Research Article: 2022 Vol: 26 Issue: 2S

The Role of Environmental Disclosure in Enhancing the Market Value of Industrial and Service Companies Listed on the Palestine Stock Exchange

Bahaa Sobhi Awwad, Palestine Technical University- kadoorie.

Abstract

The purpose of this study is to identify the extent to which industrial and service companies listed on the Palestine Stock Exchange are committed to environmental disclosure during the period 2010-2019 and its role in enhancing their market value. An analytical descriptive approach was followed and the necessary data was collected from reports and financial statements of those companies. The study sample consisted of 22 industrial and service companies due to direct repercussions of their activities on the environment. The results of the study indicate a decrease in the general average of the environmental disclosure index for those companies; it amounted to (48%) which means that most of the companies under consideration do not commit to voluntary disclosure of environmental information related to their operations. The results also show a strong, positive, however, not statistically significant correlation between environmental disclosure and market value. In light of these results, the study recommends the need for companies to adopt various policies that help reduce the negative effects of their activities towards the environment and raise awareness of the importance of environmental matters in enhancing their market reputation which, in turn, affects performance and raises their market value. The researchers also recommend that these companies should develop mandatory mechanisms for disclosing environmental information from the competent authorities that all Palestinian companies abide by.

Keywords

Environmental Disclosure, Market Value, Palestine Stock Exchange

Introduction

Environmental issues have become one of the most important topics that impact and preoccupy the world; they have received great attention in recent years in various societies and countries especially in the aftermath of the many risks that have affected the environment as a result of technological and industrial development. Recently, attention to the environment has become an international issue. For example, in 1972, the United Nations held a conference in Stockholm on the Human Environment; another conference on Environment and Development was held in Rio de Janeiro in 1992. These conferences together with other activities have formed the so-called "modern truth" of international environmental law (Benny Domi, 2020).

In the context of countries’ efforts to preserve the environment and protect society, the establishments must contribute with the countries they are located in to this, and they are supposed to develop programs to control the environmental pollution elements arising from the exercise of their activities within the community. Thus, they must disclose the information related to environmental affairs as well as the returns and obligations that they bear as a result of exercising their effective activities in the environment, especially because the need for environmental information has become a necessity in each society and the stakeholders there (Al-Nabulsi, 2011). Environmental disclosure leads to meeting the needs of the parties involved in the project for financial information that helps them assess the efficiency of the establishments with regard to the use of their economic resources and the extent to which they fulfill their responsibilities towards protecting the environment and preserving it from pollution (Hassan, 1999).

As a result, the main objective of the current study is to address the role of disclosing the (green accounting to show the impact of the enterprise's activities on the environment, (El-Sayed, 2013)) for industrial and service companies listed on the Palestine Stock Exchange in enhancing their market performance and its reflection on their market value. The study is deemed significant mainly because it relates to and investigates the activity and practices, of these companies, that increase environmental pollution. Thus, it was necessary to know the extent to which these companies comply with disclosure requirements and their interest in environmental matters and the impact of this on its reputation, performance, and then market value.

Theoretical Framework and Previous Studies

The problem of misuse of natural resources and environmental degradation has become one of the biggest problems facing developing countries. Environmental issues resulting from the practice of economic activity of industrial companies have received more attention from researchers and scholars. Great attention has been directed towards the negative effects resulting from pollution caused by these companies in its various forms such as (Pollution of air, water, soil ... etc.). This, by turn, has forced the societies where these companies exist to act in a more responsible manner. All parties want to know the extent of the impact of these units on the environments in which they operate in order to modify their performance by taking appropriate decisions (Al-Ajmi, 2017). The role of environmental disclosure in institutions is also considered as a means of informing stakeholders of environmental and social goals through the preparation of environmental reports that face great challenges in light of the multiplicity of social, political and cultural pressures (Balqacem & Zargoun, 2020).

Environmental disclosure has been tackled and defined differently by many by researchers; the most important of these definitions comes from (Al-Siddiq, 2009) who states that environmental disclosure is “a set of information items related to the performance of the company’s environmental management activities and the financial implications thereof in the past, present and future.” According to (Bani Doumi, 6, 2020) environmental disclosure is “the process of displaying and evaluating data and information related to the environmental activities of business establishments in the financial statements so that it serves and facilitates the work of information users and decision makers and leads to rationalizing their decisions when evaluating the environmental performance of these establishments.” The United Nations Environmental Protection Committee (UNEP, 1992) identified the most important objectives assumed for the disclosure of environmental information by saying that it constitutes an excellent database for conducting studies on the environmental impacts of similar industries. It helps in identifying problems related to the source and composition of contaminated excreta. It also helps in reducing and, to some extent, eliminating fear for the company's management about the safety of operations and the efficiency of environmental protection measures especially when the owners of these companies are informed of the nature and extent of their responsibilities and their contribution with the management in reducing those costs at an early stage. The decision-makers need to be reassured that these additional costs are justified by the advantages of protecting the environment. Moreover, Al-Tamimi & Al-Khashali (2007) have argued that disclosure of environmental information results in more confidence and trust in the information provided to users of financial statements to rationalize their decisions in light of contemporary environmental changes and their magnitude, on the one hand, and the environmental legislation binding on them, on the other hand. (Al-Sayed, 2013) has also stressed that the awareness of decision makers of the importance of accounting disclosure about environmental performance supports the competitive capabilities of economic units; additionally, the disclosure of environmental costs in the adjusted profit list fits the needs of users to rationalize decisions. Finally, environmental disclosure helps users and regulators in evaluating the performance of economic units.

According to (Murray et al., 2016), there are different trends and dimensions in the field of disclosure of environmental performance in terms of the scope of disclosure and it is divided into: first, disclosure of environmental costs only without disclosing the value of environmental benefits due to the difficulties encountered in measuring those benefits. In such a case, disclosure can be made in the financial and conventional statements or in separate reports. Second: Disclosure of each of the environmental costs and benefits whether in independent reports or within the traditional lists. While in terms of the form of disclosure, (Maliah et al., 2014) have postulated that they can be (a) descriptive reports in which the environmental performance is disclosed in the form of structural descriptive; (b) quantitative descriptive or quantitative reports which usually contain quantitative information about environmental performance such as the amount of emissions; (c) financial reports that entail obtaining the environmental performance in financial form that enables the determination of the cost and return on the environmental activity. With regard to the disclosure site, (Nile, 2015) has showed that environmental performance is disclosed within environmental reports independent of the financial statements and their appendices; they are also likely to be located within the social reports of the organization and it has three types of reports. First, there are descriptive reports on social and environmental performance; second, there are also reports on social and environmental costs. And finally, there are reports on the profit adjusted for costs of social and environmental performance. Abu Zaid (2007) has mentioned several reasons that help environmental disclosure. For example, the environmental issues began to increase and they needed to be discussed in projects since 1990; the increasing needs of shareholders for environmental data and its importance in their investments has recently become a necessity. In addition, environmental disclosure was not required in the past by local or international legislative rules, so the accounting profession did not pay attention to it except in recent years.

Based on these premises, many studies have established links between the benefits of environmental disclosure and performance evaluation of the companies. For instance, the study of (Fouda et al., 2019) was carried out with the aim of identifying the impact of disclosure of environmental information on the value of the facility, the researchers have carried out a case study on Sidi Kerir Petrochemical Company. The study findings showed that environmental disclosure has resulted in double benefits for the company itself and for the various entities that use environmental information which will be able to rationalize their investment decisions in light of their reliance on information. The study also showed that environmental disclosure has a positive impact on society's acceptance of the facility which is manifested in their quest and search for buying its products and also in the expansion of its investments. The study conducted by (Bani Doumi, 2020) confirmed that Jordanian industrial companies carry out environmental disclosure at a rate of (16.7%) on average, and this indicates that the level of environmental disclosure in these companies was low. The study findings also showed that there is a positive relationship between the levels of environmental disclosure in the annual financial reports of public shareholding companies, on the one hand and the financial leverage ratio, the foreign shareholders’ ownership ratio, and the ownership ratio of board members, on the other hand. However, the researcher found a negative relationship between the size of the company and the nature of its activity, and the levels of disclosure in the annual financial reports of the Jordanian industrial public shareholding companies.

Similar results were found by (Qasim, 2017) who studied Jordanian companies. The study findings showed that most Jordanian companies do not adhere to environmental disclosure, and there are no environmental laws and legislations that stimulate environmental disclosure due to the fact that there is noticeable shortage or lack in sufficient knowledge and skill for the accounting department staff in environmental disclosure. Qasin (2017) also found that there is no significant impact of environmental laws and legislation, environmental administrative and regulatory procedures, and return on shareholders’ equity on the elements of financial performance.

With regard to Kuwaiti industrial companies, the study conducted by (Al-Ajmi, 2017) showed that there is no impact of environmental accounting disclosure on the decisions of the investors regarding environmental procedures and activities, environmental accounting procedures, and environmental assets, liabilities and costs. These companies must disclose environmental procedures and activities within their financial statements; they should also increase transparency in accounting information, and not be misled while continuing to follow the accounting procedures related to their affairs. As for the companies listed on the Egyptian Stock Exchange, the study of Al Hoshi (2017) concluded that there is a positive and moral impact of the level of disclosure of corporate social responsibility in its environmental and social dimensions on both the company’s value and stock liquidity, and therefore companies should be encouraged to participate in social responsibility activities, especially the environmental activities in addition to establishing mechanisms to encourage companies to disclose and show the extent to which they fulfill their social responsibilities.

And whether the level of disclosure of environmental information practiced by companies listed on the Brazilian stock market affects their profitability and value, the study carried out by Pedron, et al., (2021) showed that the level of disclosure of environmental information does not reflect on profitability and value and that disclosure by most of the sample companies was weak; therefore, significant differences in the characteristics of the companies that disclose and those that do not disclose environmental information were found.

The study done by Gerged, et al., (2020) was meant to examine the relationship between the environmental disclosure of companies and the value of the companies that work in the Gulf Cooperation Council countries; the study results showed that, the environmental disclosure was increasing from its low base as compared with indicators of the previous years. The study results also indicated that the environmental disclosure is significantly and positively related to the fair value, which was measured using Tobin's Q (TBQ). Finally, the researchers found that there is a weak positive relationship between environmental disclosure and return on assets. In China, public concern about environmental problems has led to the need to adhere to environmental regulations in disclosing corporate information on environmental practices. The study conducted by Yang, et al., (2020) aimed to measure the impact of environmental information disclosure on the fixed value of manufacturing companies in China during the period 2006-2016 The main study results showed that the disclosure of environmental information has a significant impact on the value of listed manufacturing companies, and disclosures of environmental information play a more important role in the value of non-state-owned enterprises than state-owned enterprises. Furthermore, using the PSM-DID model for East, Central and West China, the same study found that disclosure of environmental information significantly affects company value in East and West China but has little impact on Central China. In Italy, a study was carried out by Fazzini & Maso (2016) with the aim to provide an insight into how environmental information is reflected in the market value and the importance of the value of voluntary environmental information disclosed by companies. The study was based on the degree of environmental disclosure (i.e., the company's transparency in reporting environmental information) and the practice of assertion (i.e., whether the company's environmental policies are subject to independent evaluation for the reporting period or not). The study findings confirmed that voluntary environmental disclosure represents value-related information and is positively related to the market value of companies. Furthermore, when such information is subject to an independent evaluation for the reporting period, no additional benefit can be found to result from ensuring such information.

As for the study carried out by Setiadi, et al., (2017) which aimed to examine the impact of the independence of the board of directors and environmental disclosure on the value of 134 companies in Indonesia during the period 2009-2013, the researchers concluded that both the independence of the board of directors and environmental disclosure significantly affect the value of the company. Also, the study of Nor, et al., (2016) sought to verify the existence of an effect between environmental disclosure and the financial performance of 100 companies in terms of market value in Malaysia for the year 2011. The analysis of data showed mixed results due to the existence of environmental disclosure practices in Malaysia. The study findings showed that development in environmental accounting and expansion of the social focus towards the environment is always increasing although there are no regulations and legal requirements for companies in Malaysia to urge them to disclose the environment. However, there is still a need for environmental disclosure if companies want to add legitimacy to their position among society and here the role of regulators to facilitate the provision of such information emerges. Another study was carried out by Okpala & Iredele (2018) and showed a significant negative relationship between social and environmental disclosure and the market value of eighty-four Listed companies in Nigeria during the period between 2011 to 2016.

In light of the above reviewed literature, the topic of studying the relationship between the environment and the performance of the business sector has received great attention from many international organizations, countries and researchers. Many companies around the world have developed a set of policies aimed at preserving the environment. Also, the environmental disclosure by companies is a commitment to the members of society and this will increase confidence in the mutual relationship between them. Therefore and based on the results of the previous literature, the researchers of the current study have noticed the discrepancy in the extent of adherence to the environmental disclosure of companies; they ranged between positive, mixed and negative. Consequently, in this study the extent of commitment of industrial and service Palestinian companies will be investigated. In other words, the main objective of this study is identify the extent of commitment of Palestinian companies to environmental disclosure and its impact on enhancing the market value of these companies.

Study Methodology

In this part of the study, we will address the identification of the study population and sample, variables, hypotheses as well as research methodology. In order to achieve the objectives of the field study on industrial and service companies listed in the Palestine Stock Exchange, data from financial reports related to environmental disclosure and market value was collected, and then the researchers used of Statistical Packages for Social Sciences (SPSS) to analyze data in a practical analytical aspect to interpret the results of the study.

Study Population

The study population consisted of (46) companies listed on the Palestine Stock Exchange according to the data of the Monetary Authority and the Palestine Stock Exchange for the year 2021. The companies are shown in Table 1 below.

| Table 1 Study Population |

|

|---|---|

| Sector | Number of companies |

| Services | 9 companies |

| Insurance | 7 companies |

| Banks | 7 companies |

| Industry | 13 companies |

| investment | 10 companies |

| Total | 46 companies |

Source: The Palestine Monetary Authority and Palestine Stock Exchange, 2021

Study Sample

All industrial and service companies listed on the Palestine Stock Exchange were chosen

by the researchers during the period 2010-2019 because their activities are directly related to the environment. Thus, the sample size was (22) companies as shown in Table 2.

| Table 2 Study Sample |

|

|---|---|

| Birzeit Pharmaceutical Company ((BPC) | Jerusalem for Medical Products (JPH) |

| Vegetable Oil Industries Company (VOIC) | Palestine Poultry Company (AZIZA) |

| Dar Al-Shifa Pharmaceutical Company | Beit Jala Pharmaceutical Company |

| Golden Wheat Mills (GMC) | Jerusalem Cigarette Company (JCC) |

| Arabia for the Manufacture of Paints (APC) | National Aluminium and Profiles Industry (NAPCO) |

| National Carton Industry Company (NCI) | Palestine Plastic Industries Company (PPIC) |

| Al Sharq Electrode Company | Palestinian Telecommunications ( PALTEL) |

| Wataniya Palestinian Telecom Mobile (Ooredoo) | Palestinian Electric ( PEC ) |

| National Towers Company (ABRAJ) | The Arab Hotels Corporation (AHC) |

| Ramallah Summer Resorts (RSR) | Nablus Specialized Hospital |

| Palestinian Distribution & Logistics (WASSEL) | Pal Aqar Company for Real Estate Development & Management L.T.D |

Source: The Palestine Monetary Authority and Palestine Stock Exchange, 2021

Study Variables

The study relied on testing the data collected from the reports and financial statements of the study sample companies listed on the Palestine Stock Exchange during the period between 2010- 2019 in order to clarify the effect of the independent variable represented by environmental disclosure. If the listed companies disclose one of the following axes (the presence of quantitative data related to environmental performance in the financial statements, the presence of a descriptive disclosure of information related to environmental performance, the presence of special and detailed reports that include information on environmental performance, the presence of electronic disclosure on the Internet about environmental performance) during one year, the company is given (1), and if the company do not disclosed, it is given (0) (Saidi, 2014). On the other hand, the dependent variable in this study is represented by the market value of the company and it will be measured using the following equation:

Market value=ordinary share price on the 31st December at the end of each year X the number of ordinary shares subscribed (Al-Amri, 2010; James, 2006).

Hypotheses and Study Model

The main problem of this study lies in answering the following question: To what extent are the industrial and service companies listed on the Palestine Exchange committed to environmental disclosure? What is the type of relationship between the environmental disclosure of these companies and their market value? Accordingly, the main hypothesis of the study can be formulated as follows:

H01: There is no statistically significant effect of environmental disclosure on the market value of industrial and service companies listed on the Palestine Stock Exchange.

To clarify the effect between the independent variable and the dependent variable, a model was built for the study as follows:

MVit=B0+B1EDit+eit

Whereas:

MVit: is the dependent variable: market value

EDit: is the independent variable: environmental disclosure

eit: It is the extent of the random error due to the fact that the model equation does not include the rest of the variables affecting MVit

B0: It is the constant regression coefficient that represents the value of the dependent variable when the independent variable has no effect.

B1: is the regression coefficient of the EDit variable which represents the extent to which the EDit variable affects the dependent variable MVit

Statistical Analysis and Hypothesis Testing

Descriptive Analysis

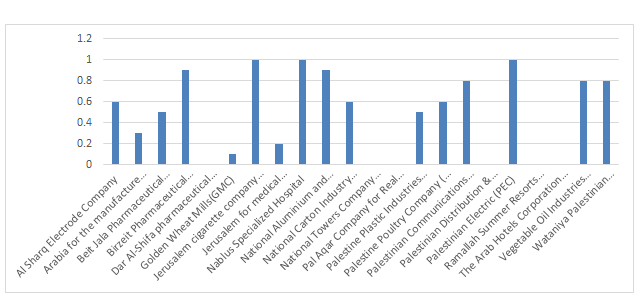

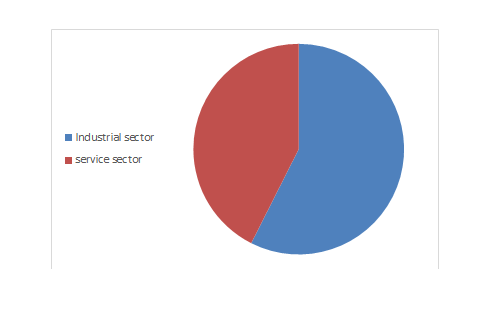

It is evident from Table (3) and Figure (1) below that the environmental disclosure rate ranged between 0%-100%. Some companies (e.g., Dar Al-Shifa Pharmaceutical Company, National Towers Company, Arab Hotels Corporation, Ramallah Summer Resorts, Palestinian Distribution and Logistics Services, Pal Aqar Company for Real Estate Development & Management L.T.D) valued at 0% on the environmental disclosure index during the study period, while the companies (Jerusalem Cigarettes Company, Palestinian Electricity, Nablus Specialized Hospital) recorded the value of 100% on the same indicator. The environmental disclosure of the sample companies during the study period was 48%, which is generally low, while the average market value of the industrial and service companies listed in the Palestine Stock Exchange ranged between the highest average for Palestinian Telecom (513074250) and the lowest average for Al Sharq Electrode Company (1354500) and the general average market value of the sample companies during the period of the study is (33297620). This reflects the importance of the industrial and services sector in Palestine. Figure 2 confirms that the environmental disclosure index for the industrial sector which is (57.44%) is higher than the environmental disclosure index for the services sector which is (42.56%).

| Table 3 Descriptive Analysis of the Data of Industrial and Service Companies Listed on the Palestine Stock Exchange During the Period 2010-2019 |

||||

|---|---|---|---|---|

| Company | Average market value | Average number of share contributed | Average share price | Company's Environmental Disclosure Index |

| Birzeit Pharmaceutical Company ( BPC) | 73673357.5 | 16936199.2 | 4.205 | 90% |

| Jerusalem for medical products(JPH) | 34489140 | 12812000 | 3.052 | 20% |

| Vegetable Oil Industries Company(VOIC) | 34468000 | 4000000 | 8.617 | 80% |

| Palestine Poultry Company ( AZIZA ) | 37089200 | 13096000 | 2.83 | 60% |

| Dar Al-Shifa pharmaceutical company | 30200000 | 8700000 | 3.3 | 0% |

| Beit Jala Pharmaceutical Company | 10710000 | 5150000 | 1.33875 | 50% |

| Golden Wheat Mills(GMC) | 11235000 | 1500000 | 0.749 | 10% |

| Jerusalem cigarette company(JCC) | 10155000 | 9700000 | 1.092 | 100% |

| Arabia for the manufacture of paints(APC) | 6382500 | 1500000 | 4.255 | 30% |

| National Aluminium and Profiles Industry (NAPCO) | 7980696 | 6251400 | 0.715 | 90% |

| National Carton Industry Company(NCI) | 4720000 | 5000000 | 0.944 | 60% |

| Palestine Plastic Industries Company (PPIC) | 7413000 | 7000000 | 1.059 | 50% |

| Al Sharq Electrode Company | 1354500 | 750000 | 1.806 | 60% |

| Palestinian Communications( PALTEL) | 513074250 | 96086250 | 5.077 | 80% |

| Wataniya Palestinian Telecom Mobile( ooredoo) | 34636500 | 60630000 | 0.895 | 80% |

| Palestinian Electric ( PEC ) | 77280000 | 6000000 | 1.288 | 100% |

| National Towers Company (ABRAJ) | 12255000 | 10700000 | 1.144 | 0% |

| The Arab Hotels Corporation (AHC) | 17200000 | 25000000 | 0.688 | 0% |

| Ramallah Summer Resorts (RSR) | 10914000 | 3700000 | 2.951 | 0% |

| Nablus Specialized Hospital | 7513600 | 6080000 | 1.358 | 100% |

| Palestinian Distribution & Logistics (WASSEL ( | 8905000 | 8450000 | 0.918 | 0% |

| Mean | 1528597.73 | 2514141 | 0.608 | 0% |

Figure 1: Environmental Disclosure Index of Industrial and Service Companies Listed on the Palestine Stock Exchange Between the Years 2010-2019

Figure 2: A Comparison Between the Industry and Services Sector for the Environmental Disclosure Index During the Period 2010-2019

Pearson Correlation Matrix

Table (4) Shows the correlation between the study variables; the test used is called the zero test or the correlation coefficient matrix. It indicates the strength of the correlation between the factors, that is, increasing one variable leads to a greater increase in the other variable, but in scientific research it is not possible to rely on this test to explain the results completely as they are primary indicators that may change in the regression analysis. As it appears from Table 4 below, the study model is free of correlation problems because the independent variables are appropriately linked to the dependent variable in a way that suits the purposes of the analysis.

| Table 4 Person Correlation Matrix |

||||

|---|---|---|---|---|

| Market value | Number of shares contributed | Price of share | Environmental disclosure | |

| Market value | 1 | |||

| Number of shares contributed | 0.2119 | 1 | ||

| Price of share | 0.4971 | 0.3214 | 1 | |

| Environmental disclosure | 0.5214 | 0.2357 | 0.3649 | 1 |

Model Specification Test

Table 5 shows a Pregibon test to ensure that the model is well described and free from omissions of important elements. The result indicates that the model is well defined, and no important elements representing the dependent factor are omitted or missed. The results of this test show that Hatsq is higher than 5%, which means that the model is well defined. The table also shows that the outliers test - and through the result obtained - shows that there are no extreme values and significantly different from the rest of the data, so the model is free from the problems of divergent values. In other words, the data are distributed normally; and statistically Skewness ratios should not exceed 4 and Kurtosis ratios should not exceed 1.

| Table 5 Pregibon, Skewness, and Kurtosis Tests |

||||

|---|---|---|---|---|

| Test | Coef. | P>|t| | T | Std. Err. |

| Hat | 0.3664 | 0.003 | 3.25 | 0.0245 |

| Hatsq | 0.7125 | 0.678 | 0.69 | 0.1638 |

| Cons | 0.1328 | 0.844 | 0.33 | 0.0365 |

| Kurtosis | Skewness | |||

| 0.745 | 2.975 | Market value | ||

| 0.751 | 3.144 | Environmental disclosure | ||

Hypothesis Testing

After confirming the model description tests, we will test the main hypothesis of the study, which states that there is no statistically significant effect of environmental disclosure on the market value of industrial and service companies listed on the Palestine Stock Exchange. Table 6 shows that the T-Value=1.67 is not significant at the significance level P=0.257 ≥ 0.05, the F-Value=1.362, and the Adjusted R^2=0.017. This means that the independent variable (environmental disclosure) has no explanatory power for the market value of industrial and service companies listed on the Palestine Stock Exchange. Therefore the null hypothesis which states that there is no statistically significant effect of environmental disclosure on the market value of industrial companies listed on the Palestine Stock Exchange is accepted.

| Table 6 Results of the Regression Test for the Main Hypothesis |

|||||

|---|---|---|---|---|---|

| P-Value | R2 | Adjusted R2 | T-Value | F-Value | |

| Environmental disclosure --Market value | 0.257 | 0.064 | 0.017 | 1.67 | 1.362 |

**: Significant value at the level of significance 0.01 *: Significant value at the level of significance 0.05

Discussion of Findings and Recommendations

The results of the descriptive study support the results of most of the previous studies, including (Bani Doumi, 2020; Nor et al., 2016; Gerged et al., 2020; Qasim, 2017; Pedron et al., 2021; Al-Ajmi, 2017) especially those conducted in developing countries. The study findings show that there is a general decline in the environmental disclosure indicators of industrial and service companies in Palestine, where the general average of the environmental disclosure indicator for these companies during the years 2010-2019 was 48%. This can be attributed as shown by (Qasem, 2017) due to the lack of mandatory environmental laws and legislations that stimulate environmental disclosure, with the lack of knowledge and sufficient skill for the accounting department employees. However, between (Fazzini & Maso, 2016).

The voluntary environmental disclosure represents information related to the value and positively related to the market value of the companies. The results of the statistical analysis also show that there is a strong positive correlation according based on Pearson correlation coefficient matrix between the independent variable (i.e., market value) and its calculation elements and the dependent variable (i.e., environmental disclosure), but it was not statistically significant according as shown in the results of the analysis based on Regression equation and this result is consistent with the study of (Al-Ajami, 2017; Pedron et al., 2021), while it is inconsistent with the study of (Al-Hoshi, 2017; Gerged et al., 2020). It can be argued that the assumed objectives for the disclosure of environmental information that are set to protect the environment, according to (UNEP, 1992), are not handled adequately and interest in them is still weak in the Palestinian environment, especially in light of the exceptional circumstances that the Palestinian situation is going through.

With this in mind, it is necessary to raise the level of awareness among companies of the importance of environmental matters and the need for them to adopt various policies that help reduce the negative effects of their activities towards the environment. And they should work hard to develop mandatory mechanisms by the accounting legislative bodies for the disclosure of environmental information that companies adhere to in a periodic and orderly manner.

Conclusion

The study aimed to identify the extent to which industrial and service companies listed on the Palestine Stock Exchange during the years 2010-2019 are committed to environmental disclosure, and its impact on the market value of these companies. To achieve this goal, the relationship between the independent variable, which is environmental disclosure, and the dependent variable, which is the market value, was chosen. The study results show a decrease in the general average of the environmental disclosure index among the companies under consideration and a strong positive correlation between environmental disclosure and market value is found, but it is not statistically significant. Based on these results, the study recommends the need to raise the level of awareness, among companies in Palestine, of the importance of environmental matters and to work hard to develop mandatory disclosure mechanisms about environmental information.

Acknowledgement

Special thanks to Palestine technical university - Kadoorie for their valuable support.

References

Abu Zaid, M.Al.M. (2007). A proposed accounting framework for disclosing environmental performance in light of environmental quality standards applied to the fertilizer sector in the Arab Republic of Egypt. Master's Thesis in Environmental Sciences, Ain Shams University, Egypt.

Al-Ajmi, A.M.Al. (2017). Finance, Al al-Bayt University, Mafraq, Jordan. [The impact of environmental accounting disclosure on investor decisions in Kuwaiti industrial companies. Unpublished Master's Thesis, College of Business.

Al-Amiri, M.A. (2010). Advanced financial management. Ithra’a Publishing and Distribution House: Amman, Jordan.

Al-Hoshi, M.M. (2017). The direct and indirect impact of the level of disclosure of social responsibility on the value of the company: An empirical study on companies listed on the Egyptian Stock Exchange. Accounting Research Journal, Tanta University, 2, 393-444.

Al-Siddiq, B.M.I. (2009). The concept of environmental disclosure and its mechanisms, money and economics, 62, 36-37.

Al-Tamimi, I., & Al-Khashali, Sh. (2007). The impact of environmental uncertainty in determining strategic objectives: A field study in Jordanian pharmaceutical companies. The Jordanian Journal of Business Administration, 3(1).

Balqacem, Q., & Zargoun, M. (2020). The impact of institutional characteristics on the environmental disclosure of industrial establishments: An applied study of the Algerian cement establishments during the period (2015-2018). Algerian Journal of Economic Development, 7(1), 111-124.

Bani Doumi, K.M. (2020). Environmental disclosure in Jordanian industrial public share holding companies: a comparative study between environmentally sensitive and non-sensitive companies. Unpublished Master's Thesis, Yarmouk University, Irbid, Jordan.,

El-Sayed, A.S.A. (2013). The role of accounting disclosure on the environmental performance of economic units in rationalizing decisions: A field study. Unpublished Master's Thesis, College of Graduate Studies, Al-Neelain University, Khartoum.

Fouda, Sh., El-Sayed, O.O., & El-Shafei, Y.Z. (2019). The impact of disclosure of environmental information on the value of the facility with the application to Sidi Kerir Petrochemical Company. Journal of Contemporary Business Studies, Kafrelsheikh University, 7, 772-851.

Fazzini, M., & Maso, A. (2016). The value relevance of “assured” environmental disclosure: The Italian experience. Sustainability Accounting, Management and Policy Journal, 7(2).

Gerged, A.M. (2020). Is corporate environmental disclosure associated with firm value? A multicounty study of Gulf Cooperation Council firm.Business Strategy and the Environment, Wilfy.

Hassan, M.H.A. (1999). Environmental disclosure in financial reports and statements and its positive effects: An applied study on Saudi companies. The Scientific Journal of Research and Business Studies, Helwan University, 13(2), 152-198.

James, R. (2006). Financial Evaluation", Work book. John Wiley & Sons. Maliah, S.N.A. & Nirhayati, A. (2014). Management Accounting practices in selected Asian Countries: A review of the literature.Managerial Auditing Journal, 19(4), 142-160.

Crossref, GoogleScholar, Indexed at

Murray, A., Sinclair, D., Power, D., & Gray, R. (2016). Do financial markets care about social and a environmental disclosure? Further evidence and exploration from the UK.Accounting Auditing & Accountability Journal, 19(2), 74-92.

Crossref, GoogleScholar, Indexed at

Nabulsi, D. (2011). The impact of disclosing environmental costs in the financial statements on the quality of accounting information in industrial companies in the city of Aqaba. Unpublished Master's Thesis, Al-Balqa' Applied University, Al-Balqa', Jordan.

Nile, A.A.S.A.H. (2015). Measuring and analyzing the effectiveness of environmental costs in the pharmaceutical industry. Unpublished Master's Thesis, Ain Shams University, Cairo, Egypt.

Crossref, GoogleScholar, Indexed at

Nor, N.M., Bahari, N., Adnan, N., Sheh Kamal, M., & Ali, I. (2016). The effects of environmental disclosure on financial performance in Malaysia. Procedia Economics and Finance, 35, 117-126.

Crossref, GoogleScholar, Indexed at

Okpala, O., & Iredele, O. (2018). Corporate social and environmental disclosures and market value of listed firms in Nigeria. Copernican Journal of Finance & Accounting, 7(3).

Pedron, A., Macagnan, C., Simon, D., & Vancin, D. (2021). Environmental disclosure effects on returns and market value. Environment, Development and Sustainability, 23.

Qassem, S.M.W. (2017). The impact of environmental disclosure on the financial performance of Jordanian industrial companies. Unpublished Master's Thesis, Al-Isra Private University, Amman, Jordan.

Saidi, S.H. (2014). Accounting measurement of environmental impacts and their disclosure in industrial establishments: A case study of the Hama Bouzyan Cement Corporation. Unpublished Master's Thesis, Faculty of Graduate Studies, University of Constantine, Algeria.

Setiadi, I., Rahmawatim, Suhardjanto, D., & Djuminah (2017). Board independence, environmental disclosure, and firm value. Review of Integrative Business and Economics Research, 6(4).

United Nations Environment Program (1992). Report of the Governing council on the work of its third special session.

Yang, Y., Wen, J., & Li, Y. (2020). The impact of environmental information disclosure on the firm value of listed manufacturing firms: Evidence from China.International Journal of Environmental Research and Public.

Crossref, GoogleScholar, Indexed at

Received: 20-Nov-2021, Manuscript No. ije-21- ije-21-9863; Editor assigned: 30-Nov-2021, PreQC No. ije-21-9863 (PQ); Reviewed: 05-Dec-2021, QC No. ije-21-9863; Revised: 10-Dec-2021, Manuscript No. ije-21-9863 (R); Published: 03-Jan-2022