Research Article: 2018 Vol: 17 Issue: 1

The Impact of Intellectual Capital Dimensions on Vietnamese Information Communication Technology Firm Performance: A Mediation Analysis of Human and Social Capital

Hoang Thanh Nhon, International University-Vietnam National University

Bui Quang Thong, International University-Vietnam National University

Nguyen Van Phuong, International University-Vietnam National University

Keywords

Intellectual Capital, Human Capital, Organizational Capital, Social Capital, Information Communication Technology (ICT).

Introduction

Vietnam ICT industry has the bright future as Vietnam has been emerging as a production centre for both IT hardware and software services (ITU, 2015). The expected growth rate of Vietnam’s ICT market is eight percent in the period of 2016-2020 (ITU, 2015). Hence, the government has devised a master plan for ICT sector which specifies targets for 2020 turning Vietnam into an advanced ICT country (ITU, 2015; Taking-off strategy: Does it stepping up the development of the ICT industry in Vietnam, 2013). However, unlike other well-developed industries in term of inputs, firm size, management knowledge, ICT with short product life cycle, high customer demand and very unpredictable technological changes, attaining and managing Valuable, Rare, Inimitable and Non-Substitutable (VRIN) sources like intellectual capital is very important to superior performance. However, the intellectual capital of Vietnamese ICT firms is a shortage (Taking-off strategy: Does it stepping up the development of the ICT industry in Vietnam, 2013). Therefore, to survive and grow in a highly competitive and uncertain institutional environment, they must increase their efforts in intellectual capital development. Intellectual capital often referred to as the value is created by three types of intangible resources, that is, human capital such as individual’s knowledge, skill and education, organizational capital including all non-human knowledge containers involving information and communication systems, databases, process manuals, strategies, routines and social capital regarding to social relationships of an organization or individual with customers, investors, competitors or suppliers (Taking-off strategy: Does it stepping up the development of the ICT industry in Vietnam, 2013). Although the popularities of western studies on intellectual capital have built on the assertion that it is the key source of superior performance, there are very few studies in developing countries validating, operationalizing above propositions where the business environment is very unstable like Vietnam. In this article, several contributions can be made to management literature as the following. Firstly, we extend previous literature by offering insights into the relevance of the social, human and organizational capital, for achieving ICT firm’s outstanding performance in the face of environmental uncertainties. Secondly, we advance existing research in this field by explicitly discussing how organizational, social and human capital development leading to the achievement of the outstanding performance. Lastly, we measure the mediating role of the social capital in the model by evaluating the extent to which its effects on performance through organizational and human capital is contingent on environmental uncertainties. In sum, to fill above gaps, we build and validate the conceptual model of the interrelationships among intellectual capital dimensions and firm performance and then suggest how to use the outcome of model test effectively.

Theoretical Backgrounds And Hypothesis Developments

Resource-Based View

The ICT sector is a service sector, thus, strategic intangible resources such as intellectual capital, resulting from knowledge and skills of employees, processes and information systems and customer relationships are very important. It is claimed that ICT firm with strong intellectual capital can achieve sustainable competitive advantages and differentiate themselves from their competitors (Zeglat & Zigan, 2013; Wernerfelt, 1984). For this reason, we use Resource-Based View (RBV) as a theoretical framework for this study. RBV is an economic tool used to determine the strategic resources available to a firm (Wernerfelt, 1984). Therefore, it is argued that the management and development of intellectual capital are vital means of ICT firm’s strategic management and performance (Wernerfelt, 1984). The RBV looking inside the company for resources of superior performance is valuable, enabling firm strategies that improve its efficiency and effectiveness, rare, not available to other competitors, imperfectly imitable, not easily implemented by others and non-substitutable, not able to be replaced by some other non-rare resource (Cao & Wang, 2015).

Firm Performance

The firm has been examined by academia for a considerable time in measuring the health of the firm. The reliable and valid measurement of performance is critical for research. Initially, relying on a purely financial perspective, the firm performance measurement has been gradually extended to multiple dimensions. Several classification criteria have been suggested. Venkatraman & Ramanujam proposed that firm performance should be measured in terms of financial and operational aspects (Venkatraman & Ramanujam, 1986). Financial performance is measured by indicators such as sales growth, earning per share and profitability which is reflected by return on investment, return on sales and return on equity. However, operational or non-financial performance emphasizes factors such as product quality and productivity, market share and marketing effectiveness (Demirbag, Tatoglu, Tekinkus & Zaim, 2006). To ensure that firm performance is measured accurately, Dess & Robinson recommended that firm should employ both financial and non-financial performance measurement. Rather than relying on a single indicator, utilizing multiple indicators enables firms to measure performance via more complex and informative measures as well as assess the contribution of each indicator to the latent variable (Dess & Robinson, 1984).

Intellectual Capital

The Impact of Human, Organizational and Social Capital on Firm Performance

The first definition of intellectual capital was suggested by an economist, John Kenneth Galbraith in 1969, he believes that intellectual capital is not only an intangible asset but also an ideological process (Bontis, 1998; Edvinsson & Sullivan, 1996; Huang & Jim, 2010). Other scholars suggest that intellectual capital is the accumulation of all knowledge, information, intellectual property, experiences, social networks, capabilities and competencies that enhance organizational performance not only held by individuals but also embed in its business process (Bontis, Chua & Richardson, 2000; Subramaniam & Youndt, 2005; Rastogi, 2003). Rastogi offers a comprehensive definition describing intellectual capital “as the holistic or meta-level capability of a company to coordinate, orchestrate and deploy its knowledge resources toward creating value in pursuit of its future vision” (Choo, Tayles & Luther, 2010). Over past years, the concept of intellectual capital has been defined in multiple ways, resulting in a lack of consensus regarding its components (Intellectual Capital Information). However, synthesizing the existing academic discussions, we find that the widely accepted definition for intellectual capital should have three components: Human, organizational and social capital (Bontis, 1998; Phusavat, Comepa, Sitko-Lutek & Ooi, 2011; Hsu & Fang, 2009; Sharabati, Jawad & Bontis, 2010; Aramburu & Saenz, 2011).

Embedded in employees, human capital may be defined as the summation of abilities, skills, attitude, commitment, experience and educational background of employees that enable them to act in ways which are economically valuable to both individual and to the firm (Shih, Chang & Lin, 2010). Human capital brings value to the company as a criterion of competency and creativity possessed by employees which allows them to identify business opportunities, create new knowledge and solve problems (Nonaka & Von Krogh, 2009). The firm does not have its own human capital but rather lease the acquired knowledge, skills and experience of the employee. Quality of human capital in a firm is influenced by hiring practices and training activities (Gilbert, Von & Broome, 2017). The economic value of human capital is dependent on how an employer uses and develops. Therefore, scholars confirmed that it is deemed as the most important intangible resource of firm’s development, especially in innovative sectors like ICT (Cao & Wang, 2015). Hence, the first hypothesis is proposed as the following:

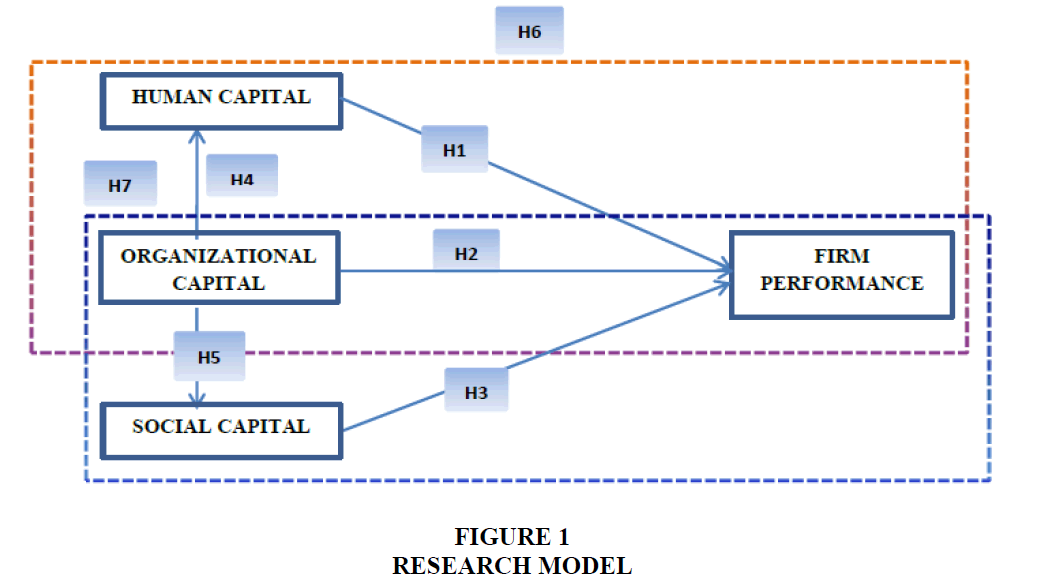

H1: Human capital has a positive and significant influence on firm performance.

Defined as the institutionalized knowledge and codified experiences preserved in the organizational image, culture, routines, procedures, information systems and patents (Gilbert, Von & Broome, 2017; Nahapiet & Ghoshal, 1998) organizational capital is a strategic intangible asset. The purpose of organizational capital is to coordinate communication and action among individuals in an organization (Gilbert, Von & Broome, 2017). From the literature review, scholar suggests three distinct dimensions of organizational capital as the following: (a) The structural, (b) the cultural and (c) knowledge dimension (Gilbert, Von & Broome, 2017). The first dimension, structural dimension, refers to the formal procedures and processes of the organization providing the decision-making guideline. This includes human resource policies and guidelines of the labor-management practices such as hiring, tasking, staffing and disciplinary action (Nonaka & Von Krogh, 2009; Gilbert, Von & Broome, 2017, Nahapiet & Ghoshal, 1998). The cultural dimension accounts for processes serving for the long-term strategy of the firm. This include formal objectives, strategic plan, mission, values, vision (Akdere & Roberts, 2008; Djuric & Filipovic, 2015), the organizational culture and tradition (Baughn, Neupert, Anh & Hang, 2011; Kostopoulos, Bozionelos & Syrigos, 2015; Oldroyd & Morris, 2012) and corporate social responsibility (Ferreira, Roseta & Sequeira, 2012). The knowledge dimension accounts for processes through which knowledge and information are created, utilized, exchanged and preserved. This includes investment in research and development (Youndt, Subramaniam & Snell, 2004) copyrights and patents (Ellinger et al., 2011).

Comparing with human and social capital, it is least flexible (Gilbert, Von & Broome, 2017). Major ICT firms are small and medium size, thus, developing organizational capital that is less hierarchical in nature and allows for autonomy and independence in decision making allowing in increased innovation and absorption of new knowledge (Cao & Wang, 2015). As the result, the firm performance is improved. Based on these arguments, we hypothesize the following:

H2: Organizational capital positively relates to firm performance.

It is acknowledged in the literature that the influence of social capital on firm performance has been increasing (Kianto, Andreeva & Pavlov, 2013). However, the concept of social capital has been much debated in terms of definition, measurement and operationalization (Hsu, Chang, Huan & Chiang, 2011). So far, there are three distinct theoretical perspectives of social capital proposed by scholars are the functional, network and multidimensional perspective (Gilbert, Von & Broome, 2017). The functional perspective developed by Coleman & Putnam defines social capital as a functional resource that enhances collaboration among individuals in an organization (Coleman, 1988; Putnam, 1993). The network perspective of the social capital theory suggested by Bourdieu defines social capital as a resource embedded in social networks in which individuals or organizations are members (Bourdieu, 2011). When member’s network is expanded and trust is established, the members are more willing to share intellectual resources, in turn, motivating knowledge exchange activities. The last perspective, multidimensional perspective, is developed by synthesizing the functional and network perspective (Gilbert, Von & Broome, 2017). Therefore, this perspective conceptualizes social capital as a resource both inherent in a network and as a resource facilitating action among network member that it is available for productive purposes (Grootaert, 2004). In general, social capital encompasses the context, stock of relationships, interpersonal trust and norms that allow certain behaviours and sustainable relationships between individuals as well as ensure conditions for organizational development and knowledge exchanges (Zack, McKeen & Singh, 2009). Hence, how social capital enabling accessing, processing, synthesizing and exchanging knowledge within and across organizations will influence the performance of knowledge-based organization like ICT firm. The hypothesis is the following:

H3: Social capital may positively relate to firm performance.

The Impact of Organizational Capital on Human and Social Capital Development and Mediating Role of Organizational Capital

Investment in Research and Development (R&D), a type of investment in organizational capital, is fundamental to create new knowledge’s, products and services. R&D investment activities increase the opportunities and avenues for organizational members to identify and apply technology in product and service (Zack, McKeen & Singh, 2009). This also improves the members’ own understanding and learning about new knowledge’s and technologies (Youndt, Subramaniam & Snell, 2004). Accordingly, the more investments in R&D, the more it supports its individuals to enhance their expertise, knowledge, thus, build up human capital.

The other investment in organizational capital is a regular training provision for the employees. It is typically argued that firms can increase their human capital by providing comprehensive training activities to their current employees. The training activities focusing on developing personal knowledge and skills may not only increase employee’s human capital but also help employees increase social capital by building relationships with their colleagues and share knowledge among them (Youndt, Subramaniam & Snell, 2004; Tseng, Wang & Yen, 2014). Likewise, as individuals learn and increase their human capital, they may create knowledge that potentially forms the foundation for organizational learning and knowledge accumulation (Youndt, Subramaniam & Snell, 2004).

The investment in Information System (IS) is also important for human and social capital. There is a consensus that information system is the infrastructure of many organizations (Youndt, Subramaniam & Snell, 2004). At primary level, information system creates repositories where knowledge can be codified and institutionalized. In addition, IS investments also enable the creation and diffusion of knowledge from and across dispersed and globalized sources (Youndt, Subramaniam & Snell, 2004). Nowadays, computer network, a type of information system, removes physical and temporal limitations to communication and connects people to create online social networks (Youndt, Subramaniam & Snell, 2004). These online connections enhance cooperation, sharing of knowledge not only among employees within the firm, but also across firms (Youndt, Subramaniam & Snell, 2004).

The last investment in organizational capital is the investment in organizational culture. Numerous literature regards organizational culture as an important impact on the development of intellectual capital’s components, especially on human and social capital (Youndt, Subramaniam & Snell, 2004; Kostopoulos, Bozionelos & Syrigos, 2015). Mouritsen argued that organizational culture is pivotal to the value of intellectual capital (Ellinger et al., 2002). Petty & Guthrie advocates that corporate culture is crucial toward firm’s successfulness and is capable of increasing intellectual capital within that firm (Mouritsen, Larsen & Bukh, 2001). Different kinds of organizational culture would have different influences on intellectual capital. However, developing types of culture that refer to flexibility, openness, quick adaptability and responsiveness is appropriate for a knowledge-based organization like ICT firm and is an important driver to support the development of the intellectual capital’s components, especially human and social capital (Gilbert, Von & Broome, 2017). Synthesizing above arguments, we propose the following hypothesizes:

H4: The increase in organizational capital positively increases in human capital.

H5: The increase in organizational capital positively increases in social capital.

H6: The organizational capital has an indirect influence on firm performance through social capital.

H7: The organizational capital has an indirect influence on firm performance through human capital.

Conceptual Frameworks

Based on the above theoretical backgrounds and hypotheses, we propose an integrated model as the following(Figure 1):

Methodologies And Data Analysis

Data Collection and Respondent Characteristics

We conduct a survey of the Vietnamese ICT firms, the majority of them are five-year-olds or smaller. The targeted respondents are directors, project managers and senior managers who represent the best source of information for our study. Eventually, 350 responses were directly collected from 450 questionnaires were distributed. After excluding missing data and outliers based on boxplot analyses 319 responses were analysed. Table 1 presents the demographic information of the research sample.

| Table 1: Demographic Information Of The Research Sample | |||

| Variable | Category | N | Percentage (%) |

| Age | 20s | 10 | 3 |

| 30s | 255 | 80 | |

| 40s | 54 | 17 | |

| Education | Vocational school | 13 | 4 |

| Bachelor’s degree | 267 | 84 | |

| Master’s degree | 39 | 12 | |

| ICT category | Software Services | 200 | 57 |

| Hardware Services | 31 | 9 | |

| Hardware manufacturing | 10 | 3 | |

| Digital Media | 80 | 23 | |

| Telecommunication | 30 | 9 | |

Measurements

The questionnaire was developed from validated scales. This has been seen as a step to ensure content validity of measurements. However, the survey was conducted in Vietnamese due to the pre-dominantly Vietnamese setting. Two academic domain experts with fluent Vietnamese and English proficiency were invited for the translation process. The questionnaire was pretested in meetings with 10 academic domain experts and 10 senior managers from Vietnamese ICT firms. The purpose of the pre-test is to evaluate the content validity of the measures and whether the respondent understood the instructions, items and scales.

Five-point Likert-scale items ranging from “1” (strongly disagree or strongly dissatisfaction) to “5” (strongly agree or strongly satisfaction) were used to measure the intellectual capital dimensions, firm performance and environmental uncertainties. All items in detail are reported in Appendix A. The measurement of the three dimensions of capital, human, organizational and social capital, was mainly derived from measurement scales developed by Subramanian, Youndth & Snell (2004). Firm performance measurement was adapted from using scales developed and validated by Wkilund & Shepherd (2003). Environmental uncertainties measurement scales are developed based on the basis of studies by Atuahene-Gina & Murray (2004).

Construct Validity and Reliability Measurement

Firstly, we use Cronbach’s alpha (α) for reliability analysis in order to measure the internal consistency of the measurement scales (Hair, Anderson, Tatham & Black, 1998). The acceptable value of α should be above 0.6 (Hair, Anderson, Tatham & Black, 1998). Secondly, we apply Exploratory Factor Analysis (EFA) techniques to condense the data contained in a group of original variables into a smaller set of new dimensions or factors with minimum loss of information (Hair, Anderson, Tatham & Black, 1998). Lastly, Confirmatory Factor Analysis (CFA) is used to provide an evaluation of how questionnaire items logically and systematically represent constructs involved in the conceptual model. In other words, to assess the validity and reliability of the measurement model, we need to conduct tests of convergent and discriminant validity. To achieve adequate converge, factor loading score of every item of each factor should be 0.5 or higher, Construct Reliability (CR) of every construct should be above 0.6 and Average Variance Extracted (AVE) should exceed 0.5 (Hair, Anderson, Tatham & Black, 1998). To support discriminant validity, AVE for any two constructs must be greater than the squared correlation estimate between these two constructs (Hair, Anderson, Tatham & Black, 1998).

Mediation or Indirect Influence Analysis

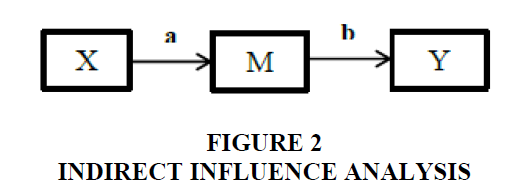

In prior research, when researchers test the structural model, they often focus only on direct relationship measurement among constructs, thus, to strengthen the causal effect relationship measurement among constructs, we performed indirect effect test. Indirect effect measurement involves in testing how an independent variable (X) affects a dependent variable (Y) through one or more potential intervening variables or mediators (M(s)) (Hayes, 2013). Hayes defined a method to test the indirect effect, called Bootstrapping method, as the followings:” Bootstrapping is a computationally intensive method that involves repeatedly sampling from the dataset and estimating the indirect effect in each resampled data set. By repeating this process thousands of times, an empirical approximation of the sampling distribution of the product of a and b (a and b values are the standardized coefficient value of X => M, M = >Y, respectively) is built and used to construct confident intervals for indirect effect. If zero is contained in the interval, there is no indirect effect of X to Y through M.” (Hayes, 2013) (Figure 2).

The Result of the Construct Reliability and Validity Evaluation

At first, we use Cronbach’s alpha (α) for reliability analysis in order to measure the internal consistency of the measurement scales (Hair, Anderson, Tatham & Black, 1998). The acceptable value of α should be above 0.6 (Hair, Anderson, Tatham & Black, 1998). The α of human, social and organizational capital are 0.89, 0.9 and 0.6 representing reasonable scale reliability. Firm performance and environmental uncertainties with α of 0.611 and 0.699 also represent good scale reliability. Next, we use EFA technique to conduct dimensionality analysis indicated by factor loading score. The general purpose of factor analytic techniques is to condense the information contained in original construct into a smaller set of new composite dimensions or factors (Hair, Anderson, Tatham & Black, 1998). In our study, all factor loading scores are higher than the suggested level of 0.5 (Hair, Anderson, Tatham & Black, 1998) which results in the satisfaction of the condition of uni-dimensionality confirmation (Hair, Anderson, Tatham & Black, 1998).

The Result of Convergent and Discriminant Validity Evaluation

Before verifying the hypotheses, CFA was conducted to assess how the conceptual model fit data with the help of AMOS software. Regarding overall model fitness, to make sure data fit to model well, Root Mean Square Error of Approximation (RMSEA) should be smaller than or equal to 0.08 (Hair, Anderson, Tatham & Black, 1998), Goodness of Fit Index (GFI) and Comparative Fit Index (CFI) should satisfy thresholds of 0.9 (Hair, Anderson, Tatham & Black, 1998). Our test resulted acceptable fit for dataset (GFI=0.9, CFI=0.91 and RMSEA=0.08). Further, we use CFA technique to test convergent and discriminant validity. We checked all Average Variance Extracted (AVEs) and Composite Reliabilities (CRs). All AVEs are higher the suggested level of 0.5 (Hair, Anderson, Tatham & Black, 1998) and CRs are also above the proposed level of 0.7 (Hair, Anderson, Tatham & Black, 1998). Therefore, convergent validity is satisfied. For the test of the discriminant validity, Cheung, Chiu & Lee suggested that if the AVE of each construct is larger than the squared correlation coefficient of that construct compared with any other construct in the model, constructs indeed are different from one another (Hair, Anderson, Tatham & Black, 1998). The test result in Table 2 demonstrates that all constructs carry sufficient discriminant validity.

| Table 2: Constructs Carry Sufficient Discriminant Validity | |||||

| Human Capital | Organizational Capital | Social Capital | Firm Performance | Environmental Uncertainties | |

|---|---|---|---|---|---|

| Human Capital | 0.593* | 0.207 | 0.263 | 0.504 | 0.352 |

| Organizational Capital | 0.207 | 0.664* | 0.263 | 0.405 | 0.137 |

| Social Capital | 0.263 | 0.301 | 0.598* | 0.396 | 0.319 |

| Firm Performance | 0.504 | 0.405 | 0.396 | 0.646* | 0.362 |

| Environmental Uncertainties | 0.352 | 0.137 | 0.319 | 0.362 | 0.657* |

* Diagonal entries are AVE values

Hypotheses Verification

In hypothesis verification step, we test all hypotheses using process software. Collectively, H1, H2, H3, H4 and H5 represent direct individual effects; H6 and H7 represent indirect effects whereby the association between organizational capital and firm performance is mediated by human and social capital, respectively. Such mediated effects were tested using bootstrapping analysis, a powerful method for determining the statistical significance of mediation, to confirm a significant indirect effect proposed by Hayes (2009).

The Tests of the Direct and Indirect Effects

We adopted Hayes’s suggestion to test direct and indirect effects (H1, H2, H3, H4, H5, H6 and H7). The results in Table 3 showed that the organizational (β=0.308, p<0.001) and human capital (β=0.28, p<0.001) are positively related to firm performance, while social capital is less positively related to firm performance than two other dimensions (β=0.0983, p<0.05). Thus, H1, H2 and H3 are statistically supported. The organizational capital is positively related to human and social capital ((β=0.2630, p<0.01) and (β=0.404, p<0.001)), respectively, so, H4 and H5 are supported. In addition, because of the significance of H2, we confirm that there are no full mediation effects in this model. The full mediation effects occur when organizational capital has no direct influence on firm performance (Hayes, 2009). Therefore, there may be only partial mediation effects of human and social capital on the relationship between organizational capital and firm performance. The test outcomes showed that the partial mediation effects of human and social capital are confirmed (β=0.0755, p<0.001) and (β=0.0680, p<0.001), so, H6 and H7 are supported.

| Table 3: Organizational And Human Capital Are Positively Related To Firm Performance | |||||

| Model 1 | β | se | p | LLCI | ULCI |

|---|---|---|---|---|---|

| constant | 0.7361 | 0.1931 | 0.0002 | 3.562 | 1.1159 |

| Human capital = >Firm performance (H1) | 0.2946 | 0.0369 | 0.0000 | 0.2219 | 0.3672 |

| Organizational capital = >Firm performance (H2) | 0.3085 | 0.0519 | 0.0000 | 0.2064 | 0.4106 |

| Social capital = >Firm performance (H3) | 0.1683 | 0.0335 | 0.0000 | 0.1024 | 0.2341 |

| Model 2 | β | se | p | LLCI | ULCI |

| constant | 2.7772 | 0.2293 | 0.0000 | 2.3263 | 3.2281 |

| Organizational capital = >Human capital (H4) | 0.2630 | 0.00735 | 0.0004 | 0.1185 | 0.4075 |

| Model 3 | β | se | p | LLCI | ULCI |

| constant | 3.3659 | 0.2531 | 0.0000 | 1.7802 | 2.7756 |

| Organizational capital = >Social capital (H5) | 0.4040 | 0.0811 | 0.0000 | 0.2445 | 0.5636 |

| Model 4 | β | Boot-se | p | BootLLCI | BootULCI |

| Organizational capital = >Human capital = >Firm performance (H6) | 0.0775 | 0.0226 | 0.0000 | 0.0340 | 0.1238 |

| Organizational capital = >Social capital = >Firm performance (H7) | 0.0680 | 0.0193 | 0.0000 | 0.0340 | 0.1070 |

Discussion

The main contributions of this study are to interpret the mediating effect of human and social capital on the relationship between organizational capital and Vietnamese ICT firm performance. Basing on the test result, this article reveals that intellectual capital dimensions have significant influences on firm performance in which findings confirm that human capital has the most important contributions in forming these influences. Therefore, any innovative or creative activity must focus on human resource development. Second, this article has drawn the conceptual framework based on RBV and intellectual capital theory to complement the limitations of both. Prior researches are based on RBV and intellectual capital for explaining better business performance in well-developed countries and traditional industries. By developing the intellectual capital dimensions deployment as an aspect of RBV, the current study provides an answer to why with a similar amount of the intellectual capital, the ICT western firms use them more successfully while Vietnamese ICT companies do not. It is explained that major local ICT firms are micro or small and medium firms, they are working in business environment in which they are facing a number of challenges in terms of regulatory framework and intellectual property protection, quality and availability of skilful persons, financial supporters which are barriers to the development of Vietnamese ICT sector. Therefore, they expect that they could gain long-term development if such environmental factors are improved. Third, the mediating roles of human and social capital could be considered key sensors to explain how organizational capital positively improves firm performance. ICT staffs are high-education and creative experts who prefer working as non-managerial staffs to as employees under time management pressure, so, firm’s organizational culture, environment and structure will influence on their performance as well as firm performance. Because of this special feature of ICT job, staffs must actively build their own social network to support them work independently. In addition, their major communication and information exchanges are online and carried out in multi-culture environments. When mutual trusts in a social network are established, they are willing to share intellectual resources, in turn, motivating innovation activities and consequently building a positive corporate culture as well as firm performance improvement. In addition, ICT advance applied in organizational changes or operation are considered to play a central role in enhancing working environment as well as determining staff’s productivity. The discussion on the impact of ICT advance on growth and productivity was stimulated by the famous sentence of Robert Solow: “You can see the computer age everywhere but in the productivity statistics” (Solow, 1987). Therefore, effective accumulation of the organizational capital can help employee creating and acquiring knowledge derived from a range of intangible assets that comprise a firm’s competitive advantages. Concretely, organizational capital should not be the sole factor influencing on firm performance, the integration of the interrelationships among social, organization and social capital in explaining firm performance in a specific context will provide us a clear picture of how intellectual capital is crucial to the existence and development of ICT firm.

Implications

The findings of this paper provide meaningful theoretical and practical contributions to the intellectual capital literature by extending prior findings. The first theoretical contribution is pertaining to the dimensions of the intellectual capital at theoretical approach in the Vietnamese-like emerging economies. Because of the inadequate market and legal support, dysfunctional competitor behaviour of firms is widespread; the evaluation of intellectual capital should not be the same as Western countries. Second, despite extensive discussions regarding the influence of organizational capital on firm performance, there are very few researches on its impacts on firm performance via other intellectual capital dimensions within the contexts of ICT sector. The findings show that to values of corporate cultures form the foundation of the Valuable, Rare, Inimitable and Non-Substitutable (VRIN) assets, there are needs for building mutual trusts in social network extensions. In addition, the findings also provide practical implications for ICT management. Facing global trends and unpredictable environment, ICT managers must develop their own human organizational and social capital to meet customer’s challenge demand and must maintain and build up strong network ties with employees, customers, suppliers and competitors to observe environmental changes rapidly and adjust their own business direction effectively and with flexibility.

Conclusion And Limitations

Vietnam is on the road to a knowledge-based economy in which ICT is considered as one of the key sectors. This study gives brief insights into Vietnamese ICT sector in term of the interrelationship among social, human, organizational capital and firm performance. By refining objectives in business operation, ICT firms must understand their own capabilities, especially their internal strengths to face to unpredictable changes in the environment. Social, organizational and human capital, dimensions of intellectual capital, is recognized as the key intangible resources for firm’s long-term performance. Accordingly, this study extends previous studies by investigating the central role of organizational capital as the key factor for the sustainable development of the ICT firms in future when firms become larger and more structured. However, the initiative of Vietnamese ICT firms to motivate innovation activities and develop intellectual capital is still in infancy. Hence, we hope that the findings will be helpful to top managers and policy makers in Vietnam and in developing countries in their work to find a good solution to enhance the performance of ICT firms in long-term.

This research also contains some limitations. First, this study just explores the definition of the dimensions of intellectual capital and its impact on firm performance. This study employs static data, which has inevitable drawbacks in reflecting the long-term impacts of IC’s dimensions and performance. The use of panel data may be the future direction of following-up studies. Second, there are some other dimensions of intellectual capital such as customer capital should be investigated in future. Lastly, there are other stakeholders such as employees and managers involved in the relationship between intangible capital and firm performance. Further studies should take into account the perspectives of these stakeholders.

APPENDIX

| Appendix 1: Questionnaire Items |

| Firm performance |

|---|

| We demonstrated more profitability than other market competitors |

| We have greater capacity in developing new products or services than other competitors |

| We have higher quality of products or services than other competitors |

| We have greater capability in developing new products, service or programs |

| We have greater ability to attract and retain essential employees |

| We achieve greater satisfaction among customers or clients |

| We experienced a greater growth in sales than other market competitors |

| Social Capital |

| Our employees are skilled at collaborating with each other to diagnose and solve problems |

| Our employees share information and learn from one another |

| Our employees interact and exchange ideas with people from different areas of the organization |

| Human Capital |

| Our employees are active in upgrading employee’s skills |

| Our employees are bright |

| Our employees are satisfied with working conditions |

| Our employees always come up with new ideas |

| Organizational capital |

| We have the know-how to improve the organizational capability |

| Our organizational culture includes a clear organization structure |

| Our organization invest abundant resources to acquire new knowledge and information system |

| Our organization always provide training for employees |

| Environmental Uncertainties |

| Marco policies is highly uncertain |

| Technological development is highly unpredictable |

| Product market is a very complex environment |

| Customer demand is hard to forecast |

| Customer tend to look for new products all the time |

References

- Akdere, M. & Roberts, P.B. (2008). Economics of social capital: Implications for organizational performance. Advances in Developing Human Resources, 10(6), 802-816.

- Aramburu, N. & Saenz, J. (2011). Structural capital, innovation capability and size effect: An empirical study. Journal of Management & Organization, 17(3), 307-325.

- Asiaei, K. & Jusoh, R. (2015). A multidimensional view of intellectual capital: The impact on organizational performance. Management Decision, 53(3), 668-697.

- Atuahene-Gima, K. & Murray, J.Y. (2004). Antecedents and outcomes of marketing strategy comprehensiveness. Journal of Marketing, 68(4), 33-46.

- Baughn, C.C., Neupert, K.E., Anh, P.T.T. & Hang, N.T.M. (2011). Social capital and human resource management in international joint ventures in Vietnam: A perspective from a transitional economy. The International Journal of Human Resource Management, 22(5), 1017-1035.

- Bontis, N. (1998). Intellectual capital: An exploratory study that develops measures and models. Management Decision, 36(2), 63-76.

- Bontis, N., Chua, C.K.W. & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85-100.

- Bourdieu, P. (2011). The forms of capital. Cultural Theory: An Anthology, 1, 81-93.

- Call, M.L., Nyberg, A.J. & Thatcher, S. (2015). Stargazing: An integrative conceptual review, theoretical reconciliation and extension for star employee research. Journal of Applied Psychology, 100(3), 623.

- Cao, J. & Wang, Z. (2015). Impact of intellectual capital on firm performance: The influence of innovation capability and environmental dynamism presented at AMCIS Conference. Fajardo, Puerto Rico, AIS e-Library publishing.

- Coleman, J.S. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94, 95-120.

- Demirbag, M., Tatoglu, E., Tekinkus, M. & Zaim, S. (2006). An analysis of the relationship between TQM implementation and organizational performance: Evidence from Turkish SMEs. Journal of Manufacturing Technology Management, 17(6), 829-847.

- Dess, G.G. & Robinson, R.B. (1984). Measuring organizational performance in the absence of objective measures: The case of the privately?held firm and conglomerate business unit. Strategic Management Journal, 5(3), 265-273.

- Dess, G.G. & Shaw, J.D. (2001). Voluntary turnover, social capital and organizational performance. Academy of Management Review, 26(3), 446-456.

- Djuric, M. & Filipovic, J. (2015). Human and social capital management based on complexity paradigm: Implications for various stakeholders and sustainable development. Sustainable Development, 23(6), 343-354.

- Edvinsson, L. & Sullivan, P. (1996). Developing a model for managing intellectual capital. European Management Journal, 14(4), 356-364.

- Ellinger, A.D., Ellinger, A.E., Bachrach, D.G., Wang, Y.L. & Elmadag Bas, A.B. (2011). Organizational investments in social capital, managerial coaching and employee work-related performance. Management Learning, 42(1), 67-85.

- Ellinger, A.D., Ellinger, A.E., Yang, B. & Howton, S.W. (2002). The relationship between the learning organization concept and firms' financial performance: An empirical assessment. Human Resource Development Quarterly, 13(1), 5-22.

- Ferreira-Lopes, A., Roseta-Palma, C. & Sequeira, T.N. (2012). When sociable workers payoff: Can firms internalize social capital externalities? Structural Change and Economic Dynamics, 23(2), 127-136.

- Gilbert, J.H., Von A.D. & Broome, M.E. (2017). Organizational intellectual capital and the role of the nurse manager. A proposed conceptual model: Nursing outlook.

- Grootaert, C. (2004). Measuring social capital: An integrated questionnaire. World Bank Publications.

- Hair, J.F., Anderson, R.E., Tatham, R.L. & Black, W.C. (1998). Multivariate data analysis. London: Prentice Hall.

- Hayes, A.F. (2009). Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Communication Monographs, 76(4), 408-420.

- Hayes, A.F. (2013). Introduction to mediation, moderation and conditional process analysis. A regression-based approach. New York: Guilford.

- Hsu, C.P., Chang, C.W., Huang, H.C. & Chiang, C.Y. (2011). The relationships among social capital, organizational commitment and customer-oriented pro-social behaviour of hospital nurses. Journal of Clinical Nursing, 20(9-10), 1383-1392.

- Hsu, Y.H. & Fang, W.C. (2009). Intellectual capital and new product development performance: The mediating role of organizational learning capability. Technological Forecasting and Social Change, 76(5), 664-677.

- Huang, Y.C. & Jim, W.Y.C. (2010). Intellectual capital and knowledge productivity: The Taiwan biotech industry. Management Decision, 48(4), 580-599.

- Huang, C.C., Tayles, M. & Luther, R. (2010). Contingency factors influencing the availability of internal intellectual capital information. Journal of Financial Reporting and Accounting, 8(1), 4-21.

- Intellectual capital information. Journal of Financial Reporting and Accounting, 8(1), 4-21.

- ITU releases annual global ICT data and ICT development index country rankings (2015). Retrieved from www.itu.int

- Kianto, A., Andreeva, T. & Pavlov, Y. (2013). The impact of intellectual capital management on company competitiveness and financial performance. Knowledge Management Research & Practice, 11(2), 112-122.

- Kostopoulos, K.C., Bozionelos, N. & Syrigos, E. (2015). Ambidexterity and unit performance: Intellectual capital antecedents and cross?level moderating effects of human resource practices. Human Resource Management, 54(S1).

- Mouritsen, J., Larsen, H.T. & Bukh, P.N. (2001). Intellectual capital and the ‘capable firm’: Narrating, visualizing and numbering for managing knowledge. Accounting, Organizations and Society, 26(7), 735-762.

- Nahapiet, J. & Ghoshal, S. (1998). Social capital, intellectual capital and the organizational advantage. Academy of Management Review, 23(2), 242-266.

- Nonaka, I. & Von Krogh, G. (2009). Perspective-tacit knowledge and knowledge conversion: Controversy and advancement in organizational knowledge creation theory. Organization Science, 20(3), 635-652.

- Oldroyd, J.B. & Morris, S.S. (2012). Catching falling stars: A human resource response to social capital's detrimental effect of information overload on star employees. Academy of Management Review, 37(3), 396-418.

- Phusavat, K., Comepa, N., Sitko-Lutek, A. & Ooi, K.B. (2011). Interrelationships between intellectual capital and performance: Empirical examination. Industrial Management & Data Systems, 111(6), 810-829.

- Putnam, R.D. (1993). The prosperous community. The American Prospect, 4(13), 35-42.

- Rastogi, P.N. (2003). The nature and role of IC: Rethinking the process of value creation and sustained enterprise growth. Journal of Intellectual Capital, 4(2), 227-248.

- Sharabati, A.A.A., Jawad, S.N. & Bontis, N. (2010). Intellectual capital and business performance in the pharmaceutical sector of Jordan. Management Decision, 48(1), 105-131.

- Shih, K., Chang, C. & Lin, B. (2010). Assessing knowledge creation and intellectual capital in banking industry. Journal of Intellectual Capital, 11(1), 74-89.

- Solow, R.M. (1987). We'd better watch out. New York Times Book Review, 12, 36.

- Subramaniam, M. & Youndt, M.A. (2005). The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal, 48(3), 450-463.

- Taking-off strategy: Does it stepping up the development of the ICT industry in Vietnam? (2013). Retrieved from http://www.business-in-asia.com/vietnam/vietnam_ict.html

- Tseng, J.F., Wang, H.K. & Yen, Y.F. (2014). Organizational innovability: Exploring the impact of human and social capital in the banking industry. Total Quality Management & Business Excellence, 25(9-10), 1088-1104.

- Venkatraman, N. & Ramanujam, V. (1986). Measurement of business performance in strategy research: A comparison of approaches. Academy of Management Review, 11(4), 801-814.

- Wernerfelt, B. (1984). A resource?based view of the firm. Strategic Management Journal, 5(2), 171-180.

- Wiklund, J. & Shepherd, D. (2003). Knowledge?based resources, entrepreneurial orientation and the performance of small and medium?sized businesses. Strategic Management Journal, 24(13), 1307-1314.

- Youndt, M.A., Subramaniam, M. & Snell, S.A. (2004). Intellectual capital profiles: An examination of investments and returns. Journal of Management Studies, 41(2), 335-361.

- Zack, M., McKeen, J. & Singh, S. (2009). Knowledge management and organizational performance: An exploratory analysis. Journal of Knowledge Management, 13(6), 392-409.

- Zeglat, D. & Zigan, K. (2013). Intellectual capital and its impact on business performance: Evidences from the Jordanian hotel industry. Tourism and Hospitality Research, 13(2), 83-100.