Research Article: 2020 Vol: 19 Issue: 3

The Impact Role of Dynamic Capabilities in Enhancing the Performance of Family Business Quantitative Evidence from the Jordanian Construction Industry Sector

Excimirey A. Al-Manasrah, Al-Balqa Applied University

Abstract

The purpose of this paper is to investigate the impact role of dynamic capabilities throughout its dimensions, absorptive capability, adaptive capability, and innovative capability in enhancing the performance of family businesses in the Jordanian construction industry sector. The study used a quantitative approach by applying a survey data from a purposive sample totaled to 95 useful responses of family businesses selected from the Jordanian Constructions Contractors Association. Simple regression analyses were used to test hypotheses suggested in this paper. Results showed that absorptive capability and innovative capability have positive impact on family business performance, while adaptive capability does not have a significant impact on family business performance.

Keywords

Dynamic Capabilities, Absorptive Capability, Adaptive Capability, Innovative Capability, Family Business, Familiness and Jordan.

Introduction

Family business is the main aspect of ownership and management of the majority of businesses in the world, for example, UK family businesses are estimated represent 65% of all private sector enterprises and in China, family businesses represent 82.7 % of the total non-public enterprises (Wang, 2016), at least 80% of business in Asia, Europe, Latin America and United States are owned and/or controlled by families (Poza, 2013), almost 98% of commercial activities in the Gulf Cooperation Council are family-run (Sonfield et al., 2016). According to Jordanian official figures, around 90% of small and medium-sized businesses are family-owned (The Jordan Times, 2016). Jordan is an Arab country in the Middle East with an area of 89,342 km2 and a population numbering 10 million. Jordan's industrial sector includes mining, manufacturing, construction, and power, the most promising segment of theses sector is construction. The Jordanian construction sector plays an important economic contribution role because it is considered a key driver for other sectors. Despite Arab spring regional turbulence, a decline in remittances, security costs, and increasing food and oil price, Jordan survives and tries to recuperate its economic situation and achieves a GDP growth between 2010 and 2016 around 2.5%. Jordanian government plans for the next ten years to make Jordan a regional center for architectural and engineering in the Middle East (The Economy Policy Council). Most of the construction companies in Jordan are family businesses, adopting a corporate governance to run business is not common in Jordan because of the fear of extra costs of applying corporate governance and family’s relations in Jordan are so solid that oblige founder of business to employ family businesses and pass leadership positions to them (Sonfield et al., 2016), for example, The Nuqul Group one of the largest Jordanian privately owned company stated that the secret ingredient of the group success consists of the values through disciplined corporate governance and a quite collaboration between first and second generation in the family and it seems that this inter-generational exchange has led to an understanding of the importance of talent retention and a clear drive towards innovation (Tharawat Magazine, 2009). Although, family in Arab countries plays an important role in their culture and history and reflects in their social and economic life, rare studies have been conducted on family business in the Arab World, and in particular family business’ dynamic capabilities.

Literature Review

Family Business Performance

Reviewing family business literature found so difficult to offer a specific definition of family business because of its intrinsic diversity, each operational definition focuses on different forms of family’s involvement in the business; ownership, governance, management, and transgenerational succession, these different involvement forms lead to behaviors and outcomes that may differ from nonfamily business (Chrisman et al., 2005). The family involvement in the organization’s governance could play a key role in the exploitation of available resources and capabilities. The diversity of family businesses and their performance make them a subject area worthy of exploration. Familiness construct in this study is grounded in the Resource-Based View (RBV), familiness is an established construct in research on family business and is defined as the unique bundle of resources a particular firm has because of the systems interaction between the family, its individual members and the business (Habbershon & Williams, 1999). The RBV perspective stated that integration between business systems and family business leads to form capabilities very hard to duplicate because of institutionalization of the perceived value of the combined two businesses through family’s vision and intention for transgenerational sustainability (Chrisman et al., 2005). The debate is still open about family business issues combination related to performance. Some studies have sought to explain that high level of familiness can achieved various benefits (Habbershon & Williams, 1999) while other studies argued that familiness can have negative effects and high level of familiness can also be inversely related to the performance of firm (Pearson et al., 2008). Chrisman et al. (2005) concluded that founding family involvement affects the performance of large firms and altruism and entrenchment can have positive and negative effects on family firm performance. Wang (2016) suggested that family businesses are shaped by the environment and they have to continuously renew, configure and recreate their capabilities to adapt market changes. This situation is intrinsically linked to the concept of dynamic capabilities. Pounder (2015) stated that family firm is one where the family owns enough of the equity to be able to exert control over strategy and is involved in a top management position. Generation managing the firm, the extent of ownership control, corporate and business strategy, and industry appear to have some positive or negative influence on performance.

Dynamic Capabilities

An organization’s capability is the leading edge of strategic development by stretching and exploiting the organization’s capability that creates new opportunities difficult for competitors to match (Scholes et al., 2002). RBV reported that internal resources are more important for an organization than external factors in achieving and sustaining competitive advantage and stated that organization performance will primarily be determined by internal resources (David, 2013). Capabilities that are considered as a “special type” of resource which allows the deployment, enhancement of “ordinary assets” and increases their productivity but it seemed that strategic literature distinguishes capabilities from dynamic capabilities defining them as the “firm ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments” (Teece et al., 1997). Wang & Ahmed (2007) claimed that dynamic capabilities consisted of three elements namely absorptive capability, adaptive capability, and innovative capability.

Absorptive Capability

Today an organization’s absorptive capacity (AC) is mostly conceptualized as a dynamic capability and it is grounded in the macroeconomics that viewed it as the ability of an economy to utilize its capital resources effectively. Cohen & Levinthal (1990) are considered who originated the AC’s concept and identify it as a business’ ability to recognize the value of new information, assimilate it and apply it to commercial ends. AC is the ability to absorb external knowledge from the business environment, in other words the firm’s capacity to acquire, assimilate, transform and exploit external knowledge (Zahra & George, 2002). The AC is one of the main determining factors of corporate capacity in businesses, as it can significantly develop the capacity for exploring new opportunities through the creation of new skills and the lowering of cognitive inflexibility of senior management (Zahra et al., 2009). Some researchers have found positive relationships, both direct and indirect between absorptive capacity and organizational performance (Wales et al., 2013). Other researchers stated that absorptive capacity does not have a direct impact on organizational performance, justifying that the simple acquisition and assimilation of external knowledge, without effective transformation and commercialization through specific innovation outputs, cannot lead to concrete financial results (da Costa et al., 2018). Some studies stated that high levels of familiness are positively related to certain dimensions of AC (transformation and utilization) and inferior in other dimensions (acquisition and assimilation), in other words family businesses have the ability to transform and use external knowledge but inferior in acquiring and assimilating external knowledge (Andersen, 2015). Hernandez-Perlines (2018) found that absorptive capacity positively moderates the effect of entrepreneurial orientation on the international performance of family businesses; Kamal & Flanagan (2012) identified some key factors influencing the absorptive capacity of small and medium sized rural construction companies. These factors involved: cost and affordability, availability and supply, demand, infrastructure, policies and regulations, labor readiness, workforce attitude and motivation, communication and source of new knowledge and culture.

Adaptive Capability

Adaptive capability reflects the ability of a firm to identify and capitalize on emerging market opportunities and the ability to align its resources and routines to the changing external market (Alvarez & Merino, 2003). Adaptive capability is an action of responding and reaction focuses on searching balancing between exploration and exploitation strategies through flexible resource modification, application and renewal (Wang & Ahmed, 2007). According to Eshima & Anderson (2017) transition of adaptive capability is related to the firm’s capacity to fulfill the changes in market and product assumptions with firm’s resources. The core component of adaptive capability shapes the development of strategies, as mechanisms for managers that are applied to performance improvement (Wang & Ahmed, 2007). Firms that have ability to adapt to the development process will achieve business success (Clarke et al., 2015). Although the

argument around the high cost of implementing adaptive capability (Mckee et al., 1989), it is justified by the improvement in performance (Bourgeois, 1980). Enablers of dynamic organizational adaption play an essential role particularly significant among family firms who face specific threats to survive or to achieve transgenerational success (Chirico & Salvato 2008), They proposed that knowledge integration among family members will be positively associated with dynamic adaptation of capabilities in family business and those family firms who own high levels of internal social capital and affective commitment to change, and low levels of relationship conflict will be successfully adapt to dynamic markets.

Innovative Capability

Innovative capability is the firm’s competence in engaging in new ideas; novel designs original technologies, and creative processes (Lumpkin & Dess, 1996). “Innovation-oriented familiness” is the influence of the business family on the innovativeness of the family firm and its role ranges from setting the strategic framework for innovation to being directly involved in innovation operations (Weismeier-Sammer 2014). Highly innovative firms have definite increased market share, high product success, greater returns on investment and long-term returns, unlike less innovative firms (Allocca & Kessler, 2006). Innovative capability moderates the relationship between strategic goals and financial performance (Donkor et al., 2018), in other words, high levels of innovative capacity, high levels of strategic goals increase financial performance massively. Fuetsch et al. (2019) paper showed that family firms have been successful innovators over generations share variety of common values and approaches in their innovation behavior. Steeger & Hoffmann (2016) stated that most of the literature found family firms to be less innovative because of risk aversion and longing for preserving socioemotional wealth and they can become more innovative if both willingness and ability conditions are fulfilled and that self-assessment or ownership criteria alone do not necessarily identify innovative behavior in family firms. Although many studies showed that innovation positively affects the success of family firms (Casillas & Moreno, 2010; Craig et al., 2014) the level of innovation variates from older to younger generation of family firms, it is appeared that first generation is more innovative (Block, 2012) and the following generation tends to avoid risk in innovation projects but high-risk tolerance for radical innovation can negatively impact the family firm’s success (Naldi et al., 2007). Park et al. (2019) identified market conditions, technology and regulation as innovation drivers that have positive effects on family firm performance. It is clear that the effect of innovation management on family performance depends on different practices and principles (Fuetsch et al., 2019).

Research Model

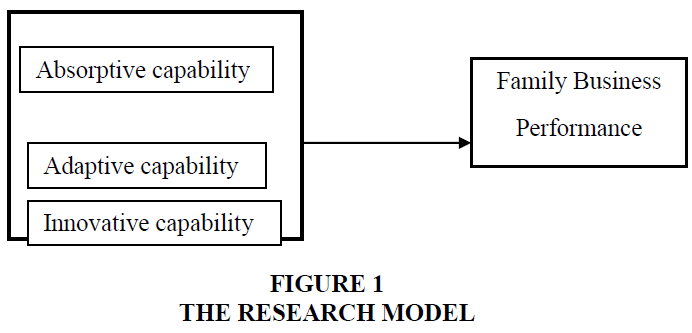

The study adopted the operational definition for the family business as is one in which family members dominate the ownership and management of the company, the researcher developed the research model (Figure 1) based on Wang & Ahmed’s definition (2007) that claimed that dynamic capabilities consisted of three elements namely (absorptive capability, adaptive capability, and innovative capability) because of the clearly decomposed components and the distinctive nature of these elements. Family business performance is measured by the capability of the business to grow in a dynamic environment. So, three hypotheses were developed.

Hypotheses

H1 Absorptive capability positively influences family business performance

H2 Adaptive capability positively influences family business performance

H3 Innovate capability positively influences family business performance

Research Methodology

Sample

A total of 95 family businesses were selected from the Jordanian Constructions Contractors Association because most of the construction companies in the association are family businesses. The study used a purposive sampling technique and distributed survey questionnaires face-face to the executive’s presidents of the companies.

Table 1 presents some of the characteristics of the constructing family businesses in terms of age of business, ownership form, generation control, managerial and partnership structure. In total, 73.7 percent of family businesses indicated that they are in the industry for more than 20 years. Most of the ownership form is partnership 63.1 percent. In terms of generation control, the majority of the family businesses are governed by the first and second generations 68.4 percent. Only 26.3 percent of the businesses are directed by the founder generation. In respect to managerial and ownership structure, it is noticed that the general manager is one of the family members in all the companies and 89.5 percent of the family businesses do not have partners from outside the family.

| Table 1 Family Business Characteristics | ||

| Demographic characteristics | Frequency | Percentage |

| Age of business (years) | ||

| 6-10 years | 10 | 10.5 |

| 11 – 20 years | 15 | 15.8 |

| More than 20 years | 70 | 73.7 |

| Ownership form | ||

| Partnership | 60 | 63.1 |

| Limited Liability Company | 30 | 31.6 |

| Limited Partnership | 5 | 5.3 |

| Generation in control | ||

| 1st generation | 25 | 26.3 |

| 1st + 2nd generation | 65 | 68.4 |

| 2nd generation | 5 | 5.3 |

| Is the general manager one of the family’s member? | ||

| Yes | 95 | 100 |

| No | - | - |

| Does the business have partners from outside the family? | ||

| Yes | 10 | 10.5 |

| No | 85 | 89.5 |

Measures

A survey questionnaire was developed to collect primary data for this study. The survey consisted of two parts, the first part collected data on the characteristics of companies. The second part consisted of 20 questions directly measure study variables. In the questionnaire, the operational definition of “family business” based on (Chrisman et al., 2005) in its simple form in which family business refers to a business that is owned and or managed by a family. All constructs were measured with a multiple item 5-point Likert scales (1=strongly disagree; 5 strongly agree). The independent variables in this study were captured by three constructs, respectively, absorptive capability, adaptive capability and innovate capability (Table 2).

| Table 2 Cronbach’s Reliability Tests | ||||

| Variables | Means | Std. deviation | Alpha | No. of items |

| Absorptive capability | 4.042 | 0.676 | 0.791 | 5 |

| Adaptive capability | 4.136 | 0.782 | 0.862 | 5 |

| Innovative capability | 3.694 | 0.826 | 0.897 | 5 |

| Performance | 3.881 | 0.694 | 0.793 | 7 |

The development of the dynamic constructs was based on Wang & Ahmed’s definition (2007). The absorptive capability construct consisted of items examining whether the family business regularly organizes meetings with external partners and institutions to acquire new expertise and knowledge. Adaptive capability construct was measured by assessing the capability of the business to make modifications in internal processes to respond to market changes. Innovative capability construct was composed of items measured the family role in introducing new products or services better than their competitors. The dependent variable (performance) consisted of items indicated the ability of the family business to grow and achieve family objectives. Cronbach alpha was used to measure the internal consistency reliability of each construct. The reliabilities of this study are acceptable, Cronbach alphas are over 0.80 are good as recommended by Sekaran & Bougie (2016).

Results

Simple Regression analyses were used to test hypotheses suggested in this paper (H1, H2, and H3). For absorptive capability, the results showed (Table 3) that absorptive capability has significant and positive impact on the dependent variable, (t= 2.639, P<0.05). Hence the H1 was supported.

| Table 3 Simple Regression Analysis: The Effect of Absorptive Capability on Performance | |||||||||

| Dependent Variable | Model Summary | ANOVA | Coefficients | ||||||

| R | R2 | Adjusted R2 | F | DF | Sig* | Β | T | Sig* | |

| Performance | 0.264 | 0.070 | 0.060 | 6.966 | 1 93 94 |

0.010 | 0.271 | 2.639 | 0.010 |

For adaptive capability, the simple regression analysis results indicated (Table 4) that adaptive capability was not significantly related to the dependent variable, (t=1.020, P>0.05). So H2 was rejected.

| Table 4 Simple Regression Analysis: The Effect of Adaptive Capability on Performance | |||||||||

| Dependent Variable | Model Summary | ANOVA | Coefficients | ||||||

| R | R2 | Adjusted R2 | F | DF | Sig* | Β | T | Sig* | |

| Performance | 0.105 | 0.011 | 0.000 | 1.041 | 1 93 94 |

0.310 | 0.093 | 1.020 | 0.310 |

Finally, for innovative capability, the simple regression analysis results in (Table 5) indicated that innovative capability significantly influenced the dependent variable (t=4.234, P<0.05). Therefore, H3 was accepted.

| Table 5 Simple Regression Analysis: The Effect of Innovative Capability on Performance | |||||||||

| Dependent Variable | Model Summary | ANOVA | Coefficients | ||||||

| R | R2 | Adjusted R2 | F | DF | Sig* | Β | T | Sig* | |

| Performance | 0.402 | 0.162 | 0.153 | 17.923 | 1 93 94 |

0.00 | 0.338 | 4.234 | 0.00 |

Conclusion

This paper has shed some light on the effects of dynamic capabilities on the family business performance because the construct of dynamic capabilities has received considerable attention in the strategic management research but little research has been devoted to studying dynamic capabilities in family firms especially in Arab world. The importance of the paper stems from the fact that it brings new empirical research in the Arab family businesses to dynamic capabilities issues related with performance utilizing statistical analyses that have been rarely been performed. The findings of the current paper support H1 (Absorptive capability positively influences family business performance), in accordance with some authors who argue that absorptive capacity positively moderates the effect of entrepreneurial orientation on the international performance of family businesses. On the other hand, the effect of the adaptive capability on the family business performance (H2) was not supported. According to Alvarez & Merino (2003) adaptive capability reflects the ability of a firm to align its resources and routines to the changing external market, this view is found not applicable in the Jordanian context of construction sector, this can be explained from family-owned business perspective that view family traditions and their legacy are kept intact and become a habit that directs decision making impeding change. It seemed that family businesses in Jordan do not prefer frequently adjustments in their internal processes and organizational structures to respond to market changes. Finally, H3 (Innovative capability positively influences family business performance), was supported. In accordance with Fuetsch et al. (2019) findings family firms have been successful innovators over generations share variety of common values and approaches in their innovation behavior. Weismeier-Sammer (2014) found that highly innovative firms have definite increased market share, high product success, greater returns on investment and long-term returns, unlike less innovative firms. This view is applicable in the Jordanian construction environment which is characterized by high level of competition and family businesses in this sector are very interested in introducing novelty in the way they executed their projects.

Study Limitations and Future Studies

Although this paper has offered some contributions to the Arab family business literature, it has also limitations, particularly the purposive sampling approach, due to the small size of the sample as it was only applied on the Jordanian construction industry sector. The findings cannot be generalized to all family businesses in the Arab world because Jordan represents only one of the Arab countries among 22 countries in the Middle East. So the researcher recommends more comprehensive studies on dynamic capabilities elements related to family business performance to be conducted in other Arab countries and to treat each element independently of the other elements due to the element’ specificity.

References

- Allocca, M.A. & Kessler, E.H. (2006). Innovation speed in small and medium-sized enterprises. Creativity and Innovation Management, 15 (3), 279-295.

- Alvarez, V.S. & Merino, T.G. (2003). The history of organizational renewal: Evolutionary models of Spanish savings and loans institutions. Organizational Studies, 24 (9), 1437-1461.

- Andersen, J. (2015). The absorptive capacity of family firms. Journal of Family Business Management.

- Block, J.H. (2012). R&D investments in family and founder firms: an agency perspective. Journal of Business Venturing, 27 (2), 248-265.

- Bourgeois, L.J. (1980). Strategy and environment: a conceptual integration. Academy of Management Review, 5(1), 25-39.

- Casillas, J.C., & Moreno, A.M. (2010). The relationship between entrepreneurial orientation and growth: The moderating role of family involvement. Entrepreneurship & Regional Development, 22(3-4), 265-291.

- Chirico, F., & Salvato, C. (2008). Knowledge integration and dynamic organizational adaptation in family firms. Family Business Review, 21(2), 169-181.

- Chrisman, J.J., Chua, J.H., & Sharma, P. (2005). Trends and directions in the development of a strategic management theory of the family firm. Entrepreneurship theory and practice, 29(5), 555-575.

- Clarke, P., O’Connor, R.V., Leavy, B., & Yilmaz, M. (2015). Exploring the relationship between software process adaptive capability and organisational performance. IEEE Transactions on Software Engineering, 41(12), 1169-1183.

- Cohen, W.M., & Levinthal, D.A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 128-152.

- Craig, J.B., Dibrell, C., & Garrett, R. (2014). Examining relationships among family influence, family culture, flexible planning systems, innovativeness and firm performance. Journal of Family Business Strategy, 5(3), 229-238.

- da Costa, J.C.N., Camargo, S.M., Toaldo, A.M.M., & Didonet, S.R. (2018). The role of marketing capabilities, absorptive capacity, and innovation performance. Marketing Intelligence & Planning.

- David, F.R. (2013). Strategic management, concept and cases. London.(GB).

- Donkor, J., Donkor, G.N.A., Kankam-Kwarteng, C., & Aidoo, E. (2018). Innovative capability, strategic goals and financial performance of SMEs in Ghana. Asia Pacific Journal of Innovation and Entrepreneurship.

- Eshima, Y., & Anderson, B.S. (2017). Firm growth, adaptive capability, and entrepreneurial orientation. Strategic Management Journal, 38(3), 770-779.

- Fuetsch, E., Frank, H., Keßler, A., Bachner, C., & Süss-Reyes, J. (2019). Principles for innovation management in family firms: An analysis of long-term successful good practices with a practitioner validation of the principles. Journal of Family Business Management, 9(3), 319-348.

- Habbershon, T.G., & Williams, M.L. (1999). A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12(1), 1-25.

- Hernandez-Perlines, F. (2018). Moderating effect of absorptive capacity on the entrepreneurial orientation of international performance of family businesses. Journal of Family Business Management.

- Kamal, E.M., & Flanagan, R. (2012). Understanding absorptive capacity in Malaysian small and medium sized (SME) construction companies. Journal of Engineering, Design and Technology.

- Lumpkin, G.T., & Dess, G.G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. Academy of Management Review, 21(1), 135-172.

- McKee, D.O., Varadarajan, P.R., & Pride, W.M. (1989). Strategic adaptability and firm performance: a market-contingent perspective. Journal of Marketing, 53(3), 21-35.

- Naldi, L., Nordqvist, M., Sjöberg, K., & Wiklund, J. (2007). Entrepreneurial orientation, risk taking, and performance in family firms. Family Business Review, 20(1), 33-47.

- Park, H.Y., Misra, K., Reddy, S., & Jaber, K. (2019). Family firms’ innovation drivers and performance: a dynamic capabilities approach. Journal of Family Business Management.

- Pearson, A.W., Carr, J.C., & Shaw, J.C. (2008). Toward a theory of familiness: A social capital perspective. Entrepreneurship Theory and Practice, 32(6), 949-969.

- Pounder, P. (2015). Family business insights: an overview of the literature. Journal of Family Business Management.

- Poza, E.J. (2013). Family business. Cengage Learning.

- Scholes, K., Johnson, G., & Whittington, R. (2002). Exploring corporate strategy. Financial Times Prentice Hall.

- Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach. John Wiley & Sons.

- Sonfield, M.C., Lussier, R.N., & Fahed-Sreih, J. (2016). American versus Arab/Islamic family businesses. Journal of Entrepreneurship in Emerging Economies.

- Steeger, J.H., & Hoffmann, M. (2016). Innovation and family firms: ability and willingness and German SMEs. Journal of Family Business Management.

- Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic management journal, 18(7), 509-533.

- Tharawat Magazine. (2009). Meet Jordan’s Largest Family Business, The Nuqul Group, Issue 4. Retrieved from https://www.tharawat-magazine.com/family-business-winning-strategies/family-bus-profile-nuqul-group-jordan/

- The Economy Policy Council. (n.d.) Jordan economic growth plan 2018-2022. Retrieved from http://extwprlegs1.fao.org/docs/pdf/jor170691.pdf

- The Jordan Times (2016). Family-owned firms eyed for Amman Bourses listing.

- Wales, W.J., Parida, V., & Patel, P.C. (2013). Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strategic Management Journal, 34(5), 622-633.

- Wang, C.L., & Ahmed, P.K. (2007). Dynamic capabilities: A review and research agenda. International Journal of Management Reviews, 9(1), 31-51.

- Wang, Y. (2016a). Environmental dynamism, trust and dynamic capabilities of family businesses. International Journal of Entrepreneurial Behavior & Research.

- Wang, Y. (2016b). Investigating dynamic capabilities of family businesses in China: A social capital perspective. Journal of Small Business and Enterprise Development.

- Weismeier-Sammer, D. (2014). The role of familiness for family business innovativeness. International Journal of Entrepreneurial Venturing, 6(2), 101-117.

- Zahra, S.A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185-203.

- Zahra, S.A., Filatotchev, I., & Wright, M. (2009). How do threshold firms sustain corporate entrepreneurship? The role of boards and absorptive capacity. Journal of Business Venturing, 24(3), 248-260.