Research Article: 2021 Vol: 25 Issue: 4S

The Moderating Role of Audit Quality on the Relationship between Women in Top Management Team and Bank Earnings Management

Emna MILADI, University of Sfax

Jamel CHOUAIBI, University of Sfax

Citation Information: Miladi, E. (2021). The moderating role of audit quality on the relationship between women in top management team and bank earnings management. Academy of Accounting and Financial Studies Journal, 25(S4), 1-11.

Abstract

Purpose – We examine how women in top management team (TMT) influence earnings management in banking industry and the role of audit quality on the effect of women in TMT on bank earnings management. Design/methodology/approach – This study used data collected from Datastream, complemented by information hand collected from financial report. For a sample of American commercial listed banks covering 2009-2018, several valuation models and regressions are employed. We develop a composite index of audit quality to analyze the moderating effect of audit quality on the link between women in TMT and bank earnings management. For robustness test, three alternative measures of gender diversity in TMT are tested. Findings – Results show that women in TMT are strongly inclined to reduce bank earnings management thereby ensuring an effective and transparent managerial decisions. Our results hold when we use alternative measures of gender diversity in TMT. We also find that audit quality moderates the negative relationship between the presence of women on TMT and bank earnings management. Practical implications – This finding suggests that advocating banks to hire more female managers helps to reduce earnings manipulation practices in US commercial banks. This study not only expands the literature on bank earnings management practice in developed-country, but also provides policy implications for female top executives and audit quality. Originality/value – We extent the literature on the effect of women directors on firm earnings management by particularly focusing on the banking sector, to our knowledge, it is the first study that establishes a link between the presence of women in TMT and earnings management in banking industry.

Keywords

Gender Diversity, Bank Earnings Management, Top Management Team, Audit Quality.

Introduction

Over the last twenty years, the number of women in full-time employment has increased by more than a third (Davies Lord, 2011). For instance, the improvement of gender balance in corporate leadership positions has remained a worldwide concern. The recent Davies report (2015) has shown that, in the U.S, Women’s share of top executive positions increased 6 percentage points from 2011 to 2015. Flowing this trend, the issue of gender diversity and its implications for company management has attracted an increasing interest in recent years. Emp irical evidences concerning gender impact on corporate decision-making are mixed. Some studies explore gender differences in earnings quality, and document a negative relation between women executive directors and earnings management, suggesting that women are less likely to take risks than men particularly in the financial decision (Srinidhi et al., 2011; Zahra et al., 2005; Barua et al., 2010; Krishnan & Parsons, 2008; Peni & Vahamaa, 2010). In contrast, others studies argues that women’s effect on earnings management is similar to that of men, and find no significant effect of gender diversity in TMT on earnings management (Sun et al., 2011; Ye et al., 2010; Lakhal at al., 2015).

Although a growing body of research has focused on the earnings management implication of gender diversity in TMT for industrial firms, however, in our study we examine the relationship between women executive directors and earnings management by focusing on banking industry. According to agency theory (Jensen & Meckling, 1976), the quality of audit services is a monitoring tool that minimizes opportunistic management practices, such as earnings management. This study focuses on the moderating role of audit quality which is perceived as a governance control mechanism since it reduces aggressive earnings management. This study specifically examines the moderating role of audit quality on the effect of women in TMT on bank earnings management. For our analysis, we employ a sample of 790 bank-year observations during 2009-2018. Following prior research, (Anandarajan et al., 2007; Beatty et al., 2002; Cornett et al., 2009), we measure earnings management by using loan loss provisions (LLP) as a proxy for capturing bank managers’ discretionary decisions to manipulate earnings. We follow Kouaib & Almulhim (2019) to estimate a composite index of audit measures. This index was developed by including three indicators to estimate the overall audit quality.

Our results show that bank earnings management present significant differences between banks with female and male top executives. Gender diversity in TMT is negatively associated with bank earnings management and the audit quality moderates this relationship. Our results hold when we use alternative measures of gender diversity in TMT.

The main contribution of this study to the literature is that, to our knowledge, it is the first study that examines the relationship between gender diversity in TMT and earnings management in banking industry, that offers managerial and policy implications. Our results contribute to the existing literature on various ways. First, this paper contributes to the debate on gender diversity in TMT, and its impact on the use of discretionary LLP in financial reporting. Second Our results indicate that the best stategy for banks to reduce earnings manipulation is to hire more women in TMT. Overall, our findings provide policy implications for banking decision making by offering evidence of the impact of female top executives.

Ours paper is organized as follows. Section 2 reviews the related literature and develops hypothesis. Section 3 describes the sample and discusses the research design. Section 4 provides our empirical results and robustness tests. Section 5 concludes the study.

Literature Review and Hypothesis Development

Related Studies

Prior research suggests that there are significant differences between men and women in view of leadership style. Rigg & Sparrow (1994) argue that women leaders are considered more people-oriented and place more emphasis on the team approach than men. Moreover, male leaders are seen as more authoritarian and paternalistic than women. Rosener (1989) states that women tend to be more transformational in their leadership than men. Eagly, Karau, & Makhijani (1995) suggest that women are more ethical than men in attitudes and behaviors. Men are more focused on economic benefits and professional success, and are more likely to violate rules to succeed in competitions, however, women are more socialized in shared values, and are less likely to be unethical (Betz et al., 1989; Butz & Lewis, 1996;

Mason & Mudrack, 1996). In this context, Companies with a higher proportion of women in leadership positions are less likely to commit securities fraud (Cumming et al., 2015).

Regarding their greater ethical sensitivity, Lam & Shi (2008) find that women are less accepting of unethical behaviour in Hong Kong, while the gender effect is not statistically significant in mainland China. Research in this area indicates that ethical decisions between gender differ under different contexts, for example, Bernardi & Guptill (2008) study 713 students from seven different countries and find that the idea that women are more ethical than men is only valid in the United States and Canada. Collins (2000) provides a review of forty-seven articles published in the Journal of Business Ethics over the period 1982-1999. Twenty-two of these studies show that women are more sensitive to ethics than men, whereas fifteen studies suggest that gender has no impact on ethical attitudes and behaviours.

Prior research indicates that women are more risk averse than men and tend to use strategies that focus on avoiding the worst outcomes. According to (Byrnes et al., 1999), women are more cautious and less aggressive than men in corporate decision-making, and they tend to be more risk-averse. Powell & Ansic (1997) argue that female executives are more disposed to be risk averse and vigilant as compared to their male counterparts. While, Schubert et al. (1999) find that there are no differences in the risk-attitudes of men and women, when they have to make a risky investment choice. This suggests that women avoid aggressive policies and are more cautious in a variety of business and finance settings. Thus, we expect significant gender differences in ethical attitudes and in the likelihood to engage in earnings management for american top executives.

Hypothesis Development

Recent studies confirm that the existence of gender diversity in top management team has helped to expand the debate concerning corporate decision-making. Indeed, some studies have investigated whether gender can involve in accounting manipulations. Arun et al. (2015) find that companies with a greater number of women directors are more likely to engage in more conservative financial reporting policies. However, Clikeman et al. (2001) document no significant differences in the men's and women's attitudes toward earnings management. While, Barua et al. (2010) and Peni & Vahamaa (2010) document that female CFOs are less likely to manipulate earnings than their male counterparts. Krishnan & Parsons, (2008) find that women senior executives improve the quality of reported earnings. Moreover, Srinidhi et al. (2011) find that firms with female directors exhibit higher earnings quality. Instead, Hili and Affes (2012) found no association between the presence of female directors and earnings management.

According to critical mass theory, when the proportion of the minority group becomes large enough, this minority group can have considerable influence on decisions-making (Chesterman et al., 2005; Dahlerup, 1988; Ely, 1995). Thus, a critical mass of women in the TMT influences corporate decision-making including financial performance decisions and managers’ discretionary decisions. This theory is supported by Granovetter (1978), who argues that a small change in the heterogeneity of a group can lead to a large change in the group's overall behaviour.

Gavious et al., (2012) found a negative association between female managers and earnings management that imply firms with female CEOs engage in earnings management lower than those males. Na & Hong (2017) explore the relationship between CEO gender and earnings management, the result shows that male CEOs engage more aggressively in earnings management both in discretionary accruals and real activities earnings management. However, Lakhal et al., (2015) find that women standing in CEO and CFO positions do not affect earnings management practices in the French context. Du et al., (2016) found an inverted U-shaped relationship between the proportion of female executives and earnings management.

Therefore, women in top management team are likely to avoid earnings management practices. Accordingly, the preceding discussion leads to the following hypothesis :

H1: There is a negative relationship between the presence of women in the top management team and bank earnings management.

There is a growing number of studies that examine the relationship between audit quality and the level of earnings management. Evidence from these studies seems to suggest that that audit quality constrains the earnings management.

Previous literature suggested that a longer auditor tenure leads to higher earnings quality. Specifically, Myers et al. (2003), Chen et al. (2008), and Kramer et al. (2011) reported an increase in earnings quality after auditor rotation. Kinney & Libby (2002) find that association between auditor’s tenure and abnormal accruals is negative.

Several studies how examine the relation between audit fees and earnings management have find that accruals are negatively related to audit fees, consistent with the notion that higher audit effort is associated with higher earnings quality. Caramanis & Lennox, (2008) find that low audit effort is associated with aggressive earnings management. Similarly, Gupta et al., (2011) provide evidence that earnings management is greater in firms that pay lower audit fees. Houqe et al. (2017) examine the effects of audit quality on earnings management of Indian listed firms. They find that firms that use high quality auditors have a lower degree of accrual earnings management. Similarly, Frankel et al. (2002) showed a significant negative association between audit quality (audit fees) and earnings management but audit quality (Big N audit firms) shows no significant association with this finding. To test the moderating effect of the audit quality on the link between the presence of women in the top management team and bank earnings management, the following hypothesis is proposed :

H2: Audit quality significantly moderates the relationship between women in top management team and bank earnings management

Research Design

Data and Sample

The sample of this study consists of commercial listed banks in the U.S. Our Data, the gender of top manager’s variables, corporate governance-related variables and financial variables, are collected from Datasteam database. Following prior studies (e.g., Anandarajan et al., 2007; Leventis et al., 2011), We exclude development banks, cooperative banks, import-export banks and investment banks. We drop commercial banks with missing data. We obtain a final sample of 790 bank-year observations during 2009-2018.

Measuring Gender Diversity in TMT

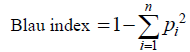

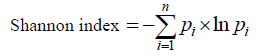

We measure the gender diversity in the TMT by the percentage of women in the top management team (equaling to the number of women top managers scaled by the total number of top managers). We also use three alternative measures of gender diversity in TMT. we employ the Blau index of diversity (Blau, 1977). We also calculated the Shannon Index introduced by Shannon (1948). To compute both the Blau index and Shannon index we employed the following equations:

Where:

Pi = The percentage of (male/female) directors in the top management team.

n = The number of distinguished categories (males/females).

The range of the Blau index values is between 0 (when there is only one category in the bank; i.e. either males or females) and 0.5 (when both categories have an equal number of males and females on the TMT). The range of the Shannon index values is between 0 (when there is only one category in the bank; i.e. either males or females) and 0.69 (when both categories have an equal number of males and females on the TMT). Lastly, we use a dummy variable to indicate that the proportion of women in top management is above 10%.

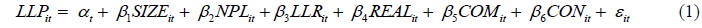

Measuring Bank Earnings Management

In this study, we measure earnings management using the Loan loss provisions. We follow both Beatty et al., (2002) and Cornett et al., (2009) to estimate Loan loss provisions. Specifically, we estimate fixed-effects ordinary least-squares (OLS) regression and remove any influential observation by employing Cook (1977) distance criterion. Basic regression is exhibited below:

Where:

LLP = loan loss provisions as a percentage of total loans ;

SIZE = natural logarithm of total assets;

NPL = non-performing loans as a percentage of total loans;

LLR = loan loss allowance as a percentage of total loans;

REAL = real-estate loans as a percentage of total loans;

COM = commercial and industrial loans as a percentage of total loans;

CON = consumer and installment loans as a percentage of total loans;

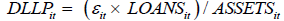

Table 1 presents descriptive statistics and regression results of Eqs. (1). The error term in Eq. (1), representing the unexplained component of the regression, is regarded as Discretionary Loan Loss Provisions (DLLP). Higher absolute value of the error term indicates higher bank earnings management. According to Cornett et al. (2009), we standardize the error term and then DLLP is defined as below:

(2)

(2)

Table 1. Descriptive statistics and regression results of discretionary and non-discretionary accruals

| Panel A : Descriptive statistics of discretionary and non-discretionary accruals variables | |||||

|---|---|---|---|---|---|

| Variable | p25 | Median | Mean | p75 | S.D |

| LLP | 0.0012 | 0.0027 | 0.0066 | 0.0068 | 0.0118 |

| SIZE | 6.7511 | 7.1194 | 7.2102 | 7.5384 | 0.7346 |

| NPL | 0.0055 | 0.0099 | 0.0159 | 0.0200 | 0.0175 |

| LLR | 0.0098 | 0.0130 | 0.0158 | 0.0191 | 0.0102 |

| REAL | 0.0029 | 0.0049 | 0.0058 | 0.0073 | 0.0284 |

| COM | 0.0013 | 0.0023 | 0.0037 | 0.0041 | 0.0274 |

| CON | 0.0002 | 0.0007 | 0.0012 | 0.0020 | 0.0161 |

|

Panel B : Regression result |

|||||

| Variables | LLP/TL | ||||

| Coef. | t-Stat. | ||||

| Constant | -0.0496*** | -3.79 | |||

| SIZE | 0.0053*** | 3.02 | |||

| NPL | 0.2118*** | 8.08 | |||

| LLR | 0.8860*** | 19.26 | |||

| REAL | 0.1900*** | 3.25 | |||

| COM | -0.2649*** | -3.02 | |||

| CON | 0.1001* | 1.66 | |||

| Adj. R2 | 0.412 | ||||

Note : *Statistical significance at 10% level, **Statistical significance at 5% level, ***Statistical significance at 1% level.

Where LOANS is total loans; and ASSETS is total assets.

Measuring Audit Index

For our study, audit quality is used as a variable that moderates the effect of women in TMT on bank earnings management. We follow Kouaib & Almulhim (2019) to estimate audit index. Specifically, we include three types of proxies to measure audit quality: (i) audit effort (EFFORT); is an indicator variable that takes the value 1 if the natural logarithm of audit-related service fees is above the annual median fee, and 0 otherwise, (ii) audit tenure (TENURE); is an indicator variable that takes the value 1 if the number of years that auditor has audited the bank's financial statements is less than the median of the auditor independence rotation for a given year, and 0 otherwise, (iii) auditor independence (INDEP) ; is an indicator variable that takes the value 1 if the natural logarithm of non-audit service fees is below the annual median fee, and 0 otherwise. Therefore, an AINDEX index of 3 indicates a higher audit quality. Definitions of three proxies of audit quality are provided in Table 2.

Table 2. Definitions of variables

| Variable | Definition |

|---|---|

| Bank Earnings management measure | |

| DLLP | Discretionary loan loss provisions as a percent of total assets |

| Women Directors measures | |

| Women directors | The number of women top managers scaled by the total number of top managers |

| Blau index | Blau index , where Pi is the percentage of (male/female) directors in the top management team and n is the number of distinguished categories (males/females) in the bank |

| Shannon Index | Shannon Index , where Pi is the percentage of (male/female) directors in the top management team and n is the number of distinguished categories (males/females) in the bank |

| Fraction >10% | A dummy variable equals 1 if the proportion of women in top management is above 10% |

| Audit index | |

| Audit effort | An indicator variable that takes the value 1 if the natural logarithm of audit-related service fees is above the annual median fee, and 0 otherwise |

| Audit tenure | An indicator variable that takes the value 1 if the number of years that auditor has audited the bank's financial statements is less than the median of the auditor independence rotation for a given year, and 0 otherwise. Auditor independence rotation is the number of years after which the bank rotates its auditor. |

| Auditor independence | An indicator variable that takes the value 1 if the natural logarithm of non-audit service fees is below the annual median fee, |

| AINDEX | Audit index composed of three audit characteristics: EFFORT, TENURE, and INDEP |

| Control variables | |

| Size | The logarithm of total assets |

| Market-to-Book Ratio | Market value of equity divided by book value of equity |

| ROA | Return on assets |

| Stock Volatility | The variance of the bank’s daily stock returns measured over a year |

| Leverage | The ratio of total debt to total assets |

| CEO duality | A dummy variable equals 1 if the CEO is the chair of the board. |

| Board size | The total number of borad directors |

| Board independence | The total number of independent directors divided by the total number of board members |

Measuring Control Variables

Several bank-level characteristics are associated with a bank's earnings management and must therefore be included as control variables. Thus, our control variables include Size, the logarithm of a bank’s total assets ; Market-to-Book Ratio (MTB), the market value of equity plus the book value of liabilities divided by the book value of assets ; return on assets (ROA) ; Stock Volatility, the variance of daily stock returns over a fiscal year ; leverage, thetotal debt divided by total assets. Because earnings management practices can also be explained by a bank's governance, we include the following control varaibles. CEO duality, a dummy variable quals 1 if the CEO is the chair of the board. ; Board size, the total number of borad directors; Board independence, the total number of independent directors divided by the total number of board members.

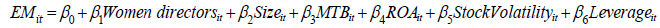

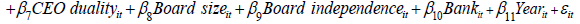

Empirical Model

To examine the effect of gender diversity in top management team on bank earnings management, we employ ordinary least squares (OLS) regression. We use two models listed below to examine moderating role of audit quality on the relationship between gender diversity in top management team and bank earnings management.

(3)

(3)

(4)

(4)

Where our dependent variable is earnings management (EM), which is introduced in paragraph 3.3. Our primary variable of interest is Women directors, the percentage of women in the top management team, which is defined in paragraph 3.2. AINDEX is the audit quality index, which is defined in paragraph 3.4. Our control variables are defined in paragraph 3.5.Bank and Year control for bank and year fixed effects.

Empirical Results

Descriptive Statistics

Table 3 presents descriptive statistics for the sample. The mean values of earnings management (EM) is 0.0037 with a standard deviation of 0.0041. Women form on average 14.5% of top management teams, which suggest that top management team are still overwhelmingly dominated by men. However, this situation is improving. At the end of 2009, the average proportion of women in top management was less than 12,42% and on avearge, 55,69% of top management team is composed by at least 10% of women executives. By the end of 2018, the average proportion of women has reach 18,62% and on avearge, 75,94% of top management team is composed by at least 10% of women executives.

Table 3. Desciptive statistics of variables

| Variable | p25 | Median | Mean | p75 | S.D |

|---|---|---|---|---|---|

| Dependent variables | |||||

| DLLP | 0.0011 | 0.0025 | 0.0037 | 0.0051 | 0.0041 |

| Independent variables | |||||

| Women directors | 0.0833 | 0.1366 | 0.1453 | 0.2143 | 0.1053 |

| Blau index | 0.1527 | 0.2359 | 0.2261 | 0.3367 | 0.1407 |

| Shannon Index | 0.2070 | 0.2752 | 0.2342 | 0.3301 | 0.1233 |

| Fraction >10% Audit index |

0 1 |

1 2 |

0.6291 1.544 |

1 3 |

0.4833 1.0891 |

| Control variables | |||||

| Size | 6.8314 | 7.1354 | 7.2525 | 7.4921 | 0.6449 |

| Market-to-Book Ratio | 0.9700 | 1.2300 | 1.3276 | 1.5700 | 0.5236 |

| ROA | 0.8600 | 1.1000 | 1.0980 | 1.3400 | 0.8109 |

| Stock Volatility | 0.2170 | 0.2467 | 0.3566 | 0.3484 | 0.5452 |

| Leverage | 0.0604 | 0.0972 | 0.1155 | 0.1464 | 0.0814 |

| CEO duality | 0 | 1 | 0.6481 | 1 | 0.4778 |

| Board size | 11 | 12 | 12.389 | 14 | 2.5488 |

| Board independence | 0.7857 | 0.8500 | 0.8264 | 0.8889 | 0.0907 |

Note: Table 3 reports descriptive statistics for dependent variable (DLLP), independant variable (Women directors) and control variables. The sample period is from 2009 to 2018. Definitions of all variables are provided in table 2.

Table 3 also presents descriptive statistics for control variables and shows that the mean (median) values for the market-to-book ratio and return on assets are 1.32 (1.23) and 1.09 (1.1), respectively. The board is composed of 12 members on average. Among these members, 82.64% on average are independent. 68.81% of boards in our sample are chaired by the CEO, which raises questions regarding the effective control that boards have over the CEO's decisions in US. Table 4 presents the correlation matrix among variables. Almost all of the reported correlations are significant at the five percent level or better. VIF and tolerance tests are conducted when running OLS regressions further confirming that multicollinearity is not a concern. The findings report that presence of female in TMT are negatively correlated with earnings management practices in banking sactor. As for control variables, the results show that : SIZE, Stock Volatility, Leverageis significantly positively correlated with EM, while MTB, ROA, Board size and Board independenceare significantly negatively correlated with EM.

Table 4. Correlation Matrix

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (1)DLLP | 1 | ||||||||||

| (2) Women directors (3)AINDEX |

-0.027 * 0.023 |

1 0.200* |

1 | ||||||||

| (4)SIZE | 0.147* | 0.337* | 0.647* | 1 | |||||||

| (5)MTB | -0.345* | 0.072* | -0.101* | -0.123* | 1 | ||||||

| (6)ROA | -0.315* | -0.032* | -0.016 | 0.026* | 0.377* | 1 | |||||

| (7)Stock Volatility | 0.151* | -0.057* | -0.131* | -0.076* | -0.166* | -0.136* | 1 | ||||

| (8)Leverage | 0.164* | 0.060* | 0.173* | 0.297* | -0.184* | 0.010 | 0.018 | 1 | |||

| (9)CEO duality | 0.004 | 0.233* | 0.083* | 0.110* | 0.165* | 0.117* | 0.026* | -0.086* | 1 | ||

| (10)Board size | -0.013* | 0.085* | 0.261* | 0.347* | -0.138* | -0.023 | -0.004 | -0.023 | -0.049* | 1 | |

| (11)Board independence | -0.084* | 0.022 | 0.119* | 0.120* | 0.042* | -0.025* | 0.000 | -0.090* | -0.089* | -0.076* | 1 |

Note: Table 4 presents the correlation matrix among variable. The sample period is from 2009 to 2018. Definitions of all variables are provided in table1. * indicates significance at the 5% level of significance or better.

Regression Results

Table 5 reports the results of our OLS regressions. Model 1 predict the effect of gender diversity in TMT on bank earnings management. As shown in Table 5, the estimated coefficient on Women directorsis negative and significant at the 1% level. This result suggests that the presence of more women in TMT is associated with less bank earnings management practices. This result suggests that a critical mass of women in the TMT influences managers’ discretionary decisions as predicted by the critical mass theory.

Table 5. Moderating effect of audit quality on the relation between women directors and bank earnings management : Fixed-effects regressions

| Dependent variable DLLP | ||

|---|---|---|

| Model 1 | Model 2 | |

| Constant | 0.0580*** | 0.0605*** |

| (11.45) | (10.81) | |

| Women directors | -0.0058*** | -0.0024** |

| (-3.42) | (-2.81) | |

| Women directors × AINDEX | - - |

-0.0013* |

| (-1.72) | ||

| Size | -0.0038*** | -0.0057*** |

| (-5.23) | (-8.08) | |

| Market-to-Book Ratio | -0.0019*** | -0.0029*** |

| (-7.05) | (-10.20) | |

| ROA | -0.0015*** | -0.0015*** |

| (-10.40) | (-10.76) | |

| Stock Volatility | 0.0007*** | 0.0011*** |

| (3.99) | (5.12) | |

| Leverage | 0.0047* | 0.0043* |

| (2.40) | (2.18) | |

| CEO duality | -0.0007 | -0.0004 |

| (-1.43) | (-0.84) | |

| Board size | -0.0001 | -0.0001 |

| (-0.45) | (-0.62) | |

| Board independence | -0.0096*** | -0.0092*** |

| (-4.25) | (-4.03) | |

| Within R-squared | 0.5120 | 0.4995 |

| No. Of obs.(Year fixed-effects) | 790 (yes) | 790 (yes) |

| No. of bank (bank fixed-effects) | 79 (yes) | 79 (yes) |

Note: Model (1) shows the effect of women directors on bank earnings management. Model (2) analyzes the moderating role of audit quality on the relation between women directors and bank earnings management. The dependent variable bank earnings management (DLLP) is the standardized absolute value of discretionary loan loss provisions. Women directors is measured by the percentage of women in the top management team. Definition of all variables are provided in table 2. Bank fixed-effects and year fixed-effects are controlled. The heteroscedasticity robust standard errors are clustered at the bank level and t -statistics are in parentheses. *Statistical significance at 10% level, **Statistical significance at 5% level, ***Statistical significance at 1% level.

As for control variables, The estimated coefficient on Size is negative and significant at the 1% level. This evidence suggests that banks tend to manipulate less earnings when they become larger. ROA and Market-to-Book Ratio are negatively linked to bank earnings management, implying that earnings are more transparent for more profitable banks. The positive relation between Stock Volatility and earnings management indicates that risky banks have poorer earnings quality. This evidence complies with the extant literature (Kanagaretnam et al., 2014; Jiang et al., 2016; Fan et al., 2019).

We also find a positive relationship between leverage and earnings management suggesting that High debt banks are more likely to engage in earnings management. The estimated coefficient on board independence is negative and significant at the 1% level suggesting that banks with an independent board are less inclined to engage in earnings management practices, thus, independent directors strengthen the monitoring of the board and reduce managers’ discretionary decisions.

Table 5 also reports the results the moderating effect of audit quality on the relation between women directors and bank earnings management. In model 2, the results indicate that when we introduce a new variable (AINDEX), the effect of women directors remained unchanged (significantly negative), and the coefficient on the interaction between (Women directors × AINDEX) is negative and significant. Theses Findings support that audit quality could change-by reducing-the relationship between women directors and earnings management. This result supports H2 and sustains well the idea that audit quality moderates the relationship between the presence of women in TMT and bank earnings management.

Robustness checks

In Table 6 we re-estimate equation (3) using three alternative measures of the gender diversity in TMT, these include, Blau index, Shannon index, and Fraction >10%, all this variables are defined in paragraph 3.2. We test whether our main result is sensitive to these measures by substituting these measures for gender diversity in TMT. We find that all measures of top executive gender are negative and statistically significant.

Table 6. Alternative measures of women directors and bank earnings management

| Dependent variable = DLLP | |||

|---|---|---|---|

| Variables | (1) | (2) | (3) |

| Constant | 0.0581*** | 0.0595*** | 0.0595*** |

| (11.51) | (11.81) | (11.77) | |

| Blau index | -0.0048*** | - | - |

| (-3.57) | - | - | |

| Shannon Index | - | -0.0053*** | - |

| - | (-3.28) | - | |

| Fraction >10% | - | - | -0.0007** |

| - | - | (-2.33) | |

| Size | -0.0038 *** | -0.0040*** | -0.0040*** |

| (-5.25) | (-5.42) | (-5.40) | |

| Market-to-Book Ratio | -0.0019 *** | -0.0020*** | -0.0019*** |

| (-7.19) | (-7.29) | (-7.09) | |

| ROA | -0.0015 *** | -0.0015*** | -0.0015*** |

| (-10.38) | (-10.30) | (-10.26) | |

| Stock Volatility | 0.0007 *** | 0.0007*** | 0.0007*** |

| (3.99) | (3.99) | (3.96) | |

| Leverage | 0.0044* | 0.0046* | 0.0054** |

| (2.26) | (2.34) | (2.73) | |

| CEO duality | -0.0007 | -0.0007 | -0.0008 |

| (-1.34) | (-1.35) | (-1.65) | |

| Board size | -0.0001 | -0.0001 | -0.0001 |

| (-0.32) | (-0.29) | (-0.33) | |

| Board independence | -0.0097*** | -0.0099*** | -0.0104*** |

| (-4.32) | (-4.43) | (-4.65) | |

| Within R-squared | 0.5128 | 0.5134 | 0.5077 |

| No. Of obs. (Year fixed-effects) | 790 (yes) | 790 (yes) | 790 (yes) |

| No. of bank (bank fixed-effects) | 79 (yes) | 79 (yes) | 79 (yes) |

Note: Tables 6 reports the panel regression results of bank earnings management on the alternative measures of Women directors during the sample period of 2009 to 2018. Dependent variable is bank earnings management (DLLP). Blau index, Shannon Index and Fraction >10% are alternative measures of gender diversity in TMT. Definition of all variables are provided in table 2. In three columns, bank fixed-effects and year fixed-effects are controlled. The heteroscedasticity robust standard errors are clustered at the bank level and t -statistics are in parentheses. *Statistical significance at 10% level, **Statistical significance at 5% level, ***Statistical significance at 1% level.

Conclusion

This paper analyzes whether audit quality moderates the relationship between gender diversity in TMT and manipulative practices related to earnings in banking sector. Using a sample of 790 bank-year observations during 2009-2018, the empirical results suggest that there is a negative relationship between the presence of women in the top management team and bank earnings management. Our results are robust for alternative measures of gender diversity in TMT. Results indicate that audit quality moderates the relationship between the presence of women on TMT and bank earnings management.

Our study makes several contributions. This study extends the literature that examines whether top executive gender affects earnings quality in the American context. We also extend the literature on the impact of gender diversity in TMT on firm earnings management by particularly focusing on the banking sector, which is excluded by prior studies. This study offers a contribution back to the moderating role of auditing in bank earnings management in view of gender diversity in TMT.

Our finding provides important implications. The results of our study provide better insights for management and policy makers in designing policies to adopt more diversity in TMT, since the presence of women directors reduces the problem of manipulative practices related to earnings. Our findings indicate that although it may be beneficial to improve earnings quality by hiring more women executives in the developed country context.

The findings of this study have some limitations that should be considere. First, our study is conducted based on the American context, and therefore our conclusions may not be consistent with those of other markets. Future research could examines whether top executive gender affects bank earnings quality in the context of an emerging market. Second, we do not identify other characteristics of female senior managers such as age, education, and experience, that could mitigate or enhance the relashionship between top executive gender and bank earnings management. Future research could analyze these characteristics that could affect this relationship. Finally, in this study, we only used commercial banks. Future research work should be done in other non-commercial banks. This will enhance the scope of the findings and level of generalization.

References

- Anandarajan, A., Hasan, I., & McCarthy, C. (2007). Use of loan loss provisions for capital, earnings management and signaling by Australian banks. Accounting& Finance, 47(3), 357–379.

- Arun, T., Almahrog, Y. & Aribi, Z. (2015). Female Directors and Earnings Management : Evidence from UK companies. International Review of Financial Analysis, 39, 137–146.

- Barth, M.E., Gomez-Biscarri, J., Kasznik, R., López-Espinosa, G., (2017). Bank earnings and regulatory capital management using available for sale securities. Rev. Ac- count. Stud. 22 (4), 1761–1792.

- Barua, A., L. Davidson, D. Rama, and S. Thiruvadi. 2010. CFO gender and accruals quality. Accounting Horizons 24 (1) : 25–39. doi :10. 2308/acch.2010.24.1.25

- Beatty, A. L., Keand, B., & Petroni, K. R. (2002). Earnings management to avoid earnings declines across publicly and privately held banks. The Accounting Review, 77(3), 547–570.

- Bernardi, R. A., & Guptill, S. T. (2008). Social Desirability Response Bias, Gender, and Factors Influencing Organizational Commitment : an International Study. Journal of Business Ethics, 81(4), 797−809.

- Betz, M., O'Connell, L., & Shepard, J. M. (1989). Gender differences in proclivity for unethical behavior. Journal of Business Ethics, 8(5), 321−324

- Blau, P. M. (1977). Inequality and Heterogeneity: A Primitive Theory of Social Structure. New York: Free Press

- Burkhardt, K., Nguyen, P., & Poincelot, E. (2020). Agents of change: Women in top management and corporate environmental performance. Corporate Social Responsibility and Environmental Management, 27(4), 1591-1604.

- Butz, C. E., & Lewis, P. V. (1996). Correlation of gender-related values of independence and relationship and leadership orientation. Journal of Business Ethics, 15(11), 1141−1149.

- Byrnes, J., Miller, D. & Schafer, W. (1999). Gender differences in risk taking: A meta-analysis.

- Chen, C.-Y., Lin, C.-J., Lin, Y.-C., 2008. Audit partner tenure, audit firm tenure, and discretionary accruals: does long auditor tenure impair earnings quality? Contemp. Account. Res. 25 (2), 415–445

- Chesterman, C., Ross-Smith, A., & Peters, M. (2005). The gendered impact on organisations of a critical mass of women in senior management. Policy and Society, 24, 69–91.

- Clikeman, P. M., Geiger, M. A., & O'Connell, B. T. (2001). Student perceptions of earnings management : the effects of national origin and gender. Teaching Business Ethics, 5 (4), 389−410.

- Cohen, B. D., & Dean, T. J. (2005). Information asymmetry and investor valuation of IPOs: Top management team legitimacy as a capital market signal. Strategic Management Journal, 26(7), 683-690.

- Collins, D. (2000). The quest to improve the human condition : the first 1500 articles published in Journal of Business Ethics. Journal of Business Ethics, 26(1), 1−73.

- Cornett, M. M., McNutt, J. J., & Tehranian, H. (2009). Corporate governance and earnings management at large US bank holding companies. Journal of Corporate Finance, 15(4), 412–430.

- Dahlerup, D. (1988). From a small to a large minority : Women in Scandinavian politics. Scandinavian Political Studies, 11, 275–298.

- Davies, L. (2011). Women on Boards. Department for Business, Innovation & Skills: Londod Research (JABR), 31(3), 1107-1118.

- Davies, L. (2015), Women on boards davies review annual report. Department for Business, Innovation & Skills: Londod.

- Dong, M., Zhang, X., (2015). Selective Trading of Available-for-Sale Securities: Evidence from U.S. Commercial Banks. Working Paper. University of Lausanne and University of California, Berkeley.

- Du, X., Lai, S., & Pei, H. (2016). Do women top managers always mitigate earnings management? Evidence from China. China Journal of Accounting Studies, 4(3), 308-338.

- Eagly, A. H., Karau, S. J., & Makhijani, M. G. (1995). Gender and the effectiveness of leaders : A metaanalysis. Psychological Bulletin, 117, 125–145.

- Ely, R. J. (1995). The power in demography : Women’s social constructions of gender identity at work. Academy of Management journal, 38, 589–634.

- Fan, Y., Jiang, Y., Zhang, X., & Zhou, Y. (2019). Women on boards and bank earnings management: From zero to hero. Journal of Banking & Finance, 107, 105607.

- Frankel, R.M., Johnson, M.F. and Nelson, K.K. (2002). The relation between auditors’ fees for nonaudit services and earnings management. The Accounting Review, Vol. 77 No. S1, pp. 71-105

- Gavious, I., Segev, E., & Yosef, R. (2012). Female directors and earnings management inn high-technology firms. Pacific Accounting Review, 24(1), 4–32. http://dx.doi.org/10.1108/01140581211221533.

- Granovetter, M. (1978). Threshold models of collective behaviour. American Journal of Sociology, Vol. 83, pp. 1420–1443

- Hili, W., & Affess, H. (2012). Corporate boards gender diversity and earnings persistence: The case of French listed firms. Global Journal of Management and Business Research, 12(22)

- Houqe, M.N., Ahmed, K. and Zijl, T. (2017). Audit quality, earnings management, and cost of equity: evidence from India. International Journal of Auditing, pp. 1-13.

- Jensen, M. and Meckling, W., (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, Vol. 3, pp. 305-360.

- Jiang, J.X., Petroni, K.R., Wang, I.Y., 2010. CFOs and CEOs: who have the most influ- ence on earnings management? J. Financ. Econ. 96 (3), 513–5260

- Jiang, L., Levine, R., Lin, C., 2016. Competition and bank opacity. Rev. Financ. Stud. 29 (7), 1911–1942

- Kanagaretnam, K., Lim, C.Y., Lobo, G.J., 2014. Effects of international institutional fac- tors on earnings quality of banks. J. Bank. Financ 39, 87–106

- Kinney, W. R., & Libby, R. (2002). Discussion of the relation between auditors’ fees for nonaudit services and earnings management. The Accounting Review, 77(s-1), 107–114. doi:10.2308/accr.2002.77s-1.107

- Kong. Journal of Business Ethics, 77, 463−479.

- Kouaib, A., & Almulhim, A. (2019). Earnings manipulations and board's diversity: The moderating role of audit. The Journal of High Technology Management Research, 30(2), 100356.

- Kramer, S.T., Georgakopoulos, G., Sotiropoulos, I., Vasileiou, K.Z., 2011. Audit firm rotation, audit firm tenure and earnings management. Int. J. Bus. Manage. 6 (8), 44–57

- Krishnan, G. V., & Parsons, L. M. (2008). Getting to the bottom line : an exploration of gender and earnings quality. Journal of Business Ethics, 78, 65−76

- Lakhal, F., Aguir, A., Lakhal, N., & Malek, A. (2015). Do women on boards and in top management reduce earnings management? Evidence in France. Journal of Applied Business

- Lam, K., & Shi, G. (2008). Factors affecting ethical attitudes in Mainland China and Hong

- Leventis, S., Dimitropoulos, P., & Anandarajan, A. (2011). Loan loss provisions, earnings management and capital management under IFRS : The case of EUcommercial banks. Journal of Financial Services Research, 40(1–2), 103–122.

- Mason, E. S., & Mudrack, P. E. (1996). Gender and ethical orientation : A test of gender and occupational socialization theories. Journal of Business Ethics, 15(6), 599−605. Psychological bulletin, 125(3), 367–383.

- Myers, J.N., Myers, L.A., Omer, T.C., 2003. Exploring the term ofthe auditor-client relationship and the quality ofthe quality of earnings: a case for mandatory auditor rotation? Account. Rev. 78 (3), 779–799.

- Na, K., & Hong, J. (2017). CEO Gender And Earnings Management. Journal of Applied Business Research, 33(2), 297.

- Peni, E., and S. Vahamaa. 2010. Female executives and earnings management. Managerial Finance 36 (7) : 629–645. Doi :10.1108/ 03074351011050343

- Powell, M., & Ansic, D. (1997). Gender differences in risk behaviour in financial decision-making: An experimental analysis. Journal of Economic Psychology, 18(6), 605-628.

- Rigg, C., & Sparrow, J. (1994). Gender, diversity and working styles. Women in Management Review.

- Rosener, J. (1989). Ways women lead. Harvard Business Review.

- Schubert, R., Brown, M., Gysler, M., & Brachinger, H. (1999). Financial Decision-Making : Are Women Really More Risk-Averse ? The American Economic Review, 381-385.

- Shannon, C. E. (1948). A Mathematical Theory of Communication. Bell System Technical Journal 27 (3): 379–423. doi:10.1002/j.1538-7305. 1948.tb01338.

- Srinidhi, B., Gul, F. A., & Tsui, J. (2011). Female directors and earnings quality. Contemporary Accounting Research, 28, 1610–1644.

- Sun, J., Liu, G., & Lan, G. (2011). Does female directorship on independent audit committees constrain earnings management ? Journal of Business Ethics, 99, 369–382.

- Ye, K., Zhang, R., & Rezaee, Z. (2010). Does top executive gender diversity affect earnings quality ? A large sample analysis of Chinese listed firms. Advances in Accounting, 26, 47–54.

- Zahra, S. A., Priem, R. L., & Rasheed, A. A. (2005). The antecedents and consequences of top management fraud. Journal of Management, 31, 803–828.