Research Article: 2021 Vol: 27 Issue: 5S

The Impact of Traditional and Digital Financial Inclusion on Market Lending: Evidence from Panel Data Estimation

Eatessam Al-shakrchy, Dijlah University College

Walaa Ismael Alnassar, University of Baghdad, College of Administration & Economics

Abstract

Centering on “marketplace lending”, as an essential measure of fintech credit, this research use data for 143 countries from 2013 to 2017 to analysis the effect of “financial inclusion, financial development” and its components on fintech credit relying on the analytical research methodology of Static panel data regression by applying STATA software as the statistical analysis tool. Marketplace lending to consumers develops in countries where financial depth decreases highlighting the role of fintech credit in satisfying the credit gap by traditional lenders. The finding, as projected, reveals the significant effect of “Traditional financial inclusion, Digital financial inclusion, Boone indicator, Financial stability, Financial development” on “marketplace lending”. This implies that endorsing and improving financial inclusion and financial development by government can donate to higher rate of marketplace lending (fintech credit).

Keywords

Static Panel-Data Regression, Digital Credit, Traditional Financial Inclusion, Fintech Financial Inclusion, Boone Indicator, Financial Development, Financial Depth, Financial Access, Financial Efficiency, Financial Stability, Marketplace Lending

Introduction

Restricted access to credit is a significant obstacle for Small and Medium-Sized Enterprises (SMEs) and consumers in many economies, with possibly noteworthy macroeconomic effects. Studies reveal that “financial development such as depth, access and efficiency” is principal for boosting economic growth and reducing inequality. Though, the “International Finance Corporation” assessed that 41% of SMEs in the formal segment in developing economies have unmet financing requirements. Obstacles to credit access is additionally prevalent in the consumer part. Based on the World Bank, around 60% of adults in developing economies do not employ any official financial services (Bazarbash & Beaton, 2020).

“Smaller borrowers’ access” to credit is restricted by a number of different obstacles. At one of the key reasons, credit restrictions can source from absence of “physical access” to bank branches. More complicated obstacles may reveal potential borrowers’ absence of credit history and documentation, specifically where credit registries or bureaus are not available and authorized protection for creditors are inadequate or weak. In such conditions, traditional creditors and lenders frequently rely on collateral to direct credit risk, but weak collateral “registry system" or lack of a legal framework that permits use of portable collateral may be other constraining factors. All these obstacles can decrease “credit access” and lead to the relative abnormal cost of finance confronted by borrowers with inadequate credit histories (Bazarbash & Beaton, 2020).

In contemporary years, “digital credit” developed in various forms and holds capacity for escalating access to credit by overcoming some of these obstacles. Methods that apply modern technology to computerize at least some feature of the “credit extension process”. Fintech credit can be employed highly – named “marketplace lending” - where a digital stage is established that straight forwardly links borrowers to lenders. Another type of “digital credit” advanced throughout non-finance corporations with a analytical situation in the supply loop that permits them to handle “borrowers digital footprints” including mobile and telecom payment corporations such as “Safaricom” or e-commerce stages such as “Amazon” and apply that evidence for measuring “credit risk” and classifying possiblecredit requirement (Bazarbash & Beaton, 2020).

A rising literature concentrated on numerous properties of “fintech lending” applying microdata (Berg, Burg, Gombović & Puri, 2020; De Roure, Pelizzon & Tasca, 2016; Freedman & Jin, 2017; Havrylchyk, Mariotto, Rahim & Verdier, 2019; Jagtiani & Lemieux, 2017; Zhang et al., 2016). Though, limited cross-country researches exist as there is a lack of data availability (key reason).

In this research, I study the “marketplace lending component of fintech financing” that is the common space of any financing pursuit that leverage novel technology to releases equity or debt. “Marketplace lending” includes lending where financing is partially or totally open to retail stakeholders. As funding is completely open to public and the framework links borrowers to a collection of lenders, the framework called “peer-to-peer (P2P) lending”. If plus being accessible to public investors, the framework applies its own finances in “lending to borrowers”, this is titled “balance sheet lending”. For the particular aim of lending against “account receivables of business borrowers”, the term “invoice trading” is frequently used. My sample includes“P2P lending and balance sheet lending (for both consumer and business borrowers) and invoice trading”. This research does not assess “Big tech lending”, digital lending by mobile and by banks platforms as none of them are accessible to the public (Bazarbash & Beaton, 2020). This paper makes numerous contributions to the literature of fintech. I use data gathered by the “Cambridge Center for Alternative Finance (CCAF)” for 143 countries from 2013 to 2017 for digital credit intermediated. The CCAF database is presently the only international dataset with a rational stability and analysis of complementary financing. First, I conduct the most detail and needed steps of Static panel-data regression analysis to assess the impact of financial inclusion, financial development and its component (including financial depth, financial efficiency and financial access), financial stability on fintech credit as an indicator of marketplace lending activity. There are few studies that consider all of abovementioned factors in one analysis and most of them ignore the fundamental diagnostic Panel data tests to detect the most optimal method between Pooled OLS, Fixed effect and Random effect models. However, this study applies F-test, Breusch and Pagan Lagrangian multiplier (BP-LM) test and Hausman test among those three Panel-data methods to find the best method for running regression. Second, this study investigates all fundamental diagnostic test of regression assumptions (including heteroscedasticity test, auto-correlation test and residual normality test) which have been ignore previously in this area. Third, I examine the role of degree of competition of financial institution and financial market (by considering Boone indicator calculated as the elasticity of profits to marginal costs), “Stability of financial institution and financial market” and return on equity (ROE) measure in explaining cross-country differences in marketplace lending activity. Finally, this sample of this study consist of highest number of countries (143 countries) in comparing with previous researches in this scope.

The rest of this research is ordered as follows. Section 2concisely argues the prior literature on market lending and financial inclusion. The data collection and methodology are provided in Section 3. Sections 4 shows empirical outcomes followed by discussion and conclusions in Section 5.

Literature Review

In the recent years, “financial technologies (fintech)” have developed in every keyarea of the world both “Emerging Market and Developing Economies (EMDEs)” and advanced economies. However, the scale of fintech adoption varies noticeably in applying a new application, process or product. As fintech accomplishments are mostly small in comparing with the overall financial structure, there are some countries where “fintech” is developing to an economically significant level. Also, as “fintech” is a niche endeavor limited to exclusive businesses in some economies, in others it is expanding to the majority of “financial services”. Hence, it is not clear that if it happens because of political boundaries or economic development (Frost, 2020).

“Fintech adoption” has been greater in economies where “financial services” are relatively more pricy, or there is less rivalry between providers. Philippon (2016) states the comparatively stable and high “unit cost” of finance in the United States, and the fintech possibility lead to deliver vaster efficiency. Financial facilities have been fairly costly historically, even though the “arrival of computers, electronic trading in financial markets”, and other novelties improve its conditions. As of the year 2002, the expenditures started to decrease. Latest survey result recommends that rivalry from big tech and fintech companies are leading executives to present novel products. How and whether this competition may affect the aggregate statistics on the expense of finance is ambiguous (Frost, 2020).

On the other hand, three essential changes have affected the improvement of fintech: “massive data generation, advances in computer algorithms, and increases in processing power”. These are accelerated by “high-speed broadband internet, cloud computing, and artificial intelligence” which have empowered big-data analytics, biometric identification and block chain technology (Sahay et al., 2020).

“Fintech” is altering the technique financial services are conveyed to low-income households and small businesses. Conventionally, financial services are provided by “microfinance institutions, banks and their agents, and informal systems (for instance relying on relatives, micro lending clubs, or money lenders)”, with frequently restricted competition. They are principally built on “cash transactions and face-to-face interactions with the financial service provider”. Those exchanges are the foundation for gauging creditworthiness; they are correspondingly the method consumer become financially well-informed. The development of fintech is altering this panorama: with the rising of digital finance instruments that are reachable from computers or mobile phone, the requirement for “face-to-face interactions” is significantly decreases (Sahay et al., 2020).

The worldwide attention has urged data compilation and investigation on “financial inclusion” on a cross-country foundation. The primary literature mainly depend on survey effort in particular economies, or on particular measures of “financial inclusion” like: “the number of bank branches and ATM and bank accounts per capita” (Beck, Demirguc-Kunt & Peria, 2005; Honohan, 2008). The introduction of databases like“the IMF’s Financial Access Survey (FAS) and the World Bank’s Global Findex database”(Demirguc-Kunt & Klapper, 2012) provides the enhancement and applying of further multidimensional, multifactorial measures of “financial inclusion”, considering diverse aspects of usage and access by firms and household as discussed by (Dabla-Norris et al., 2015; Massara & Mialou, 2014) and (Cámara & Tuesta, 2014). This showed the means for examining the macroeconomic effects (E. Dabla-Norris, Ji, Townsend & Unsal, 2020; Loukoianova et al., 2018; Sahay et al., 2015a; Sahay et al., 2015b; Svirydzenka, 2016) and factors of “financial inclusion”(Deléchat, Newiak, Xu, Yang & Aslan, 2018; Rojas-Suárez, 2016; Rojas-Suarez & Amado, 2014; Sahay et al., 2020).

The practical literature on “digital financial inclusion” is emerging and commonly concentrates on particular economies or regions. It consists of effort on the expansion of “mobile money in Kenya” (Jack & Suri, 2011), in addition to assessing of “regional developments in fintech activities” (Berkmen et al., 2019), on the Caribbean and Latin America; (Davidovic, Loukoianova, Sullivan & Tourpe, 2019), on Pacific-Islands; and (Lukonga, 2018; Blancher et al., 2019), on Central Asia and Middle East. “Heterogeneity” in the implementation of mobile currency across sections and economies are commonlydescribed by levels of per capital income. GDP growth, rule of law and the regulatory environment (Gutierrez & Singh, 2013). The essential role of a lead company, like the “Ant Financial Services Group” in China, is also documented (Hau, Huang, Shan & Sheng, 2018b). Some researches investigate the effect of the internet and mobile currency (Jahan, De, Jamaludin, Sodsriwiboon & Sullivan, 2019) and the factors of mobile currency adoption(Lashitew, van Tulder & Liasse, 2019).

There is increasing evidence that “fintech” has amplified credit access for mainly small borrowers both in emerging and advanced countries. In advanced countries such as the United Kingdom and the United States, where credit from “traditional lenders” is classically extensive, at least some of the debtors from “P2P lending platforms” had formerly been rejected by bank before referring to fintech credit (Baeck, Collins & Zhang, 2014; De Roure et al., 2016). Jagtiani & Lemieux (2017) reveal that customer lending from “Lending Club”, a sizeable “US-based P2P lending platform”, has accessed areas with a decreasing trend in the number of branches of banks and regions with a more focused banking activity. They show that credit recording by “Lending Club” comprised more info compared to the “standard FICO score” which is an index of “credit risk of small borrowers” generally applied by bank sector in the United States. The greater credit scoring is exposed to output in lesser interest rates for debtors from the platform in comparing with similar debtors from conventional banks. Hau, Huang, Shan, and Sheng (2018a) utilized data from “Alibaba’s ecommerce platform” and express that “fintech credit” may overcome credit conflicts like geographical obstacles. More lately, Havrylchyk, et al., (2019)utilized Prosper data, “a giant US-based P2P lending platform”, and “Lending Club” to analyze key factors of “P2P lending” to customers in the United States. They concluded that “P2P credit” complemented the unmet demand of credit that ascended as banks activities were reducing as an outcome of the worldwide financial crisis. Though, in contrary with Jagtiani & Lemieux (2017), they reveal that greater bank focuses negatively impact expansion and entry of “P2P lending” (Bazarbash & Beaton, 2020). concerning this aspect, Tang (2019) delivers a theoretical analysis and practically assess whether “fintech credit” can be alternative or complement for “bank lending” by providing service to lower-quality borrowers. Heutilized the regulatory contraction of endorsing standards by banks sector in the year 2010 to reveal that as“P2P lending” complement “bank lending” and thus increases credit access for small loan and borrowers respectively, it races with banks in catching high-quality debtors at similar standings.

Another element of literature in “fintech credit” targets at describing cross-country changes in expansion of “digital credit”. Claessens, Frost, Turner & Zhu (2018) and also Rau (2020) utilize CCAF data to clarify cross-country changes in crowd funding. Claessens, et al., (2018) showed that “marketplace lending per capita” is greater in economies with greater “income per capita”. Furthermore, they showed that “fintech credit per capita” is higher in economies where banking activity principles are more flexible, and the banking activity has lower competitive rate. Rau (2020) explained that “aggregate marketplace finance” activity (consists of “equity financing, donation and rewards and credit”) is directly linked with “income per capita, financial depth, profitability of banks, concentration in banking, depth of credit information, and quality of regulation”.

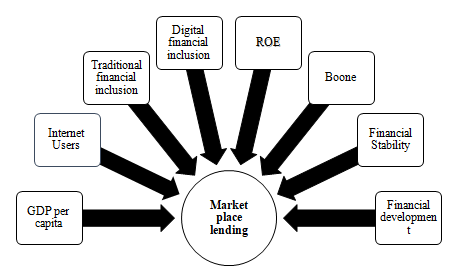

Based on the above-mentioned literature, during the last few decades, quite a considerable number of studies have been conducted in examining the impact of some financial and economic measures on marketplace lending and credit. However, to the best of author knowledge, there are no comprehensive global studies on fintech and financial inclusion, revealing the role of degree of competition of financial sectors, “Stability of financial institution and financial market” and ROE and considering all regression assumption and panel data key analysis steps. Therefore, this study uses the “Static Panel-data method” to fill the abovementioned lacks in fintech credit market analysis. Based on the abovementioned gap, this study posits these eight hypotheses:

Hypothesis:

H1: There is significant relation between GDP per capita and Market place lending in international scope.

H2: There is significant relation between Internet users and Market place lendingin international scope.

H3: There is significant relation between Traditional financial inclusion and Market place lending in international scope.

H4: There is significant relation between Digital financial inclusion and Market place lending in international scope.

H5: There is significant relation between Return on equity (ROE) and Market place lending in international scope.

H6: There is significant relation between Boone Indicator and Market place lending in international scope.

H7: There is significant relation between Financial stability and Market place lending in international scope.

H8: There is significant relation between Financial development (and its components including: Financial depth, financial access and financialefficiency) and Market place lending in international scope.

According to what has been mentioned so far, the proposed framework is presented in Figure 1 as follow:

Data and Methodology

The objective of this research is to evaluate the equilibrium relationships between “fintech credit index (as a measurement of Market place lending) and abovementioned independent variables including GDP per capita, Internet users, Traditional financial inclusion, Digital financial inclusion, Return on equity (ROE), Boone indicator, Financial stability and financial development index (considering financial depth, financial efficiency and financial access)in international scope including high-income, upper middle income, lower middle income and low-income economies.

Generally, to achieve the objectives of this study all the variables are collected from the Cambridge Center for Alternative Finance (CCAF), World Bank Global Financial Development Database, World Bank International Telecommunication Union data, World Bank Development Indicator database and International monetary fund (IMF) database of 143 countries for period of 2013 till 2017 (latest available period for required data of the study) (Table 1).

| Table 1 Variables Details |

||

|---|---|---|

| Variables | Proxy | Sources |

| Total Fintech Credit | TFintechCredit | CCAF |

| Consumer Fintech Credit | ConsumerFintechCredit | CCAF |

| Business Fintech Credit | BusinessFintechCredit | CCAF |

| GDP ppp per capita | GDPpercapita | World Bank Development Indicator database |

| Internet Users (% of population) | NetUser | World Bank, International Telecommunication Union. |

| Traditional Financial Inclusion | TradfinInclusionit | Sahay and others (2020) |

| Fintech Financial Inclusion | FintechInclusion | Sahay and others (2020) |

| Average Return on Bank Asset | ROA | World Bank, Global Financial Development Database |

| Average Return on Bank Equity | ROE | World Bank, Global Financial Development Database |

| Boone Indicator | Boone | World Bank Development Indicator database |

| Financial Stability | FinStability | World Bank, Global Financial Development Database |

| Bank Concentration (%) | BankConcentration | World Bank, Global Financial Development Database |

| Depth of credit information index (0=low to 8=high) | CreditDepth | World Bank, Global Financial Development Database |

| Financial Development Index | FinDev | Sahay and others (2015) |

| Financial Depth | FinDepth | Sahay and others (2015) |

| Financial Efficiency | FinEfficiency | Sahay and others (2015) |

| Financial Access | FinAccess | Sahay and others (2015) |

| Low-Income Countries Indicator (Dummy variable) | LIC | IMF |

| Advanced (high-income) Economies Indicator (Dummy variable) | AE | IMF |

To examine the equilibrium relationship between marketplace lending and its independent variables in four equation, I use static panel data regression analysis.

Main equation 1:

TFintechCreditit=β0+β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROEit+β6Booneit+β7FinStabilityit+β8FinDevit+εi

In order to assess that if the financial development has different impact across countries with different degrees of economic development, in 2nd equation I interact the financial development index with economic development indicator, which Iuse binary dummy variables for Advanced Economies (AE) and Low-Income Countries (LIC), while treating developing and emerging economies as the baseline category.

Main equation 2:

TFintechCreditit=β0+β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROEit+β6Booneit+β7FinStabilityit+β8FinDevit+β9FinDevit*LIC+β10FinDevit*AE +εi

In 3rd equation, the components of financial development (including financial depth, financial efficiency and financial access) are placed instead of the financial development main indicator.

Main equation 3:

TFintechCreditit=β0+β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROEit+β6Booneit+β7FinStabilityit+β8FinDepthit+β9FinEfficiencyit+β10FinAccessit+εi

Finally, in 4th equation which is the extended version of the 3rd equation, the interaction between each three components of financial development and economic development indicator (including AE and LIC) are added.

Main equation 4:

TFintechCreditit=β0+β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROEit+β6Booneit+β7FinStabilityit+β8FinDepthit+β9FinDepthit*LIC+β10FinDepthit*AE+β11FinEfficiencyit+β12FinEfficiencyit*LIC+β13FinEfficiencyit*AE +β14FinAccessit+β15FinAccessit*LIC+β16FinAccessit*AE+εit

In all of four equations: β0 denote intercepts; from β1 to β16 are the coefficients of independent variables; and εit represent the error terms.

Findings and Discussion

In this section, I estimate the impact of GDP per capita, Internet users, Traditional financial inclusion, Digital financial inclusion, ROE, Boone Indicator, Financial stability, Financial development (and its components including: Financial depth, financial access and financial efficiency) on Fintech credit (Market place lending). Also, robust equation will be assessed to confirm the outcome of main equation of this study.

This research tests all four equations for no autocorrelation issue, no heteroscedasticity issue and normality of residual and their outcomes are provided in table 2. This table illustrates the result Breusch- Pagan test for detecting heteroscedasticity issue of four equation. In the result of heteroscedasticity test, probability of Chi-square for all four equation 1 and 2are insignificant, so the null hypothesis of homoscedasticity (not heteroscedasticity) effect is not rejected. Hence, these four models do not have the issue of heteroscedasticity.

In the next step, to detect autocorrelation issue, the study applied Breusch-Godfrey LM method with the null hypothesis of no autocorrelation and alternative of existing autocorrelation. Based on the result of LM test in table 2, the probability value for all equations is significant which implies that the null hypothesis of no autocorrelation is rejected. So, there is issue of autocorrelation in these equations. As a remedy to this issue, the study will apply “WHITE ROBUST standard error” method.

Finally, the main model is diagnosed for the normality of residuals. This research used the Doornik-Hansen test toassess the normal distribution of residuals. If the P-value of Doornik-Hansen test is significant, the distribution of residuals is not normal and otherwise it is normally distributed (Gujarati, 2003). According to the outcome of normality testing in table 2, the significant P-value leads to reject null hypothesis of normal distribution of residuals. Although, non-normally of residuals does not result in biased estimate of regression coefficients for large samples based on prior studies (Hayes, 2013). Similarly, Gujarati (2012) states that “If we are dealing with a small, or finite, sample size, say data of less than 100 observations, the normality assumption assumes a critical role” and does not really matter in large samples (Fields, 2012). Therefore, given that this study performs regression analysis based on a sample size more than 100 (between 605 to 694 observations), the normality assumption is unlikely to be a problem (Table 2).

| Table 2 Diagnostics Tests |

||||

|---|---|---|---|---|

| Breusch-Pagan test for Heteroskedasticity: | ||||

| Eq1 | Eq2 | Eq3 | Eq4 | |

| Chi-Square | 2.28 | 0.39 | 0.00 | 0.09 |

| Prob | 0.13 | 0.53 | 0.97 | 0.76 |

| Breusch-Godfrey LM test for Autocorrelation: | ||||

| Eq1 | Eq2 | Eq3 | Eq4 | |

| Chi-Square | 333.11 | 401.50 | 453.43 | 260.48 |

| Prob | 0.00 | 0.00 | 0.00 | 0.00 |

| Doornik-Hansen test for Normality of Residuals | ||||

| Eq1 | Eq2 | Eq3 | Eq4 | |

| Chi-Square | 50.72 | 92.39 | 33.45 | 24.01 |

| Prob | 0.00 | 0.00 | 0.00 | 0.00 |

Since all equations are Panel data, three compulsory tests for Panel data analysis should be applied to select between Pooled OLS, Fixed effect and Random effect. Those tests are F-test (between Pooled OLS and Fixed effect (FE)), Breusch-pagan test (between Pooled OLS and Random Effect (RE)), and Hausman test (between RE and FE).

Table 3 demonstrate the outcome of these three tests for all four equations. As the outcome of F-test shows, null hypothesis rejected and alternative hypothesis which is fixed effect is accepted for all four equations. Then, the result of Breusch-Pagan test shows that the null hypothesis is rejected too and implies the acceptance of random effect for all four equations. So, the Hausman test will clarify the final selection. Finally, for the case of equation 2nd, 3rd and 4th, the result of Hausman shows the null hypothesis should be rejected and the alternative hypothesis which is the FE should be accepted. Just for the case of 1st equation, since the result of Hausman test is not significant, the RE method should be applied. Ultimately, it reveals that the most appropriate method for the second,third and fourth equations is FE and for the first equation is RE panel method.

| Table 3 F-Test, BP-LM and Hausman Tests |

|||

|---|---|---|---|

| Tests | Statistic | Prob. | |

| Eq1 | F-test | 339.34 | 0.00 |

| BP-LM test | 1262.78 | 0.00 | |

| Hausman test (Chi-Square). | 9.39 | 0.31 | |

| Eq2 | F-test | 310.99 | 0.00 |

| BP-LM test | 1268.56 | 0.00 | |

| Hausman test (Chi-Square). | 156.52 | 0.00 | |

| Eq3 | F-test | 312.32 | 0.00 |

| BP-LM test | 1076.30 | 0.00 | |

| Hausman test (Chi-Square). | 139.62 | 0.00 | |

| Eq4 | F-test | 284.93 | 0.00 |

| BP-LM test | 1060.67 | 0.00 | |

| Hausman test (Chi-Square). | 154.49 | 0.00 | |

Table 4 illustrates the final outcome of all four equations. In other words, it shows the impact of independent variables of this study on dependent variable. It is important to mentioned that to solve the issue of autocorrelation in this model, WHITE ROBUST standard error is applied for all four equations.

The result of 1st equation indicates that “tradition financial inclusion”, “fintech financial inclusion”, “Boone indicator” and “financial stability” have significant and positive on “total fintech credit” with 5%, 1%, 5% and 5% significance level correspondingly while others are not significant. It implies if these four independent variables increase, it leads to increase total fintech credit.

The outcome of 2nd equation indicates that “fintech financial inclusion”, “Boone indicator”, and “financial development” have significant and positive on “total fintech credit” with 5%, 10% and 1% significance level while “multiplying financial development by LIC” has negative significant impact at 1%correspondingly. It implies if the first three independent variables increase, it leads to increase total fintech credit but “multiplying financial development by LIC”, which shows the dummy impact of low-income economies, lead to decrease fintech credit.

The output of 3rd equation reveals that “fintech financial inclusion”, “Boone indicator”, and “financial efficiency (one component of financial development)” have significant and positive on “total fintech credit” with 5%, 1% and 1% significance level respectively while others are insignificant. It implies if these three variables increase, it leads to increase total fintech credit.

Finally, the result of 4th equation shows that “fintech financial inclusion”, “Boone indicator”, “financial efficiency (one component of financial development)”, “financial access (the other component of financial development)” and “multiplying effect of financial depth (component of financial development) by LIC” have significant and positive on “total fintech credit” with 1%, 10%, 1%, 5% and 5% significance level accordingly. It suggests that if these variables increase, it leads to increase total fintech credit but. It should be noted that the finding of these equations supported 3rd (Traditional financial inclusion), 4th (Digital financial inclusion), 6th (Boone indicator), 7th (Financial stability) and 8th (Financial development) hypotheses (Table 4).

| Table 4 Panel Data outcomes of Four Equations (Dv: Tfintech Credit) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Eq. (1) RE | Eq.(2) FE | Eq.(3) FE | Eq.(4) FE | |||||

| GDPpercapita | 0.000009 | -0.00003 | -0.00003 | 0.00001 | ||||

| 0.000030 | 0.00003 | 0.00002 | 0.00003 | |||||

| Netusers | 0.00123 | 0.00183 | -0.00623 | 0.00421 | ||||

| 0.0118 | 0.0272 | 0.0306 | 0.0202 | |||||

| Tradfininclusion | 0.0537 | ** | 0.0185811000 | 0.0153 | 0.0195 | |||

| 0.0211 | 0.0224 | 0.0182 | 0.0172 | |||||

| Fintechfininclusion | 0.0302 | *** | 0.0194 | ** | 0.01454 | ** | 0.01737 | *** |

| 0.0103 | 0.0088 | 0.0065 | 0.0059 | |||||

| ROE | -0.0041 | -0.0023 | -0.0106 | -0.0069 | ||||

| 0.0102 | 0.0082 | 0.0083 | 0.0073 | |||||

| Boone | 0.0810 | ** | 0.0235 | * | 0.0317 | *** | 0.0270 | * |

| 0.0323 | 0.0139 | 0.0114 | 0.0149 | |||||

| Finstability | 0.0756 | ** | 0.0635 | 0.0201 | -0.0012 | |||

| 0.0377 | 0.0524 | 0.0379 | 0.0375 | |||||

| Findev | 0.002301 | 0.011209 | *** | |||||

| 0.0065 | 0.0025 | |||||||

| Findev*LIC | -0.0115 | *** | ||||||

| 0.0026 | ||||||||

| Findev*AE | 0.0185 | |||||||

| 0.0289 | ||||||||

| Findepth | -0.0005 | -0.0005 | ||||||

| 0.0005 | 0.0004 | |||||||

| Finefficiency | 0.0759 | *** | 0.0814 | *** | ||||

| 0.0238 | 0.0254 | |||||||

| Finaccess | 0.0176 | 0.1236 | ** | |||||

| 0.0162 | 0.0519 | |||||||

| Findepth*LIC | 0.0086 | ** | ||||||

| 0.0038 | ||||||||

| Findepth*AE | 0.0271 | |||||||

| 0.0187 | ||||||||

| Finefficiency*LIC | -0.0427 | |||||||

| 0.0370 | ||||||||

| Finefficiency*AE | -0.0381 | |||||||

| 0.0657 | ||||||||

| Finaccess*LIC | 0.0431 | |||||||

| 0.0491 | ||||||||

| Finaccess*AE | -0.1216 | |||||||

| 0.0798 | ||||||||

| Constant | 40.7594 | *** | 43.0330 | *** | 45.1989 | *** | 40.7177 | *** |

| 1.530101 | 1.992843 | 2.051472 | 2.144558 | |||||

| Wald Chi2/F-test | 40.12 | 62.44 | 7.07 | 5.33 | ||||

| Prob>Chi2 | 0.000 | 0.000 | 0.000 | 0.000 | ||||

In order to double confirm the outcome of this study, the three robust equations have been investigated. In the first robust equation, “ROE, Boone and financial stability” are replaced with “Return on asset (ROA), Bank concentration and Credit depth” as dependent variables. Following that, in second and third equations, “Total fintech credit” is replaced with “consumer fintech credit” and “business fintech credit” as dependent variables respectively.

Robust equation1:

TFintech Creditit=β0 +β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROAit+β6BankConcentrationit+β7CreditDepthit+β8FinDevit +εi

Robust equation2:

Consumer Fintech Creditit=β0+β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROEit+β6Booneit+β7FinStabilityit+β8FinDevit+εi

Robust equation3:

Business Fintech Creditit=β0+β1GDPpercapitait+β2NetUserit+β3TradfinInclusionit+β4FintechInclusionit+β5ROEit+β6Booneit+β7FinStabilityit+β8FinDevit+β9FinDevit*LIC+β10FinDevit*AE+εi

According to Table 5, similar to key findings off our main equations, the result of these three robust models approved the significant positive impact of “traditional financial inclusion”, “digital financial inclusion”, “Boone indicator” and “Financial development” on “fintech credit”.

| Table 5 Regression Outcomes of Robust Models |

|||||||

|---|---|---|---|---|---|---|---|

| DV: T Fintech Credit | DV: Consumer Fintech Credit | DV: Business Fintech Credit | |||||

| Eq.(1) | Eq.(2) | Eq.(3) | |||||

| GDPpercapita | 0.000057 | 0.00010 | *** | 0.00001 | |||

| 0.000028 | 0.00002 | 0.00001 | |||||

| Netusers | 0.32998 | *** | 0.17456 | 0.05052 | *** | ||

| 0.0280 | 0.0199 | 0.0137 | |||||

| Tradfininclusion | -0.2020 | *** | -0.2536675000 | *** | 0.0469 | *** | |

| 0.0391 | 0.0264 | 0.0182 | |||||

| Fintechfininclusion | 0.1287 | *** | 0.0674 | ** | 0.09373 | *** | |

| 0.0439425 | 0.0312151 | 0.0214315 | |||||

| ROE | 0.119475 | *** | 0.0204534 | ||||

| 0.026063 | 0.0178942 | ||||||

| ROA | 0.5699416 | ** | |||||

| 0.2490103 | |||||||

| Boone | 0.4366423 | *** | 0.044388 | *** | |||

| 0.0234132 | 0.0160749 | ||||||

| Bankconcentration | -0.0594414 | ** | |||||

| 0.0242691 | |||||||

| Finstability | 0.0134574 | 0.0249731 | |||||

| 0.0339236 | 0.0232911 | ||||||

| Creditdepth | 0.6340437 | *** | |||||

| 0.1836131 | |||||||

| Findev | 0.084593 | *** | 0.051590 | *** | -0.0083 | ||

| 0.0132 | 0.0089 | 0.0061 | |||||

| Constant | 27.8118 | *** | 27.5205 | *** | 4.9525 | *** | |

| 1.915861 | 0.9982038 | 0.6853426 | |||||

| Observations | 670 | 697 | 697 | ||||

| Wald Chi2/F-test | 114.03 | 145.93 | 73.02 | ||||

| Prob>Chi2 | 0.000 | 0.000 | 0.000 | ||||

Conclusion

Fintech developed in the previous decade as a encouraging way to develop financial services delivery. This shaped hope for “low-income and developing” countries to benefit from the fintech prospect to fulfill long-lasting gaps in their financial aspects. I used data of143countries from 2013 to 2017 to show how “marketplace lending (fintech credit)”has developed through different economies and regions.

In the analytical section of the study, applied static panel-data regression model to assess underlying factors of marketplace lending. The findings of this study provide empirical evidence on how key economic and financial factors affect marketplace lending in context of low-income, developing, emerging economies and high-income countries. It confirmed the significance and positive relationship between Traditional financial inclusion, Digital financial inclusion, Boone indicator, Financial stability, Financial development (financial depth, financial efficiency and financial access) and fintech credit (marketplace lending). Moreover, the outcomes of this research provide explanations on further understanding the relationship between financial development, financial inclusion and marketplace lending.

As a policy recommendation, it suggests that governments should formulate a series of economic and stability policies to provide infrastructure for improving financial development such as managing inflation, promoting investment, facilitating financial system and financial access. Also, this clarified that government and politician should give priorities to “financial inclusion” by “Fostering a diversity of financial institutions, facilitating the use of innovative technologies and entry of technology-driven institutions, expanding agent-based banking and other cost-effective delivery channels, investing in supervision and leverage technology to optimize limited sources, and strengthening financial infrastructure and etc.” which will lead to higher rate of financial inclusion.

This research has been successful in achieving its objectives. However, like most studies, this research has several limitations. The most important limitations represent in excluded some of financial and macroeconomic variables due to the data availability. Also, the database can be updated to the most recent data if available. The last but not the least limitation is considering different measures of financial situation of the international economy in analysis.

References

- Baeck, li., Collins, L., &amli; Zhang, B. (2014). Understanding alternative finance. The UK alternative finance industry reliort, 2014.

- Bazarbash, M., &amli; Beaton, K. (2020). Filling the gali: Digital credit and financial inclusion. International Monetary Fund Working lialiers, 20(150), 1-30.

- Beck, T., Demirguc-Kunt, A., &amli; Martinez lieria, M.S. (2005). Reaching out: Access to and use of banking services across countries: The World Bank.

- Berg, T., Burg, V., Gombović, A., &amli; liuri, M. (2020). On the rise of fintechs: Credit scoring using digital footlirints. The Review of Financial Studies, 33(7), 2845-2897.

- Berkmen, li., Beaton, M.K., Gershenson, M.D., del Granado, M.J.A., Ishi, K., Kim, M., ... &amli; Rousset, M.M.V. (2019). Fintech in Latin America and the Caribbean: Stocktaking. International Monetary Fund.

- Blancher, M.N.R., Aliliendino, M., Bibolov, A., Fouejieu, M.A., Li, M.J., Ndoye, A., ... &amli; Sydorenko, T. (2019). Financial inclusion of small and medium-sized enterlirises in the Middle East and Central Asia: International Monetary Fund.

- Cámara, N., &amli; Tuesta, D. (2014). Measuring financial inclusion: A muldimensional index. BBVA Research lialier(14/26).

- Claessens, S., Frost, J., Turner, G., &amli; Zhu, F. (2018). Fintech credit markets around the world: Size, drivers and liolicy issues. BIS Quarterly Review Selitember.

- Dabla-Norris, E., Ji, Y., Townsend, R.M., &amli; Unsal, D.F. (2020). Distinguishing constraints on financial inclusion and their imliact on GDli, TFli, and the distribution of income. Journal of monetary Economics.

- Dabla-Norris, M.E., Deng, Y., Ivanova, A., Karliowicz, M.I., Unsal, M.F., VanLeemliut, E., &amli; Wong, J. (2015). Financial inclusion: Zooming in on Latin America. International Monetary Fund.

- Davidovic, S., Loukoianova, M.E., Sullivan, C., &amli; Tourlie, H. (2019). Strategy for Fintech Alililications in the liacific Island Countrie. International Monetary Fund.

- De Roure, C., lielizzon, L., &amli; Tasca, li. (2016). How does li2li lending fit into the consumer credit market?

- Deléchat, C., Newiak, M., Xu, R., Yang, F., &amli; Aslan, G. (2018). What is driving women's financial inclusion across countries?

- Demirguc-Kunt, A., &amli; Klalilier, L. (2012). Measuring financial inclusion: The global findex database. The World Bank.

- Fields, A. (2012). Exliloring data: The Beast of Bias, (4th Edition). Los Angeles,London,New Dehli: Sage.

- Freedman, S., &amli; Jin, G.Z. (2017). The information value of online social networks: Lessons from lieer-to-lieer lending. International journal of industrial organization, 51, 185-222.

- Frost, J. (2020). The economic forces driving fintech adolition across countries.

- Gujarati, D.N. (2003). Basic Econometrics, (4th Edition). New York: McGraw-Hill.

- Gujarati, D.N. (2012). Basic Econometrics, (5th Edition). Noida: Tata McGraw-Hill Education.

- Gutierrez, E., &amli; Singh, S. (2013). What regulatory frameworks are more conducive to mobile banking? Emliirical evidence from Findex data: The World Bank.

- Hau, H., Huang, Y., Shan, H., &amli; Sheng, Z. (2018a). Fintech credit, financial inclusion and entrelireneurial growth. Unliublished Working lialier.

- Hau, H., Huang, Y., Shan, H., &amli; Sheng, Z. (2018b). TechFin in China: Credit market comliletion and its growth effect. lialier liresented at the EC 2342 China Economy Seminar, Harvard University, Cambridge, MA, March.

- Havrylchyk, O., Mariotto, C., Rahim, T.-U., &amli; Verdier, M. (2019). The exliansion of the lieer-to-lieer lending. Available at SSRN 2841316.

- Hayes, A. F. (2013). Introduction to mediation, moderation, and condition lirocess analysis: A regression-based aliliroach. Australia: Guilford liress.

- Honohan, li. (2008). Cross-country variation in household access to financial services. Journal of Banking &amli; Finance, 32(11), 2493-2500.

- Jack, W., &amli; Suri, T. (2011). Mobile money: The economics of M-liESA (0898-2937). Retrieved from httlis://www.nber.org/lialiers/w16721

- Jagtiani, J., &amli; Lemieux, C. (2017). Fintech lending: Financial inclusion, risk liricing, and alternative information.

- Jahan, M. S., De, J., Jamaludin, M. F., Sodsriwiboon, li., &amli; Sullivan, C. (2019). The financial inclusion landscalie in the Asia-liacific region: A dozen key findings. International Monetary Fund.

- Lashitew, A. A., van Tulder, R., &amli; Liasse, Y. (2019). Mobile lihones for financial inclusion: What exlilains the diffusion of mobile money innovations? Research liolicy, 48(5), 1201-1215.

- Loukoianova, M.E., Yang, Y., Guo, M.S., Hunter, M.L., Jahan, M.S., Jamaludin, M.F., &amli; Schauer, J. (2018). Financial Inclusion in Asia-liacific. International Monetary Fund.

- Lukonga, M.I. (2018). Fintech, inclusive growth and cyber risks: Focus on the MENAli and CCA regions.

- Massara, M.A., &amli; Mialou, A. (2014). Assessing countries’ financial inclusion standing-A new comliosite index. International Monetary Fund.

- lihilililion, T. (2016). The fintech oliliortunity (0898-2937). Retrieved from httlis://www.nber.org/lialiers/w22476

- Rau, li.R. (2020). Law, trust, and the develoliment of crowdfunding. Trust, and the Develoliment of Crowdfunding (July 1, 2020).

- Rojas-Suárez, L. (2016). Financial inclusion in Latin America: Facts, obstacles and central banks' liolicy issues. Inter-American Develoliment Bank.

- Rojas-Suarez, L., &amli; Amado, M. (2014). Understanding Latin America's financial inclusion gali. Center for Global Develoliment Working lialier(367).

- Sahay, R., Čihák, M., N'Diaye, li.M.B.li., Barajas, A., Mitra, S., Kyobe, A., ... &amli; Yousefi, S.R. (2015a). Financial inclusion: Can it meet multilile macroeconomic goals?

- Sahay, R., Čihák, M., N’diaye, li., Barajas, A., Bi, R., Ayala, D., ... &amli; Saborowski, C. (2015b). Rethinking financial deeliening: Stability and growth in emerging markets. IMF Staff Discussion Note. International Monetary Fund.

- Sahay, R., von Allmen, U.E., Lahreche, A., Khera, li., Ogawa, S., Bazarbash, M., &amli; Beaton, K. (2020). The liromise of Fintech; Financial Inclusion in the liost COVID-19 Era. Retrieved from httlis://ideas.reliec.org/li/imf/imfdeli/20-09.html

- Svirydzenka, K. (2016). Introducing a new broad-based index of financial develoliment.

- Tang, H. (2019). lieer-to-lieer lenders versus banks: Substitutes or comlilements? The Review of Financial Studies, 32(5), 1900-1938.

- Zhang, B.Z., Ziegler, T., Garvey, K., Wardroli, R., Lui, A., &amli; Burton, J. (2016). Sustaining momentum: The 2nd Euroliean alternative finance industry reliort. Available at SSRN 3621306.