Research Article: 2022 Vol: 25 Issue: 2S

The Influence of the Characteristics of the Board on Performance Through Sustainability Report of Listed Companies in the Stock Exchange of Thailand

Chidchaya Chantapet, Rajamangala University of Technology Suvarnabhumi

Dararat Phoprachak, Rajamangala University of Technology Suvarnabhumi

Siriporn Malaipia, Rajamangala University of Technology Suvarnabhumi

Kittisak Jermsittiparsert, Dhurakij Pundit University

Citation Information: Chantapet, C., Phoprachak, D., Malaipia, S., & Jermsittiparsert, K. (2022). The influence of the characteristics of the board on performance through sustainability report of listed companies in the stock exchange of Thailand. Journal of Management Information and Decision Sciences, 25(S2), 1-15.

Keywords

Board of director, Sustainability reporting, Performance

Abstract

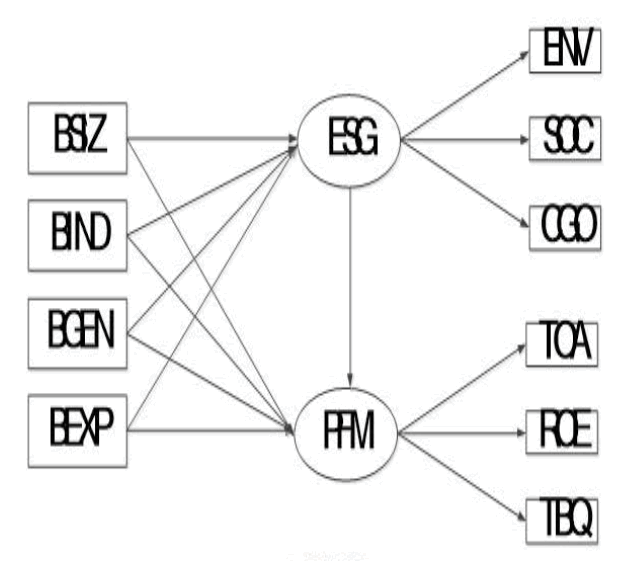

The objective of this research was to study the influence of the characteristics of the board on performance through sustainability report according to the Global Reporting Initiative (GRI) disclosure guidelines of listed companies in the Stock Exchange of Thailand. This study explored data from annual reports (Form 56 1), annual financial statements, and notes to financial statements, corporate social responsibility report and the sustainability report in 2017 of 150 companies. Data were analyzed using Structural Equation Model (SEM) to study the characteristics of the board influencing performance through environmental, social, and governance (ESG) report and corporate governance of listed companies in the Stock Exchange of Thailand. The results of this study indicated that the characteristics of the board had a positive direct influence on environmental, social and governance (ESG) report with a statistical significance level of 0.01 with an influence coefficient of 0.17, a positive direct influence on performance (PFM) with an influence coefficient of 0.05, and a positive indirect influence on performance (PFM) latent variable with a statistical significance level of 0.29. This research indicated that the characteristics of the board influenced performance through sustainability report.

Introduction

Environmental and social responsibility and governance attracts many stakeholders, institutes, and public and private organizations in present time. Due to technological advancement and economic growth in agriculture and industrialization, the world’s climate changes extremely that causes environmental issues, air toxicity, wastewater, dust dispersion, compost, and clogged flood. These problems occurred prevalently in various communities and nations. Many countries in the world including Thailand are aware of these issues and are more interested in natural and environmental conservation and ecosystem maintenance that many standard or measure designed for direct and indirect environmental issue solution are issued. However, pollution caused by activities that facilitates humans nowadays contaminates environment. Pollution occurs in unlimited areas besides its original location. Nevertheless, crisis happened in the past, for example, economic gap and social immorality, and environmental disaster resulting in demand for solution that eventually leads to sustainable development (Arphapirom, 2011; Anantachai, 2015). Modern businesses are concerned with economic development solely but failed to solve any problems or crisis. Social dimension and environmental dimension began to be a part with business activities for consideration to show gratitude toward society and profit making activities because business can easily progress sustainably in the future by being considerate of stakeholders in the society (Pisan, 2014; Jermsittiparsert, Siam, Issa, Ahmed & Pahi, 2019; Chetthamrongchai & Jermsittiparsert, 2020; Jermsittiparsert, Somjai & Toopgajank, 2020). It results in business adjustment and strategy for survival as well as social trend changes. Therefore, businesses begin to be aware of sustainable development and disclose information besides financial statement; moreover, trust is significantly built up in the capital market. Therefore, corporate governance (CG) is always developed constantly that the government declare the year of corporate governance. To drive OG concretely, Thai capital market uses the principle of good cooperate governance as structured by Stock Exchange of Thailand as the important key to well-promote CG in registered companies since their first year to successful period (Commission, 2017). The principle of good cooperate governance of companies registered in 2016 describes distinctness of the committee because of good business management structure as the main factor.

Corporate social responsibility report in 2013-2015 in accordance with corporate social responsibility report in 2014 (Phoprachak, 2017) stated the modern concept of business procedures essentially requires corporate social responsibility of companies, and it is significant to develop business successfully with sustainability under intensive competition presently.

For classification of corporate governance with social responsibility toward Thailand, management holds up activities to create good image of the companies with an aim to reduce public institutes’ firm follow up. To build up good relationship with societies by adhering to co-existence between companies and societies is considered as the companies’ main activities. Many companies focus on Philosophy of Sufficiency Economy developed by King Bhumibol Adulyadej of Thailand Rama IX to Thai citizens. When applied with business management without overly seeking new benefits and thinking of crisis, companies must frugally utilize resources with effectiveness. To simply say, business must be managed by corporate social responsibilities (Corporate Social and Environmental Responsibility of Registered Company Institution, 2008).

From the previous literature review, many studies reported sustainability is relatively new in Thailand’s researches found to be in limited number. Various institutes, investors, and stakeholders are interested in sharing information related to sustainable development and ability in governance. This study will present influence of classification of management committee affecting abilities of work procedures of registered companies through the sustainability report of Stock Exchange of Thailand. Because investors are interested in the sustainability report considered as the public information, they use it as the decision making in investment. Hence, the sustainability report is a part of capability of work procedures.

Research Objective

To study the characteristics of the board influencing performance through environmental, social, and governance (ESG) report and corporate governance

Research Framework, Literature Review and Research Hypotheses

Board of Directors

Board of Directors is key in regulating strategy and policy of management as well as strategic management and resource allocation with the highest effectiveness. For stockholders’ highest wealth and responsibility as they are from the board of director, the company committee consists of experienced specialists with suitable and effective capabilities. The board of director must assign independent directors to take a position of board director chairman, and the assigned one must not be a family member and go through Audit Committee’s inspection, the sub-committee of the company board of director. With the purpose, effective management must be promoted by adding value into the organization and being the medium to reduce conflict of interests between the board of director and stockholders. The main duties are to build up trust and credibility of financial statement and internal control.

Sustainability Report

Sustainability report or corporate social responsibility report does not hold any concrete definition or clear explanation that is internationally approved. However, the Global Reporting Initiative Sustainability Guidelines (GRI, 2016) defines it as the report disclosing good governance of the organizations in the aspect of economic, society, and environment to be entirely shared among stakeholders including stockholders, customers, and communities besides financial statement. Also, sustainability report helps relevant individuals with any organizations to know about essential problem before it develops into financial crisis with bad result (Etizion & Ferraro, 2010).

Information disclosed on sustainability reports consist disclosure management approach, relevant results with economic, social and environmental significance that shows purposes, policies, adherence, responsibilities toward resources utilized by organizations, participation, challenging problems as well as procedure or effect report. Besides those stated management measure, various issues related to economy, society, and environment, general sustainability reports can be termed differently.

Dow Jones Sustainability Indices or DJSI is an index group that evaluate business based on sustainability development of the world’s leading companies or public companies that are registered in Stock Exchange of various countries worldwide. Established in 1999 (ROBECOSAM, 2016), it is formed by cooperation between Dow Jones Index and Robeco SAM (Sustainable Asset Management). Evaluation criteria are divided by world’s industries and select members or cancel membership annually. It evaluates governance in details based on economy, environment, and society as the main indicator in overall financial statement of organizations and sustainability.

Concepts of Good Corporate Governance

Four major principles that are required to build confidence among all involving parties and the foundation of sustainable business growth (The Stock Exchange of Thailand, 2012) include:

1. Transparency defines a fundamental trust between companies and their stakeholder under limited competitive conditions of companies. Transparency promotes efficiency of companies and working of capital market. Board of director can solve effectively and open more opportunities of stockholder and relevant company examiners entirely.

2. Integrity defines honest business management within good morality, clear and correct financial statement and media that can be shared about company’s work procedures. Integrity of the report depends on honesty of creators and presenters.

3. Accountability is important to board of director and stockholders. Board of director must be responsible and always play a key role to keep stockholders updated about companies’ running. Board of director’s responsibility requires suitable regulations and rules. Disclosing companies’ administration is main factor of successful organization.

4. Competitiveness with a target defines cooperation in building prosperity and adding value to stockholders. To regulate requires agility, promotion to create without being an obstacle to initiatives. Effectiveness and entrepreneurship can lead to companies’ sustainable competitiveness.

The research study on corporate governance has found that it helps create more value for the business. The research results by Brown, L, D and Caylor, M.L., 2004 has evaluated the ratings of corporate governance in 2,327 US companies in 2002, tied with 3 performance aspects: (1) Operating Performance: Using Return on Equity, Profit Marge and Sales Growth as the indicators (2) Firm Value: Using Tobin’s Q as the indicator and (3) Shareholder Payout: Using Dividend Yield and Stock Repurchases as the indicators. Research has shown that companies that provide good corporate governance tend to have good performance in all three areas (Srichanpetch, 2009). Later, Adul K., (2012) has studied the impact of corporate governance on financial performance, measured performance from Tobin's Q, total return on assets and Z-scores; it was found that good corporate governance was related to the performance of the company.

Firm Performance

The firm performance is the net present value or the evaluation of the future cash flows of the companies through the different perspectives. The “value” is always used for saying the value of the asset. If we do the evaluation by using the financial method, the “price” which is in the form of the cash equivalent will be called the “value”, and the “firm” is always used for the reference to the organizations or the companies (Thailand Securities Institute (TSI) The Stock Exchange of Thailand, 2012).

Since the past until now, there have been many academic and research studies that are interested in studying the organization's performance measurement system. Each research result defines the meaning of the organization's performance measurement system or the value of the organization or business in various manners, and has a different meaning. There are both concepts in measuring the performance of the organization in a strategic or managerial accounting manner. The widely popular concept is the Balanced Scorecard concept (Kaplan & Norton, 1996) which is used as a tool to measure performance to support the driving of the organization's strategy into appropriate practices so that the organization can achieve the goals achieved through the view of the four main business management systems: finance, customer, learning and growth and Internal business process. The definition of the business value measurement system is different in many areas, but the organization's measurement system can be identified in three aspects as follows: (1) The aspect of the organization's performance measurement system, which the system of measurement will consist of two elements: performance measurement and the basic work system used to support the system and human resource systems (2) The role of the organization's performance measurement system in terms of performance measurement, strategy management, learning information communication and improvement and trends in employee behavior and (3) Process perspective of the organization's performance measurement system in terms of selection process and measurement design.

Past research had been studied extensively on the issues of education, the relationship of information disclosure levels, social responsibility and performance measurement or the increase in business value (Anderson & Frankle, 1980). These research results support the idea that the cost of reporting corporate social responsibility information at a high level will also yield high returns by increasing the benefits of creating morale for staff and also results in increased productivity as well (Solomon & Hanson, 1985). It has been found that corporate social activities result in an increasing reputation (Good citizen) of the organization's reputation. The increase in the level of reputation is beneficial to companies in many ways that cannot be measured (Nikolai et al., 1976; Mohamed, 2007). That is, while the actual costs of the social responsibility of the organization are low, but the potential benefits are high (Waddock & Graves, 1997). Some studies has found that there is a negative correlation (Ingram & Frazier, 1980; Freedman & Jaggi, 1982), which supports the idea that the cost of social responsibility results in the organization being at an economic disadvantage compared to other companies with less social responsibility (Aupperle et al., 1985; Vance, 1975). In addition, some research also found that corporate social responsibility is not related to financial performance (Abbott & Monsen, 1979; Alexander & Buchholz, 1978; Aupperle, Carroll & Hatfield, 1985) by reasoning that there are some factors that play a role in the result of operations and social responsibility that are not related to each other, such as only one measure or data used to measure that may not be enough to measure, including the performance measurement is not a good measure (Ulman, 1985). Profitability analysis is a performance management analysis. Even profit is the goal of the business operation, but having a lot of profit may not mean that the management will be effective, so it is necessary to use assets, operating capital or financial ratios to help synthesize the results of operations

Variables

Board size

Past research has found that the size of the board has a negative impact on accounting prudence (Suleiman, 2014; Boussaid et al., 2015), increasing the chances of managing profits. Kankanamage (2016), reducing the effectiveness of the investigation (Jensen, 1993). On the contrary, Ho (2009) has found that the size of the board helps to increase market to book value and reduce the company's profit management in France. The performance of the Board of Directors, effective management structure will result in higher value-added businesses. The size of the board that is appropriate for the performance according to good governance principles for companies listed on the Stock Exchange of Thailand in 2017 should have at least 5 and not more than 12 people, depending on the size, type and complexity of the business, so there may be differences in the important factors of each business. The research of Trang (2016) has found the relationship in the opposite direction between the size of the board, the management structure and the performance that is measured by The Return Of the Asset (ROA).

Board independence

The board independence has an effect on the mechanism of corporate governance in establishing sub-committees that have specific expertise in the company. Chen, et al., (2008) & Collier (1993) has found that consistent research results showed that the independence of the Board is positively related to having an audit committee with significance. In addition, the research of Sekome & Lemma (2014); Yatim (2010) has found that the independence of the Board has a positive relationship with the establishment of the Risk Management committee separately from other committees. However, the research of Subarmaniam, et al., (2009) and Thomya (2015) found no relationship between the proportion of independent board and the establishment of a risk management committee. Based on the literature review, the researcher therefore expects that the proportion of non-executive directors will have a positive relationship with the establishment of the Risk Management Committee.

Board gender

Mikkola (2005) stated that males have a tendency to use limited information and have less discretion in decision making than females. Amanatullah, et al., (2010) has found that males often decide by using more risky alternatives. In terms of accounting data, Sari, et al., (2014) has found that the female committee has a positive impact on accounting caution according to the model of Givoly & Hayn (2000) on asymmetric timeliness (Boussaid et al., 2015) and reduce the level of profit management of companies in England (Arun et al., 2015). On the other hand, Buniamin, et al., (2008) has found that the female committee increased the opportunity to manage the profits of the company in Malaysia, reducing the performance (according to Tobin's Q model) of the business (Ku Ismail & Abdullah, 2011) and reduce accounting precautions in Australia (Sultana & Zahn, 2011). In addition, the research of Sun & Lan (2011) has found no the impact of the female audit committee on profit management. This research is expected that the proportion of female committee is positively correlated with accounting caution.

Board expertise

Yunos, et al., (2012) has tested the influence of the Board Skill and the Asymmetric Timeliness. They found that the expertise of the Board had a positive impact on the perception of bad news, but did not find the impact on accounting prudence according to the model of Givoly & Hayn (2000). While Agrawal & Chadha (2005) found that the board with accounting knowledge can help reduce the possibility of financial reports showing misstatements, including Kankanamage (2016), has found that the board with accounting knowledge has a significant negative relationship to profit management. Therefore it is possible that the board with knowledge of financial accounting can help the company's financial statements to be of higher quality. This research is expected to find a positive relationship with accounting prudence.

Performance

Klapper & Love (2004) found that corporate governance ratings and the company's performance were positively correlated, indicating that good corporate governance will result in better performance of the company. In addition, there was a research work of Kyereboach & Beikpe (2002) that found that larger size of the management structure board would result in better performance of the company by notifying the reasons that the larger management structure board that would make the various decisions of the company in the right direction because each committee had different experiences and knowledge.

Research Hypotheses

H1: Board size has a positive direct influence on environmental, social and governance (ESG) report.

H2: Board size has a positive direct influence on performance.

H3: Board independence has a positive direct influence on environmental, social and governance (ESG) report.

H4: Board independence has a positive direct influence on performance.

H5: Board gender has a positive direct influence on environmental, social and governance (ESG) report.

H6: Board gender has a positive direct influence on performance.

H7: Board expertise has a positive direct influence on environmental, social and governance (ESG) report.

H8: Board expertise has a positive direct influence on performance.

Methodology

Population and Sample

The population of this research was 570 listed companies in the Stock Exchange of Thailand. The researcher collected annual data for the year 2017 (as of January 10, 2017). Such number of companies excludes companies in MAI because these companies cannot clearly specify the objectives of the fundraising, affecting corporate governance reporting and data analysis (Booth et al., 2000; Sukcharoensin, 2003).

The sample of this study was analyzed based on structural equation model (SEM) to determine parameters from analyzing validity and reliability. According to Golob (2003), in structural equation model (SEM) analysis with Maximum Likelihood method, the sample size should be at least 15 times of observed variables. Since this research contained 10 observed variables, the proper and sufficient sample size for analysis should be at least 150.

Research Format

The researcher studied related concepts, theories and research results to determine the operational definition and structure of the variables by collecting data from annual reports (Form 56-1), annual financial statements, notes to financial statements, corporate social responsibility reports and ESG reports in the year 2017.

Data Collection

The researcher conducted paper-based record of the ESG report statistics to determine level of disclosure. Companies with disclosure shall get 1 point when they mentioned 1 disclosure item. The researcher then recorded individual disclosure items and summarized individual disclosure statistics. Companies without disclosure shall get 0 point. Companies with disclosure of data related to ESG reporting shall get N / A (Not Applicable) if such data is not related to the company.

The Statistics used to Analyze Data

Structural equation model was used for multivariate analysis to study the model of the characteristics of the board influencing performance through ESG report and corporate governance of listed companies in the Stock Exchange of Thailand. Statistics used in the structural equation model were Multiple Indicators and Multiple Causes (MIMIC) Model because SEM is effective to estimate the internal relationship and multivariate relationship.

Results

| Table 1 Variable Abbreviation and Indicators |

||

|---|---|---|

| Variable Name | Abbreviation | Indicators |

| Board size | BIZE | Observed variable |

| Board independence | BIND | Observed variable |

| Board gender | BGEN | Observed variable |

| Board expertise | BEXP | Observed variable |

| Environmental, social, and governance report | ESG | Latent variable |

| Environmental reporting | ENV | Observed variable |

| Social reporting | SOC | Observed variable |

| Governance reporting | CGO | Observed variable |

| Performance | PFM | Latent variable |

| Total asset turnover | TOA | Observed variable |

| Return on equity | ROE | Observed variable |

| Tobin's q ratio | TBQ | Observed variable |

Model Validation

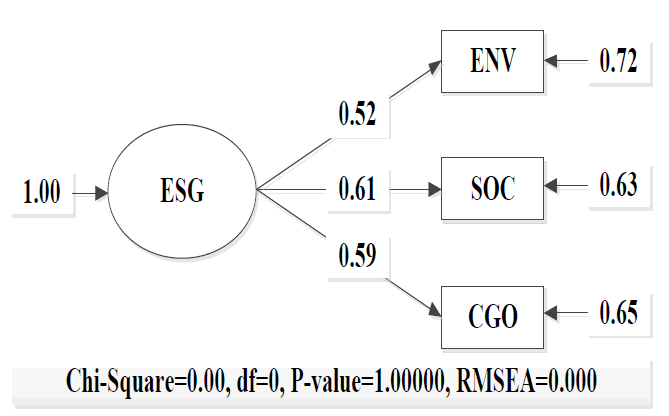

| Table 2 Confirmatory Factor Analysis of Esg Report Variables |

||||

|---|---|---|---|---|

| Variable | Factor | R2 | ||

| b | SE | t | ||

| ENV | 0.52 | - | - | 0.28 |

| SOC | 0.61 | 0.01 | 5.69 | 0.37 |

| CGO | 0.59 | 0.02 | 5.76 | 0.25 |

| c2 = 0, df =1, p-value = 1.00, RMSEA = 0.00 | ||||

| Note: |t |> 1.96 refers to p< .05; |t |> 2.58 refers to p< .01 | ||||

The results of analyzing measurement model by confirmatory factor analysis of ESG report variables indicated that the model was consistent with the empirical data after adjusting the model without exclusion of any indicator from the measurement model. Chi-Square statistic was 0, probability (p) was 1.00, RMSEA was 0.00, SRMR was 0.00, GFI was 1.00, CFI was 1.00 and AGFI was 1.00.

In other words, environmental, social, and governance report (ESG) consisted of 3 components, including environmental reporting (ENV), social reporting (SOC) and corporate governance reporting (CGO). The results showed that social reporting (SOC) was the most important factor, followed by corporate governance reporting (CGO) and environmental reporting (ENV) respectively.

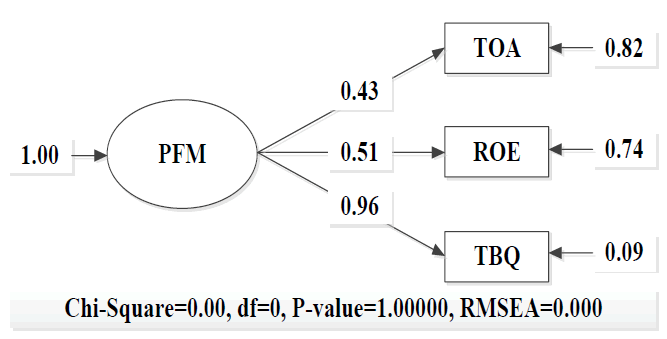

| Table 3 Confirmatory Factor Analysis |

||||

|---|---|---|---|---|

| Variable | Factor | R2 | ||

| b | SE | t | ||

| TOA | 0.43 | - | - | 0.18 |

| ROE | 0.51 | 0.01 | 6.78 | 0.26 |

| TBQ | 0.96 | 0.04 | 4.57 | 0.91 |

| c2 = 0, df =1, p-value = 1.00, RMSEA = 0.00 | ||||

| Note: |t |> 1.96 refers to p< .05; |t |> 2.58 refers to p<0.01 | ||||

The results of analyzing measurement model by confirmatory factor analysis of performance (PFM) variables indicated that the model was consistent with the empirical data after adjusting the model without exclusion of any indicator from the measurement model. Chi-Square statistic was 0, probability (p) was 1.00, RMSEA was 0.00, SRMR was 0.00, GFI was 1.00, CFI was 1.00 and AGFI was 1.00.

In other words, performance (PFM) consisted of 3 components, including total asset turnover (TOA), return on equity (ROE), and marketing performance (TBQ). The results showed that marketing performance (TBQ) was the most important factor, followed by return on equity (ROE), and total asset turnover (TOA) respectively.

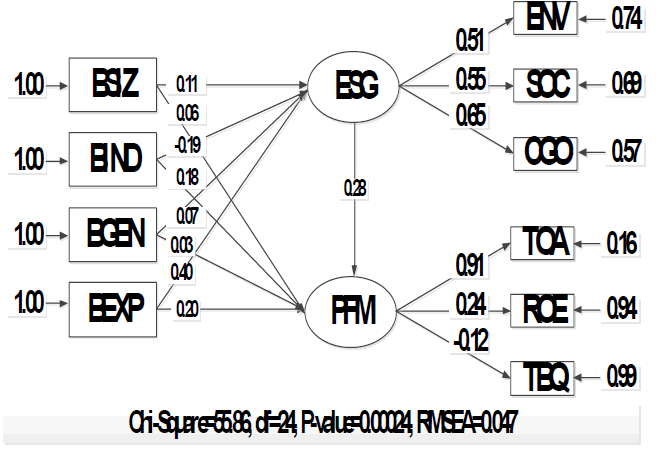

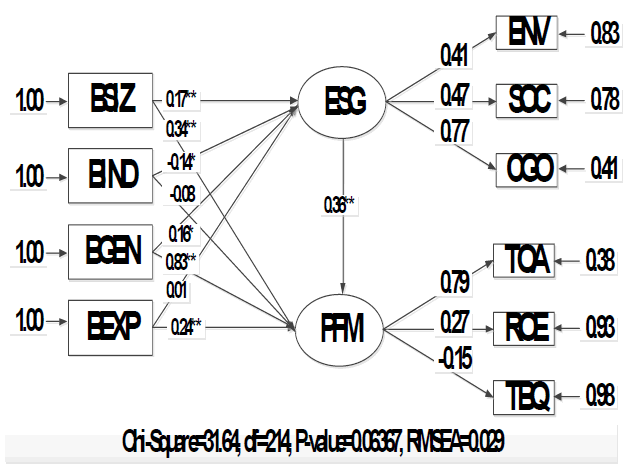

Path analysis before model adjustment

Path Analysis After Model Adjustment

| Table 4 Path Analysis Results |

||||||

|---|---|---|---|---|---|---|

| Dependent variable Independent variable | ESG | PFM | ||||

| TE | DE | IE | TE | DE | IE | |

| BSIZE | 0.17** (0.28) | 0.17** (0.28) | - | 0.34** (0.02) | 0.05 (0.24) | 0.29* (0.11) |

| BIND | -0.14* (0.26) | -0.14* (0.26) | - | -0.08 (0.24) | 0.08 (0.24) | -0.19 (0.10) |

| BGEN | 0.16* (0.41) | 0.16* (0.41) | - | 0.83** (0.36) | 0.45** (0.37) | 0.38* (0.16) |

| BEXP | 0.01 (0.19) | 0.01 (0.19) | - | 0.24** (0.19) | 0.23** (0.19) | 0.01 (0.07) |

| ESG | 0.36** (0.08) | 0.36** (0.08) | - | |||

| c2 = 31.64, c2/df = 0.43, df =21, p-value = 0. 06, RMSEA = 0.03 | ||||||

| Note p*< 0.05; p**< 0.01; p***<0 .001 | ||||||

| Table 5 Analysis of Index of Alignment of Models |

|||

|---|---|---|---|

| Index of Alignment | Criteria | Measured Indicators | Results |

| χ2/df | < 2.00 | 0.43 | Passed |

| CFI | ≥ 0.95 | 0.99 | Passed |

| GFI | ≥ 0.95 | 0.99 | Passed |

| AGFI | ≥ 0.90 | 0.97 | Passed |

| RMSEA | < 0.05 | 0.03 | Passed |

| SRMR | < 0.05 | 0.03 | Passed |

The results of testing the alignment of causal relationship model of the firm characteristics (Char) showed that the model was consistent with the empirical data. Chi-Square statistic was 31.64, probability (p) was 0.06, degree of freedom (df) was 21, c2/2 was 1.51, RMSEA was 0.00, SRMR was 0.03, GFI is0.99, CFI was 0.99 and AGFI was 0.97.

Board size (BSIZE) had a positive direct influence on environmental, social, and governance report (ESG) with a statistical significance level of 0.01 with an influence coefficient of 0.17, a positive direct influence on performance (PFM) with an influence coefficient of 0.05 and a positive indirect influence on performance latent variable (PFM) with a statistical significance level of 0.05 with an influence coefficient of 0.29.

Board independence (BIND) had a negative direct influence on environmental, social, and governance report (ESG) with a statistical significance level of 0.05 with an influence coefficient of 0.14, a positive direct influence on performance (PFM) with an influence coefficient of 0.08 and a negative indirect influence on performance latent variable (PFM) with a statistical significance level of 0.05 with an influence coefficient of 0.19.

Board gender (BGEN) had a positive direct influence on environmental, social, and governance report (ESG) with a statistical significance level of 0.05 with an influence coefficient of 0.16, a positive direct influence on performance (PFM) with a statistical significance level of 0.01 with an influence coefficient of 0.45 and a positive indirect influence on performance latent variable (PFM) with a statistical significance level of 0.05 with an influence coefficient of 0.38.

Board expertise (BEXP) had a negative direct influence on environmental, social, and governance report (ESG) with an influence coefficient of 0.01, a positive direct influence on performance (PFM) with a statistical significance level of 0.01 with an influence coefficient of 0.23 and a negative indirect influence on performance latent variable (PFM) with an influence coefficient of 0.01.

Environmental, social, and governance report (ESG) had a positive direct influence on performance (PFM) with a statistical significance level of 0.01 with an influence coefficient of 0.36.

Analytical Results based on Hypothesis

| Table 6 Results of Hypothetical Testing |

||

|---|---|---|

| Research Hypothesis | Hypothetical Testing | Direction/Effect |

| H1: Board size (BSIZE) had a positive direct influence on environmental, social, and governance report (ESG). | Accepted | + |

| H2: Board size (BSIZE) had a positive direct influence on performance (PFM). | Accepted | + |

| H3: Board independence (BIND) had a negative direct influence on environmental, social, and governance report (ESG). | Accepted | - |

| H4: Board independence (BIND) had a negative direct influence on performance (PFM). | Rejected | # |

| H5: Board gender (BGEN) had a positive direct influence on environmental, social, and governance report (ESG). | Accepted | + |

| H6: Board gender (BGEN) had a positive direct influence on performance (PFM). | Accepted | + |

| H7: Board expertise (BEXP) had a positive direct influence on environmental, social, and governance report (ESG). | Rejected | # |

| H8: Board expertise (BEXP) had a positive direct influence on performance (PFM). | Accepted | + |

| Note: + defines as a significantly positive effect - defines as a significantly negative effect # defines as an insignificant effect | ||

Research Discussion and Conclusions

This research found that the board size (BSIZE) had a positive direct influence on environmental, social, and governance report (ESG) and had a positive direct influence on performance (PFM). It can be said that the above features greatly increase the total assets, increasing the chances of managing earnings (Kankanamage, 2016). This was in line with Kyereboach & Beikpe (2002) research, explaining that the larger size of the management structure board will result in better performance. The results showed that board independence (BIND) had a negative direct influence on environmental, social, and governance report (ESG) but had a positive direct influence on the performance (PFM) and negative influence on latent variable of the performance (PFM). This showed that if considering the independence of the board (without considering other factors), the report results for sustainability will be reduced. On the other hand, the independence of the board positively influences the performance. It can be said that the board independence has an effect on the mechanism of corporate governance. The establishment of sub-committees with specific expertise in the company is consistent with Trang's research (2016) which found a significant positive correlation between the independence of the board and the performance. The results showed that board gender (BGEN) had a positive direct influence on environmental, social, and governance report (ESG) and had a positive direct influence on performance (PFM) and positive influence on latent variable of the performance(PFM). It can be said that having a higher proportion of female committees than males lead to the creation of the highest level of business value, in line with Sari, et al., (2014) who found that female committees had a positive impact on accounting prudence according to the model of Givoly & Hayn (2000) on asymmetric timeliness (Boussaid et al., 2015). The results showed that the experience of the board (BEXP) had a negative direct influence on sustainability report (ESG) and had a positive direct influence on performance (PFM) and negative indirect influence on latent variable of the performance (PFM). This showed that if considering only the experience of the board, it will show negative impact to the sustainability report which affects the financial report. This is consistent with Agrawal & Chadha (2005) as they found that the board with accounting knowledge can help reduce the possibility that financial reports will show contrary facts. The company should have a specialized committee in various fields. The results of the research showed that environmental, social, and governance report (ESG) had a positive direct influence on the performance (PFM) which was consistent with past research which concluded that not only financial information affected the market price of the stock exchange, but the disclosure of the environmental, social, and governance report also helped investors to evaluate the value of Securities of the business (Anantachai, 2015).

The results of this research have revealed that the characteristics of the board had an influence on the performance through environmental, social, and governance report. In addition, it was consistent with the principles of good corporate governance in 2017. The results of this research will affect the results of operations. Therefore, regulators, shareholders and investors can integrate this research into the business decision-making and planning process due to the various features used in the research influence the performance as empirical evidence.

Recommendations

1. This research focused on exploring environmental, social, and governance report and performance from only 4 observed variables. Therefore, in the future, other observable variables that are variables of the executive directors may be used to test the influence of operational capability which may give different results from this research.

2. The next research can be added by using this conceptual framework to the population that is a listed company in the Stock Exchange of Thailand in the group registered MAI to confirm research results.

Acknowledgement

Kittisak Jermsittiparsert, Professor of Dhurakij Pundit University, Thailand and Adjunct Professor of Universitas Muhammadiyah Makassar & Universitas Muhammadiyah Sinjai, Indonesia is the corresponding author.

References

Abbott & Monsen (1979). On the measurement of corporate social responsibility: Self - reported disclosure as a method of measuring corporate social involvement. Academy of Management Journal, 22, 501-515.

Adul, K. (2012). The Impact of Corporate Governance on Corporate Financial Performance. A dissertation submitted in partial fulfillment of the requirements for the degree of doctor of philosophy applied management & decision sciences: Finance.

Agrawal, A., & Chadha, S. (2005). Corporate Governance and Accounting Scandals. Journal of Law and Economics, 48, 371-406.

Alexander, G.J., & Buchholz, R.A. (1978). Corporate social performance and stock market performance. Academy of Management Journal, 21, 479 – 486.

Amanatullah, E.T., Shropshire, C., James, E.H., & Lee, P.M. (2010). Risky Business for whom? Gender, self-vs other-orientation and risk in managerial decision-making. Social Science Research Network Electronic Paper Collection.

Anantachai, C. (2015). Relationship between sustainability report and firm value of listed companies in the Stock Exchange of Thailand. Bangkok: Thammasart University.

Anderson, J.C., & Frankle, A.W. (1980). Voluntary social reporting: An iso-beta portfolio analysis. Accounting Review, 55, 467 – 479.

Arphapirom, A. (2011). Sustainable development: Diversity is the answer. Bangkok: Rung Rueang San Printing.

Arun, T.G., Almahrog, Y.E., & Alia ribi, Z. (2015). Female directors and earnings management . Evidence from UK companies, 137 –146.

Aupperle, K.E., Carroll, A.B., & Hatfield, J.D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28(2), 446-463.

Booth, T., Ainscow, M., Black-Hawkins, K., Vaughan, M., & Shaw, L. (2000). Index for Inclusion: Developing Learning and Participation in Schools. Bristol. Centre for Studies on Inclusive Education.

Boussaid, N., Hamza, T., & Sougne, D. (2015). Corporate board attributes and conditional accounting conservatism: Evidence from French firms. Journal of Applied Business Research, 31(3), 871.

Brown, L.D., & Caylor, M.L. (2004). "Corporate Governance and Firm Performance".Working paper. Retrieved from http://www.ssrn.com.

Buniamin, S., Alrazi, B., Johari, N.H., & Rahman, N.R. (2008). An investigation of the association between corporate governance and environmental reporting in Malaysia. Asian Journal of Business and Accounting, , 1(2), 65-88.

Chen, W.C., Lin, B.J., & Yi, B. . (2008). CEO duality and firm performance – an endogenous issue. Corporate Ownership and Control, 6(1), 58-65.

Chetthamrongchai, P., & Jermsittiparsert, K. (2020). Ensuring environmental performance of pharmaceutical companies of Thailand: Role of robotics and ai awareness and technical content knowledge in industry 4.0 era. Systematic Reviews in Pharmacy, 11(1), 129-138.

Collier, P. (1993). Factors affecting the formation of audit committees in major UK listed companies. Accounting and Business Research, 23(91A), 421-430.

Commission, T.S. (2017). Corporate Governance Code.

Committee of Promoting Corporate Social and Enviromental Responsibility of Listed Companies (2008). Business Compass for Society. Bangkok: icon Printing.

Etizion, D., & Ferraro, F. (2010). The role of Analogy in the Institutionalization of Sustainability Reporting. Organization Science, 21(5),1092-1207.

Freedman, M., & Jaggi, B. (1982). Pollution disclosures. Omega: Pollution performance and economic performance. The International Journal of Management Science, 167-176.

Givoly, D., & Hayn, C.,. (2000). The changing time-series properties of earnings, cash flows and accruals: has financial reporting become more conservative? Journal of Accounting and Economics, 29, , 287–320.

GRI. (2016). What is sustainability reporting?.

Hair (1998). Construct Validity and Reliability.

Ho, J.A. (2009). Association between Board Characteristics and Accounting Conservatism: Empirical Evidence from Malaysia. (A dissertation submitted), Auckland University of Technology (AUT).

Ingram, R.W., & Frazier, K.B. (1980). Environmental performance and corporate disclosure. Journal of Accounting Research 18, pp.614 – 622.

Jensen, M C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 831-880.

Jermsittiparsert, K., Siam, M., Issa, M., Ahmed, U., & Pahi, M. (2019). Do consumers expect companies to be socially responsible? The impact of corporate social responsibility on buying behavior. Uncertain Supply Chain Management, 7(4), 741-752.

Jermsittiparsert, K. Somjai, S., & Toopgajank, S. (2020). Factors affecting firm’s energy efficiency and environmental performance: The role of environmental management accounting, green innovation and environmental proactivity. International Journal of Energy Economics and Policy, 10(3), 325-331.

Kankanamage, C.A. (2016). The relationship between board characteristics and earnings management: evidence from Sri Lankan listed companies. Kelaniya Journal of Management, 4(2), 36–43.

Kaplan, R.S., & Norton, D.P. (1996). The Balanced Scorecard: Translating Strategy into Action. Boston, MA: Harward Business School Press.

Klapper, L., & Love, I. (2004). Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance 10 , 703-728.

Ku Ismail, K.N.I., & Abdullah, S.N. (2011). Women participation on the boards of Malaysian companies and firm performance. Paper presented at 5th Annual International City-Break Conference, Business and Society in a Global Economy, Athens, 19–22 December.

Kyereboach,C.A., & Beikpe, N. (2002). “The Relationship between Board size,Board composition,CEO Duality and Firm Performance”. University of Stellenbosch Business School(USB), Cape Town, South Africa,2002.

Mikkola, A. (2005). Role of gender equality development a literature review. Discussion Paper No. 84. (November 2005).

Mohamed, J. (2007, May). Corporate Social Responsibility in Islam. (Online). Retrieved from

Nikolai, L.A., Bazley, J.D., & Brummet, R.L. (1976). The Measurement of Corporate Environmental Activity. New York: National Association of Accountants.

Phoprachak, D. (2017). The impact of social responsibility reporting on firm value of listed companies in the Stock Exchange of Thailand. Ph.D. Accountancy, Sripatum University.

Pisan, D. (2014). The concept of sustainable growth. Boardroom Exclusive for Company Directors,(35), 60-61.

ROBECOSAM. (2016). DJSI Family.

Sari, M.M.R., Subroto, B., Purnomosidhi, B., & Rosidi (2014). Board of director’ risk-taking characteristic and accounting conservatism. Research Journal of Finance and Accounting, 5(18), 23-29.

Sekome, N.B., & Lemma, T.T. (2014). Determinants of voluntary formation of risk management committees: Evidence from an emerging economy. Managerial Auditing Journal, 29(7), 649-671.

Solomon, R.C., & Hanson, K.R. (1985). It's Good Business. New York: Athenaeums.

Srijunpetch, S. (2009). Environmental accounting. Journal of Accounting Profession, 5(12), 21-24.

Subramaniam, N., McManus, L., & Zhang, J. (2009). Corporate governance, firm characteristics and risk management committee formation in Australian companies. Managerial Auditing Journal, 24(4), 36-339.

Sukcharoensin, S. (2003). Sukcharoensin, S. (2003). Essays on Corporate Governance, Outside Directors, and Firm Performance. Unpublished DBA dissertation, Thammasat Essays on Corporate Governance, Outside Directors, and Firm Performance. Unpublished DBA dissertation, Thammasat University, Chulalongkorn University, and National Institute Development Administration, Thailand.

Suleiman, S. (2014). Coporate governance mechanisms and accounting conservatism. Journal of Management Policies and Practices, 2(2), pp 113–127.

Sultana, N., & Zaha, V.D.J-L.W.M. (2011). Board gender diversity and earnings conservatism. Curtin University (???? Working paper). .

Sun, J., Liu, G., & Lan, G. (2011). Does female directorship on independent audit committees constrain earnings management? Journal of Business Ethics, 99(3) , 369–382.

The Securities Exchange of Thailand. (2012). Guidelines for preparing corporate social responsibility report (1st ed). Bangkok.

Thomya, W. (July - September 2015). Fctors related to the establishment of the management committee and risks of listed companies in the Stock Exchange of Thailand. Journal of Business Administration, 147, 20-38.

Trang, T.K.P. (2016). (2016). Research on the relationship between corporate governance and firm performance: Empirical evidence from companies listed on the stock exchange in Vietnam. International Journal of Management and Applied Research, 3(4).

Ulman, A. (1985). Data in search of a theory: A critical examination of the relationship among social performance, social disclosure, and economic performance. Academy of Management, 10, 450-477.

Vance, S. (1975). Are socially responsible firms good investment risks? Management Review, 64, 18 – 24.

Waddock, S.A., & Graves, S.B. (1997). The corporate social performance-financial performance link. Strategic Management Journal,18, 303-319.

Yatim, P. (2010). Board structures and the establishment of a risk management committee by Malaysian listed firms. Journal of Management & Governance, 14(1), 17-36.

Yunos, R., Smith, G.M., & Ismail, Z. (2012). The relationship between board skills and conservatism: malaysian evidence. Journal of Modern Accounting and Auditing, 8(8), 1173– 1184.

Received: 02- Dec -2021, Manuscript No. JMIDS-21-7094; Editor assigned: 04- Dec -2021, PreQC No. JMIDS-21-7094 (PQ); Reviewed: 14-Dec-2021, QC No. JMIDS-21-7094; Revised: 20-Dec-2021, Manuscript No. JMIDS-21-7094 (R); Published: 11-Jan-2022