Research Article: 2017 Vol: 18 Issue: 1

The Nexus Between Foreign Direct Investment, Economic Growth and Public Debt in the Southern Mediterranean Countries: Evidence From Dynamic Simultaneous-Equation models

University of Sfax

Nizar Zouidi

University of Gafsa

Sami Hammami

University of Sfax

Keywords

GDP, Foreign Direct Investment, Public Debt, GMM.

Introduction

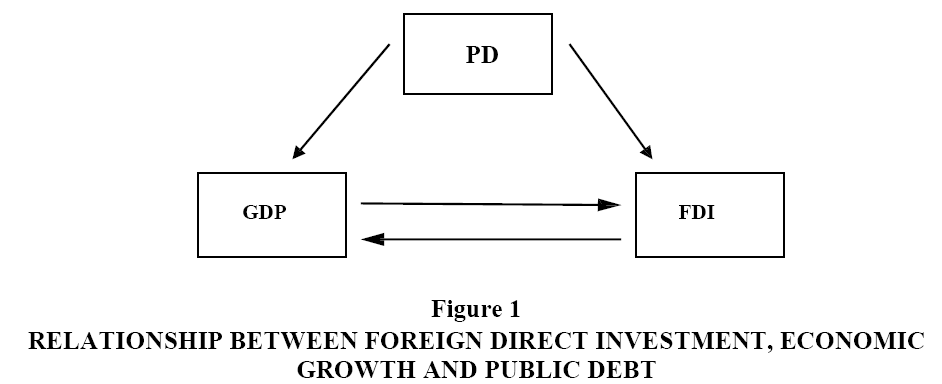

Nowadays, the nexus among public debt (PD), foreign direct investment (FDI) and economic growth is at the heart of the research debate. This study deals with three major axes. First, it shows the impact of public debt and foreign direct investment on the Gross domestic product (GDP) (Serrao, 2016; Atul & Amirkhalkhali, 2014; Mo, 2001; Beja, 2007). Then, it explores the impact of foreign direct investment and gross domestic product on the public debt (Jurgita & Ausrine, 2013; Nguyen, 2015). Finally, it looks into the impact of public debt and gross domestic product on foreign direct investment (Azeez, 2015; Jilenga, 2016; Avom, 2015; Moga, 2016).

The southern Mediterranean countries are vulnerable to both the impact of the economic crisis (subprime 2007) and the Arab spring movement. These economic shocks had a significant impact on trade, foreign direct investment and economic growth. In other words, these countries are vulnerable to such crisis. Moreover, the 2007 financial crisis led to the slowdown of economic activity, the rise of the global financial volatility and the spread of the factors that decrease the degree of resilience of the different economies in the region. These global economic problems had been aggravated by the immediate negative impact of the 2011 Tunisian revolution which was characterized by a long period of uncertainty and instability. During that period, this southern Mediterranean region became the epicentre of a wave of political, social and economic transitions. As a result, Tunisia has been going through a period of profound transformation that give rise to new challenges and opportunities.

The slowdown of the global economy and the decline of the European FDI have impacted the southern Mediterranean countries although they are less integrated into the global economy since the European FDI does not exceed 50% of the total amount of investment (IMF 2013).

In recent years, Southern Mediterranean countries have attempted to attract FDI through various measures such as macroeconomic stabilization, exchange rate policies, signing of partnership agreements with Europe, tax exemption and the institutional reforms. The adoption advent of these measures led to the liberation of initiative, the stimulation of foreign direct investment and the expansion of the economic activity.

Foreign direct investment is an important factor that could increase economic growth, adapt the offer to the business needs and solve the problems in the labour market. However, the increase of the public debt and the weakness of foreign direct investment in the country had an impact on liquidity, unemployment rate, exports, inflation and economic growth. According to Carton (2013), low economic growth causes an increase of the public debt rate and a lower foreign direct investment.

The direct links between public debt, the foreign direct investment and the economy are the subject of a current debate, various authors argue that the importance of foreign direct investment and public debt in terms of economic policy (Rogoff, 2009; Cecchetti & Fabrizio, 2011; Rahman, 2015; Muritala, 2011).

The main objective of this article is to examine the relationship between public debt, foreign direct investment and economic growth in the southern Mediterranean countries. For this reason, the remaining part of this paper is organized as follows. Section one presents a literature review. The second section discusses the methodology and the econometric specification. Section third reports and discusses the results and finally presents the conclusion and the implications.

Literature Review

Public Debt and Economic Growth

The link between economic growth and public debt has been widely studied. The lack of a consensus in the results of studies about the same country or the same geographical area is related to the methodological differences, which are generally very diverse and often contradictory. The nature of the studied data also contributes to these differences. For example, Serrao (2016) studied the relationship between public debt and economic growth in some advanced economies over the 1946/2009 period. Their results show that the real GDP growth rate has not declined sharply whereas the public debt-to-GDP ratio is lower than 220%. Besides, their study showed that a negative effect of public debt is stronger on the real GDP growth rate only in the advanced economies when the public debt-to-GDP ratio is above 220%. Their research also found that the public debt/GDP ratio would strongly decrease the real GDP growth rate in the advanced countries when the public debt/GDP ratio goes above 220%. Their research also found that the public debt/GDP ratio would strongly decrease the real GDP growth rate in the advanced countries when the public debt/GDP ratio goes above 220%. More recently, in the OECD countries, Atul & Amirkhalkhali (2014) have investigated the impact of public debt on economic growth over the 1996-2007 period, using a Swamy random generalized least squares (RGLS) technique. It was found that the public debt coefficient was negative, but small and not statistically significant. In the case of the country-specific estimates of the model, the impact of the debt-to-GDP ratio on economic growth was mixed, but still insignificant for all the countries excepting Luxembourg and the USA.

Abdelhafidh (2013) studied the impact of debt on economic growth in Tunisia over the 1970-2010 periods. Using the autoregressive distributed lag approach, we found that in the long-as well as in the short-run, external debt have a negative effect on economic growth. In addition, the results obtained suggest that the debt accumulated by Tunisia between 1970 and 2010 decreased its economic growth. Debt has a negative effect on growth in an environment conducive to corruption and capital flight. These two factors have negatively influenced the economic growth (Mo, 2001; Beja, 2007). Aide WADE (2014) studied the relationship between public debt and economic growth in the West African Economic and Monetary Union (WAEMU) zone over the 1950/2014 period. The author used panel data of eight macroeconomic variables (The GDP per capita growth, the population growth rate, the inflation rate, public debt (% of GDP). The applications of the generalized method of moments suggest that the effect of the public debt on economic growth is positive at the level of 48%. Beyond this level, any increase of public debt has a negative effect on economic growth. These findings are further confirmed through the use of the well-known Hansen threshold method, which found a threshold of 49.83%. Beyond this threshold, a one percentage point increase of the public debt-to-GDP reduces economic growth by 0.08 percent.

Recently, Reinhart & Rogoff (2010) have analysed the evolutions of public debt and the real growth rate for 40 countries. Their results revealed a weak relationship between government debt and long-term growth for debt levels below 90% of GDP. Regarding the emerging and advanced economies, Kumar & Woo (2010) showed an inverse relationship between debt and economic growth. When the debt-to-GDP ratio increases by 10 percent points, GDP per capita growth decreases by about 0.2 percentage point per year. Only the high debt levels, above 90% of GDP, have a significant negative effect on economic growth.

Until recent years, little empirical literature has attempted to explain the link between government debt and economic growth. For instance (Cecchetti & Fabrizio, 2011) examined the annual data about the GDP per capita and the non-financial sector debt in 18 OECD countries over the period 1980-2010. Their results revealed a negative relationship between government debt and economic growth. In another work, analysed the impact of government debt on economic growth in 12 Euro Area countries over the four consecutive decades up to 1970. The authors showed a non-linear impact of debt on economic growth in the European countries. This impact becomes negative when government debt exceeds 90% of GDP.

Economic Growth and Foreign Direct Investment

There are many studies which tested the effect of FDI on economic growth. In a recent study that focuses on Bangladesh, Rahman (2015) studied the relationship between economic growth and foreign direct investment for the period 1999 and 2013 using a panel data to macroeconomic variables (FDI inflow, GDP Growth rate %, CPI inflation, Balance of trade). Based on multiple regression technique, we found that foreign direct investment had a positive effect on economic growth and inflation rate and a negative relationship between foreign direct investment and balance of in Bangladesh. Khaliq & Noy (2007) uses twelve sectors of foreign direct investment to determine the relationship economic growth and foreign direct investment in Indonesia over the period 1997-2006. The results obtained suggest that the electricity, gas and water have a positive impact on economic growth. However, transport communications and other private and services sectors have a negative impact on economic growth. Ledyaeva & Linden (2006) analysed the interaction between foreign direct investment and economic growth. The applications GMM-model suggests that economic growth can explain by foreign direct investment in the analysed period. Moreover, the initial income has a significant negative effect on economic growth. The coefficient is 0.69 and this indicates that initial income decreases by 0.69% when there is an increase of 5% debt to GDP.

Mohanasundaram & Karthikeyan (2015) studied the causal link between economic growth and foreign direct investment in India between 1971 and 2006. Their results show the existence of a unidirectional relationship going from FDI to GDP. In their study, they used the Granger causality test, the Johansen co-integration test and the vector autoregression (VAR) model. In the same vein, Omri et al. (2014) used the GMM for 13 Middle East and North African countries (MENA) to examine the relationship between foreign investment, domestic capital and economic growth. Their results show that there is a bi-directional causal relationship between foreign investment and economic growth. Muritala (2011) used the Ordinary Least Square (OLS) technique to examine the impact of investment and inflation on economic growth performance. The results of the regression revealed that, on the one hand, there is positive relationship between investment and economic performance and, on the other hand, there is a negative correlation between inflation and economic growth.

In study about some European Union countries (Bulgaria, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovak Republic and Slovenia), Acaravci & Ozturk (2012), used Autoregressive Distributed Lag (ARDL) model approach to investigate the existence of a long-run relationship between FDI, exports and economic growth. They found a causal relationship between FDI, export and economic growth in four out of ten the countries considered.

Many studies have focused on the African countries. Some of them examined the relationship between FDI and economic growth for a single country whereas others dealt with it for multiplies countries. For instance, Antwi & Xicang (2013) studied the relationship between FDI and economic growth in Ghana for the period 1980-2010 using time series data. Their results showed that the GDP independent variable is significant in explaining FDI. On the other hand, on investigating the determinants of foreign direct investment, Almfrajia, Mahmoud & Liu (2013) found that several factors, such as the adequate levels of human capital, well-developed financial markets and open trade regimes, can affect FDI.

Economic Growth, Public Debt and Foreign Direct Investment

The third line of research analyses the relationship between economic growths, foreign direct investment. In this context, we can cite some recent investigations conducted by (Azeez & Fapet, 2015; Avom & Luc, 2015; Moga & Jilenga, 2016; Checherita & Rother, 2010).

A different line of research is represented by Moga & Jilenga, (2016) who examined the relationship between external debt, investment and economic growth for Tanzania over the period 1971/2011 using the ARDL model and the Bounds test approach of co-integration. Their results support the idea that debt helps to promote investment and stimulate long-term economic growth. On their part, in a study carried out about Nigeria over the period of 1990-2013, Azeez & Fapet (2015) showed that debt is negatively and insignificantly related to economic growth while foreign direct investment is significantly related. Indeed, foreign direct investment is believed to be significant for economic growth. Therefore, foreign direct investment inflows tend to have more impact on the Nigerian economy than external debt inflows do.

Furthermore, Checherita & Rother (2010) analysed the relationship between the government?s debt-to-GDP ratio, the investment and the per-capita GDP growth rate through a sample of 12 Euro zone countries (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal and Spain) for a period of roughly four decades starting in 1970. Their results revealed that the government debt (level or change) is found to have an impact on the economic growth rate.

There are other studies, about the Central African Economic and Monetary Community (CEMAC). For instance, Avom & Fabrizio (2015) studied the incidence of external debt on macro-economic indicators. Their results show a negative impact of external debt on both domestic investment and economic growth. The effect on growth begins at a given threshold which implies the existence of Laffer?s debt curve.

Econometric Method and Data

In this paper, we examine the three-way linkages between foreign direct investment, public debt and economic growth for nine southern Mediterranean countries, namely Tunisia, Algeria, Egypt, Jordan, Libya, Lebanon, Morocco, Syria and Turkey. The data are obtained from the World Development Indicators produced by the World Bank. The Public debt, foreign investment and economic growth are in fact endogenous. As mentioned earlier, most existing literature supposes that economic growth is likely to lead to changes foreign direct investment and public debt. It also establishes that these two variables are often key determinants of economic growth. Hence, the interrelationship between GDP, public debt and foreign direct investment should be considered simultaneous in a modelling framework. This is why we opt for the Cobb-Douglas production function as follows:

Yit=KPD?it FDI?it (1)

After logarithmic transformation Eq. (1) is written as follows:

LnYit=?0+?1i LnPDit+?2i LnFDIit+?it (2)

Where the subscript i=1, ?, N denotes the country and t=1, ?, T denotes the time period (the period of study is 1990-2015); ln Yit is the real gross domestic product, PD represents the level of the public debt and FDI indicates the foreign direct investment. K is the growth factor and the residual term. We then transform the production function Eq. (2), into regression equations to derive the empirical models to simultaneously examine the interactions between GDP, public debt and foreign direct investment. These simultaneous equations are constructed on the basis of theoretical and empirical insights of the recent literature. The three-way linkage between these variable is presented in the following three equations:

LnGDPit=?0+?1i LnPDit+?2i LnFDIit+?3i LnURit+?4i LnPOPit ?it (3)

LnPDit=?0+?1i lnGDPit+?2i LnFDIit+?3i LnEXPit+?4i LnRSVit ?it (4)

LnFDIit=?0+?1i LnPDit+?2i lnGDPit+?3i LnRERit+?4i LnINFit+?5i LnINFit ?it (5)

Our study covers the Southern Mediterranean countries and then we use annual data over the period 1990-2015.We defines the variables as follows:

GDP: Real GDP per capita, proxy for economic growth of a country

FDI: Foreign Direct Investment

PD: Public Debt

RER: Real Exchange Rate

POP: Population

INF: Inflation

OPN: Indicator of Openness

EXP: Exportations

UR: Unemployment Rate

RSV: Total of Reserves

Eq. (3) enables us to examine the impact of foreign direct investment and the public debt on economic growth. In fact, an increase of foreign direct investment is likely to increase economic growth (Pelinescu and Magdalena, 2009) while an increase public debt can decrease economic growth (Kumar and Woo, 2010). Indeed, this equation states that public debt and FDI and other variables, namely, unemployment rate and population can determine economic growth (Wade, 2014; Malam & Abubakar, 2015).

Moreover, inflation, exchange rate and unemployment might be strongly linked to foreign direct investment and, therefore, may be determinant factors of economic growth. Oyin (2014) found that foreign direct investment is a factor of economic development, which was confirmed by Dinda (2009) & Asiedu (2006).

Eq (4) shows the interaction between economic growth and foreign direct investment with the public debt. For this part, we try to explain how public debt acts in the presence of FDI and GDP. As a result, we include the exportations (Jurgita et al., 2013), the total reserves (Nguyen, 2015). This author showed that in all cases, an inflation increase leads to the debt decrease.

Eq (5) examines the determinants of foreign direct investment. An increase of GDP will probably increase foreign direct investment (Lim and Pahlaj, 2013; Ngellechey, 2015; Issam, 2016; Omri, 2014). Actually, Foreign Direct Investment is widely believed to have positive effects on economic growth, as both of them are complementary or substitutable.

Moreover, public debt has a greater positive impact on FDI (Ngellechey, 2015; Ribeiro, 2012; Vaicekauskas & Lakstutiene, 2012). In contrast, Ostadi and Ashja (2014) showed that external debt has a significant negative effect on foreign direct investment, whereas a high foreign debt damages the foreign investor?s vision and creates negative expectations of the future economy, which reduces investment. For this reason, we include the real exchange rate, which is a variable that affects foreign direct investment (Nikolina & Pangiis, 2000; Osinubi & Tokunbo 2009; Patrick et al. (2013). An accelerated appreciation of the real exchange rate can reduce the accumulation of FDI. Another variable can determine foreign direct investment, inflation (Ker & Poon (2012); Ehimare (2011) and trade openness (Mebratu, 2013).

The above simultaneous equations are estimated by the GMM method and the Arellano & Bond?s GMM method and Arellano estimator (1991). The GMM method is the most commonly used in models with panel data, besides, it uses a set of instrumental variables to solve the problem of endogeneity. It also avoids the estimation bias that may arise from the correlation between the lagged dependent variables and the error terms.

The statistical description of all variables is presented in the Table 1.

| Table 1 Descriptive Statistics |

||||

| Variables | Mean | Std-Dev | Min | Max |

| GDP | 0.7345116 | 1.764132 | 0.0156213 | 10.43207 |

| FDI | 72.9354 | 4.24571 2 | 0.0602316 | 1293.787 |

| PD | 26.12569 | 13.59477 | 3.418521 | 76.18931 |

| RER | 2.1532 | 2.315609 | 1.24564 | 10.1275 |

| POP | 4.95894 | 4.056746 | 1.55641 | 8.54038 |

| INF | 8.335124 | 0.1635375 | 8.789091 | 10.8786 |

| OPN | 6.843196 | 0.956258 | 6.356276 | 6.36399 |

| EXP | 1.95162 | 25.7769 | 31.30998 | 89.7467 |

| UR | 2.564458 | 0.1065476 | 0.1521433 | 1.68912 |

| RSV | 26.98978 | 17.43687 | 3.823152 | 65.1496 |

The correlation matrix coefficient for the variables is given in Table 2. In fact, all the correlation coefficients between the explanation variables and the dependent variable are statistically significant at 5% at least. Accordingly, public debt, inflation and unemployment are negatively correlated with economic growth while trade openness, foreign direct investment, population and exportations are positively linked to economic growth. In addition, all the correlation coefficients between the independent variables are relatively low, which helps to eliminate the possibility of co-linearity between these variables.

| Table 2 Matrix of Correlation |

||||||||||

| Vrbs | GDP | PD | FDI | RER | POP | INF | RIR | EXP | UR | RSV |

| GDP | 1.0000 | ? | ? | ? | ? | ? | ? | ? | ? | ? |

| PD | -0. 20015* | 1.0000 | ? | ? | ? | ? | ? | ? | ? | ? |

| IDE | 0.18394** | 0.97271 | 1.0000 | ? | ? | ? | ? | ? | ? | ? |

| RER | 0.05321 | 0.72173 | 0.42178 | 1.0000 | ? | ? | ? | ? | ? | ? |

| POP | -0.08275* | 0.015829 | 0.26721 | -0.15471* | 1.0000 | ? | ? | ? | ? | ? |

| INF | -0.0958** | 0.389475 | -0.8746** | 0.08321 | 0.54690 | 1.0000 | ? | ? | ? | ? |

| OPN | 0.27484** | 0.21457 | 0.54289 | -0.01528* | 0.07361 | 0.88378 | 1.0000 | ? | ? | ? |

| EXP | 0.15043* | 0.094672 | 0.52142 | 0.42849 | 0.0931** | 0.03675 | 0.53810 | 1.0000 | ? | ? |

| UR | -0.01679* | 0.527841 | -0.67271* | 0.51742 | -0.5205 | 0.5217* | 0.07109 | -0.6210* | 1.0000 | ? |

| RSV | 0.073216 | 0.543274 | 0.864361 | 0.02748* | 0.64578 | 0.46571 | 0.89321 | 0.73211 | 0.4732 | 1.0000 |

Results of the GMM Estimates

To estimate the three way linkage between economic growth, foreign direct investment and public debt in some southern Mediterranean countries during 1990-2015, we use Arellano & Bond?s (1991) GMM. This model is the most commonly used method with panel data. However, the choice of the method is made because this method to be accurate and effective.

In this paper, three specifications tests are used for the simultaneous equation: The first is the test of over identification restrictions (Sargan/Hansen) to provide some evidence of the instruments' validity. In fact, the acceptance of the null hypothesis indicates the validity of the over identification restrictions. The second is the best of endogeneity/exogeneity (the Durbin?Wu?Hausman), which examines the presence of a correlation between the specific effects and the explanatory variables. The aim of this test is to choose between the fixed and the random effects models, Kpodar (2007). A rejection of the null indicates that endogenous regressors effects on the estimates are meaningful. Finally, the third is the autocorrelation of Arellano and Bond (1991), which tracks the existence of the second order autocorrelation in first differences. In fact, the null hypothesis indicates the absence of first and second order autocorrelation in the equation.

Table 3 presents the empirical methods for the assessment of the interactions between economic growth, foreign direct investment and public debt. For this reason, the Arellano and Bond (1991) GMM approach is used for all the countries. Eq (3) shows that the effect of the public debt on economic growth in the Southern Mediterranean countries is negative and statistically significant, which indicates that an increase of public debt by ten percent leads to a decrease of economic growth by 0.121%. This confirms the results showed by Kumar and Woo (2010), Cecchetti & Fabrizio (2011), Serrao (2016). As it was expected, foreign direct investment is positively and significantly related to economic growth. This result is consistent with the literature. It indicates that foreign direct investment can influence economic growth through the transfer of technology, knowledge and the human capital accumulation. Foreign direct investment played an important role to increase the economic growth. In fact, it is an important factor in technology transfer, stimulating creativity and innovation and improving business competitiveness. Therefore, FDI has a positive impact on economic growth.

| Table 3 Estimation Results by Simultaneous Equations ? |

||||||

| Variables | Economic growth | Public debt | Foreign direct investment | |||

| Coefficient | p-value | Coefficient | p-value | Coefficient | p-value | |

| GDP | - | - | -0.8472 | 0.945 | 1.984 | 0.043** |

| Public debt | -0.121 | 0.000* | - | - | -0.345 | -0.000* |

| FDI | 0.152 | 0.04** | -0.783 | -0.892 | - | - |

| RER | - | - | -0.164 | 0.05 | ||

| POP | -0.0524 | 0.09*** | - | - | - | - |

| INF | - | - | -1.094 | 0.089*** | 0.712 | 1.892 |

| OPN | - | - | - | - | 0.839 | 0.000* |

| EXP | - | - | -0.429 | 1.517 | - | - |

| UR | -0.381 | 0.621 | - | - | - | - |

| RV | - | - | 2.094 | 1.762 | - | - |

| Const | -0.345 | 0.000* | - | 0.432 | 0.2145 | 0.000* |

| Hansen J-test | 31.654 | 0.257 | -0.589 | 0.327 | 22.826 | 0.524 |

| DWH test (p- value) | 21.451 | 0.000* | - | - | 17.41 | 0.000* |

| AR2 test | -1.53 | 0.389 | -0.891 | 0.852 | -0.199 | 0.011* |

Hansen J-test refers to the over identification test for the restrictions in GMM estimation. The Durbin?Wu?Hausman (DWH) is the test for endogeneity. The AR2 test is the Arellano? Bond test for the existence of the second-order autocorrelation in first differences.

* Coefficient significantat1% level.

** Coefficient significantat5% level.

*** Coefficient significantat10% level.

On the other hand, the population growth has a negative and significant effect on economic growth, which fell by 0.052% following a 10% increase of population. This result is consistent with the literature that indicates that population has a positive effect on economic growth in terms of unemployment (Wade, 2014; Furuoka, 2010). In recent years, the relationship between population and economic development in the Southern Mediterranean countries has attracted a considerable attention from economists and researchers. For example, Furuoka (2010) showed that an important part of the working population is not economically active.

Moreover, rising unemployment creates uncertainty, which negatively affects economic growth. However, the increase of the unemployment rate in the Southern Mediterranean countries has an impact on liquidity, foreign debt, exports, inflation and economic growth. In this context, the rise of the unemployment rate is an indicator of resilience and a huge macroeconomic imbalance and fragility. Unemployment, which is one of the major macroeconomic imbalances, is particularly linked to the dynamics of an aggregate demand, the evolution and the transformation of economic structures and technical progress. The unemployment problem will not be solved quickly because the active population is growing and newcomers to the labour market are adding to the stock of people already unemployed.

Eq (4) shows the interaction between economic growth and foreign direct investment to public debt. In this context, we try to explain how public debt acts in the presence of GDP and FDI. This equation also shows that both GDP growth and the stock of foreign direct investment have a positive but not significant effect on the southern Mediterranean region. This is the conservation hypothesis, which states that there is a unidirectional causal relationship between public debt and foreign direct investment. Regarding inflation, there is a negative and significant effect running from inflation to public debt. The inflation coefficient is 1.094, indicating that an increase of inflation by 10% leads to a decrease of public debt by 1.094%. The Southern Mediterranean countries, especially Tunisia, Egypt, Libya and Syria, have had too high inflation levels. For instance, in Tunisia, it reached almost 6.4% due to the effect of the revolution, the political instability and high international food and fuel prices negatively affected the domestic prices, despite the high-level of the subsidies. The same results were found by van Bon (2015).

The empirical findings of Eq. (5) show that public debt has a significant negative effect on foreign direct investment. The coefficient is 0.345, which indicates that an increase of public debt by 0.345 decreases foreign direct investment by 1%. The same results were found by (Muhammad & Asmat, 2011; Yasmin et al., 2003). This means that higher public debt creates constraints in private lending and foreign direct investment, besides it discourages FDI inflows. As it was expected, the impact of economic growth on foreign direct investment is positive and statistically significant. This result supports the idea that economic growth is actively encouraging the inflow of foreign direct investment into the market. This confirms the results showed by Xiaohui & Sinclair (2002); Ang (2008). Then, another determinant of foreign direct investment is trade openness which has a negative and statistically insignificant on foreign direct investment. This means that trade openness is likely to be more successful in attracting FDI. The signing of partnership agreements with Europe, the tax exemption and the openness policy in the Southern Mediterranean countries are a source of FDI attractiveness and economic growth. Trade openness should have a positive impact on foreign direct investment, which contributes to the reduction of the debt to GDP ratio (Berg and Krueger, 2003).

Therefore, according to the overall results, three concluding remarks are made. First, there is a bi-directional causal relationship between foreign investment and economic growth. Second there is a uni-directional causal relationship between public debt and economic growth. Finally there is a uni-directional causal relationship between public debt and foreign direct investment for the Southern Mediterranean region as a whole (Figure 1).

Conclusion

For the last few years, the issue of causality relationship among foreign direct investment, public debt and economic growth has been an interesting topic concerning development economic economists. The foreign direct investment is an important factor to ensure economic growth in southern Mediterranean countries and recognized as one of the most important strategic commodities (Asiedu, 2006). The objective of this study is to determine the causal relationship between foreign direct investment, public debt and economic growth in southern Mediterranean countries. To achieve our goal, we used annual data for 26 years from 1990 to 2015. Several studies have examined this relationship in these countries, but no study investigated this interaction via simultaneous equation.

Empirical results showed that first; there is a bi-directional causal relationship between foreign investment and economic growth. Second, there is a unidirectional causal relationship from public debt to economic growth. Finally, there is a unidirectional causal relationship between public debt and foreign direct investment. Our findings present a bidirectional causal relationship between foreign direct investment and economic growth, a high-level of foreign direct investment leads to a high-level of economic growth and vice versa. This result supports the idea that foreign direct investment considered very important for the economic development and economic growth in the southern Mediterranean countries.

The main policy implications arising from our study can be presented as follows: first, evidence showed that the public debt of the southern Mediterranean countries is very heavy. Therefore, it is necessary to orient the economic policies to improve the debt service to support economic growth and improve the standard of living. In addition, the stabilization of the debt ratio generally leads to a significant investment growth. Secondly, democratic transition, political instability and poor governance present a challenge to attracting foreign direct investment in the southern Mediterranean countries. Besides, it is important for policy makers to implement sound economic policies which can attract the foreign direct investment and improve the debt services. These reforms improve the efficiency of the economy and strengthen the aspects of supply in the economy.

Future research should also focus on the relationship between the foreign direct investment, public debt and trade openness in the southern Mediterranean countries. However, we believe that this research provides empirical results which are useful for the understanding of this type of national economy in the region as well as in determining the most effective the economic policies in order to increase economic development. It is apparent globally that the economic and public policies in the southern Mediterranean countries will necessarily be implemented jointly to create both growth and to best limit the public debt increase. However, the question remains, can the country to consider implementing these public policies?

References

- Abdelhafidh, S. (2013).Dette ext?rieure et croissance ?conomique en Tunisie. Panoeconomicus, 6, 669-689.

- Abdul, K. & Ilan, N. (2007). Foreign direct investment and economic growth: Empirical evidence from sectoral data in Indonesia. Review of Development Economics, 7(1), 44-57.

- Afzalur, R. (2015). Impact of foreign direct investment on economic growth. Empirical evidence from Bangladesh. International Journal of Economics and Finance, 7(2).

- Ali, A. & Ilhan, O. (2012). Foreign direct investment, export and economic growth: empirical evidence empirical evidence from New EU countries. Romanian Journal of Economics.

- Asiedu, E. (2006). Foreign direct investment in Africa: The role of natural resources, market, size, government policy, institutions and political stability. World Economy, 29(1), 63-77.

- Aida, W. (2014). L?impact de la dette publique sur la croissance ?conomique dans la zone UEMOA?Working paper.

- Alex, E. (2011). Effect of exchange rate and inflation on foreign direct investment and its relationship with economic growth in Nigeria. Economics and Applied Informatics, 11(1), 16.

- Almfrajia, M.A., Mahmoud, K.A. & Liu, Y. (2013). Economic growth and foreign direct investment inflows. The case of Qatar. Procedia - Social and Behavioural Sciences, 109, 1040-1045.

- Amilcar, S. (2016). Impact of public debt on economic growth in advanced economies. International Journal of Managerial Studies and Research (IJMSR), 4(2), 70-76.

- Ang, J. (2008). Determinants of foreign direct investment in Malaysia. 2(3).

- Elizabeth, A. (2006), Foreign direct investment in Africa: The role of natural resources, market size, government policy, institutions and political instability. The World Economy. 29(1), 63-77.

- Bello, M. & Auwal, A. (2015). Do unemployment and inflation substantially effect economic growth? Journal of Economics and Development Studies, 3(2), 132-139.

- Bolanle, A. & Fapet, O. (2015). External debt or foreign direct investment: which has creator significant economic impact on Nigeria? European Scientific Journal, 11(19).

- Cecchetti, G., Mohanty, M. & Zampolli, F. (2010). The future of public debt: Prospects and implications. BIS Working Papers No. 300.Bank for International Settle public debt and foreign direct investments.

- Checherita, C. & Rother, P. (2010). The impact of high and growing government debt on economic growth. An empirical investigation for the euro area. (ECB Working Paper Series No. 1237).

- Cristina, C. & Philipp, R. (2010). The impact high and growing government debt on economic growth an empirical investigation for the Euro area. Working paper series, No. 1237.

- Cecchetti M. & Fabrizio, Z. (2011).The real effects of debt. BIS Working papers No. 352.

- Desir, A., Luc, N., Ars?ne, A. & Njamen, K. (2015). ?La dette ext?rieure sujette pour la Croissance ?conomique et l?investissement? Working Paper Series.

- Dar A. & Amirkhalkhali, S. (2014). On the impact of public debt on economic growth. Applied Econometrics and International Development, 14(1).

- Dinda, S. (2009). Factors affecting FDI in Nigeria: Empirical investigation. Mandras School of Economics.

- Elena, P. & Magdalena, R. (2009). The impact of foreign direct investment on the economic growth and countries export potential. Romanian Journal of Economic Forecasting. Institute of Economic Forecasting.

- Edsel, B. (2007). Capital flight and economic performance. Munich Personal RePEc Archive.

- Fumitaka, F. (2010). The fertility-development relationship in the United States. New evidence from threshold regression analysis. Economics Bulletin, Access Econ, 30(3), 1808-1822.

- Ilan, N. (2007).What do exogenous shocks tell us about growth theories? University of Hawaii working paper, 7-28.

- Issam, A. (2016). Foreign direct investment in Lebanon. International Journal of Economy, Management and Social Sciences, 5(3), 39-51.

- Jurgita, S. & Ausrine, L.(2013). The interaction of public debt and macroeconomic factors: Case of the Baltic states. Economics and Business.

- Kumar, M.J. & Woo. (2010). Public debt and growth. IMF Working Paper 10/174.

- Lim, G. & Pahl, M. (2013).The relationship between gross domestic product and foreign direct investment: The case of Cambodia. KASBIT Business Journal, 6, 87-99.

- Marilen, G., Pirtea, A. & Paulo, R. (2013). An empirical study on public debt?s determinants: Evidence from Romania. Transylvanian Review of Administrative Sciences, No. 38 E/2013, 144-157.

- Mikael, L. (2006). Testing for foreign direct investment gravity model for Russian regions. Working Paper.?

- Muhammad, A. & Asmat, U. (2011). Impact of public debt on foreign direct investment in Pakistan: A quantitative approach. Finance Management, (38), 4225-4227.

- Mebratu, S., Renshui, W. & Jihong, L. (2013). Foreign direct investment and trade openness in Sub-Saharan economies: A panel data granger causality analysis. South African journal of Economics, 82(3), 402-421.

- Moga, T., Jilenga, H. & Mathieu, D. (2016). The impact of external debt and foreign direct investment on economic growth: Empirical evidence from Tanzania. International Journal of Financial Research, 7(2).

- Mohammad, A. & Mahmud, K.A. (2013). Foreign direct investment and economic growth. Literature review from 1994 to 2012. Procedia - Social and Behavioural Sciences, 129(2014), 206-213.

- Mohan, T. & Karthikeyan, P. (2015). Foreign direct investment and economic growth: Empirical evidence from India. Afro-Asian J Finance and Accounting, 5(4).

- Nikolina, K. & Panagiotis, L (2000). Foreign direct investment and real exchange rate inter-linkages. Open Economies Review, 11, 135-148.

- Nguyen, V. (2015).Citizen participation in city governance: Experiences from Vietnam. Public Administration and Development, 35(1), 34-45.

- Osinubi, T.S. (2009). Foreign direct investment and exchange rate volatility in Nigeria. International Journal of Applied Econometrics and Quantitative Studies, 6(2).

- Ostadi, H. & Ashja, S. (2014). The relationship between external debt and foreign direct investment in D8 member countries (1995-2011). Unpublished thesis, Islamic Azad University, Isfahan, Iran.

- ?zlem, A. & Evren, ?. (2013). An empirical evaluation of the relationship between trade openness and external debt: Turkish case. International Econometric Review (IER).

- Ogunleye, O. (2014). The effect of foreign direct investment: Case study Nigeria. Working Paper, 9(3).

- Omri, A. (2014). Causal interactions between CO2 emissions, FDI and economic growth: Evidence from dynamic simultaneous-equation models. Economic Modelling, 42, 382-389.

- Ong, K., Geok, T., Poon, C., Tan Lay, Y. & Kah, C.Y, (2012). Factors affecting foreign direct investment decision in Malaysia. Working paper, (1).

- Ozturek, S. (2012). Effects of global financial crisis on Greece economy. Procedia Economics and Finance, 23, 568-575.

- Paolo, P., Rolf, S. & Manfred, K. (2006). Public debt and long term interest rates the case of Germany, Italy and the US. Working Paper Series, No. 656.

- Patrick, E., Emmanuel, D. & Prudence, A.O. (2013). Impact of macroeconomic factors on foreign direct investment in Ghana: A co-integration analysis. European Scientific Journal, 9(8).

- Pak. H.M. (2001). Corruption and economic growth. Journal of Comparative Economics, 2(7), 66-79.

- Philipp, R. (2010). The impact of high and growing government debt on economic growth an empirical investigation for the euro area. Working Paper Series, No. 1237.

- Karthikeyan, P. (2015). Foreign direct investment and economic growth: empirical evidence from India. Afro-Asian Journal of Finance and Accounting, 5(4), 344-355.

- Reinhart, C.M. & Rogoff, K. (2010b). Growth in a time of debt. American Economic Review, 100(2), 573-578.

- Reinhart, C., Kenneth, S. & Rogoff, K. (2009a). The aftermath of financial crises. American Economic Review, 99(2) ,466-472.

- Ribeiro, R., Vaicekauskas, T. & Lakstutiene, A. (2012). The effect of public debt and other determinants on the economic growth of selected European countries. Economics and Management, 17(3), 914-921.

- Ribeiro, F. (2012). Internationalization of state-owned enterprises through outward foreign direct investment: Empirical evidence from Brazil?s Petrobras. Journal of International Business Studies, 10, 7-14.

- Samuel, A., Gifty, A. & Xicang, Z. (2013). Impact of foreign direct investment on economic growth: Empirical evidence from Ghana. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(1), 18-25.

- Svetlana, L. & Michael, L. (2006). Foreign direct investment and economic growth: Empirical evidence from Russian regions. BOFIT Discussion Papers, 17.

- Taiwo, M. (2011). Investment, inflation and economic growth: Empirical evidence from Nigeria. Research Journal of Finance and Accounting, 2(5).

- Svetlana, L. & Mikael, L. (2006). Testing for foreign direct investment gravity model for Russian regions. UEF Electronic Publications. No. 32.

- Vaicekauskas, T. & Lakstutiene, A. (2012). The effect of public debt and other determinants on the economic growth of selected European countries. Economic and Management, 17(3).

- The fertility-development relationship in the United States. New evidence from threshold regression analysis

- Yasmin, B., Aamrah, H. & Choudhry, M. (2003). Analysis of factors affecting foreign direct investment in developing countries. Pakistan Econ Social Rev, XLI(1& 2), 59-75.