Research Article: 2022 Vol: 26 Issue: 1S

The Reflection of Accounting and Financial Slack on Investment Decision with Fintech as Mediator / Applied Study in Iraqi Fintech Companies

Fadi Hassan Jaber, Imam Al Kadhum College

Mohanad Hameed Yasir, University of Kufa

Citation Information: Jaber, F.H., & Yasir, M.H. (2022). The reflection of accounting and financial slack on investment decision with fintech as mediator / applied study in iraqi fintech companies. Academy of Accounting and Financial Studies Journal, 26(S1), 1-14.

Abstract

The study aims to study the relationship between financial slack, which represents a vital variable that play a big impact on the investment decision in Iraqi investment environment and to enhance this relationship with the existence of financial technology representing an intermediate support variables. The study used to test hypotheses by using statistical analysis program Amos 25 to analyze and discuss the research variables. And sample of 11 Iraqi companies that use financial technology was reached after testing the basic assumptions to determine between the variables that represent financial technology as a turning point in the activities of companies operating in the Iraqi environment and the most important recommendations.

Keywords

Financial Slack, Accounting, Finance, Investment Decision, Fin Tech, Iraq.

Introduction

It represents a critical responsibility for many financial institutions, especially in Iraqi work environment, which is characterized by instability and which have sudden crises due to the nature of the Iraqi economy, and this requires a philosophy and mechanisms that differ from criteria that take into account stability and certainty in the environment, so the researcher explains financial stagnation through three The main dimensions of the available, potential and future stagnation are to assist financial institutions in understanding and developing the mechanisms of financial stagnation that are associated with a large and influential investment decision, as studies indicated that show that the investment decision is the most important factor affecting the competitiveness and sustainability of achieving Objectives of the facility.

The financial slack, through its indicators, affects the crisis funds and helps support and enhance the investment decision. The researcher adds one of the most important factors affecting the interaction of variables, which is financial technology that helps Iraqi banks that are trying seriously to integrate with the development of global business and through business on modern means in ensuring Achieving the best investment decision and strengthening its enforcement through the use of financial technology whose research variables attributed strength and sensitivity to this study highlights that the financial recession in Iraq is a critical issue and needs accuracy, analysis and professionalism due to financial crises 2008, 2014 and 2020, as well as the investment decision, and this is that the financial stagnation depends on sustainability in financing to achieve achievement and that any cut in the financing process, which is reflected on the extent of achieving the best profitability in the quality of financing and also affects and also Iraqi financial institutions are not at the required level but they are in a state of Development and improvement, which need to keep pace with the global financial environment in how to face and maintain the required level of financial stagnation and how to enhance its investment decisions by relying on the best financial ideas, especially with regard to the use of financial technology that it lacks in comparison with Surrounding countries.

Literature Review and Theoretical Framework

Definitions and Reasons of Financial Slack

Financial Institutions' Financial Slack Organizations acquire four kinds of slack, according to (Voss et al., 2008) human resource slack, customer relationship slack, operational slack, and financial slack. “Financial resources in overabundance of what is needed to sustain the organization” is the financial slack (Ang & Straub, 1998). In 2D-absorption and rarity it differs from other kinds of slack. Financial slack is linked to financial resources that are scarce and absorb slowly ((Voss et al., 2008). High cash reserves (receivables, short-term investments, cash, etc.) and the ability to obtain financing were particularly important (reserve borrowing capacity, credit lines, etc.). These resources seem to be plentiful since there are many methods that may be developed internally or purchased on the open market. Financial resources also have the lowest level of absorption due to their perfect divisibility that allows for simple and fast distribution across many activities. Heterogeneity is another feature of financial slack.

Financial slack is classified into three categories by Bourgeois and Singh (1983): available, recoverable, and prospective slack. Available slack refers to all financial resources that aren't allocated to a particular activity. Financial resources that are utilized in one activity but might easily be utilized for something else are referred to as recoverable slack (for instance, securities, inventories, receivables). Potential slack refers to financial resources that might be supplied by extra external funding and is dependent on the existing level of debt. Financial slack, including financial reserves, is indeed a buffer, which not only protects against losses caused by external changes, but also protects against internal shocks caused by shareholder disputes (Sharfman et al., 1988).

Financial slack is a concept that builds on the concept of financial reserves as a buffer, with the notion that accessible financial resources may help companies expand and grow faster. As a result, financial slack serves as both a passive kind of protection and an active source of innovation and investment. Corporations with a financial slack have more resources and may take advantage of excellent investment possibilities. This is very useful in a setting where continuous innovation is required. It is well recognized that innovation processes were fraught with risk, and there is no assurance that success will be achieved. Financial slack allows businesses to innovate without taking resources away from core operations.

Despite the fact that Barnard (1968) highlighted the importance of slack in his work on the Executive Functions, the term slack was not used until March & Simon (1958) published their seminal book on ‘organization' in 1958. Various researchers (Cyert & March, 1963; Pfeffer & Salancik, 1978; Thompson, 1967) and resource-based theorists (Penrose, 2009) saw companies as a unit, with survival as the ultimate aim.

The slack is described as a buffer of real or prospective resources that allows an organization to respond quickly to internally demands for change or externally pressures for change of policy, as well as to ensure changes in strategy in reaction to external environment (Bourgeois, 1981, Nohria & Gulati, 1997). According to Cyert & March (1963); Dimick & Murray (1978); Geiger & Cashen (2002), numerous academics both at home and abroad classified financial slack into groups from various perspectives based on the definition. Bourgeois & Singh (1983) classified financial slack into three categories: accessible financial slacks, prospective financial slacks, and recovered financial slacks in their research of connections between executive team strategic, finance slacks conduct, and political behavior.

Availability of financial slacks that seems to be a financial resource, is not committed in the organization's work responsibilities; reclaimable financial slacks that is a financial resources, has indeed been absorbed into an organization' structural operating procedures, however the organization could indeed reclaim it by redesigning, including management fees, marketing fees, and, excessive costs and so on; the appropriate financial slacks that is a financial resource, is not committed in the organization's work responsibilities; the appropriate financial slack Furthermore, several academics distinguished between non-precipitating and precipitating financial slacks. Precipitation slacks have limited mobility and flexibility, owing to high managerial, financial, and marketing costs, among other things. These excess resources are extremely viscous, and converting them into other requirements takes a long time and has a high cost of conversion.

Cash equivalents, cash, and other financial assets are often included in non-precipitating slacks. Non-precipitating slacks seem to have more mobility and flexibility than precipitating slack, can be utilized rapidly by directors, and have a lower operating cost (Latham & Braum, 2008; (Wan & Yiu, 2009). Depending on the above theory, this study describes financial slacks as a combined application of more than the cashflow of existing initiatives' operations and debt require (including cash equivalents and cash) and enterprises' reserve debt capacity (including banks essentially give the entrepreneurship credit), the latter serving as a buffer of funds required by the industry. It is one of the most important financial resources for meeting the low-risk financial requirements of businesses. The relaxation level in the corporate finance funding chain might well be reflected in the amount of financial slacks.

Why of Financial Slack

The capacity of internally resources configurations to provide revenue possibilities is critical to success. The access to financial slacks are therefore one of the resources, which is important to increasing companies' capacity to create new possibilities (Bradley et al., 2011). During potential financial instability caused by internal or market crises, the financial slack is utilized to seek financial stability. The presence of slacks allows for the allocation of actual or prospective resources, allowing for the implementation of financial adjustments in response to internally pressures and assisting in strategy changes. The slack, based on this assumption, offers a framework capable of influencing financial performance (Bourgeois, 1981; Bradley et al., 2011b; Cyert & March, 1963; Deephouse & Wiseman, 2000; George, 2005; Zhong, 2011).

Measures of Financial Slack

Financial slacks are useful resource that may help financial firms compete more effectively by allowing them to “consider taking benefit of possibilities offered by the environment” (Thompson, 1967). Unused slack resources enable businesses to try out new methods (Hambrick & Snow, 1977). As a result, financial institutions may innovate and gain substantial strategic advantages, resulting in significantly improved long-term performance. Furthermore, financial slack encourages innovation by lowering directors' risk aversion. Available slack protects against losses and makes management more accepting of “experiments” (Singh, 1986). Since their directors have a higher risk capacity, corporations with financial slack respond more aggressively to changing environmental demands (Cheng & Kesner, 1997). Since it offers resources to seize opportunities once the externally environment changes, financial slacks provide additional financial strategic choices for companies to gain competitive benefits (Moses, 1992; Chiu & Liaw, 2009). During economic downturns and crises, once companies with financial slacks may buy key resources for a fraction of their economic worth, this strategic benefit is very important.

Generate relative value that reduces company profitability and degrades the performance of financial institutions Aside from cost and opportunity, financial slack seems to have a negative impact since it exacerbates agency issues and costs. Separation of ownership and management leads to agency conflicts between shareholders and directors, as well as a reduction in performance (Jensen & Meckling, 1976). In this scenario, financial slack provides extra resources to directors for their opportunist conduct that does not help shareholders and devalues the company. Financial slack may harm a company's performance in four ways.

As a consequence, “for every particular financial institution, there is an optimum amount of slack resources.” If a company's performance surpasses that threshold, it will suffer (Sharfman et al., 1988). “Companies with a lot of slack gain a competitive edge, whereas corporations with a lot of slack should manage carefully,” says the author. Either kind of action should improve performance. Organizations with a modest degree of slack may do the worst. It is a question of empirical testing to determine if slack effect on performance was convex or concave. Generally, data either supports or cannot refute the inverse U-shapes connection (Nohria & Gulati, 1996; Tan, 2003; Tan & Peng, 2003; George, 2005; Lee 2011). There have been no investigations that have taken into account the convex functional of performance. Financial slack is evaluated, as in prior research, by analyzing available and prospective slack (Daniel et al., 2004; Gral, 2014).

Investment Decisions

The growth and investment of financial institutions have a strong connection. This article has some research importance since investment choice is not only the primary goal of a company's development and a substantial foundation of a company's future cash flow growth, but it is also the beginning point of a company's financial decision. Researchers at domestically and overseas have long been worried about the issue of financial slacks. The idea of organization slack was originally introduced in 1963 by Cyert and March's book 'the corporate behavioral theory,' which defined it as the difference between resources acquired by internal small groups of the resources and organization and needed to meet the organization's needs. The idea was thereafter continuously refined by international academics, with Bourgeois' (1981) definition of financial slack being the most generally recognised by subsequent generations. Financial slack, he said, is the company's real or prospective idle resources; it allows the company to effectively cope with internally or externally pressures and react to the need for a change in strategy in the external environment. Financial slack is an important component of organizational slack, and the notion of financial slack offers a theoretical foundation for detecting financial slack. In his analysis of the pecking order hypothesis, he says:

The Impact of Financial Slack on the Investment Scale

The quantity of financial slack resources has an impact on the investment decisions of businesses. The main goal of retaining duplicate resources is to help companies better comprehend future investment possibilities. There is a lot of study in the literature on the connection between large cash holdings and investments. Whenever a company has a significant quantity of cash assets, the phenomena of excessive investment will inevitably emerge (Tompson, 1967; Stulz, 1990). Excess cash kept by businesses has made them indifferent to investment and development possibilities, and their quantity of investment may be much higher than their usual cash holdings (Shin & Kim's, 2002). Over-investment is a significant problem for companies that have a lot of cash on hand (Yang Xingquan et al., 2010). These studies show that having a large amount of cash on hand may lead to excessive investing. There seems to be little study on a company's capacity to reserve liabilities and financial redundancy. As long as the enterprise's loan interesting rate does not grow along with the loan, banks credit results in excessive investment, encouraging businesses to engage in new initiatives on a continual basis (Duan &Yoon, 1993).

Inadequate investment will lead to inadequate of financial slack, whereas excessive financial slacks will result in overwhelming investments (Smith & Kim, 1994). Internal capital is plentiful, which may decrease reliance on high-cost external financing. In addition to retaining cash, businesses anticipate future financing restrictions and set aside a part of their current loan capacity, allowing them to borrow debt capital at a cheap cost. The buildup of financial slack, driven by financial flexibility, will be used by businesses to fulfill future investment demands. Enterprise directors would monitor financial slacks for their personal benefit. The financial slacks would be utilized to increase future investment, allowing the board of directors to increase their influence over the company's assets. As a consequence, we arrive to the following hypothesis.

The Impact of Project Investment Risk on the Relationship Between Financial Slacks and Investments When businesses make investment choices, project investment risk is an essential factor to consider. When the project's investment risk is low and the enterprise has adequate capital slacks resources, the enterprise would be committed to expanding its investment and generating profits; once the project's investment risk is high, even when the enterprise has adequate capital slacks resources, the enterprise will not enlarge its investment scale. As a consequence, we arrive to the following hypothesis:

According to Almeida et al. (2004), these fundraising expenses might influence how they execute their investment and financial strategies. According to the resource-based perspective, organizational slack may be utilized to foster creativity, enable strategic behavior, and therefore enhance performance of organization (Cheng & Kesner, 1997; Iman, 2019). The viewpoint of organizational inertia, on the other side, states that organizational slack will result in organizational inertia, which may impair performance (Leonard-Baton, 1992; Davis & Stout, 1992). It is critical to clarify that financial outlook is a measure of change in a company's financial position that is very helpful to investors, lenders, and board members. In this regard, knowing the effect of cash flow on economic condition is critical for board of director decision-making, since excess money flow might cause organizational stagnation, but it can also encourage measures that lead to organizational success. Furthermore, the exclusion of market performance factors (market return) is warranted.

The New Player Fintech or Financial Technology

Fintech or financial technology is a term used to denote corporations that offer modern In the financial sector, technology plays an important role. Since 2010, such businesses have become a notable trend. Fintech companies are often micro, small, or medium-sized businesses with a clear concept of how to offer new or enhance current services (new products) in the financial services sector but a limited amount of capital. Typically, they are fintech start-ups, which are rapidly increasing in number (according to different estimates, their number has already surpassed 10 thousand corporations). Fintech companies are often funded via venture capital and crowd financing. Fintech start-up businesses, according to some experts, improve the financial system's efficiency (Vlasov, 2017; (Vovchenko et al., 2017; Setyawati et al., 2017). The development of fintech companies may be attributed to two factors. The global financial crisis of 2008, for example, has clearly revealed to customers the flaws in the conventional banking structure that contributed to the catastrophe. Second, the development of new technologies that helped offer financial services with mobility, simplicity of using it (visualization of data), speed, and reduced costs (Anikina et al., 2016).

The potential market for FinTech service users is enormous: basically the whole adult inhabitant of the world. These people, depending on the McKinsey Social Sector website (Chaia et al., 2010), are prospective FinTech consumers. The growing number of individuals across the globe who are unable or unable to utilize conventional banking services leads to the growth of FinTech, which provides similar services while being quicker, cheaper, and more lucrative than banks. These developments imply an increase in operational and long-term risks for financial institutions (Novokreshchenova et al., 2016; Fetai, 2105; Thalassinos et al., 2015). FinTech is one of the fastest expanding areas of the economy, depending on a study by Accenture (a multinational management consulting, technology services, and outsourcing firm). Investments in the sector have grown quickly, reaching 12, 2 billion dollars in 2014, up from 930 million dollars in 2008. The greatest rise was seen in Europe ( Accenture, 2015). However, this does not imply a decline in interest in this area in general. In contrast, despite an increase in total fintech investment, these companies are still unable to seriously compete with the banking and insurance industries of financial services depending on a survey of young entrepreneurs who use banking services in Latvia (2016-2017), the majority of clients are not ready to replace them with FinTech alternatives (Kims, 2017).

FinTech business application areas, new technology, financial services benefits and drawbacks in contrast to conventional financial firms many studies (for example, Harrison et al., 2014) demonstrate that company innovations drive both micro and macroeconomic growth. The use of information technology in the financial sector is an area with a lot of room for innovation, thus it attracts both venture capitalists and investors. According to Webster and Pizalla (2015), the rivalry between fintech and conventional banking services is becoming fiercer every year as information technology advances. Simultaneously, fintech is piqueing the attention of progressive financial institutions, who want to retain and enhance their leadership position in the sector by providing contemporary, high-quality services to their customers in a simple and efficient manner, wherever and at any time.

FinTech is defined as the use and use of technology to expand banking and financial services. FinTech's growth will inevitably alter the role of technology, consumer behavior, ecosystems, and the regulation and industry (Puschmann, 2017). Several recent FinTech studies have even projected that such technology advancements would disrupt the industry and fundamentally alter the corporate environment (e.g., Gomber et al., 2017; Iman, 2014; Iman, 2018b; Ng & Kwok, 2017, among others). FinTech is defined by Puschmann (2017) as “incremental or disruptive innovations in or in the context of the financial services sector driven by IT advances, resulting in new intra-or inter-organizational business models, goods and services, organizations, processes, and systems.”

Conversely, Gomber et al. (2017) defined FinTech as efforts in the financial sector that use technology-based innovations to challenge existing roles, business models, and service offerings. Furthermore, Ng and Kwok (2017) divided FinTech companies into four categories: efficient payment processes, robo-advisors, peer-to-peer loading and deposit platforms, and crowdfunding. This article stands out since it focuses on evaluating business performance in relation to FinTech products and services. If we want to close this gap, we must understand not just how and why FinTech operates in Indonesia, and even how FinTech goods and services impact the sector. Companies often use two primary ratios to evaluate profitability ratios: return on equity (ROE) and return on assets (ROA) (Gitman & Zutter, 2011).

In overall, the purpose of a profitability proportions was to start measuring or determine the revenue earned by a company, to assess the profit's accumulation over time, to assess the company's net income after taxes with its own capital, and to measure the company's productivity in relation to all company funds utilised, both from its own capital and loan capital (Brealey et al., 2012). Profitability and operational efficiency are referred to as ROA. ROA is often used to evaluate your company's performance against that of rivals and comparable industries (Gitman & Zutter, 2011). The return on assets (ROA) is determined by dividing net income by total assets, where total assets include both debt (liability) and capital (equity).

Meanwhile, a company's capacity to produce net income with stock held is measured by its return on equity (ROE) (Gitman & Zutter, 2011). The DuPont method may be used to determine ROE (return on equity), which is affected by three factors: debt (leverage), operational efficiency and profitability. The return on equity (ROE) is determined by dividing net income by equity. In these words, financial slack refers to the surplus of a company's financial resources which came from profit, and as a consequence, the agents were given greater leeway in allocating it to other purposes in support of FinTech initiatives. FinTech product and service innovation will be a fascinating case study for at least two reasons. First and foremost, FinTech innovations are usually focused towards altering or supplementing existing financial systems. Second, technology-based developments are inextricably linked to the banking and financial services industries (Gomber et al., 2017). It will alter the landscape of regulation and competition (Ng & Kwok, 2017). Third, and most significantly, it will have an impact on the company's profitability, particularly in terms of its capacity to compete against entrenched conventional banking (Iman, 2014).

Barriers of Fintech

"FinTech allows intermediaries, investors, and issuers to communicate, study, interact, share, trade collaborate, compete, crowdsource in methods which are significantly different from the past, posing a regulatory challenge. Investors may follow a lead trader on social trading sites; investors could following a lead investor on angel investing sites; and on market information web pages, social media analytics and artificial intelligence could educate retail investors' securities investment and trade decision-making" (IOSCO, 2017)

FinTech is a term used to describe financial technology. Despite the lack of agreement on the ideal description of FinTech and the fact that it is premature to describe a sector that is constantly developing, following the many attempts to define it will provide a solid understanding of this current word. The word "FinTech" refers to businesses or representatives of businesses that integrate financial services with cutting-edge technology (Dorfleitner, 2017; Bromiley, 1991).

The word "Fintech" is used to characterize a range of new models of business and innovative technologies which have the potential to revolutionize the financial services sector, depending on IOSCO (2017). FinTech is a "technology-enabled innovations in financial products that may lead to additional models of business, applications, procedures, or products with a related substantial impact on the supply of financial services," according to the Financial Stability Board (Financial Stability Board, 2017).

Results

The research discusses the level of indicators through the arithmetic mean and the deviation of values from its arithmetic mean by standard deviation, as well as identifying the extent of data distribution naturally through the method (Kurtosis & Skewness) to obtain the validity of using simple regression and correlation between research indicators, and will also identify the differentiation between companies And the extent of the differences between them at the level of research indicators, then it will be confirmed that there is a relationship between them through the correlation coefficient, while the amount of effect will be extracted through the simple regression method. All results are extracted using the statistical program (Amos v.24) and the results are as follows:

Descriptive Statistics

This paragraph is dedicated to identifying and diagnosing the level of research indicators for the purpose of conducting descriptive statistics to reveal the level of indicators for the research companies. As well as diagnosing the similarity in the distribution of data. In this case, it is necessary to rely on a set of descriptive measures represented by the arithmetic mean that shows the level of The research indicators for the researched companies and the standard deviation that shows the extent of the deviation of the values from their arithmetic mean It is noted from Table 1 that (Financial Slack) is one of the first two indicators is the ratio of cash to total assets, which got an average arithmetic (0.821) and the highest ratio is for the company (Almanafaa) while the lowest percentage is for the company (Al-Zawraa) and the ratios recorded by the companies are very large, given that these companies work in financial technology and their need to maintain large liquidity to meet the daily demand cases. The second indicator is the percentage of financial stagnation is the difference between the percentage of cash retention With the rate of the market sector, and that the rate of the market sector is (0.821) and the difference between the retention rate and the sector rate showed an average of (0.0001), i.e. some companies were the difference between what maintains liquidity and the rate of the market It was great, and the highest difference is for Almanafaa with a percentage of 0.14 while the lowest percentage of financial stagnation was for Al-Zawraa, which means that companies have (Financial Slack) have financial stagnation in addition to their need in varying proportions but they are close to each other except one company , With a standard deviation for both indicators (0.262). Also, there is the level of financial technology that means the percentage of change in corporate revenues has achieved an average (0.654) and this is a significant change in revenue, meaning that companies achieved huge revenues as a result of the development of financial technology tools and was the biggest change in the company (AL-Iraqia) while the lowest in the company (Al-Zawraa). As for the return on investment, it was positive in all companies at a rate of (0.006), and the company (Altaf, Nobles) was achieving the highest return, while the lowest were three companies equal (AL-Nibal Al-Arabya, Almanafaa, Al-Rabita)). Also, the data collected was subjected to a test (Kurtosis & Skewness) which tests the normal distribution and shows that all dimensions achieved a greater level of significance (0.05). Therefore, these data are distributed naturally and give the authority to conduct parameter data tests.

| Table 1 Descriptive Statistics of Financial Slack, Fintech and Investment Decision | ||||

| COM. | C % | FS% | Fintech | ROI |

| Sama Baghdad | 0.938 | 0.117 | 1.189 | 0.007 |

| Altaf | 0.725 | -0.096 | 0.186 | 0.010 |

| Al-Nibal Al-Arabya | 0.931 | 0.110 | 0.235 | 0.002 |

| Al-Harri | 0.952 | 0.131 | 0.636 | 0.009 |

| Al-Iraqia | 0.915 | 0.094 | 1.315 | 0.007 |

| Nobles | 0.889 | 0.068 | -0.079 | 0.010 |

| Almanafaa | 0.960 | 0.139 | 0.737 | 0.002 |

| Al_Rabita | 0.945 | 0.124 | 1.222 | 0.002 |

| Al_Zawraa | 0.101 | -0.720 | -0.116 | 0.007 |

| Al_Muhej | 0.854 | 0.033 | 1.212 | 0.005 |

| Minimum | 0.10 | -0.72 | -0.116 | 0.002 |

| Maximum | 0.96 | 0.14 | 1.315 | 0.01 |

| Mean | 0.821 | -0.0001 | 0.654 | 0.006 |

| SD | 0.262 | 0.262 | 0.567 | 0.003 |

| Z- Skewness | -1.504 | -1.927 | -0.249 | -0.717 |

| Z- Kurtosis | 1.681 | 1.611 | -1.359 | -0.98 |

Discriminant Test

The research data was collected from (10) companies operating in financial technology, and the differentiation and difference between the companies will be recognized, according to the results of Table 2. It became clear that the company (Almanafaa) was maintaining a large percentage compared to other companies at the level of (Financial Slack) while it was The lowest retention rate is (Al-Zawraa), and with a similarity ratio (Wilks Lambda) has reached (0.084), which is a simple similarity ratio, and the differences between companies were significant because the level of significance (0.000) which is less than (0.05). As for financial technology, the company was (Al-Iraqia), and it possesses the highest financial technology in comparison with other companies, while the lowest was to own financial technology is (Al-Zawraa) with a similarity rate (Wilks Lambda) has reached (0.861) which is a relatively large similarity, and the differences are relatively large. Among the companies it was not significant because the level of significance (0.686) is greater than (0.05). And that the investment decisions were the company (Altaf) and it achieved the best return on investment compared to other companies, while the company whose lowest return was (Al-Rabita) and with a similarity rate (Wilks Lambda) has reached (0.762) which is a relatively large similarity, and the differences are Among companies, it was not significant because the level of significance (0.222) is greater than (0.05).

| Table 2 Discriminant Test of Financial Slack, Fintech and Investment Decision | ||||||

| Index | Group | Discriminant Function | Wilks Lambda | Chi-square | df | Probability |

| Financial Slack | Sama Baghdad | 1.389 | 0.084 | 107.728 | 9 | 0.000 |

| Altaf | -1.137 | |||||

| Al-Nibal Al-Arabya | 1.301 | |||||

| Al-Harri | 1.553 | |||||

| Al-Iraqia | 1.119 | |||||

| Nobles | 0.808 | |||||

| Almanafaa | 1.643 | |||||

| Al_Rabita | 1.470 | |||||

| Al-Zawraa | -8.541 | |||||

| Al-Muhej | 0.395 | |||||

| Fintech | Sama Baghdad | 0.359 | 0.861 | 6.526 | 9 | 0.686 |

| Altaf | -0.313 | |||||

| Al-Nibal Al-Arabya | -0.280 | |||||

| Al-Harri | -0.012 | |||||

| Al-Iraqia | 0.442 | |||||

| Nobles | -0.490 | |||||

| Almanafaa | 0.056 | |||||

| Al-Rabita | 0.381 | |||||

| Al-Zawraa | -0.515 | |||||

| Al-Muhej | 0.374 | |||||

| Investment decision | Sama Baghdad | 0.146 | 0.762 | 11.850 | 9 | 0. 222 |

| Altaf | 0.730 | |||||

| Al-Nibal Al-Arabya | -0.568 | |||||

| Al-Harri | 0.438 | |||||

| Al-Iraqia | 0.146 | |||||

| Nobles | 0.600 | |||||

| Almanafaa | -0.665 | |||||

| Al-Rabita | -0.730 | |||||

| Al-Zawraa | 0.146 | |||||

| Al-Muhej | -0.243 | |||||

Pearson Correlation

Before the simple regression test and path analysis, it is necessary to identify the extent of a correlation relationship between the research indicators, and according to Table 3 showed that there is a correlation relationship between (Financial Slack and the intermediate variable (Fintech) reached (0.701) which is significant at the level of significance (0.01) At the same time, there is a correlation relationship between (Financial Slack) and the dependent variable (the investment decision) amounted to (0.374) which is significant at the level of significance (0.01) while the relationship between financial technology and the investment decision reached (0.443) and it is significant at the level of (0.01). Results Simple and multiple regressions will be tested in the next section.

| Table 3 Pearson Correlation Among Financial Slack, Fintech and Investment Decision | |||

| Investment decision | Fintech | Financial Slack | Variables |

| 0.374** | 0.701** | 1 | Financial Slack |

| 0.443** | 1 | Fintech | |

| 1 | Investment decision | ||

Empirical Results

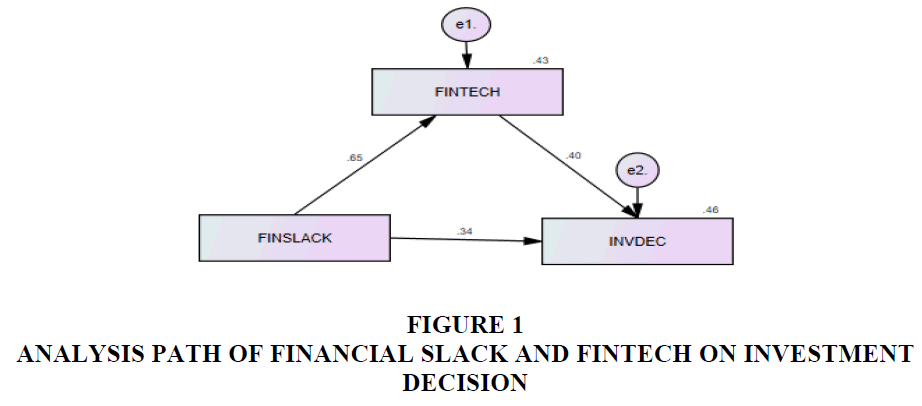

It was assumed that there is a positive relationship effect of positive stagnation in the investment decision through financial technology, that is, the dependent variable is the real function of the independent variable financial stagnation through financial technology, and the path analysis method will be used to test the effectiveness of the intermediate variable, and according to the results of the Figure 1 The interpretation factor (R2) was (0.46), meaning that the independent and intermediate variable interprets what is (0.46) of the variance in the dependent variable, while the remaining (0.54) is due to factors and variables that were not addressed by the model. As for the results of the hypothesis test shown in Figure 1 and Table 4 They are as follows:

| Table 4 Regression of Financial Slack on Fintech and Investment Decision | ||||||

| Independent Variable | Dependent Variable | Coefficient | Std. Error | C.R. | Prob. | Decision |

| Financial Slack | Fintech | 0.65 | 0.033 | 12.264 | 0.000 | Acceptance |

| Financial Slack | Investment decision | 0.34 | 0.189 | 3.820 | 0.000 | Acceptance |

| Fintech | 0.40 | 0.06 | 6.557 | 0.000 | Acceptance | |

| Mediation | 0.26 | 0.035 | 7.429 | 0.000 | Acceptance | |

According to Figure 1 and Table 3, it was found that there was a significant effect of Financial Slack in financial technology. Significant at the level of (0.01), while the effect of financial technology on the investment decision was (0.40) and it is significant at (0.01), just as the financial recession affects the investment decision through financial technology by (0.26) and we conclude from that that the intermediate variable of financial technology Between (Financial Slack) and the investment decision have an acceptable effect with a significant level (0.01).

Discussion and Recommendations

The review and reconsideration of the means that the financial institutions depend on, and that they must adopt the methodology of work based on financial technology, which represents the additional value in the practice of financial business. Likewise, investment decisions represent an important choice and represent a large part in achieving success, and adding the sustainability of financial technology achieves success and spread, both of which depend on neutralizing the best level of financial recession, that fear and risk are two essential elements present in any financial business and that the best methods must be adopted in achieving the appropriate level of recession. Financial, because a task must be added and the re-enlightening of the means used by the current financial institutions and the transition to the use of contemporary work methodologies that depend on developing financial products and relying on modern financial management.

The results of the study are acceptable, especially with regard to financial stagnation, especially in an unstable financial environment in Iraq, which is constantly exposed to various financial crises, but the means for determining the level of financial stagnation must be updated in addition to the investment decisions need to provide more basic data that institutions lack Finance In addition, the use of financial technology applications needs to provide financial human resources that are able to apply them in the best possible way, commensurate with the levels of understanding the different financial products of the customers.

References

Accenture (2015). The future of finTech and banking: Digitally disrupted or reimagined? Retrieved from https://www.accenture.com/us-en/insight-future-fintech-banking.

Bradley, S.W., Shepherd, D.A., & Wiklund, J. (2011). The importance of slack for new organizations facing ‘tough’environments. Journal of Management Studies, 48(5), 1071-1097.

Cyert, R.M., & March, J.G. (1963). A Behavioral Theory of the Firm. Prentice-Hall Inc.

Dorfleitner (2017). FinTech in Germany. ISBN: 978-3-319-54665-0. Retrieved from www.springer.com/cda/content/document/cda.../9783319546650c2.pdf?SG WID

Fetai, B. (2015). Financial integration and financial development: Does financial integration matter? European Research Studies Journal, 18(2), 97-106.

Gitman, L., & Zutter, C.J. (2012). Principles of Managerial Finance. Harlow: Pearson

Gral, B. (2014). How Financial Slack Affects Corporate Performance. Wiesbaden: Springer Gabler

Hambrick, D., & Snow, C. (1977). A Contextual Model of Strategic Decision Making in Organizations. Academy of Management Proceedings, 109-112.

Iman, N. (2014). Innovation in financial services: A tale from e-banking development in Indonesia. International Journal of Business Innovation and Research, 8(5), 498-522.

Iman, N. (2018). Assessing the dynamics of fintech in Indonesia. Investment Management and Financial Innovations, 15(4), 296-303.

Iman, N. (2019). Traditional banks against fintech startups: A field investigation of a regional bank in Indonesia. Banks and Bank Systems, 14(3), 20-33.

Lee, S. (2011). How financial slack affects firm performance: Evidence from US Industrial firms. Journal of Economic Research, 16(1), 1-27.

Ng, A.W., & Kwok, B.K.B. (2017). Emergence of Fintech and cybersecurity in a global financial centre: Strategic approach by a regulator. Journal of Financial Regulation and Compliance, 25(4), 422-434.

Nohria, N., & Gulati, R. (1997). What is the Optimum Amount of Organizational Slack? A study of the relationship between slack and innovation in multinational firms. European Management Journal, 15, 603-611.

Puschmann, T. (2017). Fintech. Business & Information Systems Engineering, 59(1), 69-76.

Sharfman, M., Wolf, G., Chase, R., & Tansik, D. (1988). Antecedents of Organizational Slack. Academy of Management Review, 13(4), 601-614

Stulz R. (1990). Managerial discretion and optimal financing policies. Journal of Financial Economics, 26, 3-27.

Tan, J. (2003). Curvilinear Relationship between organizational slack and firm performance: Evidence from Chinese state enterprises. European Management Journal, 21(6), 740-749.

Tompson, J.D. (1967). Organizations in action. New York: McGraw-Hill

Vlasov, V.A. (2017). The Evolution of E-Money. European Research Studies Journal, 20(1), 215-224.

Vovchenko, G.N., Tishchenko, N.E., Epifanova, V.T., & Gontmacher, B.M. (2017). Electronic Currency: The Potential Risks to National Security and Methods to Minimize Them. European Research Studies Journal, 20(1), 36-48.

Webster, I., & Pizalla, J. (2015). Fintech: Are banks responding appropriately? Retrieved from http://www.ey.com/Publication/vwLUAssets/EY-fintech-are-banks-respondingappropriately/$FILE/EY-fintech-are-banks-responding-appropriately.pdf