Research Article: 2018 Vol: 17 Issue: 6

The Influence of Strategic Assets and Market Orientation to the Performance of Family Business in Makassar City, Indonesia

Henni Zainal, Universitas Indonesia Timur

W. Kristina Parinsi, STIE Pembangunan Indonesia

Chalid Imran Musa, Universitas Negeri Makassar

Farid Said, Politeknik Pariwisata Negeri Lombok Indonesia

Haedar Akib, Universitas Negeri Makassar

Abstract

The article results of this study explain the effect of strategic assets and market orientation on the performance of the family business. The population is a family business entity of 1,455 units with a sample of 150 obtained by purposive proportional random. The analysis technique used is Structural Equation Modeling (SEM) with LISREL software. The results show that strategic assets and market orientation have a direct and significant effect on the performance of the family business in the city of Makassar. This finding reinforces the views of experts and the results of research that human resources, knowledge management, organizational capabilities, and experience of business actors are organizational strategic assets. Likewise, market information and its dissemination and organizational response to the market are dimensions of market orientation. Therefore, it is necessary to improve the performance of the family business through sharpening internal focus (organizational assets) and the organization's external focus (market orientation). The performance of family businesses is a populist economic actor who contributes to strengthening the local, regional and national economy.

Keywords

Organizational Assets, Market Orientation, Business Performance, Family Business.

Introduction

Entrepreneurship research traditionally considers individuals and business institutions (companies) not to pay too much attention to the family context, whereas in a modern way that considers business and family as separate institutions have begun to be abandoned. Business and family development is a separate, but related field of inquiry (De Massis et al., 2014; De Massis et al., 2016; Papilaya et al., 2015). There is recognition of the importance of the context of family households in understanding business creation and growth (Welter, 2011). Recent studies have even focused on the underlying role of family households in business growth (Alsos et al., 2014; Carter et al., 2015; Hasan, 2014; Hasyim & Hasan, 2017; Papilaya et al., 2015), so that collectively challenging the idea of separation between business and family.

Alsos et al. (2014), Chrisman et al. (2005), Habbershon et al. (2003) argue that there is a unique value derived from family interaction and a business approach that supports competitive advantage. Habbershon et al. (2003) see the relationship between business and family leads to dynamic capabilities that are unique and can shape the behavior of the company. The relationship between business and family is a priority to achieve a sustainable competitive advantage, and vice versa (Gordon & Nicholson, 2008; Miller et al., 2003). Miller & Le Breton- Miller (2005), Pendrian et al. (2018) argue that family businesses create value for customers by exploring operational excellence and quality improvement based on their unique resources. Papilaya et al. (2015) states that unique resources and family business competencies owned have greater potential to succeed in a changing market environment.

Empirical studies show that family businesses contribute substantially to job creation and increase community income (Faccio & Lang, 2002; Arregle et al., 2007; Astrachan & Shanker, 2003; Berlemann & Jahn, 2016; Bertrand & Schoar, 2006; Bird & Wennberg, 2014; Bjuggren et al., 2011; Block & Spiegel, 2013; Hasan, 2018; Papilaya et al., 2015). However, there are also several empirical studies that state that family businesses carry out business activities inefficiently because they prioritize social goals, such as control and nepotism rather than economic goals, such as profit and growth. Debates about the efficiency of family ownership have been going on for a long time and are still developing today (Bjuggren et al., 2013; Dyer, 2006; Evert et al., 2016; Miller et al., 2003).

Family businesses have several problems and limitations in controlling their resources, market research, and lack of formal planning that leads to the need to invest in developing the resources they have in line with the implementation of strategies and the creation of competitive advantage and performance improvement (Barney, 2001). Also, family businesses face competition from various parties, not only with fellow business people who have the same scale, but also with big entrepreneurs, so that they need to make new market breakthroughs, determine the intended market focus, improve product quality and competitiveness of goods produced (Papilaya et al., 2015).

Based on the background of the problem, the article results of this study explain the effect of strategic assets and market orientation on the performance of the family business in Makassar, Indonesia.

Literature Review

In examining the uniqueness and characteristics of family enterprises, researchers primarily using resource-based views introduce concepts, such as “familiness” (Habbershon et al., 2003), “family capital” (Hoffman et al., 2006), “family effect” (Dyer, 2006), and “family social capital” (Arregle et al., 2007). The resource-based view focuses on efforts to achieve a sustainable competitive advantage over time (Haedar Akib, 2003; Prahalad & Hamel, 2000; Wernerfelt, 1984) and examines the resources of idiosyncratic companies that contribute to maintaining competitive advantage (Barney, 1991:1986). The family's unique family resources come from family and business interactions and are considered complex, dynamic, and intangible (Habbershon et al., 2003). Also, it is stated that the unique characteristics of family enterprise resources can create benefits, and otherwise can also create harm to family enterprises (Sirmon & Hitt, 2003).

In a comparison of the performance of various types of companies (Barney, 2001; Breton?Miller & Miller, 2015; Carmeli, 2004; Daraba et al., 2018; Fahed-Sreih & El-Kassar, 2017; Lu et al., 2013; Papilaya et al., 2015; Pendrian et al., 2018; Prahalad & Hamel, 2000; Sirmon & Hitt, 2003; Wernerfelt, 1984) resource-based views are an important perspective. This theory shows that the level of company performance is mainly due to its resources. This view assumes that resources are distributed asymmetrically between competing companies and do not move perfectly. To provide a sustainable competitive advantage, resources must be valuable, scarce, and not have equal substitutes.

Akib (2003) and Barney (1991) suggest that there are three types of resources, which include physical capital resources, human capital resources, and organizational capital resources. The first category corresponds to a group of tangible resources while human resources and capital are intangible organizations (Michalisin et al., 1997). Tangible resources are concrete and include resources, such as raw materials and land. Intangible resources are non-material and mostly tacit (Carmeli, 2004). It is generally asserted that intangible resources can provide a competitive advantage for the company (Barney, 1991; Michalisin et al., 1997; Prahalad & Hamel, 2000). Meanwhile, tangible resources are flexible and fairly easy to imitate (Carmeli, 2004), intangible resources are difficult to develop or emulate. Both of these resources are part of the organization's “knowledge”, tacit knowledge, explicit knowledge, and cultural knowledge (Akib, 2003; Hoffman et al., 2006; Tuomi, 1999) as a source of competitive advantage.

The study of family firms relates to their resources and abilities (Habbershon et al., 2003; Hasan, 2018). The tangible resources of a family business can be compared to a non-family business, but the characteristics of the family's intangible resources seem quite different. This intangible resource is called the concept of “familiness” (Cabrera-Suárez et al., 2001; Chrisman et al., 2005; Habbershon et al., 2003; Sirmon & Hitt, 2003). It is suggested that “familiness” results from the interaction between family and business and refers to some unique resources (Habbershon et al., 2003). Sirmon & Hitt (2003) identify five resources as components of “familiness”, which include human capital, social capital, survivability capital, patient capital, and governance structure. Other family behaviors have been identified in the concept of “family capital” which includes information channels, obligations and expectations, reputation, identity, and moral infrastructure (Alda, 2018; Arregle et al., 2007; Hoffman et al., 2006).

The resource component in the family business as the first variable/construct is a strategic asset, with dimensions: human resources, knowledge management, organizational capability, and managerial experience. Based on the view of strategic management, unique company assets are a source of competitive advantage (Hoskisson et al., 1999). The second construct is market orientation, which involves gathering market information systematically about customer needs, disseminating market information to all organizational units/departments, and designing and implementing organizational responses to market information in a coordinated and comprehensive manner (Kohli & Jaworski, 1990). Both of these constructs are a research framework and at the same time as a determinant factor for the business performance of the family under study.

Research Methodology

This type of research is quantitative-exploratory with the aim of analyzing the influence of strategic assets and market orientation on the performance of the family business in the city of Makassar. This family business is spread in some sub-districts with business activities in the industrial sector which are grouped into food and beverage businesses, timber and rattan, handicrafts, and metal businesses. The market category of businesses serves local and national markets, as well as export markets. The unit of analysis is the family business represented by the business actor at the managerial level or the manager who understands and is involved in developing his business. The population is 1,455 business entities (family businesses) in Makassar City, while the samples are drawn proportionally at random 126, according to the requirements of Structural Equation Modeling (SEM), at least five times the number of indicators. To avoid too small some samples that cause measurement errors, then based on the opinion of Cooper et al. (2006), the number of samples was increased to 150 family businesses in the city of Makassar.

Data collection uses a questionnaire in the form of closed questions with the nature of the ordinal data scale. Strategic assets refer to the thinking of Dollinger (2008) and Grant (2016) based on four dimensions, namely: human resources, knowledge management, organizational capability, and business experience. Then, market orientation refers to the thoughts of Kohli & Jaworski (1990) which includes systematic collection of market information about customer needs, dissemination of market information to all organizational units/departments, designing and realizing organizational responses to market information in a coordinated and comprehensive manner. Meanwhile, the performance measurement of the family business is based on two dimensions, namely financial performance and non-financial performance. Financial performance is measured by the perceptions of business people on profitability and sales growth, while non-financial performance is measured based on customer satisfaction and employee satisfaction.

Data were analyzed using inferential statistical methods to test hypotheses through Structural Equation Modeling/SEM with LISREL software (Bowen & Guo, 2011; Hair et al., 2006).

Results And Discussion

This statistical analysis is based on the estimation of the structural model to analyze the hypothetical model where the results have alignment with the estimated value of the structural model of the research as outlined in the parsimony adjusterd measurement criteria. Seeing the value of the saturated model that explains the number of data parameters of this study is the same as the number of moment samples, with requirements namely 0.000 and df=0 (Table 1), it is concluded that this research model has a perfect fit of the data set used.

| Tabel 1 Parsimony-Adjusted Measures |

|||

| Model | PRATIO | PRATIO | PCFI |

| Default model | 0.817 | 0.453 | 0.499 |

| Saturated model | 0.000 | 0.000 | 0.000 |

| Independence model | 1.000 | .000 | .000 |

Source: Result of analysis of research data, 2016-2017.

After parsimony testing, which was continued by looking at the results of the alignment testing of the study sample data and the moment of observation or research indicators that met the requirements of the goodness of fit indices (Table 2), it was stated that the research data had met the structural model. Structural models are used to measure the effect of exogenous latent variables on endogenous latent variables and find out manifest variables or loading factors produced.

| Table 2 Criteria Data Alignment Research Result (Good Of Fit Indices) |

|||

| Criteria | Expected Cut-off Value | Test result | Evidencne |

| P-Value | Expected small | 0.0000 | Fit |

| Rel Chi-Square | ≤ 2.00 | 0.0000 | Fit |

| CFI | ≥ 0.80 | 1.0000 | Fit |

| RMSEA | ≤ 0.08 | 0.0198 | Fit |

| GFI | ≥ 0.80 | 0.9692 | Fit |

| AGFI | ≥ 0.70 | 0.8198 | Fit |

Source: Result of analysis of research data, 2016-2017.

The value of contribution from each variable can be seen from the explanation of the structural relationship between variable and acceptance level and rejection of hypothesis with the criterion of P-value test <α (0.05), showing the significance of hypothesis proposed. The test results are shown in Table 3 as follows.

| Table 3 Criteria Results Testing Hypothesis Research |

|||||

| Variable | Estimate | SE | CR | P Value | Decision |

| X1 to Y | 0.991 | 3.961 | 2.293 | 0.023 | Significant |

| X2 to Y | 11.831 | 13.247 | 2.798 | 0.025 | Significant |

Source: Result of analysis of research data, 2016-2017.

The findings of this study indicate that the parameter estimation value of the exogenous variable of strategic asset (X1) to the endogenous variable of business performance (Y) is 0.991> 0.000, and the critical ratio value in the positive value coefficient is 2.293 or 22.93 with P value 0.023<α (0.05)(1.196), so the resulting decision criterion is to reject H0 and receive H1. Thus, it is evident that exogenous latent variables or strategic assets (X1) have a significant effect on endogenous latent variables or business performance (Y). Based on significance test, it can be proved that strategic asset variable (X1) has the positive and significant effect to business performance variable (Y), with path coefficient 0.13 or 13 percent at a significant level and with the critical ratio (CR) at tcount amounted to 2.293 or 22.93 percent. Also, there is also the effect of epsilon (ε) factor of 1-0.2293=0.7707 or 77.07 percent on business performance caused by other variables outside of this research model at a rate of 0.05.

The parameter estimation value of the exogenous variables of market orientation (X2) has an effect on the endogenous variable of business performance (Y) of 11.831>0.000, and the critical ratio value on the path coefficient is positive 2.798 or 27.98 with P value 0.025<α (0.05) (1.196), so the decision criterion is to reject H0 and accept H1. Thus, it is evident that the exogenous variables of market orientation (X2) have a significant effect on the endogenous variable of business performance (Y). Based on significance test, it is stated that market orientation variable (X2) has a positive and significant effect on business performance (Y) with a path coefficient of 0.08 or 8 percent with the Critical Ratio (CR) at t value of 2.798 or 27.98 percent. Also, there is an influence of other variables outside of this study model, or epsilon (ε) factor of 1-0.2798=0.7202 or 72.02 percent at a 0.05 level. The findings of this study indicate the development of research conducted by Aisyah et al. (2017), Akib (2012), Qureshi & Mian (2010) stating that successful businesses have good ability in handling market opportunities. This success is due to its business activities based on customer needs. Nevertheless, research by previous researchers did not examine the capabilities of family businesses in transmitting datadriven market change information, so that customer-based business activities should be synchronized with the management of customer data for long-term performance outcomes.

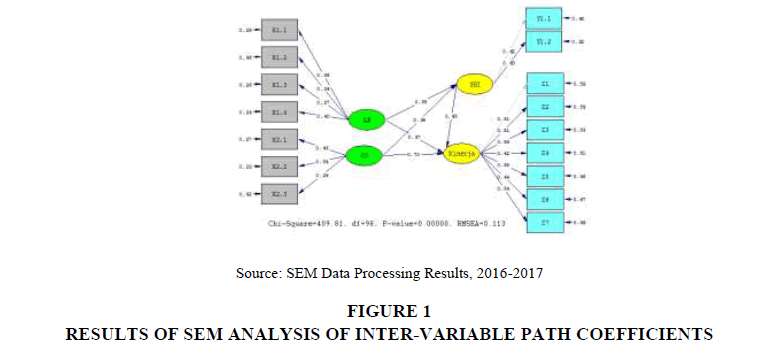

The description above is an “example or representation” explanation of the magnitude of the influence of the path coefficients of each variable constructed by the hypothesis, structural model and value, as in the “final iteration model” visualized in Figure 1.

In fact, (Figure 1), the contribution of path coefficients shows the direct and indirect effects of exogenous variables on endogenous variables, but according to the purpose of this article only explained the influence of strategic assets (X1) and market orientation (X2) on business performance (Z). While the relationship of variables that are “not explained” are: the influence of strategic assets and market orientation on the external business environment (Y), as well as the influence of the external business environment on the performance of the family business in Makassar.

The findings of this study complement the results of previous studies proposed by Akib (2003), Chen et al. (2012), Hasan (2018), Karami et al. (2014), Muhammad (2016) stating that knowledge management in business practices is more emphasized on hard competency reinforcement that is related to job duties and functions in promoting performance, so that specialization is understood only on the ability of the worker to complete the work he/she is responsible for . While in this study found more than just the hard competence in question, as well as exploring the soft competency and trying to reveal about the practice of knowledge management in elaborating work based on the initiative, morale, and sense of ownership, so the existence of employees so appreciated his work and ideas in performing performance.

The results show that strategic assets (Alda, 2018; Carmon, 2013; Dollinger, 2008; Grant, 2016; Jufri et al., 2018; Michalisin et al., 1997) have a direct and significant effect on the performance of family business ventures. Strategic assets with HR indicators, knowledge management, organizational capabilities and the experience of managers who are utilized contribute to improving family business performance. This finding supports the views of experts and the results of previous studies (Acquaah, 2016; Agyapong & Boamah, 2013; Akib et al., 2015; Alda, 2018; Carmon, 2013; Lu et al., 2013; Michalisin et al., 1997; Moss et al., 2014; Thrassou et al., 2018), that the practice of family business in managing strategic assets is minimally focused on improving performance, both in the form of increased sales and profit growth (Agyapong & Boamah, 2013; Papilaya et al., 2015; Rengifurwarin et al., 2018). Another finding from this study is that market orientation has a direct and significant influence on the performance of the family business. Thus, a clear market orientation (Escribá-Esteve et al., 2008; Kohli & Jaworski, 1990; Papilaya et al., 2015; Thrassou et al., 2018), both in the process of gathering information and disseminating information to employees to encourage shared commitment, as well as responding to changes due to customer expectations and attendance competitors, contributing positively to improving the business performance of family businesses.

Conclusion

Strategic assets and market orientation have a positive and significant effect on the performance of the family business in the city of Makassar. Management of the strategic assets of the family business is oriented towards increasing competitiveness and business performance. The performance of this family business can interpret changes in the external and internal business environment based on human resource competencies, organizational capabilities, knowledge management, and managerial experience. This family business also constantly strives to improve the performance of its management-based human resource competencies, both those obtained through training and market information sharing, as well as through sharing experiences. Therefore, in order for family businesses to remain as pillars of economic conditions that contribute to the economy at various levels, it is necessary to evaluate the achievements of the markets served to suit their business environment. Also, family businesses need to sharpen their internal focus (strategic assets) and external focus (market orientation) in order to improve business performance in a synergistic and sustainable manner.

References

- Acquaah, M. (2016). Family businesses in sub-saharan Africa: Behavioral and strategic perspectives. Springer.

- Agyapong, A., & Boamah, R.B. (2013). Business strategies and competitive advantage of family hotel businesses in Ghana: The role of strategic leadership. Journal of Applied Business Research, 29(2), 531.

- Aisyah, S., Musa, C.I., & Ramli, A. (2017). Effect of characteristics and entrepreneurial orientation towards entrepreneurship competence and crafts and arts SMEs business performance in Makassar. International Review of Management and Marketing, 7(2), 166-173.

- Akib, H. (2003).Spread the wilderness of knowledge management. Management and Businessman.

- Akib, H. (2012). Develop capability of knowledge-based organizations. Gorontalo: STIA Bina Taruna.

- Akib, H.R., & Guntur, M. (2015). Quality improvement strategies of academic services and student affairs at the graduate program state university of Makassar, Indonesia. International Journal of Applied Business and Economic Research, 13(4), 2019-2027.

- Alda, M. (2018). A strategic fund family business decision: The pension fund liquidation. Journal of Business Research, 91, 248-265.

- Alsos, G.A., Carter, S., & Ljunggren, E. (2014). Kinship and business: How entrepreneurial households facilitate business growth. Entrepreneurship & Regional Development, 26(1-2), 97-122.

- Arregle, J., Hitt, M.A., Sirmon, D.G., & Very, P. (2007). The development of organizational social capital: Attributes of family firms. Journal of Management Studies, 44(1), 73-95.

- Astrachan, J.H., & Shanker, M.C. (2003). Family businesses’ contribution to the US economy: A closer look. Family Business Review, 16(3), 211-219.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120.

- Barney, J.B. (1986). Organizational culture: Can it be a source of sustained competitive advantage? Academy of Management Review, 11(3), 656-665.

- Barney, J.B. (2001). Is the resource-based view a useful perspective for strategic management research? Yes. Academy of Management Review, 26(1), 41-56.

- Berlemann, M., & Jahn, V. (2016). Regional importance of Mittelstand firms and innovation performance. Regional Studies, 50(11), 1819-1833.

- Bertrand, M., & Schoar, A. (2006). The role of the family in family firms. Journal of Economic Perspectives, 20(2), 73-96.

- Bird, M., & Wennberg, K. (2014). Regional influences on the prevalence of family versus non-family start-ups. Journal of Business Venturing, 29(3), 421-436.

- Bjuggren, C.M., Daunfeldt, S.O., & Johansson, D. (2013). High-growth firms and family ownership. Journal of Small Business & Entrepreneurship, 26(4), 365-385.

- Bjuggren, C.M., Johansson, D., & Sjögren, H. (2011). A note on employment and gross domestic product in Swedish family-owned businesses: A descriptive analysis. Family Business Review, 24(4), 362-371.

- Block, J.H., & Spiegel, F. (2013). Family firm density and regional innovation output: An exploratory analysis. Journal of Family Business Strategy, 4(4), 270-280.

- Bowen, N.K., & Guo, S. (2011). Structural equation modeling. Oxford University Press.

- Breton?Miller, L., & Miller, D. (2015). The arts and family business: Linking family business resources and performance to industry characteristics. Entrepreneurship Theory and Practice, 39(6), 1349-1370.

- Cabrera-Suárez, K., De Saá-Pérez, P., & García-Almeida, D. (2001). The succession process from a resource-and knowledge-based view of the family firm. Family Business Review, 14(1), 37-46.

- Carmeli, A. (2004). Assessing core intangible resources. European Management Journal, 22(1), 110-122.

- Carmon, A.F. (2013). Is it necessary to be clear? An examination of strategic ambiguity in family business mission statements. Qualitative Research Reports in Communication, 14(1), 87-96.

- Carter, S., Mwaura, S., Ram, M., Trehan, K., & Jones, T. (2015). Barriers to ethnic minority and women’s enterprise: Existing evidence, policy tensions and unsettled questions. International Small Business Journal, 33(1), 49-69.

- Chen, C., Chang, M., & Tseng, C. (2012). Retracted: Human factors of knowledge?sharing intention among taiwanese enterprises: A model of hypotheses. Human Factors and Ergonomics in Manufacturing & Service Industries, 22(4), 362-371.

- Chrisman, J.J., Chua, J.H., & Steier, L. (2005). Sources and consequences of distinctive familiness: An introduction. Entrepreneurship Theory and Practice, 29(3), 237-247.

- Cooper, D.R., Schindler, P.S., & Sun, J. (2006). Business research methods.

- Daraba, D., Cahaya, A., Guntur, M., & Akib, H. (2018). Strategy of governance in transportation policy implementation: Case study of bus rapid transit (BRT) program in Makassar City. Academy of Strategic Management Journal.

- De Massis, A., Chirico, F., Kotlar, J., & Naldi, L. (2014). The temporal evolution of proactiveness in family firms: The horizontal S-curve hypothesis. Family Business Review, 27(1), 35-50.

- De Massis, A., Kotlar, J., Frattini, F., Chrisman, J. J., & Nordqvist, M. (2016). Family governance at work: Organizing for new product development in family SMEs. Family Business Review, 29(2), 189-213.

- Dollinger, M.J. (2008). Entrepreneurship: Strategies and resources. Marsh Publications.

- Dyer, W.G. (2006). Examining the family effect on firm performance. Family Business Review, 19(4), 253-273.

- Escribá-Esteve, A., Sánchez-Peinado, L., & Sánchez-Peinado, E. (2008). Moderating influences on the firm’s strategic orientation-performance relationship. International Small Business Journal, 26(4), 463-489.

- Evert, R.E., Martin, J.A., McLeod, M.S., & Payne, G.T. (2016). Empirics in family business research: Progress, challenges, and the path ahead. Family Business Review, 29(1), 17-43.

- Faccio, M., & Lang, L.H. (2002). The ultimate ownership of Western European corporations. Journal of Financial Economics, 65(3), 365-395.

- Fahed-Sreih, J., & El-Kassar, A.N. (2017). Strategic planning, performance and innovative capabilities of non-family members in family businesses. International Journal of Innovation Management, 21(7), 1750052.

- Gordon, G., & Nicholson, N. (2008). Family wars: Classic conflicts in family business and how to deal with them. Kogan Page.

- Grant, R.M. (2016). Contemporary strategy analysis: Text and cases edition. John Wiley & Sons.

- Habbershon, T.G., Williams, M., & MacMillan, I.C. (2003). A unified systems perspective of family firm performance. Journal of Business Venturing, 18(4), 451-465.

- Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (2006). Multivariate data analysis, (6th ed.) Uppersaddle River: Pearson Prentice Hall.

- Hasan, M. (2014). Industrial sector productivity and elasticity of job opportunities. Economix, 2(2).

- Hasan, M. (2018). Creative economy development in the economic education perspective. JEKPEND: Journal of Economics and Education, 1(1), 81-86.

- Hasyim,H., & Hasan, M.(2017). Empowerment strategy and competitive advantages of small industries. In Seminar Nasional Dies Natalis, 56, 185-192. Penerbit UNM.

- Hoffman, J., Hoelscher, M., & Sorenson, R. (2006). Achieving sustained competitive advantage: A family capital theory. Family Business Review, 19(2), 135-145.

- Hoskisson, R.E., Wan, W.P., Yiu, D., & Hitt, M.A. (1999). Theory and research in strategic management: Swings of a pendulum. Journal of Management, 25(3), 417-456.

- Jufri, M., Akib, H., Ridjal, S., Sahabuddin, R., & Said, F. (2018). Improving attitudes and entrepreneurial behaviour of students based on family environment factors at vocational high school in Makassar. Journal of Entrepreneurship Education, 21(2), 1-14.

- Karami, S., Gholami, M., Qanbari, M., & Sahafi, M. (2014). Investigating the relation between organizational culture and knowledge management in the educational department general of Golestan (Iran). In the First national conference of training and psychology. Marvdasht (Iran).

- Kohli, A.K., & Jaworski, B.J. (1990). Market orientation: The construct, research propositions, and managerial implications. The Journal of Marketing, 1-18.

- Lu, Y., Au, K., Peng, M.W., & Xu, E. (2013). Strategic management in private and family businesses. Springer.

- Michalisin, M.D., Smith, R.D., & Kline, D.M. (1997). In search of strategic assets. The International Journal of Organizational Analysis, 5(4), 360-387.

- Miller, D., & Le Breton-Miller, I. (2005). Management insights from great and struggling family businesses. Long Range Planning, 38(6), 517-530.

- Miller, D., Steier, L., & Le Breton-Miller, I. (2003). Lost in time: Intergenerational succession, change, and failure in family business. Journal of Business Venturing, 18(4), 513-531.

- Moss, T.W., Payne, G.T., & Moore, C.B. (2014). Strategic consistency of exploration and exploitation in family businesses. Family Business Review, 27(1), 51-71.

- Muhammad, H. (2016). Development of informal economic education patterns as efforts to establish good economic behavior. In the Proceedings of the national seminar mega trend of innovation and creation of research results in supporting sustainable development, 82-87. Lembaga Penelitian UNM.

- Papilaya, J., Soisa, T.R., & Akib, H. (2015). The influence of implementing the strategic policy in creating business climate, business environment and providing support facilities towards business empowerment on small medium craft enterprises in Ambon Indonesia. International Review of Management and Marketing, 5(2), 85-93.

- Pendrian, O., Karnen, K.A., Rachmawati, R., & Kusumastuti, R.D. (2018). Entrepreneurial orientation in a family business group: The role of the corporate center and its effect on business unit performance. In Increasing Management Relevance and Competitiveness, 49-54. CRC Press.

- Prahalad, C.K., & Hamel, G. (2000). The core competence of the corporation. Strategic Learning in a Knowledge Economy, 3-22. Elsevier.

- Qureshi, S., & Mian, S.A. (2010). Antecedents and outcomes of entrepreneurial firms marketing capabilities: An empirical investigation of small technology based firms. Journal of Strategic Innovation and Sustainability, 6(4), 28.

- Rengifurwarin, Z.A., Akib, A.H., Jasruddin, U.N.M., & Salam, R. (2018). Snapshot of public service quality in the center for integrated business service (CIBS), cooperative micro small and medium enterprises (CMSME), Maluku Province, Indonesia. Journal of Entrepreneurship Education,21(3).

- Sirmon, D.G., & Hitt, M.A. (2003). Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice, 27(4), 339-358.

- Thrassou, A., Vrontis, D., & Bresciani, S. (2018). The agile innovation pendulum: A strategic marketing multicultural model for family businesses. International Studies of Management & Organization, 48(1), 105-120.

- Tuomi, I. (1999). Corporate knowledge: Theory and practice of intelligent organizations. Metaxis Helsinki.

- Welter, F. (2011). Contextualizing entrepreneurship-conceptual challenges and ways forward. Entrepreneurship Theory and Practice, 35(1), 165-184.

- Wernerfelt, B. (1984). A resource?based view of the firm. Strategic Management Journal, 5(2), 171-180.