Original Articles: 2023 Vol: 26 Issue: 2

The mediating effects of procedural rationality in strategic decision-making between adherence to Islamic financial values and strategic decision-making effectiveness

Anas Osama Hakeem, Umm Al Qura University

Citation Information: Hakeem, A. (2023). The mediating effects of procedural rationality in strategic decision-making between adherence to islamic financial values and strategic decision-making effectiveness: case of saudi arabia’s financial sector. Journal of Management Information and Decision Sciences, 26 (2), 1-14.

Abstract

Purpose âÂ?Â? This research examines the link between adherence to Islamic financial values and strategic decision-making effectiveness. This takes into account the mediating effect of procedural rationality on strategic decision-making. Design/methodology/approach âÂ?Â? The research model was tested using a structural equation modelling design based on survey data from 162 Saudi companies that pertain to the financial sector, by used by software (SPSS and SmartPLS). Findings âÂ?Â? The results showed that these companiesâÂ?Â? adherence to Islamic financial values positively impacted the effectiveness of decision-making strategies. However, the findings did not demonstrate any significant effect of adherence to Islamic financial values on procedural rationality. But the results revealed the positive impact of highly adopting procedural rationality on strategic decision-making effectiveness. Originality/value âÂ?Â? The findings have revealed that adherence to Islamic financial values will help decision-makers in organisations make strategic decisions distinctively and effectively. This could be achieved by following the criteria of Shariah. In this way, organisations will ensure that their activities will be fair and ethical via real and clear economic activities that are not based on ignorance or a lack of knowledge that will yield economic benefits to their organisations and society in general. For readers, these findings enrich knowledge about strategic decision-making and adherence to Islamic financial values. These two areas of research have not been relatively tackled when this study investigated such relationships. For business and management practice, the procedural rationality based on Islamic financial values as a practice supports the strategic decision makers to improve the firmâÂ?Â?s performance and to applied a best practices (employee involvement, process approach, leadership) that ensure continuous improvement and organisational stability.

Keywords

Adherence to Islamic Financial Values, Procedural Rationality, Strategic Decision-Making Effectiveness.

Introduction

In reviewed literature on organisational values, only a limited number of studies shed lights on intangible resources, including studies on adherence to Islamic financial values (Branine & Pollard, 2010). The limited available empirical evidence has suggested that adherence to Islamic financial values in companies may positively impact the outcomes of companies’ activities - including the outcomes of strategic decision-making (Abdul Cader, 2017; Helmy et al., 2014; Shafique et al., 2015). This has also suggested that this relationship may be complex and dependent on a number of factors. However, one can note the absence of clear results in the available studies (Bianchi et al., 2017; Imran et al., 2017; Monteiro et al., 2017; Thanos et al., 2017). Subsequently, this research paper focuses on the relationship between adherence to Islamic financial values within companies and strategic decision-making effectiveness. Moreover, this article aims to investigate procedural rationality in strategic decisions as a mediator between adherence to Islamic financial values and strategic decision-making effectiveness.

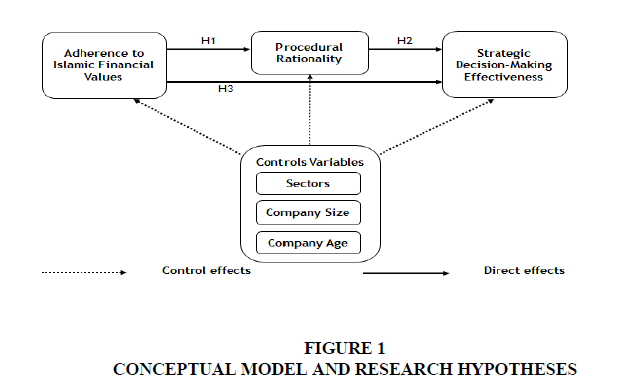

This study focuses on procedural rationality in strategic decision-making for a number of reasons. First, earlier studies have confirmed that procedural rationality plays a crucial role in strategic decision-making and must subsequently be involved in any research that studies this strategy (Keillor et al., 1998). Second, prior studies have revealed that, in spite of attracting a great deal of interest, most studies tackled procedural rationality in strategic decision-making in a segmented fashion (Bhatnagar, 1992). Third, other studies, like Child et al. (2010) and Elbanna et al. (2014), have shown that there is limited theoretical and empirical evidence on the factors that augment or restrict procedural rationality in strategic decision-making. Subsequently, this study examines the effect of procedural rationality as a mediator between adherence to Islamic financial values and strategic decision-making effectiveness Figure 1.

Theory and Hypotheses

Since the scope of this study is investigating the relationship between adopting Islamic financial values and the effectiveness of strategic decision-making, the following hypothesis has been developed (Maierhofer et al., 2002).

H1: The greater the adherence to Islamic financial values, the more effective it will be on strategic decision-making.

The Mediating Role of Procedural Rationality

This study suggests that procedural rationality may act as a mediator between the organisations' values and their effectiveness in making strategic decisions. Previous studies in literature unveiled that the organisations' values have a positive association with their outcomes (Dabi? et al., 2015; Heavey et al., 2009; Schein, 2010; Schein & Schein, 2017; Tihanyi et al., 2005). Moreover, prior studies revealed that procedural rationality can have a positive influence on the organisations’ outcomes (Dean & Sharfman, 1996; Eisenhardt et al., 1997; Elbanna & Child, 2007a; Janis, 1989; Nutt & Wilson, 2010).

Taking the financial companies in Saudi Arabia as an example, implementing Islamic finance is fundamental due to the application of Islamic laws that govern institutions and business practices (Alfalih, 2016). Given the high political activity of top management teams within financial institutions, they are forced to engage in investments or financial activities that are prohibited by Islamic laws in order to serve their self-interests. Such practices are not easy for decision-makers, as the top management teams within the Saudi Arabian financial institutions are usually Shariah-compliant legal committees that evaluate decisions based on Islamic laws before adopting or implementing them (Al-Kandi et al., 2013). Shariah is the system of religious laws based on the essence of Islam that governs the day-to-day life of Muslims. Therefore, adopting Islamic finance will decrease political activities, and subsequently, the effectiveness of strategic decision-making will be enhanced (Hove et al., 2014; Zin & Adnan, 2016; Zin et al., 2017). In other words, the top management teams’ decisions will be based on their organisations’ values; hence, their decisions will be effective (Guest & King, 2004).

These Arguments Lead to the Following Hypotheses

H2: The greater the adherence to Islamic financial values, the stronger the procedural rationality will be in strategic decision-making.

H3: The stronger procedural rationality in strategic decision-making, the more effective it will be in strategic decision-making.

H4: Procedural rationality in strategic decision-making mediates the relationship between adherence to Islamic financial values and strategic decision-making effectiveness.

Research Method

Sample and Procedure

The research setting is a number of companies located in Saudi Arabia and are part of Saudi Arabia’s financial sector, namely, banks, finance companies, insurance companies, investment companies, real estate development companies and Awqaf (endowments) companies. The main activity of these companies is financial, and all of them employ more than 100 employees (Zahra Shaker & Garvis Dennis, 2000). This study targets the members of top management teams as the inside board members (i.e. those executives who also serve on the board of directors for the responding company, according to Finkelstein and Hambrick 1990 and (Goll & Rasheed 2005). Another reason for investigating all of these companies was generating data that would represent all the companies in Saudi Arabia and thus make sure that the sample is representative (Miller, 2008).

As for data collection, in order to investigate Saudi Arabian companies under strict monetary rules and time constraints, an electronic survey was selected as the most appropriate data collection method. The distribution period of the survey lasted nearly three months. From mid-December 2018 until mid-March 2019, 1,500 questionnaires were distributed to 375 companies. In total, 379 questionnaires were returned from 177 companies. At least two responses were collected from each company to guarantee the validity of the survey results. Out of the 379 questionnaires, only 15 responses were excluded for some reasons, such as incomplete answers or irrelevant responses. The remaining 364 answers from 162 companies represented a final response rate of 25%. Thus, the total response rate was quite satisfactory, since earlier studies reported that top executives had been less likely to reply (Hunt et al., 1984; Menon et al., 1999).

This study implemented Structural Equation Modelling technique to analyse collected data. The study is based on testing causal relationships hypothesised in the research framework of multiple independent and intervening variables. Analysing data was conducted using SPSS (Statistical Package for the Social Sciences) and SmartPLS (Partial Least Squares Path Modelling) software packages.

Measures

To measure the constructs, the previously tested scales were used. Table 1 includes the scales used to measure the main variables of the study.

Independent Variable: Adherence to Islamic Financial values. In this study, adopting Islamic financial values was measured using a seven-item scale taken from Haniffa & Hudaib 2002, and scaled on Likert scale (1= Not at all; 7 = Completely). The 7 items were: (1) to what extent were strategic decisions affected by commitment to operating within Shariah principles/ideals; (2) to what extent were strategic decisions affected by commitment to providing returns within Shariah principles; (3) to what extent were strategic decisions affected by the current direction of your firm to serving the needs of the Muslim community; (4) to what extent were strategic decisions not affected by the future direction of your firm to serving the needs of the Muslim community; (5) to what extent were strategic decisions affected by commitment to engage only in permissible investment activities according to Shariah principles; (6) to what extent were strategic decisions affected by commitment to engage only in permissible financing activities according to Shariah principles; (7) to what extent were strategic decisions affected by commitment to fulfil contracts (aquds) according to Shariah principles’. Adopting Islamic financial values in this study is calculated as the sum of these seven items. This seven-item measure displays the acceptable levels of reliability (α=0.970; CR=0.975) and validity (AVE=0.848), as shown in supplement Table 1. Supplement Table 1 provides the items, source, measurement and descriptive statistics relating to adherence to the Islamic financial values construct (Ezzi et al., 2014).

Dependent Variable: Strategic Decision-Making Effectiveness. Strategic decision-making effectiveness was measured by a four-item scale, taken from Jansen et al., (2013), and also scaled using the same seven-points of Likert scale as above. The items included: (1) to what extent have strategic decisions contributed to the turnover growth of your firm; (2) to what extent have strategic decisions contributed to the profit growth of your firm; (3) to what extent is the decision-making team satisfied with the decision; and (4) to what extent has the decision led to the expected result. The Strategic Decision-Making Effectiveness variable is calculated as the sum of these four items. This four-item measure displays acceptable levels of reliability (α=0.837; CR=0.891) and validity (AVE=0.671), as shown in supplement Table 2. Supplement Table 2 below provides the items, source, measurement and descriptive statistics relating to the strategic decision-making effectiveness construct (Lengler et al., 2016).

Mediator Variable: Procedural Rationality in Strategic Decision-Making. In this study, procedural rationality in strategic decision-making was measured by a five-item scale taken from Dean & Sharfman (1996), which was scaled on a seven-point Likert scale. These items included: (1) how extensively did the top decision-making group in your firm look for information before making strategic decisions? (1= Not at all, 7= Extensively); (2) how extensively did the top decision-making group analyse relevant information for decision before making a strategic decision? (1= Not at all, 7= Extensively); (3) how important were quantitative analytic techniques (such as net present value or discounted cash flow analysis, etc.) for making the strategic decision? (1= Not at all important, 7= Very important); (4) in general, how effective was the top decision-making group in your firm at focusing its attention on relevant information and ignoring irrelevant information for the decision? (1= Not at all effective, 7= Very effective); (5) how would you describe the process that had the most influence on the decision of top decision-making groups? (1= Mostly analytical, 7= Mostly axiomatic). This measure or its variants have been widely used with similar reliability estimates (Dean & Sharfman, 1996; Elbanna & Child, 2007a; Papadakis, 1998; Thanos et al., 2017). The Cronbach’s alpha value in this study is (0.845), as revealed in Table 1, which is similar to the values of previous studies that used a similar scale to measure procedural rationality. In sum, with regard to the present study, this three-item measure shows acceptable levels of reliability (α=0. 845; CR=0.890) and validity (AVE=0.619), as displayed in supplement Table 1.

Control Variables: Based on previous studies, this study investigated the effects of three variables (type of sector, companies’ age and companies’ size) on entrepreneurial orientation, adherence to Islamic financial values, politicisation and strategic decision-making effectiveness. Further understanding of these three variables is as follows

Type of Sector: The present research studied the type of sector: banks, finance companies, insurance companies, investment companies, real estate development companies and Awqaf (endowments) companies (De Clercq et al., 2015; Thanos et al., 2017).

Company Age: The current study examined the effect of company age since it impacts organisational processes and outcomes (Zahra & Garvis, 2000). The company age was calculated based on the number of years in operation (Liu et al., 2011).

Company Size: The survey shed lights on the impact of company size depending on the number of full-time employees (García-Villaverde et al., 2013; Thanos et al., 2017; Wales et al., 2015). The company size influences its growth and outcomes (Dimitratos et al., 2004).

As Table 2 shows, the main findings of this survey unveiled that there was a strong relationship between adopting Islamic values in companies and the effectiveness of strategic decision-making. However, the findings did not demonstrate any significant effect of adopting Islamic financial values on procedural rationality. It is important to note that the results highlighted a strong relationship between procedural rationality and the effectiveness of decision-making strategies. More specifically, the study found out that the higher the level of procedural rationality in strategic decision-making is, the more effective decision-making strategies will be (Martín-Tapia et al., 2010).

Mediator Analysis

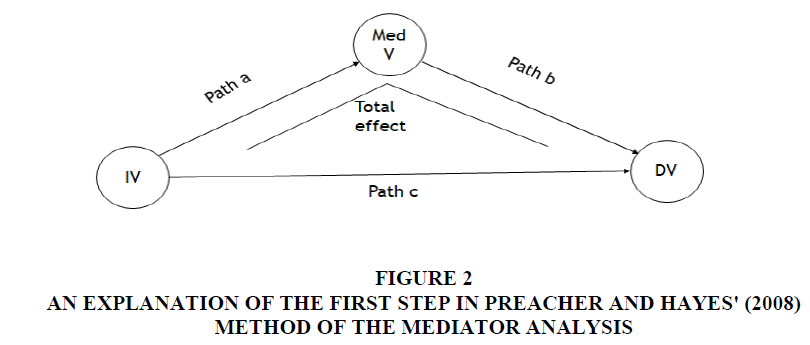

Mediator analysis was used to understand possible causal relationships by discovering the fundamental mechanisms or processes by which one variable affects another one via a mediator variable (Baron & Kenny, 1986). To examine the role of procedural rationality in strategic decision-making as a mediator between adherence to Islamic financial values and strategic decision-making effectiveness, this research implemented the method of Preacher & Hayes (2008), as opposed to Baron & Kenny (1986) method. This choice can be explained by the idea that while Baron & Kenny (1986) framework is one of the oldest methods to study mediation analysis, the technical literature has disputed some of their tests (Zhao et al., 2010). Preacher & Hayes (2008) approach is, however, one of the most popular and easiest methods that has been used in more contemporary studies. This method has also overcome the limitations identified in Baron & Kenny (1986) methods Figure 2.

Preacher & Hayes (2008) pointed out that mediation analysis involved two basic steps. The first step is that the bootstrap of the total effect must be significant, which means the p-value must be less than 0.05. That is, the p-value of the relationship between the independent variable and the dependent variable via mediator must be less than 0.05. As demonstrated in Figure (2) below, Path (a) starts from the independent variable to the mediator variable, Path (b) starts from the mediator variable to the dependent variable, and Path (c) starts from the independent variable to the dependent variable. Accordingly, the total effect is Path (a) along with Path (b); that is, it starts from the independent variable to the dependent variable through the mediator variable.

Figure 2: An Explanation Of The First Step In Preacher And Hayes' (2008) Method Of The Mediator Analysis.

According to the p-values of the total effects from table 1, ISV → SDME is statistically significant. That is, ISV → SDME is statistically significant at the 0.000 percentage level of significance, which means ISV met the requirements of the first step in the mediator analysis.

| Table 1 Reliability And Validity Test |

|||||

|---|---|---|---|---|---|

| Construct | No. of Questions | Cronbach’s alpha | Composite Reliability (CR) | Average Variance Extracted (AVE) | DV/IV* |

| Adherence to Islamic Financial values | 7 | 0.97 | 0.975 | 0.848 | IV |

| Procedural Rationality | 5 | 0.845 | 0.89 | 0.62 | Med |

| Strategic Decision-Making Effectiveness | 4 | 0.837 | 0.891 | 0.671 | DV |

| *DV=dependent variable, IV= independent variable, Med=mediator variable | |||||

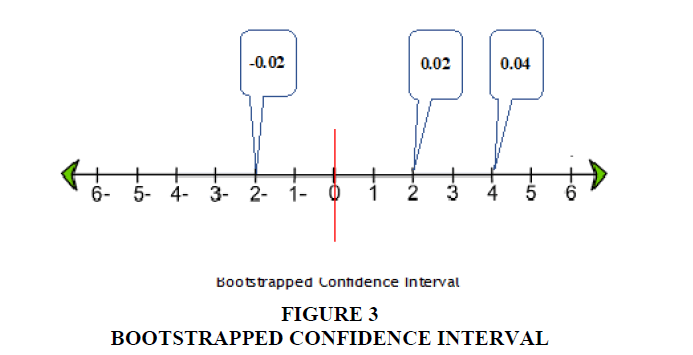

The second step is the bootstrapped confidence interval (lower and upper levels) (Preacher & Hayes, 2008). This means the zero integer should not be between the lower and upper levels of the bootstrapped confidence interval. For example, as demonstrated in Figure (3), if the lower level is 0.02 and the upper level is 0.04, it means the values are not between 0, and therefore the second step is achieved. However, if the lower level is -0.02 and the upper level is 0.02, it means 0 is between them, and therefore, the second step is not achieved Figure 3.

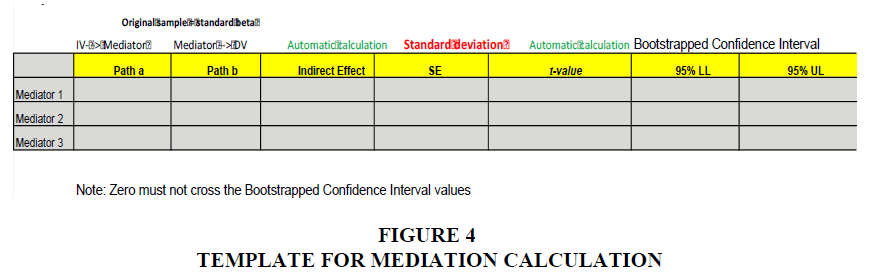

To calculate the bootstrapped confidence interval (lower and upper levels), we used the following template for mediation calculation Figure 4.

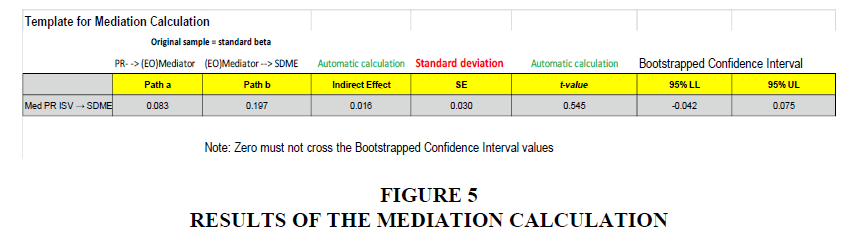

As revealed in Figure 5, the bootstrapped confidence interval (lower and upper levels) of HX refers to procedural rationality in strategic decision-making as a mediator between adopting Islamic financial values and the effectiveness of strategic decision-making. It showed that 0 crossed the Bootstrapped Confidence Interval values, where the lower level was -0.042 and the upper level was 0.075. Subsequently, the second step in the mediator analysis was not fulfilled. Thus, the role of procedural rationality in strategic decision-making as a mediator between adherence to Islamic financial values and strategic decision-making effectiveness was not statistically significant.

As shown in Table 3, the main findings revealed that the total effect of the companies’ age on adherence to Islamic financial values obtained p-values of (0.001 and 0.029). Thus, the p-values obtained were statistically important at a (0.01 and 0.05) percent level of significance, hence confirming the positive effect of this relationship. However, the total effect of the companies’ age on procedural rationality in strategic decision-making and strategic decision-making effectiveness obtained p-values more than a (0.05) percent level of significance, which is (0.663). This means that p-values did not obtain any statistical significance, hence emphasising the negative effect of the type of sectors on procedural rationality in strategic decision-making.

In addition, the total effect of the companies’ size on adherence to Islamic financial values obtained p-values of more than a (0.05) percent level of significance, which is (0.185). This means that p-values did not obtain any statistical significance, hence enhancing the negative effect of the companies’ size on adherence to Islamic financial values. However, as Table 3 reveals, the total effect of companies’ size on procedural rationality in strategic decision-making and strategic decision-making effectiveness obtained p-values (0.000 and 0.022). This means that the p-values obtained were statistically important at the (0.00 and 0.05) percent level of significance. This confirmed the positive effect of company size on procedural rationality in strategic decision-making and strategic decision-making effectiveness.

| Table 2 Total Effects |

|||||||

|---|---|---|---|---|---|---|---|

| NNo | Relationships | Sample | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | Results |

| H1 | AIFV → PR | 0.083 | 0.088 | 0.063 | 1.316 | 0.189 | Not supported |

| H2 | PR → SDME | 0.197 | 0.201 | 0.050 | 3.959 | 0.000** | Supported |

| H3 | AIFV → SDME | 0.451 | 0.452 | 0.047 | 9.589 | 0.000** | Supported |

| H4 | AIFV → PR → SDME | 0. 038 | 0.041 | 0.030 | 1.237 | 0.217 | Not supported |

| * Significant at p < 0.05, ** Significant at p < 0.01 | |||||||

| Table 3 Total Effects Of The Control On Procedural Rationality, Entrepreneurial Orientation |

|||||||

|---|---|---|---|---|---|---|---|

| NNo | Relationships | Sample | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | P Values | Results |

| 11 | Co Age -> AIFV | -0.199 | -0.199 | 0.058 | 3.452 | 0.001** | Supported |

| 22 | Co Age -> PR | -0.021 | -0.025 | 0.049 | 0.436 | 0.663 | Not supported |

| 33 | Co Age -> SDME | -0.121 | -0.117 | 0.055 | 2.187 | 0.029 | Supported |

| 44 | Co Size -> AIFV | -0.082 | -0.083 | 0.062 | 1.328 | 0.185 | Not supported |

| 55 | Co Size -> PR | 0.230 | 0.230 | 0.054 | 4.270 | 0.000** | Supported |

| 66 | Co Size -> SDME | 0.115 | 0.111 | 0.050 | 2.290 | 0.022 | Supported |

| 77 | Sectors -> AIFV | 0.091 | 0.088 | 0.050 | 1.823 | 0.069 | Not supported |

| 88 | Sectors -> PR | -0.185 | -0.187 | 0.052 | 3.591 | 0.000** | Supported |

| 99 | Sectors -> SDME | -0.065 | -0.068 | 0.047 | 1.382 | 0.168 | Supported |

| * Significant at p < 0.05, ** Significant at p < 0.01 | |||||||

Table 2 also conveys that the p-values of the type of sectors’ total effect are more than a 0.05 percent level of significance, which are (0.069 and 0.168). As such, p-values did not obtain any statistical significance, hence confirming the negative effect of the type of sectors on adhering to Islamic financial values and strategic decision-making effectiveness. However, this study revealed that the total effect of the type of sectors on procedural rationality in strategic decision-making obtained p-values of (0.000). This means that the p-values obtained were statistically significant at a (0.01) percent level of significance, hence emphasising the positive effect of this relationship.

Discussion

The aim of the present research is exploring the link between adherence to Islamic financial values and strategic decision-making effectiveness within organisations, taking into consideration mediating relationships. The paper suggested that companies that adopted Islamic financial values would develop their strategic decision-making effectiveness. However, the study findings revealed that adopting these values did not affect the procedural rationality in strategic decision-making (Mohamed, 2018). Likewise, the research results unveiled the positive effect of procedural rationality in strategic decision-making on strategic decision-making effectiveness. Focusing only on Saudi Arabian firms was a response to recent calls for the importance of involving different cultures while implementing a study model (Thanos et al., 2017).

A number of important theoretical implications can be drawn from the findings. First, the positive link between adopting Islamic financial values and strategic decision-making effectiveness suggests that Islamic finance will help decision-makers make strategic decisions distinctively and effectively. This could be achieved by following the two principles of halal (lawful) and haram (unlawful), outlined within Islamic teachings. For instance, one could avoid participating in activities that are prohibited by Shariah (Islamic law), such as interest-based loans and gambling. In this way, one guarantees that any monetary transactions are deemed fair and ethical, and that this is done via real economic activities that will yield economic benefits to their companies and society in general (Elbanna & Child, 2007b). Moreover, this will be through conducting clear economic activities that are not based on ignorance or a lack of knowledge (Berson et al., 2008).

Consequently, decision-makers will deal with any information within the framework of Islamic financial values. In other words, these values, acting as filters through which information flows, are subject to interpretation by strategic decision-makers. Indeed, the interpretation of information that is based on Islamic financial values is of critical importance to the organisation’s overall strategic decision-making process. It urges strategic decision-makers to explore any information that may help them find or create better strategies, hence both profitable and adhering to Islamic financial values (Dada & Fogg, 2016).

Second, these research findings confirmed similar findings in previous studies. For example, Algumzi showed that ethics, identity and a strong religious belief, are the principal elements that impacted Saudi Arabian organisations. However, prior studies enhanced the idea that improving the decisions of organisations and making them more effective depend on the extent to which they follow such values Haniffa & Hudaib, 2002 (Kammer et al., 2015).

In spite of some evidence in literature that supports the findings of the present study, current literature does not clearly and explicitly describe the relationship between implementing Islamic financial values and strategic decision-making effectiveness within companies (Alfalih, 2016; Rice, 1999). The current research’s findings seemed to be a notable contribution as it is one of the first studies that focused on exploring the relationship between Islamic finance and strategic decision-making effectiveness, as well as the one that unveiled the effects of adhering to these values with respect to an organisation strategic decision-making effectiveness (Cheng et al., 2010).

Conclusion

To answer the main research question, we have investigated whether adherence to Islamic financial values increases procedural rationality in strategic decision-making, and also whether the high levels of procedural rationality would have a positive effect on strategic decision-making effectiveness. The results suggested that adherence to Islamic financial values would not affect the levels of procedural rationality in strategic decision-making, but procedural rationality would affect the strategic decision-making effectiveness positively. A possible explanation for these results is that in real business practices and applications, there is a degree of divergence between organisations and their adherence to Islamic teachings. This may also affect their strategic decision-making processes and outcomes. In light of this, future studies should examine at what level of adherence to Islamic financial values the results of procedural rationality can be more positive.

The first limitation of this study relates to selecting only those sectors that fell under the umbrella of the Saudi Arabian financial sector. The second limitation of this study was that the sample was only from Saudi Arabia, which means that the findings cannot be generalised to the whole Middle East or Arab countries. The third limitation of this study is related to withholding information by participants with regard to their positions in companies and the names of these companies. This resulted in excluding their responses. This could have negatively affected the study, but out of 379 questionnaires, only 15 questionnaires were excluded, so it did not significantly affect the overall results.

References

Abdul Cader, A. (2017). Islamic principles of conflict management: A model for human resource management.International Journal of Cross Cultural Management,17(3), 345-363.

Indexed at, Google Scholar, Cross Ref

Alfalih, A. (2016). Religion, culture and management: a comparative study of the impact of Islam and Saudi culture on HRM practices of indigenous and foreign owned and managed corporations in Saudi Arabia.

Al-Kandi, I., Asutay, M., & Dixon, R. (2013). Factors influencing the strategy implementation process and its outcomes: evidence from saudi arabian banks.Journal of Global Strategic Management,14(1), 5-15.

Baron, R. M. & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

Berson, Y., Oreg, S., & Dvir, T. (2008). CEO values, organizational culture and firm outcomes.Journal of Organizational Behavior: The International Journal of Industrial, Occupational and Organizational Psychology and Behavior,29(5), 615-633.

Indexed at, Google Scholar, Cross Ref

Bhatnagar, D. (1992). Understanding political behaviour in organizations: A framework.Vikalpa,17(2), 15-24.

Indexed at, Google Scholar, Cross Ref

Bianchi, C., Glavas, C. & Mathews, S. (2017). SME international performance in Latin America: The role of entrepreneurial and technological capabilities. Journal of Small Business and Enterprise Development, 24(1), 176-195.

Branine, M. & Pollard, D. (2010). Human resource management with Islamic management principles: A dialectic for a reverse diffusion in management. Personnel Review, 39(6), 712-727.

Cheng, V., Rhodes, J., & Lok, P. (2010). A framework for strategic decision making and performance among Chinese managers.The International Journal of Human Resource Management,21(9), 1373-1395.

Indexed at, Google Scholar, Cross Ref

Child, J., Elbanna, S. A. I. D., & Rodrigues, S. (2010). The political aspects of strategic decision making.The handbook of decision making, 105-137.

Dabi?, M., Tipuri?, D., & Podrug, N. (2015). Cultural differences affecting decision-making style: a comparative study between four countries.Journal of Business Economics and Management,16(2), 275-289.

Dada, O., & Fogg, H. (2016). Organizational learning, entrepreneurial orientation, and the role of university engagement in SMEs.International Small Business Journal,34(1), 86-104.

De Clercq, D., Dimov, D., & Thongpapanl, N. (2015). Structural and relational interdependence and entrepreneurial orientation in small and medium-sized enterprises: The mediating role of internal knowledge-sharing.International Small Business Journal,33(5), 514-536.

Indexed at, Google Scholar, Cross Ref

Dean Jr, J. W., & Sharfman, M. P. (1996). Does decision process matter? A study of strategic decision-making effectiveness.Academy of management journal,39(2), 368-392.

Dimitratos, P., Lioukas, S., & Carter, S. (2004). The relationship between entrepreneurship and international performance: the importance of domestic environment.International Business Review,13(1), 19-41.

Indexed at, Google Scholar, Cross Ref

Eisenhardt, K. M., Kahwajy, J. L. & Bourgeois, L. J. (1997). Conflict and strategic choice: How top management teams disagree. California Management Review, 39(2), 42-62.

Elbanna, S., & Child, J. (2007a). Influences on strategic decision effectiveness: Development and test of an integrative model.Strategic Management Journal,28(4), 431-453.

Elbanna, S., & Child, J. (2007b). The influence of decision, environmental and firm characteristics on the rationality of strategic decision?making.Journal of Management Studies,44(4), 561-591.

Indexed at, Google Scholar, Cross Ref

Elbanna, S., C. Thanos, I. & M. Papadakis, V. (2014). Understanding how the contextual variables influence political behaviour in strategic decision-making: a constructive replication. Journal of Strategy and Management, 7(3), 226-250.

Indexed at, Google Scholar, Cross Ref

Ezzi, S. W., Teal, E. J., & Izzo, G. M. (2014). The influence of Islamic values on connected generation students in Saudi Arabia.Journal of International Business and Cultural Studies,9, 1-19.

García-Villaverde, P. M., Ruiz-Ortega, M. J., & Canales, J. I. (2013). Entrepreneurial orientation and the threat of imitation: The influence of upstream and downstream capabilities.European Management Journal,31(3), 263-277.

Indexed at, Google Scholar, Cross Ref

Goll, I., & Rasheed, A. A. (2005). The relationships between top management demographic characteristics, rational decision making, environmental munificence, and firm performance.Organization studies,26(7), 999-1023.

Guest, D., & King, Z. (2004). Power, innovation and problem?solving: the personnel managers’ three steps to heaven?.Journal of management studies,41(3), 401-423.

Heavey, C., Simsek, Z., Roche, F., & Kelly, A. (2009). Decision comprehensiveness and corporate entrepreneurship: The moderating role of managerial uncertainty preferences and environmental dynamism.Journal of Management Studies,46(8), 1289-1314.

Indexed at, Google Scholar, Cross Ref

Helmy, S., Labib, A., & AbouKahf, A. (2014). The impact of Islamic values on interpersonal relationship conflict management in Egyptian business organizations “an applied study”.Procedia-Social and Behavioral Sciences,143, 1090-1110.

Hove, P., Sibanda, K., & Pooe, D. (2014). The impact of Islamic banking on entrepreneurial motivation, firm competitiveness and performance in South African small and medium enterprises.Mediterranean Journal of Social Sciences,5(15), 165.

Indexed at, Google Scholar, Cross Ref

Hunt, S. D., Chonko, L. B., & Wilcox, J. B. (1984). Ethical problems of marketing researchers.Journal of Marketing Research,21(3), 309-324.

Imran, M., Aziz, A. & Hamid, S. (2017). The relationship between entrepreneurial orientation, business networks orientation, Export market orientation and SME export performance: A proposed research framework. International Journal of Academic Research in Business and Social Sciences, 7(10), 230-248.

Indexed at, Google Scholar, Cross Ref

Janis, I. L. (1989).Crucial decisions: Leadership in policymaking and crisis management. Simon and Schuster.

Jansen, R. J., Cur?eu, P. L., Vermeulen, P. A., Geurts, J. L., & Gibcus, P. (2013). Information processing and strategic decision-making in small and medium-sized enterprises: The role of human and social capital in attaining decision effectiveness.International small business journal,31(2), 192-216.

Indexed at, Google Scholar, Cross Ref

Kammer, M. A., Norat, M. M., Pinon, M. M., Prasad, A., Towe, M. C. M., & Zeidane, M. Z. (2015). Islamic finance: Opportunities, challenges, and policy options.

Keillor, B. D., Boller, G. W., & Luke, R. H. (1998). Firm-level political behavior and level of foreign market involvement: implications for international marketing strategy.Journal of Marketing Management (10711988),8(1).

Lengler, J. F., Sousa, C. M., Perin, M. G., Sampaio, C. H. & Martinez-Lopez, F. J. (2016). The antecedents of export performance of Brazilian small and medium-sized enterprises (SMEs): The non-linear effects of customer orientation. International Small Business Journal, 34(5), 701-727.

Indexed at, Google Scholar, Cross Ref

Liu, Y., Li, Y., & Xue, J. (2011). Ownership, strategic orientation and internationalization in emerging markets.Journal of World Business,46(3), 381-393.

Maierhofer, N. I., Kabanoff, B., & Griffin, M. A. (2002). The influence of values in organizations: Linking values and outcomes at multiple levels of analysis.International Review of Industrial and Organizational Psychology 17.

Indexed at, Google Scholar, Cross Ref

Martín-Tapia, I., Aragón-Correa, J. A., & Rueda-Manzanares, A. (2010). Environmental strategy and exports in medium, small and micro-enterprises.Journal of World Business,45(3), 266-275.

Menon, A., Bharadwaj, S. G., Adidam, P. T., & Edison, S. W. (1999). Antecedents and consequences of marketing strategy making: a model and a test.Journal of marketing,63(2), 18-40.

Indexed at, Google Scholar, Cross Ref

Miller, C. C. (2008). Decisional comprehensiveness and firm performance: towards a more complete understanding. Journal of Behavioral Decision Making, 21(5), 598-620. Doi: 10.1002/bdm.607.

Mohamed, H. (2018). Macro and micro-level Indicators of Maq??id al-Shar? ‘ah in socio-economic development policy and its governing framework.Islamic Economic Studies,25(3).

Monteiro, A. P., Soares, A. M., & Rua, O. L. (2017). Entrepreneurial orientation and export performance: the mediating effect of organisational resources and dynamic capabilities.

Indexed at, Google Scholar, Cross Ref

Nutt, P. C. & Wilson, D. C. (2010). Handbook of decision making, John Wiley & Sons.

Papadakis, V. M. (1998). Strategic investment decision processes and organizational performance: an empirical examination.British Journal of Management,9(2), 115-132.

Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models.Behavior research methods,40(3), 879-891.

Rice, G. (1999). Islamic ethics and the implications for business.Journal of business ethics,18(4), 345-358.

Schein, E. H. & Schein, P. (2017). Organizational Culture and Leadership, Jossey-Bass.

Schein, E. H. (2010).Organizational culture and leadership(Vol. 2). John Wiley & Sons.

Shafique, M. N., Ahmad, N., Khurshid, M., & Ahmad, H. (2015). Islamic values & principles in the organization.Arabian Journal of Business and Management Review (Oman Chapter),5(2), 14.

Thanos, I. C., Dimitratos, P. & Sapouna, P. (2017). The implications of international entrepreneurial orientation, politicization, and hostility upon SME international performance. International Small Business Journal, 35(4), 495-514.

Indexed at, Google Scholar, Cross Ref

Tihanyi, L., Griffith, D. A., & Russell, C. J. (2005). The effect of cultural distance on entry mode choice, international diversification, and MNE performance: A meta-analysis.Journal of international business studies,36(3), 270-283.

Wales, W., Wiklund, J., & McKelvie, A. (2015). What about new entry? Examining the theorized role of new entry in the entrepreneurial orientation–performance relationship.International Small Business Journal,33(4), 351-373.

Indexed at, Google Scholar, Cross Ref

Zahra Shaker, A., & Garvis Dennis, M. (2000). International corporate entrepreneurship and firm performance: The moderating effect of international environment hostility.Journal of Business Venturing,15(5-6), 469-492.

Indexed at, Google Scholar, Cross Ref

Zhao, X., Lynch JR, J. G. & Chen, Q. (2010). Reconsidering baron and kenny: myths and truths about mediation analysis. Journal of Consumer Research, 37(2), 197-206.

Indexed at, Google Scholar, Cross Ref

Zin, S. M., & Adnan, A. A. (2016). How do Intellectual Capital and Islamic Values Relate toSmall Business Performance? AConceptual Framework.J. Appl. Environ. Biol. Sci,6(3S), 42-49.

Zin, S. M., Adnan, A. A., & Abdullah, I. H. T. (2017). Intellectual capital: how do Islamic ethics rejuvenate It.Asian Social Science,13(3), 70-79.

Received: 25-Dec-2022, Manuscript No.JMIDS-22-13040; Editor assigned: 27-Dec-2022, Pre QC No. JMIDS-22-13040 (PQ); Reviewed: 10-Jan-2023, QC No. JMIDS-22-13040; Revised: 11-Jan-2023, Manuscript No. JMIDS-22-13040(R); Published:18-Jan-2023