Research Article: 2019 Vol: 18 Issue: 2

The Non-Oil Trade Deficit in Saudi Arabia: How can it be Managed?

Mohammed A. Aljebrin, Majmaah University

Abstract

Economists agree that persistent trade deficits indicate poor economic health. However, opinions vary widely regarding the factors that influence trade deficits, and studies that focus specifically on non-oil trade deficits are limited. This study was an investigation of relationships between Saudi Arabia’s non-oil trade deficit and specific economic measures that were shown in previous research to be related to trade deficits in other countries. The researcher used Stock and Watson’s Dynamic Ordinary Least Squares (DOLS) approach (1993) as an empirical method to estimate the critical parameters of the non-oil trade deficit in Saudi Arabia over a 25- year period (1998-2015). To meet the requirements of the DOLS application, a time series was used to analyze the data. This allowed the designation of the order of integration for each series, generating the data for review. The results of our assessment suggest that a unique theoretical sign can be expected for the individual variables. This confirms that statistically significant positive relationships exist between the non-oil trade deficit and (a) real income, (b) relative national prices to foreign prices, and (c) international reserves. In contrast, a negative and considerable correlation was found between the Real Effective Exchange Rate (REER) and the non-oil trade deficit. Policymakers are currently challenged with controlling the domestic inflation rate, and the results of this study substantiate the positive relationship between Saudi Arabia’s non-oil trade deficit and relative domestic to foreign prices. Therefore, the findings indicate that controlling domestic prices is an important element of managing the non-oil trade deficit. The negative relationship between the non-oil trade deficit and real effective exchange rate strongly suggests that policymakers should also support the real effective exchange rate. Saudi Arabia needs strategic plans and policies that promote the development of innovative and dynamic trade sectors that potentially accelerate economic diversification. Economic diversification is dependent on inventive processes that improve productivity, products that promote sustainable growth, new markets, and institutions that allow for more efficient production. Strategies should strive to encourage both vertical and horizontal diversification beyond oil production, which would further integrate non-oil trade into the global value chain and attract foreign direct investment to the non-oil sector.

Keywords

Non-Oil Trade Deficit, Current Account Imbalances, DOLS Estimation, Saudi Arabia.

Introduction

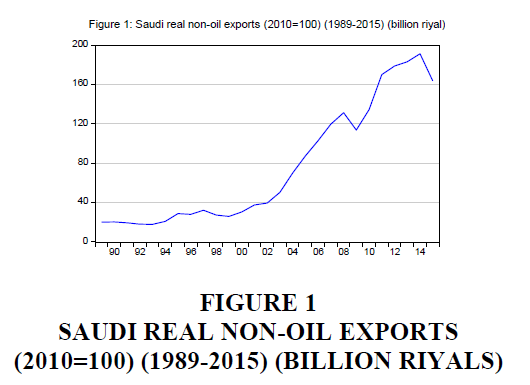

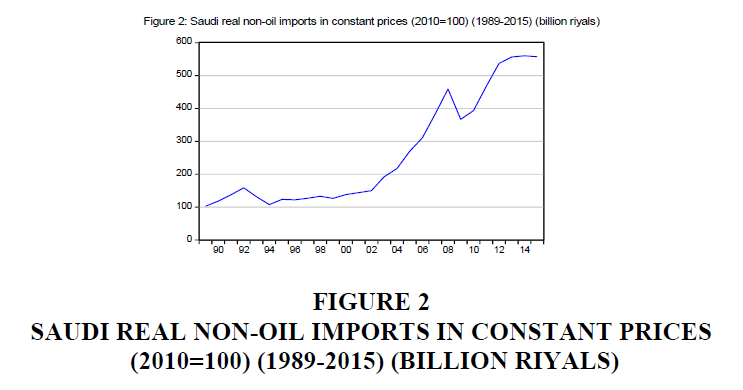

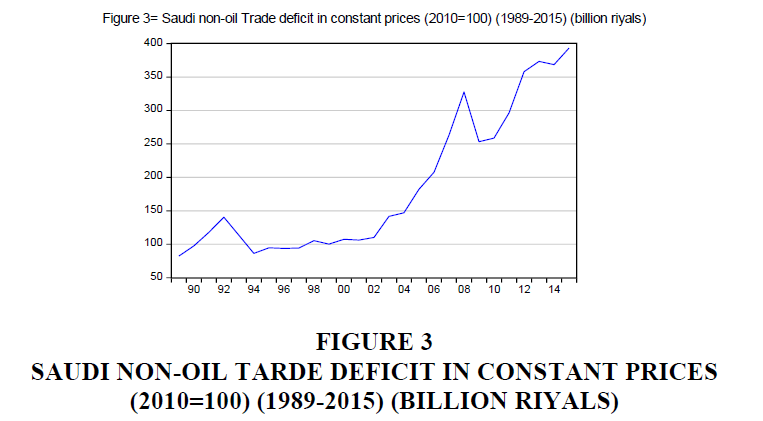

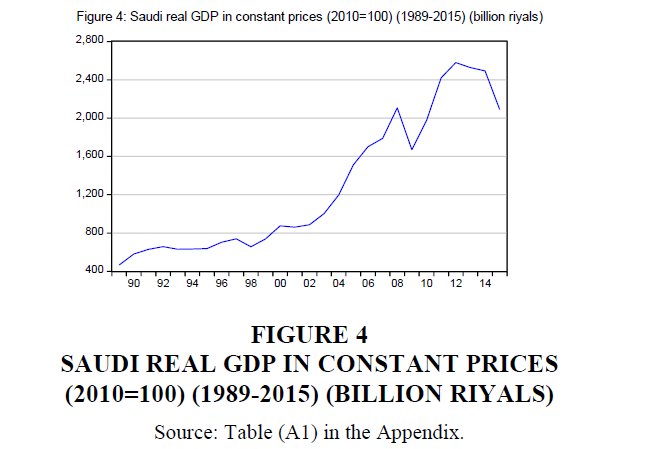

In the face of declining per-barrel oil prices and uncertainty regarding reserves, oilexporting countries are seeking ways to manage both oil and non-oil trade deficits. However, there are varying perspectives regarding how specific factors related to trade deficits influence broader economic health indicators. Data from the Saudi Arabian Monetary Agency (SAMA, 2016) suggests positive relationships may exist between non-oil exports, non-oil imports, non-oil trade deficit, and real GDP. Moreover, during the past few years, the non-oil trade deficit in Saudi Arabia has come under great scrutiny, leading to questions regarding the factors that may have contributed to this deficit. The current body of research offers no clear data describing specific factors that may or may not influence the non-oil trade deficit, and some argue that it poses no problem at all (Behar & Fouejieu, 2016; Ghosh & Ramakrishnan, 2006; Griswold, 1998; Mohammad, 2010; Moon, 2001). To address this fundamental economic issue, the current researcher conducted an empirical investigation of specific factors that have influenced the nonoil trade deficit in Saudi Arabia from 1989 to 2015, using Stock & Watson’s (1993) DOLS approach.

Specifically, this study examined the correlations between the non-oil trade deficit and the following variables: real income, relative prices, real effective exchange rate, and international reserves in Saudi Arabia from 1989 to 2015. The results provide statistically supported evidence that can guide policy makers regarding action priorities and identify other opportunities to facilitate reducing the non-oil trade deficit in Saudi Arabia. Also, this research substantially increases the body of knowledge regarding the validity of trade deficit theories relative to a developing country like Saudi Arabia.

This report is organized as follows. The rational for the research and research objective are presented, followed by a literature review of the theoretical background and empirical evidence that support the focus and methodology for the study, including specific economic models assessed and the econometric methodology applied. The paper concludes with a presentation of the empirical results, discussion, and finally, conclusions and concluding remarks.

Rationale For The Study And Research Objective

Economists agree that managing trade deficits is critical to maintaining strong economic health (Oke, 2007; Rodrik, 2001). There is substantial research available relating to the trade deficit in Saudi Arabia, but few studies consider non-oil trade deficits. Some researchers consider it a concern while others do not (Griswold, 1998). A synopsis of trade accounts from various countries reveals that many of them are experiencing a trade deficit, and the issue has become a topic of debate in both domestic and global economic and political arenas. Discussions about trade deficits and even non-oil trade deficits for oil exporting countries likely focus on their economic influence, financing possibilities, and probable determinants.

Many institutions and authors are concentrating on examining this subject from the perspective of developed and developing nations (Behar & Fouejieu, 2016; Ghosh & Ramakrishnan, 2006; Mohammad, 2010; Moon, 2001:2005). Individual writers have expressed that it is not a problem per se, while institutions have indicated studies showing that trade deficits delay growth and development, causing financial crisis, loss of industries, redundancy, and other economic problems. The objective of this study was to provide an analysis of reliable longitudinal data that provides a more detailed view of variables that likely influence the non-oil trade deficit in Saudi Arabia. By providing empirical evidence regarding relationships among the factors that influence the non-oil trade deficit, this research provides implications for ways to manage these factors in efforts to control the non-oil trade deficit. Furthermore, the findings and implications of this study are likely to be useful for other countries that face similar challenges.

Literature Review

Engaging in international trade is recognized as a successful method for developing economic growth, a robust job market, and social welfare. International trade accounts for a high percentage of the Gross Domestic Product (GDP) of several countries. This type of trade is crucial in countries that are unable to produce domestically, relying on external sources for capital and consumer goods. Trade has played a key role in achieving worldwide economic growth throughout the 19th and 20th centuries. International trade and long-term capital flows have served as “engines of growth” that have generated explosive economic growth and expansion in most developed countries and several underdeveloped nations as well (Oke, 2007). According to (Rodrik, 2001), no country has been able to prosper without foreign trade. Without external trade, a major component of foreign exchange earnings, countries would be unable to import any capital or consumer goods or services that were not domestically available. Historically, international trade has been appreciated for its comparative advantage in the worlds of both commerce and economics, contributing heavily to a nation’s GDP. A persistent deficit in a country’s international trade highlights poor economic health, calling its economic sustainability into question.

Oil exporters have accumulated surplus stores of oil for nearly a decade, leading to questions about whether the surplus was too large, from both normative and global imbalance perspectives (Arezki & Hasanov, 2013; Beidas-Strom & Cashin, 2011). In the second half of 2014, a reduction of the per-barrel price left per-barrel oil prices averaging barely $50 in 2015-a stark contrast to the triple-digit prices of the previous four years. Based on futures prices, it appears that this steep decline of oil prices will not improve substantially over the next few years. Despite being expected to continue to yield net benefits to the world economy, oil exporters will be the hardest hit, especially because they have suffered the immediate financial blows associated with shifts in the market (Husain et al., 2015).

Added to the existing financial strain, foreign-owned balances demand payment. Quite a few countries are able to offset these external debts. Different countries have varying abilities to meet these financial obligations, and while several countries have significant external financial resources, some may encounter difficulty with procuring funds and demands on their reserves (Versailles, 2015). From a normative viewpoint, exporters should strive to be net external savers when dealing with finite resources so they can keep financing imports after initial resources are depleted. Consequently, lawmakers in oil-exporting countries are considering alternate methods for increasing their current account balances.

Recent research addressed current account imbalances in the Middle East (Behar & Fouejieu, 2016). Behar & Fouejieu (2016) argued that, following the drop in oil prices, several oil-exporting countries recognized the need to bolster their external balances. They also argued that the function of the exchange rate is undermined by the oil exporters’ special characteristics, requiring heavier reliance on fiscal policy. These findings were based on a regression analysis of the determinants of the current account balance as well as the trade balance. The findings showed an insignificant or absent relationship between account balances and the exchange rate, and a substantial relationship with the fiscal balance or government spending, particularly for the oil exporters that lack diversity, including the Gulf Cooperation Council.

In an earlier study, Mohammad (2010) examined both the long-term and short-term causes of Pakistan’s trade deficit using annual data from 1975 to 2008. For the long-term analysis, the researcher used the Johansen co-integration technique. To examine short-term factors, a vector error correction model was applied. Variables tested included foreign income and direct investment, domestic consumption, and real effective exchange rate. The results of the study confirmed that all of the variables significantly affected Pakistan’s trade deficit.

To investigate trade balance determinants, Falk (2008) used both fixed-effects models and linear-mixed models, focusing on the panel data for 32 advanced and emerging economies during the 1990-2007 timeframe. Falk concluded that the results from both models, when allowing for random slope coefficients, illustrated that the trade balance as a GDP allocation has a considerable positive relationship to the real foreign GDP per capita of the trading partners. Trade balance is adversely affected by real domestic GDP per capita, and it improves with a real depreciation of the real exchange rate index. Conversely, countries with a trade balance deficit and/or a substantially positive net foreign direct investment have a trade balance that is considerably less susceptible to fluctuations in the real effective exchange rate index.

To examine the current account deficit, Ghosh & Ramakrishnan (2006) focused on the following three variables: inter-temporal trade, the gap in domestic investment and reserves, and the discrepancy of values between the exportation and importation of goods and services. If an externally high investment causes the deficit, only a small amount of savings is reflected, and there is not much need for concern as long as the investments are funneled towards providing growth. The authors also argued that importing additional goods causes no foreseeable harm, acquiring a trade deficit now and later exporting the same to enjoy a profit. Furthermore, no harm is caused if the deficit can be readily covered by foreign funds, as both New Zealand and Australia have done. However, problems can arise if there is any difficulty procuring funds to cover the deficit such as investors’ withdrawing private financing, as occurred in Mexico and Thailand in 1995 and 1997, respectively.

In two separate studies, Moon (2001:2005) showed that trade deficits delay a country’s economic development and lead to a host of other issues such as the accrual of greater foreign balances, reliance on one trade sector, the distortion of domestic priorities, impeded growth, and the risk of financial crisis. Moon used the past behaviors of Latin American and East Asian countries as the basis for his conclusions.

Illustrating the importance of exchange rates, Hacker & Hatemi (2002) examined the trade balances and exchange rates for the Czech Republic, Hungary, and Poland in comparison to Germany. The results of their study demonstrated a positive long-term relationship between trade balances and exchange rates for all three nations. However, Hungary was the only country out of the three that did not experience the J-curve effect or any of its characteristics. Examining the same issue, Baharumshah (2001) used an unrestricted VAR model to compare the bilateral trade balances of the United States and Japan with that of Thailand and Malaysia from 1980 to 1996. He confirmed the existence of a stable and favorable long-term relationship between the trade balance and the exchange rate. However, he also showed that the evidence supporting the J-curve effect in Thailand and Malaysia is mixed when analyzing their trade balance for the short-term. The Thai data appears to show a delayed J-curve response, while the Malaysian data showed no supporting evidence for the J-curve at all. Bahmani-Oskooee & Kantipong (2001) examined the disaggregated data for the J-curve among Thailand and its central trading partners, the United Kingdom, Germany, the United States, Singapore, and Japan, from 1973 to 1997. The J-curve was only evident in bilateral trade between Japan and the United States.

Representing a different viewpoint, Griswold (1998) sees the trade deficit as resulting from the rise of factors in macroeconomics that have no direct correlation to trade as opposed to being caused by the inequitable trading practices of other nations or the absence of competition. This author further argues that the trade deficit is merely the “mirror image” of excess capital and the economic expansion of a nation fueled by high investment. This argument contradicts the “worry position,” which claims that trade deficits lead to greater external debts that have the potential to crash down at any time along with losing foreign funding.

In conjunction with their economic assessment, Udwadia & Agmon (1988) analyze the trade deficit from political and moral standpoints. They insist that the deficit is a problem-free issue and claim that political and moralistic perspectives tend to overemphasize any potential crises that result from persistent trade deficits, and that they have minimal influence on the economy. Political perspectives argue that trade surpluses are deemed to be beneficial to the country and considered necessary for those who believe that profit establishes power. Moral grounds dictate that debt is bad, and these perspectives advise against spending beyond your means, while advocating saving money for potential future needs. The authors emphasize the interdependence of the political, moral, and economic viewpoints to show that the trade deficit is not a concern.

The above literature review confirms that, most likely, a trade deficit or non-oil trade deficit is prevalent in several nations. Economists have shared varying arguments denying or supporting that a problem exists, and they offer different arguments regarding the sources of trade deficits. However, identifying sources of economic growth in a given region is fundamental to investigating factors that influence trade deficits. A recent study provided insight into the sources of economic growth in Saudi Arabia (Euchi et al., 2018). These researchers completed an analysis of Saudi Arabia’s economic diversification strategies based on four variables: investment in education, entrepreneurship, international tourism, and oil production over the period 1970-2014. Using the FMOLS technique, they found that oil production had the highest contribution to economic growth in Saudi Arabia, followed by the tourism sector and entrepreneurship activity, while the contribution of education is positive (Euchi et al., 2018). These results indicate a need for growth in non-oil sectors.

Ibrahim (2016) suggested using the DOLS approach (Stock & Watson, 1993) to estimate the essential parameters of Egypt’s trade deficit from 1979 to 2014. Ibrahim reported that the results confirmed the existence of a significant positive relationship between Egypt’s trade deficit and determinants like real income, relative domestic to foreign prices, and global reserves. Ibrahim also reported a negative and noteworthy correlation between the real effective exchange rate and the trade deficit. Based on these findings, the current researcher applied this approach to examine how these factors influence the non-oil trade deficit in Saudi Arabia. To establish the foundations of the study, a review of Saudi Arabia’s recent economic history and structures follows below.

Recent Economic Structure in Saudi Arabia

The Saudi government maintained its economic growth throughout 2015 by investing in development projects and continuing structural and regulatory reforms. These reforms focused on attaining economic growth sustained through a diversified production base and varying the types of goods and services exported, in addition to expanding the non-oil sector’s contributions. Saudi Arabia’s real GDP increased by 3.5 percent to a little over SAR 2,520 billion in 2015 based on the 2010 constant prices, which is comparable to the increase of 3.6 percent in 2014. In 2015, the GDP of the oil sector grew by 4.0 percent to just over SAR 1,085 billion, and the overall GDP of the non-oil sector rose by slightly more than 3 percent to almost SAR 1,415 billion. In 2015, the growth rate of the non-oil private sector GDP increased by 3.4 percent to almost SAR 990 billion, while that of the non-oil government sector increased 2.5 percent to nearly SAR 425 billion (SAMA, 2016).

The Saudi economy maintained its international sovereign credit rating with the ongoing growth of its GDP. Recently, Fitch Ratings and Standard and Poor's (S&P) Ratings Services announced fixing Saudi Arabia’s sovereign credit rating at (AA), with a stable outlook. Similarly, Moody's Corporation announced fixing the Kingdom's sovereign credit rating at a higher credit score of (AA3) while maintaining a stable outlook. In actuality, the State public budget recorded a deficit of nearly SAR 362 billion, or almost 15 percent of the GDP. In 2015, a surplus of SAR (-200.54) billion, or 8.28 percent of GDP was recorded in the current account of the balance of payments. The broad money supply (M3) grew by 2.6 percent to nearly SAR 1,774 billion in 2015, which slowed from the previous jump of almost 12 percent to almost SAR 1,729 billion in 2014. The money circulated outside of banks increased roughly 10 percent, and other quasi-monetary deposits increased by 3.4 percent. By the end of 2015, market capitalization of issued shares fell to barely SAR 1,579 billion, a decrease of 12.9 percent, from SAR 1,812.9 billion at the end of the previous year (SAMA, 2016). According to the Saudi Arabian Monetary Agency, the quantity of traded shares increased by 6.0 percent up to 65.9 billion with a value of SAR 1,660.6 billion (SAMA, 2015:2016).

Figures 1-4 below show comparable trends between non-oil exports, non-oil imports, the non-oil trade deficit, and real GDP. This suggests that a positive relationship may exist between these variables.

Table 1 shows that between 1990 and 2015, the non-oil trade deficit in Saudi Arabia accounted for between 21% and 28% percent of the non-oil GDP, but this value ranged between 12% and 19% of the total GDP. Therefore, no noteworthy change occurred throughout the 1990- 2015 period.

| Table 1: Structure Of Saudi Arabia’s Non-Oil Trade Deficit In Current Prices And Its Yearly Relative Shares Of The Gdp 1990-2015 | |||||

| Period | Non-Oil Exports (billion riyal) |

Non-Oil Imports (billion riyal) |

Non-Oil Trade Deficit* (billion riyal) |

% of * | |

|---|---|---|---|---|---|

| Non-Oil GDP | GDP | ||||

| 1990 | 15.471 | 89.522 | 74.051 | 27 | 77 |

| 2000 | 24.806 | 112.178 | 87.372 | 21 | 12 |

| 2010 | 134.609 | 393.301 | 258.692 | 24 | 13 |

| 2011 | 175.504 | 484.210 | 308.706 | 25 | 12 |

| 2012 | 190.148 | 573.167 | 383.019 | 28 | 14 |

| 2013 | 201.369 | 614.965 | 413.596 | 28 | 15 |

| 2014 | 216.034 | 635.190 | 419.156 | 26 | 15 |

| 2015 | 188.636 | 645.627 | 456.991 | 26 | 19 |

Source: Saudi Arabian Monetary Agency (SAMA) (2016), Annual Report, No. 52

http://www.sama.gov.sa/ar-sa/EconomicReports/Pages/AnnualReport.aspx.

Note: *calculated by the author.

Reviewing Saudi Arabian non-oil trade performance requires a close examination of the structure of non-oil exports and non-oil imports. Table 2 shows the categories of non-oil exports between 1990 and 2015, listing the average growth rates of non-oil export components for this duration, as well as their shares of total exports. Compared to several other developing nations that export oil, Saudi Arabia has a considerably smaller share of non-oil exports despite Saudi policymakers’ emphasis on the need for a diversified economic strategy. This further underscores the fundamental necessity of finding innovative, competitive markets-or at least more varied reliance on new goods and services.

Regarding non-oil exports, Table 2 also reveals that contributions of the Chemical and Plastic Products categories together accounted for more than half of all goods exported, with respective totals of 30.72 and 30.37 percent of non-oil exports. In addition, the electrical machines, equipment & tools, and base metals & articles of base metals categories represented the most average annual growth rates from 1990 to 2015, enabling these sectors to show increased shares of total exports as of 2015. Furthermore, the re-exports category also netted higher average growth rates within the same timeframe, consequently increasing its full share of exports to 17.08% as of 2015.

| Table 2: Non-Oil Export Categories In Current Prices And Annual Average Growth Rates 1990-2015 | |||||

| Non-Oil Exports | Value (billion riyal) |

Yearly average Growth Rate* (%) |

% of Non-Oil Exports* |

||

|---|---|---|---|---|---|

| 1990 | 2015 | 1990-2015 | 1990 | 2015 | |

| Food stuffs | 1.182 | 13.611 | 10.27 | 7.64 | 7.22 |

| Chemical Products | 5.661 | 57.951 | 9.75 | 36.59 | 30.72 |

| Plastic Products | 3.758 | 57.284 | 11.51 | 24.29 | 30.37 |

| Base Metals and Articles of Base Metals | 1.231 | 13.845 | 10.16 | 7.96 | 7.34 |

| Electrical Machines, Equipment & Tools | 0.301 | 3.573 | 10.40 | 1.95 | 1.89 |

| Other Exports | 0.924 | 10.159 | 10.06 | 5.97 | 5.39 |

| Re-exports | 2.414 | 32.213 | 10.92 | 15.60 | 17.08 |

| Total | 15.471 | 188.636 | 10.52 | 100 | 100 |

Source: Saudi Arabian Monetary Agency (SAMA) (2016), Annual Report, http://www.sama.gov.sa/ReportsStatistics/Pages/AnnualReport.aspx.

Note: *calculated by the author.

Current non-oil account imbalances occupy such a small share of the export basket that they require only limited attention. Because non-oil account imbalances exert such a minute influence, an unlikely surge in value would have to occur in order for them to have a significant effect on growth figures. This issue is particularly evident in exports without much diversification.

Table 3 shows the structure of non-oil imports between 1990 and 2015, the average growth rates of non-oil import categories within that period, and each category’s share of total non-oil imports. It is clear that total non-oil imports increased dramatically between 1990 and 2015, showing an average growth rate of 8.25 percent. The higher average growth rate of non-oil imports increases the trade account balance deficit, and accordingly, amplifies the need for finding the means to control this deficit.

| Table 3: Non-Oil Import Categories In Current Prices And Annual Average Growth Rates, 1990-2015 | |||||

| Non-Oil Imports | Value (billion riyal) |

Yearly average Growth Rate* (%) | % of Non-Oil Imports* | ||

|---|---|---|---|---|---|

| 1990 | 2015 | 1990-2015 | 1990 | 2015 | |

| Live Animals and Animal Products | 4.838 | 24.130 | 6.64 | 5.36 | 3.68 |

| Vegetable Products | 3.880 | 33.857 | 9.05 | 4.30 | 5.17 |

| Animal & Vegetable Fats, Oils, & Their Products | 0.403 | 0.3401 | 8.91 | 0.45 | 0.52 |

| Prepared Foodstuffs, Beverages, Spirits, Vinegar, & Tobacco | 3.639 | 30.540 | 8.88 | 4.03 | 4.66 |

| Mineral Products | 0.760 | 9.406 | 10.59 | 0.84 | 1.44 |

| Products of Chemical & Allied Industries | 7.232 | 55.014 | 8.45 | 8.01 | 8.40 |

| Artificial Resins and Plastic Materials, Cellulose Esters, Rubber, & Synthetic Rubber | 3.518 | 22.146 | 7.64 | 3.90 | 3.38 |

| Raw Hides and Skins, Fur Skins and Articles Thereof, Travel Goods and Hand Bags | 0.358 | 2.151 | 7.44 | 0.40 | 0.33 |

| Wood & Articles of Wood, Charcoal, Cork & Articles of Cork and Wicker Work | 1.249 | 6.414 | 6.76 | 1.38 | 0.98 |

| Paper Making Materials, Paper Card Board & Articles Thereof | 1.736 | 8.193 | 6.40 | 1.92 | 1.25 |

| Textiles and Textile Articles | 7.947 | 21.627 | 4.09 | 8.80 | 3.30 |

| Footwear, Headgear, Umbrellas, Sunshade Whips, Artificial Flowers, Articles of Human Hair & Fans | 0.895 | 3.830 | 5.99 | 0.99 | 0.58 |

| Articles of Stone Plaster, Asbestos, Ceramic Products, Glass & Glassware | 1.677 | 8.860 | 6.88 | 1.86 | 1.35 |

| Pearls, Precious & Semi-Precious Stones, Precious Metals, Articles and Imitation Jewelry | 6.213 | 21.785 | 5.15 | 6.88 | 3.33 |

| Base Metals & Articles of Base Metals | 7.830 | 64.473 | 8.80 | 8.67 | 9.84 |

| Machinery, Mechanical Appliances, Electrical Equipment & Parts | 14.777 | 178.321 | 10.48 | 16.37 | 27.22 |

| Transport Equipment | 18.471 | 120.516 | 7.79 | 20.46 | 18.40 |

| Optical, Photographic, Measuring, Checking, Precision, Medical & Surgical Instruments & Apparatus, Clocks & Watches, Musical Instruments, Sound Records & Reproducers & Parts Thereof | 2.836 | 16.915 | 7.40 | 3.14 | 2.58 |

| Arms, Ammunition, and Parts Thereof | 0.028 | 8.213 | 25.51 | 0.03 | 1.25 |

| Miscellaneous Manufactured Articles | 1.751 | 15.130 | 9.01 | 1.94 | 2.31 |

| Work of Art Collection Pieces and Antiques | 0.244 | 0.111 | (-3.10) | 0.27 | 0.02 |

| Total | 90.282 | 655.033 | 8.25 | 5.36 | 3.68 |

Source: Saudi Arabian Monetary Agency (SAMA) (2016), Annual Report, http://www.sama.gov.sa/ReportsStatistics/Pages/AnnualReport.aspx.

Note:*calculated by the author.

The machinery, mechanical appliances, electrical equipment & parts import sector witnessed the highest share of total non-oil imports, amounting to 27.22% in 2015. This category achieved a yearly average growth rate increase of 10.48% between 1990 and 2015. Transport equipment imports also achieved a high share of total non-oil imports, reaching 18.4% of non-oil imports in 2015.

In 2017, Saudi Arabia became the 22nd largest exporter of goods and represented the 27th largest import market in the world. Foreign trade represented 61% of its GDP. The country's trade balanced, but structurally it was in surplus. Exports dropped more than 40%, while imports decreased only 2.2%. The trade surplus continued to shrink in 2016 only to recover at the end of the year. Both oil and non-oil exports increased in 2017, but imports continued to fall. Oil exports rose to SAR 614 billion, showing a 19.1% increase in December 2017, and achieving a 20.27% annual increase. In contrast, non-oil exports stood at SAR 177 billion, with a 17.2% increase in December 2017, but showing an overall 0.2% annual decrease. Imports of goods and services, on the other hand, fell to SAR 722 billion, a 2.88% annual decrease (Trading Economics, 2019).

The non-oil trade balance analysis demonstrates that Saudi Arabia’s total non-oil imports increased dramatically during the 1990-2015 period. The increased average growth rate in nonoil imports has increased the trade account balance deficit, and accordingly amplifies the need for finding the resolution to control this deficit. This study examined the factors that affect the non-oil trade deficit and how it can be managed.

Methodology

Prior empirical and theoretical analyses imply that there are many factors that influence the trade balance. The researcher investigated potential correlations between the non-oil trade balance and the factors likely to affect the non-oil trade balance, basing the assessment on the calculations that follow. The non-oil trade balance gauges the comparative value of a country’s non-oil exports and non-oil imports. This researcher used the logarithm of the non-oil trade balance to calculate the non-oil trade deficit for the purposes of this study, as suggested by Rose & Yellen (1989).

Non-oil trade deficit was defined as:

NTD= f (Y, DF, REER, R) (1)

Where NTD is non-oil trade deficit, Y is real income, DF is relative domestic prices to foreign prices, and REER is the real effective exchange. We used the real effective exchange rate because it considers the relative weight of the trading partners of the respective countries. Lastly, R represents international reserves.

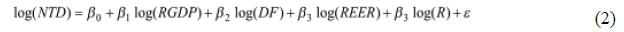

This research sought to combine new developments in co-integration analysis. The precision of this analysis is crucial given the degree that such calculations are used to plan the economic development of a country. Therefore, this study examined the correlation between the non-oil trade deficit and real income, relative prices, the real effective exchange rate, and international reserves in Saudi Arabia from 1989 to 2015 using Stock & Watson’s (1993) DOLS methodology, focusing on a time series from 1989 to 2015 for the analysis. To satisfy the requirements for the DOLS application, the researcher also assessed the properties of the processes that generated the data comprising the time series to delineate the order of integration for every series using the following model:

Where NTD is real non-oil trade deficit, RGDP is real income, DF is relative domestic to foreign prices, REER is the real effective exchange rate, R is the international reserve, and "?" is the error term.

The researcher acquired all of the data included in this analysis from the Saudi Arabian Monetary Agency (SAMA, 2016), except for international reserves, which were sourced from the World Bank Development Indicator. All the data was adjusted to reflect real values (2010 constant prices) using the consumer price index (2010=100) as illustrated in Table A1 in the appendix. Time series properties of the processes that generated the data were analyzed, specifying the order of integration for the individual series that met the requirements for using the DOLS application.

Empirical Results

Augmented Dickey-Fuller (ADF) and Phillips and Perron (PP) unit root tests were conducted for each series to verify whether the variables were stationary and integrated of the same order. Table 4 shows the results of both tests for the individual variables. The Akaike Information Criterion (AIC) was used to select the lag parameter for the ADF test to avoid serial correlation in the residual (Akaike, 1973).

| Table 4: Unit Root Tests | ||||

| ADF | PP | |||

|---|---|---|---|---|

| Log (NTD) | Level | C | -0.026400 | -0.054529 |

| C,T | -1.670578 | -1.786789 | ||

| First Diff. | C | -4.365929a | -4.352138a | |

| C,T | -4.309553b | -4.256862b | ||

| Log (Y) | Level | C | -1.061279 | -1.658714 |

| C,T | -1.690019 | -1.690019 | ||

| First Diff. | C | -4.244079a | -3.592205b | |

| C,T | -4.194580b | -4.162560b | ||

| Log (DF) | Level | C | -1.954344 | -2.415875 |

| C,T | -0.400730 | -0.226806 | ||

| First Diff. | C | -2.384393 | -2.267456 | |

| C,T | -3.382050c | -3.429926c | ||

| Log (REER) | Level | C | -1.859254 | -1.920663 |

| C,T | -0.387240 | -0.802008 | ||

| First Diff. | C | -3.240408b | -3.244810b | |

| C,T | -3.937974b | -3.955010b | ||

| Log (R) | Level | C | -0.058123 | -0.215391 |

| C,T | -2.440877 | -2.441155 | ||

| First Diff. | C | -3.983111a | -3.983111a | |

| C,T | -3.949892b | -3.931048b | ||

Notes: ADF-Dickey-Fuller (1979) unit root test with the Ho: Variables are I (1); PP-Phillips and Perron (1988) unit root test with the Ho: Variables are I (1); a, b, and c indicate significance at the 1%, 5%, and 10% levels, respectively. (C, T) indicate that the test executed with intercept and trend, respectively.

As Table 4 depicts, the null hypothesis was rejected for the first differences of all variables, but not for the levels of all variables in the two tests. Therefore, we can conclude that the series are integrated for order one.

Tables 5 and 6, respectively, provide the findings of the Likelihood Ratio tests based on the Trace and the Maximum Eigenvalue of the Stochastic Matrix. The two tests validate the existence of two co-integrating vectors between the variables, indicating the existence of a longterm relationship among them.

| Table 5: Co-Integration Test Based On Trace Of The Stochastic Matrix | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob** |

|---|---|---|---|---|

| None* | 0.870432 | 105.7516 | 69.81889 | 0.0000 |

| At most 1* | 0.676163 | 52.61929 | 47.85613 | 0.0167 |

| At most 2 | 0.380425 | 23.30391 | 29.79707 | 0.2314 |

| At most 3 | 0.308013 | 10.85716 | 15.49471 | 0.2204 |

| At most 4 | 0.048195 | 1.284279 | 3.841466 | 0.2571 |

Note: Trace test indicates 2 co-integrating eqn (s) at the 0.05 level; *denotes rejection of the hypothesis at the 0.05 level; **MacKinnon-Haug-Michelis (1999) p-values.

| Table 6: Co-Integration Test Based On Maximal Eigenvalue Of The Stochastic Matrix | ||||

| Hypothesized No. of CE(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | Prob** |

|---|---|---|---|---|

| None* | 0.870432 | 53.13235 | 33.87687 | 0.0001 |

| At most 1 | 0.676163 | 29.31537 | 27.58434 | 0.0297 |

| At most 2 | 0.380425 | 12.44675 | 21.13162 | 0.5042 |

| At most 3 | 0.308013 | 9.572878 | 14.26460 | 0.2415 |

| At most 4 | 0.048195 | 1.284279 | 3.841466 | 0.2571 |

Note: Max-eigenvalue test indicates 2 co-integrating eqn (s) at the 0.05 level; *denotes rejection of the hypothesis at the 0.05 level; **MacKinnon-Haug-Michelis (1999) p-values.

The variables can be equivalently represented in terms of a long-run DOLS framework, given that they are co-integrated.

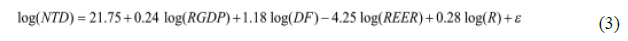

Table 7 exhibits the findings of the long-run DOLS estimates for equation 2. The explanatory power is high (R2=99.7), and all of the explanatory variables are significant at p<0.0l, except for real GDP, which is significant at p<0.05 as illustrated in Table A2 in the appendix.

| Table 7: Dols Estimates In The Long Run (1989-2015) | |

| Variable | Coefficient |

|---|---|

| C | 21.75a |

| LOG(RGDP) | 0.24b |

| LOG (DF) | 1.18ba |

| LOG (REER ) | -4.25a |

| LOG(R) | 0.28a |

| R2=99.7, Durbin-Watson=2.72 | |

Source: Table (A2) in Appendix.

Note: a and b indicate significance at the 1% and 5% levels, respectively.

Discussion

Countries that depend heavily on oil exports need to examine the influences of non-oil trade deficits on key economic variables, and they are further called upon to identify where and how to prioritize efforts to support economic sustainability (Behar & Fouejieu, 2016). The results of this study contribute to the body of literature that addresses the issue of trade deficits, specifically, the non-oil trade deficit in oil-exporting countries. Arguments regarding the importance of trade deficits in general offer different viewpoints. Many authors have argued that trade deficits are not a long-term problem or that they have little overall effect on economic growth (Ghosh & Ramakrishnan, 2006; Griswold, 1998; Udwadia & Agmon, 1988). Others strongly argue that trade deficits indicate poor economic health and threaten economic sustainability (Edwards, 2002; Moon, 2001:2005; Musisinyani et al., 2017). The results of this study serve to clarify how the non-oil trade deficit in Saudi Arabia relates to key variables that have been investigated in other research related to trade deficits, specifically, (a) real income, (b) relative national prices to foreign prices, (c) international reserves, and (d) real effective exchange rate.

In justifying the importance of trade deficits to developing countries, Moon (2005) posited that both political economists and economic policy makers acknowledge the importance of trade balance as a target of economic development policy. For policy makers, a deficit is often viewed as an indicator of policy failure, regardless of its source, and a deficit poses a problem to be solved. Political economists believe that trade deficits send signals to international investors and financiers, so deficits can have a substantial influence on economic and political outcomes. This perspective views trade deficits as potential causal determinants that can play a vital role in the development of poor nations. Moon (2001:2005) showed that trade deficits delay a country’s economic development. The substantial relationships found in this study between Saudi Arabia’s non-oil trade deficit and several key economic variables support Moon’s argument that trade deficits require attention and action from both political and policy perspectives. In other words, regardless of whether a trade deficit signals an imminent financial crisis, trade balance is a valid objective, and proactively managing large trade deficits is likely a wise thing to do. Furthermore, efforts to restore and maintain reasonable trade balance can be especially important to developing countries and oil-exporting countries in the face of declining prices.

The current results contradict findings reported by Behar & Fouejieu (2016) regarding relationships between exchange rates and account balances. These authors argue that fiscal policy is likely more important than attempts to control the exchange rate in managing trade deficits. However, the current results agree with Mohammad’s (2010) finding that Pakistan’s trade deficit was significantly correlated with its real effective exchange rate, as well as foreign income and direct investment, and domestic consumption. The demonstrated negative relationship between the non-oil trade deficit and real effective exchange rate in Saudi Arabia indicates that supporting exchange rates is an important component of managing the non-oil trade deficit in this country.

Theoretically, unsustainable current account deficits influence major economic variables, and past economic crises experiences imply that a current account deficit in excess of 5% indicates serious economic problems. For example, in 2011, the account deficit in Zimbabwe was 24.5% of its GDP, indicating the financial crisis (Musisinyani et al., 2017). Edwards (2002) argues that the current account deficit in a country is one of the most prominent indicators of an impending economic crisis, and that a current account deficit that exceeds 5% of GDP indicates an existing economic crisis, which was well demonstrated in Zimbabwe (Musisinyani et al., 2017).

Countries that depend heavily on oil exports need to examine the influences of non-oil trade deficits on key economic variables, and they are further called upon to identify where and how to prioritize efforts to support economic sustainability (Behar & Fouejieu, 2016). The results of this study serve to clarify how the non-oil trade deficit in Saudi Arabia relates to key variables that have been investigated in other research related to trade deficits, specifically, (a) real income, (b) relative national prices to foreign prices, (c) international reserves, and (d) real effective exchange rate.

A recent study indicated that Saudi Arabia’s economy is still heavily dependent on oilexports (Euchi et al., 2018). Furthermore, a detailed examination of Saudi Arabia’s economic structure between 1990 and 2015 shows that the non-oil trade deficit in Saudi Arabia accounted for between 21% and 28% percent of the non-oil GDP, and this value ranged between 12% and 19% of the total GDP. Therefore, based on arguments presented by other researchers (Edwards, 2002; Moon, 2001:2005; Musisinyani et al., 2017) it is in the best interest of the country to address this issue as part of promoting economic stability in the country. The results of our assessment demonstrate that a unique theoretical sign can be expected for the individual variables that were included in the analysis. This confirms that statistically significant positive relationships exist between the non-oil trade deficit and (a) real income, (b) relative national prices to foreign prices, and (c) international reserves. In contrast, a negative and considerable correlation was found between the real effective exchange rate and the non-oil trade deficit.

The positive relationship between Saudi Arabia’s non-oil trade deficit and relative domestic to foreign prices indicates a need to control domestic prices. So, policy makers are challenged with controlling the domestic inflation rate. Policy makers in Saudi Arabia face the additional challenge of managing finite oil reserves while considering the needs of both future and existing generations. Governments are often pressured to allocate a substantial share of oil revenues to the populace, generally as per capita spending such as wages or subsidies. Nonetheless, governments are able to balance such short-term necessities against factors like sustaining intergenerational equity and so on. In agreement with Euchi et al. (2018), the current study supports the importance of governments’ investing in health and education to establishing a sustainable framework for future economic development, as well as investing in adequate accumulation of the resources needed to allow sustainable per capita spending levels, particularly once oil reserves have been depleted. As such, economic decisions regarding oil revenues will dictate prosperity for generations to come.

Economic diversification and macroeconomic stability have been shown to fortify each other. The existing verifiable data confirms that countries that have varied economic structures are more likely to withstand sudden external disturbances. In 2008 and 2009, at the time of the great recession, economies with varied export structures were better equipped to weather the international trade shocks. Moreover, economies with more complex structures tend to have lower output volatility. Likewise, the instability of government revenue decreases as the country’s economy increases in complexity and diversification. Consequently, a low level of diversification and dependence on oil may partially explain the rather high instability in both output and government income noted in the oil-exporting economies of Arab countries between 2005 and 2014. Therefore, suitable economic and financial policies are required to foster macroeconomic stability, in turn creating a practical and varied non-oil sector (Behar & Fouejieu, 2016; Beidas-Strom & Cashin, 2011; Euchi et al., 2018; Ghosh & Ramakrishnan, 2006; Husain et al., 2015). The high relevance of the non-oil trade deficit in Saudi Arabia to other economic indicators analyzed in this study supports the importance of supporting economic diversification and coordinating efforts to create healthy trade balances.

Conclusions And Concluding Remarks

There are varying opinions throughout the literature regarding the factors that influence economic growth, and how trade deficits influence critical economic indicators. Given current economic trends worldwide, oil-exporting countries share the challenge of managing trade balances, so non-oil trade deficits are receiving closer attention. This study added precision and depth to ongoing discussions in this area by providing research that focused specifically on nonoil trade deficits.

Research has indicated that oil production has the highest contribution to economic growth in Saudi Arabia, followed by the tourism sector and entrepreneurship activity, and the contribution of education is positive, but insignificant. Such results clearly imply the need for diversification, and recently, the non-oil trade deficit has received considerable attention in this country. The results of the study provide empirical estimates for Saudi Arabia regarding the critical parameters of the non-oil trade deficit in Saudi Arabia from 1989 to 2015. The findings confirmed the existence of a significant positive relationship between the non-oil trade deficit in Saudi Arabia and the following factors: real income, relative domestic to foreign prices, and international reserves. There was a significant negative relationship between non-oil trade deficit and real effective exchange rate.

These results imply that policy-makers in Saudi Arabia should prioritize controlling domestic prices and supporting the real effective exchange rate. Furthermore, Saudi Arabia needs strategic plans and policies to promote the development of innovative and dynamic trade sectors that could hasten economic diversification. Given that economic diversification depends on creative processes that improve productivity, products that promote sustainable growth and new markets, and institutions that allow for more efficient production, policy makers should strive to develop economic policies that encourage both vertical and horizontal diversification beyond oil production. Such strategies would further integrate non-oil trade into the global value chain and attract foreign direct investment to the non-oil sector. Stimulating international trade in Saudi Arabia is a logical way to encourage vertical and horizontal diversification. Therefore the Saudi Arabian government has announced plans to establish four economic cities in different regions of the country in order to promote international trade, attract foreign investment, and diversify the non-oil sectors.

Overall, the present results imply that other countries may also benefit by focusing on domestic price control and supporting real effective exchange rates. However, the results and conclusions of this study may be limited in several respects. The geographic region examined was restricted to the kingdom of Saudi Arabia. Replicating this study in other countries may pose a challenge with regard to obtaining sufficient data across a 25-year period. Also, there may be substantial differences in how these variables operate in other oil-exporting countries because general economic and sociocultural conditions vary widely. Furthermore, the study generated only correlational evidence indicating directional relationships among the variables. Future research that seeks to establish causal relationships among the variables would provide both insight and feedback regarding the effectiveness of various policy interventions directed at reducing non-oil trade deficits. Potentially, path analyses could contribute information about dynamic relationships among the variables. It will be important to conduct studies that discover more precisely how real income, relative domestic to foreign prices, and international reserves interact to affect the non-oil trade deficit. Also, future research that provides similar data aggregated across several oil-exporting countries could identify consistent relationships or trends.

Appendix A: Tables

| Table (A1): Econometric Data (1989-2015) | |||||

| Period | Non-oil Trade Deficit (2010=100) (Billion Riyal) |

Gross Domestic Product (2010=100) (Billion Riyal) | Relative Domestic Prices to Foreign Prices | Real Effective Exchange Rate | International Reserves (Billion Dollars)* |

|---|---|---|---|---|---|

| 1989 | 82.33 | 61.71 | 0.25 | 0.7 | 18.59 |

| 1990 | 97.63 | 76.79 | 0.29 | 0.87 | 13.44 |

| 1991 | 117.83 | 96.14 | 0.32 | 1.55 | 13.3 |

| 1992 | 140.47 | 111.24 | 0.37 | 3.14 | 7.47 |

| 1993 | 113.56 | 139.1 | 0.4 | 3.32 | 9.22 |

| 1994 | 86.36 | 155.2 | 0.44 | 3.35 | 9.14 |

| 1995 | 94.62 | 175 | 0.46 | 3.39 | 10.4 |

| 1996 | 93.77 | 204 | 0.52 | 3.39 | 16.02 |

| 1997 | 94.32 | 229.4 | 0.54 | 3.39 | 16.21 |

| 1998 | 105.42 | 265.9 | 0.56 | 3.39 | 15.54 |

| 1999 | 100.27 | 287.4 | 0.57 | 3.39 | 18.33 |

| 2000 | 107.53 | 307.6 | 0.57 | 3.4 | 20.85 |

| 2001 | 106.3 | 340.1 | 0.57 | 3.47 | 18.87 |

| 2002 | 110.2 | 358.7 | 0.57 | 3.97 | 22.19 |

| 2003 | 141.7 | 378.9 | 0.57 | 4.5 | 24.54 |

| 2004 | 146.98 | 417.5 | 0.59 | 5.85 | 29.3 |

| 2005 | 182.08 | 485.3 | 0.64 | 6.2 | 157.39 |

| 2006 | 207.66 | 538.5 | 0.64 | 5.78 | 228.96 |

| 2007 | 263.37 | 617.7 | 0.67 | 5.73 | 309.29 |

| 2008 | 327.59 | 744.8 | 0.71 | 5.64 | 451.28 |

| 2009 | 253.29 | 895.5 | 0.81 | 5.43 | 420.98 |

| 2010 | 258.69 | 1042.2 | 0.91 | 5.54 | 459.31 |

| 2011 | 296.53 | 1206.6 | 1 | 5.62 | 556.57 |

| 2012 | 358.17 | 1371.1 | 1.07 | 5.93 | 673.74 |

| 2013 | 373.45 | 1656.6 | 1.12 | 6.06 | 737.8 |

| 2014 | 368.66 | 1843.8 | 1.21 | 6.87 | 744.44 |

| 2015 | 393.32 | 2101.9 | 1.31 | 7.08 | 626.99 |

Sources: Saudi Arabian Monetary Agency (SAMA), Annual Report, 2016.

Key: *World Bank, World Bank Development Indicator.

| Table (A2): Dynamic Ordinary Least Squares (Dols) Regression Results | |||||

| Dependent Variable: LOG (NTD) | |||||

| Method: Dynamic Least Squares (DOLS) | |||||

| Date: 03/22/17 Time: 09:20 | |||||

| Sample (adjusted): 1990 2014 | |||||

| Included observations: 25 after adjustments | |||||

| Co-integrating equation deterministics: C | |||||

| Fixed leads and lags specification (lead=1, lag=1) | |||||

| Long-run variance estimate (Bartlett kernel, Newey-West fixed bandwidth=3.000) | |||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. | |

|---|---|---|---|---|---|

| LOG (RGDP) | 0.237694 | 0.101315 | 2.346094 | 0.0470 | |

| LOG (REER) | -4.248433 | 0.540145 | -7.865351 | 0.0000 | |

| LOG (DF) | 1.178251 | 0.153861 | 7.657877 | 0.0001 | |

| LOG (R) | 0.279964 | 0.042411 | 6.601248 | 0.0002 | |

| C | 21.75187 | 2.914684 | 7.462856 | 0.0001 | |

| R-squared | 0.997483 | Mean dependent variable | 11.97901 | ||

| Adjusted R-squared | 0.992449 | S.D. dependent variable | 0.512552 | ||

| S.E. of regression | 0.044540 | Sum squared residence | 0.015871 | ||

| Durbin-Watson stat | 2.722340 | Long-run variance | 0.000888 | ||

References

- Akaike, H. (1973). Information theory as an extension of the maximum likelihood principle. Second International Symposium on Information Theory, 267-281.

- Arezki, R., & Hasanov, F. (2013). Global imbalances and petrodollars. The World Economy, 36(2), 213-232.

- Baharumshah, A.Z. (2001). The effect of exchange rates on bilateral trade balance: New evidence from Malaysia and Thailand. Asian Economic Journal, 15(2), 291-311.

- Bahmani-Oskoee, M., & Kantiapong, T. (2001). Bilateral J-curve between Thailand and her trading partners. Journal of Economic Development, 26(2), 107-117.

- Behar, A., & Fouejieu, A. (2016). External adjustment in oil exporters: The role of fiscal policy and the exchange rate.The World Economy,41(3), 926-957.

- Beidas-Strom, S., & Cashin, P.A. (2011). Are middle eastern current accounta imbalances excessive? International Monetary Fund.

- Dickey, D.A., & Fuller, W.A. (1979). Distribution of the estimators for autoregressive time series with a unit root.Journal of the American Statistical Association,74(366a), 427-431.

- Euchi, J., Omri, A., & Al-Tit, A. (2018). The pillars of economic diversification in Saudi Arabia.World Review of Science, Technology and Sustainable Development,14(4), 330-343.

- Falk, M. (2008).Determinants of the trade balance in industrialized countries(No. 013). FIW research reports.

- Ghosh, A., & Ramakrishnan, U. (2006). Do current account deficits matter? Finance and Development: A Quarterly Magazine of the IMF, 43(4), 44-45.

- Griswold, D.T. (1998). America's maligned and misunderstood trade deficit.USA Today-New York,127, 14-17.

- Hacker, R.S., & Hatemi-J, A. (2002). The effect of exchange rate changes on trade balances in the short and long run: Evidence from German trade with transitional central European economies.Economics of Transition,12(4), 777-799.

- Husain, M.A.M., Arezki, M.R., Breuer, M.P., Haksar, M.V., Helbling, M.T., Medas, P.A., & Sommer, M. (2015).Global implications of lower oil prices(No. 15). International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/sdn/2015/sdn1515.pdf

- Ibrahim M. (2016). Trade deficit in Egypt: Is it can be controlled? Advances in Management & Applied Economics, 6(6), 89-10.

- Mohammad, S.D. (2010). Determinants of balance of trade: Case study of Pakistan. European Journal of Scientific Research, 41(1), 13-20.

- Moon, B.E. (2001). The dangers of deficits: Reconsidering outward-oriented development. InInternational Studies Association-Hong Kong conference Globalization and its Challenges in the 21st Century, 26-28.

- Moon, B.E. (2005). Deficits in trade, deficits in development. Inannual meeting of the International Studies Association, Honolulu,1-5.

- Oke, O.A. (2007). International trade as an engine of growth in developing countries: A case study of Nigeria (1980-2003). Retrieved from http://searchwarp.com/swa213339.htm

- Phillips, P.C., & Perron, P. (1988). Testing for a unit root in time series regression.Biometrika,75(2), 335-346.

- Rodrik, D. (2001). The global governance of trade: As if development really mattered. Retrieved from https://wcfia.harvard.edu/files/wcfia/files/529_rodrik5.pdf

- Rose, A.K., & Yellen, J.L. (1989). Is there a J-curve?Journal of Monetary Economics,24(1), 53-68.

- Saudi Arabian Monetary Agency (SAMA) (2015). Annual report, No. 52. Retrieved from http://www.sama.gov.sa/ar-sa/EconomicReports/Pages/AnnualReport.aspx

- Saudi Arabian Monetary Agency (SAMA) (2016). Annual report, No. 52. Retrieved from http://www.sama.gov.sa/ar-sa/EconomicReports/Pages/AnnualReport.aspx

- Saudi Arabian Monetary Agency (SAMA) (2017). Annual statistics. Retrieved from http://www.sama.gov.sa/ar-sa/EconomicReports/Pages/YearlyStatistics.aspx

- Stock, J.H., & Watson, M.W. (1993). A simple estimator of co-integrating vectors in higher order integrated systems. Econometrica, 61(4), 783-820.

- Trading Economics.com. (2019). Balance of trade. Retrieved from https://tradingeconomics.com/saudi-arabia/balance-of-trade

- Udwandia, F.E., & Agmon T. (1988). Trade deficits: A look beyond the economic view. Technological Forecasting and Social Change, 33, 109-118.

- Versailles, B. (2015). MENAP oil-exporting countries: Grappling with lower oil prices and conflicts. In Regional economic outlook: Middle East and Central Asia, October 2017, (pp.19-32). International monetary fund.

- World Bank Development Indicator (2010). World bank.