Research Article: 2018 Vol: 17 Issue: 5

The Improvement of Bachelors Training in the Field of Anti-Crisis Management of Enterprises

Olga Tamer, Tyumen Industrial University

Svetlana Lapteva, Tyumen Industrial University

Svetlana Zaitseva, Tyumen Industrial University

Anatoly Kozlov, Tyumen Industrial University

Abstract

The problem of business failure risk prediction is still relevant on the modern stage of industry and production development in market economy. In modern times, many commercial enterprises (organizations) of various forms of ownership found themselves on the verge of failure, because an enterprise became unable to fully meet the creditors’ requirements within three months. The conditions of uncertainty under which the enterprises’ business activity is carried increase the risks of business failures. In our research we view the bachelors advanced professional training in the field of production management as an integral formation process of competent, prognostic specialists with orientation towards innovations, with the ability to ensure safe and effective functioning of the exciting and new economic processes, to apply new scientific methods and technologies during their research and implementation, with the ability to develop, evaluate and realize innovative propositions, to economically wisely organize and manage the production process. In their turn, all these factors determine the financial stability of enterprises. The innovative didactic system of the bachelors professional economic training improvement that is elaborated in target- and content-related, procedural and organizational aspects, allows to transform the scientific knowledge into educational and to adapt the bachelors professional training to the modern requirements in the field of anti-crisis management of enterprises under uncertain and risk conditions.

Keywords

Educational Program, Production Management, Anti-Crisis Program, Professional Training, Economic Profile.

JEL Classification: M11, M12, M19.

Introduction

The financial stability of enterprises directly influences the economic and social stability of the society. Due to this fact, various theories of evaluation of business efficiency and financial stability of enterprise are widely applied in the economic analysis of enterprises’ business activity. The basis of these theories is represented by foreign and domestic evaluation methods of business failure probability (Dolganov et al., 2015; Kondratieva, 2016; Lagkueva & Gurieva, 2015). Business failure associated with the enterprise’s crisis condition is a complex process that is characterized in legal, managerial, organizational, financial and accounting-analytical terms. The occurrence of business failure is viewed as occurrence of an enterprise’s crisis condition when it is unable to fully ensure the financial security in its production activities. On the initial stage, the diagnostics of business failure probability is aimed at exploring the causes of bankruptcy indicators occurrence (Mitrofanova & Esaulova, 2017; Rudakova, 2015; Sinichenko, 2013). Early diagnostics allows to timely detecting the problem, to immediately engage in its resolution, to apply the defense mechanism and to choose the sequence of procedures that are aimed at decreasing of the business failure risk. There are various techniques and methods that serve as a basis for the prediction of financial indicators of the enterprise’s performance. The majority of the methods allow evaluating the failure risks under the conditions of uncertainty (Frost et al., 2016; Jackson, 2015; Jarnyh, 2017).

The preliminary analysis of the situation with regard to the improvement of the educational activity of bachelors in “Economics” (“Economics and production management” profile) allowed to detect the following deficiencies: the students demonstrate an inadequate formation level of competencies in anti-crisis management field that represent a system of diagnostic methods of business failure and its prevention; they do not fully apply various techniques and methods in innovative and predictive mode that serve as a basis for prediction of the financial indicators of the enterprise’s business activity, for the evaluation of business failure risk under the conditions of uncertainty.

The relevance of our research topic is determined by the problems that are associated both with theoretical nature of the failure indicators identification and with practical nature that depends on a constantly changing legislation. It is also determined by the absence of statistical data on the failure and risk levels; by the gaps in the knowledge in the issue that is associated with the probability of fraudulent failure. The identification of the business failure probability under the risk conditions is necessary for the evaluation of the enterprise’s state in modern market conditions. This will allow to timely fix economic situation, to immediately apply a set of measures that are aimed at the recovery of the enterprise’s solvency. When choosing among different contractors, the identification of the business failure probability under the risk condition will allow estimating the contractor’s solvency and reliability.

The choice and relevance of our research topic “The improvement of bachelors training in the field of anti-crisis management of enterprises” was determined by the objective requirements to the improvement of the students’ educational activity on the one hand, and, on the other hand, by the lack of sophistication in the theoretical-methodological, organizationalmethodical bases of its development. The main contribution of our research into the world pedagogical scientific field “Theory and methods of professional education” is represented by the innovative didactic system of the improvement of bachelors professional economic training. Elaborated in target and content-related, procedural and organizational aspects, it allows to transform the scientific knowledge into educational and to adapt the bachelors professional training to the modern requirements in the field of anti-crisis management of enterprises under uncertain and risk conditions.

Literature Review

Various evaluation theories of business efficiency and financial stability of enterprise are widely applied in the economic analysis of the enterprises’ business activity (Wang et al., 2009; Weedon & Riddell, 2015). The basis of these theories is represented by foreign and domestic evaluation methods of business failure probability.

We should note the value of the following researches that were conducted in the field of anti-crisis management: the diagnostics of business failure risk on the basis of multivariate analysis with the use of multi-factor model (Kozlov et al., 2016); the research of the specificity of managerial crises that accounts for economic and social causes of business failure (Argenti); the research of domestic enterprises on the basis of discriminant multivariate diagnostic models of industrial enterprises failure risk (Savitskaya; Davydov, Belikov; Saifullin, Kadykov; Zaitseva; Fedotova). Nevertheless, we should acknowledge that modern stage of the professional education development requires a deep analysis of the existing experience and theoretical approaches in order to find the ways of improvement of the bachelor’s professional training in the field of anti-crisis management (Lapteva & Vorobyova, 2018).

It is important to note that the diagnostics of business failure risk level under uncertain conditions is widely used in economic analysis. The method of multivariate analysis is widely used for this purpose. In his works, Beaver made the first attempt to apply analytical coefficients to predict business failures. In his analysis, the greatest weight was attributed to the indicator that represented the ratio between the cash flow and borrowed capital. The economic analysis of the business failure level under uncertain conditions often draws upon multivariate models that were developed by Altman, Lecce, Toffler, and Tishaw. They form the basis of the multivariate discriminant analysis method (Kozlov et al., 2016). E. Altman’s researches provide the instruments of multivariate multiplicative discriminant analysis and the method that allows calculating Altman Z-score. Altman distinguished five indicators that are the most significant for the predictive model of evaluation of the business failure risk. He composed a multi-factor regression equation. It is the function of the indicators that characterize the enterprise’s economic potential, the results of its productive-economic activity during the past period. We should acknowledge the degree of elaboration of the issue of modelling in the research of business failure risk probability and special contribution made by the British researchers Toffler and Teashow (1977). In their work, they tested Altman’s approach on the basis of the statistical information of the commercial activity of eighty British companies and built four-factor predictive model (Raei et al., 2016).

Taking into account the inflationary factors and differences in the legislative framework, the use of this four-factor predictive model does not fully fit for diagnosing of the Russian enterprises’ failures. One of the reasons is overestimated capital assets, because the significance of the outmoded assets is exaggerated and almost equates the significance of the capital assets. All these factors unreasonably lead to the growth in the proportion of the own capital due to the overestimation of assets.

One of the most qualitative methods that are used in the diagnostics of the enterprise’s solvency is Argenti method. It is also called A-score and is associated with managerial crisis. The basis of the A-score method research is the following hypothesis: managerial deficiencies lead to the business failure and to the development of managerial crisis. The research of managerial crisis is a multi-year process that leads the enterprise to the failure. The process of the failure occurrence can be divided into three stages:

1. The company demonstrates a range of deficiencies that “lead” to the failure, that is a range of deficiencies becomes evident even several years before the factual failure takes place.

2. Constant manifestation of the company’s deficiencies and, as a result of the accumulation of these deficiencies, there is a high probability of mistakes on that part of the company that can lead to the failure.

3. All the signs of the approaching insolvency manifest themselves in the company’s production-economic activity, the probability of the business failure risks increases.

The Argenti model takes into account both economic and social causes of business failure. This is the main advantage of the model (Lapteva & Vorobyova, 2018; Lockwood, 2005). We should note that in complex economic analysis of the failure risks evaluation the enterprises focus on a single criterion. Despite of certain advantages, in empirical researches it does not always reflect the reliable result.

That is why big audit firms that specialize in consulting and in the prediction of business failure probability under the risk conditions use the systems of criteria to solve multi-criteria tasks in their researches (Meyer et al., 2011; Moss & Pini, 2016; Naeve-Stoß, 2013). As we have already mentioned, the prediction of the failure risk probability is a multi-criteria task. Such kind of a predictive decision is subjective one, and the calculated values of parameters are predictive in their nature under uncertain and risk conditions. Multi-criteria analysis is necessary for making the decisions that associated with anti-crisis management. It allows to prevent the growth of the business failure probability and to take the measures that are aimed at decreasing of the failure risk levels under the market conditions of the enterprise’s production-economic activity.

Multivariate models of the failure risks diagnostics appeared in Russian economy in 1990s, but they were not widely used due to the absence of private ownership in Russia at that period. Under the conditions of market economy, the development of the domestic discriminant functions in relation to each branch of industry became necessary. They were to account for the main directions of the enterprises’ production-economic activity and for the specificities of our reality.

During the development of the discriminant evaluation model of the business failure probability, Savitskaya (2012) analyzed statistical information on 200 Russian manufacturing enterprises during three years. She used the results of this analysis to ground the main indicators of the business failure risk. On the basis of statistical data, twenty-six financial coefficients were calculated for each enterprise during each year.

Correlation and multivariate analysis pointed to the following indicators that possessed the greatest significance in the change of enterprises’ financial conditions. These indicators determined:

1. The proportion of the own working capital in the process of current assets formation.

2. The volume of the working capital per ruble of the fixed capital.

3. The turnover of aggregate capital.

4. The return on assets, financial independence, solvency ratio.

All these indicators served as a basis of the discriminant multivariate diagnostic model of the business failure risk of manufacturing enterprises. The testing results of the discriminant multivariate model and the sample size allows to suppose the possibility of using this multivariate model for the express-analysis of the financial condition of manufacturing enterprises and, at the same time, of evaluating their business failure risk level with a sufficiently high degree of probability.

Thus, on the modern stage of industry and production development in market economy, the problem of prediction of the business failure risk is still relevant. Nowadays, many commercial enterprises (organizations) of various forms of ownership found themselves on the verge of failure, because an enterprise became unable to fully meet the creditors’ requirements within three months.

The uncertain conditions under which the enterprise’s activity is carried within economic relations increase the failure risks. All the systems of the business failure risks prediction are developed on the basis of multivariate analyses that characterize an enterprise’s financial state under the market conditions and include the indicators in the amount that ranges between 2 and 7. This serves as a basis for using of various diagnostic methods of the business failure and for calculating of the composite index of the business failure risk probability with indicators that have different weight values. This allows predicting the probability of the crisis situation risk in advance, before the actual failure takes place. In so doing, it is supposed that the life cycles of the commercial organizations in market economy ranges between 4 and 5 years.

The purpose of the research is the improvement of the professional training of bachelors of economic profile in the field of anti-crisis management of enterprise. The tasks of the research:

1. To reveal the features of the students professional training content and to identify the pedagogical conditions that are able to ensure the realization of the professional tasks in the field of anti-crisis management. The latter is viewed as a system of methods for diagnosing of the business failure risk probability and its prevention.

2. To carry out the analysis of economic methods that exists in domestic and foreign practice in the field of diagnosing of the business failure probability in enterprises under the risk conditions.

3. To reveal the features of multivariate analysis that is necessary for making the decisions in anti-crisis management and for evaluating of the risk level of the failure probability through diagnosing of the business failure probability, through the use of the defense mechanisms, through the choice of the sequence of procedures that are aimed at decreasing of the failure risk level.

4. To develop the technological provision of the conditions for the realization: of the techniques and methods that serve as a basis for the prediction of the financial indicators of the enterprise’s activity; of the set of measures that are aimed at decreasing of the business failure risk level under the market conditions of the enterprise’s production-economic activity.

Research Methodology

To achieve the purpose of the research and to solve its tasks, we used a complex of research methods: the analysis of philosophical, psychological-pedagogical, sociological, educational and instructional literature; modelling and designing of didactic theories, synthesis, comparison, systematization, abstraction, analysis, generalization of theoretical and research data; the research and generalization of the Russian universities experience in the formation of the students’ professional competencies; observation, questioning, conversation, peer review, studying of documentation, testing; pedagogical experiment that allowed to obtain the data on the level of the students’ professional readiness; mathematical-statistical methods and application software for processing of the pedagogical experiment results. Noyabrsk Oil and Gas Institute served as experimental facility.

The reliability and scientific validity of the results are conditioned by the methodological validity of theoretical positions; by the development of diagnostic methods that are adequate in relation to the research tasks, subject and object; by the representativeness of the sample; by quantitative and qualitative analysis of experimental data; by the application of the research results in pedagogical practice. During the elaboration of the empirical-experimental approbation methods of the pedagogical experiment results, the students’ readiness for the use of the system of diagnostic methods of business failure risk probability and its prevention was chosen as in integrative indicator of the effectiveness of the technological approaches that were developed in the research.

When defining the differentials of the formation level of experimental group students’ readiness for the use of the system of prediction and prevention methods of the business failure risk probability, we focused on the dynamics indicators of the students’ skills and abilities in the field of anti-crisis management. During the research, we drew upon the following scientific methods: horizontal and vertical balance analysis; method of coefficients; the methods that allow predicting the business failure probability; comparative analysis; methods of complex analysis of the enterprises’ financial condition.

The Results Of The Research

The scientific novelty of the research is based on the following achievements:

1. It is for the first time that the content of the bachelor’s professional economic training in the field of anticrisis management is made the subject of the special pedagogical research.

2. The complex of interdisciplinary tasks in the field of anti-crisis management that was developed in the research brings the students to the level of obtaining of the research knowledge, abilities in the field of the enterprise’s financial condition analysis and optimization of its financial-economic activity. This becomes possible through the use of the prediction results of the business failure probability under the risk and uncertain conditions.

The theoretical significance of the research is conditioned by the fact that the systems of the business failure risk prediction is made the basis for designing of the bachelors professional economic training content in the field of anti-crisis management. These systems are developed on the basis of multivariate analyses that include the indicators of the enterprise’s financial state under the market conditions. The content of the professional economic training is also designed on the basis of the methods of the business failure prediction that are used to calculate the complex indicator of the failure risk probability with due regard to the indicators that have different weight values. This allows predicting the occurrence of the enterprises’ crisis situation in advance.

According to the research hypothesis, the effectiveness of the bachelor’s professional economic training depends on the following conditions:

1. The students educational activity will be designed with due regard to the system approach to the prediction of the business failure risk under uncertain conditions and on the basis of multivariate analysis.

2. The system of interscientific knowledge, abilities and skills is formed on the level of content-related and controlling components. This system will allow ensuring a high level of the bachelors’ readiness for professional activity in the field of anti-crisis management.

In our research, the improvement of the bachelors professional training in the field of antcrisis management was carried out on the basis of the selection principles and criteria that were developed in pedagogical science, with due regard to the methodological foundations for meeting of the requirements of federal state educational standards of higher education in relation to the bachelors training in the field of production management. Within the process of the bachelor’s professional training modernization to ensure their successful professional activity under the conditions of innovative transformations in the economy, the content of their professional training is characterized by the prevailing role of the subject from the elective part. Their content represents a complex of the elements of sciences about the enterprises’ financial stability under the risk and uncertain conditions (Rider et al., 2012). The essence of the subjects from the elective part is conditioned by the genetic structure of the production process; by the logical structure of professional knowledge, skills and abilities that reflect the functional relations and genesis of the work flow and production processes. The main criteria of the material selection on the subjects help to ensure the logical structure of the elective part subject organization and their relationships with other disciplines. The preliminary analysis of the problem condition associated with improvement of the educational activity of bachelors of “Economics” (“Economics and production management” profile) allowed detecting the indirectapplied interdisciplinary relations that define the field of common interscientific problems in anti-crisis management. Besides, through the use of comparative analysis, it allowed to synthesize a multidimensional vision of the problem and a complex approach to its solution on the basis of the system of diagnostic methods of the business failure risk probability prediction and its prevention.

The initial stage of the business failure probability diagnostics that was considered in our research is focused on the analysis of the causes of business failure indicators. Early diagnostics allows to timely detecting a problem, to immediately engage in its resolution, to apply the defense mechanism, to choose the sequence of the procedures that are aimed at decreasing of the business failure risk level. The modern economic theory distinguishes two groups of business failure: objective and subjective causes (Table 1).

| Table 1 Types Of Business Failure Causes |

||

| Name | Type of causes | Significance for the business failure risk level |

| Objective causes |

|

Depend on the general economic situation in Russia. It is impossible to eliminate them on the level of enterprise, but they must be taken into account in planning and predicting of the financial result of the enterprise’s activity. |

| Subjective causes |

|

Associated with the enterprise’s poor economic performance. |

Since the business failure is preceded by the enterprise’s financial problems and further worsening of its financial state, the first failure signs can be diagnosed and the complex of measures that are aimed at its prevention can be immediately applied. There are various techniques and methods that serve as a basis for predicting of the financial indicators of the enterprise’s performance. The majority of the methods allow estimating the business failure risks under uncertain conditions. The methods of diagnosing of the enterprise’s financial condition allow predicting and preventing the failure.

Thus, the basis for designing of the bachelor’s professional economic training content in the field of anti-crisis management is formed by the systems of the business failure risks prediction. These systems are developed on the basis of multivariate analyses that include the indicators of the enterprise’s financial state under the market conditions. The content of professional economic training is also designed on the basis of the methods of the business failure prediction that are used to calculate the complex indicator of the business failure risk probability with due regard to the indicators that have different weight values (Table 2).

| Table 2 Methods And Models That Allow Predicting The Enterprise’s Financial State Under The Business Failure Risk Conditions |

|

| The name of the method, prediction model | The basis of multivariate analysis |

| The evaluation of possible business failure through the financial analysis of the enterprise’s performance parameters. | The comparison of actual indicators with planned ones, the comparison with standards, calculation of possible deviations in the dynamics. |

| The analysis of financial flows. | If the indicator (the availability of funds on the account within a certain period) is negative, it is viewed as a first sign of the business failure. The second sign of the business failure is irrational application of the borrowed funds. |

| Formalized and non-formalized criteria of the business failure prediction. | The indicators that point to the real financial problems (the growth of negative incomes and losses in the enterprise’s production-economic performance; the growth of excess and unnecessary inventory and production supplies; significant proportion of outmoded equipment; the growth of overdue accounts payable and receivable, etc.) The indicators that have unsatisfactory values (inefficient investments; insufficient diversification of the enterprise’s performance; disruptions in the rhythm of the production process, etc.) |

| Altman’s multivariate models. | Altman’s two-factor model. Z-quantitative indicator: Z= -0.3877-1.0736 x K2+0.0579 x K2 Where, ?1 is a ?urrent liquidity ratio (or funded ratio); ?2 is a ratio of the borrowed funds concentration (the proportion of the borrowed capital in the total amount of sources). Altman’s multivariate model. Altman Z-score Z=0.717 X1+0.847 X2+3.107 X3+0.42 X4+0.995 X5, where, X1 is own working capital/ total assets; X2 is undistributed profits/total assets; X3 is profit before interest payments/total assets; X4 is book values of the own capital/borrowed capital; X5 is sales volume (earnings)/total assets. |

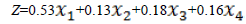

| Toffler’s multivariate model. | Discriminant four-factor predictive model developed by Toffler is represented in the following form: where, x1 is the profit on sales/short-term liabilities; x2 is current assets/value of liabilities; x3 is short-term liabilities/total assets; x4 is earnings/total assets. |

| Argenti method. | A-score method study is based on the following hypothesis: managerial shortcomings lead to the business failure and to the development of managerial crisis. Argenti model accounts for both economic and social causes of the business failure. This is its main advantage. |

| R-model developed by Irkutsk State Economic Academy (prof. Davydova) | Four-factor R-model R=8.38 x ?1+1.00 x ?2+0.054 x ?3 +0.63 x ?4 where, R is business failure risk indicator; ?1 is ratio of the working capital to assets; ?2 is ratio of net profits to net worth; ?3 is the ratio of sales to assets; ?4 is the ratio of net profits to expenses. |

| G.V. Savitskaya’s multivariate model. | Discriminant multivariate model for diagnosing of manufacturing enterprises’ business failure risk: Z=0.111 X1+13.239 X2+1.676 X3+0.515 X4+3.80 X5 indicators: the share of the own working capital in the process of working assets formation; the share of working capital per ruble of the stock capital; total capital turnover; return on assets, the enterprise’s financial independence; solvency ratio. |

| O. P. Zaitseva’s multivariate model. | Complex bankruptcy coefficient is calculated according to the formula with the following weight values: ?=0.25 ?1+0.1 ?2+0.2 ?3+0.25 ?4+0.1 ?5+0.1 ?6 The enterprise’s loss ratio that is characterized by the ratio of the net loss to the own capital; the ratio of the accounts payable to the accounts receivable: the indicator of the relation between the short-term liabilities and the most liquid assets; this ratio is the reciprocal value of the absolute liquidity indicator; unprofitable sales of the products; the coefficient is characterized by the ratio of the net loss to the sales volume of this product; the leverage ratio (financial risk), the ratio of the borrowed capital (long- and short-term liabilities) to the own sources of funding; asset utilization ratio as a reciprocal value of the assets turnover ratio – the ratio of the whole amount of assets (total balance) to the earnings. |

The analysis of the enterprise’s financial condition and optimization of its financialeconomic activity, with due regard to the diagnostic results of the business failure probability prediction under the risk and uncertain conditions consisted of several stages (Table 3).

| Table 3 Designing Of The Bachelors Professional Economic Training Content In The Field Of Anti-Crisis Management |

||

| No.of the stage | The name of the stage | The content of the bachelors professional economic training in the field of anti-crisis management |

| 1st stage | Theoretical bases of the evaluation of the enterprise’s financial condition and identification of its business failure probability. | The review of the methods for diagnosing of the enterprise’s financial condition. |

| The notion, causes and methods for diagnosing of the business failure. | ||

| 2nd stage | The analysis of the enterprise’s financial condition. | The characteristics of the enterprise’s production-financial activity. |

| The analysis of the enterprise’s assets and capital structure. | ||

| The evaluation of the enterprise’s solvency and liquidity. | ||

| 3rd stage | The diagnostics of the prediction results of the business failure probability under the risk and uncertain conditions. | The realization of the system of methods and multivariate models for diagnosing of the enterprise’s failure risk probability. |

| Multi-criteria analysis of the enterprise’s financial stability and its business failure probability. | ||

| 4th stage | The development of measures that are aimed at the optimization of the enterprise’s financial-economic activity under the conditions of business failure risk. | The development of possible directions of the enterprise’s financial recovery. |

| The predictive appraisal of the effectiveness of measures that are aimed at the enterprise’s financial recovery. | ||

Discussion

The original innovative learning system designed for bachelors in economics allows transforming scientific knowledge into educational one, as well as adapting the process of teaching and learning to modern requirements for enterprise crisis management performed in the climate of uncertainty and risk. The reliability and scientific validity of the theses are conditioned by the methodological validity of the theoretical positions; by the development of diagnostic methods (Nizamidou & Fotios, 2015; Ronez, 2017; Smyth et al., 2017), that are adequate in relation to the research tasks, subject and object; by the representativeness of the sample; by quantitative and qualitative analysis of experimental data. Comparative analysis enabled the synthesis of a multidimensional view of the problem with an integrated approach to its solution. This was performed using the diagnostic methods for forecasting failure probability and ways around the probable triggers. Outlined stages for diagnosing and forecasting the probability of failure in the climate of risk (Table 3) allow students to apply their knowledge in future business with greater benefits. The entrepreneurial intent of students is typically linked to their attitude towards an entrepreneurial career, to how they view the problems associated with entrepreneurship and to the extent of how the whole thing works out as they run their business (subjective standard) ( Olokundun, 2018).

Original methods proved to be handy in the learning process. The educational content and quality must be in tune with the requirements imposed by the government, and this implies the development of forecasting mechanisms intended for predicting future economic and social needs, and identifying trends in the appearance of new profession titles (Markova & Minin, 2017). When starting a business, a young specialist has to assess its financial potential and determine the probability of failure (Curry et al., 2018), which can be done by using our methods from Table 2.

Future Research And Practical Implementations

As a result of our research, an innovative didactic system was developed that allowed to adapt the bachelor’s professional economic training to the modern requirements in the field of anti-crisis management by the application of the research results in pedagogical practice.

Our researches cannot claim to have been able to provide a comprehensive scientific description of all the aspects of such complex process as the improvement of the bachelor’s professional economic training in the field of anti-crisis management.

The following problems need further elaboration:

1. The development of methodical approaches to the studying of the complex of measures that are aimed at decreasing of the business failure risk levels under the market conditions of the enterprise’s productiveeconomic activity.

2. The improvement of the modern methods of information support that favors the possibility of multivariate analysis. This kind of analysis is necessary for making the decisions in the field of anti-crisis management in order to prevent the growth of the enterprise’s business failure probability.

Conclusions

The empirical-experimental approbation of the research results that are associated with the improvement of the bachelor’s professional economic training in the field of anti-crisis management confirms the correctness of the research hypothesis, the validity of its conceptual provisions and allows coming to the following conclusions:

1. The innovative didactic system of the bachelors professional economic training that is elaborated in targetand content-related, procedural and organizational aspects, allows to transform scientific knowledge into educational and to adapt the bachelors professional training to the modern requirements in the field of anticrisis management of enterprises under uncertain and risk conditions.

2. The complex of interdisciplinary tasks in the field of anti-crisis management that was developed in the research brings to student to the level of obtaining of the research knowledge, abilities in the field of the enterprise’s financial condition and optimization of its financial-economic activity. This becomes possible through the use of the prediction results of the business failure probability under the risk and uncertain conditions.

3. The basis for designing of the bachelor’s professional economic training content in the field of anti-crisis management is formed by the systems of the business failure risks prediction. These systems are developed on the basis of multivariate analyses that include the indicators of the enterprise’s financial state under the market conditions. The content of professional economic training is also designed on the basis of the methods of the business failure prediction that are used to calculate the complex indicator of the failure risk probability with due regard to the indicators that have different weight values. This allows predicting the occurrence of the enterprises’ crisis situation in advance.

References

- Curry J., Xia H., & Chen K.C. (2018). Teaching note: To sell or not to sell? A case on business valuation. Journal of the International Academy for Case Studies, 24(2), 1-8.

- Dolganov, D. N., Zakonnova, L. N., & Sedovskih, M. E. (2015). The motivational readiness and attitudes of the technical university students towards carrying out of the research activity. Vestnik of Kuzbass State Technical University, 3(109), 172-180.

- Frost, J., Hattke, F., & Reihlen, M. (2016). Multi-level governance in universities: Strategy, structure, control. Multi-Level Governance in Universities, 1-15.

- Jackson, D. (2015). Employability skill development in work-integrated learning: Barriers and best practice. Studies in Higher Education, 40(2), 350-367.

- Jarnyh, V. (2017). Crisis in the organization. What's next? Business magazine Business Key, 2006, I, 7-8. Available at: http://www.bkworld.ru/archive/y2006/n08- 2006/n08-2006_157.html.

- Kondratieva, K. V. (2016). The evaluation of the effectiveness of anti-crisis management of enterprise. Vestnik of Perm University, 4 (31), 189-200.

- Kozlov, A. V., Tamer, O. S., Lapteva, S. V., Temirbaev, R. M., Vorobyeva, T. I., & Bondarovskaya, L. V. (2016). Didactic system for improving the students’ research activities. Man in India, 97(15), 461-480.

- Lagkueva, A. B., & Gurieva, S. B. (2015). The formation of the scientific-research competencies of the modern university students. Innovational science, 6(1), 223-224.

- Lapteva, S., & Vorobyova, T. (2018). Implementing practice-oriented approach in professional program for bachelor’s training in the fuel and energy complex. Astra Salvensis.

- Lockwood, N. R. (2005). Crisis management in today’s business environment. SHRM research quarterly, 4, 1-9.

- Markova, S., & Minin, K. (2017). Role of education in development of professional values of specialists. Journal of Entrepreneurship Education, 20(3), 1-5

- Markova, S., Depsames, L., Burova, I., Tsyplakova, S., & Chigarov, E. (2017). Role of education in development of professional values of specialists. Journal of Entrepreneurship Education, 20(3).

- Meyer, M., Roodt, G., & Robbins, M. (2011). Human resources risk management: governing people risks for improved performance: opinion paper. SA Journal of Human Resource Management, 9(1), 1-12.

- Mitrofanova, E.A., & Esaulova, I.A. (2017). Anti-crisis personnel management: the conceptual approach. University Vestnik, 12, 18-27.

- Moss, J., & Pini, B. (2016). Visual research methods in educational research. Springer.

- Naeve Bump, N. (2013). Study reform from a student perspective: case studies for the reconstruction of student perceptions, assessments and study strategies in the context of the teacher training course for vocational schools. EUSL.

- Nizamidou, C., & Fotios, V. (2015). HR’S Strategic Role in Terms of Crisis Management. International Journal of Technical Research and Applications, Special Issue, 34, 1-5.

- Olokundun, A. (2018). Experiential Pedagogy and Entrepreneurial Intention: A Focus on University Entrepreneurship Programmes. Academy of entrepreneurship journal, 24 (2), 1-13.

- Raei, R., Saeidi, K. M., Fallahpour, S., & Fadaeinejad, M. (2016). A hybrid model for estimating the probability of default of corporate customers. Iranian journal of management studies, 9(3), 651-673.

- Rider, S., Hasselberg, Y., & Waluszewski, A. (2012). Transformations in research, higher education and the academic market: The breakdown of scientific thought, 39.

- Ronez, M. (2017). HR-Human Resource Contribution to Crisis Management. Asia Risk Management Institute.

- Rudakova, O.Y. (2015). Anti-crisis management of organizational changes. Izvestiya of Altai State University, 2 (86). 151-157.

- Savitskaya, G.V. (2012). The analysis of the economic activity. Moscow, Minsk.

- Sinichenko, Z.I. (2013). The role of scientific activity in the specialist’s professional training/Z.I. Sinichenko. Vestnik of Taganrog Institute of management and economics, 1 (17). 90-94.

- Smyth, L., Davila, F., Sloan, T., Rykers, E., Backwell, S., & Jones, S. B. (2016). How science really works: the student experience of research-led education. Higher Education, 72(2), 191-207.

- Wang, J., Hutchins, H. M., & Garavan, T. N. (2009). Exploring the strategic role of human resource development in organizational crisis management. Human Resource Development Review, 8(1), 22-53.

- Weedon, E., & Riddell, S. (2015). Higher education in Europe: widening participation. Widening Higher Education Participation, 49-61.