Research Article: 2018 Vol: 22 Issue: 2

The Impact of the Application of the Governance Mechanisms on the Efficiency of the Audit Performance and the Level of Disclosure in the Financial Reports: An Applied Study to a Sample of Companies Listed in the Iraqi Stock Exchange

Nadhim Shaalan Jabbar, University of Al-Qadisiyah

Keywords

Iraqi Stock Exchange (ISX), Corporate Governance (CG), World Trade Organization (WTO).

Introduction

Researchers and practitioners have dedicated a considerable attention in studying the problem of corruption and they have necessitated the need to develop and establish institutional framework designed to address the problem through-out and specific action plans. These plans are actually aimed at frightening corruption in all its forms and manifestation in the life aspects so as to accelerate the process of economic progress. The issues of financial and administrative corruption are not confined in terms of their impacts to the negative aspects present in a certain sector of society, but they also extend to all members and sectors of society. They actually have a direct impact on the country’s overall performance in the market and impede economic development, as well as causing a disruption in the structural foundation of the larger community. Additionally, such ill practices can turn individuals against their own values by embracing code of conducts which are considered alien and unwelcomed in any society where those values and principles are usually well-established. In order to achieve the objectives of the present study, the researcher is divided into three main parts: the research methodology, theoretical framework and the practical perspectives. Finally, the researcher has ended his researcher with a series of conclusions and remarkable recommendations for further studies.

Literature Review

The study of the governance of corporates has been the concern of many scholars and researchers due to its importance in regulating the codes of conducts to the corporates various performances including auditing. These studies are at the local and international levels. To avoid a synthesis of the repeated related literature, the researcher refers to some of the remarkable studies in this concern below.

Al-Beshtawi, Zraqat & Al-Husseini’s (2015) study entitled "Corporate Governance and its Impact on Disclosure Level in the Accounting Information in Iraq”. The study aimed at explaining the impact of corporate governance on the level of accounting disclosure in the financial statements. The problem of the study was focused on answering the main question which is: (what is the impact of corporate governance on the level of disclosure on the financial statements?) The study concluded with a number of conclusions, the most important of which are:

? The level of disclosure in the financial statements of the Public Shareholding Company in Iraq.

? A positive relationship with statistical significance indicating the concentration of individual ownership in the Public Shareholding Company in the Kingdom of Saudi Arabia and the level of disclosure in the financial statements.

? There is no statistically significant negative relation between the independence between the members of the board of directors of the Public Shareholding Company in Iraq and the level of disclosure in the financial statements.

? The existence of positive correlation with positive a statistical significance of the size of the company and the level of disclosure in the financial statements of the public shareholding company in Iraq.

Al-Anzi’s (2014) study entitled “An Analysis of the Impact of Corporate Governance on the Quality of Accounting Disclosure: An Applied Study to a Sample of Iraqi Banks”. This study aims to examine the relation between administration board size and the accounting disclosure level in a sample of 1o Iraqi banks. The study reached to a number of theoretical and practical conclusions that the most important of which are:

? There is no clear legal text emphasize the application of the principles and mechanisms of corporate governance in Iraq, but the legislations that control the Iraqi companies include implication of such principles and mechanisms.

? The good application of the corporate governance leads to decreasing the problems result from the gap between the stockholders and the executive managers due to the negative practices of those executive managers, so it helps in sort of, control the managers by being interesting on the stockholders benefits.

? The study sample companies have different levels of disclosure, the highest rate is (80%) and the lowest is (56%), the average is (68%).

Anwar (2015) conducted a study entitled “Does Corporate Governance Taken Seriously by Iraqi Listed Companies?” This study was applied to a sample of selected Iraqi banks and corporates of different sectors (Insurance, Agricultural and Tourism) listed in the Iraqi Stock Exchange to examine how seriously the corporate governance is adapted by the sample of the study, as well as to determine the reasons of why is not taken seriously by the other corporates of the sample of the study. The study concludes that corporate governance is taken serious in the Bank sector of the Iraqi Stock Exchange and is not taken serious in other sectors such as Insurance, Agricultural and Tourism.

Al-Sartawi (2015) conducted a study entitled “The Effect of Corporate Governance on the Performance of the listed Companies in the Gulf Cooperation Council Countries” in which he investigates the effect of corporate governance on the performance of listed gulf companies. And at the same time investigates the level of difference between these companies in implementing the corporate governance. The study result indicated that, despite of the variation in applying corporate governance between the GCC listed companies, there is a sufficient level of commitment to the principles of corporate governance as well as the results showed that some performance indicators effected by corporate governance principles.

Al-Sartawi (2018) conducted an empirical study entitled “Corporate Governance and Intellectual Capital: Evidence from Gulf Cooperation Council Countries” for showing the relationship between Intellectual Capital Governance (GCC).However, in the GCC counties empirical studies are still at the early stages and a subject of negligibility. On the other hand, a study that was conducted in Bahrain by Sarea & Shaima (2016) revealed that investing in intellectual capital will decrease earning management practices because of the existence of talented employees and the style of management applied will lead the company to be more interested in real revenues rather than manipulating the numbers. Additionally, a study conducted by Al-Musalli & Ismail (2012) examined the relationship between board of directors’ characteristics (educational level diversity, nationality diversity, board interlocking, board size and number of independent directors) and intellectual capital performance in a sample of 147 banks in Gulf Cooperation council (GCC) countries for the period 2008-2010 revealing that IC performance of GCC listed banks is low because of the negative relationship with the independent directors in GCC listed banks (Al-Ajmi, 2009).

Another Study in China done by Sami, Wang & Zhou (2011) discussed the link between operating performance and corporate governance; the results show a positive relation between corporate governance measures and operational performance. Onakoya, Fasanya & Ofoegbu (2014) explores the impact of corporate governance practices on bank performance in Nigeria. Nine banks were examined in the study for the period from 2006 to 2010. The data were analysed by using regression test. It was found that ownership structure and the board size are positively affected by the return on equity. Whereas, negatively associated with return on assets. Added to that, there is no effect of board structure on corporate governance practice.

Some explores the effect of corporate governance mechanisms on Nigerian banks performance. They found that corporate governance is associated significantly with banks performance. As well as, they also found that loan deposit ratios and poor asset quality are negatively affecting the banks performance. In Sri Lanka, the impact of corporate governance practice on firm performance was tested. It was found that size of board is negatively associated with the firm value. In Malaysia, investigation was done on the effect of corporate governance on Malaysian firm's performance on sample of thirty firms in 2007 annual reports of those firms. Results show that corporate governance negatively associated with ROE and ROA.

Another study adopted by Fallatah & Dickins (2012) to investigate the relationship between corporate governance characteristics and firm performance in Saudi-listed companies on sample of 292 observations for the period from 2006 to 2009 using the ROA measure. The results found that corporate governance and firm performance (measured as return on assets) are unrelated.

Through the previous presentation of the results of previous studies in the area of governance, accounting disclosure and stock price, it becomes clear that most of the previous studies dealt with the study of corporate governance and standards, focusing in part on the efficiency of the market and the quality of financial reports. Therefore, this study differs from the previous ones in its coverage of many axes related to studying the level of commitment of companies participating in the Iraqi Stock Exchange by applying the principles of governance and its impact on achieving the quality of accounting.

Research Methodology

Research Problem

Corporate governance mechanisms are primarily designed to protect and guarantee the rights of shareholders and all interested parties associated with the company's business through the control and control of the performance of the company's management. Therefore, the interest in implementing the concept of corporate governance was the best solution to deal with the negatives that accompanied the collapse of many economic institutions. The absence of clear laws and regulations for governance in the Iraqi environment will lead to the concealment of many facts from the financial and non-financial information that may affect the level of disclosure in the financial statements, which leads to the reluctance of investors to invest in that environment because the guarantees are weak and discouraging investment. Hence, the research problem can be addressed through the following main question:

How corporate governance mechanisms can address negatives, tighten controls and enhance corporate performance?

Research Importance

Corporate governance is considered as one of the most important pillars for corporates to enhance their performance through the role they play in disclosing the information needed by investors, creditors, suppliers and other stakeholders in these companies that in return attracts the capital these corporates need in their financing process. Therefore, this leads to the development of accounting practices that make the accounting information contained in the financial reports reflect the real financial position of the company and minimize the errors a possible extent by using preventive system that prevents the occurrence of such errors and avoids additional costs and burdens.

Research Objective

The study aims to study the implications of the application of corporate governance mechanisms at the level of disclosure and the efficiency of audit performance through studying some of mechanisms of corporate governance and seeking to measure them and identify the extent of commitment to a sample of listed companies in the Iraqi Stock Exchange.

Research Hypothesis

The present study is built on one basic hypothesis which is:

H: There is no impact of the governance mechanisms on the efficiency of the audit performance and the level of disclosure in the financial reports of the listed companies listed in the Iraqi Stock Exchange.

Research Limits

The present research is limited on examining a sample of shareholding companies listed in the Iraqi Exchange which are composed of five economic sectors for the period from 2011 to 2015.

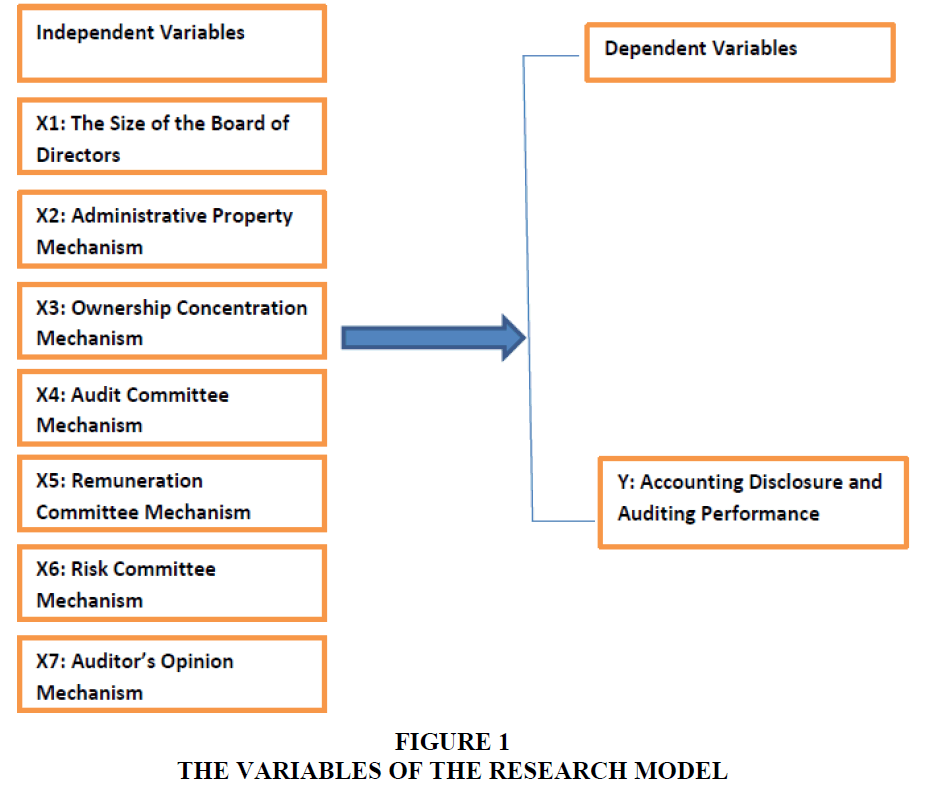

Research Modal

The study is based on a modal of analysis composed of seven independent variables which all resulted with a dependent variable, as shown in Figure 1.

An Overview Of The Corporate Governance

The Concept of Corporate Governance

Corporate governance has become one of the most common terms in the modern global business dictionary. This raises the question, "Is corporate governance a vital component of successful business or is it just another heresy that will fade and decay over time?" In fact, the term imposed itself by force or coercion or voluntarily created by unstable conditions, disturbed unrest and violent incidents that swept through some financial and business markets and cast doubt on them. It raised many questions about the credibility of the data issued by these companies and the possibility of their reliability in making any decision and in expressing the reality of the situation of companies. The importance of governance is not limited to those treatments in the financial markets, but it is also extended to businesses, governments, countries and international institutions especially after the collapse of the major companies in the world. The emergence of these scandals has devastating effects and consequences which led to the emergence of the importance of governance. The definitions of the term have varied so that each one indicates the viewpoint of IRS adopter. Globally speaking, there is no specific universal definition among accountants, administrators, lawyers and financial analysts. Each definer refers to this concept as a reflection of his personal view point. Below is a set of various definitions to this concept adopted by various researchers and practitioners:

1. Hitt, Ireland & Hoskisson (2016:308) state that governance of corporates broadly refers to the mechanisms, relations and processes by which a corporation is controlled and is directed; involves balancing the many interests of the stakeholders of a corporation.

2. According to the Organization of Economic Cooperation and Development OECD, “Corporate governance is the system by which business corporations are directed and controlled. The corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation, such as, the board, managers, shareholders and other stakeholders and spells out the rules and procedures for making decisions on corporate affairs. By doing this, it also provides the structure through which the company objectives are set and the means of attaining those objectives and monitoring performance”.

3. John & Senbet (1998) defined corporate governance as “deals with the way in which suppliers of finance to corporate assure themselves of getting a return on their investment”.

4. According to Cadbury, “Corporate Governance is concerned with holding the balance between economic and social goals and between individual and communal goals. The corporate governance framework is there to encourage the efficient use of resources and equally to require accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society” (Cadbury, 2000:198).

5. Demirag, Sudarsanam & Wright (2000) referred to the corporate governance as a set of contractual relationships between corporate management and stakeholders through the creation of procedures and structures used to manage the affairs of the company and directing its work to ensure enhanced performance, disclosure, transparency and accountability And maximize interest for long-term shareholders, taking into account the interests of different parties (Demirag, Sudarsanam & Wright, 2000:301).

6. Hermanson & Rittenberg (2003) define corporate governance as "processes through stakeholder actions to provide risk management and management through management and control of organizational risk and to emphasize the adequacy of controls to avoid these risks".

Through the previous definitions, it is possible to say that corporate governance refers to the system that is designed to develop applications and good practices for the management of the company to preserve the rights of the shareholders, employees of the company and the stakeholders by investigating the implementation of contractual relations among them following financial and accounting instruments in accordance with disclosure and transparency standards.

Governance Significance and Justification

The importance of corporate governance has increased significantly in recent years to achieve development and enhance the economic well-being of peoples. This was highlighted by the financial crisis, the collapse and the scandals of major companies, such as Enron Company for Energy and the subsequent series of discoveries of companies manipulating their financial statements that did not reflect their actual reality in collusion with major international companies for auditing and accounting. At the economic level, the importance of corporate governance in achieving economic development and avoiding financial crises is increasing. This is achieved through the establishment of a number of performance standards, which strengthen the economic fundamentals in the markets and uncover cases of manipulation, financial and administrative corruption and mismanagement and to work to stabilize them and reduce the extreme fluctuations in them and thus achieve the desired economic progress (OECD, 2012).

As far as the accounting and auditing levels, Michael (2005) point out that the significance of the governance is embodied in the following:

1. Combating the financial and administrative corruption radically.

2. Ensuring integrity and impartiality for all employees in the company starting from the board of directors and the executive managers to the lowest level of their employees.

3. Avoiding any intentional errors or unintentional deviations preventing and/or minimizing heir continuation or using advanced control systems.

4. Maximizing the use of accounting and internal control systems and achieving the efficiency of spending and linking expenditure to production.

5. Achieving sufficient disclosure and transparency in the financial statements.

6. Ensuring maximum effectiveness for external auditors, ensuring that they are highly independent and not subject to any pressure from the Board of Directors or Executive Managers.

Corporate Governance Mechanisms

The availability of mechanisms that ensure the sound and stable management of companies while avoiding many other negative impacts is one of the important and critical requirements for ensuring the quality of corporate governance. The majority of writers and researchers agreed to divide corporate governance mechanisms into two internal mechanisms and external mechanisms (Bushman & Smith, 2003:237).

Internal Corporate Governance Mechanisms

The internal corporate governance mechanisms focus on the company's activities and take the necessary measures to achieve the company's objectives. The internal corporate governance mechanisms can be classified as follows:

Board of Directors

According to Middlemist (2004), the board of directors consists of individuals who are elected by the shareholders to be responsible for representing the firm’s owners by monitoring top-level managers’ strategic decisions. In general, the board makes decisions as a fiduciary on behalf of shareholders. Issues that fall under a board's purview include the hiring and firing of executives, dividend policies, options policies and executive compensation. Moreover, a board of directors is in charge of helping a corporation set broad goals, supporting executive duties and ensuring the company has adequate, well-managed resources its disposal (Kim et al., 2012: 69).

Due to the large number of tasks assigned to the Board, the sensitivity of its work and its presence as a supreme authority mandated by shareholders to take care of their interests, the board aims to form an affiliated number of committees the most prominent of which are:

Audit Committee

It is also called the internal audit committee, which is a standing committee emanating from the board of directors consisting of a number of non-executive board members, the main role of the audit committee in relation to the internal control system is to investigate the adequacy, effectiveness of its implementation and make recommendations to the board of directors which will activate and develop the system to achieve the company's objectives and protect the interests of the owners and other stakeholders with high efficiency and reasonable cost. Therefore, the members of the committee must have experience in the fields of accounting and auditing as well as delegating the authority to work in accordance with the provisions issued by the board. Responsibilities of the audit committee typically include:

? Overseeing the financial reporting and disclosure process.

? Monitoring choice of accounting policies and principles.

? Overseeing hiring, performance and independence of the external auditors.

? Oversight of regulatory compliance, ethics and whistle-blower hotlines.

? Monitoring the internal control process.

? Overseeing the performance of the internal audit function.

? Discussing risk management policies and practices with management.

Remuneration Committee

It consists of three non-executive members of the Board of Directors that are independent. The functions and duties of the Remunerations Committee are focused on determining the salaries, bonuses and benefits of senior management. According to Mintz (2003), the duties of the Remuneration Committee can be summarized as follow:

? Identify and review the remuneration and other benefits of Senior Management and recommend to the Board of Directors for approval.

? Develop policies to manage senior management reward programs and review these policies periodically.

? Take steps to modify senior management compensation programs that result in payments that are not reasonably related to the performance of the senior management member.

? Develop management policies and review them consistently.

Risk Committee

The Risk Committee is composed of at least three members and preferably independent. The committee's task is to develop a well thought out strategy for potential risks. This strategy should be clear, written and adapted to the nature of the unit's activity, in addition to establishing risk management under its supervision and working with the executive management. According to Holdings & Charter (n.d.), the functions of the Risk Committee shall be as follows:

? Coordinate with risk management with regard to risk discussion, degree and prevention methods.

? Validate reports regularly raised from risk management.

? Monitor the Company's commitment to risk management policy and risk limits of all types.

? Review the risk management system applied in the economic unit and makes any observations in the event of a defect.

? The Board of Directors should be informed of future plans to address potential risks that may have affected the Company's performance, failure or collapse.

Appointment Committee

Board members and employees should be appointed among the best candidates who fit their skills and experience with the specific skills and expertise of the company. In order to ensure transparency in the appointment of the members of the Board of Directors and the rest of the staff, the Committee has developed a number of duties:

? The appointment committee of the company shall, together with the board of directors and with the approval of the competent minister, develop the skills and expertise required to be available to the board member and the required employees.

? The Nominating Committee shall establish transparent recruitment mechanisms, ensuring the best qualified candidates.

? The committee and the rest of the board of directors should evaluate the required skills of the company continuously.

? The committee must announce the job to be occupied and invite qualified applicants to apply.

? The Commission should object to objectivity by comparing the qualifications and skills of the applicant to the specifications set by the company (Adams, Hermalin & Weisbach, 2010).

Ownership Concentration

The measurement of the mechanism of concentration of ownership can be determined by the shares owned by the major shareholders and are measured by a percentage representing at least 5% of the shares issued by the company. The greater the percentage, the more motivated owners of ownership focused in monitoring the activities of the company and participation in administrative decisions. Ownership structures in companies are usually divided into two main parts: ‘concentrated ownership’ and ‘dispersed ownership’. A concentrated ownership structure occurs when ownership or control is concentrated for a small number of individuals or institutions and a large proportion of the company's shares so that they can control the performance of the company because they have the right to vote the so-called ‘internal control systems’. Whereas, distributed ownership is contrary to concentrated ownership. This means that there are a large number of shareholders but they own a small number of the company's shares. These small shareholders do not have the incentive to monitor the company's activities closely and tend not to participate in the policies and decisions of the management. The dispersed ownership structure is called ‘external systems’.

Administrative Ownership Mechanism

The structure of administrative property means the amount or proportion of shares held by members of the board of directors or executive directors of the company's shares, where these directors or members of the board of directors are more inclined to control if they have the shares they hold in such companies. The property management is that the administration will work to maximize its interests at the expense of the interests of the shareholders, so that the administrative property can affect the agency costs (Youssef, 2012).

Executive Compensation/Executive Pay

The executive management compensation mechanism is considered as one of the most complex internal governance mechanisms, therefore a high accuracy is required when making executive compensation decisions. This system is regarded as the one of the best ways to reduce the issues caused by the agency, where salaries and bonuses are paid to managers in order to motivate them to carry out the duties required of them. The main goal of the compensation system is not only to achieve the satisfaction of executives but to attract the best employees in economic units and maintain them and ensure loyalty to the company and motivate them to work better to achieve the objectives of economic unity.

Internal Audit

The internal audit function plays an important role in the governance process, as it enhances this process by increasing the ability of citizens to hold the company accountable. Internal auditors, through their activities, increase credibility and fairness, improve the behaviour of employees of state-owned enterprises and reduce the risk of administrative and financial corruption. In this respect, Cohen (2004) maintains that the independence of this function is strengthened when reporting directly to the Audit Committee rather than to management. Furthermore, the effectiveness of the Internal Audit Committee can be increased when it is able to distribute the internal audit staff to obtain important information on special issues Such as strengthening the internal control system and the quality of accounting policies used.

External Corporate Governance Mechanisms

These mechanisms refer to a set of measures that are controlled by those outside an organization and serve the objectives of entities such as regulators, governments, trade unions and financial institutions. These objectives maintain adequate debt management and legal compliance. External mechanisms are often imposed on organizations by external stakeholders in the forms of union contracts or regulatory guidelines. External organizations, such as industry associations, may suggest guidelines for best practices and businesses can choose to follow these guidelines or ignore them. Typically, companies report the status and compliance of external corporate governance mechanisms to external stakeholders (Gebba, 2015). The external corporate governance mechanisms are divided into:

The Market for the Corporate Control

The market is one of the mechanisms of external governance that is used when the internal governance mechanisms of the company fail to control the performance of the executive management. The poor external governance mechanisms will result in a very poor performance which in return leads these companies to be targeted by other competitors for future acquisition. Hence, this matter necessitates the companies’ managers to carefully elevate their performance to the very dimensions of their economic units from the spectre of targeting and retain their positions.

External Audit Mechanism

The role of the external auditor in the recent period has exceeded the traditional role of giving his opinion of the fairness of the financial statements that constitute the main work and the emergence of another role of the achievement of corporate governance, which has become in many eyes an effective tool for economic and financial stability and a means through which to preserve the rights of shareholders and other stakeholders. According to Abbott & Parker (2004), external audit is the cornerstone of good corporate governance. External auditors assist these companies to achieve accountability and integrity, improve operations and instil confidence among stakeholders and clients in general.

Regulations and Legislations

The regulations and legislations affect the key players in the governance process, not only in relation to their role and function in the process, but also in how they interact with each other. For example, the Sarbanes-Oxley Act was imposed new requirements on joint stock companies to increase independent board members, strengthen oversight by the Audit Committee on the financial reporting process and request the Executive Director and CFO to certify financial reporting and effective communication between the external auditor and the audit committee (Al-Tamimi & Jabbar, 2009: 115).

Other External Governance Mechanisms

In addition to the above stated external governance mechanisms, there are other external ones that impact the effectiveness of governance in important ways and complement other mechanisms in protecting the interests of the Company's stakeholders. Cohen (2004) add that they also include regulators, financial analysts and some international organizations. For example, Transparency International is exerting enormous pressure on governments and countries to fight financial and administrative corruption. The World Trade Organization (WTO) is lobbying to improve financial and accounting systems. In the banking sector, the Basel Committee is exerting pressure to practice governance (Cohen, 2004).

Based on the above, it is clear that the main objective of the implementation of corporate governance is through these mechanisms in order to reduce the risks that surround the economic unit. Any failure to implement these mechanisms will lead to a disastrous outcome and due to the diversity of governance mechanisms and the multiplicity of their sources, carrying out these mechanisms requires a comprehensive framework that takes into account all stakeholders in the companies. Each of these parties plays an important role in the governance process. Accordingly, the governance mechanisms will be adopted as variables to measure the level of their application for their clarity and measurability, as they are the latest findings of accounting literature in measuring corporate governance as well as the possibility of linking them to the efficiency of audit performance and the level of disclosure in financial reports.

Empirical Analysis

Describing the Sample of the Study

The sample of the study is composed of nineteen Iraqi shareholding companies registered and listed in the Iraqi Stock Exchange and their as required for the study are available for the period 2011 to 2015. The sample of the study composed of five economic sectors:

1. Banking Sector: Eight Iraqi banks out of twenty three others were selected for their financial reports availability within the Securities Trading Commission.

2. Industry sector: Three Iraqi industrial companies out of eighteen others were selected due to the availability of their financial reports within Securities Trading Commission.

3. Agriculture Sector: A sample of three out of six listed companies was selected for their financial reports availability within the Securities Trading Commission.

4. Services Sector: A sample of two Iraqi companies out of seven others was selected for their financial reports availability within the Securities Trading Commission.

5. Hotel and Tourism Sector: A sample of three companies out of nine companies was selected for their financial reports availability within the Securities Trading Commission.

Measuring the Level of Accounting Disclosure in the Economic Sectors

Standard and Poor's index will be adopted for measuring the dependent variable of the disclosure level for the period from 2011 to 2015 and then identifying the impact of independent variables of governance mechanisms at the level of disclosure in the financial reports of the auditors of companies sample of the study throughout following the statistical models of correlation, regression and other statistical tests through the use of the SPSS program.

Data Statistical Analysis

Statistical analysis of the data was carried out through the use of the SPSS V.20 program. Symbols were given to the independent variables and the code of the dependent variable to facilitate dealing with those variables in the program as shown in Table 1.

| Table 1: The Study Variables | |||

| Independent Variable | Dependent Variable | ||

|---|---|---|---|

| Code | Representation | Code | Representation |

| X1 | The size of the Board of Directors. | Y | Accounting disclosure Audit performance Efficiency. |

| X2 | The administrative property mechanism. | ||

| X3 | The proprietary focus mechanism. | ||

| X4 | The mechanism of the Audit Committee. | ||

| X5 | The mechanism for the existence of the Rewards Committee. | ||

| X6 | The mechanism of existence of the Risk Committee | ||

| X7 | The Audit opinion mechanism | ||

General Statistics of the Study Variables

Table 2 shows the most important statistical means used for analysing the variables of the study (the independent and dependent variables).These statistical means are: the arithmetic mean, the deviation standard and the minimum and maximum values for each variable:

Table 2 shows that the arithmetic mean of the board size variable is 0.94, the highest value is 1 and the lowest value is 0 and the standard deviation is 0.245, meaning that the percentage of compliance with this mechanism by the sample companies is high and this is evident through The value of the arithmetic mean of this variable.

| Table 2: General Statistics Of The Study Variables | ||||||

| Independent Variable | Dependent Variable | Sample Size | Minimum Value |

Maximum Value |

Arithmetic Mean | Standard Deviation |

|---|---|---|---|---|---|---|

| Board Size | Accounting Disclosure and Auditing Performance | 95 | 0 | 1 | 0.94 | 0.245 |

| Administrative Property | 95 | 0.02 | 79.38 | 22.36 | 20.02 | |

| Ownership Concentration | 95 | 5.48 | 87.03 | 42.87 | 21.44 | |

| Review Committee | 95 | 0 | 1 | 36 | 0.482 | |

| Remuneration Committee | 95 | 0 | 1 | 0.11 | 0.309 | |

| Risk Committee | 95 | 0 | 1 | 0.26 | 0.443 | |

| Opinion of Auditor | 95 | 0 | 1 | 0.37 | 0.485 | |

| 95 | 36 | 71 | 54.01 | 12 | ||

The mean value of the administrative property is 0.02 and the highest value is 79.38. The mean value is equal to 22.36 and the standard deviation is 20.02. This means that there are companies with a high ownership ratio by the members of the Board of Directors which researched to about 79, whereas other companies have a low percentage of board members which reached to 2%.

The third variable, it represents the ownership concertation. The data reveal that the arithmetic mean of this variable is 42.87 and the lowest ratio is 5.48. It represents the lowest percentage of the ownership concentration companies or the highest percentage of concentration of ownership in companies sample study that reached to 87.03.This means that there is who owns about the 87% of the shares of those companies. The standard deviation of this variable was 21.44, which is considered to be somewhat high. This is due to the difference in the ownership of the shares of these companies by the major shareholders; in some companies has a high percentage of ownership, while others have low ownership ratios reached 5.48%.

The fourth variable is the variable of the Audit Committee, i.e., the existence of the Audit Committee where it reached the lowest value 0. It is evidence that the companies do not have a review committee. The highest value is 1, i.e., the companies have a review committee and the arithmetic mean value of this variable is equal to 0.36 (36%) of the companies. The study sample has review committees and the rest of the companies do not have such committee.

Regarding the fifth variable which represents the Remuneration Committee, the lowest value is 0 and the highest value is 1, the arithmetic mean ratio is 0.11 with a standard deviation ratio 0.309. This means that 11% out of the other companies do not have remuneration committees.

The sixth variable, which represents the risk committee, has the lowest value of 0 and the highest value is 1 and the mean value of the calculation is equal to 0.26 and the standard deviation value is 0.443.Throughout the arithmetic ratio of the Risk Committee variable, it is clear that 26% of the study sample companies have a risk committee whereas the rest of the companies do not have a risk committee.

The last independent variable, which represents the opinion of the auditor, has the lowest value of 0 and the highest value of 1, the ratio of the arithmetic mean is equal to 0.37 and the standard deviation ratio 0.485. Through the arithmetic mean of the opinion of the auditor, 37% is an unqualified opinion, while the supplementary percentage means that the opinion of the auditor is conservative.

Concerning the independent variable which represents the Accounting Disclosure and Auditing Performance, the data reveal that the lowest percentage of it reaches to (36%, which indicates that the companies are disclosed in this percentage whereas in return that there are some other companies where the disclosure of the accounting and auditing performance percentages reach to 71%.

Analysis of Correlation between Independent and Dependent Variables

For the purpose of analysing the correlation between the variables, the results values of these correlations were first found using the SPSS vr.20 as shown in Table 3.

| Table 3: Correlation Between The Variables Of The Study | |||||||

| Dependent Variable | Independent Variable | ||||||

|---|---|---|---|---|---|---|---|

| Disclosure of Accounting and Auditing Performance | Board Size | Administrative Prosperity | Ownership Concentration | Review Committee | Remuneration Committee | Risk Committee | The Opinion of Auditor |

| Pearson Correlation | 0.167 | 0.239* | -0.225* | 0.381** | 0.732** | 0.462** | 0.897** |

| Sig. (2-tailed) | 0.106 | 0.019 | 0.028 | 0.000 | 0.000 | 0.000 | 0.000 |

| N | 95 | 95 | 95 | 95 | 95 | 95 | 95 |

| ** Correlation is significant at the 0.01 level (2-tailed) * Correlation is significant at the 0.05 level (2-tailed) |

|||||||

Table 3 illustrates the significant correlations with positive direct reverse of 5% for all variables with the response variable which represents the level of disclosure of accounting and auditing performance with different degrees of strength as the positive direct reverse value for all the variables is less than 5%, except for the first variable, which is the variable size of the board of directors. The value of the correlation between the size of the board of directors and the disclosure of accounting and auditing performance is 0.167 and the direct reverse value is equal to 0.106. This means that there is no significant correlation between the two variables. Moreover, the correlation between administrative ownership and disclosure of accounting and the auditing performance is 0.239 with a significant value of 0.019. This indicates that there is a significant correlation between the variables. Additionally, the value of the correlation between the concentration of ownership and disclosure was (-0.225) with a significant value (0.028). This indicates that there is a correlation between the two variables, meaning that the higher the concentration of ownership in the companies sample study the lower the level and quality of disclosure and vice versa. As for the fourth variable, which represents the Audit Committee, the correlation between it and the disclosure was 0.897 with a significant value 0.000. This indicates that there is a significant correlation between the two variables. The value of the correlation between the fifth variable for the Remuneration Committee and the disclosure of accounting and auditing performance is (0.462) with direct reverse value of 0.000. It can be inferred that there is a significant positive correlation between the variables. The correlation between the sixth variable, the existence of the risk committee and the level of disclosure, was 0.732 with a significant value of 0.000. This means that there is a significant correlation between the two variables. The last variable, which is the opinion of the auditor, has a correlation value with the disclosure of accounting and auditing performance as 0.381 with a significant value of 0.000. This also indicates that there is a correlation between the two variables.

Following the modal of regression for showing the correlations between the independent and dependent variables of the study, the coefficient for each variable, the t-test and f-test values, the type of the correlations among the variables of the study and the significance level to each variable included, the researcher demonstrates the results of the overall statistical results of these variables in the following Table 4.

| Table 4: The Effect Of Independent Variables Analysis Results In The Dependent Variable | |||||||||

| Dependent Variable | Independent Variables | Coefficient | F-Test Value | Independent Variable Coefficient | T-Test Value | Dependent Variable Coefficient | T-Test Value | Sig. | Correlation Type |

|---|---|---|---|---|---|---|---|---|---|

| Accounting Disclosure and Auditing Performance Level | Board size | 3% | 2.666 | 46.333 | 9.539 | 4.857 | 1.633 | 0.106 | - |

| Administrative Property | 6% | 5.657 | 50.801 | 28.110 | 0.144 | 2.378 | 0.019 | + | |

| Ownership Concentration | 5% | 4.974 | 59.420 | 21.936 | -0.126 | -2.230 | 0.028 | + | |

| Review Committee | 80% | 382.148 | 46.016 | 67.319 | 22.337 | 19.549 | 0 | + | |

| Remuneration Committee | 21% | 25.266 | 52.118 | 44.902 | 17.982 | 5.027 | 0 | + | |

| The Opinion of Auditor | 54% | 107.508 | 48.786 | 49.665 | 19.854 | 10.369 | 0 | + | |

| 15% | 15.822 | 50.533 | 35.088 | 9.438 | 3.978 | 0 | + | ||

The above table shows that the highest value of the F test is for the Audit Committee, followed by the Risk Committee and so on for the other variables. The level of acceptance or rejection of the hypothesis depends on whether the F-test value increased or decreased. Thus, the null hypothesis is accepted if the F-test value is raised as the case with the Risk Committee variable in the Table 4.Whereas, the null hypothesis is rejected and replaced with an alternative hypothesis when the F-test value is decreased as it is with the size of the Board of Directors.

Evidently, the strongest influence by the independent variables in the dependent variable is done by the presence of the Audit Committee. This demonstrates the significant role played by the Audit Committee, which is a link between the regulatory bodies and the Board of Directors. Its presence also leads to the transparency of financial reports and makes them more visible to all users, whether internal or external. Additionally, the presence of the Risk Committee is accurate and important in identifying the potential risks and finding solutions before they occur or to deal with the risks that have already occurred and to eliminate the negative effects, which may lead to the detriment of the interests of all users and the survival of those risks without a committee to address them perhaps This will hinder the functioning of these companies if they continue to exist. Moreover, there is a change in the existence of the Remuneration Committee, which is no less important than the previous two committees because they have an important role in determining the remuneration of the members of the Board of Directors and the executive directors in a manner consistent with their performance. As far as the Opinion Auditor variable is concerned, it occupies the fourth level as it has a positive impact on the level accounting and auditing performance disclosure level. Also, the acquisition of the Board of Directors to the issued shares is considered as an enhancing and motivating factor for them through linking their interest with that of the company as a whole and hence the variable of the Administrative Property has a positive influence on the level of the accounting and auditing performance. The Ownership Concentration variable effect the reverse effect in the sense that the greater the number of shareholders who own 5% or more of the number of shares issued whenever the negative impact on the level of disclosure and often in family companies and may be due to their fear of disclosure as a disclosure For the secrets of the company. Finally, the Size of the Board has no effect according to the table demonstrated above.

Conclusion And Recommendations

Conclusion

1. Corporate governance is one of the new requirements for improving the economy through a positive reflection of the application of its principles of disclosure and transparency by the listed companies in the financial markets, especially as the latter is an important source of funding and information about these companies.

2. Corporate governance is an important measure of reassurance to investors and decision makers based on financial reports prepared and revised in according with corporate governance mechanisms.

3. Creating a transparent and fair system that creates safeguards against corruption and mismanagement and minimizing misinformation, through the principle of disclosure of accounting information, which is an important factor in reducing the cost of the company's capital and ensuring its continuity. On the other hand, raising the efficiency of the financial market.

4. There is no legal provision or legislation in Iraq with regard to the mechanisms or principles of corporate governance except for some texts that exist within the laws such as corporate law, bank law or other laws. However, these laws and regulations cannot compensate for the absence of the principles of governance because these principles Issued by a specialized international organization and has important paragraphs that are more accurate.

5. The results of the study show the commitment of the research sample companies to implement some of the mechanisms of governance, where the highest commitment to these mechanisms is for the banking sector followed by the other sectors in turn, which was due to the entry of external investors in this sector were implementing the principles and mechanisms of governance in their countries.

Recommendations

1. Supporting the application of the corporate governance mechanisms for activating vital practices for corporate managements in consistence with the international rules and regulations, such as the corporate’s compliance to present financial reports quarterly with high level of transparency governed by accepted accounting and auditing standards.

2. The application of governance mechanisms requires the dissemination of a culture of governance in the society. If society recognizes that governance is the first line of defence and a bastion against any corruption or corruption that attempts to deprive society of its wealth, money and gains, it will support its application.

3. The importance of increasing the level of disclosure and transparency in the annual financial reports and all economic sectors to avoid fraud and manipulation by containing those reports on all information that is characterized by accuracy, objectivity and credibility so that this information is useful to all users.

4. The crucial necessity to update some Iraqi laws on the work of companies such as corporate law, banking law, the law of financial markets and the unified accounting system so as to fit the international developments and become supportive mechanisms of corporate governance.

5. The need to adhere to the application of the best governance mechanisms by companies, which will contribute to reducing financial and administrative corruption and open up a wide scope for foreign investment in the Iraqi environment.

6. The need for more efforts by the parties involved in the work of companies and financial markets to follow best practices in terms of international principles and standards and adapt them to the Iraqi environment and obligates companies to implement them because of their importance in improving the content of financial reports.

7. Effective participation in the holding of seminars and conferences on the subject of corporate governance and study of this concept and mechanisms of implementation of all Iraqi companies, especially those listed in the Iraqi market for securities and discussed with all parties concerned.

Acknowlegement

I would like to show my warm thank to Mr. Abdullah Najim Abd Al Khanaifsawy who supported me at every bit and without whom it was impossible to accomplish the end task. His translation and guidelines have empowered me to positively finish this article.

References

- Abbott, L.J. & Parker, S. (2000). Auditor selection and audit committee characteristics. Auditing, 19(2), 46-66.

- Adams, R.B., Hermalin, B.E. & Weisbach, M.S. (2010). The role of boards of directors in corporate governance: A conceptual framework and survey. Journal of Economic Literature, 48(1), 58-107.

- Al-Ajmi, J. (2009). Audit firm, corporate governance and audit quality: Evidence from Bahrain. Advances in Accounting, 25(1), 64-74.

- Al-Anzi, A.M. (2014). An analysis of the impact of corporate governance on the quality of accounting disclosure: an applied study to a sample of Iraqi commercial bank. AL-Qadisiyah Journal for Administrative and Economic Sciences, 16(4).

- Al-Beshtawi, S.S.S.H., Zraqat, O.M. & Al-Husseini, M. (2015). The impact of governance on non-financial performance in the Iraqi commercial banks and Islamic banks. International Journal of Finance Research, 8(3).

- Al-Musalli, M.A.K. & Ismail, K.N.I. (2012). Intellectual capital performance and board characteristics of GCC banks. Procedia Economics and Finance, 2, 219-226.

- Al-Sartawi, A.M. (2015). The effect of corporate governance on the performance of the listed companies in the gulf cooperation council countries. Jordan Journal of Business Administration, 11(3), 705-725.

- Al-Sartawi, A.M. (2018). Corporate governance and intellectual capital: Evidence from Gulf Cooperation Council countries. Academy of Accounting and Financial Studies Journal, 22(1).

- Al-Tamimi. & Jabbar, N.S. (2009). The role of the auditor in the promotion of disclosure of financial reports under corporate governance-An analytical study of a sample of public shareholding companies. Unpublished PhD thesis. Institute of Higher Accounting and Financial Studies, Baghdad University.

- Anwar, I.A. (2015). Does corporate governance taken seriously by Iraqi listed companies? European Scientific Journal, 11(13), 499-518.

- Bushman, R.M. & Smith, A.J. (2003). Transparency, financial accounting information and corporate governance. Economic Policy Review, 9(1), 65-87.

- Cadbury, S.A. (2000). The corporate governance agenda. Corporate Governance, 8(1), 7-15.

- Cohen, J. (2004). The corporate governance mosaic and financial reporting quality. Journal of Accounting Literature, 87-152.

- Demirag, I., Sudarsanam, S. & Wright, M. (2000). Corporate governance: Overview and research agenda. British Accounting Review, 32(4), 341-354.

- Fallatah, Y. & Dickins, D. (2012). Corporate governance and firm performance and value in Saudi Arabia. African Journal of Business Management, 6(36).

- Gebba, T.R. (2015). Corporate governance mechanisms adopted by UAE national commercial banks. Journal of Applied Finance & Banking, 5(5), 23-61.

- Hermanson, D.R. & Rittenberg, L.E. (2003). Internal audit and organizational governance. Research opportunities in internal auditing.

- Hitt, M.A., Ireland, R.D. & Hoskisson, R.E. (2016). Strategic management: competitiveness & globalization: concepts and cases, Case 17 Starbucks Corporation. The New S-Curves, 223-236.

- Holdings, N.I.I. & Charter, R.C. (n.d.). e.g. 1-2.

- John, K. & Senbet, L.W. (1998). Corporate governance and board effectiveness. Journal of Banking & Finance, 22(4), 371-403.

- Kim, K.J. (2012).Corporate governance and monitoring parties and participation. Dar Al-Marikh for Publishing, Translation and Translation of Ashmawi, Mohamed Abdel-Fattah, Ghannam, Ghareeb Jabr.

- Michael, A.H. (2005). Auditing under the corporate governance system. Research and the papers of the first Arab Conference on Internal Audit in the framework of corporate governance, Cairo.

- Middlemist, R.D. (2004). Separation of ownership and managerial control. Basis of the Modern Corporation.

- Mintz, S.M. (2003). Improving corporate governance systems: A stakeholder’s theory approach. Retrieved from: http://www.aaahq/Am2003/cpe/ethics/Forum, p.14.

- OECD. (2012). Corporate governance, value creation and growth. Corporate Governance, Value Creation and Growth, 91. Retrieved from: https://doi.org/10.1787/9789264179547-en

- Onakoya, A.B.O., Fasanya, I.O. & Ofoegbu, D.I. (2014). Corporate governance as correlate for firm performance: A pooled OLS investigation of selected Nigerian banks. IUP Journal of Corporate Governance, 13(1), 7-15.

- Sami, H., Wang, J. & Zhou, H. (2011). Corporate governance and operating performance of Chinese listed firms. Journal of International Accounting, Auditing and Taxation, 20(2), 106-114.

- Sarea, A. & Shaima, A. (2016). The relationship between intellectual capital and earnings quality: Evidence from listed firms in Bahrain Bourse. International Journal of Learning and Intellectual Capital, 13(4), 302-315.

- Youssef, A. (2012). Determining the ownership structure of the establishment in the holding of the financial reports: An empirical study. Damascus University Journal of Economic and Legal Sciences. 28(1).