Research Article: 2022 Vol: 25 Issue: 4S

The Relationship between Managerial Accounting and Corporate Value Creation in the Context of Structural Equation-Based Research

Ahmad Y.A. Bani Ahmad Ayassrah, Jerash Governorate Council

Ibrahim Y.A. Jwaifel, Jerash University

Mohammed Salah-Eldin Abdel-Aziz, Applied College Najran University

Osama Wagdi, International Academy for Engineering & Media Science

Karim Mamdouh Abbas, Modern University for Technology and Information

Mohammad Ahmad Saleh Alnaimat, Al-Zaytoonah University of Jordan

Islam Yahiya Ahmad Bani Ahmad, Al Albayt University

Citation Information: Bani Ahmad Ayassrah A.Y.A., Jw aifel, I.Y.A., Abdel-Aziz, M.S.E, Wagdi, O., Abbas, K.M., Saleh Alnaimat, M.A., & Bani Ahmad, I.Y.A. (2022). The relationship betw een managerial accounting and corporate value creation in the context of structural equation-based research. Journal of Management Information and Decision Sciences, 25(S4), 1-18.

Keywords

Managerial Accounting Tools, Value Creation, Key Factors

Abstract

There are many deficiencies in realizing the innovation of managerial accounting practice in enterprises. It is important in this context to examine the impact of managerial accounting on corporate value creation. Based on the survey data, factor analysis method was used to construct a structural equation model in this study. In addition, in this article, it is investigated whether the application of managerial accounting tools can improve the ability of businesses to create value. The results show that the managerial accounting tool is positively associated with corporate value creation. Since the managerial accountingtool method is positively related to its effect on the main factors of value creation, it can be said that it affects corporate value creation.

Introduction

In recent years, managerial accounting research has entered a new phase. In 2016, the American Institute of Management Accountants published the Global Managerial accounting principles to encourage the practice of corporate management accounting. However, many academic studies have revealed that the application of managerial accounting in many maritime enterprises still lags. The rapid change in communication technology, Eastern European Countries and the Soviet Union adoption of free market economies by independent states leaving the Union, living in a constantly changing environment and operating in conditions of stronger competition requires their presence.

Today's management accounting, which helps to plan and control traditional management activities, cannot provide information that will be useful to strategic management.

Because strategic management, which is the management of change, is also used in business functions still requires several changes with the same orientation.

Strategic management accounting, economic, technological, social, political (legal) regulations) financial effects of developments on the business, competitor's cost structures, prices, market share, relative levels of production and sales capacities, and it also aims to collect and analyze information about the ability of business resources to respond to market development and report it to management.

This information is particularly useful in determining the effects of changes in the external environment of the enterprise on the enterprise and in the formulation, implementation, and selection of strategies. It is aimed at controlling and evaluating implementation results with strategies.

For this purpose, strategic managerial accounting is used in the preparation of long-term strategic plans and provides information to assist strategic management in its control.

Some thinkers define strategy as “a business's long-term determining the main objectives and the resources necessary to achieve these objectives. Defined as ways that are allocated and accepted in their use. So it's pointless talking about strategy is meaningless between goals, means and strategy

Study can express the dialectical relationship as seen in figure 1.

Planning is one of the Basic Functions of Management

Planning is the determination of the business purpose and objectives, and the determination of the appropriate tools, resources and methods to achieve these determined goals.

The success of a business and their units' understanding of their goals and the ways and means of achieving those goals from this point of view, planning, goals, ways, and it can be said that it is an evaluation process between methods.

Management accounting, by preparing retrospective management reports, presents the current or very recent situation of the unit that is the subject of planning in numerical form and helps managers in their future planning studies.

At this stage, detailed historical “balance sheets”, “income and expense reports”, “cost statements” as managerial accounting reports, which are especially important? Etc. and the analysis reports obtained as a result of their detailed analysis.

The reason is that many enterprises still have no clear understanding that the managerial accounting should service value creation. Based on the theory of value network and organization learning, and according to the characteristics of value creation in Marine enterprises, this paper divides value creation activities into six key factors: research and development, organization and operation, supplier management, customer management, social responsibility fulfillment and learning activities. Through the path analysis, this paper discusses how the managerial accounting tools influence the value creation of enterprises by influencing these key factors.

Method

External data is difficult to find in the open market, as managerial accounting falls within the scope of corporate internal management. For this reason, a survey application was made in this article.

The surveys were distributed to 657 listed companies in.....country (insert your country). It was implemented on a voluntary basis.

In this study, SPSS22.0 was used to perform factor analysis on the data obtained from the questionnaire, PLS-SEM was used to perform exploratory analysis and path analysis on the data, and Bootstrapping was used to test the mediation effect.

Analysis

Theoretical Basis and Research Hypothesis

The theory of value creation holds that enterprise value management is a series of value-based management activities, which promote enterprises to create value through value driving factors and value management mode, so as to realize the maximization of the wealth of enterprises or shareholders (Boulos & Haspeslaghand,2001). The research on value driving factors has experienced the value chain theory, value network theory and organization learning theory. The value chain theory holds that the research and development, production, sales and after-sales activities of enterprises can create value for enterprises (Michael,1985). They are linked together as a chain, which is called the value chain. Later, the value chain theory was replaced by the value network theory. Value network theory broke through the chain thought and extended value chains of an enterprise into various network relations between the enterprises. The value network theory is integrated with the capability school, which holds that the network relationship between enterprises and many stakeholders such as suppliers, employees, customers, competitors, partners and shareholders, as well as the ability to deal with these relationships, plays a key role in the value creation of enterprises (Adrian Slywotzky, 1998). In the 1990s, Professor Peter Senge proposed the theory of organization learning that studies the ability of enterprises to create value from the perspective of system theory. According to the theory, in order to cope with the constantly changing external environment, organizations need to keep learning (Donald & Ouml,1993). The theory of learning organization combines the internal and external factors that affect the value creation of enterprises, and pushes the research on the value creation of enterprises to a new height. Therefore, according to the value network theory, organization learning theory and the characteristics of the value creation of Marine enterprises, this paper divides the factors affecting the value creation of Marine enterprises into six key factors: research and development ability, organization and operation ability, supplier management ability, customer management ability, social responsibility fulfillment ability and learning ability.

Managerial Accounting Tool Method and Enterprise Value Creation

The relationship between managerial accounting and enterprise value creation can be reflected in the definition of Management Accounting. In the International Institute of Accountants (1999) revised the "Concept of Management Accounting" announcement, managerial accounting is defined as: effective use and integration of enterprise resources, including non-financial resources, to create value for shareholders, customers and other stakeholders. The role of managerial accounting in enterprise value creation has been re-emphasized in the newly revised Managerial accounting Bulletin of the IMA (2012) and the Global Managerial accounting Principles published by the IMA (2016). It can be seen that the goal of managerial accounting is value creation, which has become a widely accepted view. Feng Qiaogen (2015) believes that managerial accounting is essentially a kind of value management behavior of enterprise organizations. It takes business activities as the core and aims to realize organizational strategy and create organizational value. In 2016, the Basic Management Guidelines issued by the Ministry of Finance also clearly stated that the managerial accounting tool method is a specific means to achieve the goal of management accounting. Therefore, the managerial accounting tool method should be able to promote the value creation ability of enterprises. Therefore, hypothesis 1 is proposed.

H1 Managerial accounting tool is positively correlated with enterprise value creation

Key Factors of Enterprise Value Creation and Enterprise Value Creation

Based on the value chain theory and value network theory, this paper divides the value-creating activities of Marine enterprises into three categories: internal value-creating activities, external network relations and learning ability, and further divides the internal value-creating activities into research and development and organization and operation. The external network relationship is further divided into six aspects, namely supplier relationship management, customer management and corporate social responsibility management, plus learning ability. These six aspects are taken as value creation factors to study the impact of Marine enterprises' ability in these six aspects on enterprise value creation.

Dutta, et al., (2005) believe that enterprise internal capabilities include R&D capabilities, marketing capabilities and manufacturing capabilities. Research and development ability can promote the innovation of new products or processes and form the competitive advantage of enterprises. In the opinion of Prahalad & Hamel (1990), the operational ability of enterprises is the main reason for the difference in benefits between enterprises, and the key for enterprises to have different core abilities. Gronroos (2011) believes that enterprises provide a necessary foundation for value creation, and that customers can transform such potential value into reality, so as to realize value creation. Therefore, customers are the key to value creation, and creating customer value is the key to the success of Marine enterprises. Takeishi (2001) believes that enterprises that can build enterprise networks are more likely to gain competitiveness than those that cannot build network relationships with other enterprises. Therefore, the construction of network relationship between Marine enterprises and external suppliers and customers is particularly important to the creation of enterprise value. Prahalad & Hamel (1990) believed that learning ability is the core ability of organizations. Teece, et al., (1997) believe that enterprises can learn and accumulate new skills and abilities through learning ability. Accordingly, the following hypotheses are proposed.

H2 R&D ability/Organization operation ability/Supplier relationship management capability/customer management ability/ learning ability/social responsibility fulfillment ability is significantly positively correlated with enterprise value creation.

Key Factors of Managerial Accounting Tools and Value Creation

The concept of managerial accounting tool method first appeared in the "Basic Guidelines for Management Accounting" issued by the Ministry of Finance. Managerial accounting tool method is a general term for various managerial accounting tools and methods, mainly including 26 managerial accounting methods. These tools and methods are widely used in enterprise research and development, organization and operation, supplier management, customer management, corporate social responsibility and learning, etc. From the previous analysis, it can be seen that the application of managerial accounting tools and methods can help enterprises improve their abilities in these aspects. Hypothesis 3 is further proposed.

H3 Managerial accounting tools have a positive impact on enterprise R&D ability/organization's operational capability/supplier relationship management capability/customer management ability/ learning ability social responsibility fulfillment ability.

The Mediating Role of Key Factors of Value Creation in the Influence of Managerial Accounting Tool Methods on Enterprise Value Creation

The managerial accounting tool approach can improve the enterprise's ability in the key factors of value creation. Managerial accounting improves the contribution of these key factors to enterprise value creation by promoting enterprise research and development ability, organization and operation ability, learning ability, supplier management ability, customer management ability and enterprise social responsibility ability, thus improving enterprise value creation ability. Therefore, hypothesis 4 is put forward.

H4 Managerial accounting tool method influences enterprise value creation through its influence on key factors of value creation

Research Design

In order to guarantee the accuracy and rationality of the content of the questionnaire, the questionnaire survey items refer to a large amount of relevant literature, and careful modification process to a premade and modification of the questionnaire, the questionnaire mainly includes: the content of the respondents position, age, respondents place unit nature and scale of operation, management basic information such as time, as well as to the enterprise managerial accounting tools surveyed key factors method, value creation and value creation ability investigation of three main scale. According to the Suggestions of Podsakoff & Organ (1986), the above three aspects are not included in the questionnaire, so as to avoid logical inference through causal relationship. The questionnaire USES a five-point scale to score the items. 1 is "very inconsistent", 2 are "relatively inconsistent", 3 is "relatively consistent", 4 is "consistent" and 5 is "very consistent".

The target population for this study was defined as the senior managers of Chinese Marine enterprises. A total of 657 questionnaires were issued and 413 were recovered. Questionnaires with incomplete answers, random answers or strong regularity were excluded from the recovered questionnaires. A total of 286 questionnaires were valid, with an effective recovery rate of 83%. Formal research use questionnaire survey site questionnaire star professional data collection online research system, and on the basis of Chin (1998); Gefen (2000) put forward the implementation of PLS-SEM analysis of the minimum sample size requirements are: In the conceptual model with the largest item of construct 10 times of the test item number, or the build path relationship most endogenous latent variable path number 10 times. In the conceptual model constructed in this paper, the largest number of items in the managerial accounting tool is 26, so the number of samples collected in this paper meets the requirements.

Design of Main Variables

This paper studies the impact of managerial accounting on the value creation of Marine enterprises. The main variables include the managerial accounting tool method, key factors of value creation and enterprise value creation ability. Among them, the managerial accounting tool method is the explanatory variable, the value creation ability is the explained variable and the key factor of value creation is the intermediary variable. The specific design is as follows:

Main Dimensions and Measures of Managerial Accounting Tools

This paper takes the 26 methods of managerial accounting tools listed in the Basic Guidelines for Managerial accounting of the Ministry of Finance as the main dimensions of managerial accounting tools. In terms of measurement, according to the core content of each tool and method and refer to the items in the paper of Zhong Fang, Wang Man & Zhou Peng (2019). The specific design is as follows:

| Table 1 Variable Scale of Managerial Accounting Tool Method |

|||

|---|---|---|---|

| Potential variable | Variable symbol | Item design | Study |

| Managerial accounting tool | SM | Draws a strategic map and determines the strategic priorities of the enterprise according to the strategic map | Zhong Fang, Wang Man, Zhou Peng (2019) |

| VCM | Analyzes and manages each node of the value chain (procurement, design, production, sales and after-sales service, etc.), minimizes operational links, and focuses on suppliers and competitors | Basic Guidelines on Managerial accounting Guidelines on The Application of Management Accounting | |

| RB | Budgeting rolls backwards from period to period and always remains fixed period | ||

| ZBB | Prepares a budget from zero | ||

| FB | On the basis of analyzing the quantitative relationship between business volume and budget items, determines different business volumes and corresponding budget items | ||

| OB | Divides the company's production process into operations and sets the operation budget | ||

| CB | Prepares the operation budget, financial budget and capital expenditure budget, etc., and all departments and personnel at all levels participate in the budget preparation | ||

| TCM | Sets the price and expected profit level, then determines the target cost and designs the operation process | ||

| SCM | Establish SCM standard cost, calculate and analyze the difference between standard cost and actual cost | ||

| VCW | Cost accounting distinguishes between variable cost and fixed cost. Variable production cost is included in product cost, while fixed production cost and non-production cost are not included in product cost | ||

| ABC | Divides the production process into operations and calculates the activity-based cost and product cost | ||

| CVP | Uses the relationship between cost, quantity sold, price and profit to make sales and production plans | ||

| SA | Quantifies the changes in factors that affect the realization of target profit, cost or sales volume, etc., to determine the impact of each factor change on the target and its sensitivity | ||

| MA | When evaluating the profitability of a given product or project, analyzes how changes in the variables of the product or project lead to changes in other relevant variables | ||

| MDP | Measures business results in terms of regions, products, departments, customers, channels and employees, and analyzes profit and loss drivers | ||

| BM | Refers to the advanced business process and management mode of benchmarking enterprise, and continuously improves and innovates | ||

| DCF | Considers the present value of cash inflow and outflow in each period of the project and takes it as the basis for decision making in the decision making of investment projects | ||

| PM | Invites project participants to collaborate in the project management process to plan, organize, coordinate and control resources by means of earned value, cost effectiveness or value engineering | ||

| COC | Analyzes capital raising costs and occupancy costs | ||

| KPI | In the formulation of performance indicators, selects the indicators that can most effectively drive enterprise value creation through analyzing the performance characteristics of enterprise strategic objectives and key achievement areas | ||

| EVA | According to the requirements of SASAC or regulatory authorities, EVA is used to evaluate the enterprise's own performance | ||

| BSC | Takes finance, customer, internal process and learning innovation as the basis for performance evaluation | ||

| RM | Plots the risk and its rank matrix according to the probability of occurrence and the severity of the consequences of the risk | ||

| RL | According to its own strategy, business characteristics and risk management requirements, RL conducts risk identification, risk analysis, risk response measures, risk reporting and communication and other management activities in the form of forms | ||

| TQM | Systematic, continuous improvement of total quality management of product quality, process and service | ||

| LCM | Quantifies and analyzes all costs throughout the life cycle (product requirements, planning and design, production and operation, recovery and disposal) | ||

Main Dimensions and Measures of Value Creation

Enterprise value is the ultimate goal of enterprise value creation, and customer value is the guarantee of enterprise value realization. In this paper, the definition of the value creation ability of ocean enterprises breaks through the previous research methods which take the long term and short term performance as the measurement index. From the perspective of management, customer value and enterprise value are taken as the basis to measure the enterprise value creation ability. The value creation of enterprises should be conducive to the realization of enterprise value and customer value. Therefore, the topic of value creation should reflect enterprise value and customer value, and Noe (2014)'s definition of enterprise value creation should be used for reference. The specific items of value creation are as follows:

| Table 2 Variable Scale of Value Creation |

|||

|---|---|---|---|

| Latent variable | Variable symbol | Item design | Study |

| Value Creation | VC1 | Can effectively get new customers | Noe (2014) |

| VC2 | Reduces costs by improving management processes | ||

| VC3 | Improves short-term profitability through operating activities | ||

| VC4 | Has a long-term competitive advantage | ||

Main Dimensions and Measures of Key Factors of Value Creation

From the perspective of value chain, enterprises' value-creating activities can be divided into research and development and organizational operation, which constitute the main value-creating activities within enterprises. The key capabilities in these major value-creating activities determine the effect of enterprise value creation. The ability of research and development, product innovation and organization and operation are the key for an enterprise to gain competitiveness. The activities of the enterprise to create value but also rely on the external network, such as suppliers, customer relations and the relationship between external stakeholders, therefore, from the point of the value network, the enterprise value creation should also include key factors: supplier relationship management, customer management in the enterprise and the ability of corporate social responsibility management three aspects. In addition, the learning ability of an organization has a long-term and irreplaceable effect on its value creation. Therefore, the main factors of value creation selected in this paper include: research and development, organization and operation, supplier relationship management, customer management, corporate social responsibility management and learning ability. The variable measurement of key factors of value creation is shown in Table 3.

| Table 3 Variables of Key Factors of Value Creation |

|||

|---|---|---|---|

| Latent variable | Variable symbol | Item design | Study |

| Research and Development Capability | RD1 | Ratio of Research and development Funds to Total assets | Yao xuefang, Ding Jinxi, Shao Rong, Cheng Can (2010) |

| RD2 | r&d personnel account for the proportion of total personnel | ||

| RD3 | Degree of R&D personnel | ||

| RD4 | R&D personnel engaged in R&D hours | ||

| RD5 | Number of patents (new drugs) approved | ||

| RD6 | Number of self-created R&D institutions | ||

| RD7 | The number of R&D platforms of and research institutions, colleges and universities | ||

| Organization and Operation Ability | OC1 | Material purchasing according to order Requirements | Zhong fang,Wang man,Zhou peng (2019) |

| OC2 | Has a strict inventory management approach | ||

| OC3 | Has an effective method of cost control | ||

| OC4 | Has an Effective product quality control method | Noe (2014) | |

| OC5 | Products have a high market share | ||

| Supplier relationship management Capabilities | SMC1 | Shares market intelligence information with key suppliers | Frohlich M T, Westbrook R (2007), Narasimhan and Kim (2002) |

| SMC2 | Coordinates logistics activities with key suppliers in real time | ||

| SMC3 | Invites key suppliers to participate in the development and design of products | ||

| SMC4 | Coordinates production planning with key suppliers | ||

| SMC5 | Strives to build long-term relationships with suppliers | ||

| Customer Management Capability | CMC1 | Actively interacts with customers to improve product or service quality | Narver and Slater,1990; Narver etc, 2004; Song hua and Lu qiang (2017) |

| CMC2 | Strives to build long-term relationships with customers | MITHAS S, KRI SHNAN M S, FOR-NELL C2005 | |

| CMC3 | Has a set of procedures for identifying and quickly responding to customer needs | Liu Shu qing, Dong Lina (2014) | |

| CMC4 | Provides customers with products or services without quality problems | ||

| Learning Ability | LA1 | Has an organizational management model that can stimulate the active growth of employees | Peter M. Senge (1990) |

| LA2 | Has a set of career goals for employees and provides effective organizational support | ||

| LA3 | Provides employees with the training, learning and promotion opportunities needed to meet their promotion platform and career goals | ||

| Fulfilling social responsibilities Ability | SR1 | Responds to the requirements of policies and regulations on CSR Fulfillment | Huang Xiang Meng (2017) |

| SR2 | Attaches importance to the demands of stakeholders | ||

| SR3 | Focuses on the economic benefits of fulfilling social responsibilities | ||

| SR4 | Senior managers have a certain sense of social responsibility | ||

Results

Descriptive Statistics

Descriptive Statistics of Managerial Accounting Tools

The average results of the 26 managerial accounting tools show that the top 5 managerial accounting tools are CB, BM, KPI, TQM and TCM, indicating that Marine enterprises will adopt managerial accounting tools and methods in budget, operation, management performance, cost control and other aspects. In addition, the standard deviations of the 26 observed variables were all greater than 0.75, indicating the large dispersion degree of the sample data. Each observation variables have different degrees of skewness of left or right, kurtosis of observation variables or steep or flat, according to the normal distribution of skewness and kurtosis is zero, the characteristics of the sample data do not accord with normal distribution, so the paper select PLS-SEM analysis method, the Smart - PLS software for non-normal distribution data for empirical analysis.

Descriptive Statistics of Key Factors of Value Creation

The key factors affecting value creation include research and development ability, organization and operation ability, supplier relationship management ability, customer management ability, learning ability and social responsibility fulfillment ability. According to the skewness and kurtosis of the data, the data of the six dimensions do not conform to the normal distribution. The standard deviations of all the 28 items were greater than 0.75, indicating a large degree of dispersion of the sample data. The mean value of each item of research and development ability is below 2.7, which is relatively small compared with other abilities. The average value of the other five abilities is around 3.5, indicating that Marine enterprises attach more importance to the cultivation of these abilities.

Descriptive Statistics of Value Creation

A description of the value creation results including four item, based on the mean and standard deviation of the numerical results found that ocean enterprises to improve management processes to reduce costs, improve the short-term profitability through business activities, but will it be any good to get new customers and long-term competitive advantage is more valued, in actual operation, both on the Marine enterprise value creation does help, but how to reduce cost and improve short-term profitability of Marine is the increase of enterprise value.

Preliminary Test of Reliability and Validity

Reliability Test

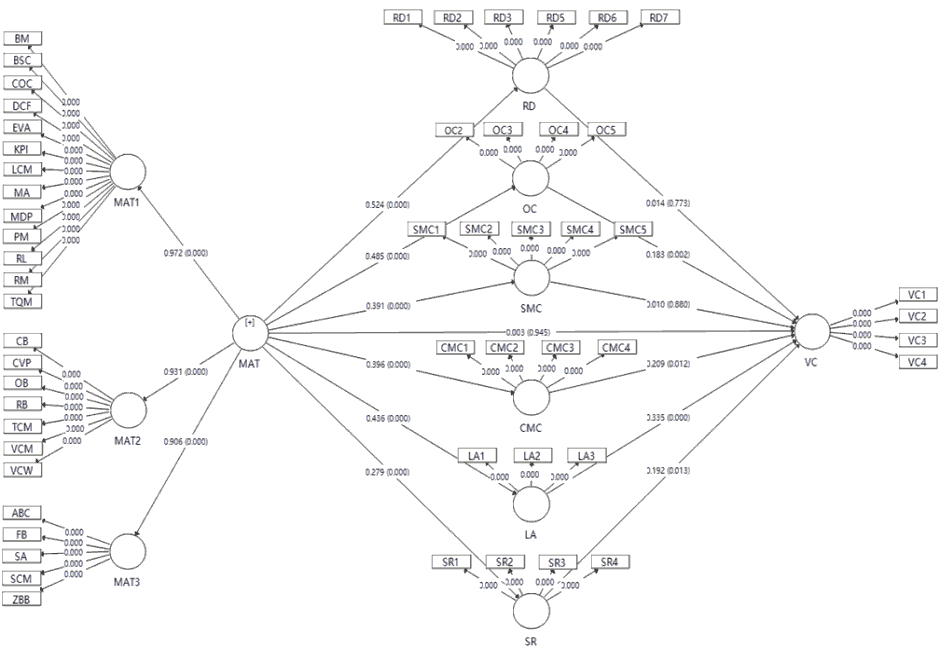

According to the test results, the reliability coefficients of all latent variables and the total table are above 0.7, so the scale can be judged to have a high reliability. Specifically, the coefficient of the subscale of managerial accounting tools was 0.966, CITC value was greater than 0.5, and the deleted Cronbach's value was less than the total reliability of the scale. The coefficient of the R&D capability subscale is 0.916 and the CITC value is greater than 0.5. The deleted Cronbach's value of the item is all less than the total reliability of the scale except the "r&d working time", so delete this item. The coefficient of the organization's operational capacity subscale is 0.717. Cronbach's value after deleting "material procurement according to order requirements" is lower than the total reliability, but its CITC value is 0.389 less than 0.5, which does not meet the retention criteria, so delete this. The other four abilities and value creation have good reliability. To sum up, the items RD4 and OC1 need to be deleted in the reliability test.

Validity Test

In this paper, KMO and Bartlett sphericity tests were performed on each potential variable. KMO values were all greater than 0.7, and significance probability of Bartlett sphericity test was all less than 0.001. Therefore, the data were suitable for factor analysis. In addition, the factor load of each variable in the component matrix is greater than 0.5, and the variance of cumulative interpretation is more than 60%, which indicates that the construction validity of the measurement tool is good. Managerial accounting tools to effectively extract the three factors, the first principal component includes 13 tools: RM, RL, TOM, PM, LCM, EVA and BSC, COC, MDP, KPI, DCF model, BM, MA, the second principal components including seven tools: CB, TCM, VCM, VCW, CVP, OB, RB, the third component includes six tools: ZBB, FB, ABC, SCM, SA, SM, as a result of the strategic map factor loading value of 0.413 is less than 0.5, delete item SM in a follow-up study.

External Model Estimation

In this paper, the remaining 55 items were further analyzed in terms of convergence validity and discriminant validity. According to Anderson, et al., (2006), the standard load of the measurement items in this paper was between 0.6 and 0.9, most of which exceeded the ideal standard of 0.7. The T value of each variable is greater than 1.96, reaching a significant level. The combined reliability values of all latent variables are above 0.8 and above the standard of 0.7. The AVE value of each latent variable is above 0.5, which all exceeds the standard of 0.5. Therefore, it can be judged that the measurement items of each latent variable in the conceptual model have higher convergence validity.

Fornell & Larcker (1981) proposed that the square root of AVE value of a latent variable should be greater than the correlation coefficient between this latent variable and all other latent variables in the model. The inspection result shows that the managerial accounting toolkit and managerial accounting tools distinction validity is bad, because they are derived from managerial accounting tools do factor analysis, no significant difference between validity belong to the category of normal, but the model AVE other latent variables involved in the value of the arithmetic square root were greater than itself with other latent variable correlation coefficient, this paper use the validity of the scale has the very good difference between.

Internal Model Estimation

Path Coefficient-Bootstrapping Analysis

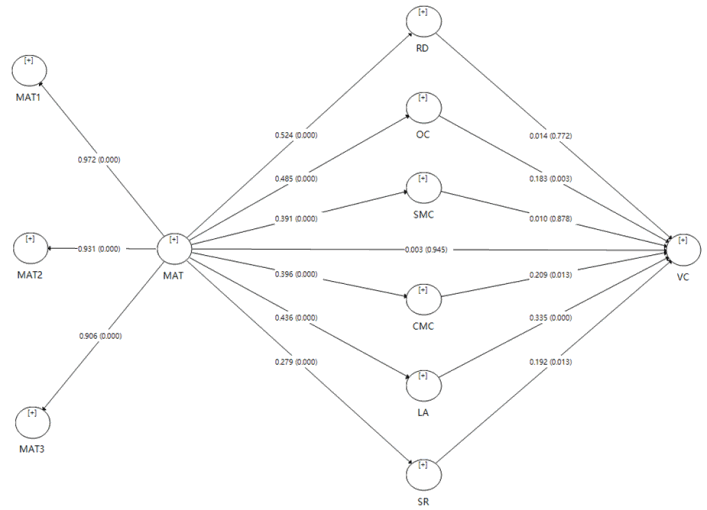

Based on the 286 samples obtained in this paper, 5000 samples were sampled to obtain the Bootstrapping test results of the overall sample data path coefficient. The path coefficient model of latent variables is shown in Figure 2. Table 4 shows that managerial accounting tools to value creation, managerial accounting tools to six key factors, six key factors to the value creation path coefficient is positive, the standard deviation is small, in addition to the managerial accounting tools, research and development ability and the ability of supplier relationship management, other latent variable T test value is bigger and have reached significant level, suggests that this paper received support hypothesis test.

| Table 4 Six Key Factors to The Value Creation Path Coefficient |

|||||||

|---|---|---|---|---|---|---|---|

| Hypothesis | Influence path | Path coefficient | Standard deviation | T value | P value | Conclusion | |

| H1: | MAT àVC | 0.003 | 0.046 | 0.068 | 0.946 | Refuse | |

| H2a: | RD à VC | 0.014 | 0.047 | 0.287 | 0.774 | Refuse | |

| H2b: | OC à VC | 0.183 | 0.061 | 3.006 | 0.003 | Accept | |

| H2c: | SMC à VC | 0.01 | 0.065 | 0.151 | 0.88 | Refuse | |

| H2d: | CMC à VC | 0.209 | 0.082 | 2.549 | 0.011 | Accept | |

| H2e: | LA à VC | 0.335 | 0.069 | 4.88 | 0 | Accept | |

| H2f: | SR à VC | 0.192 | 0.076 | 2.526 | 0.012 | Accept | |

| H3a: | MAT à RD | 0.524 | 0.046 | 11.409 | 0 | Accept | |

| H3b: | MAT à OC | 0.485 | 0.046 | 10.429 | 0 | Accept | |

| H3c: | MAT à SMC | 0.391 | 0.058 | 6.728 | 0 | Accept | |

| H3d: | MAT à CMC | 0.396 | 0.056 | 7.057 | 0 | Accept | |

| H3e: | MAT à LA | 0.436 | 0.049 | 8.883 | 0 | Accept | |

| H3f: | MAT à SR | 0.279 | 0.065 | 4.3 | 0 | Accept | |

| H4: | Intermediary | Accept | |||||

Determination Coefficient (R2) Analysis of the Initial Model

The primary indicator of internal model evaluation is the determination coefficient, and R2 represents the explanatory power of variance for each endogenous latent variable. R2 is between 0 and 1, and higher values indicate higher explanatory power. Recommendations by Hair (2011); Henseler (2009) that R2 of 0.75, 0.50, or 0.25 can be considered significant, moderate, and weak in explanation. However, earlier Chin (1998); Ringle (2004) considered R2 of 0.67 as significant, 0.333 as moderate, and 0.19 as weak explanatory power. This paper is an exploratory study and therefore adopts the criteria proposed by Chin (1998); Ringle (2004).

It can be seen from Table 5 that the three managerial accounting toolkits have a higher explanatory power for managerial accounting tools. Managerial accounting tools have weak or nearly moderate explanatory power for R&D ability, organization and operation ability, supplier relationship management ability, customer management ability, learning ability and social responsibility fulfillment ability. Moreover, the total explanatory power of the six mediating variables to value creation is 0.651, close to the significance standard of 0.67, indicating that these variables have a high explanatory power to value creation.

| Table 5 Determination Coefficients of The Initial Model |

||

|---|---|---|

| R Square | R Square Adjusted | |

| RD | 0.275 | 0.273 |

| OC | 0.235 | 0.232 |

| SMC | 0.153 | 0.15 |

| CMC | 0.157 | 0.154 |

| LA | 0.19 | 0.187 |

| SR | 0.078 | 0.075 |

| VC | 0.651 | 0.642 |

Effect Value (F2) Analysis of the Initial Model

F2 effect value is a measure index to measure the relative influence of exogenous latent variable on endogenous latent variable. F2 is 0.02 for small effect, 0.15 for medium effect and 0.35 for large effect (Cohen, 1988). The Table 6 shows that value creation is as explained variable, managerial accounting tools, research and development capabilities, and supplier relationship management ability of its influence was close to zero (data results only keep 3 decimal places), but the organization operating ability, customer management ability, learning ability and social ability to fulfill obligations have influence on above it has little effect, value chain and value net ability of factors can impact on value creation.

By examining the effect of managerial accounting tools on the six intermediary variables, it is found that the influence of managerial accounting tools on them all reaches above the medium level, indicating that managerial accounting tools have a great influence on the factor ability of value chain and value network.

| Table 6 Effect Values of The Initial Model |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| MAT | MAT1 | MAT2 | MAT3 | RD | OC | SMC | CMC | LA | SR | VC | |

| MAT | 17.054 | 6.514 | 4.563 | 0.379 | 0.307 | 0.181 | 0.186 | 0.235 | 0.085 | 0 | |

| RD | 0 | ||||||||||

| OC | 0.045 | ||||||||||

| SMC | 0 | ||||||||||

| CMC | 0.041 | ||||||||||

| LA | 0.113 | ||||||||||

| SR | 0.041 | ||||||||||

| VC | |||||||||||

Forecast Correlation (Q2) Analysis of the Initial Model

When evaluating the prediction accuracy of the model, not only the R2 value, but also the prediction validity Q2 value proposed by Stone (1974); Geisser (1974) can be referred to. The Q2 value is an indicator of the model's predictive relevance. Q2 value greater than 0 indicates that the path model has predictive correlation with the prediction of latent variables. It can be seen from Table 7 that the Q2 values of all latent variables are greater than 0, indicating that the path model has a good predictive correlation with the predicted latent variables.

| Table 7 Prediction Correlation of The Initial Model |

|||

|---|---|---|---|

| SSO | SSE | Q² (=1-SSE/SSO) | |

| MAT | 7150 | 7150 | |

| MAT1 | 3718 | 1627.141 | 0.562 |

| MAT2 | 2002 | 965.503 | 0.518 |

| MAT3 | 1430 | 673.186 | 0.529 |

| RD | 1716 | 1400.318 | 0.184 |

| OC | 1144 | 1002.593 | 0.124 |

| SMC | 1430 | 1301.14 | 0.09 |

| CMC | 1144 | 1013.733 | 0.114 |

| LA | 858 | 728.881 | 0.15 |

| SR | 1144 | 1076.764 | 0.059 |

| VC | 1144 | 700.341 | 0.388 |

Test and Analysis of Mediating Effects

It can be seen from Table 8 that before the addition of mediating variables, the direct effect value of managerial accounting tools on the path of value creation was 0.003 and the P value was 0.945, which did not reach the significance level.

After adding the mediating variable, the total indirect effect value achieved through the six mediating variables is 0.382 and the P value is 0.000, reaching the significance level. The specific indirect effect is shown in the table. The final total effect of managerial accounting tools on value creation is 0.385 and the P value is 0.000, reaching the significance level.

By figure 3 shows, the path coefficient of the mediation variables are positive, in addition to the research and development ability and the path coefficient of supplier relationship management ability was not significant, the remaining four variables are reaching significance level, managerial accounting tools through operating capacity, customer management ability, ability to learn and to fulfill social responsibility ability, can indirectly affect the enterprise value creation, through the role of the mediation model at the same time, the implementation of the total effect is also significant; These four mediating variables perform a partial mediating function.

| Table 8 Model Path Coefficient and Significance Test |

||||

|---|---|---|---|---|

| Path | Path coefficient | Standard deviation | T value | P value |

| Total indirect effect | ||||

| MAT à VC | 0.382 | 0.054 | 7.126 | 0 |

| Specific indirect effect | ||||

| MAT à RD à VC | 0.007 | 0.025 | 0.285 | 0.776 |

| MAT à OC à VC | 0.089 | 0.032 | 2.776 | 0.006 |

| MAT à SMC à VC | 0.004 | 0.027 | 0.144 | 0.885 |

| MAT à CMC à VC | 0.083 | 0.035 | 2.377 | 0.018 |

| MAT à LA à VC | 0.146 | 0.033 | 4.384 | 0 |

| MAT à SR à VC | 0.054 | 0.023 | 2.331 | 0.02 |

| Total effect | ||||

| MAT à RD | 0.524 | 0.046 | 11.409 | 0 |

| MAT à OC | 0.485 | 0.046 | 10.429 | 0 |

| MAT à SMC | 0.391 | 0.058 | 6.728 | 0 |

| MAT à CMC | 0.396 | 0.056 | 7.057 | 0 |

| MAT à LA | 0.436 | 0.049 | 8.883 | 0 |

| MAT à SR | 0.279 | 0.065 | 4.3 | 0 |

| MAT à VC | 0.385 | 0.054 | 7.172 | 0 |

| RD à VC | 0.014 | 0.047 | 0.287 | 0.774 |

| OC à VC | 0.183 | 0.061 | 3.006 | 0.003 |

| SMC à VC | 0.01 | 0.065 | 0.151 | 0.88 |

| CMC à VC | 0.209 | 0.082 | 2.549 | 0.011 |

| LA à VC | 0.335 | 0.069 | 4.88 | 0 |

| SR à VC | 0.192 | 0.076 | 2.526 | 0.012 |

Model Fitting and Testing

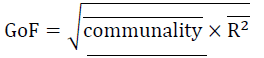

In PLS-SEM analysis, GoF was used to test the goodness of fit of the overall model. As an absolute indicator, GoF can be compared with the goodness of fit index obtained by other methods, and the goodness of fit of conceptual model can be judged. Amato et al. (2004) proposed the following calculation formula:

Wherein, is the average of the common degree of common factor variance of all latent variables in the conceptual model; (R2) 12 is the average interpretable variance of all latent variables in a conceptual model. It can be seen from Table 9 that GoF in this study is: GoF=√(0.665×0.437)=0.539, indicating that the overall fitting degree among all constructs in the conceptual model constructed in this paper is good.

| Table 9 Analysis of Goodness of Fit |

|||||

|---|---|---|---|---|---|

| Variable name | Variable symbol | Variable category | Measure pattern | Common degree (AVE) | R2 |

| Kit 1 | MAT1 | endogenous latent variable | response type | 0.602 | 0.945 |

| Kit 2 | MAT2 | endogenous latent variable | response type | 0.605 | 0.867 |

| Kit 3 | MAT3 | endogenous latent variable | response type | 0.655 | 0.82 |

| R&D ability | RD | endogenous latent variable | response type | 0.708 | 0.275 |

| organizational operation ability | OC | endogenous latent variable | response type | 0.541 | 0.235 |

| supplier management ability | SMC | endogenous latent variable | response type | 0.598 | 0.153 |

| customer management ability | CMC | endogenous latent variable | response type | 0.737 | 0.157 |

| learning ability | LA | endogenous latent variable | response type | 0.803 | 0.19 |

| social responsibility performance ability | SR | endogenous latent variable | response type | 0.772 | 0.078 |

| value creation | VC | endogenous latent variable | response type | 0.628 | 0.651 |

| Mean | 0.665 | 0.437 | |||

Conclusion

Main Conclusions

Managerial Accounting Influences Marine Enterprise Value Creation through Key Factors of Value Creation

This paper found that Managerial accounting tools do not have a direct impact on value creation but need to influence value creation by influencing key factors of value creation. This reveals the real way that managerial accounting affects enterprise value creation. Therefore, when choosing managerial accounting methods, enterprises should choose managerial accounting tools according to the matching between managerial accounting tools and key factors of value creation, so as to realize the contribution of managerial accounting methods to enterprise value creation.

Managerial Accounting Tools have been widely used in Marine Enterprises

But from the perspective of the surveyed enterprises, the application of strategic management, activity-based costing and risk management tools is still relatively limited. Strategic management is a strategic tool that connects all links of enterprise value creation. Risk management tools can improve the ability of enterprises to prevent risks. Activity-based costing can help enterprises control cost and eliminate non-value-added activities. These tools will promote enterprises' research and development ability, organization and operation ability, supplier management ability, customer management ability and learning ability. Marine enterprises should make more use of these managerial accounting tools.

Key Factors of Value Creation Ability Affects Value Creation

Marine Enterprises need to Improve R&D and Supplier Management Capability to Improve Value Creation

In theory, r&d capability and supplier management capability should promote the value creation of enterprises. However, the test of the hypothesis proves that r&d ability and supplier management ability do not have significant influence on value creation. This indicates that these two capabilities do not play an obvious role in promoting enterprise value creation in the sample enterprises. Marine enterprises should improve these capabilities. Moreover these test items have lower mean value. The r&d ability and supplier management ability of sample enterprises may be relatively backward. The surveyed enterprises attach more importance to the development of customer management ability and social responsibility fulfillment ability, so these aspects contribute more to the enterprise value.

Research Enlightenment

This paper discusses the relationship among managerial accounting tools, key factors of value creation and value creation by constructing model diagram. For Marine enterprise managerial accounting tools can exert positive influence on value creation ability, is only the effect of the effect is not obvious, this was partly due to managerial accounting as a new discipline, compared with other management theory, the development system is not yet mature, on the other hand ocean enterprises for the application of managerial accounting tools methods in the actual operation is not enough attention, fail to realize that managerial accounting tools for the enterprise to achieve value-added, win the competitive advantage of important guiding significance.

In addition, the ability of Marine enterprises to address key elements of value creation can mediate between managerial accounting tools and value creation. Managerial accounting tools can influence the value creation of enterprises by influencing their organizational operation, customer management, organizational learning and social responsibility fulfillment. In the process of operation management, Marine enterprises should make full use of managerial accounting tools to make cost control more efficient, quality management more comprehensive and performance management more timely. In the customer-centered customer management activities, the strategic map is used to determine the strategic focus of the enterprise, define the development direction, find the key nodes that the value chain or value network can help the enterprise to retain customers, respond to the needs of customers actively and provide them with quality products or services; Carry out the learning and training of employees in the organization, stimulate their independent growth, provide them with promotion opportunities, and create a learning organizational culture; The cultivation of enterprises' ability to fulfill social responsibility is a way for enterprises to create value. It is of great help to improve the financial value of enterprises to carry out management throughout the whole life cycle of products and analyze the profitability of enterprises from multiple dimensions. The entire above are inseparable from the application of managerial accounting tools and methods.

References

References

Abernethy, M.A., & Lillisa, M. (1995). The impact of manufacturing flexibility on management control system design. Accounting Organizations and Society, 20(4), 241-258.

Alomiri, M., & Drury, C. (2007). A survey of factors influencing the choice of product costing systems in UK organizations. Managerial accounting Research, 18(4), 399-424.

Chin, W.W. (1998). The partial least squares approach for structural equation modeling. Modern Methods for Business Research. Mahwah, NJ, US: Lawrence Erlbaum Associates Publishers.

Chodúr, M., Pálka, P.E., & Svoboda, J. (2010). Application of the customer value concept for measurement and value chain processes management. Proceedings of the 6th European Conference on Management Leadership and Governance, 439-442.

Christopher, D., Ittner, D., & Larcker, F. (2001). Assessing empirical research in managerial accounting: A value-based management perspective. Journal of Accounting and Economics, 32, 349-410.

David, A.H., & Katherine, J.K. (2007). What’s the difference? Diversity constructs as separation, variety or disparity in organizations. Academy of Management Review, 32, 1199-1228.

Falaghi, H., & Haghifam, M.R. (2005). Distributed generation impacts on electric distribution systems reliability: Sensitivity analysis. Belgrade: The International Conference on Computer as a tool IEEE, 1465-1468.

Feng, Q. (2020). Innovation of managerial accounting tools-Application of ‘cross-type’ decision method. Accounting Research, 3, 23-27. Google scholar

Frohlich, M.T., & Westbrook, R. (2001). Arcs of integration: An international study of supply chain strategies. Journal of Operations Management, 19(2),185-200.

Harold, K. (1980). The management theory jungle revisited. The Academy of Management Review, 2, 15-41.

Helton, J.C. (1999). Uncertainty and sensitivity analysis techniques for use in performance assessment for radioactive waste disposal. Risk Analysis, 19(5), 759-761.

Hinkin, T.R. (1995). A review of scale development practices in the study of organizations. Journal of Management, 21(5), 967-988.

John, K.S. (1992). Vijay Govindarajan, strategic cost management: The value chain perspective. Management Accounting research, 4,179-197.

Lin, Y., & Wu, L.Y. (2014). Exploring the role of dynamic capabilities in firm performance under the resource based view framework. Journal of Business Research, 67(3), 407-413.

Luo, M., & Li, Y. (2002). A review of western postmodern management trends. Financial Science, 3, 28-32.

Macdonald, S., & Kam, J. (2007). Ring a ring o’ rose: Quality journals and gamesmanship in management studies. Journal of Management Studies, 44, 640-655.

Malmo, M., & Copenhagen, C. (2021). Niklas Luhmann and organization studies. Liber and Copenhagen Business School Press, 15-47.

Ronald, E.G., & Shelby, D. (1978). Hunt is management a science? The Academy of Management Review, 1, 15-27.

Slywotzky, A.J. (1996). Value migration: How to think several moves ahead of the competition. Boston: Harvard Business School Press.

Sponem S., & Lambert, C. (2016). Exploring differences in budget characteristics, roles and satisfaction: A configurationally approaches. Managerial accounting Research, 30(3), 47-61.

Starkey, K., & Madan, P. (2001). Bridging the relevance gap: Aligning the stakeholders in the future of management research. British Journal of Management, 12, 3-6.

Stasser, G., Vaughan, S.I., & Stewart, D.D. (2000). Pooling unshared information: The benefits of knowing how access to information is distributed among group members. Organizational Behavior and Human Decision Processes, 82, 102-116.

Stoelhorst, J.W. (2008). Why is management not an evolutionary science? Evolutionary theory in strategy and organization. Journal of Management Studies, 45, 1008-1023.

Teece, D.J.,Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509-533.

Tretyak, O.A., & Sloev, I. (2013). Customer flow: Evaluating the long-term impact of marketing on value creation. Journal of Business & Industrial Marketing, 28(3), 221-228.

Wilden, R., & Gudergan, S.P. (2015). The impact of dynamic capabilities on operational marketing and technological capabilities: Investigating the role of Environmental Turbulence. Journal of the Academy of Marketing Science, 43(2), 181-199.

Wright, T.A., & Quick, J.C. (2009). The role of positive-based research in building the science of organizational behavior. Journal of Organizational Behavior, 30(2), 329-336.

Yauch, C.A., & Steudel, H.J. (2003). Complementary use of qualitative and quantitative cultural assessment methods. Organizational Research Methods, 6, 465-481.

Yin, R.K. (2002). Case study research, design and methods. Newbury Park, CA: Sage, 3-5.

Zedeck, S. (2003). Editorial. Journal of Applied Psychology, 88, 3-5.

Received: 01-Jan-2022, Manuscript No. JMIDS-22-10889; Editor assigned: 03-Jan-2022; PreQC No. JMIDS-22-10889(PQ); Reviewed: 18-Jan-2022, QC No.JMIDS-22-10889; Revised: 25-Jan-2022, Manuscript No. JMIDS-22-10889; Published: 01-Feb-2022