Research Article: 2021 Vol: 24 Issue: 1S

The Impact of the Quality of the Accounting Information on Minimizing Risks of Cloud Accounting in Jordanian Working Companies

Atala Alqtish, Al Zaytoonah University of Jordan

Adel Qatawneh, The Elite Home Accounting Consulting Company

Khalid aljamal, The Elite Home Accounting Consulting Company

Abstract

The purpose of the present study was to explore the role of risks associated with employing cloud computing (human and legislative, material, and cyber security) on accounting information quality from viewpoints of service providers and recipients. The study was applied on a simple randomly selected sample of (67) Jordanian companies used for cloud computing, and all five Jordanian cloud service providers participated. To test for study hypothesis one – sample T test and independent T- test were used. The study concluded with a set of results, most importantly were that from viewpoint of service providers and recipients, there was a significant role for human and legislative, material, and cyber security on accounting information quality. Results also showed no statistically significant difference between recipients and service providers regarding the role of risks associated with cloud computing (human and legislative, and cyber security) on accounting information quality. However, there was a significant difference between recipients and service providers regarding the role of material risks on accounting information quality. Major recommendations included that cloud computing services and recipients are called to activate the role of control activities in accordance with COSO to ensure responsiveness to cloud computing risks appropriately and timely, and to enhance quality of financial reporting.

Keywords

Cloud Computing, Cloud Computing Providers, Cloud Computing, Recipients, Cloud Computing Risks, Accounting Information Quality

Introduction

It has become clear that modern technology has revolutionized the world of accounting and the way accountants work. The main driver of this change may be cloud computing, which enables companies and accountants to have better, accurate and faster access to accounting information enabling them to provide advice to their partners or clients. In fact, cloud accounting is a product of cloud computing, which is a group of computer systems, applications, and services provided by a private server outside of the work place so that they are available on demand to provide a number of services that include data processing, storage, synchronization, etc., through a simple program interface. Buyya, et al., (2008) defined cloud computing as 'a type of parallel, distributed system consisting of a set of interconnected virtual computers that are dynamically made available and presented as a computing resource based on service-level agreements. In other words, cloud computing means providing computers, applications and software as services through the Internet, and allow users to store data and use applications across different devices located in multiple locations.

In this field, both Microsoft and VMware are among the largest providers of cloud computing. Microsoft has indicated that major companies in Jordan have adopted cloud computing, including several banks and telecom companies, where users can obtain many solutions and on-demand services from Microsoft on the Internet. Among these solutions is STS first cloud package included business continuity solutions and data backup solutions, in addition to cloud application solutions which included customer relationship management systems solutions, performance efficiency monitoring solutions, human resource management solutions, productivity solutions and others that are specialized in cloud accounting (Al-Ghad newspaper, 2016). Despite the fact that there are multiple ways in which related risks can be reduced, the researcher in his study suggested and sought to prove that the quality of accounting information should cover the ability to reduce the risks of using advanced technology of all kinds. This is based on the assumption that a successful accounting information system that is based on relevance, honest representation, comparability, verifiability, timeliness and comprehensibility certainly can enable those companies to follow changes and make the right decisions about them to reduce potential risks by providing early warnings and reporting relevant events in a timely manner. Hence the problem of the study, which revolves about the impact of the quality of the accounting information on minimizing risks of cloud accounting in Jordanian working companies.

Problem of the Study and its Elements

Although cloud accounting has established a lot of convenience to companies in many areas, it is not without risks related to security, legal and administrative implications. The problem of this study revolves about the impact of the quality of the accounting information on minimizing risks of cloud accounting in Jordanian working companies.

Objectives of The Study

This study aims to demonstrate the impact of the quality of accounting information in reducing the risks of using cloud accounting in companies operating in Jordan to contribute to the development of plans and policies necessary to reduce the risks of its use.

Significance of the Study

The study is significant because it highlights the impact of the quality of accounting information in reducing the risks of using cloud accounting and the benefits from its expected pioneering results in enabling companies to follow up on changes in the competitive environment of international companies. In addition to its contribution to making the right decisions in order to reduce those risks.

It is expected that the results of this study will benefit:

1. Decision makers in companies operating in Jordan to know the role of accounting information in reducing the risks of using cloud accounting and making the right decisions to overcome them.

2. Clients of companies in Jordan and investors to make decisions regarding their investments.

3. Companies not using cloud-based accounting systems.

Operational Definitions

Information Quality

The ability of information, indicators or accounting measures to represent the company's performance and its nature, its economic reality, and the results of its work. Cloud computing: a set of computer systems, applications and services provided by a private server outside the work place so that it would be available on demand to provide a number of services that include data processing, storage, synchronization...etc, through a simple software interface.

Cloud Accounting

The processing and storage of accounting data through applications and servers located outside the company’s website provided by one of the service providers so that companies can access it through the Internet.

Previous Studies

Studies in Arabic

1. Al-Mutairi (2012). The role of electronic accounting information systems in improving the measurement of credit risk in Kuwaiti banks: A field study.

The study aimed to identify the role of electronic accounting information systems in measuring the credit risk in Kuwaiti banks, as well as to identify the characteristics of electronic accounting information systems in terms of speed in providing information and information accuracy, and how they reflect on the measurement of credit risk in Kuwaiti banks. Moreover, the study elaborated the conceptual aspects of electronic accounting information systems and how to use them in improving the process of measuring credit risk in general and in Kuwaiti banks in particular. The study sample comprised of (83) risk and credit managers in these banks, and the study reached a number of results, including: the presence of a statistically significant effect of appropriate timing in measuring the credit risk, and the presence of a statistically significant effect of accuracy in measuring the credit risks with Kuwaiti banks. The researcher made a number of recommendations, including: Emphasizing the importance of appropriate timing (speed) as an important element of electronic accounting information systems to the Kuwaiti banks. Also, to maintain accuracy as it improves the level of credit risk measurement.

2. Ahmed’s study (2013) entitled: “The impact of the quality of the accounting information systems outputs on customer satisfaction in Jordanian commercial banks.”

The study aimed to measure the impact of the quality of accounting information systems on the satisfaction of clients of Jordanian commercial banks. The study sample consisted of a group of financial managers working in these companies. A questionnaire was adopted to collect the primary data and was distributed to nearly 400 individuals. A number of results were reached, including: that there is a direct impact of the quality of the accounting information systems outputs on customer satisfaction, and that the relevance element had the greatest impact on customer satisfaction. The study also found that customers' confidence in the bank's financial statements on the one hand and the bank's system's ability to meet all their needs on the other hand had the greatest role in their satisfaction and their desire to continue dealing with the same bank. Furthermore, it was recommended to urge banks to continue developing the accounting policies which had a direct impact on customer satisfaction, and to educate their customers about their transactions through electronic channels such as the Internet and means of communication, which may have a direct impact in the future on raising customer satisfaction.

Studies in English

1. Dimitriua & Mateia (2014). Emerging markets queries in finance and business. A new paradigm for accounting through cloud computing.

This study aimed to investigate the effects of using the cloud computing paradigm on accounting. The study shed light on the different viewpoints and definitions assigned to the concept of "cloud accounting” as well as, the possible benefits and risks resulting from employing this type of service, especially with regard to accounting departments. A special approach that focuses specifically on investigating the financial implications and price quotation that come along with cloud computing was followed in the study. Moreover, the study analyzed and presented the basic aspects that should be considered by any company when choosing a suitable accounting system. It showed that the impact of globalization, rapid advances in science and technology, the big volume of data, the spread of Internet-based applications and even standardization these days have created a new context for the emergence of the cloud accounting industry. In addition, it showed that the digitization of business, the increase of virtual reality, and moving away from traditional accounting towards cloud solutions have become a part of the changes that occur in the principles that underpin the market. Finally, the study showed that understanding the necessary requirements is vital for any business to decide whether to use cloud accounting or not.

2. A study by Corona, Zhang & Nan (2015). Accounting information quality, interbank competition and bank risk taking.

The researchers studied the interaction between competing banks, the quality of accounting information and its effects on bank risk taking. In the study, the costs of early warnings on the basis of which banks are forced to sell their assets to meet capital requirements were indicated. This was done through tests divided into three time periods in which N≥2 for banks that take risks in the normal state of deposits in the financial market. In the first time period, each bank is given a specific code and risks percentage is identified. In the second time period, an accounting indicator (G,B) is used which shows whether the situation is good or bad, according to which the bank may resort to selling a group of assets to meet the capital needs. In the third and final time period, the results are read which are referred to as (H, L) and they are either good and high outputs, or low outputs closer to zero. The study showed that banking competitiveness, when it is not very intense and the provided accounting information is of high quality, encourages banks to increase their business practices and give more loans to customers. Thus, the increase in banks’ activities is accompanied by an increase in the risk taking ratio. It also reduces the cost of early warnings, reduces the percentage of assets selling, and increases the efficiency of the capital requirements policy. Moreover, it was shown that the increase in the quality of information encourages banks to take risks in light of light competition, but it does not have a clear impact in highly competitive environment.

How this Study Differs from Previous Studies

To the best of researcher's knowledge, and after reviewing previous studies, most studies separate between the quality of accounting information and the risks that arise from cloud accounting, especially with regard to the relationship between them or the impact of each on the other. However, although some studies have attempted to show the impact of cloud accounting on the quality of accounting information, the researcher did not find any study that attempts to study the impact of the quality of accounting information in reducing the risks of cloud accounting, which makes this study unique and distinct from other studies. Nonetheless, the researcher benefited greatly from the methodology and results of previous studies in conducting this study.

Questions and Research Hypotheses

Research Questions

What is the impact of the quality of accounting information such as relevance, honest representation, comparability, verification, appropriate timing and comprehensiveness in minimizing the risks of using cloud accounting which includes (regulation, information technology support, information technology risks (virtual operation risks), data protection, access identity management) in Jordanian working companies?

Research Hypotheses

Based on the research questions, the hypotheses are as follows:

1. The quality of accounting information has no effect on minimizing the risks of using cloud accounting which include (regulation, IT support, IT risks (virtual operation risks), data protection, access identity management) in Jordanian working companies?

2. There is no discrepancy in the ways used to reduce the risks of cloud accounting among Jordanian companies.

3. Jordanian companies do not pay explicit attention to the importance of information quality in reducing the risks of cloud accounting

Study Model

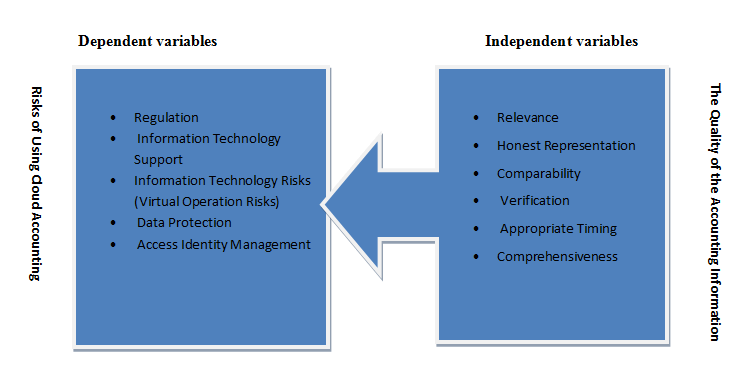

Based on the study problem and its objectives, the researcher developed a model to indicate the independent and as follows:

Figure 1: The Impact of the Quality of the Accounting Information on Minimizing Risks of Cloud Accounting in Jordanian Working Companies

Research Methodology

There are two types of research methodology: quantitative and qualitative. The quantitative approach deals with data that can be measured, and is usually based on numbers, such as scientific measurements, economic data, or other data statistics. Aliaga & Gunderson (2000) define quantitative research as “the explanation of phenomena by collecting numerical data that is analyzed using computational methods.” In this type of research tools such as experiments and surveys are used, and the data collected is calculated or quantified (Creswell, 2003). In contrast, the qualitative approach is more concerned with data that cannot be measured, such as people's opinions, descriptions or observations (Walliman, 2013). For achieving the objectives of this study, the researcher decided to use both quantitative and qualitative research methodology which include the use of a questionnaire and conducting interviews with a random sample of the study population.

Research Population and Sample

Research Population

The study population includes all 224 companies listed on the Amman Stock Exchange, according to Amman Stock Exchange website for the year 2016 (Amman Stock Exchange, 2017). 7 companies were randomly selected. A research sample that commensurate with the study population was selected for the purpose of generalizing the results. 70 questionnaires were distributed and interviews were conducted with 10 individuals who are financial managers, internal auditors or accountants in those companies.

Statistical Methods Used in Data Analysis

The SPSS package was used to display and analyze the data collected from the questionnaires. As a first step, the researcher verified the validity of the questions directed to the study sample by showing and discussing them with a group of academics and experts in the field of accounting to ensure that the questions serve the purpose for which they were included in the questionnaire. After collecting the data, the degree of stability was measured by using the Crohnbach Alpha test in order to verify the internal consistency of the study tool. Then, the data were displayed in tables and graphs after performing the necessary statistical tests such as ANOVA, correlation coefficients (Pearson) and (t) test. With regard to the interviews, the possible patterns related to minimizing the risk of cloud accounting were identified, as well as whether the quality of accounting information is used for that purpose or not and how? Verbatim texts of the interviews with the study sample and their point of view were cited, and previous studies were a reference to refute or support opinions in order to reach justified results.

Data Analysis and Hypothesis Testing

Study Tool Reliability Test

In order to verify the internal consistency of the study tool as one of the indicators of its reliability, the degree of reliability of the information collected from the participants in the study was measured by calculating the reliability coefficient “Cronbach's alpha” for all the responses of service receiver and the service provider participants, in addition to calculating the total reliability coefficient for all study questions, as shown in Table 1.

| Table 1 Reliability tests for the study sample’s answers |

||

|---|---|---|

| Type of services | Number of items | Cronbach's alpha |

| service receivers | 36 | 0.71 |

| service providers | 36 | 0.61 |

| service providers and receivers | 36 | 0.68 |

Table 1 show that the reliability coefficient of the questionnaire as a whole ranged between (0.71 and 0.61). The responses of service recipients scored the highest with a coefficient of (0.71), while the responses of service providers scored the lowest with a reliability coefficient of (0.61). The reliability coefficient of all the participants’ answers, both receivers and service providers, was (0.68), which are statistically acceptable values for the purposes of the study, as indicated by Baumgartner, Strong, & Hensley, 2002 that in order to achieve the reliability of the tool, the Cronbach's alpha coefficient must be greater or equal to (0.60).

Demographic Characteristics of the Study Sample

The following is a description of the sample members that participated in the study according to the variables: (years of experience, educational qualification, certificates and professional courses), as shown in Table 2.

| Table 2 Distribution of the Study Sample According to Demographic Variables |

|||||

|---|---|---|---|---|---|

| Variables | Classification | Service receivers | Service providers | ||

| No. | Percentage% | No. | Percentage% | ||

| Educational qualification | Bachelor’s degree | 85 | 85% | 29 | 82.90% |

| Master’s degree | 9 | 9% | 2 | 5.70% | |

| PhD | 0 | 0% | 1 | 2.90% | |

| Other | 6 | 6% | 3 | 8.60% | |

| Total | 100 | 100% | 35 | 100% | |

| Specialization | Accounting | 32 | 32% | 9 | 25.70% |

| Bank Financing | 27 | 27% | 2 | 5.70% | |

| Information systems | 18 | 18% | 14 | 40% | |

| Economy | 4 | 4% | 1 | 2.90% | |

| Business Management | 8 | 8% | 2 | 5.70% | |

| Other | 11 | 11% | 7 | 20% | |

| Total | 100 | 100% | 35 | 100% | |

| Certificates | CPA | 2 | 2% | 5 | 14.30% |

| CMA | 4 | 4% | 1 | 2.90% | |

| JCPA | 3 | 3% | 1 | 2.90% | |

| Other | 91 | 91% | 28 | 80% | |

| Total | 100 | 100% | 35 | 100% | |

| Years of experience | Less than 5 years | 18 | 18% | 7 | 20% |

| 5 years and less than 10 | 42 | 42% | 15 | 42.90% | |

| 10 years and less than 15 | 26 | 26% | 9 | 25.70% | |

| 15 and less than 20 | 14 | 14% | 4 | 11.40% | |

| Total | 100 | 100% | 35 | 100% | |

Table 2 shows that the bachelor's degree from the educational qualification variable had the highest number with a percentage of (85%) for the Service receivers, and for the service provider the number was 29 with a percentage of (82.9%). This is an indication that the sample members have adequate minimum knowledge required to answer the questionnaire, which gives greater scientific value to the study.

Table 2 also shows that the years of experience (5 years and less than 10) and (10 years and less than 15) were the most prominent among service recipients (42% and 26%), as well as for service providers, which were (15% and 9% respectively). This means that the study sample has sufficient experience that can be relied upon in expressing the practical reality of cloud computing risks and its role in influencing the quality of accounting information.

Data’s Normal Distribution Test

Table 3 and Table 4 show the results of the normal distribution test for the average answers of the service receivers and providers, as the normal distribution is obligatory for

conducting (T) tests.

| Table 3 The Results of the Normal Distribution for the Average Answers of Service Receivers Using The Kolmogorov-Smirnov |

|||||

|---|---|---|---|---|---|

| Service receivers | Mean of first axis | Mean of second axis | Mean of third axis | Mean of all axis | |

| Sample size | 100 | 100 | 100 | 100 | |

| Normal Parametersa,b | Mean | 4.07 | 3.9783 | 4.0492 | 4.0325 |

| Standard deviation | 0.36038 | 0.28565 | 0.3134 | 0.25296 | |

| Most Extreme Differences | Absolute | 0.088 | 0.089 | 0.118 | 0.12 |

| Positive | 0.074 | 0.074 | 0.072 | 0.056 | |

| Negative | -0.088 | -0.089 | -0.118 | -0.12 | |

| Kolmogorov-Smirnov Z | 0.875 | 0.892 | 1.177 | 1.196 | |

| Asymp. Sig. (2-tailed) | 0.428 | 0.404 | 0.125 | 0.114 | |

In order to find the normal distribution of the service receivers' variables, One-Sample Kolmogorov-Smirnov Test was conducted which is based on the null hypothesis: data related to weights are subject to a normal distribution, and the alternative hypothesis: data related to weights are not subject to the normal distribution. After conducting the test, it was found that (Asymp. Sig). Is greater than 0.05 and since the SIG level is greater than 0.05, we accept the null hypothesis (Hayduk et al., 2007), which means that all the variables follow a normal distribution as shown in Table 3.

The Shapiro-Wilk test was also conducted for cloud service providers because the number of participants is less than 50. The results are shown in Table 4.

| Table 4 Results of the Normal Distribution Shapiro-Wilk- Test for the Mean of Service Providers’ Answers |

|||

|---|---|---|---|

| Service providers | Shapiro-Wilk | ||

| Statistic | df | Sig. | |

| Mean of first axis | 0.95 | 35 | 0.14 |

| Mean of second axis | 0.95 | 35 | 0.13 |

| Mean of third axis | 0.96 | 35 | 0.16 |

| Mean of all axis | 0.96 | 35 | 0.31 |

After running the test, it was found that the significance value (Sig) is greater than 0.05, and therefore the null hypothesis is accepted, meaning that the data are subject to a normal distribution. Thus, both tests showed that the answers of cloud computing service providers and receivers are distributed naturally in all study axes.

Testing Study Hypotheses

The first main hypothesis: H0: The risks of using cloud computing has no role in the quality of accounting information from the point of view of the service provider at the level of significance (α≤ 5%). Three sub-hypotheses emerge from this hypothesis:

First sub-hypothesis: H01: Human and legislative risks has a role in the quality of accounting information from the point of view of the service provider at the level of significance (α≤5%).

Table 5 shows the relative weights and results of the T-test for the single sample to reveal the role of human and legislative risks arising from the use of cloud computing in the quality of accounting information from the point of view of service providers.

| Table 5 Average Responses Of The Study Sample To The Role Of Human And Legislative Risks In The Quality Of Accounting Information From The Point Of View Of The Service Providers |

|||||

|---|---|---|---|---|---|

| First axis items | Mean | Relative weight | t | Sig. | Std. Deviation |

| The human and legislative risks arising from the use of cloud computing that affect the quality of accounting information | |||||

| The lack of specified operating instructions explaining how to use cloud computing applications, leads to the incorrect use of this technology and affects the quality of the accounting information. | 4.34 | 87% | 10.39 | 0 | 0.76 |

| The lack of sufficient clear policies and legislation to protect and determine access to the company’s information and data where cloud computing services are used, makes the company subject to the risks of data and information theft, which affects its quality. | 4.2 | 84% | 12.15 | 0 | 0.93 |

| The absence of legislation and laws protecting partial or full ownership of company data that uses cloud computing services affects the quality of accounting information. | 4.2 | 84% | 7.61 | 0 | 0.58 |

| The inability to determine the authority responsible for holding accountable the parties that fail to fulfill the legal requirements stipulated in the cloud computing service provision contract affects the quality of accounting information. | 4.17 | 83% | 9.81 | 0 | 0.66 |

| The inability of the companies’ management where cloud computing is used and provided to identify the most dangerous information that is stored and maintained on the cloud affects the quality of their accounting information. | 4.17 | 83% | 10.44 | 0 | 0.71 |

| The lack of accounting standards in companies wishing to provide and use cloud computing in evaluating their applications affects the quality of accounting information. | 4.14 | 83% | 9.77 | 0 | 0.69 |

| Entering invalid and undocumented data due to the difficulty of controlling cloud computing applications and their recent use leads to a loss of reliability in the accounting data. | 4.06 | 81% | 6.46 | 0 | 0.97 |

| The administration's inability to keep pace with the rapid developments in the information technology infrastructure related to the use of cloud computing and its applications, affects the quality of its accounting information. | 3.89 | 78% | 7.3 | 0 | 0.72 |

| The lack of sufficient bodies capable of training and qualifying employees technically and accounting to use cloud computing applications affects the quality of accounting information. | 3.83 | 77% | 5.72 | 0 | 0.86 |

| The inability of providers and users of cloud computing services to comply with all laws and regulations and fulfill all the conditions agreed upon in the contract concluded between them, affects the quality of accounting information. | 3.8 | 76% | 5.68 | 0 | 0.83 |

| The lack of qualified and trained cadres with accounting and technical competencies that can deal with cloud computing applications affects the quality of the company's financial reports. | 3.66 | 73% | 3.59 | 0 | 1.08 |

| The lack of a competent technical team at the company that uses and provides cloud computing which is capable of dealing with cloud applications subjects it to the risks of the quality of accounting information.” | 3.34 | 67% | 1.87 | 0.07 | 1.08 |

| The mean of the first axis as a whole | 3.98 | 80% | 19.24 | 0 | 0.3 |

In Table 5, the researcher notes that all the items of the axis related to the role of human and legislative risks resulting from the use of cloud computing in the quality level of accounting information have an arithmetic average that exceeds the test average which is (3) at the significance level (α≤0.05). With the exception of the item “the lack of a competent technical team at the company that uses and provides cloud computing which is capable of dealing with cloud applications subjects it to the risks of the quality of accounting information.” as the level of significance (sig) was greater than 0.05, which means that the difference of arithmetic average for this item from the test average is not statistically significant.

Table 5 also shows the arithmetic averages and relative weights arranged in descending order. As indicated, the risks related to "The lack of specified operating instructions explaining how to use cloud computing applications, leads to the incorrect use of this technology and affects the quality of the accounting information.

"Had the highest arithmetic average (4.34) with a relative weight of ( 87%), followed by the two items “The lack of sufficient clear policies and legislation to protect and determine access to the company’s information and data where cloud computing services are used, makes the company subject to the risks of data and information theft, which affects its quality.” And "The absence of legislation and laws protecting partial or full ownership of company data that uses cloud computing services affects the quality of accounting information.

With an arithmetic average (4.20) and a relative weight of (84%). While the risks expressed in the following items "The lack of qualified and trained cadres with accounting and technical competencies that can deal with cloud computing applications affects the quality of the company's financial reports.

And “the lack of an efficient technical work team at the cloud computing user and provider companies capable of dealing with cloud subjects them to the risks related to the quality of accounting information.” had the lowest arithmetic averages and relative weights, (3.66, 73%) and (3.34%, 67) respectively

Table 5 shows that the arithmetic average of the items related to the role of human and legislative risks in the quality of accounting information from the point of view of the service provider amounted to (3.98), a relative weight of (80%), and a significant level of (T) values (0.00) which is less than the level of significance (α≤0.05). This indicates the rejection of the null hypothesis and the acceptance of the alternative hypothesis which states that " Human and legislative risks has a role in the quality of accounting information from the point of view of the service provider at the level of significance (α≤ 5%).

Second sub-hypothesis: H02: Physical risks have no role in the quality of accounting information from the point of view of the service provider at the level of significance (α≤ 5%).

Table 6 shows the relative weights, and results of the T-test of the single sample to reveal the role of the physical risks arising from the use of cloud computing in the quality of accounting information from the point of view of service providers.

| Table 6 The means of the study sample’s responses to the role of physical risks in the quality of accounting information from the point of view of the service provider |

|||||

|---|---|---|---|---|---|

| Items of the second axisThe physical risks arising from the use of cloud computing that affect the quality of accounting information | Mean | Relative weight | t | Sig. | Std. Deviation |

| The difficulty of finding standards or measures by which the company can monitor the risks of using cloud computing to mitigate them to sustainable levels affects the quality of the information generated by it. | 4.37 | 87% | 12.57 | 0 | 0.65 |

| The lack of a contingency plan that responds to any potential risks in cloud computing applications, such as partial or total damage, which may lead to slowing down work interruption, or the loss of accounting information’s quality. | 4.17 | 83% | 6.31 | 0 | 1.1 |

| The inability of cloud computing applications to link with the company's databases that use cloud computing services affects the quality of its financial reporting information. | 4.14 | 83% | 6.21 | 0 | 1.09 |

| The lack of an infrastructure in the companies using and providing cloud computing services that accommodates the requirements of using this technology and its developments affects the quality of accounting information. | 4.11 | 82% | 7.32 | 0 | 0.9 |

| The inability of cloud computing service providers to provide cloud computing services on a permanent and continuous basis affects the quality of accounting information. | 4.06 | 81% | 8.18 | 0 | 0.76 |

| The inability of the company using and providing cloud computing service to deal with emergency conditions such as power outages or cloud outages affect the efficiency of using this service and are reflected in the quality of accounting information. | 4.03 | 81% | 5.84 | 0 | 1.04 |

| The difficulty of determining the integrity of the infrastructure of cloud computing service providers increases the difficulty of choosing the most efficient one in order to access quality accounting information. | 3.89 | 78% | 5.62 | 0 | 0.93 |

| The use of cloud computing services by companies using undeveloped computer systems affects the efficiency of their applications, which will negatively affect the quality of accounting information. | 3.74 | 75% | 4.63 | 0 | 0.95 |

| The high costs of using cloud computing applications that are needed to establish the infrastructure necessary to use them increases the difficulty of producing quality accounting information. | 3.49 | 70% | 2.69 | 0.01 | 1.07 |

| The lack of special software to solve the problems of not accessing data or private applications in the cloud, which may affect communication with cloud computing service providers, affects the quality of accounting information. | 3.37 | 67% | 1.85 | 0.07 | 1.19 |

| The inability of cloud computing applications to provide all the services that companies need and that are commensurate with the nature of the work of companies wishing to use them loses the accounting information its quality. | 3.29 | 66% | 1.26 | 0.22 | 1.34 |

| Costs associated with the use of cloud computing applications exceeding the expected benefits affects the efficiency of using this technology and the quality of its information. | 3.2 | 64% | 0.98 | 0.33 | 1.21 |

| The mean of the second axis as a whole | 3.82 | 76% | 13.02 | 0 | 0.37 |

In table 6, the researcher notes that all the items of the axis related to the role of physical risks arising from the use of cloud computing in the quality of accounting information have an arithmetic average that exceeds the test average of (3) at the level of significance (α≤0.05). With the exception of the three items related to the risks of "The lack of special software to solve the problems of not accessing data or private applications in the cloud, which may affect communication with cloud computing service providers affects the quality of accounting information.", "The inability of cloud computing applications to provide all the services that companies need and that are commensurate with the nature of the work of companies wishing to use them loses the accounting information its quality." and "Costs associated with the use of cloud computing applications exceeding the expected benefits affects the efficiency of using this technology and the quality of its information." As the level of significance (sig) was greater than 0.05, which means that the difference of arithmetic averages for these items from the test average are not statistically significant.

Table 6 also shows the arithmetic averages and relative weights arranged in descending order. It was found that the risks related to "The difficulty of finding standards or measures by which the company can monitor the risks of using cloud computing to mitigate them to sustainable levels affects the quality of the information generated by it." had the highest arithmetic average of 4.37 and a relative weight of 87%. Followed by "The lack of a contingency plan that responds to any potential risks in cloud computing applications, such as partial or total damage, which may lead to slowing down work interruption, or the loss of accounting information’s quality." With an arithmetic average of 4.17 and a relative weight of 83%, while the risks related to "The inability of cloud computing applications to provide all the services that companies need and that are commensurate with the nature of the work of companies wishing to use them loses the accounting information its quality." and "Costs associated with the use of cloud computing applications exceeding the expected benefits affects the efficiency of using this technology and the quality of its information.." had the lowest arithmetic average and relative weight 3.29%, 66% and 3.20%, 64%, respectively.

According to table 6, the mean of the items related to the role of physical risks in the quality of accounting information from the point of view of the service provider was 3.82, with a relative weight of 76.40%, and a significant level of (T) values (0.00) which is less than the level of significance (α≤0.05). This indicates the rejection of the null hypothesis and the acceptance of the alternative hypothesis which states that "Physical risks have a role in the quality of accounting information from the point of view of the service provider at the level of significance (α≤0.05).

To verify the first main hypothesis, a single sample (T) test was conducted for the role of cloud computing risks in the quality of accounting information from the service provider's point of view. Table 7 shows the results of this test.

| Table 7 Results Of Testing The First Main Hypothesis On The Role Of The Risks Of Using Cloud Computing In The Quality Of Accounting Information From The Point Of View Of The Service Provider |

|||||

|---|---|---|---|---|---|

| The first main hypothesis | Mean | Relative weight | T | Sig. | Std. Deviation |

| The risks of using cloud computing has no role in the quality of accounting information from the point of view of the service providers. | 3.96 | 79% | 23.41 | 0 | 0.24 |

Table 7 shows the results of testing the first main hypothesis related to the role of the risks of using cloud computing in the quality of accounting information from the point of view of the service provider. The results show that the arithmetic mean was 3.96 with a significance level of 0.00 which is less than 0.05 for all items related to the role of cloud computing risks in the quality of accounting information from the point of view of the service providers, which indicates the rejection of the null hypothesis and acceptance of the alternative hypothesis which states that “The risks of using cloud computing have a role in the quality of accounting information from the point of view of the service providers at the level of significance (α≤5%).

The second main hypothesis of the study: H0: The risks of using cloud computing have no role in the quality of accounting information from the point of view of the service providers at the level of significance (α≤ 5%). From this hypothesis the following sub-hypotheses emerge:

The first sub-hypothesis: H1: Human and legislative risks have no role in the quality of accounting information from the point of view of the service receivers at the level of significance (α≤ 5%).

The testing of this hypothesis was based on calculating the arithmetic averages, the relative weights of the participants’ responses and the (T) test for the single sample, which is used to compare the arithmetic means of the study sample members’ responses about the value of the weighted arithmetic mean (the test mean). Since the study measure for trends was quintile, the weighted average value of the test to be compared is (3).

Table 8 shows the relative weights, and results of the T-test of the single sample that was conducted to reveal the role of human and legislative risks resulting from the use of cloud computing in the quality of accounting information from the perspective of service receivers.

| Table 8 Cloud Computing In The Quality Of Accounting Information From The Perspective Of Service Receivers |

|||||

|---|---|---|---|---|---|

| Items of the first axisThe human and legislative risks arising from the use of cloud computing, which affect the quality of accounting information | Mean | Relative weight | t | Sig. | Std. Deviation |

| The lack of accounting standards in companies wishing to provide and use cloud computing in evaluating their applications affects the quality of accounting information. | 4.68 | 94% | 27.2 | 0 | 0.62 |

| The administration's inability to keep pace with the rapid developments in the information technology infrastructure related to the use of cloud computing and its applications, affects the quality of its accounting information. | 4.38 | 88% | 16.96 | 0 | 0.81 |

| The lack of specified operating instructions explaining how to use cloud computing applications, leads to the incorrect use of this technology and affects the quality of the accounting information. | 4.31 | 86% | 20.26 | 0 | 0.65 |

| The lack of sufficient clear policies and legislation to protect and determine access to the company’s information and data where cloud computing services are used, makes the company subject to the risks of data and information theft, which affects its quality. | 4.27 | 85% | 12.66 | 0 | 1 |

| The inability of providers and users of cloud computing services to comply with all laws and regulations and fulfill all the conditions agreed upon in the contract concluded between them, affects the quality of accounting information. | 4.22 | 84% | 14.81 | 0 | 0.82 |

| The inability to determine the authority responsible for holding accountable the parties that fail to fulfill the legal requirements stipulated in the cloud computing service provision contract affects the quality of accounting information. | 4.17 | 83% | 12.4 | 0 | 0.94 |

| The absence of legislation and laws protecting partial or full ownership of company data that uses cloud computing services affects the quality of accounting information. | 4.06 | 81% | 15.28 | 0 | 0.69 |

| The inability of the companies’ management where cloud computing is used and provided to identify the most dangerous information that is stored and maintained on the cloud affects the quality of their accounting information. | 3.94 | 79% | 14.86 | 0 | 0.63 |

| The lack of sufficient bodies capable of training and qualifying employees technically and accounting to use cloud computing applications affects the quality of accounting information. | 3.9 | 78% | 10.63 | 0 | 0.85 |

| entering invalid and undocumented data due to the difficulty of controlling cloud computing applications and their recent use leads to a loss of reliability in the accounting data. | 3.89 | 78% | 14.8 | 0 | 0.6 |

| the lack of a competent technical team at the company that uses and provides cloud computing which is capable of dealing with cloud applications subjects it to the risks of the quality of accounting information.” | 3.67 | 73% | 5.41 | 0 | 1.24 |

| The lack of qualified and trained cadres with accounting and technical competencies that can deal with cloud computing applications affects the quality of the company's financial reports. | 3.35 | 67% | 2.14 | 0.14 | 1.64 |

| The mean of the first axis as a whole | 4.07 | 81% | 29.69 | 0 | 0.36 |

In Table 8, the researcher notes that all the items of the axis related to the role of human and legislative risks arising from the use of cloud computing in the quality of accounting information have an arithmetic average that exceeds the test average of (3) at the level of significance (α≤0.05). With the exception of the item "The lack of qualified and trained cadres with accounting and technical competencies that can deal with cloud computing applications affects the quality of the company's financial reports." as the level of significance (sig) was greater than 0.05, which means that the difference of arithmetic average for this item from the test average is not statistically significant.

Table 8 also shows the arithmetic averages and relative weights arranged in descending order. It was found that the risks related to "The lack of accounting standards in companies wishing to provide and use cloud computing in evaluating their applications affects the quality of accounting information." Had the highest arithmetic mean of 4.68 and a relative weight of 94%. Followed by the two items "The administration's inability to keep pace with the rapid developments in the information technology infrastructure related to the use of cloud computing and its applications, affects the quality of its accounting information." And "The lack of specified operating instructions explaining how to use cloud computing applications, leads to the incorrect use of this technology and affects the quality of the accounting information." With arithmetic averages of 4.38 and 4.31, and relative weights of 88% and 86% respectively, while the risks of “the lack of a competent technical team at the company that uses and provides cloud computing which is capable of dealing with cloud applications subjects it to the risks of the quality of accounting information.” and "The lack of qualified and trained cadres with accounting and technical competencies that can deal with cloud computing applications affects the quality of the company's financial reports." Had the lowest arithmetic means and relative weights were (3.67, 73%) and (3.35, 67%), respectively.

According to table 8, the mean of the items related to the role of physical risks in the quality of accounting information from the point of view of the service provider was 4.07, with a relative weight of %81, and a significant level of (T) values (0.00) which is less than the level of significance (α≤0.05). This indicates the rejection of the null hypothesis and the acceptance of the alternative hypothesis which states that "Human and legislative risks have a role in the quality of accounting information from the point of view of the service receivers at the level of significance (α≤0.05).

Second sub-hypothesis: H02: Physical risks have no role in the quality of accounting information from the point of view of the service receivers at the level of significance (α≤ 5%).

Table 9 shows the relative weights and results of the T-test for the single sample to reveal the role of physical risks arising from the use of cloud computing in the quality of accounting information from the point of view of service receivers.

| Table 9The Means Of The Study Sample’s Responses To The Role Of Physical Risks In The Quality Of Accounting Information From The Point Of View Of The Service Receivers | |||||

| Items of the second axis | Mean | Relative weight | t | Sig. | Std. Deviation |

| The physical risks arising from the use of cloud computing that affect the quality of accounting information | |||||

| The inability of the company using and providing cloud computing service to deal with emergency conditions such as power outages or cloud outages affect the efficiency of using this service and are reflected in the quality of accounting information. | 4.57 | 91% | 22.43 | 0 | 0.7 |

| The inability of cloud computing service providers to provide cloud computing services on a permanent and continuous basis affects the quality of accounting information. | 4.47 | 89% | 27.2 | 0 | 0.54 |

| The difficulty of determining the integrity of the infrastructure of cloud computing service providers increases the difficulty of choosing the most efficient one in order to access quality accounting information. | 4.32 | 86% | 19.42 | 0 | 0.68 |

| Costs associated with the use of cloud computing applications exceeding the expected benefits affects the efficiency of using this technology and the quality of its information. | 4.29 | 86% | 17.37 | 0 | 0.74 |

| The lack of a contingency plan that responds to any potential risks in cloud computing applications, such as partial or total damage, which may lead to slowing down work interruption, or the loss of accounting information’s quality. | 4.28 | 85.60% | 20.62 | 0 | 0.77 |

| The inability of cloud computing applications to provide all the services that companies need and that are commensurate with the nature of the work of companies wishing to use them loses the accounting information its quality. | 4.28 | 86% | 16.7 | 0 | 0.62 |

| The lack of special software to solve the problems of not accessing data or private applications in the cloud, which may affect communication with cloud computing service providers, affects the quality of accounting information. | 4.14 | 83% | 14.17 | 0 | 0.8 |

| The difficulty of finding standards or measures by which the company can monitor the risks of using cloud computing to mitigate them to sustainable levels affects the quality of the information generated by it. | 4.08 | 82% | 14.99 | 0 | 0.72 |

| The inability of cloud computing applications to link with the company's databases that use cloud computing services affects the quality of its financial reporting information. | 3.46 | 69% | 4.97 | 0 | 1.06 |

| The high costs of using cloud computing applications that are needed to establish the infrastructure necessary to use them increases the difficulty of producing quality accounting information. | 3.46 | 69% | 4.35 | 0 | 0.93 |

| The lack of an infrastructure in the companies using and providing cloud computing services that accommodates the requirements of using this technology and its developments affects the quality of accounting information. | 3.36 | 67% | 3.84 | 0 | 0.94 |

| The use of cloud computing services by companies using undeveloped computer systems affects the efficiency of their applications, which will negatively affect the quality of accounting information. | 3.03 | 61% | 0.31 | 0.76 | 0.97 |

| The average of the second axis as a whole | 3.98 | 80% | 34.25 | 0 | 0.29 |

In table 9, the researcher notes that all the items of the axis related to the role of the physical risks resulting from the use of cloud computing in the quality of accounting information have obtained an arithmetic average that exceeds the test average which is (3) at the level of significance (α≤0.05). With the exception of the item “The use of cloud computing services by companies using undeveloped computer systems affects the efficiency of their applications, which will negatively affect the quality of accounting information.” as the level of significance (sig) was greater than 0.05, which means that the difference of arithmetic average for this item from the test average is not statistically significant.

Table 9 also shows the arithmetic averages and relative weights arranged in descending order, as indicated, the risks related to "The inability of the company using and providing cloud computing service to deal with emergency conditions such as power outages or cloud outages affect the efficiency of using this service and are reflected in the quality of accounting information. Had the highest arithmetic average of (4.57) and a relative weight of (91%). Followed by the two items “The inability of cloud computing service providers to provide cloud computing services on a permanent and continuous basis affects the quality of accounting information.” and “The difficulty of determining the integrity of the infrastructure of cloud computing service providers increases the difficulty of choosing the most efficient one in order to access quality accounting information.” with an arithmetic averages of (4.47) and (4.32), and relative weights of 89% and 86% respectively, while the risks related to “The lack of an infrastructure in the companies using and providing cloud computing services that accommodates the requirements of using this technology and its developments affects the quality of accounting information. “ and "The use of cloud computing services by companies using undeveloped computer systems affects the efficiency of their applications, which will negatively affect the quality of accounting information." had the lowest arithmetic averages and relative weights; (3.36, 67%) and (3.03, 61%), respectively. Table (14), shows that the arithmetic average of the items related to the role of physical risks in the quality of accounting information from the point of view of the service receiver amounted to 3.98, a relative weight of 80%, and a significant level of (T) values 0.00, which is less than the level of significance (α≤0.05). This indicates the rejection of the null hypothesis and the acceptance of the alternative hypothesis which states that "Physical risks have a role in the quality of accounting information from the point of view of the service receiver at the level of significance (α≤ 5%).”

To verify the second main hypothesis, a single sample (T) test was conducted for the role of cloud computing risks in the quality of accounting information from the service receivers’ point of view. Table 10 shows the results of this test.

| Table 10 Results Of Testing The Second Main Hypothesis Regarding The Role Of The Risks Of Using Cloud Computing In The Quality Of Accounting Information From The Point Of View Of The Service Receivers |

|||||

|---|---|---|---|---|---|

| The second main hypothesis | Mean | Relative weight | t | Sig. | Std. Deviation |

| The risks of using cloud computing has no role in the quality of accounting information from the point of view of the service receivers | 4.03 | 81% | 40.82 | 0 | 0.25 |

Table 10 shows the results of testing the second main hypothesis related to the role of the risks of using cloud computing in the quality of accounting information from the point of view of the service receivers. The results show that the arithmetic mean was 4.03 with a significant level of 0.00 which is less than 0.05 for all items related to the role of cloud computing risks in the quality of accounting information from the point of view of the service receiver, which indicates the rejection of the null hypothesis and acceptance of the alternative hypothesis which states that “The risks of using cloud computing have a role in the quality of accounting information from the point of view of the service receivers at the level of significance (α≤5%).

Findings and Recommendations

Preamble

This study aimed to reveal the role of the risks of using cloud computing (human, legislative, physical, and computer security) in the quality of accounting information from the perspectives of the service providers and receivers, in order to help develop the necessary plans and policies to reduce the risks of its use. It also aimed to identify the difference between the two views of the service receivers and providers regarding the role of the risks of using cloud computing (human, legislative, physical, and computer security) in the quality of accounting information, as well as to investigate the role of the risks of using cloud computing in the quality of accounting information. After the completion of the statistical analysis, the most important results and recommendations are presented as follows.

Results

The study reached the following results:

1. Human and legislative risks have a role in the quality of accounting information from the point of view of the service receivers as well as the service providers at the level of significance (α≤0.05).

2. Physical risks have a role in the quality of accounting information from the point of view of service receivers as well as the service providers at the level of significance (α≤0.05).

3. Computer security risks have a role in the quality of accounting information from the point of view of the service receivers as well as the service providers at the level of significance (α≤0.05).

4. The risks of using cloud computing have a role in the quality of accounting information from the point of view of the service receivers as well as the service providers at the level of significance (α≤0.05).

5. There is no difference between the service receivers and the service providers regarding the role of human and legislative risks in the quality of accounting information at the level of significance (α≤0.05).

6. There is a difference between the service receivers and the service providers regarding the role of physical risks in the quality of accounting information at the level of significance (α≤0.05).

Recommendations

In light of the results that have been reached, the researcher recommends the following:

1. For the administration of companies using cloud computing to follow up on local and international releases related to cloud accounting information systems technology, its risks, and the most important developments related to it to avoid these risks and thus enhance the quality of the financial reports’ information.

2. For specialized professional bodies, including the Jordanian Certified Public Accountants Association, to hold practical training courses for companies regarding to the uses of cloud computing and how to reduce all risks associated with it.

3. For the administrations of cloud computing companies to activate the role of control activities in accordance with the framework of the COSO Committee in general to ensure that the response to cloud computing risks is implemented in an appropriate and timely manner and to enhance the quality of financial report’s information.

4. For companies management to hold training courses for employees and financial managers to train them to work according to an accounting information system based on cloud computing and thus reduce the risks associated with it.

5. For researchers and scholars to investigate issues related to cloud computing, including its components and characteristics that are appropriate to the environment of Jordanian companies, and to make comparisons between the various Jordanian sectors that use cloud computing.

References

- Ahronovitz, M., Amrhein, D., Anderson, P., de Andrade, A., Armstrong, J., Arasan, B., Bartlett, J.,… & Carlson, M. (2011). Cloud computing use cases white paper produced by the cloud computing use cases discussion group. Retrieved from http://www.cloud-council.org/Cloud_Computing_Use_Cases_Whitepaper-4_0.pdf.

- Azadi, A., Azadi, E., & Lari, M. (2013). Investigating the effects of cloud computing on accounting and its comparison with traditional models. Advances in Environmental Biology, 7(10), 2836-2846.

- Adel, A., Reza, S., & Justice O. (2013). Cloud computing from SMES perspective: A survey-based investigation. Journal of Information Technology Management, 24(1), 260-350.

- Ahmed, A., Michael, N., & Dechun, W. (2013). Does mandatory adoption of improve accounting quality? Preliminary evidence. Contemporary Accounting Research, 30(4), 24-76.

- Bizarro, P., & Garcia A. (2012). Cloud computing from an Auditor’s Perspective. Internal Auditing, 27(5), 58-89.

- Buyya, R., Yeo, C., & Venugopal, S. (2008). Market-oriented cloud computing: Vision, hype, and reality for delivering it services as computing utilities. Proceedings of the 10th IEEE International Conference on High Performance Computing and Communications. Dalian: China.

- CAI (2013). Cloud solutions best practices - Benchmark study. Retrieved from http://cloudaccountinginstitute.org.

- Catalina, I. (2015). Cloud computing - Impact on business. Aalborg University: Copenhagen.

- Chornous, A., & Ursulenko, O. (2013). Risk management in banks: New approaches to risk assessment and information support. Ekonomika, 92(1), 192-214.

- The Committee of Sponsoring Organizations 'COSO’ (2012). Enterprise risk management for cloud computing. Washington. D.C. Retrieved from https://www.coso.org/Documents/Cloud-Computing-Thought-Paper.pdf.

- Defelice, A. (2010). Cloud computing: What accountants need to know. Retrieved from https://www.Knowledge-tree.com/blog/2011/03/5/10-cloud-based-apps-give-mid-sized-companiescompetitive-edge.

- Dhali, S. (2015). A study on cloud computing adoption of small and medium enterprises. Malmö, Sweden: Malmo University.

- Dimitriua, A., & Mateia, N. (2014). Emerging markets queries in finance and business. A new paradigm for accounting through cloud computing. Procedia Economics and Finance, 15(1), 22-33.

- Ernst & Young (2012). Cloud computing issues and impacts. Global Technology Industry Discussion Series.

- Gartner, A. (2009). Gartner highlights five attributes of cloud computing. Is the world's leading research and advisory company. Retrieved from: http://www.gartner.com/newsroom/id/1035013.

- Glazer, R., & Walter, W. (1993). A measuring the value of information: The Information-Intensive Organization. Ibm System Journal, 32(1), 40-72.

- Grabinski, K., Kedzior, M., & Krasodomska, J. (2014). The polish accounting system and IFRS implementation process in the view of empirical research. Journal of Accounting and Management Information Systems, 13(2), 12-30.

- Grance & Grance, P.T. (2009). The definition of cloud computing. National Institute of Standards and Technology, 53(6), 32-39.

- Grossman, R.L. (2009). The case for cloud computing. IT Professional, 11(2), 23-48.

- Hayduk, L., Cummings, G., Boadu, K., Pazderka-Robinson, H., & Boulianne, S. (2007), Testing! Testing! One, two, three–testing the theory in structural equation models. Personality and Individual Differences, 42(5), 841-850.

- Hill, S., & Wright, R. (2013). The cloud takes shape. New York: KPMG.

- Ilie, S., & Windekilde, I. (2014). Cloud computing - Impact on business. Copenhagen, Denmark: Aalborg University.

- Jones, S., Irani, Z., Sivarajah, U., & Love, P. (2017). Risks and rewards of cloud computing in the UK public sector: A reflection on three organisational case studies. Information Systems Frontiers, 21, 359-382.

- Kinkela, K. (2015). Practical and ethical considerations on the use of cloud computing in accounting. Journal of Finance and Accountancy, 1-8.

- KPMG (2013). Taking a sober look at security. New York: KPMG.

- Kieso, W.,& Warfield (2016). Intermediate Accounting (16th edition).

- Marston, S., Li, Z., Bandyopadhyay, S., Zhang, J., & Ghalsasi, A. (2011). Cloud computing the business perspective. Decision Support Systems, 51(1), 176-189.

- Mell, P., & Grance, T. (2011). The Nist definition of cloud computing. Retrieved from https://nvlpubs.nist.gov/nistpubs/legacy/sp/nistspecialpublication800-145.pdf.

- NIST (2011). National institute of standards and technology special publication. Retrieved from https://nvlpubs.nist.gov/nistpubs/legacy/sp/nistspecialpublication800-145.pdf.

- Molnar, D., & Schechter S. (2010). Self-hosting vs. Cloud-hosting: Accounting for the security impact of hosting in the cloud. Workshop on the Economics of Information Security: Harvard University, Cambridge.

- Peter, H. (2010). Standards and standardization handbook. Pictures Shutterstock, European Commission a valiable. Retrieved from https://www.iec.ch/about/globalreach/academia/pdf/academia_governments/handbook-standardisation_en.pdf.

- Sacer, I., & Ioluic, A. (2013). Information technology and accounting information systems' quality in croatian middle and large community. Journal of Information Technology and Accounting Information Systems' Quality in Croatian Middle and Large Community, 37(2), 86-102.