Research Article: 2021 Vol: 25 Issue: 4S

The Relationship between Unemployment and the Rate of Economic Growth in Jordan A Case Study of Jordan during the Period 2003-2018

Salah Turki Alrawashdeh, Al Balqa Applied University

Zaynab Hassan Alnabulsi, Al Balqa Applied University

Citation Information: Alrawashdeh, S.T., & Alnabulsi, Z.H. (2021). The relationship between unemployment and the rate of economic growth in jordan a case study of jordan during the period 2003-2018. Academy of Accounting and Financial Studies Journal, 25(S4), 1-12.

Abstract

The study's goal was to look into the relationship between unemployment rates and economic growth rates in Jordan from 2003 to 2018. To answer the central problems of the current study, time series stability, co-integration, and Granger causality tests were used. The results supported the integrative relationship between the study's variables and the Granger's causality test by achieving a one-way relationship between unemployment rates and economic growth rates in Jordan. There was also an inverse relationship between the variables of the study that had an impact on unemployment levels in Jordan, while unemployment does not affect the economic growth in the country. The study recommended finding mechanisms to help the private sector increase its level of interaction with the economy's structure and seek to attract foreign and Arab investments to create job opportunities and distribute them fairly.

Keywords

Unemployment, Economic Growth Rate, Real GDP, Jordan Economic.

Introduction

Economic theories indicate a negative correlation between unemployment and economic growth. If growth rates rise, unemployment rates will decline and vice versa (Radulescu & others, 2019). Despite the nature of this relationship in general, research conducted in this area confirms that this relationship is not certain and the outcomes differ from one economic system to another in the direction and amount. One of the most important rules governing the nature of the relationship is related to the size of the economic sectors' dependence on employment. The more productive processes are dependent on labor-intensive goods, the greater the degree of certainty of such a relationship and the greater the degree of response of unemployment rates to change in growth rates. In contrast, if the production sectors rely heavily on automation, the degree of verification and realization of this relationship is in doubt. In addition, the concentration of economic growth in certain sectors and its impact on the entire or most sectors tend to be highly important in this context. If the sectors that depend on the production of labor-intensive goods are the driving force behind economic growth, then this situation is considered to have a negative impact on unemployment rates, and vice versa. The public sector and the size of the labor force affect this relationship and even weaken it greatly (Al-Ghad Newspaper, 2010).

According to the General Statistics Service, jobless rates reached 18.2 percent in 2017 (Al-Dustour Newspaper, 2017), while economic growth reached (2.3 percent) and began to drop substantially when compared to prior years' rates (Al-Atoum, 2018). This reduction is reasonable and connected to the Ministry of Labor's employment policy. Without the region's regional difficulties, it is clear that unemployment rates in the Kingdom will not reach these high levels. The Jordanian labor market was impacted by this, as well as the Syrian asylum crisis (Jordanian Economic and Social Council, 2016).

The current economic situation has resulted in a high rate of unemployment and a slow pace of economic growth, which is the subject of this study. The high unemployment rate should paint a reasonable image of Jordan's economy. The study's difficulty is the nature of economic strategies that favor growth trends and do not appear to match the impact of growth trends on unemployment levels (Taleb & Labeeq, 2016). Furthermore, the research is useful in determining the nature of the reciprocal link between unemployment and Jordanian economic growth rates. This connection is not given enough consideration by economic parties. This implies that economists have dominated their strategies for reaching high growth rates without giving adequate consideration to the nature of the link between growth rates and crucial economic indicators like unemployment. The awareness that economic expansion will impact their standards of living, such as the reduction of unemployment and poverty levels, is not as high as the interest of Jordan's inhabitants (Ayad, 2016). As a consequence, this research will be a significant and useful resource for academic scholars and economic entities.

Literature Review

Unemployment is defined as the compulsory cessation of part of the labor force in the economy from work, with the desire and ability to work. The labor force is the number of people who are capable of working and willing, taking into account the exclusion of the elderly and minors (Selman & Abdelah, 2017). The full employment in the canonical thought is when workers represent 96% of the workforce (Nasr, 2006; Mert, 2021). Kharboush (2015) sought to examine the relationship between unemployment rates, inflation and economic growth in Algeria during the period 1991-2013. The study used the methodology of joint integration, causal test, and error correction model. The results of the study of the instability of the time series of both: inflation and unemployment rate, only after the application of the first difference where it became stable at the first difference. And a one-way causal relationship in the sense that real GDP causes a change in inflation. According to the error correction model, the actual deviation from the two variables is corrected by 32.41 per year.

Abdul-Khaliq, et al. (2014) studied the relationship between unemployment and economic growth rate in Arab countries. It analyzed the relationship between GDP growth rates and unemployment rates in several Arab countries like Jordan, Syria, Algeria, Morocco, Palestine, Tunisia, Lebanon, Egypt between the years 1994-2010. The study was adopted to analyze the relationship on the EGLS model to prove the relationship. The results showed an inverse relationship to the effect of economic growth on unemployment so that a 1% increase in growth leads to a reduction in the unemployment rate by 0.16%. And Angus and others (2013) aimed at showing the effect of inflation on unemployment and economic growth in the long run. The demand for money was introduced through the introduction of the cash-inadvance model to invest in research and development (R & D) in the scale-invariant model which shows the inconsistency of the labor market. The results showed that high inflation leads to an increase in the cost of alternative cash and results in the reduction of inventions and thus economic growth.

The unemployment rate and economic growth in Jordan

The unemployment rate at the level of the Jordanian economy is very high, as indicated by figures issued by General Statistics Service, which is characterized by an upward trend (higher than 10 percent), chronic (continued at a high rate between 12-15.3 percent of 1999). Economists emphasize that unemployment is chronic due to a number of factors, including a weak relationship between employment and economic growth based on reports to be cited later, demographic factors that are incompatible with growth rates, trends in labor demand, and public-sector employment policies, low efficiency of operating support programs, low levels of training, and the lack of skills in the public sector. Jordan's unemployment rate in the new century is above 10%, which is particularly concerning because it is structural and has become embedded in the country's official and non-official institutions' systems and practices. Even while it did not surpass 2% in the 1970s, it has now become a frequent occurrence (General Statistics Service, 2016).

According to official estimates, the unemployment rate in Jordan in 1976 (1.6 percent), indicating that the operator at the time was unable to find enough workers, and the economic growth rate in Jordan was more than 8.5 percent, with price increases of about 12 percent, these indicators in this period show the extent of the recovery and vitality that characterized the Jordanian economy, a period in which the Jordanian economy was characterized by a period in which the Jordanian economy was characterized by a period in which the Jordanian (which is why the quality of learning and training was better than it is now). As a result, Jordan was able to export skilled workers to the Gulf. With grants and help, it was experiencing an extraordinary economic boom at the time. Jordan's Arab government accounts for half of the country's revenue, and the time was distinguished by a shortage of taxes and the absence of various sales taxes. The scenario evolved over time (General Statistics Service, 2015).

After the mid-1970s, unemployment began to grow. Due to Jordanians' large income from the Gulf and their desire for relatively cushy government positions, foreign workers began to enter the nation and Jordanians were hesitant to work in numerous occupations. Unpaid government expenditure, the proliferation of alternative employment, and expansionary government policies continued in 1990. In 1989, the real growth rate collapsed to negative 10.7%, and the dinar's exchange rate fell. The unemployment rate increased to 16.8%, while high prices increased by 16.2% with a real growth rate of negative 0.3 percent. Unemployment continued to climb, hitting new highs of 17.4% in 1991 before dropping to 15% in 1992, aided by the savings of Jordanians returning from the Gulf States and resulting in a 14.2% real economic growth rate. Jordan's economy has grown at its fastest rate in the last 50 years (General Statistics Service, 2017).

However, unemployment rates rose to 19.2 percent in 1993 as a result of returnee savings and the failure of the economic structure to direct these savings to value-added enterprises that contribute to job creation and take advantage of these funds and investments, the majority of which went to unproductive properties that contributed to hiring non- Jordanians only in the construction profession. Annual employment rates hit 6.3 percent between 2003 and 2013. However, it did not exceed the average population growth rate of 2.2 percent, implying that the rate of government employment has reached three times the rate of population increase (General Statistics Service, 2015).

According to General Statistics Service statistics from 2011, female jobless rates were 2.4 times greater than male unemployment rates. The ratio of female graduates from Jordanian universities, colleges, and institutions explains this. In light of the economic crisis, unemployment had considerably improved until late 2010. Refers to the behavior of unemployment rates during periods of rapid economic development in the twenty-first century. The average unemployment rate from 2005 to 2008 was 13.7 percent, whereas the average during the recessions from 2009 to 2013 was 12.6 percent. This means that during periods of growth, unemployment rates were 12 percent in the second quarter of 2014, and the rate among males was 10.4 percent compared to 21.1 percent among females for the same period, i.e., that unemployment levels declined despite the general economic situation remaining stagnant and declining (General Statistics Service, 2016).

According to a World Bank research, Jordan's economic development prospects would remain restricted in the long term, with growth rates remaining around 2.5 percent by 2020, despite encouraging economic growth, job creation, and hosting more than 660,000 Syrian refugees (World Bank, 2017).

According to the previous investigation, experts discovered a weakness in the selected growth plan, which is deviating from its core goal: the creation of new employment based on economic growth rates (General Statistics Service, 2017).

The unemployment rate and economic growth in an international context

With sustained recovery in investment, trade, and industry, the World Bank predicted that the global economy will expand by 3.1 percent in 2018, especially after a good performance in 2017, which was widely seen as short-lived. In the long run, the slowing of the anticipated growth rate - a measure of the pace with which the economy expands at full employment of labor and capital - jeopardizes the achievements gained in raising people's living standards and contributing to global poverty reduction. The World Bank forecasted that developed-country GDP would drop to 2.2 percent in 2018, in accordance with central banks' abandonment of post-financial-crisis adjustment measures and the peaking of investment. He predicted that the growth rate in emerging markets and developing countries in general would rise to 4.5 percent in 2018, with unemployment rates returning to which was before levels and the economic picture improving in both developed and developing countries, requiring policymakers to investigate appropriate approaches to maintain the momentum required for growth (The World Bank, 2018). Bringing attention to the link between unemployment and economic growth shows chances for economic development, which leads to social development and the role it plays in improving economic growth rates. At the same time, a faster rate of economic growth and a lower rate of unemployment do not always suggest a significant link between the two.

The Relationship between Economic Growth and Unemployment

The general trend of this relationship indicates that there is a relationship between low unemployment rates and high economic growth rates. The relationship between unemployment rates and economic growth rates becomes clear through the following simplification:

High growth rates  The High Level of employment

The High Level of employment  Low unemployment rates Economic growth trends are represented by the prevailing economic policy, with Keynesian analysis confirming the demand-driven recovery policy (Palley, 2019). It is believed widely that the unemployment rate will fall automatically in response to the high rates of economic growth. There is a strong relationship between growth rates and change in unemployment rates. High growth rates indicate that the economy require additional labor to be secured from supernumerary labor accumulated in previous periods. On the other side, stagnation usually accompanied by low or negative growth rates, shows an increase in unemployment due to job losses. The slowdown in the economy indicates that the economy's ability to create new jobs is below the required level, where unemployment is expected to begin to decline. This is normal in the analysis of the relationship between growth and unemployment. However, the trend is less consistent with the unemployment rate and growth rates. The high growth rate of 2% does not lead to a decrease in unemployment by 1%. The concept of full employment is linked to the concept of desired unemployment rate (the lowest unemployment rate achieved without increasing inflation). The unemployment rate is related to the actual output; when it is low, individuals lose jobs leading to high unemployment. The natural output, also known as potential output, is the difference between the high output that causes inflation to rise and the low output that causes it to fall. There is a mid-level GDP that keeps inflation stable, and this mid-level GDP is known as natural GDP, a condition in which inflation has no propensity to accelerate or slow down (Rivero & Ramos-Herrera, 2018; Nasr, 2006).

Low unemployment rates Economic growth trends are represented by the prevailing economic policy, with Keynesian analysis confirming the demand-driven recovery policy (Palley, 2019). It is believed widely that the unemployment rate will fall automatically in response to the high rates of economic growth. There is a strong relationship between growth rates and change in unemployment rates. High growth rates indicate that the economy require additional labor to be secured from supernumerary labor accumulated in previous periods. On the other side, stagnation usually accompanied by low or negative growth rates, shows an increase in unemployment due to job losses. The slowdown in the economy indicates that the economy's ability to create new jobs is below the required level, where unemployment is expected to begin to decline. This is normal in the analysis of the relationship between growth and unemployment. However, the trend is less consistent with the unemployment rate and growth rates. The high growth rate of 2% does not lead to a decrease in unemployment by 1%. The concept of full employment is linked to the concept of desired unemployment rate (the lowest unemployment rate achieved without increasing inflation). The unemployment rate is related to the actual output; when it is low, individuals lose jobs leading to high unemployment. The natural output, also known as potential output, is the difference between the high output that causes inflation to rise and the low output that causes it to fall. There is a mid-level GDP that keeps inflation stable, and this mid-level GDP is known as natural GDP, a condition in which inflation has no propensity to accelerate or slow down (Rivero & Ramos-Herrera, 2018; Nasr, 2006).

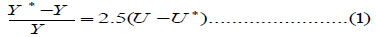

The relationship between real growth and changes in the unemployment rate is defined by the Okun Act (which was introduced in the United States economy). This law asserts that every 2.5% growth in GDP leads to a 1% reduction in the unemployment rate. (Daly, Hobijn, 2010),

If we represent the natural (potential) GDP as Y * and the real GDP as Y , the actual unemployment as U and full employment as U *:

Therefore exactly could a one-percentage-point rise in unemployment not result in a one-percentage-point decrease in production rates? To address this question, it is not always in the case of a decrease in economic activity. The institutions will reduce the amount of hours worked before the layoffs. This is supported by the notion that by lying off people, competent workers will have an easier time finding work, while inefficient workers will stay in the labor market and be ready for re-employment. This is referred to as "labor hoarding."

Analysis of the relationship between Economic Growth and Unemployment

Using quarterly data for the US economy from 1947 to 1957, Arthur Okun established an inverse connection between GDP and unemployment rate in 1962. His research revealed that a 3% drop in the GDP rate would result in a 1% rise in the jobless rate, assuming other parameters remained constant. Okun attributed this to firms being less inclined to invest money in purchasing new machinery and equipment during manufacturing, and lower net investment leads to lower capital addition and hence lower capacity development. Unemployed individuals gradually lose their talents, their sense of dignity, and their motivation.

The rate of economic growth and its impact on unemployment under the OKUN Act are measured by the following relationship:

Change in unemployment rate: ΔUt. Economic Growth Rate: ΔYt The fixed limit: β0 the flexibility between economic growth and unemployment. β1 : Error percentage et

The Okun model stresses the linear link between unemployment rates and GDP growth rates. It connects through the interaction between the labor market and the production market. As a result, the rule is approximate in terms of things other than work, such as productivity and real pay. The outcomes of legal studies are determined by the time period and the state's economic situation. This begs the question, "Why does GDP change quicker than unemployment when reversing the trend?" The solution might be found in a decrease in the multiplier effect due to the circulation of money based on employment, and some unemployed people stopped looking for job opportunities, requiring their removal from unemployment records for the coming years, and some employees work part-time, in addition to a decrease in work productivity due to employers' desire to keep more jobs than they need (Okun, 1962).

Explaining the Trends of Economic Growth in Jordan

In Jordan, there appear to be distinct tendencies in economic growth. First, negative tendencies can be seen in the Oxford Economy study on the Jordanian economy in 2015, which highlights the nature of the dangers that exist during the year, including the geopolitical situation and subsequent political and security issues in the area. The second risk is the public budget's reliance on external sources and poor performance. The third danger is a long-term deficit in the external balance. Exports exceed imports, and the current account of the balance of payments accounts for a deficit of around 10% of GDP. The fourth threat is that the global price of energy and food may climb once again. The fifth danger is the likelihood of a worldwide economic crisis and its influence on the economies of the Arab Gulf countries, which are inextricably connected to the Jordanian economy. The sixth danger is a delay in implementing the energy plan. The seventh threat is political tension and its influence on the economy (Oxford Economic Group Report, 2015). Other concerns not addressed in the study include: unemployment and poverty, the magnitude of foreign debt, market limitations, and changes in the dollar exchange rate related to the Jordanian dinar, and a decline in demand in the fertilizer, phosphate, and potash sectors.

In addition to the Oxford Economy report, which highlighted the performance of the Jordanian economy and the trends of economic growth, the World Bank's report on the performance of the Jordanian economy, which indicated a gradual recovery of the Jordanian economy in 2015, can be used to infer the trends of economic growth in Jordan. With a real GDP of 2.5 percent vs 3.1 percent in 2014, the consequences of the security situation in Iraq and Syria may be explained by growth to the closure of commercial outlets with both Iraq and Syria. However, the global drop in oil prices had an effect on both the budget deficit and the current account. The study also emphasized the need of private investment in energy diversification, as well as the favorable impact of the government's recent stimulus measures for the housing and tourist industries. Despite its poor growth rate in 2015. Economic growth is anticipated to reach 2.3 percent in 2017 and slightly increase to about 2.6 percent in the medium term, between 2017 and 2019, if measures aimed at encouraging private sector investment have a beneficial impact (2015 World Bank Report)

Economic Interpretation of the Contribution of Economic Growth to the Provision of Employment Opportunities

The World Bank forecasts that by 2020, Jordan will need to generate around 400000 permanent employments, based on historical numbers and data from the International Monetary Fund. However, anticipated economic growth rates through 2020 imply that the economy will be unable to produce more than 275.000 jobs over that time frame, which is concerning. This means that by 2020, the anticipated shortfall will have grown to around 125 thousand jobless people, and that the only way to increase the number of jobs available would be through economic growth rates of 6-7 percent (Report of the International Monetary Fund, 2014). As a result, the researchers feel that government-led economic stimulus measures are critical. However, they lack an integration and interaction plan with the private sector, which may produce jobs when the ministries and government institutions are saturated. Except for the Ministries of Health and Education, there are no genuine and tangible chances to use true partnerships between the public and private sectors to tackle the problem of unemployment and develop job opportunities in the private sector. It was observed in earlier data linked to in the research that its function is weak and that it is below the needed level, necessitating the government to offer additional incentives for it and to attract foreign and Arab investments to affect all provinces in order to generate and distribute employment fairly.

Methodology

The standard and descriptive analytical methods will be used in the analysis, interpretation and justification of the data. The standard method of study will include the Johansson’s Co-integration Test, the Unit Root Test of Stationary and Granger test for causation. A two-year period of Jordanian economic data was used to calculate unemployment rates and real GDP growth rates (2003-2018). A total of 60 observations and quarterly data were gathered and analyzed for this project. Statistics from Jordan's Central Bank and the General Statistics Service were used to compile the data.

Data Collection

The researchers will utilize the statistical package (E views) in estimating the sample to acquire the findings of the analysis and first testing of the data under investigation, as this software is used by researchers for economic analysis of data, economic measurement, and developing and designing economic models.

The hypothesis of the chain Stability test: H0: ρ = 1 H1: ρ <1

The hypothesis of joint integration testing: there is no statistically significant and complementary relationship at the 5% level between economic growth rates and unemployment rates in Jordan.

The Causality Test hypothesis: There is no one-way causal effect from economic growth to unemployment; there is no two-way causal effect from unemployment rates to economic growth rates and there is no two-way causal effect of unemployment to economic growth and economic growth to unemployment.

Test Hypotheses

The Root of the Unit Test

The Unit Root Test will be used in order to determine the stability of the time series of unemployment and growth. The stability of the series can be defined as: If the time series of the Yt variable is distinct in a constant medium, and the time-to-time variation is only dependent on time differences, this confirms that the Yt series is stable over time. The Fuller- Dickey Augmented (ADF) test is one of the most important tests used to test the stability of time series and determine the degree of integration by means of the following equation:

The test works through the following assumptions: If Yt is a first-order integral (1 I), this hypothesis is rejected if the calculated value γ=0 is greater than the critical value γ for T of the parameter (i.e. that is, Y thas a random direction without a specific direction, and by accepting this hypothesis we conclude that Yt when γ = 1 random patht β 1= γ 0, and Y thas a random direction but without a specified direction or drift= a. (Guajarati & Porter, 2009) in Table 1.

| Table 1 Unit Root Test |

||||

| Null Hypothesis D(GROWTH )has a unit root | ||||

| Exogenous: Constant | ||||

| Lag length:0(Automatic based on SIC,MAXLAG=10) | ||||

| t-Statistic | Prob | |||

| Augmented Dickey-Fuller test statistic | -6.172144 | 0.0000 | ||

| Test critically values: | 1%level | -3.560023 | ||

| 5%level | -2.917539 | |||

| 10%level | -2.596601 | |||

The test result of the series of economic growth in the first difference shows that the calculated value of the economic growth variable in Jordan in absolute terms is also greater than the absolute value. Therefore, we accept the null hypothesis that the time series is stable and reject the alternative hypothesis in Table 2.

| Table 2 Unit Root Test |

||||

| Null Hypothesis D(GROWTH )has a unit root | ||||

| Exogenous: Constant | ||||

| Lag length:0(Automatic based on SIC,MAXLAG=10) | ||||

| t-Statistic | Prob | |||

| Augmented Dickey-Fuller test statistic | -8.549207 | 0.0000 | ||

| Test critically values: | 1%level | -3.5654005 | ||

| 5%level | -2.919966 | |||

| 10%level | -2.597954 | |||

The result of the series stability test for the series of unemployment rates in Jordan confirms that the calculated value of the unemployment variable in absolute terms is also greater than the absolute value of the absolute value. Therefore, we accept the null hypothesis that the time series is stable and reject the alternative hypothesis. Accordingly, the following test can be used to test the complementary relationship between unemployment variables and economic growth in Jordan through the test of joint integration.

Johansson’s Co-integration Test

The study will test the null hypothesis to determine which vectors represent a common integration relationship with significant statistical significance. Integral vectors corresponding to the highest calculated Eigen values will be tested under the hypothesis of null hypothesis (H0) that there are no common integration vectors in: The idea of cointegration between two time series is that if the two series are complementary of the same class (d: xt-I (d) and yt-I (d)

If there is a relationship between these variables, such as: Yt = a0 + a1Xt + Ut

In this case, there is a common integration between Xt and Yt: Xt, Yt- CI (d, b). The function Yt = a0 + a1Xt + Ut is called the integrative regression gradient and the idea can be generalized to more than two variables. In this case, the condition of the equivalence of chains in integration may not apply, but requires that the degree of integration of the dependent variable does not exceed the degree of integration of any independent variables (Granger, 1996) in Table 3.

| Table 3 Johansson’s Co-Integration Test |

||||

| Series: GROWTH UNEMPLOYMENT | ||||

| Lags interval(in first differences)1 to 1 | ||||

| Unrestricted Co-integration Rank Test(Trace) | ||||

| Hypothesized No.of CE(s) |

Eigenvalue | Trace Statistic |

0.05 Critical Value |

Prob |

| None | 0.383411 | 27.75714 | 15.49077 | |

| AT most 1 | 0.039293 | 2.123910 | 3.841056 | 0.1451 |

Trace test indicates 1 cointegrating eqn(s) at the 0.05 level. Denotes rejection of the hypothesis at the 0.05 level. Mackinnon-haug-Michelis (1999) p-values.

The results of the co- integration test confirm the existence of an integrative relationship between the economic growth rates and the unemployment rates in Jordan. This indicates that there is a causal effect of one or two directions between the variables of the study. This requires the need to perform the following test according to the study plan to analyze the relationship, through the Granger causality test.

The Causality Test (Granger causality Test)

The method of the causality test depends on the relationship of simultaneous integration, through two main stages: The first is to estimate the relationship in the ordinary lower squares method, so that we obtain the regression equation of co-integration. Then, we obtain the estimated regression coefficients, the linear mix generated by the regression of the long-term equilibrium relationship. In the second stage, the stability of the remainders obtained from the first step is tested (Granger & Engle, 1987) in Table 4.

| Table 4 Granger Causality Test |

|||

| Lags:2 | |||

|---|---|---|---|

| Null Hypothesis: | Obs | F-Statistic | Prob |

| UNEMPLOYMENT does not Granger Cause GROWTH | 60 | 2.23908 | 0.1175 |

| GROWTH does not Granger Cause UNEMPLOMENT | 11.6752 | 7.E-05 | |

The results of the Granger's causality test confirm that there is no bi-directional relationship between unemployment rates and economic growth rates. On the other hand, the one-way relationship between Jordan's unemployment rates and Jordan's growth rates has been correlated with the effect of economic growth rates in unemployment rates to 99.993 (100) - 0.007). Accordingly, the zero hypothesis that the economic growth rates in Jordan are not affecting Jordan's unemployment rates and accepting the alternative hypothesis that Jordan's economic growth rates are affecting Jordan's unemployment levels The probability of unemployment affecting growth is 88.25 (100 - 11.75), which is statistically objectionable, which necessitates accepting the zero hypothesis that unemployment in Jordan does not affect economic growth in Jordan.

Hypotheses testing revealed that both economic growth and unemployment rates in Jordan are stable over time, with a complimentary connection between them that suggests a causal influence in one or both directions. Furthermore, unemployment in Jordan has little effect on economic growth in Jordan.

Discussion

To explain and justify the unilateral nature of this relationship by researchers, which confirms that there is a causal effect of growth in unemployment levels, and the absence of a causal effect of unemployment levels on growth rates. The economic reports of the General Statistics Service indicate that Jordan, on the average, has created approximately 50,000 jobs annually, both through the private and public sectors in recent years, of which Asian non- Jordanian workers acquired only 5074 jobs in 2013 in the QIZs and a large part of the new opportunities acquired by the Syrian refugees. Jordan has committed to provide jobs for nearly 200,000 Syrians in various economic sectors, although this is linked to economic financial assistance approved by the London Conference to Assist Refugee Countries in 2016. This is in contrast to what economic experts point to in view of the potential of the Jordanian economy, which indicates that economic growth is even improving through low unemployment rates. Jordan needs to create 100,000 jobs for Jordanian workers. Researchers think that this justifies and explains why the causal effect of the unemployment levels (whose rates of growth are supposed to increase growth rates) in Jordan is not achieved in economic growth rates in Jordan. (General Statistics Service, Central Bank of Jordan, Annual Data).

Results

Economic growth in Jordan has an influence on unemployment, but unemployment does not affect economic growth in Jordan, according to the research. The following were the outcomes of the testing.

- A substantial level of 5 percent unemployment means that there is no two-way link between unemployment and economic growth in Jordan

- A one-way link with a causal influence on Jordan's economic growth rates was established in Jordan's unemployment levels at a substantial level of 5%.

- Failure to achieve a one-way link with a causal influence of unemployment levels in Jordan's economic growth rates at a substantial level of 5%.

- To generate job possibilities, Jordan's economic decision-makers must distinguish between divergent patterns in the growth rates of the future, such as those in the Oxford Economies study against those in the World Bank report, which are more cautious.

- As a result of the political and security crisis, as well as the closure of commercial outlets with Syria and Iraq, economic growth rates in Jordan were negatively affected, but unemployment rates in the nation were favorably affected as well.

- According to the data, the Jordanian economy had times of economic success, which were accompanied by high rates of economic growth, without a detrimental impact on unemployment rates.

Conclusion

In the conclusions of the current study. There are no possibilities for the private sector to interact with the structure of the economy, with the exception of the ministries of health and education. Increasing private sector assistance and encouraging international and Arab investments to generate and distribute job opportunities equally are two ways to do this. Private investment in alternative energy sources should not hold down the execution of the energy policy. Thus, the oil bill will be smaller. Transfers to the Jordanian economy can be optimized by guiding Jordanian expatriates overseas to high-value-added production regions. Monetary strategies, such as debt reduction relative to GDP, can help Jordan become less susceptible to global economic volatility. It was noted that bilateral trade should be conducted with nations whose economic situations are similar to Jordan's.

These findings led to these recommendations:

- It is necessary to develop institutions that will allow for more engagement between the private sector and the economic framework, as there are no other options than the health and education ministries.

- Assisting the private sector in attracting international and Arab investments, which will in turn help to generate jobs and distribute them fairly.

- Attracting private investment in energy alternatives should not hold down the implementation of the energy plan. This will help reduce the cost of fuel.

- Jordanian expats' remittances should be directed to productive areas with added value, in order to maximize their impact on the Jordanian economy.

- Jordanian economic susceptibility to global economic swings can be reduced by adopting measures that reduce the level of debt relative to GDP.

- It is recommended in the research that bilateral trade agreements be signed with nations whose economic situations are similar to Jordan's.

- A new round of unemployment rate and growth rate investigations is recommended in the research.

Limitation

For the purpose of statistical analysis the Limitations of the Study was based on temporal limitations by identified specific years, and spatial limitations by the data set is given for Jordan.

References

- Abdul-Khaliq? Sh., Soufan, Th., & Abu Shihab, R. )2014). The Relationship between unemployment and Economic Growth Rate in Arab country, Developing Country Studies. www.iiste.org. 4(7), 62-66.

- Al-Atoum, R. (2018). Global Economic Growth Forecasts and the 20 Major Economies Worldwide, Book Time - 04/02/2018 12:13, http://alsaa.net/article-38535

- Al-Dustour Newspaper, (2017). Published on Wednesday 31-5-2017. 5:14 PM, http://www.addustour.com/articles/9596

- Al-Ghad Newspaper, (2010). Economic Growth and Unemployment Rate: A Relationship, published on Sunday 7 February 2010. 03:00 am, available on Al-Ghad Newspaper on 30/4-2018: http: // www. alghad.com/articles/53794

- Angus, C., & Guido, C., & Yuichi, F. (2013). Inflation, Unemployment and Economic Growth in a Schumpeterian Economy", Munich Personal RePEc Archive, MPRA Paper No. 50510, posted 9. October 2013 06:44 UTC.

- Ayad, H. (2016). The Impact of Economic Growth and the Poverty Index on Poverty in Developing Countries: A Standard Study for 1970-2013, University of Abu BakrBelqayd, Tlemcen, Algeria.

- Central Bank of Jordan, (2015). published quarterly statistical data 2016-2003, Amman, available: http://statisticaldb.cbj.gov.jo/index?action=level2&lang=en&cat_id=21

- Daly, M., & Hobijn, B. ( 2010). Okun’s Law and the Unemployment Surprise of 2009, FRBSF Economic Letter 2010-07, ON LINE: https://www.frbsf.org/economic-research/files/el2010-07.pdf.

- Econometrics of Journal, (1996). Models Memory Long of Varieties. “Zhuanxin, Ding and., J.W Clive, Granger. 1(7).

- Engle, R.F., & Granger, C.W.J. (1987). Co-Integration and error correction: representation, estimation, and testing, Econometrics, 55(2), 251-276.

- General Statistics Service, Statistical data published 2015 - 2017, Amman, available: http://dosweb.dos.gov.jo/en/

- Guajarati, D.N., & Porter, D.C. (2009). Basic econometrics, McGraw-Hill, International Edition, (5th. ed.)

- Kharboush, M.(2015), The Relationship between Inflation, Unemployment and Economic Growth in Algeria Using Joint Integration and Error Correction Model, Algerian Enterprise Performance Magazine, 7, 147-156.

- Mert, M. (2021). Economic growth under Solow-neutrality, Economic Research-EkonomskaIstra?ivanja, DOI: 10.1080/1331677X.2021.1875860

- Nasr, Abdulmahmood, (2006). Theoretical Macroeconomics of the Medium, Dar Al-Khuraiji for Publishing and Distribution, Riyadh, 447.

- Okun, A.M. (1962). Potential GNP & Its Measurement and Significance, American Statistical Association, Proceedings of the Business and Economics Statistics Section, Cowles Foundation,Yale university, 98-104. https://milescorak.files.wordpress.com/2016/01/okun-potential-gnp-its-measurement-and-significance-p0190.pdf.

- Oxford Economics Group Report on Jordan's Economic Performance. (2015). Available: https://www.oxfordeconomics.com/

- Palley, Th. (2019) Unemployment and Growth: Putting Unemployment into Post Keynesian Growth Theory, Review of Political Economy, 31(2), 194-215. DOI: 10.1080/09538259.2019.1644729

- Radulescu, M., Serbanescu, L., & Sinisi, C.I. (2019) Consumption vs. Investments for stimulating economic growth and employment in the CEE Countries – a panel analysis, Economic Research-Ekonomska Istra?ivanja, 32(1), 2329-2353. DOI: 10.1080/1331677X.2019.1642789

- Report of the International Monetary Fund, (2014): http://www.imf.org/external/arabic/index.htm.

- Rivero, S., & Ramos-Herrera, M., del C. (2018) Inflation, real economic growth and unemployment expectations: an empirical analysis based on the ECB survey of professional forecasters, Applied Economics, 50(42), 4540-4555. DOI: 10.1080/00036846.2018.1458193

- Selman, M., & Amira, A. (2017). Unemployment and Inflation: Algeria 2000-2015, Unpublished Master Thesis, Faculty of Economic Sciences, University of Abu BakrBelqayd, Tlemcen, Algeria.

- Taleb, S. Sh., & Labeeq, M. (2016), The Impact of Economic Growth on Unemployment in the Jordanian Economy during the Period 1990-2012, Journal of Economic and Financial Research, 6, 105-126.

- The World Bank, (2018). Global Economy to Edge Up to 3.1 percent in 2018 but Future Potential Growth a Concern, https://www.worldbank.org/en/news/press-release/2018/01/09/global-economy-to-edge-up-to-3-1-percent-in-2018-but-future-potential-growth-a-concern

- World Bank Report, (2017). http://www.bankaldawli.org/.