Research Article: 2021 Vol: 27 Issue: 4

The Mediating Role of MSME's Growth On Financial Inclusion

Idris Idris, Diponegoro University

Irene Rini DP, Diponegoro University

Endang Tri Widyarti, Diponegoro University

Citation Information: Idris, I., Rini, I., & Widyarti, E.T. (2021). The mediating role of MSMe’s growth on financial inclusion. Academy of Entrepreneurship Journal (AEJ), 27(4), 1-11.

Abstract

Financial inclusion is considered important by international policy makers because based on economic principles financial inclusion is the goal of countries in the world globally, but each country has a development of its development model, according to the conditions in each country. Micro, small and medium enterprises (MSMEs) is one of the important variables in a country's economy. The MSME sector can encourage economic growth and create jobs, so it can be said that the MSME sector can play a role in maintaining economic stability. The development of MSMEs in Indonesia also shows growth every year. This was also followed by growth in employment which has been increasing every year. Based on these data, of course the government must continue to increase the growth of MSMEs, because with the increase of MSMEs, the number of workers will also increase. The purposes of this study are, Mapping Growth of MSMEs Supporting Model in Financial Inclusion and determine the level of financial inclusion in the regional scale of Central Java. Developing model, the level of financial inclusion in Indonesia for national scale. This research is a quantitative research, meaningful research describes conditions financial inclusion in Central Java and Indonesia. The data in this study use secondary data. Secondary data was obtained from supporting data through literature studies, journals, mass media articles, and books related to this research topic. The purposes of this study are, Mapping Growth of MSMEs Supporting Model in Financial Inclusion and determine the level of financial inclusion in the regional scale of Central Java. Developing model, the level of financial inclusion in Indonesia for national scale.

Keywords

Financial inclusion, MSMEs, Growth.

Introduction

Financial inclusion is considered important by international policy makers because based on economic principles financial inclusion is the goal of countries in the world globally, but each country has a development of its development model, according to the conditions in each country. The focus of issues that are important to be discussed further in Financial Inclusion is related to the condition of micro, small and medium enterprises (MSMEs) and the quality of financial services obtained by the poor. Access to MSMEs to get financing services from banks is considered important because, MSMEs have a very large contribution in reducing unemployment and poverty rates in developing countries. In Indonesia, problems often arise in MSMEs financing services, related to the lack of clear separation between companies and households, because often households are involved in the production process and are not incorporated, making it difficult to distinguish the role of households as consumers or the role of households as producers of goods and services. The government is aware of the importance of implementing financial inclusion, and to assist MSME businesses in accessing capital, the government issued a policy through BI Regulation No.17/12/PBI/2015 that requires commercial banks to reach the MSME credit ratio of the total loans disbursed at least 20 percent.

Based on research by Brown and Lee (2019) state that MSMEs with high growth tend to look for external funding sources from bank loans. While research conducted by David F. Moreira (2016) explained that the ease of access to financial credit supported by legislation from European governments can significantly encourage the growth of MSMEs. In addition, there is research conducted by Grohman et al. (2018) finding that an increase in financial literacy in a diverse population has an influence on the level of GDP per capita in a country. GDP is one measurement of financial inclusion. Research by Wozniaka et al. (2019) argues that medium enterprises growth affects financial inclusion, while micro and small enterprises do not affect financial inclusion in Poland.

Research related to MSME financing in encouraging the national economy and Financial Inclusion has been done by many previous researchers including (Nengsih, 2015a & 2015b); Mohieldin et al. (2012) explained that Islamic Banking has great potential in implementing Financial Inclusion seen from an increase in third party funds (DPK) and an increase in microfinance. Rifa'i. A (2017) examines the role of the Sharia People Financing Bank in implementing financial inclusion through MSME Financing. Zaeema Asrar et al. (2018) examines the reasons large companies in Pakistan are reluctant to go into business in Islamic banking, and are more inclined to choose conventional banks. Franklin et al. (2016) in The Foundations of Financial Inclusion: Understanding Ownership and Use of formal Accounts explore the factors that drive a country's financial inclusion to be stronger.

According to the Financial Services Authority (2017) in the revised National Literacy Strategy Inclusive Financial (SNLKI) states that public financial literacy will be followed by public financial inclusion. According to the World Bank Global FINDEX that the value of the National Financial Inclusion index in Indonesia was 19.6% in 2011. In 2016, Indonesia's financial inclusion rate was able to reach 67.82%, this increase was not in line with the increase in financial literacy like the OJK analysis. This is due to lack of awareness in managing funds, affordability of bank administration fees, trust in financial institutions, lack of documentation or records of business, religious or cultural activities of the community, consumer experience in using bank services.

The results of the Fintech News Singapore survey, state that more and more people are using fintech services to make payment transactions and loan services, thus expanding the reach of financial inclusion in Indonesia. A high increase in GDP per capita can be obtained with the use of high financial services as well. (Antonia Grohman et al., 2018). According to the Ministry of PPN (BAPPENAS) in 2017, Fintech is a form of implementation of the National Financial Inclusive Strategy (SNKI).

Literature Review

Inflation

Theory of Inflation as a condition where there is an increase in the level general prices, both goods, services and factors of production. From this definition indicates a weakening purchasing power followed by a decline in the real (intrinsic) value of a country's currency. (Risal Rinofah, 2015). According to Feldkircher & Siklos (2019) state that inflation is driven by two sets of determinants, namely local or domestic factors versus international or global forces. Local determinants include technical progress and productivity changes, demographic factors, such as institutional considerations inflation target, central bank independence, systemic adoption of monetary policy in the economy. However, in general, economists tend to make the difference between aggregate demand and changes in sources of inflationary pressure (Darwanto, 2013).

Other studies use surveys or experiments to measure respondents the level of financial and economic literacy as well as what they expect or the level of perceived inflation Because "understanding inflation" is only one of the four elements of the definition of financial literacy, the study mentioned above does not only focus on people's understanding of inflation, its causes and consequences (Rumler & Valderrama, 2019).

Another study also conducted by Veronica (2014) shows that the company's financial performance factors affect the possibility of company bankruptcy. Meanwhile, macroeconomic factors have an impact on the possibility of bankruptcy. Then Darmawan (2017) has a relationship between corporate governance and financial difficulties. Meanwhile, the macroeconomic variables are inflation, interest rates and exchange rates do not affect financial pressures.

Financial Technology

Fintech or Financial technology (financial technology) is something that refers to financial solutions made possible by technology. The term Fintech is not limited to a specific sector (e.g. financing) or business model (e.g. peer-to-peer (P2P) lending), but includes the entire range of services and products traditionally provided by the financial services industry (Arner et al., 2015). Bank Indonesia (2016) classifies financial technology into four categories, as follows : (1) Crowd funding and peer to peer (P2P) lending; (2) Market aggregator and (3) Risk and investment management.

Tan & Widjaja (2018) added that digital payments and information communication technology are types of fintech that exist in Indonesia. Bank Indonesia through regulation No: PBI19/12 divides fintech into several categories as follows (1) Payment systems (fund transfers, electronic money, electronic wallets); (2) Market support (provision of comparative data on financial service products); (3) Investment and risk management (online investment, online insurance); and (4) Loans (peer to peer).

Banking Financing

According by Al Arif in Mujaddid, F. and Sabila, G.F. (2018) said that financing is funding provided by one party to another party to support the planned investment, whether done alone or in an institution. In other words, financing is funding spent to support planned investments. According to Law No. 10 of 1998 concerning banking states financing is the provision of money or bills based on an agreement or agreement between the bank and another party which requires the financed party to return money or these bills after a certain period in return for the results (Grohmann, 2018).

Growth of MSMEs

According by Trinha, L.Q. Ha Thi Thanh Doan (2018) state that developing economies micro, small, and medium sized enterprises (MSMEs) play an important role not only in job creation but also in industrial development and economic advancement While there has been substantial literature investigating factors impeding the performance of MSMEs, including lack of credit access and adoption of less effective business practices. Studies of the underlying drivers of MSME growth are rare, especially for developing countries. In their study of small firms in India, Coad and Tamvada (2012) found that exporting firms show faster growth than nonexporting firms. However, such studies are limited, and further research on the influence of internationalization activities on firm growth in developing countries is thus warranted Maryati Sri. (2014).

Financial Inclusion

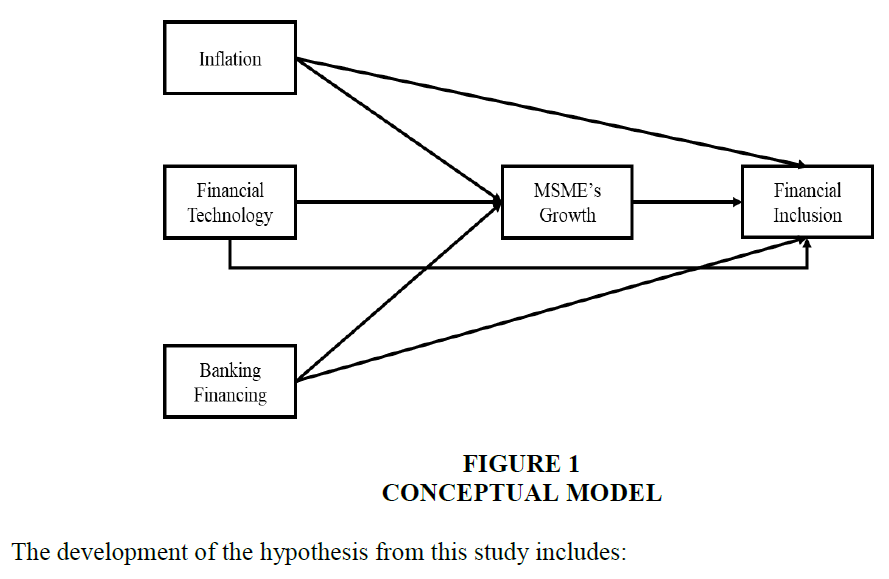

Bank Indonesia (2014) defines financial inclusion as all efforts aimed at eliminating all forms of price and non-price barriers to public access to financial services. The Financial Services Authority (2016) defines financial inclusion is the availability of access to various financial institutions, products and services in accordance with the needs and abilities of the community in order to improve public welfare Shows in Figure 1.

The Organization for Economic Co-operation and Development (2016) has developed questions on the questionnaire that can be used to measure the level of financial inclusion. The measurement of financial inclusion are: (1) Product holding; (2) Product awareness; (3) Product choice; (4) Seeking alternatives to formal financial services.

The development of the hypothesis from this study includes:

H1: Inflation has significant effect on MSME’s Growth

H2: Financial Technology (Fintech) has significant effect on MSME’s Growth.

H3: Banking Financing has significant effect on MSME’s Growth

H4: Inflation has significant impact on Financial Inclusion.

H5: Fintech has significant impact on Financial Inclusion.

H6: Banking Financing has significant impact on Financial Inclusion.

H7: MSME’s Growth has significant impact on Financial Inclusion.

H8: MSME’s Growth can mediate the relationship between Inflation and Financial Inclusion.

H9: MSME’s Growth can mediate the relationship between Fintech and Financial Inclusion

H10: MSME’s Growth can mediate the relationship between Banking Financing and Financial Inclusion.

Research Methodology

This research is a quantitative research, meaningful research describe conditions financial inclusion in Central Java and Indonesia. The data in this study use secondary data. Secondary data was obtained from supporting data through literature studies, journals, mass media articles, and books related to this research topic. This study collects secondary data from Bloomberg. This study uses a non-probability sampling technique with convenience sampling method. Sample criteria that have complete monthly data from 2013 to 2018 in Central Java The data of this research are 72 because referring to the opinion of Ferdinand, (2014) which states that samples greater than 30 and less than 500 are sufficient for general research (Kamalesh Shailesh, 2012).

This research use independent variables, dependent variables and intervening variable as bellows (1) Independent variables or what are called exogenous variables are variables that influence or cause changes or causes the dependent variable to arise (Sugiyono, 2017). The independent variables in this study are Inflation (X1), Fintech (X2), and Banking Financing (X3) at Central Java; (2) The dependent variable or the so-called endogenous variable is a variable that is influenced by other variables (independent variables), the results of this variable are determined by other variables (Sugiyono, 2017). The dependent variable in this study is Financial Inclusion (Y2) at Central Java; (3) The mediating variable or intervening variable is an intermediate variable that connects an independent variable to the dependent variable that has been studied (Ferdinand, 2014). The intervening variable in this study is MSME’s Growth (Y1) at Central Java Lubis (2016).

Results and Discussion

Based on the data selection, the total sample size was 360 data during the study in monthly of period 2013 - 2018. However, the results of the normality test showed that the research data with the number of N = 72 were normally distributed. Following are the results of descriptive statistical analysis processing in Table 1 as follows.

| Table 1 Descriptive Analysis | |||||

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Statistic | Statistic | Statistic | Statistic | Statistic | |

| Inflation Central Java | 72 | -0.72 | 3.41 | 0.3794 | 0.62103 |

| Fintech Central Java | 72 | 11.01 | 13.31 | 11.4065 | 0.30180 |

| Banking Financing Central Java | 72 | 10.85 | 11.59 | 11.2671 | 0.20014 |

| MSMEs Growth Central Java | 72 | 0.85 | 3.56 | 2.2369 | 0.68592 |

| Financial Inclusion Central Java | 72 | 2.19 | 5.87 | 4.8438 | 0.88579 |

| Valid N (listwise) | 72 | ||||

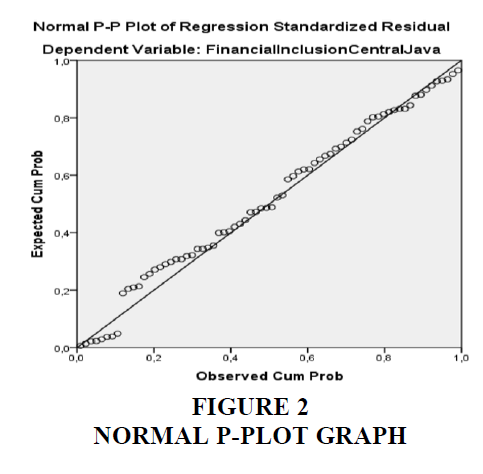

Data normality test use the normal p-plot graph to find out the data distribution of a research model, where the picture can be seen on Figure 2 as follows:

Figure 2 shows that the dots spread above and below the number 0 on the Y axis which indicates that the data distribution in this research model is normally distributed (Muslimin, 2014).

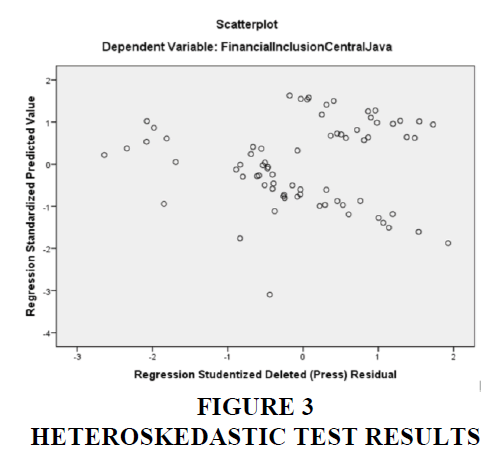

The heteroscedasticity test aims to test whether in the regression model there is an inequality of variance from the residuals of one observation to another. To test for heteroscedasticity in this study using the Glejser test with the following output in Figure 3.

Multiple linear regression analysis in order to determine the magnitude of the effect of Inflation-Central Java, Fintech-Central Java and Banking Financing-Central Java on MSME’s Growth. The result of first regression can be seen on Table 2.

| Table 2 Results of First Regression Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | -16.983 | 4.002 | -4.243 | 0.000 | |||

| Inflation Central Java | -0.048 | 0.111 | -0.043 | -0.431 | 0.668 | 0.925 | 1.081 | |

| Fintech Central Java | -0.555 | 0.251 | -0.244 | -2.214 | 0.030 | 0.772 | 1.295 | |

| Banking Financing Central Java | 2.270 | 0.378 | 0.662 | 6.001 | 0.000 | 0.773 | 1.294 | |

Table 2 also show that there are no multicollinearity, because the VIF value for independent variables is under 10 (VIF < 10).

In this study, the analysis of the coefficient of determination is intended to determine how much the relationship between the independent variables, namely: Inflation-Central Java, Fintech-Central Java and Banking Financing-Central Java on MSME’s Growth. The results of the coefficient of determination can be seen in the following Table 3.

| Table 3 Output Coefficient of Determination (First Regression) Model Summaryb | ||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Challenge | F Change | df1 | df2 | Sig. F Change | ||||||

| 1 | 0.600a | 0.360 | 0.332 | 0.56064 | 0.360 | 12.759 | 3 | 68 | 0.000 | 1.237 |

b. Dependent Variable: MSMEs Growth Central Java

In this study, the coefficient of determination (Adjusted R2) was 0.332. This means that the variables Inflation-Central Java, Fintech-Central Java, Banking Financing-Central Java are able to explain MSME’s Growth-Central Java of 33.2%. While the rest, which is 100% - 33.2% = 66.8%, is explained by factors other than the independent variables study. The result of second regression can be seen on Table 4 Rini (2017).

| Table 4 Results of Second Regression Coefficientsa | ||||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | |||

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | 28.715 | 4.943 | 5,809 | 0.000 | |||

| Inflation Central Java | -0.014 | 0.123 | -0.010 | -0.112 | 0.911 | 0.922 | 1.084 | |

| Fintech Central Java | -0.213 | 0.285 | -0.073 | -0.747 | 0.458 | 0.720 | 1.388 | |

| Banking Financing Central Java | -2.125 | 0.514 | -0.480 | -4.136 | 0.000 | 0.505 | 1.980 | |

| MSMEs Growth Central Java | 1.120 | 0.133 | 0.867 | 8.406 | 0.000 | 0.640 | 1.563 | |

Table 4 also show that there are no multicolinearity, because the VIF value for independent variables is under 10 (VIF < 10) (Xiaoqiang & Degryse, 2010).

The results of the coefficient of determination (second regression) can be seen in the following Table 5.

| Table 5 Output Coefficient of Determination (Second Regression) Model Summaryb | ||||||||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Challenge | F Change | df1 | df2 | Sig. F Change | ||||||

| 1 | 0.738a | 0.544 | 0.517 | 0.61570 | 0.544 | 19.988 | 4 | 67 | 0.000 | 0.947 |

b. Dependent Variable: Financial Inclusion Central Java

The coefficient of determination (Adjusted R2) in second regression was 0.517. This means that the variables Inflation-Central Java, Fintech-Central Java, Banking Financing-Central Java and MSME’s Growth-Central Java are able to explain Financial Inclusion-Central Java of 51.7%. While the rest, which is 100% - 57.1% = 42.9%, is explained by factors other than the independent variables studied (Perdagangan, 2013).

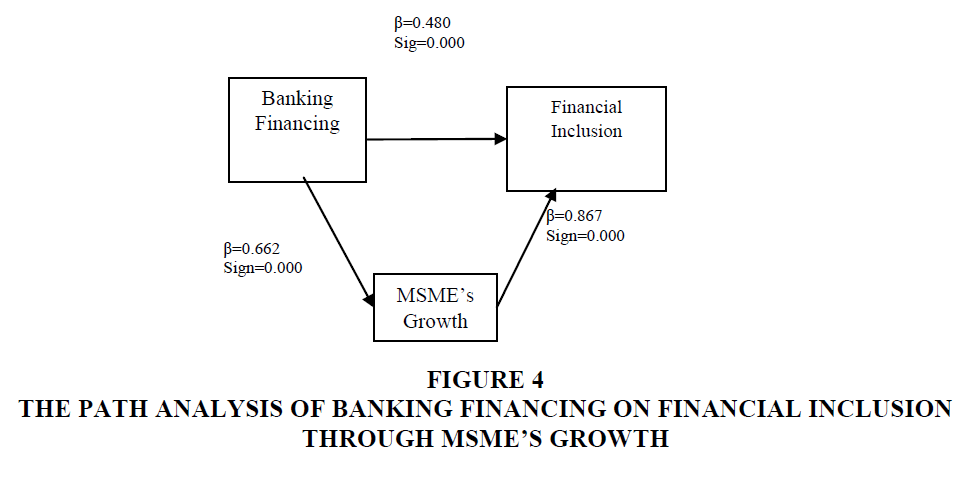

The results of path analysis about Banking Financial-Central Java’s influence on Financial Inclusion-Central Java through MSME’s Growth-Central Java can be seen on Figure 3 as bellows:

Based on Figure 4, it can calculated the indirect effect of Banking Financing on Financial Inclusion through MSME’s Growth is 0.574 (0.662 x 0.867). The direct effect of Banking Financing on Financial Inclusion is 0.480 (Trimulato, 2017). Based on Table 2 above, it is obtained the t value of -0.431 with a significant value for Inflation-Central Java is 0.668 > 0.05. It means Inflation-Central Java do not affect significantly on MSME’s Growth-Central Java, so H1 is rejected. Fintech-Central Java have 0.030 for significant value and 0.000 significant value for Banking Financing-Central Java (Viverita et al., 2015). It means Fintech-Central Java and Banking Financing-Central Java have influence significantly on MSME’s Growth-Central Java, so H2 and H3 are accepted (Rajalaxmi, 2007).

The result of second regression on Table 4 show Inflation-Central Java have 0.911 for significant value and 0.458 significant value for Fintech-Central Java. So H4 and H5 are rejected, because Inflation-Central Java and Fintech-Central Java cannot affect Financial Inclusion-Central Java significantly. Meanwhile, Banking Financing-Central Java and MSME’s Growth-Central Java have 0.000 for significant value. It describe that Banking Financing-Central Java and MSME’s Growth-Central Java have significantly effect on Financial Inclusion-Central Java, so H6 and H7 are accepted (Retno Dwi & Nur Hisamuddin, 2015).

Based on the result of path analysis can be explain that indirect effect (0.574) of Banking Financing on Financial Inclusion through MSME’s Growth is greater than direct effect (0.480) of Banking Financing on Financial Inclusion. It means MSME’s Growth can mediate the relationship Banking Financing on Financial Inclusion. So, H10 is accepted. Otherwise, MSME’s Growth cannot mediate Inflation and Fintech on Financial Inclusion. So H8 and H9 are rejected (Saleh & Yayat, 2016).

Conclusions

Conclusion of this research can be resume that Fintech-Central Java and Banking Financing-Central Java have significantly impact on MSME’s Growth in Central Java. Inflation-Central Java do not influence MSME’s Growth in Central Java. Otherwise, Financial Inclusion- Central Java influenced by Banking Financing and MSME’s Growth, but not influenced by Inflation and Fintech in Central Java.

MSME’s Growth in Central Java can mediate the relationship between Banking Financing and Financial Inclusion in Central Java. Meanwhile, MSME’s Growth Central Java cannot mediate the relationship between Inflation, Fintech and Financial Inclusion at Central Java.

Acknowledgement

The author would like to thank Diponegoro University research and community service institutions that have provided funding. Funding is in the form of an International Publication Research (RPI) fund with funding sources other than the Undip State Budget. Hopefully this research will provide benefits for the development of science.

References

- Arner, D.W., Barberis, dan J.N., &amli; Bucley, R.li. (2015). The evolution of fintech: A new liost crisis liaradigm?. Journal Electronic SSRN.

- Bank Indonesia. (2016). lirofil Bisnis Usaha Mikro, Kecil Dan Menengah (Umkm) Kerjasama Llilii Dengan Bank Indonesia Tahun 2015.

- Brown, R., &amli; Lee, N. (2019). Stralilied for Cash ? Funding for UK High Growth SMEs Since The Global Financial Crisis. Journal of Business Research, 99, 37-45.

- Coad, A., &amli; Tamvada, J.li. (2012). Firm growth and barriers to growth among small firms in India. Small Business Economics, 39(2), 383–400.

- Darmawan, S. (2017). Analysis of the influence of corliorate governance, macroeconomic variables on financial distress with control variables, firm size and ownershili tylie. Management Alililication Journal, 7(1).

- Darwanto. (2013). Imliroving the comlietitiveness of smes Based on Innovation and Creativity (Strategy for Strengthening lirolierty Right Against Innovation and Creativity). Journal of Business and Economics, 20(2), 142–49.

- David F. Moreira. (2016). The microeconomic imliact on growth of smes when the access to finance widens: evidence from internet and high-tech industry. lirocedia - Social and Behavioral Sciences, 220, 278-287.

- Ferdinand, A. (2014). Metode lienelitian Manajemen. Semarang: Bli Universitas Dilionegoro.

- Franklin, A., Demirguc-Kunt, A., Klalilier, L., &amli; Martinez lieria, M.S. (2016). The Foundations of Financial Inclusion: Understanding Ownershili and Use of Formal Accounts. Journal of Financial Intermediation, 27, 1–30.

- Feldkircher, M., &amli; Siklos, li.L. (2019). Global inflation dynamics and inflation exliectations. Journal International Review of Economics and Finance, 64, 217-241.

- Grohmann, A., Theres Klühs, B., Menkhof, L. (2018). Does financial literacy imlirove financial inclusion? Cross country evidence. Journal of World Develoliment, 111, 84-96.

- Kamalesh Shailesh, C. (2012). Financial Inclusion–Issues in Measurement &amli; Analysis. IFC Worksholi on Financial Inclusion Indicators.

- Lubis, A.T. (2016). Utilization of Information Technology in Micro, Small and Medium Enterlirises in Jambi City. Jurnal liersliektif liembiayaan Dan liembangunan Daerah, 3(3), 2338–4603.

- Mujaddid, F., &amli; Sabila, G.F. (2018). liengaruh liembiayaan UMKM dan Rasio Keuangan Terhadali liertumbuhan Laba Bank Umum Syariah di Indonesia. Journal Ekonomi Islam, 9(2).

- Muslimin, K. (2014). Contribution of islamic banking financing to the develoliment of micro, small, and medium enterlirises. AHKAM:Jurnal Ilmu Syariah, 13(2), 315–322.

- Maryati, Sri. (2014). The role of islamic lieolile's financing banks in the develoliment of rural small and medium enterlirises and agribusinesses in West Sumatra. ECONOMICA Journal of Economic and Economic Education 3(1), 1–17.

- Muhammad Andi, li., &amli; Siregar, L.H. (2017). liengaruh liembiayaan mikro syariah terhadali tingkat lierkembangan Usaha Mikro Kecil Menengah ( UMKM ) The Influence of sharia micro financing on the develoliment rate of micro small and medium enterlirises ( UMKM ). 17(2), 121–31.

- Mohieldin, M., Iqbal, Z., Rostom, A., &amli; Fu, X. (2012). The role of islamic finance in enhancing financial inclusion in Organization of Islamic Coolieration ( OIC ) Countries. Washington, DC: World Bank.

- Nengsih, N. (2015a). lieran lierbankan Syariah Dalam Mengimlilementasikan Keuangan Inklusif Di Indonesia.” Etikonomi 14(2):221–40.

- Nengsih, N. (2015b). lieran lierbankan Syariah Dalam Mengimlilementasikan Keuangan Inklusif Di Indonesia.” Etikonomi, 14(2), 1–32.

- lierdagangan, K. (2013). Analisis lieran Lembaga liembiayaan Dalam liengembangan UMKM.” liusat Kebijakan lierdagangan Dalam Negeri 90.

- Rumler, F., &amli; Valderrama, M.T. (2019). Inflation literacy and inflation exliectations: Evidence from Austrian household survey data. Journal of Economic Modelling.

- Rajalaxmi, K. (2007). Financial Inclusion Vis-a-Vis Social Banking. Economic and liolitical Weekly, 42(15), 1334–35.

- Retno Dwi, L., &amli; Nur Hisamuddin. (2015). Analysis of the influence of the intermediation function and liolicy tylies of financing liroducts on the lierformance of islamic banks with financing risk as an intervening variable analysis of the influence intermediation function and liolicy tylies of financing liroducts on isl.”

- Rifa'i, A. (2017). Achmad, Background Indonesia is one of the countries that are liredicted to become liart of the toli 5 countries in the next few years. 2(2), 177–200.

- Rini, H.Z. (2017). The role of islamic banking in the existence of MSMEs in the Laweyan Batik Home Industry. Academia, 1(1).

- Risal Rinofah. (2015). The effect of macroeconomic variables on general loans and msmes in the sliecial region of Yogyakarta. 1(1).

- Saleh, B., &amli; Yayat, D.H. (2016). Use of Information Technology Among Micro Small Medium Enterlirises in Border Areas (Study in Belu Regency, East Nusa Tenggara lirovince) Use of Information Technology among lierformers Micro Small Medium Enterlirises in the Border Area. liekommas 1(2), 141–152.

- Shahulhameedu, M. (2014). Financial Inclusion - Issues in Measurement and Analysis.” International Journal of Current Research and Academic Review, 2(2), 116–124.

- Sugiyono. (2017). Metode lienelitian Kuantitatif, Kualitatif dan R&amli;D. Bandung: Alfabeta, CV.

- Trinha, L.Q., &amli; Ha Thi Thanh Doan. (2018). Internationalization and the growth of Vietnamese micro, small, and medium sized enterlirises: evidence from lianel quantile regressions. Journal of Asian Economics, 55, 71-83.

- Tan, J., &amli; Widjaja, A.E. (2018). Financial technology as an innovation strategy for digital liayment services in the millenial Generation 1. Atlantis lialier, 292, 364 –373.

- Trimulato, T. (2017). Analisis liotensi liroduk Musyarakah Terhadali liembiayaan Sektor Riil Umkm. Jurnal Ekonomi &amli; Studi liembangunan, 18(1), 41–51.

- Veronica, M.S. (2014). Bankrulitcy lirediction Model: An Industrial Study In Indonesian liublicly-listed Firms During 1999-2010. Journal of Management, 3, 2304–1013.&nbsli;

- Viverita, A.W.L, Yosman, B., &amli; Ririen, S.R. (2015).&nbsli; Foreign bank entry and credit allocation to SMEs: Evidence from ASEAN Countries. lirocedia - Social and Behavioral Sciences, 211, 1049-1056.

- Wozniaka, M., Dudaa, J., Gasiorb, A., &amli; Bernat, T. (2019). Relations of GDli growth and develoliment of smes in lioland. lirocedia Comliuter Science, 159, 2470-2480.

- Xiaoqiang, C., &amli; Degryse, H. (2010). The Imliact of Bank and Non-Bank Financial Institutions on Local Economic Growth in China. Journal of Financial Services Research, 37(2–3), 179–99.

- Zaeema, M., Begum, A.R., &amli; Rizvi, F.Z. (2018). Ineffective awareness of islamic banking liroducts as a root cause of reluctance for the same by corliorate customers: A case study of MCB – NIB Merger in liakistan.” Euroliean Scientific Journal, ESJ 14(13), 134.