Original Articles: 2017 Vol: 21 Issue: 1

The Roles of International Entrepreneur Orientation and Geographical Scope Level to Determine International Performance: A Case in the Malaysian Halal Food Industry

Abstract

The purpose of this paper is to investigate the role of geographical scope level as a moderator of the relationship between international entrepreneurial orientation and the international performance of small and medium enterprises (SMEs) in the Malaysian halal food industry. Most of the previous studies have discovered that there is a positive relationship between international entrepreneur orientation (IEO) and the international performance. Unfortunately, many studies were focused on developed countries and high technology industry. Furthermore, the role of geographical scope as a moderator also been excluded in the majority of studies from both international business and international entrepreneurship. This study offers an alternative in developing countries and other industry settings that influenced through the Islamic religious factor in producing special dietary requirements for Muslim consumers, which is known as the halal food industry. This study is a quantitative research designed using the survey method. The result of the survey shows that there is a significant relationship between two groups of small and medium enterprises towards their geographical scope level, international entrepreneur orientation, and international performance. Moreover, SMEs that export to wider geographical scope achieve higher international performance and growth as global exporters compare to those SMEs that operates within a narrow scope only gets to attain lower performance and growth as international exporters.

Keywords

Entrepreneurial orientation. International entrepreneur orientation. International performance. Geographical scope level, Small and medium enterprises. Halal food industry

Introduction

Falling trade barriers and innovations in information and communication technology (ICT), particularly the widespread use of the Internet and e-commerce, have provided new opportunities for the internationalization of small and medium-sized enterprises (Knight, 2001). One response to this changing environment is an increasing interest in entrepreneurship. The entrepreneurs are the core decision makers and have the greatest influence on their firms, business strategy and roadmaps formulation, setting the firm’s goals and steering the firm forward (Masurel et al., 2003). They play an important role in economic growth, innovation, competitiveness and poverty alleviation (Kropp et al., 2006).

At the firm level, the market diversification and exporting become an opportunity for entrepreneurs being less dependent on the domestic market. By reaching new customers in foreign markets as entrepreneurs may also explore more of the economic scale and to achieve lower production costs while producing more efficiently for their business growth. It is argued that entrepreneurial orientations (EO) have contributed significantly to the development of the performance of small and medium enterprises (Wang, 2008). Entrepreneurial orientation has been conceptualized as the process and decision-making activities used by entrepreneurs that lead to entry and support of business activities (Lumpkin and Dess, 2001; Kropp et al., 2006). While it is often believed that EO has a universally positive influence on firm performance (Wales et al. 2013).

Although EO has been regarded as a vehicle for success and survival in an increasingly competitive and global economy (Covin and Slevin, 1991), the concept was originally developed in the US and have been used in Europe regions in the high technology industry. A large number of well-established theories in international business research have been derived from the context of advanced markets and highly industrialized research settings, which raises the question whether these theories can be applied to the context of emerging markets as well (e.g. Jaworski and Kohli, 1993; Dawar and Chattopadhyay, 2002; Burgess and Steenkamp, 2006). Therefore, it may be biased toward Asian regions, mainly if it is involving different economy sectors such as Malaysian halal industry for example. Some studies have attempted to test the cross-cultural and/or the cross-national validity of EO.

Additionally, research on small firm internationalization has been criticized for the lack of attention given to international entrepreneurship (IE) field of study (Zahra, 1993; Oviatt and McDougall, 1994) and IE is one of the emerging areas of international business research. McDougall and Oviatt (2000) define international entrepreneurship as “a combination of innovative, proactive and risk-seeking behavior that crosses national borders and is intended to create value in organizations” (p. 903). In the international business context, the term international entrepreneurial orientation (IEO) extends the concept of entrepreneurial orientation to cover processes and activities that cross national borders (Coviello and Jones 2004; Knight and Cavusgil 2004, 2005). Geographical scope becomes one of the main issues to differentiate between early internationalization of small firms in IE and traditional SMEs (Oviatt and McDougall, 1994; Knight and Cavusgil, 1996, Kuivalainen et al., 2007).

Since, SMEs are the backbone of the Malaysian economy, therefore, it is crucial to understand why some SMEs are successful and others are less successful in their internationalization from the Malaysian business context. Therefore, this study makes a significant contribution to both practitioners and researchers pertaining to this. The research question in this study is how a geographical scope level moderates the relationship between international entrepreneurial orientation and the performance of SMEs in the Malaysian halal food industry.

Literature Review and Hypothesis Development

Theoretical perspective – Resource-Based View

The Resource-Based View (RBV) of the firm argues that firm performance is better explained by differences in firm resources than in industry structure (Wernerfelt, 1984). Resources can be tangible or intangible in nature. Tangible resources include capital, access to capital and location (among others). Intangible resources consist of knowledge, capabilities and reputation among others.

One of the principal insights of the RBV is that not all resources are of equal importance or possess the potential to be a source of sustainable competitive advantage. Barney (1991) proposes that advantage-creating resources must come across four conditions, namely, value, rareness, inimitability, and non-substitutable. It must allow the firm to conceive implement strategies that improve its efficiency and effectiveness in satisfying the needs of customers.

Chandler and Hanks (1994a) have argued that firm performance is a function not only of the accessibility to resources but also of an entrepreneur’s managerial competence. Few studies have considered small firms from a RBV (Lerner and Almor, 2002), even small firms are likely those which must rely heavily on the resource of owner skills. Entrepreneurial characteristics are considered as resources for the entrepreneur as well as the firm (Alvarez and Busenitz, 2001). For small business owners, EO is involving also management skills, and therefore this resource which leads to competitive advantages. EO describes firm-level strategic processes that firms use to obtain a competitive advantage and it is considered an important driver of firm performance (Rauch et al. 2009). Firms high in EO innovate frequently, make risky decisions, and act proactively on opportunities. Thus, EO focuses on obtaining a competitive advantage by looking for new opportunities, anticipating demands aggressively, taking a risk and positioning new products in markets (Lumpkin and Dess, 1996). For a small business entrepreneur, EO is equivalent to management skills and it consequently is a unique intangible resource that leads to competitive advantages (Runyan et al., 2006).

From the above statements, it is clear that in the halal industry the production process is frequently unique to meet Muslim dietary requirements and offers value creation for both Muslim and non-Muslim consumers through halal certification. Therefore, it is important for the owners-managers in this industry develop their international entrepreneur orientation (IEO), intangible capability to venture into export markets as a source of their competitive advantage.

Entrepreneurial Orientation

Entrepreneurial orientation (EO) has been suggested as an essential attribute of high performing firms (Covin and Slevin 1989; Lumpkin and Dess 1996; Dess et al. 1997; Lee and Peterson 2000), and the role of culture for strengthening EO has been highlighted in many studies (Lumpkin and Dess 1996; Lee and Peterson 2000; Marino et al. 2002). The concept of EO is relatively broad, as it refers to the decision-making styles, management behavior, and culture of the whole firm. The EO concept suggests that firms should be entrepreneurial in order to achieve superior performance (Dess et al. 2011).

The original framework of EO was introduced by Miller (1983) who used the dimensions of innovation, proactiveness, and risk-taking to measure entrepreneurship. These three dimensions were also adopted by subsequent studies (Covin and Slevin 1989; Lumpkin and Dess 1996; Lee and Peterson, 2000 ). Covin and Slevin (1989, 1991) expanded upon the idea that engaging in product-market innovation, being the first to introduce new markets (proactiveness), and undertaking risky ventures are at the core of entrepreneurship. Their conceptualization of EO as the concurrent exhibition of risk-taking, proactiveness, and innovativeness has become widely accepted in the scholarly community (Bhuian et al. 2005).

Lumpkin and Dess (1996) and Lee and Peterson (2000) described EO as the process, practice, and decision-making activity that contributes to new entry into the marketplace. They also distinguished between EO and entrepreneurship. They characterized EO as the entrepreneurial process that managers use to act entrepreneurially, whereas entrepreneurship can be defined as a new entry into the market. According to Lumpkin and Dess (1996), the essential quality of entrepreneurship is based on new entry or newly established markets with novel or existing products, as considerably as the launch of new ventures. In short, EO has been used to refer to the strategy- making processes of firms engaged in an entrepreneurial activity (Lumpkin and Dess, 2001).

In these circumstances, EO can boost firms’ profitability by ensuring that they constantly seek new opportunities which enable firms to create first-mover advantages, charge premium prices, and skim the top of the market ahead of their competitors. The ability to respond quickly to customer needs may also deliver a positive impact because it provides the firm with a first-mover advantage. First-mover advantage refers to being the first firm to enter a given foreign market with a particular product or process (Knight et al., 2004). According to these authors, advantages may accrue to the pioneering firm for several reasons. First, for a time at least, the firm enjoys a monopoly in the given product market. Second, the first mover has a better chance to establish a propitious market position. Third, it advances early up the relevant product-market learning curve. Finally, first movers are better positioned to influence initial consumer preferences regarding the characteristics and benefits of the pioneering product.

However, Lumpkin and Dess (1996) indicated that the relationship between EO and firm performance is context specific. They emphasized the need for investigating the role of environmental and organizational variables to enhance the understanding of how EO contributes to performance. They included organizational culture as one of the key contingencies that are associated with the EO-performance relationship. Some studies also emphasize the role of national culture as a stimulator for strong EO. Lee and Peterson (2000) proposed that only countries with specific cultural tendencies will stimulate strong EO and therefore experience more entrepreneurship and global competitiveness. Their model emphasized the importance of a national culture’s ability to produce strong EO within entrepreneurs and firms. In a study conducted by Boso et al., (2012a) they found that EO enables firms to influence the market and market behaviors by offering innovative products in emerging markets that satisfy export customers, latent needs. Some other study by Gruber-Muecke et al. (2015) confirmed that market orientation and EO do have an impact on firm performance in emerging markets.

The results concerning the relationship between EO and performance are not conclusive (Rauch et al. 2009). The theory posits that EO enhances performance (Lumpkin and Dess 1996), but existing empirical evidence does not fully support this assumption. For example Lee et al. (2001) find only a weak evidence of the positive relationship between EO and performance in the case of new ventures, while Slater and Narver (2000) find no relationship between EO and profitability. Moreno and Casillas (2008) also suggest that the direct influence of EO on firm growth is not significant. In contrast, Wiklund and Shepherd (2005) confirmed a positive relationship between EO and business performance. Several studies suggest that the link between EO and performance is likely more complex than a simple main-effects-only relationship and that this link can vary depending on both the context in which firms act and several internal characteristics (Chaston and Sadler-Smith 2011; Rauch et al. 2009; Wiklund and Shepherd 2003).

International Entrepreneur Orientation

Subject areas within the field of IE further emphasize the importance of the decision-makers and show that decision-makers' attitudes towards internationalization (e.g.,Oviatt and McDougall, 1994), as well as their ability to discover, evaluate and exploit business opportunities across national borders (e.g. Oviatt and McDougall, 2005), impact SMEs' internationalization patterns. Other scholars in IE, for example, Knight (2001), Jantunen et al. (2007) also have suggested that EO can be meaningfully extended to the field of IE as a way of examining and explaining the cross-border internationalization of firms.

In addition to this, the development of internationalization studies with a focus on the increasingly active role played by international entrepreneurs of SMEs (Bell et al., 2003; Johanson and Vahlne, 2003). This is because the decision-making power within SMEs and the impulsion for a firm’s internationalization often lies with the international entrepreneur, opposed to the management team, which are responsible for decision-making in larger multi-national firms (Bhuian et al., 2005). A firm’s IEO can also enable the business to identify and exploit these internationalization opportunities.

IEO is a multi-dimensional concept (Covin and Slevin,1991), reflecting the firm’s overall pro-activeness and aggressive in its pursuit of international markets (Knight, 2000; 2001). The concept of IEO incorporates three dimensions drawing from the work of Miller (1983). These three dimensions reflect the firm’s propensity to engage in international innovative, proactive and risk-taking behaviors in order to achieve the firm’s competitive and internationally oriented goals (Knight, 2001).

Therefore, firms with a strong IEO create a significant advantage and differentiation over their competition, facilitating both market share and profitability. A substantial degree of IEO also brings new customers to the firm and helps the firm to retain existing customers by providing new products. Customers are frequently willing to pay premiums for innovations and improved products, especially when the competition does not provide similar offerings (Robinson and Min, 2002). Additionally, in order to address customer needs that may not yet be known, firms must engage in new exploration, support novel ideas, experiment, and stimulate creativity, all of which are essential elements of EO (Covin et al. 2006).

Past studies revealed that firms which have IEO tend to be more successful compared to other firms (Lee and Peterson, 2000). In fact, IEO was found to be positively related to performance (Zahra and Covin, 1995; Wiklund and Shepherd, 2005), although the empirical findings are not entirely consistent. For example, Lee et al. (2001) found only weak evidence of a positive association with the start-up’s performance, while Slater and Narver (2000) found that there was no relationship between EO and business profitability. Lumpkin and Dess (1996) considered the relationship with performance to be context-specific. Zhou (2007) in his study found that foreign market knowledge leads to early and rapid internationalization and more importantly; this effect is driven by international entrepreneurial orientation. His findings support the entrepreneurial nature of smaller and younger international firms (Oviatt and McDougall, 1995; Knight and Cavusgil, 2004). Acedo and Jones (2007) argue that entrepreneurial characteristics such as innovative, proactive, risk-seeking behavior, indicate that a particular mindset or cognition may play a part in internationalization and its speed that relate to early internationalization.

International Performance

International performance is normally evaluated as a financial and non-financial performance measure. It has also been broadly known as objective measures of performance are more appropriate than a subjective evaluation of performance by owners-managers of firms. Nevertheless, collecting objective data is real difficult, largely because owners-managers are generally are not willing to release confidential company information to outsiders (Dess and Robinson, 1984; Jantunen et al. 2007). On the other hand, owners-managers of firms are generally willing to provide a biased evaluation of their firm's performance (Sapienza, et al., 1988). Therefore, this study used subjective performance based on Crick et al. (2006) that argues that a single criterion to measure international performance is inappropriate and more comprehensive subjective measurement is required.

Geographical Scope level as Moderator

For the moderator variable (foreign market scope) this study used as a dummy variable with which SMEs was divided into those which have either narrow or wide geographical scope. These firms were classified as follows: (i) narrow scope for those firms that exported to three regions or less (these firms can be considered ‘international’ firms), and (ii) wide scope for those firms that exported to at least four regions and more simultaneously as ‘global’ firms. Based on previous studies, the scope will give some indications of whether or not SMEs have global scope in their operations based on the number of countries or regions or where they are located (Kuivalainen et al., 2007, Crick, 2010). The summary of the proposed conceptual framework and hypothesis is shown in the diagram below.

It is important to highlight that religion also shapes, values and therefore how the entrepreneurs manage the entrepreneurial activities of their firms. Highly religious entrepreneurs will tend to use religious criteria to inform their decision making, even if it harms their short-term commercial interests (Dodd et al., 2007). Although previous studies inform our understanding of the influence of social-ethnic characteristics of a firm’s entrepreneurial behavior in general, none of these studies empirically examined the relationship between these socio-cultural characteristics and a firm’s IEO on international performance in halal food industry (Ismail and Kuivalainen, 2015).

The present study involves an exploratory view and anticipates that the geographical scope level will moderate the relationship between IEO and international performance. The being of a moderating effect implies that the relationship between two variables (e.g. X and Y) varies as a function of the value of a third variable (e.g. Z), labelled as a moderator (Zedeck, 1971). A moderator explains when or under what conditions X affects Y, or when the relationship is likely to be more substantial. Thus, this study proposes the following hypothesis:

Hypothesis 1:Geographical scope level moderates the relationship between SMEs’ international entrepreneurial orientation and international performance. The correlation in between them is stronger for a wider scope than for narrow one.

Methodology

Data and Sample Collection

This study adopts a quantitative research design using a survey method combined with a statistical discussion. The firm is classified as micro, small and medium-sized when its number of full-time employees are less than five, between five and 50, and between 51 and 150, respectively, for the manufacturing sector (SME, Annual Report, 2007). The sample thus comprised producers and at the same time, exporters, drawn from the SME exporters listed with the Malaysia Exporters of Halal Products directory (MATRADE) and Halal Development Corporation directory (HDC). These databases yielded 400 export firms and all are SMEs. However, only 300 companies were available as the respondents for this study after confirming the current status of their business. From the 195 questionnaires returned, the usable questionnaires were only 174. Hence, the response rate was 58% (174 firms).

Measurements

All measurement items in the questionnaire were adopted and adapted from published works that were relevant to this subject. The independent variable is IEO which comprises proactiveness, innovativeness, and risk-taking adopted from Jantunen et al. (2007). The construct consists of nine items measured by 5-point Likert Scale anchors of 1 = strongly disagree to 5= strongly agree. The Cronbach‘s Alpha value of the scale was α = 0.88 based on reliability test. The dependent variable International performance (INT) was measured with a 5-point Likert scale with three items of subjective measurements, namely overseas sales volume, sales growth (turnover), and profitability adopted from Crick et al. (2006) using the 5-point Likert scale of 1=very badly to 5=very well. The Cronbach‘s Alpha value of the scale was α = 0.93 based on reliability test. For the moderator, scope level, the scope measurement was adapted from the studies conducted by Zucchella (2002) and Chetty and Hunt (2003, 2004). They recommended the use of a number of regions as a basis for scope level. This study classified low scope (regional firm) as those that export to between one and three regions, and high scope as those that export simultaneously to four regions and more (global firm) based classification.

Data Analysis

The analysis of quantitative data was based on a parametric method using the Moderated Multiple Regression (MMR) analysis (Cohen and Cohen, 1983) to introduce the moderating effects in multiple ways. MMR is an extension of multiple regression equations that includes additional predictors carrying information regarding the moderating effect (Aguinis, 2004). Before creating the multiplicative terms, there is a need to centre both the independent variables and the moderating ones, thus avoiding the problem of multicollinearity (Venkatraman, 1989). The scope is hypothesized by a binary grouping of moderator variables in which each moderator has two categories for the product term. The coding scheme used to be the dummy coding for each level of scope (0 = low, 1 = high). The specific test was applied to examine whether all the sub-group variances were equally based on Levene’s Test of Homogeneity of Variance. Based on the results of Levene’s Test, the observed significant level of international performance was more than an alpha level of 0.05. The result shows the sub-group variances of these two variables are based on the low and the high scope which is equal.

Results and Discussion

Geographical Scope Level Moderates The IEO-Scope Relationship

Table 1 presents the results of the moderating effect of geographical scope level in the relationship between international entrepreneurial orientation (IEO) and international performance (INT). Specifically, the Table 1 shows Model 1, R= .434 R2 =.189, and F (2, 171)= 19.863, p=.000. Thus R2 means that 18.9% of the variance in INT increase is explained by IEO and scope. The interaction effects of the scope are differentiated into those of narrow scope and wide scope. Model 2 shows the results after the product term has entered the equation. As shown in Table 1, the addition of the product term results in R2 change to 0.218, F (1, 170) =4.202, p=.013. The significant difference between R2=0.189 in Model 1 and R2 =0.218 based on F statistic is identical to t statistic for the regression coefficient, for the product term (i.e. p=.013) in Model 2 supports the presence of a moderating effect. In other words, the moderating effect of scope explains 2.9 % of variance in INT increases above and beyond the variance explained by IEO and scope.

| Table 1: Model Summary for Int On Ieo For Scope | |||||||||

| Model | R | R2 | Adjusted R2 | Std. Error of the Estimate | Change Statistics | ||||

|---|---|---|---|---|---|---|---|---|---|

| R2 Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | .434a | .189 | .179 | .81873 | .189 | 19.863 | 2 | 171 | .000 |

| 2 | .467b | .218 | .204 | .80620 | .029 | 6.359 | 1 | 170 | .013 |

a. Independent variables: (Constant), scope, IEO

b. Independent variables: (Constant), scope, IEO, IEO.Scope

c. Dependent variable: INT

Table 2, the resulting regression unstandardized coefficients equation for Model 1 is as follows:

| Table 2 : Coefficients For Int On Ieo For Scope | ||||||

| Unstandardized Coefficients | Standardized Coefficients | |||||

|---|---|---|---|---|---|---|

| Model | B | Std. Error | Beta | t | Sig. | |

| 1 | (Constant) | 1.366 | .431 | 3.170 | .002 | |

| IEO | .434 | .117 | .270 | 3.711 | .000 | |

| Scope | .495 | .136 | .264 | 3.627 | .000 | |

| 2 | (Constant) | 2.071 | .508 | 4.075 | .000 | |

| IEO | .240 | .139 | .149 | 1.731 | .085 | |

| Scope | -1.947 | .977 | -1.038 | -1.992 | .048 | |

| IEO.Scope | .629 | .249 | 1.357 | 2.522 | .013 | |

a.Dependent variable: INT

INT = 1.366+.434 IEO+.495 Scope …..E1

The coefficients for both IEO and scope in Model 1 are statistically significant at p= 0.0001 levels. The equation shows that for 1 point increase in IEO, INT is expected to increase by 0.434, given that the scope is held constant. On the other hand, the regression coefficient associated with scope indicates the difference in the INT increase between wide and narrow scope is 0.495 given that IEO is held constant. Table 2 also includes information regarding the regression unstandardized coefficients after the product term has entered the equation. The equation is as follows:

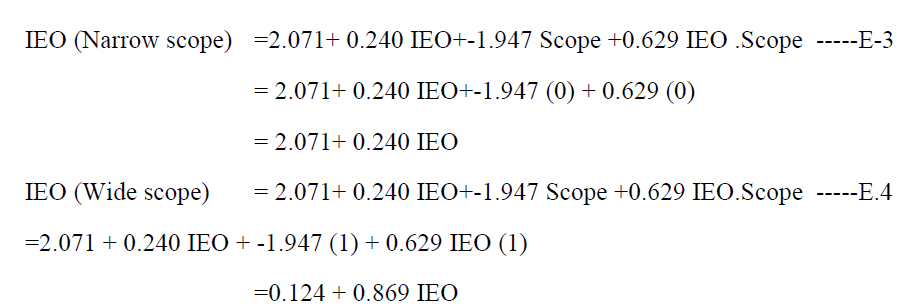

INT = 2.071 + .240 IEO +-1.947 Scope +0.629 IEO. Scope …….E 2

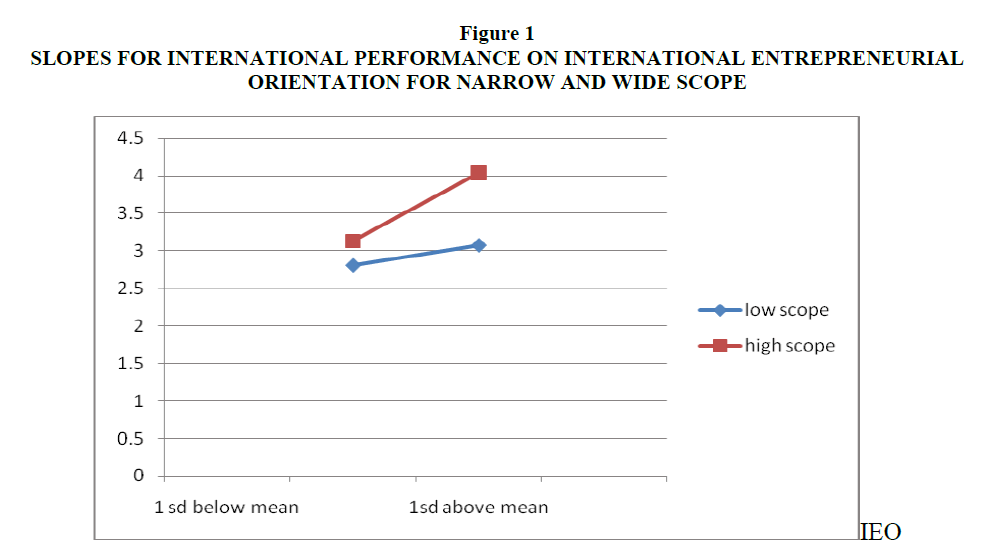

Results from the equation 2 lead to the conclusion that there is a moderating effect of the geographical scope level of IEO-INT relationship. Indeed equation 2 further demonstrates that there is a 0.629 difference between the slope of INT increase on IEO between the narrow scope and the wide scope. This result indicates that the slope regressing INT on IEO is less steep for narrow scope compared to wide scope. For further descriptions of the moderating effect, the regression equation for each group is constructed to produce the graph of the IEO-INT relationship for each of the scope level. Established along the code assigned for geographical scope (0= narrow scope, 1= wide scope), the following equations are developed:

Applying the values of IEO (M= 3.759, SD=.562), the values of 4.32 (1SD above the mean) and 3.20 (1SD below the mean) produce the graph shown in Figure 1. As anticipated, the examination of Figure 1 showing the IEO-INT relationship for each of the SMEs groups separately indicates that the relationship is stronger (i.e. steeper slopes) for SMEs from the wide scope compared to the narrow scope. Based on this result, this study found support for H1 that is the correlation between IEO and INT is stronger for wider scope than narrow scope SMEs. Thus H1 receives full support.

INT.

The result revealed that SMEs which have a wider scope level of global scope, tend to experience a high level of IEO and be more successful compared to other SMEs at narrow scope or operating in fewer regions (1-3 regions) in their international performance achievements. While all firms surveyed display some degree of IEO differences, it appears that those firms who were more proactive, innovative and risk taking-oriented had greater levels of international performance success (and to some degree, greater levels of predictable future export success). It is required that the owners-managers who were able to export to global scope having a high level of IEO capability to respond quickly to customer demand, resulted in better international performance, benefited from first-mover advantage as producers and exporters of the Malaysian halal food industry. The finding suggests that high IEO of owners-managers are more likely to exploit export opportunities until global reach scope. The risk of entering the export market has paid off for proactively-oriented entrepreneurs as they have outperformed conservative-oriented entrepreneurs (low IEO capability). Since the halal industry is one of the emerging industries, particularly for Muslim consumers, it offers added value to the consumers mainly from Islamic “shariah” compliance with the authority (government and relevant agencies) to produce quality halal food that is wholesome and safe for human wellness and well-being. Indeed, for Muslims, buying and consuming only halal food is compulsory and this affects all Muslims worldwide. Today, Muslims account for a quarter of the world’s population and they are expected to reach 30% by 2025 (Roberts, 2010). Producers and exporters also stand to benefit from halal certification provides an independent third-party quality assurance step valued by conscientious consumers, which guides to worldwide acceptance of their products and services. Therefore, in that location there is a growing demand to increase consumers’ awareness of the benefits of halal certification and educating entrepreneurs on utilizing this tool (Rajagopal et al., 2011). Also, communicating it to the consumer as they “focused differentiation” (Porter, 1980), whereby, there is a perceived added value to a particular consumer segment. Arguably, that owner-managers’ decision to enter the global market rather than the international market, serves them to enhance their international performance.

On the other hand, the lower relationship between conservative (narrow IEO capability) and international performance indicates that the owners-managers actions are not merely reactive, but are detrimental to international performance and overall success of the firm in the long run. There is a possibility that firms that operate in the narrow scope consist of those that are concentrating on one or a few regions or some newly-established firms. They may have faced with the risk factor and the lack of expertise in export markets.

This current result supports past studies showing that firms which have IEO tend to be more successful compared to other firms (Lee and Peterson, 2000). In fact, IEO has been found to be positively linked to performance (Zahra and Covin, 1995; Wiklund and Shepherd, 2005). The findings are in line with McDougall et al. (1994) who indicated that entrepreneurs are people who “are alert” about potentially profitable resource combinations while others are not. The findings also support the study by Crick and Spence (2005) which demonstrated that high-performing SMEs are characterized by owners and managers who can identify and exploit international opportunities. The findings also corroborate some of the findings by Zhou (2007) and Knight and Cavusgil (2004) who proposed high IEO and international performance of the global firms. Nevertheless, the findings contradict the Acedo and Jones (2007) argument that entrepreneurial characteristics such as innovation, proactiveness, risk-seeking behavior, indicate that a particular mindset or cognition may play a part in internationalization and its speed but their study does not focus on scope level. Thus, it can be speculated that firms who aggressively pursue a wider geographical scope level would perform better, and expect to perform better in terms of their IEO and international performance compared to narrow geographical scope firms. In other words, entering the global market is viewed as accountable for their growth.

Conclusion

IEO has been identified as an important factor for an SME’s success. A review of the relevant literature indicates that the bulk of the literature on IEO, geographical scope and international performance has been conducted in developed countries and high technology industries. However, little research has been done on this topic in Malaysia and the halal food industry. The results obtained in this research indicate that there are significant relationships among IEO, geographical scope level and international performance based on subjective measurements. The findings revealed that there are significant differences in terms of geographical scope level as a moderator among SMEs in the Malaysian halal food industry based on the number of regions. As a result, there exist differences in terms of the level of owners-managers’ IEO capabilities and international performance between these two groups of SMEs.

These findings suggest that SMEs in developing countries like Malaysia can rapidly export their halal products in the worldwide marketplace, searching for the opportunities of halal foods and niche market, by entering into export markets as first mover advantage. Entrepreneurial-oriented firms have an inclination to be an industry leader in proactive, innovative and risk takers. They should also take advantage of resources provided by various external sources and government programs designed to promote Malaysian halal to foreign markets such as HDC, MIHAS, MATRADE, MITI, and JAKIM. The other ways are through using communications technology such as the Internet and e-commerce as a platform to market the halal food products worldwide and also develop networking to reach consumers beyond their own national borders.

References

- Acedo, F.J. & Jones, M.V. (2007). Speed of Internationalization and Entrepreneurial Cognition: Insights And A Comparison Between International New Ventures, Exporters And Domestic Firms. Journal of World Business, 42(3), 236-252.

- Aguinis, H. (2004). Regression Analysis For Categorical Moderators. The Guilford Press.

- Alvarez, S.A., & Busenitz, L.W. (2001). The Entrepreneurship Of Resource-Based Theory. Journal of Management, 27(6), 755-775.

- Barney, J. (1991). Firm Resources and Sustainable Competitive Advantage. Journal of Management, 17(1), 99-120. Bell, J., McNaughton, R., Young, S. & Crick, D. (2003). Towards an integrative model of small firm Internationalization. Journal of International Entrepreneurship, 1(4), 339-362.

- Bhuian, S.N, Menguc, B. & Bell S.J. (2005). Just Entrepreneurial Enough: The Moderating Effect Of Entrepreneurship On The Relationship Between Market Orientation And Performance. Journal of Business Venturing, 58 (1), 9-17.

- Boso, N., Cadogan, J.W. & Story, V.M. (2012). Complementary Effect Of Entrepreneurial And Market Orientations On Export New Product Success Under Differing Levels Of Competitive Intensity And Financial Capital. International Business Review, 21(4), 667-681.

- Burgess, S.M. & Steenkamp, J.B.E.M. (2006). Marketing Renaissance:How Research In Emerging Markets Advances Marketing Science And Practice, International Journal of Research in Marketing, 23(4), 337-356.

- Chandler, G. & Hanks, S.H.(1994). Founder Competence, the Environment, and Venture Performance.Entrepreneurship Theory and Practice, 18(3), 77-89.

- Chaston, I. & Sadler-Smith, E. (2011). Entrepreneurial Cognition, Entrepreneurial Orientation And Firm Capability In The Creative Industries. British Journal of Management, 23(3), 415-432.

- Chetty, S. & Hunt, C.C. (2003). Paths into internationalization among small- to medium-sized firms. A global versus regional approach. European Journal of Marketing, 37 (5/6), 796-820.

- Chetty, S. & Hunt, C.C. (2004). A Strategic Approach to Internationalization: A Traditional Versus a Born Global Approach. Journal of International Marketing, 12(1), 57-81.

- Cohen, J. & Cohen, P. (1983). Applied multiple regression/correlation analysis for the behavioral sciences (2nd ed), Hillsdale, NJ, Erlbaum.

- Coviello, N. & Jones, M. (2004). Methodological Issues in International Entrepreneurship Research. Journal of Business Venturing, (19), 485-508.

- Covin, J. G. & Slevin, D. P. (1989). Strategic Management of Small Firms in Hostile and Benign Environments. Strategic Management Journals, 10, 75-87.

- Covin, J.G. and Slevin, D.P. (1991). A Conceptual Model of Entrepreneurship as Firm Behavior. Entrepreneurship Theory and Practice, 16(1), 7-25.

- Covin, J. G. & Miles, M P. (1999). Corporate Entrepreneurship and the Pursuit of Competitive Advantage.Entrepreneurship Theory and Practice, 23(3), 47-63.

- Covin, J.G., Green, K., & Slevin, D.P. (2006). Strategic Process Effects On The Entrepreneurial Orientation Sales Growth Rate Relationship. Entrepreneurship: Theory and Practice, 30(1), 57-81.

- Crick, D. & Spence, M. (2005). The Internationalization Of High Performing Uk High-Tech Smes: A Study Of Planned And Unplanned Strategies. International Business Review, (14), 167-85.

- Crick, D., Bradshaw, R & Chaudry, S. (2006). Successful Internationalizing Uk Family And Non-Family-Owned Firms: A Comparative Study. Journal of Small Business and Enterprise Development, 13(4), 498-512.

- Crick, D. (2010). The Internationalization of Born Global and International New Venture SMEs, International Marketing Review, 26 (4/5), 453-476.

- Dawar, N. & Chattopadhyay, A. (2002). Rethinking Marketing Programs For Emerging Markets. Long Range Planning, 35(5), 457-474.

- Dess, G.G. & Robinson, J.R. (1984). Measuring Organizational Performance In The Absence Of Objective Measures: The Case Of The Privately-Held Firm And Conglomerate Business Unit. Strategic Management Journal, 5(3), 265-273.

- Dess, G., Lumpkin, G. & Covin, J. (1997). Entrepreneurship Strategy Making and Firm Performance: Tests Of Contingency And Configurational Models. Strategic Management Journal, 18(1), 2-23.

- Dess GD, Pinkham, BC. & Yang, H. (2011). Entrepreneurial Orientation: Assessing The Construct?s Validity And Addressing Some of Its Implications For Research In The Areas Of Family Business And Organizational Learning. Entrepreneurship Theory Practice, 35(5), 1077-1090.

- Drakopoulou, S., Gotsis, G. & George, G. (2007). The Interrelationships between Entrepreneurship and Religion. TheInternational Journal of Entrepreneurship and Innovation, 8 (2), 93-104(12).

- Gruber-Muecke, T., & Hofer, K.M. (2015). Market Orientation, Entrepreneurial Orientation And Performance In Emerging Markets. International Journal of Emerging Markets, 10(3), 560-571.

- Ismail, N.A. & Kuivalainen, O. (2015). The Effect of Internal Capabilities and External Environment on Small- and Medium-Sized Enterprises? International Performance and the Role of the Foreign Market Scope: The Case of the Malaysian Halal Food Industry. Journal of International Entrepreneurship 13(4), 418-451. Online publication date: 9-Sep-2015.

- Jantunen A., Nummela, N., Puumalainen, K. & Saarenketo, S. (2007). Strategic Orientations of Born Globals-Do They Really Matter?. Journal of World Business, 1-13.

- Jaworski, B.J. & Kohli, A.K. (1993). Market Orientation-Antecedents and Consequences. Journal of Marketing,57(3), 53-70.

- Johanson, J. & Vahlne, J.E. (2003). Business Relationship Learning and Commitment in the Internationalization Process. Journal of International Entrepreneurship, 1(1), 83-101.

- Knight, G.A. & Cavusgil, S.T. (1996). The Born Global Firm: A Challenge to Traditional Internationalization Theory. Advance in International Marketing, 8, 11-26.

- Knight, G. (2000). Entrepreneurship and Marketing Strategy: The SME under Globalization. Journal of International Marketing, 8(2), 12 -32.

- Knight, G. (2001). Entrepreneurship and Strategy in the International SME. Journalof International Management, 7,155-171.

- Knight, G. & Cavusgil, S. (2004). Innovation, Organizational Capabilities, And The Born Global Firm. Journal of International Business Studies, 35(2), 124-141.

- Knight, G. & Cavusgil, S. (2005). A Taxonomy of Born-Global Firms. Management International Review, 2005,45(3), 15-35.

- Kropp,F., Linsday,N.J. & Shoham, A. (2006). Entrepreneurial, Market and Learning Orientations and International Entrepreneurial Business Venture Performance in South African Firms. International Marketing Review, 23(5), 504-523.

- Kuivalainen, O., Sundqvist, S. & Servais, P. (2007). Firms Degree of Born Globalness. International Entrepreneurial Orientation and Export Performance. Journal of World Business, 42, 253-267.

- Lee, S.M. & Peterson, S.J. (2000). Culture, Entrepreneurial Orientation, and Global Competitiveness. Journal of World Business, 35(4), 401-416.

- Lee C.K, Lee, J.M. & Pennings. (2001) Internal Capabilities, External Networks, and Performance: a Study on Technology-based Ventures. Strategic Management Journal, (22), 615-640.

- Lerner,M., & Almor, T. (2002). Relationships among Strategic Capabilities and the Performance of Women-Owned Small Ventures. Journal of Small Business Management, 40, 109?125.

- Loane, S. & Bell, J. (2006). Rapid Internationalisation among Entrepreneurial Firms in Australia, Canada, Ireland and New Zealand: An Extension to the Network Approach. International Marketing Review, 23(5), 467? 485.

- Lumpkin G.T. & Dess G.G. (1996). Clarifying Entrepreneurial Orientation Construct and Linking It to Performance. Academy Management Review, 21(1), 135-172.

- Lumpkin, G.T. & Dess, G.G. (2001). Linking Two Dimensions of Entrepreneurial Orientation to Firm Performance: The Moderating Role of Environment and Industry Life Cycle. Journal of Business Venturing, (16), 429-451.

- Masurel, E., Montfort, K.V. & Lentink, R. (2003). SME: Innovation and the Crucial Role of the Entrepreneur: Series Research Memoranda 0001, VU University Amsterdam, Faculty of Economics, Business Administration and Econometrics.

- Marino, L., Strandholm, K., Steensma, H.K., & Weaver, K.M. (2002). The Moderating Effect of National Culture on the Relationship between Entrepreneurial Orientation and Strategic Alliance Portfolio Extensiveness. Entrepreneurship: Theory and Practice, 26, 145-160.

- McDougall, P.P., Shane, S. & Oviatt, B.M. (1994). Explaining the Formation of International Joint Ventures: The Limits of Theories from International Business Research. Journal of Business Venturing, 9, 469-487.

- McDougall, P. & Oviatt, B. (2000). International entrepreneurship: The intersection of two research paths. Academy of Management Journal, 43 (5), 902-906.

- McDougall, P.P. & Oviatt, B.M. (2005). Defining International Entrepreneurship and Modeling the Speed of Internationalization. Entrepreneurship Theory and Practice, 29 (5), 537-554.

- Miller, D. (1983). The Correlates of Entrepreneurship in Three Types of Firms. Management Science, 29, 770-791.

- Miller, D. & Friesen, P. (1984). Organizations: A Quantum View. Englewood Cliffs, NJ, Prentice Hall.

- Moreno, A. M., & Casillas, J. C. (2008). Entrepreneurial Orientation and Growth of SMEs: a Causal Model, Entrepreneurship: Theory and Practice, 32(3), 507?528.

- Morris, M.H. & Paul G.W. (1987). The Relationship between Entrepreneurship and Marketing in Established Firms, Journal of Business Venturing, 2, 247-259.

- Oviatt, B.M. & McDougall, P.P. (1994). Toward a Theory of International New Ventures. Journal of International Business Studies,1, 45-64.

- Oviatt, B.M, & McDougall, P.P. (1995). Global Start -Ups: Entrepreneurs on a Worldwide Stage. Academy of Management Executive, 9(2), 30-44.

- Oviatt B.M, McDougall, P.P. (2005). Defining International Entrepreneurship and Modeling the Speed of Internationalization. Entrepreneurship Theory Practice, 22, 537-553.

- Ozcan, P. & Eisenhardt, K.M. (2009). Origin of Alliance Portfolios: Entrepreneurs, Network Strategies, and Firm Performance. Academy of Management Journal, 52, 246-279.

- Porter, M.E. (1980). Competitive Strategy, New York: Free Press.

- Ramachandran, K. & Ramnarayan, S. (1993). Entrepreneurial Orientation and Networking: Some Indian Evidence.

- Journal of Business Venturing, 8(6), 513?524.

- Rajagopal, S., Ramanan,S., Visvanathan, R. & Satapathy, S. (2011). Halal Certification: Implication for Marketers in UAE. Journal of Islamic Marketing, 2(2), 138-153.

- Rauch, A., Wiklund, J., Lumpkin, G.T., & Frese, M. (2009). Entrepreneurial Orientation and Business Performance: an Assessment of Past Research and Suggestions for the Futures. Entrepreneurship: Theory and Practice, 33(3), 761?787.

- Reed, R. & DeFillippi, R. (1990). Causal Ambiguity, Barriers to Imitation, and Sustainable Competitive Advantage. Academy of Management Review, 15, 88-102.

- Roberts, J. (2010). Young, Connected and Muslim, Marketing Week, available at: www. marketingweek.co.uk/in-depth-analysis/cover-stories/young-connected-and-muslim/ 3014934, article (accessed 18 November 2010).

- Robinson, W.T. & Min, S. (2002). Is the First to Market the First to Fail? Empirical Evidence for Industrial Goods Businesses. Journal Marketing Research, 39, 120-128

- Runyan, R., Droge, C. & Swinney, J. (2008). Entrepreneurial Orientation versus Small Business Orientation: What are Their Relationships to Firm Performance?. Journal of Small Business Management, 46(4), 567-588.

- Sapienza, H.J., Smith, K.G., & Gannon, M.J. (1988). Using Subjective Evaluations of Organizational Performance in Small Business Research. American Journal of Small Business, 12(3), 45-53.

- Slater, S. F., & Narver, J. C. (2000). Market Oriented is More than Being Customer-Led. Strategic Management Journal, 20, 1165-1168.

- SME Annual Report (2007), http://www.bnm.gov.my/files/publication/sme/en/2007/appendieces.pdf. Accessed on April, 2009.

- Venkatraman, N. (1989). The Concept of Fit in Strategy Research: Towards Verbal and Statistical Correspondence,

- Academy of Management Review, 14(3), 423-444.

- Wales, W., Gupta, V. and Moussa, F. (2013). Empirical Research on Entrepreneurial Assessment: a Comprehensive Qualitative Assessment, International Small Business Journal, 31(4), 357?383.

- Wang, C. L. (2008). Entrepreneurial Orientation, Learning Orientation, and Firm Performance. Entrepreneurship Theory and Practice, 32, 635-657.

- Wernerfelt, B. (1984). A Resource-Based View of the Firm. Strategic Management Journal, 5, 171-180.

- Wiklund, J. & Shepherd, D. (2003). Knowledge-Based Resources, Entrepreneurial Orientation, and the Performance of Small and Medium Sized Business. Strategic Management Journal, 24(13), 1307-1314.

- Wiklund, J & Shepherd, D. (2005). Entrepreneurial Orientation and Small Business: A Configurational Approach,

- Journal Business Venturing, 20, 71-91.

- Zahra, S.A. (1993). Environment, Corporate Entrepreneurship, and Financial Performance: a Taxonomic Approach, Journal of Business Venturing, 8, 319-340.

- Zahra, S.A. & Covin J.G. (1995). Contextual Influences on the Corporate Entrepreneurship-Performance Relationship: A Longitudinal Analysis. Journal Business Venturing, 10(1), 43?58

- Zedeck, S. (1971). Problems with the use of?moderator? variables. Psychological Bulletin, 76, 295-310.

- Zhou, L. (2007). The Effects of Entrepreneurial Proclivity and Foreign Market Knowledge on Early Internationalization. Journal of World Business, 42(3), 281-293.