Research Article: 2019 Vol: 18 Issue: 1

The Role of Investment Strategy in the Strategic Management System of Service Companies

Volodymyr Panchenko, Volodymyr Vynnychenko Central Ukrainian State Pedagogical University

Anastasiya Ilyina, Kyiv National University of Trade and Economics Iryna Mihus, "KROK" University

Maksym Vavrin, Ivan Franko National University of Lviv

Yurii Karpenko, Higher Educational Establishment of Ukoopspilka "Poltava University of Economics and Trade"

Abstract

The article forms a comprehensive understanding of the role of investment strategy in the methodological field of strategic management. The leading elements of the structure of the investment strategy for behavior of service com r service companies are identified and classified, and it is proposed to identify four types of investment panies in the market. The strategic chart of the service company was formed on the basis of strategic perspectives.

Keywords

Strategic Management, Investment Strategy, Service Company, Investment Behavior, Strategic Chart, Strategic Perspectives.

JEL Classifications

M21

Introduction

In the current global environment any national economy needs to be more dynamic and able to quickly adapt to changes in the global market environment, which will allow it to achieve high economic growth in the future. One of the prerequisites for achieving this goal is to increase the ability of the real sector of the economy to attract investment and introduce advanced technologies. This problem can be solved by implementing a strategic planning system in investment activities for service companies.

Literature Review

Significant contribution to the development of the theoretical base of strategic management of the formation of functional strategies was made by such scientists as (Arnold, 2010; O’Donohoe et al., 2010; Kaplan et al., 2001). Applied aspects of the investment activity of companies and the development of investment strategies are presented in detail in the scientific works (Dietel, 2007; Krosinsky & Robbins, 2012; Nofsinger, 2017). For all the importance of research into the issues of investment strategies, there are a number of unresolved methodological issues associated with evaluating the choice of a strategy that would provide a sound analytical basis and ensure the steady growth of a company.

Methodology

The methodology of our research is formed on the basis of fundamental concepts of strategic management: 1) the strategic planning process is a series of steps: analysis, goal setting and choice; 2) functional strategies (investment strategies) are built on a hierarchical basis; all structural divisions can have their own strategies, coordinated with one another and integrated into the company development strategy as a whole; 3) strategic planning is a continuous process of plan formulation, implementation and adjustment.

Findings and Discussions

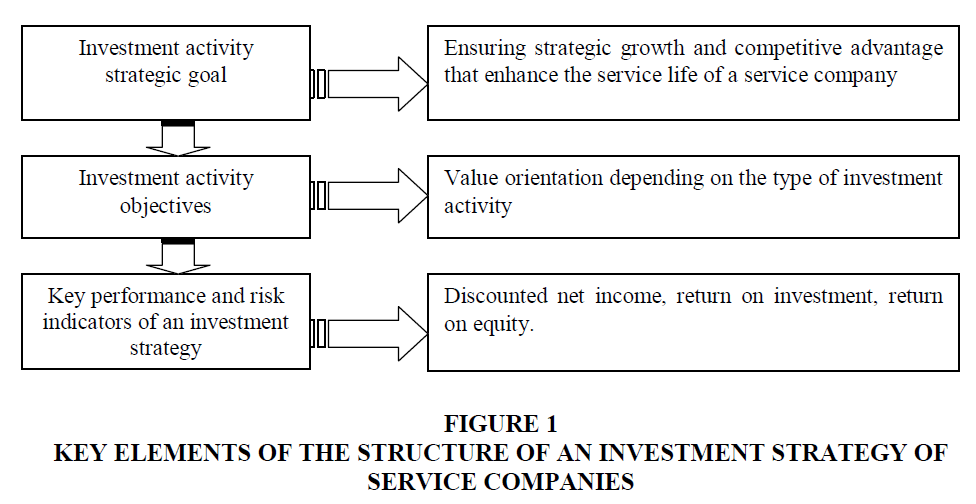

The active development of the investment potential of service companies is connected with the strategic planning of the investment activity. From the authors' point of view, the investment strategy is a system of goals of investment activity and ways of their achievement on the basis of forecasting of conditions of external and internal investment environment, and also a system of monitoring of business results (Ackert & Deaves, 2009; Bachher & Monk, 2013). Key elements of the investment strategy structure are presented in Figure 1.

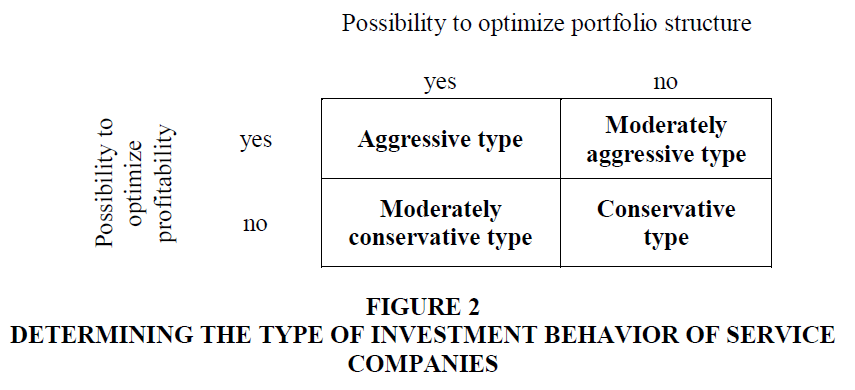

In the current practice of service companies we can distinguish the following types of investment behavior: conservative, moderately conservative, moderately aggressive and aggressive.

The selection of the type of investment behavior of a service company is based on the problems of the possibility of correlation of different investment projects in a portfolio or strategic program and the eligibility of choosing the investment projects with the best profitability. Variants of acceptable types of investment behavior (in the author's version) are shown in Figure 2.

1 The aggressive type of behavior illustrates the continuity of both possibilities (possibility to optimize profitability and possibility to optimize portfolio structure), which requires constant adjustment of the investment strategy.

2 The moderately aggressive type of investment behavior requires constant monitoring of investment projects in order to identify the most profitable and include them in the investment portfolio.

3 The moderately conservative behavior requires constant monitoring of investment risk.

4 The conservative type of investment behavior requires passive monitoring.

It is advisable to start developing a system of investment goals with the identification of investment opportunities or investment potential of the company (Brown et al., 2012). The assessment of investment potential should be made in the following main areas: potential of formation of investment resources of a service company; efficiency of investment activity; the quality of investment management; assessment of the risk level of the implemented investment programs and projects, as well as financial investments. In order to adequately identify projects that are worthy of further consideration it is necessary to formulate strategic investment goals that will depend on the overall business strategy (Karpenko et al., 2018; Drobyazko et al., 2019; Durmanov et al., 2019).

In the context of economic transformations and limited pricing, of all strategies we consider most appropriate for service companies a strategy aimed at minimizing costs (“cost leadership”) due to the monopolistic nature of infrastructure. Therefore, the main goal of the investment activity of a service company should be to create opportunities to provide a range of services that are not provided by competitors but which are thought to have consumer demand (Ward & Griffiths, 1996).

When using a differentiation strategy the main goal of the investment activity strategy is to ensure sustainable growth and competitiveness by expanding the range of services provided or attracting new client groups.

The goal system should be designed so that the goals are clear to every employee of the company who will participate in the implementation of the investment strategy (Makedon et al., 2019). An instrument that will solve this problem should be a strategic chart, which will indicate the place of each employee in the system of investment strategy implementation. For service companies, due to the high social importance of the economic sphere, the strategic chart should be supplemented by a block of socio-economic component, which will reflect all external effects from the implementation of the investment strategy. The proposed strategic chart for a service company is presented in the Table 1.

| Table 1 Strategic Chart of Investment Activities for a Service Company | |||

| Strategic perspective | Goal | Objectives | Indicators |

| 1. Socio-economic component | Improving the availability and quality of services based on return on investment | Revenue and profit growth | Return on investment |

| Revenue growth rate | |||

| Increasing the company life cycle | Ensuring sustainable growth | Sustainable growth ratio | |

| Increasing competitiveness | Expanding the range of services provided and improving their quality | Increasing the revenue by expanding the range of services | |

| Replacing or upgrading aging equipment | Increasing the productivity of assets | Productivity of assets | |

| The degree of depreciation of fixed assets | |||

| 2. Customer component | Reduced customer service time | Reduced service time per a customer | One customer service time |

| Keeping the customer service schedule | One customer service costs | ||

| 3. Internal business processes | Increase in the efficiency of the use of available resources | Business cycle optimization | Percentage of capacity utilization |

| 4. Training and growth | Further training of employees | Increase in the number of employees with professional education | The number of employees with professional education |

| Mastering of related specialties | The number of employees who have mastered new types of activity | ||

The strategic chart enables to determine the goals and objectives for each area, as well as the indicators by which the activity of the responsibility centers in each area will be evaluated. A system of incentives, direct (bonus system) and (or) indirect (promotion perspectives) is required to improve staff efficiency.

Based on the key indicators of the effectiveness and efficiency of the investment strategy, the management of the company should develop criteria for selecting investment projects to include them in the investment portfolio of the company. These criteria can be divided into two groups: qualitative and quantitative. The qualitative criteria can be referred to:

1 Compliance of the investment project with the goals and areas of the investment strategy;

2 Relevance of the project in the current economic situation and the forecasted one;

3 Belonging of the project to the investment program provided by the investment strategy;

4 Presence of innovative solutions in the project;

5 Presence of alternatives;

6 Additional effects generated during project implementation (synergism, positive image of a company, reduction of staff turnover, creation of incentives for management, reduction of aggregate risk of investment activity through diversification);

a. Possibility to re-profile business processes involved in project implementation; availability of reliable information on the evaluation of the investment project (additional expert opinions, certificates).

The following groups of indicators are referred to quantitative indicators of the investment project evaluation:

1. Investment project risk level indicators (discount rate);

2. Performance indicators for the project as a whole and participation in the project of individual groups of investors (discounted net income, return on investment, return on equity, sustainable growth ratio);

3. Indicators of the project impact on the operational activities of the company (increase in turnover, increase of revenue per 1 euro of investment, intensity of fixed capital);

4. Indicators of the impact of the investment project on the indicators of financial sustainability of the service company (ratio of own and borrowed sources of financing);

5. Correspondence of the amount of investment needed to the opportunities available to attract investment resources over time.

Thus, the strategy of sustainable development of a service company is based on an investment strategy. The developed investment strategy enables a service company to respond quickly to changes in the external environment, maintain competitiveness at a high level.

Recommendations

It is recommended that the assessment of the achievement of the set goals and the monitoring of the investment strategy be carried out by comparing actual and planned indicators, as well as by defining critical values of key indicators. Monitoring of key indicators will help to avoid significant losses, since the reduction of project indicators to a critical point by the management of a service company should provide conditions for “exit” from such a project.

Conclusion

To sum up, the following practical basics in developing a service company investment strategy should be highlighted. An investment strategy is a part of the overall business strategy and is aimed at making effective use of the available investment potential in the conditions of forecasted changes of external and internal investment factors. The development of an investment strategy makes it possible to increase efficiency of investment activity and also to minimize risks of making wrong decisions.

References

- Ackert, L., & Deaves, R. (2009). Behavioral finance: Psychology, decision-making, and markets.

- Arnold, G. (2010). Investing: the definitive companion to investment and the financial markets. Financial Times. New Jersey: Prentice–Hall.

- Bachher, J., & Monk, A.H. (2012). Platforms and vehicles for institutional co-investing.

- Brown, J.R., Martinsson, G., & Petersen, B.C. (2012). Do financing constraints matter for R&D?. European Economic Review, 56(8), 1512-1529.

- Dietel, W.M. (2007). Mission stewardship. New York: The FB Heron Foundation.

- Drobyazko, S., Potyshniak, O., Radionova, N., Paranytsia, S., & Nehoda, Y. (2019). Security of organizational changes via operational integration: ensuring methodology. Journal of Security and Sustainability Issues.

- Durmanov, A., Bartosova, V., Drobyazko, S., Melnyk, O., & Fillipov, V. (2019). Mechanism to ensure sustainable development of enterprises in the information space.

- Kaplan, R.S., Davenport, T.H., Robert, N.P.D.K..S., Kaplan, R.S., & Norton, D.P. (2001). The strategy-focused organization: How balanced scorecard companies thrive in the new business environment. Harvard Business Press.

- Karpenko, L.M., Serbov, M., Kwilinski, A., Makedon, V., & Drobyazko, S. (2018). Methodological platform of the control mechanism with the energy saving technologies. Academy of Strategic Management Journal.

- Krosinsky, C., & Robins, N. (2012). Sustainable investing: The art of long-term performance. Routledge.

- Makedon, V., Hetman, O., Yemchuk, L., Paranytsia, N., & Petrovska, S. (2019). Human resource management for secure and sustainable development. Journal of Security & Sustainability Issues, 8(3).

- Nofsinger, J.R. (2017). The psychology of investing. Routledge.

- O’Donohoe, N., Leijonhufvud, C., Saltuk, Y., Bugg-Levine, A., & Brandenburg, M. (2010). Impact investments: An emerging asset class. JP Morgan, 6.

- Ward, J.M., & Griffiths, P.M. (1996). Strategic planning for information systems. John Wiley & Sons, Inc..