Research Article: 2022 Vol: 21 Issue: 3

The Paradox of Corporate Social Responsibility Disclosure in Developing Countries: Evidence from Indonesia

Eko Budi Santoso, Universitas Airlangga & Universitas Ciputra

Basuki, Universitas Airlangga

Isnalita, Universitas Airlangga

Citation Information: Santoso, E.B., Basuki., Isnalita. (2022). The paradox of corporate social responsibility disclosure in developing countries: Evidence from Indonesia. Academy of Strategic Management Journal, 21(3), 1-18.

Abstract

This study examines the relationship between social responsibility disclosure and earnings management. The research is based on the paradox where companies that actively carry out social responsibility are considered companies that behave ethically in their business practices are actually involved in financial fraud scandals. This study uses data on companies in Indonesia that publish GRI-based social responsibility disclosures. The results show that the disclosure of social responsibility is positively associated with discretionary and real earnings management. This means that companies in developing countries practice earnings management when they disclose social responsibility. In addition, this study also found a complementary relationship between accrual and real earnings management. The results of this study indicate that stakeholders need to be careful not to believe that companies disclosing social responsibility are companies that also behave ethically in their business practices.

Keywords

Corporate Social Responsibility, Earnings Management, Assurance, Business Ethics, Naturalistic Fallacy.

Introduction

Corporate social responsibility is an issue that continues to develop in line with business developments and has become an integral part of a company's activities. Corporate social responsibility is one part of the company's business strategy to improve its performance. The results of past studies indicate that the disclosure of corporate social responsibility affects the company's performance such as sales growth, profit, increase in stock prices, and firm value (Blazovich & Smith, 2011; Handayani et al., 2017; Harjoto & Jo, 2011; Hasan et al., 2016; Husnaint & Basuki, 2020; Isnalita & Narsa, 2017; Lys et al., 2015). These benefits encourage companies to carry out their corporate social responsibility activities actively and disclose to gain legitimacy in running their business and obtain the title as a company that behaves ethically in carrying out its business activities. Companies that actively carry out corporate social responsibility are considered as companies that conduct ethically in their business activities by not only pursuing a single bottom line, namely profit but also caring about the other bottom line, namely the planet and people. This concept is known as the triple bottom line (Elkington, 2018).

The problem arises when there is a paradox between the concept and practice of disclosing corporate social responsibility, where companies that actively carry out and inform their corporate social responsibility are involved in financial scandals. This condition shows that companies that actively disclose corporate social responsibility do not necessarily label companies that behave ethically in running their business. Disclosure of corporate social responsibility can be a tool used to deceive stakeholders into fraudulent acts committed by the company. Hemingway & Maclagan (2004) suggested that managers can use corporate social responsibility activities as a tool to cover up financial fraud committed by companies. The existence of companies that actively carry out corporate social responsibility activities and at the same time carry out financial manipulation shows that the motivation to carry out and report corporate social responsibility activities is not always based on ethical considerations. Managers can disclose corporate social responsibility, but the disclosure is not intended as a form of corporate ethical behavior but to deceive stakeholders. The values contained in corporate social responsibility are not necessarily ethical values integrated into the company but can be an opportunistic behavior of managers for personal gain. This opportunistic behavior can be encouraged because of the naturalistic fallacy in society which assumes that companies that carry out automatic corporate social responsibility disclosures are companies that behave ethically in their business activities.

This study investigates the behavior of companies that disclose corporate social responsibility, whether as a substantive or symbolic strategy (Ashforth & Gibbs, 1990; Hahn & Lülfs, 2014; Hrasky, 2011; Kim et al., 2012; Milne & Patten, 2002). Disclosure of corporate social responsibility is substantive if the disclosure is a manifestation of a company's identity that behaves ethically in running its business. In contrast, the strategy is symbolic if the disclosure is only used to give an impression to stakeholders but is not the company's identity. This means that companies can disclose corporate social responsibility but at the same time behave unethically in their other business activities, namely in their financial reporting. Specifically, this study examines the relationship between corporate social responsibility disclosure as reflected in the sustainability report on the ethical behavior reflected in the company's earnings management actions, whether companies that disclose corporate social responsibility will have low earnings management (substantive) or not (symbolic).

This research was conducted in Indonesia for two reasons. First, there is the fact that there is a large public companies in the aviation sector that actively carry out corporate social responsibility activities and disclose them in a structured report and receive awards in the field of corporate social responsibility but are later found to have committed fraud in the financial statements, namely in revenue recognition. This casts doubt on whether companies use corporate social responsibility disclosure as a substantive strategy or a symbolic strategy. Second, the existence of Indonesia as a developing country, which can provide an overview of the corporate social responsibility disclosure strategy in developing countries, which can be different from developed countries. Developing countries have low investor protection, so that managers' opportunistic behavior becomes more difficult to control compared to developed countries that have high investor protection (Chih et al., 2008; Lanis & Richardson, 2013). This shows a high tendency of symbolic strategy in developing countries. In addition, past research on the disclosure of corporate social responsibility in developed countries showed that companies that actively carry out corporate social responsibility would reduce the possibility of doing earnings management (Almahrog et al., 2018; Hong & Andersen, 2011; Kim et al., 2012). Meanwhile, research conducted in developing countries gives inconclusive results (Choi et al., 2013; Jordaan et al., 2018; Muttakin et al., 2015; Setiawan et al., 2019).

This study focuses on companies that use GRI-based corporate social responsibility disclosures. Disclosure of corporate social responsibility in Indonesia is voluntary. The rules that apply in Indonesia only provide an obligation for companies to carry out corporate social responsibility activities but do not regulate the disclosure standards, such as standards for financial statement disclosures. Constitution number 40/2007 article 66 only states that companies must report corporate social responsibility activities in the annual report. This causes corporate social responsibility disclosure to be only a small part of the annual report and tends to be unstructured and contains more philanthropic activities. On the other hand, corporate social responsibility disclosures based on GRI include broader disclosures, namely economic, environmental, and social aspects, so that the scope is more comprehensive than just philanthropic activities. Corporate social responsibility disclosure based on GRI is the best disclosure standard currently widely accepted and adopted by many countries and is the basis for disclosure that best reflects the triple bottom line concept (Bouten et al., 2011; Hahn & Lülfs, 2014; KPMG, 2020). Companies that choose to disclose GRI-based corporate social responsibility in a voluntary disclosure environment will only provide two alternatives: The disclosure is the actual identity of the company, or the company is trying to give the best impression so that the disclosure looks like the company's identity. One way to trick investors is to provide the best impression as if the company behaves ethically in running its business, and disclosure of corporate social responsibility can be a surefire strategy to make this happen.

By developing a measurement model from Tsalis et al. (2020) into a comprehensive measurement, the results of the study show that the disclosure of social responsibility is positively related to earnings management, both discretionary and real. This shows that the company uses the disclosure of social responsibility as a symbolic strategy to cover up the company’s unethical behavior from the stakeholders. The results of this study serve as a warning to stakeholders not to take social responsibility reports for granted and simply categorize companies providing them as ones that behave ethically in their business practices.

Literature Review And Hypothesis Development

Since the beginning of the development of the concept of corporate social responsibility, it is actually a manifestation of the company's ethical behavior (Carroll, 1979; Garriga & Melé, 2004; Jamali & Mirshak, 2007). However, in its development, corporate social responsibility can contribute to the value of the company so that it evolves into part of the company's business strategy. This is a natural thing. The resourced-based view approach places corporate social responsibility as part of a strategic intangible resource that can contribute to a company's competitive advantage over other companies (Clarkson et al., 2011; García-Sánchez et al., 2021). Through the disclosure of its corporate social responsibility, the company can form a positive image in the eyes of the market, which ultimately shapes the company's reputation. However, the problem arises when corporate social responsibility focuses more on actions to form an image and is no longer a reflection of ethical business practices. This can result in companies using corporate social responsibility disclosures as a form of corporate image in the community, but the company still applies unethical business principles in their operations. This study uses legitimacy theory as the basis for explaining the relationship between corporate social responsibility disclosure and corporate ethical behavior. This theory comes from the concept of institutional legitimacy, which states that companies will gain legitimacy when the value system that exists in an entity is in line with the value system of the larger social system in which the entity is a part (Dowling & Pfeffer, 1975). When there is a difference between the two value systems, it will pose a threat to the legitimacy of the company. If the two value systems are in line, the company will have a license to continue operating. The increase in social and environmental issues in the community encourages companies to be actively involved in these issues through activities and corporate social responsibility disclosure. This is important because the company's existence depends on society's acceptance. The company will be active in disclosing corporate social responsibility to shape public perception of the company to obtain and maintain its legitimacy. When the company gains legitimacy from the community, the company will be able to continue running its business and obtain economic benefits from the community. Legitimacy theory is a tool to manage public perception so that companies still gain legitimacy to run their business.

Legitimacy theory can be the basis for explaining why companies actively disclose corporate social responsibility even though the disclosure is still voluntary. The company is also active in promoting the disclosure of corporate social responsibility and obtaining awards. Having a good reputation in the field of corporate social responsibility will get community support which is important for the survival of the company. Legitimacy theory shows that the disclosure of corporate social responsibility can positively affect the company's financial performance. Based on the legitimacy theory, corporate social responsibility disclosure is part of a strategy for companies to continue to live and develop, including overcoming negative issues in the company. Companies can use corporate social responsibility disclosures to neutralize or divert negative public views of the company, such as negative stigma against the company's business (Grougiou et al., 2016) as well as the volatility of the company's stock price (Ling & Sultana, 2015). Furthermore, the literature on legitimacy theory divides the legitimacy theory approach into two parts, namely the substantive and symbolic legitimacy approaches (Ashforth & Gibbs, 1990; Hahn & Lülfs, 2014; Hrasky, 2011; Kim et al., 2012; Milne & Patten, 2002). The first approach is substantive legitimacy. This approach focuses on real changes made by the company. In the substantive legitimacy approach, the company applies the values contained in corporate social responsibility to the company's business practices. The ethical values in corporate social responsibility are also applied to other aspects of the company, including the financial aspect. The company sees that corporate social responsibility does communicate the company's contribution to society and the environment and its healthy business practices, including the financial aspect. The company carries out activities and disclosures of corporate social responsibility not only so that the company looks good in the eyes of the stakeholders, but this is done because it is an embodiment of the ethical values held by the company. The research by Kim et al. (2012) found that companies that are actively carrying out corporate social responsibility are positively associated with earnings quality, which means that companies that are actively engaged in social responsibility also limit the company's earnings management practices.

The second approach is symbolic legitimacy, a strategy that only aims to emphasize changes in people's perceptions without making changes to the company's internals. This approach shows the tendency of companies to use corporate social responsibility disclosure as a window dressing and manipulative activity. The company can disclose corporate social responsibility to gain a reputation as an ethical company in its business practices, but at the same time, the company can commit fraud on the financial reporting side. Companies can cover up financial fraud committed by disclosing corporate social responsibility. Accounting scandals in companies that actively carry out their corporate social responsibility are examples of symbolic legitimacy approaches. Symbolic legitimacy indicates the paradox that occurs in the disclosure of corporate social responsibility, which is called the naturalistic fallacy. The term was put forward by the English philosopher George Edward Moore in his book Principia Ethica. According to Moore (1993), naturalistic fallacy arises when the term “pleasant” or “desirable” is defined as something that is “good”. In other words, a good thing means something that is pleasant or desirable. If humans can do things that are pleasant or desirable, it means that humans have done good things. Moore states that good has a higher quality than pleasant or desirable, so that good cannot be equated with pleasant or desirable. The naturalistic fallacy occurs when the words good and pleasant describe the same object, then both are considered to have the same quality attributes. The naturalistic fallacy in corporate social responsibility occurs when stakeholders and society believe companies that are actively taking corporate social responsibility actions are companies that behave ethically in their business. Along with concern for environmental and social issues as well as the existence of a company that is the party responsible for these problems. This increases the demands from stakeholders for companies to disclose corporate social responsibility. Companies that have done this are considered as companies that have done something that is pleasing or desired by the community. Stakeholders then generalize that companies that are active in corporate social responsibility (have done things that are pleasant, desirable) are companies that hold ethical principles in their business practices (good). This fallacy is exploited by opportunistic managers to carry out socially responsible activities only for economic purposes. Fritzsche (1991) stated that the company's activities could be categorized into window dressing when it is associated with personal interests and organizational egoism. Furthermore, Hemingway & Maclagan (2004) stated that the company carries out corporate social responsibility activities as a tool to cover up or disguise fraud committed by the company so that the company's performance looks good. Companies can also carry out and report corporate social responsibility activities to give the impression that the company is a transparent company even though the company practices fraudulent practices such as earnings management.

Earnings management practice is an unethical act because it has the potential to mislead the parties who use it in the decision-making process (Healy & Wahlen, 1999). The results of Choi & Pae's (2011) research found that companies with high ethical commitment will engage in lower earnings management, more conservative earnings reporting, and more accurate cash flow predictions than companies with low ethical commitment. Earnings management practice is an opportunistic act that triggers fraud in the financial sector, reflecting the ethical orientation of an organization (Baskaran et al., 2020; Beneish, 2001; Muttakin et al., 2015). Opportunistic managers will try to carry out corporate social responsibility activities as a strategy to divert the attention of stakeholders to this opportunistic behavior. This condition can cause corporate social responsibility activities to only become a tool for corporate imagery as a mechanism to hide fraudulent practices in unethical financial reporting.

One of the many reasons naturalistic fallacies can develop is because financial statements are more difficult to understand than non-financial reports. To be able to understand financial statements, a good understanding of accounting is needed so that the information contained therein can be analyzed to make decisions. Narrative non-financial reports are considered easier to understand because they do not require any special knowledge. Because both statement is issued by the same source, namely the company, it is considered that the information can represent the company. In this condition, stakeholders will choose the information that is easier to understand.

Previous research conducted by developing countries supports the symbolic legitimacy of corporate social responsibility disclosure in developing countries. Muttakin et al. (2015) on companies in Bangladesh found that corporate social responsibility is positively related to earnings management practices. Furthermore, Muttakin found that export-oriented companies dominated by strong foreign buyers will make more disclosures and have lower earnings management. This shows that ethical behavior is influenced by pressure from external parties and not based on the values that the company believes in. Research by (Jordaan et al., 2018) on South African companies found that companies with better corporate social responsibility performance tend to carry out earnings management by increasing earnings through discretionary accruals. Setiawan et al. (2019) conducted research in the banking industry in Indonesia and found that the disclosure of corporate social responsibility is positively related to earnings management.

H1: The value of corporate social responsibility disclosure is positively associated with earnings management

Research Methodology

The sample of this research is companies listed on the Indonesian stock exchange for the period 2013-2019 that publish sustainability reports in accordance with GRI standards, which are not included in companies in the financial industry (SIC 6) and have complete data availability according to the data needed in this study. Based on these criteria, 261 firm-year observations were obtained. The dependent variable in this study are accruals-based earnings management and real earnings management.

Accruals-based Earnings Management

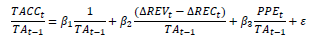

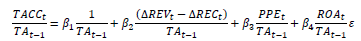

This study employ accruals-based earnings management as measured by two earnings management models, namely the Modified Jones model (Dechow et al., 1995) and the Kothari model (Kothari et al., 2005), as follows:

Modified Jones Model

Kothari Model

The earnings management value of each model is a residual from the results of the annual cross-sectional industry regression.

Real Earnings Management

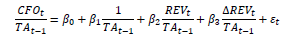

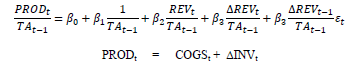

The measurement of real earnings management used in this study is the model developed by Roychowdhury (2006). Real activity manipulation is a management action that deviates from normal business practices in order to meet or pass certain profit thresholds. Real earnings management is measured by (1) abnormal production costs, (2) cash flows from abnormal operating activities, (3) abnormal discretionary expenses. Roychowdhury (2006) further states that companies with abnormally high production costs, lower cash from operational activities, and lower discretionary costs are more likely to indicate the occurrence of high real earnings management. To be able to capture the effect of real earnings management from these three variables, a combination index of real earnings management is formulated, namely the difference in abnormal production costs minus cash flows from abnormal operational activities minus abnormal discretionary costs (Chen et al., 2021; DA Cohen et al., 2008).

Abnormal Cash Flow from Operations (AB_CFO)

Abnormal Production Costs (AB_PROD)

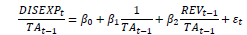

Discretionary Expenses (AB_DISEXP)

DISEXPt=Research & Development (R&D) + Advertising + Selling, General and Administrative (SG&A) Expenses. As long as SG&A is available, advertising and R&D are set to zero if they are missing. The measurement in this study ignores advertising expenses because these costs are considered insignificant compared to R&D and SG&A (Enache & Srivastava, 2017; Srivastava, 2019).

The real earnings management value of each model is a residual from the results of the annual cross-sectional industry regression. If the estimation results are consistent with the hypothesis, then the corporate social responsibility disclosure variable is positively associated with corporate social responsibility disclosure variables, abnormal production costs, and their combinations. It is also negatively associated with cash flows from abnormal operating activities and abnormal discretionary costs.

Corporate Social Responsibility

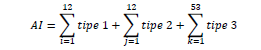

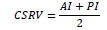

The independent variable in this study is the disclosure of corporate social responsibility as measured by the value index of corporate social responsibility disclosure using content analysis. The value index of corporate social responsibility disclosure is calculated by developing the measurement used by (Tsalis et al., 2020). However, the Tsalis measurement only focuses on environmental categories and this study extends these measurements to all categories in GRI, namely economic, environmental, and social. In addition, this research modified Tsalis formula to focus on measuring the value of corporate social responsibility, which is a combination of accountability and performance of corporate social responsibility disclosure, to provide a comprehensive picture of the value of corporate social responsibility disclosure. Based on this, the process of measuring the value of corporate responsibility in this study is as follows:

1. Rearrangement of corporate social responsibility disclosure items. During the research period, GRI issued two rules regarding GRI, namely the GRI-G4 guidelines in 2013 and the GRI Standard in 2016, so that researchers compiled new items by matching the items in the GRI-G4 and GRI Standards.

Divide these items into 3 types, namely:

Type 1: Indicators are qualitative (12 items)

Type 2: Items are quantitative but show no performance (12 items)

Type 3: Items are quantitative and can be used to measure performance (53 items)

2. Develop a scoring system for the accountability index and performance index, as a scoring system for the accountability index, used to assess indicators of type 1, type 2, and type 3

1. Information not presented

2. Information is presented but is quantitative

3. Information presented is quantitative but cannot be used to assess the performance

4. Information presented is quantitative, and the data is used to measure performance

The maximum score of AI ranges is 195 and the total AI score of each observation is AI score divided with maximum AI Score resulting range from 0 to 1

Rating system for performance index used to assess type 3 indicators

1. Lower performance than the previous period

2. Same performance as the previous period

3. Better performance than the previous period

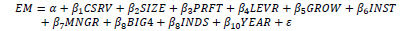

This study uses control variables based on previous research-proven to affect earnings management (Chaney et al., 2011; Doidge et al., 2007; Kim et al., 2012; Muttakin et al., 2015). The control variables are firm size, profitability, leverage, growth, and institutional ownership, managerial ownership, and audit quality. This study uses an ordinary least square regression model with a robust standard error to ensure no heteroscedasticity problem. It includes the fixed year and industry effects gradually to test the robustness of the measurement model. The researcher winsorizes the study variables at the 1st and 99th percentiles to ensure that the results are not affected by extreme values. Hypothesis 1 in this study is estimated by the following equation:

Results And Discussion

Desctiptive Statistics and Univariate Analysis

Table 1 presents an overview of the research sample by industry type and year. Based on these data, it can be seen that there is an increase every year in companies that adopt GRI in disclosing their social responsibility. The increasing trend of GRI-based social responsibility disclosure, even though the disclosure is still voluntary, is an interesting thing to observe. Meanwhile, based on industry, the highest number of industries that use GRI-based disclosures come from the manufacturing industry (82), mining (70), as well as transportation and public utilities (43). The lowest amount comes from retail trade (2) and services (3).

| Table 1 Sample Distribution By Year And Industry |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Industry (SIC) | Year | ||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Total | ||

| 01-09 | Agriculture, Forestry, Fishing | 1 | 3 | 3 | 2 | 5 | 5 | 5 | 24 |

| 10-14 | Mining | 7 | 9 | 8 | 9 | 11 | 12 | 14 | 70 |

| 15-17 | Construction | 1 | 2 | 3 | 1 | 2 | 5 | 7 | 21 |

| 20-39 | Manufacturing | 4 | 8 | 11 | 11 | 12 | 18 | 18 | 82 |

| 40-49 | Transportation & Public Utilities | 3 | 6 | 5 | 6 | 6 | 6 | 11 | 43 |

| 50-51 | Wholesalde Trade | 1 | 2 | 2 | 2 | 2 | 3 | 4 | 16 |

| 2-59 | Retail Trade | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 2 |

| 70-89 | Services | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 3 |

| Total | 17 | 30 | 32 | 31 | 38 | 49 | 64 | 261 | |

Tables 2a and 2b presents descriptive statistics and univariate analysis using the Pearson correlation of the research variables. In Panel A, it can be seen that the average value of negative earnings management (DACC_MJ=-0.002 and DACC_K=-0.017) indicates that the average sample companies perform earnings management by lowering the value of earnings. The CSRV variable has an average value of 0.153 which indicates that although there has been an increase in the number of companies that disclose social responsibility, the disclosure value is still low. This shows that the company has not implemented social responsibility properly and can also indicate a symbolic strategy in disclosing social responsibility. Panel B on the correlation analysis shows that the CSRV variable is positively correlated with the earnings management variable at least based on contemporary observations which provide initial support for the hypothesis. The correlation value between independent variables shows the highest value of 0.417, which is still at the moderate level so that it does not show concern for multicollinearity. This result is supported by the results of the Multicollinearity test in each estimation model which shows a mean value of vif <10, which means that there is no multicollinearity problem.

| Table 2a Descriptive Statistic And Correlation |

||||||

|---|---|---|---|---|---|---|

| Variables | N | Mean | Median | St. Dev. | Minimum | Maximum |

| DAC_MJ | 261 | -0.002 | 0.005 | 0.073 | -0.218 | 0.191 |

| DAC_K | 261 | -0.017 | -0.008 | 0.073 | -0.234 | 0.156 |

| AB_PRD | 261 | -0.053 | 0.009 | 0.25 | -1.037 | 0.403 |

| AB_CFO | 261 | 0.032 | 0.015 | 0.103 | -0.206 | 0.436 |

| AB_DEX | 261 | 0.023 | -0.024 | 0.188 | -0.376 | 1.051 |

| CMBREM | 261 | -0.108 | 0.017 | 0.481 | -2.022 | 0.902 |

| CSRV | 261 | 0.153 | 0.138 | 0.079 | 0.023 | 0.402 |

| SIZE | 261 | 23.812 | 23.808 | 1.108 | 20.957 | 26.413 |

| PRFT | 261 | 0.057 | 0.041 | 0.093 | -0.166 | 0.421 |

| LEVR | 261 | 0.534 | 0.53 | 0.237 | 0.133 | 1.74 |

| GROW | 261 | 0.103 | 0.072 | 0.293 | -0.366 | 1.882 |

| INST | 261 | 0.656 | 0.66 | 0.145 | 0.189 | 0.9 |

| MNGR | 261 | 0.009 | 0 | 0.03 | 0 | 0.151 |

| BIG4 | 261 | 0.736 | 1 | 0.442 | 0 | 1 |

| Table 2b Panel B: Pearson Correlation |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DAC_MJ | DAC_K | AB_PRD | AB_CFO | AB_DEX | CBMREM | CSRV | SIZE | PRFT | LEVR | GROW | INST | MNGR | BIG4 | |

| DAC_MJ | 1 | |||||||||||||

| DAC_K | 0.601*** | 1 | ||||||||||||

| AB_PRD | 0.100* | 0.306*** | 1 | |||||||||||

| AB_CFO | -0.371*** | -0.657*** | -0.588*** | 1 | ||||||||||

| AB_DEX | -0.073 | -0.153*** | -0.863*** | 0.283*** | 1 | |||||||||

| CBMREM | 0.160*** | 0.359*** | 0.984*** | -0.631*** | -0.901*** | 1 | ||||||||

| CSRV | 0.129** | 0.082* | 0.034 | 0.011 | -0.036 | 0.03 | 1 | |||||||

| SIZE | -0.005 | 0.021 | 0.021 | -0.004 | 0.014 | 0.006 | 0.266*** | 1 | ||||||

| PRFT | 0.136** | -0.316*** | -0.552*** | 0.742*** | 0.253*** | -0.545*** | 0.043 | -0.048 | 1 | |||||

| LEVR | -0.201*** | -0.042 | -0.045 | -0.131** | 0.144*** | -0.052 | -0.106** | 0.068 | -0.241*** | 1 | ||||

| GROW | 0.015 | 0.049 | 0.072 | -0.116** | -0.067 | 0.088* | -0.127** | 0.039 | 0.035 | -0.005 | 1 | |||

| INST | 0.007 | -0.101* | -0.355*** | 0.204*** | 0.319*** | -0.353*** | 0.029 | -0.277*** | 0.205*** | -0.248*** | 0.003 | 1 | ||

| MNGR | 0.071 | 0.121** | 0.059 | -0.082* | -0.072 | 0.076 | -0.064 | -0.079 | -0.093* | -0.019 | 0.046 | -0.149*** | 1 | |

| BIG4 | 0.031 | -0.106** | -0.182*** | 0.216*** | 0.119** | -0.187*** | 0.115** | 0.132** | 0.244*** | -0.417*** | -0.039 | 0.340*** | -0.047 | 1 |

Table 3 shows the results of the analysis of the relationship between social responsibility disclosure and discretionary earnings management based on the estimation model. The results are presented into 2 groups of specifications; the first specification group (1) and (3) is the initial model without using industry and year effects. The second group (2) and (4) uses the year and industry effect. The results show that the disclosure of social responsibility has a significant positive coefficient on discretionary earnings management. These results are consistent with using the two earnings management variables in both groups of specifications.

| Table 3 Disclosure Of Corporate Social Responsibility And Accruals-Based Earnings Management |

||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DAC_MJ | DAC_MJ | DAC_K | DAC_K | |

| CSRV | 0.115** (1.94) |

0.113** (2.08) |

0.099** (1.69) |

0.112** (2.00) |

| SIZE | -0.001 (-0.20) |

-0.002 (-0.37) |

-0.001 (-0.13) |

-0.002 (-0.50) |

| PRFT | 0.089** (1.81) |

0.142*** (2.55) |

-0.257*** (-4.70) |

-0.256*** (-4.43) |

| LEVR | -0.061** (-2.09) |

-0.071*** (-2.75) |

-0.046** (-1.70) |

-0.055** (-2.18) |

| GROW | 0.005 (0.30) |

-0.004 (-0.24) |

0.017 (1.05) |

0.018 (1.00) |

| INST | -0.018 (-0.49) |

-0.049* (-1.58) |

-0.019 (-0.52) |

-0.042* (-1.33) |

| MNGR | 0.183 (1.19) |

0.193 (1.25) |

0.204* (1.29) |

0.243* (1.56) |

| BIG4 | -0.012 (-0.98) |

-0.022* (-1.64) |

-0.013 (-1.02) |

-0.014 (-1.03) |

| _cons | 0.049 (0.41) |

0.077 (0.66) |

0.041 (0.35) |

0.077 (0.66) |

| Ind f.e. | No | Yes | No | Yes |

| Year f.e. | No | Yes | No | Yes |

| r2 | 0.074 | 0.282 | 0.143 | 0.318 |

| N | 261 | 261 | 261 | 261 |

References

Almahrog, Y., Aribi, Z.A., & Arun, T. (2018). Earnings management and corporate social responsibility: UK evidence.Journal of Financial Reporting and Accounting, 16(2), 311-332.

Indexed at, Google Scholar, Cross Ref

Anagnostopoulou, S.C., & Tsekrekos, A.E. (2017). The effect of financial leverage on real and accrual-based earnings management.Accounting and Business Research,47(2), 191-236.

Indexed at, Google Scholar, Cross Ref

Ashforth, B.E., & Gibbs, B.W. (1990). The double-edge of organizational legitimation.Organization Science,1(2), 177-194.

Indexed at, Google Scholar, Cross Ref

Baskaran, S., Nedunselian, N., Ng, C.H., Mahadi, N., & Rasid, S.Z.A. (2020). Earnings management: a strategic adaptation or deliberate manipulation?.Journal of Financial Crime, 27(2), 369-386.

Indexed at, Google Scholar, Cross Ref

Beneish, M.D. (2001). Earnings management: A perspective.Managerial Finance, 27(12), 3-17.

Indexed at, Google Scholar, Cross Ref

Blazovich, J.L., & Smith, L.M. (2011). Ethical corporate citizenship: Does it pay? Research on Professional Responsibility and Ethics in Accounting, 15, 127-163.

Indexed at, Google Scholar, Cross Ref

Bouten, L., Everaert, P., Van Liedekerke, L., De Moor, L., & Christiaens, J. (2011). Corporate social responsibility reporting: A comprehensive picture?. Accounting Forum, 35(3), 187-204.

Indexed at, Google Scholar, Cross Ref

Carroll, A.B. (1979). A three-dimensional conceptual model of corporate performance. The Academy of Management Review, 4(4), 497-505.

Indexed at, Google Scholar, Cross Ref

Chaney, P.K., Faccio, M., & Parsley, D. (2011). The quality of accounting information in politically connected firms. Journal of Accounting and Economics, 51(1-2), 58-76.

Indexed at, Google Scholar, Cross Ref

Chen, S., Guo, J., Liu, Q., & Tong, X. (2021). The impact of XBRL on real earnings management: unexpected consequences of the XBRL implementation in China. Review of Quantitative Finance and Accounting, 56(2), 479-504.

Indexed at, Google Scholar, Cross Ref

Chih, H.L., Shen, C.H., & Kang, F.C. (2008). Corporate social responsibility, investor protection, and earnings management: Some international evidence. Journal of Business Ethics, 79(1-2), 179-198.

Indexed at, Google Scholar, Cross Ref

Choi, B.B., Lee, D., & Park, Y. (2013). Corporate social responsibility, corporate governance and earnings quality: Evidence from Korea. Corporate Governance: An International Review, 21(5), 447-467.

Indexed at, Google Scholar, Cross Ref

Choi, T.H., & Pae, J. (2011). Business Ethics and Financial Reporting Quality: Evidence from Korea. Journal of Business Ethics, 103(3), 403-427.

Indexed at, Google Scholar, Cross Ref

Cohen, D., Pandit, S., Wasley, C.E., & Zach, T. (2020). Measuring Real Activity Management. Contemporary Accounting Research, 37(2), 1172-1198.

Indexed at, Google Scholar, Cross Ref

Cohen, D.A., Dey, A., & Lys, T.Z. (2008). Real and accrual-based earnings management in the pre- and post-sarbanes-oxley periods. The Accounting Review, 83(3), 757-787.

Indexed at, Google Scholar, Cross Ref

Dechow, P.M., Sloan, R.G., & Sweeney, A. (1995). Detecting Earnings Management. The Accounting Review, 70(2), 193-225.

Doidge, C., Andrew Karolyi, G., & Stulz, R.M. (2007). Why do countries matter so much for corporate governance? Journal of Financial Economics, 86(1), 1-39.

Indexed at, Google Scholar, Cross Ref

Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. The Pacific Sociological Review, 18(1), 122-136.

Indexed at, Google Scholar, Cross Ref

Elkington, J. (2018). 25 years ago I coined the phrase “Triple Bottom Line.” here’s why it’s time to rethink it. Harvard Business Review.

Enache, L., & Srivastava, A. (2017). Should intangible investments be reported separately or commingled with operating expenses? New evidence. Management Science, 64(7), 3446-3468.

Indexed at, Google Scholar, Cross Ref

Fritzsche, D.J. (1991). A model of decision-making incorporating ethical values. Journal of Business Ethics, 10(11), 841-852.

Indexed at, Google Scholar, Cross Ref

Garriga, E., & Melé, D. (2004). Corporate social responsibility theories: Mapping the territory. Journal of Business Ethics, 53(1-2), 51-71.

Indexed at, Google Scholar, Cross Ref

Grougiou, V., Dedoulis, E., & Leventis, S. (2016). Corporate social responsibility reporting and organizational stigma : The case of “Sin” industries. Journal of Business Research, 69(2), 905-914.

Indexed at, Google Scholar, Cross Ref

Gunny, K.A. (2010). The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research, 27(3), 855-888.

Indexed at, Google Scholar, Cross Ref

Hahn, R., & Lülfs, R. (2014). Legitimizing negative aspects in GRI-oriented sustainability reporting: A qualitative analysis of corporate disclosure strategies. Journal of Business Ethics, 123(3), 401-420.

Indexed at, Google Scholar, Cross Ref

Hamza, S. E., & Kortas, N. (2019). The interaction between accounting and real earnings management using simultaneous equation model with panel data. In Review of Quantitative Finance and Accounting (Vol. 53, Issue 4). Springer US.

Indexed at, Google Scholar, Cross Ref

Handayani, R., Wahyudi, S., & Suharnomo, S. (2017). The effects of corporate social responsibility on manufacturing industry performance: The mediating role of social collaboration and green innovation. Business: Theory and Practice, 18, 152-159.

Indexed at, Google Scholar, Cross Ref

Harjoto, M.A., & Jo, H. (2011). Corporate governance and CSR nexus. Journal of Business Ethics, 100(1), 45-67.

Indexed at, Google Scholar, Cross Ref

Hasan, I., Kobeissi, N., Liu, L., & Wang, H. (2016). Corporate Social Responsibility and Firm Financial Performance : The Mediating Role of Productivity. Journal of Business Ethics, 149(3), 671-688.

Indexed at, Google Scholar, Cross Ref

Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

Indexed at, Google Scholar, Cross Ref

Hemingway, C. A., & Maclagan, P. W. (2004). Managers’ personal values as drivers of corporate social responsibility. Journal of Business Ethics, 50(1), 33-44.

Indexed at, Google Scholar, Cross Ref

Hong, Y., & Andersen, M.L. (2011). The relationship between corporate social responsibility and earnings management: An exploratory study. Journal of Business Ethics, 104(4), 461-471.

Indexed at, Google Scholar, Cross Ref

Hrasky, S. (2011). Carbon footprints and legitimation strategies: Symbolism or action? Accounting, Auditing & Accountability Journal, 25(1), 174-198.

Indexed at, Google Scholar, Cross Ref

Husnaint, W., & Basuki, B. (2020). ASEAN corporate governance scorecard: Sustainability reporting and firm value. Journal of Asian Finance, Economics and Business, 7(11), 315-326.

Indexed at, Google Scholar, Cross Ref

Isnalita, & Narsa, I.M. (2017). CSR disclosure, customer loyalty, and firm values (Study at Mining Company Listed in Indonesia Stock Exchange). Asian Journal of Accounting Research, 2(2), 8-14.

Indexed at, Google Scholar, Cross Ref

Jamali, D., & Mirshak, R. (2007). Corporate social responsibility (CSR): Theory and practice in a developing country context. Journal of Business Ethics, 72(3), 243-262.

Indexed at, Google Scholar, Cross Ref

Jordaan, L.A., de Klerk, M., & de Villiers, C.J. (2018). Corporate social responsibility and earnings management of South African companies. South African Journal of Economic and Management Sciences, 21(1), 1-13.

Kim, S. H., Udawatte, P., & Yin, J. (2019). The effects of corporate social responsibility on real and accrual‐based earnings management: Evidence from China.Australian Accounting Review,29(3), 580-594.

Indexed at, Google Scholar, Cross Ref

Kim, Y., Park, M. S., & Wier, B. (2012). Is earnings quality associated with corporate social responsibility? The Accounting Review, 87(3), 761-796.

Indexed at, Google Scholar, Cross Ref

Kothari, S.P., Leone, A.J., & Wasley, C.E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163-197.

Indexed at, Google Scholar, Cross Ref

KPMG. (2020). The KPMG Survey of sustainability reporting 2020. In KPMG.

Lanis, R., & Richardson, G. (2013). Corporate social responsibility and tax aggressiveness: a test of legitimacy theory. Accounting, Auditing & Accountability Journal, 26(1), 75-100.

Indexed at, Google Scholar, Cross Ref

Larcker, D.F., & Richardson, S.A. (2004). Fees paid to audit firms, accrual choices, and corporate governance. Journal of Accounting Research, 42(3), 625-658.

Indexed at, Google Scholar, Cross Ref

Ling, T.C., & Sultana, N. (2015). Corporate social responsibility: What motivates management to disclose? Social Responsibility Journal, 11(3), 513-534.

Indexed at, Google Scholar, Cross Ref

Lys, T., Naughton, J.P., & Wang, C. (2015). Signaling through corporate accountability reporting. Journal of Accounting and Economics, 60(1), 56-72.

Indexed at, Google Scholar, Cross Ref

Milne, M.J., & Patten, D.M. (2002). Securing organizational legitimacy: An experimental decision case examining the impact of environmental disclosures. Accounting, Auditing & Accountability Journal, 15(3), 372-405.

Indexed at, Google Scholar, Cross Ref

Moore, G.E. (1993). Principia Ethica (Revised Ed). Cambridge University Press.

Muttakin, M.B., Khan, A., & Azim, M.I. (2015). Corporate social responsibility disclosures and earnings quality: Are they a reflection of managers’ opportunistic behavior? Managerial Auditing Journal, 30(3), 277-298.

Indexed at, Google Scholar, Cross Ref

Roychowdhury, S. (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics, 42(3), 335-370.

Indexed at, Google Scholar, Cross Ref

Sanjaya, I.P.S., & Saragih, M.F. (2012). The effect of real activities manipulation on accrual earnings management: The case in Indonesia stock exchange (IDX). Journal of Modern Accounting and Auditing, 8(9), 1291-1300.

Scholtens, B., & Kang, F.C. (2012). Corporate social responsibility and earnings management: Evidence from Asian economies. Corporate Social Responsibility and Environmental Management, 20(2), 95-112.

Indexed at, Google Scholar, Cross Ref

Setiawan, D., Prabowo, R., Arnita, V., & Wibawa, A. (2019). Does corporate social responsibility affect earnings management? Evidence from the indonesian banking industry. Business: Theory and Practice, 20, 372-378.

Indexed at, Google Scholar, Cross Ref

Srivastava, A. (2019). Improving the measures of real earnings management. Review of Accounting Studies, 24(4), 1277-1316.

Indexed at, Google Scholar, Cross Ref

Tsalis, T.A., Nikolaou, I.E., Konstantakopoulou, F., Zhang, Y., & Evangelinos, K.I. (2020). Evaluating the corporate environmental profile by analyzing corporate social responsibility reports. Economic Analysis and Policy, 66, 63-75.

Indexed at, Google Scholar, Cross Ref

Vorst, P. (2016). Real earnings management and long-term operating performance: The role of reversals in discretionary investment cuts. Accounting Review, 91(4), 1219-1256.

Indexed at, Google Scholar, Cross Ref

Received: 11-Oct-2021, Manuscript No. ASMJ-21-8878; Editor assigned: 14-Oct-21, PreQC No. ASMJ-21-8878(PQ); Reviewed: 04-Nov-21, QC No. ASMJ-21-8878; Revised: 22-Jan-2022, Manuscript No. ASMJ-21-8878(R); Published: 31-Jan-2022