Economics, Business and Management Research (AEMBR), 46, 293–299.

Yunita, A., & Kusumah, E.P. (2019). The effects of perceived usefulness, perceived ease of use and attitude on the user intention of the village of financial system (Siskeudes) in bangka region. Humanities and Social Sciences Reviews, 7(4), 644–650.

Kuhmonen, T., & Kuhmonen, I. (2015). Rural futures in developed economies: The case of Finland. Technological Forecasting and Social Change, 101, 366–374.

Latuconsina, Y.M., & Soleman, K. (2019). Identification of local wisdom values to prevent fraud in village financial management in Leihitu District. Maneksi Journal, 8(2), 235–241.

Long, H., & Liu, Y. (2016). Rural Restructuring in China. Journal of Rural Studies, 47, 387–391.

Lukman, J.P., Ibrahim, M.A., & Nara, N. (2021). The effectiveness of electronic government in the application-based siskeudes in Paconne Village, Luwu Regency. Enrichment: Journal of Management, 11(2), 396–401.

Mohamed Shaffril, H.A., Ahmad, N., Samsuddin, S.F., Samah, A.A., & Hamdan, M.E. (2020). Systematic literature review on adaptation towards climate change impacts among Indigenous People in the Asia Pacific Regions. Journal of Cleaner Production, 258, 120595.

Salleh, Md. S. (2015). Islamic economics revisited : Re-contemplating unresolved structure and assumptions. 8th International Conference on Islamic Economics and Finance, (January).

Nafidah, L.N., Tjahjadi, B., & Soewarno, N. (2020). The pseudo-culture: Financial management risk in village government. Opcion, 36(26), 2759–2791.

Nurjaman, R. (2018). Fighting corruption from the bottom: Strategies for strengthening local accountability in village financial management. Journal of Society and Culture, 20(1), 31–48.

Organisation for Economic Co-Operation and Development (OECD). (2006a). A paradigm shift in rural development.

Organisation for Economic Co-Operation and Development (OECD). (2006b). OECD rural policy reviews: The new rural paradigm: Policies and Governance. In OECD Observer.

Pangayow, B. (2017). Gap in expectation of quality of village financial reports between financial managers and community in Sentani District, Jayapura Regency. Regional Journal of Accounting and Finance, 12(1), 1–11.

Prasetyo, A., & Muis, A. (2015). Village financial management after Law No. 6 of 2014 concerning Villages: Potential problems and solutions. Decentralized Journal, 13(1), 16–31.

Pratolo, S., & Jatmiko, B. (2020). IT-based financial management and governance training role toward village government employee understanding on financial management. EJA (E-Jurnal Akuntansi), 30(4), 851–860.

Pura, R. (2019). Effect of competence of human resources and application of village based financial system on performance of village financial management. Qualitative and Quantitative Research Review, 4(1), 192–205.

Richter, R. (2019). Rural social enterprises as embedded intermediaries: The innovative power of connecting rural communities with supra-regional networks. Journal of Rural Studies, 70(December), 179–187.

Rosnidaha, I., Muna, A., Michael, A., & Fariani, N. (2021). Improving accountability of village funds through village financial management based on government accounting standard. Empowerment Journal: Publication of Community Service Results, 5(1), 1–6.

Samsuddin, S.F., Shaffril, H.A.M., & Fauzi, A. (2020). Heigh-ho, heigh-ho, to the rural libraries we go! - A systematic literature review. Library and Information Science Research, 42(1).

Seran, M.S.B. (2021). Value for money : Analysis of the impact of village government performance on village financial management in Subun Bestobe Village. Scientific Journal of Public Administration: Journal of Public Administration Thought and Research, 11(1), 140–148.

Husni, L., & Ilwan, M. (2019). The authority of the audit board of the republic of Indonesia in carrying out audits of village financial management. International Journal of Scientific Research and Management, 7(10), 191–199.

Shaleh, K., Sinaga, O., & Saudi, M.H. (2021). Reinforcing bugis culture values and adopting in village financial management patterns. Turkish Journal of Computer and Mathematics Education, 12(8), 523–531.

Shaleh, K., Subing, H.J.T., & Yustina, A.I. (2020). Village financial management: Based on local tradition. Integrated Journal of Business and Economics, 4(1), 23.

Sir, J.S., Samadara, S., & Manuain, D. (2019). Optimizing the use of village funds and efforts to develop village-owned enterprises in South Central Timor Regency. ICECS.

Srirejeki, K. (2015). Village financial governance. Journal of accounting and business, 15(1), 33–37.

Steiner, A., & Teasdale, S. (2019). Unlocking the potential of rural social enterprise. Journal of Rural Studies, 70(December), 144–154.

Sujana, E., Saputra, K.A.K., & Manurung, D.T.H. (2020). Internal control systems and good village governance to achieve quality village financial reports. International Journal of Innovation, Creativity and Change, 12(9), 98–108.

Sujana, I.K., Suardikha, I.M.S., & Laksmi, P.S.P. (2020). Whistleblowing system, competence, morality, and internal control system against fraud prevention on village financial management in Denpasar. E-Jurnal Akuntansi, 30(11), 2780.

Sulistyaningsih, E. (2020). Village financial management problems in accomplishing good governance in suburban government. Palarch’s Journal of Archaeology of Egypt/Egyptology, 17(9), 494–503.

Sululing, S., Ode, H., & Sono, M.G. (2018). Financial management model village. International Journal of Applied Business & International Management P-ISSN: 261, 3(2), 39–56.

Sumaryanto, A.D., Ngaisah, S., & W., Y.P.A. (2019). The role of universities in overcoming corruption of village financial management. Advances in economics, business and management research, 88, 45–50.

Sumiyanti, Y., & Umiyati, I. (2019). The effect of understanding of village devices concerning village financial management of the accuracy of village time (Case Study in Villages in Subang District). JPSAM (Journal of Public Sector Accounting and Management), 1(1), 37–54.

Supheni, I., Rahmawati, & Probohudono, A.N. (2019). Impact of village financial implementation on village financial management accountability. Journal of Economics, 24(1), 111.

Tan, T.J.A., Erlina, & Khadafi, M. (2017). The effect of good governance implementation, financial management, quality of human resources, community participation and supervision on village financial accountability in deli serdang regency. International Journal Public Budgeting, Accounting, 4(1).

Taufiq, M., & Yatminiwati, M. (2020). Urgency of the village of financial management under the government regulations. Wiga: Journal of Economics Research, 10(1), 45–59.

Temenggung, Y.A. (2016). Rural financial management in perspective law No. 6 of 2014 concerning the village. International Journal of Social Sciences, 43(1), 42–54.

Umami, R., & Nurodin, I. (2017). The effect of transparency and accountability on village financial management. Scientific Journal of Economics, 6(11), 74–80.

Utama, A.A.G.S., & Wulandari, T.N.A. (2020). Fraud prevention using village financial management control system. Advances in Social Science, Education and Humanities Research, 394, 288–293.

Wahyuningsih, P., & Kiswanto. (2016). Factors affecting the accountability of village financial management. Accounting Analysis Journal, 5(3), 139–146.

Wong, G., Greenhalgh, T., Westhorp, G., Buckingham, J., & Pawson, R. (2013). RAMESES publication standards: Meta-narrative reviews. Journal of Advanced Nursing, 69(5), 987–1004.

Yudha, E.P., Juanda, B., Kolopaking, L.M., & Kinseng, R.A. (2020). Rural development policy and strategy in the rural autonomy era. Case study of pandeglang regency-Indonesia. Human Geographies, 14(1), 125–147.

Yunianingrum, & Kolopaking, L.M. (2018). Ability of village government officials and effectiveness of village financial management. Journal of Communication Science and Community Development [JSKPM], 2(4), 495–508.

Yusar, L.K., & Mulyani, S. (2020). Analysis of determining factors for successful implementation of village financial management. Journal of Accounting Auditing and Business, 3(2), 84.

Received:: 30-Dec-2021, Manuscript No. JMIDS-21-7727; Editor assigned: 02-Jan-2022, PreQC No. JMIDS-21-7727 (PQ); Reviewed: 15-Jan-2022, QC No. JMIDS-21-7727; Revised: 23-Jan-2022, Manuscript No. JMIDS-21-7727 (R); Published: 30-Jan-2022