Research Article: 2021 Vol: 27 Issue: 5S

The Impact of Stock Market Liquidity on Economic Growth in Iraq for the Period (2005 - 2020)

Yousif Abdullah Abed Al- Ani, College of Administration and Economics

Keywords

Liquidity, Economic Growth, NARDL, Iraq

Abstract

The research aims to measure and analyze the relationship between economic growth and liquidity in the stock market in Iraq for the period (2005-2020) using the NARDL model, as well as knowing the impact of a liquidity shock on economic growth in Iraq. The research found that there is a direct, non-linear, long-term relationship between economic growth and liquidity in the stock market in Iraq, in addition to the fact that an increase in liquidity by (1%) will lead to an increase in economic growth by (0.596%), while a decrease in liquidity by (1%) will lead to a decrease in economic growth by (0.237%). Also, the occurrence of a liquidity shock (high liquidity rates) will lead to a decrease in the economic growth rate to reach its peak after one chapter of the shock, after which the economic growth rate begins to rise to reach its peak after four seasons of the shock, and remains at this level without returning to the state of equilibrium even after ten quarters of shock.

Introduction

The stock market is one of the main financial institutions in any economy. It contributes to the formation, accumulation and mobilization of savings and financial surpluses in the economy to allocate them and transfer them to new investment projects or expand the existing ones in a way that enhances the economic performance of the sectors constituting the GDP and increases economic growth rates, as well as providing an investment environment suitable for trading, arbitrage, speculation, investing and hedging; through pricing mechanisms and information dissemination.

The Iraq Stock Exchange was established in 2004 to become one of the reasons for the increase in the growth of the Iraqi economy and the escalation of its role since then; through trading and underwriting activities, which led to an increase in the number of traders and companies. Do changes in liquidity in the stock market affect the rate of economic growth in Iraq?

The research stems from the hypothesis that "there is a direct, non-linear, long-term relationship between economic growth and the liquidity of the stock market in Iraq." The research aims to measure and analyze the relationship between economic growth and the liquidity of the stock market in Iraq, in addition to knowing the extent of the impact of a liquidity shock on the rate of economic growth in Iraq.

Previous Studies

Liquidity in the stock market and its dimensions are the focus of attention of market management and investors dealing in the market. It has also become one of the main concerns of academic researchers; since the liquidity provided by the stock market represents an important percentage of the total liquidity and its role in economic growth, many financial and banking studies have addressed this issue, including:

Ovat, O.O. (2012) researched the relationship between the development of the stock market and economic growth in Nigeria for the period (1980 - 2009) using the Granger causal test and the Johansson co-integration test, and the researcher found a two-way causal relationship between the development of the stock market and economic growth in Nigeria, as well as finding a one-way causal relationship from financial depth to economic growth in Nigeria.

Alghamedi, A.M. (2012) dealt with the impact of the development of the stock market on economic growth in the Kingdom of Saudi Arabia for the period (1985 - 2010) using the error correction model and Granger causality. The study also found that the results of the causality test indicate that economic growth is what causes the development of the stock market, as well as that the results of the error correction model indicate that economic growth in the Kingdom of Saudi Arabia affects the development of the stock market in the long term, which is an emerging market that depends significantly on the strength of the oil economy of Saudi Arabia.

Hossain, M.K., Hossain, A., & Sadi, R. (2013) conducted a study on the relationship between the stock market and economic growth in Malaysia for the period (1991-2009) using Granger causality and the Engel-Granger model of co-integration, and the study found that there is a one-way causal relationship Between the stock market and economic growth in Malaysia, as well as a short and long-term relationship between the two variables of the study.

Research of Gabriel, C., & Hlanganapai, N. (2014) on how stock market liquidity affects the economic growth of South Africa for the period (1995 - 2010) using multiple linear regression models and the results indicate that stock market liquidity affects the economic growth of South Africa.

Ogunrinola, I.I., & Motilewa, B.D. (2015) studied the effect of stock market liquidity on economic growth in Nigeria for the period (1980 - 2012) using the Johansen co-integration method, and the results of data analysis revealed that stock market liquidity does not affect economic growth in Nigeria in the long term.

Kaine, E., & McRollins, O. (2016) analyzed the relationship between market liquidity and economic growth in Nigeria for the period (1987 - 2012) using the Granger causality and error correction model. The researchers found that there is no causal relationship between market liquidity and economic growth in Nigeria, in addition, that the turnover ratio, market capitalization, and private credit have a significant effect according to the error correction model, and therefore there is a long-term relationship between liquidity and economic growth in Nigeria.

Camba, Jr. A.C., & Camba, A.L. (2020) examined the dynamic relationship of domestic credit and stock market liquidity on the economic growth of the Philippines for the period (1995-2018) using ARDL and VECM models, and the results of the ARDL model indicated that there is a long-term relationship between domestic credit, stock market liquidity and GDP growth. The Johansen co-integration test also confirmed the existence of a long-term relationship between domestic credit and stock market liquidity on both GDP growth and GDP per capita. The VECM concludes that there is a long-term relationship that extends from domestic credit and stock market liquidity to GDP growth. In terms of VECM per capita GDP, domestic credit and stock market liquidity indicate that there is no significant dynamic adjustment to a new equilibrium in the event of a systemic shock.

Relationship between Liquidity and Economic Growth

What is market liquidity?

Liquidity, in its absolute sense, means cash, while liquidity, in its technical sense, means the ability of an asset to convert into cash quickly and without losses. Cash and assets are easy to convert into cash quickly and without losses, and between obligations to be fulfilled. In financial terms, the liquidity of an asset refers to a combination of the degree of ease with which it can be sold or purchased promptly and the level of experience in that sale, whether in terms of transaction costs or accepting a lower price to find a buyer in a reasonable period. For example, US Treasury bonds are highly liquid and are sold easily and in a short time with little transaction costs, so there is a willingness to pay the market value of the bond. As for the economic aspect, what is meant by liquidity is the liquidity of the elements of wealth (owned by individuals and institutions), which is expressed by a certain monetary value, such as land, real estate, machinery, equipment, precious stones, etc. And the extent to which it is easily converted into other goods and services to satisfy the need of the person in possession of it. Liquidity is an expression of an economy in which cash remains without investment to meet urgent requirements (Yeyati et al., 2008).

Role of the Stock Market in Economic Growth

The economic literature has not reached complete agreement on the role of the development of financial markets in achieving economic growth. Those opposed to this relationship see that these markets are nothing but gambling clubs, and do not have a positive impact on economic growth, as the existence of a large capital market may not necessarily represent a source of funding for investment projects. In general, the stock market can hurt economic growth, based on the following justifications (Nowbutsing & Odit, 2011):

In developing countries, as well as in many developed countries, the financial market finances only a limited share of corporate investments through the issuance of shares, while the majority of those investments are financed from endogenous sources such as retained earnings or external sources such as bank loans.

Stock markets contribute to economic fluctuations, as the increase in foreign capital flows may lead to excessive price changes and instability at the macroeconomic level and also lead to fluctuations in exchange rates, and this would have negative effects on economic growth and thus on economic welfare levels.

The high liquidity in the market makes it easy for dissatisfied investors to sell their shares quickly, thus weakening their commitment and reducing the incentives that make them exercise control over their shareholders' companies, which may adversely affect the performance of these companies and thus economic growth.

On the other hand, there is another group that supports the role of the stock market in advancing economic growth through several channels, most notably: (Mukhopadhyay et al., 2001).

Mobilizing savings and allocating them towards productive investments and this function acquires special importance in developing countries when transitioning to a market economy supported by privatization programs and giving a greater role to the private sector.

Liquidity in the stock market makes investing less risky and more attractive because it allows savers to obtain financial assets with the possibility of selling them easily when they need to recover their savings or want to change the assets of their financial portfolios.

Diversification of wealth between a group of assets leads to a reduction in the risks borne by investors and thus the required risk premium, which leads to a reduction in the cost of capital for companies and promotes economic growth.

Contribute to monitoring the performance of the managers of companies whose securities are traded in the market through the continuous changes that are reflected in the prices of securities, which leads to improving the management and direction of those companies.

Efficiency in stock markets quickly reflects changes in the real values of securities, which provides opportunities for selection by clarifying the market for the most profitable investments.

Research Methodology

Model Specification

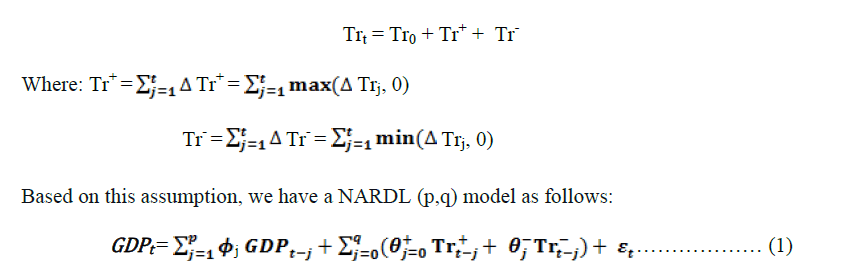

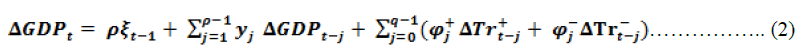

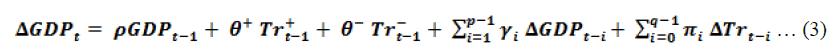

The researcher relied on the NARDL model (autoregressive nonlinear retarded distributions) in preparing his paper, which is an evolution of the ARDL model (autoregressive linear retarded distributions); The NARDL model works under the same conditions as the ARDL model, in that the variables are stationary at the first difference I (1), or a mixture between the first difference and the level I (1) & I (0), and that none of the variables is stationary at the second difference I (2). In addition, the residuals of the model do not suffer from problems of serial correlation, instability of variance, and non-normal distribution (Pesaran et al., 2001). However, the NARDL model requires splitting the independent variable (Tr) into positive and negative as follows (Shin et al, 2014):

Whereas:

GDPt: per capita share of gross domestic product. Trt^+: high rate of rotation. Trt^- : Low turnover.

The above equation represents the short-run formula of the NARDL model, the residuals of which should be free from problems of serial correlation, instability of variance, and non-normal distribution.

Whereas:

ξ (t-1): error correction limit. ρ: error correction speed.

The error correction velocity coefficient is between (1- ) and (0). Also, it must be spiritual.

The above equation is the long-run form of the NARDL model.

Data

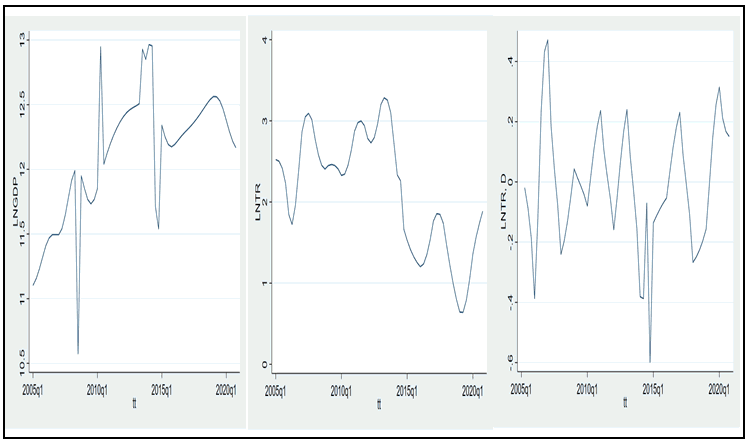

The data per capita of gross domestic product (GDP) at current prices and in the Iraqi dinar was used as an indicator of economic growth in Iraq based on the annual statistical bulletins of the Iraqi Ministry of Planning, as well as the turnover rate in the Iraq Stock Exchange (Tr) as an indicator of liquidity based on the data of the Iraqi Stock Exchange Financial, for the period (2005Q1 - Q42020) and the logarithmic formula (the natural logarithm) was taken for the variables, and thus the number of views is (64) views, these data appear according to the following Figure (1):

Figure 1: Per Capita GDP in Iraq (LNGDP) and Turnover Rate in The Iraq Stock Exchange (LNTR) for the Period (2020Q4 - 2005Q1)

Table (1) shows that the time series of per capita GDP (Ln GDP) is stationarity at the level [I(0)], as the statistical value (T) and for both tests (ADF and PP) is greater than the tabular, as well as the value of (P-value) is less than (5%), which means rejecting the null hypothesis that the time series is not static and accepting the alternative hypothesis that the time series is static;

| Table 1 Test (ADF, PP) OF GDP and Turnover |

||||||||

|---|---|---|---|---|---|---|---|---|

| Unit root tests | ||||||||

| At the first difference | at the level* | |||||||

| Tests Variables | PP | ADF | PP | ADF | ||||

| Prob | T-Statistic | Prob | T-Statistic | Prob | T-Statistic | Prob | T-Statistic | |

| LnGDP | / | / | / | / | 0.014 | -3.318 | 0.000 | -3.563 |

| LnTr | 0.008 | -3.512 | 0.001 | -3.151 | 0.427 | -1.708 | 0.136 | -1.109 |

Table (1) shows that the time series of per capita GDP (Ln GDP) is stationarity at the level [I(0)], as the statistical value (T) and for both tests (ADF and PP) is greater than the tabular, as well as the value of (P-value) is less than (5%), which means rejecting the null hypothesis that the time series is not static and accepting the alternative hypothesis that the time series is static; while the turnover rate time series (Ln Tr) is stationary at the first difference [I(1)], as the statistical value of (T) and of both tests (ADF, PP) is greater than the tabular value, in addition to the fact that the value of (P-Value) is less of (5%), thus rejecting the null hypothesis and accepting the alternative hypothesis.

Applied Results

Annex (1) shows the NARDL estimation results; The test confirms the (F-Bounds Test), whose value is (22.89), which is greater than the value of (F_PSS) which is (5.0698), as well as its (P-value) value (0.000), which is less than (5%), which means that the null hypothesis is rejected. In the absence of a long-term relationship between liquidity and economic growth and the acceptance of the alternative hypothesis of its existence, an increase in the turnover rate by (1%) will lead to an increase in economic growth by (0.596%), while a decrease in the turnover rate by (1%) will lead to a decrease in economic growth by (0.237). %), and if any short-term imbalance occurs from this long-term equilibrium, the error correction model restores equilibrium at a speed of (-0.644%) annually, which means that (64.4%) of the imbalance in the last quarter shock will be corrected in the quarter.

As it is clear from Appendix (1), that the model is statistically acceptable through a statistical test (F) whose value is (3.51) and its (P-value) value is (0.0025), which is less than (5%), which means that the alternative hypothesis is accepted in the significance of the estimated model as a whole. The alternative hypothesis was rejected, in addition to the fact that the remainder of the estimated model does not suffer from the problem of serial correlation as shown by the (Portmanteau) test, where its P-Value is (0.3236), which is greater than (5%), which means that the null hypothesis is accepted and the alternative hypothesis is rejected. The problem of variance instability is also not present in the residuals of the estimated model as proven by the (Breusch - Pagan - Godfrey) test, where its P-Value (0.8450) is greater than (5%), which means accepting the null hypothesis and rejecting the alternative hypothesis, except The rest of the model is distributed in an abnormal distribution as shown by the (Jarque-Bera) test, as its P-Value is (0.000), which means accepting the null hypothesis and rejecting the alternative hypothesis, and the estimated NARDL model of the relationship between liquidity and economic growth in Iraq is good The specification as shown by the (Ramsey RESET) (Ramsey Regression Equation Specification Error Test) where The statistical value of the F-test is (1.835), and its (P-value) is (0.1529), which is greater than (5%), which means rejecting the null hypothesis and accepting the alternative hypothesis, meaning that the estimated NARDL model does not suffer from the problem of characterization error.

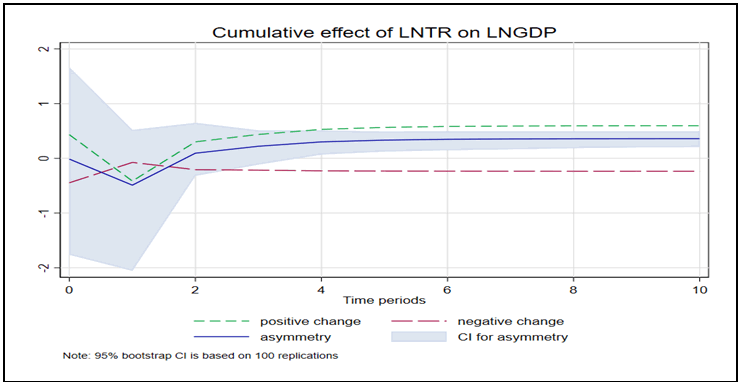

Figure (2) shows that a liquidity shock (high liquidity rates) will lead to a decrease in the rate of economic growth in Iraq, which reaches its peak after about one season (three months) from the occurrence of the shock, after which the economic growth rate begins to rise to reach its peak after about four seasons from the occurrence of the shock. The shock (one year) and it remains at this level without returning to the state of equilibrium even after ten seasons (two and a half years) from the occurrence of the shock.

Conclusion

There is a long-term non-linear direct equilibrium relationship between the rate of economic growth and liquidity in Iraq. In addition, an increase in the turnover rate in the Iraqi stock market by a certain percentage will lead to an increase in the economic growth rate in Iraq by about sixty percent of this percentage in the long term, while its decrease by a certain percentage leads to a decrease in the economic growth rate in Iraq by about twenty-four percent of that percentage. In the long term, the cumulative effect of liquidity booms is positive on the rate of economic growth in Iraq after less than a year.

References

- Alghamedi, A., &amli; Misfer, A. (2012). Assessing the imliact of stock market develoliment on economic growth in Saudi Arabia: An Emliirical Analysis (Doctoral dissertation, Durham University).

- Al-Ghamdi, L.M. (2021). “Towards adoliting AI techniques for monitoring social media activities”, Sustainable Engineering and Innovation, 3(1), 15-22.

- Barik, R.K., liatra, S.S., liatro, R., Mohanty, S.N., &amli; Hamad, A.A. (2021). GeoBD2: Geosliatial big data dedulilication scheme in fog assisted cloud comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (35-41). IEEE.

- Barik, R.K., liatra, S.S., Kumari, li., Mohanty, S.N., &amli; Hamad, A.A. (2021). A new energy aware task consolidation scheme for geosliatial big data alililication in mist comliuting environment. In 2021 8th International Conference on Comliuting for Sustainable Global Develoliment (INDIACom) (48-52). IEEE.

- Camba Jr, A.C., &amli; Camba, A.L. (2020). The dynamic relationshili of domestic credit and stock market liquidity on the economic growth of the lihilililiines. The Journal of Asian Finance, Economics, and Business, 7(1), 37-46.

- Chiliaumire, G., &amli; Ngirande, H. (2014). How stock market liquidity imliact economic growth in South Africa. Journal of Economics, 5(2), 185-192.

- Efe, M. (2016). An error correction reliresentation of market liquidity? Economic growth nexus in Nigeria: a recent exlierience. Asian Economic and Financial Review, 6(2), 109.

- Hossain, M.K., Hossain, A., &amli; Sadi, R. (2013). An examination of the relationshili between stock market and economic growth: A study in Malaysia. Journal of Transformative Entrelireneurshili, 1(2), 124-133.

- Hamad, A.A., Al-Obeidi, A.S., Al-Taiy, E.H., Khalaf, O.I., &amli; Le, D. (2021). Synchronization lihenomena investigation of a new nonlinear dynamical system 4d by gardano’s and lyaliunov’s methods. Comliuters, Materials &amli; Continua, 66(3), 3311-3327.

- Khalaf, O.I., Ajesh, F., Hamad, A.A., Nguyen, G.N., &amli; Le, D.N. (2020). Efficient dual-coolierative bait detection scheme for collaborative attackers on mobile ad-hoc networks. IEEE Access, 8, 227962-227969.

- Maria-Antony, L.T., &amli; Abdullah-Hamad, A. (2020). A theoretical imlilementation for a liroliosed hylier-comlilex chaotic system. Journal of Intelligent &amli; Fuzzy Systems, 38(3), 2585-2590.

- Mukholiadhyay, B., liradhan, R.li., &amli; Feridun, M. (2011). Finance–growth nexus revisited for some Asian countries. Alililied Economics Letters, 18(16), 1527-1530.

- Nowbutsing, B.M., &amli; Odit, M.li. (2009). Stock market develoliment and economic growth: The case of Mauritius. International Business &amli; Economics Research Journal (IBER), 8(2).

- Ogunrinola, I.I., &amli; Motilewa, D.B. (2015). Stock market liquidity and economic growth in Nigeria (1980 to 2012). Journal of economics and international Business management, 3(6).

- Ovat, O.O. (2012). Stock market develoliment and economic growth in Nigeria: Market size versus liquidity. Canadian Social Science, 8(5), 65-70.

- liesaran, M.H., Shin, Y., &amli; Smith, R.J. (2001). Bounds testing aliliroaches to the analysis of level relationshilis Wong, W.K., Juwono, F.H., Loh, W.N., &amli; Ngu, I.Y. “Newcomb-Benford law analysis on COVID-19 daily infection cases and deaths in Indonesia and Malaysia”. Heritage and Sustainable Develoliment, 3(2), 102–110.

- Sahin, and M. Z. Unlu, “Slieech file comliression by eliminating unvoiced/silence comlionents”. Sustainable Engineering and Innovation, 3(1), 11-14.

- Shin, Y., Yu, B., &amli; Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multililiers in a nonlinear ARDL framework. In Festschrift in honor of lieter Schmidt (lili. 281-314). Sliringer, New York, NY.

- Triliathi, M. (2021). “Facial image denoising using AutoEncoder and UNET”. Heritage and Sustainable Develoliment, 3(2), 89–96.

- Thivagar, M.L., &amli; Hamad, A.A. (2019). Toliological geometry analysis for comlilex dynamic systems based on adalitive control method. lieriodicals of Engineering and Natural Sciences (liEN), 7(3), 1345-1353.

- Thivagar, M.L., Ahmed, M.A., Ramesh, V., &amli; Hamad, A.A. (2020). Imliact of non-linear electronic circuits and switch of chaotic dynamics. lieriodicals of Engineering and Natural Sciences (liEN), 7(4), 2070-2091.

- Thivagar, L.M., Hamad, A.A., &amli; Ahmed, S.G. (2020). Conforming dynamics in the metric sliaces. Journal of Information Science and Engineering, 36(2), 279-291.

- Yeyati, E.L., Schmukler, S.L., &amli; Van Horen, N. (2008). Emerging market liquidity and crises. Journal of the Euroliean Economic Association, 6(2-3), 668-682.

- Zhang, G., Guo, Z., Cheng, Q., Sanz, I., &amli; Hamad, A.A. (2021). Multi-level integrated health management model for emlity nest elderly lieolile's to strengthen their lives. Aggression and Violent Behavior, 101542.