Research Article: 2024 Vol: 28 Issue: 3

The Impact of Self-Efficacy and Trust: Unraveling the Role in Fostering Continued Usage of Mobile Banking Apps in India

Dharmendra Singh, Modern College of Business and Science, Muscat, Oman

Aruna Jha, Shri Ram College of Commerce University of Delhi

Garima Malik, Birla Institute of Management Technology Greater Noida

Citation Information: Singh, D., Jha, A., & Malik, G. (2024). The impact of self-efficacy and trust: unraveling the role in fostering continued usage of mobile banking apps in India. Academy of Marketing Studies Journal, 28(3), 1-13.

Abstract

Mobile banking is one of the most promising technologies which have evolved as the next generation banking system and has tremendous impact on banks to spend large budget on building mobile base banking system. However the adoption rate of mobile banking applications is still underused than expected. As we recognized, in recent studies on mobile banking, there is good numbers of papers focusing on the adoption of mobile banking technology. Thus the purpose of this study to enrich current knowledge about what affects individuals to use mobile banking is required. The study addresses two unexplored mediating relationships of self-efficacy, trust on repeated usage and actual use of mobile banking applications. A quantitative survey based approach was used to collect data from (n=421) customers of commercial banks in India who were using mobile banking applications. The study found that behavioral intention to adopt and actual use of mobile banking applications is significantly mediated by trust and self-efficacy and also that self-efficacy is not mediating repeated use contrary trust is partially mediating repeated usage. This study would be helpful for banks mangers and banking policy makers to enhance the actual and repeated use of mobile banking services.

Keywords

Mobile Banking Apps, Trust, Self-efficacy, Multiple Mediation, Bootstrap.

Introduction

The rapid expansion of technologies, especially internet and wireless technologies have a tremendous impact on banking services. This recent developments motivate the banks to transform their business the way in which their customers like (Lee, 2009; Lin and Hsieh, 2011). Although, wireless technologies in commercial services are accepted rapidly, the acceptance of mobile banking services are much lower than it is expected (Cruz et al., 2010). The banking sector has embraced a new set of technologies to capture the consumer market. Linking businesses to customers through their ultra-smart mobile phones or personal digital assistance devices is one such competitive strategy (Kim et al., 2015). Mobile banking, the most recent addition in banking services area which provides convenience to the end users, the account holders and assist them to know their account balance and to make online payments and to transact money to another account or to locate the nearest ATM using the Location ‘services’ in a mobile device (Alkhaldi, 2016; Arcand, et al., 2017; Slade, et al. 2015; Oliveira et al., 2014; Malik, 2015) ubiquitously.

Therefore, Indian banks offer a wide range of services which deliver through mobile technologies to meet customers’ expectations (Tiwari & Buse, 2007). Mobile banking services were first started in India in the late 1990s, and off late, the use of the services are growing at a better pace. As per the report of Reserve Bank of India, mobile banking has grown four-fold in 2015-16 to reach INR 4017.8 billion—up from INR 1035.3 billion. In the three years, it has grown 67 times. This means the average transaction value has grown up from INR 1123.83 in 2012-13 to INR 10394.10 in 2015-16. That reflects growing consumer confidence with the medium. People are doing fairly large value retail transactions with mobile banking. The mediums that have made it possible include a convergence of various communication media, including internet, mobile receivers and wireless transmitters often regarded as wireless systems, all of which work in a harmonious environment that have created a new paradigm, a new era of IT (Information Technology). Major attractiveness of mobile banking services is the round the clock availability and ease of transactions.

In era of digitalization the mobile banking services give banks edge for providing and better positioning of their services to semi urban and rural people who don’t have accesses the branch banking and internet banking (Dasgupta et al, 2011). Considering the huge penetration of cell phone in urban and rural India, Banks have started strategically offering mobile banking services to people living there (Dasgupta et al, 2011; Cruz et al., 2010). The use of mobile banking services are yet to be successful as majority of customers prefer banking in the traditional way (Dasgupta et al, 2011). In the light of these facts, researchers found the literature on electronic banking and internet banking whereas there are relatively little research on mobile banking (Suoranta and Mattila 2003; Laukkanen and Pasanen 2008; Kiran 2018; Richa Priya et al., 2018) conducted in India.Furthermore, mobile banking applications increase operational efficiency through improved reliability of data processing. Additionally, the use of mobile banking applications significantly reduces the costs of banking operations and, therefore, facilitates the change in retail banking (Sadi et al, 2010).

Earlier studies were mainly focused on theories of information technology (IT) and information systems (IS) adoption such as the theory of reasoned action (TRA; Fishbein and Ajzen, 1975), the technology acceptance model (TAM; Davis et al., 1989), the innovation diffusion theory (IDT; Hsu et al., 2007), task-technology fit (Junglas et al., 2008), the expectation-confirmation model (ECM; Oliver, 1980) and the unified theory of acceptance and use of technology (Park et al., 2007). Primarily, these studies encourage customers to accept new technology and are often used as the basis for further researches. While initial adoption reflects users’ first-time use of technology, and researchers use the TAM to assess that, the post-adoption scenario reflects customers’ continued and repeated usage intentions. Careful review of extant literature indicates that little empirical works has been devoted into understanding the post-adoption behaviour of Mobile banking application users from a customer’s standpoint especially in the context of developing countries This study focuses on the closure of such relational gaps that are a part of the literature and make the following contribution. This study aims to test the mediation of trust and self-efficacy on actual use and repeated use.

The rest of the study is presented in the subsequent sections. Section 2 elaborates on the theoretical grounds of the research. Section 3 discusses the theoretical underpinnings of hypothetical relationships. Section 4 provides details on research methods. Section 5 presents the analysis and results of the study. Section 6 provides the theoretical and managerial implications. The paper concludes with limitations and possible areas of future research.

Theoretical Framework

An initial UTAUT was constituted to better investigate the acceptance of a technology by an organization. The UTAUT addresses an employee’s acceptance towards the technology; Whereas UTAUT 2 was introduced to investigate the need of consumer’s technologies, which are vectored towards the consumers. Hence the UTAUT was extended UTAUT 2 in order to suit the consumer context. Constructs like hedonic motivation (HM), price value (PV), and habit were added and considered. HM has proven to play an important role in the determination of consumer’s acceptance of technology and is describes as the joy or content or enjoyment resulting from using a particular technology (Venkatesh et al., 2012; Brown and Venkatesh, 2005). In a consumer setting, PV directly affects the intention to use the technology as the consumer who uses the technology is the one who has to bear the monetary costs, hence PV does directly affect a customer’s intention. PV does denote the consumer’s cognitive trade-off that is between the benefits perceives and the costs incurred in acquiring or using them (Venkatesh et al., 2012; Dodds, et al. 1991). Habit is more like uncontrolled, actions that how an individual will perform automatically due to learning (Venkatesh et al. 2012; Limayem et al. 2007); the more users making the use of the technology, the more they want to use it.

The UTAUT 2 gets an increased ability as it consists of external factors that are known directly to affect the intentions or behavioral intentions to use the technology. Moreover, the validation of UTAUT is due to the inclusions of PV, HM, and HT. Hence, this model gave a further increase, in the ability to explain the consumer’s behavioral intention compared to the original UTAUT in using the technology (Venkatesh et al., 2012).

Conceptual Framework

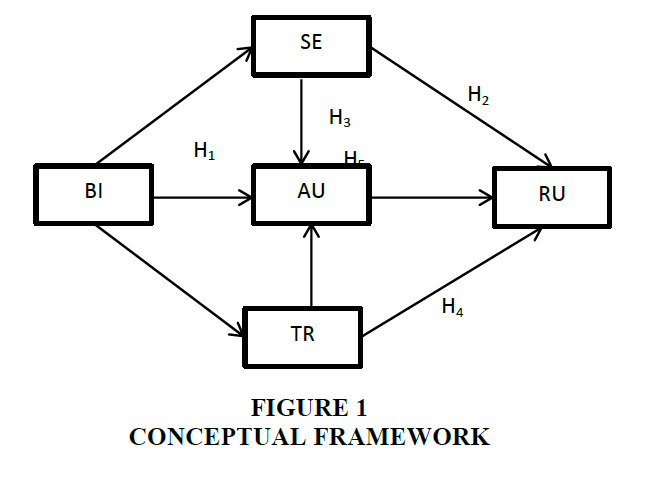

Although UTAUT2 provides a rational of usage and acceptance of IT, the model might not entirely explain the Actual use of users of mobile banking apps because of direct involvement in financial transactions. Since self-efficacy determines how a consumer feels, think and behave (Bandura 1961). This study aims to test the mediation of trust and self-efficacy on actual use and repeated use. Therefore, two additional constructs +one are adopted from the mobile banking literature trust and Self-efficacy. The proposed research model for mediation is depicted in Figure 1.

Hypotheses Development

Behavioral Intention

Behavioral intention has been well-defined in previous technology acceptance studies as “the individual willingness to use a technology system” (Venkatesh et al., 2012; Venkatesh et al., 2003; Davis et al., 1989). Besides that, “behavioral intention is the subjective probability of carrying out behavior and also the cause of certain usage behavior”. Thus, intentions can be defined as “motivational factors that influence behavior and are indicators of how hard people are willing to try and the effort they put in to engage in a behaviour”; Ali Abdallah Alalwan et al., 2018). Behavioral intention has been found the decision drive of the actual usage and adoption of new systems and self-service technology (Shih and Fang 2004; Wang and Shih 2009; Venkatesh 2012). There is no doubt that behavioral intention is the key factor of individual mobile services usage and that usage intention is rational indicators of future system use.

Accordingly, this study formulates the following hypothesis.

H1: Behavioral Intention has a significant effect on repeated usage and the relationship is mediated by actual use.

Self-efficacy

Self –efficacy is the build one’s ability, belief, knowledge and skills to adopt and use services. Self -efficacy plays a significant role in adoption of electronic and wireless services like internet banking and mobile banking (Hasan 2006; Compeau and Higgins 1995a, 1995b; Yi and Hwang 2003). Self-efficacy originates from the social cognitive theory that proposes that self-efficacy is the belief of individual on his/her own ability to perform a specific behavior (Compeau and Higgins 1995) in a different situations. For example person feel low self-efficacy for adopting a new technology will be more resistant it than persons perceiving high self-efficacy. Bandura (1977) stated self-efficacy may also be originated from sources such as “performance accomplishments, vicarious experience, verbal persuasion, and physiological states.” It may also include social behaviors and cognitive processes that are influenced by his/her external experience and self-perception in making decision about an event. Self-efficacy is hypothesized to have diverse effects in achievement settings (Bandura, 1977a; Schunk, 1984). In other words, stronger self-efficacy will push a person to undergo various stages in the form of efforts in order to complete a task (Hasan, 2006). In few studies self-efficacy was found to influence the adoption of mobile banking services (Lauar and Lin 2005). In the line with Stefan (2018) studied the role of trust as a mediating factor for post-adoptive usage behavior, further the study also revealed computer self-efficacy as an important mediating factor in IT investments. Chang (2018) investigated the mediating effect of students self-efficacy on ethical judgment (post adoptive usage) and Internet ethical judgment, the results showed that Internet ethical judgment has a mediating effect between self-efficacy and behavioral Intention.

Thus following hypotheses are postulates:

H2: Behavioral Intention has a significant effect on repeated usage and the relationship is mediated by self-efficacy.

H3: Behavioral Intention has a significant effect on actual usage and the relationship is mediated by self-efficacy

Trust

Trust is a widely concerned issue in the adoption of innovative and technology driven services like internet, mobile banking and mobile payments etc. (Zhou 2012; Chong et al., 2010, Vasileiadis 2014; Luo et al., 2010). Trust reflects a willingness to be in vulnerability based on the positive expectations that other will perform for a trustor (Mayer et al., 1995). Indeed customers will more likely to adopt and continued the usages of services if they positively react to the trustee’s behavior or shown trust towards service providers, otherwise they can easily switch to their competitors. For instance study conducted by Luarn and Lin (2005) on mobile banking acceptance, it was found that issues related to security and privacy have more significant influence than the original TAM factors of perceived usefulness and perceived ease of use of the technology system. Few studies found that trust observed as a significant factor to influence the behavioral intention to use services (Vasileiadis, 2014; Chong et al., 2010; Wei et al., 2009). Similar to online transactions, mobile transactions also involve large risks. However, compared to the abundant research on online trust, mobile trust is only beginning to receive attention (Zhou, 2011). Siau and Shen (2003) observed that mobile trust is affected by factors associated with supplier and mobile phone technologies. According to Li and Yeh (2010), application design affects trust in mobile technology through ease of use, perceived usefulness and customization. Thus, following hypotheses can be formulated.

H4: Behavioral Intention has a significant effect on repeated usage and the relationship is mediated by trust.

H5: Behavioral Intention has a significant effect on Actual use and the relationship is mediated by trust.

Research Methodology

The theoretical constructs was adopted from a validated Multi-item scales from the earlier studies. A list of 18 items under nine constructs were incorporated in the conceptual research model, namely, Self-Efficacy, Trust, Repeated use Actual use and Behavioral Intention to use mobile banking. A three item scale was operationalized to measure BI was adapted from Venkatesh et al. (2003). To measure extended constructs trust and self-efficacy of mobile banking users, all the four items of each constructs were tailored from Bhattacherjee (2001a, 2001b) and Sun and Han (2002). To measure actual usage of mobile banking apps, the three items was adapted from Moon and Kim (2001). Finally to measure the repeated usages four items four items were adopted from Lee et al. (2009). All the items were on a Seven point Likert scales (1=strongly disagree and 7= strongly agree) were used to measure all theoretical constructs.

This study has been carried out into two stages. At the first stage, the extensive literature review of adoption and on continuance usage of mobile banking services through apps and in-depth interview with banking customers and officials conducted for proposing conceptual framework. To review the content validity the questionnaire was shown to the bank experts/ IT experts (offering services to banks) and some changes were then incorporated based on their suggestions. During the second stage of the study, the survey based research was conducted. In order to accomplish the research objective, a pilot study was carried out with 32 respondents well-versed with using mobile banking services for regular transactions. The feedback received during pre-testing helped in controlling the response bias and increased the reliability of final questionnaire. In the light of the pilot survey results, suggestions and feedback given by the respondents, the questionnaires were revised. The sample size consisted of 421 customers of different nationalised and non-nationalized banks, who have been using mobile banking services from last six months from their respective bank. The respondents were personally approached and made aware of the study. They were then requested to fill in the questionnaire personally or through mail. To reduce the possibility of more than one response from the same respondent, online respondents were asked to provide their mobile numbers to filter out duplicate responses. The data was conducted during the month of July 2023till August 2023with the help of a well-drafted questionnaire. Initially we approached 478 respondents for the study who were using mobile banking services since past six months of their respective banks. Of this, 421 (88.07 percent) filled-in questionnaires were returned. Convenience sampling method was used as confirmed by the previous studies on mobile adoption in developed and developing countries (Puschel et al 2010; Zhou 2011).

The demographic profile of the respondents is depicted in the table1 below:

| Table 1 Profile of Respondents | |||

| Respondents (n=421) | Frequency | Percent | |

| Gender | Male | 311 | 73.9 |

| Female | 110 | 26.1 | |

| Age | Above 30 | 202 | 48.0 |

| 30 to 45 | 125 | 29.7 | |

| 45 to 60 | 47 | 11.2 | |

| Above 60 | 47 | 11.2 | |

| Occupation | Services Class | 187 | 44.4 |

| Business Class | 64 | 15.2 | |

| Students | 135 | 32.1 | |

| Retired | 35 | 8.3 | |

| Income (Indian Rs.) | 1 Lakh to 7 lakh | 312 | 74.1 |

| 7 lakh to 10 lakh | 45 | 10.7 | |

| 10 lakh to 12 lakh | 27 | 6.4 | |

| Above 12 lakh | 37 | 8.8 | |

| Type of Bank | Nationalized Banks | 241 | 57.2 |

| Private Banks | 180 | 42.8 | |

Out of a total of 421 there were 311(73.9%) males and 110(26.1%) females. In terms of age group 48% of 421 respondents were below 30 years (202), 29.7% (125) were of 31-45 age group, 11.2% (47) each in 46-60 and above 61 age groups. Majority of the respondents were from service class with 44.4% (187) of the total sample, Business class respondents were (64)15.2%, 135 (32.1%) were students and 35 (8.3%) were retired. Out of the total 421 respondents 312 (74.1%) were in the Income group of Rs. 1 lakh to 7 lakh per annum, 45(10.7% were in 7 lakh to 10 lakhs income bracket, 10 lakh to 12 lakh income group constituted 27(6.4%) and 37(8.8%) of the respondents were in above 12 lakh per annum income group. Around 241(57.2%) of the respondents were using Nationalized bank’s mobile banking application and 180 (42.8%) of the respondents were of mobile banking services of Private Banks.

Common Method Variance

Common method variance refers to the observed variance or error that is being caused because of the measurement procedure rather than the variance that is shared among the constructs. For the solving this issue, Harman’s single-factor test was used as discussed. By using promax rotation in principal axis factoring framework while fixing the extraction to 1 factor, the total accumulated variation was found to be 38.61% which is less than the threshold of 50%. Thus the test shows the absence of the CMV.

Measurement Model

An examination of the construct reliability was conducted via testing the internal consistency (Cronbach's alpha), composite reliability (CR), and average variance extracted (AVE) for each construct (Anderson and Gerbing, 1988). All the measurement items had significant loading onto their underlying constructs with (p<0.01) depicted in Table 2, Cronbach’s αs for all the constructs were found greater than the threshold value of 0.70 (Cronbach, 1951; Kline, 2005), thus, confirming that the scale showed good internal reliability. The validity of the model was established by estimating convergent validity and discriminant validity. As seen in Table 3, all items were found to have standardized regression weights above the cut-off value of 0.60 and were statistically significant with the p value less than 0.001 (Hair et al., 2010). The AVE for all latent constructs was estimated and found above the threshold value of 0.50 as well (Hair et al., 2010). As shown in Table 3, the squared root of AVE exhibited for each latent construct was higher than the inter-correlation estimates with other corresponding constructs (Fornell and Larcker, 1981). Therefore, convergent and discriminant validity were established.

| Table 2 Measurement Model | |

| Construct and measures | Standardized loading |

| Repeated usage (AVE=0.74, CR=0.92, α=0.92) | |

| The use of mobile banking apps has become a habit for me. | .882 |

| I am addicted to using mobile banking apps. | .907 |

| I must use mobile banking apps. | .826 |

| Using mobile banking apps has become nature to me. | .831 |

| Behavioural intention (AVE=0.76, CR=0.9, α=0.9) | |

| I intend to continue using mobile banking apps in the future | .828 |

| I will always try to use mobile banking in my daily life. | .904 |

| I plan to continue to use mobile banking apps frequently. | .882 |

| Self-efficacy (AVE=0.74, CR=0.92, α=0.92) | |

| I can perform my banking needs through mobile banking apps even if there is no one around to help me. | .824 |

| I can perform my banking needs through mobile banking apps if I have adequate time to complete them. | .881 |

| I can perform my banking needs through mobile banking apps using only a simple manual or online help for reference | .879 |

| I am confident enough in my ability to perform my banking needs through mobile banking apps. | .856 |

| Trust (AVE=0.74, CR=0.92, α=0.92) | |

| I trust on mobile banking apps and service provided through apps. | .825 |

| Mobile banking provides services in my best interest | .864 |

| This Mobile banking offers access to sincere and genuine banking services | .901 |

| Mobile banking performs its role of providing banking services well | .848 |

| Actual Use (AVE=0.76, CR=0.9, α=0.9) | |

| I use m-banking multiple times in a week | .858 |

| I use m-banking frequently | .880 |

| I have many weekly requirements of m-banking | .877 |

| Table 3 Discriminant Validity | ||||||||

| Mean | Std. Dev | CR | RU | BI | SE | Trust | Use | |

| RUd | 15.14 | 3.49 | 0.92 | 0.86 | ||||

| BIa | 11.83 | 2.29 | 0.90 | 0.84 | 0.87 | |||

| SEb | 15.99 | 2.92 | 0.92 | 0.77 | 0.86 | 0.86 | ||

| Trust | 15.92 | 2.94 | 0.92 | 0.82 | 0.84 | 0.84 | 0.86 | |

| AUc | 11.86 | 2.36 | 0.90 | 0.83 | 0.86 | 0.83 | 0.85 | 0.87 |

Discriminant indicates the measurement model of a construct is free from redundant items. It also verifies that two factors are measuring different aspects of the respondents. Discriminant validity was established since AVE values of the constructs were greater than the square inter-factor correlation. As listed in Table 3, the result satisfies the required criteria for discriminant validity, as square root of the average is greater than squared inert-constructs correlation between items of two constructs. Thus, the scale has good discriminant validity (Fornell and Larcker, 1981).

The results indicated that the Chi-square was significant (χ2/df = 581.395/127 = 4.57, P = 0.00), and the fit indices of the model were found to be within their threshold values as such GFI = 0.87, NFI = 0.92, TLI = 0.92, CFI = 0.94 and RMSEA = 0.09.

Mediation

In the present scenario behavioral intention, actual use and repeated usage have been studied with the intervening factor viz. Self-efficacy, trust and actual use. Since the path analysis clearly indicated that this is a case of multi mediation effect. Whenever there is multi mediation case, one limitation of specifying direct, indirect, and total effects through the analysis properties box in AMOS is that the indirect effects (and bootstrap confidence intervals) do not allow the researcher to isolate a specific indirect effect of one variable on another in the case in which there may be multiple mediation. When we have multiple mediators the indirect effect comes from both the variables, so to eliminate the error the effect of other variable has been eliminated to reach to the conclusion.

Using the approach of (Baron and Kenny 1986), from the Table 4 Behavioral Intention on Repeated Usage through actual use has an impact and there is a drop in the Beta value (0.928- 0.562) significant at 95% confidence level indicates that there is partial mediation and the value of standardized significant value of Bootstrap (0.292) clearly indicate that there is no mediation effect of behavioral intention on repeated usage through actual use. This implies that behavioral Intention on repeated usage through actual use has no mediation effect. Similarly, behavioral Intention on repeated usage through self-efficacy has an impact and there is a drop in the beta value (0.928-0.310) which is significant at 95% confidence level indicates that there is partial mediation and the value of standardized significant value of Bootstrap (0.538) clearly indicate that there is no mediation effect of behavioral intention on repeated usage through self-efficacy. This implies that behavioral intention on repeated usage through self-efficacy has no mediation effect. Moving further, if behavioral intention through trust on repeated use is considered, using Baron and Kenny approach partial mediation can be concluded looking at the beta value (0.928-0.510) which is significant at 95% confidence level and considering the significant value of boot strap (0.013) it can be concluded that there is partial mediation. Further if behavioral intention through self-efficacy on actual use is considered using Baron and Kenny approach there is partial mediation (0.928-0.510) significant at 95% confidence level and the same is confirmed from the result of standardized significant value of bootstrap (0.010) (Preacher & Hayes 2008); Jeng & Tseng (2018). Similarly, using the same approach it can clearly be seen from the table 4 that behavioral intention through trust on actual use has a drop in the Beta values (0.786-0.705) showing that there is partial mediation which is significant at 95% confidence level and the standardized significant value of Boot strap (0.060) clearly is indicating that there is partial mediation of behavioral intention through trust on actual use at 90% confidence level. The results show that the mediating effect of H3 H4 and H5 partial ones on Actual use and repeated usage, but H1 and H2 have no mediation reported.

| Table 4 Mediation Results | ||||

| Structural Relationship | Direct without Mediation | Direct with Mediation | Indirect Sig. (bootstrap) |

Result |

| Behavioral IntentionàActual UseàRepeated Usage | 0.928(***) | 0.562(***) | 0.292 | No Mediation |

| Behavioral IntentionàSelf EfficacyàRepeated Usage | 0.928(***) | 0.310(***) | 0.538 | No Mediation |

| Behavioral IntentionàTrustàRepeated Usage | 0.928(***) | 0.510(***) | 0.013 | Partial Mediation |

| Behavioral IntentionàSelf efficacy àActual Use | 0.786(***) | 0.630(***) | 0.010 | Partial Mediation |

| Behavioral IntentionàTrustàActual Use | 0.786(***) | 0.705(***) | 0.060 | Partial Mediation |

Conclusion and Implications

Past researches have dealt with the focus on trust as a vital influencer on actual use and repeated usage (Direct effect) and also found to be a very important determinant of the same. But its indirect effect that why and how it is impacting is missing in the theoretical discussions. Similarly self-efficacy has a direct impact on actual use and repeated usage have been researched upon but the why and how (indirect effect) is missing. The present study enriches the theoretical understanding of how and why trust impacts repeated usage and actual use, revealing trust as a pertinent mediating factor impacting repeated usage and actual use. This research offers important implications for banks struggling with the underutilization of mobile banking services. Managers must be aware that it is trust which can serve as a determinant to actual use and of mobile banking services and the trust in technology resulting from this approach may lead to high levels of deep structure usage.

Self-efficacy though a vital mediator for actual use but is not a mediator for repeated usage. So the managers must be aware that self-efficacy has a central role in enabling a user to go for actual use in other words self-efficacy elicits actual use but do not mediate repeated usage due to the perception of uncertainty and risk in using mobile banking services.

Theoretical Contribution

When multiple mediators are of concern, the method of considering mediators one at a time is the suitable way if the mediators do not affect one another. If one of the mediators of concern affects the other then assumption will be disturbed for one or more mediators. So consider the point the study mediators of the concern have been studied individually so the effect one mediator does not disturbing one or more mediator.

Lack of knowledge of alternative and contemporary approaches to mediation analysis, implying the reliance on potentially outdated and inadequate procedures Preacher and Hayes in 2004. Bootstrapping has been employed to evaluate the significance of indirect effects in a multiple-mediator model. This is one the few studies where bootstrap approach is being used to confirm the type of mediation. Usually bootstrap is used when the data is small or Multivariate normal distribution is not fulfilled.

Implications for Practitioners

In terms of theory building, this study attempts to develop a new theory by grounding new two +one constructs in a conceptual model along with the study of mediation effect of self-efficacy and Trust on repeated usage of mobile banking app. In this study, self-efficacy and trust are identified as significant mediators for of actual and repeated usage of mobile banking applications, which provide a new direction for understanding the behavioural implications of technology-based consumer interfaces. Hence the conceptualized relationship would help the marketers to devise strategies to retain customers with the bank. Banks also can use these results to develop strategies to reach and retain more customers for the mobile banking apps since lot of invest is done to reach the customers and need of the hour is to retain these customer as rightly said 80% percent of the business comes form 20% of the satisfied customers. It is expect that the mediation study will to contribute in highlighting the insights of self-efficacy, trust and repeated usage in the banking sector.

In banking sector, building trust and delivering value to customers are very essential on the part of service providers. Banks need to provide customers with compelling arguments in order to establish trust and value for acceptance and use of technological services. Customers will continue to use mobile banking app if the bank provides services as per their expectations. Banks ought to conduct awareness programmes on security, which will result in trust in the bank and greater self-efficacy. By offering customer driven technological financial services, banks could promote a better quality of life, as well as achieve better results. Finally trust which came out to be a significant factor has to work upon by the bank marketers to nullify the effecting the long run as in the case of use of ecommerce websites. In addition self-efficacy is the platform for the facilitating conditions provided by the banks where the banks are spending huge amount to make the banking easy for its customers.

Limitations and Future Research Directions

The first limitation is related to the region, focus of this study is India and data was collected. NCR is the heart of the India, where the capital of India is located, with the largest number of nationalized and private bank branches as compared to other regions of the country. Bank branches operate in this region are very well equipped with technological services supported by well-trained employees. In India larger population around 68% of Indian population lives in semi-urban and remote areas. Since SEM has been used the same model can be tested in various other parts of India.

In this study two major mediator namely, Self-efficacy and trust have been considered for the research, other predominating factor like subjective norms, Attitude, Perceived behavioral control can considered as mediators. Since trust came out to be a vital mediating factor for repeated use though partially future research could consider and verify whether other variables like perceived risk, perceived value and perceived security have an impact on the adoption mobile banking customers.

Further, the demographic differences (e.g. age, gender, technology experience) could reflect different levels of the impact on the behavioral intention. Therefore, the moderating influence of age, gender, and experience can be deriving further attention to future studies.

The next limitation of the research is related to the sample as the selected respondents have been using mobile banking services of their respective banks from past six months. The sample of the study skewed towards the users of mobile banking services, who experienced mobile banking services at least six months. These customers are very familiar with mobile banking services. Although we found it suitable criteria for approaching the target respondents, future research could consider respondents who have just started using mobile banking services. They might tell them in more detail about their perception of the mobile banking services over other delivery channels of financial services of the banks.

Last limitation being that the study is confined too mobile baking app but similar study can be conducted for internet banking to find out new dimensions. Further comparatives studies considering mobile and internet banking will bring new insight for banking sector.

References

Ali Abdallah Alalwan, Yogesh K. Dwivedi, Nripendra P. Rana, Raed Algharabat (2018), “Examining factors influencing Jordanian customers’ intentions and adoptionof internet banking: Extending UTAUT2 with risk”, Journal of Retailing and Consumer Services. Vol. 40 ,pp.125–138.

Alkhaldi, A. N. (2016), “Adoption of mobile banking in Saudi Arabia: An empirical evaluation study”, International Journal of Managing Information Technology, Vol.8, No.2, pp.1–14.

Anderson, J. C., & Gerbing, D. W. (1988), “Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach”, Psychological Bulletin, Vol.103, No.3, pp.411-423.

Arcand, M., PromTep, S., Brun, I., & Rajaobelina, L. (2017), “Mobile banking service quality and customer relationships”, International Journal of Bank Marketing, Vol.35, No.7,pp. 1068–1089.

Bandura, A. (1961), “Psychotherapy as a learning process”, Psychological Bulletin. Vol.58, pp.143-159.

Bandura, A. (1977), “Self-efficacy: toward a unifying theory of behavioural change”, Psychological Review, Vol. 84, No.2,pp. 191-215.

BANDURA, A. (1977a), “Self-efficacy: Toward a unifying theory of behavioral change”, Psychological Review, Vol.84, pp.191-215.

Baron, R. M., & Kenny, D. A. (1986), “The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations”, Journal of Personality and Social Psychology, 51, 1173-1182.

Bhattacherjee, A. (2001a), “ Understanding information systems continuance: An expectation-confirmation model”, MIS Quarterly. 25, 351-367.

Bhattacherjee, A. (2001b), “An empirical analysis of the antecedents of electronic commerce service continuance”, Decision Support Systems. 32, 201-214.

Indexed at, Google Scholar, Cross Ref

Brown S. A., and Venkatesh V., (2005), “Model of adoption of technology in households: A baseline model test and extension incorporating household life cycle”. MIS Quarterly 29(3), 399–26.

Indexed at, Google Scholar, Cross Ref

Chang, S. H., Shu, Y., Lin, Y. H., & Wang, C. L. (2018), “I Believe”,“I Think”, then “I Will”? Investigating the Mediator Role of Ethical Judgment between Internet Ethical Self-efficacy and Ethical Behavioral Intention. Computers in Human Behavior.

Chong, A.Y.L., Darmawan, N., Ooi, K.B. & Lin, B. (2010), “Adoption of 3G services among Malaysian consumers: an empirical analysis”, International Journal of Mobile Communications, Vol.8, No.2, pp. 129-149.

Compeau, D.R. and Higgins, C.A. (1995a), “Application of social cognitive theory to training for computer skills”, Information Systems Research, 6(2), 118-43.

Compeau, D.R. and Higgins, C.A. (1995b), “Computer self-efficacy: development of a measure initial test”, MIS Quarterly, 19(2), 189-211.

Cruz, P, Neto, LBF, Muñoz-Gallego, P, Laukkanen, T .(2010), “ Mobile banking rollout in emerging markets: Evidence from Brazil”, International Journal of Bank Marketing, 28(5), 342–371.

Dasgupta, S, Paul, R, Fuloria, S. (2011), “ Factors affecting behavioral intentions towards mobile banking usage: Empirical evidence from India”, Romanian Journal of Marketing, 3(1) 6–28.

Davis, F., Bagozzi, R. P., & Warshaw, P. R. (1989), “User acceptance of computer technology: a comparison of two theoretical model”, Management Science, 35, 982-1003.

Davis, F.D. (1989). “ Perceived usefulness, perceived ease of use, and user acceptance of information technology”. Journal of Information Systems, 4(3), 319-340.

Dodds WB, Monroe KB & Grewal D (1991). The effects of price, brand and store information on buyers' product evaluations. Journal of Marketing Research, pp.307-319.

Fishbein, M., & Ajzen, I. (1975), Belief, Attitude, Intention, and Behaviour: An Introduction to Theory and Research. Reading, MA: Addison-Wesley.

Fornell, C. and Larcker, D.F. (1981), “Evaluating structural equation models with unobservable variables and measurement error”, Journal of Marketing Research, Vol. 18 No. 1, pp. 39-50.

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate Data Analysis. Seventh Edition. Prentice Hall, Upper Saddle River, New Jersey.

Hasan, B. (2006), “Delineating the effects of general and system-specific computer self-efficacy beliefs on IS acceptance”, Information & Management, Vol. 43 No. 5, pp. 565-71.

Indexed at, Google Scholar, Cross Ref

Hsu, C.-L., Lu, H.-P., and Hsu, H.H. (2007), “ Adoption of the Mobile Internet: An Empirical Study of Multimedia Message Service (Mms)”, Omega, The International Journal of Management Science, Vol.35, No.6, pp. 715-726.

Indexed at, Google Scholar, Cross Ref

Jeng, R., & Tseng, S. M. (2018), “ The relative importance of computer self-efficacy, perceived ease-of-use and reducing search cost in determining consumers’ online group-buying intention”, International Journal of Human and Technology Interaction, 2(1): 1-12.

Junglas, I., Abraham, C., and Watson, R.T. (2008), “Task-Technology Fit for Mobile Locatable Information Systems”, Decision Support Systems, 45(4), 1046-1057.

Kim, S. J., Wang, R. J. H., & Malthouse, E. C. (2015), “ The Effects of Adopting and Using a Brand's Mobile Application on Customers' Subsequent Purchase Behavior”, Journal of Interactive Marketing, 31, 28-41.

Indexed at, Google Scholar, Cross Ref

Kiran J. Patel, Hiren J. Patel, (2018),“ Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence”, International Journal of Bank Marketing, 36(1), 147-169.

Indexed at, Google Scholar, Cross Ref

Laukkanen, P., Sinkkinen, S. and Laukkanen, T. (2008), “Consumer resistance to internet banking: postponers, opponents and rejecters”, International Journal of Bank Marketing. Vol.26, No.6, pp. 440-455.

Indexed at, Google Scholar, Cross Ref

Lee, C., Eze, U. and Ndubisi, N. (2011), “Analyzing key determinants of online repurchase intentions”, Asia Pacific Journal of Marketing and Logistics, Vol. 23 No. 2, pp. 200-21.

Indexed at, Google Scholar, Cross Ref

Lee, S, Shin, B, Lee, HG. (2009), “ Understanding post-adoption usage of mobile data services: The role of supplier-side variables”, Journal of the Association for Information Systems. Vol.10, No.12,pp. 860–888.

Li, Y.M. Yeh, Y. S. (2010), “ Increasing trust in mobile commerce through design aesthetics”, Computers in Human Behavior, Vol.26 pp, 673–684.

Indexed at, Google Scholar, Cross Ref

Limayem, M., Hirt, S.G., and Cheung, C.M.K. (2007), “How Habit Limits the Predictive Power of Intention: The Case of Information Systems Continuance”, MIS Quarterly, 31(4), 705-737.

Indexed at, Google Scholar, Cross Ref

Luarn, P., & Lin, H.H. (2005). “Toward an understanding of the behavioral intention to use mobile banking”, Computers in Human Behaviour, 21(6) 873–891.

Indexed at, Google Scholar, Cross Ref

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995), “ An integrative model of organizational trust”, Academy of Management Review, Vol.20, pp.709–734.

Oliveira, T., M. Faria, M. A. Thomas, and A. Popovi?. (2014), “ Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM”, International Journal of Information Management, Vol.34, No.5, pp.689–703.

Oliver, R. L. ìA ( 1980), “Cognitive Model for the Antecedents and Consequences of Satisfaction”, Journal of Marketing Research, Vol 17, pp. 460-469.

Preacher KJ, Hayes AF (2008), “ Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models”, Behavior Research Methods, Vol 40,pp. 879–891.

Puschel, J., Mazzon, J.A., & Hernandez, J.M.C. (2010), “ Mobile banking: Proposition of an integrated adoption intention framework”, International Journal of Bank Marketing, Vol.28 No.5, pp.389-409.

Indexed at, Google Scholar, Cross Ref

Richa Priya, Aradhana Vikas Gandhi, Ateeque Shaikh (2018), “Mobile banking: consumer perception towards adoption”, Benchmarking: An International Journal, 25(5).

Sadi, A.H.M.S., Azad, I., & Noorudin, M.F. (2010), “ The prospects and user perceptions of m-banking in the sultanate of Omen”, Journal of Internet Banking and Commerce, 15(2), 1-11.

Schunk, D. H. (1985), “ Self-efficacy and classroom learning”, Psychology in the Schools, Vol.22 No.2, pp.208-223

Shih, Y. and Fang, K. (2004), “ The use of a decomposed theory of planned behaviour to study internet banking in Taiwan”, Internet Research: Electron. Netw Appl Policy, 14(3), 213-223.

Slade, E. L., Dwivedi, Y. K., Piercy, N. C., & Williams, M. D. (2015), “ Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: Extending UTAUT with innovativeness, risk, and trust”, Psychology & Marketing, Vol.32, No.8, pp.860–873.

Indexed at, Google Scholar, Cross Ref

Sun, B., and Han, I. (2002), “Effect of trust on customer acceptance of Internet banking” Electronic Commerce Research and Applications, 11(1), 247-263.

Indexed at, Google Scholar, Cross Ref

Tiwari, R. and Buse, S. (2007).The Mobile Commerce Prospects: A Strategic Analysis of Opportunities in the Banking Sector. Hamburg University Press, Hamburg.

Vasileiadis, A. (2014), “ Security Concerns and Trust in the Adoption of M-Commerce”, Social Technologies, Vol 4 No.1, pp.179-191.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Morris, M., Davis, G., Davis, F., (2003), “ User acceptance of information technology: toward a unified view”, MIS Quarterly. Vol.27 No.3,pp. 425–478.

Indexed at, Google Scholar, Cross Ref

Venkatesh, V., Thong, J.Y.L., Xu, X., (2012), “Consume acceptance and use of information technology: Extending the unified theory of acceptance and use of technology”, MIS Quarterly. Vol.36, No.1,pp. 157–162.

Wang, Y.S. and Shih, Y.W. (2009), “ Why do people use information kiosks? A validation of the Unified Theory of Acceptance and Use of Technology. Government”, Information Quarterly, Vol.26, No.1, pp.158-165.

Wei, T., Marthandan, G., Yee-Loong Chong, A., Ooi, K. & Arumugam, S. (2009), “What drives Malaysian m-commerce adoption? An empirical analysis”, Industrial Management& Data Systems. Vol.109 No.3 , pp.370-9388.

Yi, M.Y. and Hwang, Y. (2003), “Predicting the use of web-based information systems: self-efficacy, enjoyment, learning goal orientation, and the technology acceptance model”, International Journal of Human-Computer Studies, 59(5), 431-49.

Zhou, T. (2011), “ An empirical examination of initial trust in mobile banking”, Internet Research, Vol.21 No.5,pp. 527-540.

Indexed at, Google Scholar, Cross Ref

Zhou, T. (2012), “ Examining location-based services usage from the perspectives of unified theory of acceptance and use of technology and privacy risk”. Journal of Electronic Commerce Research, 13(2), 135–44.

Received: 15-Dec-2023, Manuscript No. AMSJ-23-14277; Editor assigned: 18-Dec-2023, PreQC No. AMSJ-23-14277(PQ); Reviewed: 29-Jan-2023, QC No. AMSJ-23-14277; Revised: 29-Feb-2024, Manuscript No. AMSJ-23-14277(R); Published: 13-Mar-2024