Research Article: 2019 Vol: 23 Issue: 6

The Size Effect Anomaly: The Case Of Amman Stock Exchange

Sari Sulaiman Malahim, Al-Balqa Applied University

Mousa Saeed Matar, Al-Balqa Applied University

Abstract

This study aims to test the effect of company size on risk adjusted return in Amman Stock Exchange (ASE) and investigating if there are anomalies in that Bourse. According to efficient market hypothesis, risk adjusted return for small-capitalization (CAPS) must quietly equal risk adjusted return for large-capitalization(CAPS); otherwise, this will lead to breaking the efficient market hypothesis and existing of anomalies in Amman Stock Exchange. On this paper an attempt to investigate if there is a statistically difference between small-caps and large-caps risk adjusted return. And also an attempt to investigate the existing of anomalies in Amman Stock Exchange. The size of company was determined on the basis of the company total assets; to implement that criteria, the median for all companies was estimated, then companies less than median were considered as small- caps and companies more than median were considered as large- caps. The hypothesis of this study was examined by using parametric tests as one-sample test and paired sample test. It was found that there was a statically significant relationship between risk adjusted return between large-caps and small-caps and also found that the risk adjusted return for small caps outperform the risk adjusted return for large- caps. This study can be a source of help to technical analysts to benefit from that anomaly and to improve their investment strategies regarding that information. And it is also a source of help to academic people and researcher to perceive that inefficiency case.

Keywords

Efficient Market Hypothesis, Size Effect, Anomalies, Risk Adjusted Return, Amman Stock Exchange, Small and Large Capitalization (CAPS).

Introduction

Small size effect is considered as a puzzle in capital market literature and many researchers have studied that puzzle to interpret the abnormal return which can be earned from investing in small company’s more than large companies (Lee, 2009). Many researchers have observed that phenomenon but couldn't interpret it (Alrabadi & Qudah 2012). One of the interpretations of that phenomenon was that: these small size companies are neglected firms and it doesn’t take its rights in analyzing, then its calculated beta was less than actual beta (Abiodun, 2013). Another interpretation for that phenomenon that these companies hadn’t trade volume as large companies and only a few of market makers may deal with their stocks (Niresh &Velnampy, 2104). Another interpretation, that most of the small companies are startups or young companies with either high potential growth and high book-market value or small capitalization but more vulnerable to violent swings (Keim, 1993). Finally, others claim that small companies have funding problems and work in a volatile environment then these small-caps have more room to grow and more market price appreciation than large-cap (Roll, 1995).

Research Problem

According to efficient market hypothesis, risk adjusted return for small-capitalization (CAPS) must quietly equal risk adjusted return for large-capitalization (CAPS) (Charest & Guy, 1998). Therefore, the problems of the study were (Does company size have effect on risk adjusted return for small and large capitalization (CAPS) in Amman Stock Exchange) and by answering the three sub-questions:

1. Is there a statically significant difference between risk adjusted return for small and large CAPS?

2. Does it expect that risk adjusted return for small CAPS is greater than risk adjusted return for large CAPS?

3. Does it expect that investors can earn abnormal return using that puzzle?

Research Objectives

The general objective of the study is testing the effect of company size on risk adjusted return for small and large capitalization (CAPS) Amman Stock Exchange, through the following:

1. Examine the existing of small size effect in Amman Stock Exchange.

2. Build strategies using that inefficiency case and earning abnormal return.

3. Identify the obstacles and difficult ties facing investors Amman Stock Exchange.

Literature Review

Based on Alrabadi (2019) which aims to investigate the low-volatility puzzle in ASE during (2006-2015), the study confirm the existence of low volatility effect and also there are statically differences in rate of return between lowest-volatility and highest –volatility portfolios.

Tadepalli & Jain (2018) ascertain the existence calendar anomalies in either emerging markets (India Russia and Brazil) vis-à-vis the developed markets and the possibility to benefit from that anomalies in both markets.

According to Allozi & Obeidat (2016) study which aims to investigate the relationship between firm size estimated by total assets and either earning per share (EPS) and total risk for a listed manufacturing firms in Amman Stock Exchange. The result of the study investigate that there was a positive relationship between EPS and systematic risk and firm size, which means that large firms had accomplished more return adjusted by risk in comparison with small size firms and the anomaly of firm size was not exsisted. This study recommended to study other anomalies in Amman stock exchange using daily or weekly information, and to study the impact of neglected companies. The result of the study revealed that seasonality phenomenon was not exsisted in Amman stock exchange and no abnormal return has found.

Based on Niresh & Velnampy (2104), firm size has been considered as a critical variable in explaining firm profitability and many studies have tried to recognize the effect of firms size, panel data during 2005-2018 was obtained from listed manufacturing firms, ROA was used to estimate profitability and Ln of total assets was used as a proxy of firm size. The results of the study revealed that there is a positive effect between firm size and profitability.

The study of Dahmash (2013) aims to investigate the impact of company size on efficiency, the study used the industrial companies listed in Amman stock exchange using annual closing prices to analyze the abnormal return for either small and large companies and revealed that large companies had outperformance small companies and no size effect was found.

Al-Jarrah & Khamees (2009) study examined seasonality in Amman stock exchange or January effect. The study had classified the return into three categories. First, high yield months (January, March, April, August, September, October). Second, average yield months (February, April, may, July and November).

Kawakatsu & Morey (1999) revealed that financial leberization in emergency markets has no effect on these markets and those markets were efficient before leberization. According to Omet (1997) insured that Jordanian Stock Exchange has to improve its techniques and efficiency to attract investment. Its study aimed to test the liquidity and pricing efficiency in Jordanian Stock Exchange during (1978-1996).

Lonie & Abeyranta (1996) study found that the firms with high Eps and Dps had earned abnormal returns while those with low Eps and Dps had earned abnormal loss, and firms with no change in Eps and Dps had more abnormal return compared with other that had increased its Eps and Dps.

Roll (1995) compared the risk adjusted return for small size companies as with large size companies during (1962-1997), he found that annual yields for small size companies outperformed large size companies with a rate 12% with even risk for the two groups.

The study of Agrawal & Tandom (1994) aims to investigate seasonality in stock prices, the study tested the impact of January effect on stock return of companies listed in the market, and the study revealed that there was no significant difference between January return and other months and no seasonality phenomenon has found in the market

Keim (1993) found that the size of the company has no significant impact on stock yield either if we use the book value or market value as a measure of size while the existence of size impact was found before the return was adjusted with risk and there was no difference between risks of portfolios consisting of small size or large size companies.

The study of Banz (1981) aims to investigate the relationship between the return and market stock value for small size and large size companies during (1939-1975), the results of the study revealed that the variability in return for small companies was more than large companies, and large companies had an access annual return of 3.4%.

Research Methodology and Data

To achieve the main objectives of the study, the data for this study was gathered from secondary sources, the closing prices of stocks as published in Amman Stock Exchange (2000-2018). These data were used to compute normal returns and abnormal returns of the selected Jordanian firms for the mentioned period. As well as, to assess the difference in between small and large companies return. A sample of industrial listed firms in Amman Stock Exchange were selected which accounts 40% of the study population. The independent variable of this study will be the size of the firm which will be measured by company's total assets. And the dependent variable will be stock return which will be measured by the percentage change in stock market value. For the purpose of analysis the total assets for the sample of the study was determined, and they are sorted as ascending order then the median is estimated. The companies with total assets more than median were classified as large companies. However, companies less than median was classified as small companies. Paired sample t.test was used to find the difference between the realized return for small and large companies, and one sample t.test was used to find the average return for small and large companies.

Research Hypotheses

To achieve the objectives of the study, the following hypotheses were formulated as:

H01 There is a statically significant difference between risk adjusted return for small size-cap and large size-cap.

H02 The mean of risk adjusted return for small –cap is greater than risk adjusted return of large -cap

H03 There is a statically difference abnormal return in favor to small-cap.

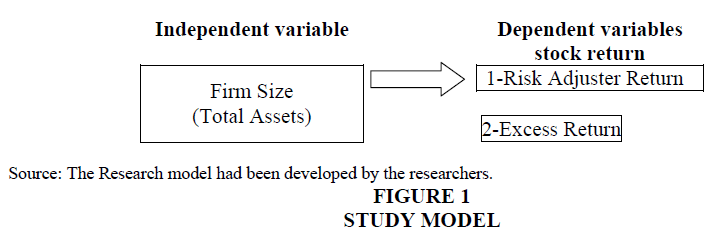

Research Model

This study consists of the following variables: the independent variable will be the size of the firm which will be measured by company's total assets. And the dependent variable 1: risk adjusted return, Dependent variable 2: Excess return = (risk adjusted return for small-cap –risk adjusted return for large-cap) (Figure 1).

Empirical Model

Research model was developed. According to efficient market hypothesis, risk adjusted return for small-capitalization (CAPS) must quietly equal risk adjusted return for large-capitalization (CAPS).

Rit=α+βit large cap+€

Rit=α+βit small cap+€

excess return=Rit(small cap)-Rit(large cap)

Rit =(P1- P0) /P0

Risk adjusted return=actual return/βit

Where: Rit: estimated return of the stock, α: intercept of the model, βit: slope of the model, €: random error.

Empirical Analysis

Table 1 shows the average excess return and accumulated average excess return for companies involved in the study for the mentioned period.

| Table 1 Average Excess Return and Accumulated Averrage Excess Return for Small Caps | |||

| Serial | Year | Average excess return | Accumulative average excess return |

| 1 | 2000 | 0.00955 | 0.03001 |

| 2 | 2001 | 0.00986 | 0.04022 |

| 3 | 2002 | 0.01021 | 0.04999 |

| 4 | 2003 | 0.00977 | 0.05799 |

| 5 | 2004 | 0.008 | 0.06342 |

| 6 | 2005 | 0.00543 | 0.07107 |

| 7 | 2006 | 0.00765 | 0.07884 |

| 8 | 2007 | 0.00777 | 0.08426 |

| 9 | 2008 | 0.00542 | 0.09091 |

| 10 | 2009 | 0.00665 | 0.09614 |

| 11 | 2010 | 0.00523 | 0.10323 |

| 12 | 2011 | 0.00709 | 0.11573 |

| 13 | 2012 | 0.0125 | 0.11894 |

| 14 | 2013 | 0.00321 | 0.12503 |

| 15 | 2014 | 0.00609 | 0.13269 |

| 16 | 2015 | 0.00766 | 0.13913 |

| 17 | 2016 | 0.00644 | 0.1489 |

| 18 | 2017 | 0.00977 | 0.15702 |

| 19 | 2018 | 0.00812 | 0.166 |

Testing the First Hypothesis

H01 There is a statically significant difference between risk adjusted return for small size-cap and large size-cap.

This hypothesis was examined by using simple regression and paired sample t.test, the result of the test was as clarified in the following table.

Estimated Rit for large-cap =α+βit large-cap+€ = 0.243-(2.876)-7

Estimated Rit for small-cap =α+βit small-cap+€=0.321+ (2.976)-9

Testing rule: the decision rule, accept Ho if calculated t value is less than tabulated t value and reject Ho if calculated value is greater. As clarified in the Table 2, the calculated t is equal 2.5640 which were more than tabulated t which was equal 1.918, and sig. was located in the reject region for null hypothesis, the slope of model was positive for small–cap and negative for large–cap. Also the results insure that there is a strong positive relationship (R2=0.82) between the difference in risk adjusted return for small and large cap, and the independent variable (small cap) interpret 0.798 (R²=0.798) from the variation in the difference in the risk adjusted return for small and large cap. The output of the test insures that there is a statically significant difference between risk adjusted return for small and large companies and in favor of small-cap.

| Table 2 Test of Hypothesis | ||||||||

| Mean residual | T- calculate | T-tabulated | Sig. | Result | α | β | R2 | Adjusted R2 |

| 0.09083 | 2.564 | 1.9818 | 0.082 | Accept | 0.23 | 0.654 | 0.798 | 0.82 |

Testing The Second Hypothesis

H02 The mean of risk adjusted return for small –cap is greater than risk adjusted return of small-cap.

This hypothesis was examined using one sample t.test; the output of test was clarified in the following two tables:

The results in Table 3 indicate that the risk adjusted return for small cap equals 0.014083 and there is a positive slope (β=0.689) in risk adjusted return for small cap. Also there is a strong positive relationship (R=0.9) between small cap and risk adjusted return; in addition, the coefficient of determination (R²=0.81) which means that 0.81 of the variation of the risk adjusted return has been interpreted by the independent variable (small cap).

| Table 3 One Sample T.Test for Estimating Risk Adjusted Return of Small-Caps | |||||||

| Mean | T-calculated | T-tabulated | Result | α | β | R2 | R |

| 0.01408 | -1.708 | 1.91818 | accept | 0.2408 | 0.698 | 0.81 | 0.901 |

As clarified in the Tables 3 & 4 risk adjusted return for small-cap outperforms risk adjusted return for large-cap.

| Table 4 One Sample T.Test For Estimating Risk Adjusted Return of Large-Caps | |||||||

| Mean | T-calculated | T-tabulated | Result | α | β | R2 | R |

| 0.05 | -1.708 | 1.91818 | accept | 0.433 | 0.897 | 0.86 | 0.927 |

Testing The Third Hypothesis

H03 There is a statically difference abnormal return in favor to small-cap.

Table 5 clarifies the output of paired sample t.test for the difference of abnormal return between small-cap and large-cap, Abnormal return=Rit (Small-cap)-Rit (large cap).

| Table 5 Sample T.Test for the Difference of Abnormal Return Between Small-Caps and Larg-Caps | ||||

| Mean residual | T- calculate | Tabulated | Sig. | Result |

| 0.09083 | 2.564 | 1.9818 | 0.032 | Accept |

As clarified in Table 5, the small–cap had excess abnormal return of 0.09083 with a significance of 0.032, if we suppose that funding cost for small–cap is greater than large-cap at a rate of 4%, then there was a net abnormal return for small-cap at a rate of 0.05083 which justify the appreciation of market value for small-cap and existing of a puzzle in Amman Stock Exchange.

Conclusion and Recommendation

According to study result after analyzing the data and testing the hypothesis we conclude that: There is a statically significant difference between risk adjusted return for small size-cap and large size-cap, and the mean of risk adjusted return for small cap is greater than the mean of risk adjusted return of large-cap. Finally, there is a statically difference abnormal return in favor to small-cap. The mentioned results had insured the existing of anomaly in Amman Stock Exchange and investors either individuals or institutions can benefit from that case by tilting their portfolios toward small size companies.

The researchers recommend the following: studying other anomalies in Amman Bourse like January effect and Monday effect. Studying the small effect in Amman Bourse using daily or weekly information and compare the results. Studying small size effect in Amman Bourse using standard deviation to estimate risk adjusted return instead of beta to insure or reject the results of this study. Studying small size effect in Amman Bourse using Net sales or number of employees as a proxy of company size. Applied this study on other sectors like banking and commercial sectors and compare the results. Applied this study on the same sector using capital assets pricing model to estimate normal return. Introducing these results to both individual and institutional investors to benefit from that phenomenon. Applied this study in other emerging markets and compare the results.

References

- Abiodun, B.Y. (2013). The effect of firm size on firms profitability in Nigeria. Journal of Economics and Sustainable Development, 4(5), 90–94.

- Agrawal, A., & Tandom, K. (1994). Anomalies or the illusions? Evidence from stock markets in eighteen countries. Journal of International Money and Finance,13, 83-106.

- Al-Jarrah, I.M., Khamees, B., & Haddad, F.S. (2009). The effect of anomaly in monthly trading in amman stock exchange over the period 2002-2006. Jordan Journal of Business Administration, 5(4), 523-527.

- Al-Jarrah, I.M., Khamees, B., & Qteishat, I.H. (2011). The "turn of the month anomaly" in Amman stock exchange: Evidence and implications. Journal of Money, Investment and Banking, 21, 7-11.

- Allozi, N.M., & Obeidat, S. (2016). The relationship between the stock return and financial indicators (profitability, leverage): An empirical study on manufacturing companies listed in Amman Stock Exchange. Journal of Social Sciences, 5(3), 409-413.

- Alrabadi, D.W., & AL-Qudah. K. (2012). Calendar anomalies: The case of Amman stock exchange. International Journal of Business and Management, 7(24), 120-121.

- Alrabadi, H. (2019). Low-volatility puzzle: Evidence from Amman stock exchange. Jordan Journal of Business Administration, 15(2), 169-179.

- Banz, W. (1981). The relationship between return and market value of common stocks. Journal of Financial Economics, 9 (2), 3–18.

- Charest, B., & Guy, M. (1998). Dividend information stock return and Market efficiency. Journal of financial Economics, 6(3), 297-330.

- Dahmash, F.N. (2013). Abnormal earnings persistence in the Jordanian context. International Journal of Business and Management, 8(15), 33–43. International Journal of Business and Management, 9(4), 57–64.

- Kawakatsu, H., & Morey, M. (1999). Financial liberalization and stock market efficiency: An empirical Examination of nine emerging Countries. Jordan of Multinational Financial Management, 2(9), 353-371.

- Keim, D.R. (1993). Size related anomalies and stock return seasonality: Further empirical evidence. Journal of Financial Economics, 12, 13-32.

- Lee, J. (2009). Does size matter in firm performance? Evidence from US Public firms. International Journal of the Economics of Business, 16(2), 189-203.

- Lonie, A., & Abeyranta, G. (1996). The stock market reaction to the divided announcement. Journal of Economic Studies, 23(1), 135-136.

- Niresh, J.A., & Velnampy, T. (2104). Firm size and profitability: A study of listed manufacturing firms. International Journal of Business and Management, 9(4), 57-64.

- Omet, G. (1999). The Jordanian stock exchange: Prospects and challenges. Derasat University of Jordan, 26(1), 132-139.

- Roll, R. (1995). A possible explanation of the small firm effect. Journal of Finance, 213(3), 879-888.

- Tadepalli, M.S., & Jain, R. (2018). Persistence of calendar anomalies: Insights and perspectives from literature. American Journal of Business, 33(1/2), 18-60.