Research Article: 2020 Vol: 24 Issue: 1

The Role of Motivation in Curbing Resistance to Innovation in Mobile Payment Services in South Africa: A Focus on University Students

Reginald Masocha, University of Limpopo

Lillian Chiwenga, University of Limpopo

Abstract

Despite high mobile technologies penetration in South Africa, mobile payment services have been adopted by relatively few users. This study intended to explore the resistance to innovation through examining the reasons for slow adoption of mobile payment services among consumers and how motivation influences the adoption process. Absence of relative advantage, absence of compatibility, complexity, perceived risk and absence of self-efficacy have been employed as factors influencing motivation of consumer’s towards mobile payment services. Non-probability sampling method was used in this study and a sample of 225 respondents participated in the survey. Data was analysed using structural equation modelling (SEM) to assess the relationships between the research constructs. The software AMOS version 25 was used to conduct path analysis of the postulated hypotheses. All the hypotheses in the study were supported and the results of this study may assist players in the financial sector with better knowledge on the connection between all the recognised affecting components and the customers’ resistance from utilising mobile payment services in South Africa. Furthermore, this research adds towards knowledge endeavouring to minimise the resistance and enhancing the pace at which consumers adopt mobile payment services.

Keywords

Consumer Resistance, Mobile Payment Services, Product Innovation.

Introduction

The contemporary world is being changed drastically by the progressions in web technology. Everyday activities have continuously moved from traditional conditions to cell phone-based virtual situations. Thakur and Srivastava (2014) argue that of all consumer-level innovations in history, the acquisition of mobile devices has transpired at a rapid momentum and to the most profound level. Advanced gadgets such as iPods, smart phones and tablets makes the existence of consumers less demanding and generate new uses that give an additional esteem which changes how monetary services are offered to consumers. With the wide reach of mobile phones in South Africa, financial institutions have joined forces with other organisations to close the payment services gap by giving the unbanked a safe and advantageous medium (Nkaelang et al., 2012). The rise of mobile payment markets, which has become one of the major components of mobile commerce, has been enabled by the technological advancements in the sphere of mobile communications (Pidugu, 2016; Masocha & Dzomonda, 2018).

Teo et al. (2013) defined mobile payment services as the utilisation of phones to make settlements for merchandise, services and accounts via wireless technology. Whereas Tiago et al. (2016) defined mobile payment services as a substitute method of making settlements for merchandise, services and accounts, using mobile devices such as a smartphone or tablet to ease the commencement, authorisation and achievement of the settlement process using wireless and other communication technology. A significant study (Tiago et al., 2016) has shown that mobile payments enable individuals to discard the utilisation of money in exchange of convenience, speed, better potential and conveying of reliable details between gadgets. Hence, mobile payment is encountering rapid growth in numerous business sectors as more and more commercial entities understand its capability.

An enquiry by Teo et al., (2013) outlines that consumers’ response to innovation can be positive or negative. Buyers may embrace or oppose an innovation. An assessment of the present literature on mobile payments outlines that many investigations largely focus on forces that influence the acquisition of innovation (Trachuk & Linder, 2017; Masocha & Dzomonda, 2018). The research on innovation suffers from seasoned-exchange predisposition that is making assumptions that each advancement is great and ought to be adopted by everyone. Actually, some researches argue that many innovations are most likely to be faced by resistance from consumers. This argument has prompted this research study with respect to the role of motivation in curbing consumers’ resistance in using mobile payment services. The major argument in this study is that motivation is required for consumer to adopt innovations and regardless of an innovation fulfilling all the requirements for adoption without motivation consumers are likely to remain in resistance (Hsbolah & Idris, 2009).

According to Lai (2011), motivation refers to the reasons underlying behaviour and can be broadly defined as the attribute that moves consumers to do or not to do something. Li et al. (2011) also defined motivation as an internal state of desire that directs goal-orientated behaviour. Currently, buyers are no longer inclined to using tangible monies in exchange for goods and services; they increasingly prefer to make use of their phones to settle bills (Low, 2016). However, motivation is vital in explaining behavioural patterns of consumers especially when they are faced with unfamiliar environments such as new innovations (Li et al., 2019). Despite high mobile technologies prioritisation by banks in South Africa, mobile payment services have been adopted by relatively few users. However, many youth particularly university students have been found to be high adopters of many recent innovative products (Linnes & Metcalf, 2017). The thesis for this study is that despite of high resistance for mobile payment services amongst most consumers, the active adoption amongst youthful consumers can be explained by the presence of motivation. Hence, this study intends to find out the relationship between motivation and factors underlying consumers’ resistance to innovation and the subsequent impact on mobile payment services adoption. The study was conducted at the University of Limpopo in the Limpopo province of South Africa utilising tertiary students.

Hypotheses

H1: Relative advantages (RA) and consumers’ motivation (MO) in mobile payment services are significantly and positively associated.

H2: Compatibility (COMP) and motivation (MO) in mobile payment services are significantly and positively associated.

H3: Product complexity (COMPL) and motivation (MO) in mobile payment services are significantly and positively associated.

H4: Perceived risk (PR) and motivation (MO) in mobile payment services are significantly and positively associated.

H5: Self-efficacy (SE) and motivation (MO) in mobile payment services are significantly and positively associated.

H6: Motivation (MO) in mobile payment services and consumers’ usage of mobile payment services (MPS) are significantly and positively associated.

Literature Review

Mobile Payment Services

Mobile payment services are another method of making payment settlements for goods, services, and bills or invoices. Mobile payment services use mobile gadgets (such as a mobile phone, smart-phone, or Personal Digital Assistant) and electronic communication technologies (i.e. mobile telecommunications networks, or proximity technologies) (Teo et al., 2013). Kim et al. (2010) claim that mobile devices can be utilised in several payments, such as payments for digital content (e.g. ring tones, logos, news, music, or games), concert or flight tickets, parking fees, as well as bus, train and taxi fares.

Kim et al. (2010) identified two broad categories of payments; payments for purchases and payments of bills or invoices. Mobile payments compete with or complement cash, cheques, credit cards and debit cards in the payment of purchases. Whereas in payments of bills or invoices, mobile payments give access to account-based payments, including money transfers, online banking payments or direct debit assignments. In South Africa, mobile payment services serve as a first step to transform the financial environment and to include the unbanked to form the bigger part of the banked. Mobile payments services in South Africa are provided by almost all banks in partnership with other shopping outlets e.g. Capitec in partnership with Shoprite Checkers and Pick n Pay, FNB eWallet, Absa cashsend and MPESA (Nkaelang et al., 2012).

Product Innovation

Lee et al. (2012) define innovation as a concept, application or device recognised as advanced by people or units of acquisition. Innovation consists of developments in current characteristics, or creation of advanced characteristics to a current commodity, or may be an absolutely contemporary or advanced commodity presented in an identical of different market (Kleijinen et al., 2009). Technological innovation is a repetitive process beginning with the recognition of another demand as well as new chances for a creation resulting in the improvement or advancement, production followed by promoting errands vital for the business accomplishment of the innovation.

Mohtar & Abbas (2015) identified two categories of innovation, namely, incremental and radical innovation with radical innovation being the common associated with high resistance and therefore the focus of this study. According to Mohtar & Abbas (2015), a radical innovation can be defined as an item, procedure or administration characterised by phenomenal function attributes or well-known attributes which provide huge enhancements in potential or value that modify current demands or prompt different ones. Lee et al. (2012) argue that even though innovation provides the possibility for fundamental performance advancement, performance benefits are often hindered by consumers’ unwillingness to acquire and utilise the accessible systems.

Consumer Resistance

According to Khan & Hyunwoo (2009), consumer resistance pertains to consumers' adverse response towards an innovation, either because it creates prospective adjustments from an acceptable status quo or because it is in contradiction with their belief structure. Resistance to change is an aspect of consumer resistance characterised by consumers’ refusal to adopt the alterations enforced by an innovation (e.g. changes in the product or changes in the way in which consumers use the product). Johnson (2015) and Mirza et al. (2016) defined consumer resistance as a consumer’s attempt to discard a certain product or service, despite it being innovative in nature. A natural reaction of human beings to any changes that interrupt the stability of their living environment or their organisation’s activities is usually resistance to that change. One of the main critical success factors for the adoption of technological innovation is consumer resistance, and adoption has been rendered as the outcome of overcoming resistance.

Resistance guides consumers’ reaction towards three forms, it may take the form of direct rejection, postponement or opposition. When consumers hold up the adoption of an innovation, it is called postponement. It merely refers to propelling the adoption decision to future. On the other hand, disapproving the innovation or searching for more information after the trial of the innovation is called opposition. It is a type of rejection, but the consumer is prepared to try or examine the innovation before eventually rejecting it. The most ultimate form of resistance is when consumers directly reject an innovation (Kleijnen et al., 2009). Mirza et al., (2016) identified two categories of factors that influence consumers’ resistance. These factors are based on consumers’ attributes and the features of the innovation. This study will focus on relative advantage, perceived risk, complexity, compatibility, motivation and self-efficacy. It is of vital importance to understand these factors and their effects on consumers’ resistance to increase the chances of innovation success.

Motivation and Financial Mobile Payment Services

The definition of motivation starts with the root word, motive. Oxford Dictionary defines motive as a reason for doing something. Therefore, motivation can be defined as the act of providing motive that causes someone to act (Burton, 2012). Motivation can also be defined as goal-directed arousal that drives consumers need. It entails internal processes that provide behaviour with power and direction. Power describes the strength, determination, and concentration of the concerned behaviour, while direction provides a specific purpose to the behaviour (Mirza et.al, 2016). According to Watchravesringkan et al. (2010), motivation is based on goals, or ends, that people try to achieve with their current activity.

There are two broad categories of motivation namely intrinsic motivation, extrinsic motivation. Intrinsic motivation occurs when an individual engages in an activity such as a hobby that is initiated without obvious external incentives (Watchravesringkan et al., 2010). Li et al. (2011) is of the view that extrinsic motivation involves performing behaviour to achieve some separable goal, such as receiving rewards or avoiding punishment. Both these motivational factors might be of importance to a consumer’s decision to resist an innovation. The demands of individuals are prompted by an objective stimulation known as motivation. It involves interior procedures that impart behaviour with potential and direction. Potential describes the power, assurance and attentiveness of the related behaviour, whereas direction conveys a certain motive to the behaviour (Mirza et al., 2016). Ozdemir & Trott, (2009) established that consumers are most likely to resist the innovation if the motivation is low. Motivation prompts the demands as well as plans of customers to adopt innovative products.

Relative Advantage and Mobile Payment Services

Researchers have established that one exceptionally significant element that influences the adoption of and or resistance to innovation is relative advantage (Püschel et al. 2010; Riquelme & Rios, 2010). Relative advantage of an innovation is defined by Mirza et al., (2016) as the extent to which an innovation is seen as more desirable or superior compared to the concept it substitutes. Financial gain, social benefits, time spared, risks eliminated and perceived usefulness can be used to rate relative advantage. Consequently, researchers expressed that consumers are very likely to resist an innovation if they perceive the innovation to be characterised with inferior relative advantage (Al-Jabri & Sohail, 2012; Mndzebele, 2013; Mohtar & Abbas, 2015). According to Hsbolah & Idris (2009) there is a positive relationship that exists between relative advantage and consumer’s motivation within the context of adoption of new innovation. Thus, subsequent adoption of technology is expected when there is a positive relationship between relative advantage and motivation.

Compatibility in Mobile Payment Services

According to Arvidsson (2014), the uniformity between an innovation and the values, encounters and prospects is known as compatibility. Compatibility is a measure of how prepared customers are to embrace an innovation. It is of exceptional significance in technological markets and has been considered as a significant element involved in the evolution of attitude. Lin (2011) argues that substantial compatibility with consumer demands and an innovation is more desirable as it enables the innovation to be explained in an accustomed manner. Chemingui & Lallouna, (2013) are of the opinion that the chances of adopting an innovation are higher if the innovation is highly compatible.

Complexity in Mobile Payment Services

The extent to which an innovation is intricate to utilise as well as comprehend is known as complexity (Kleijnen et al., 2009). Abbas et al. (2017) asserted that customers effectively embrace slightly complex innovations and the opposite is true. Pidugu (2016) establishes that mobile payment services have always appeared to be highly fragmented, with many technologies co-existing and being controlled by different stakeholders creating a complex environment. Past research strongly recommends that there is a solid effect of complexity of an innovation on its adoption and its dismissal (Abbas et al., 2017; Mirza et al., 2016).

Perceived Risk in Mobile Payment Services

According to Pidugu (2016), perceived risk refers to a combination of one or more aspects that include economic, function, tangible, time, societal and cognitive risks that consumers may experience while performing online transactions. For many years, perceived risk has been utilised to clarify the behaviour of consumers. Past researches convey and confirms the relation as well as the impact of perceived risk on the behaviour of individuals in diverse disciplines such as electronic trading (Crespo et al., 2009; Kim et al., 2008), electronic filing system (Azmi & Bee, 2010), buying vouchers or coupons on the internet, buying via mail order and internet banking (Aldás-Manzano et al., 2009; Ozdemir & Trott, 2009). Risk taking and motivation are critical variables when consumers venture into new behaviours such as adoption of product innovations (Li et al., 2019). Per se, the study hypothesises that perceived risk and motivation are directly related in the adoption of mobile payment services amongst university students.

Self-Efficacy in Mobile Payment Services

The confidence of an individual consumer in his or her own potential is illustrated by the connection between consumer resistance to innovation and self-efficacy. Self-efficacy is a factor of recognised accessibility along with the applicability of a product. It is described as a consumer’s self-assurance in his or her potential to execute behaviour. Therefore, (Trachuk & Linder, 2017) defined self-efficacy as the trust in an individual’s own potential and capability to organise as well as conduct activities that are necessary to achieve a desired result (Trachuk & Linder, 2017). Previous studies have established self-efficacy to be negatively related to consumer resistance and positively related to consumer adoption of innovative products (Mirza et al., 2016; Chen, 2008; Duane et al., 2014; Hsu & Lee, 2011 & Kim et al., 2010).

Methodology

Quantitative research design was applied in this study. The research population for this study comprised of all customers that conducted banking in Polokwane South Africa. The study utilised convenience sampling method to select participants to the survey. A sample size of 225 respondents was used for this study. To assemble the required information, a self-administered questionnaire was utilised. The questionnaire consisted of eight parts. The study utilised purposive sampling to select respondents. The first section (Section A) of the questionnaire focused on the demographic factors of the respondents that were deemed relevant to the achievement of the objectives of the study. The remaining sections focused on the constructs that were investigated in the study, namely, Section B focused on the participants’ knowledge of and usage pattern of mobile payment services. Section C to H dealt with the six influencing factors identified as relative advantage, compatibility, complexity, perceived risk, motivation and self-efficacy where participants agreed or disagreed to the questions pertaining to these six factors using a 5-point Likert scale.

The data collected from the target respondents was interpreted using the SPSS software. Descriptive analysis was used to present data in a more appropriate way and to generate useful statistics values and meaningful graphic displays. Internal consistency test was applied to determine the consistency of the measures using Cronbach’s coefficient alpha (α), composite reliability (CR), and average variance extracted (AVE). Pearson Correlation test was applied in the study to examine divergent validity. A pre-test of the questionnaires was done to further find the validity of the questionnaire. The strength and direction of the relationships between two constructs as postulated in the hypotheses was tested using SEM through the AMOS software.

Results and Data Analysis

From the research findings related to the respondents’ demographic details, it was established that most respondents (62%) surveyed were females aging between 21-30 years, thus, 68% of the total research population. Furthermore, the majority of the respondents held an undergraduate certificate constituting 81.6% and 80% were unemployed. The findings also revealed that 85.6% owned an android smartphone, 8% owned an iPhone and those who owned an android tablet constituted about 1.6%. Table 1 below presents these findings.

| Table 1 Sample Characteristics | |

| Variable | Frequency |

| Gender | Male (38%), Female (63%) 0.489 |

| Age in years | 21-30 (68%), Below 21 (27.2%), 31-40 (4.8%) |

| Qualifications held | Undergraduate (81.6%), Post graduate (10.4%), Matric (7.2%) |

| Employment status | Unemployed (80%), Employed (16%) |

| Ownership of | Android smartphone (85.6%), iPhone (8%) Android tablet (1.6%) |

Furthermore, data was analysed for dimensionality through structural equation modelling (SEM). SEM pertains to a second-generation multivariate method that integrates multiple regressions and confirmatory factory analysis to concurrently predict interrelatedness of the latent variables hypothesized in the research model. SEM is comprised of two parts, namely measurement model and structural model. The measurement model involves the estimation of relationships between, unobserved (latent) variables and their respective observed variables. The measurement model also involves validity and reliability assessments. On the other hand, the structural model specifically focuses on path analysis between endogenous and exogenous variables, prominently known as independent and dependent variables, respectively. In this study, SEM was performed through the software AMOS version 26 software.

For the measurement model, confirmatory factor analysis (CFA) was simultaneously performed with the assessment of validity (Fornell & Lacker, 1981). Table 2 below shows the psychometric properties of measurement model as well as validity and reliability assessments. Herein, for internal consistency reliability was conducted through two methods, namely, Cronbach’s alpha and composite reliability. For the purpose of satisfactory internal consistency, values of Cronbach’s alpha (CRa) that exceed 0.70 are recommended. Consequently, most of the values in the study attest to satisfactory internal consistency as they ranged between 0.781 and 0.954 (Table 2). Composite reliability (CR) which ascertains overall reliability and consistency in a construct is deemed acceptable when it also exceeds the value 0.70.

| Table 2 Measurement Model | |||||

| Constructs | Items | SFLs | CRa | CR | AVE |

| Compatability (COMPA) | COMPA1 | 0.901 | 0.862 | 0.814 | 0.662 |

| COMPA2 | 0.814 | ||||

| COMPA3 | 0.715 | ||||

| Complexity (COMPL) | COMPL1 | 0.732 | 0.781 | 0.760 | 0,514 |

| COMPL2 | 0.683 | ||||

| COMPL3 | 0.734 | ||||

| Motivation (MO) | MO1 | 0.773 | 0.834 | 0.822 | 0.607 |

| MO2 | 0.766 | ||||

| MO3 | 0.798 | ||||

| Self-efficacy (SE) | SE1 | 0.905 | 0.954 | 0.925 | 0.804 |

| SE2 | 0.900 | ||||

| SE3 | 0.885 | ||||

| Mobile payment services (MPS) | MPS2 | 0.847 | 0.786 | 0.756 | 0.609 |

| MPS3 | 0.708 | ||||

| Relative advantage (RA) | RA1 | 0.814 | 0.868 | 0.843 | 0.644 |

| RA2 | 0.684 | ||||

| RA3 | 0.895 | ||||

| Perceived risk (PR) | PR1 | 0.604 | 0.780 | 0.777 | 0.540 |

| PR2 | 0.800 | ||||

| PR3 | 0.785 | ||||

Nominal validity in the study was established through a pre-test of the questionnaire and no major challenges were found in the instrument. Convergent validity in this study was determined through the utilization of standardised factor loadings (SFLs) which are required to be above 0.50 (Hair et al., 2010). As outlined in Table 2 most of the SFLs represented good convergent validity as they exceeded the recommended value. On the other, discriminant validity which outlines the extent to which constructs are different was ascertained through two approaches, namely, correlation coefficients and average variances extracted (AVE). Herein, low correlation coefficients (r) indicate that the constructs are separate from each other and the rule of thumb is that r should be less than 0.80. Accordingly, all the r values in this study were below the value. Additionally, the AVE values in the study also signified acceptable discriminant validity as all of them were above the stipulated value of 0.50. Lastly, the test for discriminant validity in the study was further determined at the hand of Square roots of average variance extracted (Square roots of AVE). Per se, the requirement is that square roots of AVE values should exceed the inter-construct correlation coefficients in the horizontal and vertical. Accordingly, this was satisfied for all constructs as Square roots of AVE appearing in bold in the diagonal (Table 3) were significantly high.

| Table 3 Inter-Construct Correlations and Square Root of AVE | |||||||

| COMP | COMPL | RA | PR | SE | MO | MPS | |

| COMP | 0.814 | ||||||

| COMPL | -0.084 | 0.717 | |||||

| RA | 0.785 | 0.581 | 0.802 | ||||

| PR | 0.483 | 0.459 | 0.360 | 0.735 | |||

| SE | 0.537 | 0.537 | 0.509 | 0.307 | 0.897 | ||

| MO | 0.029 | 0.212 | 0.442 | 0.249 | 0.190 | 0.779 | |

| MPS | 0.601 | -0.031 | -0.041 | 0.019 | -0.007 | 0.260 | 0.781 |

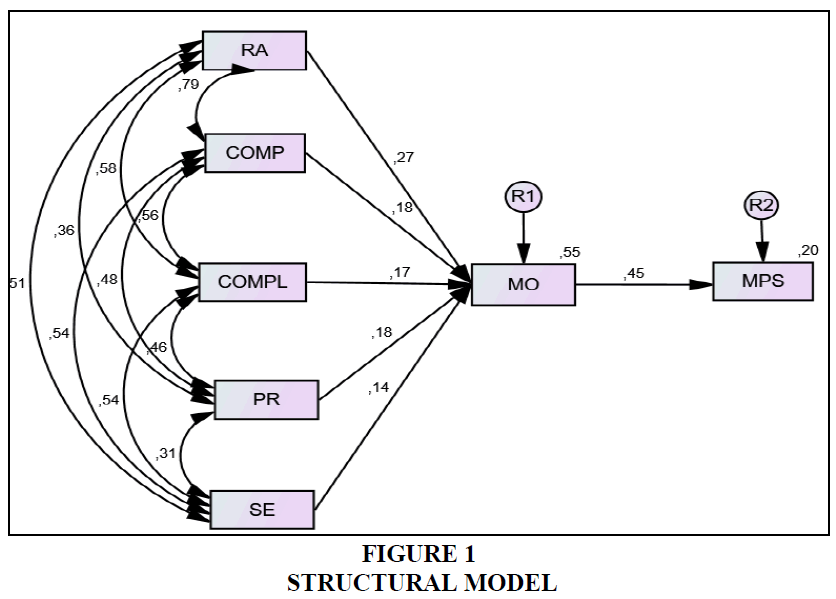

The structural model addresses analysis pertaining to the hypothesised relationships. Herein the goodness-of-fit of the model depicted acceptable values. The goodness-of-fit indices that were utilised in the study were normed chi-square (Cmin/df) which was 4.805, Goodness-of-Fit Index (GFI) was 0.951, Normed Fit Index (NFI) also known as the Bentler-Bonett Normed Fit was 0.942 and Comparative Fit Index (CFI) was 0.952, Standardised Root Mean Squared Residual (SRMR)=0.042. Furthermore, the Squared multiple correlation (R2) values are depicted in Figure 1 which contains the structural model. The R2 values determine the predictive of the model and in this case 0.55 and 0.20 depicts that the model explains 55% and 20% in the dependent variables motivation (MO) and mobile payment services usage (MPS), respectively.

Properties of the structural model which pertains to the testing of hypotheses (standardised path weights (β), standard error (SE) critical ratio (CR) and hypotheses decisions) are presented in Table 4 below. Decisions pertaining to the hypotheses were based on the significance level (α) which is set at 0.05. The direct effects in the study between the stated hypotheses were all found to be significant at the hand of the SEM approach that was utilised. Herein, the most significant result was in relation to hypothesis H6 (β=0.446; p<0.001). Thus, (H6) pertaining to motivation (MO) in mobile payment services and consumers’ usage of mobile payment services (MPS) were found to be significantly and positively associated. Next, H1 was found to be significant (β=0.265; p<0.001), signifying that relative advantages (RA) and consumers’ motivation (MO) in mobile payment services are significantly and positively associated. Furthermore, H2 statistics (β=0.184; p=0.003) support that compatibility (COMP) and motivation (MO) in mobile payment services are significantly and positively associated. Next, H4 was the fourth most significant relationship (β=0.180; p=0.003), meaning that low perceived risk (PR) and motivation (MO) in mobile payment services are significantly and positively associated. The fifth most significant relationship was H3 (β=0.168; p=0.006). Thus, low product complexity (COMPL) and motivation (MO) in mobile payment services are significantly and positively associated. The least significant relationship related to H5 (β=0.137; p=0.025). Still self-efficacy (SE) and motivation (MO) in mobile payment services were found to be significantly and positively associated.

| Table 4 Hypothesis Testing Results | ||||||

| Hypothesised relationships | Estimate (β) | S.E. | C.R. | P | Decision | |

| H1 | RA → MO | 0.265 | 0.059 | 4.330 | - | Supported |

| H2 | COMP → MO | 0.184 | 0.060 | 3.006 | 0.003 | Supported |

| H3 | COMPL→MO | 0.168 | 0.063 | 2.747 | 0.006 | Supported |

| H4 | PR→MO | 0.180 | 0.056 | 2.938 | 0.003 | Supported |

| H5 | SE → MO | 0.137 | 0.056 | 2.242 | 0.025 | Supported |

| H6 | MO → MPS | 0.446 | 0.104 | 4.374 | - | Supported |

Discussion and Findings

Factors that contribute to resistance of mobile payment services have been in this study revealed to be significantly and positively related to the presence of motivation to adopt. Firstly, the relationship between relative advantage and motivation was found to be significant and positive through SEM. Thus, the absence of relative advantage will result in lower motivation towards the adoption of mobile payment thereby resulting in high consumer resistance. Past literature has consistently shown that relative advantage has a significant and negative effect on consumers’ resistance (Mirza et al., 2016). When consumers perceive lower relative advantage over different innovative products, they are most likely to resist the innovation which leads to higher consumer resistance towards the innovation. Secondly, in the second hypothesis concerning the relationship between compatibility and consumers’ motivation was found to be significant and positive. This is in line with Lin (2011) who suggests that when customers realise that an innovation is compatible with their lifestyles and preferences, they are more likely to adopt it. Greater compatibility between individual needs and technological innovation is preferable because it allows the innovation to be interpreted in a more familiar context. Therefore, based on the research findings in this study, it is concluded that the intention of using mobile payment services would increase with compatibility.

Furthermore, the relationship between complexity in MPS and motivation was found to significant and positive. Based on the findings of this research, it has been established that innovative products that are less complex are easily adopted by customers and vice versa. According to Tiago et al., (2016), if an innovation is considered complex it will be difficult for consumers to use and therefore, cannot be exploited for its usage and advantages. As mobile payment services have very user-friendly interfaces, consumers see them as easy to use, and hence form positive attitudes toward them (Lin, 2011). Consistently, the results of the study also resulted in the support of the fourth hypothesis between low perceived risk of MPS and motivation in mobile payment services. Thus, perceived risk associated with the financial, performance and security were found to be a significant in motivating customers towards the use of mobile payment services. This supports past studies (Brahim, 2015; Carter & Curry, 2013) which found that perceived risk is one of the best and most consistent predictors of innovation resistance. Therefore, respondents who perceived mobile payment services to be less risky than normal payment methods have expressed motivation toward MPS.

Fifthly, the relationship between self-efficacy and motivation in mobile payment services usage was found to be significant. On the basis of this study, it has been proven that there is a positive relationship between the absence of self-efficacy and consumer lack of motivation toward mobile payment services (Boonsiritomachai & Pitchayadejanant, 2017). Lower levels of self-efficacy in consumers lead to higher levels of consumer resistance towards mobile payment services, which imply that consumers who have higher levels of self-efficacy related to mobile payment services expressed less levels of motivation towards mobile payment services. Lastly, the relationship between motivation usages of MPS was also found to be significant. The findings of this research study proved that lower levels of motivation are associated with higher consumer resistance to innovation (Boonsiritomachai & Pitchayadejanant, 2017).

Conclusions

Awareness about mobile payments has grown vastly over the last couple of years; however, some potential consumers are still reluctant to adopt the use of mobile phones to engage in financial transactions due to different reasons. This study has managed to investigate the relationship between factors that influence resistance to mobile payment services and how motivation is related to them all. The study also sought to establish how motivation towards mobile payment services is related to the usage of mobile payment services. In the study, all the factors, namely, relative advantage, perceived risk, compatibility, complexity and self-efficacy were found to be related to motivation which is subsequently related to the usage of mobile payment services. Thus, respondents who find mobile payment services to offer relative advantages, lower perceived risk, high compatibility, low complexity, and had high self-efficacy are likely to be highly motivated towards mobile payment services. Based on the identified factors that influence consumer’ resistance in this study, the researchers recommends that service providers try to eliminate these concerns and induce consumers’ motivation. Service providers and associated merchants may adopt legal third-party endorsements to ensure payments security. Assurance of integrity of personal information can also reduce consumers’ resistance and enhance adoption.

Additionally, the results of this study also proved that there is a positive relationship between the absence of motivation and consumer resistance towards mobile payment services. Motivation drives consumers’ requirements and expectations to make use of mobile payment services. This implies that the absence of motivation has a positive impact on customer resistance to innovation because motivation derives consumer intentions and desires to adopt technological innovative products. However, these findings should be interpreted in the light of various limitations. Firstly, the research did not include some factors that some consumers may consider important to the resistance of mobile payment services such as trust and cultural barriers. The study focused on educated customers with knowledge and access to bank accounts. Therefore, the results may not be directly applied to all segments of customers because there are different segments in Polokwane, some of which are rural areas composed of uneducated customers who might not be aware of mobile payment services. Thus, it would be valuable in future research to extend the geographical area. Future research can expand studies on innovation resistance from individual to organizational perspective. It would be worthwhile to investigate how service providers and merchants are dealing with the innovation and consumers’ characteristics factors to overcome or decrease the level of resistance. Future research can also focus on the usability of mobile payment services, e.g. assessing the significance of usage pattern in consumers’ activities such as shopping and paying for bills.

References

- Abbas, M., Shahid Nawaz, M., Ahmad, J. & Ashraf, M. (2017). The effect of innovation and consumer related factors on consumer resistance to innovation. Cogent Business & Management, 4(1), 131-205.

- Aldás-Manzano, J., Lassala-Navarré, C., Ruiz-Mafé, C. & Sanz-Blas, S. (2009). The role of consumer innovativeness and perceived risk in online banking usage. International Journal of Bank Marketing, 27(1), 53-75.

- Al-Jabri, I., & Sohail, M.S., (2012). Mobile banking adoption: Application of diffusion of innovation theory. Journal of Electronic Commerce Research, 13, 379-391.

- Arvidsson, N. (2014). Consumer attitudes on mobile payment services–results from a proof of concept test. International Journal of Bank Marketing, 32(2), 150-170.

- Azmi, A.C., & Bee, N.L. (2010). The Acceptance of the e-Filing System by Malaysian Taxpayers: A Simplified Model. Electronic Journal of e-Government, 8(1).

- Boonsiritomachai, W., & Pitchayadejanant, K. (2017). Determinants affecting mobile banking adoption by generation Y based on the Unified Theory of Acceptance and Use of Technology Model modified by the Technology Acceptance Model concept. Kasetsart Journal of Social Sciences.

- Brahim, S.B. (2015). Typology of resistance to e banking adoption by Tunisian. Journal of Electronic Banking Systems, 1.

- Burton, K. (2012). A study of motivation: How to get your employees moving. Management, 3(2), 232-234.

- Carter, R.E., & Curry, D.J. (2013). Perceptions versus performance when managing extensions: new evidence about the role of fit between a parent brand and an extension. Journal of the Academy of Marketing Science, 41(2), 253-269.

- Chemingui, H., & Ben lallouna, H. (2013). Resistance, motivations, trust and intention to use mobile financial services. International Journal of Bank Marketing, 31(7), 574-592.

- Chen, Y.S. (2008). The driver of green innovation and green image–green core competence. Journal of business ethics, 81(3), 531-543.

- Crespo, A.H., del Bosque, I.R. & de los Salmones Sanchez, M.G. (2009). The influence of perceived risk on Internet shopping behavior: a multidimensional perspective. Journal of Risk Research, 12(2), 259-277.

- Duane, A., O'Reilly, P., & Andreev, P. (2014). Realising M-Payments: Modelling consumers' willingness to M-pay using Smart Phones. Behaviour & Information Technology, 33(4), 318-334.

- Fornell, C., & Larcker, D. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

- Hair, J.F., Wolfinbarger, M.F., Oritinau, D.J., & Bush, R.P. (2010). Essentials of marketing research (2nd ed). New York: McGraw-Hill.

- Hsu, L. & Lee, S.N. (2011). Learning tourism English on mobile phones: How does it work?. Journal of Hospitality, Leisure, Sports and Tourism Education (Pre-2012), 10(2), 85.

- Johnson, B.E., & Webster-Lam, C. (2015). Authentication for a commercial transaction using a mobile module. U.S. Patent 8,996,423.

- Khan, K., & Hyunwoo, K. (2009). Factors affecting consumer resistance to innovation smartphone. Jonkoping International Business School, Master Thesis within Business Administration.

- Kim, D.J., Ferrin, D.L., & Rao, H.R. (2008). A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision support systems, 44(2), 544-564.

- Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behaviour, 26, 310-322.

- Kleijnen, M., Lee, N. & Wetzels, M. (2009). An exploration of consumer resistance to innovation and its antecedents. Journal of economic psychology, 30(3), 344-357.

- Lai, E.R. (2011). Critical thinking: A literature review. Pearson's Research Reports, 6 , 40-41.

- Lee, Y.K., Park, J.H., Chung, N., & Blakeney, A. (2012). A unified perspective on the factors influencing usage intention toward mobile financial services. Journal of Business Research, 65(11), 1590-1599.

- Li, Y., Tan, C.H., Xu, H., & Teo, H.H. (2011). Open source software adoption: motivations of adopters and amotivations of non-adopters. ACM SIGMIS Database: the DATABASE for Advances in Information Systems, 42(2), 76-94.

- Lin, H.F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International journal of information management, 31(3), 252-260.

- Low, K.H. (2016). Factor affecting consumer resistance to paypal mobile payment adoption: A study of generation x consumers in Malaysia. Retrieved from http://eprints.utar.edu.my/2427/1/Thesis_(PayPal).pdf

- Masocha, R., & Dzomonda, O. (2018). Adoption of mobile money services and the performance of small and medium enterprises in Zimbabwe. Academy of Accounting and Financial Studies Journal, 22(3), 12-15.

- Mirza, H.H., Mohsen, D., Hamed, D., & Mojtaba, D. (2016). Factors affecting consumer resistance to innovation in mobile phone industry. International Journal of Asian Social Science, 6(9), 497-509.

- Mohtar, S.B., & Abbas, M.A.Z.H.A.R. (2015). Consumer resistance to innovation due to perceived risk: Relationship between perceived risk and consumer resistance to innovation. Journal of Technology and Operation Management, 10, 1-13.

- Mndzebele, N. (2013). The effects of relative advantage, compatibility and complexity in the adoption of EC in the hotel industry. International Journal of Computer and Communication Engineering, 2(4), 473.

- Nkaelang, B., Ojo, S., & Mbarika, V. (2012). Agile Decision Making Framework to Support Mobile Microloans for Unbanked Customers. AMCIS 2012 Proceedings. Retrieved from http://aisel.aisnet.org/amcis2012/ proceedings/ICTinGlobalDev/8

- Ozdemir, S., & Trott, P. (2009). Exploring the adoption of a service innovation: A study of Internet banking adopters and non-adopters. Journal of Financial Services Marketing, 13(4), 284-299.

- Pidugu, K. (2016). Mobile payment adoption in South Africa: A merchant’s perspective Unpublished Doctoral dissertation. University of Pretoria, South Africa.

- Püschel, J., Mazzon, J.A., & Hernandez, J.M.C. (2010). Mobile banking: Proposition of an integrated adoption intention framework. International Journal of bank marketing, 28(5), 389-409.

- Riquelme, H.E., & Rios, R.E. (2010). The moderating effect of gender in the adoption of mobile banking. International Journal of bank marketing, 28(5), 328-341.

- Thakur, R., & Srivastava, M. (2014). Adoption readiness, personal innovativeness, perceived risk and usage intention across customer groups for mobile payment services in India. Internet Research, 24(3), 369-392.

- Teo, A.C., Chea, C.M., Ooi, K.B., & Wong, J.C.J. (2013). Why consumers resist mobile payment? A conceptual model, Diversity, Technology, and Innovation for Operational Competitiveness: Proceedings of the 2013 International Conference on Technology Innovation and Industrial Management, ToKnowPress.

- Tiago, O, Manoj, T, Goncalo, B., & Filipe, C. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in human behaviour, 61, 404-414.

- Trachuk, A., & Linder, N. (2017). The adoption of mobile payment services by consumers: An empirical analysis results. Business and Economic Horizons, 13(3), 383-408.

- Watchravesringkan, K., Nelson Hodges, N., & Kim, Y.H. (2010). Exploring consumers' adoption of highly technological fashion products: The role of extrinsic and intrinsic motivational factors. Journal of Fashion Marketing and Management: An International Journal, 14(2), 263-281.

- Hsbolah, M.H., & Idris, K. (2009). E?learning adoption: the role of relative advantages, trialability and academic specialisation. Campus-Wide Information Systems, 26(1), 54-70.

- Li, M., Lauharatanahirun, N., Steinberg, L., King-Casas, B., Kim-Spoon, J., & Deater-Deckard, K. (2019). Longitudinal link between trait motivation and risk-taking behaviours via neural risk processing. Developmental Cognitive Neuroscience, 40, 100725.

- Linnes, C., & Metcalf, B. (2017). Generation and their Acceptance of Technology. International Journal of Management and Information Systems, 21(2), 11-26.