Research Article: 2019 Vol: 23 Issue: 6

The Relationship between Financial and Fiscal Reporting Under the Income Perspective

Nexhmie Berisha Vokshi, University of Prishtina

Abstract

Robust financial reporting systems of business organizations contribute to financial stability and spur increased confidence and transparency. Along with financial reporting, business organizations’ fiscal reporting is also a very important and highly influential element. Accounting and tax purposes and requirements are not always the same: accounting involves the preparation of information for the purpose of decision-making, while the purpose of taxation is to collect income and to be used as a governmental economic instrument. This results in a very important and focal point for this study: analyzing the relationship between financial reporting and fiscal reporting in Kosovo under the influencing elements and legal framework related to their reporting, with particular emphasis on income financial reporting and income tax. The paper was structured in three sections, starting with the literature review, the regulatory framework for reporting income for accounting and fiscal purposes, and empirical analysis of the relationship between financial reporting of income and their fiscal reporting. The research is quantitative and the research sample consists of 264 businesses with turnover of over 1 million€. Data was conducted through a questionnaire filled out in businesses and addressed to accountants (one employee in each business, total of 264 accountants interviewed), and were processed through descriptive statistics and quantitative analytical method. The study reflected the current situation on reporting requirements regarding income under accounting and fiscal legislation, providing us with the reality that businesses face in relation to the two reporting areas, and that there is a correlation between accounting and taxation, in which accounting is prevalent. As the research findings show that there is a correlation between accounting and fiscal rules when recording and reporting income, this leaves room for further research in order to study the process of harmonization of both accounting and fiscal regulations.

Keywords

Accounting, Accountants, Taxation, Financial Statements, Financial Reporting, Fiscal Reporting, Income.

JEL Classifications

M 41, H 29.

Introduction

To be properly oriented in their activities and in the many relations with other business organizations, businesess need accurate, complete and timely accounting information, which is provided through financial statements. Therefore, financial and fiscal reporting under the regulatory frameworks will greatly contribute to their development and orientation.

Consequently, the purpose of this research is to present the reality in Kosovo regarding the preparation of financial statements under the legal regulatory framework on accounting and taxation, focusing on recording and reporting of income, thus evidencing the current state of what is provided to business organization directors and to accounting information users.

To achieve this goal, research objectives were set. In this case, the following considerations are of particular importance:

a. Knowledge of the legal regulatory framework on accounting, financial reporting and auditing, as well as fiscal legal regulatory framework;

b. Knowledge and implementation of International Accounting Standards (IAS) regarding the recording and reporting on financial statements’ elements;

c. Current relevance of financial and fiscal reporting, dominance of accounting rules over fiscal ones or vice versa.

Since the study emphasizes the relation between two forms of income reporting, data that represent the attitudes and opinions of accountants will be used. This will show the mutual relationship between accounting and fiscal rules when recording and reporting income and income tax.

Literature Review

The financial and fiscal reporting of businesses and the relationship between these two areas has led many authors to deal with this issue. The purpose of the research was the fact that this relationship is complex and that both domains are dominated by constant changes as time demands.

According to Professors Najim and Qassim, the absence of professional accounting agencies and the various international taxation systems cause a conflict between accounting practices and principles. Thus, it is important that countries unify applications of financial reporting principles, so that company’s goals are easier achieved. (Al-Karaawy, 2018)

As Professor Florentina in her paper “Issues Concerning the Relationship between Accounting and Taxation in Determining Financial Result” said: “Taxation still has a pretty big influence on Romanian accounting practice. Romanian accounting provides information so the state can charge tax obligations of operators in our country because the state is the main user of the financial statements of companies”. This means that qualitative accounting information including taxation is very important for the business directors, but also the state as its main user. (Moisescu, 2018)

Businesses need to ensure that their economic activities are being reported fairly and transparently through financial reports. This means that qualitative accounting ensures business performance and compliance with tax authorities. According to PhD student Mihaela-Nicoleta Bacanu on her paper “Is accounting-taxation relation a contributor to the sustainability ”, each of the two domains are contributors to the sustainable development and both of them are interdependent. Thus, the relation between accounting and taxation is also a contributor to the sustainable development. If the accounting results are presented at their real values, and they are high, the fiscal results can also be high, but this depends on the fiscal elements that are added or deducted from the accounting results. The higher the fiscal results, the higher the taxes are, so the fiscal income are higher, improving in this way the economic performance and also the environmental and social performance (B?canu, 2017).

The main objective of accounting is the fair and transparent presentation of the financial position, in this case also the financial performance. But this objective is influenced by the relationship between accounting and taxation. Related to this, the study regarding the importance of accounting system in accounting and taxation of businesses emphasizes that accounting regulation and tax planning are essential in maintaining harmony between the accounting system and tax system of businesses (Mates et al., 2016).

A very important issue in the reporting area is the identification of the link and the degree of link between accounting and taxation. This link was studied by Lamb,1998 and the study was based on four countries: UK, USA, France and Germany. Empirical research on the relationship between fiscal rules and accounting practices presented a classification in five cases. The first case concerns the disconnection of fiscal rules and practices from financial reporting practices and rules, while the other four involve different forms of linkage. More precisely, the fourth and fifth cases are clear cases of fiscal impact on the choice of accounting policy (Lamb, 1998).

Issues related to differences or overlaps between financial and fiscal reporting have been the subject of many scholars and debates. In this regard, a discrepancy between the two reports will lead to irregular decision making by managers, because it is supposed that they have misleading information. Just as businesses may face double reporting, this study will highlight the Kosovo reality towards this issue.

Regulatory Framework for Reporting of Income for Accounting and for Fiscal Purposes

Regulatory Framework on Income Accounting

The legal framework in Kosovo related to accounting, financial reporting and auditing, treats income recording and reporting according to the accounting standard for income, whose objective is the accounting processing of income that come from certain types of transactions and economic events. Income is defined as the gross income of economic benefits over the period arising from ordinary economic activity and which result in an increase in net capital, unless such increases are related to contributions from equity participations. The key issue in accounting for income is to determine the moment of their acknowledgment. Income must be measured at the fair value of the amount received or payable (IAS 18).

Income from rent are treated as income from economic activity and taxed as such (27, www.iasplus.com). Meanwhile, regarding income from intangible assets, accounting legislation (IAS38) generally treats intangible assets, in particular the gains or losses arising from the deregistration of intangible assets are defined as the difference between the net amount of the sale (if any) and the carrying amount, which is acknowledged as gains or losses. Benefits are not treated as income (IAS 18). They may be different, for example cost savings, use of intellectual property by the business organization in a production process. Consequently, it can reduce the cost of production in the future, but not increase future income. Acknowledging and reporting of interest income, with regard to the accounting regulatory framework, is well defined with the relevant Income Standard.

Accounting legislation (IAS 12) also deals with income tax, which includes all taxes based on taxable profits. Accounting profit means the profit/loss for the period prior to the deduction of tax expenses. Taxable profit/loss is the profit/loss of the period, determined by rules set by fiscal authorities, under which income taxes are paid. Tax expenses are the total amount involved in determining the profit/loss for the period relating to current tax and deferred tax. Current tax is the actual amount payable in respect of the taxable profit for a period. Meanwhile, deferred tax is the amount of tax payable in future periods relating to taxable temporary differences.

The main issue in accounting for income taxes is the way in which should be recorded, currently and in the future, tax consequences of:

a. Future recovery/repayment of assets/liabilities that are acknowledged in the statement of financial position of the business organization;

b. Transactions and other events that are acknowledged in the business organization's financial statements.

If the recovery/settlement of the carrying amount would make future tax payments greater than if there were no recovery/settlement, the legal basis requires the business organization to acknowledge the deferred tax liability.

In general, the steps related to the accounting of the income tax to be followed by the business organization are as follows:

a. Acknowledgment of the current tax and its measurement;

b. Identifying which assets/liabilities are expected to affect taxable profit (if recovered/settled);

c. Determining the tax base of elements at the end of the period;

d. Acknowledgment of deferred taxes;

e. Distribution of current and deferred tax to relevant elements in the profit/loss statement, income statement and equity statement;

f. Submission and disclosure of the requested information.

Fiscal Regulatory framework on Income

The Kosovo fiscal legislation has determined the legal basis (No.06-L-105) on taxable income generated in Kosovo and abroad. Taxable income for a taxable period means the difference between gross income received or incurred during the taxable period and allowable deductions.

Gross income is earned or accumulated income, including income from production, trade, finance, investment, rent, use of intangible assets, interest income, etc. Likewise, it determines the taxable gross income and tax-exempt income. Gross income from business activities for taxpayers with gross annual income of over € 50,000 must be reported in the tax period during which they are received or acknowledged. Meanwhile, taxpayers with a threshold of up to € 50,000 must report their income in the tax period during which that income was truly or constructively received.

Income from intangible assets, under the fiscal legislation, includes income from patents, copyrights, licenses, exclusive rights and other assets that consist only of rights and do not have a physical form. The right to use real estate is inviolable. Income from interest include interest on loans granted to persons or business organizations, interest on bonds or other securities issued by business organizations, interest from interest bearing accounts held in banks or other financial institutions Meanwhile, they do not include interest from Kosovo Pension Savings Trust funds or any other pension fund.

The fiscal legislation also regulates any other form of income that comes from any source, such as, for example, income from lottery gains or debt forgiveness, other than those exempt from tax in accordance with the law. Money or other gifts are included in the proceeds if they exceed the amount of € 5,000 in the tax period.

The Table 1 below summarizes the accounting and fiscal regulatory framework in Kosovo for the treatment of income.

| Table 1 Financial and Fiscal Reporting on Income | ||

| Income | Financial reporting | Fiscal reporting |

| Income | IAS 18 | Law 05/L-028 and 06-L-105 (PIT and CIT) |

| Income from rent | IAS 17 | Treated as income from economic activity and taxed as such. |

| Income from intangible assets | IAS 38 | Includes income from patents, copyrights, licenses, exclusive rights and other assets that consist only of rights and do not have a physical form. The right to utilize real estate is inviolable. |

| Income from interest | IAS 18 | Includes interest on loans granted to persons or business organizations, interest on bonds or other securities issued by business organizations, interest from interest bearing accounts held in banks or other financial institutions. |

| Income tax | IAS 12 | Law 05/L-028 and 06-L-105 (PIT and CIT) |

| Other forms of income | IAS 12 and IAS 01 | Law 05/L-028 and 06-L-105 |

Empirical Analysis of the Relationship Between the Financial Reporting and Fiscal Reporting of Income

Following, we present the analysis of data and research results regarding the current situation of the relationship between income accounting and their reporting for fiscal purposes.

Since the focus of this research is to identify the relationship between the two reporting areas from income perspective, the following research questions are based on six elements of income (rental income, income from intangible assets, interest income, income tax, current taxes and deferred taxes). Accountants have given us information regarding the fact that when recognizing, recording and reporting the income, they use: (i) the accounting rules and then make the necessary adjustments for fiscal purposes, (ii) fiscal rules only or (iii) accounting rules only.

Therefore, the research questions are as follows:

1. When recognizing, recording, and reporting income, do you use accounting rules and then make the necessary fiscal adjustments?

2. When recognizing, recording, and reporting income, do you use only accounting rules?

3. When recognizing, recording, and reporting income, do you use only fiscal rules?

The above research questions raise the following hypotheses:

H1: In the case of acknowledging, recording and reporting of income there is dependence between accounting and taxation, in which accounting dominates;

H2: In the case of acknowledging, recording and reporting of income we have dependence between accounting and taxation, in which the fiscal rules dominate.

Research Method

Our quantitative research targeted businesses, with a representative sample of 264 of selected businesses, with a confidence level of 95%. The selected sample consists of accountants who work as employees in these businesses and a questionnaire was structured on this basis. The data are analyzed through descriptive statistics as well as through the cross-tab analytical method, to identify the dependency between dependent variables (research questions related to acknowledging, recording and reporting of six income elements) and independent, separate variables (three features of the accountants, such as: professional experience, completion of trainings and knowledge of the legal regulatory framework). The use of this analytical method is reasonable given the fact that the variables are discrete categories. We leveraged such variables to obtain the right information to prove the raised hypotheses.

Research Results

Element 1: Income from Rent

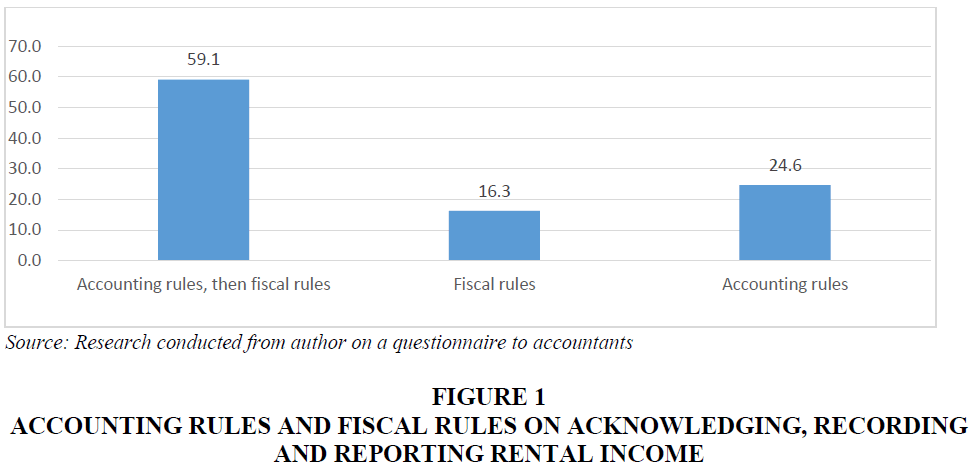

To the question “When acknowledging, recording and reporting income, are the accounting rules used first, and then adjustments or modifications for fiscal needs are made, only accounting rules are used, or only fiscal rules?”, 59.1% stated that they initially apply the accounting rules and then make fiscal adjustments, 24.6% only use accounting rules, while 16.3% only use fiscal rules Figure 1 & Table 2.

Source: Research conducted from author on a questionnaire to accountants

Figure 1 Accounting Rules and Fiscal Rules on Acknowledging, Recording and Reporting Rental Income

| Table 2 Frequency: Accounting Rules and Fiscal Rules on Acknowledging, Recording and Reporting of Rental Income (In Percentage) | ||

| Frequency | Valid Percent | |

| Accounting rules, then fiscal rules | 156 | 59.1 |

| Fiscal rules | 43 | 16.3 |

| Accounting rules | 65 | 24.6 |

| Total | 264 | 100.0 |

As a deendent variable, this research question is further cross-examined with three independent variables that represent the professional experience of respondents, their participation in professional trainings (continuous professional development) and their knowledge of the accounting legal framework. This analysis aims to further investigate these factors’ influence, or lack of thereof, on the statements of professionals that accounting is dominant when acknowledging, recording and reporting income.

Professional experience leads accountants to point out that rental income is recorded and reported according to accounting rules, and then they make necessary adjustments or disclosures on fiscal issues. Of those with 1 to 3 years of work experience, 56.3% have claimed this, versus 18.8% who said they only use fiscal rules and 25.0% who only use accounting rules. Of the professionals with 4 to 6 years of work experience, 61.9% of them use the rules as in the first case, versus 16.7% who only use accounting rules and 21.4% only fiscal rules. Even between those with more than 6 years of experience, 59.2% have chosen the first option, while 25.5% of them only use accounting rules, and 15.2% only fiscal rules Table 3.

| Table 3 Acknowledging, Recording and Reporting of Rental Income Versus Professional Experience (In Percentage) | |||||

| How many years have you practiced your profession? | Total | ||||

| 1-3 years | 4-6 years | over 6 years | Less than a year | ||

| Accounting rules, then fiscal rules | 56.3 | 61.9 | 59.2 | 50.0 | 59.1 |

| Fiscal rules | 18.8 | 21.4 | 15.2 | 16.3 | |

| Accounting rules | 25.0 | 16.7 | 25.5 | 50.0 | 24.6 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Participation in professional training influences the attitudes of accountants regarding the recording and reporting of rental income in accordance with accounting rules, followed by fiscal adjustments. Of those who attend trainings very often and often, 80.5% and 52.5% respectively maintain such a stance, while 19.5% and 23.0% respectively say that they only use accounting rules, while 24.6% of those who are often trained use only rules fiscal Table 4.

| Table 4 Acknowledging, Recording and Reporting of Rental Income Versus Participation in Professional Trainings (In Percentage) | ||||||

| How often have you participated in professional trainings? | Total | |||||

| Never | Occasionally | Rarely | Often | Very often | ||

| Accounting rules, then fiscal rules | 50.0 | 49.5 | 48.0 | 52.5 | 80.5 | 59.1 |

| Fiscal rules | 26.3 | 12.0 | 24.6 | 16.3 | ||

| Accounting rules | 50.0 | 24.2 | 40.0 | 23.0 | 19.5 | 24.6 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

The level of knowledge of the law influences accountants to point out that in the case of recording and reporting on rental income, they use accounting rules and then adjustments or disclosures on fiscal matters are made. Of those with great and sufficient knowledge of the law, 79.7% and 60.2% respectively confirmed the proposition, while 15.3% and 22.1% respectively said that they only use accounting rules, and finally 5.1% and 17.7% stated that they only use fiscal rules for this category of income (Table 5).

| Table 5 Acknowledging, Recording and Reporting of Rental Income Against Knowledge of the Legal Framework (In Percentage) | |||||

| How much do you know about the legal framework? | Total | ||||

| I have an average knowledge | I have enough knowledge | I have little knowledge | I have great knowledge | ||

| Accounting rules, then fiscal rules | 50.8 | 60.2 | 31.0 | 79.7 | 59.1 |

| Fiscal rules | 22.2 | 17.7 | 20.7 | 5.1 | 16.3 |

| Accounting rules | 27.0 | 22.1 | 48.3 | 15.3 | 24.6 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Element 2: Income from Intangible Assets

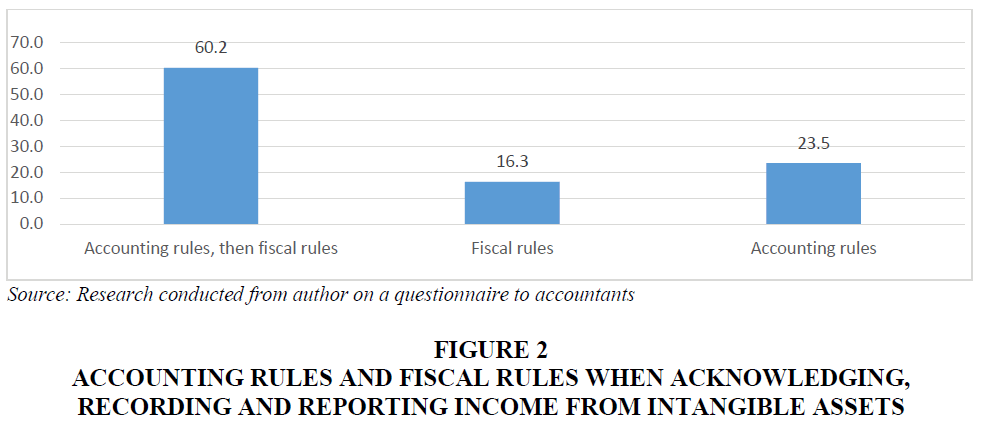

Regarding the question of which rules are used when acknowledging, recording and reporting income from intangible assets, 60.2% of respondents stated that they first use accounting rules and then make fiscal adjustments, 23.5% stated that they only use accounting rules, 16.3% only use fiscal rules Figure 2 & Table 6.

Source: Research conducted from author on a questionnaire to accountants

Figure 2 Conceptual framework

| Table 6 Frequency: Accounting Rules and Fiscal Rules When Acknowledging, Recording and Reporting Income Intangible Assets (In Percentage) | ||

| Frequency | Valid Percent | |

| Accounting rules, then fiscal rules | 159 | 60.2 |

| Fiscal rules | 43 | 16.3 |

| Accounting rules | 62 | 23.5 |

| Total | 264 | 100.0 |

Work experience leads accountants to state that income from intangible assets is recorded and reported according to accounting rules, and then they make necessary adjustments or disclosures on fiscal issues. Of those with 1 to 3 years work experience, 56.3% have claimed this, versus 18.8% who said they only use fiscal rules and 25.0% who only use accounting rules. Of the professionals with 4 to 6 years of work experience, 61.9% of them use the rules as in the first case, versus 16.7% who only use accounting rules and 21.4% only fiscal rules. Even between those with more than 6 years of experience, 60.9% have chosen the first option, while 23.9% of them only use accounting rules, and 15.2% only fiscal rules Table 7.

| Table 7 Acknowledging, Recording and Reporting Income From Intangible Property Versus Professional Experience (In Percentage) | |||||

| How many years have you practiced your profession? | Total | ||||

| 1-3 years | 4-6 years | over 6 years | Less than a year | ||

| Accounting rules, then fiscal rules | 56.3 | 61.9 | 60.9 | 50.0 | 60.2 |

| Fiscal rules | 18.8 | 21.4 | 15.2 | 16.3 | |

| Accounting rules | 25.0 | 16.7 | 23.9 | 50.0 | 23.5 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Professional trainings on this category of income has not led accountants to record and report them in accordance with accounting rules and then make fiscal adjustments. Of those who attend trainings very often and often, 80.5% and 57.4% respectively maintain such a stance, while 19.5% and 23.0% respectively say that they only use accounting rules, while 19.7% of those who are often trained use only rules fiscal. On the other hand, even those who have never attended trainings have all chosen the first option, so we can say that there is no dependency between the dependent and independent variables (Table 8).

| Table 8 Acknowledging, Recording and Reporting Income From Intangible Property Versus Professional Trainings (In Percentage) | ||||||

| How often have you participated in professional trainings? | Total | |||||

| Never | Occasionally | Rarely | Often | Very often | ||

| Accounting rules, then fiscal rules | 100.0 | 46.3 | 48.0 | 57.4 | 80.5 | 60.2 |

| Fiscal rules | 29.5 | 12.0 | 19.7 | 16.3 | ||

| Accounting rules | 24.2 | 40.0 | 23.0 | 19.5 | 23.5 | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

The level of knowledge of the law leads accountants to employ accounting rules and then adjustments or disclosures on fiscal matters are made. Of those with great and sufficient knowledge of the law, 84.7% and 57.5%, respectively, have chosen the first option, while 15.3% and 22.1%, respectively, said they only use the accounting rules. Of the professionals with average knowledge, 50.8% have chosen the first option with regard to the recording and reporting of this income. Also, 20.4% of those with sufficient knowledge of the legal framework have stated that they only use fiscal rules for this category of income (Table 9).

| Table 9 Acknowledging, Recording and Reporting Income from Intangible Property Versus Legal Knowledge (Inpercentage) | |||||

| How much do you know about the legal framework? | Total | ||||

| I have an average knowledge | I have enough knowledge | I have little knowledge | I have great knowledge | ||

| Accounting rules, then fiscal rules | 50.8 | 57.5 | 41.4 | 84.7 | 60.2 |

| Fiscal rules | 22.2 | 20.4 | 20.7 | 16.3 | |

| Accounting rules | 27.0 | 22.1 | 37.9 | 15.3 | 23.5 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Element 3: Income from Interest

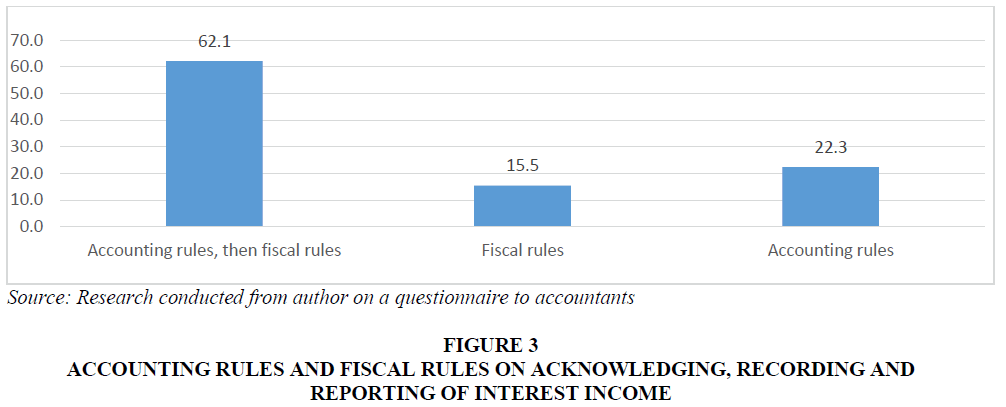

Regarding the question of what rules are used when acknowledging, recording and reporting interest income, 62.1% of respondents stated that they initially use accounting rules and then make fiscal adjustments, 22.3% stated that they only use accounting rules, 15.5% only use fiscal rules Figure 3 and Table 10.

Source: Research conducted from author on a questionnaire to accountants

Figure 3 Conceptual framework

| Table 10 Frequency: Accounting Rules and Fiscal Rules on Acknowledging, Recording and Reporting of Interest Income (In Percentage) | ||

| Frequency | Valid Percent | |

| Accounting rules, then fiscal rules | 164 | 62.1 |

| Fiscal rules | 41 | 15.5 |

| Accounting rules | 59 | 22.3 |

| Total | 264 | 100.0 |

The duration of professional engagement leads accountants to declare that interest income is recorded and reported according to accounting rules, and then they make necessary adjustments or disclosures on fiscal issues. Of those with 1 to 3 years work experience, 56.3% have claimed this, versus 18.8% who said they only use fiscal rules and 25.0% who only use accounting rules. Of the professionals with 4 to 6 years of work experience, 61.9% of them use the rules as in the first case, versus 16.7% who only use accounting rules and 21.4% only fiscal rules. Even between those with more than 6 years of work experience, 63.6% have chosen the first option, while 22.3% of them only use accounting rules, and 14.1% only fiscal rules Table 11.

| Table 11 Acknowledging, Recording and Reporting of Interest Income Versus Professional Experience (In Percentage) | |||||

| How many years have you practiced your profession? | Total | ||||

| 1-3 years | 4-6 years | over 6 years | Less than a year | ||

| Accounting rules, then fiscal rules | 56.3 | 61.9 | 63.6 | 50.0 | 62.1 |

| Fiscal rules | 18.8 | 21.4 | 14.1 | 15.5 | |

| Accounting rules | 25.0 | 16.7 | 22.3 | 50.0 | 22.3 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Professional training leads accountants to record and report interest income in accordance with accounting rules and then makes fiscal adjustments. Of those who attend trainings very often and often, 84.4% and 57.4% respectively maintain such a stance, while 15.6% and 23.0% respectively say that they only use accounting rules, while 19.7% of those who are often trained use only rules fiscal (Table 12).

| Table 12 Acknowledging, Recording and Reporting of Interest Income Versus Participation in Trainings (In Percentage) | ||||||

| How often have you participated in professional trainings? | Total | |||||

| Never | Occasionally | Rarely | Often | Very often | ||

| Accounting rules, then fiscal rules | 50.0 | 48.4 | 60.0 | 57.4 | 84.4 | 62.1 |

| Fiscal rules | 27.4 | 12.0 | 19.7 | 15.5 | ||

| Accounting rules | 50.0 | 24.2 | 28.0 | 23.0 | 15.6 | 22.3 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

The level of knowledge of the law leads accountants to emphasize that they use accounting rules and then adjustments or disclosures on fiscal matters are made. Of those with great and sufficient knowledge of the law, 84.7% and 57.5%, respectively, have chosen the first option, while 15.3% and 22.1%, respectively, said they only use the accounting rules. Also, 18.6% of those with sufficient knowledge of the legal framework have stated that they only use fiscal rules for this category of income. Of the professionals with average knowledge, 50.8% have chosen the first option with regard to the recording and reporting of these incomes (Table 13).

| Table 13 Acknowledging, Recording and Reporting of Interest Income Versus Professional Experience (In Percentage) | |||||

| How much do you know about the legal framework? | Total | ||||

| I have an average knowledge | I have enough knowledge | I have little knowledge | I have great knowledge | ||

| Accounting rules, then fiscal rules | 50.8 | 59.3 | 51.7 | 84.7 | 62.1 |

| Fiscal rules | 22.2 | 18.6 | 20.7 | 15.5 | |

| Accounting rules | 27.0 | 22.1 | 27.6 | 15.3 | 22.3 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Element 4: Income Tax

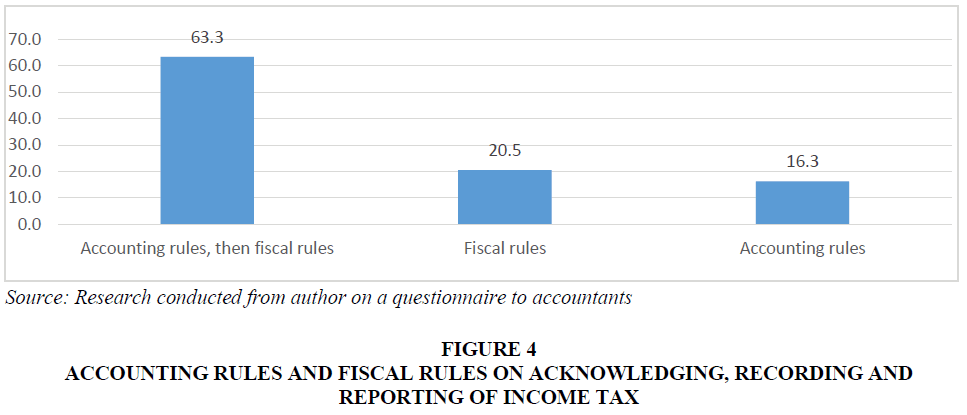

Regarding the question of what rules are used in acknowledging, recording and reporting of income tax, we see that 62.5% of professionals stated that they first use the accounting rules followed by fiscal adjustments, 20.5% of them only use fiscal rules, while 16.3% only use accounting rules (Figure 4 and Table 14).

Source: Research conducted from author on a questionnaire to accountants

Figure 4 Conceptual framework

| Table 14 Frequency: Accounting Rules and Fiscal Rules on Acknowledging, Recording and Reporting of Income Tax (In Percentage) | ||

| Frequency | Valid Percent | |

| Accounting rules, then fiscal rules | 167 | 63.3 |

| Fiscal rules | 54 | 20.5 |

| Accounting rules | 43 | 16.3 |

| Total | 264 | 100.0 |

The duration of professional engagement leads accountants to declare that income tax is recorded and reported according to accounting rules, and then they make necessary adjustments or disclosures on fiscal issues. Of those with 1 to 3 years of work experience, 62.5 have claimed this, versus 28.1% who said they only use fiscal rules and 9.4% who only use accounting rules. Of the professionals with 4 to 6 years of work experience, 61.9% of them use the rules as in the first case, versus 11.9% who only use accounting rules and 21.4% only fiscal rules. Even between those with more than 6 years of work experience, 64.1% have chosen the first option, while 17.4% of them only use accounting rules, and 14.1% only fiscal rules (Table 15).

| Table 15 Acknowledging, Recording and Reporting of Income Tax Versus Professional Experience (In Percentage) | |||||

| How many years have you practiced your profession? | Total | ||||

| 1-3 years | 4-6 years | over 6 years | Less than a year | ||

| Accounting rules, then fiscal rules | 62.5 | 61.9 | 64.1 | 50.0 | 63.3 |

| Fiscal rules | 28.1 | 26.2 | 18.5 | 20.5 | |

| Accounting rules | 9.4 | 11.9 | 17.4 | 50.0 | 16.3 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Professional trainings have not lead accountants to record and report income tax in accordance with accounting rules and then make fiscal adjustments. Of those who attend trainings very often and often, 76.6% and 67.2% respectively maintain such a stance, while 11.7% and 13.1% respectively say that they only use accounting rules, while 11.7% and 19.7%, respectively, only use fiscal rules. On the other hand, even those who have never attended trainings have all chosen the first option, so we can say that there is no dependency between the dependent and independent variables (Table 16).

| Table 16 Acknowledging, Recording and Reporting of Income Tax Versus Professional Trainings (In Percentage) | ||||||

| How often have you participated in professional trainings? | Total | |||||

| Never | Occasionally | Rarely | Often | Very often | ||

| Accounting rules, then fiscal rules | 100.0 | 46.3 | 68.0 | 67.2 | 76.6 | 63.3 |

| Fiscal rules | 31.6 | 12.0 | 19.7 | 11.7 | 20.5 | |

| Accounting rules | 22.1 | 20.0 | 13.1 | 11.7 | 16.3 | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Meanwhile, the level of knowledge of the law has led accountants to use the accounting rules and then adjustments or disclosures on fiscal matters are made. Of those with great and sufficient knowledge of the law, 89.8% and 54.0%, respectively, have chosen the first option, while 10.2% and 27.6%, respectively, said they only use the accounting rules. Also, 33.6% of those with sufficient knowledge of the legal framework have stated that they only use fiscal rules. Of the professionals with average knowledge, 55.6% have chosen the first option with regard to the recording and reporting of these income taxes (Table 17).

| Table 17 Acknowledging, Recording and Reporting of Income Tax Versus Knowledge of the Law (In Percentage) | |||||

| How much do you know about the legal framework? | Total | ||||

| I have an average knowledge | I have enough knowledge | I have little knowledge | I have great knowledge | ||

| Accounting rules, then fiscal rules | 55.6% | 54.0% | 62.1% | 89.8% | 63.3% |

| Fiscal rules | 20.6% | 33.6% | 10.3% | 20.5% | |

| Accounting rules | 23.8% | 12.4% | 27.6% | 10.2% | 16.3% |

| Total | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

Element 5: Current Taxes

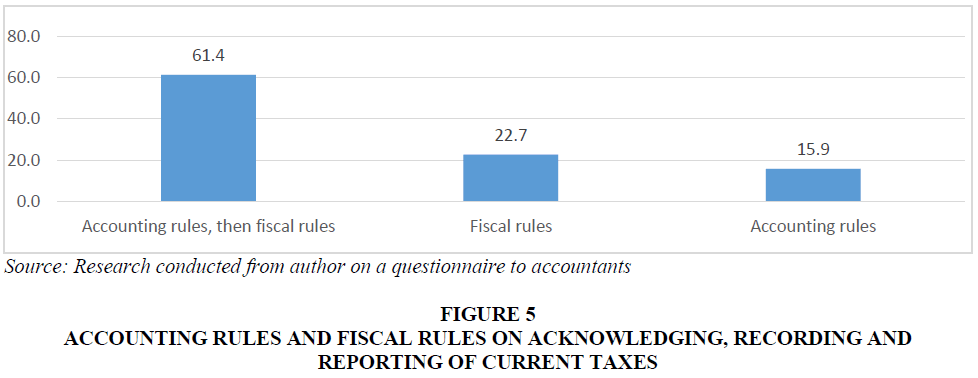

To the next question, “what rules do you use when acknowledging, registering and reporting current taxes?”, 61.4% of respondents answered that they initially use the accounting rules and then make fiscal adjustments, 22.7% only use fiscal rules, while 15.9% use the accounting rules Figure 5 & Table 18.

Source: Research conducted from author on a questionnaire to accountants

Figure 5 Conceptual framework

| Table 18 Frequency: Accounting Rules and Fiscal Rules on Acknowledging, Recording and Reporting of Current Taxes (In Percentage) | ||

| Frequency | Valid Percent | |

| Accounting rules, then fiscal rules | 162 | 61.4 |

| Fiscal rules | 60 | 22.7 |

| Accounting rules | 42 | 15.9 |

| Total | 264 | 100.0 |

Professional experience, in terms of practicing the profession, not in terms of duration, leads accountants to declare that current taxes are recorded and reported under the accounting rules, and then they make the relevant adjustments according to the fiscal rules. Of those with 1 to 3 years of experience, 56.3% made the first choice, while 18.8% of them only use fiscal rules and 25.0% only accounting rules. Of those with over 6 years of experience, 64.1% made the first choice, and also all respondents with one year of experience Table 19.

| Table 19 Acknowledging, Recording and Reporting of Current Tax Versus Professional Experience (In Percentage) | |||||

| How many years have you practiced your profession? | Total | ||||

| 1-3 years | 4-6 years | over 6 years | Less than a year | ||

| Accounting rules, then fiscal rules | 56.3 | 47.6 | 64.1 | 100.0 | 61.4 |

| Fiscal rules | 18.8 | 40.5 | 20.1 | 22.7 | |

| Accounting rules | 25.0 | 11.9 | 15.8 | 15.9 | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Professional trainings lead accountants to record and report current taxes in accordance with the accounting rules and then make the fiscal adjustments. Of those who attend trainings very often and often, 80.5% and 57.4% respectively maintain such a stance, while 7.8% and 18.0% respectively say that they only use accounting rules, and 11.7% and 24.6% respectively only use rules fiscal Table 20.

| Table 20 Acknowledging, Recording and Reporting of Current Tax Versus Professional Trainings (In Percentage) | ||||||

| How often have you participated in professional trainings? | Total | |||||

| Never | Occasionally | Rarely | Often | Very often | ||

| Accounting rules, then fiscal rules | 50.0 | 49.5 | 60.0 | 57.4 | 80.5 | 61.4 |

| Fiscal rules | 34.7 | 12.0 | 24.6 | 11.7 | 22.7 | |

| Accounting rules | 50.0 | 15.8 | 28.0 | 18.0 | 7.8 | 15.9 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

The level of knowledge of the law also leads accountants to stress that in the case of current tax recording and reporting, they use accounting rules and then adjustments or disclosures on fiscal matters are made. Of those with great and average knowledge, 89.9% and 60.3%, respectively, made the first choice, while 5.1% and 19.0%, respectively, stated they only use accounting rules, and 5.1% and 20.6% only fiscal rules. Of the professionals with sufficient knowledge, 49.6% chose the first option Table 21.

| Table 21 Acknowledging, Recording and Reporting of Current Tax Versus Knowledge of the Law (In Percentage) | |||||

| How much do you know about the legal framework? | Total | ||||

| I have an average knowledge | I have enough knowledge | I have little knowledge | I have great knowledge | ||

| Accounting rules, then fiscal rules | 60.3 | 49.6 | 51.7 | 89.8 | 61.4 |

| Fiscal rules | 20.6 | 33.6 | 20.7 | 5.1 | 22.7 |

| Accounting rules | 19.0 | 16.8 | 27.6 | 5.1 | 15.9 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Element 6: Deferred Taxes

To the following question, “When acknowledging, recording and reporting the deferred taxes what rules are used?”, 61.7% of respondents answered that they use the accounting rules and then make fiscal adjustments, 20.1% answered that they only use accounting rules, while 18.2% only use fiscal rules Figure 6 & Table 22.

| Table 22 Frequency: Accounting Rules and Fiscal Rules on Acknowledging, Recording and Reporting of Deferred Taxes (In Percentage) | ||

| Frequency | Valid Percent | |

| Accounting rules, then fiscal rules | 163 | 61.7 |

| Fiscal rules | 48 | 18.2 |

| Accounting rules | 53 | 20.1 |

| Total | 264 | 100.0 |

Professional experience, in terms of practicing the profession, not in terms of duration, leads accountants to declare that deferred taxes are recorded and reported under the accounting rules, and then they make the relevant adjustments according to the fiscal rules. Of those with 1 to 3 years of experience, 62.5% made the first choice, while 9.4% only use fiscal rules and 28.1% only accounting rules. Of those with over 6 years of experience, 62.0% made the first choice, and also all respondents with one year of experience Table 23.

| Table 23 Acknowledging, Recording and Reporting of Deferred Tax Versus Professional Experience (In Percentage) | |||||

| How many years have you practiced your profession? | Total | ||||

| 1-3 years | 4-6 years | over 6 years | Less than a year | ||

| Accounting rules, then fiscal rules | 62.5 | 54.8 | 62.0 | 100.0 | 61.7 |

| Fiscal rules | 9.4 | 28.6 | 17.9 | 18.2 | |

| Accounting rules | 28.1 | 16.7 | 20.1 | 20.1 | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Professional trainings lead accountants to record and report deferred taxes in accordance with accounting rules, and then makes fiscal adjustments. Of those who attend trainings very often and often, 80.5% and 57.4% respectively maintain such a stance, 11.7% and 27.9% respectively say that they only use accounting rules, while 7.8% and 14.8 respectively only use rules fiscal Table 24.

| Table 24 Acknowledging, Recording and Reporting of Deferred Tax Versus Professional Trainings (In Percentage) | ||||||

| How often have you participated in professional trainings? | Total | |||||

| Never | Occasionally | Rarely | Often | Very often | ||

| Accounting rules, then fiscal rules | 50.0 | 51.6 | 56.0 | 57.4 | 80.5 | 61.7 |

| Fiscal rules | 28.4 | 24.0 | 14.8 | 7.8 | 18.2 | |

| Accounting rules | 50.0 | 20.0 | 20.0 | 27.9 | 11.7 | 20.1 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Knowledge of the legal framework leads accountants to point out that in the case of deferred tax recording and reporting, they use accounting rules and then adjustments or disclosures on fiscal matters are made. Of those with great and average knowledge, 89.9% and 65.1%, respectively, made the first choice, and 10.2% and 20.6%, respectively, stated they only use accounting rules, while 14.3% of those with average knowledge only use fiscal rules. Of the professionals with sufficient knowledge, 50.4% stated that deferred taxes are recorded and reported under the accounting rules and then the necessary fiscal adjustments are made Table 25.

| Table 25 Acknowledging, Recording and Reporting of Deferred Taxes Versus Knowledge of the Law (In Percentage) | |||||

| How much do you know about the legal framework? | Total | ||||

| I have an average knowledge | I have enough knowledge | I have little knowledge | I have great knowledge | ||

| Accounting rules, then fiscal rules | 65.1 | 50.4 | 41.4 | 89.8 | 61.7 |

| Fiscal rules | 14.3 | 26.5 | 31.0 | 18.2 | |

| Accounting rules | 20.6 | 23.0 | 27.6 | 10.2 | 20.1 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Summary of Research Results and Confirmation of Hypotheses

The research outcomes identified the relationship between two areas of reporting by businesses in Kosovo. More specifically, it was identified that in the case of acknowledging, recording and reporting of income, there is a correlation between accounting and taxation, in which accounting is dominant.

The attitudes and statements of the respondents (accountants) that they are dominated by the accounting rules are affected by their knowledge of the legal basis, their professional experience, and less by their participation in trainings. This is due to the fact that their continuous professional development has not undermined their attitude towards the use of these rules, as they are well defined by the legal frameworks on financial and fiscal reporting. In addition, the results from the data analysis confirmed the first hypothesis raised in this study: H1 = In the case of acknowledging, recording and reporting of income there is a dependence between accounting and taxation, in which accounting dominates. Meanwhile, the second hypothesis is rejected: H2 = In the case of acknowledging, recording and reporting of income we have dependence between accounting and taxation, in which the fiscal rules dominate (dominance of taxation).

We summarize the research results in the Table 26 below, to reflect the relationship between accounting and taxation when acknowledging, recording and reporting income:

| Table 26 Income: Accounting Rules & Fiscal Rules | |||

| Income | Accounting rules, then fiscal rules | Accounting rules | Fiscal rules |

| Income from rent | ? | ||

| Income from intangible assets | ? | ||

| Income from interest | ? | ||

| Income tax | ? | ||

| Current tax and deferred tax | ? | ||

Summary and Conclusion

The study has presented an overview of the financial and fiscal reporting of income by businesses in Kosovo.

Initially, the developments and legal arrangements related to the reporting of the elements of the financial statements, with particular emphasis on the category of income, were presented. This resulted in the fact that accounting and tax laws and regulations have differences in income recording and reporting, and this fact represents a very important factor that should be considered by professionals when reporting income in financial statements. Consequently, in addition to the legal description which guides and leads professionals in their work with regard to income reporting, in order to ascertain the factual situation regarding this issue there was a need for empirical research, based on the opinions and statements of the businesses (professional employees).

The primary data collected through the questionnaire addressed to accountants helped us to analyze the relationship between income accounting and their fiscal adjustment. Through this, we gained the information and highlighted the fact that there is a dependent relationship between accounting and fiscal rules for acknowledging, recording and reporting of income, in which accounting dominates. Thus, from the analysis of the data collected from the businesses, we accept the fact of accounting dominance when acknowledging, recording and reporting on income. This research result was also supported by the analytical research, which showed that the variables of work experience, professional training and knowledge of the legal framework influenced the attitudes and statements of professionals on the issue.

Since the study has shown that there is a dependent relationship between the two reporting areas, then we consider that there is room for future regulatory developments and further research on narrowing the differences between the two types of reports and to study the possible approximation process of accounting and taxation.

References

- B?canu, M.N. (2017). Is accounting-taxation relation a contributor to the sustainability?. Annals of the„Constantin Brâncu?i” University of Târgu Jiu, Economy Series, 4, 227.

- Mates, D., Adriana, P., Ursach, A., & Ajta, E. (2016). The influence of accounting system regarding accounting and taxation of entities. Journal of legal studies, 62.

- Moisescu, F. (2018). Issues concerning the relationship between accounting and taxation in determining financial result. European Journal of Sustainable Development, 297.

- Al-Karaawy, N.A.A.Q.M. (2018). The impact of international taxation systems variations on the application of financial accounting principle. Academy of Accounting and Financial Studies Journal, 8.

- Margaret Lamb, C. N. (1998). International variations in the connections between tax and financial reporting. Accounting and Business Research, 28(3), 174.

- Corporate Income Tax (CIT) (2019). Retrieved from https://gzk-gov.net/Law No. 06/L-105

- Personal Income Tax (PIT) (2015). Retrieved from https://gzk-gov.net/Law No.05/L-028

- Accounting, Financial Reporting and Auditing (2018). Retrieved from https://gzk.rks-gov.net/Law No.06/L-032

- For value added tax (2015). Retrieved from https://gzk.rks-gov.net/Law No.05/L-037

- https://www.iasplus.com/

- https://www.ifrs.org/issued-standards/list-of-standards/conceptual-framework/