Research Article: 2023 Vol: 27 Issue: 4

The relationship between voluntary disclosure of carbon emission information and audit hours

Suyon Kim, Jeonbuk National University

Citation Information: Kim, S. (2023). The relationship between voluntary disclosure of carbon emission information and audit hours. Academy of Accounting and Financial Studies Journal, 27(4), 1-12.

Abstract

The purpose of this study is to examine the relationship between the voluntary disclosures of carbon emissions influences audit hours. Using, 1,671 Korean firms from 2018 to 2021, this study uses regression analysis to determine whether the voluntary disclosure of carbon emissions is related to total audit hours. This study further tests the impact of voluntary disclosure of carbon emissions on audit hours of engagement partners, CPA, and staff. The findings of this study imply that even though managers’ voluntarily disseminating information alleviates information asymmetry, auditors perceive it as an increase in inherent risk, which is a driver for higher audit hours. Also, this study deepens the understanding of the effect of voluntary disclosure of carbon emissions on audit hours by rank. The result suggests that if the auditor recognizes that the company's voluntary disclosure activities cause an audit risk, they will not only put partners and CPAs, who are expected to have sufficient expertise and experience, into the audit work, but also increase the audit hours of staff.

Keywords

Voluntary Disclosure, Carbon Emission, Audit Hours, Audit Hours by Rank.

Introduction

The purpose of this research is to determine whether auditors' audit hours are correlated with voluntary disclosure of carbon emissions. There is an information asymmetry problem among information users who participate in the capital market, and managers use a system of disclosure to alleviate the information asymmetry problem. Previous studies have also confirmed that when a company releases key information, the problem of information asymmetry between the company and external information users is alleviated (Lang & Lundholm, 1996). In addition, disclosing information voluntarily increases firm value (Frankel et al., 1995) and decreases the cost of capital and cost of debt (Hwang & Kim, 2013).

Despite the potential benefits to the capital market and the decrease of information asymmetry between firms and external information users that may result from management's disclosure efforts, auditors may view voluntary disclosure as a risk factor that increases audit risk as part of their audit risk assessment. When auditing, external auditors evaluate whether the financial statements are prepared in conformity with Generally Accepted Accounting Principles. As they do so, the external auditors establish an audit risk model that considers both inherent and control risks of the audited company to determine the level of detection risk (Wu, 2012, Bedard & Johnstone, 2003). Accounting complexity is one of the primary elements that may influence audit risk, as shown in research by Hoitash & Hoitash (2018), which suggests that economic communication through the number and quantity of accounting transactions or occurrences incurs accounting complexity. In a similar vein, if management has voluntarily revealed information that is included in the financial statements, this might be a factor that increases the audit risk. Therefore, auditors will increase the amount of work they put into auditing a company if they perceive that the firm is high-level inherent risks caused by management’s voluntary disclosure initiatives.

This study employs the data from Carbon Disclosure Project (CDP) as a proxy for voluntary disclosure. CDP provides a survey-based report that firms have the option to reply to (Ahn et al., 2017). Once the companies have decided to take part in the survey and answer the questions, they will be required to respond to standardized and informative questionnaires. Therefore, companies that voluntarily take part in the CDP may anticipate having a greater amount of work than those that do not. Collecting and analyzing data on carbon emissions is a prerequisite to responding to CDP's survey, and revealing that data requires an awareness of how that information fits into sustainability problems (Institute of Chartered Accountants in England and Wales, 2004). Therefore, as voluntary carbon disclosure poses a higher audit risk for corporations than non-disclosure, external auditors must confirm the accuracy of the information that firms choose to report, leading to more audit hours. Thus, this study analyzes whether auditors perceive voluntary disclosure of carbon emissions as an audit risk and increase audit hours.

The rest of the paper is structured as shown in the following paragraphs. The process of developing hypotheses and conducting an in-depth analysis of the previous research is laid out in detail in Section 2. After that, the research design, which consists of the data selection procedure and the model, is provided in Section 3, and Section 4 describes the results that were gathered from the study. The study's conclusions and data analysis are presented in Section 5, which concludes the findings of this study.

Theoretical Background and Hypothesis Development

Voluntary disclosure of carbon emission

Carbon emission is becoming increasingly important for stakeholders who are interested in the effects of global warming. Stakeholders expect transparent information, and firms often reveal their real obligations to meet their commitments and enhance their environment-based decision (Datt et al., 2019). Furthermore, companies may seek to convince stakeholders that they care about the environment via voluntary disclosure as a means of adapting to the increased focus on the environment.

CDP is a channel for voluntarily disclosing the environmental status of carbon emissions. CDP is an environmental organization headquartered in the UK that was founded in December 2000 with the support of 35 European financial institutions. Since then, the number of member institutions has continuously expanded, and as of 2017, 803 global financial institutions (assets under management: USD 100 trillion) are participating, and 6,300 firms from 91 countries have contributed carbon emission data to CDP. CDP demands information on climate change awareness, preventative measures, and greenhouse gas emissions, and makes investment choices based on information supplied by companies through CDP. In other words, by participating in CDP, companies contribute to raising awareness of greenhouse gas emissions and reducing carbon emissions, and creating a structure that can attract global investment by showing investors the sustainable management results of companies.

The disclosure of information about carbon emissions to CDP is not mandatory, but optional; nonetheless, the information regarding carbon emissions from corporations that are released through CDP is regarded as having a very high level of reliability for the following reasons (Matsumura et al., 2014). Markets can assess the credibility of disclosed carbon emissions information by comparing a company's carbon emissions information with other companies in the same industry.

CDP conducts surveys on major companies around the world, but emissions from companies belonging to some countries such as the EU are legally regulated. Firms that voluntarily reveal information can utilize this as a reference standard to assure their credibility. In this scenario, the accuracy of carbon emission information is ensured, and these companies may be compared with other companies. Also, even though firms have the choice to provide CDP with information about their carbon emissions and decide whether or not to disclose that information, they tend to continue to disclose the information once they choose to reply to CDP's request (Stanny, 2013). The more companies respond to CDP's requests, the more costs they will incur when reporting unreliable or misinformation in the future. As stakeholder interest in climate change increases, as the number of reporting companies within the same industry increases, and as the certainty about carbon emissions information increases, the accuracy and reliability of information can be confirmed by the market. However, if the market becomes aware that a company has reported this unreliable information, the company may lose credibility in other disclosures besides carbon emissions. In this scenario, the dangers that corporations are exposed to, such as the possibility of being in the middle of a legal issue, are exceedingly significant. Therefore, it can be said that the information of companies reporting to the CDP is highly reliable even though it is voluntary.

Previous studies have focused on the relationship between carbon emission and information asymmetry. Lang & Lundholm (1996) suggested that firms’ disclosure alleviates information asymmetry, leading to a lower cost of capital. Sengupta (1998) found that both thorough and timely disclosure of information lowers the creditors' impression of the firm's potential for bankruptcy, which in turn lowers the cost of the firm's debt. The study suggested that disclosure is comparatively more crucial for firms operating in markets with a high degree of uncertainty. Also, previous studies have confirmed that voluntary disclosure increases firm value (Darrough & Stoughton, 1990; Frankel et al., 1995), and lowers the cost of equity (Botosan, 1997), the cost of debt capital (Hwang & Kim, 2013).

Although there is a possibility that voluntary disclosure of carbon emissions could yield a positive result, the altruistic responsibility hypothesis suggests that investments made to address environmental issues will likely be relatively pricey (Lee & Jeon, 2019). Oh & Park (2021) examined the relationship between voluntary disclosure of the schedule of manufacturing cost and audit report lag. Instead of having the impact of reducing information asymmetry as a result of voluntary disclosure, it is presumable that the inclusion of voluntary disclosure in financial statements has a relatively big influence on raising inherent risks and an increase in audit reporting time delays. Companies that voluntarily disclose their carbon emissions data may be subject to a larger amount and diversity of accounting information that must be included in their financial statements, thereby increasing the audit complexity.

Risk and audit hours

When auditors perform an audit, they are required to have a sufficient degree of understanding and knowledge of the auditees to ensure that the financial statements are under generally accepted accounting principles and to detect any possible fraud (Johnstone et al. 2003). When auditors plan for the audit, auditors should decide the appropriate degree of detection risk that they can fairly evaluate to prevent any significant potential misstatement per the audit risk model (Houston et al., 1999). The audit risk model includes both risks of material misstatement in financial statements and detection risk. Because of the fundamental features of the auditee and the operating environment, there is a possibility that the financial statements contain materially misleading information. However, auditors have control over the detection risk, and they can modify the amount of audit risk to an acceptable level. For instance, if auditors believe there is a significant likelihood of material misstatement, they should maintain the detection risk low so that the overall risk is still manageable.

To control detection risk, auditors adjust their efforts. The International Standard on Auditing (ISA) 330 recommends that auditors should exert more effort while carrying out audits to account for the elevated risk (ISA 330). The number of audit hours will be the most important criterion to measure audit effort (Caramanis & Lennox, 2008). Prior research has measured audit efforts using audit fees; however, audit fees are embedded with many elements such as the risk premium, legal liability costs, and the audit market's external and internal environment (Choi et al., 2008; Bills et al., 2015). Therefore, we place a primary emphasis on the audit hours as a direct assessment of the audit efforts.

Stein et al. (1994) categorized audited firms by industry and found that company size and operational complexity in each industry were the primary determinants of audit time for each industry. The findings of Bell et al. (2001) demonstrate that a high audit risk is positively correlated with a high audit hour total, which suggests that a higher audit hour total may compensate for a higher audit risk. Ji & Moon (2006) contended that auditors increase their audit effort for client firms with uncertainty problems. According to Woo & Lee's research (2009), contingent liability, such as payment guarantee, is a factor that contributes to higher audit risk, leading to an increase in audit hours. The findings of their investigation showed that a greater number of audit hours are necessary to provide payment guarantees. Furthermore, the findings suggest that more audit hours are needed for firms with higher debt ratios. Park et al. (2010) examined the variables that contribute to total auditing hour increases. The findings suggest that auditors put in more effort when confronted with audit risk.

Hypotheses Development

Prior studies on voluntary disclosure stated several positive outcomes, such as lower information asymmetry (Bhattacharya et al., 2012), positive stock price (Gelb & Zarowin 2002), lower cost of capital (Francis et al., 2005), and lower discretionary accruals (Lobo & Zhou, 2001). On the other hand, other studies may bring negative consequences. Sohn et al. (2008) argued that managers disclose only information that is beneficial to them. Richardson (2000) also confirmed that voluntary disclosure is positively related to discretionary accruals, implying that voluntary disclosure does not reduce information asymmetry, but rather managers are more actively engaged in opportunistic behavior by disclosing subjective information that is favorable to them.

Previous research has mostly focused on examining how the disclosure of information voluntarily affects the financial market. On the other hand, this research makes an effort to approach the topic from an auditing point of view. Companies that voluntarily disclose their carbon emissions data may confront a more complicated audit due to the increased volume and diversity of accounting information that must be included in their financial statements. From the perspective of auditors, as environmental issues are becoming more prevalent in the firm and included in disclosing financial statements, voluntary disclosure of carbon emissions is regarded as an inherent risk. According to the findings of Hoitash & Hoitash (2018), the number of accounting items reported in the eXtensible Business Reporting Language (XBRL), 10-K filings is a reasonable indicator of the level of accounting reporting complexity.

There is another reason for audit complexity. Carbon emissions may be viewed as an environmental debt that the firm will pay off in near future (Choi & Noh, 2016). Carbon emission is sometimes followed by litigations, which will result in expenses associated with restoration. Because provisions for any expenses related to restoration and contingent liabilities will need to be disclosed as a consequence of such occurrences, the process of compiling financial reports will become more complicated (Choi & Noh, 2016). PWC (2016) reports that audit firms recognize environmental liability reporting as fundamentally complicated. As a result of this, voluntarily disclosing information about carbon emissions will result in an increase in audit efforts due to the additional audit complexity that will arise from the reporting of environmental responsibility. When taken as a whole, it is expected that businesses engaged in voluntary disclosure of carbon emissions will increase audit hours owing to the greater risk and complexity of audits as well as the higher risk to the auditor's company.

When auditors conclude that a company has a high level of risk, they most likely devote more time to the audit (Kwon & Ki, 2011). Krishnan et al. (2012) found that audit efforts increase if management disclosed annual or quarterly profit forecast information in the previous fiscal year. It is because the auditor's business risk rises due to the increased likelihood of earnings management and lawsuit risk associated with management's profit forecasting activities. Ryu & Park (2018) also found a statistically significant positive correlation between the degree of disclosure and audit fees. Therefore, disclosing information voluntarily entails high audit risk and it will lead to higher audit hours. Because the information in voluntary disclosures might raise the risk of material misstatement of financial statements, auditors should make more audit efforts to reduce the risk of exposure and achieve a sufficient level of audit quality. This suggests that firms with high voluntary disclosure levels need the auditor’s effort to enhance the reliability of financial information. Thus, this gives rise to the following hypothesis:

H1: There is a positive relationship between voluntary disclosure of carbon emissions and audit hours.

When auditing, the external audit team is composed of quality control, engagement partners, certified public accountants (CPA), and staff. They are hierarchical groups that have sufficient knowledge, different levels of experience, and comprehension of the client firms to detect any possible accounting fraud (Johnstone et al., 2003). Public Company Accounting Oversight Board (PCAOB) (2015) explains that the average career length of each member of the audit team, including engagement partners, CPAs, staff, and expertise is the indicator of audit quality.

Bell et al. (2008) stated that following the auditor's risk management, it is important to assign an appropriate level of audit members to audit risk-related matters. Thus, the distribution of human resources invested in audit differs depending on the risk of the client firm (O’Keefe et al., 1994). Hackenbrack & Knechel (1997) also stated that audit efforts are divided into activities such as audit planning, actual audit test, review, and communication of client firms, and each audit stage is associated with the auditors of each rank. In other words, engagement partners will be more focused on overall audit planning, monitoring, and review process, while staff, relatively having less experience, will be more involved in tests of controls. Hackenbrack & Knechel (1997) contend that since each position is based on the individual's prior experiences and areas of competence, the responsibilities and duties associated with each position are distinct.

For instance, engagement partners with more experience can weaken audit risk. The engagement partner has the ultimate responsibility for the whole process, beginning with the contract with the client and continuing through the completion of the audit and the delivery of the audit report (Zerni, 2012; Bae et al., 2019). According to Bell et al. (2008), the engagement partner has an in-depth understanding of the industry that the audited company operates in, as well as its business model, strategy, and business procedures, which leads to an impact on the audit process. The registered CPA is in charge of the actual on-site audit work, such as conducting audit procedures for the account in charge. Staff members are responsible for more time-consuming tasks and play the function of supporting qualified CPAs in their job (Ryu et al., 2015).

Revealing firms’ true information on carbon emissions voluntarily implies that more accounting transactions are included in the financial reporting process than firms do not disclose. As Hoitash & Hoitash (2018) suggest, voluntarily disclosing information about carbon emission results in complexity in transactions the auditor should verify whether the process follows the Generally Accepted Accounting Principles (GAAP). Therefore, this study attempts to assess the effect of voluntary disclosure of carbon emissions on audit hours by each rank. For example, if the firm discloses the information on carbon emissions, engagement partners will regard carbon emissions as an inherent risk to adjust their effort at the beginning of the audit process, and audit hours of engagement partners will increase. Alternatively, the voluntary disclosures of carbon emissions might result in a rise in the number of accounting transactions, which could lead to an increase in the auditing activities of the staff. With this reasoning, the second hypothesis is as follows.

H2: There is a positive relationship between voluntary disclosure of carbon emissions and partner (CPA, staff) audit hours.

Research Design

Data

Table 1 details how the data set was refined and the final data set was chosen for the investigation. Non-financial firms that were listed on the Korea Stock Exchange (KSE) and the Korea Securities Dealers Automated Quotation (KOSDAQ) during the years 2018 and 2021 were included in the first data set. Both the total audit hours and the audit hours by rank are publicly disclosed and collected manually from business reports. Non-financial companies with a December year-end accounting system were included in the initial data collection, which covered the years 2018-2021. To construct the data set that was used for the analysis of this study, 1,671 businesses that lacked information on the voluntary disclosure of carbon emission and audit hours data were omitted, as were businesses that possessed insufficient information concerning the firms' financial information. After removing the firms that did not meet the standards, 1,671 firms are left for the final data set.

| Table 1 The Data Selection Process |

|

|---|---|

| Non-financial firms with information on voluntary disclosure of carbon emission and December year-end from 2018-2021 | 3,963 |

| Less: | |

| Firms without audit hours | 1,309 |

| Firms without financial data | 983 |

| Final Sample | 1,671 |

Model Specification

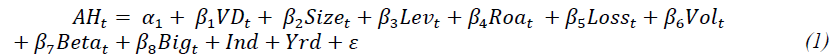

In the first hypothesis, as the firms disclose the environmental status of carbon emissions, auditors perceive disclosure as a higher audit risk, resulting in more effort invested by auditors. VD denotes as 1 if the firm discloses the information on carbon emission voluntarily. AH is the total audit hours. Thus, the following model is specified. In South Korea, as of 2014, the audit hours of each engagement partner, CPA, and staff are required to be disclosed in the audit report. Among them, engagement partners and CPA are responsible for the audit procedure while staff makes their effort in time-consuming work by supporting superiors. The natural logarithm of total audit hours and audit hours by each rank is measured (AH). The variable of our interest is VD to find the relationship between voluntary disclosure and audit hours. This study expects a positive (+) coefficient of β1. The control variables that are reported to affect audit hours are included in equation (1). Equation (1) incorporates year dummies as well as industry dummies to account for changes across firms for comparable year-industry observation

Where, AH = log (total audit hours); VD = 1 if a firm voluntarily discloses information of carbon emission, 0 otherwise; Size = log (total assets); Lev = (total liabilities/total assets); Roa = (net income/ total assets); Loss = 1 if a firm with loss in year t, and 0 otherwise; Vol = Volatility of daily price-earnings ratio in year t; Beta = Systematic risk measurement in year t; Big = 1 if a firm is audited by one of big4 accounting firms, 0 otherwise; Ind = industry dummy variables; Yr = year dummy variables

Empirical Findings

Descriptive Statistics

The descriptive statistics for the main variables used in this investigation are shown in Table 2. The mean value of voluntary disclosure of carbon emission (VD) is 0.284, and its median is 0.000. The average total audit hours are shown as 7.244 and its median value displays 7.093. The average (median) of partner audit hours spent is 4.903 (4.970). The audit hours that a CPA spends on average is 6.816, which indicates that CPAs are the ones who spend the most time on the process.

| Table 2 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Variables | Mean | STD | Q1 | Median | Q3 |

| VD | 0.284 | 0.451 | 0.000 | 0.000 | 1.000 |

| AH | 7.244 | 0.803 | 6.758 | 7.093 | 7.566 |

| PH | 4.903 | 0.902 | 4.263 | 4.970 | 5.553 |

| CH | 6.816 | 0.794 | 6.342 | 6.708 | 7.139 |

| SH | 5.892 | 1.130 | 5.182 | 5.900 | 6.540 |

Note: Where, VD = 1 if a firm voluntarily discloses information of carbon emission, 0 otherwise; AH = natural logarithm of total audit hours; PH = natural logarithm of partner audit hours; CH = natural logarithm of CPA audit hours; SH = natural logarithm of staff audit hours.

Table 3 shows the Pearson Correlation for the main variables that are used in this study. It does not take into account the impact of any other experimental or control variables that may be important before testing the Hypotheses. Instead, it provides the findings of the Pearson correlations between the key variables. The correlation indicates that voluntary disclosure of carbon emissions positively affects audit hours and audit hours by rank. The results of the correlation may have some restrictions placed on their interpretation because they do not account for the influence of the controlling variables that may have an impact on the link between each variable.

| Table 3 Pearson Correlation |

|||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| (1) VD | 1.000 | 0.424 | 0.342 | 0.453 | 0.371 |

| <.0001 | <.0001 | <.0001 | <.0001 | ||

| (2) AH | 1.000 | 0.474 | 0.955 | 0.803 | |

| <.0001 | <.0001 | <.0001 | |||

| (3) PH | 1.000 | 0.433 | 0.375 | ||

| <.0001 | <.0001 | ||||

| (4) CH | 1.000 | 0.678 | |||

| <.0001 | |||||

| (5) SH | 1.000 | ||||

Note: See Table 2 for variable definitions.

Primary Findings

The results of the multivariate tests on voluntary disclosure of carbon emission and total audit hours are summarized in Table 4, which presents the results of the testing of the first hypothesis. The VD coefficient is 0.253, which is statistically significant at the 1% level and supports the first hypothesis. These results can be interpreted that auditors who audit companies with voluntary disclosure of carbon emissions increase the amount of time invested in audits, recognizing that the audited companies are in a state of high audit risk. The findings of this study are consistent with Hoitash & Hoitash (2018), which describes that the increased quantity and variety of information that firms are required to report will lead to increase audit complexity. Also, El-Din et al. (2021) suggest that revealing information voluntarily adds to firms’ obscure economic reality arising from complexity. Therefore, the overall number of audit hours will rise as a consequence of environmental liability reporting due to the increasing complexity of audits.

| Table 4 Regression Analysis On The Relationship Between Voluntary Disclosure Of Carbon Emission And Total Audit Hours |

||

|---|---|---|

| Variables | Coeff. | t-stat. |

| Intercept | -1.193 | -3.470*** |

| VD | 0.253 | 6.980*** |

| Size | 0.316 | 25.610*** |

| Lev | 1.098 | 14.330*** |

| Roa | -0.132 | -1.120 |

| Loss | 0.078 | 1.610 |

| Vol | 0.004 | 0.040 |

| Beta | 0.051 | 1.510 |

| Big | 0.564 | 9.930*** |

| Ind Dummy | Included | |

| Year Dummy | Included | |

| F-value | 136.020*** | |

| Adj. R2 | 0.557 | |

| Observations | 1,671 | |

1) *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

2)Where, VD = 1 if a firm voluntarily discloses information of carbon emission, 0 otherwise; Size = log (total assets); Lev = (total liabilities/total assets); Roa = (net income/ total assets); Loss = 1 if a firm with loss in year t, and 0 otherwise; Vol = Volatility of daily price-earnings ratio in year t; Beta = Systematic risk measurement in year t; Big = 1 if a firm is audited by one of big4 accounting firms, 0 otherwise; Ind = industry dummy variables; Yr = year dummy variables .

Table 5 shows the result of the analysis on the relationship between voluntary disclosure of carbon emissions and audit hours spent by each partner, CPA, and staff. The coefficient of VD with the partner audit hours as the dependent variable displays 0.240 and is statistically significant at the 1% level. Similarly, the coefficient of VD with CPA audit hours shows 0.292, statistically significant at the 1% level. The correlation between VD and staff audit hours shows a value of 0.196, which is statistically significant at the 1% level. These results support the second hypothesis. If the auditor identifies actions related to voluntary disclosure as posing a risk to the audit, this information may be considered input into the audit process by members who possess both skill and experience and spend more time. Disclosure of non-financial information on carbon emissions may need a greater reliable and transparent reporting to keep investors confident in the financial markets and attract new investors. Thus, audit team members exert their audit effort as they are responsible for giving assurance on the reporting.

| Table 5 Regression Analysis On The Relationship Between Voluntary Disclosure Of Carbon Emission And Audit Hours Spent By Each Partner, Cpa, And Staff |

||||||

|---|---|---|---|---|---|---|

| Partner | Cpa | Staff | ||||

| Variables | Coeff. | t-stat | Coeff. | t-stat | Coeff. | t-stat |

| Intercept | -0.838 | -2.260 | -1.868 | -5.680*** | -3.294 | -7.450*** |

| VD | 0.240 | 6.150*** | 0.292 | 8.380*** | 0.196 | 4.330*** |

| Size | 0.224 | 16.820*** | 0.324 | 27.430*** | 0.335 | 21.380*** |

| Lev | 0.853 | 10.310*** | 1.125 | 15.360*** | 1.504 | 15.170*** |

| Roa | -0.097 | -0.760 | -0.134 | -1.190 | 0.092 | 0.620 |

| Loss | 0.119 | 2.290** | 0.068 | 1.480 | 0.108 | 1.740 |

| Vol | 0.176 | 1.510 | 0.129 | 1.250 | 0.075 | 0.530 |

| Beta | 0.053 | 1.440 | 0.046 | 1.420 | 0.092 | 2.090** |

| Big | -0.354 | -5.780*** | 0.436 | 8.010*** | 0.361 | 3.570*** |

| Ind | Included | Included | Included | |||

| Yrd | Included | Included | Included | |||

| F-value | 55.649*** | 146.510*** | 73.580*** | |||

| Adj. R2 | 0.337 | 0.580 | 0.422 | |||

| Obs | 1,671 | 1,671 | 1,671 | |||

1) *** indicates significance at the 1% level.

2)Where, VD = 1 if a firm voluntarily discloses information of carbon emission, 0 otherwise; Size = log (total assets); Lev = (total liabilities/total assets); Roa = (net income/ total assets); Loss = 1 if a firm with loss in year t, and 0 otherwise; Vol = Volatility of daily price-earnings ratio in year t; Beta = Systematic risk measurement in year t; Big = 1 if a firm is audited by one of big4 accounting firms, 0 otherwise; Ind = industry dummy variables; Yr = year dummy variables

This is the same case as emphasizing confirming audit hours by position to ensure accounting transparency (O'Keefe et al., 1994).

Discussion

This study is to examine the relationship between the voluntary disclosure of carbon emissions and total audit hours. The activities of disseminating information voluntarily lower the information asymmetry in the market and the cost of capital and debt. However, managers’ acts of willingly disclosing information about carbon emissions may be perceived as a higher audit risk by auditors. If any factors might affect financial reporting, it leads to an increase in inherent risk, which will necessitate more audit efforts. Therefore, this study assesses whether voluntary disclosure of carbon emissions is perceived as a factor that increases audit risk, thereby increases more audit hours. Using data from 1,671 Korean companies from 2018 to 2021, this study discovers that auditors put more effort that voluntarily disclosing their information on carbon emissions, as a result of the increased complexity of the auditing environment. At the same time, this study suggests how disseminating information on carbon emission affects audit hours by engagement partners, Cpa, and staff, since audit quality can be differentiated by the members of the audit team (Francis et al., 2011). The quality of the audit may be increased if the audit team is made up of individuals who have more previous experience and knowledge in the related field, as well as members who have a solid comprehension of both the business being audited and the industry to which the firm belongs. Therefore, in this study, to confirm whether auditors are assigned discriminatively to management's voluntary disclosure activities based on their position, an analysis was carried out using the information on audit hours by rank (Matsumura et al., 2014; Choi & Noh, 2016).

The result of this study finds that there is a positive correlation between voluntary disclosure of carbon emissions and total audit hours. Even in cases when management willingly reveals corporate information to reduce the information asymmetry, auditors identify this as a risk to the audit and perceive it to be an increase in the amount of work that has to be done for the audit. Second, the results of the analysis suggest that there is a positive relationship between the voluntary disclosure level of companies and the audit time by rank. When auditors consider the company's voluntary disclosure operations to be an audit risk, it is reasonable to assume that the engagement partners and CPAs will direct more attention to the audit work and use their skills and experience. At the same time, increased audit risk yields more amount of workload to be done thus increasing the audit hours of staff.

The findings of this study provide a substantial contribution to the current body of research. First, while both risk and complexity have been recognized as major factors in determining the amount of time spent on an audit, measurements of audit complexity have often been treated more as control variables rather than the variable of interest (Pong & Whittington, 1994). Although there is a widespread agreement among academics that auditing a client with a high level of complexity requires more time and effort (Hay et al., 2006; Simunic, 1980), there is a lack of emphasis on the factors that directly drive audit complexity. As a result, this study expands the research that has been studied on audit hours by determining that the voluntarily disclosing activities of a company are a driver of audit complexity. To the best of my knowledge, this is the first study to view the voluntary disclosure of carbon emission information concerning audit efforts. Second, this study proposes to explore the positions of audit members as well as audit hours by different positions utilizing significant aspects of audit efforts made by auditors to achieve its purpose. Although a significant number of previous research has focused on audit hours, most of those studies have only investigated overall audit hours. Using total audit hours is limited in identifying the experiences, competencies, and differences by auditors by rank.

Conclusion

Global warming is a real threat to mankind and many countries are suffering from its consequences. Carbon emissions, which are generally believed to be the cause of climate change, have an impact not just on the environment but also on important aspects of the economy. It is expected that many companies should proactively undertake measures to develop themselves to evolve under the impact of the environmental crisis and expands to the opportunity for sustainable existence. Although this study is based on the analysis of four years, it is expected that future research should focus on gathering more information that can be generalized as CDP data accumulates over time, as well as investigating patterns in company and market reactions to changes in the environmental regulatory system.

References

Ahn, M.G., & Ko, D.Y. (2017). The effect of voluntary carbon mission disclosure on debt characteristics. Journal of Business Research, 32(3), 261-283.

Bae, G.S., Choi, S.U., & Lee, J.E. (2014). Audit partner’s experiences and their differential associations with audit hours, audit fees, and audit quality. Korean Accounting Journal, 23(6), 175-235.

Bae, G.S., Kim, J.T., & Choi, S.U. (2019). Labor mix hours of industry specialist auditors: Analysis on audit firm and audit partner. Korean Accounting Review, 44(5), 43-74.

Indexed at, Google Scholar, Cross Ref

Bell, T.B., Doogar, R., & Solomon, I. (2008). Audit labor usage and fees under business risk auditing. Journal of Accounting Research, 46(4), 729-760.

Indexed at, Google Scholar, Cross Ref

Bell, T.B., Landsman, W.R., & Shackelford, D.A. (2001). Auditors' perceived business risk and audit fees: Analysis and evidence. Journal of Accounting Research, 39(1), 35-43.

Indexed at, Google Scholar, Cross Ref

Bhattacharya, N., Ecker, F., Olsson, P. M., & Schipper, K. (2012). Direct and mediated associations among earnings quality, information asymmetry, and the cost of equity. The Accounting Review, 87(2), 449-482.

Indexed at, Google Scholar, Cross Ref

Bills, K.L., Jeter, D. C., & Stein, S. E. (2015). Auditor industry specialization and evidence of cost efficiencies in homogenous industries. The Accounting Review, 90(5), 1721-1754.

Indexed at, Google Scholar, Cross Ref

Botosan, C.A. (1997). Disclosure level and the cost of equity capital. Accounting Review, 323-349.

Caramanis, C., & Lennox, C. (2008). Audit effort and earnings management. Journal of Accounting and Economics, 45(1), 116-138.

Indexed at, Google Scholar, Cross Ref

Choi, J.H., Kim, J.B., Liu, X., & Simunic, D. A. (2008). Audit pricing, legal liability regimes, and Big 4 premiums: Theory and cross?country evidence. Contemporary Accounting Research, 25(1), 55-99.

Indexed at, Google Scholar, Cross Ref

Choi, J.S., & Noh, J.H. (2016). Usefulness of voluntarily disclosed carbon emissions information. Korean Accounting Review, 41, 105-157.

Darrough, M.N., & Stoughton, N.M. (1990). Financial disclosure policy in an entry game. Journal of Accounting and Economics, 12(1-3), 219-243.

Indexed at, Google Scholar, Cross Ref

Datt, R.R., Luo, L., & Tang, Q. (2019). Corporate voluntary carbon disclosure strategy and carbon performance in the USA. Accounting Research Journal, 32(3), 417-435.

Indexed at, Google Scholar, Cross Ref

El-Din, M.M. A., El-Awam, A.M., Ibrahim, F.M., & Hassanein, A. (2021). Voluntary disclosure and complexity of reporting in Egypt: the roles of profitability and earnings management. Journal of Applied Accounting Research, 23(2), 480-508.

Indexed at, Google Scholar, Cross Ref

Francis, J.R. (2011). A framework for understanding and researching audit quality. Auditing: A Journal of Practice & Theory, 30(2), 125-152.

Indexed at, Google Scholar, Cross Ref

Francis, J.R., Khurana, I.K., & Pereira, R. (2005). Disclosure incentives and effects on cost of capital around the world. The Accounting Review, 80(4), 1125-1162.

Indexed at, Google Scholar, Cross Ref

Frankel, R., McNichols, M., & Wilson, G.P. (1995). Discretionary disclosure and external financing. Accounting Review, 135-150.

Gelb, D. S., & Zarowin, P. (2002). Corporate disclosure policy and the informativeness of stock prices. Review of Accounting Studies, 7, 33-52.

Indexed at, Google Scholar, Cross Ref

Hackenbrack, K., & Knechel, W.R. (1997). Resource allocation decisions in audit engagements. Contemporary Accounting Research, 14(3), 481-499.

Indexed at, Google Scholar, Cross Ref

Hay, D.C., Knechel, W.R., & Wong, N. (2006). Audit fees: A meta?analysis of the effect of supply and demand attributes. Contemporary Accounting Research, 23(1), 141-191.

Indexed at, Google Scholar, Cross Ref

Hoitash, R., & Hoitash, U. (2018). Measuring accounting reporting complexity with XBRL. The Accounting Review, 93(1), 259-287.

Indexed at, Google Scholar, Cross Ref

Houston, R.W., Peters, M.F., & Pratt, J.H. (1999). The audit risk model, business risk and audit?planning decisions. The Accounting Review, 74(3), 281-298.

Indexed at, Google Scholar, Cross Ref

Hwang, K.J., & Kim, K.B. (2013). Research paper: The effect of voluntary disclosure quality on the cost of debt. Korean Accounting Journal, 22(3), 369-397.

Institute of Chartered Accountants in England and Wales. (2004). Information for better markets-Sustainability: The role of accountants. London, U. K.: ICAEW.

Ji, H.M., & Moon, S.H. (2006). The effect of litigation risk on audit hours and conservatism. Study on Accounting, Taxation & Auditing, 43, 311-336.

Johnstone, K.M., & Bedard, J.C. (2003). Risk management in client acceptance decisions. The Accounting Review, 78(4), 1003-1025.

Indexed at, Google Scholar, Cross Ref

Krishnan, G.V., Pevzner, M., & Sengupta, P. (2012). How do auditors view managers’ voluntary disclosure strategy? The effect of earnings guidance on audit fees. Journal of Accounting and Public Policy, 31(5), 492-515.

Indexed at, Google Scholar, Cross Ref

Kwon, S.Y., & Ki, E.S. (2011). The effect of accruals quality on the audit hour and audit fee. Korean Accounting Review, 36(4), 95-137.

Lang, M.H., & Lundholm, R.J. (1996). Corporate disclosure policy and analyst behavior. Accounting Review, 467-492.

Lee, K.S., & Jeon, S.I. (2019). The effects of carbon emission information on firm values. Journal of Environmental Policy and Administration, 27, 69-98.

Indexed at, Google Scholar, Cross Ref

Lobo, G.J., & Zhou, J. (2001). Disclosure quality and earnings management. Asia-Pacific Journal of Accounting & Economics, 8(1), 1-20.

Indexed at, Google Scholar, Cross Ref

Ma, H.Y., & Kwon, S.Y. (2010). The effect of abnormal audit hours and fees on prior period error corrections. Study on Accounting, Taxation & Auditing, 51, 119-155.

Matsumura, E.M., Prakash, R., & Vera-Munoz, S.C. (2014). Firm-value effects of carbon emissions and carbon disclosures. The Accounting Review, 89(2), 695-724.

Indexed at, Google Scholar, Cross Ref

Oh, H.M., & Park, S.B (2021). The effect of voluntary disclosure of the schedule of manufacturing cost on audit report lag. Review of Accounting and Policy Studies, 26(4), 135-166.

Indexed at, Google Scholar, Cross Ref

O'Keefe, T.B., Simunic, D.A., & Stein, M.T. (1994). The production of audit services: Evidence from a major public accounting firm. Journal of accounting research, 32(2), 241-261.

Indexed at, Google Scholar, Cross Ref

Park, J., Lee, S.C., & Jeong, K. (2010). A study on the relationship between audit risk and audit fees. Korean Management Review, 39, 633-663.

Pong, C.M., & Whittington, G. (1994). The determinants of audit fees: Some empirical models. Journal of Business Finance & Accounting, 21(8), 1071-1095.

Indexed at, Google Scholar, Cross Ref

Richardson, V.J. (2000). Information asymmetry and earnings management: Some evidence. Review of Quantitative Finance and Accounting, 15, 325-347.

Indexed at, Google Scholar, Cross Ref

Ryu, S.W., Lee, J.C., Kim, E.G., & Han, S.S. (2015). Effect of total audit hour and internal quality assurance hour on audit quality (discretionary accruals). Korean Accounting Review, 40(4), 213-246.

Ryu, S.Y., & Park, B.J. (2018). The moderating effect of board characteristics on the relationship between voluntary disclosure level and audit fees. Accounting Information Review, 36(1), 115-137.

Indexed at, Google Scholar, Cross Ref

Sengupta, P. (1998). Corporate disclosure quality and the cost of debt. Accounting Review, 459-474.

Simunic, D.A. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 161-190.

Indexed at, Google Scholar, Cross Ref

Sohn, S.K., Kwak, B.J., & Jin, L.H. (2008). The effect of voluntary disclosures on analysts’ earnings forecasts. Accounting Information Research, 26(2), 1-26.

Stanny, E. (2013). Voluntary disclosures of emissions by US firms. Business Strategy and the Environment, 22(3), 145-158.

Indexed at, Google Scholar, Cross Ref

Stein, M.T., Simunic, D.A., & Keefe, T.B. (1994). Industry differences in the production of audit services. Auditing, 13, 128.

Woo, Y.S., & Lee, H.Y. (2009). The effect of loan guarantees on audit fees and audit hours. Account. Audit. Res, 49, 43-74.

Wu, X. (2012). Corporate governance and audit fees: Evidence from companies listed on the Shanghai Stock Exchange. China Journal of Accounting Research, 5(4), 321-342.

Indexed at, Google Scholar, Cross Ref

Zerni, M. (2012). Audit partner specialization and audit fees: Some evidence from Sweden. Contemporary Accounting Research, 29(1), 312-340.

Indexed at, Google Scholar, Cross Ref

Received: 10-Mar-2023, Manuscript No. AAFSJ-23-13316; Editor assigned: 10-Mar-2023, PreQC No. AAFSJ-23-13316(PQ); Reviewed: 24-Mar-2023, QC No. AAFSJ-23-13316; Revised: 27-Mar-2023, Manuscript No. AAFSJ-23-13316(R); Published: 30-Mar-2023