Research Article: 2018 Vol: 22 Issue: 3

The Implications of Internal and External Auditing Integration on the Auditing Performance and Its Impact on the Expectation Gap: an Exploratory Study in the Iraqi Environment

Nadhim Shaalan Jabbar, University of Al Qadisiyah

Abstract

Due to the exposure of the audit profession to many criticisms from the financial community and the lack of services provided by the result, resulting in a gap between the expectations of the financial community and the profession of review, it became an imperative for the profession to take into account the requirements of the financial community to reduce the expectations gap in order to avoid criticisms about the quality and credibility of its job. The cooperation and coordination between the internal auditor and the external auditor is still limited by many determinants. The management is unaware of the procedures of internal auditing and external auditing, which led to the identification of communication and cooperation between them. Cooperation is cautious due to the prevalent view that the external auditor seeks to correct errors and thus expose them to accountability.Based on what has just been mentioned,the problem of the study is centered on the following question: Does the integration of internal audit and external audit improves the quality of audit performance and narrow the expectation gap to a minimum? The present study aims to find the relationship between the integration of audit and the quality of audit performance and its impact on the expectations gap, which is an exploratory study in the Iraqi accounting environment on a sample of Iraqi companies listed in the Iraqi market for securities and external auditors who audit the accounts of these companies and the internal audit staff of these companies and academics in some Iraqi universities in the field of accounting and auditing, through the questionnaire prepared for this purpose and analyzed data using Structural Equations Modeling method (SEM) and the LISREL program to test the hypotheses.

Keywords

Expectation Gap, Performance Gap, Reasonableness Gap, Auditing Integration.

Introduction

It is worth mentioning that the increased fraud and illegal connections have resulted in lower public confidence in financial reporting and audit, and a mismatch between financial reporting users' expectations of what they should be or what references should be made. Therefore, the gap between the auditors and the users of the financial statements has emerged because of the different adequacy and level of professional performance of the audit than expected. The financial community expects auditors to ensure in their reports technical competence, impartiality, objectivity, independence and impartiality. Additionally, the financial community expects auditors to discover fundamental errors and prevent misleading statements from the financial community. The expectation gap has become a familiar reality in the audit environment which is difficult to exclude altogether if we use the review approach only to deal with it. Some of the reasons are related to the users of the financial statements themselves, but this gap can be minimized by supporting the role of the review and clarifying it. In term of integration and cooperation between internal audit and external audit, internal audit can affect the procedures performed by the external auditor. External auditor may rely on the work performed by the internal audit function in advance. The presence of an internal audit department can reduce the size of tasks and time required to implement These tasks require internal auditors to be efficient and objective, and abide by the rules and ethics of the profession and the implementation of all the work placed on them. It became clear that the internal and external audit integration (AUIN) has become a support for the rehabilitation of the performance of control either in the institution or by external parties. The internal auditor should not be seen as being in collusion with the administration. Rather, this function should be framed by the standards that would enhance it to serve the administration and guide the external auditor to serve the interested parties in order to benefit from the implementation of all aspects of the regulatory framework.

Research Methodology

Research Problem

The cooperation and coordination between the internal auditor and the external auditor, which is sought by many organizations, is still limited by many determinants. The management is unaware of the procedures of internal auditing and external auditing which led to the identification of communication and cooperation between the internal and the external auditors. In this regards, cooperation is cautious because of the prevailing perception that the external auditor is seeking to catch up with the mistakes and thus expose them to accountability. Accordingly, the research is based on the following two fundamental questions: To what extent can audit performance be performed in the light of the integration of internal and external audit? And does it narrow the expectation gap to a minimum?

Research Objective

The research aims at showing the implications of the internal and external audit integration on the audit performance and its impact on the expectations gap and the methods of narrowing this gap if it exists.

Research Hypotheses

In light of the nature of the problem and the objective of the research, the researcher presents the following hypotheses:

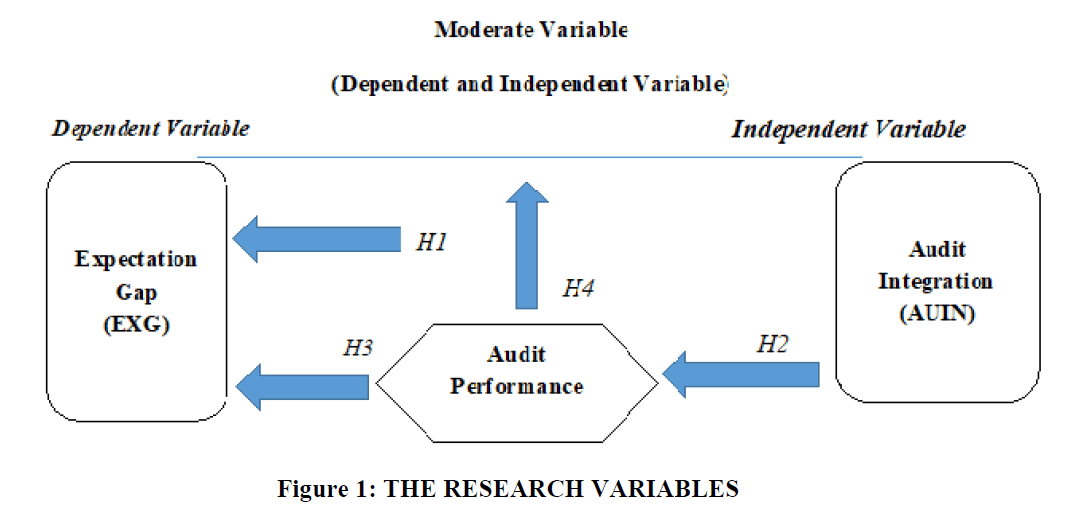

H1 There is no statistically significant relationship between the integration of the audit and the expectations gap.

H2 There is no statistically significant relationship between audit integration and the quality of audit performance.

H3 There is no statistically significant relationship between the quality of regulatory performance and the expectations gap.

H4 The quality of the audit performance does not affect the relationship between audit integration and the expectations gap, if any.

Methodology And Measurements

The Theoretical Part

The research is based on a descriptive analytical approach to the subject of the study. A number of researches and studies were published in specialized periodicals and journals, as well as published on the Internet. They were analyzed and discussed in order to serve the research objectives. Then, the best means to increase the level of commitment to more effective strategies can be suggested.

The Practical Part

The research includes an applied exploratory study, in the Iraqi accounting environment, to a sample of auditors and legal accountants in the Federal Audit Bureau, the private audit offices, the internal auditing staff and accountants in some companies and academics in some Iraqi universities in the field of accounting and auditing. Throughout the questionnaire prepared for this purpose, the sample of the study will be asked to give their views on the implications of the internal and external audit integration on the audit performance and its impact on the expectation gap and the methods of narrowing this gap. The respondents’ responses will be analyzed statistically.

The Research Variables

Figure 1 below represents the variables of the study:

Theoretical Framework

The Concept of Internal Audit

It worth mentioning to state that the concept of the internal audit has evolved greatly in the second half of the last century and changed the old view as being a hunt tool of others' mistakes. But it has changed into an effective tool serving administration so that the internal auditing contributes in designing and developing the internal monitoring system, strengthening management control over the company, assessing and managing risks, introduce the most effective ways to manage them, as well as measuring the efficient use of available resources and help achieving maximum efficiency in project management. These measures help to increase the projects chances to utilize their resources ideally, and achieve the overall quality. There were many definitions dealing with internal auditing include the following:

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes (Wood et al, 2012).

Stewart and Subramaniam (2010) defined internal auditing as “an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It also helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes”.

The Institute of Internal Auditors referred to the internal audit as a function performed by staff from within the project, which includes critical examination of procedures, policies and ongoing evaluation of plans, administrative policies and internal control procedures with a view to ensuring the implementation of these administrative policies and verifying that the internal controls are sound and their information is sound, accurate and adequate (Oprean, 2007).

According to IFAC (2001), “the external auditing is one of the classifications of auditing that can be defined as critical and neutral examination of records and documents of the economic organization by an external auditor to express a neutral, honest and artistic opinion about the authenticity of the financial reports during a specific period” (Fadzil et al., 2005).

The Concept of External Audit

As a matter of fact, the external auditing it developed and evolved throughout the history based on the idea of separation of ownership and management. The owners need an independent professional opinion on the adequacy of the management and the use of available resources. The prominent features of this development are evident in the following brief definitions.

The American Accounting Association (AAA) point out that external audit is a systematic and objective process of obtaining and evaluating evidence concerning facts and economic events so as to verify the degree of conformity between those facts and the specific criteria and to communicate the results to users of information interested in the investigation.In this regard, the AAA have defined the external auditor as “a person or group of persons who preform auditing job on the condition that they have all the required auditing rules as related to the auditor himself including (professional training, professionalism, independence and exerting necessary professional efforts)”.

IFAC (2015) defined the external audit as “a critical and neutral examination of records and documents of the economic organization by an external auditor to express a neutral, honest and artistic opinion about the authenticity of the financial reports during a specific period”.

The Concept of Integration between the Internal and the External Auditing

Shuker (2012) points out that ‘integration’ refers to the cooperation and coordination between the internal auditor and the external one during the implementation of their tasks to ensure a more comprehensive coverage of the audit work, minimize duplication of efforts, and distribute the work in a manner that achieves the audit objectives in general and benefits the institution.

The presence of the integratory relationship between the internal auditing and the external is very important and necessary for both sides due to its positive effect and benefit to their respective goals. We can identify the main objectives of the integration between the internal auditing and the external one in the following points:

1. Auditing covers all activities of the organization.

2. Implementation auditing work with high quality.

3. Reducing redundancy and duplication of work.

4. Reducing the cost of auditing.

5. Assisting the organization to achieve its goals successfully.

The efficiency of coordination and cooperation increases if the internal auditor and the external auditor held meetings along different stages of work. The external auditor needs to be aware of relevant internal auditing, and he should be informed of any important updates that may effect on the internal auditing. The external auditor needs to know of the plan of the internal auditor to discuss it. The nature, timing and extent of testing of the work assigned to auditing will depend on the opinion of the external auditor to define the risks of auditing specific area and their relative importance and the preliminary assessment of the internal auditing (International Standard No.610, 2004, 551).

Cooperation and Coordination between the Internal and the External Auditors

Basically, the scopes of cooperation and coordination between the internal and the external auditors depend primarily on the efficiency of the internal auditing and its ability to provide aid to the external auditors. Some of the most common scopes of the cooperation include:

1. The internal auditor shall assist the external auditor in carrying out certain customary procedures such as sending the instructions to the concerned parties.

2. Joint committees can be formed between the parties to conduct some audit procedures.

3. The external auditor may reduce many of the audit procedures included in his program when examining the internal auditor program in case he is convinced of its efficiency.

4. The internal auditor shall monitor, liquidate and take into account the observations made by the external auditor.

5. The external auditor may rely on the results of the internal auditor's examination of the internal control procedures.

6. The external auditor can rely on internal auditor reports to identify problems within the organization.

As stated in the international standard (610) in the field of cooperation and coordination between the internal and the external auditors, the external auditor reviews the internal auditor's reports and informs him of any important matters affecting the internal audit work. At the same time, the internal auditor shall examine the reports of the external auditor and determine what requires investigation or follow-up and take the necessary to take advantage of the observations, and hold meetings and seminars during certain periods, increasing the scope of cooperation between them. The scopes of cooperation and coordination between the internal auditor and the external auditor have been identified in the financial aspects as they are the point of convergence between them. To achieve this cooperation, the internal audit manager must ensure the internal audit of the financial activities of the entity. Effectiveness in covering the activities of the financial institution (Shuker, 2012).

Importance of Integration

The importance of integration between internal audit and external audit is embodied in several aspects, the most important of which are the following:

1. The external auditor reassures the accuracy and effectiveness of the internal control system through the accuracy and effectiveness of the internal audit system.

2. Reducing time for the performance of the external audit function, since confidence in the internal audit system results in less time for external audit, which reduces audit fees and provides greater customer satisfaction.

3. The overall assessment of the risk of the audit, and then make decisions concerning the nature, timing and extent of audit procedures

It is clear that many aspects of the work of the internal auditor are in the interest of the external auditor. Therefore, the optimal situation is the full cooperation and complementarity between them, in order to ensure the most comprehensive coverage of the institution's activities, avoid redundancy and duplication of work and reduce the costs and time required to perform the external audit as well as the completion of their oversight functions efficiently and effectively, and the complementarities between the internal auditor and external auditor. Undoubtedly, that this integration leads to concerted efforts to achieve the objectives of each of them efficiently and effectively for the benefit of the institution and that the areas of cooperation and coordination must be directed towards the indicators of successful audit work, namely efficiency, effectiveness and economic indicators, that is, cooperation in the areas of achieving these indicators.

The Concept of Expectation Gap

Singh (2004) defines expectation gap as the difference between the levels of expected performance as envisioned by the independent accountant and by the user of financial statements. Mahdi (2011) refers to the expectation gap as the difference between the levels of expected performance as envisioned by the independent accountant and by the user of financial statements. According to (Higson, 2003), the expectation gap refers to the difference between what society imagine or want and the users of the financial data about the responsibility of auditors and what those auditor think about their responsibility. Ojo (2006) defined the gap of expectation as “the difference between what the public as well as financial statement users believe auditors are responsible for and what auditors actually believe their responsibilities are”. The ASCPA and ICAA (1994) observe that the term ‘expectation gap’ should be used to describe “…the difference between expectations of the users of financial reports and the perceived quality of reporting and auditing services delivered by the accounting profession.”

The Components of Expectation Gap

Scholars assume that the expectation gap encompasses various components. Some of them are related to the external auditors, whereas some others are related to the users of the financial reports.

Audit Expectation Gap

1. The independence gap: Independence is the cornerstone of the auditor's report and the mainstay of his opinion in the financial statements. The independence of the auditor is the cornerstone of the audit profession, which requires that the auditor be neutral and objective towards the entity and that his opinion is not biased to one party at the expense of another user of the financial statements. This in turn leads to a narrowing of the independence gap.(Salehi et al., 2009)

2. Performance Gap: A gap between the expected standard of performance of auditors existing duties, and performance as expected and perceived by society (Porter and Gowthorpe, 2004). Such a gap also confirmed by scholars and researchers in a lot of countries. The main reasons of such a gap may be classified as follows: Non-audit services practicing by auditors, self-interesting auditors and economical relationship with clients, unqualified auditors, and dependent auditors.

3. Reporting Gap: The audit opinion gap in his report indicates the difference between the expectations of the users of the financial statements of the auditor and the auditor's opinion already contained in his report (Dunmore and Falk, 2001).

Gaps Related to Stakeholders

1. Reasonableness gap: A gap between what the society expect auditors to achieve and what they can reasonably be expected to accomplish. Such a gap exists because of misunderstanding of users, users’ over expectations, uneducated users, miscommunication of users, and miss-interpretation of users and unawareness of users from the audit practice limitations (Shaikh and Talha, 2003).

2. Deficient standards gap: A gap between the duties, which can reasonably be expected of auditors, and auditors existing duties as defined by law and professional promulgations (Raiborn, 2004).

3. Legal liability gap: It refers to differences in perceptions especially regarding assurances provided between the users and preparers of the financial statements and the auditors.

Reasons of Expectation Gap

1. Lack of scientific knowledge of the community and the users of financial statements about auditing profession: Some studies have related the gap of expectations to the incompetency of the users of the financial statements and the misunderstanding of the audit profession. Porter (2010) explained that 34% of the reasons for the gap in expectations are due to unreasonable expectations from the financial community.

2. Doubt in the independence and neutrality of the external auditor: The financial community must be convinced of the independence of the auditor. The real existence of the audit profession depends on this conviction. If the financial community doubts the independence of the auditors, their views are of no value, and therefore there is no need for the services of the auditors. Hence, they must avoid all relationships and circumstances that call into question their independence.

3. Lack of clear identification of the role of the auditor in the community: The need for audit services arises because of conflicts of interest .This requires from the auditor the independence and impartiality. Moreover, the complexity of economic life and accounting systems in economic units requires the availability of technical competence or specialized knowledge in the person who audits (Sikka et al., 2003).

4. Lack of professional competence of the auditor: It refers to the adequate and specialized knowledge the auditor should have in the fields of accounting and auditing. It also includes professional skills the auditor should possess in applying that knowledge in various situations and circumstances. Professional competence also denotes the behavior acquired from education and training.

5. Decrease of auditing performance quality: Among the factors that lead to low quality performance are:

a. Auditors may either compete with each other for new reviews or they avoid losing current processes.

b. Accepting small auditing processing fees which do not commensurate with the effort performed as a competition outcome.

c. Performing other services for the clients of the audit with a small fee to obtain the satisfaction of these customers and ensure the renewal of their appointment annually (Woo and Hian, 2001).

Methods for Narrowing the Expectation Gap in the Audit Process

Strengthening the independence of the external auditor

In most the world countries, the Companies Act gives the right to the Company’s external committee for appointing, setting fees and removing auditors so as to maintain the auditor’s independence and impartiality, increase public confidence in audit reports, narrow the expectations gap, and prevent any management possible pressures on the auditor’s independence.

Strengthening the role of professional organizations

It is the responsibility of professional organizations to redefine and regulate the profession of accounting and auditing for the possibility of self-censorship, increase the quality of professional performance in the audit, and increase accountability for auditors, which results in increased confidence in their work. These organizations must develop accounting and auditing and professional standards and codes of conduct. Professionals’ compliance to the profession through quality control programs for professional performance, the development of quality control programs and a rigorous system of accountability by the professional organization will lead to an improvement in the quality of professional performance to the levels expected of them and thus the satisfaction of the beneficiaries with the services performed by the auditors.

Studying the expectations of the financial community

Garcia & Herrbach (2010) points out that Studying the expectations of the financial community can be conducted by following three main steps:

1. Identifying the beneficiaries of financial reports and auditor reports and specifying those who have the right to determine their claims and needs of these financial reports.

2. Conducting a pilot study to identify the demands and needs of these beneficiaries and their expectations of auditing.

3. Proposing means and methods to meet those needs and thereby narrowing the expectations gap.

Empirical Analysis And Results

Methodology

In addition to the analytical descriptive approach that the study dealt with in its literature review, this study has an empirical field dimension related to finding the relationship between the integration of the audit and the quality of the audit performance and its impact on the expectations gap which is an exploratory study in the Iraqi accounting environment on a sample of Iraqi companies listed in the Iraqi Stock Exchange ,and external auditors who audit the accounts of these listed companies and the internal audit staff of these companies and academics in some Iraqi universities in the field of accounting and auditing. Through the questionnaire prepared for the practical part of this research study, the participants in the sample will be asked to give their views on the relationship between audit integration and quality of audit performance and its impact on the expectations gap. When the population of the study have been chosen as a prerequisite for scientific and practical qualification, scientific degree in accounting and auditing are for academics, experience and degree are for professionals. The purpose behind including academics and professionals in the sample of the study is actually to mingle the views of the two parties. A total of (110) questionnaires were distributed, (101) were retrieved and 4 were excluded from the analysis due to the lack of serious answers to their questions. Thus, the number of the analyzed questionnaires is (97) one. The data was analyzed using the Structural Equation Modeling (SEM) statistical method LISREL software for testing the hypotheses of the study. Tables 1 and 2 below can best summarize the sample of the study according to the scientific qualification and the years of the experience of the sample of the study:

| Table 1: Distribution Of The Study Sample According To The Scientific Qualification | ||

| Percentage % | Frequency | Scientific Qualification |

|---|---|---|

| 10% | 10 | Bachelors |

| 31% | 30 | Master |

| 37% | 36 | External auditor |

| 22% | 21 | Doctorate |

| 100% | 97 | Total |

| Table 2: Distribution The Sample Of The Study According To The Years Of Experience | ||

| Percentage % | Frequency | Years of Experience |

|---|---|---|

| 9.27% | 9 | Less than 5 years |

| 14.43% | 14 | From 5 – 10 years |

| 35.05% | 34 | From 15-less than 20 years |

| 41.23% | 40 | From 20 years and above |

| 100% | 97 | Total |

Study Instrument

The questionnaire was used as one of the study tools and was divided into three axes:

a. The first axis illustrates the integration of internal and external audit.

b. The second axis illustrates the audit performance quality.

c. The third axis illustrates the expectations gap.

General Statistics

| Table 3: General Statistics Of The Study | ||||||||||||||||||||

| Item | Item | Disagree | Neutral | agree | Mean | SD | Item | Disagree | Neutral | Agree | Mean | SD | Item | Disagree | Disagree | Neutral | Disagree | Strongly Agree | Mean | SD |

| EXG1 | Frequency | 0 | 33 | 50 | 3.80 | 0.67 | AUIN1 | 0 | 16 | 41 | 4.25 | 0.72 | REPE1 | 0 | 0 | 25 | 47 | 25 | 4.00 | 0.72 |

| Percent | 0 | 34.0 | 51.5 | 0 | 16.5 | 42.3 | 0 | 0 | 25.8 | 48.5 | 25.8 | |||||||||

| EXG2 | Frequency | 0 | 22 | 64 | 3.89 | 0.58 | AUIN2 | 0 | 13 | 45 | 4.27 | 0.68 | REPE2 | 0 | 0 | 24 | 54 | 19 | 3.95 | 0.67 |

| Percent | 0 | 22.7 | 66.0 | 0 | 13.4 | 46.4 | 0 | 0 | 24.7 | 55.7 | 19.6 | |||||||||

| EXG3 | Frequency | 0 | 33 | 59 | 3.71 | 0.56 | AUIN3 | 0 | 10 | 51 | 4.27 | 0.64 | REPE3 | 0 | 0 | 22 | 52 | 23 | 4.01 | 0.68 |

| Percent | 0 | 34.0 | 60.8 | 0 | 10.3 | 52.6 | 0 | 0 | 22.7 | 53.6 | 23.7 | |||||||||

| EXG4 | Frequency | 0 | 24 | 64 | 3.85 | 0.57 | AUIN4 | 0 | 16 | 40 | 4.26 | 0.73 | REPE4 | 0 | 0 | 18 | 55 | 24 | 4.06 | 0.66 |

| Percent | 0 | 24.7 | 66.0 | 0 | 16.5 | 41.2 | 0 | 0 | 18.6 | 56.7 | 24.7 | |||||||||

| EXG5 | Frequency | 0 | 24 | 63 | 3.86 | 0.58 | AUIN5 | 0 | 22 | 58 | 3.95 | 0.64 | REPE5 | 0 | 0 | 19 | 44 | 34 | 4.15 | 0.73 |

| Percent | 0 | 24.7 | 64.9 | 0 | 22.7 | 59.8 | 0 | 0 | 19.6 | 45.4 | 35.1 | |||||||||

| EXG6 | Frequency | 0 | 26 | 56 | 3.89 | 0.64 | AUIN6 | 0 | 17 | 57 | 4.06 | 0.64 | REPE6 | 0 | 0 | 16 | 55 | 26 | 4.10 | 0.65 |

| Percent | 0 | 26.8 | 57.7 | 0 | 17.5 | 58.8 | 0 | 0 | 16.5 | 56.7 | 26.8 | |||||||||

| EXG7 | Frequency | 0 | 27 | 60 | 3.82 | 0.60 | AUIN7 | 0 | 7 | 49 | 4.35 | 0.61 | REPE7 | 0 | 0 | 16 | 57 | 24 | 4.08 | 0.64 |

| Percent | 0 | 27.8 | 61.9 | 0 | 7.2 | 50.5 | 0 | 0 | 16.5 | 58.8 | 24.7 | |||||||||

| EXG8 | Frequency | 0 | 20 | 64 | 3.93 | 0.58 | AUIN8 | 0 | 4 | 54 | 4.36 | 0.56 | REPE8 | 0 | 2 | 13 | 63 | 19 | 4.02 | 0.65 |

| Percent | 0 | 20.6 | 66.0 | 0 | 4.1 | 55.7 | 0 | 2.1 | 13.4 | 64.9 | 19.6 | |||||||||

| EXG | Frequency | 0 | 209 | 480 | 3.84 | 0.41 | AUIN9 | 0 | 17 | 61 | 4.02 | 0.61 | RPEE 9 | 0 | 2 | 153 | 427 | 194 | 4.05 | 0.44 |

| Percent | 0 | 27 | 62 | 0 | 17.5 | 62.9 | 0 | 0 | 20 | 55 | 25 | |||||||||

| Frequency | AUIN10 | 0 | 18 | 56 | 4.05 | 0.65 | ||||||||||||||

| Percent | 0 | 18.6 | 57.7 | |||||||||||||||||

| Frequency | AUIN11 | 0 | 24 | 43 | 4.06 | 0.75 | ||||||||||||||

| Percent | 0 | 24.7 | 44.3 | |||||||||||||||||

| Frequency | AUIN12 | 0 | 164 | 555 | 4.17 | 0.39 | ||||||||||||||

| Percent | 0 | 15 | 52 | |||||||||||||||||

The following Table 3 below includes the values of the general statistics represented by the arithmetic mean and the standard deviation for each variable and item of this study:

The above table shows that the eighth item of the variable EXG has the highest mean, whereas the lowest means is for the third item. The eighth item of the variable AUIN also has the highest mean, whereas the lowest arithmetic mean is for the fifth item. Additionally the fifth item of the variable the role of auditing performance (REPE) has above the middle of arithmetic mean, while the lowest one is for the second item (Burton et al., 2012).

Consistency of the Questionnaire

The researcher has found Cronbach's alpha for the variables of the study which indicated the strength of the consistency and validity of the questionnaire used. This evidently reflects the questionnaire ability of analyzing and circulating the results from the sample to the community the results are shown in Table 4 below:

| Table 4: Cronbach's Alpha | ||

| Cronbach's Alpha | Item Numbers | Variables |

|---|---|---|

| 0.95 | 11 | Integration |

| 0.97 | 8 | Auditing Role |

| 0.97 | 8 | Expectations Gap |

| 0.98 | Total | |

Correlations of the Study Variables

The following Table 5 includes the correlation coefficients between the three analyzed variables in addition to their significance:

| Table 5: Correlations Of The Study Variables | ||||

| AUIN | REPE | EXG | ||

|---|---|---|---|---|

| AUIN | Pearson Correlation | 1 | 0.570** | -0.427-** |

| Sig. (2-tailed) | 0.000 | 0.000 | ||

| N | 97 | 97 | 97 | |

| REPE | Pearson Correlation | 0.570** | 1 | -0.590-** |

| Sig. (2-tailed) | 0.000 | 0.000 | ||

| N | 97 | 97 | 97 | |

| EXG | Pearson Correlation | -0.427-** | -0.590-** | 1 |

| Sig. (2-tailed) | 0.000 | 0.000 | ||

| N | 97 | 97 | 97 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | ||||

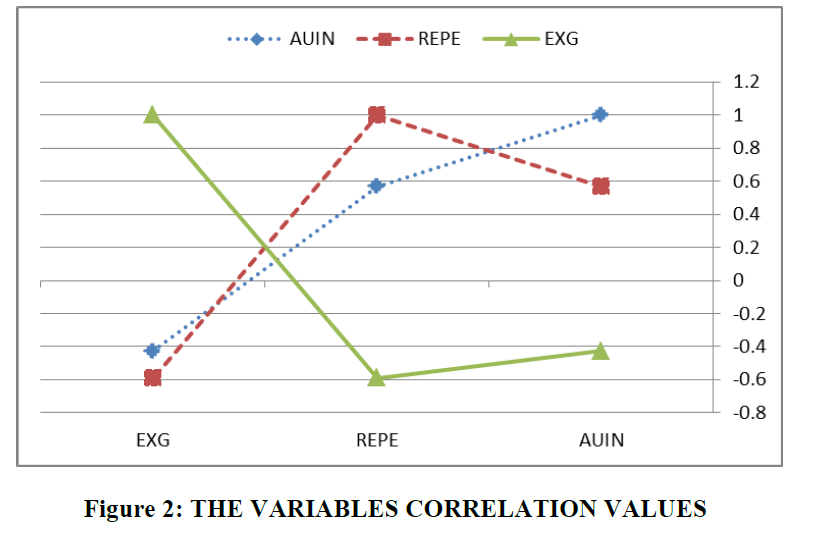

The above Table 5 shows a significant correlation between 5 and 5% between AUIN and REPE with a correlation of 0.570 and a reverse correlation between 5 and 5% between AUIN and EXG. Additionally, the correlation value is -0.427, and there is a reverse direct correlations relationship below 5% between REPE and EXG with a value of -0.590. Figure 2 shows the variables correlation values.

Structural Equation Modeling (SEM)

The aim of the Structural Equation Modeling (SEM) is to construct mathematical models proposed by the researcher to suit certain study variables. To determine the accuracy of the mathematical model, some indicators are used to accept or reject the proposed model (which will be used in this research). The ratio between Chi-squared test (χ2) and degrees of freedom (df) and the Incremental Fit Indexes, which are based on estimating the comparison of the assumed model with the null model, in which one general factor is assumed to satisfy all the measured variables, and the Comparative Fit Index (CFI) and the Incremental Fit Index (IFI). The values of these indicators are between zero and the correct one, as its high value indicates a better match of the model with the sample data Figure 2.

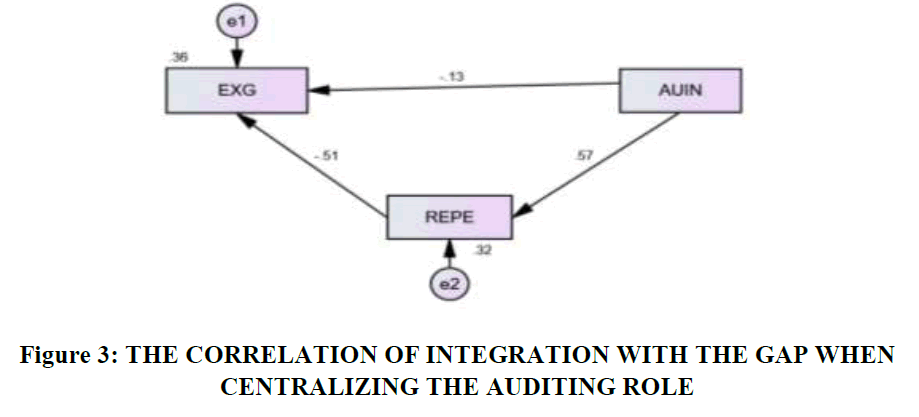

The Correlation of Integration Indirect Effect with the Gap When Centralizing the Auditing Role

The researcher has formulated the hypotheses of determining the correlation of integration with the gap when centralizing the auditing role. Figure 3 blow is a proposed model following SEM and the results of AMOS program:

The researcher has identified the direct significances between the variables of the above model following Maximum Likelihood method (ML), and the results indicate the significance of the model as illustrated in Table 6 below:

| Table 6: Values Indicators Of The Correlation Of Integration With The Gap When Centralizing The Auditing Role | ||

| Indicators | Sig. | Calculated Value |

|---|---|---|

| χ2 | 0.05> | 0.000 |

| IFI | 0.90< | 0.90 |

| Root Mean Square Residual (RMR) | 0.06> | 0.000 |

| CFI | 0.95< | 0.96 |

Table 6 illustrates the values of the indicators implying that the SEM method adopted is a good model as these indicators have met the quality requirements. As for the direct and indirect coefficients of the SEM, the researcher has modified a table for this purpose making use of the satirical analysis results reached so far:

Table 7 above illustrates the following:

| Table 7: Direct And Indirect Coefficients Of The Structural Equation Modelling | |||||

| Variables | Direct Effect Coefficient | Indirect Effect Coefficient | Total Effect Coefficient | ||

|---|---|---|---|---|---|

| Independent | Moderate | Dependent | |||

| REPE | - | EXG | -.514** | - | -.514 |

| AUIN | - | REPE | .570** | - | .570 |

| AUIN | REPE | EXG | -.134* | -.293 | -.427 |

1. The direct effect: The above results show that there is a direct and indirect effect of the auditing performance role (REPE) on the expectations gap (EXG) at the level of 5% as increasing the REPE by one unit reduces the EXG by 0.514. There is a significant direct and reverse effect of the AUIN of the EXG at the 5% level, as the increase in AUIN by one unit leads to a decrease in the EXG by 0.134. There is a direct significant effect of the AUIN on the REPE at the level of 5% as the increase in integration by one unit leads to increase the REPE by 0.57.

2. Indirect Effect: The effect on the EXG at the center of the REPE was reduced by 0.293, which represents the value of the indirect effect. The total effect of the integration on the EXG is 0.427, i.e., the increase in the value of integration by one unit leads to a decrease in the EX|G by 0.427 when there is REPE.

Statistical Results

Based on the statistical analysis to the study questionnaire, the following results are reached:

1. The results indicated the strength of the validity and reliability of the questionnaire used by the researcher.

2. The SEM model used by the researcher is a good model because its indicators have met the quality requirements.

3. In terms of direct effect, increasing the auditing role by one unit reduces the expectations gap by 0.514.

4. In terms of direct effect, the increase in integration by one unit reduces the expectations gap by 0.134.

5. In terms of direct effect, the increase in integration by one unit leads to an increase in the auditing role by 0.57.

6. As for indirect effect, the effect of integration on the expectations gap when centralizing the auditing role decreased by 0.293.

7. The increase in the value of integration by one unit leads to a decrease in the expectations gap by 0.427 when there is an auditing role.

8. Evidently, there is a significant correlation below 5% between AUIN and REPE with a correlation of 0.570. Moreover, there is an inverse significant correlation below 5% between AUIN and EXG where the correlation value was -0.427, and there was an inverse correlation and moral correlation below 5% between REPE and EXG with a value of -0.590.

Conclusions And Recommendations

Conclusions

1. The audit integration between the internal auditor’s performance and that of the external auditor achieves many benefits, the most important of which are: preventing duplication and repetition of work between the parties. Consequently, the two parties save more time, efforts, and more comprehensive coverage of all the activities of the institution.

2. The existence of the causes of the rise in the expectations gap - as their supporters wish to call them is confirmed by time and is determined by professional follow-up and quality of regulatory performance, and therefore the components of the expectations gap in the audit are inevitably changing over time.

3. Most of the managements are unaware of the internal and external auditing, which consequently led to the identification of communication and cooperation between the internal and the external auditors .The cooperation between the external and internal auditors is cautious due to the prevailing view that the external auditor seeks to catch up with the errors and thus expose managements to accountability.

Recommendations

1. Prior to utilizing the work of the internal auditor, the external auditor must first assess the work of the internal auditor as defined by the audit criteria for the auditor's use of internal audit work. Then, the external auditor should take the decision on whether he will rely on the auditor’s external work after assessing the effectively level range of that work on the nature of the internal auditor’s work. This assessment process is regarded as a gain to both the audit firm and the company under auditing.

2. The necessity of promoting the internal and external auditing expertise and keeping up with the recommendations, publications and standards issued by international and local professional organizations through training courses for the sake of ensuring the efficiency the quality of the auditing performance.

3. Changing the management's view regarding the internal auditor's relationship with the external auditor by removing the ambiguity and setting their objectives. Also, conducting joint courses, seminars and conferences to clarify the mechanisms of cooperation and increasing awareness on the importance of cooperation and the objectives that each one seeks to achieve.

4. Studying the expectations of the financial community and users of the financial statements and the attempt of taking the logical and reasonable expectations into considerations.

5. Reducing personal judgment on the auditor's work in the public and private sectors by instigating them to apply the ethical rules and general standards which lead to increase the quality of the auditing outputs.

6. The professional organizations should carry out various media methods to increase the awareness of the financial society and the users of the financial statements for about the audit profession nature so as to reduce the expectations gap of the financial community till it reaches to a reasonable level.

7. Promoting the internal and external auditors’ skills by providing them with the latest references and sources, as well as by enrolling them in courses held outside the country as an attempt to transfer expertise to the local country.

Acknowledgement

I would like to show my warm thank to Mr. Abdullah Najim Abd Al Khanaifsawy who supported me at every bit and without whom it was impossible to accomplish the end task. His translation, guidelines, and the substantial endeavors in providing the necessary sources and references have empowered me to positively finish this article.

References

- ASCPA/ICAA (1994). A Research Study on Financial Reporting and Auditing-Bridging the Expectation Gap.

- Burton, F.G., Emett, S.A., Simon, C.A., & Wood, D.A. (2012). Corporate manager’s reliance on internal auditor recommendations. AUDITING: A Journal of Practice & Theory, 31(2), 151-166.

- Dunmore P.V.Z., & Falk, H. (2001). Joint Provision of Audit and Non-audit Services, Audit Pricing and Auditor Independence, WP.

- Fadzil, F.H., Haron, H., & Muhamad, J. (2005). Internal Audit practices and Internal Control system. Managerial Auditing Journal, 20(8), 844-866.

- Garcia, A., & Herrbach, O. (2010). Organisational commitment, role tension and affective states in audit firms. Managerial Auditing Journal, 25(3), 226-239,

- Higson, A. (2003). Corporate Financial Reporting: Theory and Practice, London. SAGE Publications.

- IFAC (2015). International Standards on Auditing, ISA 610: Guide of the International Federation of Accountants. Issues of Auditing and Ethical Conduct. Translation. Association of Arab Society of Certified Accountants, Amman, Jordan.

- Mahdi, S. (2011). Audit expectation gap: Concept, nature and trace. African Journal of Business Management, 5(21), 8376-8392.

- Ojo, M., (2006). Eliminating the audit expectations gap: Myth or reality? Journal of Forensic Accounting, 8(1). Retrieved from [http://mpra.ub.uni-muenchen.de/232/1/MPRA_paper_232.pdf] 10.20.2009.

- Oprean, I., Popa, I.E., & Lenghel, R.D. (2007). Audit and financial control procedures. Risoprint Publishing, Cluj-Napoca.

- Porter, B. (2010). An empirical study of the audit expectation-performance gap. Accounting and Business Research, 24(93), 49-68.

- Porter, B.A., & Gowthorpe, C. (2004). Audit expectation-performance gap in the United Kingdom in 1999 and comparison with the gap in New Zealand in 1989 and 1999, Edinburgh: Institute of Chartered Accountants of Scotland.

- Raiborn, C., & Schorg, C. (2004). The Sarbanes-Oxley Act of 2002: An analysis of comments on the accounting-related provisions. Journal of Business Management, 10(1), 1-13.

- Salehi, M., Mansoury, A., & Azary, Z. (2009). Audit independence and expectation gap: Empirical evidences from Iran. International Journal of Economics and Finance, 1(1), 165-174.

- Shaikh, J.M., & Talha, M. (2003). Credibility and expectation gap in reporting on uncertainties. Managerial Auditing Journal, 118(6/7), 517-529.

- Shuker, H. (2012). The relationship between the internal auditor and the external auditor. Al-Mudaqiq Journal, 18 (24).

- Sikka, P., Puxty, A., Willmott, H., & Cooper, C. (2003). The impossibility of eliminating the eliminating the expectations gap: Some theory and evidence. Critical Perspectives of Accounting, 9(3), 299-330.

- Singh, R.K. (2004). Bridging All the Expectation Gap-The Changing Role of Concurrent Auditors, Available at:icai.org/icairoot/publications/complimentary/cajournal_may04/p1201-07.pdf.

- Stewart, J., & Subramaniam, N. (2010). Internal audit independence and objectivity: Emerging research opportunities. Managerial Auditing Journal, 25(4), 328-60.