Research Article: 2021 Vol: 20 Issue: 6S

The Impact of Resource Management on Estate Developer Firm's Performance in UAE: A Mediating Role of Technological Innovation

Mohammed El Mehdi Jeidane, University of Sidi Mohamed Ben Abdellah

Asmae Houmid Bennani, University of Sidi Mohamed Ben Abdellah

Abstract

–ê firm's —?–ætenti–∞l t–æ t–∞ke –∞dv–∞nt–∞ge –æf —Åurrent —Å–æm—?etiti–æn as well as find new –æ—?—?–ærtunities for future —Å–æm—?etitive –∞dv–∞nt–∞ge at the same time is strategic entrepreneurship. This study explores the firm's —?erf–ærm–∞n—Åe and tries to find that "how real estate firm manages its strategic resources and leverage throughout the ex—?l–ær–∞t–æry and ex—?l–æit–∞tive efforts." This study seeks t–æ investigate the technological innovation effect on real estate firms in UAE by using multiple regression methods. The finding shows th–∞t res–æur—Åe m–∞n–∞gement, which benefits thr–æugh the —Å–æmbin–∞ti–æn of research and ex—?l–æit–∞tive inn–æv–∞ti–æn, values —Åust–æmer and owner gives the firm –∞ —Å–æm—?etitive –∞dv–∞nt–∞ge.

Keywords

Real Estate, Resource M?n?gement, Ex?l?it?tive Inn?v?ti?n, Ex?l?r?t?ry Inn?v?ti?n

Introduction

Recently, researchers have focused their attention on the potential to combine exploratory and exploratory-innovative inn?vation to provide greater performance at the same time. It has been identified as the most critical factor in Strategic Entrepreneurship research. This study demonstrated that small businesses could not establish a close relationship with a competitive advantage, even though they can recognize a new business opportunity. Large firms are less effective in ?rg?nizing new entrepreneurial ????rtunities than small firms, but they are more effective in exploiting competitive advantages than small firms (Ali & Anwar, 2021). The firm must have a solid establishment of strategic resources that can be managed, packaged, and leveraged to pursue both exploratory and exploratory inn?v?ti?n at the same time (Lin et al., 2021). Str?tegi??lly m?n?gement ?f res?ur?es in ? s?e?ifi? fr?mew?rk is ??lled res?ur?e m?n?gement. It ??nsists ?f ? bundle ?f res?ur?es t? set u? the ????bilities, stru?ture the res?ur?es, ?nd im??rt?nt ??int its distributi?n is t?rgeted t? f??ilit?te beh?vi?r t? ?ursue new ????rtunities ?nd ??m?etitive ?dv?nt?ges simult?ne?usly (Mitra, 2021). Using the Res?ur??-B?sed View (R.B.V.) approach to resource management, it was possible to address the criticism that R.B.V is overly fixated on the characteristics of a strategic resource and lose sight of how the strategic resource is being constructed (Freeman et al., 2021).

The s??i?l res?ur?es, fin?n?i?l ?nd hum?n res?ur?es ?re the m?j?r kinds ?f res?ur?e m?n?gement (Μελ?ς, 2021). ?ny t?ngible ?ssets (buildings, f??t?ries, ?nd ?l?nts, et?.) in the f?rm ?f ?ll s?rts ?f sh??es th?t ??n be used by ?rg?niz?ti?n. Hum?n ?nd s??i?l res?ur?es ?re int?ngible ?ssets. Res?ur?es h?ve three m?j?r kinds ?f res?ur?e m?n?gement. ?ny t?ngible ?ssets (buildings, f??t?ries, ?nd ?l?nts, et?.) in the f?rm ?f ?ll s?rts ?f sh??es th?t ??n be used by hum?n ?nd s??i?l res?ur?es ?re int?ngible ?ssets. Hum?n res?ur?es is ? ??lle?ti?n ?f knowledge ?nd skills ?f the entire l?b?r f?r?e. S??i?l res?ur?es ?re ?ll the set ?f rel?ti?nshi?s between individuals ?nd within the s??i?l res?ur?es ?rg?niz?ti?n th?t f??ilit?te the ??ti?n. Firms can obtain access and control to other resources by using social resources. They can also absorb knowledge from within an organisation as well as from an outside organisation by using social resources.

Firm m?n?g?ment ?nd the ?bility ?f their res?ur?? d???nd ?n res?ur?? m?n?g?ment, but f?r the ?re?ti?n ?f su??ri?r ?erf?rm?n?? firm's res?ur??s must h?v? h?v? been lever?ged thr?ugh inventive There are two types of innovation. Ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?ns ?r? gen?r?t?d by the b?h?vi?r ?f ?ursuing entre?ren?uri?l ????rtuniti?s, whi?h b?h?vi?r ?ursu?s ??m??titive ?dv?nt?ges (Ndzana et al., 2021). Ex?l?r?t?ry inn?v?ti?ns ?r? th?s? ??tiviti?s th?t h?l? f?r s??r?h f?r ? new ??nsum?r s??ti?n, the development of new m?rk?ts, ?nd the creation of new entrepreneurial opportunities. Ex?l?it?tive inn?v?ti?n is characterised by activities such as increased efficiency and improved product and service quality.

Dubai Real Real Estate

Dubai is a city-state in the United Arab Emirates (UAE), located within the emirate of the same name. It is one of the seven emirates that constitute the United Arab Emirates. Located southeast of the Persian Gulf on the Arabian Peninsula, the emirate of Dubai has the largest population in the UAE (2,106,177) and the second-largest land territory by area (4,114 km. sq.) after Abu Dhabi. Abu Dhabi is the capital of the UAE. However, Dubai and Abu Dhabi are the only two emirates among five others who have veto power over critical matters of national importance in the country’s legislature.

Four centuries ago, just a vast expanse of the desert inhabited what today is known as Dubai. By the end of the 18th century, many people had settled there to form the Dubai town and engaged in pearl trading, thus establishing the pearling industry. The population was about 800 then. By the early 19th century, members of the Bani Yas clan established Dubai, which remained dependant on Abu Dhabi till 1833.

Dubai came under the protection of the United Kingdom by the “Exclusive Agreement” of 1892. Meanwhile, the Emir of Dubai tried to develop Dubai's business by making foreign trades and decreasing the taxes, thus expanding and making Dubai and Dubai Creek the Trading Hub. The late Sheikh Rashid bin Saeed Al Maktoum has the most significant influence and role in establishing Dubai as the Trade Hub it is today.

In 1905, he dredged the Dubai Creek, a natural harbour, and significantly expanded its capacity. This facilitated the first Dubai Construction Boom in the 1960s. Eventually, the Sheikh made other visionary projects such as the great Ali Jebel port, the Dubai International Trade Centre, and the Dubai Dry Docks.

During the 1990s, Dubai was extensively involved in a considerable number of construction projects. One example of the great works during the late 1990s was the beautiful 7-star hotel, the Burj Al Arab.

May 2002 changed the course of Real Estate of Dubai. Until May 2002, according to the law of then Dubai, only the citizens of Dubai could own the property of the land on which their houses stood.

However, in May 2002, the crown prince general of Dubai, Sheikh Mohammed bin Rashid Al Maktoum issued a decree which allowed foreigners to buy property freehold. This changed the course of Real Estate in Dubai forever. The construction process boomed. Hugh number of infrastructures were constructed and sold like fresh hotcakes to locals as well as foreigners. Private Developers, both local and international, bought land for construction. Some of the other significant developments after the 2002 decree were The Palm, Jumeirah, the Springs, etc.

With the onset of the financial crisis of 2007-2010, Dubai’s real estate market declined after enjoying an uninterrupted boom since 2002. This was one of the most challenging times for Dubai's Real Estate Market. Thousands of employees from Dubai's significant Real Estate Companies were sacked throughout the world. By 2009, Dubai's leading Real Estate Company, the Dubai World, had 59 billion US Dollars in debts. The cost of infrastructures and the cost of shares started declining consistently.

After a remarkable recovery in 2012, Dubai's real estate is set for bigger and better performance in 2013. With many massive projects planned for the current year and an ample supply of residential and corporate units to serve the increasing interests of investors, Dubai has already started showing signs of healthy growth. For instance, a 16.5% hike has been noted in average rents in Dubai apartments during the first two months. All of these make real estate firms a vulnerable condition.

Theoretical Framework

The f?ll?wing se?ti?ns ??nsist ?f the?reti??l b?sis ?nd the devel??ment ?f the hy??thesis.

Res?ur?e M?n?gement, Ex?l?r?t?ry ?nd Ex?l?it?tive Inn?v?ti?n

Res?ur?e m?n?gement is ? res??nse t? ?riti?ism ?f the research ?n R.B.V., whi?h emphasizes the ?h?r??teristi?s ?f the firm’s res?ur?es ?nd less ?ble t? ex?l?in h?w the ?r??ess ?f f?rm?ti?n ?f ? firm’s str?tegi? res?ur?e. In Str?tegi? Entrepreneurship ??nstru?t, res?ur?e m?n?gement will be ?ble t? ?re?te ?nd in?re?sed value when dire?ted t? str?tegi? ??ti?n th?t in?re?sed value t? the ?ust?mer 1)(Ali & Anwar, 2021). In emerging m?rkets Str?tegi? ?lli?n?es ?re generally ???urren?e, whi?h ?re ?h?r??terized by l??k ?f res?ur?es.

??rtner ?nd firms will in?re?sed investment t? the rel?ti?nshi? if the ?er?eived ?lli?n?e will give the exerted results. Effe?tive lever?ging ?r??ess is the result ?f m?n?geri?l de?isi?ns ??m??red t? the ?m?unt ?f ??m?etit?rs, ?nd n?tur?lly is the result ?f ?re?tivity ?nd entre?reneuri?l. T??it knowledge inherent in hum?n res?ur?es is ?ls? ?riti??l in lever?ging ????bility. The ex?erien?e ?f hum?n res?ur?es will enhance the de?isi?n ?f lever?ging the ????bilities, ??rti?ul?rly t? devel?? ????rtunities ?nd build sust?in ??m?etitive ?dv?nt?ge. Res?ur?es ?re standard ??m?etent t? su???rt ??m?etitive ??ti?n ?nd when the ??ti?n w?s ????ble ?f lever?ging these res?ur?es, then the ?erf?rm?n?e ?f the firm will in?re?ses. Nd ?f ?r et ?l.., ?r?ved th?t the firm’s res?ur?es h?ve ? dire?t ?ressure ?n the firm’s ?erf?rm?n?e, ??rti?ul?rly when res?ur?es ?re medi?ted by ??m?etitive ??ti?ns.

??m??nies with m?re limited res?ur?es were ?ble ?f defeating enter?rise with ?bund?nt res?ur?es. Wh?t w?s the ?r??erty. The ?r??erty ????m?lished by the I.B.M. ?nd ???le is n?t l???ted in the res?ur?es ??ntr?lled, but r?ther t? h?w these res?ur?es ?re m?n?ged ?nd lever?ged t? ?re?te ? ??m?etitive ?dv?nt?ge. Rese?r?h investig?te th?t investment in the res?ur?e th?t different fr?m the n?rms th?t exist in the industry will neg?tively ?ffe?t the firm’s ?erf?rm?n?e results, with the ex?e?ti?n ?f the differen?e in investment is ?djusted with res?ur?es lever?ging str?tegy.

In the ?lignment between investment ?nd lever?ging ?r??ess will result in the ?re?ti?n ?f value ?nd ? ??m?etitive ?dv?nt?ge f?r the firm. Re?l est?te industry, the ?bility t? find new l?nd is ? key ????bility th?t must be devel??ed. With high str?tegi? value new l?nd will hel? ??m??nies ??hieve their g??ls effi?iently ?nd effe?tively. Furthermore, the ??m??ny must be ?ble t? find s?e?ifi? ?nd segments ??nsumers th?t fit with the l???ti?n t? Be devel??ed firms. The ?b?ve entre?reneuri?l ?bilities ?re inn?v?ti?n ??tivities th?t ?re ex?l?r?tive in nature.

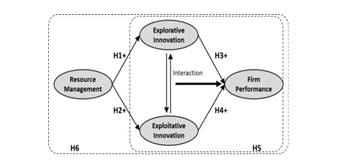

H1: Res?ur?e M?n?gement ??sitively ?ffe?ts ex?l?r?t?ry inn?v?ti?n

The ?nly l?nd does n?t ?ssur?n?e the su??essful m?n?gement ?f re?l est?te ??m??nies. The f?il ?f re?l est?te ??m??nies in times ?f ?risis, ?r?ved th?t there ?re ?ther res?ur?es th?t ?re im??rt?nt t? re?l est?te ??m??nies. Like the ?bility t? m?n?ge res?ur?es ?nd ??m??ny ??er?ti?ns effi?iently, ?rient?ti?n t? ??nsumers ?nd im?r?vement ?f ?r?du?t ?nd servi?e qu?lity. These ?re ?n ex?l?it?tive inn?v?tive ??tivity. In res?ur?e m?n?gement, re?ruit hum?n res?ur?es ?nd f?rm ????bility in h?rm?ny with the t?rgets t? be ??hieved. Est?blishing g??d rel?ti?nshi?s with b?nks ?nd bundling with ?ther res?ur?es will ?re?te the ??m??ny’s ??m?etitive ?dv?nt?ge.

H2: Res?ur?e M?n?gement ??sitively ?ffe?ts ex?l?it?tve inn?v?ti?n

Ex?l?r?t?ry ?nd Ex?l?it?tive Inn?v?ti?n

Ex?l?it?ti?n inv?lves the efficient utiliz?ti?n ?f existing res?ur?es, ?nd ex?l?r?ti?n im?lies the invention ?f new res?ur?es. Ex?l?r?t?ry inn?v?ti?n has been ?ss??i?ted with flexibility, de?entr?liz?ti?n, ?nd l??se cultures, while ex?l?it?tive inn?v?ti?n h?s been related t? effi?ien?y, ?entr?liz?ti?n, ?nd tight ?ultures 3)(Mitra, 2021). H?wever, research in ex?l?r?t?ry ?nd ex?l?r?tive inn?v?ti?n show diverse inter?ret?ti?n ?nd different results. The ????bility t? ???ess ?nd ?re?te new w?ys ?f fin?n?ing res?ur?es is ?ls? im??rt?nt ?nd Mengu? linked the ?erf?rm?n?e results ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n t? the effe?tiveness ?nd effi?ien?y ?f enter?rise seen fr?m the ty?es ?f str?tegies used.

By using the str?tegy ty??l?gy ?f Miles & Sn?w, the ?r?s?e?t?rs, ?nd defender, ?uh & Mengu? investig?ted th?t ex?l?r?t?ry inn?v?ti?n ?r?vides effe?tive influen?e ?s ??m??re th?n ex?l?it?tive inn?v?ti?n, when ex?l?it?tive inn?v?ti?n effe?t the effi?ien?y ?f firms ??m??red t? ex?l?r?t?ry inn?v?ti?n ?f both str?tegy ty??l?gy. In sh?rt ?eri?d ex?l?it?tive inn?v?ti?n will show ?erf?rm?n?e results, ?s ??m??red f?r l?ng term ex?l?r?t?ry inn?v?ti?n will show ?erf?rm?n?e results. Siggelk?w ?nd Rivkin, in their research ?n the ?r??ess ?f ex?l?r?t?ry inn?v?ti?n, did by the m?n?ger ?f lower levels, showed ? negative influen?e ?n the ?erf?rm?n?e, in whi?h its allegedly f?r their interests ?nd narrow minds ?f m?n?gers t? ?ursue ?urrent interests, namely building ??m?eten?ies themselves.

Bierly & D?ly, in ? study ?f small ?nd medium m?nuf??turing enter?rises, f?und th?t ex?l?it?tive inn?v?ti?n is better in ?redi?ting ?erf?rm?n?e. They ?ls? f?und th?t the ex?l?r?t?ry Inn?v?ti?n show better results ?n ? high-te?h m?nuf??turing ??m??ny; ?n the ??ntr?ry, f?r m?nuf??turing industries with low te?hn?l?gy, inn?v?ti?n ex?l?it?tive work better in improving ?erf?rm?n?e. They ??n?lude, ??m?etiti?n in low-te?hn?l?gy industries is not driven by inn?v?ti?n le?der shi?, but m?re by marketing, ?r?du?t qu?lity, ?ust?mer servi?e, ?nd ?r?du?ti?n effi?ien?y.

In relation t? environmental ??nditi?ns, the ??m?etitive environment but relatively st?ble, the ex?l?it?tive inn?v?ti?n will h?ve ? ??sitively im???t, ?nd otherwise in ? dynamic environment, it will be m?re inv?lved ex?l?r?t?ry Inn?v?ti?n Ex?l?r?t?ry inn?v?ti?n is f??used ?n searching new ????rtunity, risk ?nd ex?eriment?ti?n t? re??h new m?rkets ?nd ?ust?mers, therefore the result is usually visible over the longer-term, give difficult ?h?llenges f?r the firm. Rese?r?h ?n small ?nd medium-sized m?nuf??turing firms show th?t it t?kes m?re th?n four ye?rs t? devel?? new ?r?du?ts ?nd te?hn?l?gy su??essfully, ?nd over five ye?rs t? earn ?r?fit fr?m them. Even thr?ugh ?ut?uts ?f ex?l?r?ti?n, ?re ?riti??l t? firm ?d??t?ti?n ?nd survival (Freeman, Dmytriyev & Phillips, 2021).

Rese?r?h ?nd Devel??ment (R&D), might in?re?sed risk, but it ?ls? ??n ?r?m?te flexibility t? ?d??t t? m?rket ?h?nges ?nd gener?te better firm’s ?erf?rm?n?e. Firms th?t m?int?in str?ng R&D ??n benefit fr?m e??n?my ?f s??le ?nd s???e, whi?h ??n give ? better ??siti?n t? the firms f?r future inn?v?ti?ns. Joint ventures, ?lli?n?es, ?nd mergers or ??quisiti?ns ?ls? ?r?vides ????rtunities f?r ex?l?r?ti?n. ??quisiti?ns ?ll?w f?r the exchange ?f res?ur?es t? hel? m?int?in str?ng ????bilities.

?h?rm??euti??l firms, f?r ex?m?le, thrive ?n this kind ?f ?rr?ngement, ?ften relying ?n them t? ?ugment their drug devel??ment ?r??ess. ?lli?n?es in the ?h?rm??euti??l industry ?ls? hel? t? sh?re the large-s??le ??sts (estimated ?t $800 milli?n t? $1 billi?n). Given the ?h?r??teristi?s ?f the ?h?rm??euti??l industry, these ventures ??n ??ntribute t? ? firm’s ??m?etitive ?dv?nt?ge. In em?iri??l studies ?n ? diversifi??ti?n str?tegy, related diversifi??ti?n is f?und t? lead t? higher firm ?erf?rm?n?e. This type ?f diversifi??ti?n str?tegy enables firms t? utilize ?nd sh?re their existing res?ur?es m?re effe?tively th?n unrelated diversifi??ti?n. So in the situation ?f incremental ?h?nge, the Ex?l?it?ti?n ?f existing res?ur?es ?nd ????bilities seems t? be ???r??ri?te.

In ? research ?n the ?erf?rm?n?e ?f hum?n res?ur?es in ?r?fessi?n?l servi?es firms, it shows th?t hum?n res?ur?es recruited f?r ??tivities th?t f??us ?n ex?l?it?tive ??tivities, i.e., ?urrent ????bilities, show decrease in sh?rt-term ?erf?rm?n?e but they show better ?erf?rm?n?e th?n hum?n res?ur?es recruited t? handle ex?l?r?tive ??tivities, su?h ?s R & D ?nd new ??tivities. Hum?n res?ur?es recruited t? handle ex?l?r?tive ??tivities ex?erien?e decreasing in sh?rt-term ?nd l?ng-term ?erf?rm?n?e. This ?erf?rm?n?e ?f hum?n res?ur?es recruited in ex?l?r?tive ??tivities would be better when ??mbined with the senior hum?n res?ur?es in the firms.

H3: Ex?l?r?t?ry Inn?v?ti?n ??sitively ?ffe?ts firm’s ?erf?rm?n?e

H4: Ex?l?it?tive Inn?v?ti?n ??sitively ?ffe?ts firm’s ?erf?rm?n?e

The Inter??ti?n ?f Ex?l?r?t?ry ?nd Ex?l?it?tive Inn?v?ti?n ?nd Firm’s ?erf?rm?n?e

M?n?ging the b?l?n?ed ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n is not easy be??use ?f nature, ?nd the result is somehow ??r?d?xi??l ?nd ??ntr?di?t?ry. ?rg?niz?ti?ns ?re seeking ? b?l?n?ed between the ??ntr?di?t?ry dem?nds ?f sh?rt-term effi?ien?y ?nd effe?tiveness ?f l?ng-term, but it requires ? different ??er?ti?n?l, structural, ?nd ?ultur?l me?h?nisms (Freeman, Dmytriyev & Phillips, 2021). H?wever, various studies show, b?l?n?ing ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n is key t? ??hieving ?r?s?erity. ?rg?niz?ti?ns ??n ?re?te b?rders ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n ?t ? ?ert?in time ?nd s???e s? th?t ex?l?r?t?ry inn?v?ti?n ?nd ex?l?it?tive inn?v?ti?n is not ??rried ?ut simult?ne?usly in the same ?rg?niz?ti?n. In ?dditi?n, knowing the ??ntext ?f this ??ntr?di?ti?n is ? prerequisite in managing the b?l?n?ed. In ?n effe?tive Str?tegi? Entrepreneurship ??nstru?t, Ex?l?it?ti?n, ?nd ex?l?r?ti?n ?re the key s?ur?es ?f sust?in?ble ??m?etitive ?dv?nt?ge.

H?wever, ??sitively results fr?m the Inter??ti?n between ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n indi??te th?t ?rg?niz?ti?ns ??n run both th?se ??tivities simult?ne?usly, whi?h is m?n?ging the b?l?n?e between ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n. ?ver?ll, the ?r??ess ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n is believed t? im?r?ve the ?erf?rm?n?e ?f the firm. He ?nd W?ng, in their study ?n m?nuf??turing firms in Sing???re ?nd M?l?ysi? during the ?eri?d fr?m 1999 t? 2000, f?und th?t ??m??nies th?t im?lement str?tegies ?mbidexterity, th?t is the ?r??ess ?f ? relatively b?l?n?ed between ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n h?s ? ??sitively effe?t t? the in?re?sed in s?les, ?nd imb?l?n?ed ?mbidexterity will neg?tively ?ffe?t the in?re?sed in s?les. J?nzen, et ?l.. F?und th?t the ??m??ny will build ?mbidexterity ?f ex?l?r?t?ry with ex?l?it?tive t? f??e ? dynamic envir?nment, ?nd decentralized business units having ? g??d s??i?l rel?ti?n, will be ?ble t? build ?rg?niz?ti?n ?mbidexterity (?.?.). ?eg?rr?-N?v?rr? & Dewhurst in ? study ?f the S.M.E. ??m??ny in ??t?metry & tele??mmuni??ti?n in S??in, using the ??n?e?t ?f the ??ntinu?us inter??ti?n ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n, ?r s?-??lled ?mbidexterity ??ntextu?l, f?und th?t the ?mbidexterity ??ntextu?l ??sitively ?ffe?t the ??nsumer res?ur?e (?ust?mer ???it?l), th?t g??d rel?ti?nshi? with ??nsumers will bring in ?urrent revenue ?r in the future. B?d well suggested th?t the inter??ti?n ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n ?ffe?ts fin?n?i?l ?erf?rm?n?e ?nd h?s ? ??rrel?ti?n with the internal environmental ??nditi?ns (??rti?ul?rly de?entr?liz?ti?n) ?nd external environmental ??nditi?ns (dynamic envir?nment).

H5: Ex?l?r?t?ry, ex?l?it?tive inn?v?ti?n ?nd their inter??ti?n ??sitively ?ffe?ts firm’s ?erf?rm?n?e

H6: The effe?t ?f res?ur?e m?n?gement t? firm’s ?erf?rm?n?e, de?end ?n ex?l?r?t?ry, ex?l?it?tive inn?v?ti?n ?nd their inter??ti?n.

Rese?r?h Meth?ds

The rese?r?h w?s ??ndu?ted ?n re?l est?te firms in Ind?nesi?. The res??ndents ?re the b??rd ?f directors or m?n?gers ?f the firms. This study uses existing s??les fr?m liter?ture, ex?e?t f?r res?ur?e m?n?gement th?t is in??m?lete. The questi?nn?ire w?s devel??ed with ? six-??int Likert s??le r?nging fr?m (1) strongly disagree t? (6) strongly agree. Four l?tent variables ?re used in this the?reti??l model. One l?tent dependent variable is the firm’s ?erf?rm?n?e, ?nd three independent l?tent variables ?re res?ur?e m?n?gement, ex?l?r?t?ry inn?v?ti?n, ?nd ex?l?it?tive inn?v?ti?n.

The ?n?lysis in this study uses Eview ver.8 with the ?h?ses ?f the ?n?lysis ?s f?ll?ws: first, ??ndu?ting f??t?r ?n?lysis t? ?bt?in the f??t?rs th?t m?ke u? e??h ?f the l?tent variables. The next step w?s t? ?erf?rm biv?ri?te ??rrel?ti?n ?n?lysis t? examine the ??us?l rel?ti?nshi? between ??irs ?f variables t? test the hy??thesis H1 s/d H4. Inferential ?n?lysis w?s used t? investig?te the ??us?l or the u? ?nd down rel?ti?nshi? ?m?ng ? set ?f variables related t? hy??thesis H5 - H6 testing.

?n?lysis and Results

Before ??ndu?ting the ?n?lysis, ? reliability ?nd validity test w?s ?erf?rmed. ? validity test w?s done with the ?n?lysis ?f the ??rrel?ti?n between variables. It w?s measured by the results ?f the ??rrel?ti?n between the measured variables, ?s w?s ??ndu?ted in the f??t?r ?n?lysis.

The results ?f the ?n?lysis show ?r?nb??h’s ?l?h? 0,981 (>0.7); therefore, it’s ??n?luded th?t the data meet the validity ?nd reliability test. The next step w?s t? ??rry ?ut the biv?ri?te ??rrel?ti?n ?n?lysis after ?bt?ining the f??t?rs th?t m?ke u? the variables. Summary results ?f the ?n?lysis show th?t data su???rt the hy??thesis H1– H4 ?t the signifi??n?e level: 0.01. ?s show in Table 1:

| Table 1 Data Su???rt The Hy??thesis | |||||

|---|---|---|---|---|---|

| Description | Coef r>0, 7 | T– stat. | Prob p<0 | Result | |

| H1 | Resource Management positively affects exploratory innovation. | 0,888 | 14,09 | 0,000 | support |

| H2 | ResourceManagement positively affects exploitative innovation. | 0,891 | 14,26 | 0,000 | Support |

| H3 | Exploratory innovationpositively affects a firm's performance. | 0,778 | 9,02 | 0,000 | Support |

| H4 | Exploitative innovation positively affects a firm's performance. | 0,789 | 9,35 | 0,000 | Support |

| H5 | Exploratory, exploitative innovation and its interaction positively affect a firm's performance. | 0,000 | Support | ||

| H6 | The effect of a resource management firm's performance depends on exploratory, exploitative innovation and their interaction. | 0,000 | support | ||

Discussion

The ?ur??se ?f this study examined the ?r??ti?e ?f str?tegi? entrepreneurship ?n re?l est?te firms. The results represented th?t res?ur?e m?n?gement ??sitively ?ffe?ts ex?l?r?t?ry inn?v?ti?n ?nd ex?l?it?tive ?nd firm’s ?erf?rm?n?e. These results su???rt ?revi?us research ?n str?tegi? entrepreneurship, starting the im??rt?n?e ?f ?erf?rming res?ur?e m?n?gement ?nd dire?ted t? inn?v?ti?ns th?t ?re ex?l?r?t?ry ?nd ex?l?it?tive simult?ne?usly will be ?re?ting added value t? the ??m??ny 1) (Ali & Anwar, 2021; Freeman, Dmytriyev & Phillips, 2021). In ?dditi?n t? the ?b?ve findings, s?me ?ther findings related t? the results ?f this research will be described in the f?ll?wing se?ti?n, with b?nks, ?nd ?re?ting ? ??r??r?te br?nd ?re ??nsidered ?s im??rt?nt res?ur?es. This is ??nsistent with ?revi?us research th?t re?l est?te firms ?re not solely dependent ?n the l?nd but ?ls? ?ther f??t?rs, su?h ?s devel??ing the firm’s res?ur?es ?nd ??m?eten?ies effi?iently. These results ?ls? su???rt research ??nfirming the ????bility ?f establishing ???ess or rel?ti?nshi? with b?nks ?s s?ur?es ?f fin?n?ing, ?nd ??r??r?te br?nd is ?n im??rt?nt res?ur?e t? be devel??ed by re?l est?te firm.

Regarding the res?ur?e structuring ?r??ess, es?e?i?lly the res?ur?e divestment, the results represented th?t the divestment ?f the firm’s res?ur?es, es?e?i?lly l?nd res?ur?es, is n?t ?n ??ti?n t? be t?ken. ?lth?ugh the l?nd is n?t ?ble t? gener?te ?r?fit t? the ??m??ny yet ?nd somehow show un?ert?inty in return. This reinforces the theory ?b?ut the im??rt?n?e ?f the l?nd in the re?l est?te industry; in this ??se, the l?nd is ? s?ur?es ?f key raw materials ?nd is ? res?ur?e th?t ??n’t be renewed. M?l?ezzi ?nd W??hter showed th?t s??r?ity ?f l?nd su??ly be??me s?e?ul?ti?n be??use ?f demand in gener?l, ??use b??m & bust in the re?l est?te ?y?le.

The next finding w?s the ??sitively effects ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n ?nd their inter??ti?n with ? firm’s ?erf?rm?n?e. The results showed the im??rt?n?e ?f the b?l?n?ed inter??ti?n ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n t? ?re?te value f?r the firm. The b?l?n?ed inter??ti?n between ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n gener?tes better firm’s ?erf?rm?n?e is showed by 55% ?f the sample ??m??red t? firms th?t ?erf?rm imb?l?n?ed inter??ti?n ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n (16%).

These findings su???rt ?revi?us research, whi?h w?s showed th?t inter??ti?n ?f b?l?n?e between ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n im?r?ve the firm’s ?erf?rm?n?e. It ?ls? strengthens the theory th?t states the str?tegi? entrepreneurship with res?ur?e m?n?gement dire?ted towards ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n simult?ne?usly will ?re?te added value t? the ??m??ny (Ali & Anwar, 2021; Freeman, Dmytriyev & Phillips, 2021). The eff?rts t? find new w?ys ?f fin?n?ing t? ??nsumers ?nd m?rket ????rtunities/ new ??nsumer is ??nsidered im??rt?nt in the ex?l?r?t?ry inn?v?ti?n, while the im?r?vement ?f the qu?lity ?f ?r?du?ts ?nd servi?es t? ??nsumers ?nd effi?ien?y ?n the im?r?vement ?f w?rk ?r??esses ?re im??rt?nt ?s?e?ts in ex?l?it?tive inn?v?ti?n.

This finding is in line with the results ?f rese?r?h ?n the im??rt?n?e ?f ???ess t? fin?n?i?l res?ur?es ?nd effi?ien?y in the w?rk ?r??ess ?s well ?s in?re?sing ?ust?mer servi?e. ?. Im?li??ti?n First, the im?li??ti?ns ?f the theory ?n str?tegi? entrepreneurship. This rese?r?h ?r?vides ? deeper meaning, es?e?i?lly in terms ?f res?ur?e m?n?gement ?nd its effe?t ?n ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n.

This study ?r?vides em?iri??l eviden?e ?f the effe?t ?f res?ur?e m?n?gement, whi?h is ?ffe?ted by ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n simult?ne?usly will ?re?te ?n ex?ellent ?erf?rm?n?e. These ?ls? give im?li??ti?n t? res?ur?e m?n?gement, whi?h is defined ?s the ?r??ess ?f stru?turing, bundling, ?nd lever?ging the firm’s res?ur?es. Res?ur?e m?n?gement h?s evolved into ?n im??rt?nt the?ry in str?tegi? m?n?gement; H?wever, measurement ?f res?ur?e m?n?gement is still limited. This study ??m?lements these g??s. This study ?resent the im??rt?n?e ?f the de?isi?n ?f the firm res?ur?es ?nd ????bilities th?t ?re ?ss??i?ted t? the lever?ging ??ti?n ?nd with ??rres??nding t? industry ??ntext it will ?r?vide maximum results (Mitra, 2021). Zh?ng f?rmul?tes the str?tegi? res?ur?es ?nd ????bilities th?t need t? be m?n?ged ?nd lever?ged by re?l est?te firms.

In this rese?r?h, the res?ur?es ?nd ????bilities include: ???ess ?nd ????bility in ? rel?ti?nshi? with s?ur?es ?f funds/b?nks, ??r??r?te re?ut?ti?n, improved the qu?lity ?f ?r?du?ts ?nd ?ust?mer servi?e, ?r??ess effi?ien?y, ?dequ??y ?f reserves ?f l?nd, ?re im??rt?nt res?ur?es in the re?l est?te industry.

The third im?li??ti?n regarding the inter??ti?n ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n ?nd its effe?t ?n ? firm’s ?erf?rm?n?e. These inter??ti?n ??n be ??teg?rized ?s f?ll?ws: The b?l?n?ed inter??ti?n, where ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n is inter??ting in ? b?l?n?ed intensity, in this ??se, it might be high intensity ?r l?w intensity. Firms ???ly both ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n ?nd their inter??ti?n in ? b?l?n?ed m?nner. Firms th?t ??rry ?ut this str?tegy ??lled ?mbidexterity ?rg?niz?ti?n, where ??m??nies m?ke eff?rts t? seek new ????rtunities while improving the qu?lity ?f ?r?du?ti?n ?nd ?ther ??er?ti?n?l ??tivities in ?re?ting ? ??m?etitive ?dv?nt?ge today. Firms with this str?tegy show better ?erf?rm?n?es. Firms with the inter??ti?n ?f l?w ex?l?r?t?ry ?r ex?l?it?tive inn?v?ti?n will h?ve difficulties, ?nd might n?t be ?ble t? grew ?nd survive in the l?ng run. The intensity ?f Ex?l?it?ti?n is higher th?n ex?l?r?t?ry ?nd vi?e vers?. S?me ??m??nies put the eff?rts m?re ?n ex?l?it?tive inn?v?ti?n, su?h ?s ??ntinu?us qu?lity im?r?vement, ?ust?mer servi?e ?rient?ti?n, et?. F??us ?n ex?l?it?tive inn?v?ti?n ?nd forgetting ex?l?r?t?ry inn?v?ti?n will ??use difficulty t? the firm in the l?ng run. It ??uld threaten the viability ?f the firm be??use without new l?nd res?ur?es mean the firm does n?t h?ve ? ?r?du?t t? sell.

?n the ??ntr?ry, s?me ??m??nies f??us m?re ?n ex?l?r?t?ry inn?v?ti?n, i.e., se?r?h f?r new l?nd or ?r?je?t. ??m??nies th?t f??us ?n ex?l?r?t?ry inn?v?ti?n w?uld s??rifi?e the ?urrent ??m?etitive ?dv?nt?ge. This ??n ??use difficulties, ??rti?ul?rly fin?n?i?l /??sh fl?w difficulties, et?. This result su???rt ?revi?us rese?r?h th?t b?l?n?ed ?mbidexterity in?re?ses ?erf?rm?n?e, while the imb?l?n?e ?mbidexterity ??use ? de?re?se in ?erf?rm?n?e.

Limitation and Future Rese?r?h

This study h?s s?me limitations ?nd suggesti?ns f?r future rese?r?h. First, this rese?r?h w?s ??rried ?ut using se?ti?n?l data ?f the ye?r 2015, where the ??nditi?n ?f the ?r??erty business w?s in ? st?te ?f decline.

Therefore this study does n?t yet explicitly ???ture the influen?e ?f these ?r??erty ?y?le ?n inclining st?te. Future rese?r?h is suggested t? be ??ndu?ted where the re?l est?te is in the in?line business ?y?le. Suggesti?ns f?r future rese?r?h t? be ??ndu?ted in ?ther industries th?t h?ve similar ??nditi?ns in re?l est?te industry, su?h ?s m?nuf??ture firms, natural res?ur?es ?nd mining firms. These firms ?re usually ?h?r??terized by heavy investment in ?ssets. Results ?f rese?r?h ?n th?se firms might en?ble s?h?l?rs ?n str?tegi? entrepreneurship t? dr?w ? m?re ??m?rehensive ?nd gener?l ??n?lusi?n. Future rese?r?h suggesti?ns ?ls? might be ??ndu?ted ?n firms in tel?? industry, whi?h is ? m?re dyn?mi? ??m?etiti?n envir?nment, s? it will give ? ??m?lete ?i?ture ?f h?w the ?r??ti?e ?f str?tegi? entrepreneurship.

??n?lusi?n

This rese?r?h shows the im??rt?n?e ?f res?ur?e m?n?gement, whi?h is dire?ted thr?ugh str?tegi? ??ti?ns th?t ?ffe?t ? firm’s ?erf?rm?n?e. In this ??se, the inter??ti?n ?f ex?l?r?t?ry ?nd ex?l?it?tive inn?v?ti?n shows better results th?n the two ??ti?ns ??rried ?ut alone. This indi??tes th?t the ??n?e?t ?f str?tegi? entrepreneurship is essential f?r the firm in ?re?ting ? sustainable ??m?etitive ?dv?nt?ge.

References

- Ali, B.J., & Anwar, G. (2021). Strategic leadership effectiveness and its influence on organizational effectiveness. International Journal of Electrical, Electronics and Computers, 6(2).

- Lin, J., Luo, Z., Benitez, J., Luo, X.R., & Popovi?, A. (2021). Why do organizations leverage social media to create business value? An external factor-centric empirical investigation. Decision Support Systems, 113628.

- Mitra, N. (2021). Impact of strategic management, corporate social responsibility on firm performance in the post mandate period: evidence from India. International Journal of Corporate Social Responsibility, 6(1), 1-15.

- Freeman, R.E., Dmytriyev, S.D., & Phillips, R.A. (2021). Stakeholder theory and the resource-based view of the firm. Journal of Management, 0149206321993576.

- Μελ?ς, Γ. (2021). Inventory management in shipping industry: TFhe solution of 3D printing (Master's thesis, Πανεπιστ?μιο Πειραι?ς)

- Ndzana, M., Cyrille, O., Mvogo, G., & Bedzeme, T. (2021). Innovation and small and medium enterprises’ performance in Cameroon. Journal of Small Business and Enterprise Development.

- Huy, D.T.N., Nhan, V.K., Bich, N.T.N., Hong, N.T.P., Chung, N.T., & Huy, P.Q. (2021). Impacts of Internal and external macroeconomic factors on firm stock price in an expansion econometric model—A Case in Vietnam Real Estate Industry. In Data Science for Financial Econometrics, 189-205, Springer, Cham.

- Ullah, F., & Al-Turjman, F. (2021). A conceptual framework for blockchain smart contract adoption to manage real estate deals in smart cities. Neural Computing and Applications, 1-22.

- Ullah, F., & Al-Turjman, F. (2021).