Research Article: 2023 Vol: 27 Issue: 6

The role of Central Bank on Entrepreneurship Development: The case of Sudan

Yagoub Ali Gangi, Ahmed bin Mohammed Military College

Citation Information: Gangi, Y., (2023). The Role Of Central Bank On Entrepreneurship Development: The Case Of Sudan. International Journal of Entrepreneurship, 27(S6),1-10

Abstract

This paper delves into the multifaceted role that Central Bank of Sudan (CBOS) assumes in nurturing and advancing entrepreneurship within Sudan. The research employs a case Study method. The main finding of the research is that, CBOS operates as a pivotal financial institution with regulatory and monetary authority over the nation's financial landscape. Through its policies, regulations, and initiatives, CBOS shapes the economic environment in which entrepreneurs operate. It employs a combination of fiscal and monetary measures to ensure stability, provide access to finance, and facilitate a conducive atmosphere for business startups and expansions. One of CBOS's primary roles is to ensure a stable macroeconomic environment that promotes investor confidence and attracts both domestic and foreign investment. By maintaining price stability and managing inflation, CBOS enhances the predictability necessary for entrepreneurs to make informed decisions and plan for the future. Additionally, CBOS's regulatory framework governs banking and financial activities, including lending practices, which indirectly influence the availability of funding for entrepreneurial ventures. CBOS also actively supports financial inclusion, a critical aspect of entrepreneurship development. Through initiatives aimed at expanding access to financial services and promoting digital payment solutions, CBOS facilitates transactions, reduces the barriers to entry for startups, and encourages economic participation across various sectors. Furthermore, CBOS collaborates with relevant stakeholders to provide targeted financing programs for entrepreneurs. By working alongside commercial banks and development institutions, CBOS enhances entrepreneurs' access to credit, enabling them to invest in their ventures and drive economic expansion. These efforts often focus on sectors with high growth potential, such as technology, agriculture, and manufacturing.

Keywords

Central Bank, Entrepreneurship Development, Sudan

Introduction

Nowadays, entrepreneurship has become very important for most countries, to the extent that can be described as the trend of world. Because of this its development has become one of the essential function of governments and their belonging institutions. Thus, the promotion of entrepreneurship and the support to small enterprises have been part of the national policies in virtually all of the developed countries and most of the developing countries. The justification for this rests on the role of entrepreneurship and business dynamics as drivers of economic growth and job creation. The central bank is one of the important institutions that affect entrepreneurship development in different countries. This effect takes place through the development of monetary policies, credit policies and creation of financial institutions that cater for process of entrepreneurship development. The general role of central bank in promoting business sector and its specific objectives of maintaining stable macroeconomic environment are seldom questioned. A debated issue, however, is whether central banks should be assigned a role in developing entrepreneurship sector. The importance of this issue has been recognized by researchers. Thus, many studies have been undertaken to explore, explain and investigate the role of central bank in entrepreneurship development. However, most of these studies have been concentrated in developed countries; few of them have been undertaken in African developing countries.

The objective of the present study is to explore the role and responsibilities of the central bank of Sudan toward the development of entrepreneurship and Micro, Small and Medium Enterprises (MSMES). Specifically, the paper tries to investigate the performance of the central bank of Sudan in maintaining the stability of general price through its monetary policy, and making the finance available for entrepreneurs at suitable credit conditions. The important of this paper stem from the fact that the central bank of Sudan has undertaken many initiatives to enhance entrepreneurship in Sudan. One of the most important initiatives is the establishment of micro finance unit. The literature has neither paid adequate attention to this issue nor the role of central bank in maintaining stable macroeconomic conditions through monetary policy.

Since the present paper is one of the few studies that investigate this issue in the context of Sudan, it will be largely an exploratory in nature. It tries to shed some light on the initiatives which have been undertaken by the central bank of Sudan during the last ten years to improve the entrepreneurial environment through providing incentives for establishing businesses and making the finance available. It also reflects the role of central bank in stabilizing the macroeconomic situation through its monetary policy. The rest of the paper is organized into four sections. Section two provides a review for the theoretical concepts, methods and the relevant literature. Section three outlines the attempts undertaken by the central bank of Sudan to enhance entrepreneur sector in Sudan.

Theoretical Background and Literature Review:

Theoretical frameworks establish the fundamental groundwork for comprehending the underlying concepts, connections, and mechanisms pertinent to the subject of investigation. In the context of exploring the role of central banks in fostering entrepreneurship development, numerous theoretical viewpoints come into play. To initiate this exploration, diverse definitions of entrepreneurship warrant attention; herein, a selection of these definitions is introduced. For instance, the Kauffman Panel on Entrepreneurship Curriculum in Higher Education delineates entrepreneurship as "the conversion of innovation into a sustainable enterprise that yields value." From this vantage point, entrepreneurship emerges as a dynamic amalgamation of visionary and pragmatic elements. In light of this perspective, teaching entrepreneurship entails exposing and grasping the proficiencies, knowledge, and progression of innovation and the genesis of new ventures. Conversely, the definition offered by Babson College portrays entrepreneurship as "a mindset and action approach characterized by a fixation on opportunities, holistic thinking, and equilibrium in leadership." Within their entrepreneurship program, students cultivate a comprehensive set of entrepreneurial skills that extend relevance to a spectrum of organizations, be they start-ups, established entities, or those in the for-profit and not-for-profit sectors, across various industries.

Having multiple definitions of entrepreneurship, results in a large number of different measures of entrepreneurship. This means there is no unique and a single measurement for entrepreneurship that is commonly accepted to measure the performance of entrepreneurship in any country and to compare its state of development across different countries of the world. However, scholars have developed some indicators that can be adopted to measure the state of entrepreneurship development in any country and thus to evaluate its policies to promote it. Example of these indicators include number of new businesses start-up, number of jobs created by new entrepreneurship projects, the contribution of entrepreneurial project in wealth creation and economic growth. Measuring entrepreneurship could also be in terms of the share of SMEs in Gross Domestic Product (GDP), foreign exchange proceeding, total employment (Sanyang & Huang, 2010).

For example, one of the mostly widely used measures of entrepreneurship is the Global Entrepreneurship Monitor’s (GEM) Total Entrepreneurial Activity (TEA) Index, a calculation of the adult population engaged in entrepreneurial activity. GEM’s TEA Index had been widely criticized by numerous researchers for its failure to measure entrepreneurship that occurs within firms, its failure to use better data, and its lack of comparability across regions due to different interpretations of survey responses (Audretsch, 2002; OECD, 2006; Baumol et al., 2007).

The World Bank produces set of data on micro-, small- and medium-sized enterprises that covering large number of countries, which is used by some authors as indicator for entrepreneurship in different countries. General Entrepreneurship Monitor (GEM) publishes annual data on entrepreneurial activities in some countries; this is considered by some authors as indicator for entrepreneurship development in countries. In some countries national statistical bureaus produces set of data on new businesses registered and number of employment opportunities created by them.

Entrepreneurship is the mindset and process to create and develop economic activity by blending risk-taking, creativity and/or innovation with sound management, within a new or an existing Organisation (Schmiemann, 2012). Early entrepreneurship research has focused on individual entrepreneurs’ traits, motivations and intentions as the main driving forces for entrepreneurship development. At that time authors have disregarded the potential influence of socioeconomic factors and other components of ecosystem. Later on, authors have shown a growing interest in exploring the links between entrepreneurship development and different components of entrepreneurial ecosystem. Specifically, they have started to examine the role of government institutions and policies on entrepreneurship development. Along this line, they have included the wider business environment and the role that it can play in promoting entrepreneurship. Namely, they have considered the economic, political, legal, social and cultural background that can play a role in determining how entrepreneurs act. In this respect, entrepreneurship development is linked to many government and society institutions, such as central bank, ministry of finance and other organizing institutions. The argument put forward in this is that policy of these institution in any country shape the macroeconomic situation, thus can enables or constrain the entrepreneurship development. Along this line of thinking, some authors have indicated that availability of finance, suitable interest rate, and reasonable real GDP growth, low rate of unemployment and high industrial productivity are significant to entrepreneurship development (Somoye, 2013).

The central bank, as the key institution responsible for formulating and implementing monetary policy, can influence interest rates, money supply, and overall economic conditions. This can have implications for entrepreneurship development, as favorable monetary policies might encourage borrowing, investment, and entrepreneurship.

Financial Intermediation Theory

This theory explores how financial institutions, including central banks, facilitate the flow of funds between savers and borrowers. Central banks play a crucial role in providing a stable financial environment, ensuring liquidity in the banking sector, and regulating interest rates. These factors can impact the availability of funding for entrepreneurial ventures.

Credit Access and Entrepreneurship

Macroeconomic instability is considered by many economists as essential obstacle for entrepreneurship development. Because instability and the intense cyclical variations that characterize (most) developing countries may induce patterns of entry. Such macroeconomic volatility adversely affects investment projects because of the difficulties in anticipating the evolution of key variables (Katz & Bernat, 2011). Moreover, when uncertainty is high, decisions are taken on a shorter-term basis and firms demand a greater return on their projects. Economic downturns also have long-term consequences both in terms of the attrition of human capital, which may inhibit new firm formation in the following years (Stiglitz, 1998). Furthermore, some author has link the macroeconomic situation with entrepreneurship development through capital control. The theoretical grounding for why capital controls could have deleterious effects on entrepreneurship is far more extensive and, in one sense, fairly clear: any distortion that makes it more difficult to obtain financing or investment should inhibit entrepreneurship and firm expansion.

(Prati, et al., 2009) expand on this point, noting that “capital controls can substantially limit access to, and raise the cost of, foreign currency debt, especially for firms without foreign currency revenues”. Government moves towards capital controls can also drive up the risk premium for doing business in a particular country, making the cost of capital (when it is available) more expensive and also a deterrent to firm entry (Yamawaki, 1991). In an emerging market context, this is an important point, as many developing countries have undeveloped capital markets and need to tap foreign funding; capital controls would inhibit this flow of finance. Moreover, limited access to finance would also impact firms disparately, as larger firms tend to have an easier time securing bank lending (or utilizing internal funds), and indeed, researchers have found that countries with less capital account restrictions tend to have.

(Calá et al., 2015) investigated the determinants of entrepreneurship in developing countries and compare them with their counterpart in developed countries. They found that, the real interest rate and the inflation rate have a strong effect on deterring entrants. Interestingly, (Günalp & Cilasun, 2006) show that results concerning microeconomic variables are robust to the inclusion of macroeconomic variables. In particular, these variables may have a negative impact on some industries and a positive impact on others.

In addition to the macroeconomic condition, entrepreneurship development is determined by many other factors or components. (Alam, 1998) & (Rahman, 1999) in their studies for the determinants of entrepreneurship in Bangladesh have identified the following components as the main factors that determine the dynamism of entrepreneurship. (i) innovation (introducing or adding new products to existing business); (ii) expansion of business (increase in the amount of the entrepreneurs' equity capital); (iii) new line of business (starting a different line of business); (iv) employment generation (increase in the number of employees); and (v) technological change (change in production process or techniques with purchase of new machineries and improvement in the quality of existing goods or services).

The Central Bank of Nigeria, as part of its efforts to deepen credit delivery to address the challenges of unemployment, promote entrepreneurial spirits among Nigerian youths and enhance the spread of small and medium enterprises established the Youth Entrepreneurship Development Programme (YEDP). The programme is aimed at harnessing the latent entrepreneurial spirit of the teeming youths by providing timely and affordable finance to implement their business ideas. This will provide a sustainable mechanism to stimulate employment, contribute to non-oil Gross Domestic Product (GDP) and address the challenge of youth restiveness. The objectives of the facility the objectives of the Programme are to: i. Harness the entrepreneurial skills and innovative capacities of youths; ii. Improve access to finance for youth entrepreneurs using a well-structured business model; iii. Stimulate flow of finance to startup enterprises; iv. Encourage job creation; v. Increase the contribution of the non-oil sector to the GDP; and vi. Promote diversification of the economy.

The Role of Central Bank of Sudan on the Entrepreneurship Development

Traditionally, the main objective of central banks represents the choice and implementation of monetary policy strategies. The final objectives of monetary policy pursued by the central bank may be: price stability, employment, economic growth, financial stability, and external balance. These objectives should not be designed and implemented in isolation from the general objectives of economic policy. The objectives of monetary policy should be linked with other components of general economic policy of the country, the performance of each category of policy depending on the success of the entire package of measures. The entire package of macroeconomic measure should work together to maintaining the financial stability in the national economy, contributing in creation of employment opportunities, enhancing economic growth and providing supportive policies for government to maintain the balances in balance of payments and stabilize exchange rate. Although none of these measures are directly related to entrepreneurship development, all of them are indirectly affect the number and process of new businesses creation and possibility of their future success and growth.

In many developing and emerging economies, central banks have begun over the past decade to place renewed emphasis on the promotion of economic development and structural transformation, looking beyond narrow mandates for macroeconomic stability. Developmental central bank policies have included policies directed at financial sector development, entrepreneurship development, the promotion of financial inclusion and aligning the financial system with sustainable development. This marks a shift from the orthodoxy that has dominated central banking since the 1980s and that has been promoted in developing countries by institutions such as the International Monetary Fund (IMF) and multilateral development banks.

The orthodox approach to central banking – according to which central banks should primarily focus on price stability – has been severely undermined by the global financial crisis. It has become clear that central banks also ought to take responsibility for safeguarding financial stability (Dafe & Volz, 2015).

The establishment of the Central Bank of Sudan dates back to 1960. Its mandate, akin to that of other central banks, encompasses the pursuit of monetary and financial stability with the aim of fostering consistent and sustainable GDP growth rates. This entails the task of maintaining low inflation levels, ensuring exchange rate stability, and enhancing the efficiency and structure of the banking system, all of which contribute to driving economic development by channeling resources into diverse economic sectors. To realize these ambitions, the Central Bank employs a range of policies, encompassing areas such as monetary policy, financing, foreign exchange management, exchange rate regulation, as well as the promotion of banking sector growth, oversight, and efficient payment systems (Mohamed, 2015).

Like the case in most of the developing countries the central bank of Sudan has widened its mandate to promote sustainable economic development by improving the entrepreneurial environment for business growth and development. By so doing it become more active in providing financial services for SMEs sector. One of the instruments used by the central bank of Sudan to encourage entrepreneurship was the establishment of microfinance unit and other financial institution to provide capital to development projects. Moreover, since the early 2009 the central bank has issued monetary policy that encourages commercial banks to assign 12% of their total investment loans to SMEs. This new policy direction is based on the finding of previous studies undertaken to identify the main constraints of entrepreneurship development.

Easy access to credit is singled out in the literature on entrepreneurship as one of the major constraint of entrepreneurship development in Sudan. Many studies highlight the lack of credit facilities as the major obstacle that limit the growth of entrepreneurship. Additional studies show that small and micro-enterprises have little access to the resources of the organised financial sector, mainly owing to the high risk of default and high administrative costs. Consequently, they resort to moneylenders, who ask for higher interest rates. For example, the (World Bank, 2009) has identified finance as one of the major constrained for entrepreneurs. In its investment climate study, the World Bank 2009 stated that the major source of working capital for businesses in Sudan is internal funds/retained earnings with an average share of 66%. Borrowing from banks contributed only about 8.5% of working capital, compared with other non-bank and informal sources of financing that contribute a total of about 22.7%. Out of this, an average of about 3% and 2% of total working capital was financed respectively by borrowings from family/friends and purchases on credit from suppliers or advance receipts from customers. Same is true about fixed assets: 71% of purchases of fixed assets were financed by internal funds/retained earnings; while only about 10% was financed from bank borrowings.

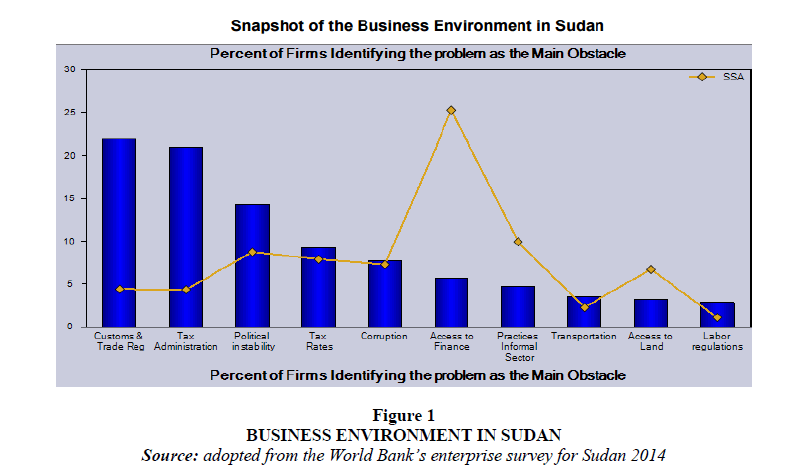

Moreover, the (World Bank, 2014) in its enterprises survey for the Sudan has found that access to finance is one of the main obstacles for entrepreneurship development in Sudan. As it can be it can be observed from the following graph that around 10% of the firms has identified access to finance as the main obstacle (Figure 1).

The Central Bank of Sudan (CBOS) has realised the importance of finance for entrepreneurship development. As consequent it has embarked in designing strategic plan and policy package that are basically directed toward entrepreneurship development. Along this line the central bank of Sudan has undertaken many initiatives. One of these important initiatives to promote entrepreneurship it has established a microfinance unit to provide finance for entrepreneurs at a suitable credit conditions. This unit has been established by the Donors’ Fund MDTF and the Central Bank of Sudan in 2008 with a capital of 20 million dollars. The main objectives for the establishment of the unit are:

• Developing collaboration and coordination on the demand side (commercial banks and Microfinance banks) through opening channels to provide services appropriate to the nature of the beneficiaries thereby advancing the level of the operative efficiency and working to reduce cost and expand outreach.

• Offering wholesale financing and financial contributions to banking and non- banking institutions working in Microfinance in order to create an enabling and inviting infrastructure for the banking sector, the private sector investors and the donors.

In this respect and according to the Microfinance Unit of the Central Bank of Sudan the unit has launched a program that aim for entrepreneurship development through the following:

• Offering financial and institutional assistance to enable banks to partially restructure by opening specialized outlets according to the policies and guidelines of the Central Bank of Sudan, whether by opening specialized branches or forming companies associated to the banks for the purpose of offering Microfinance services.

• Offering wholesale finance for the branches and specialized companies according to the predetermined standards and conditions, in addition to the financial contributions and funds offered to the Microfinance specialized companies established by the banks under the licensing conditions of the Microfinance banks.

Since its establishment in 2008 the microfinance unit has contributed in providing financial support for entrepreneurship development through implementation of various programs with different national and international financial institutions. In table (1) the development in number of entrepreneurs who had benefited from the microfinance unit services is presented.

| Table 1 Total Number Of Microfinance Beneficiary From Financial Institutions (2011 – 2015) |

|||||

|---|---|---|---|---|---|

| Year | 2011 | 2012 | 2013 | 2014 | 2015 |

| Number of Clients (1000) | 244 | 494 | 706 | 852 | 985 |

| Growth rate | - | 100% | 186% | 249% | 304% |

| The total portfolio (million SGs) | 938 | 1496 | 1546 | 2180 | 2383 |

| Growth rates | 3.20% | 4.90% | 5% | 4% | 4% |

| Source: annual reports of microfinance unit, central bank of Sudan | |||||

As depicted in table 1, the total number of banks’ clients who have benefited from microfinance services has rapidly increased from only 244 thousand in 2011 to nearly one million in 2015. This increase in number of clients reflects increasing number of new business start-up which is used as an indicator for growth of entrepreneurial activities. Unfortunately, this increase in number of clients was not associated with increase in the amount of portfolio. The average annual growth of size of portfolio had never exceeded 5% at the best case.

In table 2 the development in number of financial institutions that have expressed their interest of participating in providing microfinance is presented. These institutions include both the federal and states level institutions.

| Table 2 The Development In Number Of Participated Institutions In Microfinance (2008 – 2015) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Year/level | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

| federal | 2 | 2 | 3 | 3 | 4 | 5 | 6 | 6 |

| state | 1 | 2 | 4 | 6 | 8 | 18 | 21 | 25 |

| local | 0 | 0 | 1 | 1 | 1 | 1 | 2 | 2 |

| total | 3 | 4 | 8 | 10 | 13 | 24 | 29 | 33 |

| Growth | - | 33.30% | 50% | 25% | 30% | 47% | 16.60% | 13.80% |

| Source: annual reports of microfinance unit, central bank of Sudan | ||||||||

As can be observed from table 2, the number of intuitions that have decided to take part in microfinance services has evolved considerably over the last ten years. The annual average growth rates stand at about 31%. This implies every year more and more institution decides to join the microfinance activities. This will have a positive contribution in entrepreneurship development in the coming future.

In addition to the finance function the microfinance unit is assigned the role of providing institutional development for commercial banks and microfinance institutions through training programs. In this respect the Unit provides support to banking and non-banking institutions involved in microfinance through well studied programs to build human and technical capacities of such institutions. Moreover, the Unit also produces appropriate legislations and frameworks that create opportunities for the development of best practices and policies supportive of microfinance institutions to build on similar international successes in accordance with both Islamic and conventional banking systems. In performing this function, the unit has implemented training of trainers programs that and other capacity building programs that benefited many potential entrepreneurs.

Moreover, the central bank of Sudan has used its monetary policy to encourage SMEs development. In this respect, during the regime of direct monetary control, was determining the rates for lending to specified sectors of the economy with the aim of encouraging lending to those sectors. The central bank of Sudan ensured that the lending rates to SMEs were lower than the rates for other sectors of the economy. It also required mainstream banks to make available to indigenous industrialists a certain percentage of their credit portfolio. Recently, a new scheme was approved for the financing of the SMEs. The new scheme referred to as the Small and Medium scale Industries Equity Investment Scheme (SMIIEIS) requires banks to set annually, 10% of theft.

However, the monetary policy can also constrain SMEs development, as exchange rate and interest rate policies can limit SMEs due to the unstable exchange rate. For example, SMEs may perceive constrained issuing long-term, fixed rate, domestic currency loan or be forced to issue such debt at very high cost because, for example, investors expect higher inflation or devaluation in the future due to loose monetary policy stance. Under such circumstances, investors may prefer debt indexed to inflation rates or short-term interest rates, short maturity debt or foreign currency indexed debt. In turn, poor debt structures with large shares in short-term debt, floating rate debt or foreign currency debt can constrain the central bank’s willingness to increase interest rate or to depreciate devalue domestic currency, as this can precipitate a debt crisis (Mohamed & Mnguu 2014). For the case of Sudan, the monetary policy which had been designed and implemented by central bank of Sudan failed to combat inflation and stabilize exchange rate. Thus may have affected entrepreneurship development negatively.

Conclusion

Although a number of initiatives have been implemented, there is still a long way to go before finance needed for entrepreneurship can be described as fully satisfactory in Sudan. A lot of good practices exist in both developed and developing countries, but these practices were very limited in Sudan. Thus policy makers in Sudan need to make use of these good practices in order to develop entrepreneurship sector. Specifically, policy makers in central bank of Sudan need to borrow these good policy packages and initiatives and try to domesticate it to the conditions prevailing in the Sudan. This mainly, because replication of best practices sometimes may not provide the best results. However, knowledge sharing and mutual learning would facilitate more informed decision making. In Summary, the Central Bank of Sudan plays a multifaceted role in advancing entrepreneurship within the country. By fostering macroeconomic stability, regulating financial activities, promoting financial inclusion, and facilitating access to credit, CBOS creates an environment conducive to entrepreneurial growth. However, continuous collaboration among CBOS, government agencies, financial institutions, and entrepreneurs themselves remains essential to fully harness the potential of entrepreneurship for Sudan's economic development.

References

Acs, Z. J., Desai, S., & Hessels, J. (2008). Entrepreneurship, economic development and institutions. Small business economics, 31, 219-234..

Backman, M. & Karlsson, C. (2013), “Determinants of entrepreneurship: Is it all about the individual or the region?” CESIS Electronic Working Paper Series, Paper No. 338, Centre of excellence for Science and Innovation Studies.

Bettignies, J.d. & Brander, J.A. (2007) Financing Entrepreneurship: Bank finance versus venture capital. Journal of Business Venturing. Vol. 22, pp. 808-832.

Carla Daniela Calá,C.D.; Arauzo-Carod, J.M.; Manjón-Antolín, M. (2015), “The Determinants of Entrepreneurship in Developing Countries”, working papers, Universitat Rovira I Irgili.

Dafe, F., & Volz, U. (2015). Financing global development: The role of central banks. German Development Institute/Deutsches Institut für Entwicklungspolitik (DIE) Briefing Paper, 8.

Hodgson, G.M. (2006), “What Are Institutions”. Journal of economic issues, Vol. 15(1) pp. 1-25.

King, R. G., & Levine, R. (1993). Finance, entrepreneurship and growth. Journal of Monetary economics, 32(3), 513-542.

Klapper, L. F., & Love, I. (2011). Entrepreneurship and development: the role of information asymmetries. The World Bank Economic Review, 25(3), 448-455.

Mohamed, A.M. (2015),working paper, the central bank of Sudan.

Mohamed, Y. & Mnguu, Y. O. (2014). Fiscal and monetary policies: Challenges for small and medium enterprises (SMEs) development in Tanzania. International Journal of Social Sciences and Entrepreneurship, 1 (10), 305-320.

Schmiemann, M. (2012), Measuring Entrepreneurship in Europe, in “Entrepreneurship determinants: culture and capabilities”. Earu Stat statistical Book.

Somoye, R.O.C. (2013), “The Impact of Finance on Entrepreneurship Growth in Nigeria: A Cointegration Framework”. ACRN Journal of Entrepreneurship Perspectives, 2(2), pp. 21-45.

Wennekers, S., & Thurik, R. (1999). Linking entrepreneurship and economic growth. Small business economics, 13, 27-56.

World Bank (2010). Global Financial Indicators, Economic Outlook. Washinton: IMF, Washington, D.C.

World Economic Forum (2010). Global Entrepreneurship and the Successful Growth Strategies. USA: World Economic Forum, USA Inc.

Zapalska, Alina, Brozik, M. & Rudd, Denis (2007). The success of micro-financing, Problems and Perspectives in Management. 5 (4), 84-90.

Received: 31-Jul-2023, Manuscript No. IJE-23-13940; Editor assigned: 04-Aug-2023, Pre QC No. IJE-23-13940(PQ); Reviewed: 18-Aug-2023, QC No. IJE-23-13940; Revised: 24-Aug-2023, Manuscript No. IJE-23-13940(R); Published: 31-Aug-2023