Research Article: 2021 Vol: 20 Issue: 2

The Inclination of Corporate Voluntary Environmental Disclosure in Bangladesh: Effect of Size, Industry, and Operating Performance

Hasnan Ahmed, United International University

Hasnan Ahmed, United International University

Mofijul Hoq Masum, United International University

Abstract

Corporate environmental disclosure is highly scrutinized both by the stakeholders and the academia due to their greater impact within an economy. Interestingly, many corporations in the emerging countries go for voluntary environmental disclosure even without any mandatory requirement. Recognizing the scant literature explaining such inclination this paper attempts to uncover the underlying factors that may help for future enhancement of the culture of voluntary environmental disclosure. Studying a total of 284 firm-year observations of the years 2010 to 2014 of the publicly listed companies representing all industries of Bangladesh, a linear regression model is operationalized. This study finds that voluntary environmental disclosure varies over the years and across the industries. Moreover, voluntary environmental disclosure is affected by firm size and operating performance. Interestingly, the voluntary environmental disclosure also has a habitual influence since the firms having disclosure in one year tend to disclose more in the next year. This study provides support to the applicability of organizational legitimacy theory and the institutional theory in the context of a developing country with no strict environmental disclosure requirement.

Keywords

Environmental Reporting, Operating Performance, Voluntary Corporate Disclosure.

JEL Classifications

Q56, M14, M41

Introduction

Corporations' involvement with a greater proportion of production within an economy results high exposure to the environment. Consequently, corporate environmental disclosure becomes expected to be highly scrutinized by stakeholders of different role (Radu & Francoeur, 2017). Strong theoretical supports, for example, stakeholder theory (Freeman, 1983 & 2010) and legitimacy theory (Dowling & Pfeffer, 1975; Ashforth & Gibbs, 1990), validate the claim that environmental performance is affected by the degree of environmental disclosure. However, all kinds of environmental disclosures are not mandatory in all countries, particularly in many emerging countries. Interestingly yet, many corporations in the emerging countries without any mandatory environmental disclosure requirement have started to voluntarily disclose their environmental performance to the public (Masum et al., 2020). Studying their motivation can lead us to interesting findings that may help for future enhancement of the culture of voluntary environmental disclosure in the corporate world. Arguably, the impact of such culture on the environmental performance should be more intense than that of a mandatory disclosure requirement (Masum et al., 2021). The knowledge of the sources of motivation for corporate voluntary environmental disclosure in an emerging country context, thus, is essential. However, scholarly attempts are scant in such a context. Hence, this study focuses on the context of Bangladesh, which provides us an emerging economy setup with growing industrialization and resulting greater environmental exposure but without a significant implementation of environmental regulations. More specifically, this study intends to examine the influence of operating performance, overall profitability, and product market performance on the voluntary environmental disclosure among the corporations in Bangladesh. In addition, this study examines if past voluntary environmental disclosure contributes to that in future. The findings of this study should extend the theoretical boundaries explaining voluntary corporate environmental disclosure. From a practical perspective, the knowledge about the relationship between business performance and voluntary environmental disclosure revealed from this study would aid the policy makers to target the appropriate candidates for stimulating voluntary disclosure culture. Moreover, the knowledge about the impact of past voluntary environmental disclosure on the current one would confirm the possibility of a positive momentum of the good culture among the corporations.

Literature Review

The environmental disclosure practices have long been interpreted based on the legitimacy theory (Dowling & Pfeffer, 1975; Ashforth & Gibbs, 1990). Organizational legitimacy has become the dominant perspective in this field since many researchers apprehended corporate environmental disclosure as the attempt to create organizational legitimacy within the society (see Tregidga et al., 2007 for a detailed review). As argued by these researchers, the key interpretation of the legitimacy theory regarding corporate environmental reporting is, corporations tend either to attract public attention to their improved environmental performance or to distract their attention away from poor organizational performance of other aspects. Many investigations have been conducted in the developed countries, mostly in the European countries to explore the factors that affect environmental disclosure (along with social responsibility disclosure, in some instances) by the corporations. Among those, the highest number of evidences supports the positive effects of company size: Brammer & Pavelin (2008) in UK. The next highest level of evidences that environmental disclosure varies across industries include: Brammer & Pavelin (2008) in UK and Cormier et al. (2005) in Germany. These evidences indicate consensus about the relationship between company size and industry on the corporate environmental disclosure in the developed market.

The empirical study of corporate voluntary environmental disclosure is in a growth stage (Masum et al., 2019a & 2020a). Masum et al. (2019b) conducted a comprehensive study concerning the corporate climate change reporting and found that about 30 percent of the selected sample does not report any climate change issues in their corporate reporting. Whereas Masum et al. (2019a) conducted a comprehensive study to explore the association of five dimensions of CSR disclosure on corporate performance and concluded that the overall scenario concerning to the corporate environment related CSR is minimum and concludes that the Environment related disclosure of the business organization has a positive effect on corporate performance. The link between better firm performance and higher corporate reputation has been well-evidenced by several researchers (e.g., Brammer & Pavelin, 2006; Brown et al., 2010). More recently, based on the resource based view (Hart, 1995; Russo & Fouts, 1997) of the firm and the voluntary disclosure theory (Verrecchia, 1983 & 2001), researchers (e.g., Qiu et al., 2016) argue that firms with greater economic resources would go for more extensive voluntary disclosure. Since greater economic resources lead the voluntary disclosures, we may expect current voluntary disclosure to be affected by past firm performance. Consistent with that, Qiu et al. (2016) provide evidence that the UK firms with better past firm performance go for more voluntary social disclosures, though not more voluntary environmental disclosure.

A few other studies that investigate the relationship between financial performance and voluntary environmental disclosure include Al-Tuwaijri et al. (2004); Cormier et al. (2005), and Clarkson et al. (2011). However, these studies were conducted in different context and yielded insignificant and inconsistent results. The authors recognize the lack of focus on the link between operating performance and voluntary environmental disclosure though environmental performance is directly related to the production process and the output of the production process is directly reflected in the operating performance. In line with the institutional theory (Meyer & Rowan, 1977), Oliver (1991) presents the typology of strategic responses to institutional processes that claims habit as one of the tactics of the acquiescence strategy. Wangombe (2015) calls habit as passive adoption of corporate environmental reporting. However, there is a lack of adequate evidence about the habitual corporate environmental reporting. It is expected that the firms engaged in corporate environmental reporting continues to do that and those not engaged continues not to do that.

Research Methodology

The sample of the study consists of a total of 284 firm-year observations that include publicly listed companies representing all industries. The annual reports of the years 2010-2014 has been collected from the official repository of Dhaka Stock Exchange. The annual reports were then thoroughly examined to identify the environmental disclosure related words. The dependent variable, the environmental responsibility disclosure index (ERDI), values are the counts of the environmental disclosure related words or phrases found in the annual reports. In addition, the financial and other quantitative data are collected from the same annual reports. Based on the literature review, the ERDI is predicted to be influenced by the size, industry, present and past operating and financial performance, and past ERDI of a firm and the year of the disclosure (Masum et al., 2019a & 2020a). Size is measured by log of total assets. Operating performance is measured by both present and one-year lagged values of several proxies: log of sales, gross profit margin (GPM), and operating profit margin (OPM). Financial performance is measured by both present and one-year lagged values of net profit margin (NPM), earning per share (EPS), and financial leverage (Lev). In addition, the habitual element of voluntary environmental disclosure is measure by one-year lagged value of ERDI.

Results and Discussion

Descriptive Statistics

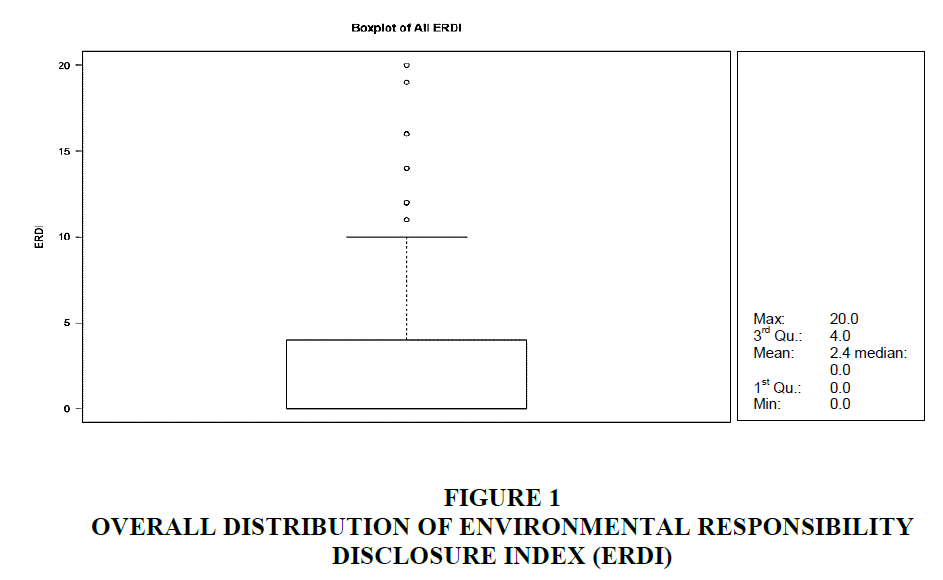

The descriptive statistics and the distribution of the environmental responsibility disclosure index of the whole sample have been portrayed in the in Figure 1. Overall, the distribution is far from a normal one. Consequently, for a robust conclusion the data analyses are conducted using both parametric and non-parametric statistical methods. The summary statistics and the box plot in Figure 1 of the ERDI of all of the industries indicate that 50% of the companies have not disclosed anything voluntarily on their environmental responsibility. However, among the remaining 50%, there are a number of outliers which disclosed exceptionally higher amount of their environmental disclosure. These findings are also consistent with the findings of Masum et al. (2019a).

Firm Performance and Environmental Disclosure

The correlation coefficients across the different variables have been plotted in Figure 1. Panel A shows the plots the correlation matrix of the variables of the same year whereas Panel B plots the one-year lagged variables and ERDI (termed as EnvRespDisc in the figure). Bigger and darker circles indicate higher correlation and smaller and lighter circles indicate lower correlation. From the matrices, it is indicative that both the lagged and same-year total assets (LTotAs and LLTotAs), total equity (LTotEq and LLTotEq), sales (LSales and LLSales), and operating profit margin (OPM and LOPM) are relatively highly correlated with ERDI (EnvRespDisc). To investigate the causal relationship, regression analysis is conducted for ERDI against lagged and same-year firm characteristics and profitability variables including the lagged ERDI. The results of the linear regression as well as its normality tests are shown in Table 1. Heteroskedasticity-robust standard errors have been used to address the heteroskedasticity issue. However, the normality test above implies that the residuals are not normally distributed. As a result, conclusive inference is not possible from the linear regression results though many factors are found to be significantly related to the environmental responsibility disclosure. In such cases, generalized linear regression model is suggested and testing the causal relationship is attempted using the variant Poisson Regression Model that allows too high number of lower values. Finally, based on the above regression results, we can conclusively infer that the voluntary environmental disclosure in the context of this study is positively influenced by sales and previous tendency of such environmental disclosure by the same firm at a statistically significance level. However, the voluntary environmental disclosure has a significantly negative impact of the total assets of the firm.

| Table 1 Results of the Linear Regression Model and Normality of Residuals | |||||

| Coefficient | Std. Error | t-ratio | p-value | ||

| const | −5.86181 | 2.28771 | −2.562 | 0.0109 | ** |

| LTotAs | −0.881760 | 0.498806 | −1.768 | 0.0782 | * |

| LSales | 0.290985 | 0.388455 | 0.7491 | 0.4545 | |

| LLSales | 1.44277 | 0.539377 | 2.675 | 0.0079 | *** |

| GPM | 1.45438 | 1.62281 | 0.8962 | 0.3709 | |

| LGPM | −0.560496 | 0.607512 | −0.9226 | 0.357 | |

| OPM | 2.71231 | 0.214379 | 12.65 | <0.0001 | *** |

| LOPM | 1.94572 | 0.1398 | 13.92 | <0.0001 | *** |

| NPM | −3.00691 | 2.78341 | −1.080 | 0.281 | |

| LNPM | 0.80256 | 0.744642 | 1.078 | 0.2821 | |

| EPS | 0.00301 | 0.005133 | 0.5863 | 0.5581 | |

| LEPS | −0.000572105 | 0.003811 | −0.1501 | 0.8808 | |

| Lev | −1.62587 | 2.42679 | −0.6700 | 0.5035 | |

| LLev | 0.073725 | 2.13897 | 0.03447 | 0.9725 | |

| Mean dependent var | 2.359155 | S.D. dependent var | 3.793879 | ||

| Sum squared resid | 3295.722 | S.E. of regression | 3.493762 | ||

| R-squared | 0.19091 | Adjusted R-squared | 0.151953 | ||

| F(13, 270) | 67.33733 | P-value(F) | 8.98E-77 | ||

| Log-likelihood | −751.0782 | Akaike criterion | 1530.156 | ||

| Schwarz criterion | 1581.242 | Hannan-Quinn | 1550.638 | ||

| Test for normality of residual - Null hypothesis: error is normally distributed Test statistic: Chi-square(2) = 217.105 with p-value = 7.18118e-048 |

|||||

Conclusion

The economic significance of the publicly listed firms combines with their environmental role. Sound practices of environmental responsibility can be fostered by more voluntary environmental responsibility disclosure. The factors leading to voluntary disclosure are crucial to be revealed as those may be the important elements in formulating policies for encouraging such disclosure among the non-disclosing firms. The results of this study indicate that voluntary environmental disclosure varies over the years and across the industries. Hence, environmental disclosure policy should not be stationary over time and should be formulated separately for different industries. Moreover, voluntary environmental disclosure is affected by firm size and operating performance. The negative relationship with the size and positive relationship with operating performance imply that more encouragement efforts are needed for the bigger firms and for the firms with poorer operating performance until a strict regulatory requirement is set for environmental disclosure. Interestingly, the voluntary environmental disclosure also has a habitual influence since the firms having disclosure in one year tend to disclose more in the next year. This finding is indeed encouraging since a sound policy action seems to last longer due to such tendency. This study provides support for the applicability of organizational legitimacy theory and the institutional theory in the context of a developing country with no strict environmental disclosure restriction. Further investigation is recommended to uncover the external influences on the voluntary environmental disclosure of the firms in the similar context.

Acknowledgement

This manuscript is prepared based on the research project partially sponsored by United International University with grant number 161001.

References

- Al-Tuwaijri, S.A., Christensen, T.E., & Hughes Ii, K.E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, Organizations and Society, 29(5-6), 447-471.

- Ashforth, B.E., & Gibbs, B.W. (1990). The double-edge of organizational legitimation. Organization Science, 1(2), 177-194.

- Brammer, S., & Pavelin, S. (2006). Voluntary environmental disclosures by large UK companies. Journal of Business Finance & Accounting, 33(7?8), 1168-1188.

- Brown, D.L., Guidry, R.P., & Patten, D.M. (2009). Sustainability reporting and perceptions of corporate reputation: An analysis using fortune. In Sustainability, environmental performance and disclosures. Emerald Group Publishing Limited.

- Clarkson, P.M., Li, Y., Richardson, G.D., & Vasvari, F.P. (2011). Does it really pay to be green? Determinants and consequences of proactive environmental strategies. Journal of Accounting and Public Policy, 30(2), 122- 144.

- Cormier, D., & Magnan, M. (1999). Corporate environmental disclosure strategies: determinants, costs and benefits. Journal of Accounting, Auditing & Finance, 14(4), 429-451.

- Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. Pacific sociological review, 18(1), 122-136.

- Freeman, R.E. (2010). Strategic management: A stakeholder approach. Cambridge university press.

- Freeman, R.E., & Reed, D.L. (1983). Stockholders and stakeholders: A new perspective on corporate governance. California Management Review, 25(3), 88-106.

- Hart, S.L. (1995). A natural-resource-based view of the firm. Academy of Management Review, 20(4), 986-1014. Masum, M.H., Hassan, N., & Jahan, T. (2019a). Corporate climate change reporting: Evidence from Bangladesh. Accounting & Management Information Systems, 18(3).

- Masum, M.H., Latiff, A.R.A., & Osman, M.N.H. (2020). Ownership structure and corporate voluntary disclosures in transition economy. The Journal of Asian Finance, Economics and Business, 7(10), 601-611.

- Masum, M.H., Latiff, A.R.A., & Osman, M.N.H. (2021). Determinants of corporate voluntary disclosure in a transition economy. Problems and Perspectives in Management, 18(4), 130.

- Masum, M.H., Uddin, M.M., Ahmed, H., & Uddin, M.H. (2019b). Corporate social responsibility disclosures and corporate performence: evidence from the listed companies in Bangladesh. Academy of Strategic Management Journal, 18(2), 1-16.

- Meyer, J.W., & Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340-363.

- Oliver, C. (1991). Strategic responses to institutional processes. Academy of Management Review, 16(1), 145-179.

- Qiu, Y., Shaukat, A., & Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1), 102-116.

- Radu, C., & Francoeur, C. (2017). Does innovation drive environmental disclosure? A new insight into sustainable development. Business Strategy and the Environment, 26(7), 893-911.

- Russo, M.V., & Fouts, P.A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40(3), 534-559.

- Tregidga, H., Milne, M., & Kearins, K. (2007). Organisational legitimacy and social and environmental reporting research: The potential of discourse analysis. In Asia Interdisciplinary Research in Accounting Conference.

- Verrecchia, R.E. (1983). Discretionary disclosure. Journal of Accounting and Economics, 5, 179-194. Verrecchia, R.E. (2001). Essays on disclosure. Journal of Accounting and Economics, 32(1-3), 97-180.

- Wangombe, D. (2015). Multi-theoretical perspective of corporate environmental reporting: A literature review. Review of Integrative Business and Economics Research, 2(2), 655.