Research Article: 2023 Vol: 27 Issue: 4

The Moderating Effect of Innovation Type on the Relationship between Dynamic Capabilities and Innovation Capabilities

Ufuk Alpsahin Cullen, Edge Hill University

Simon Bolton, Edge Hill University

Marcello Trovati, Edge Hill University

Citation Information: AC.Ufuk., Bolton.,S. Trovati.,M (2023) The Moderating Effect Of Innovation Type On The Relationship Between Dynamic Capabilities And Innovation Capabilities, International Journal of Entrepreneurship, 27(4),1-28

Abstract

Data literacy (DL) is a critical factor effecting a firm’s dynamic capabilities (DC) and innovation capability (IC) as a result. We suggest DL capabilities of a firm is one of the core DC skills and we build our DC model, namely DC Scale, accordingly. In this quantitative empirical research, we explore innovations in 137 firms and test if DC has any impact on those firms’ innovation capabilities. We calculate IC as a function of innovation continuity and innovation performance of the firm. We control for the impact of a range of effecting factors such as sector, firm age, firm size and firm performance. We also create innovation type categories and use innovation type as a moderating variable to measure its moderating effect on DC and IC relationship. Our results show no impact of DC on IC without the effect of the moderator. The results point out a dysfunction in firms to utilise DL capabilities to enhance DC but relying on tacit knowledge and visceral judgement, that is intuitive, when innovating. The innovation categories of product/service innovations and technology adoption are reactive and achieved through the use of substantive capabilities. Only one innovation category, namely organisational and process innovation (OP), moderates the effect of DC on IC. We conclude that this innovation category is linked to the firm’s ability to change the existing substantive capabilities and therefore it is linked to DC.

Keywords

SME, Dynamic capabilities, Innovation Capabilities, Data literacy, Innovation type

Introduction

Dynamic capabilities (DC hereafter) are defined as intrinsic capabilities to sense opportunities; to redeploy and reconfigure the existing resources (Teece, 2007) to seize opportunities systematically and strategically (Teece et al., 1997) and to shape the environment (Eisenhardt & Martin 2000). Previous research reveals that a firm’s ability to sense and seize internal and external opportunities (Teece, et al., 1997), and the firm’s capacity to reconfigure its resource base (Farzaneh et al., 2022) are critical components of innovative capabilities (Cohen et al.1990; Wei and Zhao 2014; Wilden et al. 2018; Farzaneh et al.2022). Consequently, firms that lack DC also lack significant innovation outcomes and inability to deal with changes in the environment (Khattab, 2017).

Our research promises original contributions. Data literacy (DL hereafter) is a critical factor affecting a firm’s DC and innovation capability (IC hereafter) as a result, especially in turbulent and fast-paced environments (Pothier & Condon 2019; Tabesh et al., 2019; Wang et al., 2019; Mikalef et al., 2021). (Mikalef et al., 2021) argue that, while DC are well defined in the management literature, there is still a lack of understanding of how DL contributes to building DC. In their seminal paper, (Zahra et al., 2006) suggest a fruitful area of investigation of whether there is a core dynamic capability skill that is common to all of the various DC the firm develops. This paper suggests DL capabilities of a firm as one of the core DC skills and we build our DC model, namely our DC Scale, accordingly (Bolton, 2016). Our DC model conceptualises and quantifies DC from the data literacy perspective (Bolton 2022). Conceptualizing DC as one single model may render it a less meaningful concept (Helfat & Winter 2011) as scarce empirical evidence reveals that individual DC dimensions have different impacts on a range of indicators of firm performance (Huang et al., 2012; Nieves et al., 2016; Singh and Rao 2017; Hernández-Linares et al., 2021) or firms might not necessarily be strong across all DC dimensions (Teece, 2018, p. 44). And therefore, our DC model identifies six distinctive dimensions (as stages), and it tests the effect of each dimension separately. Additionally, we measure the overall DC effect through statistical modelling.

Innovation capability is the ability of a firm to establish a learning philosophy in which the firm has common standards and beliefs about learning and knowledge that pervade and guide all functional areas toward innovation (Siguaw et al., 2006 & Farzaneh et al., 2022). (Farzaneh et al., 2022) argue that IC is built through producing positive innovation outcomes and sustaining innovativeness of the firm which requires the firm to accumulate knowledge and capabilities (Li et al., 2020). In this empirical research, we explore innovations in 137 firms and test if DC have any impact on the firms’ innovation capabilities. We adopt (Farzaneh et al., 2022)’s conceptualisation of IC and calculate IC as a function of innovation continuity and innovation performance of the firm.

DC field has been gaining a gradually growing popularity among scholarly, but contributions have been overwhelmingly conceptual, and the scant empirical evidence have been equivocal. We address and aim to contribute to two promising territories for empirical investigation. First, understanding ordinary and dynamic capabilities and second, understanding DC within young SME context. Since our focus is DC and IC relationship, we control for sector, firm age, firm size and firm performance. (Teece & Pisano, 2003) state that DC are embedded in the existing organizational processes and therefore any innovation that targets an improvement in the existing internal structures is a prerequisite to support further product, service and technology adoption innovations. To test authors’ premise, we create innovation type categories, including an organisational and process category, and adopt innovation type as a moderating variable in DC and IC relationship.

This paper studies DC effect in SME context because (i) there is still a lack of for empirical evidence in this context (ii) the unique obstacles and weaknesses that SMEs suffer from, make DC critically important for them (e.g., Wang et al., 2011; Hernández-Linares, et al., 2021) and (iii) firm size and firm resources relationship makes firm size one of the determinants of the boundries of rationality (Simon, 1990). Our DC model is built upon DL capabilities which is related to the firm’s information processing ability (Foss, 2002; Simon, 1990). Smaller firms may be more flexible and capable of developing certain capabilities more quickly (Drnevich & Kriauciunas, 2011). But previous research reveals that firm size is positively related to DC efficacy (e.g. Hernández-Linares et al., 2021). SMEs’ limited size might translate into wider flexibility, adaptability (Wade & Hulland, 2004; Wang et al., 2011) and stronger knowledge generating capabilities (Levy, 2011), but they might exhibit inabilities in knowledge exploitation and developing DL capabilities. Bolton attributes this inability to SMEs’ lack of expertise and experience in the key (DC, 2022). Further, SMEs have limited resources and capabilities (Drnevich & Kriauciunas 2011; Sawers et al., 2008) and they possess an immanent ineffectiveness in redeploying and reconfiguring resources (Bolton, 2022). And therefore, smaller firms might be unable to create formal, scalable and repeatable processes that are routinised and systematised (Caloghirou et al., 2004; Hernández-Linares et al., 2020; Clampit et al., 2022) whilst larger firms can dedicate more resources to develop and change their routines (Schilke, 2017). And therefore, SMEs seem to be more vulnerable to competition (Wang et al., 2011) and environmental changes (Wade and Hulland 2004; Palmié et al., 2016; Park and Kim 2013). The widespread academic approach of measuring firm performance, growth and innovativeness is perceptual judgement (e.g., Engelen et al., 2014; Pavlou & El Sawy, 2011; Ling & Kellermanns 2010). And yet, our analysis (i) is conducted with actual measures of firm performance and innovation, (ii) tests the moderating effect of the innovation type and (iii) controls for the effect of a range of organisational and ecosystem variables (e.g. Camis´on & Villar 2009; Miocevic, 2021).

We use the database of SME Productivity & Innovation Centre (PIC hereafter) at Edge Hill University. PIC is part-funded by the European Regional Development Fund to provide innovation support and advisory services to Lancashire and Liverpool City Region based small or medium-sized enterprises (Edge Hill University 2022; PIC 2022). PIC has been collecting qualitative and quantitative primary data from SMEs since 2018 as a part of the project. Overall, we use data collected from 464 SMEs based across seventeen postcode areas in the Northwest England region. We deduct the number of observations to 137 following a throughout data cleaning process and through excluding observations with missing qualitative or quantitative content/data for consistency and accuracy in data analysis.

The following chapters (i) establishes familiarity with and understanding of current research in the fields; (ii) explains and rationalises the research design; (iii) presents the key results; (iv) delves into the meaning, importance, and relevance of our results and (v) summarises the main points of our research with future recommendations.

Theory and Hypotheses

Dynamic Capabilities

Although capabilities can be easy to define in theory but quite hard to identify in practice (Strønen, et al., 2017), it can be conceptualised as non-transferrable tangible and intangible processes (Akter et al., 2017) that aim to enhance the productivity of other resources possessed by the firm (Makadok 1999 & Morgan et.al 2009). Capabilities address the crucial role of strategic management in adapting, integrating, and reconfiguring the firm’s internal and external resources, and functional competences to match the requirements of a changing environment (Teece et al., 1997: p.515). It is argued that capabilities are functional embeded in specific processes of the firm (Amit & Schoemaker 1993) and they can be aggregated into ordinary capabilities (OC hereafter) and DC. DC are related to a firm’s abiltiy to sense new opportunities and threats, seize new opportunities through business model design and strategic investments, and transform or reconfigure existing business models and strategies (Helfat and Raubitschek, 2018). Teece (2014, p. 332) describes OC in terms of technical efficiency in business functions, based on the ability to buy or build learning. The term of OC is used interchangably with operational capabilities (Winter, 2003) and substantive capabilities (Zahra et al., 2006). (Helfat & Winter, 2011) use the term of OC and DC to describe first and second order capabilities. An OC can be based on a best practice, which is not very difficult to imitate, and aim to do things effectively and efficiently (Strønen, et al., 2017). And yet, the effect of DC on firm performance work through OC and depend on the quality of the firm’s knowledge base (Zahra et al. 2006). And therefore the relationship between DC and performance is mediated by the quality of OC and the effect of OC on performance is moderated by organizational knowledge. Since we adopt DL perspective into defining DC, we support the proposition that presumes a relationship between organisational knowledge (as a product of a firm’s data literacy capability) and DC. We proposition that if an innovation activity of a firm does not significantly correlated to the firm’s DC, then it is correlated to the firm’s OC that aim to fix ad-hoc problems or challenges, that are only suited for situated problem solving and therefore they are not dynamic (Strønen, et al., 2017).

(Teece, 2007) argues that the sensing element of DC includes establishing analytical systems of scanning, searching and exploring activities across markets and technologies. And therefore, sensing is linked to the firm’s ability to identify and define problems and opportunities and to establish clear objectives and priorities (DC2). The seizing element of DC, entails evaluating existing and emerging capabilities, and investing in relevant designs and technologies that are most likely to achieve marketplace acceptance (Wilden, et al., 2013). And therefore seizing is linked to the firm’s ability to collect data and evidence and identifying insights (DC3) and the firm’s ability to evaluate options for alternative solutions/reconfigurations (DC4). Lastly, transforming or reconfiguration includes continuous alignment and realignment of specific tangible and intangible assets (Katkalo et al., 2010). The firm’s ability to seize an opportunity and reconfigure its resources to build DC is linked to its ability to develop optimal solutions, reconfiguration designs and action plans for implementation (DC5) and ability to monitor and evaluate performance against objectives (DC6). Teece also underscores the learning aspect of DC and points out the purpose of DC as to achieve congruence with business opportunities and user needs by learning, based on signature processes that are difficult to imitate (2014).

Many studies have found that firms that lack DC demonstrate poor innovation performance due to their inability to deal with changes in the environment (e.g., Khattab 2017). And therefore, DC are underpinned by managerial capabilities to both identify environmental trends and develop business models that address new threats and opportunities (Farzaneh et al., 2022; Lütjen et al., 2019). According to the DC view, top managers or entrepreneurs reconfigure available resources to define a firm’s trajectory (Eisenhardt & Martin 2000; Penrose 1959). Previous research reveals that DC can be attributed to (i) management’s ability to sense and seize opportunities and to reconfigure assets strategically in response to a changing environment (e.g., Teece 2007; Eisenhardt & Martin 2000; Teece 2014; Macpherson et al., 2015; Teece et al., 1997;

Van den Bosch et al. 1999), (ii) top management’s skills, (iii) the firm’s history, values and routines (Al-Aali & Teece 2014, p.106) and (iv) the action orientation of key managers that demonstrates the management’s potential to establish particular solutions and trajectories in response to perceived contingencies (Narayanan et al., 2009) at the firm level. This may be either through actions and contributions of employees, and/or through the adoption of new processes and routines (Macpherson et al., 2015). In this research, we recognise the importance of management’s ability (as the highest-level strategic decision-maker or the entrepreneurs themselves) in recognising and utilising DC; and we measure DC based on top management’s evaluation. Our results enable us to reinforce two patterns. First, management can capture and utilise the firm’s DC for innovation evident in a positive correlation between DC and IC. Second, management can only conceptualise and capture the firm’s OC to fix ad-hoc problems or challenges through reactive innovation evident in lack of correlation between DC and IC. For the latter, we might expect innovation through imitation (Hu, 2018), low innovation continuity and success; and low innovation capabilities as a result. (Eisenhardt & Martin, 2000) position management in a key role and argue that competitive advantage comes from how managers use DC, rather than from the capabilities themselves. Hence, entrepreneurial management seems to be important for maintaining dynamism in innovation capabilities (Strønen, et al., 2017). Consequently, management’s ability to develop DL capabilities forms a critical boundry (Simon 1990) in developing DC.

Data Literacy

DL is defined as the ability to read, write and communicate data in context, with an understanding of the data sources and constructs, analytical methods and techniques applied, and the ability to describe the use case application and resulting business value or outcome (Bhargava & D’Ignazio, 2015). DL is the ability to transform raw data into information and actionable knowledge. (Mandinach & Gummer, 2013) conceptualize DL as the ability to understand and use data effectively to inform decisions which involves knowing how to identify, collect, organize, analyse, summarize, and prioritize data and how to identify problems and opportunities, interpret the data, and determine, plan, implement, and monitor courses of action. DL is a firm’s data management abilities and the firm’s ability to identify sources of data (internally or externally), to develop feasible tools to collect data and the ability to interpret data to inform strategic decision-making. Therefore, DL enables managers/entrepreneurs to transform data into value (Pothier & Condon 2019; Tabesh et al., 2019; Wang et al., 2019). It is claimed that structured adoption of DL skills, such as data analytics, positively affects a firm’s DC especially in turbulent and fast-paced environments (Mikalef et al.,2020, Wamba et al. 2017, Mikalef etal., 2021). (Teece, 2007) argues that the capabilities of sensing, seizing, and transforming are informed by (DL. Cohen et al., 1990) connects DL with IC and argues that a firm’s DL is critical to its IC. Authors particularly emphasize the importance of the ability to exploit external knowledge that is a critical component of innovative capabilities. Ability to exploit external knowledge is also associated with a firm’s absorptive capacity (AC hereafter) (Oxford, 2021) that is a function of the firm’s level of prior related knowledge (Cohen et al., 1990). Levinthal et al., (1990) argue that firms with higher levels of AC are more proactive, exploiting opportunities present in the environment whilst firms with a modest AC are reactive, searching for new alternatives in response to a failure or a change in the ecosystem. Acquiring knowledge from external sources and assimilating as well as applying knowledge help the firm improve innovation performance (Martín-de Castro et al., 2011). Thus, innovation performance and opportunity seizing are strongly linked. The premise of the notion of AC is that the organization needs prior related knowledge to assimilate and use new knowledge. And therefore sustaining innovativeness of a firm that requires the firm to accumulate knowledge and capabilities (Li et al., 2020), is a product of the self-reinforcing nature of AC (Bower & Hilgard 1981). Prior learning experience may affect subsequent performance and its effect on subsequent learning tasks can be observed in a firm’s variety of processes and abilities such as problem-solving skills and DL capabilities (Pirolli & Anderson 1985; Li et al. 2020). (Cohen et al., 1990) claim that a firm’s problem solving skills and the firm’s learning capabilities are so similar. Similarly we argue that a firm’s DL capabilities and AC are similar. DL context might be both internal and external, prior knowledge is crucial to develop better DL capabilities and DL is process oriented whilst AC is more result oriented. In our research, innovation continuity, namely sustaining innovativeness of a firm, demonstrates the firm’s ability to learn from previous innovation activities and act upon this learning for further innovations. And therefore, innovation continuity is linked to learning from previous innovation experiences.

The DC parameters (DC Scale), that are adopted and measured in this research, manifest a firm’s DL and management capacity, namely its strategic capability, to develop an insightful and accurate assessment of organisational resources, external threats as well as opportunities (Ambrosini & Bowman 2009; Lin & Wu 2019; Teece et al. 1997) for innovation. A strategic capability is a unique ability that is mainly associated with large firms with abundant resources (Prusak 1997; Tsai 2001). SMEs are inherently less strategic, less hierarchical (Teece et al., 2016: 24) and more spontaneous which may facilitate quick adaptations and outperform strategically planned DC and strategic proactive innovations especially in VUCA - volatile, uncertain, complex, and ambiguous (Bennett & Lemoine, 2014) - enviroments (Teece et al. 2016; Pavlou & El Sawy 2010; Wilhelm et al., 2015). (Liao et al., 2003) argue that SMEs can develop a high innovation capability relatively quick, and they are more efficient in recognising DC to overcome the competence traps that lead to organisational inertia (Moradi, et al., 2021).

Research shows that firms that engage with proactive strategic innovation are better able to use externally available information (e.g., Tilton 1971; Allen 1977; Mowery 1983; Cohen & Levinthal, 1990) and therefore they have a higher level of DL, DC and management capability as a by-product of their innovation investment (Cohen & Levinthal, 1990). On the other hand, firms with lower DL capability engage with little and reactive innovative activity and therefore they are relatively insensitive to external opportunities (Cohen & Levinthal, 1990). Reactive innovation is passive (Emerald, 2013) and it is developed as a firm’s response to an impetus – such as to comply with environmental regulations, to adapt to stakeholders’ requests – in the meso and macro ecosystems. And therefore, reactive innovation is less strategic more spontaneous than proactive innovation. Proactive innovation is planned (Galvin, 2018), research-informed, knowledge-based, process oriented (Wu, et al., 2014, p. 109) and shapes the environment (Eisenhardt & Martin 2000).

Innovation and Innovation Capabilities

To meet the demands from new markets, revolutionary changes in technology or new business models, firms need to renew themselves (Chakravarthy & Doz 1992; Strønen et al., 2017)) and be innovative. There have been a number of theoretical studies of DC (e.g., Eisenhardt & Martin, 2000; Teece et al., 1997; Teece, 2007; Teece, 2014), but one of the key remaining challenges is to understand the relationship between DC and IC (Breznik & Hisrich 2014; Strønen et al., 2017). (Teece, 2007) describes the role of the entrepreneur, as an institutional one, who adapts to and also shapes the environment through innovation. Thus, DC sit at the intersection of innovation and entrepreneurial action. Innovation outputs and innovation capabilities refer to an important part of DC. Firms possessing DC have the ability to integrate key capabilities and resources of their firm to successfully stimulate innovation (Strønen, et al., 2017). Innovation requires the acquisition and utilization of new knowledge (Castaneda & Cuellar 2020), knowledge assets in organizations, such as intellectual capital (Farzaneh et al., 2022) and AC (Duodu & Rowlinson, 2019).

DC is the ability to learn from both inside and outside the firm, to integrate new resources with existing ones (Hsu & Wang, 2010; Han & Li 2015). DC enable the firm not only to integrate internal resources with external resources by linking knowledge and capabilities into the firm’s operations, but also to absorb new ideas from external sources with the goal of innovation (Qiu et al., 2019). (Keskin, 2006) reports a positive relationship between learning and innovation capability in SMEs. (Strønen et al., 2017)’s research with a university hospital reveals that regardless the outcomes (success or failure), innovation activities facilitate organisational learning that enhances IC of the firm. Their research show that innovation practices underpin IC development through learning about different aspects of innovation management. Hence, we propose that a firm’s DL capability determines a significant amount of its IC.

Although previous research provides valuable insights into how DC is linked to innovation, how DL is a linking mechanism to explain DC and innovation relationship is an under researched area especially empirically (e.g., Randhawa et al., 2021; Farzaneh et al., 2022). Therefore our DC model throws light on the DL connection between DC and innovation. In this research, IC is measured as a function of innovation continuity and innovation performance. Innovation continuity measures whether an SME has the ability to develop continuous innovations that is measured as the number of innovation projects initiated within the last three years before the PIC intervention. The continuity manifests the extent of evolutionary fitness that depends on how well the DC of a firm match the context within which the organization operates (Helfat et al., 2007) and the learning capacity of the firm (Strønen, et al., 2017). Furthermore, to maintain continuity, the firm must develop different levels of DC and DL based on environmental uncertainty (Darvizeh, 2018, p. 55; Molina et al., 2015) so as to identify changes in the ecosystem. Innovation performance is measured by the degree to which the innovation project met the desired (mostly planned) outcomes.

Previous research suggests that the DC and innovation relationship can be moderated by a variety of variables, such as ecosystem factors (Pavlou & El Sawy 2011; Wang et al. 2015), firm age, firm performance, and firm size (Arend, 2014). The moderating role of environment has been in the core of the DC literature (Fainshmidt et al., 2016; Karna et al., 2016). And yet, substantial variability in terms of moderators remains unexplained (Fainshmidt et al., 2016) pointing to the necessary exploration of other factors (Hernández-Linares, et al., 2021). In order to obtain an accurate understanding of DC and IC relationship, we design a range of control and moderating variables as explained in the next chapter.

Firm Demographics And Performance

Previous research reveals that “bigness” (Gooding & Wagner, 1985) leads to net economies of scale, increases resources available for organisational use (Gooding & Wagner, 1985) to acquire control over ecosystem entities (Aldrich & Pfeffer 1976; Pfeffer & Salancik 1978), and to attract and retain more productive employees (e.g. Williamson, 1975; Mueller, 1969; Stanford, 1980) and it produces a degree of resource certainty that insures continued productive viability (Gooding & Wagner, 1985). Firm size is vastly measured by the number of employees (e.g., Pugh et al. 1969; Child 1972; Marriott 1949; Glisson & Martin 1980; Kaen et al. 2010; Doucouré and Diagne 2020). Gooding and Wagner claim that the number of employees reflects the degree to which the availability of human resources facilitates performance (1985). Since firm size and DC relationship is not our main focus, we design firm size as a control variable, and adopt the natural logarithm of the number of employees (Menguc & Auh, 2008). In addition to firm size, we control for sector, firm age, profit, and turnover consistent with previous studies (e.g., Cai et al. 2015; Monferrer et al. 2015). DC and innovation relationship can be contingent on firm age (Arend 2013; Clampit et al. 2022; Helfat & Peteraf 2003). Thus, we control for firm age, measured as the number of years between the firm’s establishment and the PIC survey application.

The way resources are deployed is a dynamic process that is aligned with the ecosystem characteristics because DC is context dependent (Cordeiro et al. 2022; Bindra et al. 2020). Especially sector is a strong determinant of resource allocation strategy as certain industries may demand faster, more flexible transformation (Teece, 2014; Teece et al., 1997) than the others. Also, the ability to adapt to changing circumstances in multiple contexts draws on DC (Teece, 2018, p. 47). Previous research reveals correlations between sector and IC (Guan & Ma 2003; Keskin 2006; Forsman, 2011). And therefore we adopt sector as an ecosystem related variable, and we control its effect too. We adopt a broad industry category of twenty one industry sub-groups (ONS 2023) one of which (Section U) is a group of unidentified industries that cannot be categorised under any of the sub-groups. The industry information had been collected through open ended questions where the participating firms explained the existing core business activity in their own words. Hence, we extracted the industry information from the qualitative raw data as explained in the methodology chapter.

DC influence firm performance in various ways (Teece, 2007). They facilitate strategic alignment with the ecosystem (Zahra et al. 2006), facilitate the reconfiguration of the existing resources for adaptation to the ecosystem (Teece et al., 1997), change the market dynamics (Eisenhardt & Martin, 2000), enhance strategic and cognitive capabilities (Makadok, 2001), improve inter-firm performance (Gudergan et al. 2012; Wilden et al. 2013), improve the agility of organisational responses to the ecosystem (Chmielewski & Paladino 2007; Hitt et al. 2001). Since our focus is not testing the impact of DC on business performance, we control the effect of business performance. PIC measures firm performance with two variables, namely turnover and profit. We adopt the PIC approach in measuring firm performance.

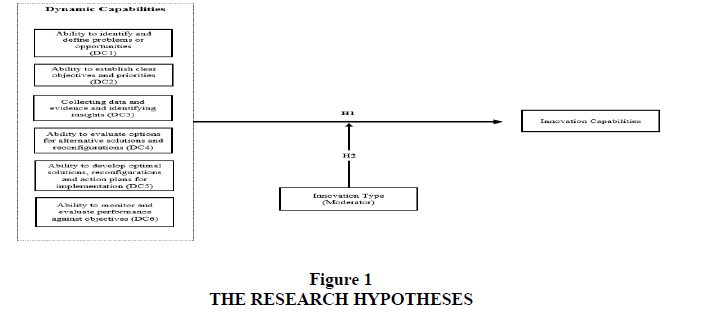

In the light of above, we explore (i) the types of innovations developed by 137 SMEs, (ii) the effect of DC on IC and (iii) whether innovation type has a moderating effect on the relationship between DC and IC. Figure 1 and Table 1 exhibit the research hypotheses.

| Table 1 Research Hypotheses |

|

|---|---|

| Number | Hypothesis Description |

| H1 | An SME’s DC predict a significant amount of its innovation capability |

| H1a | An SME’s ability to identify and define problems (DC1) predict a significant amount of its innovation capability |

| H1b | An SMEs ability to establish clear objectives and priorities (DC2) predict a significant amount of its innovation capability |

| H1c | An SMEs ability to collect data and evidence and identifying insights (DC3) predict a significant amount of its innovation capability |

| H1d | An SMEs ability to evaluate options for alternative solutions (DC4) predict a significant amount of its innovation capability |

| H1e | An SMEs ability to develop optimal solutions and action plans for implementation (DC5) predict a significant amount of its innovation capability |

| H1f | An SMEs ability to monitor and evaluate performance against objectives (DC6) predict a significant amount of its innovation capability |

| H2 | Innovation type moderates the impact of an SME’s DC on innovation capability. |

Methodology

As mentioned previously, the data were collected by PIC throughout 2018, 2019 and 2020. In order to collect quantitative data, a business diagnostic form that had been designed by PIC was used. The form enabled PIC to collect a wide range of organisational and ecosystem data from over 460 SMEs. We extracted the relevant data from the PIC database and executed a throughout data cleaning process. The data cleaning process -as explained previously- caused a drastic increase in the number of observations from 465 to 137. Consequently we used data collected from 137 SMEs. First, responses were transferred onto Excel spread sheets. Second, we worked on transferring the data from Excel onto SPSS 25 that was used to analyse the quantitative data.

Qualitative data were collected through interviews with the founders or owners or top managers of the SMEs and through open-ended questions in the business diagnostic form. Participants were asked to identify any recent innovation projects the company engaged during the past three years (successful and unsuccessful) before the first PIC intervention in 2018. Participants narrated detailed information about their innovation activities such as innovation type, whether or not an innovation met the expected or planned performance targets, results achieved, reasons of failure and factors affecting the decision of initiating an innovation project. We worked on qualitative coding with NVivo as well as manually. NVivo is a commonly used software to organize qualitative data (e.g. Ali & Lodhi 2017; Munn & Branch 2018; Nelson 2016; Ulfig 2019). We transferred the data into NVivo for computer aided disassembling, reassembling, coding, interpretation, and theme development. Next, we worked on the data manually to identify themes and to compare the NVivo generated themes with the manually generated themes to identify inconsistencies. Based on our qualitative data analysis, we identified four innovation types, namely, technology adoption (TA), organisational and process innovation (OP), new service or product development (PSD) and strategic (S) innovation. We grouped participants’ innovation activities under these innovation type categories. Our qualitative data analysis enabled us to identify five innovation performance categories, namely, ongoing, completed, failed, progress, and success. The progress performance outcome was describing an outcome that was positive but below the expected performance level. In this paper we only included the success performance category. Finally we checked the continuity of innovations. Innovation continuity was about whether or not an SME initiated subsequent innovations within the three years before PIC intervention. We also used ONS (2023) SIC categories to group SMEs under twenty one industry sub-groups. We used NVivo to extract SIC information from the core business activity narratives. Table 2 shows the sector groups.

| Table 2 Research Variables Sector (Ons 2023) |

||

|---|---|---|

| SIC Code | SIC Definition | |

| Section A | Agriculture, forestry, and fishing | 0=No, 1=Yes |

| Section B | Mining and quarrying | |

| Section C | Manufacturing | |

| Section D | Electricity, gas, steam, and air conditioning supply | |

| Section E | Water supply; sewerage, waste management and remediation activities | |

| Section F | Construction | |

| Section G | Wholesale and retail trade; repair of motor vehicles and motorcycles | |

| Section H | Transportation and storage | |

| Section I | Accommodation and food service activities | |

| Section J | Information and communication | |

| Section K | Financial and insurance activities | |

| Section L | Real estate activities | |

| Section M | Professional, scientific, and technical activities | |

| Section N | Administrative and support service activities | |

| Section O | Public administration and defence; compulsory social security | |

| Section P | Education | |

| Section Q | Human health and social work activities | |

| Section R | Arts, entertainment, and recreation | |

| Section S | Other service activities | |

| Section T | Activities of households as employers; undifferentiated goods- and services- producing activities of households for own use |

|

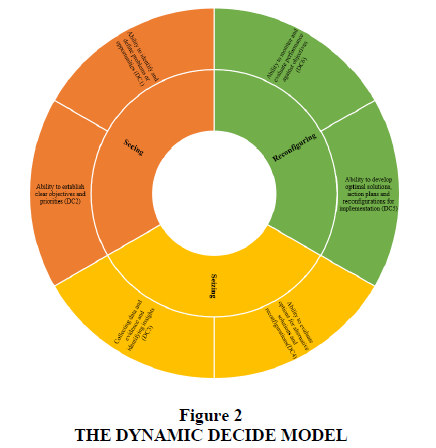

| Section U | Undefined | |

With respect to DC measurement, (Arend & Bromiley, 2009) note that there is not a consensus on how to measure DC and a variety of proxies are extracted from archival data (p. 84). Self-created single or double item measures are common (Døving & Gooderham, 2008). The lack of established scales and a desire to capture discrete sub channels (such as the ability to sense new opportunities vs the ability to capitalise on them) lead to the creation of long formative scales that aggregate DC perceptions across different processes and are adapted to settings on a study-by-study basis (Arend 2013; Kump et al., 2019; Pavlou & El Sawy, 2010). And therefore, perceptual judgments are widely used to assess the ability of DC (e.g., Hernández-Linares, et al., 2021). For example: (Clampit et al., 2022) employed a general three-item Likert-type scale to measure DC with a five-point response format ranging from “disagree” to “agree.” Hernández-Linares et al. (2021: 162) measured DC through using an established Likert-type scale with a fivepoint response format ranging from “strongly disagree” to “strongly agree”. The prevalence of subjective measures of DC (e.g., Real, et al., 2014) is defended to be a more holistic evaluation and to capture more than a single element (Rodríguez et al., 2004). There is also a strong correlation observed between objective and subjective abilities and performance measures (e.g., Dawes 1999; Dess et al., 1984; Ling & Kellermanns, 2010). We used the Dynamic Decide Model (Bolton, 2012) to measure DC. The model has been used in different subject contexts in the wider literature. For example: (Guo, 2008) explained the association between managers’ cognitive, knowledge creation and knowledge management capabilities and the effectiveness of their decisions through implementation of the Decide Model. Especially, knowledge management aspect of the model includes the organisational capabilities of knowledge acquisition, conversion and application that are strongly related to DC. Gold et al. (2001) used an extended version of the model to examine the issue of effective knowledge management from the perspective of organisational capabilities (p.186). Our Dynamic Decide Model, namely the DC scale, involved two distinct phases: (1) problem or opportunity analysis and (2) decision making. These two concepts helped frame understanding the problem(s) being addressed or opportunities identified and the factors where decisions need to be made. The Dynamic Decide Model consisted of six focussed activities as DC dimensions (Bolton, 2016). The level of each DC dimension was measured by a six-item Likert-type scale with a five-point response format ranging from “does not present a challenge” to “significant challenge or barrier”. The model is exhibited in Figure 2.

We designed IC as the dependent variable. The independent variables were the DC dimensions. The control variables were firm age, firm size, sector, profit and turnover. The research variables are explained in Table 3.

| Table 3 Research Variables |

|||

|---|---|---|---|

| Dependent Variable | Independent Variables (DC) | Moderating Variable (M) | Control Variables |

| Innovation Capability | Ability to identify and define problems or opportunities (DC1) | Innovation Type | Firm Demographics Business Age (Age) |

| Ability to establish clear objectives and priorities (DC2) Collecting data and evidence and identifying insights (DC3) |

Number of Employees (Size) Sector (SIC) Firm Performance |

||

| Ability to evaluate options for alternative solutions or reconfigurations (DC4) | Profit (P) Turnover (T) | ||

| Ability to develop optimal solutions, reconfigurations and action plans for implementation (DC5) | |||

| Ability to monitor and evaluate performance against objectives (DC6) | |||

| Total DC Score (DC) (For moderation analysis) | |||

The term moderating variable refers to a variable that can strengthen, diminish, negate, or otherwise alter the association between independent and dependent variables. Moderating variables can also change the direction of this relationship. Moderating variables are useful because they help explain the links between the independent and dependent variables. Also sometimes referred to as simply moderators, these moderating variables provide additional information regarding the association between two variables in quantitative research by explaining what features can make that association stronger, weaker, or even disappear (Hefner, 2018). We accepted innovation type as the moderating variable. Table 4 exhibit the research variables more in-detail.

| Table 4 Research Variables Detailed |

||

|---|---|---|

| Variable | Unit | Value or Variable Category |

| Business Age | Years | Numerical |

| Size | Number of Employees | Numerical |

| Turnover | £ | Numerical |

| Profit | £ | Numerical |

| Ability to identify and define problems or opportunities (DC1) |

Likert-type scale with a five-point response format ranging to “does not present a challenge (5)” from “significant challenge or barrier (1)” |

1≤ Value ≤5 |

| Ability to establish clear objectives and priorities (DC2) |

||

| Collecting data and evidence and identifying insights (DC3) |

||

| Ability to evaluate options for alternative solutions or reconfigurations (DC4) |

||

| Ability to develop optimal solutions, reconfigurations and action plans for implementation (DC5) |

||

| Ability to monitor and evaluate performance against objectives (DC6) |

||

| Innovation Continuity | The number of innovation projects that were initiated by the SME within the past 3 years before the PIC intervention. |

Numerical |

| Innovation Performance | The number of innovation projects that were successfully completed by the SME within the past 3 years before the PIC intervention. Success was assessed by the degree to which the innovation project met the planned target. |

Numerical |

| Innovation Capability | Total value of innovation continuity and innovation performance |

Numerical |

We applied principal component analysis to the DC scale. As a measure of scale reliability, the Cronbach’s Alpha (?) statistic of 0.708 suggested that the six instruments were internally consistent. The rest of the variables were measured by multiple choice and open-ended questions. The survey data allowed us to evaluate the role of DC with respect to firm performance, growth, and innovation outputs. Self-reported data are deemed reliable as their overall patterns closely match findings from real-time data (Chetty et al., 2020; Clampit et al., 2022).

Sample

PIC collected both quantitative and qualitative data using a survey instrument and through structured interviews which was consistent with recent research on DC in SMEs (Arend, 2013; Lin and Wu et al., 2014). PIC adopted the European Commission’s definition of SME. By definition, an SME employs fewer than 250 persons and either have an annual turnover that does not exceed EUR 50 million, or an annual balance sheet not exceeding EUR 43 million (European Commission, 2015). Overall, we used the data collected from 137 SMEs based across seventeen postcode areas in the Northwest England region. The participants were either founders or owners or professional top managers who were directing and controlling SMEs at the highest level.

Time Frame

The PIC data were collected during 2018, 2019 and 2020.

Findings

(Cañamares et al., 2021) describe reactive innovation as reactive strategies involve responding to external factors such as environmental regulations, pressures and ecological damage. And therefore, the reactive innovation path does not take into account anticipating regulations or resource constraints that may affect the firm’s economic performance but rather defends against problems once they arise. It does not innovate by planning but by innovating in the face of unexpected adversity (Stalmokaité & Hassler, 2020). Proactive innovation is the opposite. Proactive innovation does anticipate the future by taking action in advance and paying attention to the expected end results for behaviours such as expressing opinions or solving problems (Kiss et al., 2022). Proactive innovation is a competitive advantage as it explains the what and how of innovation strategy (Sheth & Sinfield, 2022). These innovation strategies need a balance between internal and external activities (Kratzer et al., 2017) that come from strategic improvement initiatives of the firm and constraints in the ecosystem respectively (Hofer et al., 2019). Exploitative innovation evaluates a firm’s ability to develop products, services, and processes that are competency enhancing. Exploratory innovation measures a firm’s ability to develop products, services, and processes that require the acquisition of new knowledge, skills, and competencies (Farzaneh et al., 2022). March and Simon (1958: 188) suggest that most innovations result from borrowing rather than invention. Our findings reveal that, the innovation projects initiated by SMEs were reactive, therefore passive (Emerald, 2013, p. 23), and exploitative in nature. The participants that PIC interviewed typically imitated someone else’s ideas. Imitation was simply replication or borrowing of a competitor’s innovation (Teece, et al., 1997).

Basen on our qualitative analysis, we identified four innovation type categories that had been adopted by SMEs as explained in Table 5. Technology adoption (TA) and new service or product development (PSD) innovations were more visible and developed through imitation. Strategic (S) and organisational / process (OP) innovations were hidden and trial-and-error innovations. Consequently their impact was difficult to measure with traditional metrics. Trial-and-error was an acting “from the gut” behaviour of the SME that was regarded as one of the most important elements of innovations (Azoulay et al., 2011) and organisational learning (Zahra et al., 2006).

| Table 5 Innovation Categories And Innovation Activities |

||

|---|---|---|

| Innovation Category | Examples of Innovation Activity | SPSS Value |

| Technology Adoption (TA) | New CRM or ERP investment, new machinery, new software, process digitalisation | 0=No, 1=Yes |

| Organisational / Process (OP) | Split operational teams into three departments, reengineering a department or an operation, organisational strengths review, process changes to enable bespoke designs, creating a new business function unit |

0=No, 1=Yes |

| New Service or Product Development (PSD) | New product and product range design, new product design for a new customer segment, software development, new service offering | 0=No, 1=Yes |

| Strategic (S) | Business acquisition, improving human capital through recruitment | 0=No, 1=Yes |

To test our hypotheses, we ran hierarchical multiple regression analysis. Preliminary analyses were conducted to ensure no violation of the assumptions of normality, linearity, multicollinearity and homoestaticity. There was no bivariate correlation higher than 0.7 between the independent and control variables which indicated no viloation of the assumption of multicollineairty. We checked the extreme scores for all variables as a part of the data screening process. The outliers were identified through standardised residual plots and replaced with the extreme observations at a reasonable value (Pallant, 2007, p. 154). In order to test the moderation effect of innovation type, we first created a total DC score that was the total value of the six DC items. Next, we created a product term variable (M) for each innovation type category through the compute variable feature of SPSS 25. More specifically the product term variables were technology adoption (DC*TA), organisational / process (DC*OP), new service or product development (DC*PSD) and strategic (D*S). Correlations were calculated as shown on Table 6.

| Table 6 Correlation Table |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| DC1 | DC2 | DC3 | DC4 | DC5 | DC6 | MDCO P |

MDCT A |

MDC S |

MDCNSP D |

Innovation Capability |

|

| - | - | - | - | - | 0.056 | 0.101 | 0.136 | 0.002 | -0.050 | 0.079 | |

| Age | .236* | 0.114 | 0.139 | .213* | 0.144 | ||||||

| 0.01 | 0.226 | 0.143 | 0.023 | 0.128 | 0.572 | 0.257 | 0.127 | 0.985 | 0.575 | 0.378 | |

| 1 | |||||||||||

| - | - | - | - | - | 0.098 | 0.161 | 0.063 | .229** | -0.139 | .183* | |

| Size | .201* | 0.163 | 0.018 | 0.174 | 0.044 | ||||||

| 0.03 | 0.084 | 0.853 | 0.067 | 0.644 | 0.325 | 0.070 | 0.480 | 0.010 | 0.119 | 0.039 | |

| 3 | |||||||||||

| - | - | 0.080 | 0.027 | 0.101 | 0.059 | .234* | 0.176 | .288** | -0.165 | .242* | |

| 0.04 | 0.004 | ||||||||||

| Profit | 4 | ||||||||||

| 0.71 | 0.971 | 0.509 | 0.822 | 0.402 | 0.647 | 0.035 | 0.115 | 0.009 | 0.141 | 0.030 | |

| 7 | |||||||||||

| - | - | 0.004 | - | 0.025 | 0.130 | 0.169 | 0.030 | 0.052 | -0.131 | .180* | |

| Turnover | 0.17 | 0.098 | 0.082 | ||||||||

| 2 | |||||||||||

| 0.07 4 |

0.312 | 0.970 | 0.399 | 0.798 | 0.200 | 0.061 | 0.743 | 0.569 | 0.147 | 0.045 | |

| SIC=A | - 0.08 1 |

- 0.163 | - 0.040 | - 0.049 | - 0.133 | - 0.099 | -0.058 | 0.119 | -0.032 | .208* | .275** |

| 0.39 0 |

0.081 | 0.675 | 0.604 | 0.158 | 0.315 | 0.516 | 0.179 | 0.720 | 0.018 | 0.002 | |

| SIC=C | - 0.14 7 |

- 0.061 | - 0.068 | - 0.138 | 0.037 | - 0.056 | -0.103 | 0.057 | -0.118 | -0.124 | 0.046 |

| 0.11 8 |

0.516 | 0.471 | 0.145 | 0.693 | 0.570 | 0.243 | 0.522 | 0.182 | 0.162 | 0.605 | |

| SIC=D | 0.09 1 |

0.121 | 0.068 | 0.084 | - 0.065 |

- 0.043 |

0.173 | -0.088 | .332** | -0.048 | -0.019 |

| 0.33 1 |

0.197 | 0.471 | 0.373 | 0.494 | 0.667 | 0.050 | 0.324 | 0.000 | 0.588 | 0.835 | |

| SIC=E | 0.08 9 |

0.091 | 0.106 | 0.049 | 0.004 | 0.110 | -0.127 | -0.128 | -0.072 | -0.073 | -0.085 |

| 0.34 4 |

0.334 | 0.262 | 0.605 | 0.963 | 0.264 | 0.151 | 0.147 | 0.415 | 0.413 | 0.339 | |

| SIC=F | - 0.05 7 |

- 0.015 | - 0.066 | - 0.128 | 0.003 | 0.089 | -0.058 | -0.059 | -0.032 | -0.033 | -0.068 |

| 0.54 5 |

0.875 | 0.486 | 0.173 | 0.979 | 0.364 | 0.516 | 0.507 | 0.720 | 0.712 | 0.446 | |

| SIC=G | - 0.08 1 |

- 0.092 | 0.068 | - 0.182 | - 0.133 | 0.184 | 0.159 | -0.074 | .298** | -0.042 | 0.104 |

| 0.39 0 |

0.327 | 0.471 | 0.052 | 0.158 | 0.061 | 0.072 | 0.407 | 0.001 | 0.639 | 0.243 | |

| SIC=H | 0.04 2 |

- 0.026 | 0.017 | - 0.115 | - 0.108 | - 0.076 | -0.092 | 0.010 | -0.049 | 0.062 | 0.036 |

| 0.65 7 |

0.784 | 0.854 | 0.223 | 0.254 | 0.444 | 0.298 | 0.908 | 0.581 | 0.482 | 0.683 | |

| SIC=I | - 0.12 1 |

- 0.011 | - 0.074 | 0.087 | - 0.059 | - 0.108 | -0.040 | -0.028 | -0.032 | 0.102 | 0.059 |

| 0.19 6 |

0.903 | 0.434 | 0.357 | 0.535 | 0.271 | 0.652 | 0.749 | 0.715 | 0.248 | 0.508 | |

| SIC=J | 0.07 1 |

0.107 | 0.053 | 0.142 | 0.125 | 0.033 | 0.018 | -0.134 | -0.105 | -0.043 | -0.023 |

| 0.44 8 |

0.255 | 0.573 | 0.131 | 0.184 | 0.740 | 0.843 | 0.130 | 0.235 | 0.630 | 0.797 | |

| SIC=K | 0.07 0 |

0.103 | .223* | 0.002 | 0.043 | 0.145 | 0.041 | 0.166 | .179* | -0.102 | 0.082 |

| 0.45 8 |

0.273 | 0.017 | 0.985 | 0.653 | 0.139 | 0.648 | 0.059 | 0.043 | 0.252 | 0.355 | |

| SIC=L | 0.10 5 |

.186* | - 0.066 |

- 0.128 |

- 0.094 |

- 0.070 |

-0.061 | -0.062 | -0.034 | -0.035 | -0.068 |

| 0.26 5 |

0.047 | 0.486 | 0.173 | 0.321 | 0.480 | 0.494 | 0.486 | 0.704 | 0.697 | 0.446 | |

| SIC=M | 0.01 2 |

- 0.041 |

0.007 | 0.030 | 0.057 | - 0.003 |

0.162 | 0.157 | -0.111 | 0.164 | -0.066 |

| 0.89 6 |

0.664 | 0.940 | 0.754 | 0.544 | 0.977 | 0.066 | 0.076 | 0.209 | 0.064 | 0.457 | |

| SIC=N | 0.09 6 |

- 0.040 |

- 0.061 |

0.015 | 0.082 | 0.089 | 0.001 | 0.058 | 0.133 | 0.008 | 0.104 |

| 0.30 5 |

0.669 | 0.517 | 0.871 | 0.388 | 0.368 | 0.992 | 0.514 | 0.133 | 0.930 | 0.242 | |

| SIC=O | 0.02 4 |

- 0.015 |

0.086 | 0.059 | 0.099 | 0.089 | -0.076 | -0.076 | -0.043 | -0.043 | -0.068 |

| 0.80 0 |

0.875 | 0.363 | 0.531 | 0.296 | 0.364 | 0.393 | 0.389 | 0.626 | 0.625 | 0.446 | |

| SIC=P | 0.09 0 |

0.072 | - 0.057 |

0.120 | 0.054 | - 0.020 |

-0.014 | -0.017 | 0.079 | 0.073 | -0.021 |

| 0.34 1 |

0.448 | 0.549 | 0.203 | 0.569 | 0.836 | 0.874 | 0.851 | 0.372 | 0.414 | 0.809 | |

| SIC=Q | - 0.03 4 |

0.021 | - 0.095 | 0.025 | - 0.141 | - 0.076 | -0.033 | -0.109 | 0.028 | -0.059 | -0.102 |

| 0.72 2 |

0.826 | 0.314 | 0.791 | 0.134 | 0.444 | 0.709 | 0.220 | 0.749 | 0.503 | 0.251 | |

| SIC=R | - 0.00 5 |

- 0.143 | - 0.071 | - 0.060 | - 0.108 | - 0.122 | -0.094 | -0.096 | -0.051 | -0.053 | -0.118 |

| 0.95 5 |

0.128 | 0.453 | 0.523 | 0.254 | 0.215 | 0.290 | 0.279 | 0.565 | 0.549 | 0.182 | |

| SIC=S | - .219* |

- .215* |

- 0.142 | - .222* |

- 0.094 | - 0.149 | -0.028 | -0.030 | -0.013 | -0.015 | -0.068 |

| 0.01 9 |

0.021 | 0.132 | 0.017 | 0.321 | 0.128 | 0.757 | 0.738 | 0.886 | 0.864 | 0.446 | |

| Innovatio n Capability | 0.01 9 |

0.014 | 0.172 | - 0.002 |

0.186 | .276* * |

.363** | .435** | .181* | .180* | |

| 0.84 1 |

0.885 | 0.076 | 0.983 | 0.053 | 0.006 | 0.000 | 0.000 | 0.040 | 0.041 | ||

The firm demographics and sector control variables were entered into hierarchical multiple regression analysis at Step 1. At Step 2, the firm performance control variables were entered. At Step 3, the independent variables were entered. Finally at Step 4, the product term variables (M) were entered. The R2 and adjusted R2 values indicated a significance contribution of Model 4 to the variation of the IC value. The adjusted R2 value is more precise and it takes the number of variables into account (Westfall & Arias 2020). And therefore we used the adjusted R2 value in our analysis. Model 1, Model 2 and Model 3 did not show any effect on the innovation capability. Model 4 explained 19 percent of the variance in the innovation capability. Model 4’s contribution was statistically significant as the significance of F change was 0.001. The ANOVA table indicated that the model as a whole was significant (See Table 7).

| Table 7 Model Summary | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Model Summary | |||||||||

| Model | R | R Square |

Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

| R Square Change | F Change |

df1 | df2 | Sig. F Change | |||||

| 1 | .430 | 0.185 | -0.024 | 1.574 | 0.185 | 0.884 | 20 | 78 | 0.607 |

| 2 | .430 | 0.185 | -0.037 | 1.584 | 0.000 | 0.003 | 1 | 77 | 0.957 |

| 3 | .525 | 0.276 | 0.000 | 1.555 | 0.091 | 1.485 | 6 | 71 | 0.196 |

| 4 | .667 | 0.445 | 0.188 | 1.401 | 0.169 | 5.102 | 4 | 67 | 0.001 |

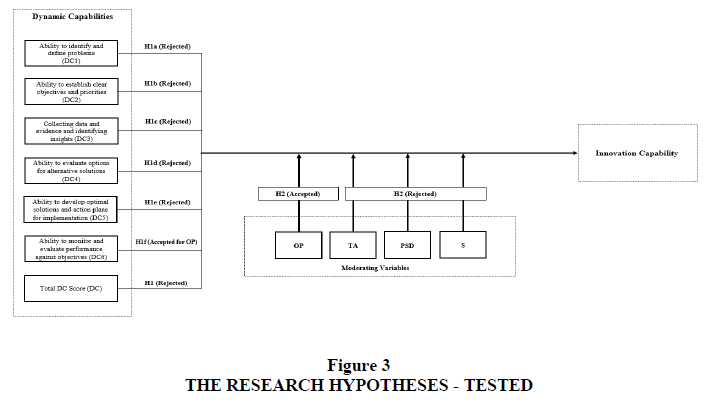

Next we assessed the contribution of each variable in Model 4. The coefficient analysis revealed that, OP innovation significantly moderated the impact of DC on IC. OP and DC6 were significantly contributing to the final equation. The moderating variable strengthened the impact of DC6 (ability to monitor and evaluate performance against objectives) on IC just for OP innovations. The full data analysis results can be seen in Table 8.

| Table 8 Data Analysis Results |

||||

|---|---|---|---|---|

| Variables | Model# | Entered Variables | Predictor variable in the model | Model Effect |

| Control (Business Demographics and Sector) |

Model 1 | Business Age (Age) Number of Employees (Size) Sector (SIC) |

None | None |

| Control (Business Performance) | Model 2 | Profit (P) Turnover (T) | None | None |

| Independent | Model 3 | Ability to identify and define problems or opportunities (DC1) | None | None |

| Ability to establish clear objectives and priorities (DC2) |

||||

| Collecting data and evidence and identifying insights (DC3) |

||||

| Ability to evaluate options for alternative solutions or reconfigurations (DC4) | ||||

| Ability to develop optimal solutions, reconfigurations and action plans for implementation (DC5) |

||||

| Ability to monitor and evaluate performance against objectives (DC6) |

||||

| Moderator (Product Term) | Model 4 | DC*TA DC*OP DC*PSD DC* S | DC6 DC*OP | F (31,67) = 1.732, p<0.05 |

Discussion

Our results reveal no correlation whatsoever between DC and IC in the context of SMEs. The product term variable strengthens the effect of DC (Only DC6) on IC only in the context of OP innovations. The hypotheses testing results can be seen in Figure 3.

SMEs copy competitiors’ technologies, products and services because those type of innovations are visible and their effect as well as their feasibility have already beed tested. And yet, OP innovations are business model innovations and therefore they are internal and hidden. The hidden nature of the OP innovation hinders SMEs to imitate it or benchmark its performance results against competitors’ results. Consequently, SMEs adopt more trial-and-error style in the OP innovation context instead. (Zahra et al., 2006) claim that trial-and-error facilitates building knowledge, routines, and slack resources in the early states of an SME, but undermines DC as the SME ages. To test authors’ claim, we ran a correlation test between the product term variables and business age. The test did not generate any significant correlation between the variables. Hence we conclude that firm age and trial-and-error innovations are not correlated.

(Teece et al., 1997) argue that a firm should first restructure the organizational processes (that most likely can support the conventional product/service only) through process innovation before introducing new technologies and product developments. And therefore, organizational reengineering or business model reconfiguration is required to support new products developed and technologies adopted. It is striking the find out that, in the process of innovation, SMEs do not engage with their DL capabilities measured with the DC scale. Only for OP, SMEs use data to monitor and evaluate performance against objectives (DC6). Because there is a lack of opportunity for benchmarking, SMEs need to develop their own evaluation criteria of OP performance. Consequently, they engage with their DL capabilities to design objectives and to monitor and evaluate performance against the objectives.

In our case, ability to innovate indicates the existence of some level of DC of the firm although the innovations are reactive and mostly imitated. What seems like a dysfunction here is the inability of top management to utilise the firm’s DL capabilities but relying on tacit knowledge and visceral judgement, that is intuitive, when innovating (Google distionary defines visceral as “based on deep feelings and emotional reactions rather than reason or thought” (2022). This type of management attitude ignores the intrinsically social and collective nature of organisational learning and therefore undermines developing DL capability and AC. When borrowing innovation ideas as well as performance metrics for those innovations from competitiors, DC are not well-targeted and deployed in order to achieve strategic goals. Consequently, SMEs might not gain a performance-related benefits from those innovations. Furthermore, (Teece et al., 1997) argue that imitation without understanding the contextual dependence of original performance, the act of imitation is likely to be difficult (Teece, 1976) and fail.

The literature on the distinction between dynamic and substantive capabilities is in its infancy (e.g., Winter 2003; Bratnicka-My?liwiec et al. 2019; Zhang et al. 2022). (Zahra et al., 2006) define a new routine for product development as a new substantive capability, but the ability to change such capabilities is a dynamic capability. In our context, organisational and process innovation (OP) is about changing the existing process routines and reconfiguring the existing resources to generate new capabilities. And therefore it is expected that OP is linked to DC more than the other innovation types. The other innovation types do not show any reconfiguration effort of the existing resources including the business model design to build new organisational capabilities. Instead, they are built upon the existing business model to imitate innovations. Strategic innovation (S) is slightly different though.

Evidence supports that the key prerequisite of sustainable competitive advantage through DC is adopting a strategic approach in innovation management (Harreld et al. 2007; Strønen et al. 2017) and and therefore it depends on the strategic capability of the firm’ management. A strategic capability is a unique ability that is mainly associated with large firms with abundant resources (Prusak 1997; Tsai 2001). SMEs are inherently less strategic, less hierarchical (Teece et al. 2016: 24) and more spontaneous which may facilitate quick adaptations and outperform strategically planned DC and strategic proactive innovations (Bennett & Lemoine, 2014). In our case, strategic innovations are more about obtaining new capabilities through buying. For example, recruiting a new accounting manager, business acquisition or recruiting an external agency to conduct a SWOT analysis for the firm. Although strategic innovation can facilitate DC development, it might not enhance innovation directly as we observe in this research. We observe similar spontenous, centralised, uninformed by data and impulsive responses to the environment in developing strategic innovations. The evidence is top management’s lack of engagement with dynamic capabilities (developed upon their data literacy capabilities) that stems from the management’s overconfidence and representativeness. Overconfidence occurs when managers are overly optimistic in their initial assessment of a situation, and they are slow to incorporate additional information about the situation into their assessment (Fischhoff et al. 1977; Alpert & Raiffa 1982) due to their confidence in their existing assumptions and opinions (Phillips & Wright 1977; Russo &Schoemaker 1989). Representativeness exists when the data literacy of a firm is poor. In this situation, decision-makers consistently underestimate the error and unreliability inherent in small samples of data (Payne et al. 1992), when they are willing to generalize from inadequate information (Tversky & Kahneman 1971) and when they make generalizations based on tacit knowledge (Kahneman et al. 1982; Collins 2010, p. 83). Cullen et al. (2023) found out that entrepreneurial orientation undermines a firm’s ability to capitalise the firm’s dynamic capabilities due to overconfidence and representativeness.

OP innovation is the only innovation type that strengthens the connection between DC and IC and facilitates the firm’s engagement with DL, although it is limited with one single DC step that is the firm’s ability to monitor and evaluate performance against objectives (DC6). And therefore we conclude that SMEs use their DC to “innovate” new business model designs (namely new organisational and process designs), but they use their substantive capabilities to adopt new technology, to develop new service or product and to design new strategies. This conclusion inevitably causes us to question whether or not there will be any contribution of technology adoption, strategy development and new product service development to long term capacity development of SMEs to adapt to changing environment. We recommend future research to investigate the ways in which substantive capabilities can be transformed into dynamic capabilities to improve innovation capabilities. We also suggest more research on data literacy capabilities especially in the SME context as ability to identify and utilise existing data sources is crucial for SMEs to improve their strategic innovations and DC.

Limitations and Recommendations for Future Research

(Helfat et al., 2007, p. 4) define dynamic capabilities as the capability to purposefully create, extend and modify a firm’s resource base. (Teece et.al., 1997) categorise innovation capabilities as dynamic or non-dynamic. The authors point out the importance of the stability level of the ecosystem conditions as a strong determinat of innovation capabilities. And yet, in order to control the stability factor of the ecosystem, we controlled the effect of the sector. However, this might be a limited approach in controlling the effect of the entire ecosystem.

Although perceptual judgements are widely used to assess the ability of DC (e.g., Hernández-Linares, et al., 2021), it might be a weakness in terms of evaluating the actual DC of a firm. In our research we measured DC based on the strategic decision-maker’s perspective. This approach enabled us to identify disfunctionalities such as the management’s incapability in identifying DC or capitalising them for proactive strategic innovation with a stronger effect on long-term capacity and data literacy development. On the other hand, our dependency of management’s evaluation might be interpreted as a weakness. Lastly, we defined DC from the DL perspective which might limit DC in a way that disables to capture their overall effect (Tanriverdi & Venkatraman, 2005).

Our research classifed SMEs into homogeneous group based on our variables such as the number of employees or the turnover of the company. This might be a limiting factor in understanding DC and IC relationship. We engaged with 137 SMEs based in the Northwest England region which might limit the generalisability of the results over ecosystems with different characteristics at meso and macro levels such as infrastructures provided for different industries, entrepreneurial support, access to universities or sustainability priorities within the ecosystem. The number of observations might appear a limiting factor. However, based on Tabachnick and Fidell (2013, p. 123)’s formula of sample size in quantitative research, we exceeded the lower threshold level of the ideal sample size (N > 50 + 8m (m: number of independent variables)). Based on the formula, the threshold should be 106 whilst our sample size is 137 (N=50+(8*7)=106).

References

Akter, S., Fosso Wamba, S., Gunasekaran, A., Dubey, R. & Childe, S. J. 2016. How to improve firm performance using big data analytics capability and business strategy alignment?. International Journal of Production Economics, 182.113-131.

Aldrich, H., E,. Pfeffer, J. 1976. Environments of Organizations. Annual Review of Sociology. Vol. 2:79-105.

Allen, T. J. 1977. Managing the Flow of Technology. Cambridge, MA: MIT Press.

Indexed at, Google Scholar, Cross Ref

Alpert, M., Raiffa, H. 1982. A progress report on the training of probability assessors. In D. Kahneman, P. Slavic, L A. Tversky (Eds.), Judgment under uncertainty: Heuristics and biases (pp. 294-305). Cambridge, England: Cambridge Univ. Press

Ambrosini, V., Bowman, C. 2009. What are dynamic capabilities and are they a useful construct in strategic management? International Journal of Management Reviews, 11(1), 29–49.

Amit, R., Schoemaker, P. J. 1993. Strategic assets and organizational rent. Strategic Management Journal, 14(1), 33-46.

Arend, R. J., Bromiley, P. 2009. Assessing the dynamic capabilities view: spare change, everyone? Strategic Organization, 7(1), 75–90.

Arend, R. J. 2013. Ethics-focused dynamic capabilities: A small business perspective. Small Business Economics, 41(1), 1–24.

Arend, R. 2014. Entrepreneurship and dynamic capabilities: how firm age and size affect the capability enhancement–SME performance relationship, Small Business Economics, 42, issue 1, p. 33-57.

Bennett, N., Lemoine, J., 2014. What VUCA Really Means for You, s.l.: Harvard Business Review.

D’Ignazio, C., and Bhargava, R. 2015. Approaches to Building Big Data Literacy. In Bloomberg Data for Good Exchange 2015. New York, NY, USA.

Bindra, S., Srivastava, S., Sharma, D. and Ongsakul, V. (2020), “Reviewing knowledge-based dynamic capabilities: perspectives through meta-analysis”. Journal for Global Business Advancement, Vol. 13 No. 3, pp. 273-295.,

Bolton, L., D., Lane, M.D. 2012. Individual entrepreneurial orientation: development of a measurement instrument, Education and Training, Vol. 54 No. 2/3, pp. 219-233.

Bolton, S., 2016. Dynamic Capabilities Development Framework, Ormskirk: Strategic Creativity Research Lab.,

Bolton, S., 2022. Dynamic Business Segmentation Insights, Ormskirk: Productivity and Innovation Centre. Indexed at,

Bower, G. H., & Hilgard, E. R. 1981. Theories of learning. 5th ed. Englewood Cliffs, N.J., Prentice-Hall. Indexed at,

Breznik, L. & Hisrich, R. 2014. Dynamic capabilities vs. innovation capability: Are they related?. Journal of Small Business and Enterprise Development. 21. 368-384. 10.1108/JSBED-02-2014-0018.

Cai, L., Liu, Q., Zhu, X., & Deng, S. 2015. Market orientation and technological innovation: The moderating role of entrepreneurial support policies. International Entrepreneurship and Management Journal, 11(3), 645–671.

Caloghirou, Y., Kastelli, I., Tsakanikas, A. 2004. Internal Capabilities and External Knowledge Sources: Complements or Substitutes for Innovative Performance? Technovation. 24. 29-39.

Camis´on, C., Villar, A. 2009. Capabilities and propensity for cooperative. internationalization. International Marketing Review, 26(2), 124–150.

Castaneda, D.I., Cuellar, S. 2020. Knowledge sharing and innovation: A systematic review. Knowledge and Process Management. 27: 159– 173.

Chen, Y.C., Li, P.C., Evans, K.R. 2012. Effects of interaction and entrepreneurial orientation on organizational performance: insights into market driven and market driving, Industrial Marketing Management, Vol. 41 No. 6, pp. 1019-1034.

Chen, Y., Li, J. Zhang, J. 2022a. Digitalisation, data-driven dynamic capabilities and responsible innovation: An empirical study of SMEs in China. Asia Pacific Journal of Management.

Chen, Y., Luo, H., Chen, J., Guo, Y. 2022b. Building data-driven dynamic capabilities to arrest knowledge hiding: A knowledge management perspective, Journal of Business Research, Volume 139, Pages 1138-1154, ISSN 0148-2963,.

Chetty R, Friedman J, Hendren N. e.al. 2020. How did COVID-19 and stabilization policies affect spending and employment? A new real-time economic tracker based on private sector data. Working paper 27431. Cambridge, MA: National Bureau of Economic Research.

Child, J., Mansfield, R. 1972. Technology, size, and organization structure. Sociology, 6: 369-393. Indexed at,

Chmielewski, D.A., Paladino, A., 2007. Driving a resource orientation: reviewing the role of resource and capability characteristics. Management Decision 45, 462e483.

Clampit, J., Lorenz, M. P., Gamble, J. E. & Lee, J., 2022. Performance stability among small and medium-sized enterprises during COVID-19: A test of the efficacy of dynamic capabilities. International Small Business Journal:Researching Entrepreneurship, 40(3), pp. 403-419.

Indexed at, Google Scholar, Cross Ref

Cohen, W., Levinthal, D., 1990. Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, 35(1), pp. 128-152.

Collins, H., 2010. Tacit and Explicit Knowledge. 1 ed. Chicago: The University of Chicago Press. Indexed at,

Cordeiro, M., Puig, F. & Ruiz-Fernandez, L., 2022. Realizing dynamic capabilities and organizational knowledge in effective innovations: the capabilities typological map. Journal of Knowledge Management.

Cullen, U.A., Bolton S., Cao, Q. 2023. Dynamic Capabilities in Action: The Interconnectedness Between Dynamic Capabilities, Entrepreneurial Orientation and SME Performance

Cullen, U.A., Bolton S., Trovati, M; 2023; E3i Diagnostic Data; PIC Data repository; PIC E3i; SME Productivity & Innovation Centre.

Darvizeh, M., 2018. Dynamic Capabilities In New Product Development And Its Effects On Firm Performance. 1 ed. Manchester: Manchester University.

Davenport, T., Prusak, L. 1998. Working Knowledge: How Organizations Manage What They Know. Boston: Harvard Business School Press.

Dawes, J. 1999. The relationship between subjective and objective company performance, measures in market orientation research: Further empirical evidence. Marketing Bulletin. Department of Marketing Massey University, 10, 65–75.

Dess, G. G., Robinson, R. B., Hitt, M. A. 1984. Industry effects and strategic management research. Journal of Management, 16(7), 7–27.

Doucouré, B. and Diagne, A., 2020. The effect of size and age on the performance of Senegalese small food companies: the role of market orientation. Transnational Corporations Review, pp. 349-359.

Døving, E. and Gooderham, P.N. 2008. Dynamic capabilities as antecedents of the scope of related diversification: the case of small firm accountancy practices. Strategic Management Journal. 29: 841-857.

Drnevich, P. L., Kriauciunas, A. P. 2011. Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strategic Management Journal, 2(3), 254–279.

Duodu, B. & Rowlinson, S. 2019.Intellectual capital for exploratory and exploitative innovation: Exploring linear and quadratic effects in construction contractor firms. Journal of Intellectual Capital.

Edge Hill University, 2022. SME Productivity & Innovation Centre.

Eisenhardt, K., Martin, J., 2000. Dynamic capabilities: what are they? Strategic Management Journal. 21, 1105e1121.

Emerald, 2013. AU Optronics Corporation leads in green innovation: A culture of proactive green innovation generates competitive advantage. Strategic Direction, 29(7), pp. 21-24.

Engelen, A., Kube, H., Schmidt, S., & Flatten, T. C. 2014. Entrepreneurial orientation in turbulent environments: The moderating role of absorptive capacity. Research Policy, 43(8), 1353–1369. doi:10.1016/j.respol.2014.03.002.

European Commission, 2015. User guide to the SME Definition, Luxembourg: European Union.

Fainshmidt, S., Pezeshkan, A., Frazier, M. L., Nair, A., Markowski, E. 2016. Dynamic capabilities and organizational performance: A meta-analytic evaluation and extension. Journal of Management Studies, 53(8), 1348–1380.

Farzaneh, M., Wilden, R., Afshari, L., Mehralian, G. 2022. Dynamic capabilities and innovation ambidexterity: The roles of intellectual capital and innovation orientation, Journal of Business Research, Volume 148, 2022, Pages 47-59,

Fischhoff, B., Slovic, P., Lichtenstein, S. 1977. Knowing with certainty: The appropriateness of extreme confidence. Journal of Experimental Psychology: Human Perception and Performance, 3(4), 552–564.

Forsman, H. 2011. Innovation capacity and innovation development in small enterprises. A comparison between the manufacturing and service sectors. Research Policy, 40(5), 739-750. Google Scholar, Cross Ref

Galvin, J., 2018. Four innovation strategies to take your company from complacent to competitive.

Gans, J., Stern, S. 2010. Is there a market for ideas? Industrial and Corporate Change, 19(3): 805–837.

Glisson, C., A., Martin, P., Y. 1980. Productivity and efficiency in human service organizations as related to structure, size, and age. Academy of Management Journal, 23: 21-37.

Indexed at, Google Scholar, Cross Ref

Gold, A. H., Malhotra, A. & Segars, A. H., 2001. Knowledge Management: An Organizational Capabilities Perspective. Journal of Management Information Systems, 18(1), pp. 185-214.

Gooding, R. Z., Wagner, J. A., 1985. A Meta-Analytic Review of the Relationship be- tween Size and Perform- ance: The Productivity and Efficiency of Orga- nizations and Their Subunits. Administrative Science Quarterly, 30(4), pp. 462-481.

Google Scholar, Cross Ref

Gudergan, S.P., Devinney, T., Richter, N.F., Ellis, R.S., 2012. Strategic implications for (non-equity) alliance performance. Long Range Planning 45, 451e476.

Guo, K., 2008. DECIDE A Decision-Making Model for More Effective Decision Making by Health Care Managers. The Health Care Manager, 27(2), pp. 118-127.

Indexed at, Google Scholar, Cross Ref

Harreld, B., O’Reilly, C. Tushman, M., 2007. Dynamic Capabilities at IBM. Californian Management Review, 49(4), pp. 21-43.

Helfat, C. E., Peteraf, M. A. 2003. The dynamic resource-based view: Capability lifecycles. Strategic Management Journal, 24(10), 997–1010.

Helfat, C.E., Winter, S.G., 2011. Untangling dynamic and operational capabilities: strategy for the (N)Everchanging world. Strategic Management Journal 32, 1243-1250.

Helfat, C.E., Raubitschek, R.S. 2018. Dynamic and integrative capabilities for profiting from innovation in digital platform-based ecosystems, Research Policy. 1391-1399.

Hernández-Linares, R., Kellermanns, F. W. López-Fernández, M. C. 2021. Dynamic capabilities and SME performance: The moderating effect of market orientation. Journal of Small Business Management, 59(1), pp. 162-195.

Hitt, M.A., Bierman, L., Shimizu, K., Kochhar, R., 2001. Direct and moderating effects of human capital on strategy and performance in professional service firms: a resource-based perspective. Academy of Management Journal 44, 13e28.

Hsu, H.W. and Wang, H.F. 2010. A Closed-Loop Logistic Model with a Spanning-Tree Based Genetic Algorithm. Computers & Operations Research, 37, 376-389.

Huang, K. F., Wu, L. Y., Dyerson, R., Chen, C. F. 2012. How does a technological firm develop its competitive advantage? A dynamic capability perspective. IEEE Transactions on Engineering Management, 59(4), 644–653.

Huysman, M., Wit, D. 2002. Knowledge Sharing in Practice.

Jones, M. 2019. What we talk about when we talk about (big) data, J. Strateg. Inf. Syst. 28 (1) 3–16.

Indexed at, Google Scholar, Cross Ref

Kaen, F.R., Baumann, H., Becker-Blease, J.R., & Etebari, A. 2010. Employees, firm size and profitability in U.S. Manufacturing Industries. Investment Management and Financial Innovations, 7, 7–23.

Kahneman, D., Slovic, P. and Tversky, A. (eds) 1982. Judgment under Uncertainty: Heuristics and Biases. Cambridge: Cambridge University Press.

Kahneman, D., Lovallo, D. 1993. Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking. Management Science 39(1):17-31.

Karna, A., Richter, A., & Riesenkampff, E. 2016. Revisiting the role of the environment in the capabilities-financial performance relationship: A meta-analysis. Strategic Management Journal, 37(6), 1154–1173.

Katkalo, V.S., Pitelis, C.N. and Teece, D.J., 2010. Introduction: On the nature and scope of dynamic capabilities. Industrial And Corporate Change, 19(4), pp.1175-1186.

Indexed at, Google Scholar, Cross Ref

Keskin, H. 2006. Market orientation, learning orientation, and innovation capabilities in SMEs: An extended model. European Journal of Innovation Management, 9(4), 396-417.

Khattab, S. A. 2017. The Impact of Dynamic Capability on Innovation (An Applied Study on Jordanian Pharmaceutical Organizations). European Journal of Business and Management, 9(20), 73–85.

Kump, B., Engelmann, A., Kessler, A., Schweiger, C. 2019. Toward a dynamic capabilities scale: measuring organizational sensing, seizing, and transforming capacities. Industrial and Corporate Change. 28. 1149-1172.

Levy, M. 2011. Knowledge retention: minimizing organizational business loss. Journal of Knowledge Management, Vol. 15 No. 4, pp. 582-600.