Research Article: 2018 Vol: 22 Issue: 1

The Implementation of International Financial Reporting Standard (IFRS) Adoption on the Relevance of Equity and Earning Book Value

Arif Makhsun, Lampung Public Polytechnic

Yuliansyah Yuliansyah, University of Lampung

Mohd Shahril Bin Ahmad Razimi, University Utara Malaysia

Keywords

Information Quality, Value Relevance, Book Value of Equity and Income, IFRS.

Background

The study applies Indonesian data to investigate the extent to which Interational Financial Reporting Standards (IFRS) impact on relevance of Equity and Earning Book Value. The last few years, International Financial Reporting Standards (IFRS) have become a hot topic in Indonesia as the country that has adopted IFRS since January 2012. According to Callao, Jarne & Laínez (2007) that the main issues of IFRS implementation is whether the use of IFRS can increase the benefit of financial reporting.

IFRS adoption certainly demands higher reporting quality from local standards, including better relevance level. However, whether this certainly is the reality in company in Indonesia after two years of stating to adopt IFRS fully, it is necessary to conduct a study that will give empirical evidence of that matter. This study investigation in manufacturing sector listed in the Indonesia Stock Exchange as this sector has the biggest segment in the Indonesian Stock Exchange (Lau & Sholihin, 2005; Yuliansyah & Razimi, 2015; Kasif et al., 2018).

Previous Studies

IFRS implementation gives different effects for each country. The following is the result of study on adoption of IFRS in some countries. Callao (2007) observed the difference of SAS (Spain Accounting Standards) and International Accounting Standards (IAS) and concluded that the obligation to use international standards does not give greater benefit viewed from the difference of comparability power from financial reporting that uses local standards and international standards. Callao et al. (2007) found IFRS adoption required a great cost as well as change of organization, business structure and accounting policy. Whereas Clarkson et al. (2011) gave evidence empirically that comparability increased with the presence of IFRS adoption in Australia, Ireland and other European countries. Liu, O’Farrell and Yao (2010) found the significant difference in net income under European Union IFRS with US-GAAP for European Union (Barth et al., 2014).

Several studies conducted in China such as Qu, Fong and Oliver (2012) and He, Wong and Young (2012) show different perspective of findings. For example, Qu, Fong and Oliver (2012) found that implementation of IFRS provides negative perspective for investors who want to know income statement information for investment decisions. He, Wong and Young (2012) find that IFRS can decrease the quality of earning as well as the combined value-relevance of earnings and book value. Study in the Rusian Maket conducted by Garanina & Kormiltseva (2013) found that adoption of IFRS does not have an impact on the increase of value relevance of financial reporting.

Yip & Young (2012) found that IFRS convergence can increase the quality of accounting information. This study also supports the Study of Jermakowicz & Gornik-Tomaszewski (2006) on companies in European Union (EU) showing that IFRS implementation gives positive effect for companies. Based on the difference from some countries, we want to study on how IFSR implementation after two years of being implemented in Indonesia.

Methodology

Secondary data of manufacturing companies registered in Indonesian stock exchange is collected. Companies having financial reports, with positive equity or income are selected. Data is obtained for 2009, 2010, 2012 and 2013. Year 2011 is used as cut down year for before and after IFRS adoption (Brüggemann et al., 2013).

Relative Value vs Equity Book Value of Company

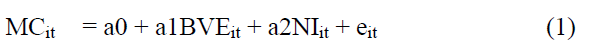

Model to measure relative relevance developed by Hung (2004) is as the following:

To measure relevance individually on variable above, then, the equation used is as the following:

Where MCit= Market Capitalization Value of companyi in the end of yeart, a1BVEit= Equity Book Value of companyi in the end of yeart, a2NIit= Net Income of companyi in the end of yeart, b1BVEit= Equity Book Value of companyi in the end of yeart, C1NIit= Net Income of companyi in the end of yeart.

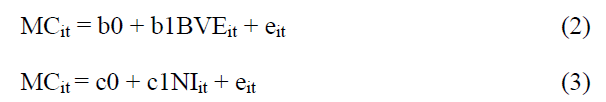

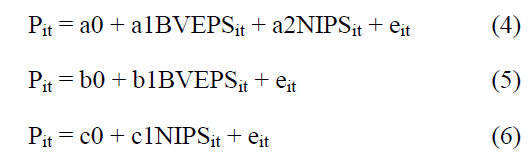

Meanwhile, to measure the value of each share sheet, it is by dividing each above variable with the number of shares circulated.

Therefore, the equation is as the following:

Pit = Share Rate of companyi in the end of yeart, a1BVEPSit = Equity Book Value per share of companyi in the end of yeart, a2NIPSit= Net Income per share of companyi in the end of yeart, b1BVEPSit = Book Value Equity per share of companyi in the end of t, C1NIPSit = Net Income per share of companyi in the end of yeart.

Incremental Relevance of Equity and Income Book Value

The measurement of incremental relevance is done by subtracting total R2 (simultaneous) with R2 (BVE, individual) and or adj R2 (NI).

Hypothesis Testing

Hypotheses that are tested are as the following:

H1: There is an increase in book value of equity and income simultaneuously after SAK of IFRS adoption being implemented fully.

H2: There is a significant increase in relevance of book value and income individually after SAK of IFRS adoption being implemented fully.

Its conclusion drawing is based on adjusted R2 (obtained from the result of regression with Eviews) between the period after and the period before full implementation of IFRS. If adjusted R2 of the period before < adjusted R2 of the period after implementation, then, the conclusion is that there is an increase of value relevance of financial report. In contrary, if the value of adjusted R2 of the period before > adjusted R2 of the period after implementation, then, the conclusion is that there a decrease of value relevance of financial report after adoption.

Hasil Pengujian Hipotesis

Multiple regression analysis is done to examine hypothesis of value relevance simultaneously and individually on variable BE and NI. This testing is done for us to be able to compare when an equation is tested by its total value and when it is tested by it per share value. The testing result of hypothesis on this value relevance can be seen on Table 1.

| Table 1: Testing Result Of Hypothesis Of Total Value | |||||

| MARKCAPit = a0 + a1BVEit + a2NIit + eit (1) | |||||

|---|---|---|---|---|---|

| Tahun | C | BVE | NI | Adj R2 | ? (%) |

| 2009 | 506.729.6 | 1.3910 | 8.3743 | 0.7141 | 24% |

| 2010 | 859.226.3 | -2.1072 | 24.5536 | 0.9510 | |

| 2012 | 6.283.771.5 | -1.8808 | 22.4768 | 0.8070 | 7% |

| 2013 | 2.317.414.9 | -1.8806 | 24.2656 | 0.8754 | |

| MARKCAPit = b0 + b1BVEit + eit (2) | |||||

| Tahun | C | BVE | Adj R2 | ? (%) | |

| 2009 | 575.742,9 | 3.4591 | 0.6711 | 9% | |

| 2010 | 966.260,6 | 3.9414 | 0.7650 | ||

| 2012 | 5.840.182,9 | 3.3606 | 0.5444 | -5% | |

| 2013 | 3.833.645,9 | 2.6430 | 0.4938 | ||

| MARKCAPit = c0 + c1NIit + eit (3) | |||||

| Tahun | C | NI | Adj R2 | ? (%) | |

| 2009 | 868.782,0 | 13.1112 | 0.6997 | 23% | |

| 2010 | 446.232,2 | 16.7923 | 0.9310 | ||

| 2012 | 5.142.840,7 | 15.7345 | 0.7804 | 4% | |

| 2013 | 1.179.223,7 | 16.2549 | 0.8241 | ||

MARKCAP: Market Capitalization (share rate x share circulated), BVE: Book Value of Equity, NI: Net Income.

Similar to Andriantomo (2013), the conclusion drawing from hypothesis of this value relevance is based on the increase and decrease of adjusted R square between period of before and after the implantation SAK of IFRS adoption.

Based on the table above, it can be seen that in model 1 there is the increase of adjusted R square from 71.41% to 95.09% in the period before IFRS and the increase in the period after IFRS from 80.70% to 87.54%. Between period of before and after IFRS, there is an increase. In model 2, there is an increase in the period before IFRS from 67.11% to 76.49%. However, it decreases after IFRS adoption which is as much as 54.44% and 49.37%. Meanwhile, in model 3, there is an increase in the period, but there is a decrease between periods. Before IFRS, 69.96% increases to be 93.09%. In the period after IFRS, 78.03% increases to be 82. 41%. Based on the fact above, it can be concluded that by using total asset of each company, there is the decrease of relevance value of equity and income both simultaneously and individually. It is because value of adjusted R square before IFRS is greater (>) than after IFRS. Therefore, the hypothesis proposed that there is an increase in the relevance of book value of equity and income simultaneously after SAK of IFRS adoption is being implemented fully cannot be accepted.

| Table 2: Hypothesis Testing Result Of Value Per Share | |||||

| PRICEit = a0 + a1BVEPSit + a2NIPSit + eit (4) | |||||

| Year | C | BVEPS | NIPS | Adj R2 | ? (%) |

|---|---|---|---|---|---|

| 2009 | 1.455,76 | 0,6987 | 2.4062 | 0.3370 | 48% |

| 2010 | 51,89 | 0,1964 | 11.1555 | 0.8213 | |

| 2012 | -2.733,61 | -0,5938 | 25.7063 | 0.7867 | 20% |

| 2013 | -1.346,99 | -0,0029 | 23.0295 | 0.9898 | |

| PRICEit = b0 + b1BVEPSit + eit (5) | |||||

| Year | C | BVEPS | Adj R2 | ? (%) | |

| 2009 | 1.986,58 | 1.6412 | 0.1678 | 33% | |

| 2010 | -1.045,41 | 3.7871 | 0.4989 | ||

| 2012 | 7.696,97 | 1.7070 | 0.0466 | 36% | |

| 2013 | -3.428,49 | 3.6355 | 0.4085 | ||

| PRICEit = c0 + c1NIPSit + eit (6) | |||||

| Year | C | NIPS | Adj R2 | ? (%) | |

| 2009 | 2.627,16 | 2.8528 | 0.3199 | 50% | |

| 2010 | 318,97 | 11.5127 | 0.8227 | ||

| 2012 | -4.710,84 | 24.9103 | 0.7827 | 21% | |

| 2013 | -1.353,61 | 23.0219 | 0.9899 | ||

MARKCAP: Market Capitalization (share rate x share circulated), BVE: Book Value of Equity, NI: Net Income.

Table 2 below shows the presence of increase and decrease that are varied. The increase is in period and the decrease is between periods. In model 4 of period before, it increases from 33.70% to 82.13%, while period of after, it increases from 78.66% to 98.98%. Model 5 has tendency that is similar to model 4 as well as model 6. It demonstrates that by using data of value per share, there is a decrease of adjusted R square showing that there is a decrease in value relevance of equity and income on share rate after the implementation of SAK of IFRS adoption.

Table 2 below shows the presence of increase and decrease that are varied. The increase is in period and the decrease is between periods. In model 4 of period before, it increases from 33.70% to 82.13%, while period of after, it increases from 78.66% to 98.98%. Model 5 has tendency that is similar to model 4 as well as model 6. It demonstrates that by using data of value per share, there is a decrease of adjusted R square showing that there is a decrease in value relevance of equity and income on share rate after the implementation of SAK of IFRS adoption.

It does not support the result of the study done by Hung & Subramanyam (2004) explaining that there is an increase of value relevance on international standard in Germany. However, this finding supports the study of Andriantomo demonstrating that even though generally there is increase in value relevance in period of 2000 to 2009, between those years there is decrease. It is in contrary with the expectation and mostly in studies stating that IFRS implementation will be able to increase value relevance of a financial report.

Thus, it can be concluded that there is no increase in value relevance after full implementation of SAK of IFRS adoption.

Meanwhile, for incremental value relevance that will measure the comparison between book value and net income, where its information content is stronger between one to another.

Table 3 shows that incremental of NI is always greater than incremental of BV. It shows that income information content describes share rate more than book value of equity.

| Table 3: Incremental Value Relevance With Total Value | |||||

| Year | Adj R2Model 1 | Adj R2Model 2 | Incr NI | Adj R2Model 3 | Incr BVE |

|---|---|---|---|---|---|

| 2009 | 0.7141 | 0.6711 | 0.0430 | 0.6997 | 0.0144 |

| 2010 | 0.9510 | 0.7650 | 0.1860 | 0.9310 | 0.0200 |

| 2012 | 0.8070 | 0.5444 | 0.2626 | 0.7804 | 0.0266 |

| 2013 | 0.8754 | 0.4938 | 0.3816 | 0.8241 | 0.0513 |

The above Table 4 shows the amount of comparison of value relevance between Book Value of equity and Net Income.

| Table 4: Incremental Value Relevance With Value Per | |||||

| Year | Adj R2Model 4 | Model 5 | Incr NIPS | Model 6 | Incr BVEPS |

|---|---|---|---|---|---|

| 2009 | 0.3370 | 0.1678 | 0.1692 | 0.3199 | 0.0171 |

| 2010 | 0.8213 | 0.4989 | 0.3225 | 0.8227 | -0.0014 |

| 2012 | 0.7867 | 0.0466 | 0.7401 | 0.7827 | 0.0040 |

| 2013 | 0.9898 | 0.4085 | 0.5814 | 0.9899 | -0.0001 |

Conclusion

This study is done with the aim to prove the existence of value relevance increase after full implementation of SAK of IFRS adoption in manufacturing sector companies in Indonesian Stock Exchange. The study result shows that there is no increase of relevance of book value of equity and income toward share rate after IFRS adoption. The analysis shows that the decrease of adjusted R square from the study result occurs between the period before and after the implementation, although in each period there is increase. It means that book value of equity and income decreases its value relevance after IFRS adoption. Justification from this decrease is “alternative information hypothesis” shown by Ponziani (Ponziani) stating that more information available from time to time that will be used more by investors in corporate evaluation. It causes investors move to non-accounting information. However, data of incremental value relevance show that the relevance of income information is stronger that book value in describing share rate.

This study is not separated from limitations. The limitations of this study among others are as the following: The study location and the range of study. Data taken from this study are manufacturing companies, thus, the result of this study needs to be careful if wants to be generalized in other sectors. The second is the range of study. The use of period in this study is limited only two years before and two years after IFRS implementation, so the data less represent only the period of implementation. Therefore, the next study is suggested to add observation years and widen the scope of study area in order to be more comprehensive in drawing conclusion of its value relevance (Balsari & Varan, 2014).

This study has some implications. The first, this study can be guidance that if investors are willing to conduct the second expansion of company, they need other alternative information in their decision making. It is because, especially manufacturing companies, the IFRS implementation cannot give adequate contribution in corporate income increase. Because the relevance of income information is stronger than book value, investors should prioritize income information rather than book value.

References

- Balsari, C.K. & Varan, S. (2014). IFRS implementation and studies in Turkey. Accounting and Management Information Systems, 13(2), 373.

- Barth, M.E., Landsman, W.R., Young, D. & Zhuang, Z. (2014). Relevance of differences between net income based on IFRS and domestic standards for European firms. Journal of Business Finance & Accounting, 41(3-4), 297-327.

- Brüggemann, U., Hitz, J.M. & Sellhorn, T. (2013). Intended and unintended consequences of mandatory IFRS adoption: A review of extant evidence and suggestions for future research. European Accounting Review, 22(1),1-37.

- Callao, S., Jarne, J.I. & Laínez, J.A. (2007). Adoption of IFRS in Spain: Effect on the comparability and relevance of financial reporting. Journal of International Accounting, Auditing and Taxation, 16(2), 148-178.

- Chebaane, S. & Othman, H.B. (2014). The impact of IFRS adoption on value relevance of earnings and book value of equity: The case of emerging markets in African and Asian regions. Procedia-Social and Behavioral Sciences, 145, 70-80.

- Christensen, H.B., Hail, L. & Leuz, C. (2013). Mandatory IFRS reporting and changes in enforcement. Journal of Accounting and Economics, 56(2), 147-177.

- Clarkson, P., Hanna, J.D., Richardson, G.D. & Thompson, R. (2011). The impact of IFRS adoption on the value relevance of book value and earnings. Journal of Contemporary Accounting & Economics, 7(1), 1-17.

- Doukakis, L.C. (2010). The persistence of earnings and earnings components after the adoption of IFRS. Managerial Finance, 36(11), 969-980.

- Garanina, T.A. & Kormiltseva, P.S. (2013). The Effect of International Financial Reporting Standards (IFRS) adoption on the value relevance of financial reporting: A case of Russia. Research in Accounting in Emerging Economies, 13, 27-60.

- Gjerde, Ø., Knivsflå, K. & Saettem, F. (2008). The value-relevance of adopting IFRS: Evidence from 145 NGAAP restatements. Journal of International Accounting, Auditing and Taxation, 17(2), 92-112.

- He, X., Wong, T. & Young, D. (2012). Challenges for implementation of fair value accounting in emerging markets: Evidence from China. Contemporary Accounting Research, 29(2), 538-562.

- Horton, J., Serafeim, G. & Serafeim, I. (2013). Does mandatory IFRS adoption improve the information environment? Contemporary Accounting Research, 30(1), 388-423.

- Hung, M. & Subramanyam, K. (2007). Financial statement effects of adopting international accounting standards: The case of Germany. Review of Accounting Studies, 12(4), 623-657.

- Jermakowicz, E.K. & Gornik, T.S. (2006). Implementing IFRS from the perspective of EU publicly traded companies. Journal of International Accounting, Auditing and Taxation, 15(2), 170-196.

- Kargin, S. (2013). The impact of IFRS on the value relevance of accounting information: Evidence from Turkish firms. International Journal of Economics and Finance, 5(4), 71.

- Kim-Duc, N., Sinh, H., Ngoc, T.D.U. & Cong, N.B.T. (2018). The suitability of proxy levered beta in business valuation: Evidence from vietnam. Asian Economic and Financial Review, 8(2), 248-268.

- Lau, C.M. & Sholihin, M. (2005). Financial and nonfinancial performance measures: How do they affect job satisfaction? The British Accounting Review, 37(4), 389-413.

- Liu, C., O?Farrell, G. & Yao, L. (2010). Net income comparability between EU-IFRS and US-GAAP before Release no. 33-8879: Evidence from fifty US-listed European Union companies.

- Muhammad, K., Sanyah, S., Imran, U.C. & Farhan, A. (2018). An empirical evidence of over reaction hypothesis on karachi stock exchange (KSE). Asian Economic and Financial Review, 8(4), 449-465.

- Paananen, M. (2008). The IFRS adoption's effect on accounting quality in Sweden. Available at SSRN 1097659.

- Qu, W., Fong, M. & Oliver, J. (2012). Does IFRS convergence improve quality of accounting information? Evidence from the Chinese stock market. Corporate Ownership & Control, 9(4), 187-196.

- Silva, F.J. & Couto, G. (2007). Measuring the impact of International Financial Reporting Standards (IFRS) in firm reporting: The case of Portugal. Available at SSRN 969972.

- Wooldridge, J. (2015). Introductory econometrics: A modern approach: Nelson Education.

- Yip, R.W. & Young, D. (2012). Does mandatory IFRS adoption improve information comparability? The Accounting Review, 87(5), 1767-1789.

- Yuliansyah, Y. & Razimi, M.S.A. (2015). Non-financial performance measures and managerial performance: The mediation role of innovation in an Indonesian stock exchange-listed organization. Problems and Perspectives in Management, 13(4), 135-145.

- This article was originally published in a special issue, entitled: ?Islamic Banking and Finance?, Edited by Dr. Muhammad Haseeb