Review Article: 2023 Vol: 29 Issue: 2

The Reliability And Relevancy Of Accounting Information Systems Impact Auditing Profession

Khalid Hasan Al Jasimee, University of Al-Qadisiyah

Hasan Talib Hashim, Southern Technical University

Tahreer Sallal Rabeea, Southern Technical University

Citation Information: Al Jasimee, K.H., Hashim, H.T., & Rabeea, T.S. (2023). The reliability and relevancy of accounting information systems impact auditing profession. Journal of the International Academy for Case Studies, 29(2), 1-10.

Abstract

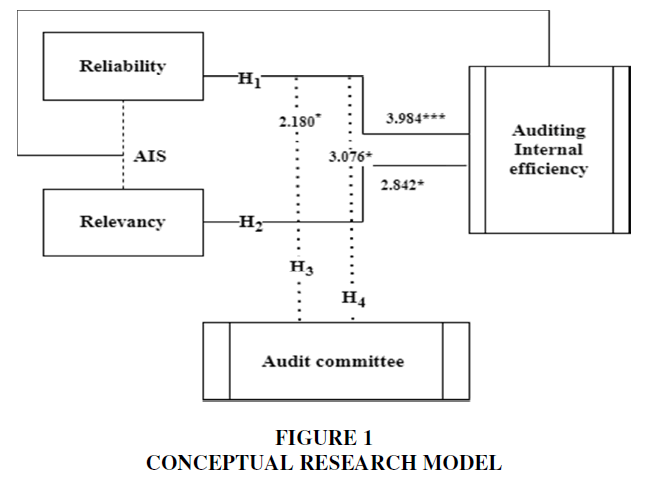

Simple random sample analysis was conducted to determine how Accounting Information System factors affect Internal Audit efficiency in Iraqi companies listed on XIS Securities Market. A moderate variable, audit committees, was also added to reveal overlapping impact relationships. Several factors were considered, including reliability and relevance as the components to be considered in the analysis of our study. This study was based on agency, adaptive structuration, and stewardship theories. Analysis was conducted using Smart PLS and Regression for PLS-SEM as the primary study's methodology. A survey of 690 individuals with responsibility for Internal Audit was conducted. In the regression analysis, reliability was found to impact the efficiency of internal audits significantly. Accounting information systems improve internal audit efficiency as well. Furthermore, the audit committee's moderation was significant in all relationships, According to the third and fourth hypotheses.

Keywords

Accounting Information Systems, Reliability, Relevance, Audit Profession.

Introduction

As a result, having a competent internal audit function unit as a component of a modern governance structure in a distinct environment is crucial. Therefore, internal audit (IA) challenges in corporate governance have gotten much interest in the past few years on various bases. Internal audit, for example, connects to the platform for internal control and risk management; Effectively enriches organizational performance as well as efficiency through the contribution of critical feedback and submissions about the performance of an organization; minimizes informational asymmetries during judgment; and is assumed to be a crucial part of confidence in the organizations and financial reporting procedures of companies, to name a few (Anggadini, 2015; Brazel & Agoglia, 2007; Kocsis, 2019; Nicolaou, 2000; Tuttle & Vandervelde, 2007).

Internal auditing is now regarded as a crucial administration component and a crucial factor of good management. In the past few years, progressive developments Globally, the intricacy of legislation, and technical improvements have recognized novel instruments and avenues for internally auditing growth that aid administration and contribute to the firm (Brazel & Agoglia, 2007; Pan & Seow, 2016). These capacities also led to the current perception of the auditor, who now retains a vast number of qualities and finest applies tailored According to the requirements of the surroundings (Warhurst, 2005). The current performance of auditing reflects its development. Audits provide insight and improve an organization's activities (Gray, 2000; Warhurst, 2005). A structured, measured approach to evaluating and improving risk, management, and governance systems assists a company in achieving its goals (Shad et al., 2019).

An accounting Information System (AIS) is an instrument that can assist organizational administration in better monitoring and developing the firm's operations and accomplishments. AIS include locating, gathering, analysing, and presenting accounting data to workers and decision-makers at various levels of the organization (Möller et al., 2020; Nicolae, 2019). The accounting information system is a control system that can be manual or computer-based. Enhances an organization's cohesion by assigning a numerical value to previous, current, and potential economic occurrences (Ioppolo et al., 2012; Worrell et al., 2013). An accounting information system's core role includes information creation, Collected data, stored data, information accounting, knowledge management, and security control (Nguyen & Nguyen, 2020).

Accounting information systems (AIS), one of a company's most important technologies, revolutionized how data is collected, analyzed, stored, and distributed. Therefore, AIS should be implemented when running a business and setting up internal control systems (Saeidi & Prasad, 2014; Soudani, 2012). Guragai et al. (2017) and Onodi et al. (2021) define AIS as a group of elements and components linked and interacting with the environment. They functioned as a unique overlapping connection with one another and the combining mechanism. Each component relies on the others to achieve the objectives set forth by the holistic accounting system, which is to offer information and data to decision-makers (Mosier & Skitka, 2018).

Literature Review

Accounting Information Systems (AIS) and Auditing

Many researchers endeavour to study the impact of effective Accounting information systems (AIS) on other organization departments from their effectiveness, performance, and goals. In general, Accounting information systems (AIS) and information technology (IT) significantly impact the efficiency of internal control and internal audit in businesses (Al-Waeli et al., 2020). In the same regard, Steinbart et al. (2012) noted that if a corporation includes an adequate auditing structure, accounting accuracy can be harbored. Robust audit control helps the organization's management place more faith in information to conduct their business operations appropriately and assess its success. Qatawneh (2021) noted that the primary function of internal audit is to perform transaction processes for financial reporting and that the Accounting information systems (AIS) aided them in this endeavour. Accounting information systems (AIS) can assist internal auditors in accomplishing their objectives by identifying, analysing, classifying, assembling, recording, reviewing, and reporting occurrences (Almaliki et al., 2019). According to Daniela & Attila (2013), Auditing improves accounting information credentials through record matching and evaluating internal controls. Furthermore, it evaluates the reliability of accounting information, calculates and reduces the accounting error risk, optimizes the efficiency of accounting transactions recorded, creates SWOT analysis (strengths, weaknesses, opportunities, and threats) of accounting stirs and reviews the whole management system (Daniela & Attila, 2013).

Moreover, Ejoh & Ejom (2014) exposed that Auditing involves the preservation of accounting records, safeguarding assets, and adhering to procedures and practices. Ebrahim & Fattah (2015) found that audit quality was good owing to adherence to international auditing standards and local audit regulations. Internal auditing, on the other contrary, evolved as a separate subset of the vast accounting industry, employing basic accounting concepts and procedures (Sieber, 2022).

Reliability

The reliability of financial information can be defined by Alsabti & Khalid (2022) as the constant validation and use of financial information by creditors and investors. Financial reporting is generally impractical without reliability and credibility (Toms, 2002). AIS success is dependent on reliability, according to Harati-Mokhtari et al. (2007). A reliable accounting information system (AIS) is also characterized by reliability, according to Butler & Gray (2006).

A precise, inconsistent level of control and flexibility has been observed in Accounting Information Systems (AIS) (Ruggeri & Rizza, 2017). Therefore, selecting an accounting information system (AIS) assessed dependability (Chenhall, 2003; Harati-Mokhtari et al., 2007; Scandura & Williams, 2000). As a result, AIS reliability was used to identify its impact on internal auditing efficiency; therefore, internal auditing should be based on AIS reliability and accuracy (Qatanani & Hezabr, 2015).

Moreover, it should be able to understand how AIS is developed and operated and how the controls are activated. As most organizations become more practical because of globalization and competition, their Accounting information systems (AIS) may be vulnerable to attack from inside and outside (Hla & Teru, 2015).

Thus, the first hypothesis can be formulated:

H1: The reliability of accounting information systems positively impacts internal audit efficiency.

Relevancy

Relevance refers to the ability of financial information to assist users in making decisions about inadequate resources and assessing performance accountability. Hla & Teru (2015) argue that information is relevant if it can influence users' economic decisions and if it is provided at the right time. The findings of El-Dalabeeh & Al-Shbiel (2012) and Ladan Shagari et al. (2017) support the notion that AIS factors play an important role in relevance. Relevance is a proper measure of accounting information's quality. Thus, the relevance of AIS was adopted to identify its impact on IAE so that relevant accounting information can influence the decisions of those using it, such as auditors and managers. Furthermore, it simplifies comprehensive knowledge, making it easier to make decisions in any problematic situation (El-Dalabeeh & Al-Shbiel, 2012).

The following hypothesis is suggested:

H2: The relevancy of accounting information systems positively impacts internal audit efficiency.

Audit Committee

The audit committee is a subcommittee of the representatives of supervisors of joint stock companies that controls the financial reporting process.

A company's audit committee comprises several members of the company's board of directors selected from among them, as defined by Butler & Gray (2006). A committee of three to five non-managerial members is responsible for maintaining the external auditor's independence from management. On the other hand, a committee of the American Institute of Certified Public Accountants investigates illegal actions by senior management in joint stock companies. It includes at least three non-executive board members with financial and accounting experience. Mosier & Skitka (2018) describe how to carry out the organization's responsibilities in a comprehensive guide.

A committee will oversee the relationship between external and internal auditing. Both internal and external auditors are audited to improve their effectiveness, efficiency, and independence from management. Besides the Audit Committee's authority to choose external and internal auditors, they submit their reports to a specialized committee composed of external managers. Thus, auditing will be improved, and investors' interests will be protected (Al-Waeli et al., 2020).

Guragai et al. (2017) state that the audit committee's primary duty is to oversee the company's financial reporting, financial performance, and internal auditing efficiency. Audit committees are based on two pillars of responsibility: management's obligation to the board of directors and the board's responsibility to stakeholders. Since the audit committee monitors the firm's external and internal audit a process, its role closely relates to the board's oversight function (Ruggeri & Rizza, 2017). As a result, the study recommended an internal control system that prevents unauthorized individuals from obtaining sensitive information installs alarms and tracks computer movement. In this study, it is proposed that the audit committee reduce the use of accounting information systems to improve the efficiency of internal auditing (Figure 1). Additionally, auditors should moderate factors affecting accounting information systems (Reliability, Relevance) and internal auditing efficiency. As a result of prior discussions, the following hypotheses have been developed:

H3: Audit committee enhances the positive effect of reliability on internal audit effectiveness

H4: Audit committee enhances the positive effect of relevance on internal audit effectiveness

Method

Data Collection

The sample comprised 690 subjects, 33% from public enterprises and 67% from private enterprises listed on IXS in IRAQ. Financial accounts managers, accountants, internal auditors, external auditors, and audit committee members should be surveyed.

The questions considered in the questionnaire were derived from literature reviews and previous studies (Scandura & Williams, 2000) (Chenhall, 2003); Tan (2016); (Qatanani & Hezabr, 2015). Thus, to evaluate reliability (RIS), we adapted the scale developed by (Harati-Mokhtari et al., 2007); Ladan Shagari et al. (2017). The items related to the Relevance (RVS) were adapted from Ladan Shagari et al. (2017). In our study, we used a five-point Likert scale, where 1 is strongly disagreeing and 5 is strongly agreeing.

Data Analysis

Firstly, to assess the questionnaire's psychometric properties, we examined item loadings by conducting factor analysis, Cronbach's α score the constructs, Kolmogorov–Smirnov test, and exploratory factor analysis.

In order to test the proposed hypotheses, Smart PLS was used to investigate the association of additional independent variables. F-Square generated cross-validated redundancy (Q2) and goodness-of-fit models and provided statistical interpretation of R and (R2) coefficients.

Finally, collinearity analysis was used in this study to test correlation coefficients and variance inflation factor (VIF) values, and the tolerance coefficient.

Results

Exploratory Factor Analysis (EFA)

For all the items, loadings higher than 0.7 were obtained. Table 1 summarizes the results of the exploratory factor analysis measurement of sampling adequacy and Cronbach's alpha coefficient values.

| Table 1 Results of Variables Adequacy | ||

| Statement | AVE | CR |

| Reliability (RIS) | 0.638 | 0.934 |

| Relevancy (RVS) | 0.661 | 0.940 |

| Internal auditing efficiency (IA) | 0.640 | 0.956 |

| Audit committee (ADC) | 0.654 | 0.961 |

For each construct, high EFA values were obtained. Also, Cronbach’s α scores were higher than 0.8, which indicated internal consistency and reliability for the elements of the scales.

Table 2 indicates that Data reveal that Cronbach's alpha coefficient ranges from 0.709 to 0.823, with values up to 0.8. Therefore, the data is exceptionally reliable. Furthermore, the Relevance and Audit committee contains ten items with a high Cronbach's Alpha coefficient. Cronbach's Alpha values range between 0.709 and 0.823, demonstrating the variables' credibility.

| Table 2 Cronbach's Alpha Coefficient Test | |

| Variables | Cronbach's Alpha |

| Reliability (RIS) | 0.824 |

| Relevance (RVS) | 0.734 |

| Internal audit Effectiveness (IA) | 0.825 |

| Audit committee (ADC) | 0.723 |

| Average Cornbrash’s Alpha of all variables | 0.776 |

Table 3 illustrates the significance of the correlation at 0.01 levels, suggesting relevance is more important than substantial levels. The Pearson correlation coefficient of the Relevance variable indicates a high level of correlation with other related variables. The Pearson coefficient indicates a high correlation between reliability and other variables. Finally, the audit committee variable is significantly correlated with other variables.

| Table 3 Pearson Correlation Test | ||||

| Pearson Correlation | ADC | IA | RVS | RIS |

| ADC | 1.000 | |||

| IA | 0.899** | 1.000 | ||

| RVS | 0.772** | 0.798** | 1.000 | |

| RIS | 0.758** | 0.787** | 0.766** | 1.000 |

Table 4 shows that the data do not survive the collinearity test. Two methods for testing for multi collinearity are correlation coefficients and variance inflation factors (VIFs). Combine all predictor variables into a correlation matrix and look for coefficients greater than .80. Correlations between these variables are strong. With a VIF of 1/Tolerance, the tolerance coefficient should not exceed one (Wheeler & Tiefelsdorf, 2005). VIF values should never exceed ten; the best-case scenario is less than six. The table of collinearity tests shows that the data are not problematic.

| Table 4 Multi Collinearity Test | ||

| Variables | Collinearity Statistics | |

| Tolerance | VIF | |

| Reliability (RIS) | 0.345 | 3.065 |

| Relevance (RVS) | 0.343 | 3.033 |

| Internal audit Effectiveness (IA) | 0.357 | 3 |

| Audit committee (ADC) | 0.434 | 2.453 |

Data Analysis Using PLS-SEM Smart PLS

The results of the regression analysis are shown in Tables 2-5.

The first hypothesis theorizes that the reliability of accounting information systems (RIS) positively impacts internal audit efficiency (IA). According to Table 5, the coefficient of RIS is significant. The β value was 0.231, and the p-value was 0.000, The significance level is less than 0.05. Therefore, at the specified significance level, the model is significant. Therefore, the first hypothesis is supported, and the RIS variable significantly impacts IA.

| Table 5 Regression Analysis Results for the First Hypothesis | ||||

| Coefficient | Std. Error | t-statistic | p-value | |

| Reliability (RIS) | 0.231 | 0.059 | 3.984*** | 0.000*** |

| R Square = 0.301; Model F- Square = 0.161 | ||||

The second hypothesis suggests that the relevancy of accounting information systems (RVS) positively impacts internal audit efficiency (IA). The results in Table 6 show that the coefficient of RVs is significant. Regarding the significance of the model, β is 0.233, and the p-value is 0.000, indicates that the model is statistically significant at the significance level of 0.05. Therefore, the second hypothesis is supported; RVS significantly influences IA.

| Table 6 Regression Analysis Results for the Second Hypothesis | ||||

| Coefficient | Std. Error | t-statistic | p-value | |

| Relevancy (RVS) | 0.233 | 0.069 | 2.842* | 0.000* |

| R Square = 0.682; Model F- Square = 0.335 | ||||

According to the third hypothesis, the audit committee's role moderates the reliability effect on internal audit effectiveness. Table 7 illustrations that β is 0.214, and the T value is 2.180; this indicates a significant positive moderate relationship between reliability and internal audit effectiveness. Therefore, the researcher failed to reject the hypothesis.

| Table 7 Regression Analysis Results for the Third Hypothesis | ||||

| Coefficient | Std. Error | t-statistic | p-value | |

| ADC x RIS | 0.214 | 0.071 | 2.180* | 0.050* |

| R Square = 0.562; Model F- Square = 0.289 | ||||

A fourth hypothesis suggests that the audit committee's role moderates the relevance effect on internal audit effectiveness. Based on Table 8, the correlation coefficient is 0.309, and the T value is 3.076; therefore, relevance and internal audit effectiveness are related significantly but moderately. As a result, the researcher did not reject the hypothesis.

| Table 8 Regression Analysis Results for the Fourth Hypothesis | ||||

| Coefficient | Std. Error | t-statistic | p-value | |

| ADC x RVS | 0.309 | 0.066 | 3.076** | 0.007** |

| R Square = 0.682; Model F- Square = 0.335 | ||||

Conclusions

This study examines the relationship between accounting information systems and internal auditing efficiency in Iraqi companies listed on the XIS. Furthermore, accounting information systems impact auditing efficiency. Developing the SEM model and testing the hypotheses presented are essential components of study. The subsequent study conclusions have been drawn based on these factors. Preliminary tests indicate that the questionnaire is consistent and stable, and the data are valid and reliable before conducting the exploratory factor analysis. This research model can be constructed based on the constructs identified by the exploratory factor analysis.

An analysis of the study constructs reveals that all items in the constructs assess the constructs intended for the study. The items were chosen from previous research, indicating that they can provide accurate measurements. Data analysis indicates that the data align with the research model, which accurately represents the relationship between variables in terms of structural relationships. Based on the assessment of the SEM model, it was determined that the model accurately matched the data and validated the suitability of the structural model. As far as achieving the target objective is concerned, the results confirm the effectiveness of the research model.

All direct hypotheses are supported in the hypothesis testing several studies support these finding. There is no doubt that the constructs that represent the main characteristics of AIS have a significant impact on internal auditing efficiency, demonstrating the importance of accounting information systems. Therefore, this refers to the reliability of the constructions in achieving the study's objectives and analyzing its findings. Based on the significant effect, a more controlled auditing environment can be achieved as a result of accounting information systems.

Furthermore, the audit committee's moderation was significant in all relationships, as suggested in the third and fourth hypotheses

Implications

Regarding the theoretical implications, it will provide accurate and factual advice on improving IAE in Iraqi companies listed on the IXS; it will enable investment decisions to be implemented on the platform and overcome obstacles. In addition, the International Accounting Standard Board (IASB) and tax officials will also use study data to enhance internal audits and develop legal regimes.

As for the practical implications, the study will provide experimental results on the abilities and skills of accounts and financial managers, accountants, internal auditors, and audit committee members. In addition, the study involves the creation of a new audit committee. Early research focused on programs and parts, paid capital, and governance.

Limitations and Future Directions

Some restrictions of study can be declared; Firstly, the sample comprised the top individuals with XI's responsibility in Iraq. A more comprehensive sample may be helpful in future studies. Also, this study used factors of accounting information systems such as reliability and relevancy as variables affecting internal auditing efficiency. Future research may include other variables such as System Integration, Flexibility, and strategic advantage.

References

Almaliki, O.J., Rapani, N.H.A., Khalid, A.A., & Sahaib, R.M. (2019). Structural equation model for the relationship between accounting information system and internal audit effectiveness with moderating effect of experience. International Business Education Journal, 12, 62-82.

Indexed at, Google Scholar, Cross Ref

Alsabti, H.A., & Khalid, A.A. (2022). Factors influencing internal accounting and financial audit effectiveness: Evidence from Oman. Academy of Accounting and Financial Studies Journal, 26, 1-11.

Al-Waeli, A.J., Hanoon, R.N., Ageeb, H.A., & Idan, H.Z. (2020). Impact of accounting information system on financial performance with the moderating role of internal control in Iraqi industrial companies: An analytical study. Jour of Adv Research in Dynamical & Control Systems, 12(8), 246-261.

Indexed at, Google Scholar, Cross Ref

Anggadini, S.D. (2015). The effect of top management support and internal control of the accounting information systems quality and its implications on the accounting information quality. Information Management and Business Review, 7(3), 93-102.

Indexed at, Google Scholar, Cross Ref

Brazel, J.F., & Agoglia, C.P. (2007). An examination of auditor planning judgements in a complex accounting information system environment. Contemporary Accounting Research, 24(4), 1059-1083.

Indexed at, Google Scholar, Cross Ref

Butler, B.S., & Gray, P.H. (2006). Reliability, mindfulness, and information systems. MIS Quarterly, 211–224.

Indexed at, Google Scholar, Cross Ref

Chenhall, R.H. (2003). Management control systems design within its organizational context: findings from contingency-based research and directions for the future. Accounting, Organizations and Society, 28(2-3), 127-168.

Indexed at, Google Scholar, Cross Ref

Daniela, P., & Attila, T. (2013). Internal audit versus internal control and coaching. Procedia Economics and Finance, 6, 694-702.

Indexed at, Google Scholar, Cross Ref

Ebrahim, A., & Fattah, T.A. (2015). Corporate governance and initial compliance with IFRS in emerging markets: The case of income tax accounting in Egypt. Journal of International Accounting, Auditing and Taxation, 24, 46–60.

Indexed at, Google Scholar, Cross Ref

Ejoh, N.O., & Ejom, P.E. (2014). The effect of internal audit function on the financial performance of tertiary institutions in Nigeria. International Journal of Economics, Commerce and Management, 2(10), 1-14.

El-Dalabeeh, A., & Al-Shbiel, S.O. (2012). The role of computerized accounting information systems in reducing the costs of medical services at King Abdullah University Hospital. Interdisciplinary Journal of Contemporary Research in Business, 4(6), 893-900.

Gray, R. (2000). Current developments and trends in social and environmental auditing, reporting and attestation: A review and comment. International Journal of Auditing, 4(3), 247-268.

Indexed at, Google Scholar, Cross Ref

Guragai, B., Hunt, N.C., Neri, M.P., & Taylor, E.Z. (2017). Accounting information systems and ethics research: Review, synthesis, and the future. Journal of Information Systems, 31(2), 65-81.

Indexed at, Google Scholar, Cross Ref

Harati-Mokhtari, A., Wall, A., Brooks, P., & Wang, J. (2007). Automatic Identification System (AIS): data reliability and human error implications. The Journal of Navigation, 60(3), 373-389.

Indexed at, Google Scholar, Cross Ref

Hla, D., & Teru, S.P. (2015). Efficiency of accounting information system and performance measures. International Journal of Multidisciplinary and Current Research, 3(2), 976-984.

Ioppolo, G., Saija, G., & Salomone, R. (2012). Developing a territory balanced scorecard approach to manage projects for local development: Two case studies. Land Use Policy, 29(3), 629-640.

Indexed at, Google Scholar, Cross Ref

Kocsis, D. (2019). A conceptual foundation of design and implementation research in accounting information systems. International Journal of Accounting Information Systems, 34, 100420.

Indexed at, Google Scholar, Cross Ref

Ladan Shagari, S., Abdullah, A., & Mat Saat, R. (2017). Accounting information systems effectiveness: Evidence from the Nigerian banking sector. Interdisciplinary Journal of Information, Knowledge, and Management, 12, 309-335.

Indexed at, Google Scholar, Cross Ref

Möller, K., Schäffer, U., & Verbeeten, F. (2020). Digitalization in management accounting and control: an editorial. Journal of Management Control, 31, 1-8.

Indexed at, Google Scholar, Cross Ref

Mosier, K.L., & Skitka, L.J. (2018). Human decision makers and automated decision aids: Made for each other?. In Automation and human performance: Theory and applications (pp. 201-220). CRC Press.

Nguyen, H., & Nguyen, A. (2020). Determinants of accounting information systems quality: Empirical evidence from Vietnam. Accounting, 6(2), 185-198.

Indexed at, Google Scholar, Cross Ref

Nicolae, T.C. (2019). Aspects regarding the use of information technology tools for processing accounting information on fair value. Ovidius University Annals, Economic Sciences Series, 19(2), 819-824.

Nicolaou, A.I. (2000). A contingency model of perceived effectiveness in accounting information systems: Organizational coordination and control effects. International Journal of Accounting Information Systems, 1(2), 91-105.

Indexed at, Google Scholar, Cross Ref

Onodi, B.E., Ibiam, O., & Akujor, J.C. (2021). Management accounting information system and the financial performance of consumer goods firms in Nigeria. European Journal of Business and Management Research, 6(1), 112-120.

Indexed at, Google Scholar, Cross Ref

Pan, G., & Seow, P.S. (2016). Preparing accounting graduates for digital revolution: A critical review of information technology competencies and skills development. Journal of Education for Business, 91(3), 166-175.

Indexed at, Google Scholar, Cross Ref

Qatanani, K.M., & Hezabr, A.A. (2015). The effect of using accounting information systems to improve the value chain in business organizations-empirical study. European Journal of Accounting Auditing and Finance Research, 3(6), 1-11.

Qatawneh, A.M. (2021). Risks of adopting automated ais applications on the quality of internal auditing. Journal: Wseas Transactions on Business And Economics, 763-779.

Indexed at, Google Scholar, Cross Ref

Ruggeri, D., & Rizza, C. (2017). Accounting information system innovation in interfirm relationships. Journal of Management Control, 28, 203-225.

Indexed at, Google Scholar, Cross Ref

Saeidi, H., & Prasad, B. (2014). Impact of accounting information systems (AIS) on organizational performance: A case study of TATA consultancy services (TCS)-India. Journal of Management and Accounting Studies, 2(03), 54-60.

Indexed at, Google Scholar, Cross Ref

Scandura, T.A., & Williams, E.A. (2000). Research methodology in management: Current practices, trends, and implications for future research. Academy of Management journal, 43(6), 1248-1264.

Indexed at, Google Scholar, Cross Ref

Shad, M.K., Lai, F.W., Fatt, C.L., Klemeš, J.J., & Bokhari, A. (2019). Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of Cleaner Production, 208, 415-425.

Indexed at, Google Scholar, Cross Ref

Sieber, J. (2022). Internal audit of the informational management process. REFLEXIE-Compendium of theory and Practice of Business, 6 (1), 91-106.

Indexed at, Google Scholar, Cross Ref

Soudani, S.N. (2012). The usefulness of an accounting information system for effective organizational performance. International Journal of Economics and Finance, 4(5), 136-145.

Indexed at, Google Scholar, Cross Ref

Steinbart, P.J., Raschke, R.L., Gal, G., & Dilla, W.N. (2012). The relationship between internal audit and information security: An exploratory investigation. International Journal of Accounting Information Systems, 13(3), 228-243.

Indexed at, Google Scholar, Cross Ref

Toms, J. S. (2002). Firm resources, quality signals and the determinants of corporate environmental reputation: some UK evidence. The British Accounting Review, 34(3), 257-282.

Indexed at, Google Scholar, Cross Ref

Tuttle, B., & Vandervelde, S.D. (2007). An empirical examination of CobiT as an internal control framework for information technology. International Journal of Accounting Information Systems, 8(4), 240-263.

Indexed at, Google Scholar, Cross Ref

Warhurst, A. (2005). Future roles of business in society: the expanding boundaries of corporate responsibility and a compelling case for partnership. Futures, 37(2-3), 151-168.

Indexed at, Google Scholar, Cross Ref

Worrell, J.L., Di Gangi, P.M., & Bush, A.A. (2013). Exploring the use of the Delphi method in accounting information systems research. International Journal of Accounting Information Systems, 14(3), 193-208.

Indexed at, Google Scholar, Cross Ref

Received: 24-Mar-2023, Manuscript No. JIACS-23-13381; Editor assigned: 27-Mar-2023, PreQC No. JIACS-23-13381(PQ); Reviewed: 11-Apr-2023, QC No. JIACS-23-13381; Revised: 25-Apr-2023, Manuscript No. JIACS-23-13381(R); Published: 02-May-2023