Research Article: 2022 Vol: 25 Issue: 5

The Role of Bilateral Investment Treaties in Promotion of Foreign Direct Investment Inflows: Evidence from Small Open Economy

Shahbaz Hassan, University of Sialkot

Citation Information: Hassan, S. (2022). The role of bilateral investment treaties in promotion of foreign direct investment inflows: Evidence from small open economy. Journal of Legal, Ethical and Regulatory Issues, 25(5), 1-15.

Abstract

Many developing countries have targeted foreign direct investment as a significant policy variable in the recent past. To promote foreign direct investment, various governments across the globe are focusing on bilateral negotiations with other countries. Currently, the government of Pakistan is also part of 48 treaties. These treaties aim to promote foreign direct investment and provide legal protection to foreign investors. The current study investigates the role of these treaties in promoting foreign direct investment. The study used both panel and time-series data for the credibility of research findings. The timespan for time series analysis is from 1985 to 2015, whereas in panel data analysis is from 1998 to 2015. Sixteen countries have been selected for panel data analysis. The study's findings show that Bilateral Investment Treaties have an insignificant contribution to achieving the specific goal of attracting FDI inflows in both the short and long run. However, the study's findings reveal that other factors such as trade openness, physical infrastructure and size of the economy facilitate foreign direct investment. In contrast, the factors that hurt the motivation of foreign investors are exchange rate volatility and political instability.

Keywords

Foreign Direct Investment, Bilateral Investment Treaties, Panel Data, Ardl Model, Trade.

Introduction

Over the last three decades, a strong impetus for economic development across countries has been provided by the (FDI) inflows. Among all forms of capital inflows, the importance and impact of Foreign Direct Investment (FDI) is considered superior. FDI provides additional capital inflows and helps the host economy enhance economic growth and development by introducing modern technology and managerial skills (Bhasin & Manocha, 2016). An inspiring characteristic of FDI inflows is that with the help of creating opportunities for ameliorating the level of production and service sector these inflows can assist an economy, wholesale and retail trade, business and legal services (Hayakawa et al., 2020; Piteli et al., 2021). These impacts have increased the level of interest among the researchers to aim theoretical and empirical literature to investigate the relationship among FDI flows for the related determinants. One of the determinants used by developing countries to increase FDI volume is signing Bilateral Investment Treaties (BITs).

On the other hand only individual commitments will be affected in case of a breach of obligation. BITs provide a clear path to the foreign investors for understanding possible ways with the help of which they can file a suit against the governing agencies in charge of default. The developed states also sign BITs to protect the investments in less developed countries (Rose- Ackerman & Tobin, 2005; Salacuse & Sullivan, 2005). Stated that the studies conducted in the recent decades have shown that BITs have become unanimously adopted international legal mechanisms that play a vital role in the effective governance and encouragement of FDI. The ground realities of the numerous BITs predict the need of moving toward BITs is to promote FDI flows within the country.

Moreover, the popularity of BITs is because of the perceptions of the policymakers that signing them will increase the ratio of FDI flows. But it is an important question whether these treaties accomplish their stated purpose or not. Moreover, either of these investment forms successfully enhances and attracts more FDI flows to developing countries like Pakistan. Soon after the 1990 election, an intense privatisation and liberalisation programmer was started. Since being liberalised in 1990, Pakistan has been inviting vast FDI inflows. The liberalisation regime has become part of the enhancing negotiation in BITs regarding the frequency of its trade and increasing investment partners. Pakistan is currently part of 48 BITs that have been involved in extending legal protection to foreign investors. Pakistan started the talk on forming a BIT with the US in 2005. Afterwards, Pakistan US relations weakened, and these talks stopped.

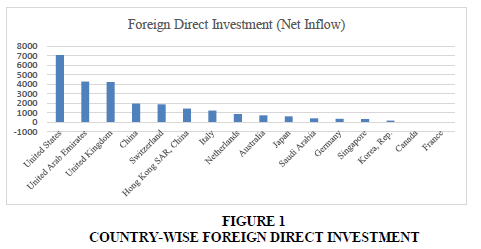

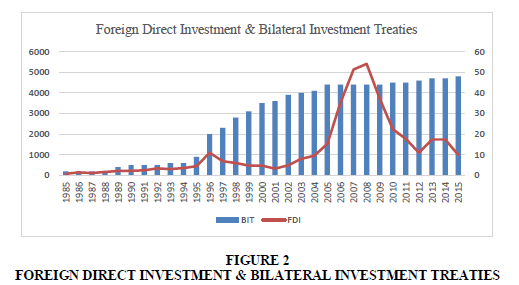

Meanwhile, Pakistan signed BIT with Turkey in 2012. Then negotiations with the US resumed in 2013, but BIT couldn't be signed again. In 2014 a BIT was signed with Bahrain, which came into force in 2015. Currently, the government is trying to enforce the BIT signed with Turkey. An overview of Pakistan's FDI net inflow from other countries over the years is shown in Figure 1, and the Volume of FDI along with BITs is shown in Figure 2, respectively. Figure 1 represents the aggregate from 1985 to 2015 FDI net inflows of each country selected in the panel data analysis. Foreign direct investment is measured on Y-axis, and the countries are labelled on X-axis. It can be observed from the figure that the massive volume of FDI inflows came from the US.

On the other hand, Pakistan hasn't signed the BIT with the US. Pakistan hasn't signed BITs with the other three countries, i.e. Hong Kong, Saudi Arabia and Canada. These four countries make 35% (the only US makes 25.6%) of aggregate from 1985 to 2015 FDI inflows. The results showed that none of the variables is highly correlated.

Following Figure 2 is a double axis graph; the left Y-axis is for foreign direct investment (shown by the red line). The right Y-axis is for the number of bilateral investment treaties (indicated by blue bars). The graph shows the minimum of both FDI and BIT's from 1985 to 1995. However, the number of BIT's increased from 9 to 20 from 1995 to 1996, and the FDI has also risen sharply in the same era. In contrast, the Number of BITs grew to 36 till 2001, but FDI has shown a downward trend in this era. From 2001 to 2007 number of BIT's hasn't increased much, but FDI has increased with its maximum potential. From 2008 till the end of the data, BIT's has remained almost constant, but FDI has shown an explosive trend. Hence, it could be summarised that there exists no clear relationship between the frequency of Bilateral Investment Treaties and FDI.

To the best of our knowledge, the relationship between FDI and BITs is not evaluated empirically, even by a single study specifically for Pakistan. Thus, the current study will fill this gap by analysing the role of previous BITs in attracting FDI. The study has manifold objectives (a) To estimate the empirical relationship between BITs and FDI, (b) To find the impact of economic factors on FDI, and (c) To identify the non-economic factors that influence the FDI.

The current study comprises five sections, and they are organised in the following manner. The theoretical background of bilateral investment treaties and the empirical evidence is provided in the 2nd Section. Model specification and econometrics technique used for estimation are described in the 3rd Section. Empirical results have been presented and analysed in the 4th Section. And lastly, the 5th Section contains concluding remarks.

Literature Review

An extensive literature has been carried out to analyse the role of BITs in promoting the FDI in developing countries. In this regard, Busse et al. 2008 found that the BITs could substitute weak domestic institutions. On the other hand, BITs promote FDI flows to developing countries. Similarly, (Buthe & Milner, 2009) hypothesised that BITs with a developing country as a partner are more attractive for making profitable investments. Pradhan (2011) conducted a study to find the growth and origin of the outward flow of FDI in Chinese and Indian multinationals. This study examined the locational determinants of such investments. Different features were found in the Chinese multinationals and that of the Indian MNCs. It was found that Chinese multinationals preferred hosts along with locational proximity, small size, and high natural resource endowments.

On the other hand, the Indian firms chose countries with large sizes and those with a BIT with India. In this regard, the firms were choosing countries irrespective of the distance from India. Considering the economies of Southeast Asia, East Asia, and South Asia accounted for the effect of summarised frequency of agreed BITs on flows of FDI. This study was conducted comprising of 15 developing economies. The study's finding showed that BITs contracted with the developed countries did not yield a significant positive effect over the growth of aggregate FDI. Meanwhile, BITs signed with the developing countries provide a significant positive impact on the aggregate FDI flows.

With the help of accounting for the regime shift incurred with the 1997 Asian Financial Crisis and using random coefficient panel models (Aisbett, 2007) investigated the link between BITs and FDI inflows. This study revealed the positive effects of BITs on flows of FDI even for the pre-1997 era. This study also revealed that with each increasing number of BIT, the positive impact starts diminishing, suggesting that enhancing the frequency of BIT yields a comparatively lower FDI-payoff. Considering the period of the Asian Financial Crisis, no statistically significant effects of Bilateral Investment Treaties on the inflows of FDI have been found. Ultimately, this suggests a decline in their importance in attracting FDI. Furthermore, considering the impact of BITs is stronger on developed countries than developing countries.

Siegmann used a Gravity type and Knowledge-Capital type model (Siegmann, 2007) to assess the FDI flows from industrialised into developing countries. A panel data of 1364 country-pairs and 25 observation years was used to conduct random effects, fixed effects, and Pooled OLS estimations. The results obtained from this study provided clear evidence about the significant positive impact of the investment agreements and DTTs on the growth of FDI flows. Furthermore, this study also suggested a complementary relationship between investment agreements and a stable institutional environment. This result was quite different as it contradicts the traditional notion of BITs that BITs act as substitutes for institutional stability. In addition to this, it was also observed that US BITs appeared to be the most efficient as inducement devices for FDI. The same was the condition of the European BITs. But this was the total opposite in the case of Asian and Pacific BITs (Omisakin et al., 2009; Yackee, 2008) examined the behaviour of foreign investors. The study observed whether formal international legal protections are strongly considered by foreign investors when they are deciding on an investment. Keeping the other things aside, my focus in this study was to examine whether the BITs affect investment decisions. The researcher will present the result obtained after conducting a statistical analysis. This statistical analysis evaluates whether the formally most substantial BITs are associated with more significant investment flows. Furthermore, the researcher did not find any critical link between the provision of protection to the investor and the investing behaviour. The studies showed that there is a dramatic relationship between these two factors.

Using extensive data from 1985 until 2011, Lejour & Salfi (2015) examined the BITs on bilateral FDI stocks. With the help of indicators for membership of international organisations and governance, they corrected for endogeneity. They found a 35% increase on average bilateral FDI stocks due to ratified BITs compared to pairs of the countries without a treaty. The study also revealed that the countries with high income and high governance levels do not profit. Compared to this, the countries with Upper middle-income were found very successful in benefiting from ratified treaties. The study found that mainly in Middle & Eastern Europe and East Asia the ratified BITs increase FDI stocks.

Transition and developing countries use BITs as legal instruments to ensure protection to investors and promote enhanced levels of inflows of FDI. An in-depth study of the relationship between bilateral investment treaties and FDI revealed the influence of trade agreements on different modes of investment. Keeping this fact into consideration, the researcher examined the impacts of BITs on both horizontal and vertical FDI flows. In this regard (Sirr et al., 2017). Found a positive relation of BITs with the vertical FDI flows compared to the horizontal FDI flows. The researchers also found that Bilateral Investment Treaties tend to play a vital role in establishing better institutions for vertical flows of FDI.

For dealing with the self-selection problem Falvey & Foster-McGregor (2018) adopt a difference-in-difference analysis while budgeting the impacts of Bilateral Investment Treaties on FDI flows by considering a sample of OECD countries as compared to a large selection of less developed economies. The outcomes of this study revealed the existence of the significant impact of the Bilateral Investment Treaty on increasing FDI inflows when a developing country has signed it. Furthermore, this study also showed that the reinvigoration of deteriorating FDI relationships, development of new FDI flows and BIT formation are majorly responsible for increasing FDI flows.

There are mixed results of the studies conducted on the different developing countries. There have been multiple studies that showed the positive impact of BIT on the growth of inflows of FDI within the country. However, studies found that the effect of BITs on FDI depends upon the stage of development of the economy. The current study identifies the determinants of FDI inflows in Pakistan's with a particular focus on the role of Bilateral Investment Treaties (Buthe & Milner, 2009).

Methodology

Model Specification

The current study used both panel data and time-series data to investigate the role of bilateral investment treaties in promoting foreign direct investment. Hence, this Section is divided into two subsections, i.e. panel data analysis and time series analysis.

Panel Data Model

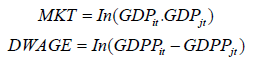

The basic gravity model to explain international bilateral trade. This model, in literature, has been intensively used by researchers to evaluate bilateral trade and investment patterns. Two distinct domains are catered for foreign investment. These domains include the market size expansion and production processes easing (Mishra & Jena, 2019; Dorakh, 2020). The market expansion is associated with horizontal motives, whereas the production process easing is associated with cheaper labour for vertical motivation. For explaining the investment, including vertical dimensions and horizontal explanation of FDI (Carr et al., 2001) used the extended gravity model. The determinant of the market size was used as an aggregate of GDP related to the contracting countries for encompassing horizontal motives. Further more, for examining the vertical motives, the variation in the GDP per capita of contracting countries was calculated. Thus, the CMM model, also known as the extended gravity-knowledge capital model, was used to evaluate the determinants of FDI inflows (Liu et al., 2020).

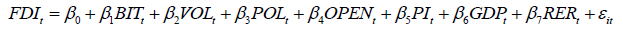

FDI flows or FDI stocks have been used as a dependent variable in most empirical work on the gravity model for investment. In this regard, current research has selected panel data from different source countries. Thus, the usage of FDI flows would be more appropriate. Globerman & Shapiro (2002) presented that this is because the calculation of FDI stock would be heterogeneous across countries. The other reason behind this is the non-availability of the data for Pakistan's FDI stock. For this purpose, as a dependent variable, the data of the net FDI inflows were used. The variable takes negative values in some periods, so the log can't apply to the dependent side. On the independent side, a log is applied, so a nil-log (semi-log) is used in the model to calculate the regression for panel data to analyse the determinants of FDI inflows among Pakistan and its investing partner. For conducting this study, the basic regression equation used is as follows:

In above equation: = FDI inflows from the home country i to Pakistan for year t;

= FDI inflows from the home country i to Pakistan for year t;

= Dummy variable for Bilateral Investment Treaty;

= Dummy variable for Bilateral Investment Treaty;

= Real GDP of the home country I;

= Real GDP of the home country I;

= Real GDP of the host country j (Pakistan);

= Real GDP of the host country j (Pakistan);

= Real per capita GDP of the home country I;

= Real per capita GDP of the home country I;

=Real per capita GDP of host country j (Pakistan);

=Real per capita GDP of host country j (Pakistan);

= Distance between the home and the host country (Pakistan);

= Distance between the home and the host country (Pakistan);

= Measure of political stability of host country (Pakistan) relative to home country.

= Measure of political stability of host country (Pakistan) relative to home country.

Bilateral investment treaties being considered the variable of our interest is incorporated as a dummy variable. The value of the variable is taken as 1. This value is one only when a BIT exists between Pakistan and the investing countries in the given year, otherwise considered 0. For expecting to have a positive sign, the variable is used to capture the impact of BITs on Pakistan's FDI inflows (Crescenzi et al., 2021).

The distance between the home country and the host country shows the geographical proximity. In this regard, the attraction of FDI can be evaluated through the geographical proximity between the host and home country. Distance is linked with the cost of transportation in the studies related to trade coverage as a dependent variable. Moreover, when FDI is taken as a dependent variable, the type of FDI will be affected by the distance between the countries (Egger, 2008; Kayam & Hisarciklilar, 2009). In investments made to achieve the production objectives and efficiency, the distance between the countries and the flow of investment is inversely proportional.

On the other hand, in the case of market expansion, a larger distance will have a positive relationship with the greater flow of investment to a destination economy. The study uses the Polity IV dataset from Penn World Table. After subtracting the score of autocracy from the score of democracy, the polity score has been computed. On the other hand, the unified polity scale ranges from +10 to -10, which represents highly democratic to highly autocratic respectively.

Time Series Model

The impact of BITs on FDI inflows is also analysed through time series analysis to improve our findings reliability of our results. The FDI flows can be determined based on different country-specific variables. One of the main determinants in this regard is the market size of the host country. The ultimate benefit of this is the expansion in market size, which attracts foreign investors (Asiedu, 2006). The FDI investment is directly proportional to the host area's (country, region, and sub-region) total income and its potential for development (Billington, 1999). The larger the size, the greater the investment and vice versa. Investors pay more attention to the market size factor than the other variables. From the theoretical perspectives, it can be observed that openness or trade restrictions could significantly impact FDI flows. This impact could either be positive or negative. There might be some policies that can be considered proved effective in the case of attracting FDI flows. Several Latin American countries have succeeded to enhance the frequency of FDI with the help of free trade agreements suggested that FDI fosters more significant trade in intermediary inputs, increase exports, or import substitution. Markusen & Maskus (2002) stated that encouraging FDI-based activities is one of the major factors responsible for varying the impact of trade openness on FDI inflows.

At present, literature related to the effects of exchange rate variation on FDI starts with the basic assumption of the imperfection of the capital market. This element will ultimately encourage foreign investors to make further investments internally. In the same way, the FDI outflows will be enabled in case of the appreciation of the host country (Xing & Zhao, 2008). Further more Pain & Van Welsum (2003) concluded that the effect of BIT on FDI inflows depends on the type of investment that a foreign investor is going to make.

A developed and improved physical infrastructure supports investment activities through many channels. Firstly, it enhances capital productivity (Looney, 1997). Secondly, it reduces the transportation and transaction costs and ultimately increases the rate of return on investment (Barro, 1990; Asiedu, 2002) and finally, it provides better access to production resources and ends good markets (Aschauer, 1989; Badawi, 2003; Suhendra & Anwar, 2014). The contribution of physical infrastructure is expected to be positive.

A conducive business environment and average macroeconomic balance are entirely based on political stability. The country's political risks are most probably dependent upon the good governance in the country and the political stability (Shahzad et al., 2012). In addition to this Husain (2009) argued that political stability plays an essential role in enhancing the ratio of attracting more FDI inflows to developing countries. Schneider & Frey (1985) stated that other factors could act as a barrier in bringing foreign investment within the country. These factors include government intervention in the economic situations, change of regime, red tape, and property rights legislation. However, the investment behaviour of the foreign investor and that of international organisations could change with a good value of governance index. The study used political instability dataset from Penn World Table.

The time series model is as follows:

In above equation:  = Total FDI net inflows in period t;

= Total FDI net inflows in period t;

= Number of active bilateral investment treaties in period t;

= Number of active bilateral investment treaties in period t;

= Volatility based on monthly data of real exchange rate. Volatility is measured using standard deviation;

= Volatility based on monthly data of real exchange rate. Volatility is measured using standard deviation;

= Political instability of Pakistan;

= Political instability of Pakistan;

= Economic Openness measured as total trade as a percentage of GDP;

= Economic Openness measured as total trade as a percentage of GDP;

= Physical infrastructure, measured by the length of roads;

= Physical infrastructure, measured by the length of roads;

= Real GDP of Pakistan in period t;

= Real GDP of Pakistan in period t;

= Real exchange rate, calculated by multiplying and dividing the official exchange rate with CPI inflation of the US and Pakistan, respectively.

= Real exchange rate, calculated by multiplying and dividing the official exchange rate with CPI inflation of the US and Pakistan, respectively.

Data Sources

Data related to the inflows of Pakistan's FDI from partner countries are taken from Hand- Book of statistic 2015. Data about the BITs negotiated by Pakistan has been collected from the Board of Investment Pakistan. The database of the World Bank has been used for collecting the data related to the independent variables the GDP per capita, the GDP, domestic credit to the private sector (FD) and trade as a percentage of GDP (OPEN). The monthly data on the official exchange rate and inflation (calculated based on the consumer price index) is taken from International Financial Statistic Database. The data relating to the political instability (Polity IV) is taken from the Penn world table database. The data relating to the distance between the capitals of contracting countries was collected from CEPII French Research Centre for International Economics, 2013.

The timespan for time series analysis is from 1985 to 2015, whereas time in the case of panel data analysis is from 1998 to 2015. Following 16 countries have been selected in panel data analysis. The name of the countries is given in Table 1. More than 90% of FDI inflows are generated from these selected countries. Out of these 16 countries, ten countries have signed BIT's before 1998, two countries have signed BIT's during the specified time, and finally, four countries haven't signed the treaties.

| Table 1 List Of Countries Included In Panel Data Analysis |

|||

|---|---|---|---|

| Countries having BITs | Countries didn't Sign BITs | ||

| Australia | Italy | Singapore | Canada |

| China | Japan | Switzerland | Hong Kong |

| France | Korea, Rep. | United Arab Emirates | Saudi Arabia |

| Germany | Netherlands | United Kingdom | United States |

Econometric Methodology

Three approaches are used for panel data estimation. The probability value of the redundant fixed effects model is 0.00, which ultimately rejects the null hypothesis, i.e. there is no cross-sectional heterogeneity. It could also be expressed as; fixed and random effects models are preferred over pooled least square. Hausman test indicates that the results of the random-effects model are more efficient and consistent than the results obtained from the fixed-effects model. In addition to this, the time-wise fixed variable's distance variable could not be used in the fixedeffects model because it will create Perfect Multi-collinearity with dummies of fixed effects. In this case, the researcher cannot estimate the fixed effects model. For the time-series data, due to the mixed order of integration of the variables, the ARDL model is employed.

Results and Discussion

The results of panel data and time series data are reported separately. The results for panel data are reported in section 4.1, whereas the time series results are presented in section 4.2.

Panel Data Result

Table 2 shows the results of parameters of equation 1 by using the random effects and fixed effects models considering the factors responsible for Pakistan's inflows of FDI. The Hausman test dictated that the random-effects model is appropriate. Thus, the results of the random-effects model are used to interpret the coefficients of parameters.

Table 2Panel Data Results |

||||

|---|---|---|---|---|

| Dependent Variable: Foreign Direct Investment | ||||

| Variables | Fixed Effects | Random Effects | ||

| Co-efficient | P-value | Co-efficient | P-value | |

| BIT | 24.98 | 0.72 | -20.08 | 0.689 |

| MKT1 | 64.02** | 0.019 | 52.17* | 0.005 |

| DWAGE2 | 24.38 | 0.321 | 22.31 | 0.218 |

| POL | -5.25* | 0 | -4.99* | 0 |

| DIS | -82.2 | 0.239 | ||

| C | -3649.22* | 0.007 | -2254.32** | 0.023 |

| Diagnostics | R2 | 0.389 | R2 | 0.102 |

| Observations | 288 | Observations | 288 | |

| Redundant fixed effects test | 120.2 (0.000) | Hausman test | 3.95 (0.412) | |

Variables significant at 1% and 5% are represented by * and **, respectively.

Variables significant at 1% and 5% are represented by * and **, respectively.

If the probability value is low for the Redundant fixed effects test, then the Fixed effects model is preferred over the Pool model.

If the probability value is low for the Hausman test, the Fixed effects model is preferred over the Random effects model.

A positive and significant value of market size (MKT) indicates the attraction toward horizontal inflows in FDI to Pakistan. Pakistan is a captive destination for market-seeking FDI due to its large market size. Meanwhile, the difference coefficient among the GDP per capita in both economies is quietly insignificant. It implies that Pakistan has failed to attract FDI as being host economy for vertical integration. Furthermore, the difference in the wage level may not be compensated for productivity. This element might negatively affect the differential GDP per capita (Globerman & Shapiro, 2002). Coefficient of time-invariant variable, distance has been found insignificant. Theoretically, the distance variable is positively related to FDI when the investment objective is to capture the local market, i.e. the distance between contracting countries is directly proportional to FDI (horizontal).

On the other hand, if the goal is gaining the level of efficiency of production, then, lesser distance is favourable. So, distance has different motives for different kinds of FDI, and it isn't easy to separate them empirically. As distance is insignificant, Pakistan receives both vertical and horizontal FDI.

The variable evaluating the political stability is negative and significant. The negative sign depicts that the democratic and political environment is not investor-friendly. This negativity also discourages inflows of FDI to Pakistan. This result is quite surprising; it will be explained in the time series analysis. The value for the variable of interest, BIT, has also been found insignificant, showing that the BITs are unfavourable and failed to enhance the FDI inflows in Pakistan. Thus, only signing the BIT's are not enough to attract FDI. In time series analysis, it will explain the factors making BIT's ineffective.

Time Series Results

Before discussing the time series results, as the efficiency and reliability of the model and coefficients depend upon the diagnostic test, the results of diagnostics of the ARDL model are presented in Table 3. The top panel in Table 3 shows that the value of bounds cointegration tests (i.e. F-stat) 7.93 is significant at a 1% level. These results depict the relationship among explanatory variables included in our model and FDI inflows during the long run. After analysing the presence of a long-run relationship, the study will now evaluate the selected model to long-run and short-run estimates. The Akaike Information Criterion (AIC) selects an ARDL (2,1,1,1,2, 2,2,2) model for net Foreign Direct Investment (FDI) for Pakistan. A serial correlation LM test is applied for Autocorrelation, ARCH LM test for Heteroscedasticity, Jarque Bera test for normality to confirm whether residuals follow the white noise process. All three tests authenticate that there is no problem in the residuals. On the other hand, the Ramsey Reset test confirms no problem with the model's specification. And finally, the stability of parameters is assessed using CUSUM and CUSUMSQ tests.

| Table 3 Diagnostics Of Time Series Regression (Ardl) |

||||

|---|---|---|---|---|

| Bounds test | F-statistic=7.93 | I(0) | I(1) | |

| 10% | 1.92 | 2.89 | ||

| 5% | 2.17 | 3.21 | ||

| 2.50% | 2.43 | 3.51 | ||

| 1% | 2.73 | 3.90 | ||

| Test statistics | P-value | |||

| Normality test | Jarque-Bera=1.91 | 0.384 | ||

| Serial Correlation | Obs*R2=1.61 | 0.203 | ||

| Heteroscedasticity Test: ARCH | Obs*R2=0.520 | 0.470 | ||

| Ramsey Reset Test | T-statistic=1.324 F-statistic=1.754 | 0.243 0.243 | ||

| Co-int Eq(-1) | -0.586 | 0.0000 | ||

| Number of observations 1985-2015 (31obs) | R2=0.994 Adj R2=0.981 | |||

The Adjusted R2 is 0.981; hence our model explains 98.1% variations of the aggregate investment. The error correction (ECM) coefficient can also confirm the long-run and short-run relationship. For a significant relation, it should be between 0 and -1. In the Pakistan foreign direct investment model, it is negative and significant, i.e. -0.586. It means 58.6% of error is adjusted in one period, i.e. a year.

For time series analysis, equation 2 is estimated by employing the ARDL model. The results of estimates are reported in Table 4. The coefficients of most independent variables are significant in the short run and the long run.

Table 4Long Run And Short Run Results Of Ardl Model |

|||

|---|---|---|---|

| Dependent Variable: Foreign Direct Investment | |||

| Variables | Co-efficient | t-stats | P-value |

| BIT | -0.052 | -0.102 | 0.921 |

| VOL | -0.50** | -2.859 | 0.021 |

| POL | -0.156* | -4.298 | 0.003 |

| OPEN | 15.51* | 7.433 | 0.000 |

| PI | 6.110* | 3.629 | 0.007 |

| GDP | 7.497* | 3.687 | 0.006 |

| RER | -0.034* | -1.451 | 0.005 |

| C | -209.3* | -3.688 | 0.006 |

| Co-int Eq (-1)* | -0.586* | -11.951 | 0.000 |

| D(BIT) | 0.763* | 6.269 | 0.000 |

| D(VOL) | 0.170* | 9.110 | 0.000 |

| D(POL) | -0.061* | -7.760 | 0.000 |

| D(OPEN) | 3.535* | 10.749 | 0.000 |

| D(PI) | -2.808 | -1.137 | 0.288 |

| D(GDP) | 12.67* | 8.952 | 0.000 |

| D(RER) | 0.008* | 1.462 | 0.002 |

| Variables significant at 1%, 5% and 10% are represented by *, ** and *** respectively. | |||

The exchange rate risk caused by the volatility in the exchange rate further stimulates the inflows of Foreign Direct Investment in the short run, as investors try to get benefit from the fluctuation in the exchange rate. The volatility in the exchange rate promotes Foreign Direct Investment when it is utilised explicitly in terms of exports (Itagaki, 1981; Cushman, 1985). Goldberg & Kolstad (1995) stated that an increase in the volatility of the real exchange rate during the short run would automatically increase the level of foreign production to the overall production. On the other hand, during the long run, the growing trend in the exchange rate volatility automatically reduces expected profits from foreign investment, irrespective of its underlying source. Hence coefficient of volatility is negative and significant in the long run. Kohlhagen (1977) & Dixit (1989) emphasised postposing the investment if the desires of the foreign investor are at risk. Despite knowing that postponing the investment will cut off how profits could be earned from that investment thus, the likelihood of delay in investment is more for industries with a long product life cycle. This delay could also be observed in firms whose estimated lifespan of specific firm assets is long (Blonigen, 1997; Dunning, 1993).

Political stability has a negative and significant coefficient in both the short and long run. Polity IV scores from the Penn world table have been used to proxy political stability. Polity IV score gives a high value to the variable when the government is democratic. In the case of Pakistan, FDI had grown drastically from 2001 to 2007 and it was a period of autocracy. On the other hand, FDI has reduced from 2008 to 2015 a democratic regime. Due to these movements, the political stability variable has a negative effect. Openness has a significant and positive coefficient in the short and long run. Hence protectionist policies will reduce the FDI inflows, in the case of Pakistan (Biglaiser & DeRouen, 2006; Chakrabarti, 2001). Physical infrastructure has no effect during the short run, whereas it gains positive and significant impact during the long run. The reason is the improved physical infrastructure boosts capital productivity and makes the business easier (Looney, 1997).

Moreover, improved infrastructure increases the investments rate of return by lowering the cost of transaction and transportation (Barro, 1990; Asiedu, 2002). Most importantly, it provides better access to production resources and ends good markets (Blejer & Khan 1984; Aschauer, 1989; Badawi, 2003; Suhendra & Anwar, 2014). If many infrastructure projects don't get completed, how can it influence the FDI, insignificant during the short run. Market size (GDP) has a positive and significant coefficient value that has been included by market size (GDP) in the short and long run. So, an argument could be acknowledged that larger markets attract more FDI (Asiedu, 2006). Market size is essential for investors because it results in economies of scale and higher sales (Wheeler & Mody, 1992; Kok & Ersoy, 2009).

The exchange rate coefficient is insignificant in the short and long run. Considering the effects of exchange rate on FDI, it has been observed that these are complicated and ambiguous. There are equal chances for increasing or decreasing the FDI inflows due to Exchange rate depreciation. In such cases, the foreign investors may lose because they have to incur costs to prevent the transaction and translation losses when currencies depreciate. Moreover, they may benefit from depreciation as the costs of inputs fall to the source country's currency. This trend allows foreign investors to increase their frequency of investment internally.

Conclusion

Since being liberalised in 1990, Pakistan has been inviting vast FDI inflows. With the enhancing negotiation in BITs regarding the frequency of its trade and increasing investment partners, the liberalisation regime has become its part. In the current study, the researcher sought to observe whether the Bilateral Investment Treaties successfully achieved desired goals, i.e. enhanced inflows of FDI to Pakistan or not. With the help of an augmented gravity model in the case of panel data and the ARDL model in time series analysis, the researcher found that Bilateral Investment Treaties failed to achieve the planned goal of attracting FDI inflows within Pakistan in the short and long run. In other words, the study does not find any importance of BITs in promoting FDI both in Panel data analysis and times series analysis. The underlying reason is that, currently, the country is facing many challenges that threaten foreign investors from investing in Pakistan: The problems of severe shortages of gas and electricity, a weak and stagnant economic situation, threat of terrorism and a deprived legal system. But the study found multiple factors supporting other factors that facilitate FDI, such as trade openness, physical infrastructure, the economy of considerable size, and similar others. The factors that hurt the motivation of foreign investors are exchange rate volatility and political instability. Recent issues of international investment disputes have changed the concerns of the treating countries. Considering the case of Pakistan, the matter of Reko - Diq is at its height. Policymakers have revised their standards and terms of conditions depending upon the size of the rewards and other open variable choices. These terms will now protect the countries from massive losses. Critics speculated that these cases would provide solid grounds on which firms could be encouraged to look for ways to exploit the terms of the contract. These terms will act based on which business could be performed in a lucrative manner, seeking compensation for unexpected risks from which the investors were not protected previously and many other similar risks. It is mandatory to examine whether BITs provide their expected rewards compared to Bilateral Investment Treaties' increasing concern and unanticipated costs. In this regard, policymakers have to establish even more authentic standards to measure the opportunity cost before selecting any BIT. However, if there is little or apparent benefit in an agreement, making those terms favour the investor becomes challenging.

References

Aisbett, E. (2007). Bilateral investment treaties and foreign direct investment: Correlation versus causation.

Indexed at, Google Scholar, Cross Ref

Aschauer, D.A. (1989). Does public capital crowd out private capital? Journal of Monetary Economics, 24(2), 171-188.

Indexed at, Google Scholar, Cross Ref

Asiedu, E. (2002). On the determinants of foreign direct investment to developing countries: Is Africa different? World Development,30(1), 107-119.

Indexed at, Google Scholar, Cross Ref

Asiedu, E. (2006). Foreign direct investment in Africa: the role of government policy, institutions and political instability. World Economy, 29(1), 63-77.

Indexed at, Google Scholar, Cross Ref

Badawi, A. (2003). Private capital formation and public investment in Sudan: Testing the substitutability and complementarity hypotheses in a growth framework. The Journal of the Development Studies Association,15(6), 783-799.

Indexed at, Google Scholar, Cross Ref

Banga, R. (2003).Impact of government policies and investment agreements on FDI inflows.

Barro, R.J. (1990). The stock market and investment.The Review of Financial Studies,3(1), 115-131.

Indexed at, Google Scholar, Cross Ref

Bhasin, N., & Manocha, R. (2016). Do bilateral investment treaties promote FDI inflows? Evidence from India. Vikalpa, 41(4), 275-287.

Indexed at, Google Scholar, Cross Ref

Biglaiser, G., & DeRouen, K. (2006). Economic reforms and inflows of foreign direct investment in Latin America. Latin American Research Review, 41 (1), 51-75.

Indexed at, Google Scholar, Cross Ref

Billington, N. (1999). The location of foreign direct investment: An empirical analysis. Applied Economics, 31(1), 65-76.

Indexed at, Google Scholar, Cross Ref

Blejer, M.I., & Khan, M.S. (1984). Government policy and private investment in developing countries.Staff Papers,31(2), 379-403.

Indexed at, Google Scholar, Cross Ref

Blonigen, B.A. (1997). Firm-specific assets and the link between exchange rates and foreign direct investment.The American Economic Review, 87,(3), 447-465.

Indexed at, Google Scholar, Cross Ref

Busse, M., Koniger, J., & Nunnenkamp, P. (2008). FDI promotion through bilateral investment treaties: more than a bit?. Review of World Economics,146(1), 147-177.

Indexed at, Google Scholar, Cross Ref

Buthe, T., & Milner, H.V. (2009). Bilateral investment treaties and foreign direct investment: A political analysis. The effect of treaties on foreign direct investment: Bilateral investment treaties, double taxation treaties, and investment flows, 171-225.

Indexed at, Google Scholar, Cross Ref

Carr, D.L., Markusen, J.R., & Maskus, K.E. (2001). Estimating the knowledge-capital model of the multinational enterprise. American Economic Review, 91(3), 693-708.

Indexed at, Google Scholar, Cross Ref

Chakrabarti, A. (2001). The determinants of foreign direct investment: Sensitivity analyses of cross-country regressions. Kyklos, 54(1), 89–113.

Indexed at, Google Scholar, Cross Ref

Crescenzi, R., Di-Cataldo, M., & Giua, M. (2021). FDI inflows in Europe: Does investment promotion work?.Journal of International Economics, 132, 103497.

Indexed at, Google Scholar, Cross Ref

Cushman, D.O. (1985). Real exchange rate risk, expectations, and the level of direct investment.The Review of Economics and Statistics, 67(2), 67297-308.

Indexed at, Google Scholar, Cross Ref

Dixit, A. (1989). Hysteresis, import penetration, and exchange rate pass-through.The Quarterly Journal of Economics,104(2), 205-228.

Indexed at, Google Scholar, Cross Ref

Dorakh, A. (2020). A gravity model analysis of fdi across the eu member states. Journal of Economic Integration, 35(3), 426-456.

Indexed at, Google Scholar, Cross Ref

Dunning, J.H. (1993). Multinational enterprises and the global economy. Wokingham: Addison-Wesley.

Indexed at, Google Scholar, Cross Ref

Egger, P. (2008). On the role of distance for outward FDI. Annals of Regional Science, 42(2), 375-389.

Indexed at, Google Scholar, Cross Ref

Falvey, R., & Foster‐McGregor, N. (2018). North‐South foreign direct investment and bilateral investment treaties.The World Economy,41(1), 2-28.

Indexed at, Google Scholar, Cross Ref

Globerman, S., & Shapiro, D. (2002). Global foreign direct investment flows The role of governance infrastructure. World Development, 30(11), 1899-1919.

Indexed at, Google Scholar, Cross Ref

Goldberg, L.S., & Kolstad, C.D. (1995). Foreign direct investment, exchange rate variability and demand uncertainty.International Economic Review, 36(4), 855-873.

Indexed at, Google Scholar, Cross Ref

Hayakawa, K., Mukunoki, H., & Yang, C.H. (2020). Liberalisation for services FDI and export quality: Evidence from China.Journal of the Japanese and International Economies,55, 101060.

Indexed at, Google Scholar, Cross Ref

Husain, I. (2009). The role of politics in pakistan's economy. Journal of International Affairs, 63(1), 1-18.

Itagaki, T. (1981). The theory of the multinational firm under exchange rate uncertainty.Canadian Journal of Economics, 14(2), 276-297.

Indexed at, Google Scholar, Cross Ref

Kayam, S., & Hisarciklilar, M. (2009). Determinants of Turkish FDI abroad. Topics in Middle Eastern and North African Economies, 11.

Kohlhagen, S.W. (1977). Exchange rate changes, profitability, and direct foreign investment.Southern Economic Journal, 44(1), 43-52.

Indexed at, Google Scholar, Cross Ref

Kok, R., & Ersoy, A.B. (2009). Analyses of FDI determinants in developing countries. International Journal of Social Economics, 36(1/2), 105-123.

Indexed at, Google Scholar, Cross Ref

Liu, H., Islam, M.A., Khan, M.A., Hossain, M.I., & Pervaiz, K. (2020). Does financial deepening attract foreign direct investment? Fresh evidence from panel threshold analysis.Research in International Business and Finance,53, 101198.

Indexed at, Google Scholar, Cross Ref

Lejour, A., & Salfi, M. (2015). The regional impact of bilateral investment treaties on foreign direct investment. Netherlands Bureau for Economic Policy Analysis, Discussion Paper, 298.

Looney, R.E. (1997). Infrastructure and private sector investment in Pakistan.Journal of Asian Economics,8(3), 393-420.

Indexed at, Google Scholar, Cross Ref

Markusen, J.R., & Maskus, К.E. (2002). Discriminating among alternative theories of the multinational enterprise. Review of International Economics, 10(4), 694-707.

Indexed at, Google Scholar, Cross Ref

Mishra, B.R., & Jena, P.K. (2019). Bilateral FDI flows in four major Asian economies: A gravity model analysis. Journal of Economic Studies, 46(1), 71-89.

Indexed at, Google Scholar, Cross Ref

Omisakin, O., Adeniyi, O., & Omojolaibi, A. (2009). Foreign direct investment, trade openness and growth in Nigeria. Journal of Economic Theory, 3(2), 13-18.

Pain, N., & Van Welsum, D. (2003). Untying the Gordian knot: The multiple links between exchange rates and foreign direct investment.JCMS: Journal of Common Market Studies,41(5), 823-846.

Indexed at, Google Scholar, Cross Ref

Piteli, E.E., Kafouros, M., & Pitelis, C.N. (2021). Follow the people and the money: Effects of inward FDI on migrant remittances and the contingent role of new firm creation and institutional infrastructure in emerging economies. Journal of World Business, 56(2), 101178.

Indexed at, Google Scholar, Cross Ref

Pradhan, J.P. (2011). Emerging multinationals: A comparison of chinese and indian outward foreign direct investment. International Journal of Institutions and Economies, 3(1), 113-148.

Rose-Ackerman, S., & Tobin, J. (2005). Foreign direct investment and the business environment in developing countries: The impact of bilateral investment treaties.Yale Law & Economics Research Paper, 293.

Indexed at, Google Scholar, Cross Ref

Salacuse, J. W., & Sullivan, N.P. (2005). Do BITs work: An evaluation of bilateral investment treaties and their grand bargain.Harvard International Law Journal,46(1), 67.

Indexed at, Google Scholar, Cross Ref

Schneider, F., & Frey, B.S. (1985). Economic and political determinants of foreign direct investment.World Development, 13(2), 161-175.

Indexed at, Google Scholar, Cross Ref

Shahzad, A., Mithani, D.A., Al-Swidi, A.K., & Fadzil, F.H. (2012). Political stability and the foreign direct investment inflows in pakistan. British Journal of Arts and Social Sciences, 9(2), 199-213.

Siegmann, T. (2007). The impact of bilateral investment treaties and double taxation treaties on foreign direct investments. U. of St. Gallen Law & Economics Working Paper, 2008-22.

Indexed at, Google Scholar, Cross Ref

Sirr, G., Garvey, J., & Gallagher, L.A. (2017). Bilateral investment treaties and foreign direct investment: There is evidence of asymmetric effects on vertical and horizontal investments.Development Policy Review,35(1), 93-113.

Indexed at, Google Scholar, Cross Ref

Suhendra, I., & Anwar, C.J. (2014). Determinants of Private Investment and The Effects on Economic Growth in Indonesia.Journal on Business Review (GBR),3(3), 1-6.

Indexed at, Google Scholar, Cross Ref

Wheeler, D., & Mody A. (1992). International investment location decisions: the case of US firms. Journal of International Economics, 33(1-2), 57-76.

Indexed at, Google Scholar, Cross Ref

Xing, Y., & Zhao, L. (2008). Reverse imports, foreign direct investment and exchange rates.Japan and the World Economy,20(2), 275-289.

Indexed at, Google Scholar, Cross Ref

Yackee, J.W. (2008). Bilateral investment treaties, credible commitment, and the rule of (international) law: Do BITs promote foreign direct investment? Law & Society Review, 42(4), 805-832.

Indexed at, Google Scholar, Cross Ref

Received: 25-May-2022, Manuscript No. JLERI-22-12077; Editor assigned: 27-May-2022, PreQC No. JLERI-22-12077(PQ); Reviewed: 09-Jun-2022, QC No. JLERI-22-12077; Revised: 29-Jul-2022, Manuscript No. JLERI-22-12077(R); Published: 05-Aug-2022