Research Article: 2022 Vol: 26 Issue: 1S

The Influence of Financial Reporting Quality, Family Ownership, and Audit Quality on Investment Efficiency

Joseph Herbert, Diponegoro University

Puji Harto, Diponegoro University

Citation Information: Herbert, J., & Harto, P. (2021). The influence of financial reporting quality, family ownership, and audit quality on investment efficiency. Academy of Accounting and Financial Studies Journal, 25(S5), 1-13.

Abstract

This study aims to examine the effect of financial reporting quality and family ownership on investment efficiency, moderated by audit quality. Size, leverage, firm age, and tangibility serve as control variables. Population used in this study is manufacture firms listed on Indonesia Stock Exchange (IDX) in the period of 2015-2019 and sample is selected with purposive sampling method, resulting in 217 firms. Statistical analysis in this study is using multiple regression model. The results show that family ownership has significant effect on investment efficiency, while audit quality significantly moderated the relationship of family ownership on investment efficiency. Financial reporting quality do not have significant effect on investment efficiency and audit quality do not moderate significantly on the relationship of financial reporting quality on investment efficiency. This study is draw on both agency and behavioral agency theories. It contributes to the literature in the following ways. Firstly, the authors examine the effect of financial reporting quality on investment efficiency. Secondly, the authors examine the effect of family ownership on investment efficiency. Third of all, the authors examine the moderating effect of audit quality on the relationship between financial reporting quality and family ownership on investment efficiency.

Keywords

Financial Reporting Quality, Family Ownership, Audit Quality, Investment Efficiency, Agency Theories.

Introduction

Phenomenon in Indonesia explains that Indonesia is experiencing investment inefficiencies based on the website aa.com.tr. Darmin Nasution as the Coordinating Minister of Economic says that the level of Icremental Capital to Output Ratio (ICOR) is still very high at 6,3% in the year of 2018 with economic growth at 5,17% compared with other states’s ICOR (i.e. Malaysia 4,6%; Phillippine 3,7%; Thailand 4,5%; and Vietnam 5,2%). He motivates government to perform economic transformation by optimizing the infrastructures that has been developed by government in the last five years. ICOR itself is a ratio between investment done in the last year and regional output growth (PDRB). ICOR could be one of the parameters to describe investment efficiency degree in any states.

Investment is interpreted as any mechanism used by company in order to gain profit or return in the future. In the practical, investment is a decision made by company for funding any assets purchase, either real assets (cars, building, land, etc.) or financial assets (bond, mutual fund, stock, draft, etc.) with thought and expectation to get higher income in the future or sold on top of the market price compared to the price incurred to get the asset. Investment is based on the previous year’s growth in sales (Biddle et al., 2009).

Over-investment is a circumstance where investment made by the firms are higher than expected, whereas underinvestment is a circumstance when investment made by the firms are lower than expected. Overinvestment generally faced when management decides to invest in negative NPV projects while underinvestment appears when management avoid investing in positive NPV projects.

Based on the agency theory, either overinvestment or underinvestment conditions rise to the surface due to the market imperfections by the existence of asymmetry information among managers, shareholders, and outside suppliers of capital (stockholder, etc.). This circumstance lead to the moral hazard and adverse selection problems (Myers & Majluf, 1984). Firms can deviate from their investment target which is optimum investment by investing in over-and-under investment NPV.

Most of the literature and prior research show that company could reduce the asymmetry information by raising the quality of financial reporting. Higher quality of financial reporting enables better supervision which allowing firms to reduce asymmetry information and agency costs caused by moral hazard and adverse selection. With this way, firms could improve investment efficiency and mitigate either over-and-under investment problems (Bushman & Smith, 2001).

On the other hand, firms in Indonesia that owned by family-controlled have a considerable existence where many of them have already been listed in the Indonesia Stock Exchange (IDX). Indonesia Institute for Corporate and Directorship (IICD) 2010 Data finds out that more than 95% business in Indonesia are firms owned and executed by family- controlled (Soerjonodibroto, 2010)

Due to the alignment effect, several agency problems will be less to happen in family firms rather than family firms as they have rights to control firms and management. The involvement of some family members in firm management make it easier for monitoring all activities within firms, therefore, reduce the informational gap circumstances. The agency theory that occurs in family firms is agency theory type II. Agency theory type II occurs on firms with concentrated ownership structure which appears to be a conflict between majority stockholders and minority non-controlling stockholders. This conflict occurs when majority controlling stockholder have rights to control the company and create policy that ignore the interest of minority non-controlling stockholders.

Behavioral agency theory states that the safeguarding of socio-emotional wealth (SEW) is reflected as the reference point in making strategic decisions (Gomez-Mejia et al., 2000). This implies that family ownership refuses to increase their capital from outside sources. They indicate that the involvement of outside finances will interfere their attempt to retain control on the business. Hence, the preservation of SEW in the form of family control motivates them to pass up good investment opportunities. Family firm has a desire to shift their business to the future generation (Massis et al., 2015). This leads family firms to place effective monitoring mechanism, therefore condense the tendency of over – and under- investment problem.

This study is also test the effect of audit quality as moderating variable on the relationship between financial reporting quality and family ownership on investment efficiency. Audit quality proxied by Big 4 audit firms consist of Ernst & Young (EY), Price Waterhouse Cooper (PWC), Deloitte, and KPMG. The big 4 audit firms provide higher quality of audit due to they have more experience and competence than smaller competitors as they usually deal with larger clients from different industries which can improve the level of auditor’s skills (O'Keefe & Westort, 1992; Reza & Ullah, 2019). Therefore, it is expected that financial report audited by big 4 have higher quality than non- big 4. Family firms will appoint higher quality auditors to provide their firm with higher audit quality, as higher audit quality will strengthen the reputation of family firms. The appointment of a high-profile auditor resulting in increasing the credibility of the published accounts, the reliability of the firm’s operations and management, thus will reduce agency costs (Piot, 2005). Higher audit quality reducing the risk premium requested by the investors, hereby, enabling firms to get extra money for invest in positive NPV projects and reduce the issues of underinvestment (Al-Thuneibat et al., 2011).

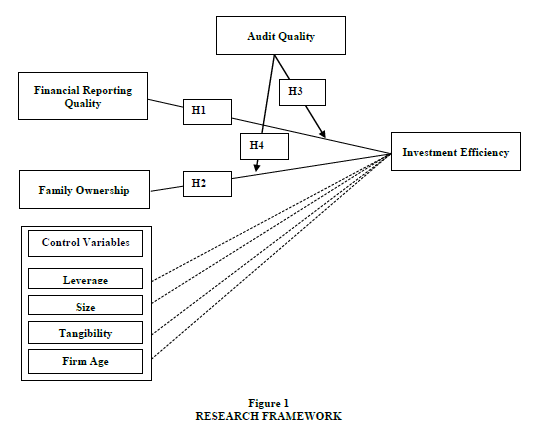

Research Framework and Hypothesis Development

Prior research found out that increasing the quality of financial reporting as a solution to solve overinvestment and underinvestment challenges as higher financial reporting quality will reduce the asymmetry information. Hence, higher quality of financial reporting restricts managers to pursuit personal goals from over- and under-investment circumstances at the cost of the shareholders, thus forcing managers to act for the interest of shareholders. Therefore, financial reporting quality become monitoring mechanism for shareholders.

The agency theory does not contemplate the existence of non-economic goals in family-controlled firms, thereby, prior literatures suggest preserving Socio-Emotional Wealth (SEW) is an important determinant for family firms by acts as references in decision-making processes. SEW is used as family firm’s goal to establish long-lasting reputational survival business and passing it to the future generation, which is likely to promote trust in other shareholders. They will not hesitate to invest in positive NPV projects and avoid to invest in negative NPV projects. Hence, family ownership will act as a monitoring mechanism to ensure companies are not in the over- and-under investment conditions.

The author predicts that the influence of financial reporting quality and family ownership on investment efficiency will be greater with higher quality audit as it could improve financial reporting quality within a firm by making published accounts more credible and as an efficient monitoring tool, higher audit quality and financial reporting quality provide specific and credible information for investors about the firms, allowing them to supervise the activities within the firms.

Family controlled-firms will appoint specialist auditor to provide their firm with higher audit quality, as higher audit quality will strengthen the reputation of family firms and increase the credibility of published accounts, the reliability of the firm’s operations and management, thus reducing agency costs (Piot, 2005). Thereby, with family controlled-firms audited by higher quality auditor, it will reduce the risk premium as demanded by the investors. Hence, this setting will attract investors to invest on FCs firms which they could get extra money for investing in positive NPV projects thus reducing the issues of underinvestment.

Financial Reporting Quality (FRQ) and Investment Efficiency

Previous studies find the connection between financial reporting quality and asymmetry information. Study conducted by Liou & Yang (2008) finds out that with financial reporting, investors can get the highlights about the firm performance accurately. According to the studies, financial reporting quality contributes as a monitoring mechanism for shareholders with providing any information relating capital to the supplier. If these reports deliver a true overview of the firms, they can mitigate the asymmetry information problem, and managers cannot sell their shares at higher prices nor will get the extra money to fund negative NPV projects. (Gomariz & Ballesta, 2013). Therefore, the quality of accounting information reduces the problem of overinvestment and underinvestment by resolving the moral hazard due to the higher quality of financial reporting enables principals to sign efficient contracts with agents and effective monitoring at lower cost would be facilitated. Therefore, the hypothesis drafted from the argument above is:

H1: Financial reporting quality positively effects investment efficiency

Family Ownership (FO) and Investment Efficiency

The extension of the behavioral agency theory, SEW theory looks at the non – financial goals of the family firms rather than financial goals as their intention to deliver work for the family members and setting up a reputation. Socioemotional wealth is fundamental thing for family firms based on the assumption that family’ goals and motivation are mainly derived from achieving socioemotional wealth and they are keen to accumulate and sustain the socioemotional wealth endowment (Gomez-Mejia et al., 2000). Hence, socioemotional wealth delivers family firm’ visions, goals, and decisions. The preservation of SEW is used by family members as a main reference while making strategic decisions as they concern the risk of losing the preservation of accumulated endowment. Thus, SEW is used due to the family firm goals are establishing long-lasting reputational business and passing it to the future generation. They will not hesitate to invest in positive NPV projects and avoid invest in negative NPV projects. Therefore, family firms will contribute as monitoring mechanism to ensure companies are not in the over- and-under investment conditions. From the argument above, the authors draft the hypothesis below:

H2: Family ownership companies positively effects investment efficiency

The Moderating Effect of Audit Quality on The Relationship Between Financial Reporting Quality and Investment Efficiency

Study by Park et al. (2017) shows that big 4 accounting firms can use their expertise and resources efficiently to perform audit which produce higher quality of accounting information in financial reporting, therefore could increase the investment efficiency.

Agency theory of the firm considers higher quality of financial reporting as a solution to reduce the challenge of over-and under-investment by mitigating asymmetry information. Increasing the quality of financial report forcing managers to act based on the interest of shareholders. To assure firm’ financial reporting quality, management and investors would assign higher quality of auditor to provide them with audited financial report. Audit quality is a continuous construct that assures financial reporting quality (DeFond & Zhang, 2014), hence make it an efficient monitoring tool, as audit quality can prevent the opportunistic behavior of the management and conflict of interest between the principal and agent arise from informational gap situations (Biddle et al., 2009). From the argument above, the authors draft the hypothesis below:

H3: The effect of financial reporting quality on investment efficiency will be greater with higher audit quality

The Moderating Effect of Audit Quality on The Relationship Between Family Ownership and Investment Efficiency

Socioemotional wealth is used as family firm goals are to establish long-lasting reputational business and shifting the business to the future generation, thus making dynastic succession is one of the key dimensions of socioemotional wealth that become the consideration of family firms in decision making process (Berrone et al., 2012). Hence, family firms will appoint higher quality auditors to provide their firm with higher audit quality, as higher audit quality will strengthen the reputation of family firms. The appointment of a high-profile auditor resulting in increasing the credibility of the published accounts, the reliability of the firm’s operations and management, thus will reduce agency costs (Piot, 2005). Higher audit quality reducing the risk premium requested by the investors, hereby, enabling firms to get extra money for invest in positive NPV projects and reduce the issues of underinvestment (Al-Thuneibat et al., 2011), leading to prediction that higher audit quality will produce positive outcomes and enhance the investment efficiency at the firm level, including family firms.

H4: The effect of family ownership on investment efficiency will be greater with higher audit quality

Research Method

Research Variables

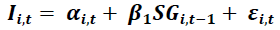

The dependent variable used in this research is investment efficiency (IE). The model to measure investment efficiency:

Where:

= The sum of investment from firm i in year t.

= The sum of investment from firm i in year t. is calculated with net increase of tangible fixed assets and intangible fixed assets divided with lagged total assets.

is calculated with net increase of tangible fixed assets and intangible fixed assets divided with lagged total assets.

=Sales difference of the firms between year t and t-1

=Sales difference of the firms between year t and t-1

The regression produces a residual which reflecting deviation from the expected investment degree. Furthermore, that residual used as proxy to determine whether firm is in overinvestment or underinvestment problems. When a residual is positive, it represents that firms are doing investment higher than expected by the firms in accordance with the sales growth (over-investment), whereas when a residual is negative, it represents that firm are investing lower than expected by the firms in accordance with the sales growth (under-investment).

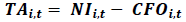

The first independent variables used in this research is financial reporting quality. To measure financial reporting quality, the author use earnings management as an inverse measure of financial reporting quality as it responds to the incentives of company information (Burgstahler et al., 2006). The discretionary accrual (DA) is adopted as a proxy for earning management. Its estimated by the modified Jones Model and later modified by Dechow et al., (1995). Recently, this measurement was used by (Purwanti & Utama, 2018).

First of all, the value of total accruals is calculated using the formula:

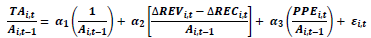

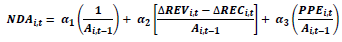

TA is the total accruals from firm I at year t, NI is net income from firm I at year t, and CFO is the operating cash flows from firm I at year t. Next, regressing another equation to determine the value of the coefficient  using the following equation:

using the following equation:

Where  is the lag of total assets from firm I at time t,

is the lag of total assets from firm I at time t, is changes in revenue from firm I at time t,

is changes in revenue from firm I at time t, is changes in receivables from firm I at time t,

is changes in receivables from firm I at time t, is property, plant, and equipment from firm I at time t.

is property, plant, and equipment from firm I at time t.

Next, the value of non-discretionary accruals (NDA) is obtained by multiplying the coefficient values of certain factors as seen in the formula below:

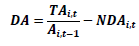

Finally, the value of discretionary accruals is calculated using the following formula:

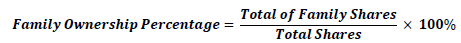

Where NDA is non-discretionary accruals from firm I at time t, and DA is discretionary accruals. The second independent variables used in this research is family ownership. the author measures percentage of family ownership using equation based on prior research conducted by Rosharlianti (2018). The following equation:

The moderate variable, audit quality as a dummy variable. As prior literature (Wahedi et al., 2019), the Big 4 accounting firms in Indonesia are Deloitte, Ernst & Young (EY), Price Waterhouse Coopers (PWC), and KPMG, therefore, if the firms are audited by one of these accounting firms, it is coded 1; otherwise, coded 0.

Several control variables are used in this research. They are leverage, size, firm age, and tangibility. Leverage is the ratio of total debt to total assets, size is the natural logarithm of total assets, tangibility, is the tangible fixed assets divided by the total assets, and firm age, the number of years when a firm started its business until presents.

Research Population and Sample

The population from this research are firms that listed in the Indonesia Stock Exchange. The research samples are manufacture firms listed in the Indonesia Stock Exchange. Samples are determined with purposive sampling method where samples determination are based on criteria. Based on the following method, the author develops criteria for samples that is going in this research. The criteria of samples are:

1. Publicly listed manufacturing firms that registered on Indonesia Stock Exchange in the year of 2015 until 2019 consecutively

2. Publicly listed manufacturing firms that publishes financial report in the year of 2015 until 2019

3. Publicly listed manufacturing firms that registered on Indonesia Stock Exchange in the year of 2015 until 2019 consecutively with family ownership

4. Publicly listed manufacturing firms that use Indonesia currency on their financial statement

Analysis Method

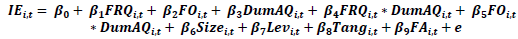

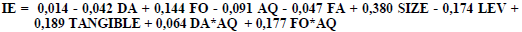

This study uses Ordinary Least Square regression model. The model used in this research is:

Description:

FRQ : financial reporting quality proxied with discretionary accrual which is measured by modified Jones Model and later modified by Dechow et al. (1995). Recently, this model is used by (Purwanti & Utama, 2018)

FO : family ownership measured by equation based on prior literature conducted by Rosharlianti (2018)

DumAQ : dummy variable of audit quality, it is coded “1” if audit is done by the big 4 audit firms, otherwise, it is coded “0”

Size : natural logarithm of total assets

Lev : ratio of total debt to total assets

Tang : the tangible fixed assets divided by the total assets

FA : the number of years when a firm started its business until presents

β0: constant

e : error

Results and Discussion

In this study, manufacture firms listed on Indonesia Stock Exchange (IDX) in the year of 2015 - 2019 are used for this research. Method used for sample selection is purposive sampling method, where the author determine sampling by setting specific criteria relating to the purpose of the study and it is expected to solve research problems. The criteria of sample for this study is manufacture firms listed in the Indonesia Stock Exchange in the year of 2015-2019 and have family ownership. The rest will be explained in Table 1 below.

| Table 1 Purposive Sampling |

||

| No | Description | Total |

|---|---|---|

| 1 | Manufacture firms listed on Indonesia Stock Exchange (IDX) in the year of 2015 - 2019 | 182 |

| 2 | Manufacture firms that aren’t listed on Indonesia Stock Exchange (IDX) in the year of 2015 – 2019 successively | (42) |

| 3 | Manufacture firms that don’t publish financial statement in the year of 2015 - 2019 | (11) |

| 4 | Non-family ownership | (67) |

| 5 | Manufacture firms that don’t use Indonesia currency on their financial statement | (9) |

| 6 | Manufacture firms that eligible as sample for this study | 53 |

| 7 | Number of firms observed = 53x5 | 265 |

| 8 | Outlier data | 48 |

| 9 | Number of firms observed after deducting outlier data | 217 |

Variable Description

Based on Table 2, it can be interpreted that this study uses 217 samples of family firms listed in Indonesia Stock Exchange (IDX) in the year of 2015-2019. In this study, financial reporting quality variable is proxied with Discretionary Accrual (DA). The minimum value of DA is -0,219 and the maximum value of DA is 0,210. Discretionary Accrual showing mean for -0,025 and standard deviation value of 0,080. Therefore, the data of DA have a lot of variance due to the standard deviation is higher than mean and distributed unevenly.

| Table 2 Descriptive Statistics |

|||||

| Variables | N | Minimum | Maximum | Mean | Standard Deviation |

|---|---|---|---|---|---|

| DA | 217 | -.219 | .210 | -.025 | .080 |

| FO | 217 | .107 | .980 | .648 | .185 |

| IE | 217 | -.145 | .113 | -.024 | .044 |

| FA | 217 | 16 | 61 | 38.714 | 9.156 |

| SIZE | 217 | 11.804 | 18.385 | 14.560 | 1.479 |

| LEV | 217 | .091 | .960 | .450 | .193 |

| TANGIBLE | 217 | .038 | .902 | .390 | .168 |

Source: processed data

For family ownership (FO) variable, the lowest value shown from Table 4.2 is 10,7% while the highest value is 98%. Family ownership has an average value of 64,8% and a standard deviation of 18,5%, which is lower from average value. This circumstance means that data distribution related to family ownership is evenly distributed and less to be variance due to the standard deviation is lower than mean.

In the case of investment efficiency (IE) variable, the minimum value shown from the Table 2 is -0,145, while the maximum value is 0,113. It is seen that investment efficiency variable showing the mean for -0,024 and standard deviation for 0,044. The standard deviation is higher than mean, indicating data distribution has not been distributed evenly.

| Table 3 Frequency Analysis Of Audit Quality |

||

| Firms Audited | % | |

|---|---|---|

| Big - 4 | 62 | 28.6 |

| Non-Big-4 | 155 | 71.4 |

| Total | 217 | 100.0 |

Source: processed data

In this study, the author uses moderate variable, namely audit quality to moderate the connection between financial report quality and family ownership on investment efficiency. Audit quality is a dummy variable in Table 3. If firms audited by Big-4 Audit Firms (E&Y, PwC, KPMG, and Deloitte), it is coded 1, otherwise, 0. Based on Table 4.3, the sample of firms used in this study is 217. It showing that the number of firms audited by Non-Big 4 Audit Firms is 155 and firms audited by Big-4 Audit Firms is 62. Therefore, the percentage of firms audited by Non-Big 4 is 71,4%, higher than firms audited by Big 4, which is 28,6%.

| Table 4 Hypothesis Test Result |

|||

| Variables | Coefficients | t | Sig. |

|---|---|---|---|

| (Constant) | .014 | .218 | .828 |

| DA | -.042 | -.661 | .509 |

| FO | .144 | 2.235 | .026* |

| AQ | -.091 | -1.096 | .274 |

| FA | -.047 | -.651 | .516 |

| SIZE | .380 | 4.646 | .000* |

| LEV | -.174 | -2.529 | .012 |

| TANGIBLE | .189 | 2.681 | .008* |

| DA*AQ | .064 | .954 | .341 |

| FO*AQ | .177 | 2.393 | .018* |

| Dependent Variable: IE | |||

| Note: * represent significance at 5% | |||

Source: processed data

Result & Discussion

Based on Table 4, the test result shows financial reporting quality proxied by discretionary accruals does not have significance effect on investment efficiency. Discretionary Accrual (DA) has coefficient for -0,042 and eligible significance value (Sig.) of 0,509, higher than 0,05. Therefore, H1 is rejected.

The result of this study is different from prior literatures as financial reporting could improve investment efficiency by reducing the informational gap between shareholders and management. This study result is in line with the prior research conducted by (Setyawati, 2015). Financial reporting quality is not the main indicators for decision-making by investors, as financial report drafted based on accounting standard, therefore any manipulations on financial report is inevitable for pursuing some goals for the firms. As for example, firms manipulate earning income to gain easy access on loan from bank by elevating earning income or lowering any expense as if the firms are profiting. Firms are also lowering earning income so they could pay taxes less than it should be.

Hypothesis 2 states that family ownership effects positively investment efficiency. Based on Table 4, the test result shows family ownership have positive significance effect on investment efficiency. Family ownership has coefficient for 0,144 and eligible significance value (Sig.) of 0,026, lower than 0,05. Therefore, H2 is accepted and proven.

This result study is in line with prior research conducted by Shahzad et al. (2018) as they found out that higher family ownership could reduce the informational asymmetry between shareholder and management, enabling the monitoring activity towards management actions and reduce the opportunity of expropriation of shareholder wealth for their personal interest. Having company owned by family members indicate the tendency to elect company’s management from family members, thus will reduce the agency conflict between stakeholder and management as is common to companies where there is a separation between owners and management. Therefore, it mitigates asymmetry information and market imperfections which is the reason for moral hazard and adverse selection.

This study result circumstance is in line with the SEW theory, which explains about non – economic goals that have to do with the family’s wishes to provide work for the family and establish a reputation in the community. Family firms use the preservation of SEW as a main reference while making strategic choices. As in SEW theory, FCs are more involved in accrual-based earnings management due to their agenda are establishing a successful and long-lasting company to be passed on to the future generation. Therefore, family ownership would act as a monitoring mechanism to ensure companies are not in the over- and-under investment conditions, by having the board of management investing more in NPV projects and avoiding in negative NPV projects.

Hypothesis 3 states that the effect of financial reporting quality on investment efficiency will be greater with higher audit quality. Based on Table 4, it can be concluded that the test result shows audit quality do not have significance effect on moderating financial reporting quality with investment efficiency. Financial reporting quality moderated by audit quality has coefficient for 0,064 and eligible significance value (Sig.) of 0,0341, higher than 0,05. Therefore, H3 is rejected.

Financial report audited by big-4 accounting firms does not give guarantee that it will increase the credibility and assurance of audited financial report, as there are many factors to consider. Financial reporting is drafted based on accounting standard, therefore any manipulations on financial report is inevitable with the purpose to reach goals for the firms. Hence, financial report is not the main indicators for decision-making by investors. Financial report audited by big-4 audit firms does not give guarantee that it will increase the credibility and assurance of audited financial report, as there are many audit factors to consider for stakeholder and investors (audit tenure, audit opinion, etc.). Audit only provide assurance and it depend on the quality of the financial report in the beginning. If the financial report already has lower quality, than audit assure that the information contained in the financial report is indeed low or vice versa. Due to there are many manipulations on financial report and its inevitable, management can conceal some specific information from auditors and this can be a risk in auditing for auditors as they can’t find the evidence. The circumstance explained in agency theory I as agent (management) are well known about firm specific information and can conceal it from principal (stockholders, investors, etc.) to pursue personal goals, thus enabling them to invest in under-and-over investment.

Hypothesis 4 states that the effect of family ownership on investment efficiency will be greater with higher audit quality. Based on Table 4, it can be concluded that the test result shows audit quality have positive significance effect on moderating family ownership with investment efficiency. Family ownership moderated by audit quality has coefficient for 0,177 and eligible significance value (Sig.) of 0,018, lower than 0,05. Therefore, H4 is accepted and proven.

The used of SEW model as decision making for family firms is in line with the goals to establish long-lasting reputational business and shifting the business to the future generation, thus making dynastic succession is one of the key dimensions of SEW that is taken into consideration by FCs in decision making (Berrone et al., 2012). Therefore, the appointment of higher quality auditors to provide firms with higher audit quality, as higher audit quality will strengthen the reputation of family firms in the eye of investors. Investors will receive appropriate accounting information, as the effect of higher audit quality is reducing the asymmetry information. Investors believe that increasing audit quality means all activities of the firms are monitored within firm, which reduce the opportunistic behavior of manager and increasing the firm performance, thus making it credible. The appointment of a high-profile auditor resulting in making the published accounts more credible, increasing the reliability of the firm’s operations and management, thus will reduce agency costs (Piot, 2005). Higher audit quality reducing the risk premium demanded by the investors and the firm is able to get extra money, which ultimately reduce the issues of underinvestment (Al-Thuneibat et al., 2011).

Conclusion

Based on the test results shown in the previous chapters, it can conclude that financial reporting quality proxied by discretionary accrual have negative and insignificant effect on investment efficiency. This circumstance is due to the financial reporting quality is not the main indicators for decision-making by investors, as financial report drafted based on accounting standard, therefore any manipulations on financial report is inevitable for pursuing some goals for the firms.

Family ownership have positive and significant effect on investment efficiency. It proves that if family ownership increase, then investment efficiency will also increase and vice versa. This circumstance is due to family ownership mitigate agency conflict as family firms tend to elect company’s management from family members, thus will reduce the asymmetry information between stakeholder and management as is common to companies where there is a separation between owners and management. The SEW theory is also a guide for family firms in decision making as its main goal is to establish a good reputation and successful firms to be passed on to the future generation. Therefore, family firms will monitor every activity and invest in more NPV positive projects to reduce over-and under investment problems.

Financial reporting quality moderated by higher audit quality have positive and insignificant effect on investment efficiency. This circumstance is due to the auditors from big-4 audit firms are not the main indicators for stakeholders and stockholders for decision making as they also consider other audit factors, like audit opinion, audit tenure, etc. Assurance given by audit quality is depended on the quality of financial report and financial report can be manipulated.

Family ownership moderated by higher audit quality have positive and significant effect on investment efficiency. It proves that if family ownership moderated by audit increase, then investment efficiency will also increase and vice versa. higher audit quality will strengthen the reputation of family firms in the eye of investors. Higher audit quality will produce positive outcomes and enhance the investment efficiency at the firm level, including FCs’ firms as the undiversified portfolio of private family firm owners implies a long-term view of the owners and greater reputation concerns.

This study has some limitations. The sample in this study, namely family ownership is obtained through analyzing the financial report published by firms in Indonesia Stock Exchange (IDX) website (www.idx.com). Family ownership firms are picked as sample for the study, while non-family ownership firms are eliminated. Not every firms are open to provide clear information about the ownership relationship, especially family ownership. Thus, there may be family ownership firm data missed due to the unclear and bias information about ownership. This study is also only focus on 53 manufacture firms listed in Indonesia Stock Exchange in the year of 2015-2019, therefore the result can’t be generalized for other industry sectors in Indonesia as it is only focus on manufacture firms.

Based on the limitations above, the author suggests that to look family ownership information, the author expected for future research to seek the information from a variety of sources like news, interview, etc. not just from a single source. The author hopes that future research could expand the sector of firms for research, not only focusing on manufacture firms as there are still many family firms in different industry sectors in Indonesia.

References

Biddle, G.C., Hilary, G., & Verdi, R.S. (2009, September 20). How Does Financial Reporting Quality Relate to Investment Efficiency? Journal of Accounting and Economics, 48, 112-131.

Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting Earnings Management. The Accounting Review, 70(2), 193-225.

Gomez-Mejia, L.R., Welbourne, T.M., & Wiseman, R.M. (2000). The Role Of Risk Sharing And Taking Under Gainsharing. The Academy of Management Review, 25(3), 492-507.

Liou, F.M., & Yang, C.H. (2008). Predicting business failure under the existence of fraudulent financial reporting. International Journal of Accounting & Information Management, 16(1), 74-86.

Myers, S.C., & Majluf, N.S. (1984). Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have. Journal of Financial Economics, 13(2), 187-221.

O'Keefe, T.B., & Westort, P.J. (1992). Conformance to GAAS Reporting Standards in Municipal Audits and the Economics of Auditing: The Effects of Audit Firm Size, CPA Examination Performance, and Competition. Research in Accounting Regulation, 6, 39-77.

Piot, C. (2005). Auditor Reputation and Model of Governance: A Comparison of France, Germany, and Canada. International Journal of Auditing, 9(1), 21-44.

Reza, M., & Ullah, S. (2019). Financial Reporting Quality of the Manufacturing Firms Listed in Indonesian Stock Exchange. Arthatama, 3(1), 37-54.

Setyawati, L.J. (2015). Kualitas Informasi Pelaporan Keuangan: Faktor-Faktor Penentu Dan Pengaruhnya Terhadap Efisiensi Investasi. Jurnal Ekonomi dan Bisnis, 186-196.

Shahzad, F., Rehman, I.U., Colombage, S., & Nawaz, F. (2018). Financial reporting quality, family ownership, and investment efficiency. Managerial Finance, 45(4), 513-535.

Soerjonodibroto, T. (2010). Practice of Directorship in Family Firms. Jakarta.

Wahedi, S., Tuhardjo, S.M., & Imam Mukhlis, S.M. (2019). Moderating Effect Of Accounting Firms On Relationship Good Corporate Governance, Government Ownership, And Firm Value. International Journal of Business, Economics, and Law, 18(5), 87.