Research Article: 2022 Vol: 25 Issue: 4S

The Impact of Money Supply on Economic Growth in Nigeria

Omankhanlen Alexander Ehimare, Covenant University Ota

Samuel-Hope Divine Chinyere, Covenant University Ota

Ehikioya Benjamin, Covenant University Ota

Citation Information: Omankhanlen, A.E, Samuell-Hope, D.C., & Ehikioya, B.I. (2022). The impact of money supply on economic growth in Nigeria. Journal of Management Information and Decision Sciences, 25(S4), 1-14.

Keywords

Money Supply, Broad Money, Economic Growth, Development, Economy

Abstract

This study investigated effect of money supply on economic growth in Nigeria between 1990 and 2018. There has been a certain relationship between the stock of money and economic development or economic activity in Nigeria since 1980. Over the years, Nigeria has been managing its economy by changing its stock of capital. As a result of the 1981 oil price crash and the balance of payment (BOP) deficit experienced during that time various stabilization strategies have been used, ranging from fiscal to monetary policy. The data used here are the annual time series data of the related variables, which are primarily secondary and taken from the CBN Statistical Bulletin, while the Autoregressive Distributed Lag data was adopted. Before we proceed to the estimation proper for the Autoregressive distributed lag (ARDL) regression model, it is important that we verify if they are jointly co-integrated or not. That is, if there exist a long relationship between the series in the model. In other to verify this, a bound co-integration is applied. This is followed by the Error Correction Model. The empirical results show that money supply components jointly enhance economic growth while the individuality of money supply indicators depicts different consequences. Broad money supply indicates positivity, yet weak significant to determine the economic growth in Nigeria. However, credit to the private sector is inversely and statistically significant to determine the economic growth in Nigeria. Inflation rate and interest rate both have inverse effect. Several policy implications can be drawn from this study. The government, in formulating monetary policy, must be aware of the fact that the economic growth responds more favorably to an increase in the money supply. The government must also be conscious of the relationship between the interest rate and credit to private sectors and the purpose in enhancing economic growth. Therefore, the study recommends that the Central Bank of Nigeria, should try to understand the role of money supply in enhancing economic growth and come up with monetary policies that will enable money supply to drive the economy properly in order to achieve economic growth.

Introduction

In recent years, the relationship between money supply and economic growth has received growing attention than any other topic in the monetary economy. Economists disagree on the effects of money supply on economic development. Although some accepted that fluctuations in the quantity of money are the most significant determinants of economic growth and that countries that spend more time observing the actions of aggregate money supply undergo a great deal of variance in their economic activities, others were skeptical about the role of money in gross national income (Robinson 1950, 1952). Evidence has shown that there has been a certain relationship between the stock of money and economic development or economic activity in Nigeria since 1980. Over the years, Nigeria has been managing its economy by changing its stock of capital. As a result of the 1981 oil price crash and the Balance Of Payment (BOP) deficit experienced during that time various stabilization strategies have been used, ranging from fiscal to monetary policy. As described above, money supply has a considerable impact on economic activity in both developed and emerging economies. The low supply of monetary aggregates in general and of money stock in particular was responsible for the fundamental inability of many African countries to achieve growth and development. Several analysts have blamed the government and its agencies for the inability of monetary policies to translate into economic growth as a result of inadequate execution and sincerity on the part of policy makers.

When we address the idea of money supply and its effects, two other problems frequently come to our mind, namely the state of inflationary pressure and the rate of unemployment. According to the monetarist, the rise in money supply in the economy triggers an increase in the general price of goods, which causes inflation in the country (Tejvan, 2017). The issue of unemployment, which is the primary objective of any economy to generate as many goods and services as possible while maintaining a reasonable degree of price stability, is also connected to the issue of inflation, but this major objective would be very difficult to accomplish at a high rate of inflation and price volatility due to excess money supply in the economy. Accordingly, this research work will investigate the technicalities involved in the regulation of the money supply in Nigeria.

Statement of problem

The main problem that has sorted out this work is recurrence. It is widely assumed that a continuous annual rate of money increase would adversely affect the rate of price levels that will lead directly to inflation, and can deny the anticipated impact of the monetary policy measure on economic growth. Recently, these inflationary pressures have led to a devaluation of Nigeria's value as a result of Expanding money supply initiatives. Money is more closely linked to the aggregate level of investment, costs, revenue, output and employment than any other single economic variable. Excessive supply of money resulting in excess demand for goods and services, in return, leads to a rise in price and deterioration in the balance of payment situation. Usually, in a time of high inflation, the investor's horizon is very short, and resources are redirected from long-term investment to those with immediate returns and inflation hedges, including real estate and currency speculation. In the light of the above, all industrial economies now see monetary management as an integral part of their obligations.

Also a recent review of the manufacturing sector indicated that the sector has been performing below expectation, contributing only about 4% of the Gross Domestic Product (GDP) in Nigeria. This has resulted in a decline in industrial productivity. Financial sector growth should, conventionally, translate into economic growth, by making funds available for investment which in turn will trigger productivity in the manufacturing sector but the reverse is the case as the total loans granted by Nigeria banks to the private sector declined by N600.60 billion from N16 trillion in the first quarter of 2017 to N15.34 trillion, in the second quarter of 2018.

There is a consensus among researchers and development experts that money supply input is a catalyst for economic growth and development. The combination of factor inputs to produce the desired growth is contentious. This is the course of the causality of the interplay of the factor.

Inputs to economic growth are an ongoing debate, particularly in an emerging volatile economy such as Nigeria. Money supply does not encourage economic growth in isolation through factor inputs such as the labor force of the financial system, which is likely to calculate the desired growth.

Research Questions

In assessing this study’s topic, these research inquisitions were projected:

1. What is the magnitude of money supply impact on economic growth?

2. To what level has credit to private sector impacted economic growth?

3. How does real interest rate influence the Nigerian economic growth level?

4. To what extent has the inflation rate impacted economic growth in Nigeria?

Objective of the Study

The study's main objective is to empirically analyze the magnitude of Nigeria 'smoney supply and its effect on the Nigerian economy. This research aims primarily to:

1. To investigate the influence of the money supply on economic growth.

2. To evaluate the impact of credit to the private sector on economic growth.

3. To analyze the impact of real interest rate on Nigeria’s economic growth levels.

4. To analyze the impact of inflation on Nigeria's economic growth.

Research Hypotheses

This study will examine the relationship between money supply and Nigerian economic growth. The hypotheses of the study are presented in the null form as shown below.

Hypothesis One

H1: Money supply to GDP (proxy for economic growth) does not have significant impact on economic. growth in Nigeria.

Hypothesis Two

H2: Credit to the private sector does not have a significant effect on Economic growth in Nigeria.

Hypothesis Three

H3: real interest rate does not have significant influence on economic growth in Nigeria.

Hypothesis Four

H4: inflation rate does not have a significant impact on economic growth in Nigeria.

Review of related literature

Conceptual Framework

Broad Money Supply (M2)

The broad money supply is a measure of the quantity of money consisting of M1, plus savings & small time deposits, overnight commercial bank deposits, plus non-institutional money market accounts (CBN, 2018). According to Omodero, (2019) Money supply is a monetary policy instrument that is extremely important to improve a nation's economic development. All M2 components are very liquid, and the non-cash components can very easily be converted into cash. Broad money includes notes & coins, with saving accounts & deposits also included. Treasury Bills & gilts can also be included. These securities are considered to be 'near money.'

Broad money (M2) in economics is a measure of the money supply that involves more than just physical money, including currency and coins (also known as narrow money). It usually includes commercial bank demand deposits, and any money kept in easily accessible accounts. Broad money may have different meanings depending on the user situation, and typically it is designed as required to be the most useful indicator in the situation. More specifically, broad money is only a term for consideration of the least liquid money type, and less of a defined meaning in all cases. Broad (percentage of GDP) in Nigeria as of 2018 was 23.53. Its highest value over the past 58 years was 28.63 in 1980, while its lowest value was 9.06 in 1996.

Credit to the Private Sector (CPS)

The task of the financial intermediation is generally carried out by the financial sector, channeling capital to profitable investment. In particular, deposit-taking institutions are well-recognized for fulfilling the crucial role of sourcing finance in supporting Nigeria's private sector consumption and investment. According to Olowofeso, Adeleke & Udoji, (2015) Private sector credit applies to financial capital made available to the private sector. Financial enterprise, such as loans and advances, sales of non-equity securities, transaction credits and other receivable accounts, which compensate for claims for repayments. Credit can be seen from two angles, in this regard; namely: Credit for commercial or business loans and the banking system. Bialek-jorwoska & Nehrebecka, (2016), opined that trade credit applies to transactions involving the supply of products by the seller or the production of a service without immediate payment. While Private sector banking system credit, includes the direct provision of loans and overdrafts to the private sector by institutions such as deposit money banks, non-interest banks and Nigerian merchant banks.

Economic Growth

Economic growth is understood, as a dynamic mechanism in which each economy creates relationships between the different production factors that, following economic policies, allow the production of a greater quantity of goods and services produced, thereby improving the well-being of the population (Gallardo et al., 2019). Economic development requires more demand which implies an increase in output per unit of input, not only inputs but also greater efficiency.

Economic growth is an important prerequisite for sustainable development.

Real Interest Rate

Interest rate plays an important role in economics, particularly in monetary theory. It may therefore come as a surprise that a consensus has not yet formed as to the existence and determinants of the interest rate.Trading Economics, (2020) states that real interest rate is the lending interest rate adjusted for inflation as measured by the GDP deflator. The terms and conditions attached to lending rates differ by country, however, limiting their comparability.

Real interest rate (%) in Nigeria was reported at 4.5222 % in 2019, (World Bank, 2020).

Theoretical Framework

The definition of money and changes in money stock are important aggregates that have far-reaching consequences for the formulation of economic policy. Changes in money stock have a profound impact on the pattern of international ties and form the basis for the articulation of the steps required to ensure the overall economic output of any country.

Basically this theory adopts an eclectic approach, which means that this research is not pinned to a particular theory but it adopts various theories which include:

i. Classical quantity theory

ii. Keynesian theory and

iii. Monetarist theory

Classical Quantity Theory

The classical theory of money, in its original and crude form, suggests that there is a direct and proportionate relationship between increases in the quantity of money and the general price level. The wording of this crude principle indicates that if money supply rises by 10%, then general prices will also grow by 10%. This wording is also attributed to the writings of the French economist-Jean Bodin published around 1968. Later in 1952, David Hume provided a better picture of the quantity theory of money as cited in Nzotta (2004). The crude hypothesis may be put forward as follows:

P = KM Where P = General price index

K = Constant Proportionality,

M = Money supply

Where K = v/y V = Velocity of money; Y = real output

Keynesian Monetary Theory

Keynes based his theory on the following assumptions.

1) As long as there is unemployment, all factors of production are in a perfectly elastic supply state.

2) The unemployed factors are homogenous, perfectly divisible and interchangeable.

3) As long as prices do not rise or fall as output changes, there will be constant returns to scales

4) Finally, as long as there are unemployed resources, effective demand and the quantity of money change in the same direction (Jhingan, 1990). Keynesians have done a great job in promoting their set of ideas. Rather than treat monetary theory in two separate compartments as the classical do, they integrate monetary theory with value theory. Apostles of Keynes do not buy the classical notion that the relationship between money and prices is direct and proportional. They share the view that it is indirect through the rate of interest.

Monetarist theory

In 1956, Professor Milton Friedman presented a "restatement of the quantity theory" in modern terms. This resulted in a new and more sophisticated version of the quantity theory and in a manner amenable to empirical testing. Friedman's concern was to show that velocity (or demand for money) was a stable function of a limited number of other important variables, i.e. that velocity bears a stable, predictable relationship to limited number of other important variables. His approach was to concentrate on the determinants of how much money people will hold rather than the motives for holding more. Monetarism consists of the school of thought that the demand for money is a stable function of many variables and that money supply is the most important determinant of interest rate, incomes (output), employment and prices (Woods,1980). The monetarists contend that all changes in money income can be traced to changes in the supply or demand for money (Odumusor, 2015).

The major tenets of monetarism could be stated as follows:

a) Money supply has a direct and significant impact on national income and expenditure.

b) Interest rates have no effect on the supply and demand for money. The demand for money is the transactions demand for money, which is determined by the level of income.

c) Change in the general price level is essentially a monetary phenomenon and exogenously determine by the monetary authorities.

Empirical Review

Bashir & Sam-Siso (2020) investigated the relationship between monetary policy and macroeconomic performance in Nigeria during 1981-2018. The stochastic properties of the time series data were examined using both conventional and unit root tests with structural breaks to account for shift dummy in the series. Their results indicates that the series are combination of both I(0) and I(1) in the same specification which prompted the use of ARDL. The results revealed that in the short run, lag value of inflation rate, exchange rate appreciation and unexpected appreciation (i.e., shift_dummy) could reduce inflation rate while lower MPR and high volume of money in circulation could stimulate inflation rate. Also, lag value of unemployment rate, high MPR and exchange rate depreciation significantly stimulate unemployment rate while unexpected appreciation reduce it.

Onwuteaka, Okoye & Molokwu (2019) Examined the impact of monetary policy on economic growth in Nigeria using secondary data from the Central Bank of Nigeria statistical bulletin covering the period 1980-2017. Estimates of the model were calculated using a multiple econometric model of the ordinary least square to determine the impact of money supply, credit in the economy, interest rate on credit, infrastructure, inflation rate, external debt, price index on Nigerian development. The findings show that money supply, interest rate on credit, infrastructure and external debt have been statistically important in explaining its effect on economic development, while other variables used in the analysis have all been found to be statistically insignificant in explaining the growth rate of the Nigerian economy.

Ayodeji & Oluwole (2018) analyzed the effect of monetary policy on economic growth in Nigeria by developing a model capable of investigating how government monetary policy has influenced economic growth through a multi-variable regression study. Error Correction Model has been implemented in order to provide a parsimonious model. As a result, two variables (money supply and exchange rate) had a positive but relatively negligible effect on economic development.

Ufoeze, Odimgbe, Ezeabalisi & Alajekwu (2018) investigated the impact of monetary policy on economic growth in Nigeria by using natural GDP logs as dependent variables against explanatory monetary policy variables: monetary policy rate, money supply, exchange rate, lending rate and market-controlled investment for the period 1986 to 2016. The research followed the Ordinary Least Squared technique and also carried out root and co-integration tests for the unit. The analysis showed that there is a long-term relationship between the variables. Moreover the key results of this study have shown that monetary policy rates, interest rates and investment have a substantial positive impact on Nigeria's economic development. Srithilat & Sun (2017) looked at the effect of monetary policy on economic growth using annual time series data from 1989 to 2016. Error Correction Model was used to evaluate the relationship between variables. The result shows that money supply, interest rate and inflation rate negatively affect real GDP per capita over the long term, and only the real exchange rate has a positive impact. The effect of the error correction model suggests the presence of a short-term causality between money supply, real exchange rate and real GDP per capita.

Yien, et al., (2017) examined the dynamic relationship between monetary policy and economic growth for Malaysia during 1980-2015, using VAR Granger Causality method. They observed that interest rate granger caused growth per capita, money supply, inflation, unemployment and foreign direct investment. More so, the study demonstrates that changing monetary policy approach in Malaysia from monetary targeting to interest rates targeting is a fruitful policy implementation. Finally, their results showed bidirectional causality between unemployment and growth per capita in Malaysia.

On the link between unemployment and monetary policy, Essien, et al., (2016) employed a Vector Autoregressive (VAR) framework for the period 1983q1–2014q1. In their analysis, the authors incorporated the effect of structural breakpoints into the VAR model as dummy variables. Their findings showed that a positive shock to policy rate raises unemployment over a 10 quarter period. Towards achieving inclusive growth in Nigeria, Nwosa (2016) employed OLS technique to examine the effect of monetary, fiscal and foreign exchange policy) on unemployment and poverty rates for the period 1980- 2013. The analysis shows that unemployment rate is mainly influenced by exchange rate (monetary policy) while poverty rate is influenced by fiscal policy.

Methodology

The connectivity between money supply and economic development in Nigeria was explored in this part of the study. The former was interpreted as the ratio of money supply to GDP, the ratio of private credit to GDP, the inflation rate and the real interest rate. The data used here are the annual time series data of the related variables, which are primarily secondary and taken from the CBN Statistical Bulletin, while the Autoregressive Distributed Lag data was adopted.

Model Specification

Where

RGDP = Real Gross Domestic Product

M2 = Money Supply

CPS = credit to private sector,

INF= Inflation rate

RINT= Real Interest Rate

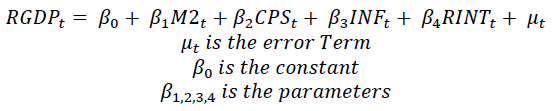

In econometric form:

The model following a semi-log linear model due to high higher series of RGDP and MKTCAPO. The structured model is presented below:

Were L is the Logarithm

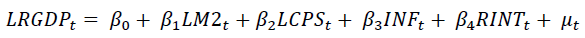

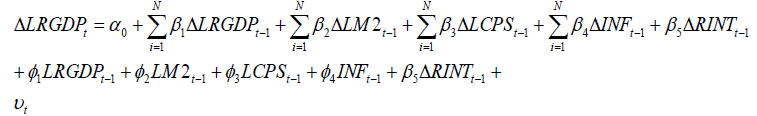

The Autoregressive Distributed Lag (ARDL) model for the study is modelled below:

Where Δ is the first difference of operator.

Results and discussion

In an attempt to verify the stationarity of variables, Augmented Dickey Fuller (ADF) tstatistics was employed to be sure of non-existence of second-differenced variable which makes bound tests result unreliable, since they are based on the criteria of stationarity at level and/or at first difference. Table 1 shows the result of ADF test. Variable-stationarity is stationary when ADF t-stat is above its critical values at 5% significance. It is non stationary when ADF t-stat is below critical values at 5% significance.

| Table 1 Augmented Dickey–Fuller (ADF) unit root |

|||||

|---|---|---|---|---|---|

| Variable | Level | First Difference | Critical Value | Lag | Order of Integration |

| LRGDP | -4.598887 | -2.967767 | 2 | I (0) | |

| LCPS | -0.464730 | -4.522678*** | -2.967767 | 2 | I (1) |

| INF | -2.027583 | -4.358594*** | -2.967767 | 2 | I (1) |

| LMS | -3.412437 | -2.967767 | 2 | I (0) | |

| RINT | -5.325035 | -2.967767 | 2 | I(0) | |

Source: Author’s Computation (2020),Where:*, **, & *** implies 10%, 5% & 1% significance level

ADF unit root test shows that the model’s variables are I(0) and I(1), thus, the usage of Autoregressive Distributed Lag is being justified.

Unit Root test

Table 1presents the Augmented Dickey-Fuller (ADF) unit root test. The unit root test was presented inform of intercept model in other to deduce the order of integration of the variables at 5% level of significant. According to the results, LRGDP, LMS and RINT are integrated of order zero. That is the series (LRGDP, LMS and RINT) does not have unit root problem at level. However, both LCPS and INF have unit root problem at level, but after the first difference, the series becomes stationary. Hence both LCPS and INF is integrated of order one. In summary, there is mixed stationary series in the model, therefore the auto regressive distributed lag model is applicable.

Bound Test for Cointegration

Before we proceed to the estimation proper for the Autoregressive distributed lag (ARDL) regression model, it is important that we verify if they are jointly co-integrated or not. That is, if there exist a long relationship between the series in the model. In other to verify this, a bound co-integration by Pesaran & Shin (1999); Pesaran et al., (2001) is applied.

The results of the bound testing for co-integration of money supply and economic growth is presented in table 2. The bound test compares the F-value of a model at 5% level with the lower bound test and upper bound test at 5% significant level. The model F-statistics value of 4.385045 showed that the value is greater than both the lower and upper bound value of 2.86 and 4.01 respectively at 5% significant level. The result showed that there exists a long run relationship among the financial development and economic growth. This implies that the null hypothesis of no co-integration among the money supply and economic growth in Nigeria cannot be accepted. This means that the alternative hypotheses of co-integration among the variables are supported.

| Table 2 Bound test for co-integration test |

||||

|---|---|---|---|---|

| F-statistic | K | Lower Bound | Upper bound | |

| 4.385045*** | 4 | 10% | 2.45 | 3.52 |

| 5% | 2.86 | 4.01 | ||

| 2.5% | 3.25 | 4.49 | ||

| 1% | 3.74 | 5.06 | ||

Source: Author’s Computation (2020),Where:*, **, & *** implies 10%, 5% & 1% significance level

The Error Correction Model result in Table 3 shows that about 9.77% percent represents the speed at which the independent variables adjust annually. The co-efficient of the Error Correction Model which is -0.097731confirmed with theoretical exposition of the Error correction modelling with the negative value and corresponding Probability Value of 0.0349, that is, the ECM is significant at 5% significance level. Short run Inflation is statistically significant at 5% level as the coefficient denotes -0.000822 t-statistics denotes -2.2157 and the p-values of 0.0452 is less than 0.05. A percent increase in the short run of INF will yield about 0.08 percent decrease in LRGDP.

| Table 3 Estimated coefficients of the short run and error correction model |

||||

|---|---|---|---|---|

| Variables | Coefficient | Stand. Error | T-Statistics | P–Value |

| Method: Autoregressive Distributed Lag Model (ARDL) | ||||

| D(LRGDPN(-1)) | 0.545183 | 0.096139 | 5.670784 | 0.0001 |

| D(INF) | -0.000822 | 0.000371 | -2.215746 | 0.0452 |

| D(LMS) | -0.014902 | 0.041063 | -0.362903 | 0.7225 |

| D(LMS(-1)) | 0.122192 | 0.032379 | 3.773875 | 0.0023 |

| D(RINT) | -0.000887 | 0.000222 | -4.003245 | 0.0015 |

| D(RINT(-1)) | 0.000486 | 0.000248 | 1.959141 | 0.0719 |

| D(LCPS) | -0.026208 | 0.032159 | -0.814938 | 0.4298 |

| CointEq(-1) | -0.097731 | 0.041491 | -2.355467 | 0.0349 |

| R-Squared | 0.537264 | |||

| Adjusted R-Squared | 0.500245 | |||

| F-Statistics | 14.51322*** (0.000066) | |||

| Durbin Watson | 2.121955 | |||

| Notes:***, ** and * means the rejection of the null hypothesis at 1%, 5% and 10% respectively. | ||||

Source: Author, 2020

Short run money supply is not statistically significant at 5% level as the as the coefficient denotes -0.014902, t-statistics denotes --0.362903 and the p-values of 0.7225 is greater than 0.05. A percent increase in the short run of MS will yield about 1.490 percent decrease in LRGDP.

Short run Real interest rate is statistically significant at 5% level as the coefficient denotes -0.0008 t-statistics denotes -4.0032 and the p-values of 0.0015 is greater than 0.05. A percent increase in the short run of RINT will yield about 0.088 percent decrease in LRGDP.

Short run LCPS is not statistically significant at 5% level as the coefficient denotes -0.02620 t-statistics denotes -0.81493 and the p-values of 0.4298 is greater than 0.05. A percent increase in the short run of LCPS will yield about -0.02620 percent decrease in LRGDP.

The value of the adjusted R-squared of 0.50024 is an indication that about 50.0% variation in Log of real gross domestic product are explained by the explanatory variables in the model(Inflation, Money supply, credit to private sector and real interest rate)while the remaining 50.0% are explained by other factors. The F-Test which is the test of overall significance of the model indicates that by its value of 14.5132 (P-value=0.0000), it is statistically significant at 5% level. Therefore, the result of the individual independent variables regressed against the dependent variables as shown above is reliable and is a true representation of the data used in the analysis.

Table 4 presents the long run estimates of the effect of money supply on economic growth in Nigeria. The constant coefficient of 8.2477 indicates that economic growth equal to 8.24770 if all explanatory variables are held constant. In more specific, economic growth will assume a value of 8.24770 if Inflation rate, money supply, credit to private sector and real interest rate does not exist in the model. The T-statistic of 18.9468 with the probability value of 0.0000 indicates that the coefficient of the constant is statistically significant at 5% significant level.

| Table 4 Long run effect of financial development and economic growth in Nigeria |

||||

|---|---|---|---|---|

| Dependent Variable: LRGDP | ||||

| Long Run Coefficients | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| INF | -0.011756 | 0.007011 | -1.676828 | 0.1174 |

| LMS | 0.953680 | 0.505555 | 1.886403 | 0.0818 |

| RINT | -0.015702 | 0.008200 | -1.914993 | 0.0778 |

| LCPS | -0.657000 | 0.077371 | -8.491553 | 0.0000 |

| C | 8.247708 | 0.435307 | 18.946860 | 0.0000 |

Source: Author’s Computation (2020),Where:*, **, & *** implies 10%, 5% & 1% significance level

The results indicates that LMS is positively and significant to determine the economic growth in Nigeria with the coefficient value of β = 0.9537, the t-statistics of t = 1.8864 and the corresponding probability value of P=0.0818). This shows that a unit increase in LMS brings about an increase of 95.37% in LRGDP in Nigeria. The positivity of LMS is statistically significance to explain the LRGDP in Nigeria. Hence the study reject the null hypothesis of no significant effect of money supply on economic growth in Nigeria. Hence the study concluded that money supply have statistically significant effect on economic growth in Nigeria.

Contrary to the effect of inflation rate on economic growth. The results indicates that inflation rate is negatively and statistically insignificant to determine the economic growth in Nigeria with the coefficient value of β=-0.01175, the t-statistics of t =-1.67682, and the corresponding probability value of P=0.1174). The study indicates that a unit increase in inflation brings about a decrease of 0.12% in LRGDP. Hence the study failed to reject the null hypothesis of no significant effect of inflation rate on economic growth in Nigeria. Hence the study concluded that inflation rate does not have any significant effect on economic growth in Nigeria. The results also indicates that real interest is inversely and statistically significant to determine the economic growth in Nigeria with the coefficient value of β =-0.0157, the t-statistics of t =-1.91499, and the corresponding probability value of P=0.0778). The result explain that for any unit increase in real interest rate brings about a decrease of 1.57% in LRGDP. More so, the estimate is statistically significant at 10% to influence economic growth in Nigeria within the observed years. Hence the study concluded that real interest rate have statistically significant effect on economic growth in Nigeria.

More so, the study indicates that LCPS is inversely but statistically insignificant to determine the economic growth in Nigeria with the coefficient value of β =-0.65700, the t-statistics of t =-8.4915, and the corresponding probability value of P=0.000). The result explain that for any unit increase in LCPS brings about a decrease of 65.7% in LRGDP. More so, the estimate is statistically significant to influence economic growth in Nigeria within the observed years. Hence the study concluded that credit to private sector have statistically significant effect on economic growth in Nigeria.

Diagnostic Tests

The ARDL models assess the effect of financial development on economic growth in Nigeriaare validated by applying Jarque-Bera normality test with the null hypothesis of normality,Breusch-Godfrey Serial Correlation LM Tests for Autocorrelations with the null hypothesis of no serial correlation, and ARCH Heteroskedasticity Tests with the null hypothesis of no Heteroskedasticity in the error term and the results as presented in Table 5.

| Table 5 Diagnostic test |

|

|---|---|

| Post Estimation Test | |

| Breusch-Godfrey Serial Correlation LM Test: | 2.338513 (0.1425) |

| Heteroskedasticity Test: Breusch-Pagan-Godfrey | 0.797154 (0.6556) |

| Jarque-Bera Statistics | 0.318772 (0.852667) |

Source: Author’s Computation (2020),Where:*, **, & *** implies 10%, 5% & 1% significance level

The serial correlation result shows that the probability value of 0.1425 implies that we accept H0 and reject H1 and conclude that there is no serial correlation in the model.The heteroscedasticity test was satisfied using the Breusch-Pagan-Godfrey’s heteroscedasticity test, the result shows that there exist no heteroscedasticity in the model.This implies that there is constant variance of the error term giving it Probability value of0.6556,hence, it is safe to conclude that the model possess homoscedasticity. Also the Jarque-bera statistics result of the normality test shows that the probability value is 0.853 which is greater than 0.05. Based on this, we concluded that the residual isnormally distributed and this result from this model is desirable.

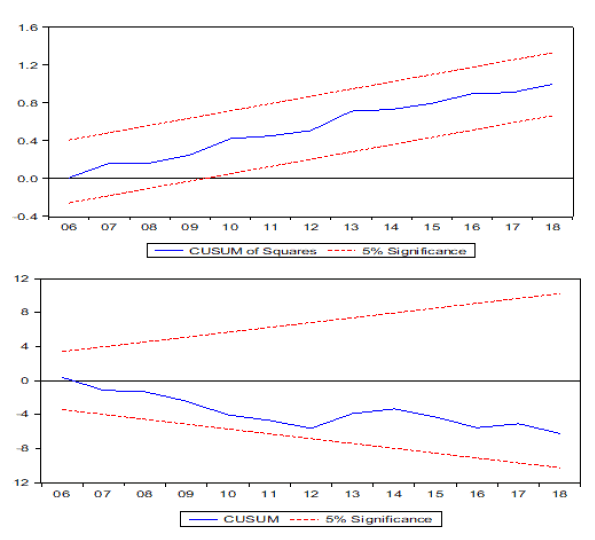

Stability Test

The plot above depicts the stability form of the model and both cumulative sum (CUSUM) and cumulative sum of squares (CUSUM of SQUARE) was applied. This stability test was appropriate in time series data, especially when we are unsure about when structural change may have taken place. CUSUM and CUSUMQ statistics are plotted against the critical bound of 5% significance. The stability forms show that the stability lines are well within the critical bounds at 5% significance level. This implies that all the coefficients in the error-correction model are stable. In general, the model is statistical stable for prediction and forecasting.

Conclusion and recommendation

This study investigated effect of money supply on economic growth in Nigeria between 1990 and 2018. The empirical results shows that money supply components jointly enhance economic growth while the individuality of money supply indicators depicts different consequences. Broad money supply indicates a positivity, yet weak significant to determine the economic growth in Nigeria, however, credit to the private supply inversely and statistically significant to determine the economic growth in Nigeria. Inflation rate and interest rate both have inverse effect, however, interest rate posits a weak significant effect on economic growth in Nigeria, and inflation rate is statistically insignificant to influence economic growth in Nigeria. The results are very much in line with existing empirical literature, most of which uncovera positive relationship between money supply and economic growth.

Several policy implications can be drawn from this study. The government, in formulating monetary policy, must be aware of the fact that the economic growth responds more favorably to an increase in the money supply. The government must also be conscious of the relationship between the interest rate and credit to private sectors and the purpose in enhancing economic growth. Therefore, the study recommends that the Central Bank of Nigeria, should try to understand the role of money supply in enhancing economic growth and come up with monetary policies that will enable money supply to drive the economy properly in order to achieve economic growth. Also policy should be make in reducing the price for credit to the private sectors because their activities contribute so much to economic growth in Nigeria. When the interest rates for obtaining credits are not choking, the private sectors will invest more, thereby giving room for more outputs and job opportunities.

Acknowledgement

The Authors appreciate Covenant University Centre for Research and Innovation (CUCRID) for sponsoring the publication of this paper.

References

Reference

Ayodeji, A., & Oluwole, A. (2018). Impact of monetary policy on economic growth in Nigeria.Open Access Library Journal, 5(e4320), 1-13. CBN (1992).

Crossref, Google Scholar, Indexed at

Bashir A.W., & Sam-Siso, E.O. (2020). Does monetary policy stimulates macroeconomic performance during Economic Downturn in Nigeria?. Journal of Social Sciences, 16, 23-36.

Białek-Jaworska, A., & Nehrebecka, N. (2016). The role of trade credit in business operations.

Central Bank of Nigeria (2018). Code of corporate governance for bureau de change in Nigeria.

Central Bank of Nigeria (2020). The interest rate development. Economic report First quarter 2020.

Essien, S.N., Manya, G.A., Arigo, M.O.A., Bassey, K.J., & Ogunyinka, S.F. (2016). Monetary policy and unemployment in Nigeria: Is there a dynamic relationship? CBN J Applied Stat, 7, 209-231.

Crossref, Google Scholar, Indexed at

Gallardo, P.H.J., Vergel, O.M., & Cordero, D.M.C. (2019). Economic growth model in developing economies. Journal of physics: Conference series, 1388, 012033.

Jhingan, M.L. (1990). Monetary theory. Delhi; Konark Publishing.

Nzotta, S.N. (2004). Money, banking and finance.Owerri; Hudson- Jude.

Nwosa, P. (2016). Impact of macroeconomic policies on poverty and unemployment rates in Nigeria, implications for attaining inclusive growth. Acta Univ Danubius. Economica, 12, 114-126.

Odumusor, C.J. (2015). Impact of money supply on the growth of the Nigerian economy, 1976 – 2015. IOSR Journal of Economics and Finance (IOSR-JEF) e-ISSN: 2321-5933, 10(1), 30-46. Google Scholar, Indexed at,

Olowofeso, E. O., Adeleke, A.O., & Udoji, A.O. (2015). Impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 6(2), 81-101.

Onwuteaka, I.O., & Pius-Vincent, M.I. (2019). - Effect of monetary policy on economic growth in Nigeria. International Journal of Trend in Scientific Research and Development, 3 590- 597.

Crossref, Google Scholar, Indexed at

Omodero, C. (2019). Effect of money supply on economic growth: A comparative study of Nigeria and Ghana. International Journal of Social Science Studies, 7(3).

Crossref, Google Scholar, Indexed at

Robinson, M.O. (1952). The generalization of the general theory in the rate of interests and other essays. Obosi: Pacific Publications.

Srithilat, K., & Sun, G. (2017). The impact of monetary policy on economic development: Evidence from Lao PDR. Global Journal of Human-Social Science: Economics, 17(2), 8-16.

Tejvan, P. (2017). Monetarist theory of inflation. Economics help.

Trading Economics (2020). Nigeria-Real interest rate.

Ufoeze, L.O., Odimgbe, S.O., Ezeabalisi, V.N. Alajekwu, U.B. (2018). Effect of monetary policy on economic growth in Nigeria: An empirical investigation. Annals of Spiru Haret University Economic Series, 18(1).

Crossref, Google Scholar, Indexed at

World Bank (2020). Nigeria - Real interest rate - actual values, historical data, forecasts and projections World Bank on November of 2020.

Woods, O.G. (1980). Introduction to money and banking. New York: D. Van Nestrand.

Yien, L.C., Abdullah, H., & Azam, M. (2017). Monetary policy inclusive growth: Empirical evidence from Malaysia. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7, 225-235.

Crossref, Google Scholar, Indexed at

Received: 20-Dec-2021, Manuscript No. JMIDS-21-3507; Editor assigned: 22-Dec-2021; PreQC No. JMIDS-21- 3507 (PQ); Reviewed: 7-Jan-2022, QC No. JMIDS-21-3507; Revised: 15-Jan-2022, Manuscript No. JMIDS-21-3507 (R); Published: 20-Jan-2022