Research Article: 2021 Vol: 20 Issue: 5

The Role of Insurance Activities in Stimulating Economic Prosperity in Saudi Arabia

Jumah Ahmad Alzyadat, Dar Aluloom University,

Bushra Saleh Alwahibi, Dar Aluloom University

Citation: Alzyadat, J.A., & Alwahibi, B.S. (2021). The role 0f insurance activities in stimulating economic prosperity in Saudi Arabia. Academy of Strategic Management Journal, 20(5), 1-12.

Abstract

This study is a practical attempt to highlight the role of insurance activities in economic prosperity in Saudi Arabia. The study used the Autoregressive Distributed Lag (ARDL) to analyze the data. The results find that the growth of insurance activities has a negative impact on economic prosperity in the short run, but turns into positive in the long run. The most important result is that the growth of insurance activities does not play a significant role in the economic prosperity in the short run. Instead, insurance products are considered as a productive factor in the long run, therefore the insurance products in KSA is a supply leading in the long run. The study recommends increasing the contribution of the insurance products in the GDP in Saudi Arabia and considering insurance as a form of effective protection for companies, individuals and the economy. Besides encouraging saving and investment in order to achieve economic prosperity.

Keywords

Saudi Arabia, Insurance sector, Economic growth, Economic Prosperity, Cobb-Douglas Production Function, ARDL.

Introduction

The insurance sector plays an important role in the economies of both developed and developing countries. Where the insurance markets act as a financial intermediary to promote economic growth as well as to manage risks. Despite the increasing importance of the insurance sector's role in financial intermediation, it has received less attention from banks and stock markets (Haiss & Sumegi, 2008). Insurance products provide various financial functions that influence economic activities, by allowing risk to be managed efficiently and domestic savings to be mobilized (Arena, 2008). The main objective of insurance companies is transfer risk; also, insurance companies are one of the major investors in the economy (Haiss & Sumegi, 2008). Given the importance of the nexus between financial stability and economic growth, it has been well recognized and emphasized in the process of economic growth. Recently, there has been interest in studying the interrelationship between insurance activities and economic growth, and emphasizing the role of insurance as a key determinant of economic activities (Outreville, 2013). Therefore, a well-developed insurance sector is essential for economic growth, as it provides long-run investments for economic growth while at the same time enhancing risk tolerance capabilities (Akinlo & Apanisile, 2014).

Saudi Arabia adopted economic policies aimed at increasing the rate of economic growth as the increase in productive activity led to an increase in the employment rate. The rise in the economic growth rate was no longer an automatic remedy against unemployment, as a new term called Jobless Growth appeared. The insurance sector is considered one of the most important sectors in the economy, its importance being a fundamental pillar of the financial services sector. As it is one of the pillars of the financial services sector in Saudi Arabia, by being classified as the third sector, in addition to being supportive of economic activities by transferring risk and encouraging savings in the long run. The Saudi Central Bank organizes and supervises the insurance market in order to protect the rights of the insured, encourage fair competition, provide distinguished insurance services, consolidate the stability of the insurance market, and provide safety by reducing risks through the reinsurance process. The contribution of insurance companies by offering various insurance products and compensating those affected in accordance with the insurance contract has led to a reduction in pressure on the concerned authorities such as banks, in addition to an increase in confidence in the productive and financial sectors in the Saudi economy. Consequently, the insurance sector witnessed an important development and widespread in recent years in Saudi Arabia. The insurance sector grew by about 8% in 2019, which was the first increase in the past three years with total written premiums of 37.89 billion Saudi riyals, and the net profit of the insurance sector more than tripled compared to 2018, which led to higher returns on assets and shareholders' equity. The rise was driven by the health, property and liability insurance sector (Saudi Central Bank, Insurance Market Report, 2019).

The insurance depth increased in 2019 to 1.28% compared to 1.20% in 2018 due to the increase in the total written premiums. The annual compound annual growth rate (average) for insurance depth has reached 4% over the past five years. The insurance depth of non-oil GDP reached 1.9% in 2019, compared to 1.8% in 2018. The insurance sector also witnessed an increase in its intensity from 1,048 riyals per person in 2018 to 1,107 riyals per person in 2019, an increase of 5.7%. The level of per capita spending on insurance services increased with an average annual increase of 1% between 2014 and 2018 (Saudi Central Bank, Insurance Market Report, 2019).

Literature Review

The insurance sector has become a major component in most economies; consequently, the Interest has also increased in the ratio of insurance products to GDP in the economy. Thus, the interlinkages between insurance activities and economic growth have been extensively examined in different economies with mixed results. Hence, there are several studies aimed at assessing the interrelationship between the growth of insurance activities and macroeconomic performance. The studies used different insurance indicators and different methodologies. The results of the feedback indicated that the growth of insurance activities boosted economic growth in many countries. Among the studies, Haiss & Sumegi (2008) in Norway, Switzerland, Norway and Iceland. Curak et al. (2009) in 10 transition European Union member countries. Ilhan & Bahadir (2011) in 29 countries. Akinlo & Apanisile (2014) in sub-Saharan Africa. Balcilar et al. (2018) in 10 African countries. Kjosevski (2012) in Macedonia. Hussein & Alam (2019) in Oman. Umoren & Joseph, (2016) in Nigeria. Kukaj et al., (2019) in Western Balkan countries.

Furthermore Devarakonda (2016); Okonkwo & Eche (2019); Ahmad & Yadav (2019); Jana (2020) in India. Other studies, including Alhassan & Fiador (2014) and Osei-Bonsu et al. (2021) emphasized the positive, short and long run link between insurance activities and economic growth in Ghana. As well Hallam (2020) in Algeria. Pradhan et al. (2017) revealed the existence of reciprocal relations between the insurance density and economic growth in some Eurozone countries. The studies by Satrovic (2019); Apergis & Poufinas (2020) showed that the results of most of the previous empirical literature confirmed the positive relationship between the development of insurance activities and the growth of economic activities in different economies. On the other hand, Oitsile et al. (2018) indicated that in the long run the rapid expansion of insurance sector products could harm economic growth. Likewise, Phutkaradze, (2014) showed that no evidence that insurance enhance economic growth in post-transition economies. Okonkwo & Eche (2019) pointed out that there is no statistical evidence of an association between insurance penetration and Economic growth in Nigeria.

Some studies have indicated that the relationships between insurance sector activities and economic prosperity are specific to each country. Any analysis of whether the insurance sector promotes economic activities depends on the conditions of the country's economy and on the percentage of insurance products in the GDP. Such a study by Ward & Zurbruegg (2000) indicated that the insurance industry in some OECD countries promotes economic growth and is counterproductive in other countries. In 77 economies for the period 1994-2005, Han et al., (2010) showed that the insurance sector played a more important role in developing economies compared to developed economies.

Chang et al. (2014) revealed that economic growth expanded insurance activities in France, Japan, the Netherlands, Switzerland, Canada, Italy, the United Kingdom and the United States of America. While no relationship was found between insurance activities and economic growth in Belgium. In a similar study by Alhassan, (2016) demonstrated the long-run relationship between insurance and economic growth in Morocco, Kenya, Mauritius, Nigeria and South Africa. The causality test also indicated the existence of a unidirectional causal relationship from the insurance to economic growth, with the exception of Morocco, where a bidirectional causal relationship was found. The study also found a unidirectional causal relationship for Algeria and Madagascar, while a mixed causal relationship exists in Gabon. For 86 developing countries. Sawadogo et al. (2018) showed that life insurance has a positive effect on economic growth; this effect varies according to the structural characteristics of countries. Thus, the positive impact of the insurance development decreases with the levels of deposit interest rate, bank credit and stock market value traded, the effect increases even more in low- and middle-income countries and countries with high-quality institutions.

Peleckienė et al. (2019) showed that insurance sector development is higher in rich countries, such as the United Kingdom, Denmark, Finland, Ireland, France and Netherlands. The results showed a positive correlation between insurance and economic growth in Luxembourg, Denmark, Netherlands and Finland. While the relationship was negative in Austria, Belgium, Malta, Estonia and Slovakia. The results show a unidirectional causality, from GDP to insurance in Luxembourg and Finland. Conversely, unidirectional causality from insurance to GDP in the Netherlands, Malta and Estonia. In the case of Austria, there is a bidirectional causal relationship between insurance and GDP. The analysis showed no causal relationship between insurance and economic growth in Slovakia. Din et al. (2020) found that the relationship between insurance and economic growth varies across countries due to factors such as the diversity of insurance products, religious and cultural traditions, education, and government participation.

Dash et al. (2018) used three different indicators of insurance market: life insurance penetration, non-life insurance penetration, and overall insurance penetration in 19 countries in the Eurozone. The results showed a unidirectional and bidirectional causal relationship between insurance market penetration and economic growth. The results are not uniform across the Eurozone countries. The study suggested that economic policies have to recognize the differences in the insurance market between economies to maintain economic growth

Lee et al. (2019) relied on data from 123 countries. The results showed that the relationship between insurance development and economic growth differed across countries due to different income levels and locations. The effect of insurance on a country's economic growth is indirect and depends on the performance of insurance companies' investment. Therefore, policymakers should consider the characteristics of their country and the nature of their insurance sector such as the interconnectedness between the financial sector and the insurance sector, to strengthen the insurance sector and stimulate economic growth.

Some empirical studies distinguished between the effect of the two types of insurance, as it distinguished between the effect of life and non-life insurance, the results were mixed. Some studies have found that both life and non-life insurance have a positive contribution to economic growth Arena, (2008) in 55 countries, Din et al. (2017a) in the USA, the UK, China, India, Malaysia and Pakistan. Others have found that life insurance increases economic growth Asongu & Odhiambo (2019) in Africa, Din et al. (2017a) in India, Pakistan and the UK, Din et al. (2017b) in 20 countries for the period 2006-2015. Ching et al. (2010) suggested that life insurance in Malaysia could be an effective financial intermediation to generate long-run savings to fund investments, and ultimately it could boost economic growth. On the other hand, other researchers found that non-life insurance boosts economic growth Din et al. (2017a) for the USA, the UK, China, India, Malaysia and Pakistan (Iyodo et al., 2018; Iyodo et al., 2020; Fashagba, 2018) in Nigeria.

Others have proven that life insurance hinders economic growth, Fashagba (2018) in Nigeria. Din et al. (2017a) of the USA, China and Malaysia. Likewise, Zouhaier (2014) demonstrated a positive effect of non-life insurance, as measured by insurance penetration on economic growth in 23 OECD countries, and a negative effect of total and non-life insurance, measured by insurance intensity on economic growth. Din et al. (2017b) emphasized that non-life insurance is more important for developing countries than for developed countries. Cristea et al. (2014) concluded that there is greater importance of life insurance than non-life insurance in Romania. Senol et al. (2020) also suggested that the life insurance industry further stimulates economic growth by providing long-run resources

Methodology

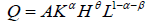

In estimating the empirical relationship between the insurance activities and economic prosperity in Saudi Arabia, this study follows Haiss & Sumegi (2008) and Oitsile et al. (2018). which adopted an endogenous growth model with a modified Cobb-Douglas production function. This function attempted to present a simplified view of the economy. In this function, the determination of the output (Q) depends on labor (L) and capital (K). This function assumes the use of only two factors of production, labor and capital, as follows:

Q = f (K,L)

It can be rewritten as follows:

The function is expanded as follows (Haiss & Sumegi, 2008)

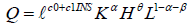

Where Q: the output (gross domestic product), A: represents technological progress, K is physical capital, H stands for human capital and L stands for labor force. Haiss & Sumegi, (2008) explained that the availability of insurance services can make business participants accept higher risks, which in turn can support technical innovation and technological advancements that can affect economic growth. Therefore, insurance enters into the production function through technological progress by improving the efficiency of both capital and labor. Distinguish technological developments into a fixed component and an insurance component as follows:

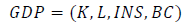

Where; (INS) it represents insurance penetration. Then extended the model with control variables. Following Arena, (2008), adding bank credit to the private sector in the economic model to represents the financial sector development. Bank credit is the main source of investment financing and thus affects aggregate demand, which ultimately boosts economic growth. Therefore, the extended model is expressed as:

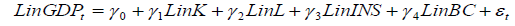

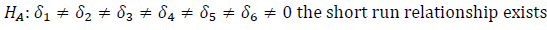

The economic model has been converted to logarithmic form to facilitate the estimation and interpretation of the regression coefficients.

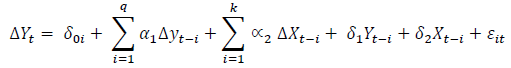

To assess the short and long-run relationships between the insurance sector and economic prosperity, this study applies the Autoregression Distributed lags approach (ARDL) suggested by Pesaran & Shin (1998) and Pesaran et al. (2001). The ARDL approach has several advantages (Nkoro & Uko, 2016) the ARDL bound test procedure Applicable regardless of whether the regression variables are I (0), (1), or both. Additionally, it can be used for small sample sizes. ARDL is a linear time series models where both the dependent variable and the explanatory variables are related not only concurrently, but also with their lagging values. The general form of the ARDL approach as proposed by Pesaran & Shin (1998) is as follows:

Where Xs are the explanatory variables, and Y is the dependent variable, `q and k are the numbers of maximum lag order in the ARDL model. The maximum lag lengths of q and k for the dependent and explanatory variables, respectively. The ARDL bound test approach is to redefine the economic model as error correction model:

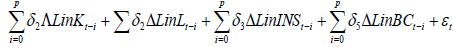

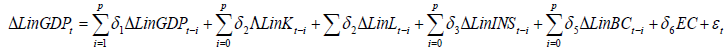

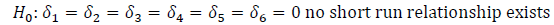

Where (δ1 – δ5) represent the coefficients of short run dynamics relationships of the underlying variables in the model. ε is the speed of short run adjustment of the model’s convergence to long run equilibrium, the error correction term (ECT). The short-run coefficients can then be derived from the following corresponding error correction model:

The null and alternative hypotheses are as follows:

Against the alternative hypothesis

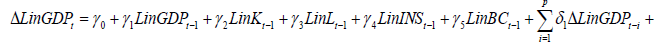

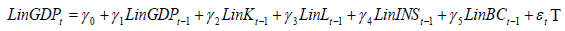

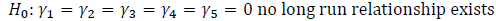

Where (γ1 – γ5) represent the coefficients of the long-run relationships, p is the lag order of the variables are defined as before. The bounds test for the absence of any level relationships between the dependent and independent variables is through the exclusion of the lagged level variables. That is, it involves the following null and alternative hypotheses

The null and alternative hypotheses are as follows:

Against the alternative hypothesis

The study employs annual secondary data from different sources including Saudi Central Bank and other sources. The dependent variable is economic growth measured by Gross Domestic Product (GDP). While the independent variables are insurance sector development proxy with insurance penetration, gross-fixed capital formation, labour, and financial development measured by the bank credit to private sector. The data cover a period from 2000 to 2019 depending on availability of data. The study adopts ARDL approach for data analysis.

Emperical Results and Interpretations

The unit roots test is not necessary in the ARDL bound approach, but it is important to ensure that the underlying variables are not I (2), which may render the ARDL inapplicable. This study apples Phillips & Perron (1988) approach to test the unit roots. Table 1 shows the results of the unit root test for stationary. The results show that all variables at its level non-stationary, but stationary at their first differences. None of the variables is I (2), therefore the ARDL applicable for the underlying variables.

| Table 1 Unit Roots Test |

|||||

| Variable | Level | 1st difference | |||

|---|---|---|---|---|---|

| Intercept | Prob. | Intercept | Prob. | Order of stationary | |

| GDP | -0.740988 | 0.8128 | -3.795644 | 0.0113 | I(1) |

| INS | -0.745997 | 0.8115 | -3.448517 | 0.0227 | I(1) |

| K | -1.349169 | 0.5844 | -3.116634 | 0.0433 | I(1) |

| L | 0.447207 | 0.9796 | -3.857386 | 0.0046 | I(1) |

| BC | -0.090755 | 0.9373 | -3.886751 | 0.0001 | I(1) |

To test the existence of long-run relationships between the dependent variable and the explanatory variables in the model. The results in Table 2 indicate that the calculated F-statistic is 10.56, which is above the upper bound value at all levels of significance. This means that reject the null hypothesis that there is no long run relationship exists, which implies that there is long-run relationship between economic growth and the variables: insurance penetration, gross-fixed capital formation, labour, and the bank credit to private sector.

| Table 2 ARDL Bounds Test Results |

||

| Null Hypothesis: No long-run relationships exist | ||

| Test Statistic | Value | K |

| F-statistic | 10.56374 | 4 |

| Critical Value Bounds | ||

| Significance | I0 Bound | I1 Bound |

| 10% | 2.45 | 3.52 |

| 5% | 2.86 | 4.01 |

| 2.50% | 3.25 | 4.49 |

| 1% | 3.74 | 5.06 |

Estimating the short and long run dynamic relationships by applying the ARDL approach, Table 3 shows the short-run coefficient, the Error Correction Term (ECT) in the economic growth model is negative and statistically significant. The negative value shows that there exists an adjustment speed from short-run disequilibrium towards the long run equilibrium, which means that the economic growth in KSA is converge to its equilibrium due to the changes in the explanatory variables (capital, labor, insurance penetration, bank credit to private sector). The Error Correction coefficient in the equation estimates (-0.40), this statistically indicated that 40% the disequilibrium of long run economic growth adjustment annually. The short-run influence of explanatory variables on economic growth in table (3) shows that capital, has a positive influence and significant on economic growth, The positive effect of capital on economic growth as expected, in theory and practice, as capital accumulation contributes to increasing the productive capacity of the economy and thus achieving economic growth. While the effect of total bank credit to the private sector and labor is positive but insignificant. The study by (Alzyadat, 2021) proved that bank credit to private sector has a significant and positive impact on non-oil economic growth in Saudi Arabia. The insurance penetration has negative influence economic growth in the short run. This results in line with Olayungbo & Akinlo (2016) for Kenya, Mauritius, and South Africa. As well Peleckienė et al. (2019) in Austria, Belgium, Malta, Estonia and Slovakia. Also the study by Oitsile et al. (2018) which found that there is no evidence that insurance penetration affects the short-run economic growth in Botswana. One possible explanation is that insurance may hinder economic growth in the short run; according t to Blum et al. (2002) is to over-emphasize the importance of the financial system’s contribution to real development in theory, and to be surprised by the weak empirical performance of the financial intermediation variables. Moreover, the important role of cash flow may lead to an unexpected short-run experimental bias, as other sources of financing may act as alternatives to self-financing and thus conflict with the business cycle. In addition, the negative relationship between insurance and economic growth can be explained by the growing insurance may cause more moral hazard, leading to a less efficient and more volatile economy (Blum et al., 2002).

| Table 3 ARDL Cointegrating and Short Run Coefficients |

||||

| Dependent Variable: LOG(GDP) | ||||

|---|---|---|---|---|

| Selected Model: ARDL(2, 2, 0, 1, 1) | ||||

| Cointegrating Form | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| DLOG(GDP(-1)) | -0.419225 | 0.154665 | -2.710540 | 0.0302 |

| DLOG(IP) | -0.660966 | 0.059761 | -11.060224 | 0.0000 |

| DLOG(IP(-1)) | -0.303485 | 0.101245 | -2.997520 | 0.0200 |

| DLOG(K) | 0.361309 | 0.145826 | 2.477667 | 0.0424 |

| DLOG(L) | 0.735338 | 0.820754 | 0.895929 | 0.4001 |

| DLOG(BC) | 0.093499 | 0.157783 | 0.592580 | 0.5721 |

| CointEq(-1) | -0.401421 | 0.111688 | -3.594116 | 0.0088 |

Cointeq = LOG(GDP) - (-0.7494*LOG(IP) + 0.9001*LOG(K) -0.3750*LOG(L) + 0.6305*LOG(BC) -12.1129 )

Table 4 indicates that there is evidence that the insurance sector development in KSA contributes to economic prosperity in the long run that a 1% increase in insurance induces a 0.74% increase in economic growth, The result is consistent with some studies, such as Lee et al. (2013) indicated that a 1% increase in the insurance premiums increase economic growth by 0.06%. In addition, Han et al. (2010) showed that a 1% increase in total insurance penetration raises economic growth by 4.8%. The result confirms the view that the insurance sector development contributes to enhancing long run economic growth in KSA. Also the results are consistent with most empirical studies in many developed and developing countries (Curak et al., 2009; Ilhan & Bahadir, 2011; Kjosevski, 2012; Akinlo & Apanisile, 2014; Alhassan & Fiador, 2014; Alhassan, 2016; Devarakonda, 2016; Umoren & Joseph, 2016; Balcilar et al., 2018; Okonkwo & Eche, 2019; Ahmad & Yadav, 2019; Kukaj et al., 2019; Hussein & Alam, 2019; Jana, 2020; Hallam, 2020; Osei-Bonsu et al., 2021). In this context, the results of Alzyadat (2020) indicated a unidirectional causal relationship between GDP and demand for insurance in KSA. Studies have unanimously agreed that the insurance sector development may enhance economic growth, whether it is a financial intermediary or a provider to transfer risks and compensation, by allowing risks to be efficiently managed, encouraging capital accumulation, and mobilizing domestic savings into investments. Moreover, insurance facilitates economic growth by protecting individuals, industry and society from economic losses, reducing fear of losses and encouraging investment.

| Table 4 Long Run Coefficients |

||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| LOG(IP) | 0.749379 | 0.246860 | 3.035638 | 0.0190 |

| LOG(K) | 0.900073 | 0.371935 | 2.419975 | 0.0461 |

| LOG(L) | 0.375029 | 0.841815 | 0.445500 | 0.6694 |

| LOG(BC) | 0.630543 | 0.404704 | 1.558037 | 0.1632 |

| C | -12.112903 | 10.479308 | -1.155888 | 0.2857 |

The influences of capital accumulation on economic growth are positive and statistically significant as expected. A 1 % increase in capital accumulation is associated increase economic growth in KSA by 0.9%. This finding is also consistent with the theory and practice. The coefficient of the labour force is also positive and statistically insignificant. As it shows that, a 1 % increase in labour force increase economic growth by 0.37%. The sum of estimated coefficient of labour and capital are 1.28, which means that the Saudi economy work in light of increasing returns to scale (IRS). That means an increase in the factors of production (labour and capital) by 100% will lead to an increase in the economic growth by 128%. This result is consistent with the recent study by Alzyadat & Almuslamani (2021) that the wholesale and retail trade sector in KSA work in light of increasing returns to scale (IRS).The effect of bank credit provided to the private sector is positive and statistically insignificant. A 1% increase in credit provided by banks to private sector is associated with 0.63% increase in economic growth. This result is consistent with the study by Alzyadat (2021). Bank credit is the main source of investment financing, as expected to enhance aggregate demand and thus promote economic growth (Oitsile et al., 2018).

Conclusions and Policy Implications

This study employs ARDL approach within the framework of the production function to investigate the effect of the insurance sector development on economic growth in Saudi Arabia during the period 2000-2019. The ARDL bounds test found a long run relationship between economic growth and insurance sector insurance development, gross-fixed capital formation, labour, and the bank credit to private sector. The Error Correction Term (ECT) in the model is negative and statistically significant. which means that the economic growth in KSA is converge to its equilibrium due to the changes in the explanatory variables (capital, labor, insurance penetration, bank credit to private sector) indicated that 40% the disequilibrium of long run economic growth adjustment annually.

The coefficients of explanatory variables on economic growth show that capital accumulation contributes to increasing the economic growth in the short and long run. While the effect of total bank credit to the private sector and labor on economic growth are positive in the short and long run but insignificant.

The results showed that the insurance sector development negatively affects economic prosperity in Saudi Arabia in the short run, with a positive effect in the long run. The insurance sector does not play an important role in the economic prosperity in the short run, but in the long run, the insurance sector is considered as a productive factor. In this case, it can be said that the insurance sector in KSA is a supply leading in the long run. It is noteworthy that insurance sector development enhances economic prosperity through achieving financial system stability, which is strengthened by the compensation provided by insurance companies for any damage in the production process because of insured events, encouraging investment, providing protection in partnership with the government. In addition to enhancing financial intermediation, creating liquidity and savings through insurance products, and strengthening corporate risk prevention, thus promoting economic growth. The study recommends increasing the contribution of the insurance sector to the GDP in Saudi Arabia and not considering insurance as luxury expenditure, but a type of effective protection for companies, individuals and the economy. Besides encouraging saving and investment, in order to achieve economic prosperity.

Acknowledgement

The authors extend the appreciation to the Deanship of Post Graduate and Scientific Research at Dar Al Uloom University for supporting and funding this research.

References

Ahmad, I., & Yadav, A. (2019). Impact of insurance sector on economic growth: A case of India. ZENITH International Journal of Multidisciplinary Research, 9(4), 332-340.

Akinlo, T., & Apanisile, O.T. (2014). Relationship between insurance and economic growth in Sub-Saharan African: A panel data analysis. Modern Economy, 5(2). 120-127.

Alhassan, A.L. (2016). Insurance market development and economic growth. International Journal of Social Economics. 43(3), 321-339.

Alhassan, A.L., & Fiador, V. (2014). Insurance-growth nexus in Ghana: An autoregressive distributed lag bounds cointegration approach. Review of Development Finance, 4(2), 83-96.

Alzyadat, J.A. (2020). Macroeconomic environment effects on demand for insurance in Saudi Arabia: An empirical analysis. International Journal of Management, 11(8). 148-162.

Alzyadat, J.A. (2021). Sectoral banking credit facilities and non-oil economic growth in Saudi Arabia: Application of the Autoregressive Distributed Lag (ARDL). The Journal of Asian Finance, Economics, and Business, 8(2), 809-820.

Alzyadat, J.A., & Almuslamani, M.S. (2021). The role of technological progress in the distribution sector: evidence from saudi arabia wholesale and retail trade sector. Journal of Distribution Science, 19(3), 15-23.

Apergis, N., & Poufinas, T. (2020). The role of insurance growth in economic growth: Fresh evidence from a panel of OECD countries. The North American Journal of Economics and Finance, 53, 101217.

Arena, M. (2008). Does insurance market activity promote economic growth? A cross‐country study for industrialized and developing countries. Journal of risk and Insurance, 75(4), 921-946.

Asongu, S.A., & Odhiambo, N.M. (2019). Insurance policy thresholds for economic growth in Africa. The European Journal of Development Research, 32, 672-689.

Balcilar, M., Gupta, R., Lee, C.C., & Olasehinde-Williams, G. (2018). The synergistic effect of insurance and banking sector activities on economic growth in Africa. Economic Systems, 42(4), 637-648.

Blum, D.N., Federmair, K., Fink, G., & Haiss, P.R. (2002). The financial-real sector nexus: theory and empirical evidence. Research Institute for European Affairs Working Paper, (43).

Chang, T., Lee, C.C., & Chang, C.H. (2014). Does insurance activity promote economic growth? Further evidence based on bootstrap panel Granger causality test. The European Journal of Finance, 20(12), 1187-1210.

Ching, K.S., Kogid, M., & Furuoka, F. (2010). Causal relation between life insurance funds and economic growth: evidence from Malaysia. ASEAN Economic Bulletin, 185-199.

Cristea, M., Marcu, N., & Cârstina, S. (2014). The relationship between insurance and economic growth in Romania compared to the main results in Europe–a theoretical and empirical analysis. Procedia Economics and Finance, 8, 226-235.

Curak, M., Loncar, S., & Poposki, K. (2009). Insurance sector development and economic growth in transition countries. International Research Journal of Finance and Economics, 34(3), 29-41.

Dash, S., Pradhan, R.P., Maradana, R.P., Gaurav, K., Zaki, D.B., & Jayakumar, M. (2018). Insurance market penetration and economic growth in Eurozone countries: Time series evidence on causality. Future Business Journal, 4(1), 50-67.

Devarakonda, S. (2016). Insurance penetration and economic growth in India. FIIB Business Review, 5(3), 3-12.

Din, S.M. U., Abu-Bakar, A., & Regupathi, A. (2017b). Does insurance promote economic growth: A comparative study of developed and emerging/developing economies. Cogent Economics & Finance, 5(1), 1390029.

Din, S.M.U., Regupathi, A., & Abu-Bakar, A. (2017a). Insurance effect on economic growth–among economies in various phases of development. Review of International Business and Strategy. 27(4), 501-519.

Din, S.M.U., Regupathi, A., Abu-Bakar, A., Lim, C.C., & Ahmed, Z. (2020). Insurance-growth nexus: A comparative analysis with multiple insurance proxies. Economic Research-Ekonomska Istraživanja, 33(1), 604-622.

Fashagba, M.O. (2018). The impact of insurance on economic growth in Nigeria. Afro Asian Journal of Social Sciences, 9(1), 1-10.

Haiss, P., & Sümegi, K. (2008). The relationship between insurance and economic growth in Europe: a theoretical and empirical analysis. Empirica, 35(4), 405-431.

Hallam, Z. (2020). Impact of insurance on economic growth in Algeria during the Period 1990-2017. Dirassat Journal Economic Issue, 11(1), 521-530.

Han, L., Li, D., Moshirian, F., & Tian, Y. (2010). Insurance development and economic growth. The Geneva Papers on Risk and Insurance-Issues and Practice, 35(2), 183-199.

Hussein, M.A., & Alam, S. (2019). The Role of Insurance Sector in the Development of the Economy of Oman. Global Journal of Economics and Business, 6(2), 356 – 364.

Ilhan, E.G.E., & Bahadir, T. (2011). The relationship between insurance sector and economic growth: An econometric analysis. International Journal of Economic Research, 2(2), 1-9.

Iyodo, B., Samuel, S.E., Adewole, C., & Ola, P.O. (2020). Impact of non-life insurance penetration on the economic growth of Nigeria. Research Journal of Finance and Accounting, 11(2), 40-50.

Iyodo, B.Y., Samuel, S.E., & Inyada, S.J. (2018). Effect of insurance industry performance on economic growth in Nigeria. International of Journal of Business and Finance Management Research, 6, 22-33.

Jana, D. (2020). Role of insurance sector on inclusive growth in India. International Research Journal of Business Studies, 13(2), 139-147.

Kjosevski, J. (2012). Impact of insurance on economic growth: The case of Republic of Macedonia. European Journal of Business and Economics, 4. 34-39.

Kukaj, H., Morina, F., & Misiri, V. (2019). The Effects of the Insurance Market in the Development of Western Balkans Countries, with Special Emphasis on Kosovo. European Journal of Sustainable Development, 8(2), 209-209.

Lee, C.C., Lee, C.C., & Chiu, Y.B. (2013). The link between life insurance activities and economic growth: Some new evidence. Journal of International Money and Finance, 32, 405-427.

Lee, H., Yong, Z., & Lim, Q., (2019). Insurance development and economic growth. Financial Statistical Journal, 1(4).

Nkoro, E., & Uko, A.K. (2016). Autoregressive Distributed Lag (ARDL) cointegration technique: application and interpretation. Journal of Statistical and Econometric Methods, 5(4), 63-91.

Oitsile, B., Galebotswe, O., & Sekwati, L. (2018). Insurance-economic growth nexus: Evidence from Botswana. Asian Economic and Financial Review, 8(6), 843-852.

Okonkwo, I.V., & Eche, A.U. (2019). Insurance penetration rate and economic growth in Nigeria: 1981-2017. International Journal of Social Sciences and Management Review, 2(1), 21-45

Olayungbo, D.O., & Akinlo, A.E. (2016). Insurance penetration and economic growth in Africa: Dynamic effects analysis using Bayesian TVP-VAR approach. Cogent Economics & Finance, 4(1), 1150390.

Osei-Bonsu, A., Abotsi, A.K., & Carsamer, E. (2021). Insurance and economic growth in Ghana. Journal of Economic and Administrative Sciences.

Outreville, J.F. (2013). The relationship between insurance and economic development: 85 empirical papers for a review of the literature. Risk Management and Insurance Review, 16(1), 71-122.

Peleckienė, V., Peleckis, K., Dudzevičiūtė, G., & K Peleckis, K. (2019). The relationship between insurance and economic growth: evidence from the European Union countries. Economic research-Ekonomska istraživanja, 32(1), 1138-1151.

Pesaran, M.H., & Shin, Y. (1998). An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs, 31, 371-413.

Pesaran, M.H., Shin, Y., & Smith, R.J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326.

Phillips, P.C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335-346. Phutkaradze, J. (2014). Impact of insurance market on economic growth in post-transition countries. International Journal of Management and Economics, 44(1), 92-105.

Pradhan, R.P., Dash, S., Maradana, R.P., Jayakumar, M., & Gaurav, K. (2017). Insurance market density and economic growth in Eurozone countries: the granger causality approach. Financial Innovation, 3(1), 1-24.

Satrovic, E. (2019). Meta-analysis of the relationship between life insurance and economic growth. Journal of Yaşar University, 14, 118-125.

Saudi Central Bank, Insurance Market Report. (2019). https://www.sama.gov.sa/ar- sa/Insurance/Pages/Publications.aspx

Sawadogo, R., Guerineau, S., & Ouedraogo, I. M. (2018). Life insurance development and economic growth: Evidence from developing countries. Journal of Economic Development, 43(2), 1-28.

Senol, Z., Zeren, F., & Canakci, M. (2020). The relationship between insurance and economic growth. Montenegrin Journal of Economics, 16(4), 145-155.

Umoren, N.J., & Joseph, E.M. (2016). Relative contributions of the insurance industry to the growth of the Nigerian economy. International Journal of Emerging Research in Management & Technology, 5(6), 189-198.

Ward, D., & Zurbruegg, R. (2000). Does insurance promote economic growth? Evidence from OECD countries. Journal of Risk and Insurance, 489-506.

Zouhaier, H. (2014). Insurance and economic growth. Journal of Economics and Sustainable Development, 5(12), 102-112.